Go through this Partnership Accounts-Goodwill – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Partnership Accounts-Goodwill – CS Foundation Fundamentals of Accounting Notes

Goodwill:

- Goodwill means the reputation of the firm.

- In other words, Goodwill is the value of reputation earned by a firm which helps it to yield more than normal profits.

Features of Goodwill:

- It is an intangible asset i.e. cannot be seen or touched, (it is not a fictitious asset).

- The value of Goodwill fluctuates from time to time.

- It is a valuable asset and placed on the asset side of Balance sheet.

Factors affecting Goodwill of a firm:

- Location of business.

- Quality of goods sold/services given.

- Reputation of owners of the firm.

- Risk involved in business.

- Efficiency of management.

- Trends of profits etc.

- Monopolistic nature of the business.

- Possibility of competition.

- Government attitude.

- Possession of special contract for availability of material.

Need for valuation of Goodwill:

- On admission of new partner.

- On retirement or death of a partner.

- When there is a change in profit sharing ratio.

- When the business is sold.

- When a firm is amalgamated with another firm.

Goodwill is the present value of a firm’s anticipated super normal | earnings. Super normal earnings means earnings over and above the normal rate of return.

Calculation of Goodwill:

1. Average Profit Method

It is a very simple and widely followed method.

Formula:

Value of Goodwill = Average profit x Number of years of purchase

Here:

(i) Average profits are the past profits after adjustments.

The following adjustments are made from the past profits.

- Abnormal income should be deducted

- Abnormal losses should be added back

- Income from investments should be deducted as it is not earned from the business.

Note: These adjustments are made because average profit is a figure which represents a profit of all past years. Hence, all abnormal items should be removed/adjusted.

(ii) Number of year of purchase – The number of year of purchase are the years for which the goodwill is expected to remain in the business i.e. the years for which the benefits of goodwill can be taken.

Weighted average profit method:

- This method is a slight modification of average profit method.

- Under this method, weights are allotted to each year’s profit.

- Weights are multiplied by the product to get the product.

- The total product is then divided by the total weight to get the weighted average profit

- The method is used when the profits are increasing year after year.

Goodwill = Weighted average profit x No. of years of purchase.

2. Super Profit Method

1. Under this method, goodwill is calculated on the basis of excess profit earned by a firm over and above normal profits.

2. There are three methods for calculating goodwill using super profit method –

- Purchase of super profit.

- Annuity method.

- Capitalization of super profit.

(i) Purchase of super profit:

Goodwill is calculated as follows

Goodwill = Super profit x No. of years of purchase

(ii) Capitalization of super profit method:

Under this method, goodwill is calculated by capitalizing super profits as follows:

Goodwill = \(\frac { Super Profits × 100 }{ Normal Rate of Return }\)

(iii) Annuity method: Under this method, goodwill is calculated by taking the present value of a terminal annuity of a super profit for a reasonable period.

Goodwill = Super Profit x Annuity

Note: Annuity Rate is generally given in question

Example:

A firm earned net profits during the last seven years as follows:

1992 ₹ 20,000 Profit

1993 ₹ 70,000 Loss

1994 ₹ 40,000 Loss

1995 ₹ 2,50,000 Profit

1996 ₹ 2,70,000 Profit

1997 ₹ 3,00,00 Profit

1998 ₹ 3,20,000 Profit

The capital invested in the firm is ₹ 12,00,000. Normal rate of return in the similar type of business is 10%. Calculate the value of goodwill on the basis of 2\(\frac { 1 }{ 2 }\) years purchases of average super profits earned during the above mentioned seven year

Solution:

(i) Actual Average Profit:

Total Profits of last Seven Years – ₹ 20,000 – ₹ 70,000 – ₹ 40,000 + ₹ 2,50,000 + 2,70,000 : ₹ 3,00,000 + ₹ 3,20,000 = ₹ 10,50,000

Average Profit = \(\frac{10,50,000}{7}\) = 1,50,000

(ii) Normal Profit = Capital Invested x \(\frac { Normal Rate of Return }{ 100 }\)

= 12,00,000 x 10/100 = ₹ 1,20,000

(iii) Super Profit = Actual Average Profit – Normal Profit

= ₹ 1,50,000 – ₹ 1,20,000 = ₹ 30,000

(iv) Value of Goodwill = Super Profit x Number of years purchased

= ₹ 30,000 x 2.5 = ₹ 75,000

(3) Capitalization method:

Under this method, goodwill is ascertained by comparing value of whole business (applying normal rate of return) with the actual capital employed of the business. The difference of the above will be termed as goodwill. Goodwill = Value of whole business – capital employed where,

Example : Suppose capital employed by a partnership firm is ₹ 1,00,000. Average profits are ₹ 25,000 and normal rate of return is 10%. Calculate the value of goodwill using capitalization method.

Solution:

Goodwill = Whole value of firm – Capital employed = ₹ 2,50,000 – 1,00,000 = ₹ 1,50,000

Working Note:

Whole value of firm = \(\frac { Average Profits × 100 }{ Normal Rate of Return }\)

= \(\frac{25,000×100}{10}\) = ₹ 2,50,000

Partnership Accounts-Goodwill MCQ Questions

1. Under super profit basis goodwill is calculated by:

(a) Average profits x years of purchase.

(b) Super profits x Years of purchase.

(c) Total of the discounted value of expected future profits.

(d) Super profit divided with expected rate of return.

Answer:

(b) Super profits x Years of purchase.

2. Goodwill brought in by incoming partner in cash is taken away by tho old partners in:

(a) Old Profit Sharing Ratio.

(b) New Profit Sharing Ratio.

(c) Sacrificing Ratio.

(d) Capital Ratio.

Answer:

(c) Sacrificing Ratio.

3. Under capitalization basis goodwill is calculated by:

(a) Average profit x years of purchase.

(b) Super profits x years of purchase.

(c) Total of the discounted value of expected benefits.

(d) Super profit divided with expected rate of return

Answer:

(d) Super profit divided with expected rate of return

4. Partners are supposed to pay interest on drawing only when provide d by the __________.

(a) Partnership Act

(b) None of these

(c) Agreement

(d) (a) and (c) above

Answer:

(c) Agreement

5. Weighted average method of calculating goodwill is used when:

(a) Profits are not equal

(b) Profits show a trend

(c) Partners who gave the guarantee

(d) None of the above

Answer:

(b) Profits show a trend

6. X, Y and Z are partners sharing profits and losses in the ratio 5:3:2. They decide to share the future profits in the ratio 3:2:1. Workmen compensation fund appearing in the balance sheet on the date if no information is available for the same will be:

(a) Distributed to the partners in old profit sharing ratio.

(b) Distributed to the partners in new profit sharing ratio.

(c) Distributed to the partners in capital ratio.

(d) Carried forward to new balance sheet without any adjustment.

Answer:

(a) Distributed to the partners in old profit sharing ratio.

7. X, Y and Z are partners in a firm. At the time of division of profit for the year there was dispute among the partners. Profits before Interest on partners capital was ₹ 10,000 and X wanted interest on capital @20% as his capital contribution was ₹ 1,00,000 as compared to that of Y and Z which was ₹ 75,000 and ₹ 50,000 respectively. Find the solution.

(a) Profits of ₹ 10,000 will be distributed equally.

(b) X will get the interest of ₹ 20,000 and the loss of ₹ 10,000 will be shared equally.

(c) All the partners will get interest their capital and the loss will be shared equally.

(d) None of these.

Answer:

(a) Profits of ₹ 10,000 will be distributed equally.

8. A and B are partners sharing profits and losses in the ratio 5:3. On admission C brings ₹ 1,00,000 as Capital and ₹ 50,000 against goodwill. New profit sharing ratio between A, B and C are 7:5:4 Find the sacrificing ratio of A and B:

(a) 3:1

(b) 4:7

(c) 5:4

(d) 2:1

Answer:

(a) 3:1

9. The following trading results are available in respect of the business carried on by a firm:

2001 – Loss – ₹ 10,000

2002 – Loss – ₹ 5,000

2003 – Profit – ₹ 80,000

2004 – Profit – ₹ 55,000

The value of goodwill on the basis of 5 years purchase of average profit of the business will be:

(a) ₹ 1,25,000

(b) ₹ 1,50,000

(c) ₹ 1,00,000

(d) ₹ 1,20,000

Answer:

(b) ₹ 1,50,000

10. X and Y share profits and losses in the ratio of 2:1. They take Z as a partner and the new profit sharing ratio becomes 3:2:1 .Z brings ₹ 5,000 as premium for goodwill. The full value of goodwill be:

(a) ₹ 5,000

(b) ₹ 20,000

(c) ₹ 30,000

(d) ₹ 25,000

Answer:

(c) ₹ 30,000

11. Find the goodwill of the firm using capitalization method from the following information:

Total Capital Employed in the firm ₹ 8,00,000

Reasonable Rate of Return 15%

Profits for the year ₹ 6,00,000

(a) ₹ 80,00,000

(b) ₹ 40,00,000

(c) ₹ 32,00,000

(d) ₹ 42,00,000

Answer:

(c) ₹ 32,00,000

12. The capital of B and D is ₹ 60,000 and ₹ 30,000 respectively with the profit sharing ratio 3:1. The new ratio admissible after 01.4.2006 is 5:3. Goodwill valued as ₹ 80,000 will be credited to B and D’s capital by ₹:

(a) ₹ 60,000 and 20,000

(b) ₹ 50,000 and 30,000

(c) ₹ 50,000 and 30,000

(d) None of these.

Answer:

(a) ₹ 60,000 and 20,000

13. A and B are partners sharing profits and losses in the ratio of 3:2 having the capital of ₹ 80,000 and ₹ 50,000 respectively. They are entitled to 10% p.a. interest on capital before distributing the profits. During the year, the firm earned ₹ 17,800 before allowing any interest on capital. Profits apportioned among them excluding interest will be:

(a) ₹ 2,880 and 1,920

(b) ₹ 8,800 and 8,800

(c) ₹ 8,000 and 5,000

(d) None of the above.

Answer:

(a) ₹ 2,880 and 1,920

14. A and B are partners sharing profit and losses in the ratio 4:1. C was manager who received the salary of ₹ 2,000 p.m. in addition to a commission of 5% on net profits after charging such commission. Profit for the year is ₹ 3,39,000 before charging salary. Find the total remuneration of C:

(a) ₹ 39,000

(b) ₹ 44,000

(c) ₹ 43,500

(d) ₹ 38,000

Answer:

(a) ₹ 39,000

15. The capital of A and B sharing profits and losses equally are ₹ 90,000 and ₹ 30,000 respectively. They value the goodwill of the firm at ₹ 80,000 which was not recorded in the books. If goodwill is to be raised now, by what amount each partner’s capital account will be debited?

(a) ₹ 20,000 and ₹ 60,000

(b) ₹ 40,000 and ₹ 40,000

(c) ₹ 60,000 and ₹ 20,000

(d) None of these.

Answer:

(d) None of these.

16. A and B are partners with the capital ₹ 50,000 and ₹ 40,000 respectively. They share profits and losses equally. C is admitted on bringing ₹ 50,000 as capital only and nothing was brought against goodwill. Goodwill in Balance Sheet of ₹ 10,000 is revalued as 80,000. What will be value of goodwill in the books after the admission of C?

(a) ₹ 60,000

(b) ₹ 30,000

(c) ₹ 20,000

(d) ₹ 15,000

Answer:

(b) ₹ 30,000

17. Formula for calculation of manager’s commission after charging such commission is:

(a) (Diff of P/L app. A/c x r %) / (100+r %)

(b) (Diff of P/L app. A/c x r %) / (100-r %)

(c) Diff of P/L app. A/c x r %

(d) None

Answer:

(a) (Diff of P/L app. A/c x r %) / (100+r %)

18. The share of profit and loss of partner in absence of oral or written agreement will be:

(a) Equal ratio

(b) Capital ratio

(c) Agreed ratio

(d) No ratio

Answer:

(a) Equal ratio

19. A, B and C partners in the firm sharing profit ratio 5:3:2. They decided to share profits in the future in 3:2:1 ratio. For the aforesaid purpose, goodwill of the firm is valued as ₹ 60,000. Thus capital account of B will be:

(a) Debited with ₹ 2,000

(b) Credited with ₹ 2,000

(c) Will have no effect.

(d) Debited with ₹ 20,000

Answer:

(a) Debited with ₹ 2,000

20. When Goodwill is not purchased goodwill account can:

(a) Never be raised in the books

(b) Be raised in the books

(c) Be partially raised in the books

(d) Be raised as per the agreement of the partners.

Answer:

(a) Never be raised in the books

21. The profits of the last four years are as follows:

| Year | Amount (₹) |

| 2000 | 40,000 |

| 2001 | 50,000 |

| 2002 | 60,000 |

| 2003 | 50,000 |

Calculate the goodwill on the basis of three purchase of average profits

(a) ₹ 1,00,000

(b) ₹ 1,50,000

(c) ₹ 2,00,000

(d) None of the above

Answer:

(b) ₹ 1,50,000

22. The profits of the last three years are as follows

| Year | Amount (₹) |

| 2004 | 17,000 |

| 2005 | 20,000 |

| 2006 | 23,000 |

The capital employed is ₹ 80,000. The return on capital employed is 15%. Calculate the value of goodwill on the basis of two years purchase of average super profit earned.

(a) ₹ 16,000

(b) ₹ 20,000

(c) ₹ 30,000

(d) ₹ 40,000

Answer:

(a) ₹ 16,000

23. The capital employed in a business is ₹ 1,50,000. The profits are ₹ 50,000 and the normal rate of profits is 20%. Calculate the amount of goodwill as per capitalisation method:

(a) ₹ 2,00,000

(b) ₹ 3,50,000

(c) ₹ 1,50,000

(d) ₹ 1,00,000

Answer:

(d) ₹ 1,00,000

24. A and B are partners in a firm with capital of ₹ 18,000 and ₹ 20,000. Z is admitted for 1/3rd share in profits and brings ₹ 34,000 as capital, calculate the

amount of goodwill

(a) ₹ 24,000

(b) ₹ 30,000

(c) ₹ 15,000

(d) None of these

Answer:

(b) ₹ 30,000

25. Ramu and Shamu are partners sharing profits/losses in the ratio of 3:2. They admit Ramesh and the new profit sharing ratio will be 2:2:1 respectively. If Ramesh brings ₹ 50,000 as goodwill, calculate the share of goodwill which Ramu will get?

[Hint → Calculate the sacrificing ratio]

(a) ₹ 25,000

(b) ₹ 30.000

(c) ₹ 50,000

(d) ₹ 15,000

Answer:

(c) ₹ 50,000

26. The profits and loss for the last three years are:

| Year | Amount (₹) |

| 2005 | 20,000 |

| 2006 | (10,000) |

| 20071 | 15,000 |

Calculate the goodwill on the basis of three years purchase of average profits

(a) ₹ 20,000

(b) ₹ 25,000

(c) ₹ 18,000

(d) ₹ 16,667

Answer:

(b) ₹ 25,000

27. The capital employed by a firm is ₹ 1,00,000 and the normal rate of return is 15%. The average profits of the firm are:

| Year | Profits (₹) |

| 2002 | 18,000 |

| 2003 | 12,000 |

| 2004 | 15,000 |

| 2005 | 22,000 |

| 2006 | 18,000 |

Calculate the goodwill on the basis of three years purchase of the super profits

(a) ₹ 6,000

(b) ₹ 10,000

(c) ₹ 8,000

(d) ₹ 12,000

Answer:

(a) ₹ 6,000

28. Under the capitalisation method, the formula for calculating the goodwill is:

(a) Super profit multiplied by the rate of return

(b) Average profits multiplied by the rate of return

(c) Super profits divided by the rate of return

(d) Average profits divided by the rate of return

Answer:

(c) Super profits divided by the rate of return

29. When goodwill is to be raised in the books when there is no goodwill in the books, then the entry to be passed is:

(a) Goodwill A/c debit and capital A/c credit

(b) Partner A/c debit and goodwill A/c credit

(c) General Reserve A/c debit and goodwill A/c credit

(d) None of these

Answer:

(a) Goodwill A/c debit and capital A/c credit

30. The excess amount which the firm can get on selling its assets over and above the saleable value of its assets is called:

(a) Surplus

(b) Superprofits

(c) Reserve

(d) Goodwill

Answer:

(d) Goodwill

31. Which of the following is NOT true in relation to goodwill?

(a) It is an intangible asset

(b) It is a fictitious asset

(c) It has a realisable value

(d) None of the above

Answer:

(b) It is a fictitious asset

32. Purchasing year means:

(a) Number of years for which the profits is calculated

(b) Number of years for which the goodwill is expected to remain

(c) Number of years in which the goodwill is to be purchased

(d) None of these

Answer:

(b) Number of years for which the goodwill is expected to remain

33. The Goodwill of the firm is NOT affected by:

(a) Location of the firm

(b) Reputation of firm

(c) Better customer service

(d) None of the above

Answer:

(d) None of the above

34. The capital employed in a firm is ₹ 50,000 and the normal rate of return is 20%. The profits for the last three years are:

| Year | Profits (₹) |

| 2000 | 20,000 |

| 2001 | 25,000 |

| 2002 | 15,000 |

Calculate the goodwill on the basis of capitalisation of super profits:

(a) ₹ 50,000

(b) ₹ 60,000

(c) ₹ 20,000

(d) None of these

Answer:

(a) ₹ 50,000

35. The net assets of a firm including fictitious assets of ₹ 5,000 are ₹ 85,000. The net liabilities of the firm are ₹ 30,000. The normal rate of return is 10% and the average profit of the firm is ₹ 8,000. Calculate the goodwill as per capitalisation of super profits.

(a) ₹ 20,000

(b) ₹ 30,000

(c) ₹ 25,000

(d) None of these

Answer:

(b) ₹ 30,000

36. Capital employed by a partnership firm is ₹ 5,00,000. Its average profit is ₹ 60,000. The normal rate of return in similar type of business is 10%. What is the amount of super profits?

(a) ₹ 50,000

(b) ₹ 10,000

(c) ₹ 6,000

(d) ₹ 56,000

Answer:

(b) ₹ 10,000

Capital Employed = ₹ 5,00,000

Normal rate of return = 10%

Average Profit = ₹ 60,000

Normal Profit = Capital employed x normal rate of return = 5,00,000 x 10%

= ₹ 50,000

Super Profit = Average Profit – Normal Profit

= 60,000 – 50,000

= ₹ 10,000

Super Profit is ₹ 10,000

37. If the new partner brings any additional amount in cash other than his capital contribution then, it is termed as:

(a) Capital

(b) Reserves

(c) Profits

(d) Goodwill

Answer:

(d) Goodwill

Whenever a new partner is admitted, he is generally expected to pay cash to old partners for his share of goodwill for the right he acquires to share in super profit of the firm in future.

The payment is made to the old partners for the sacrifice they make on their shares of profits for future. In other words, if a new partner brings any additional amount in cash other than his capital contribution then, it is termed as Goodwill:

38. A firm earns profit of ₹ 1,10,000. The normal rate of return in a similar type of business is 10%. The total assets (excluding goodwill) and total outside liabilities are ₹ 11,00,000 and ₹ 1,00,000 respectively. The value of goodwill as per capitalisation method will be:

(a) ₹ 1,00,000

(b) ₹ 10,00,000

(c) ₹ 10,000

(d) None of the above

Answer:

(a) ₹ 1,00,000

Actual earned profit = ₹ 1,10,000

Normal rate of return = 10%

Total Assets = ₹ 11,00,000

Outside Liabilities = ₹ 1,00,000

Capital Employed = Total Assets – Outside Liabilities = 11,00,000- 1,00,000 = ₹ 10,00,000

Normal Profit = Capital Employed x Normal rate of return = 10,00,000 x 10% = ₹ 1,00,000

Super Profit = Actual Profit – Normal Profit = 1,10,000 – 1,00,000 = ₹ 10,000

Goodwill = \(\frac { Super Profit × 100 }{ Normal rate of return }\)

= \(\frac{10,000 \times 100}{10}\) = ₹ 1,00,000

Goodwill will be ₹ 1,00,000.

39. Total capital employed in the firm is ₹ 8,00,000, reasonable rate of return is 15% and Profit for the year is ₹ 12,00,000. The value of goodwill of the firm as per capitalization method would be:

(a) ₹ 82,00,000

(b) ₹ 12,00,000

(c) ₹ 72,00,000

(d) ₹ 42,00,000.

Answer:

(c) ₹ 72,00,000

Calculation of Goodwill according to capitalization method would be:

Notional Capital Employed = \(\frac{12,00,000}{15 \%}\)

= 80,00,000

Less: Actual

Capital Employed 8,00,000

Goodwill (operating in the business) 72,00,000

40. A firm earns a profit of ₹ 1,10,000. The normal rate of return in a similar type of business is 10%. The value of total assets (excluding goodwill) and total outside liabilities are ₹ 11,00,000 and ₹ 1,00,000 respectively. The value of goodwill is _________.

(a) ₹ 1,00,000

(b) ₹ 10,00,000

(c) ₹ 10,000

(d) None of the above

Answer:

(a) ₹ 1,00,000

Calculation of Value of Goodwill

Profit = ₹ 1,10,000

Normal value of Capital Employed

= \(\frac { Profit }{ Normal rate of return }\) x 100

Normal Rate of Return = 10%

= \(\frac{1,10,000}{10 \%}\)

= ₹ 11,00,000

Capital Employed = Total Assets Total Liabilities

= 11,00,000 – 1,00,000

= ₹ 10,00,000

Goodwill = 11,00,000 – 10,00,00

= ₹ 1,00,000

41. A firm of X, Y and Z has a total capital investment of ₹ 2,25,000. The firm earned net profit during the last four years ₹ 35,000, 40,000, 60,000, 50,000. The fair return on the net capital employed is 15% . Find the value of goodwill if it is based on 3 years purchase of average super profit of past 4 years.

(a) ₹ 35,000

(b) ₹ 36,500

(c) ₹ 40,000

(d) ₹ 37,500

Answer:

(d) ₹ 37,500

Average Profit = \(\frac{35,000+40,000+50,000+60,000}{4}\)

= \(\frac{1,85,000}{4}\) = 46,250

Normal profit = Capital employed x Rate

= 2,25,000 x \(\frac{15}{100 }\) = 33,750

Super profit = Average profit – Normal profit

= 46,250 – 33,750 = 12,500

Goodwill of 3 years purchase = 12,500 x 3 = 37,500.

42. Goodwill is which type of asset:

(a) Tangible

(b) Intangible

(c) Depleting

(d) Current.

Answer:

(b) Intangible

An intangible asset is an asset:

- which cannot be touched

- or felt

- but which assists the firm in acquiring long term wealth, ex. goodwill patents, copyrights, etc.

Hence, option (b) is correct.

43. Sona purchased Simmi’s business from 1sl Jan, 1981. The profit disclosed by Simmi’s business for last 3 years:

1985 – ₹ 40,000 [including abnormal gain of ₹ 5,000]

1986 – ₹ 50,000 [after charging abnormal loss of ₹ 10,000]

1987 – ₹ 45,000 [excluding ₹ 5,000 for insurance premium of firms property now to be insured]

Calculate the goodwill on the basis of 2 years purchase of average profit of last 3 years.

(a) ₹ 80,000

(b) ₹ 90,000

(c) ₹ 1,20,000

(d) ₹ 1,00,000

Answer:

(b) ₹ 90,000

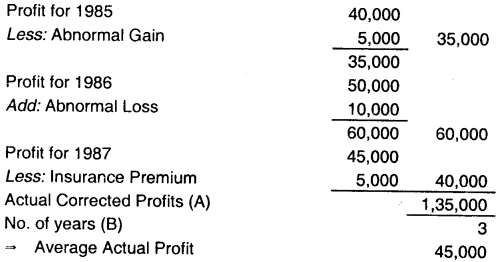

Corrected Actual Profits:

Value of Goodwill = Average Actual Profit x Years of Purchase

= 45,000 x 2 = 90,000

44. The goodwill of a business is to be valued at 3 years purchase of the average profits of the last three years. The profits of the last three years are ₹ 5,000, ₹ 6,000 and ₹ 7,000 respectively. Hence, the goodwill be valued at:

(a) ₹ 12,000

(b) ₹ 15,000

(c) ₹ 18,000

(d) ₹ 6,000

Answer:

(c) ₹ 18,000

Under this method, goodwill is valued on the basis of a certain years purchases of the average profits of the past years:

Profits for the last year – ₹ 5,000, ₹ 6,000 and ₹ 7,000.

Average profit = \(\frac{5,000+6,000+7,000}{3}\)

= \(\frac{18,000}{3}\)

= ₹ 6,000

Goodwill = Average profit x No. of yrs. purchase

= 6,000 x 3

= ₹ 18,000

45. Find the average profit of last 3 years and the goodwill of the firm for 2 years of purchase. If the profit for last 2 years is 2010 – ₹ 50,000, 2011 – ₹ 30,000, 2012 – ₹ 1,00,000:

(a) ₹ 80,000, 1,20,000

(b) ₹ 60,000, 1,20,000

(c) ₹ 60,000, 1,00,000

(d) ₹ 70,000, 80,000

Answer:

(b) ₹ 60,000, 1,20,000

Average Profit = \(\frac{50,000+30,000+1,00,000}{3}\)

= \(\frac{1,80,000}{3}\)

= ₹ 60,000

No. of year purchase = 2 years

Goodwill = Average Profit x No. of year purchase

= 60,000 x 2

= ₹ 1,20,000

46. Find the goodwill by super profit method where capital is ₹ 1,00,000, Rate 20%, Average profit is ₹ 25,000:

(a) ₹ 7,000

(b) ₹ 4,000

(c) ₹ 2,000

(d) ₹ 5,000

Answer:

(d) ₹ 5,000

Capital = ₹ 1,00,000

Rate = 20%

Average Profit = ₹ 25,000

Normal Profit = \(\frac{Capital invested × Rate}{100}\)

= \(\frac{1,00,000×20}{100}\)

= ₹ 20,000

Super Profit = Average Profit – Normal Profit

= 25,000 – 20,000

= ₹ 5,000

Goodwill = Super Profit x No. of year purchase

= 5,000 x 1

= ₹ 5,000

47. The profit of last five years are ₹ 85,000, ₹ 90,000, ₹ 70,000, ₹ 1,00,000 and ₹ 80,000. Find the goodwill if it is calculated on average profit of last five years on the basis of 3 years of purchase.

(a) ₹ 2,85,000

(b) ₹ 85,000

(c) ₹ 2,55,000

(d) ₹ 2,75,000

Answer:

(c) ₹ 2,55,000

Average Profit = \(\frac{(85,000+90,000+70,000+1,00,000+80,000)}{5}\)

= 85,000

Goodwill = 85,000 x 3

= 2,55,000

48. A firm has total investment of ₹ 2,25,000. The firm earned net profit for the last 4 years as ₹ 35,000, ₹ 40,000; ₹ 60,000 and ₹ 50,000. The fair return on capital employed is 15%. The value of goodwill on the basis of 3 years purchase of average super profits of past 4 years will be:

(a) ₹ 37,500

(b) ₹ 12,500

(c) ₹ 46,250

(d) ₹ 33,750

Answer:

(a) ₹ 37,500

Profit of last 4 years: 35,000, 40,000, 60,000, 50,000

Average profit = ₹ 46,250

Total Investment = ₹ 2,25,000

Fair Return =15%

Normal Profit = ₹ 33,750

Super profit = Average profit – Normal profit = 46,250 – 33,750 = 12,500

Goodwill = Super profit x No. of purchase year

= 12,500 x 3

= ₹ 37,500.

49. Vales and Wells were in partnership sharing profits and losses equally. They admit Sparks as a partner and decide to share profits equally between the three partner. Goodwill is valued at ₹ 60,000 but is to be immediately written off. What will be the effect of this on Yale’s capital?

(a) Will increase by ₹ 20,000

(b) Will increase by ₹ 30,000

(c) Will increase by ₹ 10,000

(d) Will decrease by ₹ 10,000

Answer:

(c) Will increase by ₹ 10,000

Goodwill = ₹ 60,000

Sparks Share of Goodwill = ₹ 60,000/3

= ₹ 20,000

This amount of Goodwill will be divided between Yales and Wells in equal ratio and as a result the capital of both will be increased by 10,000.

50. Partners who actively take part in the business?

(a) Active partner

(b) Sleeping partner

(c) Partner by estoppels

(d) All of the above

Answer:

(a) Active partner

An invested person who is involved in the daily operations of the partnership. An active partner helps run the business to enhance his or her returns and is therefore considered a material participant. This person typically shares more risk and return versus a limited or silent partner.

51. The profits of last three years are ₹ 43,000, ₹ 38,000 and ₹ 45,000. Find out the goodwill of two years purchase of average profits.

(a) ₹ 84,000

(b) ₹ 42,000

(c) ₹ 36,000

(d) ₹ 1,26,000

Answer:

(a) ₹ 84,000

Avg. profit = \(\frac{43,000+38,000+45,000}{3}\)

Goodwill = 42,000 x 2 = ₹ 84,000

52. P, Q and R are Partners and Sharing profit and losses equally. Their capital balance stood at ₹ 25,000, ₹ 20,000 and ₹ 18,000 respectively. Their last three years profit were ₹ 18,000, ₹ 12,000 and ₹ 15,000. Q died, P and R decided to continue with the partnership and Q’s share is purchased by P and R in 2:3. As per agreement, the value of goodwill is calculated at 3 years purchase price of average profit of last three years. It is decided that no goodwill account is opened in the books of account and if is to be adjusted through capital account. After the adjustment, the capital of P would be:

(a) ₹ 19,000

(b) ₹ 25,000

(c) ₹ 20,000

(d) ₹ 18,000

Answer:

(a) ₹ 19,000

Avg. profit = \(\frac{12,000+15,000+18,000}{3}\)

= 15,000

Goodwill = 15,000 x 3 = 45,000

Q share of Goodwill = \(\frac{45,000}{3}\) = 15,000

Q’ share is purchased by P & R is Ratio of 2 : 3

P’ share of contribution in Goodwill = 15,000 x \(\frac{2}{5}\) = 6,000

Capital After Retirement = 25,000 – 6,000 = 19,000

53. Total capital employed in the firm is ₹ 8,00,000. Reasonable rate of return is 15% and profit for the year is ₹ 12,00,000. The value of goodwill of the firm as per capitalization method would be:

(a) ₹ 82,00,000

(b) ₹ 12,00,000

(c) ₹ 72,00,000

(d) ₹ 42,00,000

Answer:

(c) ₹ 72,00,000

Normal Profit = \(\frac{Capital Employed × Normal Rate of Return}{100}\)

\(\frac{8,00,000 \times 15}{100}\) = ₹ 1,20,000

Normal Profits for the year = ₹ 12,00,000

Capitalisation Profit = \(\frac{12,00,000}{15}\) x 100

= ₹ 80,00,000

Goodwill = Profits – Capital Employed

= 80,00,000 – 8,00,000

= ₹ 72,00,000

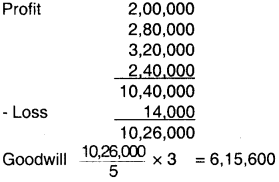

54. Calculate the amount of goodwill for 3 years purchase of following 5 years ₹ 2,00,000, 2,80,000, 3,20,000, 2,40,000 (including loss 4,000), (14,000)

(a) ₹ 31,200

(b) ₹ 6,15,600

(c) ₹ 42,000

(d) ₹ 18,200

Answer:

(b) ₹ 6,15,600

Calculate the Goodwill

55. A firms earns a profit of ₹ 1,10,000. The normal rate of return in a similar type of business is 10%. The value of total assets (excluding goodwill) and total outside liabilities are ₹ 11,00,000 and ₹ 1,00,000 respectively. The value of goodwill is:

(a) ₹ 1,00,000

(b) ₹ 10,00,000

(c) ₹ 10,000

(d) None of the above

Answer:

(a) ₹ 1,00,000

Net Capital Employed = Assets – Liabilities

= 11,00,000 – 1,00,000

= 10,00,000

Normal Return = 10,00,000 x 10%

= 1,00,000

Super Profit = 1,10,000 -1,00,000

= 10,000

Goodwill = \(\frac{Super Profit}{Normal Rate of return}\)

= \(\frac{10,000}{10 \%}\)

= 1,00,000

56. Find the goodwill of the firm on the basis of 3 years purchase by average profit method from the profit of last 5 years were 32,000; 35,000; 28,000; 26,000; 40,000 respectively.

(a) 32.200

(b) 96,600

(c) 42,000

(d) 32,000

Answer:

(b) 96,600

Average Profit of last 5 years

= 32,000 + 35,000 + 28,000 + 26,000 + 40,000

= \(\frac{1,61,000}{5}\)

= 32,200 5

G/W of A.P = 32,200 x 3 = 96,600