Pricing Decision – CA Final SCMPE Study Material is designed strictly as per the latest syllabus and exam pattern.

Pricing Decision – CA Final SCMPE Study Material

Question 1.

Divya Electronics Ltd. (DEL) produces its only product ToT. To manufacture one unit of ToT, variable cost of ₹ 2,20,000 is incurred. Market research has indicated that at a selling price of ₹ 5,10,000 no order will be received, but the demand for ToT will be increased by two units with every ₹ 5,000 reduction in the unit selling price below ₹ 5,10,000.

Requirement:

Determine the unit selling price for ToT that will maximize the profit of Divya Electronics Ltd.

Answer:

Let ‘P’ be the Selling Price per unit of ToT and ‘Q’ is the Quantity 5 Demanded, at which the profits of Divya Electronics will be maximum. ‘

Step 1: To find out Revenue function

Price Equation (P) = a – bQ

Price per Unit (P) = 5,10,000 – (5,000/2) × Q = 5,10,000 – 2,500 Q

Quantity Demanded = Q

Revenue (R) = (5,10,000 – 2,500 Q) × Q = 5,10,000 Q – 00 Q2

Step 2: To find out Marginal Revenue

Marginal Revenue (MR) = First derivative of Revenue Function

= \(\frac{d R}{d Q}==\frac{d R}{d Q}\)(5,10,000 Q – 2,500 Q2) = 5,10,000 – 5,000 Q

Step 3: To find out Marginal Cost

Marginal Cost (MC) = ₹ 2,20,000

Step 4: For Profit Maximisation

The Profit is Maximum where Marginal Revenue (MR) equals to Marginal Cost (MC).

5,10,000 – 5,000 Q = 2,20,000

5,000 Q = 2,90,000

Q = 2,90,000/5,000 = 58 units

Putting the Value of ‘Q’ in Price Equation:

P = 5,10,000 – 2,500 Q

= 5,10,000 – 2,500 (58)

= ₹ 3,65,000

Answer: The profit will be maximum, when Selling Price is fixed at ₹ 3,65,000 per unit.

![]()

Question 2.

PPL is selling special jackfruit cookies for diabetic patients at a selling price of $100 per cookie packet, the company will sell 20,000 units p.a. Market researcher of PPL has observed that people are not very health conscious they don’t know the benefits of jack fruit and that for every Rs. 2 change in the selling price of cookie packet, the demand will change by 2,000 packets. The cost comprise a fixed cost of Rs. 100,000, together with a variable cost of Rs. 5 per packet.

Required:

Calculate the selling price per packet of cookies that will result in maximum profit per annum and the amount of that profit.

Answer:

Let ‘P’ be the Selling Price per unit of cookie packet and ‘Q’ is the Quantity Demanded, at which the profits of PPL will be maximum.

Step 1: To determine the value of “a” in Demand Equation

Price Equation for cookies packet P = a – bQ

P= 100

B = 2/2000 = 0.001 Therefore,

100 = a – (2/2000) × 20,000

a = 120

Step 2: To find out Revenue function

Price Equation P = a – bQ

Price per Unit (P) = 120 – (2/2,000) × Q

= 120 – 0.001Q

Quantity Demanded = Q

Revenue (R) = (120 -0.00IQ) × Q

= 120Q – 0.001 Q2

Step 3: To find out Marginal Revenue

Marginal Revenue (MR) =First derivative of Revenue Function

= \(\frac{d R}{d Q}=\frac{d R}{d Q}\) (1200 – 0.001Q2) = 120 – 0.002Q

Step 4: To find out Marginal Cost

Marginal Cost (MC) = $5

Step 5: For Profit Maximisation

The Profit is Maximum where Marginal Revenue (MR) equals to Marginal Cost (MC).

120 – 0.002Q = 5

0.002Q = 115

Q = 115/0.002 = 57,500 units

Putting the Value of ‘Q’ in Price Equation:

P= 120-0.001 Q

P = 120 – 0.001 (57,500) = 120 – 57.5 = $ 62.50 per unit

Answers:

The Selling price of $ 62.50 per packet of cookie will result in maximum profit per annum.

Determination of the amount of maximum profit:

Selling Price per packet = $ 62.50

Variable Cost per packet = $ 5

Contribution per packet = $ 62.50 – $ 5 = $ 57.50

Units sold = 57,500 packets

Total Contribution = 57,500 × $ 57.50 = $ 33,06,250

Max. Profit = Total Contribution – Fixed Costs = $ 33,06,250 – $ 1,00,000 = $ 32,06,250

Question 3.

ISSA Pvt. Ltd. is a Tomato ketchup manufacturing company, they are manufacturing delicious ketchups which can be used to make nutritious food exciting. However, the ketchup market is very competitive and subject to frequent changes.

The finance team at ISSA prepare monthly rolling budgets as part of their planning and management control process. The data for the forthcoming new budget period are as follows:

The variable cost of producing a bottle of ketchup is $42. The planned selling price of a bottle of ketchup is $90 and at this selling price the demand for ketchup is expected to be 125,000 bottles. Information from the marketing division at ISSA suggests that for every $6 increase in the selling price the customer demand would reduce by 10,000 bottles, and that for every $6 decrease in the selling price the customer demand would | increase by 10,000 bottles.

Note: If P = a – bx then MR = a – 2bx

Required:

Calculate the revenue that ISSA would earn if the selling price of a bottle of ketchup was set so that profits w ould be maximised for the forthcoming budget period,

Answer:

Determination of “a” i.e. the price at which the sales quantity would be Zero:

P = a – bx

Here:

P = 90

b = 6/10,000 or (6 4- 10,000) = 0.0006

Therefore,

90 = a – (0.0006) × 125,000 a = 165

To find out Revenue function

Price per Unit (P) = 165 – 0.0006x

Quantity Demanded = x

Revenue (R) = (165 – 0.0006x) × x = 165x – 0.0006x2

To find out Marginal Revenue

Marginal Revenue (MR) =First derivative of Revenue Function

= \(\frac{d R}{d x}=\frac{d R}{d x}\) (165x – 0.0006x2) = 165 – 0.0012x

To find out Marginal Cost

Marginal Cost (MC) = $ 42

The Profit is Maximum where Marginal Revenue (MR) equals to Marginal Cost (MC).

165 – 0.0012x = 42

0.0012x = 123

x = 123/0.0012 = 1,02,500 units

Substituting the Value of ‘x’ in demand function

P = 165 – 0.0006x

P = 165 – 0.0006(1,02,500) = $ 103.50 per unit

Maximum Revenue

Revenue (R) = = $103.5 × 1,02,500

Units = $ 1,06,08,750

Question 4.

Subway India Ltd. (SIL) is an ISO 9001:2008, a premier multi-discipline company. SIL manufactures a diverse range of products viz. Pressure Vessels, Wagons, Steel Castings etc. To manufacture Wagons, SIL undertake structural fabrication jobs and manufacturing, retrofitting of EOT crane. It is presently the flagship company of the Subway Group comprising of renowned companies such as Krishna Agriculture, Chiang Phosphate etc. The Group was launched with the idea of one virtual company with diversified businesses, and is based on four fundamental principles – Collaboration, Sustainability, Inclusiveness and being Global.

Subway India Ltd. has two Divisions namely, Bogie Division (BD) and Wagon Division (WD) for manufacturing of Wagon. ‘BD’ manufactures Bogies and ‘ WD’ manufactures various type of Wagons like Freight Wagon, Tank Wagon, Special Wagon etc. To manufacture a Wagon, ‘WD’ needs 4 Bogies. ‘BD’ is the only manufacturer of the Bogies and supplies both ‘WD’ and outside customers. Details of ‘BD’ and ‘WD’ for the coming financial year 2018-19 are as follows:

| BD | WD | |

| Fixed Costs (₹ ) | 9,20,20,000 | 16,45,36,000 |

| Variable Cost per unit (₹ ) | 2,20,000 | 4,80,000 |

| Capacity per month (units) | 320 | 12 |

* excluding transfer costs

Market research has indicated that the demands in the market for Subway India Ltd.’s products at different quotations are as follows-

| For

Bogies |

Quotation price of ₹ 3,20,000 no tender will be awarded, but demand will increase by 30 Bogies with every ₹ 10,000 reduction in the unit quotation price below ₹ 3,20,000. |

| For

Wagons |

Quotation price of ₹ 17,10,000 no tender will be awarded, but the demand for Wagons will be increased by 2 Wagons with every ₹ 50,000 reduction in the unit quotation price below ₹ 17,10,000. |

Further, ‘BD’ is the only manufacturer of Bogies but due to increased demand, competitors are entering the market. The division is reviewing its pricing policy and carrying out some market research. After the market research, the division SBD’ has decided to introduce new type of “E” Class Bogies in the market and to obtain the patent right for such unique Bogies. High growth in future characterizes this Class.

Required:

(i) CALCULATE the unit quotation price of the Wagon that will maximise Subway India Ltd.’s profit for the financial year 2018-19.

(ii) CALCULATE the unit quotation price of the Wagon that Is likely to emerge If the divisional managers of ‘BD* and ‘WD’ both set quotation prices calculated to maximise divisional profit from sales to outside customers and the transfer price is set at market selling (quotation)

[Note: If P = a – hQ then MR = a – 2bQ]

(iii) RECOMMEND appropriate pricing strategy while introducing the ”E” Class Bogies.

Answer:

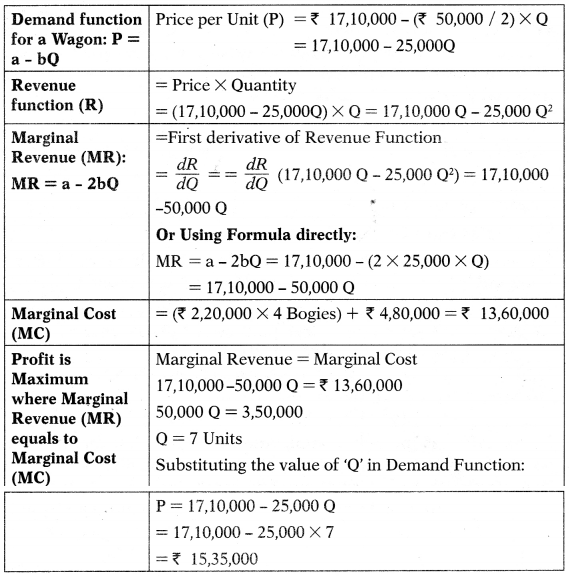

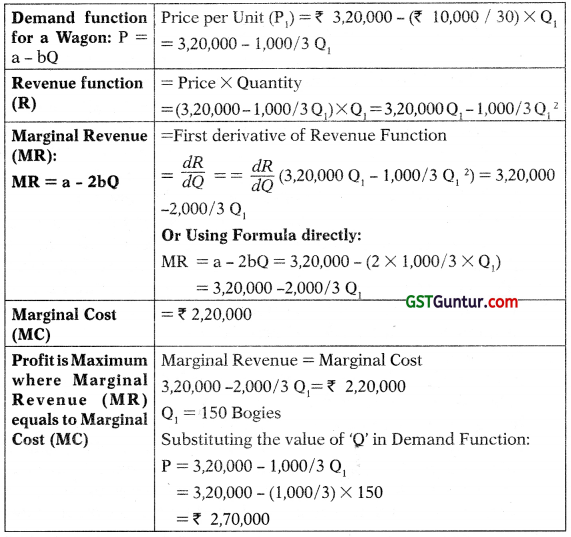

(i) Let ‘P’ be the Quotation Price per unit and ‘Q’ is the Quantity of Wagon, at which the profits of Subway India Limited will be maximum.

At 7 15,35,000 per unit Quotation Price of a Wagon, the Subway Company Ltd.’s Profit will be Maximum.

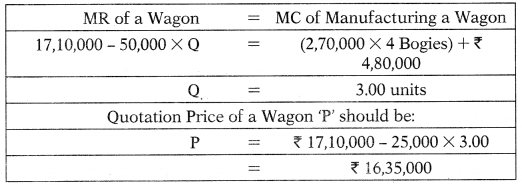

(ii) Let ‘P1‘ be the Quotation Price per unit and ‘Q’ is the Quantity of Bogies, at which the profits of Subway India Limited will be maximum.

‘BD’ will earn Maximum Profit when it Quotes ₹ 2,70,000 to the Outside Market. Since, Outside Market Quotation is Transfer Price as well, so Transfer Price to WD will be ₹ 2,70,000 and it forms part of WD’s Marginal Cost.

At ‘WD’, Division Manager would ensure that Divisional Marginal Revenue should be equal to Division’s Marginal Cost so that Profit can be Maximum.

The unit Quotation Price of Wagon that emerges as a result of Market Based Transfer Pricing is ₹ 16,35,000.

(iii) Whenever a new product is launched into the market, management can adopt either Skimming or Penetration strategy.

The idea behind Skimming Strategy is to intentionally keep a price high to recover the high R&D and marketing expenses associated with developing a new product. For Price Skimming to work, the product must be perceived as having unique advantage over its competing products, very difficult to copy or protected by patents.

Division ‘BD’ may follow Skimming Strategy by taking advantage of the distinctive features of Bogie “E”. High prices in the early stages of a Bogies’ life cycle are expected to generate high initial cash flows, this will help the division to recover the high development costs it would incur. Further, this new Bogie “E” is protected from competition through entry barrier. Such barrier is patent.

With Penetration Strategy, a low price is initially charged for the product rather than high prices. The idea behind this is that the price will make the product accessible to many buyers and therefore the high sales will compensate for the lower prices being charged. This penetration pricing is adopted for rapid market acceptance, maximum sales and discouraging competition from the market, however this strategy is not for all companies since it requires a cost structure and scale economics that remain unaffected by narrow profits margin.

The circumstances which may favour a penetration pricing policy are:

- Highly elastic demand for the product, ie. the lower the price, the higher the demand. This situation is not mentioned in this case for Bogies “E”.

- If significant economies of scale could be achieved so that higher sales volumes would result in reductions in costs. However, in this case, it cannot be ascertained.

- Where entry barriers are low, however in this case, new competitors cannot enter the market as Bogies “E” is protected by patent.

- If company desires to shorten the initial period of the product’s life-cycle to enter the growth and maturity stages quickly, how-ever, there is no evidence the division ‘BD’ wish to do this.

- Overall, due to the uniqueness, heavy R&D cost, and barrier to entry 1 for competitor, a market skimming pricing strategy is appeared to be the more appropriate pricing strategy for Bogie “E”.

![]()

Question 5.

Sree Ram Pvt. Ltd. a manufacturing organization, which manufacture and sell a number of different products. AH of its product have life cycle of less than one year. For its different products SreeRam Pvt. Ltd. uses a four stage life cycle model which involves Introduction, Growth, Maturity and Decline.

SreeRam has recently developed an innovative product. For this innovative product management of SreeRam has decided that it would be appropriate to adopt a market skimming pricing policy for the launch of the product. However, the management expects that other companies will also try to join the market very soon.

At present this product is in its Introduction stage of its life cycle and is generating significant unit profits. However, there are concerns that z these current unit profits will not continue during the other stages of the product’s life cycle.

EXPLAIN, with reasons, the changes, if any, to the unit selling price and the unit production cost that could occur when the products move from the previous stage into each of the following stages of its life cycle:

Answer:

Growth Stage

Compared to the introduction stage the likely changes are as follows:

Unit Selling Prices:

These are likely to be reducing for a number of reasons:

- The product will become less unique as competitors use reverse engineering to introduce their versions of the product.

- SreeRam may wish to discourage competitors from entering the market by lowering the price and thereby lowering the unit profitability.

- The price needs to be lowered so that the product becomes attractive to different market segments thus increasing demand to achieve the growth in sales volume.

Unit Production Costs;

These are likely to reduce for a number of reasons:

- Direct materials are being bought in larger quantities and therefore SreeRam may be able to negotiate better prices from its suppliers thus causing unit material costs to reduce.

- Direct labour costs may be reducing if the product is labour intensive due to the effects of the learning and experience curves.

- Other variable overhead costs may be reducing as larger batch sizes reduce the cost of each unit.

Fixed production costs are being shared by a greater number of units.

Maturity Stage

Compared to the growth stage the likely changes are as follows:

Unit Selling Prices;

These are unlikely to be reducing any longer as the product has become established in the market place. This is a time for consolidation and whilst there may be occasional offers to tempt customers to buy the product the selling price is likely to be fairly constant during this period.

Unit Production Costs;

Direct material costs are likely to be fairly constant in this phase and may even rise as the quantities required diminish compared to those required in the growth stage with the consequential loss of negotiating power.

Direct labour costs are unlikely to be reducing any longer as the effects of the learning and experience curves have ended. Indeed the workers may have started working on the next product so that their attention towards this product has diminished with the result that these costs may increase.

Overhead costs are likely to be similar to those of the end of the growth phase as optimum batch sizes have been established and are more likely to be used in this maturity stage of the product life cycle where demand is more easily predicted.

Question 6.

(Pricing and Product Life Cycle)

Dream Internationa] is a major airline operating from India. It is the biggest airline operator within the domestic airline segment and is a well-established player in the international airline segment. Except for a Benitne Ltd. is a leading company in the Footwear Industry. The company has four factories in different locations with state of the art equipments. Due to competition in the market, company is continually reviewing Its product range and enhancing its existing products by developing new model, mis to satisfy the demands of its customers.

The company currently has a production facility which has a capacity of 3,500 standard hours per week.

Product ‘Comfort’ was introduced to the market six months ago and is now about to enter the maturity stage of its life cycle.

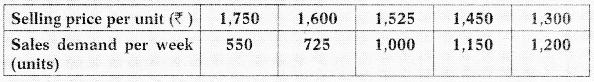

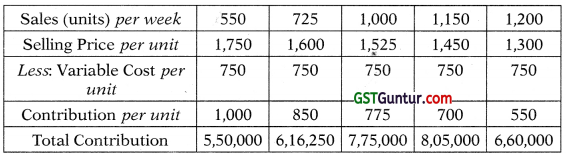

However, research by the marketing department indicates that demand of the product ‘Comfort’ in the market is price sensitive. The likely market responses are as follows:

The variable cost per unit of manufacturing ‘Comfort’ is ₹ 750. Standard hours used to manufacture one unit is 2 hours.

Product ‘Sports’ was introduced to the market two months ago using a penetration pricing policy and is now about to enter its growth stage. Each unit has a variable cost of ₹ 545 and takes 2.50 standard hours to produce. Market research has indicated that there is a linear relationship between its selling price and the number of units demanded, of the form P = a – bx. At a selling price of ₹ 1,000 per unit demand is expected to be 1,000 units per week. For every ₹ 100 increase in selling price the weekly demand will reduce by 200 units and for every ₹ 100 decrease in selling price the weekly demand will increase by 200 units.

Product ‘Ethnic’ is currently being developed and which is about to be launched in the market. This is a highly innovative designer product which the company believes that it will have a revolutionary impact on the market and consumer behaviour. The company has decided to use a market skimming approach to pricing this product during its introduction stage.

Required

(a) (i) AD VISE which of the above five selling prices should be charged for product ‘Comfort’, in order to maximize its contribution during its. maturity stage.

(ii) CALCULATE the number of units to be produced of product ‘Sports’ in order to utilize all of the spare capacity from your answer to (i) above and the selling price per unit of product ‘Sports’ during its growth stage. (2 + 3 = 5 marks)

(b) COMPARE penetration and skimming pricing strategies during the introduction stage, using product ‘Ethnic’ to illustrate your answer. (4 marks)

(c) EXPLAIN with reasons, for each of the stages of ‘Ethnic’s product 7: x .life cycle, the changes that would be expected in the

(i) average unit production cost

(ii) unit selling; price. [May 2019 Exam](3 + 5 + 4 + 8 Marks)

Answer:

(a) (i) Selling Price for “Comfort” that would maximize its contribution at Maturity Stage

Contribution per unit of “Comfort” = Selling Price per unit – Variable Cost per unit Total Contribution = Contribution per unit × Units sold

All figures in Rupees

Total contribution is maximum when sales are 1,150 units. Therefore, the selling price per unit of “Comfort” should be ₹ 1,450 per unit.

(ii) Production Number of “Sports” and Selling Price per unit

Benime Ltd. has a production capacity of 3,500 hours per week. As explained in (i) above, it would manufacture 1,150 units of “Comfort” per week. Each unit of “Comfort” requires 2 hours of production. Therefore, total production hours for Comfort would be 1,150 units × 2 hours = 2,300 hours per week.

Production capacity remaining to manufacture “Sports” = 3,500 hours – 2,300 hours = 1,200 hours per week. Each unit of “Sports” requires 2.5 hours of production.

Therefore, the number of “Sports” units that can be produced = 1,200 hours/2.5 hours = 480 units per week.

Linear relationship between Selling Price and Number of Units Demanded has been given to be P= a – bx.

P = Selling Price per unit a = Selling Price when demand will be zero

b (slope) = Change in Price/Change in Quantity x = Quantity Demanded

Given, at a Selling Price of ₹ 1,000 per unit, Quantity Demanded will be 1,000 units per week. For every ₹ 100, per unit increase/decrease in Selling Price, the Quantity Demanded will decrease/increase by 200 units per week respectively. A ₹ 500 per unit increase in Selling Price will result in fall of 1,000 units of Sales per week. The Selling Price at which Sales will be Zero ie. a = ₹ 1,500 per unit.

b (slope) = Change in Price/Change in Quantity = ₹ 100/200 = 0.50

Penetration pricing is most commonly associated with a marketing objective of increasing market share or sales volume, rather than short term profit maximization. Thus, substituting the values in the equation to find the Selling Price of “Sports” when the Quantity Sold is 480 units:

P = a – bx

= 1,500 – 0.50 × (480)

= 1,500 – 240 = ₹ 1,260

Sports should be sold at t 1,260 per unit during the growth stage.

(b) “Ethnic” is given to be a highly innovative product that is about to be launched into the market. The product with unique features that will differentiate it from other products leading to a revolutionary impact on market and customer behaviour. There seem to be no competitors providing similar products.

Skimming Price Strategy is adopted to charge high prices in the introduction stage in order to recover costs.

Skimming Price will be suitable for “Ethnic” because:

- Market for the product is not yet established. Initially high promotional expense may have to be incurred to create customer awareness and build a market for the product.

- Due to its innovative feature, the customers would not mind paying a premium for the unique product offering. Demand would be inelastic.

- The market demand is unknown. Initial capital outlay to produce this product may be high, resulting in high cost of production.

- Production and promotional costs in the initial years is likely to be high. Therefore, a higher selling price would help Benime Ltd. to recover the costs. Since demand is likely to be inelastic, charging a premium may not be a problem.

- The price can be gradually reduced once the market for the product is established. Competitors may reverse engineer and offer similar products, due to which price may have to be lowered in the long run to retain customers.

Penetration Pricing is adopted to charge a low price in the initial stage for penetrating the market as quickly as possible. For a new product, this low-price strategy will popularize the product. Once the market is established, he price may be increased.

Penetration pricing will be suitable when:

- Demand for the product is elastic, more demand when prices are low.

- Large scale production of the product yields economies of scale.

- Threat of competition requires prices to be set low. It serves as an entry barrier to prospective competitors as well.

Product “Ethnic” is an innovative product that the manufacturer believes will change the whole market once it is launched. A strategy of penetration pricing could be effective in discouraging potential new entrants to the market. However, the product is believed to be unique and as such demand is likely to be fairly inelastic. In this instance a policy of penetration pricing could significantly reduce revenue without a corresponding increase in sales. Thus, this strategy is not suitable for “Ethnic”.

(c) Impact on Unit Selling Price and Average Cost of Production per unit at each stage of “Ethnic” Product Lifecycle

Introduction Stage

As explained in (b) above, at the Introduction Stage of Lifecycle, due to high cost of production and initial promotion expenditure, the unit

cost of production will be high. Using Skimming Price Policy, the unit selling price will also be high.

Growth Stage

This is the second phase of the Life-Cycle, product awareness among customers would result in increased demand. Therefore, scale of production likely to increase. The new market segment would attract competitors, who are like to reverse engineer and offer similar products in the market. Promotional activities and marketing activities need to continue to maintain and gain market share.

Accordingly, the unit selling price would reduce from the introduction stage on account of the following reasons:

- Competitors offering similar product would take away the uniqueness feature of “Ethnic”.

- Again, to gain market share, the unit selling price may have to be lowered to make it attractive to a larger segment of customers.

The unit cost of production is also likely to reduce due to the following reasons:

- Increased production would result in increased material procurement from suppliers. Bulk purchasing discounts can be negotiated with them to lower cost of production.

- Learning curve and experience would enable the labour force to become more efficient. This leads to higher production with the same level of resources leading to cost savings.

- Larger production batches due to increase in scale of operations will reduce the unit variable overhead cost.

- Economies of scale would result due to fixed overhead cost being spread over larger number of units.

Maturity Stage

The third phase of Product Life-Cycle that is characterized by an established market for “Ethnic”. After rapid growth in sale volume in the previous stages, growth of sales for the product will saturate. Competition would be high due to large number of rivals in the market, this may lead to decreasing market share.

It is likely that the price of the product will be lowered further at the maturity stage in a bid to preserve sales volumes. The company may- attempt to preserve sales volumes by employing an extension strategy rather than reducing the selling price. For example, they may introduce product add-ons to the market that are compatible with “Ethnic”.

Unit production cost will remain constant

- Direct material cost will remain constant. If procurement is lower than the growth phase, it might even lead to slightly higher prices since supplier may not extend bulk discounts.

- The benefits of efficient production due to the effect of learning and experience may also have warned. Therefore, unit labour cost is also likely to remain constant.

- Since scale of production is no longer increasing, the unit variable overhead costs are also likely to remain constant.

Decline Stage

This last stage in the product cycle is characterized by saturated market, declining sales, change in customer’s tastes etc. Profitability may slowly start decreasing with fall in sales.

At the decline stage, Product “Ethnic” is likely to have been surpassed by more advanced products in the market and consequently will become obsolete. The company will not want to incur inventory holding costs for an obsolete product and is likely to sell “Ethnic” at marginal cost or perhaps lower.

Sales volumes at the decline stage are likely to be low as the product is surpassed by new exciting products that have been introduced to the market. Furthermore, the workforce may be less interested in manufacturing a declining product and may be looking to learn new skills. For both of these reasons, unit production costs are likely to increase at the decline stage.

![]()

Question 7.

Compass Ltd. has developed a special product. Details are as follows: The product will have a life cycle of 5,000 units. It is estimated that market can absorb first 4,500 units at ₹ 64 per unit and then the product will enter the “decline” stage of its life cycle.

The company estimates the following cost structure:

Direct Labour ₹ 6 per hour Other variable costs ₹ 19 per unit

Fixed costs will be ₹ 40,000 over the life cycle of the product. The ‘labour rate’ and both of these costs will not change throughout the product’s life cycle.

The first batch of 100 units will take 1,000 labour hours to produce. There will be an 80% learning curve that will continue until 2,500 units have been produced. Batches after this level will each take the same amount of time as the 25th batch. The batch size will always be 100 units.

Required

CALCULATE average selling price of the final 500 units that will allow the company to earn a total profit of ? 80,000 from the product if average time for 24 batches is 359.40 hours.

(Note: Learning coefficient is -0.322 for learning rate of 80%). The values of Logs have been given for calculation purpose:

log 2 = 0.30103; log 3 = 0.47712; log 5 = 0.69897; antilog of 2.534678 = 342.51; antilog of 2.549863 = 354.70; antilog of 2.555572 = 359.40; i antilog of 2.567698 = 369.57

Answer:

Average ‘Selling Price of the final 500 units

| Particulars | Amount (₹) |

| Direct Labour j (8,867.50 hrs. + 241.90 hrs. × 25 batches) × ₹ 6] | 89,490 |

| Add: Other Variable Costs (5,000 units × ₹ 19) | 95,000 |

| Add: Fixed Costs | 40,000 |

| Total Life Cycle Cost | 2,24,490 |

| Add: Desired Profit | 80,000 |

| Expected Sales Value (5,000 units × ₹ 19) | 3,04,490 |

| Less: Sales Value (4,500 units × ₹ 64) | 2,88,000 |

| Sales Value (Decline Stage) …(A) | 16,490 |

| Sales Units (Decline Stage) -(B) | 500 |

| Average Sales Price per unit ,..(A)/(B) | 32.98 |

Workings

(i) The cumulative average time per batch for the first 25 batches

The usual learning curve model is

Y = Axb

Where

Y = Average time per batch (hours) for x batches

A = Time required for first batch(hours)

X = Cumulative number of batches produced

B = Learning coefficient

The Cumulative Average Time per batch for the first 25 batches

Y = 1,000 × (25)-0.322

log y = log 1,000 – 0.322 × log 25

log y = log 1,000 – 0.322 × log (5 × 5)

log y = log 1,000 – 0.322 × [2 × log 5]

log y = 3 – 0.322 × [2 × 0.69897]

log y = 2.549863

Y = antilog of 2.549863

Y = 354.70 hours

(ii) The time taken for the 25th batch

Total Time for first 25 batches = 354.70 hours × 25 batches

= 8,867.50 hours

Total Time for first 24 batches = 359.40 hours × 24 batches

= 8,625.60 hours

Time taken for 25th batch = 8,867.50 hours – 8,625.60 hours

= 241.90 hours

Question 8.

ARC is a manufacturing organization, recently company is developing a new product. During the expected life of the product 16,000 units of the product will be sold for $82 per unit.

Production will be in batches of 1,000 units throughout the life of the product. The direct labour cost is expected to reduce due to the effects of learning for the first eight batches produced. Thereafter, the direct labour cost will remain constant at the same cost per batch as the 8th batch.

The direct labour cost of the first baich of 1,000 units is expected to be $35,000 and a 90% learning effect is expected to occur.

The direct material and other non-labour related variable costs will be $40 per unit throughout the life of the product.

There are no fixed costs that are specific to the product.

Required:

(a) CALCULATE the expected selling price to be charged from the product over its lifetime to earn profit of $215,000

Note: The learning index for a 90% learning curve = -0.152

It is now thought that a learning effect will continue for all of the 16 batches that will be produced.

(b) CALCULATE the rate of learning required to achieve a lifetime product contribution of $4,00,000, assuming that a constant rate of learning applies throughout the product’s life.

Answer:

(a) Calculation of expected selling price to be charged from the product ; over its lifetime to earn desired profit of $2,15,000

| $ | |

| Total labour cost over the product’s life ($2,04,120 + (8 × $21,854)) | 3,78,952 |

| Direct material & other related variable costs over the product’s life (16,000 × $40) | 6,40,000 |

| Add: Desired Profit | 2,15,000 |

| Total Expected Sales | 12,33,952 |

Expected selling price per unit to be charged from the product over its lifetime to earn the desired profit = \(\frac{\$ 12,33,952}{16,000}\) = $ 77.12

Working Note:

Determination of Direct labour cost for 8th batch

| for 8 batches | for 7 batches | |

| Cumulative average direct labour cost | y = axb y = $ 35,000 × 8-0.152 y = $25,515 |

y = axb y = $ 35,000 × 7-0.152 y = $ 26,038 |

| The total direct labour cost | = 8 × $ 25,515 = $ 2,04,120 |

= 7 × $ 26,038 = $ 1,82,266 |

Direct labour cost for 8th batch = $ 2,04,120 – $ 1,82,266 = $ 21,854

(b) Determination of required rate of learning

In order to achieve a contribution of $4,00,000 the total labour cost over the product’s lifetime would have to equal ($6,72,000 – $4,00,000) = $2,72,000

This equals an average batch cost of $2,72,000/16 = $17,000

This represents $ 17,000/ $35,000 = 48.571 % of the cost of the first batch 16 batches represents 4 doublings of output.

Therefore, the rate of learning required =4 √0.48571 = 83.482%

![]()

Question 9.

You have been appointed to state the most appropriate pricing policies to be most suited in the following independent situations:

(i) The company manufactures original equipment and does railways contract work. Other companies are also there in the market who also undertake similar projects.

(ii) Patented Drug for COVID 19 ready to be launched in the market.

(iii) A bike manufacturer is launching an innovative, technologically advanced bike in the highly priced segment.

(iv) A company making a variant of sanitizers, trying to enter the market. The same varieties of sanitizers are already successfully capturing the market.

(v) A successful mobile manufacturing company has built into its latest tablet, an additional sliding screen and improved processing capabilities so that the tablet is almost a laptop. [Nov. 2020] (5 Marks)

Answer:

(i) Sealed Bid Pricing

(ii) Skimming Pricing

(iii) Premium Pricing/Skimming Pricing

(iv) Market Price

(v) Demand Based Pricing

Question 10.

(Pricing Method)

(i) Name any two competition-based pricing methods.

(ii) RECOMMEND the Pricing Strategy to be adopted with reference to the following situations. You are NOT required to explain the reasons for your answer.

(a) Hub Coffee Shop follows the practice of keeping the price of its coffee or service artificially high in order to encourage favourable perceptions among buyers, based solely on the price.

(b) Tada Sky TV gave away their satellite dishes for free in order to set up a market for them.

(c) Royal Hotels Ltd. follows a competitive pricing method under which it tries to keep its price at an average level charged by the Industry.

(d) Meddisson Enterprises has piled up stocks in large quantities and the market price has fallen.

(e) Acqua LLP follows a new product pricing strategy through

which company makes profitable sales by selling out few units.

(j) Silent Ltd. produces Product BX a revolutionary product and as a reward for innovation and for taking first initiative which pricing strategy should Silent Ltd. adopt?

(g) Lavy is a well-established company has recently entered the stationery market segment and launched quality paper for printing at home and office.

(h) PJX is a perishable item, with more than 80% of its shelf life is over. [May 2019] (2 + 8 Marks)

Answer:

(i) Competition Based Pricing Methods – Going Rate Pricing, Sealed Bid Pricing

(ii) Pricing Strategy to be adopted:

(a) Premium Pricing

(b) Penetration Pricing

(c) Going Rate Pricing

(d) Pricing Below Marginal Cost

(e) Skimming Pricing

(f) Premium Pricing

(g) Market Price

(h) Any Cash Realizable Value

Question 11.

(Pricing Method)

Rone Ltd. is a manufacturing organization. The management of the company has provided the budgeted cost data of a product “X” manufactured by the company.

| Budgeted units of “X” to be produced | 2,00,000 |

| Variable cost (₹) | 32 per unit |

| Fixed cost (₹) | 16 lacs |

It is proposed to adopt cost plus pricing approach with a mark-up of 25% on full budgeted cost basis.

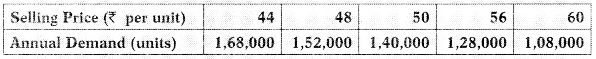

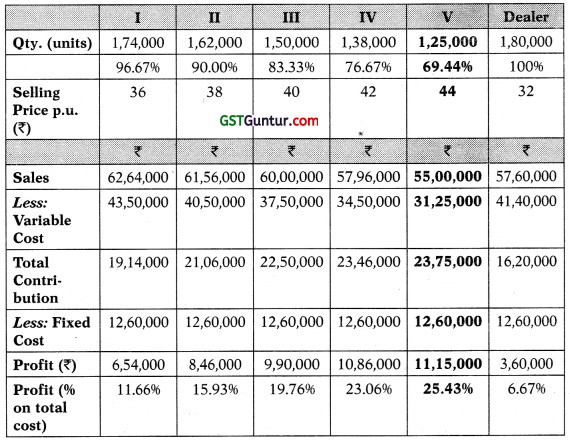

However, research by the marketing department indicates that demand of the product in the market is price sensitive. The likely market responses

are as follows:

Required

ANALYSE the above situation and DETERMINE the best course of action. [MTP 2018; RTF Nov. 2019 (10 Marks)]

Answer:

Analysis of Cost plus Pricing Approach

The company has a plan to produce 2,00,000 units and it proposed to adopt Cost plus Pricing approach with a markup of 25% on full budgeted cost. To achieve this pricing policy, the company has to sell its product at the price calculated below:

| Qty. | 2,00,000 units |

| Variable Cost (2,00,000 units × ₹ 32) | 64,00,000 |

| Add: Fixed Cost | 16,00,000 |

| Total Budgeted Cost | 80,00,000 |

| Add: Profit (25% of ₹ 80,00,000) | 20,00,000 |

| Revenue (need to earn) | 1,00,00,000 |

| Selling Price per unit (₹ 1,00,00,000/2,00,000 units) | 50 per unit |

However, at selling price ₹ 50 per unit, the company can sell 1,40,000 units only/which is 60,000 units less than the budgeted production units.

After analyzing the price-demand pattern in the market (which is price sensitive), to sell all the budgeted units market price needs to be further lowered, which might be lower than the total cost of production.

Statement Showing “Profit at Different Demand & Price Levels”

(i) Taking the above calculation and analysis into account, the company should produce and sell 1,28,000 units of “X” at ₹ 56. At this price company will not only be able to achieve its desired mark up of 25% on the total cost but can earn maximum contribution as compared to other even higher selling prices.

(ii) If the company wants to uphold its proposed pricing approach with the budgeted quantity, it should try to reduce its variable cost per unit for example by asking its supplier to provide a quantity discount on the materials purchased.

Question 12.

(Pricing Strategy)

Easy Tech Ltd. (ETL) is a leading IT security solutions and ISO 9001 certified company. The services provided by : Easy” Tech Ltd. are the solutions, well integrated systems that simplify IT security management across the length and depth of devices and on multiple platforms. Easy Tech Ltd has recently developed an Antivirus Software and company expects to have life cycle of less than one yeat. It was decided that it would be appropriate .to” adopt a market skimming pricing policy ior the launch of the product. This Software is currently in the Introduction stage of its life cycle and is generating significant unit profits.

Required

(i) EXPLAIN, with reasons, the changes, if any, to the unit selling price that could occur when the Software moves from the Introduction stage to Growth stage of its life cycle.

(ii) Also, IDENTIFY necessary strategies at this stage. [May 2018 RTP]

Answer:

(i) Following acceptance by early innovators, conventional consumers start following their lead. New competitors are likely to now enter the market attracted by the opportunities for large scale production and profit. Easy Tech Ltd. may wish to discourage competitors from entering the market by lowering the price and thereby lowering the unit profitability. The price needs to be lowered so that the product becomes attractive to different market segments thus increasing demand to achieve the growth in sales volume.

(ii) Strategies at this stage may include the following:

(a) Improving quality and adding new features such as Data Theft Protection, Parental Control, Web Protection, Improved Scan Engine, Anti Spyware, Anti Malware etc.

(b) Sourcing new market segments/ distribution channels.

(c) Changing marketing strategy to increase demand.

(d) Lowering price to attract price-sensitive buyers.

Question 13.

(Pricing Method)

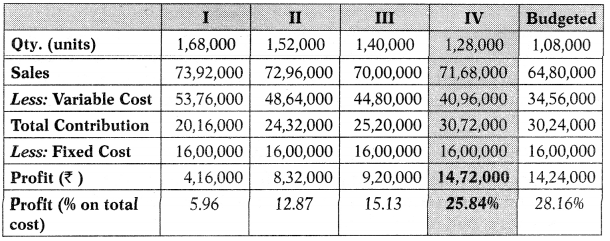

Arogya Pvt. Ltd. is a manufacturing organization, which is preparing a product. The management of the company has prepared a budget for the next year as follows:

| Fixed Cost p.a | ₹ 12,60,000 |

| Variable Cost p.u | ₹ 25 |

| Production | 1,80,000 units |

Selling price – Cost plus 25% mark up on total budgeted cost

When these budgeted figures and the pricing approach were informed to

the Marketing Manager, he came out with a remark that the demand for the product is more price sensitive and he expected the demand under various prices as given below:

The Marketing Manager further informed that a wholesale dealer is ready to buy the entire production of the company at a price of ₹ 32 p.u. In that situation he expected a savings of ₹ 2 p.u. in the selling expenses which are a part in the above stated variable cost.

Required

EVALUATE the situation and advice the most profitable course of action. [May 2019] (10 Marks)

Answer:

(a) The company has a plan to produce 1,80,000 units and it proposed to adopt Cost plus Pricing approach with a markup of 25% on full budgeted cost. To achieve this pricing policy, the company has to sell its product at the price calculated below:

| Qty. | 1,80,000 units |

| Variable Cost (1,80,000 units × ₹ 25) | 45,00,000 |

| Add: Fixed Cost | 12,60,000 |

| Total Budgeted Cost | 57,60,000 |

| Add: Profit (2596 of ₹ 57,60,000) | 14,40,000 |

| Revenue (need to earn) | 72,00,000 |

| Selling Price per unit₹ 72,00,000/1,80,000 units | 40 per unit |

However, at selling price ₹ 40 per unit, the company can sell 1,50,000 j units only, which is 30,000 units less than the budgeted production units.

After analyzing the price-demand pattern in the market (which is price g sensitive), to sell all the budgeted units market price needs to be further g lowered, which might be lower than the total cost of production.

Statement Showing “Profit at Different Demand & Price Levels”

Advice

(i) Taking the above calculation and analysis into account, the com-pany should produce and sell 1,25,000 units (ie. near to 70% of budgeted production) at ? 44. At this price Arogya Pvt. Ltd. will not only be able to achieve its desired mark up of 25% on the total cost but can earn maximum contribution as compared to other even higher selling price.

(ii) Sell to wholesale dealer is not a financially viable option. Arogya Pvt. Ltd. will get only 6.67% margin on cost which is substantially lower than the desired level of mark up. However, this option will utilize the entire production. Instead Arogya may explore other opportunities to utilize additional capacity ie. 30%, for example, international expansion through e – commerce website or outsource the unutilized capacity to others to earn additional revenue.

![]()

Question 14.

(Pricing Method)

Trion Chemicals, is engaged in manufacturing many chemical products. It is using many chemicals some of which are fast moving, some are slow moving and few are in non-moving category. The firm has a Stock of 10 units of one non-moving toxic chemical. Its book value is ₹ 2,400, realizable value is ₹ 3,500 and replacement cost is ₹ 4,200.

One of the customers of the firm asks to supply 10 units of a product which needs all the 10 units of the non-moving chemical as an input. The other costs associated with the production of the product are:

| Allocated overhead expenses | ₹ 16 per unit |

| Out of pocket expenses | ₹ 50 per unit |

| Labour cost | ₹ 40 per hour. |

For each unit two hours are required. Other material cost ₹ 80per unit.

The labour force required for the production of the product will be deployed from among the permanent employees of the firm. This temporary deployment will not lead to any loss of contribution.

Required

(i) RECOMMEND the minimum unit price to be charged to the customer without any loss to the firm.

(ii) ANALYSE with reasons for the inclusion or exclusion of each of the cost associated with the production of the product.

(iii) ADVICE a pricing policy to be followed by Trion Chemicals in per feet competition. [Oct. 2019 MTP/2020] (4 + 4 + 2 Marks)

Answer:

(i) Trion Chemicals has the opportunity to utilize 10 units of non-moving I chemical as input to produce 10 units of a product demanded by one of its customers. The minimum unit price to be charged to the customer would be-

| Cost Component | Cost per unit of product (₹) |

| Cost of Material (Realizable value = ₹ 3,500/10 units of chemical) | 350 |

| Out of Pocket Expenses | 50 |

| Other Material Cost | 80 |

| Minimum Unit Price that can be charged | 480 |

Therefore, the minimum unit price that can be charged to the customer, without incurring any loss is ₹ 480 per unit of product. As explained j below in point (ii), allocated overhead expenses and labour cost are I sunk costs that have been ignored while calculating the minimum unit price to be charged.

(ii) Analysis

| Cost of Material | Relevant and hence included at realizable value. Trion Chemicals has 10 units of non-moving chemical input that has a book value of ₹ 2,400, realizable value of ₹ 3,500 and replacement cost of ₹ 4,200. Realizable value 1 of ₹3,500 would be the salvage value of the chemical had it been sold by Trion Chemicals instead of using it to meet the current order. This represents an opportunity cost for the firm and hence included while pricing the product. Book value would represent the cost at which the inventory has been recorded in the books, a sunk cost that has been ignored. Replacement cost of ₹ 4,200 would be the current market price to procure 10 units of the input chemical. This would be relevant only when the inventory has to be replenished after use. This chemical is from the non-moving category, that means that it is not used regularly in production process and hence need not be replenished after use. Therefore, replacement cost is also ignored for pricing. |

| Labour Cost | Not relevant and hence excluded from pricing. It is given in the problem that this order would be met by permanent employees of the firm. Permanent employee cost is a fixed cost that Trion Chemicals would incur irrespective of whether this order is produced or not. No additional labour is being employed to meet this order. Therefore, this cost is a sunk cost, excluded from pricing. |

| Allocated Overhead Expenses | These expenses have been incurred at another Cost Centre, typical example would be office and administration costs. Such costs are fixed in nature that would be incurred irrespective of whether this order is produced or not. Therefore, this cost is a sunk cost, excluded from pricing. |

| Out of Pocket Expenses | These are expenses that are incurred to meet the production requirement of this order. These are additional variable expenses, that need to be included in pricing. |

| Other Material Costs | These are expenses that are incurred to meet the production requirement of this order. These are additional variable expenses, that need to be included in pricing. |

(iii) Advice on Pricing Policy

Under perfect competition conditions, Trion Chemicals can have no pricing policy of its own, here sellers are price takers. It cannot increase its price beyond the current market price. The firm can only decide on the quantity to sell and continue to produce as long as the marginal cost is recovered. When marginal cost exceeds the selling price, the firm starts incurring a loss.

Since Trion Chemicals cannot control the selling price individually in the market, it can adopt the going rate pricing method. Here it can keep its selling price at the average level charged by the industry. This would yield a fair return to the firm. An average selling price would help the firm attract a fair market share in tompetitive conditions.

Question 15.

There is a government tender for construction of bridge on Yamuna river near a local town, Voi construction company wants .0 quote price for this tender.

Company needs to complete the construction of bridge order using 500 tonnes of steel and 1,000 tonnes of fiberglass. The work force w ill have to work 2,000 hours on construction: 1,200 hours will be in ihe assembly process and the remainder will be in the finishing i.e. painting and other finishing tasks. Company will quote a price of relevant cost plus 50%.

Company has 200 tonnes of steel held in inventory. This originally cost ₹ 10 per tonne. It now has a current price of H2 and could be sold for ₹ 8 per tonne. Company no longer construct steel made bridge and has no other use for steel. It only construct fibreglass bridge on a regular basis.

There are 400 tonnes of fibreglass held in inventory. This originally cost ₹ 20 per tonne. It currently has a purchase price of ₹ 23 per tonne and a selling price of ₹ 15 per tonne. (Selling price and net realisable value can be assumed to be the same figure).

All labour is paid ₹ 4 per hour. To complete the contract on time, labour for the finishing process will have to be transferred from other work which produces contribution at a rate of ₹ 3 per hour (after labour costs). There is currently surplus capacity for assembly labour amounting to 1,000 hours for the duration of the contract. Owing to other work requirements,. however, any further assembly labour hours in excess of these 1,000 hours will have to be hired on a temporary basis at a rate of ₹ 5 per hour.

Required

Calculate the price Vol construction company will quote on the tender for contract.

Answer:

Calculation of price which Vol construction should quotes on the tender for contract

| Amount (₹) | ||

| Steel | lost net realisable value (200 × ₹ 8) | 1,600 |

| purchases (300 × ₹ 12) | 3,600 | |

| Fibreglass | (1,000 × ₹ 23) | 23,000 |

| Finishing labour | cost (800 × ₹ 4) | 3,200 |

| lost contribution (800 × ₹ 3) | 2,400 | |

| Assembly labour | (200 × ₹ 5) | 1,000 |

| Relevant cost | 34,800 | |

| Mark-up (50%) | 17,400 | |

| Quoted price | 52,200 | |

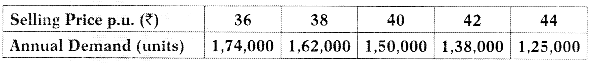

Question 16.

PolyVenyl Chemicals, is engaged in manufacturing many chemical products. It is using many chemicals some of w hich are fast moving, some are slow moving and few are in non-moving category. The firm has a stock of 10 units of one non-moving toxic chemical. Its book value is ₹ 2,400, realizable value is ₹ 3,500 and replacement cost is ₹ 4,200.

One of the customers of the firm asks to supply 10 units of a product which needs all the 10 units of the non-moving chemical as an input. The other costs associated with the production of the product are:

Allocated overhead expenses ₹ 16 per unit Out of pocket expenses ₹ 50 per unit.

Labour cost ₹ 40 per hour. For each unit two hours are required. Other material cost ₹ 80 per unit.

The labour force required for the production of the product will be deployed from among the permanent employees of the firm. This temporary -deployment will not lead to any loss of contribution.

Required

(i) RECOMMEND the minimum unit price to be charged to the customer without any loss to the firm.

(ii) ANALYSE with reasons for the inclusion or exclusion of each of the I T. cost associated with the production of the product.

(iii) ADVICE a pricing policy to be followed by PolyVenyle Chemicals in perfect competition. [Oct. 2020 MTP] (4 + 4 + 2 Marks)

Answer:

(i) (a) PolyVenyl Chemicals has the opportunity to utilize 10 units of non-moving chemical as input to produce 10 units of a product I demanded by one of its customers. The minimum unit price to be charged to the customer would be-

| Cost Component | Cost per unit of product(₹) |

| Cost of Material (Realizable value = ₹ 3,500/ 10 units of chemical) | 350 |

| Out of Pocket Expenses | 50 |

| Other Material Cost | 80 |

| Minimum Unit Price that can be charged | 480 |

Therefore, the minimum unit price that can be charged to the customer, without incurring any loss is ? 480 per unit of product. As explained below in point (ii), allocated overhead expenses and labour cost are sunk costs that have been ignored while calculating the minimum unit price to be charged.

(ii) Analysis

| Cost of Material | Relevant and hence included at realizable value. Polyvenyl Chemicals has 10 units of non-moving chemical input that has a book value of ₹ 2,400, realizable value of ₹ 3,500 and replacement cost of ₹ 4,200. Realizable value of ₹ 3,500 would be the salvage value of the chemical had it been sold by Polyvenyl Chemicals instead of using it to meet the current order. This represents an opportunity cost for the firm and hence included while pricing the product. Book value would represent the cost at which the inventory has been recorded in the books, a sunk cost that has been ignored. Replacement cost of ₹ 4,200 would be the current market price to procure 10 units of the input chemical. This would be relevant only when the inventory has to be replenished after use. This chemical is from the non-moving category, that means that it is not used regularly in production process and hence need not be replenished after use. Therefore, replacement cost is also ignored for pricing. |

| Labour Cost | Not relevant and hence excluded from pricing. It is given in the problem that this order would be met by permanent employees of the firm. Permanent employee cost is a fixed cost that Polyvenyl Chemicals would incur irrespective of whether this order is produced or not. No additional labour is being employed to meet this order. Therefore, this cost is a sunk cost, excluded from pricing |

| Allocated Over head Expenses | These expenses have been incurred at another Cost Centre, typical example would be office and administration costs. Such costs are fixed in nature that would be incurred irrespective of whether this order is produced or not. Therefore, this cost is a sunk cost, excluded from pricing. |

| Out of Pocket Expenses | These are expenses that are incurred to meet the production requirement of this order. These are additional variable expenses, that need to be included in pricing |

| Other Material Costs | These are expenses that are incurred to meet the production requirement of this order. These are additional variable expenses, that need to be included in pricing. |

(iii) Advice on Pricing Policy

Under perfect competition conditions, Polyvenyl Chemicals can have no pricing policy of its own, here sellers are price takers. It cannot increase its price beyond the current market price. The firm can only decide on the quantity to sell and continue to produce as long as the marginal cost is recovered. When marginal cost exceeds the selling price, the firm starts incurring a loss.

Since Polyvenyl Chemicals cannot control the selling price individually in the market, it can adopt the going rate pricing method. Here it can keep its selling price at the average level charged by the industry. This would yield a fair return to the firm. An average selling price would help the firm attract a fair market share in competitive conditions.

![]()

Question 17.

Mr Rakesh wants to buy a system for a single year after which it will be scrapped with plance to use it for 2500 hrs.

Cost Structure (similar products):

| Particulars | System-BY | System-AX |

| Operating Cost/ hour | ₹ 5 | ₹ 7.50 |

| Probability of System Crash | 10% | 0.5% |

| Price | ₹ 37,500 | ? |

Requirement

Find the TEV for the System- AX, if the cost of a System Crash to the buyer is ₹ 1.00,000.

Answer:

Computation of TEV

| Particulars | ₹ |

| Operating Cost [2,500 hrs. × (₹ 5.00 – ₹ 7.50)] | ₹ 6,250 |

| System Crash Savings 1,00,000 × (10.00% – 0.50%)] | ₹ 9,500 |

| Price of Next Best Alternative | ₹37,500 |

| TEV | ₹ 40,750 |