Payment of Tax – CA Final IDT Study Material is designed strictly as per the latest syllabus and exam pattern.

Payment of Tax – CA Final IDT Study Material

Question 1.

A makes intra-State supply of goods valued at ₹ 50,000 to B within State of Karnataka. B makes inter-State supply to X Ltd. (located in Telangana) after adding 10% as its margin. Thereafter; X Ltd. sells it to Y in Telangana (Intra-State sale) after adding 10% as his margin.

Assume that the rate of GST chargeable is 18% (CGST 9% plus SGST 9%) and IGST chargeable is 18%. Calculate tax payable at each stage of the transactions detailed above. Wherever input tax credit is available and can be utilized, calculate the net tax payable in cash. At each stage of the transaction, indicate which Government will receive the tax paid and to what extent.

Answer:

I. Intra-State supply of goods by A to B: A is the first stage supplier of goods and hence, does not have credit of CGST, SGST or IGST. Thus, the entire CGST (4,500) & SGST (4,500) charged will be paid in cash by A to the Central Government and Karnataka Government respectively.

| ₹ | |

| Value charged for supply of goods | 50,000 |

| Add: CGST @ 996 | 4,500 |

| Add: SGST @ 9% | 4,500 |

| Total price charged by A from B | 59,000 |

II. Inter-state supply of goods by B to X Ltd. – Margin @ 10%

| ₹ | |

| Value charged for supply of goods (₹ 50,000 × ₹ 1096) | 55,000 |

| Add: IGST @ 1896 | 9,900 |

| Total price charged by B from X Ltd. | 64,900 |

Computation of IGST payable by B to central Government in cash

| ₹ | |

| IGST payable | 9,900 |

| Less: Credit of CGST | 4,500 |

| Less: Credit of SGST | 4,500 |

| IGST payable to Central Government in cash | 900 |

Credit of CGST and SGST can be used to pay IGST [Section 49(5) of the CGST Act, 2017]. Karnataka Government will transfer SGST credit of ₹ 4,500 utilised in the payment of IGST to the Central Government.

III. Intra-State supply of goods by X Ltd. to Y

Value charged for supply of goods (₹ 55,000 × 110%) : ₹ 60,500

Add: CGST @ 9% : ₹ 5,445

Add: SGST @ 9% : ₹ 5,445

Total price charged by X Ltd. from Y : ₹ 71,390

Computation of CGST and SGST payable by X Ltd, in cash

CGST payable : ₹ 5,445

Less: Credit of IGST : ₹ 5,445

CGST payable to Central Government in cash : Nil

SGST payable : ₹ 5,445

Less: Credit of IGST [₹ 9,900 – ₹ 5,445] : ₹ 4,455

SGST payable to Telangana Government in cash : ₹ 990

Credit of IGST can be used to pay IGST, CGST and SGST in that order [Section 49(5) of the CGST Act, 2017]. Central Government will transfer IGST of ₹ 4,455 utilised in the payment of SGST to Telangana Government

![]()

Question 2.

Mr. NY, a supplier of goods pays GST under regular scheme. Mr. NY is not eligible for any threshold exemption. He has made the following outward taxable supplies during September 2020:

| Particulars | Rate of Tax | Amount (₹) | ||

| CGST | SGST | IGST | ||

| Intra-State Supply of goods | ||||

| Product A | 6% | 6% | – | 8,00,000 |

| Product B | 9% | 9% | – | 2,00,000 |

| Inter State Supply of goods | ||||

| Product A | – | – | 1296 | 3,00,000 |

| Product B | – | – | 1896 | 1,50,000 |

He has also furnished the following information in respect of supplies received by hin during September 2020:

| Particulars | Rate of Tax | Amount (₹) | ||

| CGST | SGST | IGST | ||

| Intra State Supply of goods | ||||

| Product A | 6% | 6% | – | 2,00,000 |

| ProductB | 9% | 9% | – | 1,00,000 |

| Inter-State Supply of goods | ||||

| Product A | – | – | 12% | 1,50,000 |

| ProductB | – | – | 18% | 80,000 |

Mr. NY has following ITCs with him at the beginning of September 2020:

CGST : ₹ 40,000

SGST : ₹ 28,000

IGST : ₹ 44,600

Note:

(i) Both inward and outward supplies are exclusive of taxes, wherever applicable.

(ii) All the conditions necessary for availing the ITC have been fulfilled. Compute net GST payable by Mr. NY for the month of September 2020.

Make suitable assumptions wherever required. [May 2018, (Old), 5 Marks]

Answer:

Computation of GST payable by Mr. NY for the month of September, 2020

| Particulars | CGST (₹) | SGST (₹) | IGST (₹) |

| (i) Intra-State supply of goods | |||

| Product A | 48,000 | 48,000 | |

| Product B | 18,000 | 18,000 | |

| (ii) Inter-State supply of goods | |||

| Product A | 36,000 | ||

| Product B | ——- | ——— | 27,000 |

| Total | 66,000 | 66,000 | 63,000 |

Computation of total ITC available

| Particulars | CGST (₹) | SGST (₹) | IGST (₹) |

| (i) Opening balance | 40,000 | 28,000 | 44,600 |

| (ii) Intra-State supply of goods | |||

| Product A | 12,000 | 12,000 | |

| Product B | 9,000 | 9,000 | |

| (iii) Inter-State supply of goods | |||

| Product A | 18,000 | ||

| Product B | ——— | 14,400 | |

| Total | 61,000 | 49,000 | 77,000 |

Computation of net GST payable (from cash ledger)

| Particulars | CGST (₹) | SGST (₹) | IGST (₹) |

| GST payable | 66,000 | 66,000 | 63,000 |

| Less: ITC | (5,000)- IGST |

(9,000)-IGST | (63,000) IGST |

| (61,000)- CGST | (49,000) -SGST | ||

| Net GST payable | Nil | 8,000 | Nil |

![]()

Question 3.

Sukhdev is a mining engineer. He has crossed the threshold limit for registration under the GST Law and is duly registered in the State of Maharashtra. He effects the following transactions in the month of March, 2019 and wants you to compute the tax payable in cash. He has filed bond/LDT to claim benefits from zero-rated supplies. The following are the particulars furnished by him.

| Particulars | Value of supply in ₹ |

| (a) Sukhdev being an operating member in mining and exploration service at Mumbai High, has provided certain services to the Joint Venture (JV) in which he is also a participant. He believes that the consideration received from the JV is ‘Cost Petroleum’ and not taxable. | 12,00,000 |

| (b) He has purchased certain machinery from outside the State, to render services to the JV at Mumbai High. | 6,00,000 |

| (c) He has obtained legal opinion from a local firm of advocates to enter into the contract with the JV, for providing services to it. | 1,00,000 |

| (d) He has obtained accommodation from the State Government to locate his office close to the sea shore. | 2,00,000 |

| (e) He gets a portion of the petroleum silt as part of the compensation while exploring the petroleum reserves in the Mumbai High- which as per the contract with the Government is part of ‘Cost Petroleum’. | 6,00,000 |

| (f) He sells the petroleum silt to a SEZ Developer in Mumbai | 6,80,000 |

| (g) Consideration is received towards transfer of tenancy rights, which according to Sukhdev is not liable to GST as it has suffered stamp duty. | 8,00,000 |

| (h) On violation of the terms in production sharing agreement, Sukhdev has paid liquidated damages to the Government. | 3,00,000 |

| (i) He has been assigned the right to collect royalty on behalf of Maharashtra Government, as ‘Excess Royalty Collection Contractor’. He has noticed that the mining lease holders have short paid ₹ 2,00,000 as TGST from what had been exempted to him under the assignment. | – |

| (j) He has sold self-fabricated machinery through his agent in Mumbai that has been used for 2 years, the value of which is not available in the open market. The agent sells it immediately to an unrelated customer in Mumbai | 10,00,000 |

| (k) Opening Balance and brought forward tax credits are as follows: | |

| – Electronic Cash Ledger – CGST | 12,000 |

| – Electronic Credit Ledger – CGST | 18,000 |

| – Electronic Credit Ledger – SGST | 12,000 |

| – Electronic Credit Ledger – IGST | 60,000 |

| (l) Supply value is exclusive of taxes. Supply of services are taxable at CGS 19%, SGST 9% and IGST 18% and supply of goods are taxable at CGST 2.5% SGST 2.5% and IGST 5%. Determine the tax payable in cash.

Provide suitable notes where required. |

Answer:

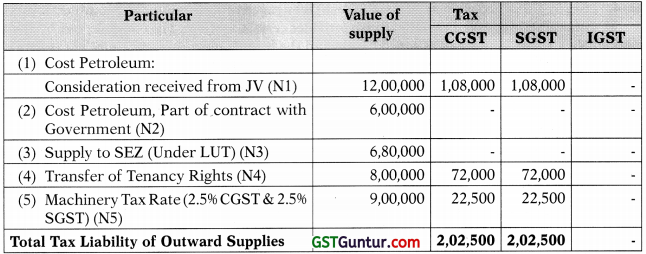

Computation of Tax Liability [payment through electronic cash ledger]

| CGST | SGST | IGST | |

| Output Tax liability (WN1) | 2,02,500 | 2,02,500 | – |

| Less. ITC | |||

| IGST (WN2) | 1,26,500 | 1,63,500 | – |

| CGST (WN2) | 45,000 | – | – |

| SGST (WN2) | – | 39,000 | – |

| Total | 31,000 | – | – |

| Add: Reverse Charge Liability Payable in Cash Without Set off ITC [Tax payable under reverse charge, being not an output tax, cannot be set off against ITC and thus, will have to be paid in cash.] |

27,000 | 27,000 | 2,00,000 |

| Total Tax Liability Payable in Cash | 58,000 | 27,000 | 2,00,000 |

Note: Services provided by the Government by way of tolerating non-performance of a contract for which consideration in the form of liquidated damages is payable to the Government under such contract, is exempt from GST. Hence, no tax will be payable by Sukhdev on such input service.

Working Note 1.

Computation of output Tax Liability of Sukhdev

Note: –

1. The operating member is providing the mining and exploration service to the joint venture, and thus, the consideration received therefor is not cost petroleum and hence, is liable to tax.

2. Cost petroleum is not a consideration for service to the Government and thus, is not taxable.

3. Supply to SEZ developer is a zero- rated supply and no tax is payable on the same if made under a bond/LUT.

4. Transfer of tenancy rights to a new tenant against consideration in the form of tenancy premium is taxable even though stamp duty has been paid on the same.

5. Since open market value of the machine is not available, the value will be 90% of the price charged for the supply of machinery by the agent to his unrelated customer (It has been assumed that the supplier has opted to value the goods at 90% of the value charged by the agent to the unrelated customer).

Working Note 2.

Computation of total Input Tax Credit

| Particular | Amount | CGST | SGST | IGST |

| (1) Inter-State Purchase of Machine (GST @5%) | 6,00,000 | – | – | 30,000 |

| (2) Legal services (RCM) (GST @18%) | 1,00,000 | 9,000 | 9,000 | – |

| (3) Renting of accommodation (RCM) (GST

@18%) |

2,00,000 | 18,000 | 18,000 | – |

| (4) Assignment, by the State Government, of the right to collect royalty from mining lease holders to the extent the exemption is not available | 2,00,000 | |||

| Eligible ITC of Taxable period | – | 27,000 | 27,000 | 2,30,000 |

| Add. Opening Balances | – | 18,000 | 12,000 | 60,000 |

| Total ITC | – | 45,000 | 39,000 | 2,90,000 |

Note: ITC may be availed for making zero rated supply even if such a supply is an exempt supply. Sale of petroleum silt, being a non- taxable supply, is an exempt supply but since it is also a zero-rated supply, ITC can be availed for making such supply.

![]()

Question 4.

Skylark Pvt. Ltd., Noida (Uttar Pradesh) is engaged in various kinds of commercial activities. It manufactures taxable goods as also provides certain services. The company has branch office in New Delhi. The Head office at Noida and the branch office in New Delhi are registered under GST. The branch office at New Delhi is eligible for full input tax credit.

The company has reported a total turnover of ₹ 256 crore (exclusive of GST) for the month of August 20XX. The following information is provided by the company in relation to such turnover:

(i) The turnover includes ₹ 45 crore from sale of securities which were purchased for ₹ 30 crore in the month of January last year.

(ii) The company supplied goods worth ₹ 50 crore to ABC Ltd. in UK under a letter of undertaking (LUT). The total export proceeds are received in the month of August 20XX itself; ₹ 30 crore in foreign currency and balance ₹ 20 crore in Indian rupees.

(iii) The company provided consulting services to Sherpa & Sons in Nepal for ₹ 30 crore under a LUT. The entire consideration is received in Indian rupees in the month of August 20XX itself, with the permission of RBI.

(iv) The turnover includes supply of goods worth ₹ 10 crore to Shanghai Jianguo Trading Company Ltd., a company based in China. As per the sale contract, the goods were to be assembled at Shanghai Jianguo Trading Company Ltd.’s office in Gurugram, Haryana. The payment of the goods is received in convertible foreign exchange in the month of August 20XX itself.

(v) Goods worth t 20 crore are supplied under a LUT to DEF Pvt. Ltd. located in a SEZ in the State of Uttar Pradesh.

(vi) Goods worth ₹ 40 lakh were being procured from a vendor in Japan. While the goods were in transit, the company secured an order for the said goods for ₹ 50 lakh from a buyer in Thailand, Thus, the goods were directly sent to Thailand without entering India.

(vii) The company owns three immovable properties in Noida. The first building is let out for running a printing press at ₹ 10 lakh per month. The second building is let out for residential purpose at ₹ 5 lakh per month. The third building is let out to a Cold Storage operator at ₹ 5 lakh per month. The cold storage operator sub-lets the building as a warehouse to store potatoes.

(viii) The remaining turnover comprised of taxable goods sold within the State and outside the State in the ratio of 3:2.

Total turnover of ₹ 256 crore includes the turnover referred to in points (i) to (vii) above. In addition to above –

(i) The company transferred its stock (taxable goods) from Noida to Delhi branch without any consideration; the value declared in the invoice is ₹ 4.5 crore (exclusive of GST). The cost of production of such goods is ₹ 10 crore. Such stock is sold to independent buyers at ₹ 15 crore (exclusive of GST).

(ii) The company had sent goods worth ₹ 12 crore (exclusive of GST) to M/s Sharma Traders in Haryana on approval basis on 15th January, 20XX, 15th February 20XX & 15th March 20XX (₹ 4 crore each month). Goods sent during all the three months are approved in the month of September 20XX.

Compute the GST liability [CGST & SGST or IGST, as the case may be] of Skylark Pvt. Ltd., Noida for the month of August 20XX. Make suitable assumptions wherever required.

Assume the rates of taxes to be as under:

| CGST | SGST | IGST | |

| Goods | 6% | 6% | 12% |

| Services | 9% | 9% | 1896 |

Answer:

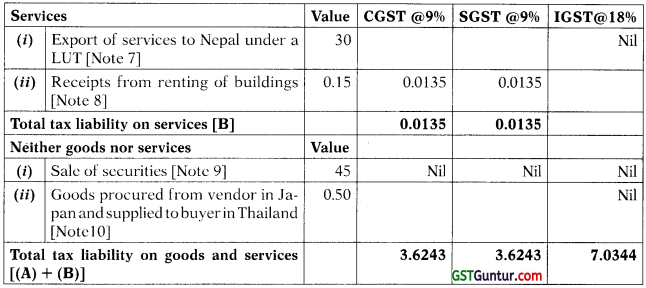

Computation of GST liability of Skylark Pvt. Ltd. for the month of August 20XX

(Amount in crores)

| Goods | Value | CGST @6% | SGST @6% | IGST@12% |

| (i) Export of goods to ABC Ltd. in UK under a letter of undertaking (LUT) [Note 1] | 50 | Nil | ||

| (ii) Supply of goods to Shanghai Jianguo Trading Company Ltd. [Note 2] | 10 | 1.20 | ||

| (iii) Goods supplied to DEF Pvt. Ltd. located in a SEZ [Note 3] | 20 | Nil | ||

| (iv) Sale within the State [Note 4] | 60.18 | 3.6108 | 3.6108 | — |

| (v) Sale outside the State [Note 4] | 40.12 | — | — | 4.8144 |

| (vi) Stock transfer from Noida to Delhi [Note 5] | 4.50 | — | — | 0.54 |

| (vii) Goods sent for sale on approval basis on 15th February, 20XX [Note 6] | 4.00 | — | — | 0.48 |

| Total tax liability on goods [A] | 3.6108 | 3.6108 | 7.0344 |

Notes:

(1) Export of goods is a zero rated supply in terms of section 16(1)(n) of the IGST Act, 2017. A zero rated supply is supplied without payment of tax under a LUT in terms of section 16(3)(a) of that Act (Receipt of consideration in foreign exchange is not a pre-requisite for export of goods).

(2) As per section 10(1)(J) of the IGST Act, 2017, where the goods are assembled or installed at site, the place of supply shall be the place of such installation or assembly. Therefore, in the given case, the place of supply will be Gurugram, Haryana.

Since the location of the supplier (Uttar Pradesh) and the place of supply (Haryana) are in two different States, the same is an inter-State supply liable to IGST [Section 7(1)(u) of the IGST Act, 2017 read with section 5(1) of that Act].

(3) As per section 7(5)(b) of the IGST Act, 2017, supply of goods and/or services to a special economic zone (SEZ) unit is treated to be a supply of goods and/or services in the course of inter-State trade or commerce. Therefore, supply of goods to a SEZ unit located within the same State shall be liable to IGST [Section 5(1) of the IGST Act, 2017].

As Per section 16(1)(b) of the IGST Act, 2017, Supply of goods and/or services to a SEZ unit is a zero rated supply. A zero rated supply is supplied without payment of tax under a LUT in terms of section 16(3)(a) of that Act.

(4) Remaining turnover will be calculated as under

₹ 256 crore – (₹ 45 crore + ₹ 50 crore + ₹ 30 crore + ₹ 10 crore + ₹ 20 crore + ₹ 0.50 crore + ₹ 0.10 crore + ₹ 0.05 crore + ₹ 0.05 crore) = ₹ 100.30 crore Supply within the State – ₹ 100.30 crore × 3/5 = ₹ 60.18

Supply outside the State – ₹ 100.30 crore × 2/5 = ₹ 40.12

(5) As per section 25(4) of the CGST Act, 2017, a person who has obtained more than one registration, whether in one State or- Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as ‘distinct persons’.

The stock transfer by Noida office to Delhi branch is an inter-State supply as the location of the supplier and the place of supply are in two different States [Section 7(1)(a) of IGST Act, 2017], Thus, the supply is leviable to IGST in terms of section 5(1) of the IGST Act, 2017. ”

Rule 28 of the CGST Rules, 2017 prescribes the provisions to determine the value of supply of goods or services or both between distinct or related persons, other than through an agent. Second proviso to the said rule lays down that where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the open market value of the goods or services. Therefore, the value of supply in this case will be ₹ 4.5 crore and open market value and cost of production of the goods will be irrelevant.

(6) As per section 31 (7) of the CGST Act, 2017, where the goods being sent or taken on approval for sale or return are removed before the supply takes place, the invoice shall be issued before or at the time of supply or six months from the date of removal, whichever is earlier.

In the given case, the time period of six months for goods sent on 15th February, 20XX expires on 15.08.20XX. Therefore, the invoice for the said goods shall be issued on 15.08.20XX and in terms of section 12(2)(a) of the CGST Act, 2017 read with Notification No. 66/2017 CT dated 15.11.2017, this date would also be the time of supply of such goods. Thus, such goods will be liable to tax in the month of August 20XX. Goods sent in the month of January would have been taxed in the month of July and goods sent in the month of March would be taxed in the month of September.

The location of the supplier (Uttar Pradesh) and the place of supply (Haryana) are in two different States, the same is an inter-State supply liable to IGST [Section 7(1)(a) of the IGST Act, 2017 read with section 5(1) of that Act].

(7) The given case is an export of service as per section 2(6) of the IGST Act, 2017, as-

(i) The supplier of service is located in India (Noida);

(ii) The recipient of service is located outside India (Nepal);

(iii) The place of supply of service is outside India (Place of supply of consulting service will be the location of recipient, i.e. Nepal);

(iv) The payment for such service has been received by the supplier of service in convertible foreign exchange or in Indian rupees wherever permitted by the Reserve Bank of

India (Receipt of export consideration in Indian rupees is permitted by RBI in the given case); and

(v) The supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8.

Export of services is a zero rated supply in terms of section 16(1)(a) of the IGST Act, 2017.

A zero rated supply is supplied without payment of tax under a LUT in terms of section 16(3)(n) of that Act.

(8) Letting out of the building including a commercial, industrial or residential complex for business or commerce, either wholly or partly, is a supply of service in terms of para 2(b) of the Schedule II to the CGST Act, 2017. Services by way of renting of residential dwelling for use as residence is exempt from tax [Notification No. 12/2017 CT (R) dated 28.06.2017], Therefore, rent of ₹ 10 lakh received from letting out of building for printing press will be liable to tax and rent of ₹ 5 lakh received from letting out of building for residential purposes will be exempt from tax.

In the given case, the Cold Storage Operator and not Skylark Pvt. Ltd. is engaged in warehousing of agricultural produce. Therefore, the Cold Storage Operator providing warehousing services for potatoes, being an agricultural produce, will be eligible for such exemption and services provided by Skylark Pvt. Ltd., being services of renting of immovable property (₹ 5 lakh), will be liable to tax.

The location of the supplier (Uttar Pradesh) and the place of supply (Noida) are in the same State, the same is an intra-State supply in terms of section 8(1) of the IGST Act, 2017 and is thus, liable to CGST and SGST.

(9) GST is leviable on supply of goods and/or services [Section 9(1) of the CGST Act, 2017], Securities are specifically excluded from the definition of goods and services as provided under clause (52) and clause (1 02) respectively of section 2 of the CGST Act, 2017. Therefore, sale of securities will not be liable to GST.

(10) Paragraph 7 of the Schedule III to CGST Act, 2017 provides that supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into India (third country shipments) is treated neither as a supply of goods nor a supply of services. Thus, there is no GST liability on such sales. Further, since such goods do not enter India at any point of time, customs duty and IGST leviable on imported goods will also not be leviable on such goods.

![]()

Question 5.

Pethalal has obtained registration in the current financial year in Uttar Pradesh. His turnover in the preceding financial year was ₹ 19,90,000. He has received the following amounts in respect of the activities undertaken by him in the month of september.

| Particulars | Amount(₹) |

| (i) Funeral services | 8,80,000 |

| (ii) Services of warehousing of jaggery | 50,000 |

| (iii) Electrically operated buses given on hire to Municipal Corporation | 5,00,000 |

| (iv) Service provided to recognized sports body as commentator | 2,00,000 |

| (v) Commission received as an insurance agent from insurance company | 65,000 |

| (vi) Commission received as business facilitator for the services provided to the urban branch of a nationalized bank with respect to savings bank accounts | 15,000 |

| (vii) Security services (supply of security personnel) provided to Damodar Engineering College (DEC)* [registered under GST] for the security of the college premises

All the engineering courses run by DEC are recognised by the law [The All India Council for Technical Education (AICTE)] |

28,000 |

Further, he has received following services in the month of September.

| Particulars | Amount(₹) |

| (a) Freight paid to unregistered goods transport agency for his business activities relating to serial number (i) above | 1,00,000 |

| (b) Legal advice received from M/s Kanoon Associates, a partnership firm, seeking advice in relation to a tax dispute of the business | 50,000 |

All the transactions stated above are intra-State transactions and amounts given are exclusive of GST, wherever applicable.

You are required to calculate net GST payable by Pethalal for the month of September. There was no opening balance of input tax credit. Rate of CGST and SGST is 9% each for all the outward supplies made by Pethalal. [RTP May 2020]

Answer:

Computation of net GST payable

| Particulars | Value | CGST | SGST |

| (1) Tax Liability Under Forward Charge (WN 1) | 2,00,000 | 18,000 | 18,000 |

| (2) Tax Liability Under Reverse Charge (WN 2) | 1,00,000 | 2,500 | 2,500 |

| 3,00,000 | 20,500 | 20,500 | |

| Less: – Input Tax Credit [Note 1] | – | – | – |

| Net GST Payable | – | 20,500 | 20,500 |

Notes:

1. GST on services provided by a GTA (not paying tax @12%) to, inter alia, a registered person is payable by the recipient of service i.e., the registered person, under reverse charge in terms of reverse charge notification. Since in the given case, GTA is unregistered, Pethalal is liable to pay tax under reverse charge @ 5% (CGST @ 2.5% and SGST @ 2.5%). Further, since said input services are being exclusively used for effecting non-taxable supplies [funeral services], input tax credit of the GST paid on the same will not be available.

2. As per section 49(4) of the CGST Act, 2017, amount available in the electronic credit ledger may be used for making payment towards output tax. However, tax payable under reverse charge is not an output tax in terms of section 2(82) of the CGST Act, 2017. Therefore, tax payable under reverse charge cannot be set off against the input tax credit and thus, will have to be paid in cash.

Working Note 1:

Supplies on which Pethalal is liable to pay GST under forward charge

| Particulars | Value(₹) | CGST(₹) | SGST(₹) |

| Funeral services [Note 1] | 8,80,000 | ||

| Services of warehousing of jaggery [Note 2] | 50,000 | ||

| Services by way of giving on hire electrically operated buses to Municipality [Note 3] | 5,00,000 | ||

| Service provided to recognized sports body as commentator [Note 4] | 2,00,000 | = 2,00,000 × 9% = 18,000 | =2,00,000 × 9% = 18,000 |

| Commission received as an insurance agent from insurance company [Note 5] | 65,000 | ||

| Commission received as business facilitator for the services provided to the urban branch of a nationalised bank with respect to savings bank accounts [Note 6] | 15,000 | ||

| Security services (supply of security personnel) provided to DEC for the security of the college premises [Note 7] | 28,000 | ||

| Total | 2,00,000 | 18,000 | 18,000 |

Notes:

1. Funeral services being covered in entry 4 of Schedule III to the CGST Act, 2017 are not a supply and thus, are outside the ambit of GST.

2. Services by way of storage/warehousing of, inter alia, jaggery are exempt from GST vide Exemption Notification No. 12/2017 CT(R) dated 28.06.2017 (hereinafter referred to as exemption notification). Thus, services of warehousing of jaggery are exempt.

3. Services by way of giving on hire to a local authority, an Electrically operated vehicle (EOV) meant to carry more than 12 passengers are exempt vide exemption notification. Buses are EOVs meant to carry more than 12 passengers. Hence, services of giving electrically operated buses on hire to Municipal Corporation are exempt from GST.

4. Services provided to a recognized sports body by an individual only as a player, referee, umpire, coach or team manager for participation in a sporting event organized by a recognized sports body are exempt from GST vide exemption notification. Thus, service provided as commentator is liable to GST.

5. Though commission for providing insurance agent’s services to any person carrying on insurance business is liable to GST, the tax payable thereon is to be paid by the recipient of service i.e., insurance company, under reverse charge in terms of Notification No. 13/2017 CT(R) dated 28.06.2017 (hereinafter referred to as reverse charge notification). Thus, Pethalal will not be liable to pay GST on such commission.

6. Services provided by a business facilitator to banking company with respect to accounts in its rural area branch is exempt from GST vide exemption notification. Thus, services provided by him in respect of urban area branch of the bank will be taxable. However, the tax payable thereon is to be paid by the recipient of service Le., banking company, under reverse charge in terms of reverse charge notification. Hence, Pethalal will not be liable to pay GST on commission received for said services.

7. Services provided to an educational institution, by way of security services performed in such educational institution are exempt from GST only when said services are provided to an institution providing services by way of pre-school education and education up to higher secondary school or equivalent, vide exemption notification. Thus, in the given case, security services provided to DEC are not exempt. Further, the tax on security services (supply of security personnel) provided by any person other than a body corporate to a registered person is payable by the recipient of service under reverse charge in terms of reverse charge notification. Hence, Pethalal will not be liable to pay GST in the given case.

Working Note 2:

Supplies on which Pethalal is liable to pay GST under reverse charge

| Particulars | Value | CGST | SGST |

| Services received from GTA [Note 1] | 1,00,000 | = 1,00,000×2.5% = 2,500 | = 1,00,000×2.5% = 2,500 |

| Legal services received [Note 2] | 50,000 | ||

| Total | 1,00,000 | 2,500 | 2,500 |

Notes:

1. GST on services provided by a GTA (not paying tax @ 12%) to, inter alia, a registered person is payable by the recipient of service i.e., the registered person, under reverse charge in terms of reverse charge notification. Since in the given case, GTA is unregistered, Pethalal is liable to pay tax under reverse charge @ 5% (CGST @ 2.5% and SGST @ 2.5%). Further, since said input services are being exclusively used for effecting non-taxable supplies [funeral services], input tax credit of the GST paid on the same will not be available.

2. Legal services provided by a partnership firm of advocates to a business entity (with an aggregate turnover up to such amount in the preceding FY as makes it eligible for exemption from registration under the CGST Act, 2017) are exempt from GST vide exemption notification. Since the aggregate turnover of Pethalal did not exceed ₹ 20 lakh [the applicable threshold limit for registration for Pethalal being a supplier of services] in the preceding FY, legal services received by him are exempt from GST.

![]()

Question 6.

Can one use input tax credit for payment of interest, penalty, and payment under reverse charge?

Answer:

No, as per Section 49(4) of the CGST Act, 2017 the amount available in the electronic credit ledger may be used for making any payment towards ‘output tax’.

As per Section 2(82) of the CGST Act, 2017, output tax means, the CGST/SGST chargeable under this Act on taxable supply of goods and/or services made by him or by his agent and excludes tax payable by him on reverse charge basis.

Therefore, input tax credit cannot be used for payment of interest, penalty, and payment under reverse charge.

Question 7.

Miss Nitya has following balances in her Electronic Cash Ledger as on 28-02-2020 as per GST portal.

| Major Heads | Minor Heads | Amount (₹) |

| CGST | Tax | 40,000 |

| Interest | 1,000 | |

| Penalty | 800 | |

| SGST | Tax | 80,000 |

| Interest | 400 | |

| Penalty | 1,200 | |

| Fee | 2,000 | |

| IGST | Tax | 45,000 |

| Interest | 200 | |

| Penalty | Nil |

Her tax liability for the month of February, 2020 for CGST and SGST was ₹ 75,000 each. She failed to pay the tax and contact you as legal advisor on 12/04/2020 to advise her as to how much amount of tax or interest she is required to pay, if any, by utilizing the available balance to the maximum extent possible as per GST Laws. She wants to pay the tax on 20-04-2020.

Other Information:-

- Date of collection of GST was 18th February, 2020.

- No other transaction after this up to 20th April 2020.

- Ignore penalty for this transaction.

- No other balance is available.

You are required to advise her with reference to legal provisions with brief notes on the legal provisions applicable. [Nov. 2018, 5 Marks]

Answer:

Calculation of Interest:

- The Due date for payment of tax collected on 18.02.2020 is 20.03.2020.

- Interest @ 18% p.a. is payable for the period for which the tax remains unpaid in terms of section 50 of CGST Act, 2017.

Since Miss Nitya wants to pay the tax on 20.04.2020, interest payable on the amount of CGST and SGST each is as follows:

= ₹ 75,000 × 1896 × 31/365 = ₹ 1,147 (rounded off)

Amount entered under any Minor head (Tax, Interest, Penalty, etc.) and Major Head (CGST, IGST, SGST/UTGST) of the Electronic Cash Ledger can be utilized only for that liability. Cross-utilization among Major and Minor heads are not possible.

Thus, Miss Nitya is liable to pay the following amount of tax and interest as under:

| CGST | SGST | |||

| Tax | Interest | Tax | Interest | |

| Tax Liability | 75,000 | 1,147 | 75,000 | 1,147 |

| Balances in Electronic cash ledger | 40,000 | 1,000 | 80,000 | 400 |

| Amount payable in cash | 35,000 | 147 | Nil | 747 |

Examiner’s Comment

Large number of examinees wrongly allowed cross utilization among major and minor head of the amount available under electronic cash ledger.

Question 8.

Divya Trader obtained permission for provisional assessment and supplied three consignments of furniture on 28th April, 2020. The tax payment on provisional basis was made in respect of all the three consignments on 20th May, 2020.

Consequent to the final assessment order passed by the Assistant Commissioner on 21st June, 2020, a tax of ₹ 1,20,000 and ₹ 1,50,000 became refundable on 1st and 3rd consignments, whereas a tax of ₹ 1,20,000 became due on 2nd consignment. Divya Trader applies for the refund of the tax on 1st and 3rd consignments on 12th July, 2020 and pays the tax due on 2nd consignment on the same day.

Tax was actually refunded to it of 1st consignment on 8th September, 2020, whereas of 3rd consignment on 18th September, 2020. Customers of Divya Trader who purchased the consignments have not taken Input Tax Credit (ITC).

Determine the interest payable and receivable, if any, under CGST Act, 2017 by Divya Trader. [Nov. 2018, 5 Marks]

Answer:

Interest payable in respect of second Consignment:

Statutory Provision

- tax becomes due consequent to order of final assessment

- interest is payable 18% p.a.

- from the first day after the due date of payment of tax

- in respect of the goods supplied under provisional assessment

- till the date of actual payment

- whether such amount is paid before after the issuance of order for final assessment.

In the given case

The due date for payment of tax on goods cleared on 28.04.2020 under provisional assessment is 20.05.2020.

Thus, interest payable in respect of 2nd consignment will be calculated as under:

No. of days 21.05.2020 – 12.07.2020

Interest ₹ 1,20,000 × 18% × 53/365 = ₹ 3,136 (rounded off)

Refund receivable in respect of first and Third Consignment:

Statutory Provision

Section 56 of CGST Act, 2017 provides that where tax becomes refundable consequent to the order of 1mai assessment, interest is receivable @ 6% p.a. from the date immediately after the expiry of 60 days from the date of

receipt of refund application till the date of refund of such tax.

In the given case

First Consignment:

Since refund of tax of 1st consignment has been paid on 08.09.2020 which is within 60 days from the date of receipt of application of refund (12.07.2020), interest is not receivable on tax refunded in respect of 1st consignment.

Third Consignment:

Interest receivable in respect of 3rd consignment is as follows:

- 60 days from the date of receiving the refund application expire on 10.09.2020.

- No. of days = 1 1.09.2020 – 18.09.2020 = 8

- Refund = ₹ 1,50,000 × 6% × 8/365 = ₹ 197 (rounded off).

![]()

Question 9.

Checker not has self-assessed tax liability under IGST Act, 2017, as ₹ 80,000. He fails to pay the tax within 30 days from the due date of payment of such tax.

Determine the interest and penalty payable by him explaining the provisions of law, with the following particulars available from his records:

Date of collection of tax 18th December, 2019 Date of payment of tax 26th February, 2020

No Show Cause Notice (SCN) has been issued to him so far, while he intends to discharge his liability, even before it is issued to him, on the assumption that no penalty is leviable on him as payment is made before issue of SCN. [May 2018, (Old), 4 Marks]

Answer:

Calculation of Interest:

Due date for payment of tax collected on 18.12.2019 is 20.01.2020.

However, since tax is actually paid on 26.02.2020, interest @ 18% p.a. is payable for the period for which the tax remains unpaid [37 days] in terms of section 50 of CGST Act, 2017 read with Notification No. 13/2017 CT dated 28.06.2017.

- Amount of interest is:

- = ₹ 80,000 × 18% × 37/365 = ₹ 1,460 (rounded off)

Calculation of Penalty:

As per section 73(11) of CGST Act, 2017, where self-assessed tax/any amount collected as tax is not paid within 30 days from due date of payment of tax, then, inter alia, option to pay such tax before issuance of SCN to avoid penalty, is not available.

Consequently, penalty equivalent to

- 10% of tax, viz., ₹ 8,000 or

- 10,000,

whichever is higher, is payable in terms of section 73(9) of CGST Act, 2017.

Therefore, penalty of

₹ 10,000 will have to be paid by Checker.

Examiner’s Comment

Majority of the examinees were ignorant in respect of due date of payment of tax and rate of interest for delayed payment of tax. They also wrongly calculated number of days for delayed payment of tax resulting into incorrect computation of amount of interest.

Question 10.

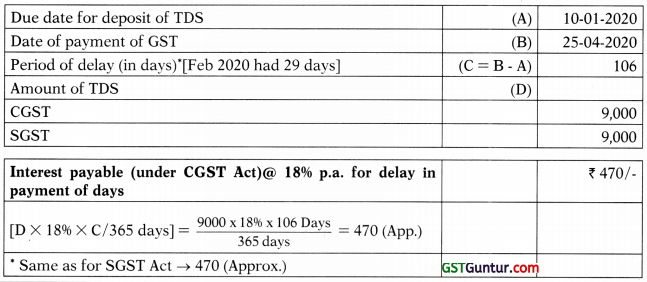

SG Ltd. a person registered in Kolkata has supplied goods to Government of Kolkata for ₹ 10,08,000 (inclusive of GST @ 12%). Determine the amount of tax to be deducted at source. Also determine the interest liability if the tax deducted at source on 25-12-2019 is deposited 25-04-2020.

Answer:

Statutory Provision:

As per Section 50(1) of the Act, the Government has to deduct tax @1%

- from the payment made or credited to the supplier of taxable goods or services or both

- where the total value of such supply, under a contract

- exceeds ₹ 2,50,000.

Such tax along with return has to be paid

- to the account of the Government by the deductor

- within 10 days after the end of the month

- in which such deduction is made.

- Else, interest shall be leviable @18% p.a. for the period for which the tax or any part thereof remains unpaid.

Calculation of TDS:

- the amount of tax to be deducted at source shall be

- CGST = 1% of ₹ 9,00,000 = ₹ 9,000

- SGST = 1% of ₹ 9,00,000 = ₹ 9,000

Computation of Interest on delay in deposit of TDS:

Question 11.

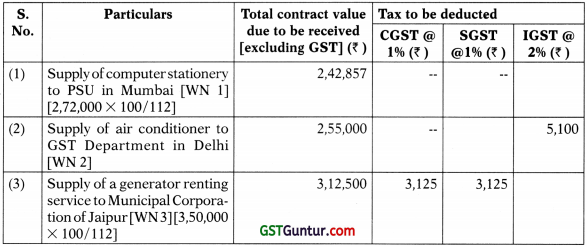

Yash Shoppe, a registered supplier of Jaipur, is engaged in supply of various goods and services exclusively to Government departments, agencies, local authority and persons notified under section 51 of the CGST Act, 2017.

You are required to briefly explain the provisions relating to tax deduction at source under section 51 of the CGST Act, 2017 and also determine the amount of tax, if any, to be deducted from each of the receivables given below (independent cases) assuming that the payments as per the contract values are made on 31.10.2020. The rates of CGST, SGST and IGST may be assumed to be 6%, 6% and 12% respectively.

(1) Supply of computer stationery to Public Sector Undertaking (PSU) located in Mumbai. Total contract value is ₹ 2,72,000 (inclusive of GST)

(2) Supply of air conditioner to GST department located in Delhi. Total contract value is ₹ 2,55,000 (exclusive of GST)

(3) Supply of generator renting service to Municipal Corporation of Jaipur. Total contract value is ₹ 3,50,000 (inclusive of GST) [May 2019 (Old), 5 Marks]

Answer:

Statutory Provision:

As per section 51 of the CGST Act, 2017, Government departments, agencies, local authority and notified persons are required to deduct tax @ 2% (1% CGST + 1% SGST/UTGST) or IGST @ 2% from payment made to the supplier of taxable goods and/or services where the total value of such supply [excluding tax and compensation cess indicated in the invoice], under a contract, exceeds ₹ 2,50,000.

In the given case:

Yash Shoppe is supplying goods and services exclusively to Government departments, agencies, local authority and persons notified under section 51 of the CGST Act, 2017, applicability of TDS provisions on its various receivables is examined in accordance with the abovementioned provisions as under:

Working Notes:

1. Supply of computer stationery to PSU in Mumbai, the total value of supply under the contract [excluding IGST (being inter-State supply)] does not exceed ₹ 2,50,000, tax is not required to be deducted.

2. Supply of air conditioner to GST Department in Delhi, the total value of supply under the contract [excluding IGST (being inter-State supply)] exceeds ₹ 2,50,000, tax is required to be deducted.

3. Supply of a generator renting service to Municipal Corporation of Jaipur, the total value of supply under the contract [excluding CGST and SGST (being intra-State supply)] exceeds ₹ 2,50,000, tax is required to be deducted.

Question 12.

Ritesh Enterprises, registered In Delhi, is engaged in supply of various goods and services exclusively to Government departments, agencies etc. and persons notified under section 51 of the CGST Act, 2017. It has provided the Information relating to the supplies made, their contract values and the payment due against each of them in the month of October, 2OXX as under:

| Particulars | Total contract value (inclusive of GST) (₹) | Payment due in October, 20XX (₹) |

| (i) Supply of stationery to Fisheries Department, Kolkata | 2,60,000 | 15,000 |

| (ii) Supply of car rental services to Municipal Corporation of Delhi | 2,95,000 | 20,000 |

| (iii) Supply of a heavy machinery to Public Sector Undertaking located in Uttarakhand | 5,90,000 | 25,000 |

| (iv) Supply of taxable goods to Delhi office of National Housing Bank, a society established by Government of India under the Societies Registration Act, 1860 | 6,49,000 | 50,000 |

You are required to determine amount of tax, if any, to be deducted from each of the receivable given above assuming the rate of CGST, SGST and IGST as 9%, 9% and 18% respectively. [MTP, May 19/RTP, May 19, 4 Marks]

Answer:

Statutory Provision:

As per section 51 of the CGST Act, 2017 read with section 20 of the IGST Act, 2017, following persons are required to deduct CGST @ 196 [Effective tax 296 (196 CGST + 196 SGST/UTGST)] or IGST @ 296 from the payment (excluding GST) made/credited to the supplier (deductee) of taxable goods or services or both, where the total value of such supply, under a contract, exceeds ₹ 2,50,000:

(a) a department or establishment of the Central Government or State Government; or

(b) local authority; or

(c) Governmental agencies; or

(d) an authority or a board or any other body, –

- set up by an Act of Parliament or a State Legislature; or

- established by any Government, with 51% or more participation by way of equity or control, to carry out any function; or

(e) Society established by the Central Government or the State Government or a Local Authority under the Societies Registration Act, 1860, or

(f) Public sector undertakings.

In the given case

Since Ritesh Enterprises is supplying goods and services exclusively to Government departments, agencies etc. and persons notified under section 51 of the CGST Act, 2017, applicability of TDS provisions on its various receivables is examined in accordance with the abovementioned provisions as under:

| Particulars | Total contract value (₹) | Payment due (₹) | Tax to be deducted | ||

| CGST (₹) | SGST (₹) | IGST (₹) | |||

| Supply of stationery to Fisheries Department, Kolkata [Value excluding GST is not more than ₹ 2,50,000/- (₹ 2,60,000 × 100/118 = ₹ 2,20,339)] | 2,60,000 | 15,000 | ——— | ||

| Supply of car rental services to Municipal Corporation of Delhi [ Value excluding GST is not more than ₹ 2,50,000/- (₹2,95,000 × 100/118 = ₹ 2,50,000)] | 2,95,000 | 20,000 | ——— | ||

| Supply of a heavy machinery to Public Sector Undertaking located in Uttarakhand [Value of excluding GST(₹ 5,90,000 × 100/118 = ₹ 5,00,000)] | 5,90,000 | 25,000 | 500 (21% of 25,000) | ||

| Supply of taxable goods to Delhi office of National Housing Bank, a society established by Government of India under the Societies Registration Act, 1860 [Value of excluding GST(₹ 6,49,000 × 100/118 = ₹ 5,50,000 (round off))] | 6,49,000 | 50,000 | 500(1% of 50,000) | 500(1% of 50,000) | |

![]()

Question 13.

State whether tax collected at source under section 52 of CGST Act, will be applicable in below mentioned scenarios –

(a) Titan sells watch on his own through its own website?

(b) ABC limited who is dealer of Titan brand sells watches through flipkart, amazon etc.?

Answer:

Statutory Provision:

As per Section 52 of CGST Act, every electronic commerce operator not being an agent, shall collect an amount calculated at such rate not exceeding one percent, as may be notified by the Government on the recommendations of the Council, of the net value of taxable supplies made through it by other suppliers where the consideration with respect to such supplies is to be collected by the operator. Hence, if the person sells on his own, TCS won’t be applicable.

In the given case:

If ABC limited who is dealer of Titan brand sells watches through Flipkart, Amazon etc., then the provision of TCS will be applicable to flipkart, amazon.