Standard Costing – CA Final SCMPE Question Bank is designed strictly as per the latest syllabus and exam pattern.

Standard Costing – CA Final SCMPE Question Bank

Question 1.

Comment on efficiency and responsibility of the Sales Manager for not using scarce resources. (May 2018, 8 marks)

Answer:

(II) Comment on Efficiency and Responsibility of the Sales Manager

In general, Gross Profit (or contribution margin) is the joint responsibility of sales managers as well as of production managers. On one hand the sales manager is responsible for the sales revenue part, on the other hand the production manager is accountable for the cost – of-goods-sold component.

However, it is the top management who needs to ensure that the target profit is achieved by the organization. The sales manager is accountable for prices, volume, and mix of the product, whereas the production manager must control the costs of materials, labour, factory overheads and quantities of production. The purchase manager must purchase materials at budgeted prices. The personnel manager must employ right people at the right place with appropriate wage rates.

The internal audit manager must ensure that the budgetary figures for sales and costs are being adhered by all departments which are directly or indirectly involved in contribution of making profit. Thus, sales manager is not responsible for contribution lost due to excess usage or inefficient usage of resources in case of scarce resources. Hence, such contribution lost must be excluded from the sales contribution volume variance.

![]()

Question 2.

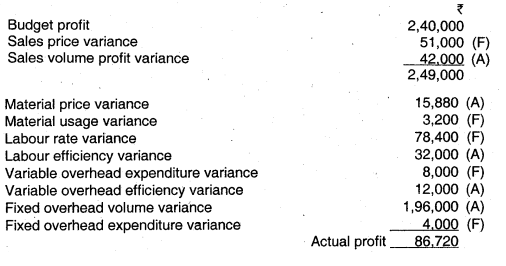

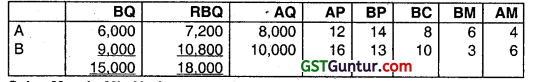

The following profit reconciliation statement has been prepared by the Cost Accountant of RSQ Ltd. for March, 2008 : (Nov 2008, 11 marks)

Budgeted production and sales volumes for March, 2008 were equal and the level of finished goods stock was unchanged, but the stock of raw materials decreased by 6,400 kg (valued at standard price) during the month.

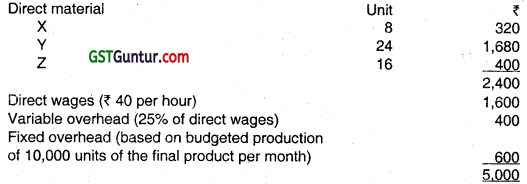

The standard cost card is as under :

The actual labour rate was ₹ 2.24 lower than the standard hourly rate.

You are required to calculate :

(i) Actual quantity of material purchased

(ii) Actual production and sales volume

(iii) Actual number of hours worked

(iv) Actual variable and fixed overhead cost incurred.

Answer:

(i) Budgeted volume = \(\frac{\text { Budgeted profit }}{\text { Budgeted profit per unit }}\)

= \(\frac{2,40,000}{24.00}\)

= 10,000 units

Difference between actual and budgeted volume

= \(\frac{\text { Fixedoverheadvolume variance }}{\text { Standardfixedoverheadrate }}=\frac{1,96,000}{112}\) = 1,750 units

Actual Production = Budgeted volume – Difference between actual and budget volume

= 10,000 – 1,750

= 8,250 units

![]()

(ii) Actual production = 8,250 units

Material quantity = 4 kg. × 8,250

Less: Difference in material use

Material =\(\frac{\text { Usage variance }}{\text { Standard price }}\) = \(\frac{\text { Usage variance }}{\text { Standard price }}=\) = 1,600 kg.

Actual usages = 31,400 kg.

Less: Decrease in stock = 6,400 kg.

Actual purchases = 25,000 kg.

(iii) Actual hours 8,250 units × 4 hours = 33,000 hours

Difference in actual and standard

\(\frac{\text { Efficiency variance }}{\text { Standard rate }}=\frac{32,000(A)}{32.00}\) = 1,000 (A) hours

Actual hours = 34.00 hours

(iv) Actual variable overhead incurred:

Standard cost of variable overhead = 8,250 × 48 = ₹ 3,96,000

Total variable overhead cost variance

= [8,000(F)+12.000(A)] = ₹ 4,000 (A)

Actual variable overhead = ₹ 4,00,000

![]()

(v) Actual fixed overhead:

Budgeted fixed overhead =

Budgeted units × Budgeted rate

= 10,000 × 112 = ₹ 11,20,000

Expenditure variance = ₹ 4,000 (F)

Actual fixed overhead = ₹ 11,16,000

It can also be calculated as below:

Actual fixed overhead:

Standard fixed overhead .

= (Actual output × Standard fixed overhead

rate per unit) 8,250 × 112 = ₹ 9,24,000

Total fixed overhead variance

[1,96,000 (A) + 4,000 (F)] = ₹ 1.92.000 (A)

Actual fixed overhead = ₹ 11.16.000

(vi) Actual sales volume:

Sales volume profit variance = Standard profit per unit (Actual quantity of sales- Standard quantity of sales)

42,000 (A) = 24 (Actual quantity of Sales -10,000)

Actual quantity of sales = 8,250 units

![]()

Question 3.

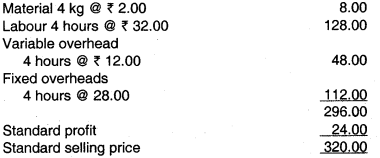

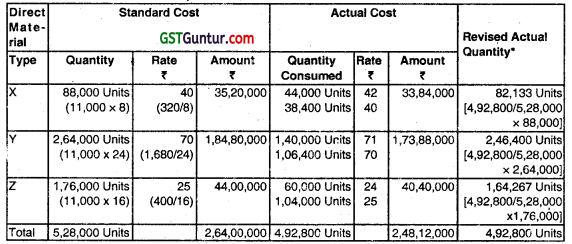

The following information relates to labour of X Ltd. (Nov 2009, 10 marks)

In a 40 hour week, the gang produced 270 standard hours.

The actual number of semi-skilled workers is two times the actual number of unskilled workers. The rate variance of semi-skilled workers is ₹ 160 (F).

Find the following:

(i) The number of workers in each category

(ii) Total gang variance

(iii) Total Sub-efficiency variance

(iv) Total labour rate variance

(v) Total labour cost variance

Answer:

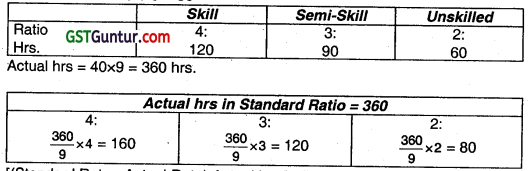

Working Note:

Standard hours produced = 270

Standard Mix : 270 ÷ 9 = 30

‘(Standard Rate – Actual Rate) Actual hrs.] = Rate Variance

Semi-skilled = 160

(3 – 2) Actual hrs = 160

Actual hrs = 160 (for semi – skilled)

Actual Semi-skilled = 2 (Unskilled actual)

160 = 2 (Unskilled)

Unskilled hrs (actual) = \(\frac{160}{2}\) = 80

Total Actual = 360

∴ Actual hrs – skilled = 360 – (160 + 80)

= 360 – 240 = 120

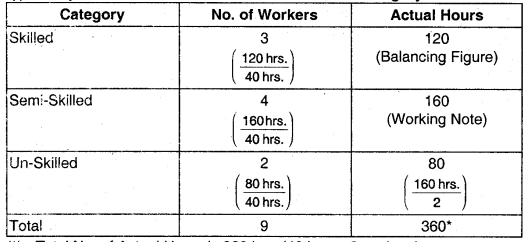

| Category | Skilled | Semi-skilled | Unskilled | Total |

| Actual Hrs. | 120 | 160 | 80 | 360 |

| 40 hr week | \(\frac{120}{40}\) = 3 | \(\frac{160}{40}\) = 4 | \(\frac{80}{40}\) = 2 | |

| No. of Workers | 3 | 4 | 2 | 9 |

![]()

(ii) Gang Variance :

= (Actual Hrs in Standard Ratio-Actual Hrs in Actual Ratio) × Standard Rate

= 1400 – 1280 = 120(F)

(iii) Sub-efficiency Variance:

= Standard Rate (Standard Hrs – Actual Hrs in Standard Ratio)

= 1050 – 1400 = 350 (A)

(iv) Total Labour Rate Variance:

= Actual Hrs (Standard Rate – Actual Rate)

= 1280 – 320 = 40 (A)

(v) Labour Cost Variance:

= (Standard Ratex Standard Hrs -Actual Rate × Actual Hrs.)

= 1050 – 1320 = 270 (A)

![]()

Question 4.

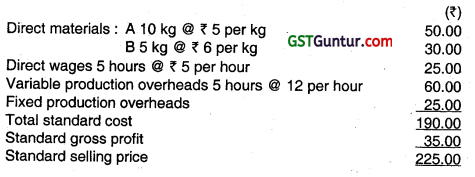

X Ltd. produces and sells a single product. Standard cost card per unit of the product is as follows: (May 2010, 12 marks)

A fixed production overhead has been absorbed on the expected annual output of 25,200 units produced evenly throughout the year. During the month of December, 2009, the following were the actual results for an actual production of 2,000 units:

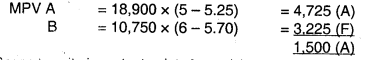

The material price variance Is extracted at the time of receipt of materials. Material purchase were A 20,000 kg. @ ₹ 5.25 per kg; B 11,500 kg @ ₹ 5.70 per kg.

Required:

(i) Calculate all variances.

(ii) Prepare an operating statement showing Standard gross profit, Variances and Actual gross profit.

(iii) Explain the reason for the difference in actual gross profit given in the question and calculated in (ii) above.

Answer:

(i) Direct Material Variance

Material Price Variance = Standard Cost of Actual Quality – Actual Cost

(At the time of receipt) = PQ × SP – PO × AP

Or

= PQ × (SP – AP)

(A) = 20,000 kg. × ( 5.00 – ₹ 5.25)

= ₹ 5,000 (A)

(B) = 11,500kg. × (₹ 600 – ₹ 5.70)

= ₹ 3,450(F)

Total = ₹ 5,000 (A) + ₹ 3,450 (F)

= ₹ 1,550 (A)

![]()

Material Usage Variance = Standard Cost of Standard Quantity for Actual Output – Standard Cost of Actual Quantity

=SQ × SP – AQ × SP

Or

= SP × (SQ – AQ)

(A) = ₹ 5 × (5,000 units × 10 Kg. – 18,900 Kg.)

= ₹ 5,500 (F)

(B) = ₹ 6 × (2,000 units × 5 Kg. – 10,750 Kg.)

= ₹ 4,500(A)

Total = ₹ 5,500 (F) + ₹ 4,500 (A)

= ₹ 1,000(F)

Material Mlx Variance = Total Actual Quantity (units) × (Average Standard Price per unit of Standard Mix – Average Standard Price per unit of Actual Mix)

= 29,650 Kg. × \(\left(\frac{(₹ 50+₹ 30) \times 2,000 \text { units }}{2,000 \text { units } \times(10 \mathrm{Kg} .+5 \mathrm{Kg})}-\frac{₹ 5 \times 18,900 \mathrm{Kg}+₹ 6 \times 10,750 \mathrm{Kg} .}{18,900 \mathrm{Kg} .+10,750 \mathrm{Kg} .}\right)\)

= ₹ 866.66 ………… (A)

Material Yield Variance = Average Standard Price per unit of Standard Mix × [Total Standard Quantity (units) – Total Actual Quantity (units)]

= \(\left\{\frac{(₹ 50+₹ 30) \times 2,000 \text { units }}{2,000 \text { units } \times(10 \mathrm{Kg} .+5 \mathrm{Kg})}\right\}\) × [(10Kg. + 5Kg.)x 2,000 units – (18,900 Kg. + 10,750 kg.)]

= ₹ 1866.66 …………. (F)

Direct Labour Variances

Labour Rate Variance = Standard Cost of Actual Time – Actual Cost

= SR × AW* – AR × AH*

Or

= (SR – AR) × AH*

= (₹ 5 – \(\frac{₹ 50,400}{10,500 \text { hours }}\)) × 10,500 hours

= 2,100 (F)

AH* refers to Actual Hours Paid

Labour Efficiency Variance = Standard Cost of Standard Time for Actual Production – Standard Cost of Actual Time

= (SH × SR) – (AH × SR)

Or

(SH – AH) × SR

= ₹ 5.00 × (2,000 units × 5 hours – 10,300 hours)

= ₹ 1,500 (A)

![]()

Idle Time Variance = Standard Rate per Hour × Actual Idle Hours

= (AH* – SR) × (AH* × SR)

Or

= (AH* × AH*) × SR

= ₹ 5.00 × (10,500 hours – 10,300hours)

= ₹ 1,000 (A)

AH* refers to Actual Hours Worked

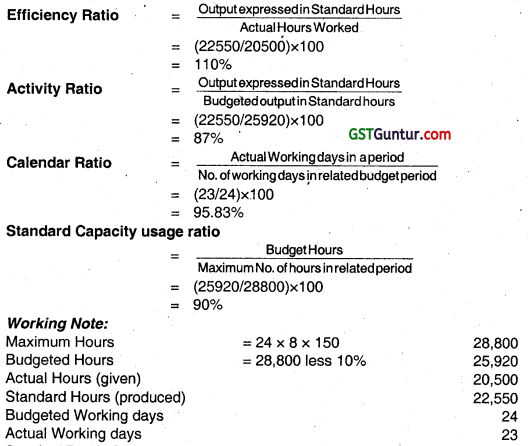

Variable Overhead Variances Cost Variance = Standard Variable Overheads for Production – Actual Variable Overheads

= 2,000 units × ₹ 601,15,000 = ₹ 5.000(F)

Expenditure Variance = Budgeted Variable Overheads for Actual Hours – Actual Variable Overheads

= 10,300 hours × ₹ 12 – ₹ 1,15,000

= ₹ 8,600 (F)

Efficiency Variance = Standard Variable Overheads for Production – Budgeted Variable Overheads for Actual Hours

= 2,000 units × ₹ 60 – 10,300 hours × ₹ 12

= ₹ 3,600 (A)

Fixed Overhead Variances Cost Variance = Absorbed Fixed Overheads – Actual Fixed Overheads

= 2,000 units × ₹ 25.00 – ₹ 56,600

= ₹ 50,000 – ₹ 56,600

= ₹ 6,600 (A)

Expenditure Variance = Budgeted Fixed Overheads – Actual Fixed Overheads

= 2,100 units × ₹ 25.00 – ₹ 56,600

= ₹ 52,500 – ₹ 56,600

= ₹ 4,100 (A) .

Volume Variance = Absorbed Fixed Overheads – Budgeted Fixed Overheads

= ₹ 50,000 – ₹ 52,500

= ₹ 2,500 (A)

![]()

(ii) Reconciliation Statement

(iii) Actual gross profit given in the question is ₹ 67,500 while calculated operating profit in statement is ₹ 67,450. The difference amount is due to material price variance that is calculated at the time of receipt of material instead of consumption of material price variance that is calculated at time of receipt of material instead of consumption of material.

Question 5.

2010- Nov (3] (a)

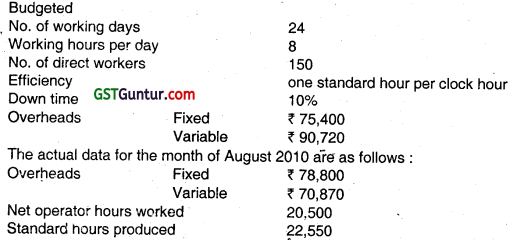

A company is engaged in manufacturing of several products. The following data have been obtained from the record of a machine shop for an average month: (Nov 2010, 10 marks)

There was a special holiday in August 2010.

Required:

(i) Calculate efficiency, activity, calendar and standard capacity usages ratio.

(ii) Calculate all the relevant fixed overhead variances.

(iii) Calculate variable overheads expenditure and efficiency variance.

Answer:

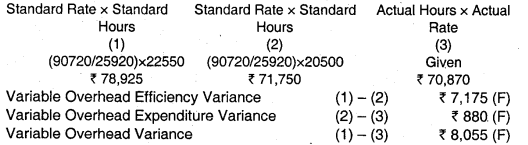

Budgeted Fixed Overheads

| Standard Rate × Standard Hours (1) | Standard Rate × Actual Hours (2) | Standard Rate × Revised Budgeted Hours (3) | Standard Rate × Budgeted Hours (4) | Actual overheads (5) |

| 2.91 × 22550 = 65621 | 2.91 × 20500 = 59655 | 2.91 × 24840 = 72284 | Given = 75400 | Given = 78800 |

Fixed Overhead Efficiency Variance (1) – (2) ₹ 5,966(F)

Fixed Overhead Capacity Variance (2) – (3) ₹ 12,629 (A)

Fixed Overhead Calendar Variance (3) – (4) ₹ 3,116(A)

Fixed Overhead Volume Variance (1) – (4) ₹ 9,779 (A)

Fixed Overhead Expenditure Variance (4) – (5) ₹ 3,400 (A)

Fixed Overhead Variance (1) – (5) ₹ 13,179 (A)

![]()

Question 6.

A company actually sold 8000 units of A and 10,000 units of B at ₹ 12 and ₹ 16 per unit respectively against a budgeted sale of 6000 units of A at ₹ 14 per unit and 9000 units of B at ₹ 13 per unit. The standard costs of A and B are ₹ 8 and ₹ 10 per unit respectively and the corresponding actual costs are ₹ 5.5 and 114.5 per unit.

Compute the product wise sales margin mix and sales margin price variances, indicating clearly, whether the variances are favourable or adverse. (May 2011, 5 marks)

Answer:

Sales Margin Mix Varlance

(Actual Qty in Actual Mix – Actual Qty in Budgeted Mix) × Budgeted Margin

A: (8,000 – 7,200) × 6 = 4,800 (Fav)

B: (10,000 – 10,800) × 3 = – 2,400 (Adv)

Total Mix Variance = 2,400 (Fav)

Sales Margin Price Variance = Actual Qty (Actual Margin – Budgeted Margin)

A 8,000(4 – 6) = -16,000 (A).

B 10,000(6 – 3) = 30.000 (F)

= 14.000 (F)

![]()

Question 7.

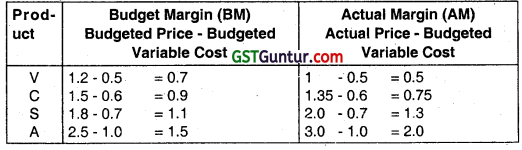

The budget and actual operating data for 2010-11 pertaining to 4 products in a store area given below:

| Budgeted date for 2010-11 | Actual operating results in 2010-11 | |||||

| Product | Gallons | Selling price (₹ per gallon) | Variable costs (₹ per gallon) | Gallons | Selling price (₹ per gallon) | Variable costs (₹ per gallon) |

| V | 2,50,000 | 1.2 | 0.5 | 1,80,000 | 1.00 | 0.45 |

| C | 3,00,000 | 1.5 | 0.6 | 2,70,000 | 1.35 | 0.50 |

| S | 2,00,000 | 1.8 | 0.7 | 3,30,000 | 2.00 | 0.75 |

| A | 50,000 | 2.5 | 1.00 | 1,80,000 | 3.00 | 1.20 |

You are required to compute for the individual products and in total: (Nov 2011, 10 marks)

(i) the sales margin price variance

(ii) the sales margin mix variance and

(iii) the sales margin volume variance

Indicate whether the variances are favourable (F) or unfavourable (A or U).

Answer:

Working Notes:

![]()

Question 8.

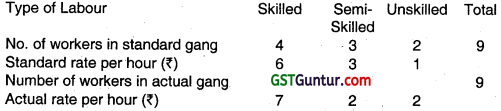

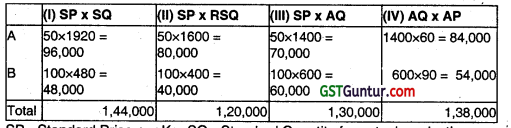

The standard set for a chemical mixture of company is as under: (May 2012)

| Material | Standard Mix (%) | Standard Price ₹/kg. |

| A | 80 | 50 |

| B | 20 | 100 |

Standard yield in production is 75%.

The actual quantity produced was 1800 kg. of output from the following:

| Material | Quantity (kg.) | Actual price |

| A | 1400 | 60 |

| B | 600 | 90 |

Calculate the total material price, mix and yield variances, indicating whether they are favourable (F) or adverse (A or U). (6 marks)

Answer:

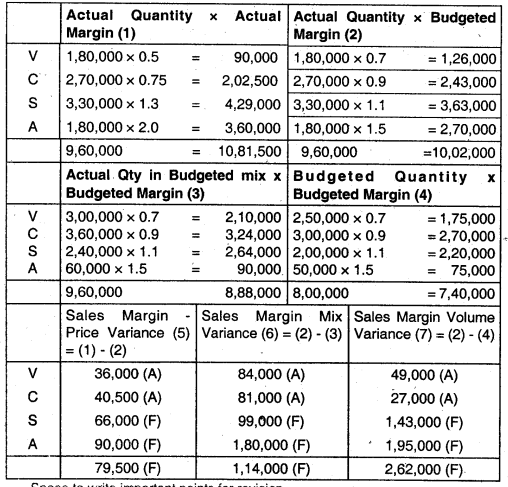

SP – Standard Price per Kg, SQ : Standard Quantity for actual production

RSQ – Revised Standard Quantity, AQ – Actual Quantity used, AP – Actual Price per kg.

![]()

Variances: (Figures ₹)

| Variances | Material Yield Variance (I – II) | Material Mix. Variance (II – III) | Material Price Variance (III – IV) |

| A | 16,000 F | 10,000 F | 14,000 A |

| B | 8,000 F | 20,000 A | 6,000 F |

| TOTAL | 24,000 F | 10,000 A | 8,000 A |

Note: Standard Input = 1800 / 0.75 = 2,400 kgs. Hence Standard quantity of A is 2,400 × 0.8 = 1920 kgs. and B = 2400 × 0.2 = 480 kgs.

![]()

Question 9.

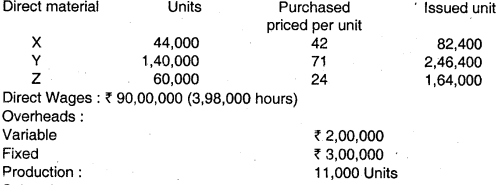

Sunglow Limited manufacturers and sells a single product. From the records of the company the following information is available for November 2012: (Nov 2012, 9 marks)

The standard cost comprises the following :

The budgeted selling price is ₹ 700 each and the budgeted sales for the month were 14,000 units.

The following were the transactions for the month:

Sales: 9,000 units at ₹ 700 each and 3,500 units at ₹ 750 each Required:

Calculate

(i) Material price variance;

(ii) Material mix variance;

(iii) Labour rate variance

(iv) Labour efficiency variance

(v) Variable overhead efficiency variance; and

(vi) Fixed overhead efficiency variance.

Answer:

Statement showing ‘Standard Cost of Material’ and ‘Actual Cost of Material’-Production 11,000 units

*Actual Quantity in Standard Proportion.

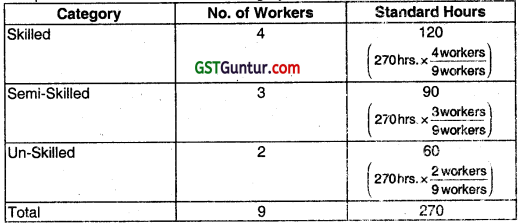

Statement showing ‘Standard Cost of Wages’ and ‘Actual Cost of Wages’- Production 11,000 units

| Standard Cost | Actual Cost | ||||

| Hours | Rate ₹ | Amount | Hours | Rate ₹ | Amount ₹ |

| 4,40,000 hrs. [11,000 × (1,600/40) | 40 | 1,76,00,000 | 3,98,000 hrs. | 22.613 (Appx.) | 90,00,00 |

![]()

(i) Material Price Variance = Actual Quantity × Std. Price – Actual Cost

Material ‘X’ = 82,400 Units × ₹ 40 – ₹ 33,84,000

= ₹ 88,000(A)

Material ‘Y’ = 2,46,400 Units × ₹ 70 – ₹ 1,73,88,000

= ₹ 1,40,000(A)

Material ‘Z’ = 1,64,000 Units × ₹ 25 – ₹ 40,40,000

= ₹ 60,000 (F)

Total = ₹ 88,000 (A) + ₹ 1,40,000(A) + ₹ 60,000 (F)

= ₹ 1,68,000(A)

(ii) Material Mix Variance = Std. Price × (Revised Actual Quantity – Actual Quantity)

Material ‘X’ = ₹ 40 × (82,133 units – 82,400 units)

= ₹ 10.680(A)

Material ‘Y’ = ₹ 70 × (2,46,400 units – 2,46,400 units)

= ₹ 0

Material ‘Z’ = 7 25 × (1,64,267 units -1,64,000 units)

= 6,675 (F)

Total = ₹ 10,680 (A) + ₹ 0 + ₹ 6,675 (F)

= ₹ 4,005 (A)

(iii) Labour Rate Variance = Actual hours × (Std. Rate – Actual Rate)

= 3,98,000 hrs. × (₹ 40 – ₹ 22.613)

= ₹ 69,20,000 (F)

(iv) Labour Efficiency = Std. Rate × (Standard hours – Actual hours)

Variance = ₹ 40 × (4,40,000 hrs. – 3,98,000 hrs.)

= ₹ 16,80,000 (F)

(v) Variable Overhead Efficiency Variance

= Std. Rate per Hour × (Standard Hours for Actual Production – Actual Hours)

= (₹ 400/40 hrs.) × [(11,000 units × 40 hrs.) – (3,98,000 hrs.)]

= ₹ 4,20,000 (F)

(vi) Fixed Overhead Efficiency Variance

= Std. Rate per Hour × (Standard Hours for Actual Production – Actual Hours)

= (₹ 600/40 hrs.) × [(11,000 units × 40 hrs.) – (3,98,000 hrs.)]

= ₹ 6,30,000 (F)

Assumption: It is assumed that Opening Inventory is valued at Standard Cost.

![]()

Question 10.

The following are the information regarding overheads of a company: (May 2013, 8 marks)

(a) Overheads cost variance = ₹ 2,800 (A)

(b) Overheads volume variance = ₹ 2,000 (A)

(c) Budgeted overheads = ₹ 12,000

(d) Actual overhead recovery rate = ₹ 8 per hour

(e) Budgeted hours for the period = 2400 hours

You are required to compute the following:

(i) Overheads expenditure variance.

(ii) Actual incurred overheads.

(iii) Actual hours for actual production.

(iv) Overheads capacity variance.

(v) Overheads efficiency variance.

(vi) Standard hours for actual production.

Answer:

Overheads Cost Variance = ₹ 2,800 (A)

Overheads Volume Variance = ₹ 2,000 (A)

Budgeted Overheads = ₹ 12,000

Actual Overhead Recovery Rate = ₹ 8 per hour

Budgeted Hours for the period = 2,400 hours

(i) Overheads Expenditure Variance = Overheads Cost Variance (-) Overheads Volume Variance

= ₹ 2,800 (A) – ₹ 2,000 (A)

= ₹ 800 (A)

(ii) Overheads Expenditure Variance = Budgeted Overheads (-) Actual Overheads

⇒ ₹ 800 (A) = ₹ 12,000 (-) Actual Overheads

Therefore, Actual Overheads = ₹ 12,800

![]()

(iii) Actual hours for actual production

= \(\frac{\text { Actual Overheads }}{\text { Actual OverheadRecovery Rate Per Hour }}\)

= \(=\frac{\text { Actual Overheads }}{\text { Actual OverheadRecovery Rate Per Hour }}\)

= 1,600 hours

(iv) Overheads Capacity Variance = Budgeted Overheads for Actual Hours (-) Budgeted Overheads

= ₹ 5* × 1600 hrs. – ₹ 12,000

= ₹ 8,000 – ₹ 12,000

= ₹ 4,000 (A)

[Note : Refer working note]

(v) Overheads Efficiency Variance = Absorbed Overheads (-) Budgeted Overheads for Actual Hour

= ₹ 10,000 – ₹ 5* × 1600 hours

= ₹ 2.000(F)

[Note : Refer working note]

(vi) Standard hours for actual production = \(\frac{\text { AbsorbedOverheads }}{\text { Standard OverheadRatePerHour }}\)

= \(=\frac{₹ 10,000}{₹ 5}\) = 2,000

[Note : Refer working note]

Working Notes:

Overhead Cost Variance = Absorbed Overheads (-) Actual Overheads

⇒ ₹ 2,800 (A) = Absorbed Overheads (-) ₹ 12,800

Therefore, Absorbed Overheads = ₹ 10,000

Standard Rate per hour = \(\frac{\text { BudgetedOverheads }}{\text { Budgeted Hours }}\) = \(\frac{₹ 12,000}{2,400 \text { hours }}\)

![]()

Question 11.

In a 40 hour week, the gang produced 270 standard hours. The actual number of semi-skilled workers is two times the actual number of unskilled workers. The rate variance of semi-skilled workers is ₹ 160 (F).

Find the following:

(i) The number of workers in each category

(ii) Total gang variance

(iii) Total sub-efficiency variance

(iv) Total labour rate variance

Indicate if the variances are Favourable (F) or Adverse (A or U). (8 marks)

Answer:

Woking Note

Computation of Standard Hours Category Wise

Computation of Actual Hours Category Wise

Semi-Skilied Workers

Labour Rate Variance = Standard Cost of Actual Time – Actual Cost

Or = Standard Rate × Actual Hours – Actual Rate × Actual Hours

Or = Actual Hours × (Standard Rate – Actual Rate)

⇒ ₹ 160(F) = Actual Hours × (₹ 3 – ₹ 2)

⇒ Actual Hours =160 Hours

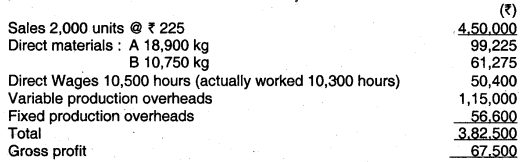

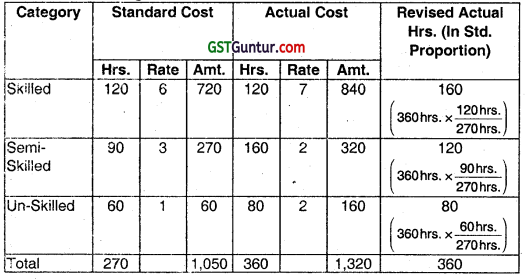

(i) Computation of Total No. of Workers In Each Category

(*) Total No. of Actual Hours is 360 hrs. (40 hrs. × 9 workers)

(ii), (iii), & (iv)

Computation of Variances

Statement Showing Standard & Actual cost

Total Gang Variance

= Total Actual Time Worked (hours) × {Average Standard Rate per hour of Standard Gang

Less: Average Standard Rate per hour of Actual Gang@}

@on the basis of hours worked

= 360 hrs. × \(\left(\frac{₹ 1,050}{270 \mathrm{hrs} .}-\frac{₹ 6 \times 120 \mathrm{hrs} .+₹ 3 \times 160 \mathrm{hrs} .+₹ 1 \times 80 \mathrm{hrs} .}{360 \mathrm{hrs} .}\right)\)

= ₹ 120(F)

Total Sub-Efficiency Variance

= Average Standard Rate per hour of Standard Gang × {Total Standard Time (hours’) Less Total Actual Time Worked (hours)}

= \(\left(\frac{₹ 1,050}{270 \text { hrs }}\right)\) × (270 hrs. – 360 hrs.)

= ₹ 350 (A)

Labour Rate Variance

= Standard Cost of Actual Time – Actual Cost

Or = Standard Rate × Actual Hours – Actual Rate × Actual Hours

Or = Actual Hours × (Standard Rate – Actual Rate)

Skilled Workers = 120 hrs. × (₹ 6 – ₹ 7)

= ₹ 120 (A)

Semi-Skilled Workers = 160 hrs. × (₹ 3 – ₹ 2)

= ₹ 160(F)

Skilled Workers = 80 hrs. × (₹ 1 – ₹ 2)

= ₹ 80 (A)

Total = ₹ 120(A) + ₹ 160(F) + ₹ 80 (A)

= ₹ 40 (A)

![]()

Question 12.

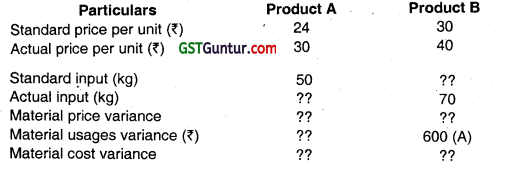

Compute the missing data, indicated by question marks, from the following: (Nov 2014, 7 marls)

Material Mix variance for both product together was ₹ 90 adverse.

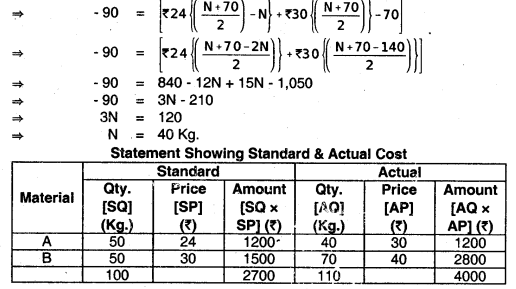

Answer:

Let SQ for product B = Q units

Material usage variance for B

= (SQ × SP) – (AQ × AP)

600 A = (SQ × 30) – (70 × 30)

600A = 30 SQ – 2100

30 SQ = 2100 – 600

SQ = \(\frac{1500}{30}\)

SQ = 50 units

So; std mix is 1 : 1

Let AQ of material A be K units. Total AQ = (K + 70) units. Since std. mix is 1 : 1 RAQ of A and B are each

\(\left(\frac{K+70}{2}\right)\) and \(\left(\frac{K+70}{2}\right)\) respectively.

It s given that material mix variance = (SQ × SP). (RAQ × SP)

90A = \(\left[\frac{(K+70)}{2} \times 24+\frac{(K+70)}{2} \times 30\right]\) – [(K × 124) + (70 × 30)]

90A = (12K + 840 + 15K + 1050) – (24K + 2100)

90A = (27K + 1890 – 24K – 2100)

120 = 3K

K = 40

Total AQ = 40 + 70 = 110 units

RAQ for A and B is 55 units each

![]()

Variance computation chart

| Particulars | (1) SQ × SP | (2) RAQ × SP | (3) AQ × SP | (4) AQ × AP |

| A | 50 × 24 = 1200 | 55 × 24 = 1320 | 40 × 24 = 960 | 40 × 30 = 1200 |

| B | 50 × 30 = 1500 | 55 × 30 = 1650 | 70 × 30 = 2100 | 70 × 40 = 2800 |

| 2700 | 2970 | 3060 | 4000 |

Material wise Break-up of variances

| Particulars | Prod. A | Prod. B | Total | ||

| (A) | Yield variance | [(1)-(2)] | 120 A | 150 A | 270 A |

| (B) | Mix variance | [(2)-(3)] | 360 F | 450 A | 90 A |

| (C) | Usage variance | [(1)-(3)] | 240 F | 600 A | 360 A |

| (D) | Price variance | [(3)-(4)] | 240 A | 700 A | 940 A |

| (E) | Total material cost | ||||

| Variance | [(1)- (4)] | 0 | 1300 A | 1300 A | |

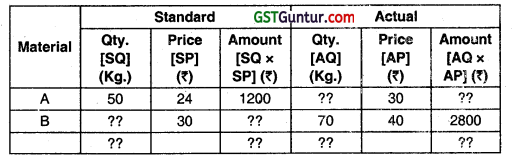

Alternative Solution:

Calculation of Missing Figures (Working)

Statement Showing Standard & Actual Cost (Incomplete)

Standard Input (Kg.) for Product ‘B’:

Let ‘T’ Kgs. be the Standard Quantity of Input for Product B

Material Usage Variance = (SQ × SP) – (AQ × SP)

Or

= (SQ – AQ) × SP

For Product B:

₹ 600 (A) = (T Kgs. – 70 Kgs.) × ₹ 30

⇒ -600 = 30T – 2,100

⇒ 30T = 1,500

⇒ T = 50 Kg.

Therefore, Standard Quantity of input for product B is 50 Kg.

Actual Input (Kg.) for Product ‘A’:

Let ‘N’ Kg. be the Actual Quantity of Input for Product A

Material Mix Variance = Std. Price × (Actual Quantity in Std. Proportion – Actual Quantity)

Or

Material Mix Variance (A + B) = Material Mix Variance (A) + Material Mix Variance (B)

![]()

Computation of Variances of Product A

Material Price Variance = Standard Cost of Actual Quantity – Actual Cost

= (SP × AQ) – (AP × AQ)

Or

= (SP – AP) × AQ

= (₹ 24.00 – ₹ 30.00) × 40 Kg.

= ₹ 240 (A)

Material Usage Variance = Standard Cost of Standard Quantity for Actual Production – Standard Cost of Actual Quantity

= (SQ × SP) – (AQ × SP)

Or

= (SQ – AQ) × SP

= ₹ 24.00 × (50 Kg. – 40 Kg.)

= ₹ 240 (F)

Total Material Cost Variance = Standard Cost – Actual Cost

= (SQ × SP) – (AQ × AP)

= ₹ 1,200 – ₹ 1,200

= ₹ 0

Computation of Variances of Product B

Material Price Variance = Standard Cost of Actual Quantity – Actual Cost

= (SP × AQ) – (AP × AQ)

Or

= (SP – AP) × AQ

= (₹ 30.00 – ₹ 40.00) × 70 Kg.

= ₹ 700 (A)

Standard Cost – Actual Cost

= (SQ× SP) – (AQ × AP)

= ₹ 1,500 – ₹ 2,800

= ₹ 1.300(A)

Important Note:

Calculation as well as Presentation may be different in this chapter. But there will be no change in final answer.

![]()

Question 13.

The standard cost of a certain chemical mixture is as under: (May 2015, 8 marks)

40% of Material A @ ₹ 30 per kg

60% of Material B @ ₹ 40 per kg

A standard loss of 10% of input is expected in production. The following actual cost data is given for the period.

350 kg Material – A at a cost of ₹ 25

400 kg Material – B at a cost of ₹ 45 Actual weight produced is 630 kg.

You are required to calculate the following variances raw material wise and indicate whether they are favourable (F) or adverse (A):

(i) Cost variance

(ii) Price variance

(iii) Mix variance

(iv) Yield variance

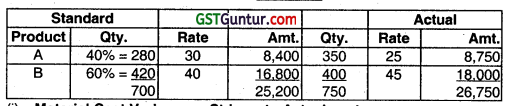

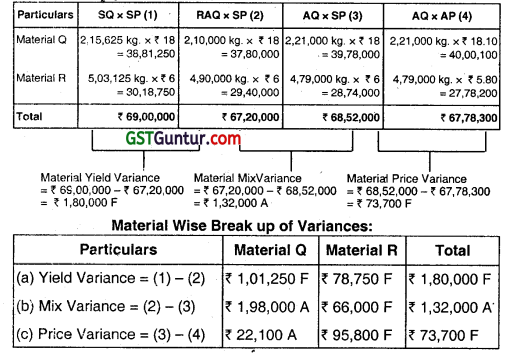

Answer:

Total Actual weight produced = 630 kg.

Add: Normal loss [\(\frac{630}{90 \%}\) × 10%] = 70 kg.

Actual Input = 700 kg.

(i) Material Cost Variance Std. cost – Actual cost

Product A = 8,400 – 8,750 = – 350 (A)

Product B = 16800 – 18,000 = -1.200(A)

= 1.550 (A)

(ii) Material Price Variance = (SR – AR) × AQ.

Product A = (30 – 25) × 350 = 1,750 (F)

Product B = (40 – 45) × 400 = -2.000 (A)

= -250(A)

(iii) Material Mix Variance = SP × (RAQ – AQ)

A = ₹ 30 × (300 Kg – 350 Kg)

= ₹ 1,500(A)

B = ₹ 40 × (450Kg. – 400Kg.)

= ₹ 2,000 (F)

Total = ₹ 1,500 (A) + ₹ 2,000 (F)

= ₹ 500(F)

(iv) Material Yield Variance = (Total Std. Qty. – Total Act. Qty.) × Avg. Std. price p.u. of Std. Mix.

= (700 – 750) × \(\frac{25,200}{700}\)

= -1800 (A)

![]()

Question 14.

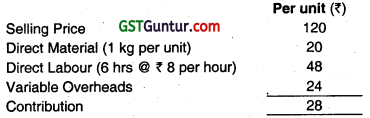

Alpha Ltd. uses standard costing system for manufacturing its single product ‘APS’. (Nov 2015, 8 marks)

Standard cost card is as follows:

Actual and budgeted activity levels in units for the month of September are:

Actual sales revenue and variable costs for the month of September are given as under:

Calculate:

(i) Direct Labour Rate Variance

(ii) Direct Labour Efficiency Variance .

(iii) Sales Volume Variance .

(iv) Sales Price Variance

(v) Comment on your findings in (i) and (ii) above.

Answer:

(i) Direct labour rate variance = Standard cost for Actual Hours Actual Cost

= (SR × AH) – Actual Cost

= (8 × 3,00,000) – 24,42,000

= 24,00,000 – 24,42,000

= – 42.000(A)

(ii) Direct labour efficiency variance

= Standard cost of standard time for Actual production – Standard cost for Actual time

= (SH × SR) – (AH × SR)

= (52,000 × 6) × 8) – (3,00,000 × 8)

= 24,96,000 – 24,00,000

= 96,000 (F)

(iii) Sales volume variance = Standard sales – Budgeted sales

= BP × AQ – BP × BQ

= (AQ – BQ) × BP

= (51,200 – 50,000) × 120

= 1,44,000 (F)

![]()

(iv) Sales price variance = Actual Qty. × (AP – BP)

= 51,200 × \(\left(\frac{61,33,760}{51,200}-120\right)\)

= – 10,240 (A)

(v) Comment:

Direct Labour Rate Variance

Adverse Labour Rate Variance indicates that the labour rate per hour paid is more than the set standard. The reason may include among other things such as:

- While setting standard, the current/ future market conditions like pending labour negotiation/ cases, has not been considered (or predicted) correctly. ‘

- The labour may have been told that their wage rate will be raised or bonus will be paid if they work efficiently.

Direct Labour Efficiency Variance

It indicates that the workers have produced actual production quantity in less time than the time allowed. The reason for favourable labour efficiency variance may include among the other things as follows:

- While setting standard, workers efficiency could not be estimated properly, this may happen due to non-observance of time and motion study.

- The workers may be new in the factory, hence, efficiency could not be predicted properly.

![]()

Question 15.

A company operates a standard cost system to control the variable works cost of its only product. The following are the details of actual production, costs and variances for November, 2015. (May 2016, 8 marks)

Production and cost (actual)

Production – 10,000 units

Direct Materials (1,05,000 kg.) – ₹ 5,20,000

Direct Labour (19,500 hrs.) – ₹ 3,08,000

Variable Overheads – ₹ 4,10,000

Cost variances

Direct materials — Price : ₹ 5,000 (F)

Direct materials — Usages : ₹ 25,000 (A)

Direct labour — Rate : ₹ 15,500 (A)

Direct labour — Efficiency : ₹ 7,500 (F)

Variable overheads : ₹ 10.000(A)

The Cost Accountant finds that the original standard cost data for the product is missing from the cost department files. The variance analysis for December, 2015 is held up for want of this data.

You are required to calculate:

(i) Standard price per kg of direct material.

(ii) Standard quantity for each unit of output.

(iii) Standard rate of direct labour hour.

(iv) Standard time for actual production.

(v) Standard variable overhead rate.

Answer:

(i) Standard Price per Kg. of Direct Material:

Material Price Variance = Standard Cost of Actual Quantity – Actual Cost

– 5,000 (F) = Standard Cost of Actual Quantity – ₹ 5,20,000

Standard Cost of Actual Quantity

= ₹ 5,20,000 + ₹ 5,000

= ₹ 5,25,000

Standard Cost of Actual Quantity = Standard Price per Kg. × Actual Quantity

⇒ ₹ 5,25,000 = Standard Price per Kg. × 1,05,000 Kg.

Standard Price per Kg. = \(\left(\frac{₹ 5,25,000}{1,05,000 \mathrm{Kg} .}\right)\)

= ₹ 5

![]()

(ii) Standard Quantity for each unit of output:

Material Usage Variance = Standard Cost of Standard Quantity for Actual Output – Standard Cost of Actual Quantity

⇒ 25,000 (A) = Standard Cost of Standard Quantity for Actual Output – ₹ 5,25000

Standard Cost of Standard Quantity for Actual Output

= ₹ 5,25,000 – ₹ 25000

= ₹ 5,00,000

Standard Cost of Standard Time for Actual Production = Standard Rate per hr. × Standard Time for Actual Production

⇒ ₹ 3,00,000 = ₹ 15 × Standard Time for Actual Output

Standard Quantity for Actual Output = \(\left(\frac{₹ 5,00,000}{₹ 5}\right)\)

Standard Quantity for each unit of output = \(\left(\frac{1,00,000 \mathrm{Kg} .}{10,000 \text { units }}\right)\)

= 10Kg.

(iii) Standard Rate of Direct Labour Hour

Direct Labour Rate Variance = Standard Cost of Actual Time – Actual Cost

⇒ 15,500 (A) = Standard Cost of Actual Time – ₹ 3,08,000

Standard Cost of Actual Time = ₹ 3,08,000 – ₹ 15.500

= ₹ 2,92,500

Standard Cost of Actual Time = Standard Rate per hr. × Actual Hours

⇒ ₹ 2,92500 = Standard Rate per hr. × 19,500 hrs.

Standard Rate per hr. = \(\left(\frac{₹ 2,92,500}{19,500 \mathrm{hrs} .}\right)\) = ₹ 15

(iv) Standard Time for Actual Production

Labour Efficiency Variance = Standard Cost of Standard Time for Actual Production – Standard Cost of Actual Time

⇒ 7,500 (F) = Standard Cost of Standard Time for Actual Production – ₹ 2,92,500

Standard Cost of Standard Time for Actual Production

= ₹ 2,92,500 + ₹ 7,500

= ₹ 3,00,000

Standard Cost of Standard Time for Actual Production

= Standard Rate per hr. × Standard Time for Actual Production

⇒ ₹ 300,000 = ₹ 15 × Standard Time for Actual Production

Standard Time for Actual Production

= \(\left(\frac{₹ 3,00,000}{₹ 15}\right)\)

= 20,000 hrs.

![]()

(v) Standard Variable Overhead Rate

Variable Overhead Variance = Standard Variable Overheads for Production – Actual Variable Overheads

⇒ 10.000(A) = Standard Variable Overheads for Production – ₹ 4,10,000

Standard Variable Overheads for Production

= ₹ 4,10,000 – ₹ 10,000

= ₹ 4,00,000

Standard Variable Overheads for Production

= Standard Variable Overhead Rate per Unit × Actual Production (Units)

⇒ ₹ 4,00,000 = Standard Variable Overhead Rate per Unit × 10,000 units

Standard Variable Overhead Rate per unit

= \(\left(\frac{₹ 4,00,000}{10,000 \text { units }}\right)\)

= ₹ 40

Or

Standard Variable Overheads for Production

= Standard Variable Overhead Rate per Hour × Standard Hours for Actual Production

⇒ ₹ 4,00,000 = Standard Variable Overhead Rate per Hour × 20,000 hrs.

Standard Variable Overhead Rate per hour

= \(\left(\frac{₹ 4,00,000}{20,000 \mathrm{hrs}}\right)\)

= ₹ 20

![]()

Question 16.

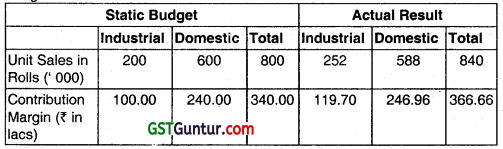

Zed company manufacturers two types of flooring rolls. Budgeted and actual data for 2015 are : (Nov 2016, 8 marks)

Compute:

(i) Sales Mix Variance and Sales Quantity Variance by type of flooring rolls and in total.

(ii) Market Share Variance and Market Size Variance.

Answer:

(a) Workings

Statement Showing “Budgeted Vs Actual Figures”

Budgeted Market Share (in %) = \(\frac{8,00,000 \text { Rolls }}{80,00,000 \text { Rolls }}\)

= 10%

Actual Market Share (in %) = \(\frac{8,40,000 \text { Rolls }}{70,00,000 \text { Rolls }}\)

= 12%

Average Budgeted Margin (per Roll) = \(\frac{₹ 340 \text { Lacs }}{8,00,000 \text { Rolls }}\)

= ₹ 42.50

![]()

Computation of Variances Sales Mix Variance = Standard Margin Less Revised Standard Margin

Or

= (AQ × BM) – (RAQ × BM)

Or

= BM × (AQ – RAQ)

Domestic = ₹ 40 × (5,88,000 – 630,000)

= ₹ 16,80,000 (A)

Industrial = ₹ 50 × (2,52,000 – 2,10,000)

= ₹ 21,00,000 (F)

Total = ₹ 16,80,000 (A) + ₹ 21,00,000 (F)

= ₹ 4,20,000 (F)

Sales Quantity Variance = Revised Standard Margin Less Budgeted Margin

Or

= (RAQ × BM) – (BQ × BM)

Or

= BM × (RAQ – BQ)

Domestic = ₹ 40 × (6,30,000 – 6,00,000)

= ₹ 12,00,000 (F)

Industrial = ₹ 50 × (2,10,000 – 2,00,000)

= ₹ 5,00,000 (F)

Total = ₹ 12,00,000 (F) + ₹ 5,00,000 (F)

= ₹ 17,00,000 (F)

Market Size Variance = Budgeted Market Share %. × (Actual Industry Sales Quantity in units – Budgeted Industry Sales Quantity in units) × (Average Budgeted Margin per unit)

= 10% × (70,00,000 Rolls – 80,00,000 Rolls) × ₹ 42.50

= ₹ 42,50,000 (A)

Market Share Variance = (Actual Market Share % – Budgeted Market Share %) × (Actual Industry Sales Quantity in units) × (Average Budgeted Margin per unit)

= (12% – 10%) × 70,00,000 Rolls × ₹ 42.50

= ₹ 59,50,000 (F)

![]()

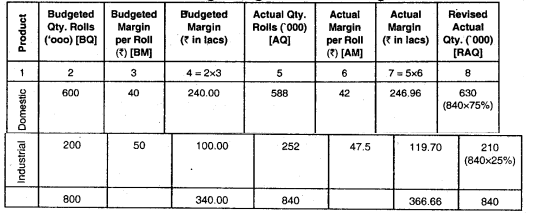

Question 17.

The following data pertains to a company which uses standard marginal costing for manufacture and sale of a single product during the year. (May 2017, 8 marks)

| Particulars | Budget | Actual |

| Sales (in units) | 60,000 | 66,000 |

| Sales (₹) | 1,80,00,000 | 2,14,50,000 |

| Direct Materials (₹) | 28,80,000 | 36,30,000 |

| Direct Labour (₹) | 43,20,000 | 52,80,000 |

| Variable Overheads (₹) | 72,00,000 | 81,84,000 |

| Total Variable Costs | 1,44,00,000 | 1,70,94,000 |

Additional information is as follows:

| Standard | Actual | |

| Direct material price per kg | ₹ 12 | ₹ 11 |

| Direct labour rate per hour | ₹ 9 | ₹ 10 |

Calculate the following variance for the year and indicate the type of variance favourable (F), unfavourable (U) or adverse (A).

(i) Direct material usage variance

(ii) Direct material price variance

(iii) Direct labour efficiency variance

(iv) Direct labour rate variance

(v) Variable overhead cost variance

(vi) Sales margin volume variance

Answer:

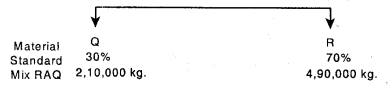

(i) Direct Material Usage Variance:

Direct Material Usage Variance

= (Standard Quantity – Actual Quantity) × Standard Rate

= (2,64,000 – 3,30,000) × 12

Direct Material Usage Variance = 7,92,000 (A)

![]()

(ii) Direct Material Price Variance:

Direct Material Price Variance

= (Standard Price – Actual Price) × Actual Quantity

= (12 – 11) × 3,30,000

Direct Material Price Variance = 3,30,000 (F)

(iii) Direct Labour Efficiency Variance:

Direct Labour Efficiency Variance

= (Standard hours – Actual hours) × Standard Rate

= (5,28,000 – 5,28,000) × 9

Direct Labour Efficiency Variance = NIL

(iv) Direct Labour Rate Variance:

Direct Labour Rate Variance

= (Standard Rate – Actual Rate) × Actual hours

= (9 – 10) × 5,28,000

Direct Labour Rate Variance = 5,28,000 (A)

(v) Variable Overhead Cost Variance:

Variable Overhead Cost Variance

= (Standard input for actual output – Actual input for actual output)

= (79,20,000 – 81,84,000)

Variable Overhead Cost Variance = 2,64,000 (A)

(vi) Sales Margin Volume Variance:

= Standard Margin – Budgeted Margin*

= \(\left(\frac{₹ 36,00,000}{60,000 \text { units }} \times 66,000 \text { units }\right)\) – ₹ 36,00,000

= ₹ 3,60,000 (F)

(*) Budgeted Margin

= ₹ 1,80,00,000 – ₹ 1,44,00,000 = ₹ 36,00,000

![]()

Working Note:

1. Calculation for Material (Standard input for Actual Output)

| Standard | Actual | |||||

| Material | Kg. | Rate | Amount | Kg. | Rate | Amount |

| 2,64,000 | 12 | 31,68,000 | 3,30,000 | 11 | 36,30,000 | |

2. Calculation for Labour (Standard hours for Actual output)

| Standard | Actual | |||||

| Labour | Hours | Rate | Amount | Hours | Rate | Amount |

| 5,28,000 | 9 | 47,52,000 | 5,28,000 | 10 | 52,80,000 | |

3. Calculation for variable Overhead Cost:

Standard input for actual output = \(\frac{72,00,000}{60,000}\) × 66,000

= 79,20,000

4. Calculation for Sales Margin:

(i) Calculation fro Profit on Sales

(ii) Sales Margin

| Standard | Actual | |||||

| Sales Margin | Unit | Rate | Amount | Unit | Rate | Amount |

| 60,000 | 159 | 95,40,000 | 66,000 | 180 | 1,18,80,000 | |

![]()

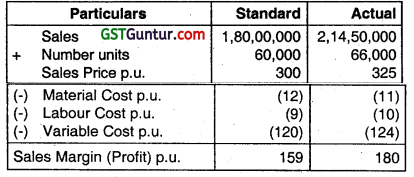

Question 18.

S. Ltd. produces and sells a single product. The product is manufactured by mixing two raw materials Q and R. The standard cost date of the product is as follows: (Nov 2017, 8 marks)

The fixed production overhead absorption rate is based on the budgeted production.

Calculate Sales price variance, Sales volume variance, Material price variance, Material mix variance, Material yield variance, Fixed overhead expenditure variance and Fixed overhead volume variance.

Answer:

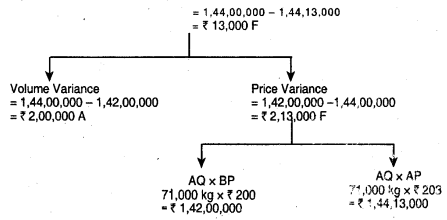

1. Sales Variances:

2. Material Cost Variance

(i) Computation of Standard Quantity (SQ) of RM

SQ at 96% = \(\frac{69,000 \mathrm{~kg} .}{96 \%}\) = 71,875 kg. .

(iii) Computation of Revised Actual Quantity (RAQ)

Total Actual Qty. = 2,21,000 + 4,79,000 = 7,00,000 kg. RM

3. Variance Computation Chart:

4. Factory Overhead Variances:

Total Factory Overhead Cost Variance = ₹ 5,52,000 – ₹ 5,08,000

= ₹ 44,000

![]()

Question 19.

Trident Toys Ltd. manufactures a single product and the standard cost system is followed. Standard cost per unit is worked out as follows: (May 2018, 12 marks)

Materials (10 Kgs. @ ₹4 Per Kg) = ₹ 40

Labour (8 hours @ ₹ 8 per hour) = ₹ 64

Variable overheads (8 hours @ ₹ 3 per hour) = ₹ 24

Fixed overheads (8 hours @ ₹ 3 per hour) = ₹ 24

Standard Profit = ₹ 56

Overheads are allocated on the basis of direct labour hours. In the month of April 2018, there was no difference between the budgeted and actual selling price and there were no opening or closing stock during the period. The other details for the month of April 2018 are as under:

| Budgeted | Actual | |

| Production and Sales | 2000 Units | 1800 Units |

| Direct Materials | 20,000 Kgs. @ ₹ 4 per kg | 20,000 Kgs. @ ₹ 4 per kg |

| Direct Labour | 16000 Hrs. @ ₹ 8 per Hr | 14800 Hrs. @ ₹ 8 per Hr |

| Variable Overheads | ₹ 48,000 | ₹ 44,400 |

| Fixed Overheads | ₹ 48,000 | ₹ 48,000 |

Required:

I. Reconcile the budgeted and actual profit with the help of variances according to each of the following method:

(a) The conventional method

(b) The relevant cost method assuming that

(i) Materials are scarce and are restricted to supply of 20000 Kgs. for the period.

(ii) Labour hours are limited and available hours are only 16000 hours for the period.

(iii) There are no scarce inputs.

Answer:

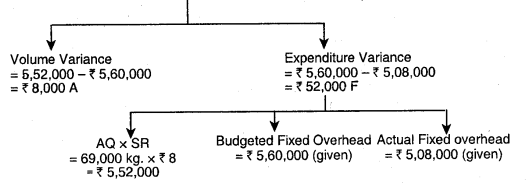

(I) Computation of Variances

Material Usage Variance = Standard Price × (Standard Quantity – Actual Quantity)

= ₹ 4.00 × (18,000* Kgs. – 20,000 Kgs.)

= ₹ 8,000 (A)

* (1800 units × \(\frac{20,000 \mathrm{kgs} .}{2000 \text { units }}\))

![]()

Labour Efficiency Variance = Standard Rate × (Standard Hours – Actual Hours)

= ₹ 8.00 × (14,400* hrs. – 14,800 hrs.)

= ₹ 3,200 (A)

*( 1800 units × \(\frac{16,000 \mathrm{hrs} .}{2000 \text { units }}\))

Variable Overhead Efficiency Variance

= Standard Variable Overheads for Production – Budgeted Variable Overheads for Actual hours

= (14,400 hrs. × ₹ 3.00) – (₹ 3.00 × 14,800 hrs.)

= ₹ 1,200 (A) ‘

Fixed Overhead Volume Variance

= Absorbed Fixed Overheads – Budgeted Fixed Overheads

= (14,400 hrs. × ₹ 3.00) – (16,000 hrs. × ₹ 3.00)

= ₹ 4,800 (A)

Sales Margin Volume Variance = Standard Margin – Budgeted Margin

= (1,800 units × ₹ 56.00) – (2,000 units × ₹ 56.00)

= ₹ 11,200 (A)

Sales Contribution Volume Variance

= Standard Contribution – Budgeted Contribution

= (1,800 units × ₹ 80.00) – (2,000 units × ₹ 80.00)

= 116,000 (A)

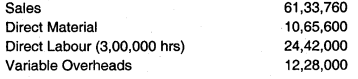

Statement Showing “Reconciliation Between Budgeted Profit & Actual Profit”

| Particulars | Convention al Method (₹) | Relevant Cost Method (₹) | ||

| Scarce Material | Scarce Labour | No Scarce Inputs | ||

| Budgeted Profit (2,000 units × ₹ 56) | 1,12,000 | 1,12,000 | 1,12,000 | 1,12,000 |

| Sales Volume Variance | 11.200(A) | NIL* | 12,000$ (A) | 16,000 (A) |

| Material Usage Variance | 8,000 (A) | 24,000 (A) | 8,000 (A) | 8,000 (A) |

| Labour Efficiency Variance | 3,200 (A) | 3,200 (A) | 7,200 (A) | 3,200 (A) |

| Variable Overhead Efficiency Variance | 1,200 (A) | 1.200(A) | 1,200 (A) | 1,200 (A) |

| Fixed Overhead Volume Variance | 4,800 (A) | N.A.# | N.A. # | N.A. # |

| Actual Profit | 83,600 | 83,600 | 83,600 | 83,600 |

![]()

Notes:

Scarce Material

Based on conventional method, direct material usage variance is ₹ 8,000 (A) i.e. 2,000 Kg. × ₹ 4. In this situation material is scarce, and, therefore, material cost variance based on relevant cost method should also include contribution lost per unit of material. Excess usage of 2,000 Kg. leads to lost contribution of ₹ 16,000 i.e. 2,000 Kgs, × ₹ 8. Total material usage variance based on relevant cost method, when material is scarce will be:

₹ 8,000 (A) + ₹ 16,000 (A) = ₹ 24,000 (A). Since labour is not scarce, labour variances are identical to conventional method.

Excess usage of 2,000 Kgs. leads to loss of contribution from 200 units i.e. ₹ 16,000 (200 units × ₹ 80). It is not the function of the sales manager to use material efficiently. Hence, loss of contribution from 200 units should be excluded while computing sales contribution volume variance.

Therefore, sales contribution volume variance, when materials are scarce will be NIL i,e. ₹ 16,000 (A) – ₹ 16,000 (A).

Scarce Labour

Material is no longer scarce, and, therefore, the direct material variances are same as in conventional method. In conventional method, excess labour hours used are: 14,400 hrs.

– 14,800 hrs. = 400 hrs. Contribution lost per hour = ₹ 10. Therefore, total contribution lost, when labour is scarce will be: 400 hrs. × ₹ 10 = ? 4,000. Therefore, total labour efficiency variance, when labour hours are scarce will be ₹ 7,200 (A) i.e. ₹ 3,200 (A) + ₹ 4,000 (A).

Excess usage of 400 hrs. leads to loss of contribution from 50 units i.e. ₹ 4,000 (50 units × ₹ 80). It is not the function of the sales manager to use labour hours efficiently . Hence, loss of contribution from 50 units should be excluded while computing sales contribution volume Variance. ($)→

Therefore, sales contribution volume variance, when labour hours are Scarce will be ₹ 12,000 (A) i.e. ₹ 16,000 (A) – ₹ 4,000 (A).

Fixed Overhead Volume Variance

(#)→

The fixed overhead volume variance does not arise in marginal costing system. In absorption costing system, it represents the value of the under or over absorbed fixed overheads due to change in production volume. When marginal costing is in use there is no overhead volume variance, because marginal costing does not absorb fixed overheads.

![]()

Question 20.

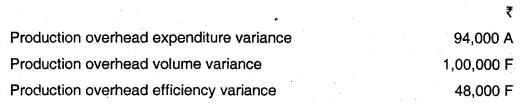

Apple Ltd., is following three variances method to analyse and understand production overhead variances. The three variances for a particular year were reported as given below: (Nov 2018, 10 marks)

The other particulars furnished from the records of the company are :

Standard machine hours for the year : 11500

Closing balance in the production Overhead

Control Account : ₹ 18,00,000

Fixed overhead rate per hour : ₹ 125

Variable overhead rate per hour : ₹ 80

Required:

Compute the following by considering the additional information also:

(i) Actual machine hours

(ii) Budgeted machine hours

(iii) Total Fixed Production Overhead amount

(iv) Applied Production Overhead amount.

Additional Information:

- Expenditure variance was computed totally for fixed and variable overheads.

- Volume variance is applicable to fixed overhead only.

- Efficiency variance is applicable only to variable overhead and fixed overhead efficiency variance was already included in volume variance.

Answer:

Given Production Overhead Volume Variance = 1,00,000 (F)

Therefore, Fixed Overhead Volume Variance = 1,00,000 (F)

(As per the additional information provided)

1,00,000 (F) = (Budgeted Hours – Standard Hours for Actual Production) × Recovery Rate per hour for Fixed Overheads

1,00,000 (F) = (Budgeted Hours – 11,500 hours) × 125

800 (F) = Budgeted Hours – 11,500 hours

Budgeted Hours = 10,700 hours.

Production Overhead Efficiency Variance = 48,000 (F)

(Standard Hours for Actual Production – Actual Hours) × Recovery Rate per hour for Variable Overheads

48,000 (F) = (11,500 – Actual Hours) ×80

600 (F) = 11,500 – Actual Hours

Since variable overhead efficiency variance is favourable, Actual Hours will be less than standard Hours.

Actual Hours = 11500 – 600

Actual Hours = 10900 hours

Applied Production Overhead (Absorbed)

1 = (Standard Hours for Actual Production x Recovery Rate per hour for fixed and variable overheads)

= 11500 × 205

Applied Production Overhead = ₹ 23,57,500/-

Production Overhead = ₹ 18,00,000 – ₹ 94,000 A + ₹ 1,00,000 F +₹ 48,000 F

= ₹ 18,54,000.

![]()

Alternative Answer:

(i) Calculation of Actual Machine Hours

Efficiency Variance = ₹ 48,000 (F) given

= Standard Variable Overhead Rate per Hour × (Standard Hours – Actual Hours)

₹ 48.000(F) = ₹ 80 × (11,500 hrs. – Actual Hours)

Actual Hours = 10,900 hrs.

(ii) Budgeted Machine Hours

Volume Variance = ₹ 1,00,000 (F)

= Standard Fixed Overhead Rate per Hour × (Standard Hours – Budgeted Hours)

₹ 1,00,000 (F) = ₹ 125 × (11, 500 hrs. – Budgeted Hours)

Budgeted Hours = 10,700 hrs.

(iii) Total Fixed Production Overhead*

Fixed Production Overhead = Standard Fixed Overhead Rate per Hour × Budgeted Hours

= ₹ 125 × 10, 700 hrs.

= ₹ 13,37,500

* Assumed Budgeted

(iv) Applied Manufacturing Overhead

= Standard Overhead Rate per Hour × Standard , Hours

= ₹ 205 × 11, 500 hrs.

= ₹ 23,57,500

Alternative (iii) & (iv)

(iii) Total Fixed Production Overhead

Expenditure Variance = Fixed Production Overhead (Budgeted) + Budgeted Variable Overheads for Actual Hours – Actual Overheads

₹ 94,000 (A) = Fixed Production Overhead + 10,900 hrs. × ₹ 80 – ₹ 18,00,000

Fixed Production Overhead = ₹ 8,34,000

![]()

(iv) Applied Manufacturing Overhead

= Actual Overhead Incurred + Total Variance

= ₹ 18,00,000 + ₹ 54,000

= ₹ 18,54,000

Working Notes:

Total Variance = Expenditure Variance + Efficiency Variance + Volume Variance

= ₹ 94,000 (A) + ₹ 48,000 (F) + ₹ 1,00,000 (F)

= ₹ 54,000 (F)

![]()

Question 21.

GRV is a chemical processing company that produces sprays used by farmers to protect their crops. One of these sprays ‘Agrofresh’ is made by using either chemical A or chemical B. To produce one litre of Agrofresh spray they have the option to use either 12 litres of chemical A or 12 litres of chemical B. During the financial year, the purchase department of GRV has planned to use chemical B as it appeared that it would be the cheaper of the two and their plans were based on a cost of chemical B of ₹ 15 per litre. Due to subsequent market movement during the year the actual prices changed and if the concerned department had purchased efficiently, the cost would have been

Chemical A ₹ 15.40 per litre

Chemical B ₹ 16.00 per litre

Production of Agrofresh spray was 1000 litres and the usage of chemical B was 12800 litres at a cost of ₹ 2,09,920.

You are the CEO of GRV and the Management Accountant has sent to you the following suggestions through e-mail: (May 2019)

“I feel that in our particular circumstances the traditional approach to variance analysis is of little use as for some of our products we can utilize one of several equally suitable chemicals and we always plan to use such chemical which will lead to cheapest production costs.

However due to sharp market movements, we are frequently trapped by the sharp price changes which lead to the choice of expensive alternative at the end.”

To check the reality in the content of the mail, your CEO asked you, the Cost Accountant of the company:

(i) to calculate the material variances for Agrofresh by using (6 marks)

- Traditional Variance Analysis

- Planning and Operational Variances

(ii) to analyse how planning and operational variances approached the variances. (2 marks)

(iii) to analyse how the advanced variances are useful to your organisation. (2 marks)

Answer:

(i) Traditional Variances:

Usage Variance = (12,000 litre – 12,800 litre) × ₹ 15

= ₹ 12,000 (A)

Price Variance = (₹ 15 – ₹ 16.4) × 12,800 litre

= 17,920 (A)

Total Variance = ₹ 12,000 (A) + ₹ 17,920 (A)

= ₹ 29,920 (A)

![]()

Operational variances:

Usage Variance = (12,000 litre – 12,800 litre) × ₹ 16

= ₹ 12,800 (A)

Price Variance = (₹ 16 – ₹ 16.40) × 12,800 litre

= ₹ 5,120 (A)

Total Variance = ₹ 12,800 (A)+ ₹ 5,120(A)

= ₹ 17,920 (A)

Planning Variances:

Controllable = (₹ 15.40 – ₹ 16) × 12,000 litre

= ₹ 7200(A)

Uncontrollable Variance = (₹ 15.00 – ₹ 15.40) × 12,000 litre

= ₹ 4,800 (A)

Total Variance = ₹ 7,200 (F) + ₹ 4,800 (A)

= ₹ 12,000 (A)

Reconciliation = 17,920 (A) + ₹ 12,000(A)

= ₹ 29,920 (A)

(ii) A planning variance simply compares a revised standard to the original standard. An operational variance simply compares the actual results against the revised amount. Controllable variance are those variances which arises due to inefficiently of a cost central department. Uncontrollable variances are those variances which arises due to factors beyond the control of the management or concerned department of the organization.

(iii) Planning variances are generally not controllable, where a revision of standards is required due to environmental / technological changes that were not anticipated at the time the budget was prepared, the planning variances are truely uncontrollable. However, standards that failed to anticipate known market trends when they were set will reflect faulty standard – setting : it could be argued that these variances were controllable at the planning stage.

![]()

Question 22.

SPS Limited uses activity based costing to allocate variable manufacturing overhead costs to products. The company identified three activities with the following information for last quarter: (Nov 2019)

| Activity | Standard Rate | Standard Quantity per unit produced | Actual Costs | Actual Quantity |

| Indirect Materials | ₹ 20 per kilogram | 0.5 kilogram per unit | ₹? 9,40,000 | 48,000 kilogram |

| Product Testing | ₹ 3 per test minute | 10 minutes per unit | ₹ 22,50,000 | 7,40,000 test minutes |

| Energy | ₹ 0.20 per minute of machine time | 4 minutes of machine time per unit | ₹ 70,000 | 3,60,000 minutes of machine time |

The company produced 80,000 units in the last quarter. Company policy is to investigate all variances above 5% of the flexible budget amount for each activity.

Required:

(i) Calculate variable overhead expenditure variance and variable overhead efficiency variance for each of the activities using activity based costing. Clearly indicate each variance as favourable or unfavourable/ adverse. (6 marks)

(ii) Interpret the results of variable overhead efficiency variance as calculated in (i) above in respect of indirect materials and product testing activity. (2 marks)

(iii) Identify the variances that should be investigated according to company, policy. Show calculations to support your answer. (2 marks)

Answer:

(i) 1. Indirect Materials:

Variable overhead Expenditure Variance = (Standard Rate – Actual Rate) × Actual Quantity

= (₹ 20 – \(\frac{₹ 9,40,000}{48,000 \mathrm{~kg}}\)) × 48,000 kg

= ₹ 20,000 (F)

Variable overhead Efficiency Variance = (Standard Qty. for Actual – Actual Quantity) × Standard Rate

= (80,000 × 0.5 – 48,000) × ₹ 20

= ₹ 1,60,000 (A)

![]()

2. Product Testing:

Variable overheads Expenditure Variance = (₹ 3 – \(\frac{₹ 22,50,000}{7,40,000}\)) × 7,40,000

= ₹ 30,000 (A)

Variable overhead Efficiency Variance = (80,000 × 10 – 7,40,000) × ₹ 3

= ₹ 1,80,000 (F)

3. Energy:

Variable overheads Expenditure Variance = (₹ 0.2 0 – \(\frac{₹ 70,000}{3,60,000}\)) × 3,60,000

= ₹ 2,000 (F)

Variable overheads Efficiency = (80,000 × 4 – 3,60,000) × ₹ 0.20

= ₹ 8,000 (A)

(ii) In case of Indirect material, the variable overhead efficiency variance is ₹ 1,60,000 (A). Which indicates that actual production quantity have been produced in more time as allowed In case of product testing, variable overhead efficiency variance is ₹ 1,80,000 (F). Which indicates that the actual production have been made in less time as allowed.

(iii) 1. Indirect Material:

= (80,000 units × 0.5 kg. per unit × ₹ 20)

= ₹ 8,00,000

Investigation to be done if, indirect material net variance is more than ₹ 40,000 (i.e. ₹ 8,00,000 × 5%) ,

Net Variable overhead cost variance = ₹ 1,60,000 (A) – ₹ 20,000 (F)

= ₹ 1,40,000 (A)

So, Indirect Material activity variances as shall be investigated.

2. Product Testing:

= (80,000 units × 10 min per unit) × ₹ 3 per test minute = ₹ 24,00,000

Investigation to be done if, product Testing net variable is more than ₹ 1,20,000 (i.e. ₹ 24,00,000 × 5%)

Net Variable Cost Variance = ₹ 180.000(F) – ₹ 30,000 (A)

= ₹ 1,50,000 (F)

So, product testing should be investigated

![]()

3. Energy:

(80,000 units × 4 min × ₹ 0.20) = ₹ 64,000

Investigation to be done if, product testing net variable is more than ₹ 3,200 i.e. ₹ 64,000 × 5%).

Net Variable Cost Variance = ₹ 8,000 (A) – ₹ 2,000 (F) = ₹ 6,000 (A) .

So, energy activity variance should be investigated.

Alternate Answer:

(i) Indirect Materials

Efficiency Variance = Cost Impact of undertaking activities more/ less than standard

= (0.50 kg. × 80,000units – 48,000 kg.) × ₹ 20

= ₹ 1,60,000 (A)

Expenditure Variance = Cost impact of paying more/ less than standard for actual activities undertaken

= 48,000kg. × ₹ 20 – ₹ 9,40,000

= ₹ 20,000 (F)

Product Testing

Efficiency Variance = Cost Impact of undertaking activities more/ less than standard

= (10 mins. × 80,000 units – 7,40,000 mins.) × ₹ 3

= ₹1,80,000 (F)

Expenditure Variance = Cost impact of paying more/ less than standard for actual activities undertaken

= 7,40,000mins × ₹ 3 – ₹ 22,50,000

= ₹ 30,000 (A)

Energy

Efficiency Variance = Cost Impact of undertaking activities more/ less than standard

= (4 mins, × 80,000 units – 3,60,000 mins.) × ₹ 0.20

= ₹ 8,000 (A)

Expenditure Variance = Cost impact of paying more/ less than standard for actual activities undertaken

= 3,60,000mins × ₹ 0.20 – ₹ 70,000

= ₹ 2,000 (F)

![]()

(ii) Indirect Materials

SPS actually spent 48,000 kg. or 8,000 kg. more than the standard allows. At a predetermined rate of ₹ 20 per kg., efficiency variance is 1,60,000 (A). Since actual quantity were higher than the standard, the variance is unfavorable. This adverse variance, could have been caused by the inferior quality, result of carelessness handling of materials by production workers or could as a result of change in methods of production, product specifications or the way in which quality of the product is checked or controlled.

Product Testing

Favorable efficiency variance amounting to ₹ 1,80,000 indicates that fewer testing minutes were expended during the quarter than the standard minutes required for the level of actual output. This may be due to employment of a higher skilled labor or improvement of skills of existing workforce through training and development leading to improved productivity etc.

(iii) Flexible Budget

| Indirect Materials | = (0.50 kg. × 80,000 units) × ₹ 20 = ₹ 8,00,000 |

= ₹ 8,00,000 × 5% = ₹ 40,000 |

| Product Testing | = (10 mins. × 80,000 units) × ₹ 3 = ₹ 24,00,000 |

= ₹ 24,00,000 × 5% = ₹ 1,20,000 |

| Energy | = (4 mins. × 80,000) × ₹ 0.20 = ₹ 64,000 |

= ₹ 64,000 × 5% = ₹ 3,200 |

Efficiency Variance for all the three activities are more than 5% of their flexible budget amount. So, according to the company policy, efficiency variances should be investigated.

![]()

Question 23.

KRI Sanitation Ltd. manufactures a single product and the standard cost system is followed. Standard cost per unit is calculated as below: (Nov 2020)

| Particulars | Amount (₹) |

| Direct Materials (4 kg. @ ₹ 7 kg.) | 28 |

| Direct Labour (5 Hours @ ₹ 9 per hour) | 45 |

| Variable overheads (6 Hours @ ₹ 2 per hour) | 12 |

The other data for the month of June 2020 is given below:

| Particulars | Budgeted | Actual |

| Production and Sales | 15,000 units | 13,800 units |

| Direct Material | 60,000 kg @ ₹ 7 per kg. | 60,000 kg. @ ₹ 7 per kg. |

| Direct Labour | 75,000 Hours @ ₹ 9 per hour | ₹ 5,69,600 (for 71,200 hours) |

| Variable Overheads | 1,80,000 | 1,72,500 |

Required

(i) Calculate following variances:

- Direct Labour Rate Variance

- Direct Labour Efficiency Variance (3 marks)

(ii) Interpret the result. (7 marks)

![]()

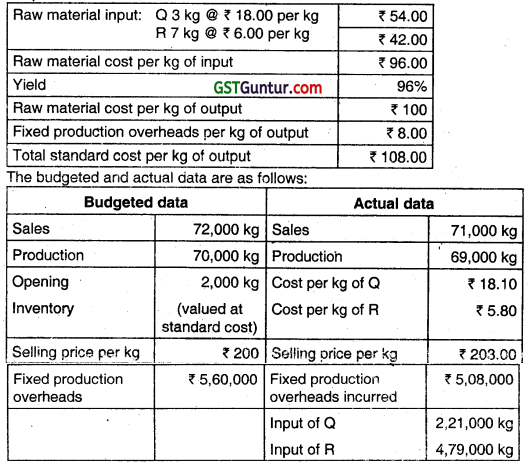

Question 24.

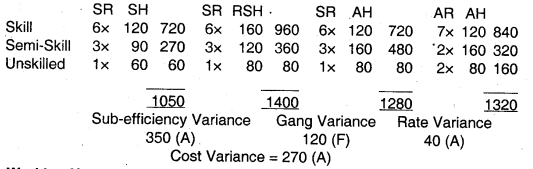

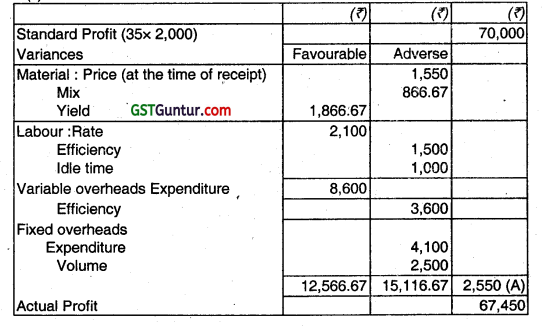

Sri Manufacturers Ltd. manufactures a single product. Standard cost per unit is as follows: (Jan 2021)

| Particulars | ₹ | |

| Materials | 12 kgs × ₹ 5 per kg | 60 |

| Labour | 10 hrs × ₹ 7 per hour | 70 |

| Variable Overheads | 10 hrs × ₹ 3 per hour | 30 |

| Fixed Overheads | 10 hrs × ₹ 3 per hour | 30 |

| Profit | 60 | |

| Selling Price | 250 |

Overheads are allocated on the basis of direct labour hours. In the month of March 2020 there was no difference between the budgeted and actual selling price and there was no opening and closing stock during the period. The other details for the month of March 2020 are as under:

| Budgeted | Actual | |

| Product and sales

Direct Materials Direct Labour Variable Overheads Fixed Overheads |

2500 units

30,000 kgs @ 5 per kg 25,000 hrs @ ₹ 7 per hour ₹ 75,000 ₹ 75,000 |

2000 units

30,000 kgs @ 5 per kg 22,500 hrs @ ₹ 7 per hour ₹ 67,500 ₹ 75,000 |

![]()

Required:

Reconcile the budgeted and actual profit with the help of variances according to each of the following methods:

(i) The conventional method (3 marks)

(ii) The relevant cost method assuming that

(a) Materials are scarce and are restricted to supply of 30,000 kgs for the period. (3 marks)

(b) Labour hours are limited and available hours are only 25,000 hour for the period. (4 marks)