Go through this Preparation of Final Accounts for Sole Proprietorship – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Preparation of Final Accounts for Sole Proprietorship – CS Foundation Fundamentals of Accounting Notes

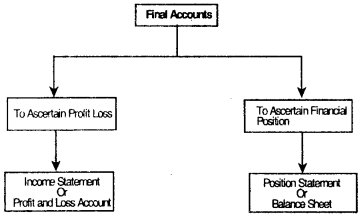

Final Accounts:

The final step of the process of accounting is the preparation of such accounts which depict the end results.

- Net Profit of the trading activities in terms of Profit made or loss incurred for a given period.

- It’s financial position in terms of asset & liabilities.

These involve the preparation of:

- Trading Account

- Profit and Loss Account

- Balance Sheet

Since the preparation of these accounts is the final stage of accounting, hence these are known as Final Accounts.

Final accounts are prepared from the balance appearing in Trial Balance.

Objectives of maintaining final Accounts:

(i) To ascertain Profit or Loss of the business

(ii) To ascertain the financial position of a business.

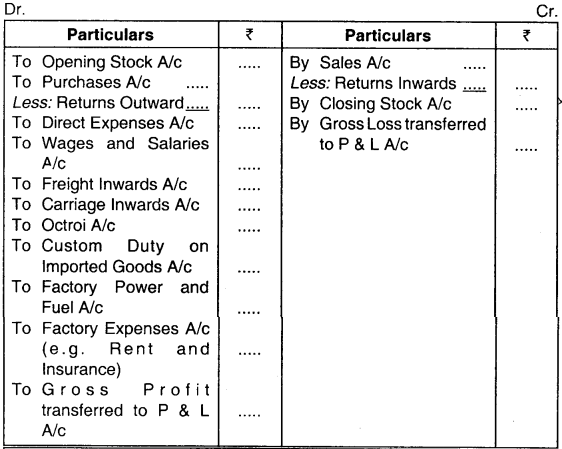

Trading Account:

- The first step in the preparation of final accounts is the preparation of trial balance.

- Trading Account shows the results of buying and selling of goods and services in the form of gross profit or gross loss for a given accounting year.

Features of Trading Account:

- It is prepared in the final accounts of a trading concern.

- It shows the result of trading activities.

- The balance of this account discloses the gross profit or gross loss.

- The balance of this account is transferred to the Profit/Loss Account.

- The trading account is based on the following equation:

- Gross Profit = Net Sales – Cost of Goods Sold OR

- Gross Loss= Cost of Goods Sold – Net Sales

Where:

- Cost of Goods Sold (COGS) = Opening Stock + Purchases + Direct Expenses – Closing Stock.

- Net Sales = Sales Sales Returns (Return Inwards)

- Net Purchases = Total Purchase – Purchase Return

This account matches the selling price and cost of goods and services sold during an accounting year.

Items of Trading Account (Debit Side):

(i) Opening Stock:

- This is the closing stock of the previous year which has been brought forward.

- In the first year of commencement, there will be no opening stock.

(ii) Purchases Less Purchase Return:

- It refers to the materials purchased by the business (either on cash or credit)

- Purchase Returns refers to the material returned to the supplier.

- Purchase Returns are riot included and hence, are deducted from purchases.

- Net Purchase = Purchase – Purchase Returns (Return Outward)

Note: Sometimes material or goods are taken for personal use, for giving as charity or by way of samples.

The purpose of these goods is not to earn profits. Hence, these are deducted from purchases.

(iii) Direct Expenses:

- Expenses directly associated with the goods are called direct expenses.

- These include the expenses to purchase the goods and to bring them to the business premises.

- Examples of these expenses are: Freight inwards, clearing charges, custom duty, cartage, octroi etc.

(iv) Gross Profit:

- This is the balancing figure of the trading account.

- It shows the excess of Net Sales over Cost of Goods Sold.

- It is transferred to the credit side of Profit and Loss Account.

Items of Trading Account (Credit Side):

(i) Sales Less Returns –

- Sales refers to the amount received or to be received from sale of goods.

- Since it is an income for the business hence, sales always has a credit balance.

- Sales Returns refers to the returns made by the customers due to detects in goods or any other reason.

- Sales Returns should be deducted from sales.

- Net Sales = Sales – Sales Returns

Note:

- Purchase Returns are also known as Return Outwards as the goods are going out of the business.

- Sales Return is also known as Return Inwards as the sold goods are coming back to the business.

(ii) Closing Stock –

- Unsold stock at the end of the accounting period.

- It refers to the stock unsold at the end of the accounting year.

- Closing stock appears on the credit-side of trading account as well as on the asset side of Balance Sheet.

- Closing stock does not appear in the Trial Balance.

Note:

As per the concept of conservatism studied in ch-1, closing stock should be measured at cost or market price whichever is lower.

(iii) Gross Loss:

- It is the net result of the Trading Account.

- it occurs when cost of goods sold is in excess of net sales.

- It is transferred to the debit of Profit and Loss Account.

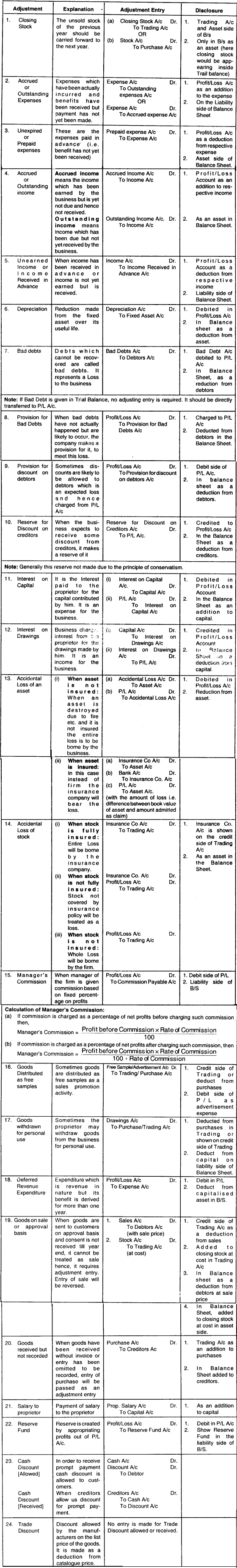

Format

Trading Account for the year ended….

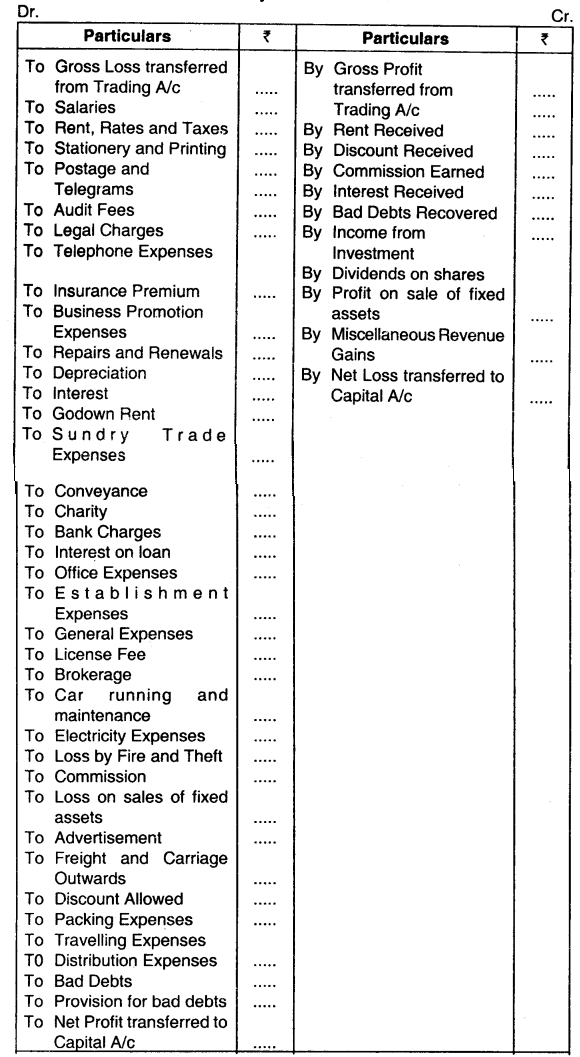

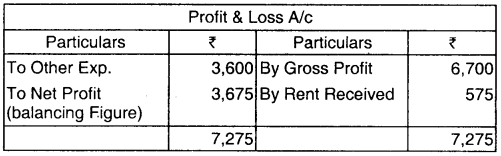

Profit and Loss Account:

- The next step after preparation of Trading Account is the preparation of Profit and Loss Account.

- Profit and Loss Account is prepared to ascertain the net profit or loss from the business.

Note:

Trading Account tells us the profit/loss from the trading activity (i.e. buying and selling of goods). Hence, it is known as Gross Profit/Gross Loss. Whereas, Profit/Loss Account tells us the profit earned or loss incurred from the whole business (i.e. after deducting expenses of the business or indirect expenses).

Hence, it is known as Net Profit/Loss.

Features of Profit and Loss Account:

- P/L A/c relates to a particular accounting period and is prepared at the year end.

- It is prepared based on accrual basis of accounting.

- It helps us to know the net results of the business in the form of Net Profit or Net Loss.

- The net profit/loss so ascertained is transferred to the capital account of proprietor.

- Profit and Loss account is also known as the income statement.

Items of Profit and Loss Account [Debit Side]:

(i) Gross Loss :

- As transferred from the trading account.

- It has been already discussed earlier.

(ii) Indirect Expenses:

Those expenses which are not directly related to the buying of goods but are necessary for conducting the business are called indirect expenses.

These can be classified as –

(i) Administrative or Office Expenses

(salaries, office rent, electricity, legal expenses, stationery, postage and stamp, etc.)

Net Profit = Total Revenue – Total Expenses Net Loss = Total Expenses – Total Revenue

(ii) Selling and Distribution Expenses

(commission of agents, advertising expenses, salesman salary, freight, cartage on sales, etc.)

(iii) Financial Expenses

(interest on loan, interest on capital, discount allowed, etc.)

(iv) Abnormal Losses

Abnormal Losses include loss of stock by fire, loss by theft, loss on sale of fixed assets etc.

(v) Bad Debts

Bad debts refers to the debts given by the company which will not be recovered. Since it is a loss to the company hence they will be shown in the P/L A/c.

Items of Profit and Loss Account [Credit Side]:

(i) Gross Profit

As transferred from the trading account.

It has been already discussed earlier.

(ii) Indirect incomes

1. Income other than from sale of goods are known as indirect incomes.

2. Some of the examples are

- Commission received

- Interest on fixed deposit

- Rent received

- Discount received

- Interest on drawings

- Income from investment, etc.

Note: The balance of P/L A/c is a Net Profit or Net Loss which is transferred to the Capital A/c.

Net Revenue = Total Revenue – Total expenses Net Loss = Total expenses – Total revenue

Note: Profit and Loss Account is based on the fundamental principle of “matching cost with revenue” of an accounting period.

Format of Profit and Loss Account:

Profit and Loss Account for the year ended ……….

Difference between Trading Account and Profit and Loss Account:

| Basis | Trading Account | Profit and Loss Account |

| 1. Relation | Trading Account is a part of Profit and Loss Account. | Profit and Loss Account is the main account. |

| 2. Nature | The Gross Profit or Gross Loss is ascertained from the Trading Account. | The Profit and Loss Account is prepared to ascertain the Net Profit or Net Loss of the business. |

| 3. Transfer of Balance | The balance of the Trading Account is transferred to the Profit and Loss Account. | The balance of the Profit and Loss Account is transferred to Balance Sheet. |

| 4. Items | Items shown in the Trading Account are Purchases, Sales, Stock, direct expenses, etc. | Items like indirect expenses related to sales, distribution, administration, finance, etc.. are shown in the Profit and Loss Account. |

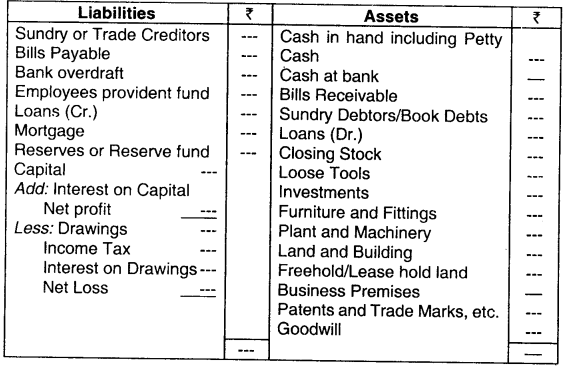

Balance Sheet:

- Balance Sheet is a statement which shows the balances of various assets and liabilities of a business on a particular date.

- It shows the financial position of a business as at a given time.

- A Balance Sheet is prepared from the balances of the real and personal accounts.

- Balance Sheet is also known as the position statement as it tells us the financial position of a business on a particular date.

- The two sides of Balance Sheet should always be equal. If any differences arises then the same should be placed on the deficit side as Suspense A/c.

- The total of both sides of the Balance Sheet must agree because of the equation, viz. Assets = Liabilities + Capital

Items of Balance Sheet [Left Side]:

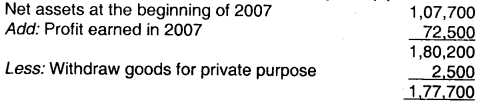

(i) Capital (Fixed Liability) –

- It refers to the amount contributed by the proprietor into the business.

- Net Profit is added to the capital while drawings are deducted from it.

It can be expressed as –

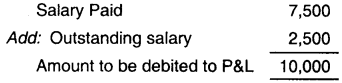

- Net Assets of the Business, Or

- Difference between Assets and liabilities.

(ii) Liabilities:

1. The obligations of the business are known as liabilities.

2. They can be classified into –

- Long term Liabilities (Fixed Liabilities)

- Current Liabilities

- Contingent Liabilities

Long term Liabilities:

- The obligation which are not to be paid in the near future are termed as long term liabilities.

- These include long term loans or debentures which are mainly raised for a period of more than one year.

- These are the fixed liabilities which are payable on the termination of the business. Example – Capital of proprietor

Current Liabilities:

- Short term obligations of the business are termed as current liabilities.

- These liabilities are payable within a period of one year.

- These include trade creditors, bills payable, outstanding expenses, bank overdraft and other short term liabilities.

Contingent Liabilities:

- These are actually not a liability but their possibility of becoming liability depends upon happening or non happening of an uncertain event.

- These are not shown in Balance Sheet, but are disclosed by way of footnotes. E.g.- Liability in respect of pending suit, bills discounted with a bank etc.

- If such events do not occur, no liability is incurred.

Items of Balance Sheet [Right Side]

(i) Assets:

The property or legal rights which are owned by a business are known as assets.

- Assets can be classified as follows:

- Fixed Assets:

Assets which are acquired for long term use and not for resale.

Examples: Land and building, plant and machinery, furniture, etc.

Current Assets (floating assets):

- Assets which have been acquired for resale or for converting into cash are called current assets.

- Current assets are likely to be realised within one accounting year.

- Examples: stock, debtors, bills receivable, etc.

Liquid Assets:

- Assets which are in cash or are readily convertible into cash are known as liquid assets.

- Example: cash, government securities etc.

Wasting Assets:

- Assets which have a fixed content and will deplete as and when the content is taken out are called wasting assets.

- Examples: coal mine, iron ore mine etc.

Intangible Assets:

- Assets which are intangible in nature (i.e. they cannot be felt or touched) are called intangible assets.

- Such assets do not have a physical existence but have a value.

- Example: goodwill of the business.

Fictitious Assets:

1. These assets can be in two forms:

- Valueless assets (i.e. patents, trademarks)

- Expenses treated as assets (preliminary expenses)

2. These include deferred revenue expenditure not yet written off.

(ii) Investments:

- They represent the capital expenditure made on purchase of shares, debentures, bonds or any other security.

- Investments will earn benefits for the firm in the form of dividend, interest etc.

- These are shown under a separate head in the right side of balance sheet along with assets.

Marshalling of Balance Sheet:

- The arrangement of asset and liabilities in a particular order in a Balance Sheet is termed as Marshalling.

It is also known as grouping. - Assets and liabilities can be arranged in the following order

- Order of liquidity (according to time)

- Order of permanence (according to purpose)

Order of Liquidity:

1. Liquidity means how quickly an asset or liability will convert into cash.

2. Here the items of Balance Sheet are arranged in descending order of liquidity (i.e. starting from most liquid and ending with least liquid).

Example:

Balance Sheet:

| Liabilities | Assets | |

| Bills payable

Sundry creditors ………………. ………………. ………………. ………………. Capital |

Cash in hand

Cash at bank ……………….. ……………….. ……………….. Plant and machinery Land and building |

Order of permanence

1. Order of permanence means starting with those assets which are to be used permanently in business and. those liabilities which are a permanent obligation of the business.

Example:

| Liabilities | Assets | |

| Capital

………………. ………………. ………………. ………………. Sundry creditors |

Goodwill

Plant and machinery ……………….. ……………….. Cash in hand |

Format

Balance Sheet of As at ……………

Difference between Balance Sheet and Trial Balance:

| Basis | Balance Sheet | Trial Balance |

| 1. Purpose | The purpose is to portray the financial position. | The purpose is to establish the arithmetical accuracy of the books of account. |

| 2. Information about Profits | It provides information as to the profitability and financial position of the firm. | No such information is possible from the Trial Balance. |

| 3. Headings | The two sides are headed as assets and liabilities. | The two columns are headed as debit and credit. |

| 4. Coverage | Only personal and real accounts appear in the Balance Sheet. | In the Trial Balance, all accounts must be written. No account should be left out. |

| 5. Use | Prepared for external use (Creditors, shareholders etc.) | Prepared for internal use. |

| 6. Period | Normally, it is prepared only at the end of the trading period. | A Trial Balance is prepared normally every month on whenever desired. |

Final Accounts with adjustments:

1. In a business there are certain transactions of expenses and incomes which need to be adjusted.

At the time of preparing final accounts, it is important to take into account these transactions. These are known as adjustments and the entries required to give them effect are called adjusting entries.

2. While bringing out any adjustment, the principle of double entry system should be kept in mind. If any one account is debited, then any other account should be credited.

Some of the items requiring adjustments are as follows:

- Outstanding expenses

- Prepaid expenses

- Bad debts/bad debt recovered etc.

Example:

Business pays salary to Mr. A at the rate of ₹ 10,000 p.m. Actually salary paid during the year is only ₹ 1,10,000. Hence ₹ 10,000 is outstanding. This amount of ₹ 10,000 is an expense related to current year but still not paid. As per the mercantile concept, this expense should be recognized and hence an adjustment entry is required to be passed

Difference between cash discount and trade discount:

| Basic | Cash Discount | Trade Discount |

| Reason | It is granted by supplier from the invoice price in consideration of prompt payment. | Granted by supplier to promote sales. |

| Shown in invoice | It is not shown in the invoice. | It is shown by way of deduction in the invoice itself. |

| Ledger posting | Cash discount account is opened in the ledger. | Trade discount is not opened in the ledger. |

| Allocation of discount | It is allowed on payment of money. | It is allowed on purchase of goods. |

| Time period | It vary with the time period of payment within which payment is received | It vary with the quantity of goods purchased. |

Closing Entries:

- Closing entries mean entries required for closing the books of accounts.

- These are the final entries which lead to the preparation of final accounts.

(i) Transfer to Trading Account –

(a) Trading A/c Dr.

To Stock A/c

To Purchases A/c

To Sales returns A/c

To Carriage inwards A/c

(Transfer of various accounts to Trading A/c)

(b) Sales A/c

Purchase Returns A/c Dr.

Closing Stock A/c Dr.

To Trading A/c

(Transfer of sales A/c and purchases return account to trading A/c and recording of closing stock)

(ii) Transfer of gross profit/ gross loss to P/L A/c –

(a) For Gross Profit:

Trading A/c Dr.

To P/L A/c

(b) For Gross Loss:

Profit/Loss A/c Dr.

To Trading A/c

(iii) Transfer entries to P/L A/c –

(a) Transfer of expenses and losses:

Profit/Loss A/c Dr.

To Rent A/c

To Salaries A/c

To Depreciation A/c

To Abnormal Losses A/c

(Transfer of various nominal A/c of Profit & Loss Account)

(b) Transfer of incomes:

Indirect incomes A/c Dr.

To Profit/Loss A/c

(iv) Transfer of Net Profit/Loss to Capital A/c –

(a) Transfer of Net Profit:

Profit/Loss A/c Dr.

To Capital A/c

(b) Transfer of Net Loss:

Capital A/c Dr.

To Profit/Loss A/c.

Manufacturing Account:

1. Trading refers to buying and selling of goods whereas manufacturing means production of goods.

2. Trading A/c does not disclose the cost of goods manufactured hence for this purpose a Manufacturing A/c is prepared.

Cost of goods manufactured = Cost of raw material + expenses incurred on production.

3. Manufacturing account shows cost of production, trading account shows the gross profit or gross loss while, profit & loss a/c shows the net profit earned or net loss suffered by the organisation during a particular period.

4. The cost of goods manufactured calculated from this account is transferred to the Trading A/c.

5. This account is prepared by manufacturing firms in addition to other final accounts which we have studied earlier.

Manufacturing A/c for the year ended…

Limitations of financial statements:

1. Final gain or loss of the business cannot be ascertained as a business is a continuing one.

2. Financial statements are based on figures which may not be exact and accurate.

3. Different firms follow different accounting policies and hence, inter firm comparison is not possible.

4. There may be undisclosed or concealed errors in financial statements which may distort their true picture.

5. Managers resort to window dressing i.e. preparing the financial statements in such a manner that it gives a wrong impression to the users of these statements.

6. Financial statements are basically prepared for the shareholders and may not contain the information required by the third parties. Financial Statements does not consider the non financial factors e.g. employees are the biggest asset of any organisation but are not recorded as assets in the balance sheet.

7. The assets are recorded at the historical cost and does not consider the realisable value or replacement cost of the asset.

Preparation of Final Accounts for Sole Proprietorship MCQ Questions

1. Which one of the following is correct:

(a) Gross profit + Sales + Direct expenses + Purchases + Closing stock – Opening stock

(b) Gross profit + Direct expenses + Purchases + Closing stock – Opening stock = Sales

(c) Gross profit + Direct expenses + Purchases + Opening – Closing stock = Sales

(d) Gross profit + indirect expenses + Purchases + Opening – Closing stock = Sales

Answer:

(c) Gross profit+Direct expenses+Purchases+Opening-Closing stock = Sales

2. The adjustment to be made for interest on capital is:

(a) Debit Profit and Loss account and deduct interest from capital

(b) Credit Profit and Loss account and deduct interest from capital

(c) Debit Profit and Loss account and add interest,to capital

(d) Credit Profit and Loss account and deduct interest from capital

Answer:

(c) Debit Profit and Loss account and add interest,to capital

3. The adjustment to be made for provision for doubtful debt is:

(a) Credit profit and Loss account and deduct the provision from debtors

(b) Debit profit and Loss account deduct the provision from debtors.

(c) Credit profit and Loss account and add the provision to debtors

(d) Debit profit and Loss account and add the provision to debtors.

Answer:

(b) Debit profit and Loss account deduct the provision from debtors.

4. Gross profit is equal to:

(a) Net profit minus expenses

(b) Purchases plus stock minus net sales

(c) Net sales plus selling price of stock minus purchases

(d) Net sales minus cost price of sales.

Answer:

(d) Net sales minus cost price of sales.

5. Net profit is equal to:

(a) Gross profit minus expenses

(b) Net sales plus purchases minus gross profit

(c) Expenses minus gross profit

(d) Gross profit minus net sales plus purchases

Answer:

(a) Gross profit minus expenses

6. Under- statement of closing work in progress in the period will:

(a) Understate cost of goods manufactured in that period

(b) Overstate current assets

(c) Overstate gross profit from sales in that period

(d) Understate net income in that period.

Answer:

(d) Understate net income in that period.

7. A decrease in the provision for doubtful debts would result in :

(a) An increase in liabilities

(b) A decrease in working capital

(c) A decrease in net profit

(d) An increase in net profit.

Answer:

(d) An increase in net profit.

8. Which of the following accounts would be closed by transfer to the Trading and Profit and Loss Account at the end of a period.

(a) Sales

(b) Salary expenses

(c) Both sales and salary expense

(d) Neither sales nor salary expense

Answer:

(c) Both sales and salary expense

9. In a Trading and Profit and Loss Account, the excess of net sales over the cost of goods sold is called:

(a) Operating income

(b) Income from operations

(c) Gross profit

(d) Net income.

Answer:

(c) Gross profit

10. In general, the accounts in the income statement are known as:

(a) Permanent accounts

(b) Temporary accounts

(c) Unearned revenue accounts

(d) Contra-asset accounts

Answer:

(b) Temporary accounts

11. If beginning and ending goods inventories are ₹ 400 and ₹ 700, respectively, and cost of goods sold is ₹ 3,400 net purchase are _________.

(a) ₹ 3,700

(b) ₹ 3,400

(c) ₹ 3,100

(d) Cannot be determined

Answer:

(a) ₹ 3,700

12. Which of the following would appear as an operating expenses in the P/L A/c of trading firm:

(a) Freight inward

(b) Freight outward

(c) Sales returns and allowances

(d) Purchases returns and allowances

Answer:

(b) Freight outward

13. Which one of the following statement is correct?

(a) Gross profit on trading is entered on the right side of the Trading account and carried down to the Left side of the Profit and Loss Account

(b) Gross profit on trading is entered on the Left side of the Trading account and carried down to the right side of the Profit and Loss Account

(c) Net profit on trading is entered on the right side of the Trading account and carried down to the left side of the Profit and Loss Account

(d) Net profit on trading is entered on the left side of the Trading and carried down to the right side of the Profit and Loss Account

Answer:

(b) Gross profit on trading is entered on the Left side of the Trading account and carried down to the right side of the Profit and Loss Account

14. After all closing entries have been posted, the balance of the P&L Account will be:

(a) A debit if a net income has been earned

(b) A debit if a net loss has been incurred

(c) A credit if a net loss has been incurred

(d) Zero

Answer:

(b) A debit if a net loss has been incurred

15. Closing Stock appearing in the Trial Balance is shown:

(a) On the Dr. side of Trading A/c

(b) On the Cr. side of Trading A/c

(c) On the Assets side of Balance Sheet

(d) On the Cr. side of Trading A/c and on the assets side of Balance sheet

Answer:

(c) On the Assets side of Balance Sheet

16. If ‘Prepaid Wages’ is given in Trial Balance, it is shown in :

(a) Debit of Trading A/c

(b) Debit of Trading A/c and Assets side of B/S

(c) Debit of P & L A/c

(d) Assets side of the B/S

Answer:

(d) Assets side of the B/S

17. If the manager is entitled to a Commission of 5% on profits before deducting his commission, he will get a commission of on a profit of ₹ 8,400.

(a) 400

(b) 442.11

(c) 420

(d) None of these

Answer:

(c) 420

18. The Trial Balance Shows Debtors ₹ 2,400; Bad Debts ₹ 221; Bad Debts Reserve ₹ 324; for Creating a Reserve for doubtful debts @ 10% on debtors, the P & L A/c will be debited by :

(a) 137

(b) 240

(c) 343

(d) 9

Answer:

(a) 137

19. Income earned but not received is shown in:

(a) Liabilities

(b) Assets

(c) Foot- note

(d) None of them

Answer:

(b) Assets

20.

| ₹ | |

| Opening capital | 50,000 |

| Closing capital | 52,000 |

| Net profit during the year | 5,000 |

If the above figures are drawn from the books of a trader, then his drawings, if any, are:

(a) ₹ 5,000

(b) ₹ 3,000

(c) ₹ 1,000

(d) ₹ 6,000

Answer:

(b) ₹ 3,000

21.

| ₹ | |

| Opening capital | 80,000 |

| Closing capital | 1,20,00 |

| Net profit during the year | 20,000 |

The trader has

(a) Drawings of ₹ 20,000

(b) Brought additional capital of ₹ 30,000

(c) Brought additional capital of ₹ 40,000

(d) Both (a) and (c) above

Answer:

(d) Both (a) and (c) above

22.

| ₹ | |

| Opening Stock | 40,000 |

| Closing Stock | 50,000 |

| Sales | 70,000 |

Assuming there is no gross profit and direct expenses, the purchases made during the year are:

(a) ₹ 80,000

(b) f 90,000

(c) ₹ 1,10,000

(d) ₹ 1,60,000

Answer:

(a) ₹ 80,000

23. Rent prepaid is shown as:

(a) Current asset

(b) Current liability

(c) Fixed asset

(d) Income

Answer:

(a) Current asset

24. The Balance Sheet gives information regarding the:

(a) Results of Operations for a particular period

(b) Financial position during a particular period

(c) Profit earning capacity for a particular period

(d) Financial position as on a particular date

Answer:

(d) Financial position as on a particular date

25. The Books of Accounts of Z Ltd. shows that the balance of sundry debtors is ₹ 50,000 and reserve for doubtful debts is ₹ 2,000. Later, the management of the company realized that debts to the extent of ₹ 1,000 will become bad and hence decided to create a reserve at 5% on debtors. The amount of reserve for doubtful debts to be shown in Profit and Loss Account is:

(a) ₹ 2,500

(b) ₹ 2,350

(c) ₹ 2,450

(d) ₹ 1,450

Answer:

(d) ₹ 1,450

26. Opening balance of debtors is ₹ 18,000 5% provision for bad debt is required to be provided on debtors. If the debtors balance is increased during the year by ₹ 5,000 and the provision for bad debts has a debit balance of ₹ 350 after transferring bad debts, the charge against the Profit and Loss Account is:

(a) ₹ 1,950

(b) ₹ 1,500

(c) ₹ 650

(d) ₹ 550

Answer:

(b) ₹ 1,500

27. Final Accounts are prepared:

(a) At the end of calender year

(b) At the end of assessment year

(c) On every Diwali

(d) At the end of accounting year.

Answer:

(d) At the end of accounting year.

28. Interest on drawing is:

(a) Expenditure for the business

(b) Expense for the business

(c) Gain for the business

(d) Loss of the business

Answer:

(c) Gain for the business

29. While making an adjusting entry in respect of closing stock, we debit:

(a) Closing Stock

(b) Trading Account

(c) Purchases Account

(d) Sales Account

Answer:

(a) Closing Stock

30. Trading account is a:

(a) Personal account

(b) Nominal account

(c) Real account

(d) None of these

Answer:

(b) Nominal account

31. The withdrawal of goods from the business by the proprietor should be debited to:

(a) Drawings account

(b) Purchases account

(c) Capital account

(d) P&L A/c

Answer:

(a) Drawings account

32. Goods given as charity should be credited to:

(a) Purchases account

(b) Charity account

(c) Sales account

(d) Trading A/c

Answer:

(a) Purchases account

33. The Loss on the sale of old machinery is debited to:

(a) Profit and Loss account

(b) Machinery account

(c) Depreciation account

(d) Trading A/c

Answer:

(a) Profit and Loss account

34. Only personal and real account are shown in:

(a) Trial Balance

(b) Balance Sheet

(c) Profit and Loss A/c

(d) Trading A/c

Answer:

(b) Balance Sheet

35. If Net Loss is ₹ 5,000. General expenses are ₹ 14,500, sales amount to ₹ 25,000, the Gross Profit will be:

(a) ₹ 20,000

(b) ₹ 11,000

(c) ₹ 9,000

(d) ₹ 9,500

Answer:

(d) ₹ 9,500

36. A firm had a Capital Balance of ₹ 1,00,000 at the beginning of a year. At the end of the year, the firm has total assets of ₹ 1,50,000 and total liabilities of ₹ 70,000. If the total withdrawals during the period were ₹ 30,000, what was the amount of net profit/net loss for the year:

(a) ₹ 10,000 Profit

(b) ₹ 20,000 Loss

(c) ₹ 50,000 Loss

(d) 7 10,000 Loss

Answer:

(a) ₹ 10,000 Profit

37. If sales are ₹ 14,900, Gross Profit ₹ 3,300, Net Loss ₹ 500. The operating expenses will be:

(a) ₹ 2,800

(b) ₹ 3,800

(c) ₹ 11,100

(d) ₹ 11,600

Answer:

(b) ₹ 3,800

38. The General Manager is entitled to a commission of 10% on net profit after charging the commission of works manager. The works manager is entitled to a commission of 5% on the net profits after charging the commission of general manager. The profit before charging any commission is ₹ 7,500. The commission of the work manager to the nearest rupee will be:

(a) ₹ 321

(b) ₹ 333

(c) ₹ 337

(d) ₹ 339

Answer:

(d) ₹ 339

39. Which of the following sets of expenses are the direct expenses of the business:

(a) Salaries, wages, and shop rent

(b) Stationery, postage and telephone

(c) Wages, carriage inward, Local taxes

(d) Advertisement, Legal fees, audit fees.

Answer:

(c) Wages, carriage inward, Local taxes

40. If the profit is 1/4 of the sales, then it is:

(a) 1/4 of the cost price

(b) 1/3 of the cost price

(c) 1/5 of the cost price

(d) 1/6 of the cost price

Answer:

(b) 1/3 of the cost price

41. If the profit is 25% of the cost price, then it is:

(a) 25% of the sales price

(b) 33.33% of the sales price

(c) 20% of the sales price

(d) None of these

Answer:

(c) 20% of the sales price

42. Sales are equal to:

(a) Cost of goods sold + Gross profit

(b) Cost of goods sold – Gross profit

(c) Gross profit – Cost of goods sold

(d) None of these

Answer:

(a) Cost of goods sold + Gross profit

43. If the Closing Stock at the end of the year is overstated by ₹ 7,500, the error causes an:

(a) Overstatement of cost of goods sold for the year by ₹ 7,500

(b) Understatement of gross profit for the year by ₹ 7,500

(c) Overstatement of net income for the year by ₹ 7,500

(d) Understatement of net income for the year by ₹ 7,500.

Answer:

(c) Overstatement of net income for the year by ₹ 7,500

44. Discount Allowed appearing in the Trial Balance are shown:

(a) On the debit side of Trading Account

(b) On the debit side of Profit and Loss A/c

(c) On the asset side of the Balance Sheet

(d) On the credit side of P/L A/c

Answer:

(b) On the debit side of Profit and Loss A/c

45. A Trial Balance contains the following information:

Discount received ₹ 2,000, Provision for discount on Creditors ₹ 1,600.

It is desired to maintain a provision for discount of creditors at ₹ 1,100.

The amount to be credited to the Profit and Loss Account is:

(a) ₹ 2,500

(b) 7 3,500

(c) ₹ 2,000

(d) ₹ 1,500

Answer:

(d) ₹ 1,500

46. Capital on 1 January ₹ 65,000, Interest on drawing ₹ 5,000, Interest on capital ₹ 2,000, Drawings ₹ 14,000, Profit for the year ₹ 15,000. His capital as on 31 December will be:

(a) ₹ 67,000

(b) ₹ 63,000

(c) ₹ 77,000

(d) ₹ 89,000

Answer:

(b) ₹ 63,000

47. Return Outwards appearing in Trial Balance are deducted from:

(a) Sales

(b) Purchases

(c) Returns Inwards

(d) Closing stock

Answer:

(b) Purchases

48. Salaries and wages appearing in Trial Balance are shown:

(a) On the debit side of Trading Account

(b) On the debit side of Profit and Loss Account

(c) On the liabilities side of the Balance sheet

(d) On the assets side of the Balance sheet

Answer:

(b) On the debit side of Profit and Loss Account

49. The Trial Balance shows opening stock ₹ 50,000, it is:

(a) Debited to the Trading Account

(b) Debited to the Profit and Loss Account

(c) Deducted from the closing Stock in the Balance Sheet

(d) Shown as an asset

Answer:

(a) Debited to the Trading Account

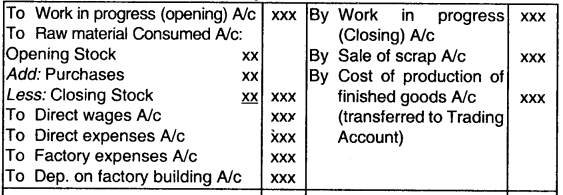

50.

From the above, answer the following –

(i) The value of closing stock is:

(a) ₹ 18,000

(b) ₹ 8,000

(c) ₹ 16,000

(d) ₹ 14,000

Answer:

(d) ₹ 14,000

(ii) Gross profit will be:

(a) ₹ 12,000

(b) ₹ 10,000

(c) ₹ 16,000

(d) ₹ 14,000

Answer:

(a) ₹ 12,000

(iii) Net profit will be:

(a) ₹ 12,000

(b) ₹ 10,000

(c) ₹ 4,000

(d) ₹ 7,000

Answer:

(c) ₹ 4,000

51. Rent paid on 1 October, 2004 for the year upto 30 September, 2005 was ₹ 2,400 Rent paid on 1 October, 2005 for the year upto 30 Sepetember ,2006 was ₹ 3,200. Rent payable as shown in the profit and loss account for the year ended 31 December 2005, would be:

(a) ₹ 6,000

(b) ₹ 3,200

(c) ₹ 2,600

(d) ₹ 3,000

Answer:

(c) ₹ 2,600

52. If sales are ₹ 6,000 and the rate of gross profit on cost of goods sold is 25%, then the cost of goods sold will be:

(a) ₹ 6,000

(b) ₹ 4,500

(c) ₹ 4,800

(d) ₹ None of the above

Answer:

(c) ₹ 4,800

53. Sales for the year ended amounted to ₹ 10,00,000, sales included goods sold to Mr. A for ₹ 50,000 at a profit of 20% on cost. Such goods are still lying in the godown at the buyer’s risk. Such goods should be treated as part of _________.

(a) Sales

(b) Closing stock

(c) Goods in transit

(d) Sales return

Answer:

(a) Sales

54. A’s trial balance provides you the following information: Bad debts ₹ 1,000. It is desired to maintain a provision for bad debts at ₹ 2,000. Amount debited to Profit and Loss A/c will be:

(a) ₹ 1,000

(b) ₹ 3,000

(c) ₹ 4,000

(d) ₹ 2,000

Answer:

(b) ₹ 3,000

55. A new firm commenced business on 1st January, 2006 and purchased goods costing ₹ 90,000 during the year. A sum of ₹ 6,000 was spent on freight inwards. At the end of the year the cost of goods still unsold was ₹ 12,000. Sales during the year ₹ 1,20,000. What is the gross profit earned by the firm?

(a) ₹ 36,000

(b) ₹ 30,000

(c) ₹ 42,000

(d) ₹ 38,000

Answer:

(a) ₹ 36,000

56. From the following figures ascertain the gross profit:

| ₹ | |

| Opening Stock (1.1.2006) | 35,000 |

| Goods Purchased during | 1,20,000 |

| Freight and packing on above | 15,000 |

| Closing stock | 25,000 |

| Sales | 1,90,000 |

| Office expenses | 4,000 |

| Selling expenses on sales | 5,000 |

(a) ₹ 36,000

(b) ₹ 45,000

(c) ₹ 50,000

(d) ₹ 59,000

Answer:

(b) ₹ 45,000

57. Following are the given figures:

| ₹ | |

| Opening Stock | 30,000 |

| Closing Stock | 28,000 |

| Purchases | 85,000 |

| Carriage on Purchases | 2,300 |

| Carriage on sales | 3,000 |

| Rent of office | 5,000 |

| Sales | 1,40,700 |

| Selling Expenses | 600 |

| Drawings | 10,000 |

(i) Gross profit will be

(a) ₹ 50,000

(b) ₹ 47,600

(c) ₹ 42,600

(d) ₹ 50,600

Answer:

(d) ₹ 50,600

(ii) Net profit will be

(a) ₹ 42,000

(b) ₹ 32,000

(c) ₹ 45,600

(d) ₹ 47,600

Answer:

(a) ₹ 42,000

58. A business concern provides the following details :

| ₹ | |

| Cost of goods sold | 1,50,000 |

| Sales | 2,00,000 |

| Opening stock | 60,000 |

| Closing stock | 40,000 |

| Debtors | 45,000 |

| Creditors | 50,000 |

The concern’s purchases would amount to (in ₹):

(a) 1,30,000

(b) 2,20,000

(c) 2,60,000

(d) 2,90,000

Answer:

(d) 2,90,000

59. What would be the amount of sales when Opening Stock is ₹ 50,000, purchases ₹ 1,50,000, wages ₹ 20,000, closing stock ₹ 40,000 and gross profit is 1/7th of sales?

(a) ₹ 2,00,000

(b) ₹ 1,86,669

(c) ₹ 1,80,000

(d) ₹ 2,10.000

Answer:

(a) ₹ 2,00,000

60. A had started business with ₹ 20,000 in the beginning of the year. During the year he borrowed ₹ 10,000 from B. He further introduced ₹ 20,000 in the business. He also gave ₹ 5,000 as loan to his son. Goods given away as charity by him was ₹ 2,000. Profits earned by him was ₹ 25,000. He also withdraw:

(a) ₹ 50,000

(b) ₹ 40,000

(c) ₹ 62,000

(d) ₹ 48,000

Answer:

(c) ₹ 62,000

61. The balances in the books of X, a sole proprietor were: Opening stock ₹ 17,000, Purchases ₹ 52,000, Wages ₹ 46,500, Fuel ₹ 15,000, Sales ₹ 1,45,000 and Closing Stock on hand ₹ 25,000, whose net realizable value was ₹ 28,000.

The Gross Profit calculated would be:

(a) ₹ 39,500

(b) ₹ 42,500

(c) ₹ 54,500

(d) ₹ 57,000

Answer:

(a) ₹ 39,500

62. Balance Sheet is prepared by _________ method:

(a) Liquidity Order

(b) Permanently Order

(c) Both (a) and (b)

(d) None of the Above

Answer:

(c) Both (a) and (b)

63. Purpose of preparing manufacturing A/c:

(a) To know cost of production

(b) To know cost of goods sold

(c) To know profit

(d) To know loss

Answer:

(a) To know cost of production

64. Bad debts recovered is shown:

(a) Cr. of Trading A/c.

(b) Dr. of Trading A/c.

(c) Cr. of P/L A/c.

(d) Assets Side of B/S.

Answer:

(c) Cr. of P/L A/c.

65. If sale is ₹ 1,00,000, Operating expenses ₹ 10, 000 and cost of goods sold is ₹ 40,000, the gross profit is:

(a) ₹ 60,000

(b) ₹ 50,000

(c) ₹ 70,000

(d) ₹ 40,000

Answer:

(a) ₹ 60,000

66. If cost of goods sold is 20,000 & profit is 33.33% on S.P. then find S.P. of goods:

(a) ₹ 30,000

(b) ₹ 40,000

(c) ₹ 32,000

(d) ₹ 31,000

Answer:

(c) ₹ 32,000

67. If Opening capital is 50,000, drawings ₹ 10,000 and Net Profit 20,000, then closing capital will be:

(a) ₹ 60,000

(b) ₹ 50,000

(c) ₹ 80,000

(d) ₹ 20,000

Answer:

(a) ₹ 60,000

68. Find additional capital:

Opening Capital – ₹ 5,000

Net Profit – ₹ 3,000

Drawings – ₹ 500

Closing capital – ₹ 10, 000

(a) ₹ 2,000

(b) ₹ 2,500

(c) ₹ 3,000

(d) ₹ 3,500

Answer:

(b) ₹ 2,500

69. Calculate net profit:

| ₹ | |

| Opening Stock | 10,000 |

| Sales | 1,50,000 |

| Office Exp. | 10,000 |

| Bad debts | 1,000 |

| Purchase | 40,000 |

| Wages | 5,000 |

| Disc. Received | 3,000 |

| Debtor | 5,000 |

Bad debts

(a) ₹ 97,000

(b) ₹ 87,000

(c) ₹ 67,000

(d) ₹ 59,000

Answer:

(b) ₹ 87,000

70. Provision are considered as:

(a) Charge on profits

(b) Appropriation of Profits

(c) Both (a) and (b)

(d) None of these

Answer:

(a) Charge on profits

71. The bills receivables which are final accounts that are prepared are a:

(a) Liability

(b) Asset

(c) Provision

(d) None of these

Answer:

(d) None of these

72. Trading A/c is a:

(a) Personal account

(b) Real account

(c) Nominal account

(d) All of the above

Answer:

(c) Nominal account

73. Which of the following is NOT considered in calculating the cost of goods sold?

(a) Opening stock

(b) Purchases

(c) Carriage inwards

(d) Carriage outwards

Answer:

(d) Carriage outwards

74. The closing stock appears in:

(a) Trading A/c and P&LA/c

(b) Trading A/c and Balance sheet

(c) Trading A/c, P&LA/c and balance sheet

(d) None of the above

Answer:

(b) Trading A/c and Balance sheet

75. If insurance premium of ₹ 12,000 is paid on 1st August, 2010 for the year ending March 2011, then calculate the amount of prepaid insurance.

(a) ₹ 4,000

(b) ₹ 8,000

(c) ₹ 6,000

(d) None of these

Answer:

(a) ₹ 4,000

76. If opening stock is ₹ 12,000, closing stock is ₹ 10,000, purchases are ₹ 50,000 and carriage inward is ₹ 2,000, then calculate the cost of goods sold:

(a) ₹ 44,000

(b) ₹ 46,000

(c) ₹ 54,000

(d) ₹ 66,000

Answer:

(c) ₹ 54,000

77. If the cost of goods sold is ₹ 1,50,000 and the gross profit is 20% of sale, then calculate the amount of sale:

(a) ₹ 2,00,000

(b) ₹ 2,50,000

(c) ₹ 1,87,500

(d) ₹ 1,80,000

Answer:

(c) ₹ 1,87,500

78. Sale of scrap of raw material appearing in the trial balance appears on the credit side of:

(a) Trading A/c

(b) P & L A/c

(c) Balance Sheet

(d) Manufacturing A/c

Answer:

(d) Manufacturing A/c

79. Bonus paid to employees is to be recorded in:

(a) P & LA/c

(b) Trading A/c

(c) Balance Sheet

(d) All of the above

Answer:

(a) P & LA/c

80. If the profit on cost is 33.33%, then what percentage of profit is on sales:

(a) 30%

(b) 40%

(c) 20%

(d) 25%

Answer:

(d) 25%

81. If the profit is 20% on sales, then find the percentage of profits on cost:

(a) 25%

(b) 16.67%

(c) 33%

(d) 42%

Answer:

(a) 25%

82. Given, opening capitals 10,000, loan from bank on behalf of the firm is ₹ 25,000 and the profit for the year is ₹ 2,000. Then, find out the closing capital:

(a) ₹ 13,000

(b) ₹ 12,000

(c) ₹ 37,000

(d) None of these

Answer:

(b) ₹ 12,000

83. The profit before adjustment is ₹ 10,000 and outstanding salary is ₹ 400 and prepaid insurance is ₹ 550, then the profit after adjustment is:

(a) ₹ 9,850

(b) ₹ 9,900

(c) ₹ 10,150

(d) None of these

Answer:

(c) ₹ 10,150

84. The gross profit of a business is ₹ 21,000. The expenses for the year are opening stock ₹ 2,000, direct expenses 2,000, carriage inwards are ₹ 500, carriage outwards ₹ 700 and salary payable ₹ 3,000. Calculate the Net profit:

(a) ₹ 17,300

(b) ₹ 16,800

(c) ₹ 14,800

(d) ₹ 12,800

Answer:

(a) ₹ 17,300

85. Salary paid in cash is ₹ 1,20,000. Salary payable for the year is ₹ 20,000 and salary paid in advance is ₹ 27,000. The salary paid in the current year also includes ₹ 10,000 which was the salary payable for the last year paid during the year. The amount of salary to be debited to the profit & loss A/c is:

(a) ₹ 1,09,000

(b) ₹ 1,03,000

(c) ₹ 1,13,000

(d) None of the above

Answer:

(b) ₹ 1,03,000

86. Provision for bad debt is made by crediting:

(a) Trading A/c

(b) P & L A/c

(c) Debtors A/c

(d) Provision for debtors

Answer:

(d) Provision for debtors

87. Discount on issue of shares is:

(a) Current asset

(b) Intangible asset

(c) Fictitious asset

(d) Fixed asset

Answer:

(c) Fictitious asset

88. The sundry debtors of ABC & Co. are ₹ 25,000. The bad debts are ₹ 3,000. The provision for doubtful debts amount to 2% and discount on debtors is to be provided @ 5%. Calculate the net debtors to be shown in the balance sheet:

(a) ₹ 21,560

(b) ₹ 25,000

(c) ₹ 21,780

(d) ₹ 20,482

Answer:

(d) ₹ 20,482

89. The opening balance of debtors is ₹ 20,000. Credit sales are ₹ 50,000 and cash sales are ₹ 72,000. Bills received during the year are ₹ 5,000 and cash received from debtors is ₹ 40,000. Then the closing balance of debtors is:

(a) ₹ 25,000

(b) ₹ 37,000

(c) ₹ 42,000

(d) None of the above

Answer:

(a) ₹ 25,000

90. The arrangement of assets and liabilities in a particular order is called:

(a) Arrangement

(b) Classification

(c) Recording

(d) Marshalling

Answer:

(d) Marshalling

91. Which of the following is False?

(a) Closing stock does not appear in trial balance

(b) Trial balance is prepared for external use

(c) Trial balance is prepared to test the arithmetical accuracy of book of accounts

(d) None of these

Answer:

(b) Trial balance is prepared for external use

92. Which of the following is NOT a limitation of financial statements?

(a) Financial statements are interim reports

(b) The assets are valued at replacement cost

(c) Managers resort to window dressing

(d) All of these

Answer:

(b) The assets are valued at replacement cost

93. Which of the following is NOT considered while preparing the manufacturing account?

(a) Wages

(b) Direct expenses

(c) Plant repairs

(d) Depreciation on office equipment

Answer:

(d) Depreciation on office equipment

94. Reserve fund is prepared by debiting:

(a) Cash A/c

(b) Sale A/c

(c) Trading A/c

(d) P&LA/c

Answer:

(d) P&LA/c

95. Income received in advance is a:

(a) Income

(b) Liability

(c) Both (a) & (b)

(d) None of these

Answer:

(b) Liability

96. Which of the following statement is true?

(a) Return Inwards and Return Outwards both appear in trading account

(b) Carriage Inwards and Carriage Outwards both appear in profit and loss account.

(c) Carriage Inwards and Carriage Outwards both appear in trading account.

(d) Neither Carriage Inwards nor Carriage Outwards appear in the trading account.

Answer:

(a) Return Inwards and Return Outwards both appear in trading account.

Return Inwards is also known as sales returns and it appear in the trading account on the credit side.

Return outwards is also known as purchase returns which appear on debit side of Trading A/c.

Carriage Inwards is a direct expenses which is shown on debit side of Trading Account.

Carriage outwards is a indirect expenses which is shown on debit side of profit & loss A/c.

On considering above points we found that option (a) is true.

97. Prakash sells goods at 20% on sales. His sales were ₹ 10,00,000. The amount of gross profit is:

(a) ₹ 1,70,000

(b) ₹ 2,50,000

(c) ₹ 2,40,000

(d) ₹ 2,00,000

Answer:

(d) ₹ 2,00,000

Sales = ₹ 10,00,000

Gross Profit = 20% of sales

Thus, Gross Profit = 10,00,000 x 20% = ₹ 2,00,000

Gross Profit amount is ₹ 2,00,000.

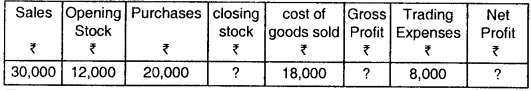

98. Given the following data:

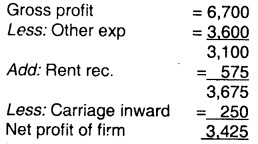

Gross profit ₹ 6,700; Carriage Inwards ₹ 250; Rent received ₹ 575 and other expenses ₹ 3,600. The net profit of the firm would be:

(a) ₹ 3,275

(b) ₹ 3,025

(c) ₹ 3,425

(d) ₹ 3,675

Answer:

(d) ₹ 3,675

99. Ram has been running business from the year 2002. He has paid ₹ 1,650 as rent upto February, 2012 (for financial year 2011-12). Total rent to be debited to profit and loss A/c of financial year 2011 – 12 will be:

(a) ₹ 1,650

(b) ₹ 1,800

(c) ₹ 2,000

(d) ₹ 1,400

Answer:

(b) ₹ 1,800

Rent paid of 11 months (April to February 2012)

= ₹ 1,650

So, one month rent will be = \(\frac{1,650}{11}\) = ₹ 150

For financial year 2011 – 12 rent of March month ₹ 150 will be debited to P/L A/c as outstanding Rent.

Thus, total amount of rent debited to P/L A/c will be (1,650 + 150) = ₹ 1,800.

100. Income tax paid by the sole- proprietor from the business bank account is debited to:

(a) Income tax account

(b) Bank account

(c) Capital account

(d) Provision for taxation account

Answer:

(a) Income tax account

On paying Income Tax from Bank A/c, the following entry will be passed:

Income Tax A/c Dr.

To Bank A/c

(Being Income Tax Paid)

Therefore, income tax paid, is debited to Income Tax Account.

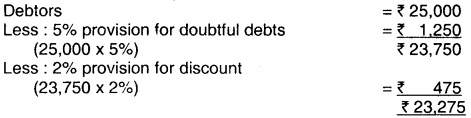

101. Debtors as appearing in Trial Balance are ₹ 25,000. Provision for doubtful debts is to be provided @ 5% and 2% of amount is to be provided for discount. What is the amount of debtors to be shown in balance sheet?

(a) ₹ 23,750

(b) ₹ 23,250

(c) ₹ 23,275

(d) ₹ 1,750

Answer:

(c) ₹ 23,275

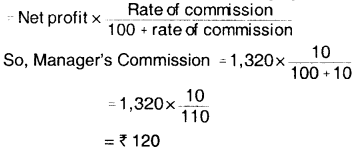

102. The net profit of a sole proprietorship firm is ₹ 1,320 (before commission). The manager of the firm gets 10% commission on the net profit after charging such commission. Manager’s commission would be:

(a) ₹ 120

(b) ₹ 132

(c) ₹ 1,188

(d) ₹ 1,200

Answer:

(a) ₹ 120

Commission on net profit after charging such commission

Manager’s commission would be ₹ 120.

103. Which of the following is correct about trade discount?

(a) It is synonymous with cash discount

(b) It is shown by way of deduction in invoice itself

(c) It is calculated on account paid or received

(d) It is allowed to engage the prompt payment

Answer:

(b) It is shown by way of deduction in invoice itself.

Trade discount is allowed by the seller to a buyer who deals in the same goods as that of the seller. Trade discount is not recorded in the books of account because it is shown by way of deduction in invoice itself.

104. Which of the following items would fall under the category of a liability?

(a) Cash

(b) Debtors

(c) Capital

(d) Land

Answer:

(b) Debtors

Trade discount is allowed by the seller to a buyer who deals in the same goods as that of the seller. Trade discount is not recorded in the books of account because it is shown by way of deduction In Invoice itself.

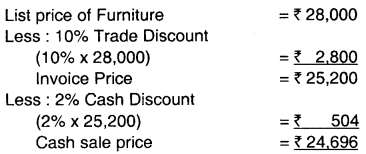

105. If a piece of furniture’s list price is ₹ 28,000 and it is sold at 10% trade discount and 2% cash discount. The cash sale price of furniture would be:

(a) ₹ 25,200

(b) ₹ 24,640

(c) ₹ 24,696

(d) None of the above

Answer:

(c) ₹ 24,696

Cash Sale Price would be ₹ 24,696.

106. What is shown in a balance sheet?

(a) Only those assets which are expressed in monetary terms

(b) Only those liabilities which are expressed in monetary terms

(c) Assets and liabilities expressed in non- monetary terms

(d) Assets and liabilities expressed in monetary terms

Answer:

(d) Assets and liabilities expressed in monetary terms

According to money measurement concept those items which can be interpreted in terms of money are recorded and shown in financial books. In other words, it can be said that those assets and liabilities which expressed in monetary terms is shown in a Balance Sheet.

107. The correct sequence of the following in the preparation of periodical final statements would be:

1. Preparation of Balance Sheet

2. Preparation of Cash Flow Statement

3. Preparation of Trial Balance

4. Preparation of Profit / Loss Statement

The correct option is:

(a) 4, 2, 1,3

(b) 3, 4, 1,2

(c) 2, 4, 3, 1

(d) 1,3, 2, 4.

Answer:

(b) 3, 4, 1,2

The correct sequence of preparation is as follows: Trial Balance, Profit/Loss statement, Balance Sheet and Cash Flow Statement. (3, 4, 1,2)

108. Match list I with list II and select the correct answer using the codes given below the list:

| List I | List II |

| X. Discount on Debentures

Y. Forfeited Capital Z. Income tax payable W. Debtors acceptance |

1. Current Liability

2. Non-Current Assets 3. Current Assets 4. Non Current Liability |

The correct option is:

| X | Y | Z | W | |

| (a) | 2 | 4 | 1 | 3 |

| (b) | 4 | 2 | 3 | 1 |

| (c) | 2 | 4 | 3 | 1 |

| (d) | 4 | 2 | 1 | 3 |

Answer:

(a) 2 4 1 3

- Discount on debentures : Non-current assets

- Forfeited capital: Non-current liability

- Income tax payable : Current liability

- Debtor’s acceptance : Current Assets

109. A company sends cars to dealers on ‘sale or return’ basis. All such transactions are however treated like actual sales and are passed through the sales day book. Just before the end of the financial year, two cars which had costed ₹ 55,000 each have been sent on ‘sale or return’ basis and have been debited to customers at ₹ 75,000 each. Cost of goods lying with the customers would be:

(a) ₹ 1,10,000

(b) ₹ 1,50,000

(c) ₹ 75,000

(d) ₹ 55,000

Answer:

(a) ₹ 1,10,000

The two cars still lying with the customer’s unapproved are costing ₹ 55,000 each.

∴ Stock with the customer at cost is ₹ 1,10,000.

The journal entries at the end of year will be:

(a) Sales a/c Dr. 1,50,000

To Debtor’s a/c 1,50,000

(75,000 x 2)

(b) Stock with Customer’s a/c Dr. 1,10,000

To Trading a/c 1,10,000

(55,000 x 2)

110. The total cost of goods available for sale with a company during the current year is ₹ 12,00,000 and the total sales during the period are ₹ 13,00,000. Gross profit margin of the company is 33 113% on cost. The closing inventory for the current year would be:

(a) ₹ 4,00,000

(b) ₹ 3,00,000

(c) ₹ 2,25,000

(d) ₹ 2,60,000.

Answer:

(c) ₹ 2,25,000

Sales is ₹ 13,00,000

G.P. Margin cost is 1/3 and on sales it will be 1/4

Cost of goods sold = 13,00,000 x 3/4

= 9,75,000

Closing Stock = Total goods available for sale – Cost of goods sold

= 12,00,000 – 9,75,000 = ₹ 2,25,000

111. How does an overcasting of purchases day book affect the cost of sales and profit?

(a) Cost of sales is decreased while profit is increased

(b) Cost of sales is increased while profit is decreased

(c) Both cost of sales and profit are increased

(d) Cost of sales is increased; gross profit is decreased but net profit remains unaffected.

Answer:

(b) Cost of sales is increased while profit is decreased

Cost of Sales = Opening stock + Purchases – Closing stock

On the basis of above it may be observed that if purchase is over cost the cost of sales will increase.

If cost of sales will increase the profit will decrease.

Sales – Cost of sales = profit

Therefore, cost of sales is increased while profit is decreased.

112. If outstanding wages appear in the trial balance, while preparing the final accounts, it will be shown in:

(a) Asset side of the balance sheet

(b) Liability side of the balance sheet

(c) Profit and Loss A/c and asset side of the balance sheet

(d) Profit and Loss A/c and Liability side of balance sheet.

Answer:

(b) Liability side of the balance sheet

Outstanding wages appearing in the trial balance cash will be shown on liability side of balance sheet

Wages a/c Dr.

To outstanding wages a/c

It will not be shown in profit and loss account as it has already been adjusted with wages.

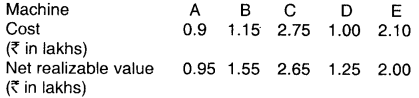

113. E Ltd., a dealer in second-hand machinery has the following five machines of different models and makes in their stock at the end of the financial year 2012-13:

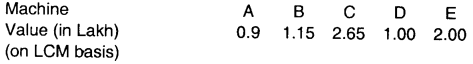

The value of stock included in the Balance Sheet of the company as on 31st March, 2013 was:

(a) ₹ 7,62,500

(b) ₹ 7,70,000

(c) ₹ 7,90,000

(d) ₹ 8,70,000.

Answer:

(b) ₹ 7,70,000

Stock is valued at lower of cost or market price (Net Realizable value) (LCM) Accordingly the value of stock to be included in Balance sheet of the company as on 31st March 2013 will be:

Total value = 7.7 Lakh i.e. ₹ 7,70,000

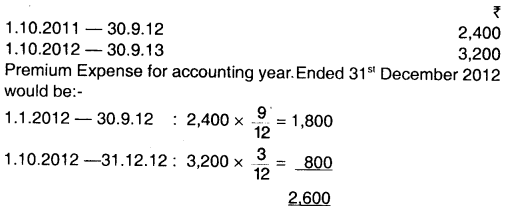

114. Fire Insurance premium paid on 1st October, 2011 for the year ended on 30th September, 2012 was ₹ 2,400 and Fire Insurance premium paid on 1st October, 2012 for the year ending on 30th September, 2013 was ₹ 3,200. Fire Insurance premium paid as shown in the profit and loss account for the accounting year ended 31st December, 2012 would be:

(a) ₹ 2,600

(b) ₹ 3,200

(c) ₹ 2,800

(d) ₹ 3,000

Answer:

(a) ₹ 2,600

Fire Insurance paid for

115. Income earned which is yet to be collected results in:

(a) Increase in capital and increase in liability

(b) Decrease in liability and increase in capital

(c) Increase in asset and increase in liability

(d) Increase in capital and increase in asset.

Answer:

(d) Increase in capital and increase in asset.

Income earned which is yet to be collected:

Accrued Income a/c Dr.

To Income a/c

This results in increase in income and thereby an increase in capital and also an increase in corresponding asset in the name of accrued income.

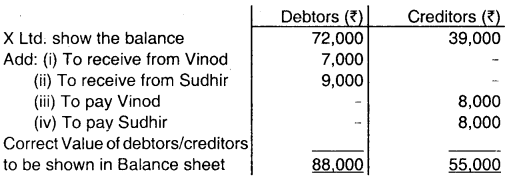

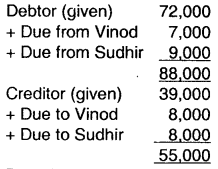

116. X Limited is in the business of trading. It is to receive ₹ 7,000 from Vinod and to pay ₹ 8,000 to Vinod. Similarly, it is to pay ₹ 8,000 to Sudhir and to receive ₹ 9,000 from Sudhir. Except above but after all the adjustment, the books of X Limited show the debtors balance at ₹ 72,000 (Dr.) and creditors balance at ₹ 39,000 (Cr.). The correct value of debtors and creditors to be shown in balance sheet would be _________.

(a) Debtors (₹ 72,000), Creditors (₹ 39,000)

(b) Debtors (₹ 88,000), Creditors (₹ 55,000)

(c) Debtors (₹ 80,000), Creditors (₹ 47,000)

(d) Debtors (₹ 79,000), Creditors (₹ 46,000)

Answer:

(b) Debtors (₹ 88,000), Creditors (₹ 55,000)

117. If the insurance premium paid is ₹ 1,000 and prepaid insurance is ₹ 300, the amount of insurance premium shown in profit and loss account will be _________.

(a) ₹ 1,300

(b) ₹ 700

(c) ₹ 1,000

(d) ₹ 300

Answer:

(b) ₹ 700

Prepaid insurance premium is not an expense of be not shown in P/L A/c. this year, so it will

Therefore, insurance premium shown in profit and loss A/c will be (1,000 300) = ₹ 700 only.

118. The expired cost of a deferred revenue expense is known as _________.

(a) Asset

(b) Expense

(c) Liability

(d) Provision.

Answer:

(b) Expense

Deferred revenue expenditure is that expenditure for which payment has been made for a liability but which is carried forward on a presumption that it will be of benefit over subsequent period or periods and expired cost of as such expenditure is known as expenses and shown in Profit & Loss A/c.

119. If prepaid rent appears in the trial balance, while preparing the final accounts it will be shown in _________.

(a) Assets side of the balance sheet

(b) Liabilities side of the balance sheet

(c) Profit and Loss A/c and asset side of the balance sheet

(d) Profit and Loss A/c and liabilities side of balance sheet.

Answer:

(a) Assets side of the balance sheet

If prepaid rent appears in the trail balance, on preparation of final accounts it will be shown on assets side of balance sheet only.

120. Gauri paid ₹ 1,000 towards a debt of ₹ 1,050, which was written-off as bad debt in the previous year. Which of the following account will be credited for this amount _________.

(a) Gauri’s personal account

(b) Bad debts account

(c) Bad debts recovered account

(d) None of the above.

Answer:

(c) Bad debts recovered account

When a bad debt is recovered which was written off in the previous year, Bad Debts Recovered A/c will be credited.

Cash A/c Dr. 1,000

To Bad Debts Recovered A/c 1,000

121. While finalising the current year’s profit, the company realised that there was an error in the valuation of closing stock of the previous year. In the previous year, closing stock was valued more by ₹ 50,000. As a result _________.

(a) Previous year’s profit was overstated and current year’s profit is also overstated

(b) Previous year’s profit was understated and current year’s profit is overstated

(c) Previous year’s profit was understated and current year’s profit is also understated

(d) Previous year’s profit was overstated and current year’s profit is understated

Answer:

(d) Previous year’s profit was overstated and current year’s profit is understated

When closing stock is overstated, it will result in net profit for the period to be overstated and COGS to be understated and net profit of preceding year is understated and COGS to be overstated.

Thus option (d) is right.

122. If Capital = ₹ 70,000; Liability = ₹ 40,000. Find Assets –

(a) ₹ 30,000

(b) ₹ 1,10,000

(c) ₹ 40,000

(d) ₹ 70,000

Answer:

(b) ₹ 1,10,000

Assets = Capital + Liability

= 70,000 + 40,000 = 1,10,000

123. If opening stock is 10,000, Purchases 20,000, Direct expenses 10,000, Indirect expenses 30,000. Find value of cost of goods sold:

(a) ₹ 10,000

(b) ₹ 20,000

(c) ₹ 30,000

(d) ₹ 40,000.

Answer:

(d) ₹ 40,000.

Cost of goods sold = Opening Stock + Direct Material + Direct

Expenses

= 10,000 + 10,000 + 20,000

= 40,000

124. P/L A/c balance (before commission) is ₹ 1,320; manager’s commission is 10%. Find the amount of manager’s commission.

(a) 120

(b) 0

(c) 132

(d) 110.

Answer:

(c) 132

P/L a/c balance (before charging commission) = 1,320

Manager’s commission = 10%

Amount of manager’s commission = 1,320 x \(\frac { 10 }{ 100 }\) = 132.

125. Adjusted closing entry affects:

(a) Trading A/c

(b) P/LA/c

(c) Balance Sheet

(d) All of the above

Answer:

(c) Balance Sheet

Adjusted closing entry reflects the entry which are required to be made & not made during the year. These entries require adjustment which affects two financial statements mainly Balance Sheet being one. Hence, adjusting closing entry affects Balance Sheet.

126. The purpose of making trading account:

(a) To know the financial position of business

(b) To ascertain the gross profit / loss

(c) To ascertain the net profit / loss

(d) None of the above.

Answer:

(b) To ascertain the gross profit / loss

Trading A/c is the first part of income statement which is prepared to ascertain the gross profit or gross loss for a given period.

Hence, option (b) is correct.

127. Prepaid Rent is shown as:

(a) Current Asset

(b) Current Liability

(c) Intangible Asset

(d) Fictitious Asset

Answer:

(a) Current Asset

Current assets are those assets having life of more than 1 year. Prepaid rent is the rent paid in advance i.e. benefit has not yet received.

Hence, prepaid rent is treated as current asset.

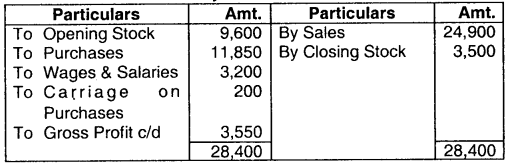

128. Trial balance of a trader shows the following balances:

Opening Stock ₹ 9,600, Purchases ₹ 11,850, Wages and Salaries ₹ 3,200, Carriage on Purchases ₹ 200, Carriage Outwards ₹ 300, Sales ₹ 24,900, Closing Stock ₹ 3,500 Gross Profit will be:

(a) ₹ 3,550

(b) ₹ 6,750

(c) ₹ 6,500

(d) ₹ 6,550

Answer:

Trading A/c for the year ended ………..

So, Gross profit will be ₹ 3,550.

129. Assets that a company expects to convert to cash to use up within one year are called:

(a) Property plant and equipment

(b) Intangible assets

(c) Long term investments

(d) Current assets

Answer:

(d) Current assets

Current assets are those assets that a company expects to convert to cash within one year. Property, plant and equipment, long-term investments are Capital assets.

130. Closing Stock of a Company, if given in adjustment, appears in:

(a) Balance Sheet only

(b) Trading Account only

(c) Profit and loss account only

(d) Trading account and balance sheet

Answer:

(d) Trading account and balance sheet

Closing stock of a company, if given in adjustment, appears at two places:

- Credit side of the Trading A/c

- Closing stock in the Current Assets on the assets side of the Balance Sheet.

Thus, option (d) is the correct answer.

131. Financial data of an entity is given below:

Gross Profit ₹ 6,700, Carriage outwards ₹ 250, Rent received ₹ 575 and Other expenses ₹ 3,600. The net profit would be:

(a) ₹ 3,025

(b) ₹ 2,850

(c) ₹ 3,425

(d) ₹ 3,275

Answer:

(c) ₹ 3,425

Profit & Loss A/c for the year ended

| Particulars | Amt. ₹ | Particulars | Amt. ₹ |

| To Carriage Outwards

To Other Expenses To Net Profit c/d |

250

3,600 3,425 |

By Gross Profit c/d

By Rent Received |

6,700 575 |

| 7,275 | 7,25 |

132. Liability in respect of a pending suit is an example of:

(a) Current liability

(b) Long term liability

(c) Contingent liability

(d) Current asset

Answer:

(c) Contingent liability

Contingent liabilities are not actual liabilities but their becoming actual liability depends on the happening of certain events. Pending suit is a contingent liability because it is only if and when suit is lost that the liability will be incurred.

133. Which of the following item appears in trading account of a business?

(a) Wages and Salaries

(b) Depreciation on buildings

(c) Freight outward

(d) Salaries.

Answer:

(a) Wages and Salaries

Wages and salaries appear in trading A/c whereas Depreciation, Freight outward and Salaries appear in Profit & Loss A/c.

134. Which of the following statements is correct about trial balance?

(a) A Trial balance is a list of all entries made in the books of account

(b) A Trial balance is a list of balances in all assets accounts

(c) A Trial balance is another ledger account

(d) A Trial balance is a list of balances in the cash account and all ledger accounts.

Answer:

(d) A Trial balance is a list of balances in the cash account and all ledger accounts.

Balances of Cash A/c and Ledger A/c are recorded in trial balance, thus it can be said it is list of balances.

135. Generally, in a balance sheet, fixed assets are shown at:

(a) Realisable value

(b) Market value

(c) Written down value

(d) Cost price.

Answer:

(a) Realisable value

Fixed assets in balance sheet are all shown at Realisable Value.

136. In order to prepare the final accounts all accounts are transferred to Trading and Profit and Loss Account:

(a) Personal

(b) Nominal and Real

(c) Nominal

(d) Real.

Answer:

(c) Nominal

In order to prepare the final accounts, all the nominal accounts are transferred to trading and profit and loss account.

Only nominal accounts impact the profits of the business.

137. Sales return is recorded where in trial balance:

(a) Dr. of Trial Balance

(b) Cr. of Trial Balance

(c) Both (a) & (b)

(d) None the above

Answer:

(a) Dr. of Trial Balance

Trial Balance is the list of Dr. and Cr. balances extracted from various accounts in the ledger including cash and bank balances from cash book. Sales return book have Dr. balance. Thus, it will be shown in the Dr. side of trial balance.

138. Cost of floating a company is an example of:

(a) Wasting assets

(b) Intangible assets

(c) Fictitious assets

(d) Liquid assets

Answer:

(c) Fictitious assets

Fictitious Assets are valueless assets but shown as assets in the financial statement (such as useless trade marks) or expenses treated as assets (such as expenses incurred to establish a company). These are not having real value. Cost of floating a company is a fictitious assets, this is not having any real value.

139. If salaries paid appearing in the trial balance for the year ending 2015 is ₹ 7,500 and it is given in the adjustment that the salary unpaid for the year ending 2015 is ₹ 2,500. The total amount to be debited to the profit and loss account under the head salaries will be:

(a) ₹ 7,500

(b) ₹ 2,500

(c) ₹ 5,000

(d) ₹ 10,000

Answer:

(d) ₹ 10,000

Amount to be debited to P&L 10,000

Note : As per accrual concept an amount should be treated as an expenses in the period in which obligation to pay has a reason, whether cash has been actually paid or not.

140. Which of the following transactions would have no impact on owner’s capital?

(a) Withdrawal of profit

(b) Investment of cash by owner

(c) Net loss

(d) Purchase of land from the proceeds of a bank loan.

Answer:

(d) Purchase of land from the proceeds of a bank loan.

(i) Bank A/c Dr.

To Bank Loan A/c

(ii) Land A/c Dr.

To Bank A/c

This transaction would have no impact on owners capital as no Nominal A/c is involved.

141. A Trader is able to get a margin of about 20% on sales. During the previous year he purchased goods worth ₹ 1,00,000 and sales were ₹ 80,000. The value of closing stock for the previous year will be:

(a) ₹ 20,000

(b) ₹ 40,000

(c) ₹ 36,000

(d) ₹ 50,000

Answer:

(c) ₹ 36,000

Cost of goods sold = 80,000 – 20%

= 64,000

Total Goods Available for Sales – Cost of Goods Sold = Closing Stock

1,00,000 – 64,000 = 36,000

142. If total assets increased by ₹ 20,000 during a period and total liabilities increased by ₹ 12,000 during the same period, the amount increases or decreases in owner’s capital for that period in:

(a) ₹ 8,000 increase

(b) ₹ 32,000 increase

(c) ₹ 20,000 increase

(d) ₹ 12,000 decrease.

Answer:

(a) ₹ 8,000 increase

Assets = Capital + Liabilities

20,000 = Capital + 12,000

Capital = 8,000

143. The closing entry for transfer of commission received, appearing in the trial balance will be:

(a) Debit Commission Received A/c,

Credit P&L A/c

(b) Debit Trading A/c,

Credit Commission Received A/c

(c) Debit P&L A/c,

Credit Commission Received A/c

(d) Debit Commission Received A/c

Credit Trading A/c

Answer:

(a) Debit Commission Received A/c,

Credit P&L A/c

The closing entry for the transfer of commission received A/c to Profit and Loss Account is Commission Received A/c Dr. xxx

To Profit & Loss A/c

144. Which of the following statement is correct in respect to adjusting entries?

(a) Adjusting entries will effect only trading account

(b) Adjusting entries will effect only balance sheet

(c) Adjusting entries may effect Balance Sheet, Trading A/c or Profit & Loss A/c

(d) Adjusting entries will effect only Profit & Loss A/c

Answer:

(c) Adjusting entries may effect Balance Sheet, Trading A/c or Profit & Loss A/c

Adjustment eateries are passed at the end of the year for outstanding, prepaid, Accrual and Unaccrual income/expense Adjusting entries involves Trading, P & L, Balance Sheet. Therefore, it may affect Trading, P & L and Balance Sheet.

145. The purchase as shown in books of accounts of a firm is ₹ 28,000. It includes the goods lost by fire for ₹ 2,800. The insurance claim received on account of this is ₹ 2,500. The amount of net purchases to be shown in Trading A/c will be:

(a) ₹ 28,000

(b) ₹ 30,500

(c) ₹ 27,700

(d) ₹ 25,200

Answer:

(d) ₹ 25,200

The net purchase is amount of goods that is purchased by the firm during the year for the purpose of sales less purchase return and loss of goods via theft or fire.

Net Purchase = Purchase – Purchase Return – Loss of Goods = 28,000 – 2,800 Net Purchase = 25,200

146. The net profit of a sole proprietorship firm is ₹ 1,320 (Before Commission). The manager of the firm gets 10% commission on net profit after charging such commission. Managers commission would be:

(a) ₹ 120

(b) ₹ 132

(c) ₹ 11,880

(d) Nil

Answer:

(a) ₹ 120

Net profit before commission = 1,320

Commission = ₹ 1,320 x \(\frac{10}{100+10}\)

= \(\frac{₹ 1,320 \times 10}{110}\)

= ₹ 120

Manager’s Commission = ₹ 120.

147. Which of the following transactions would have no impact on owners capital:

(a) Purchase of land from the proceeds of a Bank Loan

(b) Net loss

(c) Withdrawal of profit

(d) Investments of cash by owner

Answer:

(a) Purchase of land from the proceeds of a Bank Loan

Purchase of land from the proceeds of a bank loan will have no effect on owner’s equity.

Purchase of land will lead to increment in total Asset and Bank Loan will lead to increase in outside liability.

Thus, from this transaction owner’s equity will remain unaffected.

148. Goods worth ₹ 16,000 were lost by fire. The Insurance company admitted the claim for ₹ 7,500. The Insurance claim as admitted by the company would be:

(a) Added in Sales

(b) Added in Purchases

(c) Shown in liabilities side of Balance Sheet

(d) Shown in assets side of Balance Sheet

Answer:

(d) Shown in assets side of Balance Sheet

In case of loss by fire or theft if the goods are unsecured then the amount of claim admitted by the insurance company will be treated as an asset and is shown in asset side of Balance Sheet.

149. The adjusting entry for accrued expense effect _________.

(a) Expenses and liability

(b) Assets and expenses

(c) Liability and revenue

(d) Assets and revenue

Answer:

(a) Expenses and liability

Expenses which have been incurred during the year and whose benefit has been derived during the year but payment in respect of which has not been made are called outstanding or accrued expenses. At the end of the year, all such expenses must be brought into books, otherwise, the profit will be overstated and liability will be understated. The following journal entry is passed:

Expense Account Dr.

To Outstanding/Accrued Expense Account

Hence option A is correct

150. Gross profit ₹ 6700,carriage inward ₹ 250, rent received ₹ 515 & other expenses ₹ 3,600. Net profit of the firm would be _________.

(a) ₹ 3,275

(b) ₹ 3,025

(c) ₹ 3,425

(d) ₹ 3,675

Answer:

(c) ₹ 3,425

151. The difference between cost of goods sold and selling price is known as _________.

(a) Deficit

(b) Deferred revenue

(c) Loss

(d) Revenue

Answer:

(c) Loss

Gross Loss = Cost of the Goods Sold – Sales.

Hence the difference between the cost of goods sold and selling price is the gross loss.

152. What is surrender value?

(a) Amount receivable to a person when surrenders life insurance policy

(b) Amount payable to a person who surrenders a life insurance policy

(c) Premium policy

(d) Surrender of goodwill

Answer:

(b) Amount payable to a person who surrenders a life insurance policy

Surrender value is the amount that a policy holder receives from the insurer in case he plans to terminate the policy before its maturity. From this amount the insurer deducts the surrender charge and the remaining is transferred to the policyholder. Thus it is the amount payable to a person who surrenders a life insurance policy.

153. Balance sheet is prepared from _________.

(a) Real A/c

(b) Saving A/c

(c) Personal A/c

(d) Both (a) & (c)

Answer:

(d) Both (a) & (c)