Payment of Tax – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Payment of Tax – CA Inter Tax Question Bank

Question 1.

Determine with brief reasons, whether the following statements are True or False:

Electronic cash ledger balance of ₹ 5,000 under the major head of IGST can be utilized for discharging the liability of major head of CGST. (Nov 2018, 1.5 mark)

Answer:

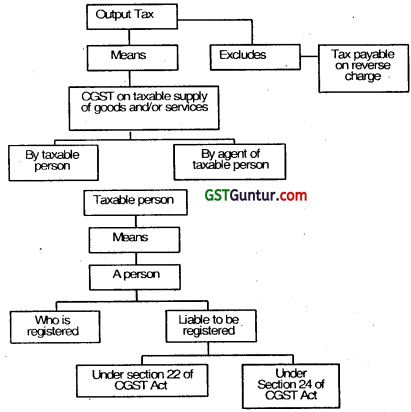

The said statement Is False.

Amount available under one major head cannot be utilised for discharging the liability under any other major head.

![]()

Question 2.

Answer the following sub division:

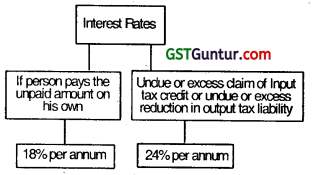

Discuss the following in terms of provisions of CGST Act, 2017: When interest shall be payable by a registered person and what is the maximum rate of interest chargeable for the same? (May 2018, 5 marks)

Answer:

The interest shall be payable by a registered person if

1. Tax or any part thereof is not paid within due date or

2. A taxable person makes an undue or excess claim of ITC under 42(10) or undue or excess reduction in output tax liability under sub-section (10) of section 43 As per section 50(1) of the CGST Act 2017, Every person who is liable to pay tax in accordance with the provisions of this Act or the rules made thereunder, but fails to pay the tax or any part thereof to the Government within the period prescribed, shall for the period for which the tax or any part thereof remains unpaid, pay, on his own, interest at 18%.

As per section 50(3) A taxable person who makes an undue or excess claim of input tax credit under sub-section (10) of section 42 or undue or excess reduction in output tax liability under sub-section (10) of section 43, shall pay interest on such undue or excess claim or on such undue or excess reduction, as the case may be, at twenty-four per cent.

![]()

Question 3.

Decide which person is liable to pay GST in the following independent cases, where the recipient is located in the taxable territory. Ignore the Aggregate Turnover and Exemption available.

(i) Mr. Raghd provided sponsorship services to WE-WIN Cricket Academy, an LLP.

(ii) ‘Safe Trans’, a Goods Transport Agency, transported goods of Kapil & Co., a partnership firm which is not registered under GST. (Nov 2018, 3 marks)

Answer:

(i) In case of services provided by any person by way of sponsorship to any body corporate or partnership firm / LLP, GST is liable to be paid under reverse charge by such body corporate or partnership firm / LLP located in the taxable territory… Therefore, in the given case, WE-WIN Cricket Academy is liable to pay GST under reverse charge.

(ii) In case of services provided by Goods Transport Agency (GTA) in respect of transportation of goods by road to, inter alia, any partnership firm whether registered or not under any law; GST is liable to be paid by such partnership firm. Therefore, in the given case, Kapil & Co. is liable to pay GST under reverse charge.

![]()

Question 4.

M/s. Daksha Enterprises has made a cash deposit of ₹ 10,000 under minor head ‘tax’ of major head ‘SGST. It has a liability of ₹ 2,000 for minor head “Interest” under the major head “SGST”.

State whether M/s. Daksha Enterprises can utilise the amount available for payment of interest. (May 2019, 2 marks)

Answer:

The cash available in any minor head of a major head cannot be utilised for any other minor head of the same major head.

Therefore, in the given case, amount of ₹ 10,000 available under minor head ‘tax’ of major head ‘SGST’ cannot be utilised for payment of liability of ₹ 2,000 under minor head ‘interest’ of the same major head.

Question 5.

State the items which are to be debited to electronic liability register of the taxable person under the CGST Act, 2017 and rules thereunder. (Nov 2019, 3 marks)

Answer:

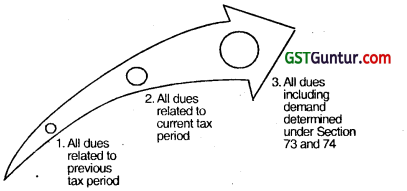

The items which are debited to Electronic Liability register are as follows:

(a) all amounts payable towards tax, interest, late fee and any other amount as per return filed;

(b) all amounts payable towards tax, interest, penalty and any other amount determined in a proceeding by an Assessing authority or as ascertained by the taxable person;

(c) the amount of tax and interest payable.

(d) any interest amount that may accrue from time to time.

![]()

Question 6.

Explain the order of discharge of tax and other dues as per provisions of Section 49(8) of the CGST Act, 2017. (Nov 2020, 5 marks)

Question 7.

In the following independent cases, decide, which person is liable to pay GST, if any. (Nov 2020)

You may assume that recipient is located in the taxable territory. Ignore the Aggregate Turnover and Exemption available.

(i) ‘Veer Transport’, a registered Goods Transport Agency (GTA) paying IGST @ 12%, transported goods by road of Dilip & Company, a sole proprietary firm (other than specified person) which is not registered under GST or any other Law. (2 marks)

(ii) Mr. Kamal Jain, an unregistered famous author, received ₹ 20 lakhs of consideration from PQR Publications Ltd. for supply of services by way of temporary transfer of a copyright covered under section 13(1 )(a) of the Copyright Act, 1957 relating to original literary works of his new book. (2 marks)

![]()

Question 8.

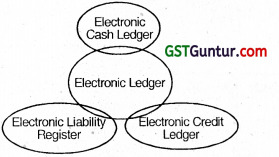

What are the three types of Ledgers to be maintained by a taxable person uhder the GST Law?

Answer:

The three types of ledgers to be maintained are: Electronic credit ledger, electronic cash ledger and electronic tax liability register.

Question 9.

What are the deposit amounts that need to be reflected in the Electronic Cash Ledger?

Answer:

Electronic Cash Ledger shall contain details of every deposit made towards tax, interest, penalty or any other amount (including the Tax Deducted at Source u/s 51 and Tax Collected at Source u/s 52).

![]()

Question 10.

What are the major and minor heads of Credit in the Electronic Cash Ledger?

Answer:

Major Heads

- IGST

- CGST

- SGST

- UTGST

Minor Heads

- Tax

- Interest

- Penalty

- Any other amount

![]()

Question 11.

What is meant by Cross-utilization of credit and how is it done in the Electronic Credit Ledger?

Answer:

Cross utilization means utilizing IGST/ CGST/ SGST/ UTGST liabilities against Electronic Credit Ledger under IGST/ CGST/ SGST/ UTGST Act. The amount available in the Electronic Credit ledger may be used for making payment towards output tax payable under the Act or Rules.

Question 12.

Is cross-utilization permissible among Major heads in the Electronic Cash Ledger?

Answer:

Yes, cross-utilization is permissible among major heads in the Electronic Cash Ledger except that CGST credit cannot be utilized for payment of SGST/ UTGST and vice versa.

Question 13.

Is there any possibility of refund under the GST Act or is adjustment alone permissible?

Answer:

There is a possibility of refund under GST Act.

![]()

Question 14.

When is a person liable to pay interest?

Answer:

When a person who is liable to pay tax under the provisions of the Act or the respective rules made thereunder, fails to pay the whole/ part of the tax due, to the account of the Government, within the prescribed time, he shall be liable to pay interest.

Question 15.

Is penalty still payable if a person pays the tax and interest as per show cause notice?

Answer:

Where the person has made payment of tax and interest under Section 50 within 30 days of issue of the show cause notice, no penalty is payable and all proceedings in respect of that tax amount is deemed to be concluded.

Question 16.

Is interest leviable on excess claim of Input Tax Credit or undue claim of Input Tax Credit?

Answer:

Yes, interest is also leviable where there is undue or excess claim of ITC under Section 42(10).

![]()

Question 17.

Is interest leviable on excess redaction of Output tax liability?

Answer:

Yes, interest is also leviable where there is undue or excess reduction in output tax liability under section 43 (10).

Multiple Choice Question

Question 1.

Which of these registers/ledgers are maintained online?

(a) Tax liability register

(b) Credit ledger

(c) Cash ledger

(d) All of them

Answer:

(d) All of them

Question 2.

Payment made through challan will be credited to which registers/ledgers?

(a) Electronic Tax liability register

(b) Electronic Credit ledger

(c) Electronic Cash ledger

(d) All of them

Answer:

(c) Electronic Cash ledger

![]()

Question 3.

What should the taxable person do if he pay’s the wrong tax i.e. IGST instead of CGST/SGST or vice versa?

(a) Remit tax again and claim refund

(b) It will be auto-adjusted

(c) It will be adjusted on application/request

(d) None of the above

Answer:

(a) Remit tax again and claim refund

Question 4.

What should the taxable person do if he pay’s tax under wrong G3TIN?

(a) Pay again under right GSTIN and claim refund

(b) Auto-adjustment

(c) Adjustment on application/request

(d) Raise ISD invoice and transfer

Answer:

(a) Pay again under right GSTIN and claim refund

![]()

Question 5.

A Company has head office in Bangalore and 4 branches in different states, all registered under GST and one ISD registered unit in Delhi. How many electronic cash ledgers will the company have?

(a) 1

(b) 4

(c) 5

(d) 6

Answer:

(c) 5

Question 6.

What is the validity of challan in FORM GST PMT-06?

(a) 1 day

(b) 5 days

(c) 15 days

(d) Perpetual validity

Answer:

(c) 15 days

![]()

Question 7.

A taxable person failed to pay tax and/or file returns on time. He should pay interest on?

(a) Gross tax payable

(b) Gross tax payable & input credit claimed

(c) Net tax payable

(d) No interest payable, if reasonable cause is shown

Answer:

(a) Gross tax payable

Question 8.

From which date interest is liable in case of excess input tax credit claimed?

(a) From the late date of the month in which credit is claimed

(b) From the due date for filing GSTR-02 of the month in which credit is claimed

(c) From the due date for filing GSTR-03 of the month in which credit is claimed

(d) From the date of utilization of credit.

Answer:

(c) From the due date for filing GSTR-03 of the month in which credit is claimed

![]()

Question 9.

What is the due date for payment of tax? .

(a) Last day of the month to which payment relates

(b) Within 10 days of the subsequent month

(c) Within 20 days of the subsequent month

(d) Within 15 days of the subsequent month

Answer:

(c) Within 20 days of the subsequent month

Question 10.

Taxable person made an online payment of tax. Due to technical snag CIN was not generated but my bank account is debited. What should he do?

(a) Wait for 24 hours for re-credit

(b) Approach bank

(c) File application with department

(d) File return without challan

Answer:

(c) File application with department

![]()

Payment of Tax Notes

Definitions of Certain Key Terms

Payments to be made in GST regime

| For Intra-state supply | CGST and SGST are to be paid. |

| For Inter-state supply | IGST to be paid, having components of both CGST and SGST |

| Wherever applicable | Interest, penalty, fees and any other amount also to be paid |

![]()

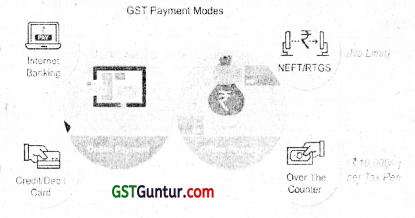

Key Features of Payment process

- Electronically generated challan from GSTN common portal in all modes of payment and no use of manually prepared challan.

- Facilitation for the tax payer by providing hassle free, anytime, anywhere mode of payment of tax;

- Convenience of making payment online;

- Logical tax collection data in electronic format;

- Faster remittance of tax revenue to the Government Account;

- Paperless transactions;

- Speedy Accounting and reporting;

- Electronic reconciliation of all receipts;

- Simplified procedure for banks;

- Warehousing of Digital Challan.

What are E-Ledgers?

Electronic Ledgers or E-Ledgers are statements of cash and input tax credit in respect of each registered taxpayer. In addition, each taxpayer shall also have an electronic tax liability register.

Types of Electronic Ledgers

A. Electronic Cash Ledger

| Cash Receipts (Credit) | Liability Payments (Debit) |

| IGST CGST SGST/UTGST CESS | IGST CGST SGST/UTGST CESS |

Cash receipts using Online modes or OTC Deposits (CIN)

|

Payment of

|

![]()

Modes of Deposit in Electronic Cash Ledger

Major and Minor Heads of Payment

Major Heads

- IGST

- CGST

- SGST/UTGST

- CESS

Each of these major heads have the five following Minor Heads

Minor Heads

- Tax

- Interest

- Penalty

- Fee

- Others

![]()

Cross utilization of funds across major or minor heads → Not Possible

Date of deposit of tax dues

Which date is considered as date of deposit of the tax dues?

| (i) | Date of presentation of cheque | ✗ |

| (ii) | Date of payment | ✗ |

| (iii) | Date of credit of amount in the account of government | ✓ |

B. Electronic credit ledger

Order of utilisation of input tax credit available in electronic credit ledger

| ITC | Order of utilization | |

| (1) | (2) | |

| IGST | IGST | CGST/SGST/UTGST any proportion |

| ITC of IGST to be completely exhausted mandatorily | ||

| CGST | CGST | IGST |

| ITC of CGST has been utilized fully | ||

| SGST/UTGST | SGST/ UTGST | IGST |

![]()

Note: The CGST credit cannot be utilized for payment of SGST / UTGST. The SGST/ UTGST credit cannot be utilized for payment of CGST.

C. Electronic liability register

Order of discharge of liability of taxable person

Manner of making payment

| Through debit Credit Ledger of Electronic | In cash, by debit in the Electronic Cash Ledger |

| Through Debit of Credit Ledger of the tax payer maintained on the common portal – ONLY Tax can be paid. | Payment can be made in cash, by debit in the Cash Ledger of the tax payer maintained on the common portal. |

![]()

E-Ledgers

Electronic Cash Ledger

- It will reflect all deposits made in cash, and TDS / TCS made on account of the tax payer.

- This ledger can be used for making ANY PAYMENT towards tax, interest, penalty, fees or any other amount on account of GST.

Electronic Credit Ledger

- It will reflect Input Tax Credit as self-assessed in monthly returns.

- The credit in this ledger can be used to make payment of TAX ONLY Le. output tax and not other amounts such as interest, penalty, fees etc.

Electronic Liability Register

- Electronic Liability Register will reflect the total tax liability of a taxpayer (after netting) for the particular month

Payment of Tax via Electronic Ledger

A. Electronic Cash Ledger

(Assume it as an account statement provided by bank, for easy understanding)

![]()

| Debit Amount (DR) | Credit Amount (CR) | ||

|

|

||

| B. Electronic Credit ledger | |||

| Debit Amount (DR) | Credit Amount (CR) | ||

| Credit amount of this ledger may be used for payment of output tax viz IGST, CGST, SGST, UTGST in the prescribed order. | Input Tax Credit as self- assessed in the return in the form of IGST, CGST, SGST, UTGST | ||

| C. Electronic Liability Register | |||

| Debit Amount (DR) | Credit Amount (CR) | ||

|

Electronic cash ledger | ||

| Amount payable towards output tax | Electronic credit ledger | ||

Interest on delayed payment of tax [Section 50]

New sub-sections (10) and (11) inserted In section 49 of the CGST Act, 2017 w.e.f 01 .01 .2020 vide Finance Act, 2019 provides a facility to the registered person to transfer an amount from one (major/minor) head to another (major/minor) head in. the electronic cash ledger.

The amount available in the electronic cash ledger can be utilised for payment of any liability for the major and minor heads. For instance, if the registered person has made a deposit of tax erroneously i.e. by virtue of human error, under a particular head instead of a specific head, the same can be transferred to the respective intended head vide Form GST PMT-09.

![]()

This Form can be used either for:

- transfer of erroneous deposits under any minor head of a major head to any other minor head of same or other major heads or

- for any of the amounts already lying unutilised under any of the minor heads in Electronic Cash ledger.

For instance, a registered person has deposited a sum of ₹ 1 000 under the head of “Interest” column of CGST & ₹ 1,000 under the head of “Interest” column of SGST, instead of the head “Fee”. Such amount can be transferred using Form GST PMT-09 for making a transfer to the head “Fee”.

The said transfer is required using the above Form, because when tho Registered person has to make the remittance of Taxllnterest/Penatty/ Feel Other amount at a stage “Offset Liabilities in any of the GST Returns/ Forms for Tax payments through Electronic Cash Ledger, adequate amount should be available under the respective head of account.

Prior to the above amendment, the Registered person has to claim a refund of such erroneous deposit or unutilized amounts using the prescribed Form and make a fresh deposit of tax for-utilization under the appropriate head.

The new section 53A provides for transfer of amount between Centre and States consequential to amendment in section 49 of the CGST Act allowing transfer of an amount from one head to another head in the electronic cash ledger of the registered person.

![]()

The tax dues which are not paid within the stipulated time are liable to interest payment. This mechanism is automatic in nature by virtue of the provisions laid under any tax laws. On similar lines, section 50 of the CGST Act, 2017 provides for applicability of interest for default in payment of taxes within the stipulated time.

Under GST law, a registered person, can make the payment of tax through electronic credit ledger or electronic cash ledger in terms of section 49 of CGST Act, 2017. Usually, the balance in electronic credit ledger is exhausted first before utilizing the balance available in the electronic cash ledger. This practice is adopted for a better working capital management.

In case a registered person does not have sufficient amount available in electronic credit ledger to pay the tax dues for a particular tax period. Also, the registered person does not have sufficient money for making deposit of balance tax amount in electronic cash ledger. In such a situation, GST common portal doesn’t have a mechanism to allow a registered person to make part payment of taxes.

If the law maker demands tax dues along with interest on the gross payments i.e. tax paid through electronic cash ledger and credit ledger, it may be an unhealthy practice from business perspective. To counter such recovery mechanism, a proviso has been inserted under Section 50 to provide that when a registered person has paid his taxes through a return specified under Section 39 of CGST Act, 2017 belatedly, interest shall be applicable only on the net taxes paid through electronic cash ledger and not on the gross taxes paid for such tax period.

![]()

Proviso to sub -section(1) has been inserted vide Section 100 of Finance Act. 2019 and effect of such insertion has been given effect from 01.09.2020. However, corresponding retrospective amendment in CGST Act, 2017 is yet to be brought in by the suitable legislation. However, CBIC has ,ssued F. No. CBEC- 20/01/08/2019-GST dated:

18th September, 2020 for giving instructions to the filed formations for giving effect to 39th GST Council decision of collecting interest under Section 50(1) only on the net tax liability paid through cash w.e.f. 01.07.2017.

Accordingly, Interest if any payable by the registered person for delay in remittance of taxes beyond the stipulated due date on account of delay in filing of return under section 39. shall be demanded only on the net cash liability of taxes and not on the gross tax liability