Returns – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Returns – CA Inter Tax Question Bank

Question 1.

Answer the following sub division:

Who is required to furnish Final Return under CGST Act, 2017 and what is the time limit for the same? Discuss. (May 2018, 5 marks)

Answer:

Final return is required to be filed by a person, if the registration under GST is cancelled or the registered person surrender the GST registration. The time limit for final return is within three months of the date of cancellation or date of cancellation order, whichever is later.

Question 2.

A tax payer can file GSTR- 1 under CGST Act, 2017, only after the end of the current tax period. State exceptions to this. (Nov 2018, 2 marks)

Answer:

A taxpayer can file GSTR-1 under CGST Act, 2017, only after the end of the current tax period. However, following are the exceptions to this rule:

- Casual taxpayers, after the closure of their business

- (ii) Cancellation of GST in of a normal taxpayer.

![]()

Question 3.

Discuss the provisions of Section 39(9) of the CGST Act, 2017, relating to rectification of errors/omissions in GST returns already filed and also state its exceptions. State the time limit for making such rectification. (Nov 2019, 5 marks)

Answer:

In GST since the returns are built from details of individual transactions, there is no requirement for having a revised return. Any need to revise a return may arise due to the need to change a set of invoices or debit/ credit notes.

Instead of revising the return already submitted, the system allows changing the details of those transactions (invoices or debit/credit notes) that are required to be amended. They can be amended in any of the future GSTR- 1 in the tables specifically provided therein for the purposes of amending previously declared details.

Omission or incorrect particulars discovered in the returns filed u/s 39 can be rectified in the return to be filed for the tax period during which such omission or incorrect particulars are noticed. Any tax payable as a result of such error or omission will be required to be paid along with interest.

![]()

Exception

It is important to note that Section 39(9) does not permit rectification of error or omission discovered on account of scrutiny, audit, inspection or enforcement activities by tax authorities.

Hence, assessee may not be able to pass on the ITC to the receiver in respect of tax payments made by him in pursuance of any of the aforementioned situations.

Time limit for making rectification

The maximum time limit within which the rectification of errors/omissions is permissible is earlier of the following dates:

- Due date of filing of return for the month of September following the end of the financial year [i.e., 20th October of next financial year] or

- Actual date of filing of the relevant annual return

![]()

Question 4.

Explain the consequences, if the taxable person under GST law files the GST return under Section 39(1) of the CGST Act, 2017, but does not make payment of self – assessment tax. (Nov 2019, 2 marks)

Answer:

If the taxable person under GST law files the GST return under section 39(1) of the CGST Act, 2017, but does not pay the self-assessment tax the return is not considered as a valid return.

Since the input tax credit can be availed only on the basis of a valid return the taxable person, in the given case will not be able to claim any input tax credit.

He shall pay interest, penalty, fees or any other amount payable under the CGST Act for filing return without payment of tax.

![]()

Question 5.

“In form GSTR-1, submission of Invoice-wise details of outward supplies is mandatory for all kind of invoices issued during the tax period.”

Comment on the validity of the above statement with reference to GST laws. (Nov 2020, 3 marks)

Question 6.

The aggregate Turnover of Mr. Prithvi, a registered person for the FY 2018-19 and 2019-20 were 240 lakhs and 270 lakhs respectively. He has not fifed the annual return (GSTR-9) under section 44(1) of CGST Act, 2017 before the due date.

Discuss the penal provisions, if any, for not filing the returns before the due date. (Jan 2021, 3 marks)

![]()

Multiple Choice Question

Question 1.

The details of out ward supplies of goods or services shall be submitted by:

(a) 10th of the succeeding month

(b) 18th of the succeeding month

(c) 15th of the succeeding month

(d) 20th of the succeeding month

Answer:

(a) 10th of the succeeding month

Question 2.

Details of Outward supplies shall include:

(a) Invoice

(b) Credit and Debit notes

(c) Revised invoice issued in relation to out ward supplies

(d) All the above

Answer:

(d) All the above

![]()

Question 3.

The details submitted by the outward supplier in Form GSTR 1 shall be furnished to the recipient regular dealer inform:

(a) GSTR4A

(b) GSTR 5A

(c) GSTR2A

(d) GSTR 6A

Answer:

(c) GSTR2A

Question 4.

The details submitted by the outward supplier in Form GSTR 1 shall be furnished to the recipient compounding dealer inform:

(a) GSTR 4A

(b) GSTR 5A

(c) GSTR 2A

(d) GSTR 6A

Answer:

(a) GSTR 4A

![]()

Question 5.

The details submitted by the outward supplier in Form GSTR 1 shall be furnished to the input service distributor inform GSTR 4A.

(a) GSTR 5A

(b) GSTR 2A

(c) GSTR 4A

(d) GSTR 6A

Answer:

(d) GSTR 6A

Question 6.

Which of the following is true?

(a) The Commissioner may extend the time limit for furnishing the details of outward supplies by notification for valid reasons

(b) The details of outward supplies shall include details of debit notes, credit notes and revised invoices issued in relation to outward supplies

(c) The details of outward supplies shall be submitted in Form GSTR-1 by all the registered taxable person other than ISD, non-resident tax payer and a person paying tax under Section 10, Section 51 and Section 52

(d) All the above

Answer:

(d) All the above

![]()

Question 7.

The details submitted by the supplier in Form GSTR 1 are communicated to the registered taxable person in

(a) Form GSTR 1A on 17th of the succeeding month

(b) Form GSTR 2A after the data entry in Form GSTR 1

(c) Form GSTR 2A after the due date of filing Form GSTR 1

(d) Form GSTR 1A on 15th of the succeeding month

Answer:

(c) Form GSTR 2A after the due date of filing Form GSTR 1

Question 8.

Which of the following is a correct statement?

(a) Every registered taxable person other than ISD, non-resident tax payer and a person paying tax under section 10, 51 or 52 shall verify, validate, modify or delete the details communicated in Form GSTR 2A

(b) The details of outward supplies communicated in Form GSTR 2A cannot be modified or altered

(c) The registered taxable person should accept the details communicated in Form GSTR 2A by 12th of the succeeding month

(d) The registered taxable person other than ISD, non-resident tax payer & a person paying tax under section 10, 51 or 52 shall furnish the details of inward supplies of goods or services excluding tax payable on reverse charge basis.

Answer:

(a) Every registered taxable person other than ISD, non-resident tax payer and a person paying tax under section 10, 51 or 52 shall verify, validate, modify or delete the details communicated in Form GSTR 2A

![]()

Question 9.

The details of inward supplies of goods or services in Form GSTR 2 shall be submitted by

(a) 10th of the succeeding month

(b) 18th of the succeeding month

(c) 15th of the succeeding month

(d) 20th of the succeeding month

Answer:

(c) 15th of the succeeding month

Question 10.

Details of Inward supplies shall include

(a) Inward supplies of goods and services communicated in Form GSTR 2A

(b) Inward supplies in respect of which tax is payable under reverse charge mechanism

(c) Inward supplies of goods and services not declared by suppliers

(d) All the above

Answer:

(d) All the above

![]()

Returns Notes

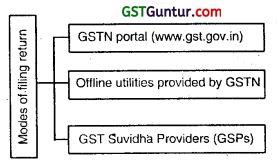

1. Modes of filling return

All the returns are to be filed online:

2. List of statements/returns under GST

| Return | Description | Who Files? | Date for filing? |

| GSTR-I | Monthly Statement of Outward supplies of Goods or Services | Registered Person with annual aggregate turnover greater than ? 1.5 crore | 10lh of the next month |

| Quarterly Statement of Outward supplies of Goods or Services | Registered Person with annual aggregate turnover upto ? 1.5 crore | 10th of the next quarter | |

| GSTR-

3B |

Monthly Return for a normal taxpayer | Registered Person | 20th of the next month |

| GSTR-4 | Quarterly Return | Taxable Person opting for Compositioh Levy | 18th of the month succeeding the quarter |

| GSTR-5 | Monthly Return for a non-resident taxpayer | Non-resident

Taxpayer |

20,h of the month succeeding the tax period or within 7 days after expiry of registration whichever is earlier |

| GSTR-9 | Annual Return | Registered Person other than an ISD, T D S / T C S Taxpayer, Casual Taxable Person and Non-resident Taxpayer | 31st December of next Financial Year |

| GSTR-

10 |

Final Return | Taxable Person whose registration has been surrendered or cancelled | Within three months of the date of cancellation or date of order of cancellation, which- ever is later. |

![]()

3. Due date of payment

Due date of payment of GST

Payment should be made on or before 20th of every month.

4. Annual Return

- This return needs to be filed by 31st December of the next Financial Year.

- In this return, the taxpayer needs to furnish details of expenditure and income for the entire Financial Year.

5. Revision of Returns

- The mechanism of filing revised returns for any correction of errors/omissions has been done away with.

- The rectification of errors/omissions is allowed in the subsequent returns.

- However, no rectification is allowed after furnishing the return for the month of September following the end of the financial year to which such details pertain or furnishing of the relevant annual return, whichever is earlier.

![]()

6. Penal provisions relating to returns

- any registered person who fails to furnish statements and returns u/s 39, Final Return within the due dates.

- shall be liable to pay a late fee of ₹ 100 per day,

- subject to a maximum of ₹ 5,000.

The GST Council at its 42nd meeting held on 5th October 2020 has recommended the following incremental changes in the return filing process:

- Effective 01.01.2021, taxpayers with turnover below ₹ 5 crores may file GSTR-3B and GSTR-1 on quarterly basis. Such taxpayers would, for the first two months of the quarter, have an option to pay 35% of the net tax liability of the last quarter, using an auto generated challan.

- Effective 01.01.2021, due date of furnishing quarterly GSTR-1 by taxpayers to be revised to 13th of the month succeeding the quarter.

Note – Notification No. 74/2020 CT dated 15.10.2020 has revised the due date for filing quarterly GSTR-1 by the registered persons having aggregate turnover up to ₹ 1.5 crores in the preceding financial year or current financial year to 13th of the month succeeding the end of quarter. Such date is applicable for the quarters ending December 2020 and March 2021.

![]()

3. Effective 01.01.2021, for monthly filers, auto-generation of liability from own GSTR-1 and ITC from suppliers’ GSTR-1 s through the newly developed facility in GSTR-2B. For quarterly filers, this facility would be effective from 01.04.2021. To ensure such auto generation of ITC and liability in GSTR 3B, GSTR-1 shall be filed mandatorily before filing GSTR-3B effective 01.04.2021.

4. GSTR-1 and GSTR-3B return filing system to be extended till 31.03.2021 and the GST laws to be amended to make GSTR-1 and GSTR-3B return filing system as the default return filing system.