Income Tax Refund | Claiming IT Refund, Schedule, Process, Status

Income Tax Refund: When there is a mismatch between actual payable tax and the tax amount paid, then the ITR refund process comes into the picture. That is if the individual pays the excessive tax amount then the refund will be initiated by the officials. Any individual will be able to claim the income tax refund under Section 237 of the Income Tax Act. To claim the income tax refund, one will have to fill the Form 30.

However, in order to claim the income tax refund, he/she will have to validate their bank account and link it with their PAN number. In this article, we will provide you with all the necessary information on the Income Tax Refund schedule, eligibility and process to claim the same. Read on to find out more.

- Income Tax Refund Eligibility

- Income Tax Refund Process

- How Much Income Tax Amount Will Be Refunded?

- How To Claim Income Tax Refund In India?

- Income Tax Refund – Form 30

- Income Tax Refund Time or Due Date

- How Is Income Tax Refund Processed?

- Income Tax Refund Status 2020-21

- How Can I Check My Income Tax Refund Status Through E-Filing Website?

- Income Tax Refund Status Types

- Income Tax Refund Delay

- FAQs on Income Tax Refund

Income Tax Refund Eligibility

Income Tax Refund, as the name suggests, it is the process where an individual can claim the reimbursement of money when he/she pays the excess tax. However, any individual falling under this category can also apply for Income Tax Refund eligibility.

- Most of the individuals would pay excess amount advance tax based on the self-assessment than the actual tax payable.

- If the tax levied on the basis of regular assessments is reduced because an error in the assessment process was corrected.

- If your TDS from salary, interest on securities or debentures, dividends, or other sources exceeds the tax payable on a regular basis.

- If you have made any investments that provide tax benefits but failed to declare the same while filing the ITR can apply for an income tax refund.

- If the individuals have paid double tax i.e. if any individual has to pay tax in both Indian and foreign country with which the Indian government has agreement can claim for IT refund.

Income Tax Refund Process

Once you find that you are eligible to apply for the income tax refund, you can file the return of your income. Any individual who wishes to apply for an income tax refund will have to apply for the same on 31st July 2021.

Note: The income tax refund scheduled might vary if it is extended.

How Much Income Tax Amount Will Be Refunded?

To know how much amount income tax amount will be refunded, one will have to calculate his/her tax liability to determine the actual payable tax. If any individuals find that he/she has paid an excess amount of tax, then the difference amount will be refunded to the individual.

For Example, Mr. Kumar was liable to pay Rs. 40,000. But Mr Kumar has paid Rs.60,000 advance tax based on his self-assessment and he found that he paid excess tax amount. Now, when Kumar applied for the income tax refund, the excess amount of 20,000 was paid by the income tax officials to Kumar.

How To Claim Income Tax Refund In India?

The steps to claim the income tax refund in India is very simple. All you will have to do is, while filing the ITR, you will have to declare all your investments in Form 16. The investments which you can declare in Form 16 are LIC, house rent bill payments, mutual fund or other investment and so on. By doing so, you can easily claim an income tax refund.

However, if you fail to declare the investments in Form 16, then you can make use the Form 30 and claim for the income tax refund. Form 30 is nothing but a simple form available on the official website of the Income Tax Department and the individual will be able to download the form for free. Form 30 is otherwise a request form to officials stating that he/she paid the excess tax and wishes to claim the refund for the same.

Income Tax Refund – Form 30

As stated above any individual will be able to download Form 30 from the official website of the income tax department. The sample From 30 for an income tax refund will look like the following:

| I, (Individual Name), of (Address), do hereby state that my total income computed in accordance with the provisions of the Income Tax Act, 1961, during the year ending on (year) being the previous year for the assessment year commencing on the 1st of April (Year), amounted to Rs. (Amount); that the total income tax chargeable in respect of such total income is Rs. (Amount) and that the total amount of Income Tax paid or treated as paid under:

Section 199, is Rs. (Amount). I, therefore, request for a refund of Rs. (Amount). (Signature) I hereby declare that I was resident/resident but not ordinarily resident/non-resident during the previous year relevant to the assessment year to which this claim relates and that what is stated in this application is correct. Dated: (Date) (Signature) |

Income Tax Refund Time or Due Date

Any individual will have to claim the IT refunds within 1 year from the date of Assessment year concludes. Also, the officials of Income Tax will provide a provision claiming the income tax refund for certain cases. However, the due date within which one will have to apply for the income tax refund is given below:

- If six consecutive assessment years have passed, income tax refund requests will not be accepted.

- For a single assessment year, the refund sum must be less than Rs.50 lakh.

- Refunds of late claims would not be subject to interest.

- The assessing officer can reconsider the claim if the delayed claims need verification.

How Is Income Tax Refund Processed?

The Income Tax (IT) refund is processed by the Income Tax authorities stationed at the Centralised Processing Centre (CPC) in Bengaluru. When the assessee files his or her Income Tax Returns, the refunds are collected (ITR). The IT refund is processed in any of the following two ways:

- IT Refund Through Cheque: The income tax refund will be processed to individuals via Speed Post. To track the same, the officials will also provide a reference number to an individual with the help of which one can monitor the delivery dates.

- IT Refund Through Bank Transfer: After scrutinising the documents submitted by the assessee, the officials will directly credit the refund amount via ECS transfer to the individual’s bank account. The officials use RTGS/NECS of the State Bank of India to pass the tax refund directly into individuals account using their 10-digit account number and MICR code.

Income Tax Refund Status 2020-21

Once the individual has applied to claim the refund from the income tax department, he/she can check the status of the same in any of the following ways:

- Through E-Filing Website

- Through TIN-NSDL Website

How Can I Check My Income Tax Refund Status Through E-Filing Website?

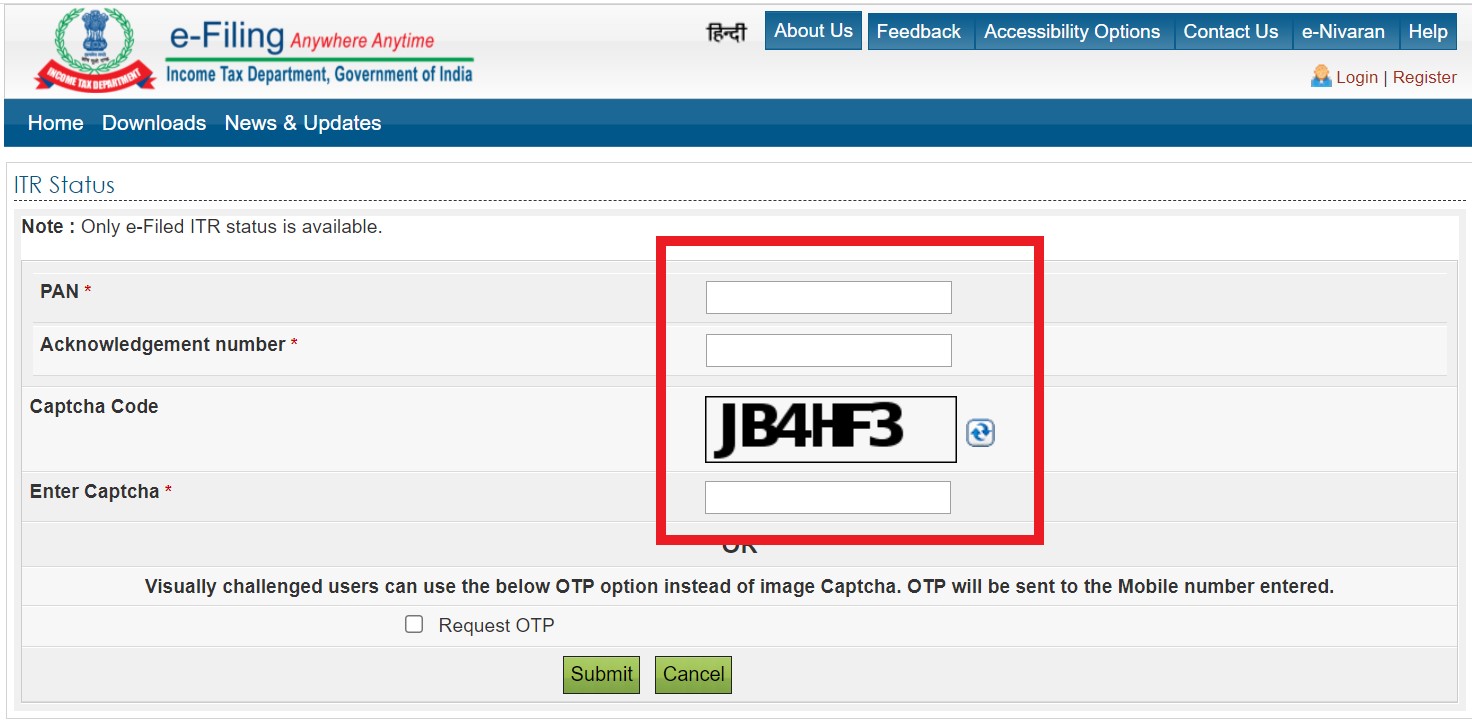

The steps to check the income tax refund status through the E-Filing website has been given below:

- Step 1: Visit the official website of e-Filing.

- Step 2: Under Quick Links, click on the “ITR Status“.

- Step 3: Now a new page will open. Enter details such as “PAN, Acoknowlegment Number, Captcha Code” as displayed on the screen.

- Step 4: Click on “Submit”.

- Step 5: Your ITR Status will be displayed on the screen.

If you are a visually impaired person, then you can just opt for the One Time Password option, where the officials will send an OTP to a registered mobile device to display your IT Refund status.

Income Tax Refund Status Types

While checking for the income tax refund status, one will come across various parameters. The various parameters and their meaning have been explained in detail in the table below:

| Parameter | Meaning |

| Not Determined |

This parameter indicates that your refund has not yet been processed i.e., your income tax refund is pending.

|

| Refund Paid |

This indicates that the income tax refund you are entitled to has been sent to you or transferred to your registered bank account.

|

| Refund Failed |

This means you gave incorrect bank information and the income tax refund could not be credited to your registered bank account.

|

| Refund Expired |

The refund cheque expires if it is not cashed within 30 days of the date of issuance (the date printed on the top right corner of the cheque). So you will have to request a new cheque

|

| The Cheque has been Encashed |

This means you have received the cheque and enchased the same

|

| Refund Returned |

The cheque issues were returned to the income tax department. In that case, one will have to request again for a refund.

|

| Refund Adjusted against Last Year’s Outstanding Demand |

If you have an unpaid income tax refund from a prior assessment year, the balance will be deducted from the expected income tax refund for the current assessment year.

|

Income Tax Refund Delay

If the refund payment is delayed, the Income Tax Department is liable to pay interest at a rate of 6% under Section 244A of the Income Tax Act. The interest on your refund will be calculated from the date the tax was charged to the date the refund was issued.

FAQs on Income Tax Refund

The frequently asked questions on income tax refund are given below:

Q. When I will get my ITR refund?

A. Usually, the ITR refunds will be processed to the individual within 20 to 45 from the date of processing the ITR.

Q. How to rectify the name on the Cheque issued by the income tax department?

A. If you find any issues in the cheque issued by the income tax department, then one will have to CMP Operations Centre stating them to issue a new cheque will correct details. Also, you can log in to the official website of the income tax department to rectify your account details.

Q. Where do I contact my income tax refund?

A. Individual can contact any of the following helpline numbers from Monday to Saturday between 9:00 AM to 8:00 PM to enquire about their income tax refund queries.

- 1800 103 0025.

- +91-80-46122000.

- +91-80-26500026.

Now that you are provided with all the necessary information on income tax refund and how to claim the same. If you have any queries on this article or in general about the income tax refund process, ping us through the comment box below and we will get back to you as soon as possible.