Pricing Decision – CA Final SCMPE Question Bank is designed strictly as per the latest syllabus and exam pattern.

Pricing Decision – CA Final SCMPE Question Bank

Question 1.

Answer the following question:

Distinguish clearly between the skimming pricing policy and penetration pricing policy. (Nov 2016, 4 marks)

Answer:

Concept of Skimming Pricing Policy:

Skimming pricing is a policy of charging high prices during the early period of a product’s existences and in the later years the prices are gradually reduced. The reasons for following such a policy are:

Inelastic Demand:

The demand is likely to be inelastic in the earlier stages till the product is established in the market. The firm can take advantage of high prices.

Sales Boost:

The change of high price in the initial periods serves to skim the cream of the market that is relatively insensitive to price. The gradual reduction in price in the later year will tend to increase the sales.

Assured Profit:

This method is preferred in the beginning because in the initial periods when the demand for the product is not known, the price covers the initial cost of production contribution is guaranteed.

Cost-Revenue Matching:

High initial capital outlays needed for manufacture, results in high cost of production. Also, the manufacturer has to incur huge promotional activities resulting in increased costs. High initiaJ prices will be able to finance the cost of production gradually, the economies of scale and savings in costs are passed on to customers.

![]()

Penetration Pricing Strategy:

1. Penetration pricing is a policy of using a low price as the principal instrument for penetrating mass market method is used for pricing a new product and to popularise it initially.

2. Profit may not be earned in the initial stages. However, prices may be increased as and when the established and its demand picks up.

3. The low price policy is introduced for the purpose of Long-term survival and profitability. Hence, careful analyses scope for market expansion and considerable amount of research and forecasting are necessary before determining price under this strategy.

4. The circumstances in which Penetrating Pricing can be adopted are:

Elastic demand:

The demand of product is high when price is low. Hence, lower prices means large and so more profits.

Mass production:

When there are substantial savings in Large-scale production, increase in demand by the adoption of low pricing policy.

Frighten off competition:

The prices fixed at a Low-level act as an entry barrier to the prospectiveness. The use of this policy by existing firms will discourage the new firms to enter the market. This pricing policy known or “stay-out-pricing”.

![]()

Question 2.

Briefly explain skimming pricing and penetration pricing policies. (Nov 2008, 4 marks)

Answer:

Skimming Pricing Policy: It is the pricing policy adopted for fixing the price of a new product. It is a policy where the prices are kept high during the early period of a products existence. This is due to the reason that whenever a product is launched the firm has to ihcur heavy promotional expenses on the product which it tries to recover by keeping the price high. In the later years the price is gradually reduced. It is called skimming price policy as charging of high prices during the initial period serves to skims the cream of the market that is relatively in sensitive to price..The gradual reduction of price is the later years will tend to increase the sales.

Circumstances in which it should be adopted

This policy is however preferable only in the initial years as during this period when the demand of the product is not known the high price covers the cost of production and other associated costs.

High initial capital outlays, needed for manufacture result in high cost of production. Added to this, the manufacturer has to incur huge promotional activities resulting in increased costs. High initial price will be able to finance the cost of production particularly when uncertainties block the usual sources of capital.

Penetration Pricing Policy : In order to popularize a new product and to penetrate mass market as quickly as possible firms tend to fix the selling price relatively low. This policy is known as Penetration Pricing Policy.

The firm may not earn profit by resorting to this policy at the initial stage. The low pricing policy is introduced for the sake of long-term survival and profitability and hence it has to receive careful consideration before implementation. Later on the price may be increased as and when the demand increases. It is opposite of skimming price policy. It needs an analysis of the scope for market expansion and hence considerable amount of research and forecasting are necessary before determining the price.

![]()

Features:

- This strategy favours using a low price as a principal instrument for penetrating mass markets early.

- It is generally used for a new product.

- The strategy is for long time survival.

- It requires considerable amount of research.

- Once the product establishes itself in the market, the price may be increased.

- Also known as stay out pricing when used for an established product at any stage of product life cycle to avoid competition.

Circumstances in which this policy can be adopted:

1. Elastic demand:

The demand of product is high when price is low. Hence, lower prices means large and so more profits.

2. Mass production:

When there are substantial savings in Large-scale production, increase in demand by the adoption of low pricing policy.

3. Frighten off competition: .

The prices fixed at a Low-level act as an entry barrier to the prospectiveness. The use of this policy by existing firms will discourage the new firms to enter the market. This pricing policy known or “stay-out- pricing”.

![]()

Question 3.

Explain briefly the concept of skimming pricing policy. (Nov 2009, 2 marks)

Question 4.

What is Price Discrimination? Under what circumstances it is possible? (May 2010, 4 marks)

Answer:

Price discrimination is charging different prices of the same product with respect to customers, products, places and time.

It is possible when

- The market being capable of being segmented

- The customers is not able to resell the product at a higher price

- The competitors’ underselling is not possible.

Types:

| 1. Price Discrimination on the Basis of Customer | In this case, the same product is charged at different prices to different customers. It is, however, potentially disruptive of customer relations. |

| 2. Price Discrimination Based on Product Version | In this case, a slightly different product is charged at a different price regardless of its cost-price relationship. |

| 3. Price Discrimination Based on Place | An example of this method is the seats in cinema theatre where the front seats are charged at lower rates than the back seats. |

| 4. Price Discrimination Based on Time | An example of this method is the practice of giving off-season concession in sale of fans or refrigerators just after the summer season. |

![]()

Question 5.

What are the disadvantages of Cost Plus Pricing? (May 2011, 5 marks)

Answer:

Disadvantages of Cost Plus Pricing:

- In many decision, incremental costs are more relevant than full cost. This is ignored.

- Fails to reflect competition adequately.

- Fixed Overheads depends on volume if volume is more cost is less, and vice-versa Increase/decrease in sales volume depends on price. Therefore it is a vicious circle- cost plus markup is a price based on sales volume & sales volume is based on price.

- It ignores demand, facts to take into account buyers’ needs and willingness to pay.

- Assumes correct cost estimation, whereas in multi product firm, costs may be arbitrarily allocated.

Question 6.

State the pricing policy most suitable in each of the following independent situations: (Nov 2011, 4 Marks)

(i) The company makes original equipments and does defense contract work. There are other companies which also undertake such projects.

(ii) The product made by a company is new to the market. It is expected to enjoy a long-term demand. Competition is expected very soon, since the product will be desirable to most customers.

(iii) Stock of processed ready-to-eat products, whose shelf-life will soon be over in the next 2 months. The product is going to be discontinued.

(iv) A company sells a homogeneous product in a highly competitive market. (Candidates need to only write the pricing policy with the corresponding sub¬division numbers of the questions. The situations need not be copied into the answer books).

Answer:

(i) Sealed Bid Pricing

(ii) Penetration Pricing

(iii) Any price that the market will pay (even below variable cost any cash received)

(iv) Going rate pricing or market price

![]()

Question 7.

Answer the following:

Explain briefly Pareto analysis and mention some of its uses. (Nov 2011, 4 marks)

Answer:

Pareto Analysis:

Pareto Analysis is a rule that emphasizes to focus on the most important aspects of decision making in order to simplify the process of decision making. Pareto Analysis is based on the 80 : 20 rule that was a phenomenon first observed by Vifredo Pareto, a nineteenth century Italian economist. He noticed that 80% of the wealth of Milan was owned by 20% of its citizens.

This phenomenon can be observed in many different business situations. The analysis of the total sales revenue might indicate that approximately 80% of its total sales revenue is earned from 20% of its products. Pareto Analysis provides the mechanism to control and direct effort by fact, not by emotions. It helps to clearly establish top priorities and to identify both profitable and unprofitable targets.

Usefulness of Pareto Analysis:

- To prioritize problems goals and objectives.

- To identify root causes.

- To select and define key quality improvement programs.

- To select key customer relations and service programs.

- To select key employee relations improvement programs.

- To select and define key performance improvement programs.

- To maximize research and product development time.

- To verify operating procedures and manufacturing processes.

- To allocate physical, financial and human resources.

![]()

Question 8.

Answer the following:

List out the qualities required for a good pricing policy. (May 2013, 4 marks)

Answer:

Qualities required for a good pricing policy:

The pricing policy plays an important role in a business because the long run survival of a business depends upon the firm’s ability to increase its sales and device the maximum profit from the existing and new capital investment.

Whereas cost is an important aspect of pricing, consumer demand and competitive environment are frequently far more significant in pricing decisions.

The pricing policy structure should:

- encourage optimum utilisation of resources;

- work towards better balance between demand and supply;

- avoid adverse effects on the rest of the economy;

- provide an incentive to producer for adopting improved technology and maximising production;

- promote exports.

![]()

Question 9.

Answer the following:

How is Pareto analysis helpful in pricing of products in the case of a firm dealing with multiple products? (May 2014, 4 marks)

Answer:

In the case of firm dealing with multi-products, it would not be possible for it to analyse price-volume relationship for all of them.

Pareto analysis is used for analysing the firms estimated sales revenue from various products and it might indicate that approximately 80% of its total sales revenue is earned from about 20% of its products. Such analysis helps the top management to delegate the pricing decision, for approximately 80% of its product to the lower level of management, thus freeing them to concentrate on the pricing decisions for products approximately 20% of which is essential for the company’s survival.

Therefore, a firm can adopt more sophisticated pricing methods for small proportion of products that jointly account for 80% of total sales revenue.

For the remaining 80% products, which account for 20% of the total sales value the firm may use cost based pricing method.

![]()

Question 10.

Answer the following:

What are the applications of Pareto Analysis in customer profitability analysis? (May 2015, 4 marks)

Answer:

Application of Pareto Analysis in Customer Profitability Analysis:

- In practice, it is generally found that 20% of customers generate 80% of the profit.

- There are always be some customers who are less profitable than others.

- Pareto Analysis is useful for evaluation of the portfolio of customer profile.

- Management can plan accordingly in which area and which product is to be produced and distributed.

Pareto Analysis can be applied in customer profitability analysis in the following manner:

- Identify most profitable customers.

- Manage each customer’s costs-to-serve.

- Discontinue unprofitable customer segment.

- Shift a customer’s purchase mix towards higher- margin products and service lines.

- Offer discounts to attract profitable customers.

- Choose types of after sale services to provide.

![]()

Question 11.

Answer the following:

State the most appropriate pricing policy to be adopted in the following independent situations: (Nov 2015, 4 Marks)

(Situations need not be copied. Only the Roman numeral and policy need to be mentioned in the answer book.).

(i) Modern patented drug entering the market.

(ii) The latest version Of a mobile phone is being launched by an – established, financially strong company.

(iii) An established company has recently entered the stationery market segment and launched good quality paper for printing at home and office.

(iv) A car manufacturer is launching an innovative, technologically advanced car in the highly priced segment.

Answer:

Pricing Policy

(i) Skimming Pricing

(ii) Penetration Pricing

(iii) Market Price

(iv) Skimming Pricing

![]()

Question 12.

Answer the following question:

What is penetration pricing? What are the circumstances in which this policy can be adopted? (May 2016, 4 marks)

Question 13.

Answer the following question:

Enumerate the uses of Pareto Analysis. (Nov 2016, 4 marks)

Question 14.

Answer the following: (Nov 2017, 4 Marks)

(a) (i) Define Pricing Strategy

(ii) State the Market Entry Strategies of pricing applicable in the following situations:

(1) Inelastic demand

(2) Mass Production

(3) Assured profit

(4) Elastic demand

Answer:

(i) Pricing Strategy:

Pricing strategy is defined as a broad plan of action by which an organization intends to reach its goal. Some illustrative strategies are:

- Expanding product lines that enjoy substantial brand equity.

- Offer quantity discounts to achieve increase in sales volume.

(ii) Market Entry Strategy applicable In following situations:

| Situation | Strategy |

| 1. Inelastic Demand

2. Mass Production 3. Assured Profit 4. Elastic Demand |

Skimming Pricing

Penetration Pricing Skimming Pricing Penetration Pricing |

![]()

Question 15.

(i) Name any two competition-based pricing methods. (May 2019, 2 marks)

Answer:

Competition based Pricing’methods:

- Going Rate Pricing.

- Sealed Bid Pricing

Question 16.

State the most appropriate pricing policy to be adopted in the following independent situations : (Nov 2020, 5 Marks)

(Situations need not be copied. Only policy name is required.)

(i) The company manufactures original equipment and does railways contract work. Other companies are also there in the market who also undertake similar projects.

(ii) Patented Drug for COVID 19 ready to be launched in the market.

(iii) A bike manufacturer is launching an innovative, technologically advanced bike in the highly priced segment.

(iv) A company making a variant of sanitizers, trying to enter the market, the same varieties of sanitizers are already successfully capturing the market.

(v) A successful mobile manufacturing company has built into its latest tablet, an additional sliding screen and improved processing capabilities so that the tablet is almost a laptop.

![]()

Question 17.

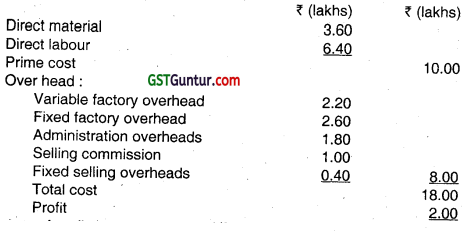

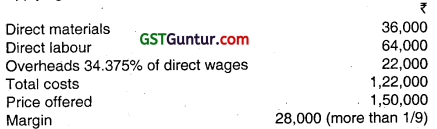

A company has prepared the following budget for the forthcoming year: (Nov 2008, 7 Marks)

The policy of the company in fixing selling prices is to charge all overheads other than the prime costs on the basis of percentage of direct wages and to add a mark up of one-ninth of total costs for profit.

While the company is confident of achieving the budget drawn up as above, a new customer approached the company directly for execution of a special order. The direct materials and direct labour costs of the special order are estimated respectively at ₹ 36,000 and ₹ 64,000. This special order is in excess of the budgeted sales as envisaged above. The company submitted a quotation of ₹ 2,00,000 for the special order based on its policy. The new customer is willing to pay a price of ₹ 1,50,000 for the special order. The company is hesitant to accept the order below total cost as, according to. the company management, it will lead to a loss.

You are required to state your arguments and advise the management on the acceptance of the special order.

Answer:

Analysis of Cost and profit:

Rate of profit on costs (2/18) = 1/9

Overhead absorption rate based on direct wages = (8.00/6.40) × 100 of direct wages

Break up of new order :

The following points emerge:

- Factory overheads only are to be recovered on the basis of direct wages.

- The special order is a direct order. Hence commission is not payable.

- The budgeted sales are achieved. Hence all fixed overheads are recovered. Hence, no fixed overheads will be chargeable to the special order.

Based on the above, the factory variable overheads recovery rate may be calculated as under:

Total variable factory overheads – ₹ 2.20 lakhs

Direct wages – ₹ 6.40 lakhs

Factory overhead rate = (2.20 / 6.40) × 100 = 34.375%

Applying this rate the cost of the special order will be as under:

Hence, the order is acceptable at the price of ₹ 1,50,000.

![]()

Question 18.

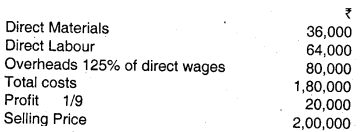

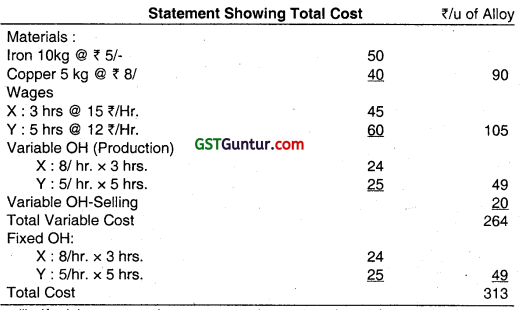

Hind Metals Manufactures an aHoy product ‘Incop’ by using iron and Copper. The metals pass through two plants, X and Y. The company gives you the following details for the manufacture of one unit of Incop: (Nov 2009, 6 marks)

Materials : ron 10 kgs. @ 5 per kg.

Copper : 5kg @ 8 per kg.

Wages : 3 hours @ 15 per hour in Plant X.

5 hours @ 12 per hour in Plant Y.

Overhead recovery : On the basis of direct labour hours.

Fixed overhead : ₹ 8 per hour in Plant X.

₹ 5 per hour in Plant Y.

Variable overhead : ₹ 8 per heur in Plant X.

₹ 5 per hour in Plant Y.

Selling overhead : (fully variable) – ₹ 20 per unit.

(i) Find out the minimum price to be fixed for the alloy, when the alloy is new to the market. Briefly explain this pricing strategy.

(ii) After the alloy is well established in the market. What should be the minimum selling price? Why?

Answer:

(i) If pricing strategy is to penetrate the market, the minimum price for a new product should be the variable cost i.e. ₹ 264/-. In some circumstances, it can also be sold below the variable cost, if it is expected to quickly penetrate the market and later absorb a price increase. Total Variable Cost is the penetration price.

(ii) When the alloy is well established, the minimum selling price will be the total cost – including the fixed cost i.e. ₹ 313 per unit. Long run costs should cover at least the total cost.

![]()

Question 19.

Attempt:

Calculate the selling price per unit to earn a return of 12% net on capital employed (net of tax @ 40%). The cost of production and sales of 80,000 units are: (Nov 2010, 4 marks)

Variable cost including material cost : ₹ 9,60,000

Fixed overheads : ₹ 5,00,000

The fixed portion of capital employed is X 12 lakhs and the varying portion is 50% of sales turnover.

Answer:

Let ‘X’ be the selling price per unit, Therefore, Turnover = 80,000 x

Capital Employed = 12,00,000 + 8,000 x

Return on capital employed after tax = 12%

Therefore,

Return on capital employed before tax = 12/0.6 = 20%

Therefore,

Return on capital employed before tax = 20% of (12,00,000 + 40,000x)

= 2,40,000 + 8,000X

Sales = 80,000x

Variable Cost = 9,60,000

Fixed Cost = 5,00,000

Profit = 80,000 x – 14,60,000

Therefore

80,000 x – 14,60,000 = 2,40,000 + 8,000 x

72,000 x = 17,00,000

x = ₹ 23.61

![]()

Alternative Answer:

Selling price per unit should cover Variable cost unit, Fixed Cost per unit and ROCE per unit.

Fixed Capital Employed = ₹ 12 lacs

Required Return (net of tax) = 12% = ₹ 1,44,000

Pre tax return = 1,44,000 / 0.6 = ₹ 2,40,000

Let Selling Price per unit = x

X = (14,60,000 + 2,40,000)/80,000 + (12% of 50% of X)/0.6

= 17,00,000/80,000 + (6/100 × 1/0.6) x

X(1 – 0.1) = 21.25

X = 21.25/0.9 = ₹ 23.61 per unit

Required Selling price = ₹ 23,61

If a student has arrived at ₹ 23.61, full 4 marks may be given even if the intermediary steps are not adequately shown.

![]()

Question 20.

Answer the following:

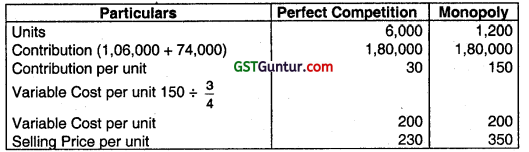

6000 pen drives of 2 GB are to be sold in a perfectly competitive market to earn ₹ 1,06,000 profit, whereas in a monopoly market only 1200 units are required to be sold to earn the same profit. The fixed costs for the period are ₹ 74,000. The contribution per unit in the monopoly market is as high as three fourths its variable cost. Determine the target selling price per unit under each market condition. (May 2011, 4 marks)

Answer:

Question 21.

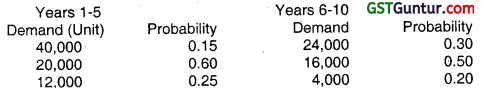

The Board of Directors of XY Company Limited are considering a new type of handy sewing machine which their R & D Department has developed. The expenditure so far on research has been ₹ 95,000 and a consultant’s report has been prepared at a cost of ₹ 22,500. The report provides the following information: (Nov 2012, 12 marks)

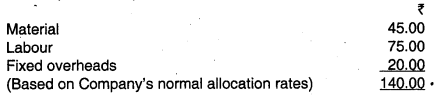

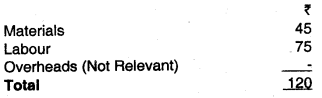

Cost of production per unit:

Anticipated additional fixed costs:

Rent for additional space ₹ 1,25,000 per annum

Other additional fixed costs ₹ 70,000 per annum

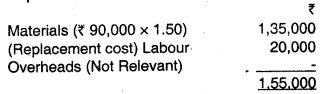

A new machine will be built with the aiailable facilities with a cost of ₹ 1,10,000 (material 90,000 and labour ₹ 20,000). The materials are readily available in stores which are regularly used. However, these are to be replenished immediately. The price of these materials have since been increased by 50%. Scrap value of the machine at the end of the 10th year is estimated at ₹ 20,000. The product scraps generated can be disposed off at the end of year 10 for a price of ₹ 1,43,000.

It is estimated that the commercial life of the machine will be no longer than 10 years and the after tax cost of capital is 10%. The full cost of the machine will be depreciated on straight line basis, which is allowed for computing the taxable income, over a period of 10 years. Tax rate is 30%.

DCF factors at 1 0%:

1 – 5 years (cumulative) – 3.79

6 – 10 years (cumulative) – 2.355

10th year – 0.386

![]()

Required:

Compute minimum selling price for the handy sewing machine.

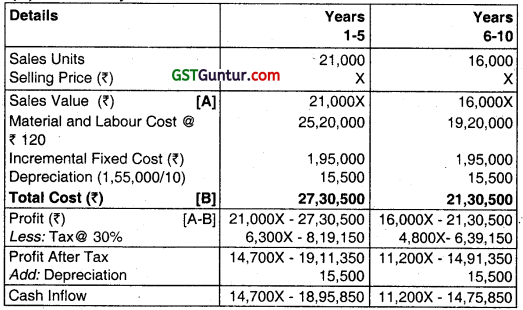

Answer:

(i) Expected Sales Volume:

Years 1-5: (40,000 × 0.15 + 20,000 × 0.60 + 12,000 × 0.25) = 21,000 units

Years 6-10: (24,000 × 0.30 +1 6,000 × 0.50 + 4,000 × 0.20) = 16,000 units

(ii) Capital Cost:

(iii) Production Variable Cost:

(iv) Profitability:

(v) Cash inflow in the Terminal Year (year 10)

| ₹ | |

| Sale Value of the Machine

Scrap Realization Total Tax@ 30% After Tax Cash Inflow |

20,000

1.43.000 |

| 1,63,000

48,900 |

|

| 1.14.100 |

![]()

(vi) Present Value of Cash Flows:

| Details | Year 0 | Year 1-5 | Year 6-10 | Year 10 |

| Capital Cost | 1,55,000 | – | – | |

| Cash Flow from Operation | – | 14.700X – 18,95,850 | 11.200X – 14,75,850 | – |

| Cash Flow Terminal Year | “ | – | – | 1,14,100 |

| Discount Factor | 1 | 3.79 | 2,355 | 0.386 |

| Present Value of Cash Flows | -1,55,000 | 55,713X – 71,85,271.50 | 26,376X – 34,75,626.70 | 44,042.6 |

(vii) Net Cash Inflows:

= (-1,55,000) + (55,713X – 71,85,271,50) + (26,376X – 34,75,626.70) + (44,042.60)

= 82,089X – 1,07,71,855.60

(viii) Computation of Minimum Selling Price

For determining Minimum Selling Price, Net Cash Inflows should be equal to zero:

82,089 X – 1,07,71,855.60 = 0

Or X = 131.22

Minimum selling price is ₹ 131.22

Note:

(a) R&D expenses of ₹ 95,000 is not relevant.

(b) Fee for consultant’s report of ₹ 22,500 is not relevant.

(c) Tax element on irrelevant costs not considered, since the benefit will arise even without this product.

![]()

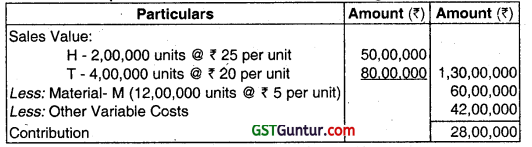

Question 22.

HTM Ltd., by using 12,00,0000 units of a material M produces jointly 2,00,000 units of H and 4,00,000 units of T. The costs and sales details are as under: (May 2013, 5 Marks)

Direct material M @ X 5 per unit – ₹ 60,00,000

Other variable costs – ₹42,00,000

Total fixed costs – ₹ 18,00,000

Selling price of H per unit – ₹ 25

Selling price of T per unit – ₹ 20

The company receives an additional order for 40,000 units of T at the rate of ₹ 15 per unit. If this order has been accepted, the existing price of T will not be affected. However, the present price of H should be reduced evenly on the entire sale of H to market the additional units to be produced.

Find the minimum average unit price to be charged on H to sustain the increased sales.

Answer:

Product H & T are joint products and produced in the ratio of 1:2 from the same direct material- M.

Production of 40,000 additional units of T results in production of 20,000 units of H.

Computation of contribution under existing situation

Let Minimum Average Selling Price per unit of H is ₹ X

Computation of contribution after acceptance of additional order of ‘T’

Minimum Average Selling Price per unit of H

Contribution after additional order of T = Contribution under existing production

⇒ 2,20,000 X – 26,20,000 = 28,00,000

⇒ 2,20,000 X = 54,20,000

⇒ X = \(\frac{54,20,000}{2,20,000}\) = ₹ 24.64

Minimum Average Selling Price per unit of H is ₹ 24.64

![]()

Question 23.

State the appropriate pricing policy in each of the following independent situations: (Nov 2013, 4 marks)

(i) ‘A’ is a new product for the company and the market and meant for large scale production and long term survival in the market. Demand is expected to be elastic.

(ii) ‘B’ is a new product for the company, but not for the market. B’s success is crucial for the company’s survival in the long term.

(iii) ‘C’ is a new product to the company and the market. It has an inelastic market. There needs to be an assured profit to cover high initial costs and the ususal sources of capital have uncertainties blocking them.

(iv) ‘D’ is a perishable item, with more than 80% of its shelf life over.

Answer:

(i) Penetration Pricing.

(ii) Market Price or Price just below market price.

(iii) Skimming Pricing.

(iv) Any cash realizable value.

![]()

Question 24.

A shoe manufacturer has a net profit of ₹ 25 per pair on a selling price of ₹ 143. He is producing 6,000 pairs per annum which is 60% of the potential capacity. The cost per pair is as under: (Nov 2014, 5 marks )

Direct materials – ₹ 35.00

Direct wages – ₹ 12.50

Work overheads (50% fixed) – ₹ 62.50

Administrative overheads (75% fixed) – ₹ 6.00

During the current year the manufacturer also estimates demand of 6,000 pairs but anticipates that the fixed charges to go up by 10% while the rate of direct labour and direct materials will increase by 8% and 6% respectively. But he has no option of increasing the selling price. Under this situation he obtains an offer to utilise further 20% of capacity. What minimum price will you recommend to ensure an overall profit of ₹ 1,67,300?

Answer:

Calculation of Profitability at 6,000 Pairs Activity

| Particulars | Existing Price Level Amount (₹) | Revised Price Level Amount (₹) |

| Selling Price per pair (A) | 143.0C | 143.00 |

| Variable Costs: | ||

| Direct Materials | 35.00 | 37.10 (₹ 35 × 1.06) |

| Direct Wages | 12.50 | 13.50 (₹ 12.5 × 1.08) |

| Works Overhead (50% of ₹ 62.50) | 31.25 | . 31.25 |

| Administration Overhead (25% of ₹ 6) | 1.50 | 1.50 |

| Total Variable Cost per pair (B) | 80.25 | 83.35 |

| Contribution per pair (C) = (A) – (B) | 62.75 | 59.65 |

| Total Contribution (O) | 3,76,500 | 3,57,900 |

| Fixed Costs | ||

| Works Overhead (6,000 pairs × ₹ 31.25) | 1,87,500 | 2,06,250 (₹ 1,87,500 × 1.1) |

| Administration Overhead (6,000 pairs × ₹ 4.50) | 27,000 | 29,700 (₹ 27,000 × 1.1) |

| Other Fixed Overheads (Note) | 12,000 | 13,200 (₹ 12,000 × 1.1) |

| Total Fixed Costs (E) | 2,26,500 | 2,49,150 |

| Profit (D) – (E) | 1,50,000 | 1,08,750 |

| Desired Profit | — | 1,67,300 |

| Additional Profit (₹ 1,67,300 – ₹ 1,08,750) | — | 58,550 |

| Additional Offer (\(\frac{6,000}{60 \%}\) × 20%) | 2,000 Pairs | |

| Profit per pair | 29.275 |

![]()

Note:

Other Fixed Overhead = Contribution – Profit – (Fixed Works Overheads + Fixed Administration Overheads)

Selling Price per pair = Variable Cost per pair + Profit per pair

= ₹ 83.35 + ₹ 29.275 = ₹ 112.625 or ₹ 112.63

Therefore, minimum selling price per pair for the additional offer shall be ₹ 112.63

Important Note:

Selling price is ₹ 143 per pair and net profit is ₹ 25 per pair, hence, total cost per pair at the existing level should be ₹ 118 (₹ 143 – ₹ 25). However, the total cost per pair given is ₹ 116. It is assumed that balance ₹ 2 per pair (₹ 118 – ₹ 116) is Other Fixed Overheads.

Alternative Treatment: This problem can also be solved by assuming the difference of ₹ 2 as Other Variable Costs with an anticipation that it will not change in the revised situation.

Question 25.

An IT company produces a CD, particulars of which are detailed below: (Nov 2014, 5 marks)

Annual Production (Units) – 40,000

Cost per Annum (₹)

- Material – 1,00,000

- Other variable cost – 1,20,000

- Fixed cost – 80,000

- Apportioned Investment (₹) – 3,00,000

Determine the unit selling price under two strategies mentioned below.

Assume company’s tax rate as 30%

(i) 20% return on investment.

(ii) 6% profit on list price, when trade discount is 40%.

Answer:

Calculation of Selling Price:

(i) Selling price to yield 20% return on investment:

Investment – 3,00,000

ROI 20% – 60,000

Tax – 30%

= PAT 100 – 30 = 70%

Pretax Profit \(\frac{60,000}{70}\) × 100 = 85,714

Sales = Cost + Return

= 3,00,000 + 85,714 = ₹ 3,85,714

Output = 40,000

Sales 1 unit

= 3,85,714/40,000

= 9.64 per unit.

(ii) Selling price to yield 6% profit on list price:

Let ‘K’ be the List Sales

{List Sales (1 – trade Discount)- Total Cost} × (1 – Tax Rate) = 0.06K

{K(1 – 0.40) – 3,00,000} × (1 – 0.30) = 0.06K

{0.60 K – 3,00,000} × 0.7 = 0.06 K

0.36 K = 2,10,000

K = ₹ 5,83,333.33

List Sales Price per unit is ₹ 14.58 \(\left(\frac{₹ 5,83,333.33}{40,000 \text { units }}\right)\)

Net Selling Price per unit is ₹ 8.75 (₹ 14.58 – 40% of ₹ 14.58)

![]()

Question 26.

A company produces a single product ‘Impex’.

For an annual sales of 40,000 units of Impex, fixed overhead is ₹ 5,50,000. The variable cost per unit is ₹ 60. Capital employed in fixed assets is ₹ 8,00,000 and in current assets is 50% of net sales (i.e. sales less discount). The company sells goods at 20% discount on the maximum retail price (M.R.P.),which is ₹ X per unit. The company wants to earn a return of 25% before tax on capital employed in fixed and current assests. (May 2015, 5 marks)

Answer:

Selling Price p. u. = x

Total Sales = 40,000 x

Selling price after discount = 0.80 x [x – 0.2x]

Units = 40,000

Variable Cost = 40,000 × 60

= 24,00,000

Capital Employed = Fixed Assets + Current Assets

= 8,00,000 + 0.5 (40,000 × 0.8x)

Fixed Cost = 5,50,000

Total Cost = 24,00,000 + 5,50,000

= 29,50,000

Required Return = 0.25 [8,00,000 + 0.5 (40,000 × 0.8x)]

Now,

Sales = Total cost + Required return

∴ 40,000 × 0.88x = 29,50,000 + 0.25 [8,00,000 + 0.5 (40,000 × 0.8x)]

∴ 32,000 x = 29,50,000 + 0.25 [8,00,000 + 16,000x]

= 29,50,000 + 2,00,000 + 4,000x

∴ x = 112.50

After Discount Sales Price = 112.50 – 20% of 112.50

= ₹ 90

![]()

Question 27.

The budgeted cost data of a product manufactured by XYZ Co. Ltd. is furnished as below: (Nov 2015, 4 marks)

Budgeted units to be produced – 200000

Variable cost (₹) – 32 per unit

Fixed cost (₹) – 16 lacs

It is proposed to adopt cost plus pricing approach with a mark up of 25% on full budgeted cost basis.

However, research by the marketing department indicates that demand of the product in the market is price sensitive. The likely market responses are as follows:

| Selling price (₹ per unit) | 44 | 48 | 50 | 56 | 60 |

| Annual Demand (units) | 168000 | 152000 | 140000 | 128000 | 108000 |

Analyse the above situation and determine the best course of action.

Answer:

Analysis of Cost plus Pricing Approach

The company has a plan to produce 2,00,000 units and it proposed to adopt Cost plus Pricing approach with a markup of 25% on full budgeted cost. To achieve this pricing policy, the company has to sell its product at the price calculated below:

| Quantity | 2,00,000 units |

| Variable Cost (2,00,000 units × ₹ 32) | 64,00,000 |

| Add: Fixed Cost | 16,00,000 |

| Total Budgeted Cost | 8000000 |

| Add: Profit (25% of ₹ 80,00,000) | 20,00,000 |

| Revenue (need to earn) | 1,00,00,000 |

| Selling Price per unit \(\left(\frac{₹ 1,00,000}{2,00,000 \text { units }}\right)\) | 50 p.u. |

![]()

However, at selling price ₹ 50 per unit, the company can sell 1,40,000 units only, which is 60,000 units less than the budgeted production units.

After analyzing the price-demand pattern in the market (which is price sensitive), to sell all the budgeted units market price needs to be further lowered, which might be lower than the total cost of production.

Statement Showing “Profit at Different Demand & Price Levels”

| I | II | III | IV | Budgeted | |

| Qty. (units) | 168000 | 152000 | 140000 | 128000 | 108000 |

| ₹ | ₹ | ₹ | ₹ | ₹ | |

| Sales | 7392000 | 7296000 | 7000000 | 7168000 | 6480000 |

| Less: Variable Cost | 5376000 | 48,64,000 | 44,80,000 | 4096000 | 3456000 |

| Total Contribution | 2016000 | 2432000 | 25,20,000 | 30,72,000 | 3024000 |

| Less: Fixed Cost | 1600000 | 1600000 | 1600000 | 16,00,000 | 1600000 |

| Profit (₹) | 416000 | 832000 | 920000 | 1472000 | 1424000 |

| Profit (% on total cost) | 5.96 | 12.87 | 15.13 | 25.84% | 28.16% |

(i) Taking the above calculation and analysis into account, the company should produce and sell 1,28,000 units at ₹ 56. At this price company will not only be able to achieve its desired mark up of 25% on the total cost but can earn maximum contribution as compared to other even higher selling price.

(ii) If the company wants to uphold its proposed pricing approach with the budgeted quantity, it should try to reduce its variable cost per unit for example by asking its supplier,to provide a quantity discount on the materials purchased.

![]()

Question 28.

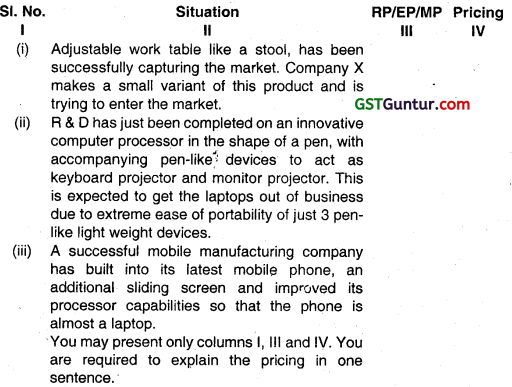

The following independent situations relate to new product pricing. Classify the products into the appropriate category: Revolutionary Product (RP), or Evolutionary Product (EP) or a Me-Too Product (MP) and state the corresponding pricing to be followed: (May 2017, 5 marks)

Answer:

| SI. No. I | RP/EP/MP III | Pricing IV |

| (i) | Me – too Products (MP) | The me – too products are price takers as the price is determined by the market mainly by the competitive forces. |

| (ii) | Revolutionary Product (RP) | Revolutionary Product may enjoy the premium price as a reward for its innovation and taking first initiative. |

| (iii) | Evolutionary Product (EP) | The Evolutionary Products are price takers as the price is determined by the market mainly by the competitive forces. |

![]()

Question 29.

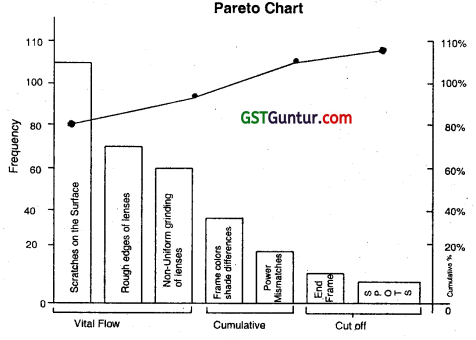

The following information is given about the type of defects during a production period and the frequencies of their occurrence in a spectacle manufacturing company: (May 2017, 4 marks)(5 marks)

Defect – No. of items

End Frame not equidistant from the centre – 10

Non-uniform grinding of lenses – 60

Power mismatches – 20

Scratches on the surface – 110

Spots/Stains on lenses – 5

Rough edges of lenses – 70

Frame colours-shade differences – 25

Construct a frequency table so that a Pareto Chart can be constructed for the defect type. Which areas should the company focus on?

Answer:

The Frequency table indicating the frequency of occurrence of defects in decreasing order of their occurrence will be as follows:

| Defect Type | No. of Items | (%) | Cumulative (%) |

| Scratches on the surface | 110 | 36.6667 | 36.6667 |

| Rough edges of lenses | 70 | 23.3333 | 60.0000 |

| Non uniform grinding of lenses | 60 | 20.0000 | 80.0000 |

| Frame colors shade differences | 25 | 8.3333 | 88.3333 |

| Power mismatches | 20 | 6.6667 | 95.0000 |

| End frame not equidistant from the centre | 10 | 3.3333 | 98.3333 |

| Spots/Stains on lenses | 5 | 1.6667 | 100.00 |

The Pareto Chart is constructed for defect type:

The purpose of Pareto Chart in this example is to direct attention to area where best returns can be achieved by solving most of the quality problems, perhaps just with a single action. In this case, use of good quality raw material say plastic may solve some percentage and handled property some percentage may be overcome.

![]()

Question 30.

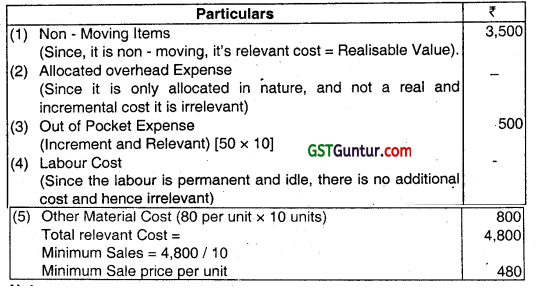

Sun Chemicals Co., is engaged in manufacturing many chemical products. It is using many chemicals some of which are fast moving, some are slow moving and few are in .non-moving category. The company has a stock of 10 units of one non-moving toxic chemical. Its book value is ₹ 2400, realizable value is ₹ 3,500 and replacement cost is ₹ 4,200. (Nov 2018)

One of the customers of the company asks to supply 10 units of a product which needs all the 10 units of the non-moving chemical as an input. The other costs associated with the production of the product are:

Allocated overhead expenses ₹ 16 per unit.

Out of pocket expenses ₹ 50 per unit.

Labour cost ₹ 40 per hour. For each unit two hours are required.

Other material cost ₹ 80 per unit.

The labour force required for the production of the product will be deployed from among the permanent employees of the company. This temporary deployment will not lead to any loss of contribution.

Required:

(i) Recommend the minimum unit price to be charged to the customer without any Eoss to the company. (4 marks)

(ii) Analyse with reasons for the inclusion or exclusion of each of the cost associated with the production of the product. (4 marks)

(iii) Advice a pricing policy to be followed by Sun Chemical in perfect competition. (2 marks)

Answer:

(i), (ii) Since minimum price is to be calculated, it means Recovery of Relevant Costs.

Statement of Relevant Cost

Notes:

- Book value is always irrelevant as it is historical and sunk cost.

- Replacement Cost:

Since stock is available, and no excess is required, we will not purchase anything from outside and hence Replacement Cost is irrelevant.

(iii) Under Perfect Competition, firm has no pricing policy of its own as the sellers are price takers, i.e. to accept the price determined by the market. There ¡s no control over market price which the buyers are willing to buy. The firm has to take a decision in favour of the quantity to sell. The firm can continue to produce as long as its marginal cost is less than or equal to its selling price, upto the point at which the marginal cost is equal to price, increase in output will add to revenue and thereafter the increase will be added to cost.

![]()

Question 31.

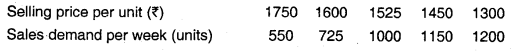

Amber Ltd. is a leading company in the Footwear Industry. The company has four factories in different locations with state of the art equipments. Due to competition in the market, company is continually reviewing its product range and enhancing its existing products by developing new models to satisfy the demands of its customers. (May 2019)

The company currently has a production facility which has a capacity of 3500 standard hours per week.

Product ‘Comfort’ was introduced to the market six months ago and is now about to enter the maturity stage of its life cycle.

However, research by the marketing department indicates that demand of the product ‘Comfort’ in the market is price sensitive. The likely market responses are as follows:

The variable cost per unit of manufacturing ‘Comfort’ is ₹ 750.

Standard hours used to manufacture one unit is 2 hours.

Product 1 Sports’ was introduced to the market two months ago using a penetration pricing policy and is now about to enter its growth stage, Each unit has a variable cost of ₹ 545 and takes 2.50 standard hours to produce. Market research has indicated that there is a linear relationship between its selling price and the number of units demanded, of the form P = a – bx. At a selling price of ₹ 1,000 per unit demand is expected to be 1000 units per week. For every ₹ 100 increase in selling price the weekly demand will reduce by 200 units and for every ₹ 100 decrease in selling price the weekly demand will increase by 200 units.

Product ‘Ethnic’ is currently being developed and which is about to be launched in the market. This is a highly innovative designer product which the company believes that it will have a revolutionary impact on the market and consumer behaviour. The company has decided to use a market skimming approach to pricing this product during its introduction stage.

Required:

(a) (i) Advise which of the above five selling prices should be charged for product ‘Comfort’, in order to maximize its contribution during its maturity stage. (3 marks)

(ii) Calculate the number of units to be produced of product ‘Sports in order to utilize all of the spare capacity from your answer to (i) above and the selling price per unit of product ‘Sports’ during its growth stage. (2 + 3 = 5 marks)

(b) Compare penetration and skimming pricing strategies during the introduction stage, using product ‘Ethnic’ to illustrate your answer. (4 marks)

(c) Explain with reasons, for each of the stages of ‘Ethnic’s product life cycle, the changes that would be expected in the

(i) average unit production cost

(ii) unit selling price. (4 + 4 = 8 marks)

Answer:

(a)

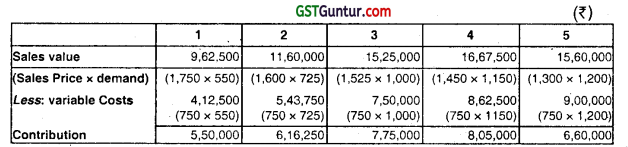

(i) Statement Showing Contribution at Different levels:

Since there is maximum contribution in (4) above, so selling price should be charged for product ‘Comfort’ is ₹ 1,450 per unit.

(ii) Capacity in terms of standard hours per week is 3,500 hrs.

To produce product comfort as per (i) above that is for selling price per unit ₹ 1,450 and sales demand per week of 1,150 units, total standard hours required are = 1,150 units × 2 hours per unit

= 2,300 standard hours

So, spare capacity in terms of hrs

= 3,500 hrs – 2,300 hrs

= 1,200 standard hours

Each unit of Product ‘Sport’ takes 2.50 standard hours to produce,.

So, No. of units of ‘Sport’ Produced = \(\frac{1,200 \text { standard hrs }}{2.5 \text { std. hrs Perunit }}\)

No. of units of product ‘Sport’ = 480 units produced.

From the given sensitivity we analyse that:

a = 1500

b = 0.5

x = 480 Units

So, Selling Price = P = a – bx

= 1,500 – 0.5 (480)

P = ₹ 1,260

![]()

(b) During the introduction stage, skimming policy with high prices, but low profit margin due to high fixed costs. Growth stage – Re duce price to penetrate market further. Maturity stage – Price to match or beat competitor. Decline Stage – cut price if not responding.

- In case of product Ethnic which is newly launched in the market the company can higher the prices and will have to keep profit margin to be low due to high fixed costs

- For Penetration Policy to enter the market and gain a high share quickly or to prevent competitors from entering. Maturity stage – Retain higher prices in some market segments Decline stage – Some increases in prices may occur in the late decline stage.

(c) 1. Growth Stage:

Compared to the introduction stage the likely changes as follows.

(i) Average Unit Production Cost

- These are likely to reduce for a number of reasons:

- Direct Materials are being bought in larger quantities and therefore Amber Ltd. may be able to negotiate better prices from its suppliers thus causing unit material costs to reduce.

- Direct labour costs may be reducing if the product is labour intensive due to the effects of the learning and experience curve.

- Other variable overhead costs may be reducing as larger batch, sizes reduces the cost of each unit.

- Fixed production costs are being shared by a greater no. of units.

(ii) Unit Selling Price:

- These are likely to be reducing for a number of reasons:

- The product will become less unique as competitors use reverse engineering to introduce their versons of the product.

- Amber Ltd. may wish to discourage competitors from entering the market by lowering the price and thereby lowering the unit profitability.

- The price needs to be lowered so that the product becomes attractive to different market segments thus increasing demand to achieve the growth is sales volume.

![]()

2. Maturity Stage:

Compared to the growth stage the likely changes are as follows

(i) Unit Production Cost:

Direct material costs are likely to be fairly constant in this phase and may even rise as the quantities required dimish compared to those required in the growth stage with the consequential loss of negotiating power.

Direct labour costs are unlikely to be reducing any longer as the effects of the Learning and Experience Curves have ended. Indeed the workers may have started working on the next product so that their attention towards his product has dimished with the result that these costs may increase.

Overhead costs are likely to be similar to those of the end of the growth phase as optimum batch sizes have been established and are more likely to be used in this maturity stage of the product life cycle where demand is more easily predicted.

(ii) Unit Selling Price:

These are unlikely to be reducing any longer as the product has become established in the market place. This is a time for consolidation and whilst there may be occasional offers to attempt customers to buy the product the selling price is likely to be fairly constant during this period.

3. Introductory stage:

As the company has adopted skimming strategy the price at introductory stage is higher but low profit margin is due to high fixed cost.

4. Decline stage:

In this case during decline stage the company cut down the prices if not repositioning.

![]()

Question 32.

DK International is developing a new product. During its expected life, 16,000 units of the product will be sold for ₹ 102 per unit. Production will be in batches of 1,000 units throughout the life of the product. The direct labour cost is expected to reduce due to the effects of learning for the first eight batches produced. Thereafter, the direct labour cost will remain constant at the same cost per batch as in the 8th batch. (May 2019)

The direct labour cost of the first batch of 1,000 units is expected to be ₹ 55,00Q and a 90% learning effect is expected to occur. The direct material and other non-labour related variable costs will be ₹ 50 per unit throughout the life of the product.

There are no fixed costs that are specific to the product.

The learning index for a 90% learning curve = – 0.152; 8-0.152 = 0.729; 70.152 = 0.744

Required:

(i) Calculate the expected direct labour cost of the 8th batch. (3 marks)

(ii) Calculate the expected contribution to be earned from the product over its lifetime. (3 marks)

(iii) Calculate the rate of learning required to achieve a lifetime product contribution of ₹ 5,00,000, assuming that a constant rate of learning applies throughout the product’s life. (4 marks)

Answer:

(i) Total direct Labour Cost for first 8 batches based on learning curve of 90% (When the direct labour cost for the first batch is ₹ 55,000.)

The usual learning curve model is Y = aXb

Where,

Y = Average direct labour cost per batch for x batches

a = Direct Labour Cost for first batch

x = Cumulative no. of batches produced,

b = Learning Coefficient / Index

Y = ₹ 55,000 × (8)-0.152

= ₹ 55,000 × 0.729

y = ₹ 40,095

Total direct labour cost for first 8 batches

= 8 batches × ₹ 40,095

= ₹ 3,20,760

Total direct Labour Cost for first 7 batches based on 90% learning curve of (When the direct labour cost for first batch is ₹ 55,000).

y = ₹ 55,000 × (7)0.152

= ₹ 55,000 × 0.744

= ₹ 40,920

![]()

Total direct labour cost for first 7 batches

= 7 batches × ₹ 40,920

= ₹ 2,86,440

Direct labour Cost for 8th Batch = ₹ 3,20,760 – ₹ 2,86,440

= ₹ 34,320

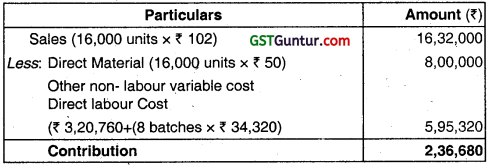

(ii) Statement Showing Contribution to be earned from the product over its lifetime:

(iii) In order to achieve a contribution of ₹ 5,00,000 , the total direct cost have to equal ₹ 3,32,000

Statement Showing life time Direct Labour Cost:

| Particulars | Amt. (₹) |

| Sales (16,000 units × ₹ 102) | 16,32,000 |

| Less: Direct Material & Other non variable Cost (16,000 units × ₹ 50) | 8,00,000 |

| Less: Contribution | 5,00,000 |

| Direct Labour Cost | 3,32,000 |

Average Direct labour cost per batch for 16 batches is ₹ 20,750 (₹ 3,32,000/16 batches).

Total direct labour cost for 16 batches based on learning Curve of r% (when the direct labour Cost for first batch is ₹ 55,000)

y = ₹ 55,000 x(16)b

₹ 20750 = ₹ 55,000 × (16)b

0.3773 = (16)b

log 0.3773 = b × log 24

log 0.3773 = b × log 2

log 0.3773 = \(\left(\frac{\log r}{\log z}\right)\) × 4 log 2

log 0.3773 = log r4

0.3773 = r4

r = \(4 \sqrt{0.3773}\)

= 78.37%

![]()

Question 33.

Recommend the Pricing Strategy to be adopted with reference to the following situations. You are not required to explain the reasons for your answer. (May 2019) (1 × 8 = 8 marks)

(a) Star Coffee Shop follows the practice of keeping the price of its coffee or service artificially high in order, to encourage favourable perceptions among buyers, based solely on the price.

(b) Sky TV gave away their satellite dishes for free in order to set up a market for them.

(c) Princeton Hotels Ltd. follows a competitive pricing method under which it= tries to keep its price at an average level charged by the Industry.

(d) Eddisson Enterprises has piled up stocks in large quantities and the market price has fallen.

(e) Acqua LLP follows a new product pricing strategy through which company makes profitable sales by selling out few units.

(f) X Ltd. produces Product X a revolutionary product and as a reward for innovation and for taking first initiative which pricing strategy should X Ltd. adopt ?

(g) An established company has recently entered the stationery market segment and launched quality paper for printing at home and office.

(h) D is a perishable item, with more than 80% of its shelf life is over.

Answer:

(a) Premium Pricing

(b) Penetration Pricing

(c) Going Rate Pricing

(d) Pricing Below Marginal Cost

(e) Skimming Pricing

(f) Premium Pricing

(g) Market Price

(h) Any Cash Realizable Value

![]()

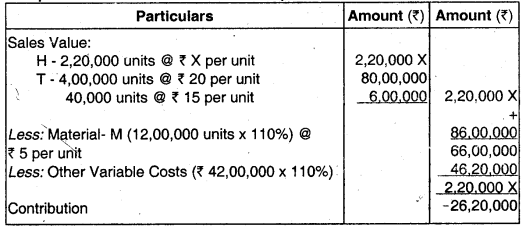

Question 34.

RK Ltd., which is producing a product, prepared a budget for the next year as follows : (May 2019, 10 marks)

Fixed Cost p.a. – ₹ 12,60,000

Variable Cost p.u. – ₹ 25

Production – 180000 units

Selling price – Cost plus 25% mark-up on total budgeted cost

When these budgeted figures and the pricing approach were informed to the Marketing Manager he came put with a remark that the demand for the product is more price sensitive and he expected the demand under various prices as given below :

| Selling Price p.u. (₹) | 36 | 38 | 40 | 42 | 44 |

| Annual Demand (units) | 174000 | 162000 | 150000 | 138000 | 125000 |

The Marketing Manager further informed that a wholesale dealer is ready to buy the entire production of the company at a price of ₹ 32 p.u. In that situation he expected a savings of ₹ 2 p.u. in the selling expenses which are a part in the above stated variable cost.

Required:

Evaluate the situation and advice the most profitable course of action.

Answer:

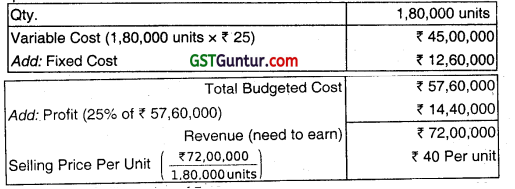

The company has a plan to produce 1,80,000 units and it produced to adopt cost plus pricing approach with a markup of 25% on full budgeted

cost. To achieve this pricing policy, the company has to sell its product at price calculated below:

However at Selling price of ₹ 40 per unit, the company can sell 1 50,000 units only, which is 30,000 units less than the budgeted production units.

After analyzing the price-demand pattern in the market(which is price sensitive), to sell all the budgeted units market price needs to be further lowered, which might be lower than the total cost of production:

Statement Showing “Profit at Different Demand & Price Levels.

| I | II | III | IV | V | |

| Qty(units) | 1,74,000 | 1,62,000 | 1,50,000 | 1,38,000 | 1,25,000 |

| ₹ | ₹ | ₹ | ₹ | ₹ | |

| Sales | 62,64,000 | 61,56,000 | 60,00,000 | 57,96,000 | 55,00,000 |

| Less: V.C | 43,50,000 | 46,50,000 | 37,50,000 | 34,50,000 | 31,25,000 |

| Contribution | 19,14,000 | 21,06,000 | 22,50,000 | 23,46.000 | 23,75,000 |

| Less: F.C. | 12,60,000 | 12,60,000 | 12,60,000 | 12,60,000 | 12,60,000 |

| Profit | 6,54,000 | 8,46,000. | 9,90,000 | 10,86,000 | 11,15,000 |

| Profit (% on total cost) | 11.66 | 15.93 | 19.76 | 23.06 | 25.43 |

![]()

Under the existing situation, the company should produce on sell 1,25,000 units at ₹ 44. At this price company will not be able to achieve its desired mark up of 25% on the total cost but can earn maximum contribution as compared to other even higher selling prices

Now if the Marketing manager wishes to sell the above production to a whole seller at 32 then, best possible and profitable course of option will be

Now if entire production of the company at ₹ 32, the Profitability earned is:

| ₹ | |

| Sales (₹ 32 × 1,80,000 units)

Less: Variable cost (₹ 25 – ₹ 2) × 180000 units Contribution |

5,7,60,000

41,40,000 |

| 16,20,000 | |

| Less: Fixed Cost | 12,60,000 |

| Profit | 3,60,000 |

| Profit (1 on Total Cost) | 6.67% |

Since the company can not achieve desired results by way of Selling entire product to whole seller, as the profit per percentage and contribution level both are below as compared to above 1,38,000 units Sales analysis.

So, the best and most profitable course of action is selling 1,38,000 units at ₹ 42 Per unit as calculated above.