Students should practice Receivable Management – CS Executive Financial and Strategic Management MCQ Questions with Answers based on the latest syllabus.

Receivable Management – Financial and Strategic Management MCQ

Question 1.

Receivables mean ___

I. Book debts

II. Debtors

III. Account receivables

Select the correct answer from the options given below:

(A) I & II

(B) II & III

(C) I & III

(D) All of the above

Answer:

(D) All of the above

Question 2.

Receivables arise –

1. If the goods are sold on credit.

2. If the goods are sold in cash

3. If the services are rendered on credit

4. If the services are rendered in cash.

Select the correct answer from the options given below:

(A) 1 only

(B) 1&2

(C) 1 & 3

(D) All 1 to 4

Answer:

(C) 1 & 3

Question 3.

A decrease in the firm’s receivables turnover ratio means that –

(A) it is collecting credit sales more quickly than before

(B) it is collecting credit sales more slowly than before

(C) sales have gone down

(D) inventories have gone up

Hint:

For example, if the firm goes from 6 turns to 3 turns, the firm is increasing the average collection period from 60 days to 120 days (assuming a 360 day year). Thus, it is collecting more slowly.

Answer:

(B) it is collecting credit sales more slowly than before

Question 4.

The goal of receivables management is to maximize the value of the firm by achieving a trade-off between –

(A) Risk & Profitability

(B) Liquidity & Profitability

(C) Return & Profitability

(D) Return & Liquidity

Answer:

(A) Risk & Profitability

Question 5.

What do we call, when a firm extends credit terms that encourage the buyers of certain products to take delivery before the peak sales period and to defer payment until after the peak sales period?

(A) Trade account

(B) Cash discount

(C) Peak trade account

(D) Seasonal dating

Answer:

(D) Seasonal dating

Question 6.

Which of the following function is required to be performed by the finance manager in relation to proper management of receivables?

(A) To obtain the optimum (not maximum) value of sales.

(B) To adopt a relaxed policy for administrative expense.

(C) To increase the opportunity cost of funds blocked in the receivables.

(D) To make more purchases at bigger discounts.

Answer:

(A) To obtain the optimum (not maximum) value of sales.

Question 7.

The payment terms 2/10, Net 30 tell us that:

(A) A 2% discount will be awarded if the payment is made within 10 days of the invoice date; otherwise, the full amount is payable within the next 10 days of the invoice date.

(B) A 10% discount will be awarded if the payment is made within 20 days of the invoice date; otherwise, the full amount is payable within 30 days of the invoice date.

(C) 296 discount will be awarded if the payment is made within 30 days of the invoice date; otherwise, the full amount is payable within the next 10 days of the invoice date.

(D) 296 discount will be awarded if the payment is made within 10 days of the invoice date; otherwise, the full amount is payable within 30 days of the invoice date.

Answer:

(D) 296 discount will be awarded if the payment is made within 10 days of the invoice date; otherwise, the full amount is payable within 30 days of the invoice date.

Question 8.

Risk of non-payment may due to –

(A) Insolvency

(B) Liquidity problems

(C) Intention of cheating

(D) All of the above

Answer:

(D) All of the above

Question 9.

The cash discount is given to customers for:

(A) Early payments

(B) Good business relations

(C) Bulk purchase

(D) Frequent purchases

Answer:

(A) Early payments

Question 10.

Which of the following tool may be used to determine the degree of risk associated with cash collections?

A. Standard deviation

B. Co-efficient of variation

Select the correct answer from the options given below:

(A) B Only

(B) Neither A nor B

(C) A only

(D) Both A and B

Answer:

(D) Both A and B

Question 11.

The accounts receivable that cannot be collected because of their bankruptcy or another reason are termed as:

(A) Collectible accounts

(B) Bad customers

(C) Doubtful accounts

(D) Uncollectible accounts

Answer:

(D) Uncollectible accounts

Question 12.

Which of the following sentence describes a correct strategy for the proper administration of receivables?

(A) Most of the firms dissuade credit sales to first-time customers.

(B) Promoting cash sales

(C) Firms must have special staff earmarked for recovery efforts.

(D) (A) and (C)

Answer:

(D) (A) and (C)

Question 13.

Accounts receivable are reported in the balance sheet:

(A) At face value

(B) At a gross value

(C) At a net realizable value

(D) At net credit sales value

Answer:

(C) At a net realizable value

Question 14.

____ may also be offered for the early payment of dues.

(A) Trade discounts

(B) Special discounts

(C) Both (A) and (B)

(D) Cash discounts

Answer:

(D) Cash discounts

Question 15.

Increasing the credit period from 30 to 60 days, in response to a similar action taken by all of our competitors, would likely result in:

(A) An increase in the average collection period.

(B) A decrease in bad debt losses.

(C) An increase in sales.

(D) Higher profits.

Answer:

(A) An increase in the average collection period.

Question 16.

Credit rating is a study of the credit standing of a customer i.e. 5 C’s. Which of the following correctly describes those 5 C’s?

(A) Character, Capacity, Capital, Conditions & Collateral security

(27 Character, Capacity, Complaint, Conditions & Collateral security

(C) Character, Charm, Capital, Con-ditions & Collateral security

(D) Charter, Capacity, Capital, Conditions & Collateral security

Answer:

(A) Character, Capacity, Capital, Conditions & Collateral security

Question 17.

An exercise of credit rating involves –

(A) Doing it internally by a team within the firm

(B) Doing it through external special agencies.

(C) (A)or(B)

(D) None of the above

Answer:

(C) (A)or(B)

Question 18.

Place the methods of collecting on delinquent accounts from the most likely lowest to highest cost.

(A) Letters, phone calls, legal action, and personal visits.

(B) Phone calls, letters, legal action, and personal visits.

(C) Letters, phone calls, personal visits, and legal action.

(D) Personal visits, phone calls, letters, and legal action.

Answer:

(C) Letters, phone calls, personal visits, and legal action.

Question 19.

An important means to get an insight into the collection pattern of debtors is the preparation of their –

(A) List of proposed discount

(B) Discount schedule

(C) Schedule of personal formation of debtors

(D) Ageing Schedule

Answer:

(D) Ageing Schedule

Question 20.

Which of the following may be a reason why you would choose a policy with a higher Average Collection S Period (ACP)?

(A) a Lower percentage of collections inmate, dates.

(B) Higher percentage of collections in early dates.

(C) a Lower percentage of collections in early dates.

(D) Higher percentage of collections in middle dates

Answer:

(B) Higher percentage of collections in early dates.

Question 21.

___ is an arrangement to have debts collected by a third party entity for a fee.

(A) Factoring

(B) Aging

(C) Forming

(D) Crediting

Answer:

(A) Factoring

Question 22.

Selling accounts receivable to a third party at a reduced price is part of the collection process known as –

(A) Settling

(B) Writing off

(C) Suing

(D) Factoring

Answer:

(D) Factoring

Question 23.

In___type of factoring the bank/factor takes all the risk and bears all the loss in case of debts becoming bad debts.

(A) Non-Recourse Factoring

(B) Invoice Discounting

(C) Maturity Factoring

(D) Recourse Factoring

Answer:

(A) Non-Recourse Factoring

Question 24.

Which one of the following would help to reduce the number of accounts receivable delinquencies?

(A) Ease the credit approval process

(B) Know your customer situations

(C) Refuse to extend payments

(D) Stop sending reminder letters

Answer:

(B) Know your customer situations

Question 25.

In factoring arrangement the debts as and when fall due is collected by the –

(A) Debtor

(B) Seller

(C) Factor

(D) Agent

Answer:

(C) Factor

Question 26.

When net sales for the year are ₹ 2,50,000 and debtors ₹ 50,000, the average collection period is:

(A) 60 days

(B) 45 days

(C) 42 days

(D) 73 days

Hint:

Average collection period = \(\frac{\text { Debtors }}{\text { Credit Sales }}\) × 365 = \(\frac{50,000}{2,50,000}\) × 365 = 73 days

Answer:

(D) 73 days

Question 27.

If credit sales for the year are ₹ 5,40,000 and Debtors at the end of the year is ₹ 90,000 the Average Collection Period will be –

(A) 30 days

(B) 61 days

(C) 90 days

(D) 120 days

Hint:

Average collection period = \(\frac{\text { Debtors }}{\text { Credit Sales }}\) × 365 = \(\frac{90,000}{5,40,000}\) × 365 = 61 days

Answer:

(B) 61 days

Question 28.

Romaji Ltd. has sales of ₹ 1,18,00,000 and its debtor turnover ratio is 4:2. The cost of goods sold is ₹ 82,60,000. Debtors =?

(A) ₹ 19,66,725

(B) ₹ 19,67,333

(C) ₹ 19,66,263

(D) ₹ 19,66,667

Hint:

Debtors Turnover Ratio = \(\frac{\text { Cost of goods sold }}{\text { Debtors }}\)

4.2 = \(\frac{82,60,000}{\text { Debtors }}\)

Debtors = 19,66,667

Note: Debtors turnover ratio can be calculated by taking ‘credit sales’ or ‘cost of goods sold As per data given in question if ‘credit sales figure is used to calculate debtors then it comes to 28,09,524, but no such option is given hence debtors are calculated on ‘cost of goods sold

Answer:

(D) ₹ 19,66,667

Question 29.

X Ltd. cash sales and credit sales are ₹ 5,67,500 & ? 87,50,000 respectively. Cost of goods sold is ₹ 61,25,000. Debtors are ₹ 8,20,833 and bills receivable are ? 2,00,000.

Debtors turnover ratio =?

(A) 6.00

(B) 7.46

(C) 10.66

(D) 5.38

Hint:

Debtors Turnover Ratio = \(\frac{\text { Cost of goods sold }}{\text { Account receivables }}\)

= \(\frac{61,25,000}{10,20,833}\)

= 6

Answer:

(A) 6.00

Question 30.

Total sales of LMN Ltd. are ₹ 31,248 out of which 25% are cash sales. The closing balance of debtors is ₹ 9,468. Debtors velocity =?

(A) 4.2 months

(B) 157 days

(C) 148 days

(D) 4.43 months

Hint:

Debtors Velocity = \(\frac{\text { Debtors }}{\text { Credit Sales }}\) × 360

= \(\frac{9,648}{23,436}\) × 360

= 148 days

Answer:

(C) 148 days

Question 31.

Debtors velocity = 3 months Sales = ₹ 25,00,000

Bills receivable & Bills payable were ₹ 60,000 and ₹ 36,667 respectively.

Sundry debtors =?

(A) ₹ 6,25,000

(B) ₹ 5,25,000

(C) ₹ 6,65,000

(D) ₹ 5,65,000

Hint:

Debtors Velocity = \(\frac{\text { Account Receivable }}{\text { Credit Sales }}\) × 12

3 = \(\frac{x}{25,00,000}\) × 12

x = Account Receivable = 6,25,000

Debtors + Bills Receivable = Account Receivable

x + 60,000 = 6,25,000

x = Debtors = 5,65,000

Answer:

(D) ₹ 5,65,000

Question 32.

K Ltd. had sales last year of ₹ 26,50,000, including cash sales of ₹ 2,50,000. If its average collection period was 36 days, its ending accounts receivable balance is closest to

(Assume a 365 day year.)

(A) ₹ 2,63,127

(B) ₹ 2,40,000

(C) ₹ 2,36,712

(D) ₹ 2,40,721

Answer:

(C) ₹ 2,36,712

Question 33.

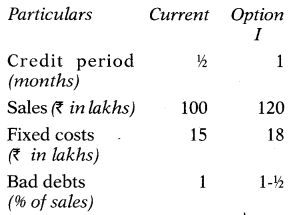

Apollo Ltd. sells its products allowing a credit period of 15 days only. The average variable cost is 60% of sales value and current sales amount to ₹ 100 lakhs. Data for the year is as follows:

Debtors are calculated on cost.

(A) Incremental profit ₹ 3.50 lakh

(B) Incremental loss ₹ 3.50 lakh

(C) Incremental profit ₹ 4.20 lakh

(D) Incremental loss ₹ 4.20 lakh

Hint:

Important Note: Above presentation is given for the understanding of the students. Since the examination is in MCQ format; data can be prepared in ruff and MCQ can be solved fast; within one minute if concepts are clear.

Answer:

(A) Incremental profit ₹ 3.50 lakh

Question 34.

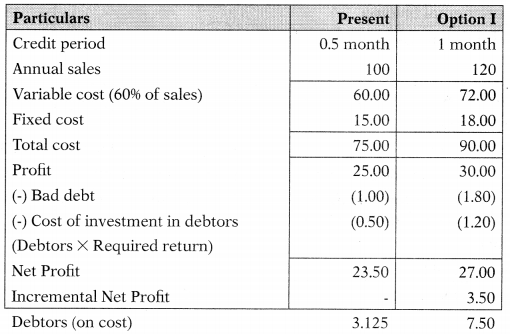

F Ltd. is examining the relaxation of its credit policy. It sells at present 20,000 units at a price of ₹ 100 per unit, the variable cost per unit is ₹ 88 and the average cost per unit at the current sales volume is ₹ 92. All the sales are on credit, the average collection period being 36 days. A relaxed credit policy is expected to increase sales by 10% and the average age of receivables to 60 days. Assuming a 15% return, should F Ltd. relax its credit policy?

Note: 1 Year = 360 days

(A) Yes, F Ltd. can change its policy as it leads to a 15.79% increase in profit

(B) No, F Ltd. need not change its policy as there is no incremental return.

(C) Yes, F Ltd. can change its policy as it leads to the incremental return of ₹ 2,400.

(D) None of the above options is correct.

Answer:

(A) Yes, F Ltd. can change its policy as it leads to a 15.79% increase in profit

Question 35.

Average cost increases from ₹ 88 to ₹ 92. Incremental profit & incremental debtors are ₹ 48,000 & ₹ 3,04,000 respectively. The cost of capital is 15%. What is the rate of incremental return on change of credit policy?

(A) 15.79%

(B) No incremental return

(C) 0.79%

(D) 1.58%

Hint:

Answer:

(A) 15.79%

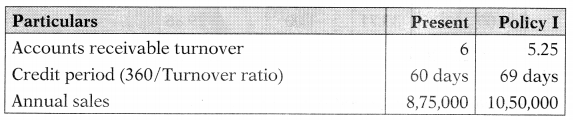

Question 36.

ABC Ltd. is considering certain relaxation in its credit policy from 60 days to 69 days.

Required rate of return and P/V ratio are 20% & 30% respectively.

Debtors are calculated on cost.

(A) Company should not change its policy as debtors are increasing.

(B) Change in policy may lead to a profit of ₹ 23,830.

(C) Change in policy may lead to an incremental profit of ₹ 18,542.

(D) Company should not change in policy due to incremental loss.

Answer:

(C) Change in policy may lead to an incremental profit of ₹ 18,542.

Question 37.

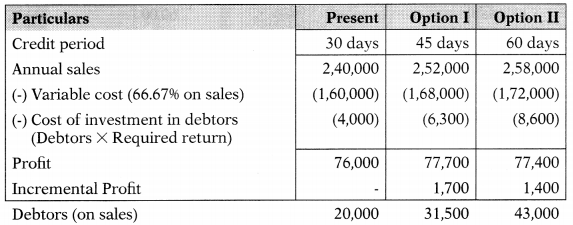

In order to increase sales from the normal level of ₹ 2,40,000 per annum, the marketing manager submits the following two proposals for relaxing the credit policy:

A proposal I: Increase the credit period from 30 days to 45 days which will lead to an increase in sales by ₹ 12,000.

Proposal II: Increase the credit period from 30 days to 60 days which will lead to an increase in sales by ₹ 18,000.

P/V Ratio and excepted pre-tax rate of return are 33.33% and 20 respectively.

Which of the following statement is correct?

Debtors are calculated on sales.

(A) Data given in the question is not sufficient because without data as to cost no conclusion can be drawn.

(B) As compared to present policy, profit will increase by ₹ 1,800 for Proposal I and by ₹ 2,000 for Proposal n.

(C) As compared to present policy, profit will increase by ₹ 1,700 for Proposal I and by ₹ 2,000 for Proposal 13.

(D) As compared to present policy, profit will increase by ₹ 1,700 for Proposal I and by 11,400 for Proposal II.

Hint:

Answer:

(D) As compared to present policy, profit will increase by ₹ 1,700 for Proposal I and by 11,400 for Proposal II.

Question 38.

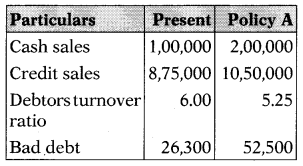

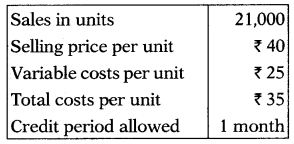

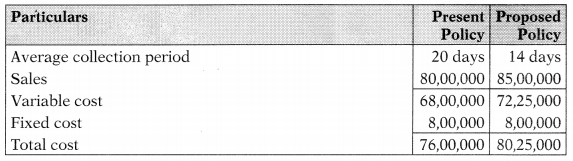

A Company has prepared the following projections for a year:

The company proposes to increase the credit period to 2 months. The change in the policy will increase the sale by 8%. The company desires a return of 25% on its investment. Debtors are calculated on cost. The company may decide to shift to the proposed policy because –

(A) Total profit in the proposed policy will be ₹ 1,30,200 whereas it is ₹ 1,05,000 for the present policy.

(B) Incremental profit is ₹ 25,200

(C) Incremental return is 36.92%

(D) All of the above

Answer:

(D) All of the above

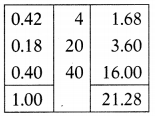

Question 39.

Analysis of the debtor’s collection history of Karina Ltd. shows the following facts. 42% of debtors pay the amount due within 4 days of sales; 18% of debtors pay within 20 days and 40% of debtors pay within 40 days of sales. What is the average collection period of Karina Ltd.?

(A) 23 days

(B) 28 days

(C) 21 days

(D) 18 days

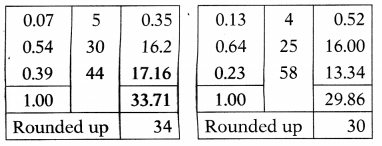

Hint:

Thus, the average collection period is 21.28 days i.e. 21 days (if rounded up)

Answer:

(C) 21 days

Question 40.

In the year 2018, 7% of customers paid the amount due in 5 days from the date of sale; 54% of customers paid the amount in 30 days and 39% of customers paid the amount in 44 days from the date of sale.

In the year 2019, 13% of customers paid the amount due in 4 days from the date of sale; 64% of customers paid the amount in 25 days and 23% of customers paid the amount in 58 days from the date of sale.

The average collection period –

(A) In the year 2019 increased by 4 days

(B) In the year 2019 decreased by 3 days

(C) In the year 2019 increased by 3 days

(D) In the year 2019 decreased by 4 days

Hint:

Answer:

(D) In the year 2019 decreased by 4 days

Question 41.

A firm has current sales of ₹ 25,48,000. The firm has an unutilized capacity. In order to boost its sales, it is considering the relaxation in its credit policy. The proposed terms of credit will be 60 days credit against the present policy of 45 days. As a result, debtors (calculated on sales) will be –

(A) Increased by 1,06,735

(B) Decreased by 1,04,712

(C) Increased by 1,06,167

(D) Increased by 1,04,635

Hint:

Increase in credit period = 60 – 45 = 15 days

Increase in Debtors = \(\frac{25,48,000}{360}\) × 15 = 1,06,167

Answer:

(C) Increased by 1,06,167

Question 42.

A firm has current sales of ₹ 38,22,000. In order to boost its sales, it is considering the relaxation in its credit policy. The proposed terms of credit will be 40 days credit against the present policy of 25 days. The firm’s sales are expected to increase by 10%. As a result, debtors (calculated on sales) will be –

(A) Increased by ₹ 1,72,725

(B) Decreased by ₹ 1,75,175

(C) Decreased by ₹ 1,75,775

(D) Increased by ₹ 1,75,175

Hint:

Increase in Debtors = \(\frac{38,22,000 \times 1.1}{360}\) × 15

Answer:

(D) Increased by ₹ 1,75,175

Question 43.

A firm has current sales of ₹ 2,56,48,750. It is considering the relaxation in its credit policy. The proposed terms of credit will be 60 days credit against the present policy of 45 days. As a result, the bad debts will increase from 1.5% to 2% of sales. The firm’s sales are expected to increase by 10%. Variable operating costs are 72% of sales. The firm’s corporate tax rate is 35%, and it requires an after-tax return of 15%. Should the firm change its credit period?

Note: Yes calculates its debtor on sales.

(A) No, the firm should not change its policy as profit will decline by ₹ 3,50,177

(B) Yes, the firm should change its policy as profit will increase by ₹ 5,39,036

(C) Yes, the firm should change its policy as profit will increase by ₹ 5,38,623

(D) Yes, the firm should change its policy as profit will increase by ₹ 3,50,105

Answer:

(D) Yes, the firm should change its policy as profit will increase by ₹ 3,50,105

Question 44.

The sales Manager of AB Ltd. suggests that if the credit period is given for 1.5 months then sales may likely increase by ₹ 1,20,000 per annum. The cost of sales amounted to 90% of sales. The risk of non-payment is 5%. The income tax rate is 30%. The expected return on investment is 13,375 (aftertax). Should the company change its credit policy?

(A) Yes, as the total net profit under the proposed policy will be ₹ 4,200.

(B) No, as the total net profit under the proposed policy will be ₹ 4,200.

(C) Yes, as incremental net profit under the proposed policy will be ₹ 4,200.

(D) No, as an incremental net loss under the proposed policy will be ₹ 4,200.

Answer:

(C) Yes, as incremental net profit under the proposed policy will be ₹ 4,200.

Question 45.

XYZ Ltd. has credit sales amounting to ₹ 32,00,000. The sale price per unit is ₹ 40, the variable cost is ₹ 25 while the average cost is ₹ 32. The average age of receivables of the firm is 72 days. The firm is considering tightening the credit standards. It will result in a fall in sales to ₹ 28,00,000, and the average age of receivables to 45 days. Assume 20% of return. The proposed policy will yield –

1 Year = 360 days and debtors are calculated on cost.

(A) Incremental profit of ₹ 1,05,350

(B) Incremental loss of ₹ 1,05,350

(C) Incremented profit of ₹ 1,05,530

(D) Incremental loss of ₹ 1,05,530

Answer:

(B) Incremental loss of ₹ 1,05,350

Question 46.

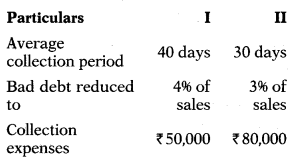

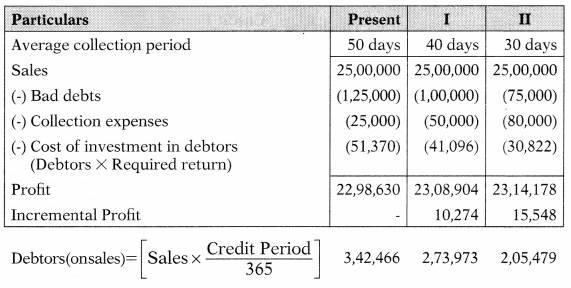

A company has sales of ₹ 25,00,000. The average collection period is 50 days, bad debt losses are 5% of sales, and collection expenses are ₹ 25,000. The cost of funds is 15%. The company has two alternative collection programs:

Debtors are calculated on sales.

Advice the company by selecting the most correct option –

(A) The company should shift toward Programme I as profit is increasing by ₹ 10,274.

(B) The company should shift toward Programme II as profit is increasing by ₹ 15,548.

(C) The company should not change its policy as Programme I & Programme II do not have any incremental profits.

(D) The company may shift to Pro-gramme I or Programme II as both have an incremental profit of ₹ 10,274 & ₹ 15,548 respectively but Programme II will be selected as it has more incremental profit as compared to Programme I.

Hint:

Answer:

(D) The company may shift to Pro-gramme I or Programme II as both have the incremental profit of ₹ 10,274 & ₹ 15,548 respectively but Programme II will be selected as it has more incremental profit as compared to Programme I.

Question 47.

H Ltd. has current sales of ₹ 20,00,000. It is planning to introduce a discount policy of 2/10, Net 30. As a result, the Company expects the average collection period to go down by 10 days and 80% of the sales opt for cash discount facility. The required return on investment is 20%, should it introduce the new discount policy?

(A) Yes, as profit is increasing by ₹ 20,888.

(B) No, as profit is decreasing by ₹ 20,889.

(C) Make no policy change.

(D) No, as profit is decreasing by ₹ 20,837.

Answer:

(B) No, as profit is decreasing by ₹ 20,889.

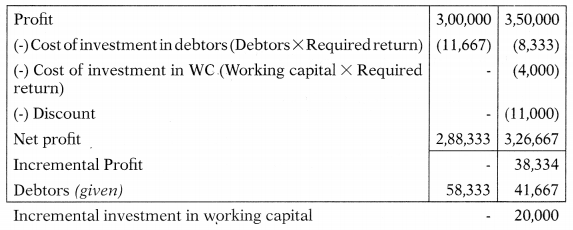

Question 48.

The current profit of R & Co. is ₹ 3,00,000. It is planning to introduce a discount policy of 2 /10, Net 30. Due to change in policy profit is expected to increase by 150,000. The firm’s current average collection period is 30 days which is expected to fall by 10 days. Present investment in debtor is ₹ 58,333 which will be reduced by ₹ 16,666. However, due to increased sales, the increased working capital required will be ₹ 20,000 (without taking into account the effect of debtors). The total discount likely to be claimed in the new policy will amount to ₹ 11,000. 20% is the required return on investment. What is the impact of change in policy?

(A) Profit will decrease by ₹ 38,000.

(B) Profit will increase by ₹ 38,000.

(C) Profit will increase by ₹ 38,334.

(D) Profit will decrease by ₹ 38,533.

Hint:

Answer:

(C) Profit will increase by ₹ 38,334.

Question 49.

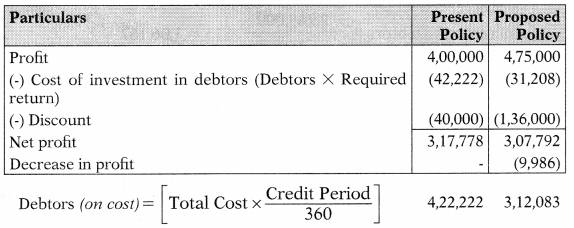

Present credit terms of P Ltd. are 1/10 Net 30. Its annual sales are ₹ 80 lakhs, its average collection period is 20 days. Its variable and average total costs to sales are 0.85 & 0.95 and its Ko is 10%. The proportion of sales on which customers currently take discount is 0.5. The company is relaxing its discount terms to 2/10 Net 30 which will increase sales by ₹ 5 lakh, reduce the average collection period to 14 days, and increase the proportion of discount to sales to 0.8. What will be the effect on the company’s profit? Take year as 360days. Debtors are calculated on cost.

(A) Profit will increase by ₹ 9,900

(B) Profit will increase by ₹ 19,986

(C) Profit will increase by ₹ 8,986

(D) Profit will decrease by ₹ 9,986

Hint:

Working Note:

Present discount = 80,00,000 × 50% × 1% = 40,000

Proposed discount = 85,00,000 × 80% × 2% = 1,36,000

Answer:

(D) Profit will decrease by ₹ 9,986

Question 50.

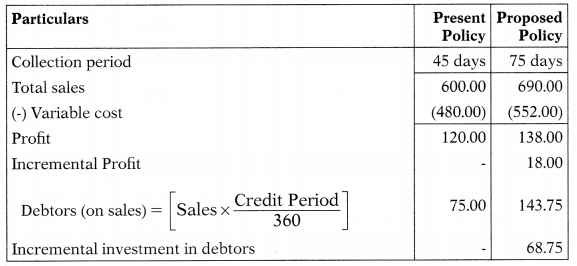

G Ltd. presently gives credit terms of ‘net 30 days’. It has ₹ 600 lakh in credit sales and its average collection period is 45 days. To stimulate sales, the company may give credit terms of ‘net 60 days’ with sales expected to increase by 15%. After the change, the average collection period is expected to be 75 days. The variable cost to sales ratio is 80% and before tax required rate of return on investment in receivables is 20%. Assume 360 days in a year. Debtors are calculated on sales. Should the company extend its credit period?

(A) Yes, as there is an incremental return of 26.18%

(B) Yes, as there is an incremental return of 26.32%

(C) Yes, as there is an incremental return of 26.52%

(D) Yes, as there is an incremental return of 26.81%

Hint:

Incremental Return = \(\frac{\text { Incremental Profit }}{\text { Incremental investment in debtors }}\) × 100

\(\frac{18.00}{68.75}\) × 100 = 26.18%

Answer:

(A) Yes, as there is an incremental return of 26.18%