Provisions for Filing Return of Income and Self-Assessment – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Provisions for Filing Return of Income and Self-Assessment – CA Inter Tax Question Bank

Question 1.

Answer the following with regard to the provisions of the Income-tax Act, 1961 :

Explain with brief reason whether the return of income can be revised u/s 139(5) of the Income-tax Act, 1961 in following cases :

(i) Defective or incomplete return filed under Section 139(9).

(ii) Belated return filed under Section 139(4).

(iii) Return already revised once u/s 139(5).

(iv) Return of loss filed under Section 139(3). (Nov 2008, 4 marks)

Answer:

(i) If Assessing Officer considers that return is defective, he may intimate the defect to assessee and give him an opportunity to rectify the defect within 15 days from date of such intimation. He can also extend time on application made by assessee. If assessee does not rectify the defect within this period, then Return shall be deemed to be VOID AB INITIO and it shall be deemed that no return is filed. But AO, even if late filed but filed before the completion of assessment, may CONDONE THE DELAY.

(ii) 139(4) Belated Return: A belated return can be filed at any time before end of the relevant assessment year or before the completion of the assessment whichever is earlier. A belated return, can now be revised.

(iii) 139 (5) Revised Return: If a person having furnished a return U/S 139(1) or in pursuance of a notice issued U/S 142(1), discovers any omission or wrong statement therein, then he may furnish a revised return at any time before the end of relevant A.Y. or before the completion of assessment, whichever is earlier. Can revised return be further revised: If the assessee discovers any omission or any wrong statement in a revised return, it is possible to revise such a revised return if it is revised within the same prescribed time. [Niranjan Lai Ram Chandra v CIT].

(iv) 139(3) Return of loss read with Section 80: If a person has sustained a loss under the head PGBP or under the head capital gain and claims that such loss should be carried forward, then he may furnish a return of loss within the time prescribed under Section 139 (3) and such return shall be deemed to have been furnished u/s 139(1). Hence, a return of loss can be revised.

![]()

Question 2.

Answer the following questions with regard to the Provisions of the Income tax Act, 1961 :

What are the particulars required to be furnished with the return of income, as per Section 139(6)? (May 2010, 4 marks)

Answer:

Particulars required to be furnished with the return of income as per (Section 139 (6)) are as follows:

- Particulars related to income exempt from tax

- Particulars related to assets of the prescribed nature and value, belonging to the assessee

- Particulars related to detail of bank account and credit card held by the assessee

- Particulars related to expenditure exceeding the prescribed limits incurred by the assessee under prescribed heads and

- Particulars related to such other outgoings, as may be prescribed.

Question 3.

Answer the following :

1. Specify the persons who are authorized to sign and verify under section 140, the return of income filed under Section 139 of the Income-tax Act, 1961 in the case of:

(i) Political party;

(ii) Local authority;

(iii) Association of persons, and

(iv) Limited Liability Partnership (LLP). (May 2011, 4 marks)

Answer:

The following persons (mentioned in Column C) are authorised as per section 140, to sign and verify the return of income filed under section 139:

| Assessee | Circumstance | Authorised Persons |

| Political party [referred to in section 139(4B)]. | – | – The chief executive officer of such party (whether he is known as secretary or by any other designation) |

| Local authority | – | – The principal officer |

| AOP | – | – any member of the association or the principal officer of such association |

| LLP | (i) in circumstances not covered under (ii) below (ii) (a) where for any unavoidable reason such designated partner is not able to verify the return; or (b) where there is no designated partner. |

Designated partner

– any partner of the LLP – any partner of the LLP |

Question 4.

Enumerate the circumstances in which an individual assessee is empowered to sign & verify his return of income u/s 139 by himself or otherwise by an authorized signatory. (Nov 2012, 4 marks)

Answer:

Signatory to return of income in case of individual [Section 140]

The following table enumerates the specific circumstances and the authorized signatories empowered to sign and verify the return of income of an individual assessee filed under Section 139(1) in each such circumstance:

| Circumstance | Return of income, to be signed by |

| (i) Where he is absent from India | the individual himself; or any person duly authorised by him in this behalf holding a valid power of attorney from the individual. (Such power of attorney should be attached to the return of income) |

| (ii) Where he is mentally incapacitated from attending to his affairs | his guardian; or any other person competent to act on his behalf. |

| (iii) Where, for any other reason, it is not possible for the individual to sign the return | any person duly authorised by him in this behalf holding a valid power of attorney from the individual (Such power of attorney should be attached to the return of income) |

| (iv) In circumstances not covered under (i), (ii) & (iii) above | the individual himself |

Question 5.

2. (B) Where the Karta of an Hindu undivided family is absent from India, the return of income can be signed by any male member of the family? Give reasoning for the statement to be true or false. (May 2014, 2 marks)

Answer:

The Statement is false. U/s 140 of the Income Tax Act, where the Karta of an HUF is absent from India, any other adult member (not necessarily male)may sign the return of income.

Question 6.

(a) Answer the following:

(ii) “Filing of Return of Income on or before due date is necessary for carry forward of losses.” Discuss the correctness of this statement. (Nov 2014, 4 marks)

(iii) Is a Political party required to file return of Income? State the provisions applicable under the Income Tax Act. (Nov 2014, 4 marks)

Answer:

(ii) Section 139(3) requires furnishing of return of loss on or before the due date specified under Section 139(1), as a pre-condition for carry forward of the following losses:

- business loss under Section 72(1) or

- speculation business loss under Section 73(2) or

- loss under the head “Capital gains” under Section 74(1) or

- loss from the activity of owning and maintaining race horses under Section 74A(3).

- Specified Business Loss u/s 73A(2)

Further, Section 80 provides that an assessee cannot carry forward and set off the above losses unless the loss has been determined in pursuance of a return of loss filed in accordance with the provisions of Section 139(3).

However, loss under the head “Income from house property” under Section 71B and unabsorbed depreciation under Section 32(2) can be carried forward for set-off even though return of loss has not been filed before the due date specified under Section 139(1).

Therefore, the statement “Filing of return of income on or before due date is necessary for carry forward of losses” is partly correct.

(iii) Yes, a political party is required to file return of income if, without giving effect to the exemption provisions under Section 13A, the total income of the political party exceeds the basic exemption limit.

In such cases, as per Section 139(4B), the Chief Executive Officer of the political party is required to furnish a return of income of the party of the previous year within the due date prescribed under Section 139(1).’

For the purpose of claiming exemption under Section 13A, the accounts of the political party have to be audited by a Chartered Accountant. Consequently, the due date of filing return for such political parties would be 31st October of the assessment year.

In other cases, the due date of filing of return would be 31st July of the assessment year.

The return must be filed in the prescribed form and verified in the prescribed manner setting forth such other particulars as may be prescribed by the CBDT.

The provisions of the Income-tax Act, 1961 would apply as if it were a return required to be furnished under Section 139(1).

![]()

Question 7.

(a) Briefly explain the following:

(i) Explain the term “return of loss” under the Income-tax Act, 1961. Can any loss be carried forward even if return of loss has not been filed as required? (May 2015, 4 marks)

Answer:

Return of Income with loss is called Return of Loss. Loss cannot be carried forward if Return of Income not filed within due date u/s 139(1). However, loss under head House Property and unabsorbed depreciation under Section 32(2) can be carried forward even if return not filed before due date.

Question 8.

Answer the following:

Who are the persons authorized to verify return of income in the case of individual under Section 139 of the Income Tax Act, 1961? (Nov 2015, 4 marks)

Answer:

The persons authorised to verify return of income in the case of individual u/s 139 of the Income Tax Act, 1961 are:

- Individual [other than those mentioned under ‘ (ii), (iii) & (iv)]

- The individual himself

- Where, he is absent from India

- The individual himself or

- Any person duly authorised by him in his behalf holding a valid power of attorney from the individual (such power of attorney shõuld be attached to the return of income)

- Where he is mentally incapacited from attending to his affairs

- His guardian or

- any other person competent to act on his behalf.

- Where, for ány other reason, it is not possible for individual to verify the return

- Any person duly aùthorised by him in his behalf holding a valid power of attorney from the individual (such power of attorney should be attached to the return of incomè).

Question 9.

Specify the persons who are authorized to verify u/s 140, the return of income filed u/s 139 of the Income Tax Act, 1961 in case, of a company. (Nov 2016, 2 marks)

Answer:

The Managing Director of a company has to verify the return of income under Section 139.

In special circumstances, however, the following persons are authorized to verify the return of income of a company:

| Circumstance | Person authorized to verify return of income of a company |

| (i) Where for any unavoidable reason such managing director is not able to verify the return or where there is no managing director | Any director of the company |

| (ii) Where the company is not resident in India | A person who holds a valid power of attorney from such company to do so |

| (iii) Where the company is being wound up | Liquidator |

| (iv) Where the management of the company has been taken over by the Government under any law | The principal officer of the company ‘ |

Where in respect of a company, an application for corporate insolvency resolution process has been admitted by the Adjudicating Authority under section 7 or section 9 or section 10 of the Insolvency and Bankruptcy Code, 2016, the return shall be verified by the insolvency professional appointed by such Adjudicating Authority.

Question 10.

By whom should the return of income be signed in the case of following, persons:

(i) Political party;

(ii) Company which is being wound up;

(iii) Hindu Undivided Family, when karta is unable to sign, and

(iv) Scientific research association. (May 2017, 4 marks)

Answer:

(i) Chief Executive Officer

(ii) Liquidator

(iii) Any Adult Member

(iv) Principal officer or any member

Question 11.

Briefly mention the provisions of Income Tax Act with regard to Quoting Aadhar Number u/s 139 AA of the Act. (May 2018, 5 marks)

Answer:

Quoting of Aadhar Number [Section 139AA]

1. Mandatory quoting of Aadhar Number:

Every person who is eligible to obtain Aadhar Number is required to mandatorily quote Aadhar Number, on or after 1st July, 2017:

(a) in the application form for allotment of Permanent Account Number (PAN) in the return of income. Quoting of Aadhaar Number mandatory In returns filed on or after 1.4.2019 [Circular No. 6/2019 dated 31.03.2019]

As per section 139AA(1)(ii), with effect from 01.07.2017, every person who is eligible to obtain Aadhaar number has to quote Aadhaar number in the return of income.

The Apex Court in a series of judgments has upheld the validity of Section 139AA. Consequently, with effect from 01.04.2019, the CBDT has clarified that it is mandatory to quote Aadhaar number while filing the return of income unless specifically exempted as per any notification issued under section 139AA(3) [detailed in point no. (5) in the next page]. Thus, returns being filed either electronically or manually on or after 1.4.2019 cannot be filed without quoting the Aaclhaar number.

2. Mandatory quoting of Enrolment Id, where person does not have Aadhar Number:

If a person does not have Aadhar Number, he is required to quote Enrolment ID of Aadhar application form issued to him at the time of enrolment in the application form for allotment of Permanent Account Number (PAN) or in the return of income furnished by him.

Enrolment ID means a 28 digit Enrolment Identification Number issued to a resident at the time of enrolment.

3. Intimation of Aadhar Number to prescribed Authority:

Every person who has been allotted Permanent Account Number (PAN) as on 1st July, 2017, and who is eligible to obtain Aadhar Number, shall intimate his Aadhar Number to prescribed authority on or before a date as may be notified by the Central Government.

Accordingly, the Central Government has, vide Notification No.31/2019, dated 31.03.2019, notified that every person who has been allotted permanent account number as on 1st July, 2017. and who is eligible to obtain Aadhaar number, shall intimate his Aadhaar number to the Principal DGIT (Systems) or Principal Director of Income-tax (Systems) by 30th September, 2019.

This notification would, however, not be applicable to those persons or such class of persons or any State or part of any State who/which are/is specifically excluded under section 139AA(3) [detailed in point (5) below].

4. Consequences of failure to Intimate Aadhar Number:

If a person fails to intimate the Aadhai Number, the permanent account Number (PAN) alloted to such person shall be made In operative after the date so notified in the prescribed manner.

6. Provision not to apply to certain persons or class of persons:

The provisions of Section 1 39AA relating to quoting of Aadhar Number would, however, not apply to such person or class or classes of persons or any State or part of any State as may be notified by the Central Government.

Accordingly, the Central Government has, vide Notification No. 37/2017 dated 11.05.2017 effective from 01.07.2017, notified that the provisions of Section 1 39AA relating to quoting of Aadhar Number would not apply to an individual who does not possess the Aadhar number or Enrolment ID and is:

- residing in the States of Assam, Jammu & Kashmir and Meghalaya;

- a non-restdent as per Income-tax Act, 1961;

- of the age of 80 years or more at any time during the previous year; not a citizen of India

![]()

Question 12.

Briefly mention the concept of Self-Assessment tax u/s 140A of the IT Act and it components. (May 2018, 2 marks)

Answer:

Self Assessment tax means any balance tax paid by the assessee on the assessed income after taking TDS and Advance tax into account before filing the Return of income. SAT or self-assessment tax is paid for a particular

financial year end.

Computation of Sell Assessment Tax:

The following procedure can be followed for the computation of self assessment tax:

- First calculate taxable amount payable on the Individual’s total Income with the help of the income tax slabs available online.

- Then add the interest that is payable under Section 234A/234B/234C.

- Once you have added the amount, deduct the relief amount under Section 90190AJ91 from the total.

- Then further subtract the MAT Credit amount under Section 115JAA.

- Further subtract the advance tax amount.

This will lead to the self-assessment tax payable on the individual’s income tax.

Question 13.

Indicate the three situations where the Return of Income has to be compulsorily filed u/s 139(1) of the Income Tax Act, 1961. (May 2018, 3 × 2 = 6 marks)

Answer:

Compulsory filing of return of Income [Section 139(1)]

1. As per Section 139(1), it is compulsory for companies and firms to file a return of income or loss for every previous year on or before the due date in the prescribed form.

2. In case of a person other than a company or a firm, filing of return of income on or before the due date is mandatory, if his total income or the total income of any other person in respect of which he is assessable under this Act, during the previous year exceeds the basic exemption limit.

3. Every person, being a resident other than not ordinarily resident in India within the meaning of Section 6(6), who is not required to furnish a return under Section 139(1), would be required to file a return of income or loss for the previous year in the prescribed form and verified in the prescribed manner on or before the due date, if such person at any time during the previous year,-

(a) holds, as a beneficial owner or otherwise, any asset (including any financial interest in any entity) located outside India or has a signing authority in any account located outside India; or

(b) is a beneficiary of any asset (including any financial interest in any entity) located outside India.

However, an individual being a beneficiary of any asset (including any financial interest in any entity) located outside, India would not be required to file return of income under this clause, where, income, if any arising from such asset is includible in the income of the person referred to in (a) above in accordance with the provisions of the Income-tax Act, 1961.

4. Further, every person, being an individual or a HUF or an AOP/BOI, whether incorporated or not, or an artificial juridical person.

whose total income or the total income of any other person in respect of which he is assessable under this Act, during the previous year.

without giving effect to the provisions of Chapter VI-A or Section 54/54B/54D/54EC or 54F1. exceeded the basic exemption limit, is required to file a return of his income or income of such other person on or before the due date in the prescribed form and manner and setting forth the prescribed particulars.

5. Any person other than a company or a firm, who is not required to furnish a return under Section 139(1), is required to file income-tax return in the prescribed form and manner on or before the due date if, during the previous year, such person-

(a) has deposited an amount or aggregate of the amounts exceeding ₹ 1 crore in one or more current accounts maintained with a banking company or a co-operative bank; or

(b) has incurred expenditure of an amount or aggregate of the amounts exceeding ₹ 2 lakh for himself or any other person for travel to a foreign country; or

(c) has incurred expenditure of an amount or aggregate of the amounts exceeding ₹ 1 lakh towards consumption of electricity; or

(d) fulfils such other prescribed conditions.

6. All such persons mentioned in (1) to (5) above should, on or before the due date, furnish a return of his income or the income’ of such other person during the previous year in the prescribed form and verified in the prescribed manner and setting forth such other particulars as may be prescribed.

Meaning of due date:

‘Due date’ means-

(a) 30th September of the assessment year, where the assessee, other than an assessee referred to in (ii) below, is-

- a company.

- a person (other than a company) whose accounts are required to be audited under the Income-tax Act, 1961 or any other law for the time being in force; or

- a working partner of a firm whose accounts are required to be audited under the Income-tax Act, 1961 or any other law for the time being in force.

(b) 30th November of the assessment year, in the case of an assessee who is required to furnish a report referred to in Section 92E.

(c) 31st July of the assessment year, in the case of any other assessee.

Question 14.

Explain the quantum of late fees under section 234 F for delay in furnishing return of income within the prescribed time limit, under section 139 (1) for A.Y. 2021-22. (Nov 2018, 3 marks)

Answer:

Quantum of late fee for delay in furnishing return of Income

Late fee under section 234F iš attracted where a person, who is required to furnish a return of income under section 139, fails to do so within the time limit prescribed under section 139(1).

| Quantum of Late Fefe | Circumstances |

| ₹ ‘5,000 | If the return is furnished on or before the 31st December of the assessment year; |

| ₹ 10,000 | In any other case |

| However, if the total income of the person does not exceed ₹ 5 lakhs, the fee payable shall not exceed ₹ 1,000 | |

Question 15.

Every person is required to file a return of income on or before due date in the prescribed form and manner as per Section 139 (1). What is the meaning of due date of filing Income Tax Returns for different categories of assessees as per Section 139 (1) of the Income Tax Act,’ 1961 ? (Nov 2018, 4 marks)

Answer:

‘Due date’ for filing of return of income as per section 139(1):

(i) 31st October of the assessment year, where the assessee, other than an assessee referred to in (ii) below, is –

(a) a company,

(b) a person (other than a company) whose accounts are required to ’ be audited under the Income-tax Act, 1961 or any other law in force; or

(c) a working partner of a firm whose accounts are required to be audited under the Income-tax Act, 1961 or any other law for the time being in force.

(ii) 31st July of the assessment year, in the case of any other assessee.

Note: In the case of an assessee who is required to furnish a report referred to in section 92E, the due date for filing return of income is 30th November of the assessment year.

![]()

Question 16.

Discuss the provisions of Section 139A(1) which provides the persons who are compulsorily required to apply for allotment of Permanent Account Number (PAN) with the assessing officer. (May 2019, 4 marks)

OR

(i) What is the fee for default in furnishing return of income u/s 234F? (May 2019, 2 marks)

(ii) To whom the provisions of Section 139AA relating to quoting of Aadhar Number do not apply? (May 2019, 2 marks)

Answer:

First Alternative

Persons who are mandatority required to apply for PAN as per section 139A(1)

(i) Every person whose total income or the total income of any other person in respect of which he is assessable under the Income-tax Act, 1961 during any previous year exceeds the basic exemption limit.

(ii) Every person carrying on business or profession whose total sales turnover or gross receipts are or is likely to exceed ₹ 5 lakhs in an previous year

(iii) Every person, being a resident, other than an individual, which entered into a financial transaction of an amount aggregating to ₹ 2,50,000 o more in a financial year

(iv) Every person who is the managing director, director, partner, trustee, author, founder, karta, chief executive officer, principal officer or office bearer of the person referred to in (iii) above or any person competent to act on behalf of the person referred to in (iii) above.

[Second Alternative]

(i) Fee for default in furnishing return of income u/s 234F

Where a person, who is required to furnish a return of income under Section 139, fails to do so within the prescribed time limit under Section 139(1), he shall pay, by way of fee, a sum of —

| Fee | Circumstances |

| ₹ 5,000 ₹ 10,000 | If the return is furnished on or before the 31st December of the assessment year in any other case |

| Note: However, if the total income of the person does not exceed ₹ 5 lakhs, the fees payable shall not exceed ₹ 1,000 | |

(ii) Persons to whom provisions of Section 139 AA relating to quoting of Aadhar Number does not apply:

The provisions of section 139 AA relating to quoting of Aadhar Number would not apply to an individual who does not possess the Aadhar number or Enrolment ID and is:

- Residing in the States of Assam, Jammu & Kashmir and Meghalaya;

- A non-resident as per Income-tax Act, 1961

- Of the age of 80 years or more at any time during the previous year;

- Not a citizen of India.

Question 17.

Elaborate the conditions, non-fulfilment of which would render a return of income filed by an assessee not maintaining regular books of accounts, defective. (Nov 2019, 4 marks)

Answer:

A return of income shall be regarded as defective unless all the following conditions are fulfilled, namely:

(a) The annexures, statements and columns in the return of income relating to computation of income chargeable under each head of income, computations of gross total income and total income have been duly filled in.

(b) The return of income is accompanied by the following, namely:

(i) a statement showing the computation of the tax payable on the basis of the return.

(ii) the report of the audit obtained under Section 44AB (If such report has been furnished prior to furnishing the return of income, a copy of such report and the proof of furnishing the report should be attached).

(iii) the proof regarding the tax, if any, claimed to have been deducted or collected at source and the advance tax and tax on self-assessment, if any, claimed to have been paid. (However, the return will not be regarded as defective if

(a) a certificate for tax deducted or collected was not furnished under Section 203 or Section 206C to the person furnishing his return of income,

(b) such certificate is produced “within a period of 2 years.

(iv) the proof of the amount of compulsory deposit, if any, claimed to have been paid under the Compulsory Deposit Scheme (Income-tax Payers) Act, 1974;

(c) Where regular books of account are maintained by an assessee, the return of income is accompanied by the following –

(i) copies of manufacturing account, trading account, profit and loss account or income and expenditure account, or any other similar account and balance sheet;

(ii) the personal accounts as detailed below –

| (1) Proprietary, business or profession | The personal account of the proprietor |

| (2) Firm, association of persons or body of ìndividuals | personal accounts of partners or members |

| (3) Paner or member of a firm, association of persons or body of individuals | partner’s personal account in firm member’s personal account in the association of persons or body of individuals |

(d) Where the accounts of the assessee have been audited, the return should be accompanied by copies of the audited profit and loss account and balance sheet and the auditor’s report.

(e) Where the cost accounts of an assessee have been audited under Section 148 of Companies Act, 2013, the return should be accompanied by such report.

(f) Where regular books of account are not maintained by the assessee, the return should be accompanied by –

(i) a statement indicating –

- the amount of turnover or gross receipts,

- gross profit,

- expenses; and

- net profit of the business or profession;

(ii) the basis on which such amounts mentioned in (i) above have been computed,

(iii) the amounts of total sundry debtors, sundry creditors, stock-in- trade and cash balance as at the end of the previous year.

![]()

Question 18.

(a) Answer sub-divisions :

(iii) State with reasons whether you agree or disagree with the following statements:

(a) Return of income of Limited Liability Partnership (LLP) could be signed by any partner.

(b) Time limit for filing return under Section 139(1) in the case of Mr. A having total turnover of ₹ 45 lakhs for the year ended 31-03-2021, whether or not opting to offer presumptive income under section 44 AD is 31st October 2021. (Nov 2011, 4 marks)

Answer:

(a) Disagree

The return of income of LLP should be signed by a designated partner. Any other partner can sign the Return of Income of LLP only in the following cases:

- where for any unavoidable reason such designated partner is not able to sign and verify the return, or,

- where there is no designated partner.

(b) Disagree

In case Mr. A opts to offer his income as per the presumptive taxation provisions of Section 44AD, then, the due date under Section 139(1) for filing of return of income for the year ended 31.03.2021 shall be 31st July, 2021.

It is only in case Mr. A does not opt for presumptive taxation provisions under Section 44AD and offers income to be lower than 8% of total turnover and his total income exceeds the basic exemption limit, he has to keep books of account as per Section 44AA and get his accounts audited under Section 44AB, in which case the due date for filing return would be 31st October, 2021.

Question 19.

(a) Answer the question.

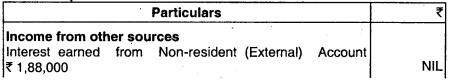

(i) Paras is resident of India. During the F.Y. 2020-21 interest of ₹ 1,88,000 was credited to his Non-resident (External) Account with SBI. ₹ 30,000 being interest on fixed deposit with SBI was credited to his saving bank account during this period. He also earned ₹ 3,000 as interest on this saving account. Is Paras required to file return of income?

What will be your answer, if he owns one shop in Kerala having area of 150 sq.ft.? (May 2012, 4 marks)

Answer:

An individual is required to furnish a return of income under sectionl 39(1) if his total income, before giving effect to the deductions under Chapter VI-A, exceeds the maximum amount not chargeable to tax i.e., ₹ 2,50,000 (for A. Y. 2021-22).

Computation of total income of Mr. Paras for A.Y. 2021-22

Since the total income of Mr. Paras for A.Y.2021-22, before giving effect to the deductions under Chapter Vl-A, is less than the basic exemption limit of ₹ 2,50,000, he is not required to file return of income for A.Y.2021-22. Owning a shop having area of 150 sq. ft in Kerala would not make any difference to the answer.

Note: In the above solution, interest of ₹ 1,88,000 earned from Non-resident (External) account has been taken as exempt on the assumption that Mr. Paras, a resident, has been permitted by RBI to maintain the aforesaid account. In case he has not been so permitted, the said interest would be taxable. In such a case, his total income, before giving effect to the deductions under Chapter VIA, would be ₹ 2,21,000 (₹ 33,000 + ₹ 1,88,000), which is not higher than the basic exemption limit of ₹ 2,50,000. Consequently, he would not be required to file return of income for A.Y.2021 – 22. Here again, ownership of shop in Kerala is immaterial.

Question 20.

Mr. Sachin filed return on 30th September, 2021 related to Assessment Year 2021-22. In the month of October 2021, his tax consultant found that the interest on fixed deposit was omitted in the tax return.

(i) What is the time limit for filing a belated return?

(ii) Can Mr. Sachin file a revised return?

Justify the above with the relevant provisions under Section 139.

Assume that the due date for furnishing return of income was 31st July, 2021 and the assessment was not completed till the month of October 2021. (Nov 2017, 5 marks)

Answer:

(i) As per Section 139(4), a belated return for any previous year may be furnished at any time:

(a) before the end of the relevant assessment year; or

(b) before the completion of the assessment, whichever is earlier.

For assessment year 2021 -22, the belated return has to be furnished before 31st March, 2021 or before completion of assessment, whichever is earlier.

(ii) As per Section 139(5), if any person, having furnished a return within the due date or a belated return, discovers any omission or any wrong statement therein, he may furnish a revised return at any time;

(a) before the expiry of one year from the end of the relevant assessment year or

(b) before the completion of assessment, whichever is earlier.

Since Mr. Sachin has filed his return after 31.7.2020, being the due date under Section 139(1) in his case, but before 31.3.2021 completion of assessment, the said return is a belated return under Section 139(4).

Thus, in the present case, Mr. Sachin can file a revised return, since he has found an omission in the belated return filed by him for A.Y.2021 -22 and assessment is yet to be completed and one year from the end of A.Y.2021-22 has not elapsed as of October, 2020.

Question 21.

State whether quoting of PAN in the following transactions is mandatory or not, as per the provisions of Income Tax Act, 1961 for A.Y.2021-22:

(i) Mr. A makes cash payment to a hotel Radisson Blu, Ahmedabad of ‘₹ 50,000 against the bill raised by the hotel.

(ii) Mr. Abhishek, in a single transaction, makes contract of ₹ 1,20,000 for sale/purchase of securities (other than shares) as defined in section 2(h) of the Securities Contacts (Regulation) Act, 1956.

(iii) Payment to Mutual Funds of ₹ 70,000 for purchase of its units.

Your answers must be supported with reasons. (May 2018, 3 marks)

Answer:

Requirement of quoting PAN in respect of certain transactions [Rule 114B of Income-tax Rules, 1962]:

(i) In case of Hotel, quoting erf PAN is mandatory if the payment is made in cash of an amount exceeding ₹ 50,000 against bill at any one time. Since in the given case amount is ₹ 50,000, hence PAN is not mandatory.

(ii) In case of purchase and sale of securities(other than shares), quoting of PAN is mandatory if contract for sale or purchase of securities (other than shares) for amount exceeding ₹ 1 lakh per transaction. Since in the given case, Mr. Abhishek make a contract of ₹ 1,20,000 for sale and purchase of securities other than shares hence PAN is mandatory.

(iii) In case of Payment to mutual fund, if amount exceeding ₹ 50,000 for purchase of its units, then quoting of PAN is mandatory. Since in the given case payment is made of 70,000, hence quoting of PAN is mandatory.

![]()

Question 22.

Mr. Mukesh born on 1.4.1960 furnished his original return for Assessment Year 2021-22 on 30.07.2021. He has shown salary income of ₹ 7.30 lakhs (computed) and interest from his savings bank of ₹ 12,700 and from his fixed deposits of ₹ 43,000. He also claimed deduction under section 80C ₹ 1.50 lakhs. He had claimed deduction u/s 80D of ₹ 25,000. He also claimed deduction u/s 80TTA of ₹ 10,000. His employer had deducted TDS of ₹ 33,950 from his salary, which he adjusted fully against tax payable.

He paid health insurance premium of ₹ 38,000 by account payee cheque for self and wife. He paid ₹ 1,500 in cash for his health check-up and ₹ 4,000 by cheque for preventive health check-up of his parents. He also paid medical insurance premium of ₹ 33,000 during the year to insure the health of his mother, aged 80 years, staying with his younger brother. He further incurred medical expenditure of ₹ 25,000 on his father, aged 81 years, who is staying with him. His father is not covered under any mediclaim policy.

He seeks your advice about possibility of revising his return and if possible file his revised return. Analyse the above narrated facts as per applicable provisions of the Income Tax Act, 1961. Does he need to revise his return and for what reasons? Please advise him suitably and if needed, re-compute his income and tax payable or refund due for the Assessment Year 2021 -22. (Nov 2020, 9 marks)

Question 23.

Mr. Hari aged 57 years is a resident of India. He provides you the following details of his income pertaining to F.Y. 2020-21.

– Interest on Non-Resident (External) Account maintained with State Bank of India as per RBI stipulations – ₹ 3,55,000

– Interest on savings bank account maintained with State – ₹ 8,000 Bank of India

Interest on Fixed Deposits with Punjab National Bank – ₹ 40,000

He seeks your advice on his liability to file return of income as per Income- tax Act, 1961 for the Assessment Year 2021-22.

What will be your answer, if he has incurred ₹ 4 lakhs on travel expenses of his newly married son and daughter in law’s honeymoon in Canada? (Nov 2020, 4 marks)

Question 24.

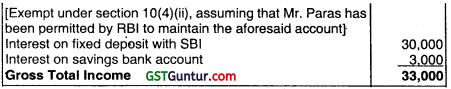

Paras aged 55 years is a resident of India During the F. Y, 2020-21, interest of ₹ 2,88,000 was credited to his Non-resident (External)” Account with SBI. ₹ 30,000 being interest on fixed deposit with SBI, was credited to his saving bank account during this period. He also earned 3,000 as interest on this saving account. Is Paras required to file return of income?

What will be your answer, if he has incurred ₹ 3 lakhs as travel expenditure of self and spouse to US to stay with his married daughter for sometime?

Answer:

An individual is required to furnish a return of income under section 139(1) it his total) income, before giving effect to the deductions under Chapter VI-A or exemption under section or section 54/154B/154D/54EC or 54F, exceeds the maximum amount not chargeable to tax i.e. 2,50,000 (for A.Y.2021 -22).

Since the total income of Mr. Paras for A.Y.2021 -22 before giving effect, inter alia, to the deductions under Chapter VI-A, is less than the basic exemption limit of ₹ 2,50,000, he is not required to file return of income forA.Y.2021 -22. If he has incurred expenditure of ₹ 3 lakhs on foreign travel of self and spouse, he has to mandatorily file his return of income on or before the due date under Sectionl 39(1).

Note: In the above solution, interest of ₹ 2,88,000 earned from Non-resident (External) account has been taken as exempt on the assumption that Mr. Paras, a resident, has been permitted by RBI to maintain the aforesaid account. However, in case he has not been so permitted, the said interest would be taxable. In such a case, his total incorne, before giving effect, inter alia, to the deductions under Chapter VI-A, would be ₹ 3,21,000 (₹ 30,000 + ₹ 2,88,000 + ₹ 3,000), which is higher than the basic exemption limit of ₹ 2,50,000. Consequently, he would be required to file return of income for A. Y.2021-22.

![]()

Question 25.

Explain with brier reasons whether the return of income can be revised under Sectionl 39(5) of the Income-tax Act. 1961 in the following cases:

(i) Belated return filed under section 139(4).

(ii) Return already revised once under section 139(5).

(iii) Return of loss filed under section 139(3).

Answer:

Any person who has furnished a return under section 139(1) or 139(4) can fife a revised return at any time before the end of the relevant assessment year or before the completion of assessment, whichever is earlier, if he discovers any omission or any wrong statement in the return flied earlier. Accordingly,

(i) A belated return filed under section 139(4) can be revised.

(ii) A return revised earlier can be revised again as the first revised return replaces the original return. Therefore, if the assessee discovers any omission or wrong statement in such a revised return, he can furnish a second revised return within the prescribed time i.e. within the end of the relevant assessment year or before the ‘completion of assessment, whichever is earlier.

(iii) A return of loss filed under section 139(3) is deemed to be return filed under section 139(1), and therefore, can be revised under section 139(5).

Question 26.

Mrs. Hetal, an individual engaged in the business of Beauty Parlour, has got her books of account for the financial year ended on 31st March, 2021 audited under section 44AB. Her total income for the assessment year 2021 -22 is 3,35,000. She wants to furnish her return of income for assessment year 2021-22 through a tax return preparer. Can she do so?

Answer:

Section 139B provides a scheme for submission of return of Income for any assessment year through a tax return preparer. However, it is not applicable to persons whose books of account are required to be audited under section 44AB. Therefore, Mrs. Hetal cannot furnish her ‘return of income for A.Y.2021 -22 through a tax return preparer.

Question 27.

State with reasons whether you agree or disagree with the following statements:

(a) Return of income of Limited Liability Partnership (LLP) could be verified by any partner.

(b) Time limit for filing return under section 139(1) in the case of Mr. A having total turnover of ₹ 160 lakhs for the year ended 31.03.2021, whether or not opting to offer presumptive income under section 44AD, is 31st October 2021.

Answer:

(a) Disagree

Time return of income of LLP should be verified by a designated partner. Any other partner can verify th Return of Income of LLP only in the following cases:-

- where for any unavoidable reason such designated partner is not able to verify the return

- where there is no designated partner.

(b) Disagree

In case Mr. A opts to offer his income as per the presumptive taxation provisions of Section 44AD, then, the due date under section 139(1) for filing of return of income for the year ended 31.03.2021, shall be 31st July, 2021.

In case Mr. A does not opt for presumptive taxation provisions under section 44AD and, has to get his accounts audited under section 44AB, since his turnover exceeds 1 crore, the due date for filing return would be 31st October,2021.

Question 28.

Mr. Vineet submits his return of income on 12-09-2021 for A. Y 2021 -22 consisting of income tome under the head salaries, “Income from house property” and bank interest. On 21 -01 -2022, he realized that he had not claimed deduction under section 80 TTA in respect of his interest income on the Savings Bank Account. He wants to revise his return of income. Can he do so? Examine. Would your answer be different if he discovered this omission on 21 -04-2022?

Answer

Since Mr. Vineet has income only under the heads “Salaries”, Income from house property” and “ Income from other sources”, he does not fall under the category of a person whose accounts are required to be audited under the Income-tax Act, 1961 or any other law in force. Therefore, the due date of filing return for A.Y. 2021-22 under section 139(1), in his case, is 31st July, 2021. Since Mr. Vineet had submitted his return only on 12.9.2021, the said return is a belated return under section 139(4).

As per section 139(5), a return furnished under section 139(1) or a belated return u/s 139(4) can be revised. Thus, a belated return under section 139(4) can also be revised. Therefore, Mr. Vineet can revise the return of income filed by him under section 139(4) in January 2022, to claim deduction under section 80TTA, since the time limit for filing a revised return is upto the end of the relevant assessment year, which is 31.03.2022.

However, he cannot revise return had he discovered this omission only on 21 -04- 2022, since it is beyond 31.03.2022, being the end of A.Y. 2021-22.

Question 29.

Examine with reasons, whether the following statements are true or false, with regard to the provisions of the Income-tax Act,1961:

(i) The Assessing Officer has the power, inter aliy, to allot PAN to any person by whom no tax is payable.

(ii) Where the Karta of a HUF is absent from India, the return of income can be verified by any male member of the family.

Answer

(i) True : Section 139A(2) provides that the Assessing Officer may, having regard to the nature of transactions as may be prescribed, also allot a PAN to any other person, whether any tax is payable by him or not, in the manner in accordance with the procedure as may be prescribed

(ii) False : Section 140(b) provides that where the Karta of a HUF is absent form India, the return of income can be verified by any other adult member of the family; such member can be a male of female member.

Question 30.

Explain the term “return of loss” under the Income – tax Act, 1961. Can any loss carried forward even if return of loss has not been filed as required?

Answer:

A return of loss is a return which shows certain losses. Section 80 provides that the losses specified therein cannot be carried forward, unless such losses are determined insurance of return file under the provision of section 139(3)

Section 139(3) states that to carry forward the losses the losses specified therein, the return should be filed within the time specified in section 139(1)

Following losses are covered by section 139(3):

- business loss to be carried forward under section 72 (1),

- Speculation business loss to be carried forward under section 73 (2), loss from specified business to be carried forward under section 73(2)

- loss under the head “Capital Gains” to be carried forward under section 74(1); and

- loss incurred in the activity of owning and maintaining race houses to be carried forward under section 74A(3)

However, loss form house property to be carried forward under section 71B and an unabsorbed depreciation can be carried forward even if return of loss has not been filed as required under section 139(3).

Multiple Choice Questions

Question 1.

Filing of Income Tax Return is compulsory if individual’s—

(a) Total income is more than exemption limit

(b) Gross total income is more than exemption limit

(c) Total income is more than 2,50,000

(d) PAN is obtained

Answer:

(b) Gross total income is more than exemption limit

![]()

Question 2.

Due date for filing of Return in case of firm or company is

(a) 30th June

(b) 31st July

(c) 31st October

(d) 31st December

Answer:

(c) 31st October

Question 3.

The return in case on a trust is required to be filed only if the total income of such person before claiming exemption under Section 11 and 12 exceeds –

(a) ₹ 10,00,000

(c) Maximum amount chargeable to tax

(b) ₹ 50,000

(d) ₹ 5,00,000

Answer:

(c) Maximum amount chargeable to tax

Question 4.

If the assessee has to carry forward the loss under the head capital gain, the return of loss must be submitted:

(a) On or before the due date mentioned in Section 139(1)

(b) At any time before the end of the relevant assessment year

(c) At any time before the expiry of one year from the end of the relevant assessment year

(d) None of the above

Answer:

(a) On or before the due date mentioned in Section 139(1)

Question 5.

If there is a loss under the head house property, it will be allowed to be ‘ carried forward (if it could not be set off from other heads of income). In this case, however the assessee:

(a) has to submit the return of loss before the due date mentioned under Section 139(1)

(b) need not submit the return of income

(c) must submit the return of income but it can be a belated return submitted as per Section 139(4)

(d) None of the above

Answer:

(c) must submit the return of income but it can be a belated return submitted as per Section 139(4)

Question 6.

A revised return may file before the—

(a) At any time before the end of relevant assessment year

(b) Before the completion of assessment

(c) (a) or (b) whichever is earlier –

(d) Expiry of 6 month from the end of relevant previous year

Answer:

(c) (a) or (b) whichever is earlier

Question 7.

Permanent account number is allotted by-

(a) Central Government

(b) Income Tax Department

(c) Bank

(d) Any of above

Answer:

(b) Income Tax Department

Question 8.

Income escaping assessment section is-

(a) 140

(b) 143

(c) 145

(d) 147

Answer:

(d) 147

![]()

Question 9.

The self-assessment tax computed under Section 140A by R is ₹ 65,000 which includes ₹ 25,000 as interest for late filing of return. The assessee deposited ₹ 30,000 as self-assessment tax. In this case:

(a) ₹ 30,000 shall be adjusted towards tax due

(b) ₹ 25,000 shall be adjusted towards interest due and balance ₹ 5,000 shall be adjusted towards tax due

(c) ₹ 30,000 shall be adjusted in the proportion of 8:5 towards tax and interest

(d) None of the above

Answer:

(b) ₹ 25,000 shall be adjusted towards interest due and balance ₹ 5,000 shall be adjusted towards tax due

Question 10.

Intimation under Section 143(1) cannot be sent after the expiry of:

(a) 4 years from the end of the month in which return of time was furnished

(b) 2 years from the end of the month in which return of income was furnished

(c) 2 years from the end of the assessment year in which the income was so assessable

(d) One year from the end of the financial year in which the return is made

Answer:

(d) One year from the end of the financial year in which the return is made

Provisions for Filing Return of Income and Self-Assessment Notes

Compulsory Filing of Return of Income [Section 139(1)]:

(1) As per section 139(1), it is compulsory for companies and firms to file a return of income or loss for every previous year on or before the due date in the prescribed form.

(2) In case of a person other than a company or a firm, filing of return of income on or before the due date is mandatory, if his total income or the total income of any other person in respect of which he is assessable under this Act during the previous year exceeds the basic exemption limit.

(3) Every person, being a resident other than not ordinarily resident in India within the meaning of section 6(6), who is not required to furnish a return under section 139(1), would be required to file a return of income or loss for the previous year in the prescribed form and verified in the prescribed manner on or before the due date, if such person, at any time during the previous year-

(a) holds, as a beneficial owner or otherwise, any asset (including any financial interest in any entity) located outside India or has a signing authority in any account located outside India ; or

(b) is a beneficiary of any asset (including any financial interest in any entity) located outside India.

However, an individual being a beneficiary of any asset (including any financial interest in any entity) located outside India would not be required to file return of income under this clause, where, income, if any, arising from such asset is includible in the income of the person referred to in (a) above in accordance with the provisions of the income-tax Act, 1961.

(4) Further, every person, being an individual or a HUF or an AOP/BOI, whether incorporated or not, or an artificial juridical person –

- Whose total income or the total income of any other person in respect of which he is assessable under this Act during the previous year

- without giving effect to the provisions of Chapter VI-A or section 54/54B/54D/54EC or 54F

- exceeded the basic exemption limit.

is required to file a return of his income or income of such other person on or before the due date in the prescribed form and manner and setting forth the prescribed particulars.

(5) Any person other than a company or a firm, who is not required to furnish a return under section 139(1), is required to file income-tax return in the prescribed form and manner on or before the due date if, during the previous year, such person –

(a) has deposited an amount or aggregate of the amounts exceeding ₹ 1 crore in one or more current accounts maintained with a banking company or a co-operative bank; or

(b) has incurred expenditure of an amount or aggregate of the amounts exceeding ₹ 2 lakh for himself or any other person for travel to a foreign country; or

(c) has incurred expenditure of an amounts or aggregate of the amounts exceeding ₹ 1 lakh towards consumption of electricity; or

(d) fulfils such Qther prescribed conditions

(6) All such persons mentioned in (1) to (5) above should, on or before the due date, furnish a return of his income or the income of such other person during the previous year in the prescribed form and verified in the prescribed manner and setting forth such other particulars as may be prescribed.

![]()

Meaning of due date :

‘Due date’ means –

(a) 31st October of the assessment year, where the assessee, other than an assessee referred to in (ii) below, is –

- a company,

- a person (other than a company) whose accounts are required to be audited under the Income-tax Act, 1961 or any other law for the time being in force; or

- a [omitted from 01.04.2020] partner of a firm whose accounts are required to be audited under the Income-tax Act, 1961 or any other law for the time being in force.

(b) 30th November of the assessment year, in the case of an assessee who is required to furnish a report referred to in section 92E.

(c) 31st July of the assessment year, in the case of any other assessee.

Note:

Section 92E is not covered within the scope of syllabus of Intermediate Paper 4: Taxation. Section 139 (1) provides a different due date, i.e., 30th November of the assessment year, for assessees who have to file a transfer pricing report under section 92E (i.e. assessees who have undertaken international transactions). Therefore, reference has been made to this section, i.e. section 92E, for explaining this provision in section 139 (1) Persons Authorised to Verify Return of Income [Section 140]:

This section specifies the persons who are authorized to verify the return of income under section 139.

| Assessee | Circumstance | Authorised Persons |

| 1. Individual | (i) In circumstances not covered under (ii), (iii) & (iv) below | • the individual himself |

| (ii) where he is absent from India | • the individual himself; or • any person duly authorised by him in this behalf holding a valid power of attorney from the individual (Such power of attorney should be attached to the return of income) |

|

| (iii) where he is mentally incapacitated from attending to his’ affairs | • his guardian; or • any other person competent to act on his behalf |

|

| (iv) where, for any other reason, it is not possible for the individual to verify the return | any person duly authorised by him in this behalf holding a valid power of attorney from the individual (Such power of attorney should be attached to the return attached to the return of income) | |

| Hindu Undivided Family | (i) in circumstance not covered under (ii) and (ii) below | the karta |

| (ii) where the is karta absent from India | any other adult member of the HUF | |

| (iii) where the karta is mentally incapacitated from attending to his affairs | any other adult member of the HUF | |

| Company | (i) in circumstances not covered under (ii) to (vi) below | the managing director of the company |

| (ii) (a) where for any unavoidable reason such managing director is not table to verify the return; or (b) where there is no managing director |

• any of the director company or any other person, as may be prescribed for this purpose

• any of the director company or any other person, as may be prescribed for this purpose |

|

| (iii) where the company is not resident in India | a person who holds a valid power of attorney from such company to do so (such power of attorney should be attached to the return). | |

| (iv) (a) Where the company is being would up (whether under the orders of a court or otherwise); or (b) where any person has been appointed as the receiver of any assets of the company | • Liquidator • Liquidator |

|

| (v) Where the management of the company has been taken over by the Central Government or any State Government under any law | • the principal officer of the company | |

| (vi) Where an application for corporate insolvency resolution process has been admitted by the Adjudicating Authority under the Insolvency and Bankruptcy Code, 2016. | insolvency professional appointed by such Adjudicating Authority | |

| 4. Firm | (i) in circumstances not covered under (ii) below |

the managing partner of the firm |

| (ii) (a) where for any unavoidable reason such managing partner is not able to verify the return; or (b) where there is no managing partner. |

• any partner of the firm, not being a minor • any partner of the firm, not being a minor |

|

| 5. LLP, | (i) in circumstances not covered under (ii) below | Designated partner |

| (ii) (a) where for any unavoidable reason such designated partner is not able to verify the return ; or

(b) where there is no designated partner. |

• any partner of the LLP or any other person, as may be prescribed for this purpose

• any partner of the LLP or any other person, as may be prescribed for this purpose |

|

| 6. Local authority | • | the principal officer |

| 7. Political party [referred to in section 139 (4B)] | • | the chief executive officer of such party (whether he is known as secretary or by any other designation) |

Self-Assessment [Section 140 A]:

(1) Payment of tax, interest and fee before furnishing return of income.

Where any tax is payable on the basis of any return required to be furnished under, inter alia, section 139, after taking into account –

(i) the amount of tax, already paid, under any provision of the Income- tax Act, 1961

(ii) the tax deducted or collected at source

(iia) any relief of tax claimed under section 89

(iii) any relief of tax or deduction of tax claimed under section 90 or section 91 on account of tax paid in a country outside India;

(iv) any relief of tax claimed under section 90A on account of tax paid in any specified territory outside India referred to in that section; [omitted]

(v) any tax credit claimed to set-off in accordance with the provisions of section 115JAA the assessee shall be liable to pay such tax together with interest and fee payable under any provision of this Act for any delay in furnishing the return or any default or delay in .payment of advance tax before furnishing the return. The return shall be accompanied by the proof of payment of such tax, interest and fee.

(2) Order of adjustment of amount paid by the assessee

Where the amount paid by the assessee under section 140A(1) falls short of the aggregate of the tax, interest and fee as aforesaid, the amount so paid shall first be adjusted towards the fee payable and thereafter towards interest and the balance, if any, shall be adjusted towards the tax payable.