Chapter 13 Securitization – Corporate Funding and Listing in Stock Exchange ICSI Study Material is designed strictly as per the latest syllabus and exam pattern.

Securitization – Corporate Funding & Listing in Stock Exchange Study Material

Question 1.

What do you mean by Securitisation? Explain the Securitisation Structure. (June 2019, 5 marks)

Answer:

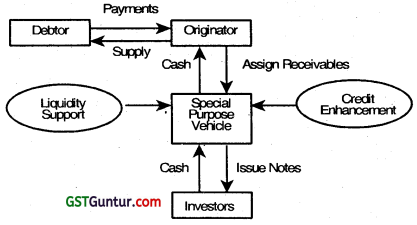

Securitization is the transformation of financial assets into securities. Securitization is used by financial entities to raise funds other than what is available via the traditional methods of on-balance-sheet funding.

There are four steps in a securitization:

- Special Purpose Distinct Entity (SPDE) is created to hold title to assets underlying securities;

- The originator or holder of assets sells the assets (existing or future) to the SPDE;

- The SPDE with the help of an investment banker, issues securities Which are distributed to investors; and

- The SPDE pays the originator for the assets with the proceeds from the sale of securities

A securitization structure typically is as under:

Question 2.

As per SEBI Regulations, explain the eligibility criteria for the Public offer of Securitized Debt Instruments. (Dec 2019, 5 marks)

Answer:

Following are the eligibility criteria for the Public Offer of Securitized Debt Instrument as per SEB| (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008:

A person cannot make a public offer of securitized debt instruments or seek listing for such securitized debt instruments unless:

(a) it is constituted as a special purpose distinct entity

(b) all its trustees are registered with the SEBI under the SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008; and

(c) it complies with all the applicable provisions of these regulations and the SEBI Act.

The requirement of obtaining registration is not applicable for the following persons, who may act as trustees of special purpose distinct entities:

(a) any person registered as a debenture trustee with SEBI;

(b) any person registered as a securitization company or a reconstruction company with the RBI under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002

(c) the National Housing Bank established by the National Housing Bank Act, 1987

(d) the National Bank for Agriculture and Rural Development established by the National Bank for Agriculture and Rural Development Act, 1981.

(e) any scheduled commercial bank other than a regional rural bank

(f) any public financial Institution as defined under clause (72) of section 2 of the Companies Act, 2013 and

(g) any other person as may be specified by SEBI.

However, these persons and special purpose distinct entities of which they are trustees are required to comply With all the other provisions of the SEBI (Public Offer and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008.

![]()

Question 3.

What are the criteria for listing of Security Receipts ? (Dec 2021, 3 marks)

Answer:

As per Regulation 38A of the SEBI (Issue and Listing of Securitised Debt Instruments and Security Receipts) Regulations, 2008 provides that an issuer may list its security receipts on a recognized stock exchange subject to the following conditions:

- the security receipts have been issued on a private placement basis;

- the issuer has issued such security receipts in compliance with the applicable laws;

- the offer or invitation to subscribe to security receipts shall be made to such number of persons not exceeding 200 or such other number, in a financial year, as may be prescribed from time to time.

- the security receipts proposed to be listed are in dematerialized form;

- the disclosures as provided in Regulation 38E of SEBI (issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008 have been made in the offer document,

- the minimum allotment made to the qualified buyers is ₹ 10 lakhs;

- such security receipts have been valued prior to listing; Although, such valuation shall not be more than three months old from the date of listing and shall be done by an independent valuer;

- the security receipts have been rated by a credit rating agency (CRA) registered with SEBI.

Although, such rating shall not be more than three months old from the date of listing.

Further, the issuer shall comply with the conditions of listing of such security receipts as specified in the SEBI (LODR) Regulations, 2015.

Question 4.

Securitization is the transformation of financial assets into securities. Discuss in brief. (June 2022, 3 marks)

Question 5.

What do you mean by framework of securitization?

Answer:

SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008

SEBI notifed SEBI (issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008 on May 26, 2008 taking into account the market needs, cost of the transactions, competition policy, the professional expertise of credit rating agencies, disclosures and obligations of the parties involved in the transaction and the interest of investors in such instruments.

Applicability

Public offers of securitized debt instruments; To listing of securitised debt instruments issued to public or any person(s), on a recognised stock exchange; or To listing of security receipts issued to qualified buyer(s) on a recognized stock exchange in terms of Chapter VIIA, Chapter VIII and Chapter X.

Eligibility

A person cannot make a public otter of securitized debt instruments or seek listing for such securitized debt instruments unless –

(a) it is constituted as a special purpose distinct entity;

(b) all its trustees are registered with the SEBI under the SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008; and

(c) it complies with all the applicable provisions of these regulations and the SEBI Act.

The requirement of obtaining registration is not applicable for the following persons, who may act as trustees of special purpose distinct entities:

(a) any person registered as a debenture trustee with SEBI;

(b) any person registered as a securitization company or a reconstruction company with the RBI under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002;

(c) the National Housing Bank established by the National Housing Bank Act, 1987;

(d) the National Bank for Agriculture and Rural Development established by the National Bank for Agriculture and Rural Development Act, 1981.

(e) any scheduled commercial bank other than a regional rural bank;

(f) any public financial Institution as defined under Clause (72) of Section 2 of the Companies Act, 2013; and

(g) any other person as may be specified by SEBI.

Question 6.

Discuss the eligibility criteria required to be fulfilled for making a public offer of securitized debt instruments or seek listing for such securitized debt instruments.

Answer:

Public Offer of Securitized Debt Instruments Offer to the Public

No offer shall be treated as made to the public, if the offer can properly be regarded, in all the circumstances –

(a) as not being likely to result, directly or indirectly, in the securitised debt instruments becoming available for subscription or purchase by persons other than those receiving the offer;

(b) otherwise as being the domestic concern of the persons making and receiving the offer.

![]()

Question 7.

Enumerate briefly the provisions for listing as prescribed under SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008.

Answer:

Listing of Securitized Debt Instruments Mandatory listing

A SPDE desirous of making an offer of securitized debt instruments to the public shall make an application for listing to one or more recognized stock exchanges.

Application for listing

A SPDE to get the securitized debt instruments issued by it listed on a recognised stock exchange or otherwise desirous of getting the securitized debt instruments issued by it so listed shall make an application to the stock exchange in the form specified by it along with the requisite documents and particulars.

Listing Agreement

Every SPDE desirous of listing securitized debt instruments on a recognised stock exchange, shall execute an agreement with such stock exchange.

Minimum public offering for listing

In respect of public offer of securitized debt instruments, the SPDE or trustee thereof shall satisfy the recognised stock exchange to which a listing application is made that each scheme of securitized debt instruments was offered to the public for subscription through advertisements in newspapers for a period of not less than two days and that applications received in pursuance of the offer were allotted in accordance with these regulations and the disclosures made in the offer document.

Continuous listing conditions

The SPDE or trustee thereof shall submit such information, including financial information relating to the schemes, to the stock exchanges and investors and comply with such other continuing obligations as may be stipulated in the listing agreement.

Trading of securitized debt instruments

The securitized debt instruments issued to the public or on a private placement basis, which are listed in recognised stock exchanges, shall be traded and such trades shall be cleared and settled in recognised stock exchanges subject to conditions specified by SEBI.

Question 8.

Briefly discuss the various provisions as laid down for trading of security receipts.

Answer:

Issuance and Listing of Security Receipts Eligibility

An issuer proposing to issue and list security receipts or only list its already issued security receipts shall comply with the provisions of chapter VIIA of SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008. Security receipts proposed to be listed shall;

- be issued in compliance with the applicable rules and guidelines, as framed by the Reserve Bank of India, from time to time;

- be issued on a private placement basis;

- comply with the provisions pertaining to issue of security receipts.

Question 9.

Describe the allotment procedure for securitized debt instrument.

Answer:

Streamlining the Process of Public Issue under the SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008

In order to make the existing process of issuance of debt securities, NCRPS and SDI easier, simpler and cost effective for both issuers and investors under the SEBI ILDS, SEBI NCRPS and SEBI SDI regulations respectively, it has been decided to reduce the time taken for listing after the closure of the issue to 6 working days as against the present requirement of 12 working days.

Please refer Lesson No. 6 as the same procedure will also be applicable for Securitized Debt Instruments.

Securitization Notes

1. SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008

SEBI notifed SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008 on 26th May, 2008 taking into account the market needs, cost of the transactions, competition policy, the professional expertise of credit rating agencies, disclosures and obligations of the parties involved in the transaction and the interest of investors in such instruments.

![]()

Applicability

Public offers of securitized debt instruments;

To listing of securitised debt instruments issued to public or any person(s), on a recognised stock exchange; or

To listing of security receipts issued to qualified buyer(s) on a recognized stock exchange in terms of Chapter VIIA, Chapter VIII and Chapter X.

Eligibility

A person cannot make a public offer of securitized debt instruments or seek listing for such securitized debt instruments unless –

(a) it is constituted as a special purpose distinct entity;

(b) all its trustees are registered with the SEBI under the SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008; and

(c) it complies with all the applicable provisions of these regulations and the SEBI Act.

The requirement of obtaining registration is not applicable for the following persons, who may act as trustees of special purpose distinct entities:

(a) any person registered as a debenture trustee with SEBI;

(b) any person registered as a securitization company or a reconstruction company with the RBI under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002;

(c) the National Housing Bank established by the National Housing Bank Act, 1987;

(d) the National Bank for Agriculture and Rural Development established by the National Bank for Agriculture and Rural Development Act, 1981.

(e) any scheduled commercial bank other than a regional rural bank;

(f) any public financial Institution as defined under Clause (72) of Section 2 of the Companies Act, 2013; and

(g) any other person as may be specified by SEBI.

2. Public Offer of Securitized Debt Instruments Offer to the Public

No offer shall be treated as made to the public, if the offer can properly be regarded, in all the circumstances –

(a) as not being likely to result, directly or indirectly, in the securitised debt instruments becoming available for subscription or purchase by persons other than those receiving the offer;

(b) otherwise as being the domestic concern of the persons making and receiving the offer.

3. Listing of Securitized Debt Instruments

Mandatory listing

A SPDE desirous of making an offer of securitized debt instruments to the public shall make an application for listing to one or more recognized stock exchanges.

Application for listing

A SPDE to get the securitized debt instruments issued by it listed on a recognised stock exchange or otherwise desirous of getting the securitized debt instruments issued by it so listed shall make an application to the stock exchange in the form specified by it along with the requisite documents and particulars.

![]()

Listing Agreement

Every SPDE desirous of listing securitized debt instruments on a recognised stock exchange, shall execute an agreement with such stock exchange.

Minimum public offering for listing

In respect of public offer of securitized debt instruments, the SPDE or trustee thereof shall satisfy the recognised stock exchange to which a listing application is made that each scheme of securitized debt instruments was offered to the public for subscription through advertisements in newspapers for a period of not less than two days and that applications received in pursuance of the offer were allotted in accordance with these regulations and the disclosures made in the offer document.

Continuous listing conditions

The SPDE or trustee thereof shall submit such information, including financial information relating to the schemes, to the stock exchanges and investors and comply with such other continuing obligations as may be stipulated in the listing agreement.

Trading of securitized debt instruments

The securitized debt instruments issued to the public or on a private placement basis, which are listed in recognised stock exchanges, shall be traded and such trades shall be cleared and settled in recognised stock exchanges subject to conditions specified by SEBI.

4. Issuance and Listing of Security Receipts

Eligibility

An issuer proposing to issue and list security receipts or only list its already issued security receipts shall comply with the provisions of chapter VIIA of SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008. Security receipts proposed to be listed shall;

- be issued in compliance with the applicable rules and guidelines, as framed by the Reserve Bank of India, from time to time;

- be issued on a private placement basis;

- comply with the provisions pertaining to issue of security receipts.

5. Streamlining the Process of Public Issue under the SEBI (Issue and Listing of Securitized Debt Instruments and Security Receipts) Regulations, 2008

In order to make the existing process of issuance of debt securities, NCRPS and SDI easier, simpler and cost effective for both issuers and investors under the SEBI ILDS, SEBI NCRPS and SEBI SDI regulations respectively, it has been decided to reduce the time taken for listing after the closure of the issue to 6 working days as against the present requirement of 12 working days.

Please refer Lesson No. 6 as the same procedure will also be applicable for Securitized Debt Instruments.