Chapter 4 Process of M&A Transactions – Corporate Restructuring Insolvency Liquidation & Winding Up Notes is designed strictly as per the latest syllabus and exam pattern.

Process of M&A Transactions – Corporate Restructuring Insolvency Liquidation & Winding Up Study Material

Question 1.

Write a note on the following:

Documents to be checked in due diligence process (Dec 2012, 4 marks)

Answer:

The following are the few types of information or documents to be checked, during the process of due diligence:

- Basic Information

- Important, Business Agreements

- Financial Data

- Marketing Information

- Litigation Aspects

- IPR Details

- Taxation aspects

- Internal control system

- Human resources aspects

- Insurance coverage

- Cultural aspects

- Environmental impact

![]()

Question 2.

Write short note on the following:

Technical due diligence. (Dec 2014, 3 marks)

Answer:

Technical due diligence:

Technical due diligence covers:

(i) intellectual property due diligence, and

(ii) technology due diligence.

(i) Intellectual property due diligence:

The recent concept of valuation of intangible assets related to intellectual property like patents, copyrights, design, trademarks, brands etc, also getting greater importance as these intellectual properties of the business are now often sold and purchased in the market by itself, like any other tangible asset.

(ii) Technology due diligence:

Technology due diligence considers aspects such as current level of technology, company’s existing technology, further investments required etc.

![]()

Question 3.

Distinguish between the following:

‘Technical due diligence’ and ‘financial due diligence’. (Dec 2013, 5 marks)

Question 4.

Distinguish between the following:

‘Audit’ and ‘due diligence’. (Dec 2014, 3 marks)

Answer:

Due Diligence and Audit

| Audit | Due diligence |

| Limited to financial analysis | Includes not only analysis of financial statements, but also business plan, sustainability of business, future aspects, corporate and managements structure, legal issues etc. |

| Based on historical data | Covers future growth prospects in addition tc historical data. |

| Mandatory | Mandatory based on the transaction |

| Positive assurance i.e. true and fairness of the financial statements | Negative assurance i.e. identification of risks if any |

| Post mortem analysis | it is required for future decision |

| Always uniform | Varies according to the nature of transaction |

| Recurring event | Occasional event |

![]()

Question 5.

Distinguish between the following:

(i) ‘Operational due diligence’ and ‘strategic due diligence’.

(ii) ‘Financial due diligence’ and ‘tax due diligence’. (June 2016, 3 marks each)

Answer:

(i) (a) Operational due diligence: Operational due diligence aims at the assessment of the functional operations of the target company, connectivity between operations, technological upgradation in operational process, financial impact on operational efficiency etc. It also uncovers aspects on operational weakness, inadequacy of control mechanisms etc.

(b) Strategic due diligence : Strategic due diligence tests the strategic rationale behind a proposed transaction and analyses whether the deal is commercially viable, whether the targeted value would be realized. It considers factors such as value creation opportunities, competitive position and critical capabilities.

(ii) Financial Due Diligence:

Financial due diligence provides peace of mind to both corporate and financial buyers, by analysing and validating all the financial, commercial, operational and strategic assumptions being made.

Financial Due Diligence includes review of accounting policies, review of internal audit procedures, quality and sustainability of earnings and cash flow, condition and value of assets, potential liabilities, tax implications of deal structures, examination of information systems to establish the reliability of financial information, internal control systems etc.

The tax due diligence comprises an analysis of:

- tax compliance

- tax contingencies and aggressive positions

- transfer pricing

- identification of risk areas

- tax planning and opportunities.

![]()

Question 6.

Critically examine and comment on the following:

A key step in any due diligence exercise is to develop an understanding of the purpose for the transaction. (June 2012, 4 marks)

Answer:

The Statement is correct. The nature of due diligence varies from the type of transaction, its volume, the motive and objective of parties to a transaction. The nature and the extent of due diligence depends upon the risk perceived by parties to a transaction. The scope of due diligence is transaction based and is depending on the needs of the people who are involved in the potential investments, in addressing key uncovered issues, areas of concern and in identifying other opportunities.

The goal of due diligence is to provide the party proposing the transaction with sufficient information to make a reasoned decision and to provide a basis for determining the appropriate terms and price for the transaction incorporating consideration of the risks inherent in the proposed transaction. Due diligence is also necessary to ensure that there are no onerous contracts or agreements that affect the acquirer’s return on investment.

![]()

Question 7.

“Section 232 contains reference to reconstruction of any company or companies or amalgamation of any two or more companies.” Comment on the relevant provisions for facilitating reconstruction and amalgamation of companies. (Dec 2012, 8 marks)

Answer:

Section 232(1) states that when an application is made to the Tribunal under Section 230 for the sanctioning of a compromise or an arrangement proposed between a company and any such persons as are mentioned in that Section, and it is shewn to the Tribunal:

(a) that the compromise or arrangement has been proposed for the purposes of, or in connection with, a scheme for the reconstruction of the company or companies involving merger or the amalgamation of any two or more companies; and

(b) that under the scheme, the whole or any part of the undertaking, property or liabilities of any company (hereinafter referred to as the transferor company) is required to be transferred to another company (hereinafter referred to as the transferee company), or is proposed to be divided among and transferred to two or more companies.

The Tribunal may, either by order sanction the compromise or arrangement or by a subsequent order, make provision for all or any of the following matters:

(a) The transfer to the transferee company of the whole or any part of undertaking, property or liability of any transferor company.

(b) The allotment or appropriation by the transferee company of any share or debenture.

(c) The continuation by or against the transferee company of any legal proceedings pending by or against any transferor company.

(d) Dissolution without winding up of the transferor company.

(e) The provision for those person who dissent from scheme.

(f) The transfer of the employees of the transferor company to the transferee company.

(g) Such incidental, consequential and supplemental measures as are necessary to secure that there reconstruction or amalgamation be fully and effectively carried out.

![]()

Question 8.

State the different kinds of approvals required to be obtained in the scheme of amalgamation. (Dec 2012, 5 marks)

Answer:

The scheme of merger and amalgamation requires various approvals. They are as follows:

1. Approval of Board of Directors: First of all the scheme must be approved by Board of Directors of both the companies.

2. Approvals of Shareholders/Creditors: Next, the approval of shareholders and creditors must be obtained in a special meeting held for obtaining their approval. More than 50% in number and 3/4 in value of shareholders must approve the scheme. Without the shareholders/ creditors approval the Tribunal cannot sanction a scheme of amalgamation.

3. Stock Exchange approval: All the companies which are listed on recognised stock exchanges have to obtain the Observation Letter, no-objection certificate from the exchanges as per the requirement of Regulation 37(1) of SEBI (LODR) Regulations, 2015.

4. Approval from financial institution/lending bank/debenture trustees etc. is to be obtained in case the money has been borrowed by the company.

5. Approval from Reserve Bank of India: If the scheme of amalgamation involves a issue of shares to non-resident Indians then Reserve Bank of India permission is required to be obtained.

6. Sanction of the National Company Law Tribunal: Approval/ Sanction of the Scheme of amalgamation by the Tribunal is required under section 230(3) of Companies Act, 2013.

7. Approval from Landholder: If the land on which the factory is situated is a lease hold land and the terms of the lease deed so specify, the approval from the lessor will be needed.

![]()

Question 9.

It is well settled principle of the Tribunal that if the shareholders approve a scheme of arrangement (whether it is amalgamation, demerger/ hive off, etc.) with required majority and is not against public policy or illegal, such scheme of arrangement shall not be disallowed. However, in rare cases Tribunal reject a scheme on the ground of res judicata. What are the circumstances where the Tribunal are applying this principle? (Dec 2012, 5 marks)

Answer:

The Tribunal applies the principle of res-judicata where a proposed scheme of compromise or arrangement has already been rejected by the Tribunal and the same person proposes another scheme which is substantially the same as the earlier one.

Question 10.

Critically examine and comment of the following:

Due diligence investigations are generally for corporate mergers and acquisitions. (Dec 2012, 4 marks)

Answer:

Due diligence investigations are generally for corporate acquisitions and mergers i.e. investigation of the company being acquired or merged. The buyer or transferee company wants to make sure to know what it is buying. Some other transactions where due diligence is appropriate could be:

- Strategic Alliances and joint-ventures

- Strategic Partnership

- Partnering Agreements

- Business Coalitions

- Outsourcing Arrangements

- Technology and Product Licensing

- Technology sharing and cross Licensing Agreements

- Distribution Relationship, etc.

![]()

Question 11.

Enumerate the main parameters to measure the post merger efficiency. (June 2013, 6 marks)

Answer:

The various indicators which can be useful in measuring the post merger efficiency are:

- The earning performance of a merged company can be measured by return on total assets and return on net worth.

- Whether the merged business creates a larger business organisation & provides a basis for growth.

- Whether the merged company is able to earn larger net profit than before or higher return on total funds employed.

- Efficiency can also be measured through other factors like improved debtor realisation, reduction in non-performing assets, economies due to large scale production.

- Efficiency can also be measured by focusing on fair market value.

- Inter firm comparison can also proves to be useful. Comparison of performance of the merged company with the similar sized company in the same business in respect of:-

- Sales

- Assets

- Net profits Earning per share :

- Dividend rate & payouts also determine its efficiency.

- Gains to shareholders in terms of increase or decrease in share prices of the merged company.

- Increase not only in the size of the merged company but also in its sources and resources to optimize its end earnings.

![]()

Question 12.

What are the approvals required in a scheme of merger ? (Dec 2013, 8 marks)

Question 13.

What are the factors relevant for ‘post-merger evaluation’? (Dec 2013, 3 marks)

Answer:

The various indicators which can be useful in measuring the post merger efficiency are:

- The earning performance of a merged company can be measured by return on total assets and return on net worth.

- Whether the merged business creates a larger business organisation & provides a basis for growth.

- Whether the merged company is able to earn larger net profit than before or higher return on total funds employed.

- Efficiency can also be measured through other factors like improved debtor realisation, reduction in non-performing assets, economies due to large scale production.

- Efficiency can also be measured by focusing on fair market value.

- Inter firm comparison can also proves to be useful. Comparison of performance of the merged company with the similar sized company in the same business in respect of.

- Sales

- Assets

- Net profits

- Earning per share.

- Dividend rate & payouts also determine its efficiency.

- Gains to shareholders in terms of increase or decrease in share prices of the merged company.

- Increase not only in the size of the merged company but also in its sources and resources to optimize its end earnings.

![]()

Question 14.

Critically examine and comment on the following:

During the diligence process, care should be taken to adhere to certain hospitality issues. (Dec 2013, 4 marks)

Answer:

During the diligence process, care should be taken to adhere to certain hospitality issues like:

(a) Be warm and respective to the professionals who are conducting diligence.

(b) Enquire on the Due Diligence team.

(c) Join them for lunch..

(d) Ensure good supply of refreshments.

(e) In case of any corrections – admit and rectify.

As regards the process of diligence, as a professional care should be taken to scrutinize every document that is made available and ask for details and clarifications, though generally the time provided to conduct the diligence may not be too long and though things have to be wrapped up at the earliest. The company may be provided with an opportunity to clear the various issues that may arise out of the diligence.

![]()

Question 15.

Examine and comment on the following.

Due diligence covers, compliances, litigations, uncovered risks and future prospects. (June 2014, 4 marks)

Answer:

Due diligence is an investigative process for providing the desired comfort level about the potential investment and to minimize the risks such as hidden uncovered liabilities, poor growth prospects, price claimed for proposed investment being on higher side etc. Due diligence is also necessary to ensure that there are no onerous contracts or other agreements that could affect the acquirer’s return on investment.

Question 16.

(a) ‘The resolution according approval of shareholders under section 230(6) is neither an ordinary resolution nor a special resolution”. Comment in the light of judicial precedent and also discuss whether filing of such resolution with the Registrar of Companies is mandatory. (June 2014) (5 marks)

(b) Do you agree that “every scheme of arrangement requires prior approval of stock exchanges”? Highlight the relevant provisions in support of your answer. (5 marks)

Answer:

(a)

- The resolution according approval of shareholders under section 230(6) is neither an ordinary resolution nor a special resolution within the purview of the Companies Act, 2013.

- A copy of this resolution is not required to be filed with the Registrar of Companies.

- The Scheme must be approved by a resolution passed by majority in number representing three-fourths in value of creditors, or class of creditors, or members, or class of members, as the case may be, present and voting either in person or, by proxy.

- The majority is dual, in number and in value.

(b)

• Pursuant to Regulation 37 of LODR Regulation, all listed companies shall have to obtain NOC from the Stock Exchange before filing of any scheme/petition proposed to be filed before Tribunal under Sections 230, 232 and 66 of Companies Act, 2013.

Thus, for listed company, every Scheme of amalgamation requires prior approval of Stock exchanges.

Nothing contained in this regulation shall apply to draft schemes which solely provide for merger of a wholly owned subsidiary with its holding company, provided that such draft schemes shall be filed with the stock exchanges for the purpose of disclosures.

![]()

Question 17.

Explain the human and cultural aspects of a merger. (June 2014, 5 marks)

Answer:

- Core of merger: There is no doubt about the fact that culture is at core of merger success or failure.

- Understanding cross cultural needs: The success or failure of merger depends upon how successfully the merging organisation understand each others cultural needs.

- What is culture: Culture describes the way people communicate with each other, the way they resolve conflict, how they celebrate, reward, lead, manage, do their work, the language they speak, how they proceed towards their work.

- Part of belief system of a company: It is the core of the companies belief system.

- Understanding cultural issues: The key to success of any merger and amalgamation is dependent op how an organisation understand the culture of their organisation.

- Importance of people in organization: People play a very important role in an organisation.

- People, Culture and attitude Any organisation while going on merger and acquisition must lay emphasis on their people, their culture and attitude.

- Creation of trust: Management should be able to create a trust among people in regard to new organisation, new system etc.

- Encouraging positive attitude towards change: Management needs to be truthful to people and provide opportunity for them to deal productively with their anxiety about change.

- Cultural surveys: Cultural issues can be handled by conducting formal and informal cultural surveys.

- Interviews and reviews: Regular and continuous interview with the managers and executives, reviewing the policy and procedure manuals are other means to handle cultural issues.

- Difference chart: Organisation should make a difference chart between the existihg organisation and new organisation and should try to focus and work on these new changes which needs to be incuicated in the existing people.

- Communication for the linkage of people’s goals and objectives with the deal: Communicate them how the strategic intent of the deal translate to people’s day to day goals and objectives.

![]()

Question 18.

“Cultural clashes are likely to be more prominent in cross-national than domestic acquisitions.” Discuss and also briefly enumerate the cultural due diligence process. (June 2014, 5 marks)

Answer:

The Cultural Due Diligence process covers

- Leadership, Strategies and Governing Principles: It covers vision, mission, values, business strategy development, leadership effectiveness, ethics, board room practices, role of independent directors etc.,

- Relationships and behaviors: It covers trust, inter/intra group relationships, community and customers.

- Communication: Feedback, information sharing, employee trust in information.

- Infrastructure: Formal procedures, processes, systems, policies, structure and teams.

- Involvement & Decision Making: Authority levels, accountability, expectations and the decision making process.

- Change Management: Creativity, innovation, recognition, continuous learning and diversity.

- Communication platforms.

- Finance: Perception of financial health and the role of the employee and the level of financial comprehension and impact on the business.

![]()

Question 19.

Examine and comment on the following:

Due diligence is essentially required to make an informed decision about a potential investment. (Dec 2014, 4 marks)

Answer:

Due diligence is an investigative process for providing, the desired comfort level about the potential investment and to minimize the risks such as hidden uncovered liabilities, poor growth prospects, price claimed for proposed investment being on higher side etc. Due diligence is also necessary to ensure that there are no onerous contracts or other agreements that could affect the acquirer’s return on investment.

Question 20.

(i) Explain the twin conditions for a valid resolution to be passed for a ‘compromise or arrangement’ under the Companies Act, 2013.

(ii) State with reasons and case law, whether a copy of such resolution has to be filed with the Registrar of Companies. (Dec 2014, 5 marks)

Answer:

(i) Twin conditions for a valid resolution to be passed for a ‘compromise or arrangement’ under the Companies Act, 2013 are as follows:

The Scheme must be approved by a resolution passed with the special majority stipulated in Section 230(6), namely a majority in number representing three-fourths in value of the creditors or class of creditors or members or class of members, as the case may be, present and voting either in person or by proxy or by postal ballot.

(ii)

- No this resolution is not required to be filed with Registrar of Companies.

- This is neither an ordinary resolution nor a special resolution.

- This is an extraordinary resolution. A copy of this resolution need not be filed with the Registrar of Companies.

![]()

Question 21.

Prepare a checklist of the questions to be analysed in cultural due diligence. (Dec 2014, 5 marks)

Answer:

Questions being analysed in Cultural Due Diligence

The following questions are being analysed for determining the different corporate culture:

- What are the primary issues driving the business strategy?

- What are the levels of relationship with the board and the senior management?

- What is the nature of the relationship between groups and units in the organization?

- What formal and informal systems are in place and what part do they play in the daily life of doing the work?

- How do people dress and address each other?

- How do the office ambience differ?

- What are the working hours?

- What are the variation in utilization of technology in daily routine?

- How actual work is performed?

- How authority and responsibility is allocated?

- How the performance evaluation is done and reward is granted?

- What are the reporting relationships in the organization?

- What are the supervisory practices in the organization?

The above questions indicate that the corporate culture is basically focused on:

- Leadership style and management practices.

- Manner of organizational functioning.

- Employees.

![]()

Question 22.

Under financial due diligence for a manufacturing industry, describe briefly the focus areas for the following aspects:

(i) Cost

(ii) Revenue (Dec 2014, 8 marks)

Answer:

Focus areas under financial due diligence:

(i) Cost

- Rationalise the costs incurred by the company.

- is there an increase in the level of costs incurred by the company.

- Ensure that provisions for liability has been made correctly on the basis of monthly/annual costs incurred by the company.

- Detailing the costs of the company along with percentage break up of the total cost.

- Summary of costs per functional classification (marketing finance etc.), different cost heads (materials salary etc.)

- Understanding of purchase policies and procedures.

- Trend analysis of movement in costs over the review period, for each cost item.

- Purchase policies and procedures.

- Input/output analysis on a monthly basis.

- Compute raw material consumption with respect to turnover on a monthly basis over the review period etc.

![]()

(ii) Revenue

- Review customer wise revenue share and ascertain any excessive dependence on few customers.

- Percentage of the sales to major customers (top ten) with respect to sales over their review period.

- Discussing any revenue – Sharing arrangements. Review the implications of the variables and fixed components and any commitments arising from such an arrangement.

- Trend Analysis: Identify the trend in customer purchases and inquire about the reasons for any significant increase or decrease in customer orders.

- Reviewing whether repeat sales happen regularly or rarely.

- Discussing with the management any long term revenue commitments with the customers.

- Geographical break-up of revenue along with any significant changes to evaluate particular regions/locations where the revenue has increased/decreased significantly!

- Providing a table on the break-up of sales into domestic sales and exports.

- Analyse the recovery period for credit sales etc.

![]()

Question 23.

Your client is intending to enter into a major commercial agreement for collaboration. You as a Company Secretary have been asked to conduct due diligence for the prospective company. Which factors you will keep in mind while conducting due diligence ? (June 2015, 7 marks)

Answer:

Factors To Be Kept In Mind While Conducting Due Diligence:

- Objectives and purpose

- Planning the schedule

- Negotiation for time

- Risk Minimisation

- Information from external sources

- Limit the report with only material facts

- Structure of information

![]()

Question 24.

Success of a merger depends upon various factors. What are the factors relevant in evaluating the effectiveness of a merger? (Dec 2015, 5 marks)

Answer:

The various indicators which can be useful in measuring the post merger efficiency are:

- The earning performance of a merged company can be measured by return on total assets and return on net worth.

- Whether the merged business creates a larger business organisation and provides a basis for growth.

- Whether the merged company is able to earn higher net profit than before or higher return on total funds employed.

- Efficiency can also be measured through other factors like improved debtor realisation, reduction in non-performing assets, economies due to large scale production.

- Efficiency can also be measured by focusing on fair market value.

- Inter- firm comparison can also proves to be useful. Comparison of performance of the merged company with the similar sized company in the same business in respect of:

- Sales

- Assets

- Net profits

- Earning per share

- Dividend rate and payouts also determine its efficiency.

![]()

Question 25.

Narrate the conditions precedent and subsequent to court’s order sanctioning a scheme of arrangement. (Dec 2016, 5 marks)

Answer:

The Tribunal shall not sanction a scheme of arrangement for amalgamation, merger etc. of a company which is being wound up with any other company or companies unless it has received a report from the Registrar of Companies to the effect that the affairs of the company have not been conducted in a manner prejudicial to public interest.

When an order has been passed by the Tribunal for dissolution of the transferor company, the transferor company is required to deliver to the Registrar a certified copy of the order for registration within thirty days and the order takes effect from the date on which it is so delivered.

Copies of the order of Tribunal are required to be affixed to all copies of Memorandum and Articles of Association of the transferee company issued after certified copy has been filed as aforesaid.

The transferor company or companies will continue in existence till such time the Tribunal passes an order for dissolution without winding up, prior to which it must receive a report from the official liquidator to the effect that the affairs of the company have not been conducted in a manner prejudicial to the interest of the members or to public interest.

Since the law requires approval of the shareholders both in majority in number and three-fourth in value, it has to be ensured that adequate number of shareholders, whether in person or by proxy attend the meeting so that the resolution can be passed by the requisite majority as mentioned above.

![]()

Question 26.

Enumerate the common mistakes made by the corporate leading to pitfalls in mergers and acquisition? (June 2017, 5 marks)

Answer:

Following are the common mistakes leading the companies to pitfalls in” mergers and acquisitions:

- Ego problems on both sides – buyer and seller.

- Attempt to hasten the integration between both the parties’ raises the likelihood of making serious errors.

- Many buyers assert their ownership by moving quickly to convert the acquired company.

- A cautious approach should be applied to competitor end runs. While the company is focused on integration, it furnishes an ideal time for competitors to make a run on the market.

- Different dynamics in case of different business of the companies.

- Lay off crucial employees from the acquired company.

- Improper cultural integration.

![]()

Question 27.

Examine and explain the following statements citing relevant provisions of laws:

(a) The amalgamated company has to issue new shares to Non-resident Indian? in amalgamation and for that it has to obtain permission of Reserve Bank of India under the provisions of the Foreign Exchange Management (FEMA) Act, 1999.

(b) M/s Happy Exports Limited was merged with M/s Smart Exports Limited. The order passed by High Court/Tribunal was filed with the Registrar of Companies (ROC). But the same was not taken on record by ROC. Will the scheme still be effective?

(c) The Tribunal can modify transfer date proposed in a scheme of amalgamation. (June 2017, 3 marks each)

Answer:

(a) The statement is true. Where the scheme of amalgamation envisages issue of shares/cash option to Non-Resident Indians, the amalgamated company is required to obtain the permission of Reserve Bank of India subject. to conditions prescribed under the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident “, Outside India) Regulations, 2000.

(b) Section 232(5) of C.A. 2013 states that every company in relation to which the order for merger or amalgamation by NCLT is made shail cause a certified copy of the order to be filed with the Registrar for registration within thirty days of the receipt of certified copy of the order. The law does not specifically mention the requirement of taking up the records by ROC of such filled copy of the order, hence scheme will be effective w.e.f. the date of filling order with ROC.

(c) The Hon’ble Supreme Court in Marshal Sons & Co. (India) Ltd. v. ltd (1977) 1 Comp LJ P. 1, observed that it is true that while sanctioning the scheme, it is open to the Court/Tribunal to modify the said date. But when the Court/Tribunal does not prescribe any specific date, the date specified in the scheme is “the transfer date”.

![]()

Question 28.

As a Company Secretary, one should advice the Board regarding compliances under various legislations. Referring and cases of mergers or amalgamations, state the circumstances that warrant compliances under any or ail of such legislations. (Dec 2017, 5 marks)

Answer:

The onus is on the Company Secretary for compliances under various legislations. In case of merger or amalgamations the following legislations are required to be looked into for the purpose of compliances:

- Companies Act, 2013

- National Company Law Tribunal Rules, 2016

- Companies (Compromises, Arrangements and Amalgamations) Rules, 2016

- Income-tax Act, 1961

- SEBI (LODR) Regulations, 2015

- Competition Act, 2002

- Indian Stamp Act, 1899

Every company registered under the Company Law is required to make necessary compliances under the Companies Act, 2Q13, National Company Law Tribunal Rules, 2016, Companies (Compromises, Arrangements and Amalgamations) Rules, 2016 and Income-tax Act, 1961 regarding capital gains or set-off and carry forward of unabsorbed depreciation or losses.

Compliances are required under SEBI (LODR) Regulations, 2015 only in cases where mergers or amalgamations are between one or more listed companies. Provisions of the Competition Act, 2002 are applicable in case the companies involved in the compromise and arrangements are dominant and large undertakings in accordance with the provisions of the said Act. In case of non-banking financial companies, approval of RBI is required. Applicability of Indian Stamp Act depends on the State governed legislation and notifications.

![]()

Question 29.

What are the key indicators that need to be measured apart from expected financial results such as earnings and cash flow to evaluate extent of success of merger? (Dec 2017, 3 marks)

Answer:

The main purpose of a merger or acquisition is to deliver the expected financial results namely earnings and cash flow. However, there are certain other measures that serve as key indicators and they also need to be measured. The indicators may be grouped as:

- Financial outcomes.

- Component measures of these outcomes namely revenues, costs, net working capital and capital investments.

- Organisational indicators such as customers, employees and operations.

Question 30.

Define the Cultural Due Diligence. How would you address the cultural difference during the merger? (Dec 2017, 4 marks)

Answer:

Cultural Due Diligence (CDD) is the process of identifying, assessing, investigating, evaluating and defining the cultures of two or more distinct corporates through a cultural analysis so that the similarities and differences that impact the merged organization are identified and remedial actions are taken well in advance. It should be carried along with M&A due diligence stage itself. The findings of cultural due diligence would be the base for post integration strategies.

Address Cultural Differences during merger in the following manner:

- Formation of strategies for cultural integration.

- Analyzing the existing cultures.

- Identifying common aspects and differences.

- Decide if you want to go on with one of the existing cultures or if you prefer an integration culture.

- Establish ‘bridges’ between both companies.

- Establish a basis and mechanisms for the new culture.

- Extensive interaction with people.

![]()

Question 31.

Define the following term:

Corporate Culture. (Dec 2017, 3 marks)

Answer:

Corporate culture influences the performance of an organization, since it determines

- Style of tackling problems

- Method or style of communication

- Adaptability of employees

- Organization commitment to strategies and ultimately to vision and mission etc.

Question 32.

(a) “Consequent to restructuring, more particularly through mergers, amalgamations or takeovers, the management needs to be sensitive to employees’ morale”. Briefly comment on the validity of the statement. (June 2018) (3 marks)

(b) What is the purpose of observation letter issued by Stock Exchanged) under SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015? (3 marks)

Answer:

(a)

- Companies need to be sensitive with regard to terms and conditions of employment.

- Usually, courts would uphold terms of employment to be no less favorable than existing terms and conditions.

- Post acquisition, the parent company may want the acquired company to adopt compensation structure of the parent entity.

- It would result in re-aligning the structure as well as pay scales of existing employees.

- The company will have to carefully handle such sensitive areas to ensure employee satisfaction and comfort, which pays in the long run in building an image apart from preventing or reducing low employee turnout.

- Additionally, company would need to consider any prevailing fringe benefits and amenities provided to employees and the feasibility of continuing the same in the new set up (post restructure).

![]()

(b) Observation letter is a letter on the draft scheme of amalgamation by the stock exchange before the same is filed with the Court/Tribunal. It is a no objection letter or letter with some observations on the scheme.

1. As per Regulation 37 (1) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the listed entity desirous of undertaking a scheme of arrangement or involved in a scheme of arrangement, shall file the draft scheme of arrangement, proposed to be filed before any Tribunal under Sections 230-234 and Section 66 of Companies Act, 2013, whichever applicable, with the stock exchange(s) for obtaining Observation letter or No¬objection letter, before filing such scheme with any Tribunal, in terms of requirements specified by the Board or stock exchange(s) from time to time.

2. The listed entity shall not file any scheme of arrangement under Sections 230-234 and Section 66 of Companies Act, 2013, whichever applicable, with any Tribunal unless it has obtained observation letter or No-objection letter from the stock exchange(s).

[Regulation 37(2)]

3. The listed entity shall place the Observation letter or No-objection letter of the stock exchange(s) before the Tribunal at the time of seeking approval of the scheme of arrangement: [Regulation 37(3)]

The validity of the ‘Observation Letter’ or No-objection letter of stock exchanges shall be six months from the date of issuance, within which the draft scheme of arrangement shall be submitted to the Tribunal.

![]()

Question 33.

“Due Diligence starts much before the process of restructuring and helps in better negotiation of deals, to handle taxation and stamp duty aspects in better manner, to minimise and resolve the human and cultural issues that may arise out of mergers/amalgamation etc.”. Discuss the statement in view of the fact that Due Diligence is considered as ‘background check’. (Dec 2018, 5 marks)

Answer:

A full knowledge of company’s actual situation on accounting issues, taxes, labor and social security is critical to mitigate risks and take assertive decisions.

Companies may find answers in the due diligence process solutions to the risks involving new business that will support decision-making. Such studies are essential for companies in cases of acquisition, merger, or consolidation. A due diligence process should preceded these operations, essential for an accurate business diagnosis, to establish guarantees and tax investment structuring.

For requiring much detail, the due diligence is not a procedure to be hastily performed. Although duration is related to the business size and the investigated scope, the study should be in a greater depth to guarantee its accuracy and reliability.

Question 34.

Corporates encounter pitfalls in post-merger statutory approval due to certain common errors, that need to be taken care of. Try to point out certain errors that need to be taken care of. (Dec 2018, 3 marks)

![]()

Question 35.

Is it possible for a shareholder to seek an amendment to exchange ratio embodied in the scheme while considering the resolution, put forth for approval. Support your answer with decided case law(s) (Dec 2018, 3 marks)

Answer:

- No, shareholders cannot seek an amendment to the swap ratio in the scheme of merger.

- IP the case of ‘Dinesh Veajlal Lakhani V/S Parke Davis (India) Ltd,’ Bombay High Court held that swap ratio is an integral part of scheme of amalgamation and hence cannot be changed on the pursual of the shareholders.

- Also, exchange ratio is calculated by experts and is very crucial to the scheme of amalgamation & hence cannot be changed.

Question 36.

Elucidate the requirement of registration of offer of schemes involving transfer of shares under the Companies Act, 2013. (Dec 2019, 5 marks)

Answer:

Mode of registration of offer Of schemes or contract involving the transfer of shares are provided under section 238 (1) of the Companies Act, 2013 (the Act). It states that in relation to every offer of a scheme or contract involving the transfer of shares or any class of shares in the transferor company to the transferee company uncter section 235 of the Act, –

![]()

(a) every circular containing such offer and recommendation to the members of the transferor company by its directors to accept such offer shall be accompanied by such information and in such manner as may be prescribed;

(b) every such offer shall contain a statement by or on behalf of the transferee company, disclosing the steps it has taken to ensure that necessary cash will.be available; and

(c) every such circular shall be presented to the Registrar for registration and no such fcircular shall be issued until it is so registered:

Provided that the Registrar may refuse, for reasons to be recorded in writing, to register any such circular which does not contain the information required to be given under clause (a) or which sets out such information in a manner likely to give a false impression, and communicate such refusal to the parties within thirty days of the application.

Section 238(2) of the Act states that an appeal shall lie to the Tribunal against an order of the Registrar refusing to register any circular under sub-Section (1) of Section 238 of the Act.

Section 238(3) of the Act states that the director who issues a circular which has not been presented for registration and registered under clause (c) of sub-Section (1) of Section 238 of the Act, shall be liable to a penalty of one lakh rupees.

![]()

Question 37.

What are the various stages involved in the merger of a company under the Companies Act, 2013? (Dec 2019, 3 marks)

Answer:

Broad stages involved in merger of a company are listed below:

Stage 1: Drafting of the Scheme

Stage 2: Obtaining the approval of the Board of Directors of the companies involved

Stage 3: Obtaining approval of the stock exchanges in case of listed companies .

Stage 4: Application / Petition for convening the meeting of members/ creditors shall be filed with National Company Law Tribunal Stage 5: Convening meetings of the shareholders and creditors and obtaining their consent on Scheme

Stage6: Approvals or No objection from Regional Director /Official Liquidator

Stage 7: Filing of final petition with NCLT for approving the Scheme

Stage 8: Obtaining order for approval for scheme of merger/amalgamation from the National Company Law Tribunal.

![]()

Question 38.

Explain issue of Sweat Equity shares and its valuation. (Aug 2021, 3 marks)

Answer:

Sweat equity shares are issued for consideration other than cash such as technical know-how, brand equity, design, patent or any other intangible asset. The intangible asset could come from promoters or director or even employees of the company.

Section 54 of the Companies Act, 2013, specifies the conditions under which sweat equity shares may be issued. The issue is to be authorised by a special resolution, the number of shares to be issued, the recipients, and at least one year must have passed after the company had been incorporated.

Valuation of shares involves two steps:

- Valuation of the share price; and

- Valuation of the intangible assets,

The valuation of the share price shall be done by a registered valuer and the intangible asset also be valued by a registered valuer (say the intellectual property right i.e. the human resource value needs to be evaluated and added or considered).

![]()

Question 39.

In order to assess the nitty-gritty of the transactions of the takeover and to opt for or opt out of the takeover deal, due diligence is carried out. As a practicing company secretary, what various aspects would you consider while carrying out due diligence with regard to Management ? (Dec 2021, 5 marks)

Answer:

Due diligence is a meaningful analysis of the collected information to arrive at some decision about the potential transaction. In order to carry out due diligence with regard to managerial aspect, I would consider the following matters: –

- Company’s HR Policies

- Assessment of Senior Level Management, resumes of key employees their qualifications and work exposures, previous background, etc.

- Summary Plan descriptions of qualified and non-qualified retirement plans

- Business Experience

- Union Contract, copies of collective bargaining agreements, description of all employees’ problems within last five years including the alleged wrongful termination, harassment discrimination, etc.

- Strike History

- Labour Relations/ Agreements, grievance procedures, labour disputes currently pending or settled within last five years.

- Workman’s’ compensation claim history / unemployment claim history

- Personnel Schemes, description of benefits of all employees’ health and ’ welfare insurance policies

- Profile of permanent employees

- Labour dues and settlement history

- Status of labour law compliances.

![]()

Question 40.

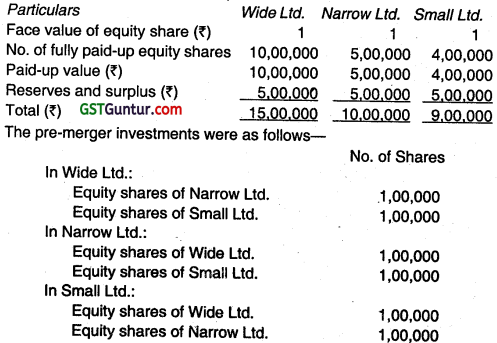

Wide Ltd. prepared a scheme of amalgamation and arrangement with Narrow Ltd. and Small Ltd. and the same was duly approved by the Tribunal concerned. In the approved scheme, the swap ratio was as under. (Dec 2012)

Narrow Ltd.: Wide Ltd. will issue 1 equity share of ₹ 1 each in exchange of 3 equity shares of Narrow Ltd.

Small Ltd.: Wide Ltd. will issue 1 equity share of ₹ 1 each in exchange of 2 equity shares of Small Ltd.

The pre-amalgamation share capital were as follows:

As the Company Secretary of Wide Ltd., you are required to advise the Chief Executive Officer:

(i) The quantum of new shares of Wide Ltd. to be issued to the shareholders of transferor company (a) Narrow Ltd.; (b) Small Ltd.; and

(ii) What will be the post-issue share capital of Wide Ltd. after cancellation of cross holding of equity shares of all companies? (10 marks)

Answer:

Calculation of Number of shares to be issued to Narrow Ltd.

The Exchange ratio being 1:3, Wide Limited will issue 1,00,000 shares to shareholders of Narrow Ltd.

Calculation of No. of shares to be issued to Small Ltd.

The Exchange ratio being 1:2, Wide Ltd. will issue 1,00,000 shares to shareholders of Small Limited.

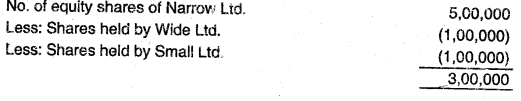

Post Issue Capital of Wide Ltd. after cancellation of cross holdings:

![]()

Question 41.

A company has filed its application for amalgamation and arrangement under provisions of Companies Act, 2013. After scrutinising the fairness of this scheme, the Tribunal ordered for calling class meetings and approved the notice submitted. However, the Tribunal also ordered publication of the notice in an English newspaper as well as in the Official Gazette. State whether the Tribunal order to publish the notice in the English newspaper as well as in the Official Gazette is tenable as per law. Also discuss relevant provisions of the Companies Act, 2013 in this regard? (June 2013, 4 marks)

Answer:

- In the above case, the Tribunal has ordered for the publication of the notice related to meeting in an English newspaper as well as in the Official Gazette.

- As per the provisions of the Companies Act, 2013, the notice of the meeting is required to be given to the creditors and/or members.

- Rule 7 Companies (Compromise, Arrangements and Amalgamation) Rules 2016 the notice of the meeting shall be advertised in such newspapers and in such manner as the Tribunal may direct, not less than thirty days before the date fixed for the meeting. The advertisement shall be in Form No. CAA.2.

- But as per the provision of the Act & Rules, Tribunal order to publish the notice in the Official Gazette is not tenable.

![]()

Question 42.

(a) While hearing a petition of amalgamation and arrangement, the Tribunal confirmed that the Tribunal would not interfere with the valuation and its swap ratio approved by the shareholders. However, the Tribunal felt that the valuation was ‘without proper basis’, the Tribunal rejected the scheme not due to valuation but because it was not possible for the Tribunal to come to the conclusion that the scheme is in public interest. Discuss whether the order of the Tribunal was made as per law citing relevant case law. (June 2013) (5 marks)

(b) In a scheme of amalgamation, the transferee/amalgamated company generally issues new shares to the shareholders of the transferor/amalgamating companies on the basis of valuation of shares of all transferor companies and the transferee company at a particular date and a swap ratio is arrived at included in the scheme. A company has prescribed its swap ratio on the basis of valuation at a date later than the appointed date.

Can the swap ratio be rejected on the ground that valuation date is later than the ‘appointed date’? Discuss with case law. (4 marks)

Answer:

(a)

- The Tribunal validly rejected the scheme.

- In a decided case, it was held that generally the Tribunal would not interfere with the valuation and swap ratio approved by all the shareholders.

- However when it feels prima facie that valuation is without proper basis, it questions the valuation, or on the ground of not proper valuation can reject the scheme.

- In this case, the Tribunal rejected the scheme of amalgamation not due to valuation but because it was not possible for the Tribunal to come to the conclusion whether the scheme is in public interest.

(b)

- The facts of the present case are similar to the case of Sumita Pharmaceuticals Ltd.

- The Tribunal held that exchange ratio, at which shareholders of amalgamating company will be offered shares in the amalgamated company, will have to be worked out based on the valuation of shares of the respective companies as per the accepted methods of valuation, guidelines and the audited accounts of the company.

- The value of each share of the amalgamating company is fixed keeping in view the value of each share of amalgamating company to be allotted in exchange for the former shares.

- Share exchange ratio based on financial positions of both companies on a date later than appointed date is not objectionable since date of negotiations between two companies cannot be ignored.

![]()

Question 43.

The Board of Directors of Bright Electronics Ltd. (BEL) has decided to amalgamate with Comfort Electricals Ltd. (CEL) which is the holding company of BEL. In order to fasten their amalgamation process, they approached their secured and unsecured creditors to seek their written consent to the proposed scheme of amalgamation. All the secured creditors of CEL have given their consent in writing but unsecured creditors have raised their doubt on the scheme and they refused to give their consent.

The Board of Directors of CEL requested the Tribunal to grant exemption or waiver from calling the meeting of secured and unsecured creditors of CEL on the ground that the proposed amalgamation would help them to pay off the entire outstanding dues of unsecured creditors. Offer your comments as to whether CEL can get exemption from convening the meeting of secured and unsecured creditors. (Dec 2015, 5 marks)

Answer:

Section 230 deals with the rights of a company to enter into a compromise or arrangement (i) between itself and its creditors or any class of them and (ii) between itself and its members or any class of them. In the given case, the proposed scheme is not acceptable to unsecured creditors of the holding company. In order to safeguard the interest of the unsecured creditors of the holding company, it is necessary to convene the meeting of the unsecured creditors and waiver may not be allowed.

Further, a subsidiary company being a creditor cannot be included along with other unsecured creditors their interest in supporting a scheme proposed by the holding company would not be the same as the interest of the other unsecured creditors [Hindustan Development Corporation Ltd. vs. Shaw Wallace & Co. Ltd. (Supra)]. Secured creditors should not be clubbed together with the unsecured creditors. Their interest would not be the same.

Since secured creditors of CEL have given their consent in writing, hence CEL can be exempted from calling the meeting of secured creditors jut not from calling the meeting of unsecured creditors.

Note: It is assumed that Bright Electronics Ltd. (BEL) is not the wholly owned subsidiary of Comfort Electricals Ltd. (CEL). In case, Bright Electronics Ltd.(BEL) is wholly owned subsidiary of Comfort Electricals Ltd. (CEL), then provisions of Section 233 will apply.

![]()

Question 44.

Ludhiana Berry Ltd. has proposed merger of Jalandhar Berry Ltd. with itself. The merger scheme has been approved by 76% shareholders of Ludhiana Berry Ltd. and 98% shareholders of Jalandhar Berry Ltd. (in value terms). Explain with the help of relevant provisions and decided cases, whether this will be binding on all the shareholders (including dissenting shareholders). (June 2016, 5 marks)

Answer:

Section 230(6) of Companies Act, 2013 provides that when the Tribunal directs the convening, holding and conducting of a meeting of creditors or members or a class of them, a particular majority of the creditors or members or a class of them should agree to the scheme of compromise or arrangement.

As per the aforesaid sub-section, the majority required is the majority in number representing three-fourth in value of the creditors or members or a class of them, as the case may be, present and voting in the meeting so convened either in person, or by proxy. After the said meeting agrees with such majority, if the scheme is sanctioned, by the Tribunal, it shall be binding upon the creditors or members or a class of them, as the case may be. In the case of Punjab and Haryana High Court in Hind Lever Chemicals Limited and Another [2005] 58SCL 211 (Punj. & Har.)

Court held that in our view, the language of Section 230(6) of the Act is totally unambiguous and a plain reading of this provision clearly shows that the majority in number by which a compromise or arrangement is approved should represent three -fourth in value of the creditors/shareholders who are ‘present and voting ’and not of the total value of the shareholders or creditors of the company.

![]()

Question 45.

ABC Bank Ltd. contemplates to merge with PQR Bank Ltd. Accordingly, draft scheme of amalgamation is placed before the Board of Directors of both the banks. The said scheme is aimed to be placed in the shareholders meeting thereafter. Mention the aspects which board of both the companies should consider in approving draft scheme of amalgamation. (Dec 2017, 5 marks)

Answer:

Boards of both the companies should give particular attention to the following:

(a) As per paragraph 6 of the master direction issued by RBI, the decision of amalgamation is approved by the Board of the Bank concerned with a two thirds majority and not just those present and voting.

(b) The values at which the assets, liabilities and the reserves of the amalgamated company are proposed to be incorporated into the books of the amalgamating company and whether such incorporation will result in a revaluation of assets upwards or credit being taken for unrealized gains.

(c) Whether due diligence exercise has been undertaken in respect of the amalgamated company.

(d) The nature of the consideration, which, the amalgamating company will pay to the shareholders of the amalgamated company.

(e) Whether the swap ratio has been determined by independent valuers having required competence and experience and whether in the opinion of the Board such swap ratio is fair and proper. ‘

(f) The shareholding pattern in the two banking companies and whether as a result of the amalgamation and the swap ratio, the shareholding of any individual, entity or group in the amalgamating company will be violative of the Reserve Bank guidelines or require its prior approval.

(g) The impact of the amalgamation on the profitability and the capital adequacy ratio of the amalgamating company.

(h) The changes which are proposed to be made in the composition of the Board of Directors of the amalgamating banking company, consequent upon the amalgamation and whether the resultant composition of the Board will be in conformity with the Reserve Bank guidelines in that behalf.

![]()

Question 46.

XYZ Ltd. and ABC Ltd. filed applications before National Company Law Tribunal (NCLT) for amalgamation of both the companies to form a new Company PQR Ltd. Regional Director by an affidavit pointed out the following inconsistencies in the applications(s):

- Main objects of XYZ Ltd. are not similar to that of ABC Ltd; and

- Authorized capital of PQR Ltd. is not sufficient to cover the total consideration.

As a Company Secretary, you are requested to brief the facts and background, along with the judicial precedents, to the counsel enabling him to proceed in the matter. (June 2018, 5 marks)

Answer:

Sanction to the scheme of amalgamation cannot be refused on the ground that the transferee company does not have sufficient authorized capital on the appointed date. Once the scheme is sanctioned the transferee company can thereafter increase its authorised capital to give effect to the scheme.

Scheme of amalgamation should provide that on amalgamation the main objects of the transferor company shall be deemed to be (additional) main objects of the transferee company. [Vasant Investment Corporation Ltd. v. Official Liquidator (1981) 51 Comp Cas 20 (Bom)].

![]()

Question 47.

A meeting of members of Jwala International Ltd. was held as per the Orders of the Tribunal for considering a scheme of compromise and arrangement in which 300 members holding 10,00,000 shares were present. 130 members holding 6,00,000 shares voted in favor, 120 members holding 1,00,000 shares voted against and remaining 50 members with 3,00,000 shares abstained. Examine with reference to provisions of the Companies Act, 2013 as to whether the scheme is approved ? (Dec 2020, 5 marks)

Answer:

- Section 230(6) of the Companies Act, 2013 requires the approval by members, creditors (separately for each class) of the company to a scheme of compromise or arrangement.

- The required majority need to be three-fourth in value present in person or through proxy or by postal ballot.

- The Tribunal may dispense with conducting a meeting; if affidavits of consent are given by the persons concerned having stake more than 90% of total stake in each class.

- While counting for approval the persons who did not attend and those do not wish to vote shall be excluded so also in invalid votes.

- In the given case, as each share is considered as a vote, 6 lakhs votes are in favor and 1 lakh votes are against, thus more than 3 times and hence the resolution is considered passed. Counting of Members present to vote or not to vote is only for statistical purpose only.

![]()

Question 48.

Woodland Telecommunications Ltd., listed with National Stock Exchange, is willing to acquire the business of Iron Finance Ltd., a Non-banking Financial Company listed with BSE through a scheme of arrangement in terms of Companies Act, 2013. Woodland Telecommunications Ltd. has an outstanding loan of ₹ 2,000 crore from ICICI Bank. Combined assets post merger would be ₹ 10,000 crore. Suggest the list of approvals required for getting the scheme of merger considered by the Tribunal. (Dec 2020, 5 marks)

Answer:

- For a scheme of compromise or arrangement to be approved by the Tribunal need to be accompanied by the approvals obtained from different Regulatory Authorities in terms of the prescribed rules.

- Approval by the Board of Directors, shareholders different classes so also creditors of different classes in separate meetings.

- If the shares in the company whether transferor or transferee are listed any stock exchange, observation letter from the concerned Stock Exchange.

- Approvals from Competition Commission of India since there exceed threshold limits in the given case.

- Regulators’ approvals specific to the business of the concerned companies may also be required, if the circumstances demand.

![]()

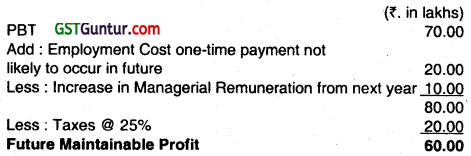

Question 49.

From the following information related to Tanu Ltd, find out:

(a) EBITA

(b) PAT

(c) Super profit

| (₹ in Lakh) | |

| Net tangible assets | 300.00 |

| Operational Revenue | 560.00 |

| Employment Cost

(including onetime payment of ₹ 20.00 lakh, not likely to occur in future) |

110.00 |

| Managerial Remuneration (to be increased by ₹ 10.00 lakh form next year) | 40.00 |

| Cost of goods sold | 230.00 |

| Finance charges | 80.00 |

| Depreciation/Amortization | 30.00 |

Tax provision is to be made @ 25%.

Expected rate of return on assets is to be assumed @ 20%. (Dec 2021, 5 marks)

Answer:

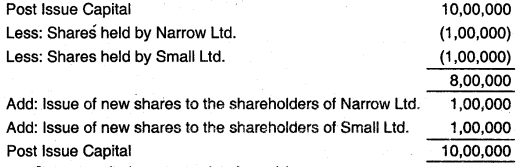

(a) Calculation of EBITA

(₹ in lakhs)

Operational Revenue : 560.00

Less : Cost of goods sold : 230.00

Employment Cost : 110.00

Managerial Remuneration : 40.00.

EBITA : 180.00

![]()

(b) PAT

(₹ in Iakhs)

EBITA : 180.00

Less: Finance charges : 80.00

Depreciation / Amortization : 30.00

PBT : 70.00

Less: Taxes @ 25% : 17.50

PAT : 52.50

(c) Computation of Super Profit

(i) Future Maintainable Profit

(ii) Super Profit

(₹ in lakhs)

Expected return on assets (₹ 300 lakh ×20%) : 60.00

Less: Future Maintainable Profit : 60.00

Super Profit : NIL

![]()

Question 50.

Explain the provisions of sub-sections (11) and (12) of section 230 of the Companies Act, 2013?

Answer:

Provisions of Section 230(11) and 230(12) read as under:

Section 230(11):

Any compromise or arrangement may include takeover offer made in such manner as may be prescribed:

Provided that in case of listed companies, takeover offer shall be as per the regulations framed by the Securities and Exchange Board.

Section 230(12):

An aggrieved party may make an application to the Tribunal in the event of any grievances with respect to the takeover offer of companies other than listed companies in such manner as may be prescribed and the Tribunal may, on application, pass such order as it may deem fit.

![]()

Process of M&A Transactions Notes

Process of Merger and Acquisition transactions

Prerequisites of Merger and Acquisition

- Due Diligence

- Business Valuation

- Planning Exit

- Structuring Business Deal

- Stage of Integration

Due Diligence

Due diligence is an investigation of a business or person prior to signing a contract, or an act with a certain standard of care. Due diligence is integral to business, it is exercised in a simple over-the-counter transaction or a complicated merger and acquisition transaction. For instance, while acquiring a company, the buyer must do thorough research of the credentials of the company, its market valuation, status of accounts receivables, position in the debt market, past performance, etc.

Types of Due Diligence

- Legal Due Diligence

- Tax Due Diligence

- Operational Due Diligence

- IP Due Diligence

- Commercial Due Diligence

- IT Due Diligence

- HR Due Diligence

![]()

Points to be considered during due diligence process

- Constitute a due diligence team comprising of technical, legai, financial and taxation experts, etc

- Assign the task to each of the member and the co-ordination among the members be supervised by a senior level officer Collect the data of the target company

- Analyse the above information/ statistics, assess the future prospects and the benefit in acquiring with reference to the market size and cutting of the competition.

- If the proposal, found feasible, follow the regulatory requirements as mentioned in the Companies Act, 2013 and the SEBI Regulations

Contents of Due Diligence report

- Comments on the management and organisation,

- Details of key managerial/ technical personnel,

- Details of marketing efforts undertaken,

- Details of financial liabilities and commitments that the intending buyer would have to meet after takeover and which are not disclosed in the audited accounts,

- Deviations from the generally accepted accounting policies/ practices,

- Analysis of major expenditure/costs, details of major/critical customers ahd suppliers,

- Compliance of taxation and other statutory laws as well as status and impact of all litigation in this respect,

- Benefits enjoyed by the intending seller which the intending buyer may lose on takeover and vice versa,

- List of adjustments to the latest financial statements compiled on the basis of all findings, which have an impact on the “price” of the target acquisition to be considered by the intending buyer.

![]()

Due Diligence check list

Financial aspects

- Read the auditor’s report and qualifying remarks, if any and director’s responsibility statement.

- Whether the company is profit making, dividend paying company

- Calculate financial ratios and compare it with the previous year(s) figures of the company and also compare with the industry trend.

- Whether the Balance sheet have any fictitious assets

- Whether any assets have been re-valued (particularly of real estates) in current year or in past

- Calculate Net worth and its components and compare it with the previous year(s) figures.

- Compare the cash flow statements of current year with that of the previous year(s).

Debtor’s aspects

- Study the demographic profile of the customer.

- Whether sales are made in concentration / very few buyers are available in the market.

- What is the debt realisation cycle

- How the sales campaign is made in order to lead the others in the market.

Creditor’s aspects

- Who are the suppliers?

- What are the terms and conditions for sales on credit?

- Whether the supplier is unique or discattered or no single supplier can mis-match the supply?

![]()

Material Control Aspect

- Make a review of all material contracts and commitments of the target company.

- Study various issues pertaining to guaranties, loans, and credit agreements.

- Study the customer and supplier contracts, Equipment leases, Indemnification agreements

Human Aspect

- Study the organization chart and biographical information,

- Summary of any labour disputes, information concerning any previous, pending, or threatened labour Stoppage

- Employment and consulting agreements, loan agreements, and documents relating to other transactions with officers, directors, key employees, and related parties

Regulatory Aspects

- Study the revenue returns filed by the company and its assessment orders

- Whether any penalty has been imposed for contraventions of the provisions of the law.

- Whether the company is abiding with the company law compliances. Check the various returns filed with the RoC

Valuation provisions under the Companies Act, 2013

Section 247 is a new section and seeks to provide that valuation in respect of any property, stocks, shares, debentures, securities, goodwill or any other assets or net worth of a company or its assets or liabilities shall be valued by a person having such qualification and experience and registered as a valuer, in accordance with such rules as may be prescribed.

![]()

Regulatory Framework for Merger/ Amalgamation

The Regulatory framework of Mergers and Amalgamations covers:

- The Companies Act, 2013

- National Company Law Tribunal Rules, 2016

- Companies (Compromise, Arrangements and Amalgamations) Rules, 2016

- income Tax Act, 1961

- SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015

- Competition Act, 200?

- Approval from industry specific regulators, wherever required.

Provisions of Merger and Acquisition^ under Companies Act 2013

Section 230 – Power to compromise or make arrangements with creditors and members.

Section 230 lays down in detail the power of a company to make compromise or arrangements with its creditors and members. Under this section, a company can enter in to a compromise or arrangement with its creditors or its members; or any class thereof.

Where a company or a creditor or %rnember of the company proposes a compromise or arrangement between it and its creditors or between it and its members or with any class of the creditors or any class of members, the company or the creditor or member, or where the company is being wound-up, the liquidator may make an application to the Tribunal.

Section 231 – Power of the Tribunal to enforce compromise or arrangement

Section 232 – Merger and amalgamation of companies

Section 232(3) states that the Tribunal, after satisfying itself that the procedure specified in sub-sections (1) and (2) has been complied with, may, by order, sanction the compromise or arrangement.

![]()

Sub-section (4) states that an order under this section provides for the transfer of any property or liabilities, then, by virtue of the order, that property shall be transferred to the transferee company and the liabilities shall be transferred to and become the liabilities of the transferee company and any property may, if the order so directs, be freed from any charge which shall by virtue of the compromise or arrangement, cease to have effect.

Section 232(5) states that every company in relation to which the order is made shall cause a certified copy of the order to be filed With the Registrar for registration within thirty days of the receipt of certified copy of the order.

Section 232(6) states that the-scheme under this section shall clearly indicate an appointed date from which it shall be effective and the scheme shall be deemed to be effective from such date and not at a date subsequent to the appointed date.

Section 233 -Merger or amalgamation of certain companies

Section 233 prescribes simplified procedure for Merger or amalgamation of

- two or more small companies, or

- between a holding company and its wholly-owned subsidiary company, or

- such other class or classes of companies as maybe prescribed

Section 234: Merger or amalgamation of a company with a foreign company

Section 234(1) states that the provisions of this Chapter XV of the Companies Act, 2013 unless otherwise provided under any other law for the time being in force, shall apply mutatis mutandis to schemes of mergers and amalgamations between companies registered under this Act and companies incorporated in the jurisdictions of such countries as may be notified from time to time by the Central Government. The Central Government may make rules, in consultation with the Reserve Bank of India, in connection with mergers and amalgamations provided under this Section.

![]()

Section 235: Power to acquire shares of shareholders dissenting from scheme or contract approved by majority

Section 235 of the Companies Act, 2013 prescribes the manner of acquisition of shares of shareholders dissenting from the scheme or contract approved by the majority shareholders holding not less than nine tenth in value of the shares, whose transfer is involved. It includes notice to dissenting shareholders, application to dissenting shareholders to tribunal, deposit of consideration received by the transferor company in a separate bank account etc.

Section 236: Purchase of minority shareholding

Section 236 prescribes the manner of notification by the acquirer (majority) to the company, offer to minority for buying their shares, deposit an amount equal to the value of shares to be acquired, valuation of shares by registered valuer, etc.

Section 237: Power of Central Government to provide for amalgamation of companies in public interest

Section 237(1) states that when the Central Government is satisfied that it is essential in the public interest that two or more companies should amalgamate, the Central Government may, by order notified in the Official Gazette, provide for the amalgamation of those companies into a single company with such constitution, with such property, powers, rights, interests, authorities and privileges, and with such liabilities, duties and obligations, as may be specified in the order.

Section 238: Registration of offer of schemes involving transfer of shares

Section 238(1) states that in relation to every offer of a scheme or contract involving the transfer of shares or any class of shares in the transferor company to the transferee company under section 235, —

(a) every circular containing such offer and recommendation to the members of the transferor company by its directors to accept such offer shall be accompanied by such information and in such manner as may be prescribed;

(b) every such offer shall contain a statement by or on behalf of the transferee company, disclosing the steps it has taken to ensure that necessary cash will be available; and

(c) every such circular shall be presented to the Registrar for registration and no such circular shall be issued until it is so registered.

![]()

Section 239: Preservation of books and papers of amalgamated companies

As per section 239, the books and papers of a company which has been amalgamated with, or whose shares have been acquired by, another company under this Chapter shall not be disposed of without the prior permission of the Central Government and before granting such permission, that Government may appoint a person to examine the books and papers or any of them for the purpose of ascertaining whether they contain any evidence of the commission of an offence in connection with the promotion or formation, or the management of the affairs, of the transferor company or its amalgamation or the acquisition of its shares.

Section 240: Liability of officers in respect of offences committed prior to merger, amalgamation, etc.

As per Section 240, notwithstanding anything in any other law for the time being in force, the liability in respect of offences committed under this Act by the officers in default, of the transferor company prior to its merger, amalgamation or acquisition shall continue after such merger, amalgamation or acquisition.

Approvals in Scheme of Amalgamation

The companies are required to obtain following approvals in respect of the scheme of amalgamation:

Authorisation

- Pre-approval authorisation about appointment of intermediaries, advisors, etc.

- Approval of Valuation Report by Audit Committee

Approval of Board of Directors

Board resolution should, besides approving the scheme, authorise a Director/Company Secretary/ other officer to make application to Tribunal, to sign the application and other documents and to do every thing necessary or expedient in connection therewith, including changes in the scheme.

![]()

Approval of Shareholders/Creditors, etc

Members’ and creditors’ approval to the scheme of amalgamation is sine qua non for Tribunal’s sanction.

This approval is to be obtained at specially convened meetings held as per T ribunal’s directions

Approval of the Stock Exchanges

A listed entity desirous of undertaking a scheme of arrangement or involved in a scheme of arrangement, shall file the draft scheme of arrangement, proposed to be filed before Tribunal with the stock exchange(s).

Approval of Financial Institutions

The approval of the Financial Institutions, trustees to the debenture holders and banks, investment corporations would be required if the Company has borrowed funds either as term loans, working capital requirements and/or have issued debentures to the public and have appointed any one of them as trustees to the debenture holders.

Approval from the Land Holders

If the land on which the factory is situated is the lease-hold land and the terms of the lease deed so specifies, the approval from the less or will be needed.

Approval of the Tribunal

Both companies (amalgamating as well as amalgamated) involved in a scheme of compromise or arrangement or reconstruction or amalgamation is required to seek approval of the respective Tribunal for sanctioning the scheme.

If transferor and transferee companies are under the jurisdiction of different Tribunals, separate approvals are necessary

Approval of Reserve Bank of India

Where the scheme of amalgamation envisages issue of shares/cash option to Non-Resident Indians, the amalgamated company is required to obtain the permission of Reserve Bank of India

Approvals from Competition Commission of India (CCI)

The provisions relating to regulation of combination as provided under Sections 5 and 6 of the Competition Act, 2002 would also be required to be complied with by companies, if applicable.

![]()

Filing requirements in the process of Merger / Amalgamation

The following forms, reports, returns, etc. are required to be filed with the Registrar of Companies, SEBI and Stock Exchanges at various stages of the process of merger/ amalgamation:

-

- when the objects clause of the memorandum of association of the transferee company is altered to provide for amalgamation/merger, for which special resolution is passed

- the company’s authorised share capital is increased