Standard Costing – CA Final SCMPE Study Material is designed strictly as per the latest syllabus and exam pattern.

Standard Costing – CA Final SCMPE Study Material

Question 1.

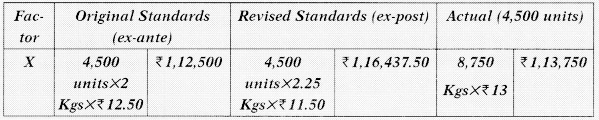

(Traditional, Planning and Operational Variance)

Required:

Calculate Traditional Variances, Operational Variances, Planning Variance

Answer:

Traditional Variances:

Usage Variance = (9,000 Kgs. – 8,750 Kgs.) × ₹ 12.50

= ₹ 3,125 (F)

Price Variance = (₹ 12.50 – ₹ 13.00) × 8,750 Kgs.

= ₹ 4,375 (A)

Total Variance = ₹ 3,125(F) + ₹ 4,375 (A)

= ₹ 1,250 (A)

Operational Variances:

Usage Variance = (10,125 Kgs. – 8,750 Kgs.) × ₹ 11.50

= ₹ 15,812.50 (F)

Price Variance = (₹ 11.50 – ₹ 13) × 8,750 Kgs.

= ₹ 13,125 (A)

Total Variance = ₹ 15,812.50 (F) + ₹ 13,125 (A)

= ₹ 2,687.50 (F)

Planning Variances:

Usage Variance = (9,000 Kgs. – 10,125 Kgs.) × ₹ 12.50

= ₹ 14,062.50 (A)

Price Variance = (₹ 12.50 11.50) × 10,125 Kgs.

= ₹ 10,125 (F)

Total Variance = ₹ 14,062.50 (A) + ₹ 10,125 (F)

= ₹ 3,937.50 (A)

![]()

Question 2.

(Revising the budget)

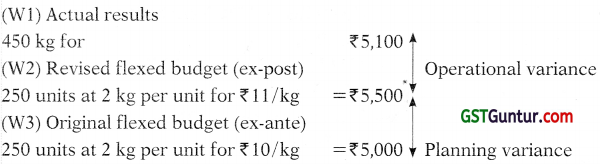

Roshan Co. manufactures Stopers which it is estimated require 2 kg of material LMN at ₹ 10/kg. In week 21 Budget is to produce 250 Stoppers. 450 kg of LMN were purchased and used in the week at a total cost of ₹ 5,100. Later it was found that the standard had failed to allow for a 10% price increase throughout the material supplier’s industry. Roshan Co carries no stocks.

Required: Analyse the Planning and Operational Variance

Answer:

Planning and operational analysis

The first step in the analysis is to calculate:

(1) Actual Results

(2) Revised flexed budget (ex-post).

(3) Original flexed budget (ex-ante).

Question 3.

(Original and Revised Flexed Budgets)

Revising the budget A transport business makes a particular journey regularly, and has established that the standard fuel cost for each journey is 20 litres of fuel at ₹ 2 per litre. New legislation has forced a change in the vehicle used for the journey and an unexpected rise in fuel costs. It is decided retrospectively that the standard cost per journey should have been 18 litres at ₹ 2.50 per litre.

Required: Calculate the original and revised flexed budgets if the journey is made 120 times in the period.

Answer:

Original flexed budget:

120 × 20 × ₹2 = ₹ 4,800

Revised flexed budget:

120 × 18 × ₹ 2.50 = ₹ 5,400

Question 4.

(Planning and Operational Variance of Material Price and

Usage Variance)

(i) In the case of Material Purchase Price Variance, suppose the standard Price of Raw Material determined was ₹ 5.00 per unit, there is economic depression worldwide, so the price of raw material was estimated to change to ₹ 5.20.

the General Market Price per unit at the time of purchase was ₹ 5.18 on the purchase of sat 10.000 units of Ra w Material.

(ii) In the case of material Usage Variance, suppose the Standard Quantity per unit be 5 Kgs., Actual Production units be 250 and Actual Quantity of Material uses is 1,450kgs. Standard Cost of material per Kg. was ₹ 1. Because of shortage of Skilled Labour it was felt necessary to use Unskilled labour and that increased Material Usage by 20%. The variances to be computer to deal with the current environmental conditions will be:

Required:

Calculate Panning and operational Variance of Material Purchase Price Variance and Material Purchase Usage Variance.

Answer:

In this case the variances to be computed should be:

(i) Material Purchase Price Variance

Planning Variance:

= (Standard Price p.u – General market Price p.u.) × Actual Quantity Purchased

= (₹ 5.00 – ₹ 5.20) × 10,000 units = ₹ 2,000 (A)

Uncontrollable

Operational Variance:

= (General Market Price p.u. – Actual Price Paid p.u.) × Actual Quantity Purchased

= (₹ 5.20 – ₹ 5.18) × 10,000 units

= ₹ 200(F)

(ii) Material Usage Variance

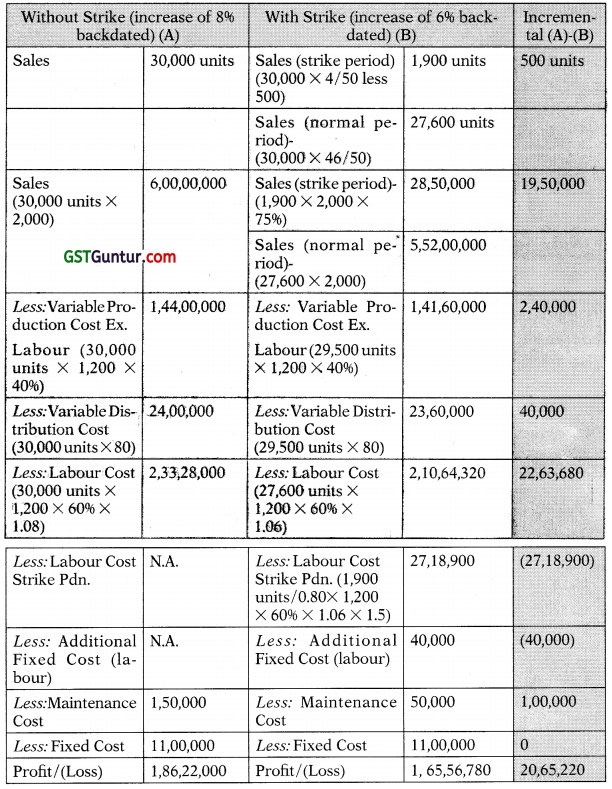

Planning Variance*:

= (Original Std. Quantity in Kgs – Revised Std.) × Standard Price per Kg.

= (1,250 Kgs. – 1,500 Kgs) × ₹ 1

= ₹ 250 (A)

uncontrollable

Operational Variance (Controllable):

= (Revised Standard t Quantity in Kgs. – Actual Quantity Uses in Kgs.) × Std. Price per Kg.

= (1,500Kgs. – 1,450Kgs.) × ₹ 1 = Rs. 50(F)

![]()

Question 5.

(Planning and Operational Variance of Material Price and Usage Variance)

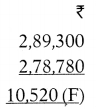

PWP company is manufacturing and selling a product ‘X’ in the market. Product ‘X’ requires product ‘D’ as an input raw material. The y Raw material ‘D’ had a standard direct material cost in the budget of 1 kg of material D @ ₹ 10 per kg which is ₹ 40 per unit of product ‘x’ manufactured.

Due to domestic riot supply of material to the market has disrupted, the average market price for Material D during the period was 11 per kg, and it was decided by the management of the company to revise the material standard cost to allow for this.

During this period company has manufactured 6,000 units of product X. They required 26,300 kg of Material D, which cost ₹ 2,78,780. For the purpose of further analysis company has appointed an expert.

Required ; Calculate:

(i) the material price planning variance

(ii) the material price operational variance and usage operational variance

Answer:

(i) The original standard cost was 4kg × ₹ 10 = ₹ 40,

The revised standard cost is 4kg × ₹ 11 = ₹ 44.

Material price planning variance

This is the difference between the original standard price for Material D and the revised standard price.

| ₹ per kg | |

| Original standard price | 10.00 |

| Revised standard price | 11.00 |

| Material price planning variance | 1.00 (A) |

The planning variance is adverse because the change in the standard price increases the material cost and this will result in lower profit.

The material price planning variance is converted into a total money amount by multiplying the planning variance per kg of material by the actual quantity of materials used.

Material price planning variance = 26,300 kg × ₹ 1.00 (A) = ₹ 26,300 (A).

(ii) Material price operational variance

This compares the actual price per kg of material with the revised standard price. It is calculated using the actual quantity of materials used.

26,300 kg of Material should cost(revised standard ₹ 11) = 2,89,300

They did cost = 2,78,780

Material price operational variance = 10,520 (F)

Material usage operational variance:

This variance is calculated by comparing the actual material usage with the standard usage in the revised standard, and then it is converted into a money value by applying the original standard price for the materials.

| kg of D | |

| 6,000 units of Product × should use (4kg) | 24,000 |

| They did us | 26.300 |

| Material usage (operational) variance in kg of D | 2,300 (A) |

| Original standard price per kg of Material D | ₹ 10.00 |

| Material usage (operational) variance in | ₹ 23,000 (A) |

The variances may be summarised as follows:

![]()

Question 6.

(Planning and Operational Variance)

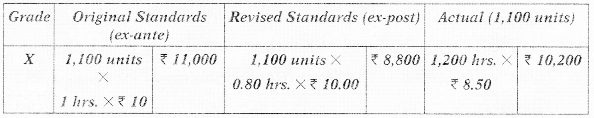

HDR Ltd produces units and incurs labour costs. A change in technology after the preparation of the budget resulted in a 25% increase in standard labour efficiency, such that it is now possible to produce 10 units instead of 8 units using 8 hours of labour-giving a revised standard labour requirement of 0.80 hours per unit. Details of actuals and budgeted for period XII are:

Required

(i) CALCULATE the variances for ‘X’ by

(a) Traditional Variance Analysis; and

(b) An approach which distinguishes between Planning and Operational Variances.

(ii) COMMENT on the results.

Answer:

(i) (a) Traditional Variances

Efficiency Variance = (1,100 hrs. – 1,200 hrs.) × ₹ 10

= ₹ 1,000 (A)

Rate Variance = (₹ 10 – ₹ 8.50) × 1,200 hrs.

= ₹ 1,800 (F)

Total Variance = ₹ 1,000 (A) + ₹ 1,800 (F) = ₹ 800 (F)

(b) Operational Variances

Efficiency Variance = (880 hrs. – 1,200 hrs.) × ₹ 10.00

= ₹ 3,200 (A)

Rate Variance = (₹ 10.00 – ₹ 8.50) × 1,200 hrs.

= ₹ 1,800 (F)

Total Variance = ₹ 3,200 (A) + ₹ 1,800 (F) = ₹ 1,400 (A)

Planning Variances

Efficiency Variance = (1,100 hrs. – 880 hrs.) × ₹ 10 = ₹ 2,200 (F)

Rate Variance = (₹ 10 – ₹ 10) × 800 hrs.

= ₹ 0

Total Variance = ₹ 2,200 (F) + ₹ 0 = ₹ 2,200 (F)

(ii) Comment

In this case, the separation of the labour cost variance into operational and planning components shows a large problem in the area of labour efficiency than might otherwise have been indicated. The operational variances are based on the revised (ex-post) standard and this gives a more meaningful performance benchmark than the original (ex-ante) standard.

Question 7.

(Planning and Operational Variance)

Managing Director of Petro-KL Ltd (PTKLL) thinks that Standard Costing has little to offer in the reporting of material variances due to frequently change in price of materials.

PTKLL can utilize one of two equally suitable raw materials and always plan to utilize the raw material which will lead to cheapest total production costs. However, PTKLL is frequently trapped by price changes and the material actually used often provides, after the event, to have been more expensive than the alternative which was originally rejected.

During last accounting period, to produce a unit of ‘P’ PTKLL could use either 2.50 Kg of ‘PG’ or 2.50 kg of ‘PD’. PTKLL planned to use ‘PG’ as it appeared it would be cheaper of the two and plans were based on a cost of ‘PG’of ₹ 1.50 per Kg. Due to market movements,

the actual prices changed and if PTKLL had purchased efficiently the cost would have been:

‘PG’ ₹2.25per Kg;

‘PD’ ₹2.00 per Kg

Production of ‘P’was 1,000 units and usage of ‘PG’amounted to 2,700 Kg at a total cost of t 6,480/-

Required

CALCULATE the material variance for ‘P’ by:

(i) Traditional Variance Analysis; and

(ii) An approach which distinguishes between Planning and Operational Variances. (10 Marks) [March 2019 MTP]

Answer:

(i) Traditional Variances (Actual Vs Original Budget)

Usage Variance = (2,500 Kg – 2,700 Kg) × ₹ 1.50

= ₹ 300(A)

Price Variance = (₹ 1.50 – ₹ 2.40) × 2,700 Kg

= ₹ 2,430 (A)

Total Variance = ₹ 300 (A) + ₹ 2,430 (A)

= ₹ 2,730 (A)

(ii) Operational Variances (Actual Vs Revised)

Usage Variance = (2,500 Kg – 2,700 Kg) × ₹ 2.25

= ₹ 450 (A)

Proce Variance = (₹ 2.25 – ₹ 2.40) × 2,700 Kg

= ₹ 405 (A)

Total Variance = ₹ 450 (A) + ₹ 405 (A)

= ₹ 855(A)

Planning Variances ‘

Controllable Variance = (₹2.00 – ₹2.25) × 2,500 Kg

= 625 (A)

Uncontrollable Variance = (₹ 1.50 – ₹2.00) × 2,500 Kg

= 1,250 (A)

Total Variance = ₹ 625 (A) + ₹ 1,250 (A)

= ₹ 1,875 (A)

Traditional Variance = Operational Variance + Planning Variance

Reconciliation

= ₹ 855 (A) + ₹ 1,875 (A)

= ₹ 2,730 (A)

![]()

Question 8:

(Planning and Operational Variance)

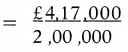

GRV is a chemical processing company that produces sprays used by farmers to protect their crops. One of these sprays ‘Agrofresh ’ is made by using either chemical A or chemical B. To produce one litre of Agrofresh spray they have the option to use either 12 litres of chemical A or 12 litres of chemical B. During the financial year, the purchase department of GRV has planned to use chemical B as it appeared that it would be the cheaper of the two and their plans were based on a cost of chemical B of ₹ 15 per litre.

Due to subsequent market movement during the year the actual prices changed and if the concerned department had purchased efficiently, the cost would have been

| Chemical A | ₹ 15.40 per litre |

| Chemical B | ₹ 16.00 per litre |

Production of Agrofresh spray was 1,000 litres and the usage of chemical B was 12,800 litres at a cost of ₹ 2,09,920.

You are the CEO of GRV and the Management Accountant has sent to you the following :

“I feel that in our particular circumstances the traditional approach to variance analysis is of little use as for some of our products we can utilize one of several equally suitable chemicals and we always plan to use such chemical which will lead to cheapest production costs. How’ever due to sharp market movements, we are frequently trapped by the sharp price changes which lead to the choice of expensive alternative at the end”

To check the reality in the content of the mail your CEO asked you, the cost accountant of the company:

(i) CALCULATE the material variance of Agi o Fresh by using

– Traditional Variance Analysis

– Planning and operational Variances (6 Marks)

(ii) ANALYSE how planning and operational variance approached the variances (2 Marks)

(iii) ANALYSE how the advanced variances at e useful to your organization (2 Marks) [May 2019 Exam]

Answer:

(i) Traditional Variances

Usage Variance = (12,000 It. – 12,800 It.) ₹ ₹ 15.00

= ₹ 12,000 (A)

Price Variance = (₹ 15.00 – ₹ 16.40) ₹ 12,800 It.

= ₹ 17,920 (A)

Total Variance = ₹ 12,000 (A) + ₹ 17,920 (A)

= ₹ 29,920 (A)

Operational Variances

Usage Variance = (12,000 1t. – 12,800 1t.) ₹₹ 16.00

= ₹ 12,800 (A)

Price Variance = (₹ 16.00 – ₹ 16.40) ₹ 12,800 It.

= ₹ 5,120 (A)

Total Variance = ₹ 12,800 (A) + ₹ 5,120 (A) = ₹ 17,920 (A)

Planning Variances

Controllable Variance = (₹ 15.40 – ₹ 16.00) ₹ 12,000 lt.

= ₹ 7,200 (A)

Uncontrollable Variance = (₹ 15.00 – ₹ 15.40) ₹ 12,000 lt.

= ₹ 4,800 (A)

Total Variance = ₹ 7,200 (A) + ₹ 4, 800 (A)

= ₹ 12,000 (A)

Reconciliation = ₹ 17,920 (A) + ₹ 12,000 (A) = ₹ 29,920 (A)

Direct Material Usage Operational Variance using Standard Price, and the Direct Material Price Planning Variance based on Actual Quantity can also be calculated. This approach reconciles the Direct Material Price Variance and Direct Material Usage Variance calculated in part.

(ii) Traditional variance analysis is applied based on the assumption that whole of the variance is due to operational deficiencies and the planning associated with setting the original standard is perfectly correct. But this assumption is not practical. When the conditions are volatile and dynamic, traditional variances need to be analysed into planning and operational variances. Planning variances try to explain the extent to which the original standard needs to be adjusted to reflect changes in operating conditions between the current situation and that imagined when the standard was originally derived. Planning variances are generally not controllable and may need to revise to cater the changes due to environmental/technological changes at a later stage. In certain situation planning variances can be considered controllable as well. Whereas operational variances explain the extent to which adjusted standards have been achieved. Operational variances are calculated after the planning variances have been established and are thus a realistic way of assessing performance. So, it Indicates a reality check of traditional variance analysis.

In GRV, as per traditional approach total variances are ₹ 29,920 (adverse), out of which ₹ 17,920 (adverse) accounts for total operational variance and ₹ 12,000 (adverse) is for total planning variance. It is necessary to analyse planning variances further. The planning variance of ₹ 12,000 (adverse) can be divided into an uncontrollable adverse variance of ₹ 4,800 and a controllable adverse variance of t 7,200. Similarly, total operational variance can be sub-classified as adverse price variance of ₹ 5,120 and adverse usage variance of ₹ 12,800. This analysis gives a clearer indication of the inefficiency of the purchasing function by the concerned department. Performance of the staff of the purchasing department should be evaluated/rewarded/based on variances which are controllable. If an adverse uncontrollable variance of ₹ 4,800 is reported in the performance reports this is likely to lead to dysfunctional motivation effects to the purchase department.

(iii) In today’s cutthroat competition managers must react quickly and accurately to the changes in technology, price fluctuation, consumer tastes, laws and regulations, economic conditions, political conditions, and international conditions etc. which are changing rapidly and dramatically. Accordingly, management accountant should be able to provide necessary inputs by a proper analysis of the things that pertains to his/her area like effect of changes in price. The unique features of advanced variance analysis are that, it considers different market conditions and changes in the dynamic environment.

Moreover, advanced variances classify variances into controllable and uncontrollable variances and helps the management to find out reasons for adverse variances so that corrective action can be taken. Similarly, if any adverse variances have arrived, because of changes in the market condition like inflation, it has to be differentiated from the other variances.

GRV is a type of organization where management of performance can be done only through advanced variance analysis. Advanced variance analysis of GRV shows that it has adverse planning variance as well as adverse operational variance. Further, the emergence of controllable and uncontrollable variances makes it a perfect case of advance variance analysis in GRV. In GRV, sharp price changes which lead to the choice of expensive alternative and efficiency of purchase department need to be analyzed, reported, and dealt separately by the joint effort of the management accountant and the top management. Hence, advanced variance analysis in GRV is an absolute necessity.

![]()

Question 9.

(Planning and Operational Variance)

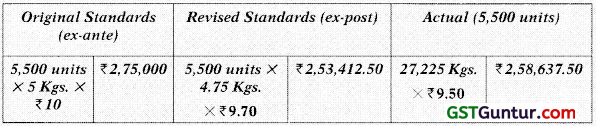

Ski Slope had planned, when it originally designed its budget, to buy its artificial ice for ₹ 10/per kg. However, due to subsequent innovations in technology, producers slashed their prices to ₹ 9.70 per kg. and this figure is now considered to be a general market price for the purpose of performance assessment for the budget period. The actual price paid was ₹ 9.50, as the Ski Slope procurement department negotiated strongly for a better price. The other information relating to that period were as follows:

Required

(i) Calculate the variance for ice by

(a) Traditional Variance analysis; and

(b) An approach which distinguishes between planning and operational Variance

(ii) INTERPRET the result [May 2019 RTP]

Answer:

(i) (a) Traditional Variances

Usage Variance = (27,500 Kgs. – 27,225 Kgs.) × ₹ 10

= ₹ 2,750 (F)

Price Variance = (₹ 10 – ₹ 9.50) × 27,225 Kgs.

= ₹ 13,612.50 (F)

Total Variance = ₹ 2,750 (F) + ₹ 13,612.50 (F)

= ₹ 16,362.50 (F)

(b) Operational Variances

Usage Variance = (26,125 Kgs. – 27,225 Kgs.) × ₹ 9.70

= ₹ 10,670 (A)

Price Variance = (₹ 9.70 – ₹ 9.50) × 27,225 Kgs.

= ₹ 5,445 (F)

Total Variance = ₹ 10,670 (A) + ₹ 5,445 (F)

= ₹ 5,225 (A)

Planning Variances

Usage Variance = (27,500 Kgs. – 26,125 Kgs.) × ₹ 10

= 13,750 (F)

Price Variance = (₹ 10 – ₹ 9.70) × 26,125 Kgs.

= ₹ 7,837.50 (F)

Total Variance = ₹ 13,750 (F) + ₹ 7,837.5O (F)

= 21,587.50 (F)

(ii) Interpretation

It is important to note that an innovation in technology is outside the control of Ski Slope and is, by nature, a planning ‘error’. Equally, the better negotiation of a price should be recognized as an operational matter. Operational variances are self- evidently under the control of operational management, so operational efficiency must be assessed with only these figures in mind. The material procurement department has clearly done well by negotiating a price reduction beyond the market dip. One might question the quality of the ice, as the usage variance is adverse (possibly the ice fails to cover the field and so more is required). Obviously, the favourable price variance is mailer than the adverse usage variance, thus, overall performance is quite poor. A supervisor cannot assess variances in isolation from each other.

![]()

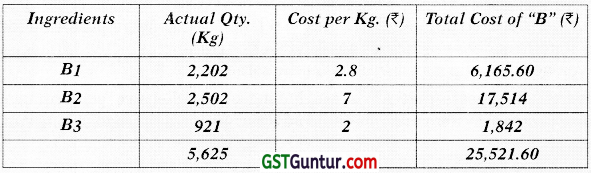

Question 10.

(Planning & Operational Variance)

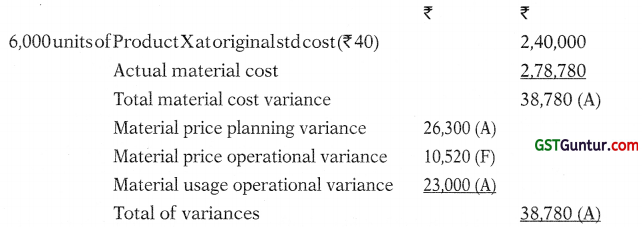

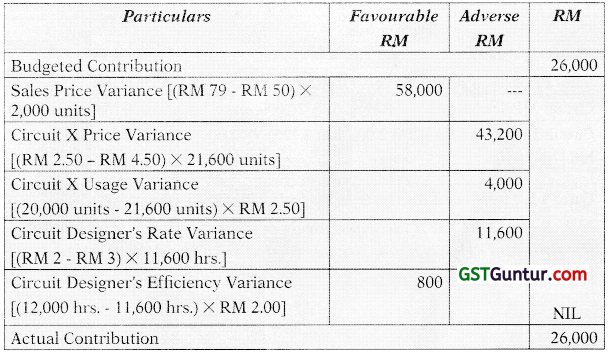

KONY Ltd., based in Kuala Lumpur, is the Malaysian subsidiary of Japan’s NY corporation, headquartered in Tokyo. KONY’s principal Malaysian businesses include marketing, sales, and after-sales service of electronic products & software exports products. KONY set up a new factory in Penang to manufacture and sell integrated circuit ‘Q50X-N’. The first quarter’s budgeted production and sales were 2,000units. The budgeted sales price and standard costs for ‘Q50X-N’ were as follows:

| RM | RM | |

| Standard Sales Price per unit | 50 | |

| Standard Costs per unit | ||

| Circuit X (10 units @ RM 2.5) | 25 | |

| Circuit Designers (6 hrs. @ RM 2) | 12 | (37) |

| Standard Contribution per unit | 13 |

Actual results for the first quarter were as follows:

| RM’000 | RM’000 | |

| Sales (2,000 units) | 158 | |

| Production Costs (2,000 units) | ||

| Circuit X (21,600 units) | 97.20 | |

| Circuit Designers (11,600 hours) | 34.80 | (132) |

| Actual Contribution (2,000 units) | 26 |

The management accountant made the following observations on the actual results-

“In total, the performance agreed with budget; however, in eveiy aspect other than volume, there were huge differences. Sales were made at what was supposed to be the highest feasible price, but we now feel that we I could have sold for RM82.50 with no adverse effect on volume. The Circuit X cost that was anticipated at the time the budget was prepared was RM 2.5 per unit. However, the general market price relating to efficient purchases of the Circuit X during the quarter was RM 4.25 per unit. Circuit designers have the responsibility of designing electronic circuits that make up electrical systems. Circuit Designer’s costs rose dramatically with increased demand for the specialist skills required to produce the ‘Q50X-N’, and the general market rate was RM 3.125 per hour – although KONY always paid below the normal market rate whenever possible. In my opinion, it is not necessary to measure the first quarter’s performance through variance analysis. Further, our operations are fully efficient as the final contribution is equal to the original budget. ”

Required

COMMENT on management accountant’s view. [MAY 2020 RTP]

Answer:

Comment

As the management accountant states, and the analysis (W.N.1) presents, the overall variance for the KONI is nil. The cumulative adverse variances exactly offset the favourable variances i.e. sales price variance and circuit designer’s efficiency variance. However, this traditional analysis does not clearly show the efficiency with which the KONI operated during the quarter, as it is difficult to say whether some of the variances arose from the use of incorrect standards, or whether they were due to efficient or inefficient application of those standards.

In order to determine this, a revised expost plan should be required, setting out the standards that, with hindsight, should have been in operation during the quarter. These revised ex-post standards are presented in W.N.2.

As seen from W.N.3, on the cost side, the circuit designer’s rate variance has changed from adverse to favourable, and the price variance for component X, while remaining adverse, is significantly reduced in comparison to that calculated under the traditional analysis (W.N.l); on the sales side, sales price variance, which was particularly large and favourable in the traditional analysis (W.N.l), is changed into an adverse variance in the revised approach, reflecting the fact that the KONI failed to sell at prices that were actually available in the market.

Further, variances arose from changes in factors external to the business (W.N .4), which might not have been known or acknowledged by standard-setters at the time of planning are beyond the control of the operational managers. The distinction between variances is necessary to gain a realistic measure of operational efficiency.

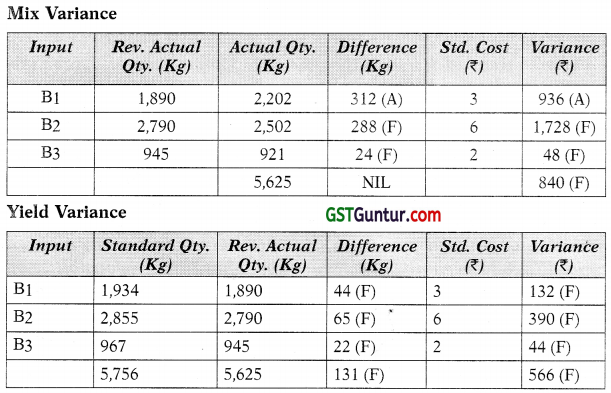

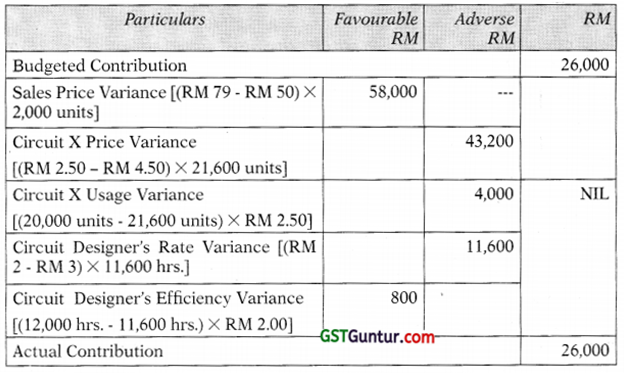

W.N.l

KONY India Ltd.

Quarter-1

Operating Statement

W.N.2

Statement Showing Original Standards, Revised Standards, and Actual Results for Quarter 1

Original Standards (ex-ante) Revised Standards (ex-post) Actual

Sales 2,000 units X RM 50.00 RM

1,00,000 2,000 units X RM 82.50 RM

1,65,000 2,000 units X RM 79.00 RM

1,58,000

Circuit

X 20,000 unit s X RM 2.50 RM 50.000 20,000 units X RM 4.25 RM 85,000 21.600 units X RM 4.50 RM 97,200

Circuit

Designer 12,000 hrs. X RM 2.00 RM 24,000 12,000 hrs. X RM 3.125 RM .37,500 11,600 hrs. X RM 3.00 RM 34,800

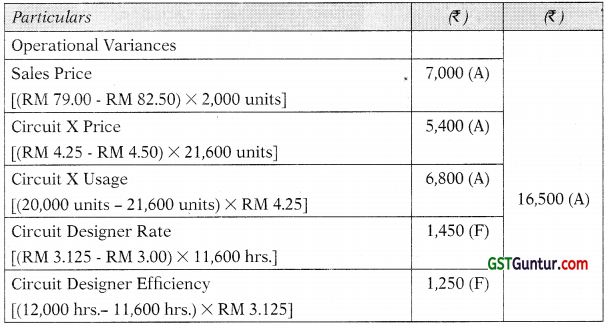

W.N.3

Statement Showing Operational Variances

| Particulars | (₹) | (₹) |

| Operational Variances |

16,500 (A) |

|

| Sales Price [(RM 79.00 – RM 82.50) × 2,000 units] | 7,000 (A) | |

| Circuit × Price [(RM 4.25 – RM 4.50) × 21,600 units] | 5,400 (A) | |

| Circuit × Usage [(20,000 units – 21,600 units) × RM 4.25] | 6,800 (A) | |

| Circuit Designer Rate [(RM 3.125 – RM 3.00) × 11,600 hrs.] | 1,450 (F) | |

| Circuit Designer Efficiency [(12,000 hrs – 11,600 hrs.) × RM 3.125] | 1,250 (F) |

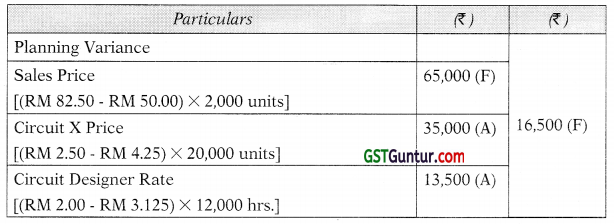

W.N.4

Statement Showing Planning Variances

| Particulars | (₹) | (₹) |

| Planning Variance |

16,500 (F) |

|

| Sales Price [(RM 82.50 – RM 50.00) × 2,000 units] | 65,000 (F) | |

| Circuit X Price [(RM 2.50 – RM 4.25) × 20,000 units] | 35,000 (A) | |

| Circuit Designer Rate [(RM 2.00 – RM 3.125) × 12,000 hrs.] | 13,500 (A) |

![]()

Question 11.

(Variance Analysis in Activity Based Costing)

N & S Co. (NSC) is a multiple product manufacturer. NSC pr oduces the unit and all overheads are associated with the delivery of units to its customers.

| Particulars | Budget | Actual |

| Overheads (₹) | 4,000 | 3,900 |

| Output (units) | 2,000 | 2,100 |

| Customer Deliveries (no.’s) | 20 | 19 |

Required

CALCULATE Efficiency Variance and Expenditure Variance by adopting ABC approach.

Answer:

Computation of Variances

Efficiency Variance = Cost Impact of undertaking activities more/less than standard

= (21 deliveries* – 19 deliveries) × ₹ 200

= ₹ 400 F

(*) \(\left(\frac{20 \text { Deliveries }}{2,000 \text { units }}\right)\) ₹ 2,100 units.

Expenditure Variance = Cost impact of paying more/less than standard for actual activities undertaken

= 19 deliveries × ₹ 200 – ₹ 3,900

= ₹ 100 (A)

Question 12.

(Variance Analysis of ABC)

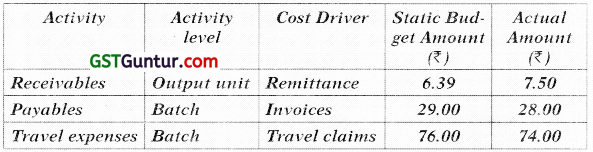

Raju is Chief Financial Officer of Millets, com, an internet company that enables customer to aider for delivery of different millets by accessing its website. Raju is concerned with the efficiency and effectiveness of the financial function. He collects the following information for three finance activities in 2021.

Rate per unit of Cost Driver

The output measure is the number of deliveries which is the same as the number of remittances. The following additional information are also given:

| Budgeted | Actual | |

| Number of deliveries | 10,00,000 | 9,48,000 |

| Delivery Batch size | 5 | 4.468 |

| Travel expenses Batch size | 500 | 501.587 |

Required

CALCULATE the flexible budget variances for 2021 to :

(i) Receivable Activities (2 Marks)

(ii) Payable Activities (4 Marks)

(iii) Travel expense Activities (4 Marks)

(Ignore fractions in all calculations) [May 2019 Exam]

Answer:

Activity-based costing, flexible-budget variances for finance function activities.

(i) Receivables

Receivables is an output unit level activity. Its flexible-budget variance can be calculated as follows:

Flexible Budget Variance = Flexible Budget Costs – Actual Costs

= ₹ 6.39 × 9,48,000 – ₹ 7.50 × 9,48,000

= ₹ 60,57,720 – ₹ 71,10,000

= ₹ 10,52,280 (A)

(ii) Payables

Payables is a batch level activity.

| Static-Budget Amounts | Actual Amounts | |

| Number of deliveries | 10,00,000 | 9,48,000 |

| Batch size (units per batch) | 5 | 4.468 |

| Number of batches (a/b) | 2,00,000 | 2,12,175 |

| Cost per batch | ₹ 29 | ₹ 28 |

| Total payables activity cost (c × d) | ₹ 58,00,000 | ₹ 59,40,900 |

Step 1: The number of batches in which payables should have been processed

= 9,48,000 actual units/5 budgeted units per batch

= 189,600 batches

Step 2: The flexible-budget amount for payables

= 1,89,600 batches × ₹ 29 budgeted cost per batch

= ₹ 54,98,400

The flexible-budget variance can be computed as follows:

Flexible-Budget Variance

= Flexible-Budget Costs – Actual Costs

= 1,89,600 × ₹ 29 – 2,12,175 × ₹ 28

= ₹ 54,98,400 – ₹ 59,40,900

= ₹ 4,42,500 (A)

(iii) Travel Expenses

Travel expenses is a batch level activity.

| Static-Budget Amounts | Actual Amounts | |

| a. Number of deliveries | 10,00,000 | 9,48,000 |

| b. Batch size (units per batch) | 500 | 501.587 |

| c. Number of batches (a/b) | ₹,000 | 1,890 |

| d. Cost per batch | ₹ 76 | ₹ 74 |

| e. Total travel expenses activity cost (c × d) | ₹ 1,52,000 | ₹ 1,39,860 ‘ |

Step 1: The number of batches in which the travel expense should have been processed

= 948,000 actual units/500 budgeted units per batch

= 1,896 batches

Step 2: The flexible-budget amount for travel expenses = 1,896 batches × ₹ 76 budgeted cost per batch

= ₹ 1,44,096

The flexible budget variance can be calculated as follows:

Flexible Budget Variance

= Flexible-Budget Costs – Actual Costs = 1,896 × ₹ 76 – 1,890 × ₹ 74 = ₹ 1,44,096 – ₹ 1,39,860

= ₹ 4,236 (F)

![]()

Question 13.

(Variance analysis of ABC)

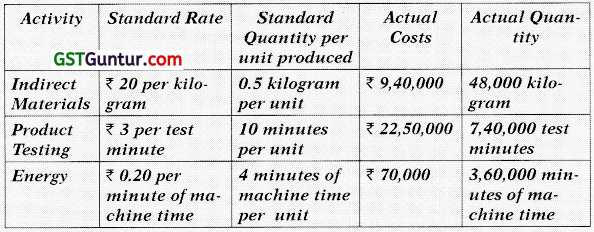

SPS Limited uses activity based costing to allocate variable manufacturing overhead costs to products. The company identified three activities with the following information for last quarter:

Required

(i) CALCULATE variable overhead expenditure variance and variable overhead efficiency variance for each of the activities using activity based costing. Clearly indicate each variance as favourable or unfavourable/adverse. (6 Marks)

(ii) INTERPRET the results of variable overhead efficiency variance as calculated in (i) above in respect of indirect materials and product testing activity. (2 Marks)

(iii) IDENTIFY the variances that should he investigated according to company policy. Show calculations to support your answer.

(2 Marks)

The company produced 80,000 units in the last quarter. Company policy is to investigate all variances above 5% of the flexible budget amount for each activity. [Nov. 2019]

Answer:

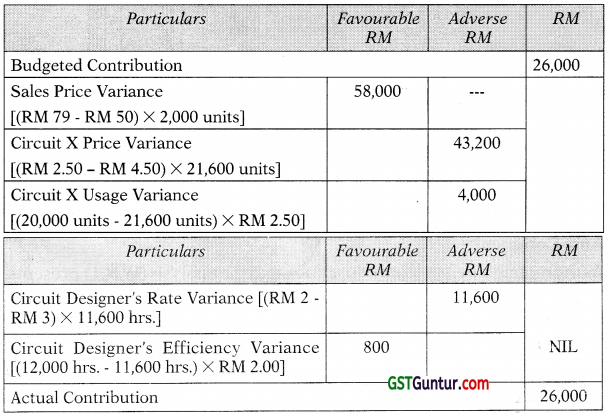

(i) Indirect Materials:

= Cost Impact of undertaking activities more/less than standard

= (0.50kg. × 80,000 units – 48,000 kg.) × ₹ 20

= ₹ 1,60,000 (A)

Expenditure Variance = Cost impact of paying more/less than standard for actual activities under- taken

= 48.000 kg. × ₹ 20 – ₹ 9,40,000

= ₹ 20,000 (F)

Product Testing

Efficiency Variance = Cost Impact of undertaking activities more/less than standard

= (10 mins. × 80,000 units – 7,40,000 mins.) × ₹ 3

= ₹ 1,80,000 (F)

Expenditure Variance = Cost impact of paying more/less than j standard for actual activities under-taken

= 7,40,000 mins × ₹ 3 – ₹ 2,50,000

= ₹ 30,000 (A)

Energy:

Efficiency Variance = Cost Impact of undertaking activities more/less than standard

= (4 mins. × 80,000 units – 3,60,000 mins.) × ₹ 0.20

= ₹ 8,000 (A)

Expenditure Variance = Cost impact of paying more/less than standard for actual activities undertaken

= 3,60,000 mins × ₹ 0.20 – ₹ 70,000

= ₹ 2,000 (F)

(ii) Indirect Materials

SPS actually spent 48,000 kg. or 8,000 kg. more than the standard allows. At a predetermined rate of ₹ 20 per kg., efficiency variance is 1,60,000 (A). Since actual quantity were higher than the standard, the variance is unfavourable. This adverse variance, could have been caused by the inferior quality, result of carelessness handling of materials by production workers or could as a result of change in methods of production, product specifications or the way in which quality of the product is checked or controlled.

Product Testing

Favourable efficiency variance amounting to ₹ 1,80,000 indicates that fewer testing minutes were expended during the quarter than the standard minutes required for the level of actual output. This may be due to employment of a higher skilled labour or improvement of skills of existing workforce through training and development leading to improved productivity etc.

(iii) Flexible Budget

| Indirect Materials | = (0.50 kg. × 80,000 units) × ₹ 20 = ₹ 8,00,000 | = ₹ 8,Q0,000 × 5% = ₹ 40,000 |

| Product Testing | = (10 mins. × 80,000 units) × ₹ 3 = ₹ 24,00,000 | = ₹ 24,00,000 × 5% = ₹ 1,20,000 |

| Energy | = (4 mins. × 80,000) × ₹ 0.20 = ₹ 64,000 | = ₹ 64,000 × 5% = ₹ 3,200 |

Efficiency Variance for all the three activities are more than 5% of their flexible budget amount. So, according to the company policy, efficiency variances should be investigated.

Alternative

Statement Showing Identification of Variances to be investigated

![]()

Question 14.

(Material, Labour Planning & Operational Variance, Variance Analysis of ABC)

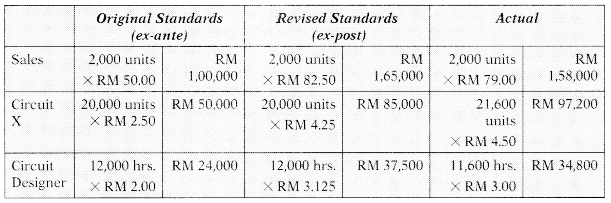

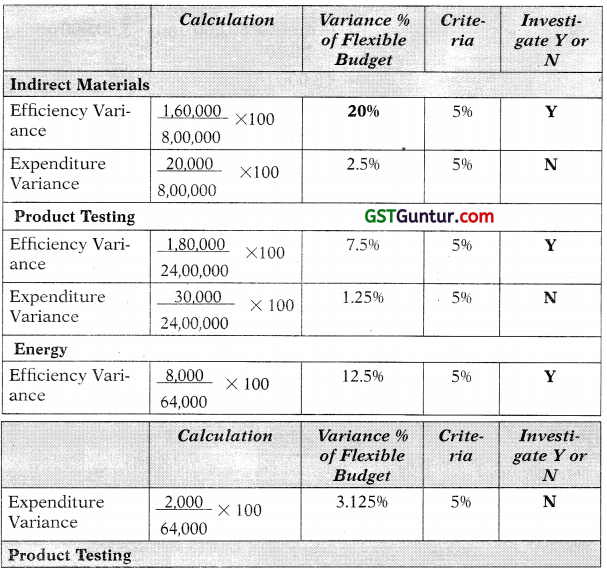

JPY Limited produces a single product. It has recently autotmated part of its manufacturing plant and adopted Total Quality Management (TQM) and Just-in- Time manufacturing system. No inventories are held for material as well as for finished product. The company currently uses standard absorption costing system. Following are related to fourth quarter of 2020-21;

| Budget | Actual | |

| Production and Sales | 1,00,000 units | 1,10,000 units |

| Direct Materials | 2,00,000 kg. @ ₹ 30/kg | 2,50,000 kg. @ ₹ 31.20/kg. |

| Direct Labour Hours | 25,000 hrs. @ ₹300/ hr | 23,000 hrs. @ ₹ 300/ hr. |

| Fixed Production Overhead | ₹ 3,20,000 | ₹ 3,60,000 |

Production overheads are absorbed on the basis of direct labour hours.

The CEO intends to introduce activity based costing system along with TQM and JIT for better cost management. A committee has been formed for this purpose. The committee has further, analysed and classified the production overhead of fourth quarter as follows:

| Budget | Actual | |

| Costs: | ||

| Material Handling | ₹ 96,000 | ₹ 1,24,000 |

| Set Up | ₹ 2,24,000 | ₹ 2,36,000 |

| Activity: | ||

| Material Handling (orders executed) | 8,000 | 8,500 |

| Set Up (production runs) | 2,000 | 2,100 |

Revision of standards relating to fourth quarter were made as below:

| Original Standard | Revised Standard | |

| Material Content per unit | 2 kg | 2 .25 kg |

| Cost of Material | ₹30 per kg | ₹31 per kg |

| Direct Labour Hours | 15 minutes | 12 minutes |

Required

(i) CALCULATE Planning and Operational Variances relating to material price, material usage, labour efficiency, and labour rate.

(ii) CALCULATE overhead expenditure and efficiency variance

using Activity Based Costing principles.

Answer:

(i) Workings

Material

Traditional Variances

Usage Variance = (2,20,000 Kgs. – 2,50,000 Kgs.) × ₹ 30

= ₹ 9,00,000 (A)

Price Variance = (₹ 30.00 – ₹ 31.20) × 2,50,000 Kgs.

= ₹ 3,00,000 (A)

Total Variance = ₹ 9,00,000 (A) + ₹ 3,00,000 (A)

= ₹ 12,00,000 (A)

Planning Variances

Usage Variance = (2,20,0000 Kg. – 2,47,500 Kg.) × ₹ 30

= ₹ 8,25,000 (A)

Price Variance = (₹ 30 – ₹ 31) × 2,47,500 Kgs.

= ₹ 2,47,500 (A)

Total Variance = ₹ 8,25,000 (A) + ₹ 2,47,5000 (A)

= ₹ 10,72,500 (A)

Operational Variances

Usage Variance = (2,47,500 Kg. – 2,50,000 Kg.) × ₹ 31

= ₹ 77,500 (A)

Price Variance = (₹ 31.00 – ₹ 31.20) × 2,50,000 Kg.

= ₹ 50,000 (A)

Total Variance = ₹ 77,500 (A) + ₹ 50,000 (A)

= ₹ 1,27,500 (A)

Direct Material Usage Operational Variance using Standard Price, and the Direct Material Price Planning Variance based on Actual Quantity can also be calculated. This approach reconciles the Direct Material Price Variance and Direct Material Usage Variance calculated in part.

Labour

Traditional Variances

Efficiency Variance = (27,500 hrs. – 23,000 hrs.) × ₹300

= ₹13,50,000 (F)

Rate Variance = (₹300 – ₹300) × 23,000 hrs.

= NIL

Total Variance = ₹ 3,50,000 (F) + NIL

= ₹ 13,50,000 (F)

Planning Variances

Efficiency Variance = (27,500 hrs. – 22,000 hrs.) × ₹ 300

= ₹ 16,50,000 (F)

Rate Variance = (₹ 300 – ₹ 300) × 22,000 hrs.

= NIL

Total Variance = ₹ 16,50,000 (F) + 0

= ₹16,50,000 (F)

Operational Variances =

Efficiency Variance = (22,000 hrs. – 23,000 hrs.) × ₹ 300

= ₹ 3,00,000 (A)

Rate Variance = (₹ 300 – ₹ 300) × 23,000 hrs.

= NIL

Total Variance = ₹ 3,00,000 (A) + 0

= ₹ 3,00,000 (A)

Direct Labour Efficiency Operational Variance using Standard Rate, and the Direct Labour Rate Planning Variance based on Actual Hours can also be calculated. This approach reconciles the Direct Labour Rate Variance and Direct Labour Efficiency Variance calculated in part.

(ii) Material Handling

Efficiency Variance = Cost Impact of undertaking activities more/less than Standard

= (8,800 orders* – 8,500 orders) × ₹ 12

= ₹ 3,600(F)

*(8,000 orders /1,00,000 units) × 1,10,000 units

Expenditure Variance = Cost impact of paying more/less than standard for actual activities undertaken

= 8,500 orders × ₹12 – ₹1,24,000

= ₹22,000 (A)

Setup

Efficiency Variance = Cost Impact of undertaking activities more/ less than standard

= (2,200 runs* – 2,100 runs) × ₹ 112

= ₹ 11,200 (F)

*(2,000 runs/1,00,000 units) × 1,10,000 units

Expenditure Variance = Cost impact of paying more/less than standard for actual activities undertaken

= 2,100 runs × ₹112 – ₹2,36,000

= ₹ 800 (A)

![]()

Question 15.

(Learning Curve Impact on Variance; Life Cycle Costing)

DK International is developing a new product. During its expected life, 16,000 units of the product will be sold for ₹ 102 per unit. Production will be in batches of 1,000 units throughout the life of the product.

The direct labour cost is expected to reduce due to the effects of learning for the first eight batches produced. Thereafter, the direct labour cost will remain constant at the same cost per batch as in the 8th batch.

The direct labour cost of the first batch of 1,000 units is expected to be ₹ 55,000 and a 90% learning effect is expected to occur. The direct material and other non-labour related variable costs will be ₹ 50 per unit throughout the life of the product.

There are no fixed costs that are specific to the product.

The learning index for a 90% learning Curve = – 0.152; 8-0.152 = 0.729; 7-0.152 = 0.744

Required

(i) CALCULATE the expected direct labour cost of the 8*h batch. (3 marks)

(ii) CALCULATE the expected contribution to be earned from the product over its lifetime. (3 marks)

(iii) CALCULATE the rate of learning required to achieve a lifetime product contribution of ₹ 5,00,000, assuming that a constant rate of learning applies throughout the product’s life. (4 marks) [May 2019 Exam]

Answer:

(i) Total Direct Labour Cost for first 8 batches based on learning curve | of 90% (when the direct labour cost for the first batch is ₹ 55,000)

The usual learning curve model is

y = axb

Where

y = Average Direct Labour Cost per batch for x batches

a = Direct Labour Cost for first batch

x = Cumulative No. of batches produced

b = Learning Coefficient/Index

y = ₹ 55,000 × (8)-0.152

= ₹ 55,000 × 0.729

= ₹ 40,095

Total Direct Labour Cost for first 8 batches

= 8 batches × ₹ 40,095

= ₹ 3,20,760

Total Direct Labour Cost for first 7 batches based on learning curve of 90% (when the direct labour cost for the first batch is ₹ 55,000)

y = ₹ 55,000 × (7)-0.152

= ₹ 55,000 × 0.744

= ₹ 40,920

Total Direct Labour Cost for first 7 batches

= 7 batches × ₹ 40,920

= ₹ 2,86,440

Direct Labour Cost for 8th batch

= ₹ 3,20,760 – ₹ 2,86,440

= ₹ 34,320

(ii) Statement Showing “Life Time Expected Contribution”

| Particulars | Amount (₹) |

| Sales (₹ 102 × 16,000 units) | 16,32,000 |

| Less: Direct Material and Other Non Labour Related Variable Costs (₹ 50 × 16,000 units) | 8,00,000 |

| Less: Direct Labour | 5,95,320 |

| Expected Contribution | 2,36,680 |

(*) Total Labour Cost over the Product’s Life

= ₹ 3,20,760 + (8 batches × ₹ 34,320)

= ₹ 5,95,320

(iii) In order to achieve a Profit of ₹ 5,00,000 the Total Direct Labour Cost over the Product’s Lifetime would have to equal ₹ 3,32,000.

Statement Showing “Life Time Direct Labour Cost”

| Particulars | Amount (₹) |

| Sales (₹ 102 × 16,000 units) | 16,32,000 |

| Less: Direct Material and Other Non Labour Related Variable Costs (₹ 50 × 16,000 units) | 8,00,000 |

| Less: Desired Life Time Contribution | 5,00,000 |

| Direct Labour | 3,32,000 |

Average Direct Labour Cost per batch for 16 batches is ₹ 20,750 (₹ 3,32,000/16 batches).

Total Direct Labour Cost for 16 batches based on learning curve of r% (when the direct labour cost for the first batch is ₹ 55,000)

y = ₹ 55,000 × (16)b

₹ 20,750 = ₹ 55,000 × (16)b

0.3773 = (16)b

log 0.3773 = b × log 24

log 0.3773 = b × 4 log 2

log 0.3773 = \(\frac{(\log r)}{(\log 2)}\) × 4 log 2

= log 0.3773 = log r4

0.3773 = r4

r = 40.3773

r = 78.37%

Alternative:

In order to achieve a contribution of ₹ 5,00,000, the total labour cost over the product’s lifetime would have to be ₹ 8,32,000 – ₹ 5,00,000 = ₹ 3,32,000.This equals an average batch cost of ₹ 3,32,000/16 = ₹ 20,750/-. This represents ₹ 20,750/₹ 55,000 = 37.73% of the cost of the first batch.

16 batched represent 4 doublings of output.

Therefore, the rate of learning required = \(\sqrt[4]{0.3773}\) = 78.37%

![]()

Question 16.

(Learning Curve Impact on Variance)

The learning curve as a management accounting has now become or going to become an accepted tool in industry, for its applications are almost unlimited. When it is used correctly, it can lead to increase business and higher profits; when used without proper knowledge, it can lead to lost business and bankruptcy. State precisely:

(i) Your understanding of the learning curve:

(ii) The theory of learning curve;

(iii) The areas where learning curves may assist in management accounting; and

(iv) Illustrate the use of learning curves for calculating the expected average units cost of making.

(a) 4 machines

(b) 8 machines

Using the data below:

Data:

Direct Labour need to make first machine = 1,000 hrs.

Learning curve = 90%

Direct Labour cost = ₹ 15 per hour.

Direct materials cost = ₹ 1,50,000

Fixed cost for either size orders = ₹ 60,000.

Answer:

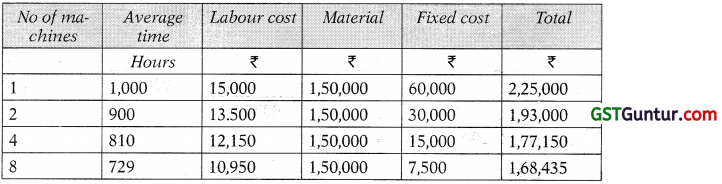

Statement showing computation of cost of making 4 machines & 8 machines:

Average cost of making 4 machines ₹ 1,77,150

Average cost of making 8 machines ₹ 1,68,435

Question 17.

(Learning Curve Impact on Variance)

Z.P.L. C experience difficulty in its budgeting process because it finds it necessary to qualify the learning effect as new products are introduced. Substantial product changes occur and result in the need for retraining. An order for 30 units of a new product has been received by Z.P.L.C So far, 14 have been completed; the first unit required 40 direct labour hours and a total of 240 direct labour has been recorded for the 14 units. The production manager expects an 80% learning effect for this type of work.

The company use standard absorption costing. The direct costs attributed to the centre in which the unit is manufactured and its direct materials costs are as follows:

| ₹ | |

| Direct material | 30.00 per unit |

| Direct Labour | 6.00 per hour |

| Variable overhead | 0.50 per direct labour hour |

| Fixed overhead | 6,000 per four-week operating period. |

There are ten direct employees working a five-day week, eight hours per day. Personal and other downtime allowances account for 25% of total available time.

The company usually quotes a four-week delivery period for orders.

You are required to:

(i) Determine whether the assumption of an 80% learning effect 1 is a reasonable one in this case, by using the standard formula y = axb

Where Y = the cumulative average direct labour time per unit (productivity)

a = the average labour time per unit for the first batch,

x = the cumulative number of batches produced,

b = the index of learning.

(ii) Calculate the number of direct labour hours likely to be required for an expected second order of 20 units.

(iii) Use the cost data given to produce an estimated product cost for the initial order, examine the problems which may be created for budgeting by the presence of the learning effect.

Answer:

(i) Total time taken to produce 14 units

Y = ax6

Y = 40(14)-0.322 = 17.14

Total time = 17.14 × 14 = 239.96 = 240 hours

It is true that learning ratio 80% is effective.

(ii) 30 units

Y = 40(30)-0.322 = 13.3 80 hours (Average time)

50 units

Y = 40(50)-0.322 = 1 1.35 hours (Average time)

Total time for 30 units = 13.38 × 30 = 401.4 hours

Total time for 50 units = 11.35 × 50 = 567.5 hours

Time taken for 20 units from 31 to 50 units (567.5 – 401.4) = 166.1 hours

(iii) Man hours = 10 × 8 × 5 × 4 = 1,600

(-) down time = 400.

= 1,200

Fixed Cost per hour = 6,000/1,200 = ₹ 5

Computation of total cost for the initial order

Material (30 × 30) = ₹ 900.0

Labour (401.4 × 6) = ₹ 2408.4

Variable Overheads (0.5 × 401.4) = ₹ 200.7

Fixed Overheads (5 × 401.4) = ₹ 2007.0

Total = ₹ 900.0 + ₹ 2408.4 + ₹ 200.7 + ₹ 2007.0 = ₹ 5516.1

![]()

Question 18.

(Learning Curve Impact on Variance)

A firm received an order to make and supply eight units of standard product which involves intricate labour operations. The first unit was made in 10 hours. It is understood that this type of operations is subject to 80% learning rate. The workers are getting a wages rate of ₹ 12 per hour.

(i) What is the total time and labour cost required to execute the above order?

(ii) If a repeat order of 24 units is also received from the same customer, what is the labour cost necessary for the second order?

Answer:

80% Learning Curve results are given below:

| Production (Units) | Cumulative Average Time (hours) | Total Time (hours) |

| 1 | 10 | 10 |

| 2 | 8 | 16 |

| 4 | 6.4 | 25.6 |

| 8 | 5.12 | 40.96 |

| 16 | 4.096 | 65.54 |

| 32 | 3.2768 | 104.86 |

Labour time required for first eight units = 40.96 hours

Labour cost

required for 8 units = 40.96 hours × ₹ 12/hr = ₹ 491.52

Labour time for 32 units = 104.86 hours

Labour time for first eight units = 40.96 hours

Labour time required for 2nd order for 24 units = 63.90 hours

Labour cost for 24 units = 63.90 hours × ₹ 12/hr = ₹ 766.80

Question 19.

(Learning Curve Impact on Variance)

The usual learning curve model is Y = axb where Y is the average time per unit for x units.

a is the time for first unit

x is the cumulative number of units

b is the learning coefficient and is equal to log 0.8/log 2 = 0.322 of a learning rate of 80%

Given that a = 10 hours and learning rare 80%, you are required to Calculate:

(i) The average time for 20 units.

(ii) The total time for 30 units.

(iii) The time for units 31 to 40.

Given that log 2 = 0.301, Antilog of 0.5811 = 3.812 log 3 = 0.4771, Antilog of 0.5244 = 3.345. log 4 = 0.6021, Antilog of 0.4841 = 3.049.

Answer:

(i) Y = AXb

Y = 10(20)-0.322

Taking log on both sides

Log y = log 10 + log 20(-0.322)

Log y = log 10 – (0.322) log 20

= 1 – (0.322) log 20

= 1-(0.322) × (1.3010)

= 1-0.41892

= 0.5811 1

Logy = 0.5811

Y = Anti log (0.5811) = 3.812 hrs (average time)

(ii) Log y = log 10 + log 30(-0.322)

Logy = 1 – (0.322) × (1.4771)

= 1 – (0.4756) = 0.5244

Y = anti log (0.5244) = 3.345 hrs (average time)

Total time = 3.345 × 30 = 100.35 hrs

(iii) Log y = log 10 + log 40(-0.322)

= 1 – (0.322) × (1.6021)

Log y = 0.4841

Y = anti log (0.4841) = 3.049 hrs

Total time = 40 × 3.049 = 121.96 hrs

Time from 31 to 40 units = 121.96 – (100.35) = 21.61hrs

![]()

Question 20.

(Learning Curve impact on Variance, Reconciliation)

City International Co. is a multiproduct firm and operates standard costing and budgetary control system. During the month of June firm launched a new product. An extract from performance report I prepared by Sr. Accountant is as follows:

| Particulars | Budget | Actual |

| Output | 30 units | 25 units |

| Direct Labour Hours | 180.74 hrs. | 118.08 hrs. |

| Direct Labour Cost | ₹ 1,19,288 | ₹ 79,704 |

Sr. Accountant prepared performance report for new product on certain assumptions but later on he realized that this new product has similarities with other existing product of the company. Accordingly, the rate of learning should be 80% and that the learning would cease after 15 units. Other budget assumptions for the new product remain valid.

The original budget figures are based on the assumption that the labour has learning rate of 90% and learning will cease after 20 units, and thereafter the time per unit will be the same as the time of the final unit during the learning period, i.e. the 20th unit. The time \ taken for 1st unit is 10 hours.

Required

Show the variances that reconcile the actual labour figures with revised budgeted figures (for actual output) in as much detail as possible.

Note:

The learning index values for a 90% and a 80% learning curve are – 0.152 and – 0.322 respectively.

[log 2 = 0.3010, log 3 = 0.47712, log 5 = 0.69897, log 7 = 0.8451, antilog of 0.6213 = 4.181, antilog of 0.63096 = 4.275]

Answer:

Working Note

The usual learning curve model is

y = axb

Where

y = Average time per unit for x units

a = Time required for first unit

x = Cumulative number of units produced

b = Learning co-efficient

W.N.1

Time required for first 15 units based on revised learning curve of 80%

(when the time required for the first unit is 10 hours)

y = 10 × (15)-0.322

log y = log 10 – 0.322 × log 15

log y = log 10 – 0.322 × log (5 × 3)

log y = log 10 – 0.322 × [log 5 + log 3]

log y = 1 – 0.322 × [0.69897 + 0.47712]

log y = 0.6213

y = antilog of 0.6213

y = 4.181 hours

Total time for 15 units = 15 units × 4.181 hours

= 62.72 hours

Time required for 25 units based on revised learning curve of 80%

(when the time required for the first unit is 10 hours)

y = 10 × (14)-0.322

log y = log 10 – 0.322 × log 14

log y = log 10 – 0.322 × log (2 × 7)

log y = log 10 – 0.322 × [log 2 + log 7]

log y = 1 – 0.322 × [0.3010 + 0.8451]

log y = 0.63096

y = antilog of 0.63096

y = 4.275 hrs

Total time for 14 units = 14 units × 4.275 hrs

= 59.85 hrs

Time required for 25 units based on revised learning curve of 80%

(when the time required for the first unit is 10 hours)

Total time for first 15 units = 62.72 hrs

Total time for next 10 units 28.70 hrs + [(62.72 – 59.85) hours × 10 units]

Total time for 25 units = 62.72 hrs + 28.70 hrs

= 91.42 hrs

W.N.2

Computation of Standard and Actual Rate

Standard Rate = \(\frac{₹ 1,19,288}{180.74 \text { hrs. }}\)

= ₹ 660.00 per hr.

Actual Rate = \(\frac{₹ 79,704}{118.08 \mathrm{hrs} .}\)

= ₹ 675.00 Per hour

W.N.3

Computation of Variances

Labour Rate Variance = Actual Hrs × (Std. Rate – Actual Rate)

= 118.08 hrs × (₹ 660.00 – ₹ 675.00)

= ₹ 1,771.20 (A)

Labour Efficiency Variance = Std. Rate × (Std. Hrs – Actual Hrs)

= ₹ 660 × (91.42 hrs – 118.08 hrs)

= ₹ 17,595.60 (A)

Statement of Reconciliation (Actual Figures Vs Budgeted Figures)

| Particulars | ₹ |

| Actual Cost | 79,704.00 |

| Less: Labour Rate Variance (Adverse) | 1,771.20 |

| Less: Labour Efficiency Variance (Adverse) | 17,595.60 |

| Budgeted Labour Cost (Revised)* | 60,337.20 |

Budgeted Labour Cost (Revised)*

= Std. Hrs. × Std. Rate

= 91.42 hrs. × ₹ 660

= ₹ 60,337.20

![]()

Question 21.

(Reconciliation and Analysis of Variances)

Trident Toys Ltd. manufactures a single product and the standard cost system is followed.

Standard cost per unit is worked out as follows:

| ₹ | |

| Materials (10 Kgs. @ ₹ 4 per Kg) | 40 |

| Labour (8 hours @ ₹ 8 per hour) | 64 |

| Variable overheads (8 hours @ ₹ 3 per hour) | 24 |

| Fixed overheads (8 hours @ ₹ 3 per hour) | 24 |

| Standard Profit | 56 |

Overheads are allocated on the basis of direct labour hours. In the month of April 2021, there was no difference between the budgeted and actual selling price and there were no opening or closing stock during the period.

The other details for the month of April, 2021 are as under

| Budgeted | Actual | |

| Production and Sales | 2,000 Units | 1,800 Units |

| Direct Materials | 20,000 Kgs. @ ₹ 4 per kg | 20,000 Kgs. (a) ₹ 4 per kg |

| Direct Labour | 16,000 Hrs. @ ₹ 8 per Hr. | 14,800 Hrs. (a ₹ 8 per Hr. |

| Variable Overheads | ₹ 48,000 | ₹ 44,400 |

| Fixed Overheads | ₹ 48,000 | ₹ 48,000 |

Required

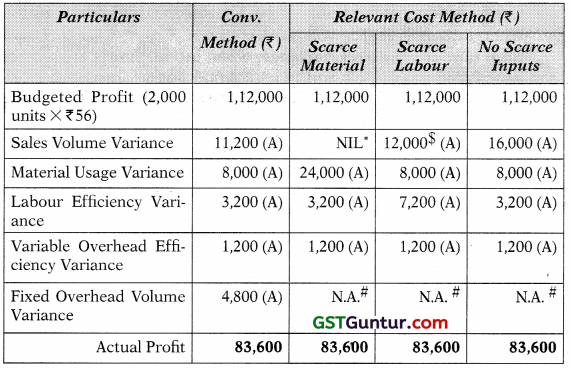

(i) RECONCILE the budgeted and actual profit with the help of variances according to each of the following method:

(A) The conventional method

(B) The relevant cost method assuming that

(a) Materials are scarce and are restricted to supply of 20,000 Kgs. for the period.

(b) Labour hours are limited and available hours are only 16, 000 hours for the period.

(c) There are no scarce inputs. (12 Marks)

(ii) COMMENT on efficiency and responsibility of the Sales Manager for not using scarce resources. (8 Marks) [May 2018 Exam]

Answer:

(I) Computation of Variances

Material Usage Variance = Standard Price × (Standard Quantity – Actual Quantity)

= ₹ 4.00 × (18,000 × Kgs. – 20,000 Kgs.)

= ₹ 8,000(A)

(1,800 units × 20,000 Kgs./2,000 units)

Labour Efficiency = Standard Rate × (Standard Hours – Variance Actual Hours)

= ₹ 8.00 × (14,400 hrs. – 14,800 hrs.)

= ₹ 3,200(A)

*(1,800 units × 16,000 hrs./2,000 units)

Variable Overhead Efficiency Variance = Standard Variable Overheads for Production – Budgeted Variable Over heads for Actual hours

= (14,400 hrs. × ₹ 3.00) – (₹ 3.00 × 14,800 hrs.)

= ₹ 1,200(A)

Fixed Overhead Volume Variance

= Absorbed Fixed Overheads – Budgeted Fixed Overheads

= (14,400 hrs. × ₹ 3.00) – (16,000 hrs. × ₹ 3.00)

= ₹ 4,800(A)

Sales Margin Volume Variance = Standard Margin – Budgeted Margin

= (1,800 units × ₹ 56.00) – (2,000 units × ₹ 56.00)

= ₹ 11,200 (A)

Sales Contribution Volume Variance

= Standard Contribution – Budgeted Contribution

= (1,800 units × ₹ 80.00) – (2,000 units × ₹ 80.00)

= ₹ 16,000 (A)

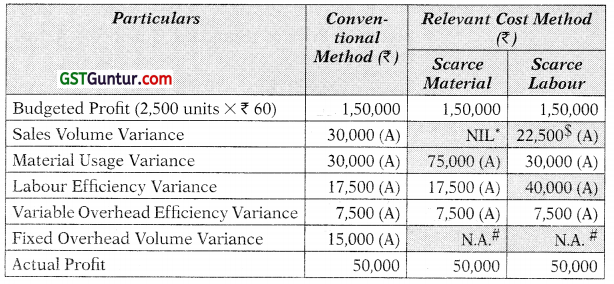

Statement Showing “Reconciliation Between Budgeted Profit & Actual Profit”

Notes

Scarce Material

Based on conventional method, direct material usage variance is ₹ 8,000 (A) i.e. 2,000 Kg. × ₹ 4. In this situation material is scarce, and, therefore, material cost variance based on relevant cost method should also include contribution lost per unit of material. Excess usage of 2,000 Kg. leads to lost contribution of ₹ 16,000 i.e. 2,000 Kgs. × ₹8. Total material usage variance based on relevant cost method, when material is scarce will be: ₹ 18,000 (A) + ₹ 16,000 (A) = ₹ 24,000 (A). Since labour is not scarce, labour variances are identical to conventional method.

Excess usage of 2,000 Kgs. leads to loss of contribution from 200 units i.e. ₹ 16,000 (200 units × ₹ 80). It is not the function of the sales manager to use material efficiently. Hence, loss of contribution from 200 units should be excluded while computing sales contribution volume variance.

(*) →

Therefore, sales contribution volume variance, when materials are scarce will be NIL i.e. ₹ 16,000 (A) – ₹ 16,000 (A).

Scarce Labour

Material is no longer scarce, and, therefore, the direct material variances are same as in conventional method. In conventional method, excess labour hours used are: 14,400 hrs. – 14,800 hrs. = 400 hrs. Contribution lost per hour = ₹ 10. Therefore, total contribution lost, when labour is scarce will be: 400 hrs. × ₹ 10 = ₹ 4,000. Therefore, total labour efficiency variance, when labour hours are scarce will be ₹ 7,200 (A) i.e. ₹ 3,200 (A) + ₹ 4,000 (A).

Excess usage of 400 hrs. leads to loss of contribution from 50 units i.e. ₹ 4,000 (50 units × ₹ 80). It is not the function of the sales manager to use labour hours efficiently. Hence, loss of contribution from 50 units should be excluded while computing sales contribution volume Variance.

($) →

Therefore, sales contribution volume variance, when labour hours are Scarce will be ₹ 12,000 (A) i.e. ₹ 16,000 (A) – ₹ 4,000 (A).

Fixed Overhead Volume Variance

(#) →

The fixed overhead volume variance does not arise in marginal costing system. In absorption costing system, it represents the value of the under or over absorbed fixed overheads due to change in production volume. When marginal costing is in use there is no overhead volume variance, because marginal costing does not absorb fixed overheads.

(ii) Comment on Efficiency and Responsibility of the Sales Manager

In general, Gross Profit (or contribution margin) is the joint responsibility of sales managers as well as of production managers. On one hand the sales manager is responsible for the sales revenue part, on the other hand the production manager is accountable for the cost- of-goods-sold component. However, it is the top management who needs to ensure that the target profit is achieved by the organization.

The sales manager is accountable for prices, volume, and mix of the product, whereas the production manager must control the costs of materials, labour, factory overheads and quantities of production. The purchase manager must purchase materials at budgeted prices. The personnel manager must employ right people at the right place with appropriate wage rates. The internal audit manager must ensure that the budgetary figures for sales and costs are being adhered by all departments which are directly or indirectly involved in contribution of making profit. Thus, sales manager is not responsible for contribution lost due to excess usage or inefficient usage of resources in case of scarce resources. Hence, such contribution lost must be excluded from the sales contribution volume variance.

![]()

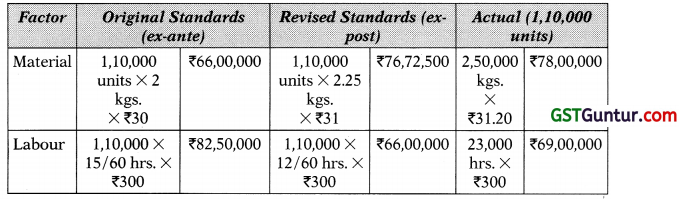

Question 22.

(Reconciliation of Budget Profit to Actual Profit through Marginal Costing)

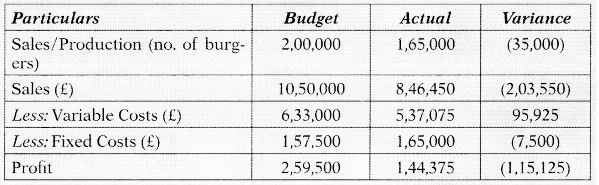

Osaka Manufacturing Co. (OMC) is a leading consumer goods company. The budgeted and actual data of OMC for the year 2020-21 are as follows-

| Particulars | Budget | Actual | Variance |

| Sales/Production (units) | 2,00,000 | 1,65,000 | (35,000) |

| Sales (₹) | 21,00,000 | 16,92,900 | (4,07,100) |

| Less: Variable Costs ) | 12,66,000 | 10,74,150 | 1,91,850 |

| Less: Fixed Costs (t) | 3,15,000 | 3,30,000 | (15,000) |

| Profit | 5,19,000 | 2,88,750 | (2,30,250) |

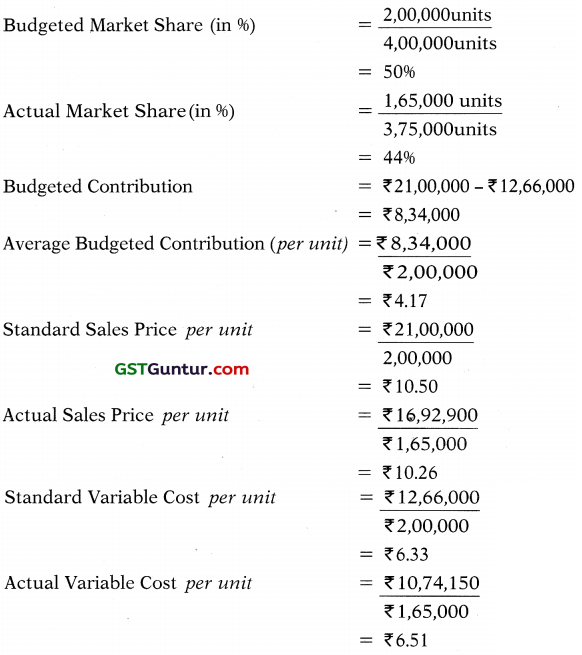

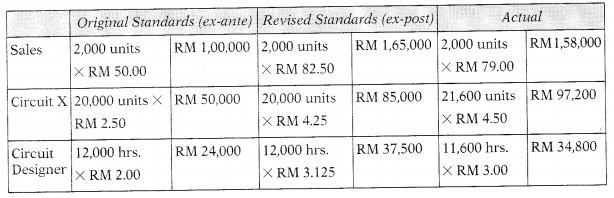

The budgeted data shown in the table is based on the assumption that total market size would be 4,00,000 units but it turned out to be

3,75,0 units.

Required

PREPARE a statement showing reconciliation of budget profit toactual profit through marginal costing approach for the year 2020-21 in as much detail as possible.

Answer:

Statement of Reconciliation – Budgeted Vs Actual Profit

| Particular | ₹ |

| Budgeted Prolit | 5,19,00 |

| Less: Sales Volume Contribution – Planning Variance (Adverse) | 52,125 |

| Less: Sales Volume Contribution – Operational Variance (Adverse) | 93,825 |

| Less: Sales Price Variance (Adverse) | 39,600 |

| Less: Variable Cost Variance (Adverse) | 29,700 |

| Less: Fixed Cost Variance (Adverse) | 15,000 |

| Actual Profit | 2,88,750 |

Workings:

Basic Workings

Calculation of Variances:

Sales Variances:

Volume Contribution Planning* = Budgeted Market Share % × (Actual Industry Sales Quantity in units – Budgeted Industry Sales Quantity in units) × (Average Budgeted Contribution per unit)

= 50% × (3,75,000 units – 4,00,000 units) × ₹ 4.17

= 52,125 (A)

(*) Market Size Variance

Volume Contribution Operational** = (Actual Market Share % – Budgeted Market Share %) × (Actual Industry Sales Quantity in units) × (Average Budgeted Contribution per unit)

= (44% – 50 %) × 3,75,000 units × ₹4.17

= 93,825 (A)

(**) Market Share Variance

Price = Actual Sales – Standard Sales

= Actual Sales Quantity × (Actual Price – Standard Price)

= 1,65,000 units × (₹ 10.26 – ₹ 10.50)

= 39,600 (A)

Variable Cost Variances

Cost = Standard Cost for Production – Actual Cost

= Actual Production × (Standard Cost per unit- Actual Cost per unit)

= 1,65,000 units × (₹6.33 – ₹6.51)

= 129.700(A)

Fixed Cost Variances

Expenditure = Budgeted Fixed Cost – Actual Fixed Cost

= ₹ 3,15,000 – ₹ 3,30,000

= ₹ 15,000 (A)

![]()

Question 23.

(Investigation of Variances)

NZSC’O Ltd. uses standard costing system for manufacturing its single product ‘ANZ’ Standard Cost Card per unit is as follows:

| (₹) | |

| Direct Materia! (1 kg per unit) | 20 |

| Direct Labour (6 hrs @ ₹ 8 per hour) | 48 |

| Variable Overheads | 24 |

Actual and Budgeted Activity Levels in units for the month of Feb’21 are:

| Budget | Actual | |

| Production | 50,000 | 52,000 |

Actual Variable Costs for the month of Feb’ 21 are given as under:

| Direct Material | 10,65,600 |

| Direct Labour (3,00,000 hrs) | 24,42,000 |

| Variable Overheads , | 12,28,000 |

Required

INTERPRET Direct Labour Rate and Efficiency Variances.

Answer:

INTERPRETATION

Direct Labour Rate Variance:

Adverse Labour Rate Variance indicates that the labour rate per hour paid is more than the set standard. The reason may include among other things such as:

(1) While setting standard, the current/future market conditions like pending labour negotiation/cases, has not been considered (or predicted) correctly.

(2) The labour may have been told that their wage rate will be raised or bonus will be paid if they work efficiently.

Direct Labour Efficiency Variance:

It indicates that the workers has produced actual production quantity in less time than the time allowed. The reason for favourable labour efficiency variance may include among the other things as follows:

(1) While setting standard, workers efficiency could not be estimated properly, this may happen due to non-observance of time and motion study.

(2) The workers may be new in the factory, hence, efficiency could not be predicated properly.

(3) The foreman or personnel manager responsible for labour efficiency, while providing his/her input at the time of budget/standard, has 1 adopted conservative approach.

(4) The increase in the labour rate might have encouraged the labours to do work more efficiently.

In this particular case it may have happened that since labour payment has been increased labour efficiency has also been increased. In a nutshell y because of additional labour rate (Adverse), labour efficiency has gone up §: (Favourable)

Workings

Labour Rate Variance = Standard Cost of Actual Time – Actual Cost

= (SR × AH) – (AR × AH)

Or

= (SR – AR) × AH

= (₹ 8.00 – ₹ 8.14) × 3,00,000 hrs.

= ₹ 42,000 (A)

Working

Actual Labour Rate per hour = \(\frac{\text { Actual Paid }}{\text { Actual Hours }}\)

= \(\frac{₹ 24,42,000}{3,00,000 \mathrm{hrs}}\)

= ₹ 8.14

Labour Efficiency Variance = Standard Cost of Standard Time for Actual Production Standard Cost of Actual Time

= (SH × SR) – (AH × SR)

Or

= (SH – AH) × SR

= (3,12,000 hrs. – 3,00,000 hrs.) × ₹ 8.00 = ₹ 96,000 (F)

Working:

Standard Hours = Actual Production × Std. hrs. per unit

= 52,000 units × 6 hrs.

= 3,12,000 hrs.

![]()

Question 24.

(Investigation of Variance)

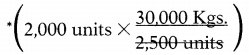

A company is planning to improve its profit level at least by 10% from the preliminary budget estimates of a profit of ₹ 32,80,000 for the coming year. It has worked out the following profit improvement plan:

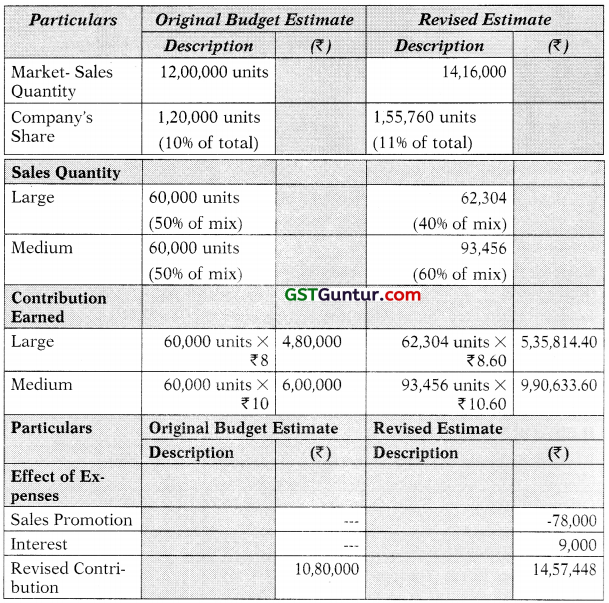

(i) In the year just concluded the sales of the company were 10% of the total market of 12,00,000 units. For the preparation of the original budget estimate, the same market demand and the same share of market for the company was envisaged. Now it has been estimated that the total market demand will increase by 18 % and the company’s market share will increase to 11% from the present level of 10%.

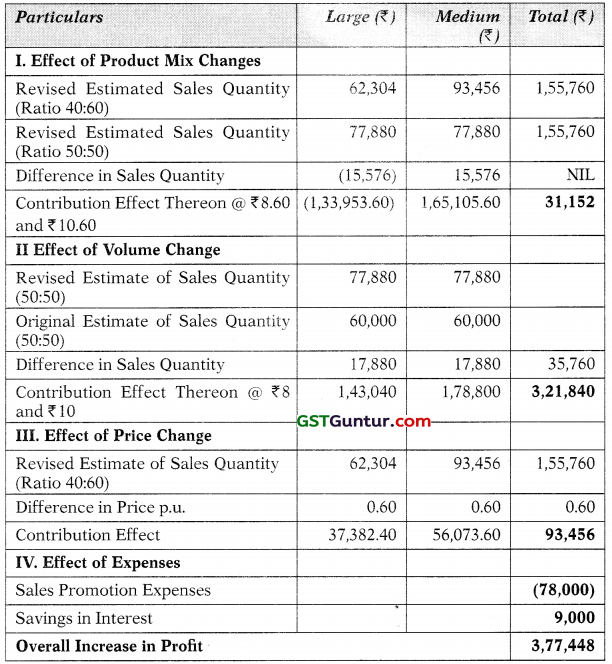

(ii) The products are sold in two sizes – large and medium. The sales mix of each size was 50:50 so far. Now it is planned that the sales will be 40% of large and 60% of medium. The medium packs and large packs have a contribution of ₹ 10 and ₹ 8 per pack respectively. The budget proposes to raise the price in such a manner that the contribution per pack will increase by ₹ 0.60 for each size.

(iii) There will bean additional expenditure on sales promotion worth ₹ 78,000.

(iv) The company proposes to save ₹ 19,000 by saving on interest cost in the coming year by better financial management.

You are required to draw a profit improvement plan in financial terms and spell out separately the effect of various factors on profit. [May 2018 Exam] (10 Marks)

Answer:

Statement Showing Change in Profit

Total Improvement in Profit ₹ 3,77,448 (11.51%).

Workings

Budget for Original and Revised Contribution

![]()

Question 25.

(Sales Variance)

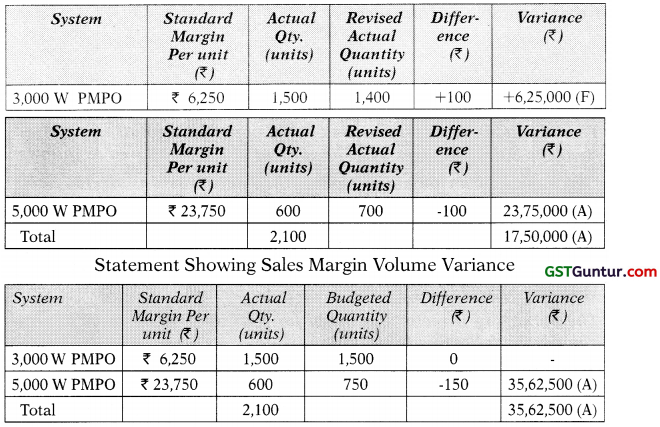

T-tech is a Taiwan based firm, that designs, develops, and sells audio equipment. Founded in 1975 by Mr. Boss, firm sells its products throughout the world. T-tech is best known for its home audio systems and speakers, noise cancelling headphones, professional audio systems and automobile sound system. Extracts from the budget are shown in ; the following table:

Home Audio System Division Jan ’ 2021

| System | Sales (units) | Selling Price (₹) | Standard Cost (per System) (₹) |

| 3.000 WPMPO | 1,500 | 18,750 | 12,500 |

| 5,000 WPMPO | 500 | 50,000 | 26,250 |

The Managing Director has sent you a copy of an email he received from the Sales Manager ‘K’. The content of the email was as follows:

“We have had an outstanding month. There was an adverse Sales Price Variance on the 3,000 W PMPO Systems of ₹ 22,50,000 but I compensated for that by raising the price of 5,000 W PMPO Systems. Unit sales of 3,000 WPMPO Systems were as expected but sales of the 5,000 W PMPOs were exceptional and gave a Sales Margin Volume Variance of 23,75,000.1 think I deserve a bonus!”

The managing Director has asked for your opinion on these figures. You got the following information.

Actual results for Jan’ 2021 were:

| System | Sales (unit) | Selling Price ₹ |

| 3,000 W PMPO | 1,500 | 17,250 |

| 5,000 W PMPO | 600 | 53,750 |

The total market demand for 3,000 WPMPO Systems was as budgeted but as a result of suppliers reducing the price of supporting UHD TV System the total market for 5,000 WPMPO Systems raised by 50% in Jan’2021.

The company had sufficient capacity tomeet the revised market demand for 750 units of its 5,000 WPMPO Systems and therefore maintained its market share

Requited

(i) CALCULATE the following Operational Variances based on the revised market details:

– Sales Margin Mix Variance

– Sales Margin Volume Variance. (4 marks)

(ii) COMMENT briefly on the measurement of the K’s performance. (6 marks) [May 2018 RTP]

Answer:

(i) Statement Showing Sales Margin Mix Variance:

(ii) A Planning Variance simply compares a revised standard (that should or would have been use if planners had known in advances what was going to happen) to the original standard. A planning variance is considered as not to be controllable by management.

The market size is not within the control of the sales manager and therefore variances caused by changes in the market size would be regarded as planning variances.

However, variances caused by changes in the selling price and consequently the selling price variances and market shares would be within the control of the sales manager and treated as operating variances.

The market size variance compares the original and revised market sizes. This is unchanged for 3,000 W PMPO Systems so the only variance that occurs relates to the 5,000 W PMPO Systems and is ₹ 59,37,500 (F) [250 system × ₹23,750].

It is vital to make this distinction because as can be seen from the scenario the measurement of the “K”s performance is incomplete if the revised market size is ignored.

The favourable volume variance of ₹ 23,75,000 referred to in the “K”s e-mail is made up of two elements, one of which, the market size, is a planning variance which is outside his control. It is this that has caused the overall volume variance to be favourable, and thus ‘K’ is not responsible for the overall favorable performance.

![]()

Question 26.

(Investigation of Variances)

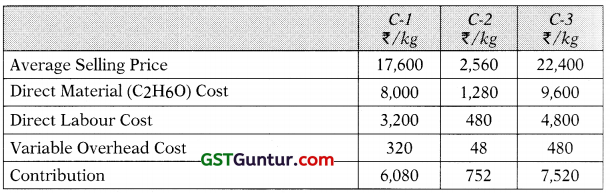

Queensland Chemicals (QC) manufactures high-quality chemicals C-1, C-2 and C-3. Extracts from the budget for last year are given below:

| C-l | C-2 | C-3 | |

| Sales Quantity (kg) | 1,000 | 3,250 | 750 |

| ₹/kg | ₹/kg | ₹/kg | |

| Average Selling Price | 17,600 | 2,560 | 22,400 |

| Direct Material (Cflfl) Cost | 8,000 | 1,280 | 9,600 |

| Direct Labour Cost | 3,200 | 480 | 4,800 |

| Variable Overhead Cost | 320 | 48 | 480 |

The budgeted direct labour cost per hour was ₹ 160.

Actual results for last year were as follows:

| C-l | C-2 | C-3 | |

| Sales Quantity (units) | 900 | 3,875 | 975 |

| ₹/kg | ₹/kg | ₹/kg | |

| Average Selling Price | 19,200 | 2,480 | 20,000 |

| Direct Material (C2H6O) Cost | 8,800 | 1,200 | 10,400 |

| Direct Labour Cost | 3,600 | 480 | 4,800 |

| Variable Overhead Cost | 480 | 64 | 640 |

The actual direct labour cost per hour was ₹ 150. Actual variable overhead cost per direct labour hour was ? 20. QC follows just in time system for purchasing and production and does not hold any inventory.

Required

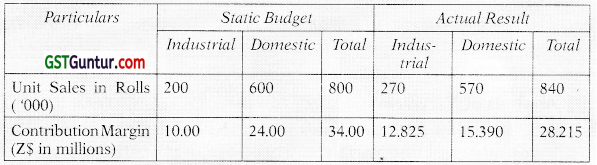

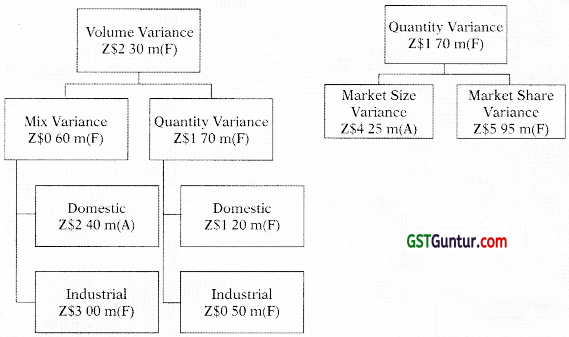

INTERPRET the Sales Mix Variance and Sales Quantity variance in terms of contribution. (10 Marks) [Aug. 2018 MTP]

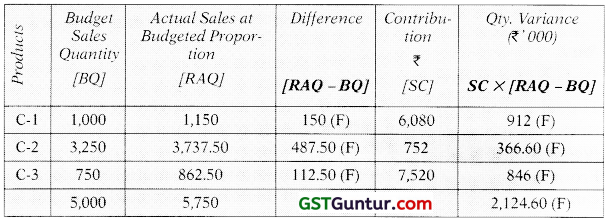

Answer:

Variance Interpretation

The sales quantity variance and the sales mix variance describe how the sales volume contribution variance has been affected by a change in the total quantity of sales and a change in the relative mix of products sold.

From the figures arrived for the sales quantity contribution variance, we can observe that the increase in total quantity sold would have gained an additional contribution of ₹ 2,124,600, if the actual sales volume had been in the budgeted sales proportion.

The sales mix contribution variance shows that the variation in the sales mix resulted in a curtailment in profit by 5,70,600. The change in the sales mix has resulted in a relatively higher proportion of sales of C-2 which is the chemical that earns the lowest contribution and a lower proportion of C-1 which earn a contribution significantly higher. The relative increase in the sale of C-3 however, which has the highest unit contribution, has partially offset the switch in mix to C-2.

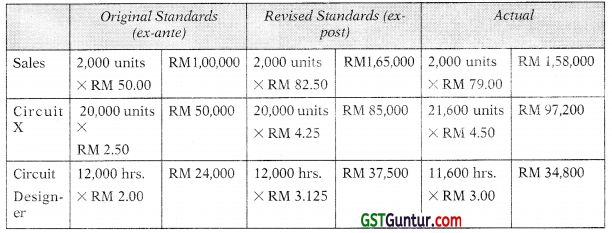

Workings

Statement Showing Standard Contribution

Sales Contribution Mix Variance

Sales Contribution Quantity Variance

![]()

Question 27.

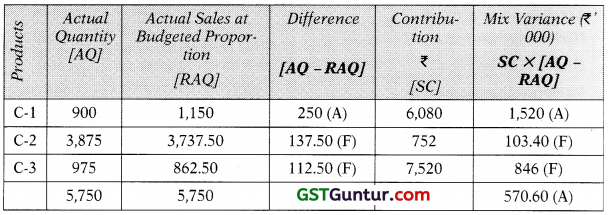

(Total Variance)

Apple Ltd., is following three variances method to analyse and un-derstand production overhead variances. The three variances for a particular year were reported as given below:

| Production overhead expenditure variance | 94,000 A |

| Production overhead volume variance | 1,00,000 F |

| Production overhead efficiency variance | 48,000 F |

The other particulars furnished from the records of the company are:

| Standard machine hours for the year | 11,500 |

| Closing balance in the Production Overhead Control Account | ₹ 18,00,000 |

| Fixed overhead rate per hour | ₹ 125 |

| Variable overhead rate per hour | ₹ 80 |

Required:

COMPUTE the following by considering the additional information also:

(i) Actual machine hours

(ii) Budgeted machine hours

(iii) Total Fixed Production Overhead amount

(iv) Applied Production Overhead amount (10 Marks)

Additional Information

- Expenditure variance was computed totally for fixed and variable overheads.

- Volume variance is applicable to fixed overhead only.

- Efficiency variance is applicable only to variable overhead and fixed overhead efficiency variance was already included in volume variance. [Nov. 2018 Exam]

Answer:

(i) Calculation of Actual Machine Hours

Efficiency Variance = ₹ 48,000 (F) given

= Standard Variable Overhead Rate per Hour (Standard Hours – Actual Hours)

₹ 48,000(F) = ₹ 80 × (11,500 hrs. – Actual Hours)

Actual Hours = 10,900 hrs.

(ii) Budgeted Machine Hours

Volume Variance = ₹ 1,00,000 (F)

= Standard Fixed Overhead Rate per × Hour (Standard Hours – Budgeted Hours)

₹ 1,00,000 (F) = ₹ 125 × (11, 500 hrs. – Budgeted Hours)

Budgeted Hours = 10,700 hrs.

Total Fixed Production Overhead*

Fixed Production Overhead = Standard Fixed Overhead Rate per Hour × Budgeted Hours

= ₹ 125 × 10, 700 hrs.

= ₹ 13.37,500

* Assumed Budgeted

Applied Manufacturing Overhead

= Standard Overhead Rate per Hour × Standard Hours

= ₹ 205 × 11, 500 hrs.

= ₹ 23,57,500

ALTERNATIVES (iii) & (iv)

(iii) Total Fixed Production Overhead

Expenditure Variance = Fixed Production Overhead(Budgeted) + Budgeted Variable Overheads for Actual Hours – Actual Overheads ₹ 94,000 (A) = Fixed Production Overhead + 10,900 hrs. × ₹ 80 – ₹ 18,00,000

Fixed Production Overhead – ₹ 8,34,000

(iv) Applied Manufacturing Overhead

= Actual Overhead Incurred + Total Variance

= ₹ 18,00,000 + ₹ 54,000

= ₹ 18,54,000

Working Notes

Total Variance = Expenditure Variance + Efficiency Variance + Volume Variance

= ₹ 94,000 (A) + ₹ 48,000 (F) + ₹ 1,00,000 (F)

= ₹ 54,000 (F)

![]()

Question 28.

Case Study (Control Through Standard Costing System)

‘HAL’ is a manufacturer, retailer, and installer of Cassette Type Split AC for industrial buyers. It started business in 2001 and its market segment has been low to medium level groups. Until recently, its business model has been based on selling high volumes of a standard AC, brand name ‘Summer’, with a very limited degree of customer choice, at low profit margins. ‘HAL’s current control system is focused exclusively on the efficiency of its manufacturing process and it reports monthly on the following variances: material price, material usage and manufacturing labour efficiency. ‘HAL’ uses standard costing for its manufacturing operations. In 2018, HAL’ employs 20 teams, each of which is required to install one of its ‘Summer’ AC per day for 350 days a year. The average revenue per ‘Summer’ AC installed is ₹ 36,000. ‘HAL’ would like to maintain this side of its business at the current level. The ‘Summer’ installation teams are paid a basic wage which is supplemented by a bonus for every AC they install over the yearly target of 350. The teams make their own arrangements for each installation and some teams work seven days a week, and up to 12 hours a day, to increase their earnings. ‘HAL’ usually receives one minor complaint each time a ‘Summer’ AC is installed and a major complaint for 10% of the ‘Summer’ AC installations.

In 2016, HAL’ had launched a new AC, brand name ‘Summer-Cool’. This AC is aimed at high level corporates and it offers a very large degree of choice for the customer and the use of the highest standards of materials, appliances, and installation. ‘HAL’ would like to grow this side of its business. A ‘Summer-Cool’ AC retails for a minimum of ₹ 1,00,000 to a maximum of X₹ 5,00,000. The retail price includes installation. In 2017 the average revenue for each ‘Summer-Cool’ AC installed was ₹ 3,00,000. Currently, ‘HAL’has 7 teams of ‘Summer-Cool’ AC installers and they can install up to 240 AC a year per team. These teams are paid salaries without a bonus element. ‘HAL’ has never received a complaint about a ‘Summer-Cool’ AC installation.