Chapter 27 Pre-Packaged Insolvency Resolution Process – Corporate Restructuring Insolvency Liquidation & Winding Up Notes is designed strictly as per the latest syllabus and exam pattern.

Pre-Packaged Insolvency Resolution Process – Corporate Restructuring Insolvency Liquidation & Winding Up Study Material

Question 1.

What are the provisions governing corporate debtor’s eligibility to Pre-packaged Insolvency Resolution Process. (June 2022, 5 marks)

Question 2.

What is Concept of Pre-packaged Insolvency Resolution Process (PPIRP)?

Answer:

As nomenclature suggests, pre-pack is a restructuring plan which is agreed to by the.debtor and its creditors prior to the insolvency filing, and then sanctioned by the court on an expedited basis. In the UK context, it generally refers to a pre-agreed business sale by an insolvency practitioner which does not require prior court and/or creditor sanction.

With the background of the formal process in India being afflicted with high costs, pre-pack allows for a cost-effective and speedy resolution process. Pre-pack also identifies and alienates the role of the Insolvency/Resolution professional as an expert in the process

Section 54A to 54P of the Insolvency and Bankruptcy Code, 2016 (‘Code’) read with the Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021 lays down the provisions of a pre-packaged insolvency resolution process with respect to its initiation, manner of carrying out the process, appointment of resolution professional, termination etc.

![]()

Question 3.

What are the benefits of Pre-packaged Insolvency Resolution Process?

Answer:

Benefits of pre-pack insolvency resolution process are as under:

- It consolidates the benefit of both formal and informal proceedings of resolution, thus broadening the options for stakeholders

- It enables faster resolution as the corporate debtor can prepare a settlement plan or resolution plan with the creditors before going to NCLT

- Reduced burden on NCLT due to out of court settlements

- With the suspension of CIRP until March 2021, pre-pack has come as a relief to promoters and corporate debtors

- It allows the corporate debtor retain control till a settlement is reached with the creditors

![]()

Question 4.

Explain Section 54 A of Insolvency and Bankruptcy Code, 2016 related to Pre-packaged Insolvency Resolution Process?

Answer:

1. An application for initiating pre-packaged insolvency resolution process may be made in respect of a corporate debtor classified as a micro, small or medium enterprise under subsection (1) of section 7 of the Micro, Small and Medium Enterprises Development Act, 2006.

2. Without prejudice to sub-section (1), an application for initiating pre-packaged insolvency resolution process may be made in respect of a corporate debtor, who commits a default referred to in section 4, subject to the following conditions, that –

(a) it has not undergone pre-packaged insolvency resolution process or completed corporate insolvency resolution process, as the case may be, during the period of three years preceding the initiation date;

(b) it is not undergoing a corporate insolvency resolution process;

(c) no order requiring it to be liquidated is passed under section 33;

(d) it is eligible to submit a resolution plan under section 29A;

(e) the financial creditors of the corporate debtor, not being its related parties, representing such number and such manner as may be specified, have proposed the name of the insolvency professional to be appointed as resolution professional for conducting the pre-packaged insolvency resolution process of the corporate debtor, and the financial creditors of the corporate debtor, not being its related parties, representing not less than sixty-six percent in value of the financial debt due to such creditors, have approved such proposal in such form as may be specified:

![]()

(f) the majority of the directors or partners of the corporate debtor, as the case may be, have made a declaration, in such form as may be specified, stating, inter alia –

- that the corporate debtor shall file an application for initiating pre-packaged insolvency resolution process within a definite time period not exceeding ninety days;

- that the pre-packaged insolvency resolution process is not being initiated to defraud any person; and

- the name of the insolvency professional proposed and approved to be appointed as resolution professional under clause (e);

(g) the members of the corporate debtor have passed a special resolution, or at least three-fourth of the total number of partners, as the case may be, of the corporate debtor have passed a resolution, approving the filing of an application for initiating pre-packaged insolvency resolution process.

3. The corporate debtor shall obtain an approval from its financial creditors, not being its related parties, representing not less than sixty-six percent in value of the financial debt due to such creditors, for the filing of an application for initiating pre-packaged insolvency resolution process, in such form as may be specified:

![]()

Question 5.

What is the minimum default amount for pre-pack cases?

Answer:

The Ministry of Corporate Affairs vide its notification dated April 09, 2021 specified ten lakh rupees as the minimum amount of default for the matters relating to the pre-packaged insolvency resolution process of corporate debtor.

Question 6.

What are the duties of resolution professional before initiation of pre-packaged insolvency resolution process?

Answer:

As per Section 54B(1), the insolvency professional, proposed to be appointed as the resolution professional, shall have the following duties commencing from the date of the approval under clause (e) of sub-section (2) of Section 54A, namely:

(a) prepare a report in such form as may be specified, confirming whether the corporate debtor meets the requirements of section 54A, and the base resolution plan conforms to the requirements referred to in clause

(c) of sub-section (4) of section 54A;

(b) file such reports and other documents, with the Board, as may be specified; and

(c) perform such other duties as may be specified.

Section 54B (3) provides that the fees payable to the insolvency professional in relation to the duties performed under subsection (1) shall be determined and borne in such manner as may be specified and such fees shall form part of the pre-packaged insolvency resolution process costs, if the application for initiation of pre-packaged insolvency resolution process is admitted. Space to write important points for revision

![]()

Question 7.

When will the duties of insolvency professional under Section 54G (1) of the Code cease?

Answer:

Section 54B(2) provides the following circumstances:

(a) If the corporate debtor fails to file an application for initiating prepackaged insolvency resolution process within the time period as stated under the declaration referred to in clause (f) of subsection (2) of section 54A; or

(b) the application for initiating prepackaged insolvency resolution process is admitted or rejected by the Adjudicating Authority, as the case may be.

![]()

Question 8.

What is the time limit for completion of pre-packaged insolvency resolution process?

Answer:

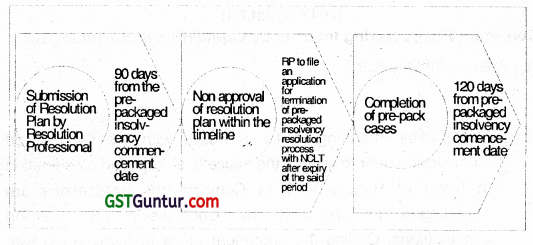

1. The pre-packaged insolvency resolution process shall be completed within a period of one hundred and twenty days from the pre-packaged insolvency commencement date.

2. Without prejudice to sub-section (1), the resolution professional shall submit the resolution plan, as approved by the committee of creditors, to the Adjudicating Authority under sub-section (4.) or sub-section (12), as the case may be, of section 54K, within a period of ninety days from the pre-packaged insolvency commencement date.

3. Where no resolution plan is approved by the committee of creditors within the time period referred to in sub-section (2), the resolution professional shall, on the day after the expiry of such time period, file an application with the Adjudication Authority for termination of the pre-packaged insolvency resolution process in such form and manner as may be specified.

Fig. Timeline of pre-packaged insolvency resolution process

![]()

Question 9.

What is “ Preliminary information memorandum”?

Answer:

Section 5(23A) of the Code states that “preliminary information memorandum” means a memorandum submitted by the corporate debtor ‘ under clause (b) of sub-section (1) of section 54G.

Question 10.

Explain Section 54G related to list of claims and preliminary information memorandum?

Answer:

1. The corporate debtor shall, within two days of the pre-packaged insolvency commencement date, submit to the resolution professional the following information, updated as on that date, in such form and manner as may be specified, namely:-

(a) a list of claims, along with details of the respective creditors, their security interests and guarantees, if any; and

(b) a preliminary information memorandum containing information relevant for formulating a resolution plan.

![]()

2. Where any person has sustained any loss or damage as a consequence of the omission of any material information or inclusion of any misleading information in the list of claims or the preliminary information memorandum submitted by the corporate debtor, every person who –

(a) is a promoter or director or partner of the corporate debtor, as the case may be, at the time of submission of the list of claims or the preliminary information memorandum by the corporate debtor; or

(b) has authorised the submission of the list of claims or the preliminary information memorandum by the corporate debtor, shall, without prejudice to section 77A, be liable to pay compensation to every person who has sustained such loss or damage.

3. No person shall be liable under sub-section (2), if the list of claims or the preliminary information memorandum was submitted by the corporate debtor without his knowledge or consent.

4. Subject to section 54E, any person, who sustained any loss or damage as a consequence of omission of material information or inclusion of any misleading information in the list of claims or the preliminary information memorandum shall be entitled to move a court having jurisdiction for seeking compensation for such loss or damage.

![]()

Question 11.

Explain the management of affairs of corporate debtor during the pre-packaged insolvency resolution process period?

Answer:

Management of affairs of corporate debtor during the pre-packaged insolvency resolution process period is as under:

management of the affairs of the corporate debtor shall continue to vest in the Board of Directors or the partners, as the case may be, of the corporate debtor, subject to such conditions as may be specified

the Board of Directors or the partners, as the case may be, of the corporate debtor, shall make every endeavour to protect and preserve the value of the property of the corporate debtor, and manage its operations as a going concern; and

the promoters, members, personnel and partners, as the case may be, of the corporate debtor, shall exercise and discharge their contractual or statutory rights and obligations in relation to the corporate debtor, subject to the provisions of this chapter and such other conditions and restrictions as may be prescribed

![]()

Question 12.

What happens when the Adjudicating Authority has passed an order for termination of pre-packaged insolvency resolution process pursuant to the decision of COC?

Answer:

As per Section 54N(4) of the Code, the Adjudicating Authority shall further pass an order:

(a) of liquidation of corporate debtor

(b) declare that the pre-packaged insolvency resolution process costs, if any, shall be included as part of the liquidation costs for the purposes of liquidation of the corporate debtor.

![]()

Pre-Packaged Insolvency Resolution Process Notes

1. Pre-Packaged Insolvency Resolution Process

Section 54A to 54P of the Insolvency and Bankruptcy Code, 2016 (‘Code’) read with the Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations,2021 lays down the provisions of a pre-packaged insolvency resolution process with respect to its initiation, manner of carrying out the process, appointment of resolution professional, termination etc.

2. Filing of application for pre-pack insolvency resolution process

- An application for initiating pre-packaged insolvency resolution process may be made in respect of a corporate debtor classified as a micro, small or medium enterprise under sub-section (1) of section 7 of the Micro, Small and Medium Enterprises Development Act, 2006.

- The minimum amount of default for initiating pre-packaged insolvency resolution process is ₹ 10 lakhs.

3. Benefits of pre-pack insolvency resolution process

- consolidates the benefit of both formal and informal proceedings of resolution

- enables faster resolution

- Reduced burden on NCLT

- relief to promoters and corporate debtors

4. Duties of resolution professional before initiation of pre-packaged insolvency resolution process

- Prepare a report in such form as may be specified, confirming whether the corporate debtor meets the requirements of section 54A,

- File such reports and other documents, with the Board, as may be specified

- Perform such other duties as may be specified

![]()

5. Minimum default amount for pre-pack cases

The Ministry of Corporate Affairs vide its notification dated April 09, 2021 specified ten lakh rupees as the minimum amount of default for the matters relating to the pre-packaged insolvency resolution process of corporate debtor

6. Duties of resolution professional during pre-packaged insolvency resolution Process

- confirm the list of claims submitted by the corporate debtor under section 54G

- inform creditors regarding their claims as confirmed under clause (a)

- maintain an updated list of claims

- monitor management of the affairs of the corporate debtor;

- inform the committee of creditors in the event of breach of any of the obligations of the Board of Directors or partners, as the case may be, of the corporate debtor

- constitute the committee of creditors and convene and attend all its meetings;

- prepare the information memorandum

- file applications for avoidance of transactions under Chapter III or fraudulent or wrongful trading under Chapter VI, if any; and

- such other duties as may be specified

![]()

7. Preliminary information memorandum

Section. 5(23A) of the Code states that “preliminary information memorandum” means a memorandum submitted by the corporate debtor under clause (b) of sub-section (1) of section 54G.

8. Management of affairs of corporate debtor

During the pre-packaged insolvency resolution process period

- management of the affairs of the corporate debtor shall continue to vest in the Board of Directors or the partners, as the case may be, of the corporate debtor, subject to such conditions as may be specified

- the Board of Directors or the partners, as the case may be, of the corporate debtor, shall make every endeavour to protect and preserve the value of the property of the corporate debtor, and manage its operations as a going concern; and

- the promoters, members, personnel and partners, as the case may be, of the corporate debtor, shall exercise and discharge their contractual or statutory rights and obligations in relation to the corporate debtor, subject to the provisions of this chapter and such other conditions and restrictions as may be prescribed