Process Costing – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Process Costing – CA Inter Costing Question Bank

Question 1.

“The value of scrap generated in a process should be credited to the process account”. Do you agree with this statement? Give reasons. (Nov 1995, 2 marks)

Answer:

The statement is incorrect. The treatment of scrap depends on the condition under which the scrap is generated. If scrap is generated out of normal loss then the value of scarp should be credited to the respective process account. If the scrap is generated out of abnormal loss or abnormal gain then the value of scrap should be credited to the abnormal loss A/c or Abnormal gain A/c.

Thus the value of scrap generated in a process is not always credited to the process account.

Question 2.

Explain normal wastage, abnormal wastage and abnormal gain and state, how they should be dealt within Process Cost Accounts. (Nov 1998, 6 marks)

Answer:

The loss, which is unavoidable and is expected during the course of production, is called normal process loss.

Normal process loss may arise due to evaporation, chemical reaction, shrinkage, etc.

Accounting treatment of normal process loss : No separate account is maintained for normal process loss. This is because the cost of normal loss is to be borne by the good units produced in the process. The cost of normal loss is ascertained and charged to respective process account.

If normal loss is disposed off for some price, then the realisable value from the sale of normal process loss is credited to the concerned process account. Thus, in this type of situation, only the difference between the cost of normal process loss and its realisable value is to be borne by the good units.

Abnormal Process Loss :

There are certain losses, which are caused by unexpected or abnormal reasons such as fire, theft, breakage, negligence etc. Such losses are known as abnormal process loss from accounting point of view.

Abnormal process loss = Actual process loss – Normal process loss.

Accounting treatment of abnormal process loss :

separate account is maintained for abnormal process loss as Abnormal Process Loss Account. This is so because, since the abnormal losses are avoidable and can be controlled, it is not fair to charge the cost of abnormal loss to the good units.

All the costs of abnormal loss are ascertained and transferred to the Abnormal loss account.

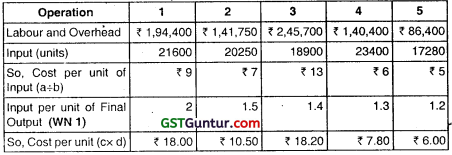

The following formula is used to ascertain the cost of abnormal loss.

of Abnormal loss

Where,

Normal output = Total input – Normal process loss

Unit of Abnormal loss = Total or Actual Process Loss – Normal Process Loss

The cost and units of abnormal process loss computed as above are credited to the concerned process account and debited to the Abnormal Process Loss A/c.

The abnormal process loss A/c is closed by transferring the balance to costing profit & loss A/c i.e. debiting Costing P&L A/c and crediting Abnormal Loss A/c.

If the abnormal loss has some scrap value and is disposed off accordingly, then only the balance abnormal loss is debited to Costing P&L A/c and credited to Abnormal loss A/c.

Abnormal process Gain :

It is quite natural that certain amount of material will be lost or scraped during the course of production. It is an expected loss, which cannot be avoided. Such a loss is anticipated in advance and is termed as normal process loss. If the actual loss is lower than the anticipated normal loss, then there arises abnormal gain.

Thus, Abnormal gain = Actual process loss – Normal process loss.

Accounting treatment of Abnormal Gain.

The accounting treatment of abnormal gain is similar to that of abnormal process loss.

A separate account Abnormal gain A/c is maintained.

The cost of abnormal gain is ascertained and this cost is debited to the respective process account and credited to the Abnormal gain A/c.

The Abnormal gain A/c is debited with the figure of reduced normal loss both in units as well as costs.

The Abnormal gain A/c is closed by transferring the balance of abnormal gain A/c to costing P&L A/c.

![]()

Question 3.

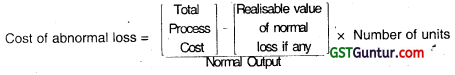

A product passes through two processes. The output of Process I becomes the input of Process II and the output of Process II is transferred to warehouse. The quantity of raw materials introduced into Process I is 20,000 kg at ₹ 10 per kg. The cost and output data for the month under review are as under:

The company’s policy is to fix the Selling price of the end product in such a way as to yield a Profit of 20% on Selling price.

Required :

(i) Prepare the Process Accounts

(ii) Determine the Selling price per unit of the end product. (Nov 2002, 9 marks)

Answer:

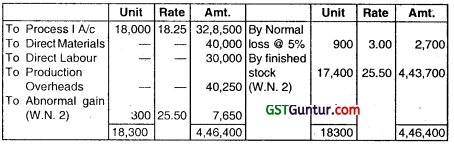

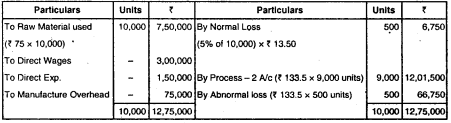

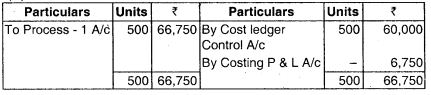

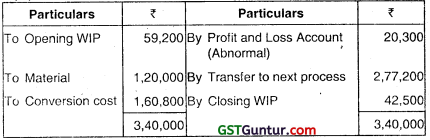

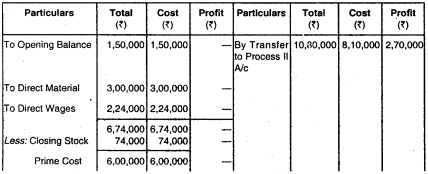

Process – I A/c

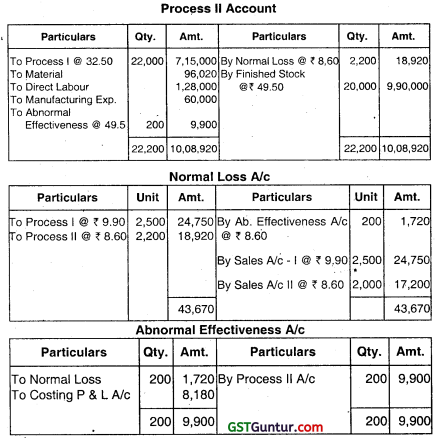

Process – II A/c

Working Notes :

1. Valuation of abnormal loss & units finished & transfer to process II A/c:

Total Expenditure incurred in the Process – Scrap realisation of normal loss

Units introduced in the Process – Normal loss unit

= \(\frac{2,00,000+60,000+40,000+39,000-3,200}{20,000-1,600}\)

= \(\frac{3,35,800}{18,400}\) = ₹ 18.25

2. Valuation of Abnormal gain & units finished & transfer to ware house:

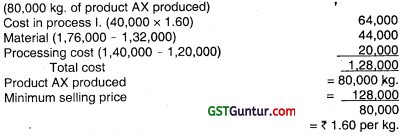

3. Determination of selling price per Unit of the end Product:

Let the S.P. be ₹ 100/-

∴ Profit = 20% of ₹ 100 = ₹ 20

∴ Cost = ₹ 100 – ₹ 20 = ₹ 80

It the cost price is ₹ 255, the selling price of the end product

\(\frac{25.5}{80}\) × 100 = ₹ 31.875

![]()

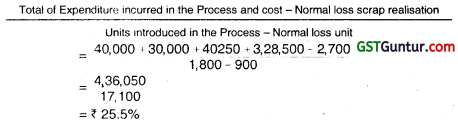

Question 4.

JK Ltd. produces a product “AZE”, which passes through two processes, viz, process I and process II. The output of each process is treated as the raw material of the next process to which it is transferred and output of the

second process is transferred to finished stock. The following data related to December, 2007:

Required:

(i) Prepare Process I and Process II account.

(ii) Prepare Abnormal effective/wastage account as the case may be each process. (May 2008, 6 + 2 = 8 marks)

Answer:

Process I Account

Question 5.

Answer the following;

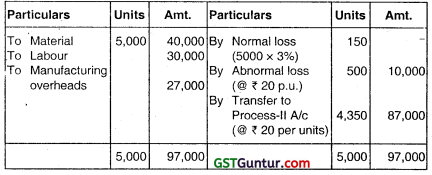

A product passes from Process I and Process II. Materials issued to Process I amounted to ₹ 40,000. Labour ₹ 30,000 and manufacturing overheads were ₹ 27,000. Normal loss was 3% of input as estimated. But 500 more units of output of Process I were lost due to the carelessness of workers. Only 4,350 units of output were transferred to Process II. There were no opening stocks. Input raw material issued to Process I were 5,000 units. You are required to show Process I account. (Nov 2008, 3 marks)

Answer:

Working Notes:

Calculation of rate:

= \(\frac{40,000+30,000+27,000}{5,000-150}\)

= \(\frac{97,000}{4,850}\)

= ₹ 20 per unit

Note: In the absence of any information, it is assumed that normal loss is not sold as scrap.

Question 6.

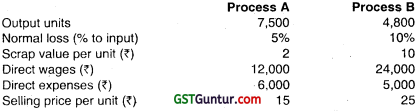

A product passes through two processes A and B. During the year 2011, the input to process A of basic raw material was 8,000 units @ ₹ 9 per unit.

Other information for the year is as follows:

Total overheads ₹ 17,400 wow recovered as percentage of direct wages. Selling expenses were ₹ 5,000. There are not allocate to the processes. 2/3 of the output of Process A was passed on to the next process and the balance was sold. The entire output of Process B was sold. Prepare Process A and B Accounts. (May 2012, 8 marks)

Answer:

Process A A/c

Cost of abnormal Loss in process A = \(\frac{95,800-800}{8,000-400}\) = \(\frac{95,000}{7,600}\)

= 12.50 per unit

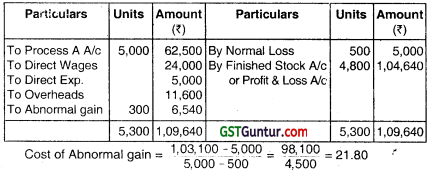

Process B A/c

Working:

Profit & Loss A/c

Note:

- Since, selling expenses are not allocable to process these are debited directly to the P/L A/c.

- It is assumed that Process A and Process B are not responsibility centres. So, Process A and Process B have not been credited to direct sales. P/L A/c is prepared to arriving at profit/loss.

Question 7.

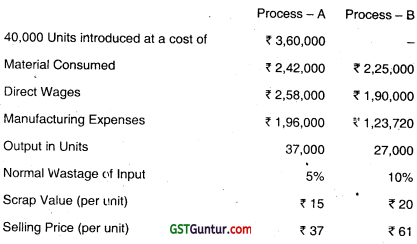

M J Pvt. Ltd. produces a product “SKY” which passes through two processes, viz. Process-A and Process-B. The details for the year ending 31st March, 2014 are as follows:

Additional Information:

(a) 80% of the output of Process-A, was passed on to the next process and the balance was sold. The entire output of Process-B was sold.

(b) Indirect expenses for the year was ₹ 4,48,080.

(c) It is assumed that Process-A and Process-B are not responsibility centre.

Required:

(i) Prepare Process-A and Process-B Account.

(ii) Prepare Profit & Loss Account showing the net profit/net loss for the year. (May 2014, 8 marks)

Answer:

(i)

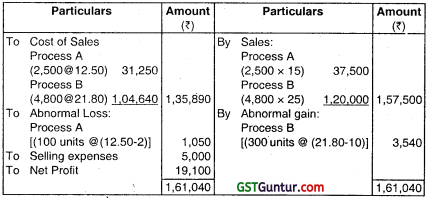

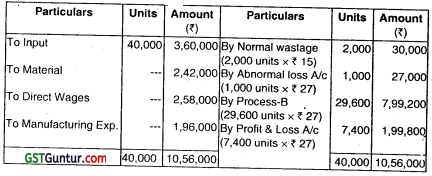

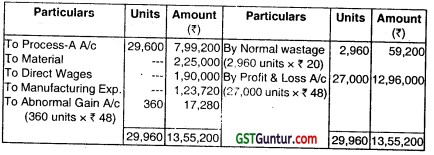

Process – A A/c

Cost per unit = \(\frac{₹ 10,56,000 \quad ₹ 30,000}{₹ 40,000 \text { unit } 2,000 \text { units }}\) = ₹ 27 per unit

Normal wastage = 40,000 units × 5% = 2,000 units

Abnormal loss = 40,000 units – (37,000 units + 2,000 units)

= 1,000 units

Transfer to Process-B = 37,000 units × 80% = 29,600 Units

Sale = 37,000 units × 20% = 7,400 units

Process-B A/c

Cost per unit = \(\frac{₹ 13,37,920-₹ 59,200}{₹ 29,600 \text { units – } 2,960 \text { units }}\) = ₹ 48 per unit

Normal wastage = 29,600 units × 10% = 2,960 units

Abnormal gain = (27,000 units + 2,960 units) – 29,600 units

= 360 units

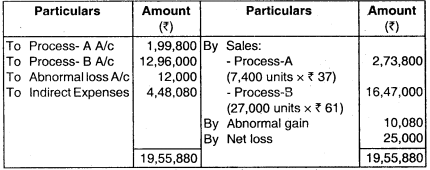

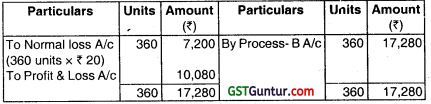

(ii) Profit & Loss A/c

Working Notes:

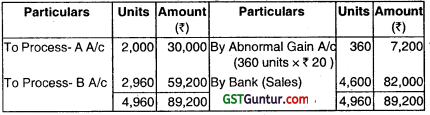

Normal wastage (Loss) A/c

Abnormal Loss A/c

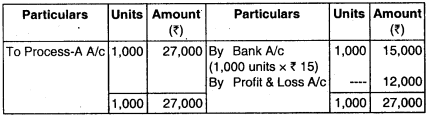

Abnormal Gain A/c

Question 8.

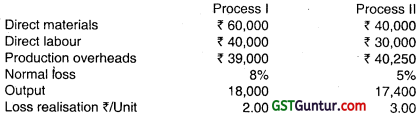

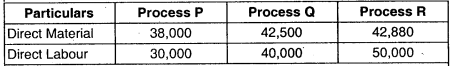

(a) Alpha Ltd. is engaged in the production of a product A which passes through 3 different process – Process P, Process Q and Process R. The following data relating to cost and output is obtained from the books of accounts for the month of April 2017:

Production overheads of ₹ 90,000 were recovered as percentage of direct labour.

10,000 kg. of raw material @ ₹ 5 per kg. was issued to Process P.

There was no stock of materials or work in process. The entire output of each process passes directly to the next process and finally to warehouse. There is normal wastage, in processing, of 10%. The scrap value of wastage is ₹ 1 per kg. The output of each process transferred to next process and finally to warehouse are as under:

Process P = 9,000 kg

Process Q = 8,200 kg

Process R = 7,300 kg

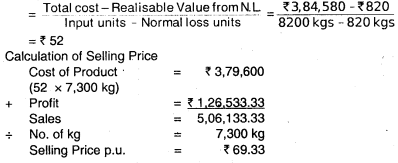

The company fixes selling price of the end product in such a way so as to yield a profit of 25% on selling price.

Prepare Process P, Q and R accounts. Also calculate selling price per unit of end product. (May 2018, 10 marks)

Answer:

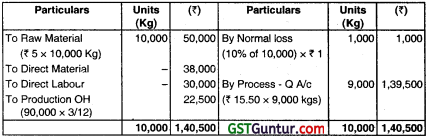

Process – P A/c

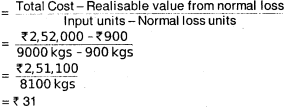

Cost per unit of completed units

\(=\frac{\text { Total Cost }- \text { Realisable Value from normal loss }}{\text { Input units }- \text { Normal loss units }}\)

= \(\frac{₹ 1,40,500-₹ 1,000}{10000 \mathrm{kgs}-1000 \mathrm{kgs}}\)

= \(\frac{21,39,500}{9000 \mathrm{k} g}\)

= ₹ 15.50

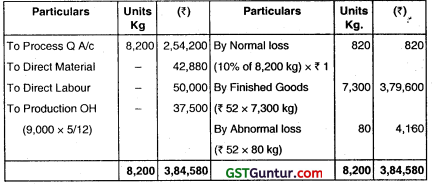

Process – Q A/c

Cost Per unit of Completed units’ and abnormal Gain

Process R A/c

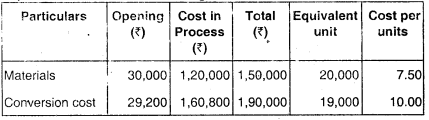

Cost per unit of Completed units and abnormal loss:

![]()

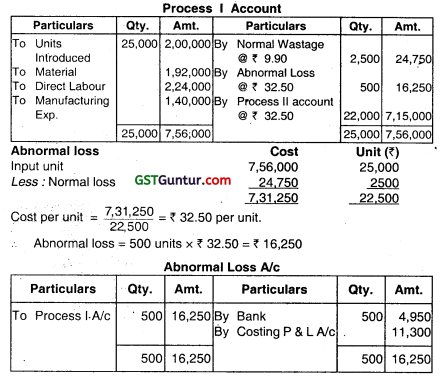

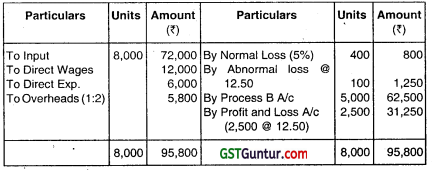

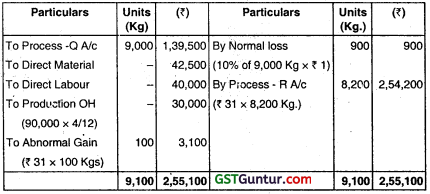

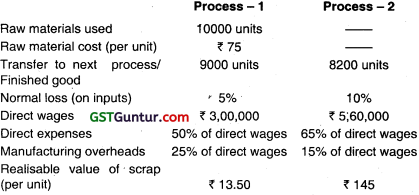

(b) A product passes through two distinct processes before completion. Following information are available in this respect:

8000 units of finished goods were sold at a profit of 15% on cost. There was no opening and closing stock of work-in-progress.

Prepare:

(i) Process-,1 and Process- 2 Account

(ii) Finished goods Account

(iii) Normal Loss Account

(iv) Abnormal Loss Account

(v) Abnormal Gain Account (Nov 2019, 10 marks)

Answer:

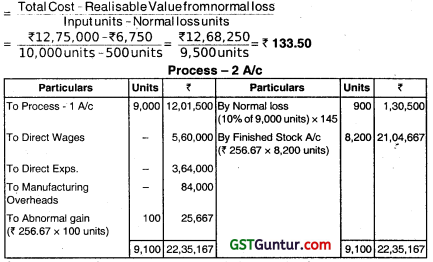

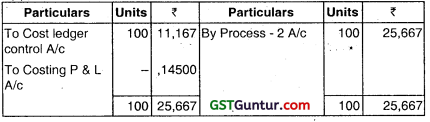

Process – 1 A/c

Cost per unit of completed units and abnormal loss:

Cost per unit of completed units and abnormal gain

\(=\frac{\text { Total Cost }- \text { RealisableValuefromnormal loss }}{\text { Inputsunits }- \text { Normallossunits }}\)

= \(\frac{₹ 22,09,500-₹ 1,30,500}{9,000 \text { units – } 900 \text { units }}\) = \(\frac{₹ 20,79,000}{8,100 \text { units }}\) = ₹ 256.67

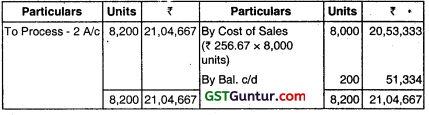

(ii) Finished Goods A/c

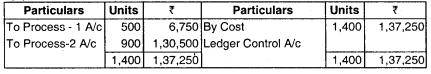

(iii)

Normal Loss A/c

(iv)

Abnormal loss A/c

(v) Abnormal Gain A/c

WIP Valuation and Equivalent Production: FIFO Method

Question 9.

Explain “Equivalent Production”. (May 2002, 2, 4 marks)

Answer:

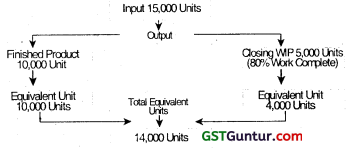

Equivalent Production

The presence of opening or closing WIP poses an accounting problem as to the evaluation of inventory as well as ascertainment of cost per unit of output. To solve this problem, the WIP or incomplete units are expressed in terms of complete units, which are termed as equivalent units of production. Thus, equivalent production refers to a systematic procedure of expressing the output of a process in terms of completed units. It is, therefore, the conversion of uncompleted production into its equivalent completed units.

Equivalent units of production means converting the uncompleted production into its equivalent completed units. To compute the equivalent units, in each process, an estimate is made of the percentage completion of the closing WIP. The WIP is inspected and an estimate is made of the degree of completion, usually on a percentage basis. Then the equivalent units of WIP can be computed by the following formula:

Equivalent units of production.

= Actual no. of units in WIP × Percentage of work completed.

E.g.

If the units in WIP be 200 and 60% work is completed then Equivalent Units = 200 × 60%

= 120 units.

![]()

Question 10.

Explain briefly the procedure for valuation of Work-in-process. (Nov 2002, 2 marks)

Answer:

Presently WIP is valued in two ways, depending upon the assumption made regarding the flow of costs: .

1. FIFO (First-In-first out) method

2. Average cost method.

When the prices of raw material and rate of labour and overhead are more of less stable WIP is valued by FIFO method.

Under this method it is assured that the raw materials issued to WIP pass through the finished goods in a progressive cycle i.e. what comes out first goes out first.

The closing WIP is valued at costs during the new period while opening WIP s valued at costs of the old period.

When the prices of raw material and rate of labour and overhead fluctuate from period to period, WIP is valued by “Average cost method.”

Under this method the closing WIP in old period is add to the cost of new period and an average rate is obtained which tries to even out price fluctuations.

Question 11.

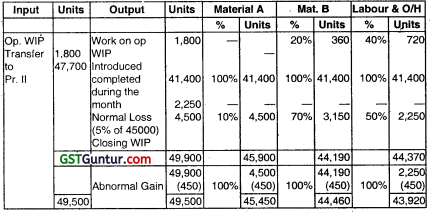

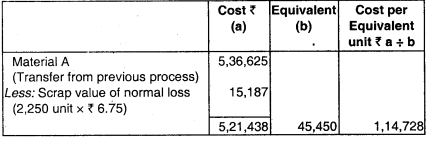

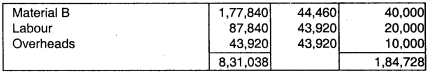

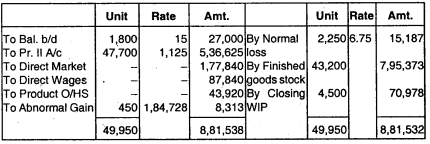

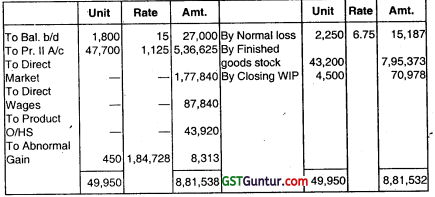

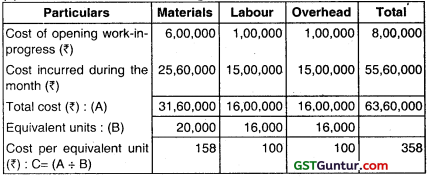

From the following information for the month of October 2003, prepare Process III Cost accounts:

Process III Cost accounts:

Opening WIP in Process III : 1800 units at ₹ 27,000

Transfer from Process II : 47,700 units at ₹ 5,36,625

Transferred to Warehouse : 43,200 units

Closing WIP’of Process III : 4,500 units

Units scrapped : ₹ 1,77,840

Direct material added in Process III : ₹ 1,77,840

Direct Wages : ₹ 87,840

Production overheads : ₹ 43,920

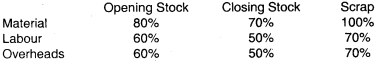

Degree of completion:

The normal loss in the process was 5% of the production and scrap was sold @ ₹ 6.75 per unit. (Nov 2003, 10 marks)

Answer:

Statement of Equivalent Production

Statement of Cost

Statement of Evaluation

Process III A/c

Working Note:

Process III A/c

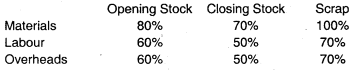

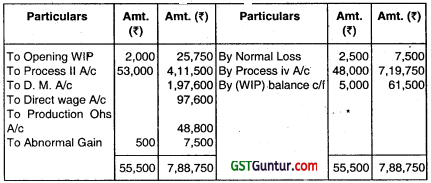

Question 12.

From the following Information for the month ending October, 2005, prepare Process Cost-accounts for Process III. Use First-in-first-out (FIFO) method to value equivalent production.

Direct materials added in Process III (Opening WIP) : 2,000 units at ₹ 25,750

Transfer from Process II : 53,000 units at ₹ 4,11,500

Transferred to Process IV : ₹ 48,000 units

Closing stock of Process III : ₹ 5,000 units

Units scrapped : 2,000 units

Direct material added in Process III : ₹ 1,97,600

Direct wages : ₹ 97,600

Production Overheads : ₹ 48,800

Degree of Completion:

The normal loss in the process was 5% of production and scrap was sold at ₹ 3 per unit. (Nov 2005, 14 marks)

Answer:

Process Cost Accounts

(Process III)

Note: Normal loss (NL)

5% of production

Production here means budgeted production = 2,000 + 53,000 = 55,000 – 5,000 = 50,000.

NL = 5% of 50,000 = 2,500/-

Working Notes:

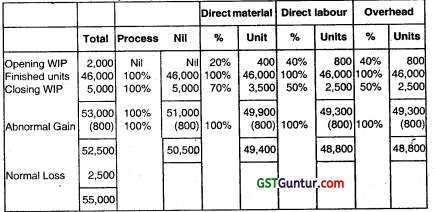

1. Statement of equivalent units:

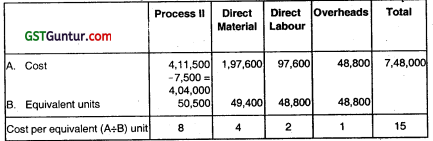

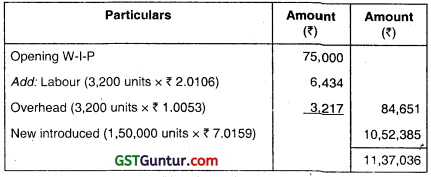

2. Statement of Cost per equivalent unit:

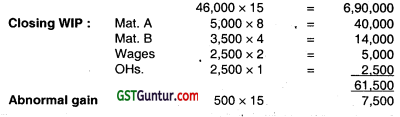

3. Statement of Valuation or Process Cost Sheet (in ₹)

Units Introduced and completely processed during the period:

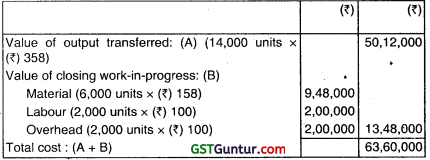

Question 13.

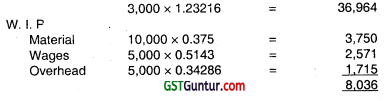

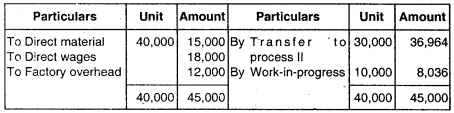

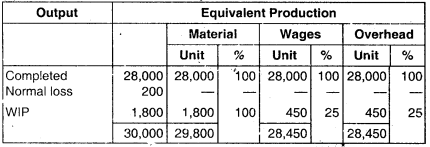

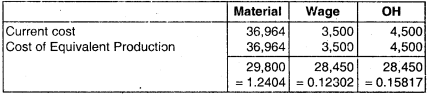

A Company produces a component, which passes through two processes. During the month of April, 2006, materials for 40,000 components were put into Process I of which 30,000 were completed and transferred to Process II. Those not transferred to Process II were 100% complete as to materials cost and 50% complete as to labour and overheads cost. The Process I costs incurred were as follows :

Direct Materials ₹ 15,000

Direct Wages ₹ 18,000

Factory Overheads ₹ 12,000

Of those transferred to Process II, 28,000 units were completed and transferred to finished goods stores. There was a normal loss with no salvage value of 200 units in Process II. There were 1,800 units, remained unfinished in the process with 100% complete as to materials and 25% complete as regard to wages and overheads.

No further process material costs occur after introduction at the first process until the end of the second process, when protective packing is applied to the completed components. The process and packing costs incurred at the end of the Process II were :

Packing Materials ₹ 4,000

Direct Wages ₹ 3,500

Factory Overheads ₹ 4,500

Required ;

(i) Prepare Statement of Equivalent Production, Cost per unit and Process I A/c. (May 2006, 4 marks)

(ii) Prepare statement of Equivalent Production, Cost per unit and Process II A/c. (May 2006, 6 marks)

Answer:

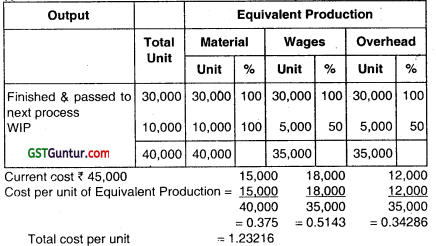

(i) Statement of equivalent production (Process -1)

Cost analysis (Process -1):

Finished & Passed to next process

Process – I

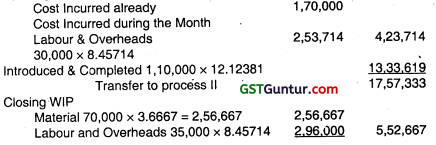

(ii) Statement of Equivalent Production

Statement of cost

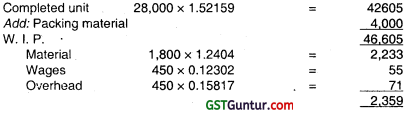

∴ Total cost per unit = 1.52159

Cost Analysis (Process – II)

Process – II

![]()

Question 14.

XP Ltd. furnishes you the following information relating to process II.

(i) Opening work-in-progress—NIL

(ii) Units introduced 42,000 units @ ₹ 12

(iii) Expenses debited to the process :

Direct material : ₹ 61,530

Labour : ₹ 88,820

Overheads : ₹ 1,76,400

(iv) Normal loss in the process = 2% of input.

(v) Closing work-in-progress — 1200 units

Degree of completion — Materials : 100%

Labour : 50%

Overhead : 40%

(vi) Finished output— 39500 units

(vii) Degree of completion of abnormal loss :

Material : 100%

Labour : 80%

Overhead 60%

(viii) Units scraped as normal loss were sold at ₹ 4.50 per unit,

(ix) All the units of abnormal loss were sold at ₹ 9 per unit.

Prepare:

(a) Statement of equivalent production.

(b) Statement showing the cost of finished goods, abnormal loss and closing work-in-progress.

(c) Process II account and abnormal (Nov 2009, 8 marks)

Answer:

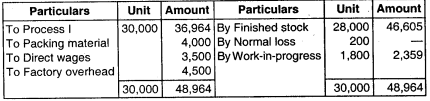

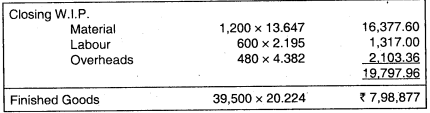

(a) Statement of Equivalent Production

(b) Statement of Cost

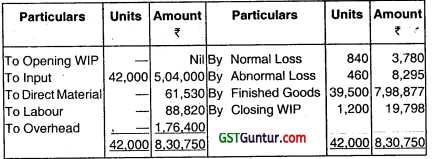

Process II Account

Abnormal Loss Account

Question 15.

Following information is available regarding Process A for the month of October 2010 :

Production Record :

(i) Opening work-in-progress

(Material: 100% complete, 25% complete for labour & overheads) : 40,000 Units

(ii) Units Introduced : 1,80,000 Units

(iii) Units Completed : 1,50,000 Units

(iv) Units in-process on 31.10.2010 : 70,000 Units

(Material: 100% complete, 50% complete for labour & overheads)

Cost Record:

Opening Work-in-Progress:

Material : ₹ 1,00,000

Labour : ₹ 25,000

Overheads : ₹ 45,000

Cost incurred during the month :

Material : ₹ 6,60,000

Labour : ₹ 5,55,000

Overheads : ₹ 9,25,000

Assume that FIFO method is used for W.I.P. inventory valuation.

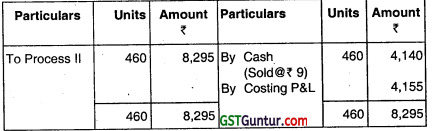

Required :

(i) Statement of Equivalent Production

(ii) Statement showing Cost for each element

(iii) Statement of apportionment of Cost

(iv) Process A Account. (Nov 2010, 8 marks)

Answer:

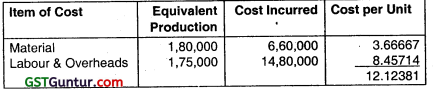

Statement of Equivalent Production

(Under FIFO Method)

Statement Showing Cost for Each Element

Statement of Evaluation

Transfer to Process II

Opening WIP Completed

Process A/c

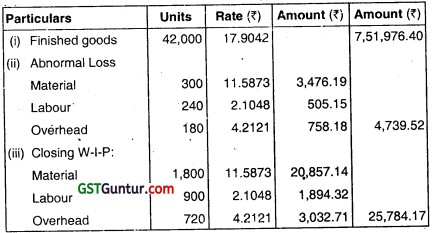

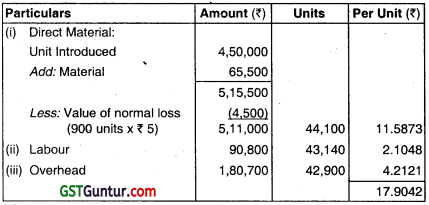

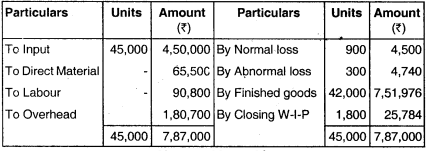

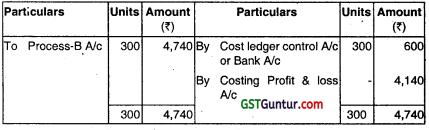

Question 16.

ABX Company Ltd. provides the following information relating to Process-B:

(i) Opening Work-in-progress – NIL

(ii) Units Introduced – 45,000 units @ ₹ 10 per unit

(iii) Expenses debited to the process:

Direct material : ₹ 65,500

Labour : ₹ 90,800

Overhead : ₹ 1,80,700

(iv) Normal loss in the process – 2% of Input

(v) Work-in-progress – 1,800 units

Degree of completion

Materials – 100%

Labour – 50%

Overhead – 40%

(vi) Finished output – 42,000 units

(vii) Degree of completion of abnormal loss:

Materials – 100%

Labour – 80%

Overhead – 60%

(viii) Units scrapped as normal loss were sold at ₹ 5 per unit.

(ix) All the units of abnormal loss were sold at ₹ 2 per unit.

You are required to prepare:

(a) Statement of equivalent production.

(b) Statement showing the cost of finished goods, abnormal loss and closing balance of work-in-progress.

(c) Process-B account and abnormal loss account. (May 2013, 10 marks)

Answer:

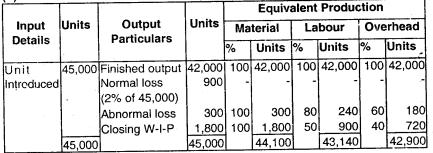

(a) Statement of Equivalent Production

(b) Statement of Cost

Cost Per Unit

(c) Process – B A/c

Abnormal Loss A/c

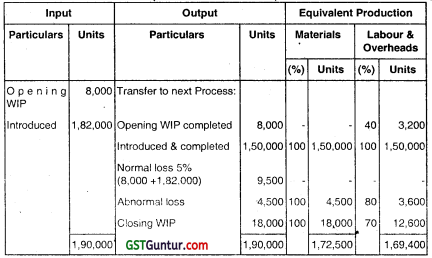

Question 17.

The following information relate to Process A:

(i) Opening Work-in-Progress : 8,000 units at ₹ 75,000

Degree of Completion:

Material : 100%

Labour and Overhead : 60%

(ii) Input 1,82,000 units at : ₹ 737,500

(iii) Wages paid : ₹ 3,40600

(iv) Overheads paid : ₹ 1,70,300

(v) Units scrapped : ₹ 14000

Degree of Completion:

Material : 100%

Wages and Overheads : 80%

(vi) Closing Work-In-Progress : 18,000 units

Degree of Completion:

Material : 100%

Wages and Overheads : 70%

(vii) Units completed and transferred 1,58,000 to next process

(viii) Normal loss 5% of total Input including opening WIP

(ix) Scrap value is ₹ 5 per unit to be adjusted out of direct material cost

You are required to compute on the basis of FIFO basis:

(i) Equivalent Production

(ii) Cost Per Unit

(iii) Value of Units transferred to next process. (Nov 2014, 8 marks)

Answer:

(i) Statement of Equivalent Production

(Under FIFO Method)

(ii)

Computation of Cost per unit

Total cost per unit = ₹ (4.0000 + 2.0106 + 1.0053) = ₹ 7.0159

(ii) Value of units transferred to next process:

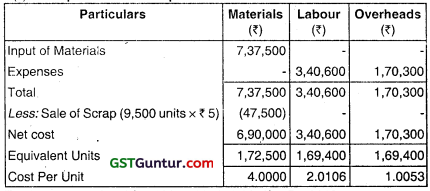

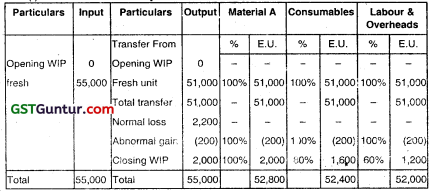

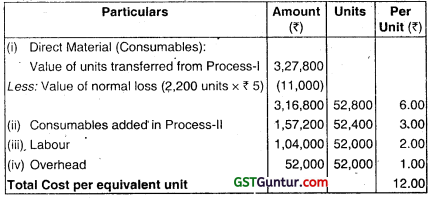

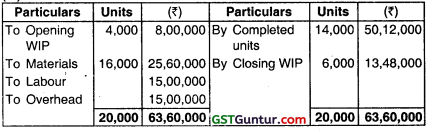

Question 18.

The following information is furnished by ABC Company for Process II of its manufacturing activitý for the month of April 2015:

(i) Opening Work-in-Progress – NïI

(ii) Units transferred from Process – I – 55000 units at ₹ 3,27,800

(iii) Expenditure debited to Process – II:

Consumables – ₹ 1,57,200

Labour – ₹ 1,04,000

Overtead – ₹ 52,000

(iv) Units transferred to Process – III – 51,000 Units

(v) Closing WIP – 2000 units (Degree of completion):

Consumables – 80%

Labour – 60%

Overhead – 60%

(vi) Units scrapped – 2000 units, scrapped units were sold at ₹ 5 per unit.

(vii) Normal loss – 4% of units introduced

You are required to:

(i) Prepare a Statement of Equivalent Production

(ii) Determine the cost per unit.

(iii) Determine the value of Work-in-Process arid units transferred to Process. III. (Nov 2015, 8 marks)

Answer:

(i) Statement for Equivalent Production:

(ii) Determination of Cost per Unit

(iii) Determination of value of Work-in-Process and units transferred to Process-III

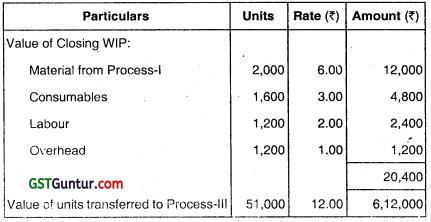

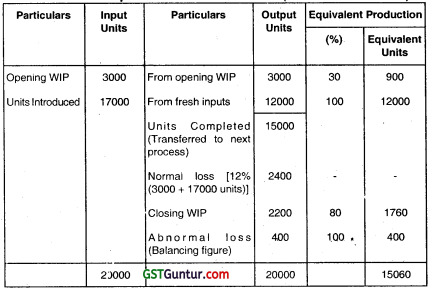

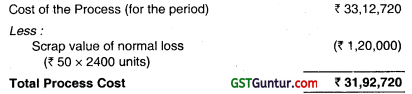

Question 19.

Following details have been provided by M’s AR Enterprises:

(i) Opening works-in-progress — 3000 units (70% complete)

(ii) Units introduced during the year— 17000 units

(iii) Cost of the process (for the period) — ₹ 33,12,720

(iv) Transferred to next process — 15000 units

(v) Closing works-in-progress — 2200 units (80% complete)

(vi) Normal loss is estimated at 12% of total input (including units in process in the beginning). Scraps realise ₹ 50 per unit. Scraps are 100% complete.

Using FIFO meihod, compute:

(i) Equivalent production

(ii) Cost per equivalent unit (Nov 2018, 5 marks)

Answer:

Statement of Equivalent Production Units (Under FIFO Method)

Computation of Cost per equivalent Production unit:

Cost Per Equivalent unit = \(\frac{131,92,720}{15060 \text { units }}\) = ₹ 212

So,

- Equivalent Production = ₹ 15060 units

- Cost per equivalent unit = ₹ 212

Question 20.

Answer the following:

MNO Ltd. has provided following details:

- Opening work n progress is 10,000 units at ₹ 50,000 (Material 100%, Labour and overheads 70% complete).

- Input of materials is 55,000 units at ₹ 2,20,000. Amount spent on Labour and Overheads is ₹ 26,500 and ₹ 61,500 respectively.

- 9,500 units were scrapped; degree of completion for material 100% and for labour & overheads 60%.

- Closing work in progress is 12,000 units; degree of completion for material 100% and for labour & overheads 90%.

- Finished units transferred to next process are 43,500 units.

Normal loss is 5% of total input including opening work in progress. Scrapped units would fetch ₹ 8.50 per unit.

You are required to prepare using FIFO method:

- Statement of Equivalent production

- Abnormal Loss Account (Jan 2021, 5 marks)

WIP Valuation and Equivalent Production: Weighted Average Method

Question 21.

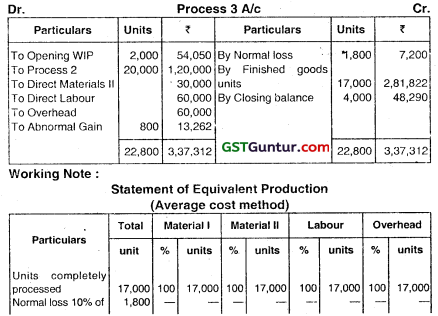

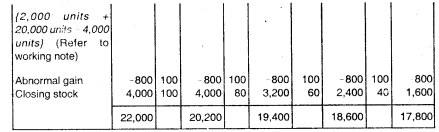

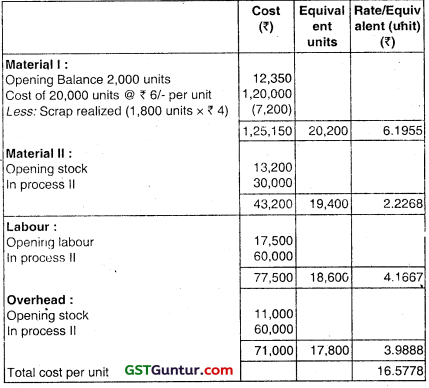

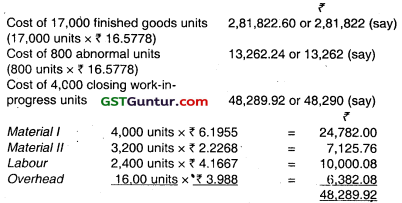

The following information is given in respect of Process No. 3 for the month of January, 2001.

Opening stock—2,000 units made-up of:

Direct Materials-I – ₹ 12,350

Direct Materials-II – ₹ 13,200

Direct Labour – ₹ 17,500

Overheads – ₹ 11,000

Transferred from Process No. 2 : 20,000 units @ ₹ 6.00 per unit.

Transferred to Process No. 4 : 17,000 units.

Expenditure incurred in Process No. 3:

Direct Materials : ₹ 30,000

Direct Labour : ₹ 60,000

Overheads : ₹ 60,000

Scrap: 1,000 units—Direct Materials 100%, Direct Labour 60%, Overheads 40%.

Normal Loss 10% of production.

Scrapped units realised 4 per unit.

Closing Stock :4,000 units—Degree of completion : Direct Materials 80%, Direct Labour 60% and overheads 40%.

Prepare Process No. 3 Account using average price method, along with necessary supporting statements. (May 2001, 10 marks)

Answer:

Statement of Cost

Statement of Evaluation

Working Note:

Normal loss given is 10% of production. Here production therefore means those units which come upto the state of inspection. In that case, opening stock plus receipts minus closing stock of WIP will represent units of production (2,006 units ÷ 20,000 units-4,000 units). In such case, the units of production comes to 18,000 units and hence 1,800 units as normal loss units.

Question 22.

A Chemical Company carries on production operation in two processes.

The material first pass through Process I, where Product ‘A’ is produced.

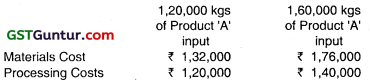

Following data are given for the month just ended:

Material input quantity : 2,00,000 kgs

Opening work-in-progress quantity (Material 100% and conversion 50% complete) : 40,000 kgs

Work completed quantity : 1,60,000 kgs

Closing work-in-progress quantity (Material 100% and conversion two-third complete) : 30,000 kgs

Material input cost : ₹ 75,000

Processing cost : ₹ 1,02,000

Opening work-In-progress cost

Materials cost : ₹ 20,000

Processing cost : ₹ 12,000

Normal process loss in quantity may be assumed to be 20% of material input. It has no realizable value.

Any quantity of Product A’ can be sold for ₹ 1.60 per kg.

Alternatively, it can be transferred to Process II for further processing and then sold as Product ‘AX’ for ₹ 2 per kg. Further materials are added in Process II, which yield two kgs of product AX’ for every kg of Product Á’

of Process I.

Of the 1,60,000 kgs per month of work completed in Process I, 40,000 kgs are söld as Product ‘A’ and 1,20,000 kgs are passed through Process II for sale as Product ‘AX’. Process II has facilities to handle upto 1,60,000 kgs of Product ‘A’ per month, if required.

The monthly costs incurred in Process II (other than the cost of Product ‘A’) are:

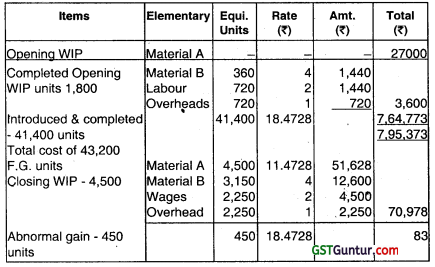

Required:

(i) Determine, using the weighted average cost method, the cost per kg of Product ‘A’ in Process I and value of both work completed and closing work-in-progress for the month just ended.

(ii) Is it processing 1,20,000 kgs of Product ‘A further?

(iii) Calculate the minimum acceptable selling price per kg, if a potential buyer could be found for additional. Output of Product ‘AX’ that could be produced with the remaining Product A’ quantity. (Nov 2006, 6+ 4 + 4 = 14 marks)

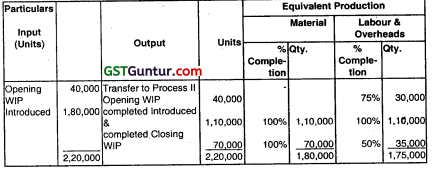

Answer:

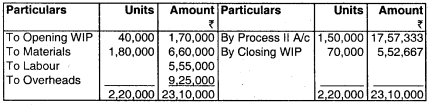

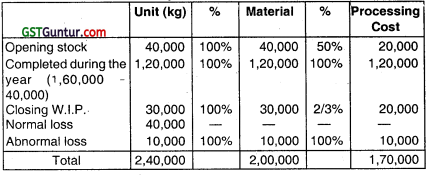

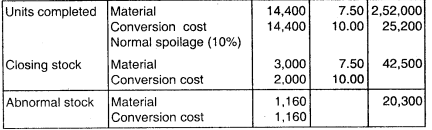

Calculation of Equivelent Production (Process I)

1. Calculation of cost of equivalent production:

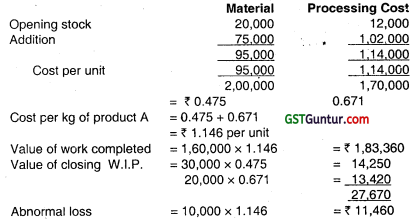

2. Evaluatiån of further processing of 1,20,000, kg. of Product A:

![]()

3. Cost of processing of 40,000 kg. of Product A:

Question 23.

ABC Limited manufactures a product ZX’ by using the process namely RT. For the month of May 2007, the following data are available:

Process RT

Material introduced (units) : 16,000

Transfer to next process (units) : 14,400

Work in process:

At the beginning of the month (units) : 4,000

(4/5 completed)

At the end of the month (units) : 3,000

(2/3 completed)

Cost records:

Work in process at the beginning of the month

Material : ₹ 30,000

Conversion cost : ₹ 29,200

Cost during the month : materials : ₹ 1,20,000

Conversion cost : ₹ 1,60,800

Normal spoiled units are 10% of goods finished output transferred to next process.

Defects in these units are identified In their finished state. Material for the product is put in the process at the beginning of the cycle of operation, whereas labour and other indirect cost flow evenly over the year. It has no realisable value for spoiled units.

Required:

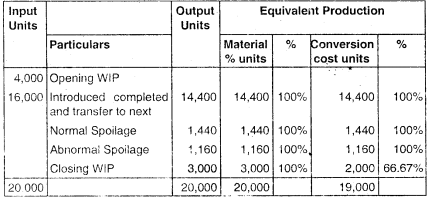

(i) Statement of equivalent production (Average cost method);

(ii) Statement of cost and distribution of cost;

(iii) Process accounts. (Nov 2007, 2 + 5 + 1 = 8 marks)

Answer:

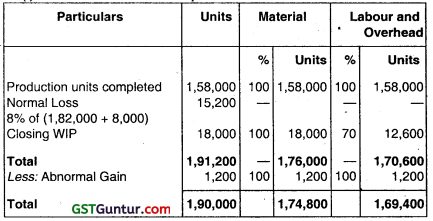

(i) Statement of Equivalent Production of Process RT

(ii) Statement showing cost of each element

Statement of Apportionment of cost

(iii) Process Account

Question 24.

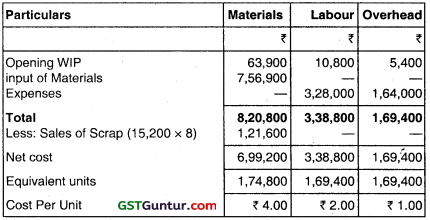

The following details are available of Process X for August 2011:

1. Opening workin-process 8,000 units

Degree of completion and cost:

Material (100%) : ₹ 63,900

Labour (60%) : ₹ 10,800

Overheads (60%) : ₹ 5,400

2. Input 1,82,000 units at : 7,56,000

3. Labour paid : ₹ 3,28,000

4. Overheads incurred : ₹ 1,64,000

5. Units scrapped : 14,000

Degree of completion:

Material : 100%

Labour and overhead : 80%

6. Closing work-in-process 18000 units

Degree of completion:

Material : 100%

Labour and overhead : 70%

7. 1,58,000 units were completed and transferred to next process.

8. Normal loss is 8% of total input including opening work-in-process.

9. Scrap value is ₹ 8 per unit to be adjusted in direct material cost.

You are required to compute, assuming that average method of inventory is used:

(i) Equivalent production, and

(ii) Cost per Unit. (Nov 2011, 8 marks)

Answer:

(i) Statement of Equivalent Production

(ii) Statement of cost

Total cost per unit = 4 + 2 + 1 = ₹ 7.00

Question 25.

Following details are related to the work done in Process-I by ABC Ltd. during the month of May 2019:

Opening work in process (3,000 units) : ₹

Materials : 180,500

Labour : 32,400

Overheads : 90,000

Materials introduced in Process-I (42,000 units) : 36,04,000

Labour : 4,50,000

Overheads : 15,18,000

Units Scrapped : 4,800 units

Degree of completion :

Materials : 100%

Labour & overhead : 70%

Closing Work-in-process : 4,200 units

Degree of completion :

Matenals : 100%

Labour& overhead : 50%

Units finished and transferred to Process-II : 36,000 units

Normal loss:

4% of total input including opening work-in-process

Scrapped units fetch ₹ 62.50 per piece.

Prepare:

- Statement of equivalent production.

- Statement of cost per equivalent unit.

- Process-I A/c

- Normal Loss Account and

- Abnormal Loss Account (Nov 2020, 10 marks)

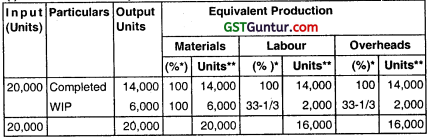

Question 26.

Following information is available regarding process A for the month of February, 2019: Production Record:

Units in process as on 01.02.2019 : 4,000

(All materials used, 25% complete for labour and overhead)

New units introduced : 16,000

Units completed : 14,000

Units in process as on 28.02.2019 : 6,000

(All materials úsed. 33-1/3% complete for labour and overhead)

Cost Records:

Presuming that average method of inventory is used, PREPARE:

(i) Statement of Equivalent Production.

(ii) Statement showing Cost for each element.

(iii) Statement of Apportionment of cost.

(iv) Process Cost Account for Process A

Answer:

(i) Statement of Equivalent Production (Average Cost Method)

* Percentage of completion ** Equivalent units

(ii) Statement Showing Cost for each element

(iii) Statement of Apportionment of cost

(iv) Process- A A/c

Inter Process Profits

Question 27.

What is inter-process profit? State its advantages and disadvantages. (Nov 2012, 4 marks)

OR

Explain the following terms in relation to process costing: Inter-Process Profit (Nov 2013, 4 marks)

Answer:

Inter Process Profit

Meaning

We know that in processing units the output for one process becomes the input for the next process. The price at which the output of one process is transferred to another, is called interprocess price. In some processing units the output from one process is transferred at cost plus a percentage for profit. This profit (transfer price-cost) is called inter process profit.

Thus, inter-process profit is the profit made by the transfer of output from one process to another.

Advantage

Inter-process profit facilitates to evaluate the performance of each process, from the cost effectiveness point of view and also from the profit point of view.

Disadvantage

However, it poses a problem especially for the valuation of closing WIP. This is because, for financial statement purpose closing WIP should be valued at cost or market value whichever is lower. Whereas under this system, WIP should be valued at cost plus profit.

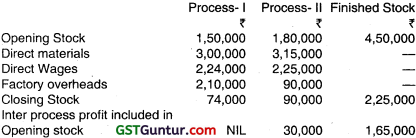

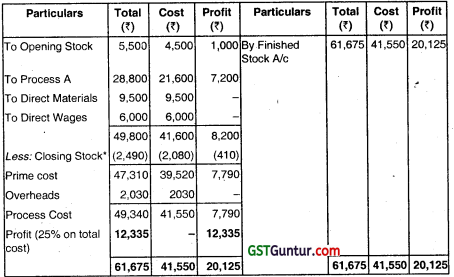

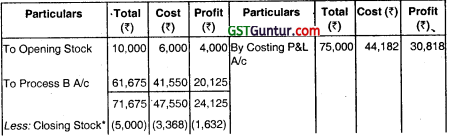

Question 28.

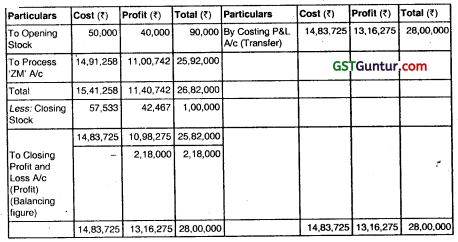

Pharma Limited produces poduct ‘Glucodin’ which passes through two processes before it is completed and transferred to finished stock. The following data relates to March, 2010.

Output of process I is transferred to process II at 25 percent profit on the transferred price, whereas output of process II is transferred to finished stock at 20 percent on transfer price. Stock in processes are valued at prime cost. Finished stock is valued at the price at which it is received from process II. Sales for the month is ₹ 28,00,000.

You are required to prepare Process-I a/c, Process-II a/c, and Finished Stock a/c showing the profit element at each stage. (May 2010, 8 marks)

Answer

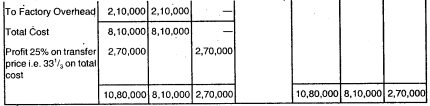

Process I A/c

Process II A/c

Working Note:

Profit element in closing stock = \(\frac{3,00,000}{18,00,000}\) × 90,000 = 15,000

Finished Stock A/c

Working Note: Profit element in closing Finished Stock

\(\frac{9,00,000}{27,00,000}\) × 2,25,000 = 75,000

Calculation of Profit on Sale

Question 29.

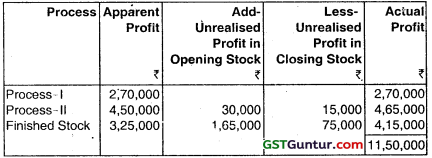

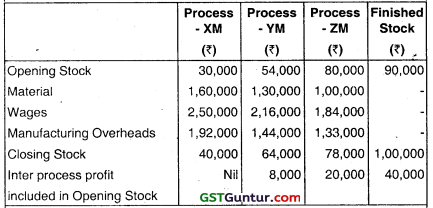

KMR td. produces product AY. which passes through three processes ‘XM’, ‘YM and ‘ZM’. The output of process ‘XM’ and ‘VM’ is transferred to next process at cost plus 20 percent each on transfer price and the output of process ZM is transferred to finished stock at a profit of 25 percent on transfer price. The following information are available iñ respect of the year ending 31st March, 2017:

Stock in processes is valued at prime cost. The finished stock is valued at the price at which it is received from process ZM’. Sales of the finished stock during the period was ₹ 28,00,000. You are required to prepare:

(i) All process accounts and

(ii) Finished stock account showing profit element at each stage. (May 2017, 8 marks)

Answer:

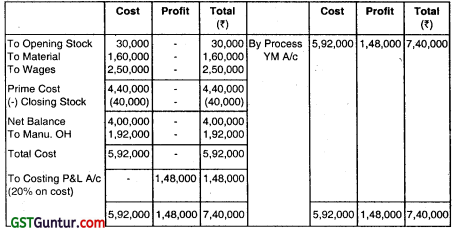

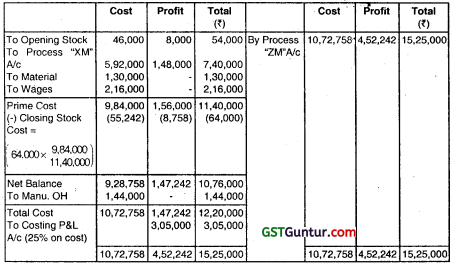

(a) (i) Process “XM” A/c

Process “VM” A/c

(ii) Finished Stock Account

Calculation of amount of unrealized profit on dosing stock:

Process ‘XM’ = Nil

Process ‘YM’ = \(\frac{₹ 1,56,000}{₹ 11,40,000}\) × ₹ 64,000 = ₹ 8,758

Process ‘ZM’ = \(\frac{₹ 4,72,242}{₹ 18,89,000}\) × ₹ 78,000 = ₹ 19,500

Finished Stock = \(\frac{₹ 11,00,742}{₹ 25,92,000}\) × ₹ 1,00,000 = ₹ 42,467.

Note: Unrealised profit on closing finished stock can also be calculated on the basis of Average cost.

Question 30.

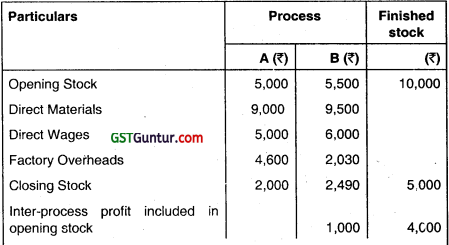

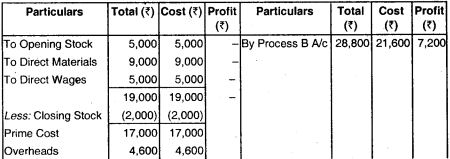

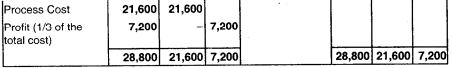

KT Ltd. Produces a product EMM which passes through two processes before it is completed and transferred to finished stock. The following data relate to May 2019:

Output of Process A is transferred to Process B at 25% profit on the transfer price and output of Process B is transferred to finished stock at 20% profit on the transfer price. Stock in process is valued at prime cost. Finished stock is valued at the price at which it is received from Process B. Sales during the period are ₹ 75,000.

Prepare the Process cost accounts and Finished stock account showing the profit element at each stage. (May 2019, 10 marks)

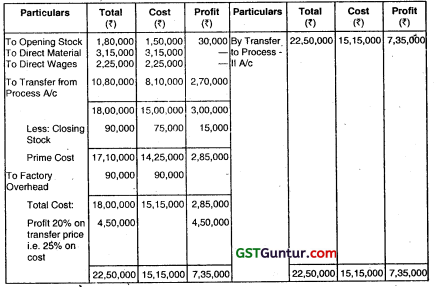

Answer:

Process A/c

Process B A/c

* Cost of Closing stock = \(\frac{41,600}{49,800}\) × 2,490 = ₹ 2,080

Finished Stock Account

* Cost of Closing stock = \(\frac{₹ 41,550}{₹ 61,675}\) × ₹ 5,000 = ₹ 3,368

Working Notes:

Let the transfer price be 100 then profit is 25: i.e. cost price is ₹ 75.

1. It cost is ₹ 75 then profit is

It cost is ₹ 21,600 then profit is \(\frac{25}{75}\) × ₹ 21,600 = ₹ 7,200

2. If cost is ₹ 80 then profit is ₹ 20

If cost is ₹ 49,340 then profit is \(\frac{20}{80}\) × 49,340 = ₹ 12,335

Operating Costing

Question 31.

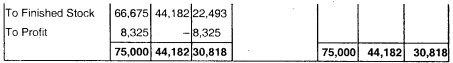

RST Ltd. manufactures Plastic Mouldeci Chair. Three models of moulded chairs, all variation of the same design are Standard, Deluxe and Executive. The Company uses an Operation Costing system.

RST Ltd. has Extrusion, Form, Trim and Finish Operations. Plastic Sheets are produced by the Extrusion Operation. During the Forming Oporation, the Plastic Sheets are moulded into Chair Seats and the legs are added.

The Standard Model is sold after this operation. During the Trim Operation, the arms are added to the Deluxe and Executive Models, and the chair edges are smoothed. Only the Executive Model enters the Finish Operation, in which padding is added. All of the units produced receive the same steps within each operation. In April, units of production and Direct Materials Cost incurred are as follows:

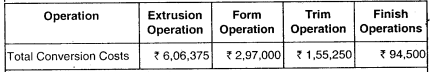

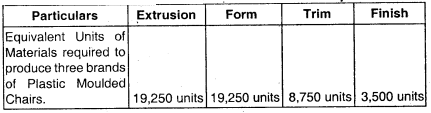

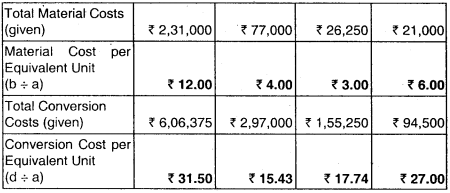

The total Conversion Costs for the month of April, are:

Required:

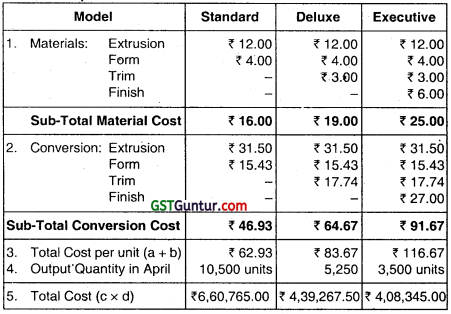

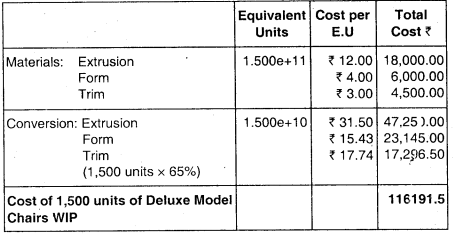

1. For each product produced by RST Ltd. during April, determine the Unit Cost and the Total Cost.

2. Now consider the following information for May. All unit costs in May are identical to the April unit cost calculated as above in (1). At the end of May, 1,500 units of the Deluxe Model remain in Work-in-Progress. These units are 100% complete as to Materials arid 65% complete in the Trim Operation. Determine the cost of the Deluxe Model Work-in Process inventory at the end of May.

Answer:

1. Computation of Cost per Equivalent Unit for each Operation

2. Computation of Total and Unit Costs for each model.

3. Valuation of WIP Inventory (1,500 units of Deluxe Model)

Question 32.

“Operation costing is defined as refinement of Process costing.’ Explain it. (May 3 marks)

Answer:

Operation costing is used for establishing cost of services rendered or service offered for sale and no items are produced. It is also applied to the operations concerned within an organisation which provides services to production departments. It is solely concerned with the determination of the cost of each operation rather than the process costing.

Operation costing provides better control and facilities, the computation of unit operation cost at the end of each operation. So, it can be said that the method of operation costing is similar to output costing but not as process costing.

Question 33.

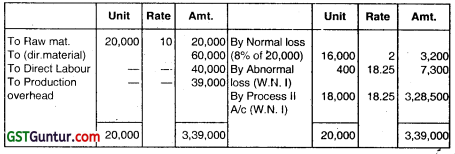

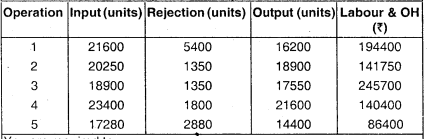

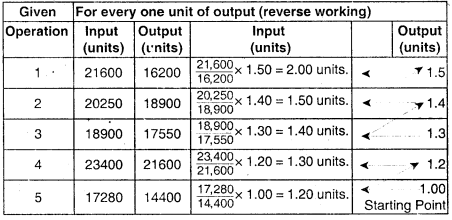

Product KLIM passes through 5 operations. The output of the 5th Operation becomes the Finished Product. The Input Rejection, Output and Labour and Overheads of each Operation for a period are as under:

You are required to:

1. Determine the Input required in each operation for one unit of Final Output.

2. Calculate the Labour and Overhead Cost at each operation for one unit of Final Output and the Total Labour and Overhead Çost of all operations for one unit of Final Output.

Answer:

1. Computing Input for output: The approach involves working backwards from Operations 5 as under:

Therefore, for every unit of output in Operation-5 Input required in Operation

1 = 2 units.

2. Labour and Overhead per unit of output