Chapter 3 Planning and Strategy – Corporate Restructuring Insolvency Liquidation & Winding Up Notes is designed strictly as per the latest syllabus and exam pattern.

Planning and Strategy – Corporate Restructuring Insolvency Liquidation & Winding Up Study Material

Question 1.

Write a short note on Leveraged buyout. (June 2019, 3 marks)

Answer:

Leveraged buyout

When one refers to something (a company, a property or an investment) as ‘highly leveraged’ it means that item has more debt than equity.

A leveraged buyout (LBO) is the acquisition of a company in which the buyer puts-up only a small amount of money and borrows the rest. The buyer can achieve this desirable result because the targeted acquisition is profitable and may provide ample cash that can be used to repay the debt.

The expectation with leveraged buyout is that the return generated on the acquisition will outweigh more than the interest paid on the debt, hence making it a very good way to experience high returns whilst only risking a small amount of capital.

![]()

Question 2.

Discuss funding of a merger or takeover through financial institutions and banks. (June 2012, 8 marks)

Answer:

Funding of a merger or takeover with the help of loans from financial institutions, banks etc. has its own merits and demerits.

Takeover of a company could be achieved in several ways and while deciding the takeover of a going concern, there are matters such as the capital gains tax, stamp duty on immovable properties and the facility for carrying forward of accumulated losses. With parameters playing a critical role, the takeover should be organized in such a way that best suits the facts and circumstances of the specific case and also it should meet the immediate needs and objectives of the management. While discussing modes of acquisition, certainly there would be a planning for organizing the necessary funding for the acquisition.

If borrowings from domestic banks and financial institutions have been identified as the inevitable choice, all the financial and managerial information must be placed before the banks and financial institutions for the purpose of getting the necessary resources.

The advantage of funding is that the period of such funds is definite which is fixed at the time of taking such loans. Therefore, the Board of the company is assured about continued availability of such funds for the pre-determined period. On the negative side, the interest burden on such loans, is quite high which must be kept in mind by the Board while deciding to use borrowed funds from financial institution. Such funding should be thought of and resorted to only when the Board is sure that the merged company or the target company will, give adequate returns i.e., timely payment of periodical interest on such loans and re-payment of the loans at the end of the term for which such loans have been taken.

However, in the developed markets, funding of merger or takeover is not a critical issue. There are various sources of finance available to an acquirer. In the Indian market, it was not easy to obtain takeover finance from financial institutions and banks because they are not forthcoming to finance securities business. Takeover involves greater risk. There is no other organised sector to provide finance for takeover by a company.

![]()

Question 3.

What is meant by Indian depository receipts (IDRs)? Why are such receipts issued? (June 2012, 5 marks)

Answer:

- Indian Depository Receipts (IDR) is a negotiable receipt created by domestic depository in India against the underlying equity shares of issuing company which is located outside India.

- IDR is a negotiable receipt which is denominated in Indian currency.

- It provides a means to Indian investors to trade in foreign equity.

- It provides a source to raise capital in India by foreign companies.

- It widens the investor base of the issuing company.

- Moreover, it increases the reputation of the issuing company.

- IDR involves low cost of raising finance as compared with other means of raising finance.

![]()

Question 4.

Explain the following :

Funding through leveraged buyouts. (June 2014, 5 marks)

Answer:

Funding through Leveraged Buyouts

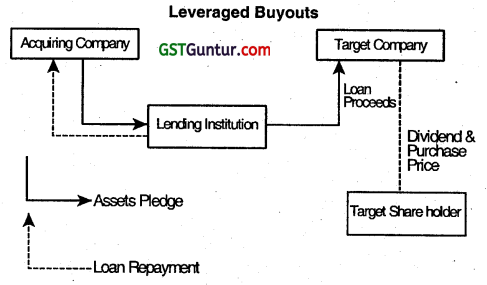

A leveraged buyout (LBO) is when a company or single asset is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target’s cash flows or assets are used’as the collateral (or “leverage”) to secure and repay the money borrowed to purchase the target-company/asset.

Since the debt has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lenders]) than the equity, the returns on the equity increase as the amount of borrowed money does until the peffect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.

Since financing is mainly done by debt, it is termed as leverage buy-out.

The acquirer resorts to a combination of a small investment and a large loan to fund the acquisition.

The loan capital is availed through a combination of repayable bank facilities and/or public or privately placed bonds.

Alternatively, the acquiring company could float a Special Purpose Vehicle (“SPV”) as a 100% subsidiary with a minimum equity capital.

![]()

The SPV can leverage this equity to gear up significantly higher debt to buyout the target company.

The target company’s assets can be used as collaterals for availing the loan and once the debt is redeemed, the acquiring company has the option to merge with the SPV.

The debt will be paid off by the SPV using the cash flows of the target company.

The purpose of leveraged buyouts is to allow companies to make large acquisitions without having to commit a lot of capital.

Bharti – Zain deal is an example of Leveraged Buyout.

A Diagram Representation:

![]()

Question 5.

Dominio Retail Ltd. has plans to make large acquisitions without committing much capital. Advise the company regarding funding of acquisitions. (Dec 2014, 3 marks)

Answer:

The appropriate strategy in such a situation is leveraged buyout. A leveraged buyout (LBO) is the acquisition of a company or division of another company, financed with a substantial portion of borrowed funds. The acquirer resorts to a combination of a small investment and a large loan to fund the acquisition. The acquired company’s fee cash flow will be used to repay the debt.

The acquiring company otherwise could float a special purpose vehicle (SPVT) as a 100% subsidiary with a minimum equity capital. The SPV can leverage this equity to gear up significantly higher door to the target company. The target company’s assets can be used as collateral for availing the loan. The debt will be paid off by the SPV using the cash flow of the target company.

![]()

Question 6.

Alps (Pvt.) Ltd. is taking over an unlisted company Mountain Ltd., through the route stipulated under section 235 of the Companies Act, 2013. Alps (Pvt.) Ltd. wants to compulsorily acquire the shares of minority shareholders of Mountain Ltd. A group of minority shareholders objected to the compulsory acquisition of their shares by Alps (Pvt.) Ltd.

(i) Will their objections stand good as per the provisions under the provisions of Companies Act, 2013 ?

(ii) Will Alps (Pvt.) Ltd. be entitled to carry forward unabsorbed, depreciation and accumulated losses of Mountain Ltd.? (June 2015, 5 marks)

Answer:

(i) In the given case, Alps (Pvt.) Ltd. is taking over an unlisted company Mountain Ltd. through the route stipulated under section 235 of the Companies Act, 2013.

- Alps (Pvt.) Ltd. wants to compulsorily acquire the shares of minority shareholders of Mountain Ltd. who are objecting to the compulsory acquisition of their shares.

- Section 235 of the Companies Act contains a compulsory acquisition mode for the transferee company to acquire the shares of minority shareholders of Transferor Company.

- According to provisions of Section 235, where 90% acceptance have been received, the transferee company may give notice to one or more dissenting shareholders that it desires to acquire their shares. Such notice is to be given within 2 months of the expiration of the offer.

- Dissenting shareholder may make an application to the Tribunal within one month from the date on which the notice was made praying that the acquisition of their shares should not be permitted.

- The Tribunal may allow or dismiss the application of dissenting shareholder.

- If the application is dismissed by the Tribunal the company is entitled as well as bound to acquire the shares of dissenting shareholders on the same basis as originally offered to all the shareholders of the transferor company.

(ii) No, Alps (Pvt.) Ltd. will not be entitled to carry forward unabsorbed depreciation and accumulated losses of Mountain Ltd.

The takeover achieved in the above process through Section 235 of the Act will not fall within the meaning of amalgamation under the Section 72A Income Tax Act, 1961 and as such benefits of amalgamation provided under the said Act will not be available to the acquisition under consideration. The takeover in the above process will not enable carrying forward of unabsorbed depreciation and accumulated losses of the transferor company in the transferee company for the reason that the takeover does not result in the transferor company losing its identity.

![]()

Question 7.

Comment on the following:

Compulsory acquisition of shares of minority shareholders of unlisted companies. (Dec 2015, 3 marks)

Answer:

- Section 235 of the Companies Act contains a compulsory acquisition mode for the transferee company to acquire the shares of minority shareholders of Transferor Company.

- According to provisions of Section 235, where 90% acceptance has been received, the transferee company may give notice to one or more dissenting shareholders that it desires to acquire their shares. Such notice is to be given within 2 months of the expiration of the offer.

- Dissenting shareholder may make an application to the Tribunal within one month from the date on which the notice is given praying that the acquisition of their shares should not be permitted.

- The Tribunal may allow or dismiss the application of dissenting shareholder.

- If the application is dismissed by the Tribunal, the company is entitled as well as bound to acquire the shares of dissenting shareholders on the same basis as originally offered to all the shareholders to the transferor company.

![]()

Question 8.

What is ‘observation letter’ issued by stock exchanges?

What are the obligations of listed companies in relation to ‘observation letter’ with reference to merger? (June 2016, 5 marks)

Answer:

Observation letter is a letter on the draft scheme of amalgamation by the stock exchange before the same is filed with the court/Tribunal. It is a no objection letter or letter with some observations on the scheme.

1. As per Regulation 37 (1) ofSEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the listed entity desirous of undertaking a scheme of arrangement or involved in a scheme of arrangement, shall file the draft scheme of arrangement, proposed to be filed before any Tribunal under Sections 230-234 and Section 66 of Companies Act, 2013, whichever applicable, with the stock exchange(s) for obtaining Observation Letter or No-objection letter, before filing such scheme with any Tribunal, in terms of requirements specified by the Board or stock exchange(s) from time to time.

2. The listed entity shall not file any scheme of arrangement under Sections 230-234 and Section 66 of Companies Act, 2013, whichever applicable, with any Tribunal unless it has obtained observation letter or No-objection letter from the stock exchange(s). [Regulation 37(2)]

3. The listed entity shall place the Observation letter or No-objection letter of the stock exchange(s) before the Tribunal at the time of seeking approval of the scheme of arrangement: [Regulation 37(3)]

The validity of the ‘Observation Letter’ or No-objection letter of stock exchanges shall be six months from the date of issuance, within which the draft scheme of arrangement shall be submitted to the Tribunal.

![]()

Question 9.

“There have been occasions when shareholders holding minuscule shareholdings have made frivolous objections against the restructuring scheme, just with the objective of stalling or deferring the implementation of the scheme. The courts/tribunal have, on a number of occasions, overruled their objections.” Comment on the statement with relevant case law. (Dec 2016, 5 marks)

Answer:

The shareholder during merger of Parke-Davis India Limited and Pfizer Limited objected to the Scheme on the grounds that the approval from the requisite majority as prescribed under the Companies Act, had not been obtained through an urgent petition before the Bombay High Court.

Bombay High Court executed a stay order in March 2003 restraining the company from taking further steps in the implementation of the scheme of amalgamation, which was further extended till September 2003.

The Supreme Court dismissed the Special Leave Petition filled by the dissenting shareholders and finally Parke-Davis then proceeded to complete the implementation of the scheme of amalgamation with Pfizer. Thus, it is relevant to state that courts/tribunal can definitely overrule the frivolous objections of the shareholders against the restructuring scheme, if the scheme is true and fair in all aspects.

![]()

Question 10.

How the rights of the minority shareholders are protected during merger/amalgamation/takeover? (June 2017, 5 marks)

Answer:

The rights of the minority shareholders are protected during merger /amalgamation /takeover as per the following provisions:

As per Sec. 244 of C.A. 2013 in case of a company having share capital, not less than 100 members or not less than 1/10th of total number of members, whichever is less or any member or members holding not less than 1 /10,h of issued share capital have the right to apply to NCLT in case of oppression and mismanagement. In case of companies not having share capital, not less than 1/5th of total number of members have the right to apply.

NCLT is also empowered to accept application by shareholders who are not otherwise eligible as above.

As per Sec. 245 of C.A. 2013 minority members or depositors may apply to NCLT on behalf of the members or depositors, if they are of the opinion that the management or conduct of the affairs of the Company are in a manner prejudicial to the interest of the company or its members or depositors. The threshold of minority action is the same as in Section 244.

Companies are bound to publish the schemes in the news papers, any interested person including a person having minority share, may appear before NCLT with his objection.

In case of take overs, SEBI has powers to appoint investigating officer to undertake investigation, in case complaints are received from any person on any matter having a bearing on the allegations of substantial acquisition of shares and takeovers.

Under section 235 of C.A. 2013, even a single dissentient shareholder holding one share may also approach Tribunal, In such case, further acquisition of shares by the transferee company will be subject to the outcome of the decision of the NCLT.

![]()

Question 11.

“A Scheme, even approved by majority, can be rejected by Court / Tribunal but such a Scheme must be held to be unfair to the meanest intelligence.” Analyse the statement citing important judicial pronouncements. (Dec 2017, 5 marks)

Answer:

- Any scheme which is fair and reasonable and made in good faith will be sanctioned if it could reasonably be supported by sensible people to be for the benefit to each class of the members or creditors concerned.

- In Sussex Brick Co. Ltd., Re, (1960) 1 All ER 772 : (1960) 30. Com Cases 536 (Ch D) it was held, inter alia, that although it might be possible to find faults in a scheme that would not be sufficient ground to reject it.

- It was further held that in order to merit rejection, a scheme must be obviously unfair, patently unfair, unfair to the meanest intelligence.

- It is the consistent view of the Courts/Tribunal that no scheme can be said to be fool-proof and it is possible to find faults in a particular scheme but that by itself is not enough to warrant a dismissal of the petition for sanction of the scheme.

- If the court/tribunal is satisfied that the scheme is fair and reasonable and in the interests of the general body of shareholders, the court/tribunal will not make any provision in favour of the dissentients.

- The Courts/Tribunal have gone further to say that a scheme must be held to be unfair to the meanest intelligence before it can be rejected. It must be affirmatively proved to the satisfaction of the Court/Tribunal that the scheme is unfair before the scheme can be rejected by the Court/Tribunal English, Scottish & Australian Chartered Bank, Re, (1893) 3 Chancery 385.

![]()

Question 12.

“While standard parameters plays a crucialrole, funding/borrowing for takeover should be organized in such a way that best suits the facts and circumstances of the specific case and should also meet the immediate needs and objectives of the management Elucidate the statement with emphasis on the demerits of borrowing from the financial institutions and banks. (June 2018, 5 marks)

Question 13.

“In addition to the normal event risks, stock swap mergers involve risks associated with fluctuations in the stock prices of the two companies”. Comment on the statement in view of the funding through swaps or stock to stock mergers. (Dec 2018, 5 marks)

Answer:

- In stock swap mergers, or stock-for-stock mergers, the holders of the target company’s stock receive shares of the acquiring company’s stock.

- Under this type of merger, the payment is made to the holder of company’s share in the form of shares & not in cash.

- A merger arbitrage specialist will sell the acquiring company’s stock short and will purchase a long position in the target company, using the same ratio as that of the proposed transaction.

- It involve risks associated with fluctuations in the stock prices of the two companies.

![]()

Question 14.

“There may be no express protection to any dissenting minority shareholder to file his objections as a matter of right, yet the Courts/Tribunals, while approving the Scheme, follow judicious approach by inviting objections through Public Notice in Newspapers.” Elucidate. (Dec 2018, 5 marks)

Answer:

As per section 230(4) of the Companies Act, 2013 it is provided that in a scheme of arrangement any person or persons holding at least 10% of the shareholding or 5% of the total outstanding debt can put objection to the proposed scheme. But this does not mean that others are disabled.

There exists inbuilt safeguard in the form of serving notices to every individual shareholder and creditor, so also to various statutory authorities and sectoral regulators. Stakeholders with lesser than specified percentage of shareholding may utilize such forums. Public notices issued in newspapers also open a forum to raise objections that are just and genuine but not frivolous. Securities and Exchange Board of India (SEBI) has powers to undertake investigation, if a complaint is received from an investor or otherwise against substantial acquisitions.

Question 15.

It is generally accepted that all mergers and acquisitions have one common goal regardless of their category or structure. Give your opinion indicating the benefits that companies can derive upon by merging. (Dec 2019, 5 marks)

Answer:

All mergers and acquisitions have one common goal to create synergy that makes the value of the combined companies greater than the sum of the two parts. Synergy may be in the form of revenue enhancement and cost savings. By merging, the companies hope to benefit from the following:

Bigger size: Many companies use M&A to grow in size and leapfrog their rivals. While it can take years or decades to double the size of a company through organic growth, this can be achieved much more rapidly through inorganic growth, i.e., mergers or acquisitions.

![]()

Preempted competition: This is a very powerful motivation for mergers and acquisitions, and is the primary reason why M&A activity occurs in distinct cycles.

Domination: Companies also engage in M&A to become a dominant player or market leader in their respective sector or industry. However, since a combination of two behemoths would result in a potential monopoly, such a transaction would come under purview of regulatory authorities.

Tax benefits: Companies also use M&A for tax purposes, although this may be an implicit rather than an explicit motive.

Economies of scale: Mergers also translate into improved economies of scale which refers to reduced costs per unit that arise from increase in total output of a product.

Acquiring new technology: To stay competitive, companies need to stay on top of technological developments and their business applications. By buying a smaller company with unique technologies, a large company can maintain or develop a competitive edge.

Increase in market share: Merger aids in increasing the market share of the merged company. This rise in the market share is achieved by providing an adequate supply of goods & services as needed by clients. Entering into an agreement with clients for continuous supply of goods and services.

![]()

Question 16.

ABCD Manufacturing and Exporting Ltd. desires to use Masala Bonds for further Augmentation of funds. Would you guide the Company as to the concept and exceptions that bars raising funds through such bonds? (Aug 2021, 5 marks)

Answer:

Masala bonds are rupee denominated bonds sold to offshore investors, who assumes foreign exchange risk to earn higher interest rates compared with dollar based overseas bond. In 2017, Reserve Bank of India (RBI) revised the norms for masala bonds.

The RBI declared that from October 03, 2017 masala bonds will no longer form part of the limit for Foreign Portfolio Investment (FPI) in corporate bonds and it will form part of External Commercial Borrowings. However, Masala Bond Proceeds cannot be utilised for the purpose of Real Estate Activities, Capital Market or Domestic Equity Investment, Purchase of Land, certain activities prohibited as per Foreign Direct Investment guidelines and relending for the activities prohibited.

HDFC was the first to issue such bonds, followed by National Highways Authority of India and National Thermal Power Corporation. Thus, the raising of funds through Masala Bonds is to tap overseas cheap funds.

![]()

Question 17.

Could you explain with certain citations indicating exceptions to the Majority Rule Held in Foss Vs Harbottle (1843) 2 Hare 461 (Ch.)? (Aug 2021, 5 marks)

Answer:

No need to take the views of majority if there is allegation of ultra vires acts by the Management held in Dhaneswari Cotton Mills Ltd. v. Nilkamal Chakravarthy [1937] 7 Comp. Cas. 417 (Cal).

Similarly, the allegation of fraud is an exception as was held in Cook v. Deeks (1916)1 AC 554 (PC). Where majority is wrongdoer and pocket property of company, an individual shareholder has right to file a suit. Menier v. Hooper’s Telegraph Works (1874)9 Ch. App. 350 (CA).

A minority of shareholder in saddle of power cannot be allowed to pursue a policy of venturing into a litigation to which the majority of the shareholders were opposed. Life Insurance Corp of India v. Escorts Ltd (1986) 59 Comp Cas. 548 (SC).

Nevertheless, the principle of Majority Rule prevails normally as held in Foss Vs. Harbottle [1843] 2 Hare 461 (Ch.) until and unless proved beyond doubt the exceptions.

![]()

Question 18.

Fitwell Ltd. is intending to make an initial public offer (IPO) of 50 crore through the book building process. Mention the provisions of the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 relating to pricing in public issue. (June 2012, 8 marks)

Answer:

Provisions of the SEBI (Issue of Capital and Disclosure requirements) Regulations, 2018 relating to pricing in public issue is as under:

Pricing:

Issuer may determine the price of specified securities in consultation with lead merchant banker or through book building process.

Differential Pricing :

An issuer may offer specified securities at different prices, subject to the following:

Retail individual investors or retail individual shareholders or employees entitled for reservation made under regulation 42 making an application for specified securities of value not more than two lakhs rupees may be offered specified securities at a price lower than the price at which net offer is made to others, provided that such difference shall not be more than 10% of the price which is offered to others.

In case of book building issue, price offered to an anchor investor shall not be lower than the price offered to others.

In case of composite issue, price of the specified securities offered in the public issue may be different from the price offered in right issue.

Price and Price band :

- The issuer may mention a floor price or price band in the red herring prospectus (in case of book building issue) and determine the price at a later date before registering the prospectus with ROC.

- The cap on the price band shall be less than or equal to one hundred & twenty percent of the floor price.

- The floor price or the final price shall not be less than the face value of the securities.

![]()

Question 19.

A Ltd. was a listed Company with Kanpur Stock Exchange but got delisted in 2012. In the year 2017, the Board passed a resolution approving a scheme of arrangement and petitioned before the National Company Law Tribunal (NCLT). Subsequent to that, scheme was placed before the members which the NCLT ordered. Two (2) shareholders holding 80% shares opposed the scheme.

As a Company Secretary, advise the Board on the next course of action(s) pursuant to the provisions of the Companies Act, 2013. (June 2018, 5 marks)

Answer:

According to Section 230(6) approval of scheme is required by majority of persons representing three fourths in value of members or creditors. Such approved scheme, when sanctioned by tribunal shall be binding on company, all creditors, members or on liquidators (in case of a company being wound up).

In the given case, two (2) shareholders, holding 80% of shares opposed the scheme. Thus, the scheme cannot be passed.

![]()

Planning and Strategy Notes

Mergers and Acquisitions – Primary Factors to be considered

- Identification of Parties

- Due Diligence

- Any third-party consents required?

- Taxation

- Risk

- Will the transaction impact existing loan/finance arrangements?

- Existing Charges / Modifications over the assets to be acquired (vit’i) Guarantees and indemnities (bank or other)

- Licences

- Supply contracts

- What IP is used in the business?

Funding through Equity Shares

- It can be considered as permanent capital of the company

- Equity needs no servicing as the company is not required to pay to its equity shareholders the fixed amount return in form of interest which would be the case if a company were to borrow by issue of bonds or other debt instruments.

- Raising money from the public by issue of shares or bonds or debentures is time consuming and involves huge costs.

![]()

Preferential Allotment

Preferential allotment, in simple words, is an offer for allotment to a select group of identified persons, and does not include public issue, rights issue, ESOP, employee stock purchase scheme or an issue of sweat equity shares or bonus shares or depository receipts issued in a country outside India or foreign securities.

Funding through Preference Shares

Issue of the preference share capital as purchase consideration to the shareholder of merging company mostly includes the payment of fixed preference dividend at a fixed rate.

Thus, before deciding to the raise funds for this purpose, by an issue of preference shares, the Board of the company has to ensure that the merged company or Target Company would be able to yield sufficient profits for covering additional liability in respect of the payment of preference dividend.

Funding through Options or securities with differential rights

- Companies can also restructure their capital through derivatives and options as the means of raising funds.

- Such issue gives companies an additional source of fund without interest cost and without the obligation to repay, as these are other forms of the equity capital.

Funding through Swaps or Stock to Stock Merger

- Under this method of funding, the holders of the target company’s stock receive shares of the acquiring company’s stock in lieu of the merger.

- Stock swap mergers might involve risk. Along with the normal risks, stock swap mergers consist of the risks associated with the fluctuations in the stock prices of two companies.

![]()

Funding through External Commercial Borrowings (ECB’s) and Depository Receipts

ECBs are commercial loans raised by eligible resident entities from recognised non-resident entities and should conform to parameters such as minimum maturity, permitted and non-permitted end-uses, maximum all-in-cost ceiling, etc.

Under the ECB framework, ECBs can be raised either under the automatic route or under the approval route. For the automatic route, the cases are examined by the Authorised Dealer Category-I (AD Category-I) banks. Under the approval route, the prospective borrowers are required to send their requests to the RBI through their ADs for examination.

‘Depository receipt’ means a foreign currency denominated instrument, whether listed on an international exchange or not, issued by a foreign depository in a permissible jurisdiction on the back of permissible securities issued or transferred to that foreign depository and deposited with a domestic custodian and includes ‘Global Depository Receipt’ as defined in section 2(44) of the Companies Act, 2013 as any instrument in the form of a depository receipt, by whatever name called, created by a foreign depository outside india and authorised by a company making an issue of such depository receipts.

Funding through Financial Institution and banks

- Funding of a merger or takeover with the help of loans from financial institutions, banks, etc. has its own merits and demerits.

- The advantage of funding is that the period of such funds is definite which is fixed at the time of taking such loans.

- On the negative side, the interest burden on such loans is quite high which must be kept in mind by the Board while deciding to use borrowed funds from financial institution.

![]()

Funding through Leveraged Buyouts (LBO’s)

A leveraged buyout (LBO) is the acquisition of a company in which the buyer puts up only a small amount of money and borrows the rest. The buyer can achieve this desirable result because the targeted acquisition is profitable and throws off ample cash used to repay the debt.

The expectation with leveraged buyouts is that the return generated on the acquisition will outweigh more than the interest paid on the debt, hence making it a very good way to experience high returns whilst only risking a small amount of capital.

Oppression and Mismanagement

Oppression: Remedy against oppression is available in section 241 (1 )(a) of the Act. Oppression may be defined as conducting the company’s affairs in a manner prejudicial to public interest or in a manner oppressive to any member or members or prejudicial to the interests of the company.

Mismanagement: Remedy against mismanagement is available in Section 241(1)(b) of the Act. Mismanagement may be defined as any change which takes place in the management or control of the Company, which will not be in the interests of members.

Class Action

A class action suit is one where the shareholders or depositors of a company collectively institute a suit against the company in Tribunal.

The legal framework for class action suits is covered in section 245 of Companies Act, 2013 as well as National Company Law Tribunal Rules, 2016.

The provisions of class action come under the head of oppression and mismanagement but there are some differences between the remedies sought under class action under Section 245 and under the general provisions of oppression and mismanagement under Section 242.

While under Section 242 the NCLT can order acquisition of the company’s shares, restrict transferability or allotment of shares, removal of managing director and other directors of the company, in class action, the orders will mainly be restraining orders. An added advantage of the provisions on class action suit is that they cover depositors also.

![]()

Rights of Minority Shareholders during Mergers/ Amalgamation/ Takeovers

As per proviso to Section 230(4) of the Act, it is provided that any objection to the compromise or arrangement shall be made by persons holding 10% or more of the shareholding or having 5% or more of the total outstanding debt as per latest audited financial statement.

Thus, shareholders holding less than 10% or more of the shareholding are not entitled to object to the scheme as matter of statutory right.

The notice convening the meetings and also the notice of hearing of the petition (in Form CAA-2) is required to be published in the newspaper as per the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016.

Though there may not be any express protection to any dissenting minority shareholders to file their objections as a matter of right on this issue, the Tribunal, while approving the scheme, may follow judicious approach more particularly in view of the publication of the public notices about the proposed scheme in the newspapers. Any interested person (including a minority shareholder) may appear before the NCLT.

In case of Takeovers,-as per SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011, SEBI has powers to appoint investigating officer to undertake investigation, in case complaints are received from the investors, intermediaries or any other person on any matter having a bearing on the allegations of substantial acquisition of shares and takeovers.

Under section 235 of the Act, a transferee company, which has acquired 90% shares of a transferor company through a scheme or contract, is entitled to acquire shares of remaining 10% shareholders.

Section 230: Power to compromise or make arrangements with creditors and members.

The section provides powers to Tribunal to make order on the application of the company or any creditor or member or in case of company being wound-up, of liquidator for the proposed compromise or arrangement including debt restructuring, etc., between company, its creditors and members

![]()

Section 231: Power of Tribunal to enforce compromise or arrangement

The section provides powers to Tribunal to enforce compromise or arrangement with creditors and members as ordered under section 230. Section also provides that, if the Tribunal is satisfied that such compromise or arrangement cannot be implemented satisfactorily with or without modifications, and the company is unable to pay its debts as per the scheme, it may make an order for winding-up of the company.

Section 232: Merger and amalgamation of companies

This section provides powers to the Tribunal to order for holding meeting of the creditors or the members and to make orders on the proposed reconstruction, merger or amalgamation of companies. The section provides for manner and procedure in which the meeting so ordered by the Tribunal to be held.

Section 233: Merger or amalgamation of certain companies

This is a new section and seeks to provide for merger or amalgamation between two small companies or between a holding company and its wholly owned subsidiary or prescribed class or class of companies by giving a notice of the proposed scheme inviting objections or suggestions by both the transferor and the transferee company from Registrar, Official Liquidator or persons affected by the scheme.

Section 234: Merger or amalgamation of company with foreign company

This is a new section and provides the mode of merger or amalgamation between companies registered under the Companies Act, 2013 and companies incorporated in the jurisdictions of such companies as may be notified from time to time by the Central Government. The Central Government may, in consultation with Reserve Bank of India make rules for the purpose of merger or amalgamation provided under this section.

Section 235: Power to acquire shares of shareholders dissenting, from scheme or contract approved by majority

This section provides the manner in which the transferee company shall acquire shares of the shareholders dissenting from the scheme or contract as approved by the majority shareholders holding not less than nine-tenths in value of the shares whose transfer is involved.

![]()

Section 236: Purchase of minority shareholding

This section provides the procedure and manner in which the registered holder of at least 90 per cent shares of a company shall notify the company of their intention to buy the remaining equity shares of minority shareholders, by virtue of an amalgamation, share exchange, conversion of securities, etc. This section provides the procedure to be followed for acquiring shares held by minority shareholders.

Section 237: Power of Central Government to provide for amalgamation of companies in public Interest

This section provides power to the Central Government to provide for amalgamation of two or more companies in public interest by passing an order to be notified in the Official Gazette.

Section 238: Registration of offer of schemes involving transfer of shares

This section provides mode of registration of offer of schemes or contract involving the transfer of shares.

Every circular containing such offer and recommendation and containing a statement shall be accompanied by requisite information and must be registered with the ROC before issue.

![]()

Section 239: Preservation of books and papers of amalgamated companies.

This section provides that the books and papers of a company which has been amalgamated will or whose shares have been acquired by, another company shall not be disposed of without the prior permission of the Central Government

Section 240: Liability of officers in respect of offences committed prior to merger, amalgamation, etc.

This section provide that notwithstanding anything in any other law for the time being in force, the liability in respect of offences committed under this Act by the officers in default, of the transferor company prior to its merger, amalgamation or acquisition shall continue after such merger, amalgamation or acquisition.