Accounting Process-II – CS Foundation Fundamentals of Accounting Notes

Go through this Accounting Process-II – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Accounting Process-II – CS Foundation Fundamentals of Accounting Notes

Accounting Errors:

Accounting Errors are the error committed by the persons responsible for recording and maintaining of a business in the course of accounting process.

Rectification of Errors:

- Errors means unintentional omission or commission of accounts or amounts while recording entries.

- Due to errors, the final accounts do not show a true and fair view. So these errors need to be rectified.

- There can be many types of errors, some may effect trial balance while others may not. Even if they do not affect trial balance, there occurrence may distort the true picture of books and accounts.

We will be first studying these errors and their nature and then in the later part of chapter, we will study how to rectify these errors

Types of Errors:

(i) Error of principle

(ii) Clerical errors

-

- Errors of omission (partial or complete)

- Error of commission

- Compensating errors

| Type of Error | Meaning | Effect in Trial Balance |

| 1. Error of principle | When there is an error in complying accounting principles. Example: 1. Treating capital expenditure as revenue or vice versa. 2. Recording sale of fixed asset as an ordinary sale. |

No effect in Trial Balance. It will tally. |

| 2. Error of omission (i) Complete omission (ii) Partial omission |

1. When an entry is totally eliminated from being recorded. 2. When an entry is recorded partially i.e. any one aspect (debit or credit) is not recorded. |

1. No effect on Trial Balance. 2. Trial Balance will be affected. It will not tally |

| 3. Error of Commission | Any type of error committed while recording entries. Example: 1. Writing wrong amount 2. Writing correct amount but on wrong side 3. Wrong casting (totalling) of subsidiary book etc. |

Trial Balance may or may not agree.

|

| 4. Compensating Errors | When two errors are committed such that one compensates with that of another. For Example: Rahul’s A/c was debited with ₹ 100 instead of ₹ 1,000 while Ajay’s A/c was debited with ₹ 1,000 instead of ₹ 100. |

Trial Balance will agree. |

Effect of errors on the Trial Balance:

If a Trial Balance is matched then it does not mean that it is free from errors. Thus, errors can be classified into two types.

- Errors which effect the Trial Balance, these errors are disclosed by the Trial Balance.

- Errors which have no effect on the Trial Balance. These errors are not disclosed by the Trial Balance.

Errors disclosed by Trial Balance:

The following are the examples of errors disclosed by Trial Balance:

- Error in casting subsidiary books

- Error in carrying forward total of one page to another

- Error in totalling the trial balance

- Error in balancing an account

- Error in preparation of schedules

- Error in carrying the balance to the trial balance

- Error of partial omission

- Double Posting to an account

- Error of posting from book of subsidiary record to ledger.

Errors not disclosed by Trial Balance:

The following errors are not disclosed by trial balance i.e. the trial matches even if the errors are present.

- Error of complete omission i.e. when a transaction has been completely omitted from being recorded

- Errors of commission

- Compensatory errors

- Errors of principle

- Recording wrong amount in subsidiary book

- Errors of duplication

Steps to Locate Errors:

- First check whether the Trial Balance is agreeing, if not there is an indication of errors.

- Even if the,trial balance has agreed still there may be errors (like compensating errors, errors of principle etc.)

- Ensure that cash and bank balances have been transferred to the Trial Balance.

- Balance the ledger accounts again and check whether the right totals have been transferred to trial balance.

- Check the totals of subsidiary books again.

- Check the opening balances.

- Check the postings of nominal accounts first.

All above points will locate the errors which are to be rectified.

Rectification of Errors:

- Errors whether affecting the trial balance or not should be rectified.

- The process of rectifying the errors is called rectification of errors.

Need for Rectification:

- To present correct accounting information

- Ascertaining actual profit or loss

- To disclose true financial position of the enterprise.

Stages of Rectification:

- Before preparation of Trial Balance.

- After preparation of Trial Balance but before preparation of Final Accounts.

- In the next accounting period (i.e. After preparation of final accounts)

Rectification before preparation of Trial Balance:

- Errors located before preparation of Trial Balance can be one sided errors or two sided errors.

- There are different rectification treatments for both.

In case of one sided error:

These are the errors affecting only one side of an Account.

Example: The total of debit side was written as ₹ 1,000 instead of ₹ 10,000. This error will affect only the debit side.

Errors affecting one account may occur on account of following reasons-

- Wrong casting

- Wrong balancing

- Wrong posting

- Wrong carry forward

- Omission of an amount in Trial Balance

Rectification of such errors:

- No journal entry is to be passed.

- Only the relevant account will be debited or credited.

- The double entry for this rectification entry will not be complete.

An agreement of Trial Balance does not prove that

- All transactions have been correctly analyzed and recorded in proper account.

- All transactions have been recorded in the books of original entry.

Example:

Total of Purchase Book was ₹ 1,00,000 short.

Rectification :

Debit purchase A/c with ₹ 1,00,000 with the words “To short total of purchase book”.

In case of two sided error:

- When there is an error which affects both aspects of a transaction (i.e. debit and credit) it is known as a two sided error.

- Example – Complete omission of an entry.

- Journal entry is required to be passed for these errors.

Errors which affect two or more accounts are as follows :

- Error of complete omission

- Error in recording subsidiary books

- Errors in posting to wrong account with or without wrong amount

- Error of principle.

Rectification of these errors

- Step – 1 : Write the correct entry which should be passed.

- Step – 2 : Write the entry which has been actually passed

- Step – 3 : Reconcile both and pass the rectifying entry.

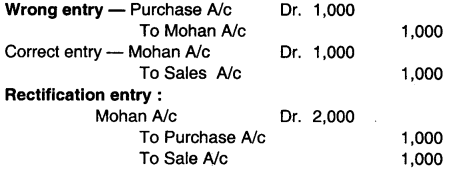

Example:

A credit sale of ₹ 1,000 to Mohan has been passed through purchase book.

Rectification –

1. Mohan had to be debited with ₹ 1,000 but he was credited with ₹ 1,000. So for rectifying it he has been debited with 2,000.

2. Purchase A/c was wrongly debited so for rectifying, it has been credited.

3. Sale A/c was not credited so for rectifying, it has been credited.

Rectification after preparation of Trial Balance but before preparation of final accounts:

- If errors are located after preparation of Trial Balance, so they can’t be rectified using the previous methods because now the ledger accounts have already been closed.

- Like earlier method, these errors can also be – (i) One sided (ii) Two sided.

One sided errors (errors affecting one A/c):

- Since the ledger accounts are already closed so one aspect of an entry cannot be rectified by posting it in the respective ledger A/c.

- For rectifying such errors, Suspense A/c is opened.

Suspense Account:

- Sometimes, it is not possible for the accountant to locate the difference in the Trial Balance. But the books cannot be closed with such difference so he puts the Trial Balance difference to a newly opened account known as Suspense Account.

- In simple words, it is an account in which the difference of the Trial Balance is put temporarily.

- If debit side is less, Suspense A/c is debited and if credit side is less, it is credited.

- When the errors are located, Suspense A/c will be closed.

- A Suspense A/c is opened in the following cases – (a) to balance the disagreed Trial Balance (b) to post uncertain items. example: payment received from unknown person).

Rectification of errors:

Any difference in trial balance whether debit or credit shall be transferred to the Suspense A/c. This will lead to the agreement of trial balance total and when the error is located, the entry will be reversed and Suspense A/c will be closed.

Example:

Sales book was under cast by ₹ 500.

Due to this, credit side of Trial Balance should be short by ₹ 500.

Rectifying entry :

Suspense A/c Dr. 500

To Sales A/c 500

After this entry the trial balance will tally and final accounts can be prepared easily.

In case of two sided errors:

It will be rectified in the same manner as two sided errors before preparation of Trial Balance were rectified. (i.e. by passing a wrong entry, then right entry and then a rectification entry.)

Rectification of errors after preparation of Final A/c:

One sided errors – When errors are detected after preparation of final accounts, then they are rectified as follows:

(i) In case of Nominal Accounts:

- Nominal Account balances are transferred to the P/L A/c at the year end.

- So in the next accounting year, when rectification is to be made, we cannot use these nominal accounts.

- For this purpose, a new account Profit and Loss Adjustment A/c is opened which substitutes all nominal accounts of the previous year.

- For rectification, if nominal account is to be debited or credited then instead of nominal account, Profit and Loss Adjustment A/c is debited or credited.

(ii) In case of Real or personal Accounts:

The rectification is done through Suspense account and other concerned account affected by the errors.

Two sided errors:

-

- in case of nominal accounts – Rectification is done through Profit & Loss Adjustment A/c and the other A/cs affected.

- In case of real or personal accounts – The rectification is carried out through two or more concerned accounts affected by the errors without involving Profit and Loss Adjustment A/c.

Examples:

Wages paid ₹ 2,000 for installation of machinery has been charged to Wages Account

| Rectification before preparation of final A/c’s | Rectification after preparation of final A/c’s |

| Machinery A/c Dr. 2,000

To Wages A/c 2,000 |

Machinery A/c Dr. 2,000

To P/L Adjustment A/c 2,000 |

Note:

- After rectification of all errors of last year the balance of P/L Adjustment A/c is transferred to Capital A/c being the net profit or loss due to rectification of errors of last year.

- If both accounts are nominal, then no rectification entry is passed.

Ascertainment of true profit of previous year:

To know the correct profit of previous year, the following is to be done:

- If P/L Adjustment A/c reveals a profit, add this to the profit of the previous year.

- If P/L Adjustment A/c shows a loss, it should be deducted from the profit of the previous year.

Accounting Process-II MCQ Questions

1. A Trial Balance will not tally if:

(a) Correct journal entry is posted twice

(b) The purchase on credit basis is debited to purchases and credited to cash

(c) ₹ 5,000 cash payment to creditors is debited to creditors for ₹ 500 and credited to cash as ₹ 5,000.

(d) None of the above.

Answer:

(c) ₹ 5,000 cash payment to creditors is debited to creditors for ₹ 500 and credited to cash as ₹ 5,000.

2. Error of commission do not permit:

(a) The Trial Balance to agree

(b) Correct total of Balance Sheet

(c) Correct totalling of Trial Balance

(d) None of the above.

Answer:

(a) The Trial Balance to agree

3. An item of ₹ 72 has been debited to a personal account as ₹ 27, is an error of:

(a) Commission

(b) Omission

(c) Principle

(d) None of the above.

Answer:

(a) Commission

4. Sales to Shyam of ₹ 500 not recorded in the books would affect:

(a) Shyam’s Account

(b) Sales Account

(c) Sales Account and Shyam’s Account

(d) Cash Account.

Answer:

(c) Sales Account and Shyam’s Account

5. Error of commission arises when:

(a) Any transaction is incorrectly recorded either wholly or partially

(b) Any transaction is left either wholly or partially

(c) Any transaction is recorded in a fundamentally incorrect manner

(d) None of these.

Answer:

(a) Any transaction is incorrectly recorded either wholly or partially

6. Errors which affect one account can be:

(a) Errors of Omission

(b) Errors of Principle

(c) Errors of Posting

(d) None of these.

Answer:

(c) Errors of Posting

7. Which of the following errors will not affect the Trial Balance?

(a) Wrong balancing of an account

(b) Wrong totalling of an account

(c) Writing an amount in the wrong account but on the correct side

(d) Omission of an account from Trial Balance.

Answer:

(c) Writing an amount in the wrong account but on the correct side

8. Purchase of office furniture for ₹ 20,000 has been debited to Purchase A/c it is :

(a) An error of omission

(b) An error of commission

(c) Compensating error

(d) An error of principle.

Answer:

(d) An error of principle.

9. In case a Trial Balance does not agree, the difference is put to:

(a) Suspense A/c

(b) Drawings A/c

(c) Capital A/c

(d) Trading A/c

Answer:

(a) Suspense A/c

10. Sale of typewriter that has been used in the office should be credited to:

(a) Sales A/c

(b) Cash A/c

(c) Capital A/c

(d) Typewriter A/c

Answer:

(d) Typewriter A/c

11. Suspense Account in the Trial Balance will be entered in the:

(a) Manufacturing A/c

(b) Trading A/c

(c) Profit & Loss A/c

(d) Balance Sheet.

Answer:

(d) Balance Sheet.

12. Rent paid to landlord amounting to ₹ 500 was credited to Rent A/c with ₹ 5,000. In the rectifying entry, Rent A/c will be debited with ₹ ________.

(a) 5,000

(b) 500

(c) 5,500

(d) 4,500

Answer:

(c) 5,500

13. Purchased goods from Gopal for ₹ 3,600 but was recorded in Gopal’s A/c as ₹ 6,300. In the rectifying entry, Gopal’s A/c will be debited with.

(a) ₹ 9,900

(b) ₹ 2,700

(c) ₹ 2,600

(d) ₹ 6,300

Answer:

(b) ₹ 2,700

14. Sohan returned goods to us amounting ₹ 4,200 but was recorded as ₹ 2,400 in his account. In the rectifying entry, Sohan’s A/c will be credited with.

(a) ₹ 1,800

(b) ₹ 4,200

(c) ₹ 2,400

(d) ₹ 6,600

Answer:

(a) ₹ 1,800

15. Error of principle arises when:

(a) Any transaction is recorded in fundamentally incorrect manner

(b) Any transaction is left to be recorded either wholly or partially

(c) Any transaction recorded but with wrong amount

(d) None of these.

Answer:

(a) Any transaction is recorded in fundamentally incorrect manner

16. Errors of carry forward from one year to another year affects:

(a) Personal Account

(b) Real Account

(c) Nominal Account

(d) Both Personal & Real A/cs.

Answer:

(d) Both Personal & Real A/cs.

17. Purchase of Office furniture ₹ 1,200 has been debited to General Expense Account. It is :

(a) A clerical error

(b) An error of principle

(c) An error of omission

(d) Compensating error

Answer:

(b) An error of principle

18. Goods purchased from A for ₹ 30,000 passed through the Sales Book. The error will result in :

(a) Increase in gross profit

(b) Decrease in gross profit

(c) No effect on gross profit

(d) Either (a) or (b)

Answer:

(a) Increase in gross profit

19. If the amount is posted in the wrong account or it is written on the wrong side of the account, it is called:

(a) Error of omission

(b) Error of commission

(c) Error of principle

(d) Compensating error.

Answer:

(b) Error of commission

20. A sale of ₹ 2,000 wrongly entered in the purchase book. It will:

(a) Decrease the gross profit by ₹ 2,000

(b) Increase the gross profit by ₹ 2,000

(c) Increase the gross profit of ₹ 4,000

(d) None of the above.

Answer:

(a) Decrease the gross profit by ₹ 2,000

21. Wages paid for erecting a machine should be debited to:

(a) Repair account

(b) Machine account

(c) Cash account

(d) Furniture account.

Answer:

(b) Machine account

22. Goods given as charity should be credited to:

(a) Charity account

(b) Sales account

(c) Purchase account

(d) Cash account.

Answer:

(c) Purchase account

23. The preparation of a trial balance is for:

(a) Locating errors of commission

(b) Locating errors of principle

(c) Locating clerical errors

(d) All of the above.

Answer:

(c) Locating clerical errors

24. Sales to Ram of ₹ 336, were not recorded. This will affect:

(a) Only Sales account

(b) Only Ram’s accounts

(c) Both the accounts

(d) None of these accounts.

Answer:

(c) Both the accounts

25. Sales to Ram, ₹ 336 have been debited to Shyam’s account. This will be rectified by:

(a) Debiting Ram’s account and Crediting Shyam’s account

(b) Debiting Shyam’s account and Crediting Ram’s account

(c) Crediting both the accounts.

(d) None of these.

Answer:

(a) Debiting Ram’s account and Crediting Shyam’s account

26. Discount allowed ₹ 93 to Mohan has been credited to his account by ₹ 39. The error will be rectified by:

(a) Crediting Mohan by ₹ 54

(b) Debiting Mohan by ₹ 54

(c) Debiting discount by ₹ 54

(d) None of these.

Answer:

(a) Crediting Mohan by ₹ 54

27. Out of the following the example of error of principle is :

(a) Omitted to record sales in sales book ₹ 500

(b) Under total of purchase book ₹ 100

(c) Purchased furniture ₹ 1, 000 was recorded in Purchase A/c

(d) None of the above.

Answer:

(c) Purchased furniture ₹ 1, 000 was recorded in Purchase A/c

28. While preparing Trial Balance, the head not included in trial balance.

(a) Drawing A/c.

(b) Suspense A/c.

(c) Capital A/c.

(d) Closing stock A/c.

Answer:

(d) Closing stock A/c.

29. ₹ 50,000 received from Ajay credited in the A/c of Abhay. It is an error of:

(a) Principle

(b) Commission

(c) Both (a) and (b)

(d) None.

Answer:

(b) Commission

30. There will be difference in trial balance if:

(a) Repair of ₹ 500 was recorded in Plant A/c

(b) Construction of roof ₹ 10,000 was recorded in Wages A/c instead of Building A/c.

(c) Paid salary to clerk ₹ 3,000 was recorded in Clerk A/c instead of Salary A/c.

(d) Received 5,000 from Manoj was debited to his account.

Answer:

(d) Received 5,000 from Manoj was debited to his account.

31. If rent received from tenant ₹ 5,000 is correctly entered in the trial balance but wrongly debited to the Rent A/c then:

(a) The trial balance will agree

(b) The debit side will exceed the credit side by ₹ 10,000

(c) The debit side total will exceed the credit by ₹ 5,000

(d) The credit side will exceed the debit side by ₹ 5,000

Answer:

(b) The debit side will exceed the credit side by ₹ 10,000

32. The method for preparing the trial balances are:

(a) Balance method

(b) Total method

(c) Both (a) and (b)

(d) Neither (a) nor (b)

Answer:

(c) Both (a) and (b)

33. Wages paid for construction of office building debited to Wages A/c is a:

(a) Error of principle

(b) Error of commission

(c) Error of omission

(d) None of the above

Answer:

(a) Error of principle

34. Suspense Account is a:

(a) Real A/c

(b) Nominal A/c

(c) Personal A/c

(d) It has no nature

Answer:

(d) It has no nature

35. If the sales book is understated by ₹ 500, the rectification entry will be:

(a) Debit sales A/c, Credit debtors A/c

(b) Debit suspense A/c, Creditors sales A/c

(c) Debit debtors A/c, Credit sales A/c

(d) None of the above

Answer:

(b) Debit suspense A/c, Creditors sales A/c

36. In case of error of commission:

(a) The trial balance agrees

(b) The trial balance will not agree

(c) The trial may agree or may not agree

(d) None of the above

Answer:

(c) The trial may agree or may not agree

37. Sale of old car credited to Sales A/c is:

(a) Error of commission

(b) Compensating error

(c) Error of omission

(d) Error of principle

Answer:

(d) Error of principle

38. If the closing stock appears in the trial balance, then it shall be recorded in:

(a) Balance Sheet

(b) Trading A/c

(c) P & L A/c

(d) Both (a) and (b)

Answer:

(a) Balance Sheet

39. Depreciation A/c appearing in the Trial Balance will be recorded in:

(a) Balance Sheet

(b) Trading A/c

(c) P & L A/c

(d) None of the above

Answer:

(c) P & L A/c

40. Difference between the total of debit and credit side of Trial Balance is transferred to:

(a) Suspense A/c

(b) Trading A/c

(c) Miscellaneous A/c

(d) Difference A/c

Answer:

(a) Suspense A/c

41. ________ is used to ensure the arithmetical accuracy of the posting that has been done.

(a) Balance Sheet

(b) Ledger

(c) Trial Balance

(d) Subsidiary Books

Answer:

(c) Trial Balance

42. If the closing stock appears in the trial balance, then it implies that:

(a) It is adjusted against opening stock

(b) It is adjusted against closing stock

(c) It is adjusted against purchase

(d) It is adjusted against sales

Answer:

(c) It is adjusted against purchase

43. Purchase of machinery on credit is recorded in:

(a) Purchase book

(b) Journal proper

(c) Cash book

(d) None of the above

Answer:

(b) Journal proper

44. The balance of various accounts are transferred to:

(a) Trial Balance

(b) Ledger

(c) Balance Sheet

(d) P & L A/c

Answer:

(a) Trial Balance

45. If the Purchase A/c is debited by ₹ 200 in excess and the Sales A/c is credited in excess by ₹ 200, then it is a:

(a) Compensatory Error

(b) Errors of Commission

(c) Error of Principle

(d) None of the above

Answer:

(a) Compensatory Error

46. A mistake in transferring the balance of an account to the trial balance is:

(a) Error of omission

(b) Errors of principle

(c) Compensatory error

(d) Error of commission

Answer:

(d) Error of commission

47. A mistake in casting of a subsidiary book:

(a) Compensating Error

(b) Error of Principle

(c) Error of Omission

(d) Error of Commission

Answer:

(d) Error of Commission

48. If purchases made for cash is correctly entered in the cash book but wrongly credited to the Purchase A/c, then it is:

(a) Compensating Error

(b) Error of Principle

(c) Error of Commission

(d) None of the above

Answer:

(c) Error of Commission

49. If a transaction is entered in the subsidiary book but it is not posted in the respective ledger, then it is:

(a) Error of principle .

(b) Error of commission

(c) Partial omission

(d) Complete omission

Answer:

(c) Partial omission

50. Which of the following error shall NOT be disclosed by the Trial Balance?

(a) Error in casting subsidiary book

(b) Error in totalling the Trial Balance

(c) Errors in preparing schedules

(d) Error of duplication

Answer:

(d) Error of duplication

51. Which of the following error shall be disclosed by the Trial Balance?

(a) Error of complete omission

(b) Error of partial omission

(c) Error of duplication

(d) Recording wrong amount in subsidiary books

Answer:

(b) Error of partial omission

52. If a wrong amount is written in the subsidiary book then:

(a) The trial balance will not agree

(b) The trial balance will agree

(c) Both (a) and (b)

(d) None of these

Answer:

(b) The trial balance will agree

53. If a transaction is entered twice in a subsidiary book then:

(a) The trial balance will agree

(b) The trial balance will NOT agree

(c) Both (a) and (b)

(d) None of these

Answer:

(a) The trial balance will agree

54. If there is an error in carrying forward the total of one page to another, then:

(a) The trial balance will NOT agree

(b) The trial balance will agree

(c) Either (a) or (b)

(d) Neither (a) nor (b)

Answer:

(a) The trial balance will NOT agree

55. If a transaction worth ₹ 215 is written as ₹ 251, then it is:

(a) Error of principle

(b) Error of commission

(c) Partial omission

(d) Complete omission

Answer:

(b) Error of commission

56. If there is transposition in figures, then the difference in trial balance will be divisible by:

(a) Nine

(b) Ten

(c) Five

(d) Three

Answer:

(a) Nine

57. Which of the following errors will affect agreement of trial balance?

(a) Repairs on building have been debited to building account.

(b) The total of purchase book is short by ₹ 10

(c) Freight paid on new machinery has been debited to freight account.

(d) Sales of ₹ 500 to Ram has been debited to Shyam’s account.

Answer:

(b) The total of purchase book is short by ₹ 10

- Repairs on building have been debited to building account.

- Freight paid on new machinery has been debited to freight account.

- Sales of ₹ 500 to Ram has been debited to Shyam’s account.

Above, all three entry was not cause of disagreement of Trial Balance as due to these errors the debit side and credit side of trial balance will remain unchanged. The total of purchase book is short by ₹ 10. Only this error will cause disagreement of trial balance as due to this error the total of debit side of trial balance will be short by ₹ 10 than the total of credit side of Trial Balance.

58. After preparing the Trial Balance, the accountant finds that the total of the debit side of Trial Balance is short by ₹ 1,000. This difference will be:

(a) Credited to suspense account

(b) Debited to suspense account

(c) Adjusted to any of account having debit balance

(d) Adjusted to any of account having credit balance

Answer:

(b) Debited to suspense account

When a trial balance does not agree, efforts are made to locate errors and rectify them. However if reason for disagreement of trial balance cannot be found, the only treatment is that difference will be debited or credited to suspense account.

If total of the debit side of Trial Balance is short by ₹ 1,000 the difference will be debited to suspense account.

59. Overcasting of sales book by ₹ 1,000 is a type of:

(a) One sided error

(b) Two sided error

(c) Compensating error

(d) Error of principle

Answer:

(a) One sided error

Overcasting of sales book by ₹ 1,000 is a type of one sided error because due to this error only credit side of trial balance will be increased by ₹ 1,000 and debit side of trial balance will remain unchanged.

60. Which one of the following is correct about errors?

(a) Errors always have impact on profits

(b) Errors do not have any impact on profits

(c) Errors may or may not have impact on profits

(d) Errors always lead to decrease in profit.

Answer:

(c) Errors may or may not have impact on profits

Unintentional omission or commission or amounts and accounts in the process of recording the transactions are commonly known as errors. Errors may occur as a result of mathematical mistakes, mistakes in applying accounting policies, misinterpretation of facts, or oversight.

Thus, errors may or may not have impact an profits.

61. Whitewash charges of building ₹ 500 have been wrongly debited to building account. It is an example of:

(a) Compensating error

(b) Error of principle

(c) Error of omission

(d) Error of commission

Answer:

(b) Error of principle

Whitewash charges of building is a revenue expenditure and it will be debited to profit and loss A/c. If any amount is debited to building A/c, it will be treated as capital expenditure.

So, ‘whitewash charges of building ₹ 500 have been debited to building account’ is an error of principle.

62. If the effect of an error is cancelled by the effect of some other errors, the errors are known as:

(a) Error of principle

(b) Compensating Error

(c) Error of omission

(d) Error of commission

Answer:

(b) Compensating Error

If the effect of an error is cancelled by the effect of some other error, the trial balance will naturally agree. Thus these type of errors are known as Compensating Error.

63. Which of the following errors will cause the disagreement of Trial Balance?

(a) ₹ 821 received from Ravi has been debited to Kavi

(b) A purchase of ₹ 281 from Sanju has been debited to his account as ₹ 281

(c) An invoice for ₹ 480 is. entered in the Sales Book as ₹ 840

(d) All of the above.

Answer:

(c) An invoice for ₹ 480 is. entered in the Sales Book as ₹ 840

An invoice of ₹ 480 is entered in the sales book as ₹ 840. This error was not cause the disagreement of Trial balance as due to this error the sales a/c will be credited by ₹ 840 and debtor a/c will be debited by ₹ 840 and hence the trial balance will match.

64. Error of principle will not permit:

(a) Correct total of the balance sheet

(b) Correct total of the trial balance

(c) The trial balance to agree

(d) None of the above.

Answer:

(d) None of the above.

Error of principle has no impact on the agreement of trial balance and even after this error the trial balance agrees and hence balance sheet will also be totalled correctly.

Hence, answer is none of the above.

65. Which of the following errors is an error of omission ________.

(a) Sale of ₹ 1,000 was recorded in the purchase journal

(b) Salary paid to Mohan and Vikas have been debited to their personal accounts

(c) The total of sales journal has not been posted to the sales account

(d) Repairs to building have been debited to building account.

Answer:

(c) The total of sales journal has not been posted to the sales account

Error of omission means any transaction or entry is completely or partially omitted from the books of accounts. Thus ‘the total of sales journal has not been posted to the sales A/c’ is an error of omission.

66. Which of the following errors are revealed by the trial balance ________.

(a) Errors of principle

(b) Errors of omission

(c) Errors of commission

(d) None of the above.

Answer:

(c) Errors of commission

Due to the errors of commission like

- Wrong casting of subsidiary books

- Posting the wrong amount in the ledger

- Posting an amount on the wrong side

- Wrong balancing of an account.

The Trial Balance will not agree and will thus, the error will be revealed by the Trial Balance.

67. Which of the following errors will result into non-agreement of the trial balance?

(a) Totalling the returns inwards journal as ₹ 11,400 instead of ₹ 12,600

(b) Recording a sales invoice for ₹ 5,600 as t 6,500 in the Sales Journal

(c) Failing to record a purchase invoice for ₹ 54,000 in the Purchases Journal

(d) Recording in the Purchases Journal, an invoice, for acquiring a non-current asset for ₹ 60,000.

Answer:

(a) Totalling the returns inwards journal as ₹ 11,400 instead of ₹ 12,600

“Totaling the return inwards journal as ₹ 11,400 instead of ₹ 12,600 “ is an error of commission means that the return inward account will be posted with wrong amount and this mistake will be reflected in the Trial Balance as the Trial Balance will not agree.

68. ₹ 1,000 was paid as rent to the landlord Krishna. This amount was debited to Krishna’s personal account. This error will ________.

(a) Affect agreement of the trial balance.

(b) Not affect agreement of the trial balance

(c) Affect the suspense account

(d) None of the above.

Answer:

(b) Not affect agreement of the trial balance

₹ 1,000 was paid as rent to the landlord, Krishna. This amount was debited to Krishna’s personal account. This error is a error of principle. Since error of principle does not affect agreement of trial balance, therefore option (b) is right.

69. If Sales is done and by mistake A’s account is transferred to Purchase A/c in such a case which accounts are affected?

(a) Purchase a/c

(b) A’s a/c

(c) Both (a) and (b)

(d) None of the above.

Answer:

(c) Both (a) and (b)

If sale is done to A, the accounting entry will be-

A’s A/c Dr.

To Sales A/c

In the given question, accounting entry passed

Purchases A/c Dr.

To Sales A/c.

The rectifying entry for the same will be-

To Purchases A/c

Hence, it affects both, Purchases A/c and A’s A/c.

70. The credit side of trial balance shows:

(a) Bank

(b) Cash

(c) Equipment

(d) None of the above

Answer:

(d) None of the above

The credit side of trial balance resembles the liabilities & income. Bank cash & equipment are assets & shown on debit side, hence, option (d) is correct.

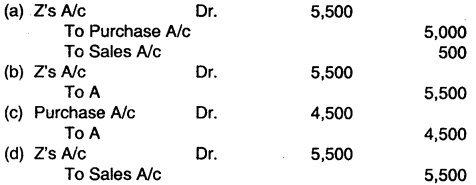

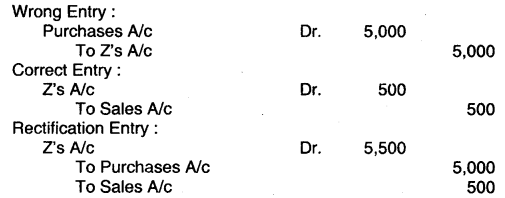

71. A sold goods of ₹ 500/- to Z which is entered in purchase book as 5,000. What will be the entry after rectification?

Answer:

72. “Wrong Casting of subsidiary book” is which type of error?

(a) Error of Omission

(b) Error of Commission

(c) Error of Principle

(d) Compensating Errors.

Answer:

(b) Error of Commission

An error of commission is a type of error committed while recording entries.

Hence, wrong casting of subsidiary book is an error of commission.

73. When two or more errors are committed in such a way that effect of one error is compensated by another error. Which type of error is this?

(a) Error of Commission

(b) Compensating Error

(c) Error of Principle

(d) None of these.

Answer:

(b) Compensating Error

A compensating error is when two or more errors are committed in such a way that the effect of one error is compensated by another error.

Hence option (b) is correct.

74. If there is any error in trial balance which is not effecting its total, will it affect any accounting procedure?

(a) Yes

(b) No

(c) Don’t know

(d) Partly Yes.

Answer:

(b) No

If there is any error in trial balance which is not affecting its total, for example the compensating errors, there will be no effect on accounting procedure.

Hence, option (b) is correct.

75. Which of the following errors are revealed by the trial balance?

(a) Errors in balancing account

(b) Errors of principle

(c) Errors of complete omission

(d) Compensatory Errors

Answer:

(a) Errors in balancing account

Trial balance do not tally when balances which are posted from Ledger A/c differ. Thus errors in balancing accounts are revealed by trial balance.

76. Which type of error is there in trial balance?

(a) Compensating error

(b) Error of Principal

(c) Error of omission/partial omission

(d) All are applicable

Answer:

(c) Error of omission/partial omission

Trial balance in general, discloses any error which affects one side of the account. These errors are disclosed by the trial balance as both sides of trial balance do not agree.

Compensating errors are group of errors, the total effect of which is not reflected in trial balance. Errors of principle do not affect the agreement of trial balance. Errors of omission/partial omission affects the agreement of trial balance.

77. When an entry is passed correctly but on wrong A/c:

(a) Compensating error

(b) Error of commission

(c) Error of principle

(d) Error of omission

Answer:

(b) Error of commission

If the transaction was debited or credited to a wrong account with correct amount and on the correct side in the books of original entry or in the ledger, it is known as error of commission.

78. Which of the following types of errors effect only one account?

(I) Error casting

(II) Errors of carry forward

(III) Error of posting

(a) (I) and (II)

(b) (I) and (III)

(c) (II) and (III)

(d) (I), (II) and (III)

Answer:

(d) (I), (II) and (III)

Trial balance in general, discloses any error which affects one side of the account. These errors are disclosed by the trial balance as both side of trial balance do not agree.

79. Commission received ₹ 2,500 correctly entered in cash book but posted on debit side of commission account, in trial balance:

(a) Debit total will be greater by ₹ 5,000 than the credit total

(b) Credit total will be greater by ₹ 5,000 than the debit total

(c) The credit total will be greater by ₹ 2,500 than the debit total

(d) The debit total will be greater by ₹ 2,500 than the credit total.

Answer:

(d) The debit total will be greater by ₹ 2,500 than the credit total.

If commission received ₹ 2,500 correctly entered in cash book but posted on debit side of commission account in trial balance then debit total will be greater by ₹ 2,500 than the credit total to make a balance.

80. If a credit sale of ₹ 15,400 to Prem has been entered as ₹ 14,500. The journal entry for rectifying the error would be:

(a) Debit Prem A/c 900

Credit Sales A/c 900

(b) Debit Sales A/c 900

Credit Prem A/c 900

(c) Debit Cash A/c 900

Credit Sales A/c 900

(d) Debit Prem A/c 15,400

Credit Sales A/c 15,400

Answer:

(a) Debit Prem A/c 900

Credit Sales A/c 900

If credit sale of ₹ 15,400 to Prem has been entered as ₹ 14,500. The journal entry for rectifying the error would be:

Prem A/c 900

To Sales A/c 900

81. Which of the following is not a Clerical error?

(a) Error of Partial Omission

(b) Error of Commission

(c) Error of Principle

(d) Error of Omission

Answer:

(c) Error of Principle

Errors other than error of principle are clerical error. Clerical Error include:

- Errors of Omission

- Errors of Commission

- Compensating error.

82. Whitewashing charges ₹ 50,000 were debited to building A/c, it is-

(a) Error of omission

(b) Error of commission

(c) Error of principle

(d) Compensating error

Answer:

(c) Error of principle

Error of principles arise because of the failure to differentiate between capital expenditure and revenue expenditure and capital receipts and revenue receipts. The distinction between capital and revenue is of relevance because any incorrect adjustment or allocation in this respect would falsify the final results shown by the profit and loss account and the balance sheet. These errors do not affect the agreement of trial balance. Hence this is the example of error of principles.

83. Suspense A/c is a ________.

(a) Real A/c

(b) Personal A/c

(c) Nominal A/c

(d) None of the above

Answer:

(d) None of the above

A suspense A/c could be a Personal, Real or Nominal A/c depending on the situation. Let us take an example you have received ₹ 5,000 but are not aware from whom and on what account this amount has been received, you can place this amount at the credit of Suspense A/c.

Later if you come to know that it was received from Ramesh, then suspense account is a personal account. Similarly if you come to know that this amount was received against sale of old computer, suspense account is a real account. In case it was received on account of services you have rendered, it is an income account i.e. a nominal account. So suspense account can be of any type.

84. Commission received ₹ 2,500 correctly entered in the cash book but posted to the debit side of commission account. In the Trial Balance:

(a) The credit total will be greater by ₹ 5,000 than the debit total

(b) The debit total will be greater by ₹ 5,000 than the credit total

(c) The Credit total will be greater by ₹ 2,500 than the debit total

(d) The debit total will be greater by ₹ 2,500 than the credit total.

Answer:

(b) The debit total will be greater by ₹ 5,000 than the credit total

Commission received is posted on the wrong side of the Commission A/c. In the Trial Balance the Debit side total will be greater by ₹ 5,000 than Credit side total.

85. An invoice from a supplier of office equipment has been debited to the stationary account. This error is known as:

(a) An error of commission

(b) A compensating error

(c) An error of principal

(d) An error of omission

Answer:

(a) An error of commission

Supplier of office equipment has been debited to Stationery A/c. This is an Error of Compensation.

86. Which of the following errors will not cause the disagreement of trial balance?

(a) ₹ 821 received from Ravi has been debited to Kavi

(b) A purchase of ₹ 281 from Sanju has been debited to his account as ₹281

(c) An invoice for ₹ 480 is entered in the sales book as ₹ 840

(d) All of the above.

Answer:

(a) ₹ 821 received from Ravi has been debited to Kavi

₹ 821 has been received from Ravi has been debited to Kavi is a compensating error but it does not shown in the trial balance and trial balance will be agreed.

87. Error of principle will not permit:

(a) Correct total of the balance sheet

(b) Correct total of the trial balance

(c) The trial balance to agree

(d) None of the above

Answer:

(d) None of the above

Due to error of principle, trial balance will agree, also Balance Sheet will agree and it is not shown in Trial Balance.

88. Charge legal expenses instead of Machinery A/c is an error of:

(a) Principles

(b) Commission

(c) Partial ommission

(d) None of the above.

Answer:

(a) Principles

Legal expenses are expenditure and machinery is an asset. Whenever there is a failure in differentiating between capital expenditure and revenue expenditure, capital receipts and revenue receipts arise and this is known as an Error of Principle. So, option (c) is correct.

89. ₹ 1,000 was paid as rent to the landlord, Krishna. This amount was debited to Krishna’s personal account. This error will:

(a) Affect agreement of the trial balance

(b) Not affect agreement of the trial balance

(c) Affect the suspense account

(d) None of the above

Answer:

(b) Not affect agreement of the trial balance

Since, the error is an error of principle, hence the agreement of the Trial Balance will not be affected.

90. Which of the following errors is on error of omission:

(a) Sale of ₹ 1,000 was recorded in the purchase journal

(b) Salary paid to Mohan and Vikas have been debited to their personal accounts

(c) The total of sales journal has not been posted to the sales account

(d) Repairs to building have been debited to building account

Answer:

(c) The total of sales journal has not been posted to the sales account

Error of omission arise on account of some act of omission on the part of the person responsible for the maintenance of books of account.

Example : Some transaction is entered in the subsidiary book, but is not posted to the ledger. Thus total of sales journal not posted to the sales account is an error of omission.

91. Which of the following errors are revealed by the trail balance:

(a) Errors of principle

(b) Errors of omission

(c) Errors of commission

(d) None of the above

Answer:

(c) Errors of commission

Errors of commission, generally result in disagreement of the trial balance and hence are reflected by it.

92. Which of the following errors will result into non-agreement of the trial balance?

(a) Totalling the returns inwards journal as ₹ 11,400 instead of ₹ 12,600

(b) Recording a sales invoice for ₹ 5,600 as ₹ 6,500 in the sales journal

(c) Failing to record a purchase invoice for ₹ 54,000 in the purchases journal

(d) Recording in the purchases journal, an invoice for acquiring a non-current assets, for ₹ 60,000

Answer:

(a) Totalling the returns inwards journal as ₹ 11,400 instead of ₹ 12,600

Totalling the returns inward journal as 11,40.0 instead of ₹ 12,600 will affect the agreement of trial balance, as Debit and Credit amounts in ledger will be different.