Overview of Accounting Standards – CA Inter Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Overview of Accounting Standards – CA Inter Accounts Question Bank

Question 1.

Accounting Standards are mandatory for all companies.” Comment (Dec 2009, 3 marks)

Answer:

Central Government to prescribe Accounting Standards According to Sec. 133 of Companies Act, 2013, the Central Government may prescribe the standards of accounting or any addendum thereto, as recommended by the Institute of Chartered Accountants of India, constituted under Sec. 3 of the Chartered Accountants Act, 1949, in consultation with and after examination of the recommendations made by the National Financial Reporting Authority. The Accounting Standard are mandatory and applicable to all companies while preparing financial statement of the company.

Where the financial statement of the company do not comply with the accounting standard, such companies shall disclose in its financial statement the following :

- The deviation from the accounting standard;

- The reasons for such deviation; and

- The financial effect, if any, arising due to such deviation.

Question 2.

List the criteria to be applied for rating an enterprise as Level-I enterprise for the purpose of Compliance of Accounting Standards in India. (Nov 2007, 4 marks)

Answer:

Enterprises which fall in any one or more of following categories are classified as level I Enterprise –

- Enterprises, whose equity or debt securities are either listed or are in the process to be listed in India or outside India.

- Banks, Insurance Companies and Financial institutions.

- All commercial, industrial and other reporting business enterprises, whose total turnover during the previous year exceeds ₹ 50 crores (as per the audited financial statement).

- All commercial, industrial and other reporting business enterprises, whose total borrowings including public deposits during the previous year exceeds ₹ 10 crores (as per audited financial statement).

- Holding or subsidiary company of any of the above enterprises any time during the year.

![]()

Question 3.

Answer the following:

List the Criteria for classification of non-corporate entities as level I Entities for the purpose of application of Accounting Standards as per The Institute of Chartered Accountants of India. (Jan 2021, 5 marks)

Question 4.

What are the three fundamental accounting assumptions recognised by Accounting Standard (AS) 1 ? Briefly describe each one of them. (May 2013, 4 marks)

Answer:

Accounting Standard-1 recognizes three fundamental accounting assumptions. These are as follows:

1. Going Concern

The financial statements are normally prepared on the assumption that an enterprise will continue its operations in the foreseeable future and neither there is intention, nor there is need to materially curtail the scale of operations.

2. Consistency The principle of consistency refers to the practice of using same accounting policies for similar transactions in all accounting periods unless the change is required

- by a statute,

- by an accounting standard or

- for more appropriate presentation of financial statements.

3. Accrual Basis of

Under this basis of accounting, transactions are Accounting recognised as soon as they occur, whether or not cash or cash equivalent is actually received or paid.

Question 5.

In the books of M/s Prashant Ltd., closing inventory as on 31.03.2015 amounts to ₹ 1,63,000 (on the basis of FIFO method).

The company decides to change from FIFO method to weighted average method for ascertaining the cost of inventory from the year 2014- 15. On the basis of weighted average method, closing inventory as on 31.03.2015 amounts to ₹ 1,47,000. Realisable value of the inventory as on 31.03.2015 amounts to ₹ 1,95,000.

Discuss disclosure requirement of change in accounting policy as per AS -1. (Nov 2015, 5 marks)

Answer:

As per AS -1, Disclosure of Accounting Policies, accounting policies refers to the accounting principles and method of applying those principles in the preparation and presentation of financial statements.

So if there is change in the accounting policies the firm should disclose in it’s statements:

- The fact that there is change in accounting policy.

- The reason for change in accounting policies.

- The effect of such change in the financial statements.

So in this case M/s. Prashant Ltd. changes valuation of inventory from FIFO to weighted average. Therefore, the firm should disclose in it’s financial statement:

1. There is a change in valuation of inventory from FIFO to weighted average.

2. The reason why such change is to be made: The company values its inventory at lower of cost and net realisable value. Since net realisable value of all items of inventory in the current year was greater than respective costs, the company valued its inventory at cost. In the present year i.e. 2014-15, the company has changed to weighted average method, which better reflects the consumption pattern of inventory, for ascertaining inventory costs from the earlier practice of using FIFO for the purpose.

3. The effect of such change in the financial statement: The change in policy has reduced current profit and value of inventory by ₹ 16,000.

![]()

Question 6.

ABC Financial Services Ltd. is engaged in the business of financial services and is undergoing tight liquidity position, since most of the assets of the company are blocked in various claims/petitions in a Special Court. ABC Financial Services Ltd. has accepted Inter-Corporate Deposits (ICDs) and it is making its best efforts to settle the dues. There were claims at varied rates of interest, from lenders, from the due date of ICDs to the date of repayment. The company has provided interest, as per the terms of the contract till the due date and a note for non-provision of interest from the due date to date of repayment was mentioned in financial statements.

On account of uncertainties existing regarding the determination of the amount and in the absence of any specific legal obligation at present as per the terms of contracts, the company considers that these claims are in the nature of “claims against the company not acknowledged as debt”, and the same has been disclosed by way of a note in the accounts instead of making a provision in the Profit and Loss Account.

State whether the treatment done by the company is correct or not as per relevant Accounting Standard. (May 2017, 5 marks)

Answer:

As per AS -1, “Disclosure of Accounting Policies,” following are considerations that govern selection of a particular Policy:

- Prudence

- Substance over form and

- Materiality

As per the above considerations and in view of uncertainty associated with future events, profits are not anticipated, but losses are provided for as a matter of conservatism. Provision should be created for all known liabilities and losses even though the amount cannot be determined with certainty and represents only a best estimate in the light of available information.

As per AS -1, ‘Accrual’ is one of the fundamental accounting assumptions. Irrespective of the terms of the contract, so long as the principal amount of a loan is not repaid, the lender cannot be placed in a disadvantageous position for non-payment of interest in respect of overdue amount. From the facts given in the question, it is apparent that the company has an obligation to pay because of the overdue interest amount.

Thus, in the given case, ABC Financial Services Ltd. should make provision for interest from the due date of ICDs to date of repayment even though the amount cannot be determined. Thus, it should represent only a best estimate in the light of available information.

Thus, the treatment done by the company that these claims are in nature of “claims against the company not acknowledged as debt” and the disclosure by way of note in the accounts instead of making a provision in the P & L A/c is not correct as per AS -1.

Question 7.

HIL Ltd. was making provision for non-moving stocks based on no issues having occurred for the last 12 months upto 31.03.2017. The company now wants to make provision based on technical evaluation during the year ending 31.03.2018.

Total value of stock ₹ 120 lakhs

Provision required based on technical evaluation ₹ 3.00 lakhs

Provision required based on 12 months no issues ₹ 4.00 lakhs

You are requested to discuss the following points in the light of Accounting Standard (AS) – 1:

(i) Does this amount to change in accounting policy?

(ii) Can the company change the method of accounting? (Nov 2018, 5 marks)

Answer:

The decision of making provision for non-moving inventories on the basis of technical evaluation does not amount to change in accounting policy. Accounting policy of a company may require that provision for non-moving stocks (inventories) should be made. The method of estimating the amount of provision may be changed. In case a more prudent estimate can be made. In the given case, considering the total value of stock, the change in the amount of required provision of non-moving stock from ₹ 4 lakhs to ₹ 3 lakhs is also not material. The disclosure can be made for such change in the following lines by way of notes to the accounts in the annual accounts of HIL Ltd. for the year 2017-18:

“The company has provided for non-moving stocks on the basis of technical evaluation unlike preceding years. Had the same method been followed as in the previous year; the profit for the year and the corresponding effect on the year end net assets would have been lower by ₹ 1 lakh.”

Question 8.

What are the items that are to be excluded in determination of the cost of inventories as per AS – 2? (May 2008, 4 marks)

OR

In determining the cost of inventories, it is appropriate to exclude certain costs and recognize them as expenses in the period in which they are incurred.” Provide example of such costs as per AS-2: Valuation of Inventories. (Nov 2012, 4 marks)

Answer:

Para 13 of AS-2 Valuation of Inventories lists down the specific costs which are to be excluded from cost of inventories.

The list is as follows:

- Abnormal amounts of wasted materials, labour or other production cost.

- Storage costs, unless those costs are necessary in the production process prior to a further production stage.

- Administrative overheads that do not contribute to bringing the inventories to their present location and condition; and

- Selling and distribution costs.

As per Para 12, Interest and other borrowing costs are usually considered as not related to bringing the inventories to their present location and condition and are therefore usually not included in the cost of inventory.

Question 9.

State whether the following statement is ‘True’ or False’. Also give reason for your answer.

3. As per the provisions of AS-2, inventories should be valued at the lower of cost and selling price. (May 2019, 1 mark)

Answer:

False:

As per AS 2, inventories should be valued at the lower of cost and net realiable value.

Net reliable value = Selling Price – Cost necessary to make sell.

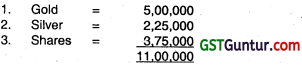

![]()

Question 10.

From the following data, find out value of inventory as on 30.04.2009 using

(a) LIFO method, and

(b) FIFO method :

(1) 01.04.2009 Purchased 10 units @ ₹ 70 per unit

(2) 06.04.2009 Sold 6 units @ ₹ 90 per unit

(3) 09.04.2009 Purchased 20 units @ ₹ 75 per unit

(4) 18.04.2009 Sold 4 units @ ₹ 100 per unit. (Nov 2009, 2 marks)

Answer:

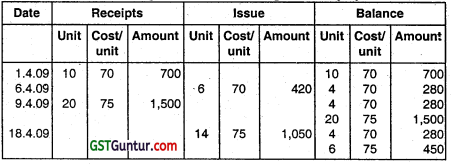

(a) Statement showing valuation of closing inventory by LIFO methoc

Value of closing inventory as per FIFO method:

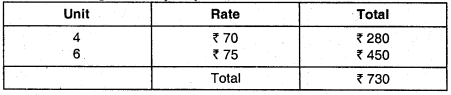

(b) Statement showing valuation of closing inventory by FIFO method

Value of closing inventory as per FIFO method:

Question 11.

Raw materials inventory of a company includes certain material purchased at ₹ 100 per kg. The price of the material is on decline and replacement cost of the inventory at the year end is ₹ 75 per kg. It is possible to convert the material into finished product at conversion cost of ₹ 125.

Decide whether to make the product or not to make the product, if selling price is

(i) ₹ 175 and

(ii) ₹ 225. Also find but the value of inventory in each case. (May 2010, 4 marks)

Answer:

Provision:

According to Para 24 of AS-2 ‘Valuation of Inventories’, materials and -other supplies held for use in the production of inventories are not written down below cost if the finished products in which they will be incorporated are expected to be sold at or above cost. But when there has been a decline in the price of materials and it is estimated that the cost of the finished products will exceed net realizable value, the materials are written down to net realisable value.

Analysis and Conclusion:

In such circumstances, the replacement cost of the materials may be the best available measure of their net realisable value.

(i) When the selling price be ₹ 175

Incremental Profit = ₹ 175 – ₹ 125 = ₹ 50

Current price of the material = ₹ 75

Therefore, it is better not to make the product. Raw material inventory would be valued at net realisable value i.e. ₹ 75 because the selling price of the finished product is less than ₹ 225 (100 + 125) per kg.

(ii) When the selling price be ₹ 225

Incremental Profit = ₹ 225 -1125 = ₹ 100

Current price of the raw material = ₹ 75

Therefore, it is better to make the product.

Raw material inventory would be valued at ₹ 100 per kg because the selling price of the finished product is not less than ₹ 225.

Question 12.

HP is a leading distributor of petrol. A detail inventory of petrol in hand is taken when the books are closed at the end of each month. At the end of month following information is available :

Sales : ₹ 47,25,000

General overheads cost : ₹ 1,25,000

Inventory at beginning 1,00,000 litres @ 15/- per litre Purchases

June 1 two lakh litres @ 14.25

June 30 one lakh litres @ 15.15

Closing inventory 1.30 lakh litres

Compute the following by the FIFO as per AS-2 :

(i) Value of Inventory on June 30.

(ii) Amount of cost of goods sold for June.

(iii) Profit/Loss for the month of June. (Nov 2010, 5 marks)

Answer:

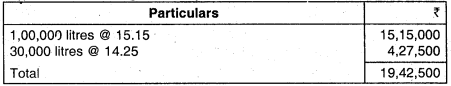

(i) Cost of Closing Inventory for 1,30,000 litres as on 30th June

(ii) Computation of Cost of Goods Sold

(iii) Computation of Profit

Question 13.

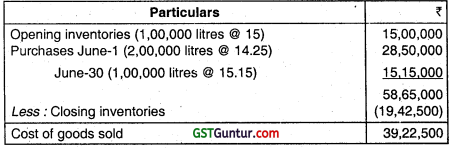

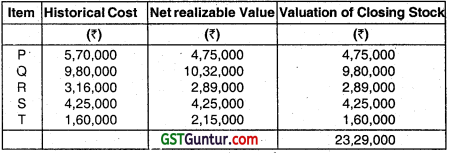

Best Ltd. deals in five products, P, Q, R, S, and T which are neither similar nor interchangeable. At the time of closing of its accounts for the year ending 31st March 2011, the historical cost and net realisable value of the items of the closing stock are determined as follows:

What will be the value of closing stock for the year ending 31st March, 2011 as per AS-2 “Valuation of inventories”? (May 2011, 4 marks)

Answer:

According to AS 2 “Valuation of Inventories, inventories should be valued at the lower of cost and net realizable value. Inventories should be written down to net realizable value on an iterm-by-item basis.

Valuation of inventory (item wise) for the year ending 31st March 2011

The value of inventory for the year ending 31st March 2011 – ₹ 23,29,000

Question 14.

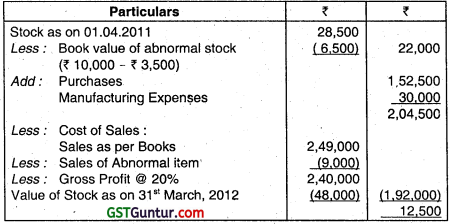

From the following information ascertain the value of stock as on 31st March, 2012:

Stock as on 01.04.2011 : ₹ 28,500

Purchases : ₹ 1,52,500

Manufacturing Expenses : ₹ 30,000

Selling Expenses : ₹ 12,100

Administration Expenses : ₹ 6,000

Financial Expenses : ₹ 4,300

Sales : ₹ 2,49,000

At the time of valuing stock as on 31st March, 2011 a sum of ₹ 3,500 was written off on a particular item, which was originally purchased for ₹ 10,000 and was sold during the year of ₹ 9,000. Barring the transaction relating to this item, the gross profit earned during the year was 20% on sales. (Nov 2012, 4 marks)

Answer:

Statement showing valuation of stock as on 31.3.2012

Question 15.

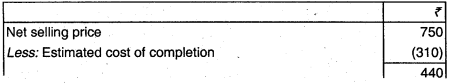

On 31st March 2013 a business firm finds that cost of a partly finished unit on that date is ₹ 530. The unit can be finished in 2013-14 by an additional expenditure of ₹ 310. The finished unit can be sold for ₹ 750 subject to payment of 4% brokerage on selling price. The firm seeks your advice regarding:-

(i) the amount at which the unfinished unit should be valued as at 31st March, 2013 for preparation of final accounts and

(ii) the desirability or otherwise of producing the finished unit. (May 2013, 4 marks)

Answer:

Valuation of unfinished unit:

Incremental cost ₹ 310 (cost to complete) is less than incremental revenue ₹ 720 (₹ 750 – ₹ 30). The enterprise will therefore decide to finish the unit for sale at ₹ 750.

Note: The aforesaid solution is based on assumption that partly finished unit cannot be sold in semi finished form and its NRV is zero without processing it further.

![]()

Question 16.

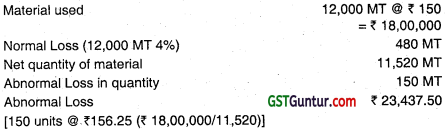

Capital Cables Ltd., has a normal wastage of 4% in the production process. During the year 2013-14 the Company used 12,000 MT of raw material costing ₹ 150 per MT.

At the end of the year 630 MT of wastage was in stock. The accountant wants to know how this wastage is to be treated in the books.

Explain in the context of AS 2 the treatment of normal loss and abnormal loss and also find out the amount of abnormal loss if any. (Nov 2014, 5 marks)

Answer:

According to AS-2, (Revised) ‘Valuation of Inventories’, abnormal amounts of wasted materials, labour and other production costs are excluded from cost of inventories and such costs are recognised as expenses in the period in which they are incurred.

The amount of normal loss will be included in computing the cost of inventories (finished goods) at the year end.

Amount of Abnormal Loss:

Therefore, ₹ 23,437.50 will be charged to the Profit and Loss Statement.

Question 17.

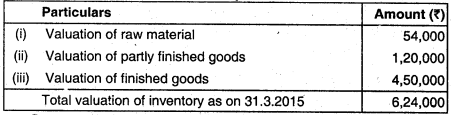

Mr. Mehul gives the following information relating to items forming part of inventory as on 31-3-2015. His factory produces Product X using Raw material A.

(i) 600 units of Raw material A (purchased @ ₹ 120). Replacement cost of raw material A as on 31 -3-2015 is ₹ 90 per unit.

(ii) 500 units of partly finished goods in the process of producing X and cost incurred till date ₹ 260 per unit. These units can be finished next year by incurring additional cost of ₹ 60 per unit.

(iii) 1500 units of finished Product X and total cost incurred ₹ 320 per unit. Expected selling price of Product X is ₹ 300 per unit.

Determine how each item of inventory will be valued as on 31-3-2015. Also calculate the value of total inventory as on 31 -3-2015. (May 2015, 5 marks)

Answer:

(i) Valuation of Raw Material: If finished product is expected to be sold below cost then raw material should be valued at NRV if there is decline in price of material. In such circumstances, the replacement cost of materials may be best available measure of their net realizable value.

Here product x is expected to be sold at ₹ 300 per unit which is below than total cost per unit which is ₹ 320. Then raw material is to be valued at replacement cost.

So, valuation of raw material is done as follows:

No. of units × Replacement Cost/unit = 600 × 90 = ₹ 54,000

Raw material is to be valued at ₹ 54,000

(ii) Valuation of WIP : 500 units of partly finished goods will be valued at ₹ 240 per unit i.e. lower of cost ₹ 320 (₹ 260 + additional cost ₹ 60) or Net estimated selling price ₹ 240 (Estimated selling price ₹ 300 per unit less additional cost of ₹ 60).

(iii) Cost of Finished Goods: As per AS-2, inventory is to be valued at cost or realizable value which ever is lower. Here the cost of finished good is ₹ 320 per unit and finished good is expected to be sold at ₹ 300 which is less than the cost of finished goods. So, finished good is valued at expected selling price, as calculated follows:

1500 units × ₹ 300 per unit = ₹ 4,50,000

So, finished good is valued at ₹ 4,50,000 to the year end.

Valuation of Total inventory as on 31 .3.2015

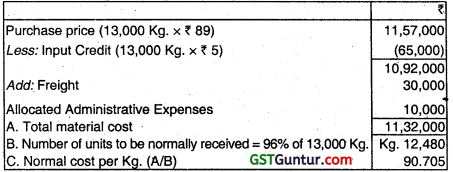

Question 18.

Z Limited ordered 13,000 kg. of chemicals at ₹ 90 per kg. The purchase price includes GST of ₹ 5 per kg. in respect of which full Input credit is admissible. Freight incurred amounted to ₹ 30,000. Normal transit loss is 4%. The company actually received 12,400 kg. and consumed 10,000 kg. The company has received trade discount in the form of cash amounting to ₹ 1 per kg. The chemicals were delivered in containers. The containers were not reusable, hence sold for ₹ 500. The administrative expenses incurred to bring the chemicals were ₹ 10,000.

Compute the value of inventory and allocate the material cost as per AS-2. [Modified] (May 2016, 5 marks)

Answer:

Cost of Inventory and allocation of material cost is shown below:

Allocation of Material cost:

The difference due to rounding off of normal cost per Kg. has been adjusted. Thus the inventory will be valued at ₹ 2,17,692.

Note:

1. The Company has received trade discount In the form of cash. Therefore, discount has been treated as trade discount in the given answer.

2. Abnormal losses are recognized as separate expenses.

3. Containers are used for delivery of the chemicals and are not reusable. Cost of these containers is treated as selling and distribution expense. The sale value of these containers will be credited to Profit and Loss Account and shall not be considered for the purpose of valuation of inventory.

Alternatively, the sales value of container amount of ₹ 500 may be deducted, while computing material cost. In that case the material cost will be computed as ₹ 11,31,500(11,32,000-500) instead of ₹ 11,32,000.

Accordingly the allocation of material cost will get changed.

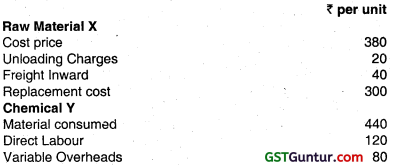

Question 19.

A Limited is engaged in manufacturing of Chemical Y far which Raw Material X is required. The company provides you following information for the year ended 31st March, 2017.

Additional Information:

(i) Total fixed overhead for the year was ₹ 4,00,000 on normal capacity of 20,000 units.

(ii) Closing balance of Raw Material X was 1,000 units and Chemical Y was ₹ 2,400 units.

You are required to calculate the total value of closing stock of Raw Material X and Chemical Y according to AS 2, when

(a) Net realizable value of Chemical Y is ₹ 800 per unit

(b) Net realizable value of Chemical Y is ₹ 600 per unit (Nov 2017, 5 marks)

Answer:

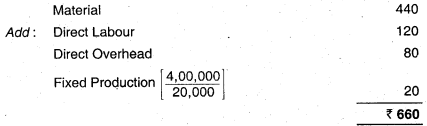

Valuation of finished goods stock:

(a) Cost per unit of finished goods:

∴ Cost per unit of finished goods = ₹ 660 per unit

(b) Valuation of finished goods will be:

if NRV is ₹ 800 per unit,

Value per unit (Lower of cost 660 & NRV) = 660

Total value of finished goods stock = ₹ 660 × 2400 units

= ₹ 15,84,000

If NRV is ₹ 600 per unit,

Value per unit (Lower of cost 660 & NRV) = 600

Total value of finished goods stock = ₹ 600 × 2400 units

= ₹ 14,40,000

Valuation of Raw Materials:

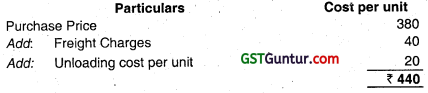

(a) Cost per unit of Raw Material:

(b) Total value of Raw Materials (Closing Stock)

1. Finished Goods are valued at cost

- Raw Materials cost per unit ₹ 440

- Replacement cost per unit ₹ 300

- Relevant value per unit ₹ 440 [Since finished goods are valued at cost.]

- Total value for 1.000 units = 1000 × ₹ 440

= ₹ 440,000

2. Finished goods are valued at NRV

- Raw Materials cost per unit ₹ 440

- Replacement cost per unit ₹ 300

- Relevant value per unit ₹ 300 [Since finished goods are valued at NRV]

- Total value for ₹ 1,000 units = 1000 × ₹ 300

= ₹ 3,00,000

![]()

Question 20.

Wooden Plywood Limited has a normal wastage of 5% in the production process. During the year 2017-18 the Company used ₹ 16,000 MT of Raw material costing ₹ 190 per MT. At the end of the year, 950 MT of wastage

was in stock. The accountant wants to know how this wastage is to be treated in the books.

You are required to:

1. Calculate the amount of abnormal toss.

2. Explain the treatment of normal loss and abnormal loss.

[In the context of AS-2 (Revised)] (May 2019, 5 marks)

Answer:

As per AS 2 (Revised) ‘Valuation of Inventories’, abnormal amounts of wasted materials, labours and other production costs are excluded from cost of inventories and such costs are recognised as expenses in the period in which they are incurred. The normal loss will be included in determining the cost of inventories (finished goods) at the year end.

Amount of Abnormal loss:

Material used 16000 MT @ ₹ 190 = ₹ 30,40,000

Normal loss (5% of 16000 MT) 800 MT

Net quantity of material 15,200 MT

Abnormal loss in quantity 150 MT

Abnormal loss ₹ 30,000

(150 units @ ₹ 200 (\(\frac{₹ 30,40,000}{15,200}\))

Amount of ₹ 30,000 will be charged to the Profit and Loss Statement.

Question 21.

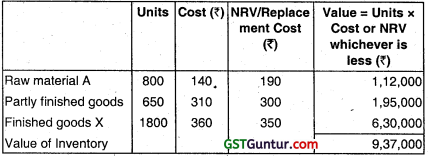

Mr. Rakshit gives the following information relating to items forming part of inventory as on 31st March, 2019. His factory produces product X using raw material A.

(i) 800 units of raw material A (purchased @ ₹ 140 per unit).

Replacement cost of raw material A as on 31st March, 2019 is ₹ 190 per unit.

(ii) 650 units of partly finished goods in the process of producing X and cost incurred till date ₹ 310 per unit. These units can be finished next year by incurring additional cost of ₹ 50 per unit.

(iii) 1,800 units of finished product X and total cost incurred ₹ 360 per unit.

Expected selling price of product X is ₹ 350 per unit.

In the context of AS-2, determine how each Item of inventory will be valued as on 31st March, 2019. Also, calculate the value of total inventory as on 31st March. 2019. (Nov 2019, 5 marks)

Answer:

As per AS 2 (Revised) “Valuation of Inventories”, materials and other supplies held for use in the production of inventories are not written down below cost if the finished products in which they will be Incorporated are expected to be sold at cost or above cost. However, when there has been a decline in the price of materials and it is estimated that the cost of the finished products will exceed not realisable value, the materials are written down to net realisable value. In such circumstances, the replacement cost of the materials, may be the best available measure of their net realisable value. In the given case, selling price of product X is ₹ 350 and total cost per unit for production is ₹ 360.

Hence the valuation will be done as under:

- 800 units of raw material A will be valued at cost of 140 per unit as being lower of cost and Replacement Cost

- 650 units of partly finished goods will be valued at ₹ 300 per Unit i.e. lower of cost (₹ 310) or Net realisable value ₹ 300 (Estimated Selling Price ₹ 350 per unit less addition cost ₹ 50)

- 1800 units of finished product X will be valued at NRV of ₹ 350 per unit since it is lower than cost 360 per unit of product X.

Valuation of Total Inventory as on 31.03.2019:

Note: It has been assumed that the partly finished unit cannot be sold in semi-finished form and Its NRV is zero without processing it further.

Question 22.

Answer the following:

Mr. Jatin gives the following information relating to the items forming part of the inventory as on 31.03.2019. His enterprise produces product P using Raw Material X.

(i) 900 units of Raw Material X (purchased @ ₹ 100 per unit). Replacement cost of Raw Material X as on 31.03.2019 is ₹ 80 per unit.

(ii) 400 units of partly finished goods In the process of producing P. Cost incurred till date is ₹ 245 per unit. These units can be finished next year by incurring additional cost of ₹ 50 per unit.

(iii) 800 units of Finished goods P and total cost incurred is ₹ 295 per unit.

Expected selling price of product P is 280 per unit, subject to a payment of 5% brokerage on selling price.

Determine how each item of inventory will be valued as on 31.03.2019. Also calculate the value of total Inventory as on 31.03.2019. (Jan 2021, 5 marks)

Question 23.

In the case of a manufacturing company:

(i) List the items of inflows of cash receipts from operating activities;

(ii) List the items of ‘outflows” of investing activities (2 × 2 = 4 marks)

Answer:

(i) Inflows of cash receipts from operating activities:

(a) Cash receipts from rendering of services.

(b) Cash receipts from the sale of goods.

(c) Refund of income-tax.

(d) Royalties, fees, commission and other revenues.

(ii) Outflows of Investing activities:

(a) Cash payment for acquiring fixed assets.

(b) Cash advances and loans to third parties.

(c) Cash payment for acquisition of shares, warrants or debt instruments of other enterprises and interest in joint ventures.

Question 24.

What are the main features of the cash flow statement? Explain with special reference to AS 3? (Nov 1999, 5 marks)

Answer:

Main features of Cash Flow Statements (As per AS-3):

1. According to AS-3, cash flow statement deals with the provisions of information about the historical changes in cash and cash equivalents of an enterprise during the stated period from operating, investing and financing activities.

2. Cash flow from operating activities can be reported using either:

- the direct method, in which mostly the classes of gross cash receipts and gross cash payments are disclosed.

- the indirect method, in this net profit or loss is adjusted for the purpose of transactions of non-cash nature.

3. According to AS-3, an enterprise must disclose the components of cash and cash equivalents and must present a reconciliation of amounts in its cash flow statement with the equivalent items reported In the balance

sheet.

4. When the cash flow statement is used along with the other financial statements, it provides information that enables the user to evaluate the changes in net assets of an enterprise. This statement also enhances

the comparability of the operating performances.

5. For companies listed on stock exchanges compliance of AS-3 is compulsory due to the listing agreement.

Question 25.

Define briefly the classification of activities, as suggested in Accounting Standard 3, to be used for preparing a cash flow statement. Give two examples of each such class of activities. (May 2001, 4 marks)

Answer:

According to AS-3 (Cash Flow Statement), the cash flow statement must report cash flows by operating, investIng and financing activities:

1. Operating Activities

These are the principal revenue producing activities of the enterprise. This activity does not include in it the investing and financing activities.

Examples of operating activities are cash receipt from the sale of goods and cash payment to the supplier of goods.

2. Investing Activities

These activities include the acquisition and disposal of long-term assets and other investments which are not included in cash equivalents.

Example of investing activities are paymeñt made on acquiring building for business or cash received from the sale of furniture.

3. Financing Activities

Those activities that results in changes in the size and composition of the owners capital and borrowing of the enterprise.

Example of the financing activities are cash proceed from issue of shares and cash paid to redeem debentures.

Question 26.

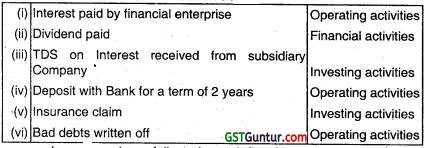

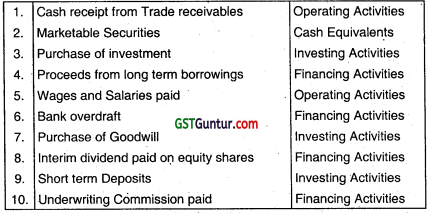

Classify the following activities as per AS-3 Cash Flow Statement:

(i) Interest paid by financial enterprise

(ii) Dividend paid

(iii) Tax deducted at source on interest received from subsidiary company

(iv) Deposit with Bank for a term of two years

(v) Insurance claim received towards loss of machinery by fire

(vi) Bad debts written off

Which activity does the purchase of business falls under and whether netting off of aggregate cash flows from disposal and acquisition of business units is possible? (May 2016, 4 marks)

Answer:

Purchase of business falls under cash flow from investing activities or operating activities depending upon situation.

No cash flows from Disposal and acquisition of business.

Question 27.

Classify the following activities as

(i) Operating Activities,

(ii) Investing activities,

(iii) Financing activities and

(iv) Cash Equivalents.

1. Cash receipts from Trade Receivables

2. Marketable Securities

3. Purchase of investment

4. Proceeds from long term borrowings

5. Wages and Salaries paid

6. Bank overdraft

7. Purchase of Goodwill

8. Interim dividend paid on equity shares

9. Short term Deposits

10. Underwriting commission paid. (May 2018,5 marks)

Answer:

Classification of Activities

Question 28.

Answer the following questions:

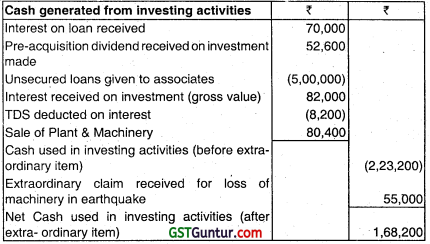

(a) Prepare cash flow from investing activities as per AS 3 of M/s Subham Creative Limited for year ended 31.3.2019.

Particulars : Amount (₹)

Machinery acquired by issue of shares at face value : ₹ 2,00,000

Claim received for loss of machinery in earthquake : ₹ 55,000

Unsecured loans given to associates : ₹ 5,00,000

nterest on loan received form associate company : ₹ 70,000

Pre-acquisition dividend received on Investment made : ₹ 52,800

Debenture interest paid : ₹ 1,45,200

Term loan repaid : ₹ 4,50,000

Interest received on investment (TDS of ₹ 8,200 was deducted on the above interest) 73,800

Purchased debentures of X Ltd., on 1st December, 2018 which are redeemable within 3 months 3,00,000

Book value of plant & machinery sold (loss incurred ₹ 9,600) 90,000 (May 2016, 5 marks)

Answer:

Cash Flow Statement from Investing Activities of M/s Subham Creative Limited for the year ended 31-03-2019:

Note:

- Debenture interest paid and Term Loan repaid are financing activities and therefore not considered for preparing cash flow from investing activities.

- Machinery acquired by issue of shares does not amount to cash outflow, hence also not considered in the above cash flow statement.

- Purchase of debentures of X Ltd. on 1st December, 2018 which are redeemable within 3 months to be considered as cash equivalents and not part of financing activities.

Question 29.

Mention four Assets, where AS – 10 is not applicable. (Nov 2008, 2 marks)

Answer

AS-10 deals with “Property, Plant and Equipment”.

This Standard does not apply to:

1. Biological assets related to agricultural activity other than bearer plants. This Standard applies to bearer plants but it does not apply to the produce on bearer plants; and

2. Wasting assets including mineral rights, expenditure on the exploration for and extraction of minerals, oil, natural gas and similar non-regenerative resources.

However, this Standard applies to property, plant and equipment used to develop or maintain the assets described in (a) and (b) above.

![]()

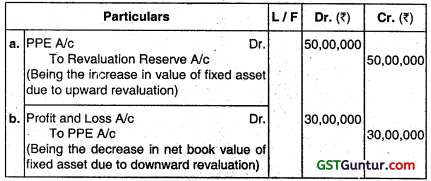

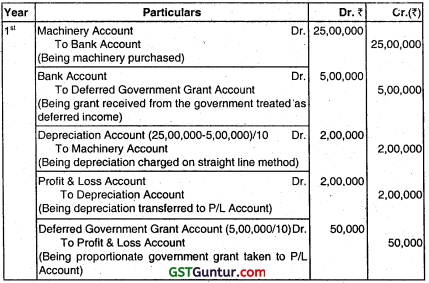

Question 30.

What is the accounting entry to be passed as per AS-10 for the following situations;

(a) Increase in value of PPE by ₹ 50,00,000 on account of revaluation.

(b) Decrease in the value of PPE by ₹ 30,00,000 on account of revaluation. (May 2008, 2 marks)

Answer:

Note: It has been assumed that both the above instances are independent of each other and revaluation Is done for first time.

Question 31.

A company acquired a machine on 1.4.2006 for ₹ 5,00,000. The company charged depreciation upto 2008-09 on straight line basis with estimated working life of 10 years and scrap value of ₹ 50,000. From 2009 -10. the company decided to change depreciation method at 20% on reducing balance method. Compute the amount of depreciation to be debited to Profits and Loss A/c for the year 2009 – 10. (May 2010, 2 marks)

Answer:

Annual depreciation charged by the company up to 2008-09

\(=\frac{\text { Cost price of the machine-Scrap value }}{\text { Useful life of the machine }}\)

\(\frac{₹ 5,00,000-₹ 50,000}{10}\) = ₹ 45,000

WDV of machine at the end of 2008-09 by Straight Line Method (SLM)

= ₹ 5,00,000 – (₹ 45,000 × 3) = ₹ 3,65,000

Depreciation to be charged in 2009-2010

Book value of the machine as per SLM as on 2008-09 = 3,65,000

Dep. to be charged = 3,65,000 × \(\frac{20}{100}\) = 73,000

Question 32.

During the current year 2009 – 10 M/s L & C Ltd. made the following expenditure relating to its plant and machinery:

General repairs : ₹ 4,00,000

Repairing of Electric Motors : ₹ 1,00,000

Partial Replacement of parts of Machinery : ₹ 50,000

Substantial improvements to the electrical wiring system which will increase efficiency of the plant and machinery : ₹ 10,00,000

What amount should be capitalised according to AS-10? (May 2010, 4 marks)

Answer:

Provision:

According to AS-10 Property, Plant and Equipment, the cost of an item of PPE shall be recognised as an asset if and only if

- It is probable that future economic benefits associated with the item will flow to the firm,

- The cost can be measured, reliably.

Analysis and Conclusion:

Therefore, in the given case, repairs amounting ₹ 5 lakhs and partial replacement of parts of machinery worth ₹ 50,000 should be charged to statement of profit & loss. ₹ 10 lakhs incurred for substantial improvement to the electrical wiring system which will increase efficiency should be capitalized.

Question 33.

Carrying amount of a machine is ₹ 1,00,000 (Historical cost less depreciation). The machine is expected to generate ₹ 25,000 net cash flow for 5 years. The net realizable value (or net selling price) of the machine on current date is ₹ 85,000. The enterprises required rate of earning is 10% p.a. State the value at which the enterprise should carry its machine. The present value factors at 10% are 0.909, 0.826, 0.751, 0.683 and 0.621 at the end of first, second, third, fourth and fifth year respectively. (May 2011, 4 marks) [IPCC Gr. II]

Answer:

Value in use is the present value of estimated future cash flow expected to arise from the continuing use of an asset. Therefore,

Value in use = ‘₹ 25,000 × (0.909 +0.826 + 0.751+ 0.683 + 0.621) ₹ 94,750 Net selling price = ₹ 85,000

Recoverable amount is the higher of an asset’s value in use and its net selling price i.e.94,750.

Carrying value of a machine = ₹ 1,00,000 (recorded in the books)

Carrying amount is the amount at which an asset is recognized in the balance sheet after deduction any accumulated depreciation (amortization) and accumulated impairment losses thereon.

In the given case, carrying amount of machine will be lower of its recoverable amount ₹ 94,750 and its book value i.e. ₹ 1,00,000. Therefore, the enterprise should carry its machine at value of ₹ 94,750.

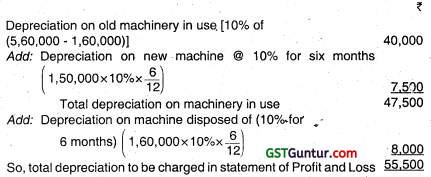

Question 34.

In the Trial Balance of M/s Sun Ltd. as on 31-3-2011, balance of machinery appears ₹ 5,60,000. The company follows rate of depreciation on machinery @ 10% p.a. On scrutiny it was found that a machine appearing in the books on 1-4-2010 at ₹ 1,60,000 was disposed of on 30- 9-2010 at ₹ 1,35,000 in part exchange of a new machine costing ₹ 1,50,000.

You are required to calculate:

(i) Total depreciation to be charged in the Profit and Loss Account.

(ii) Loss on exchange of machine.

(iii) Book value of machinery in the Balance Sheet as on 31 -3-2011. (Nov 2011, 5 marks)

Answer:

Assumption: The question has been solved on the basis of written down value method due to absence of related information regarding straight line method.

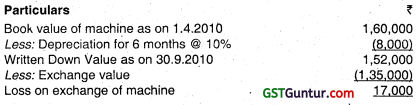

(i) Total Depreciation to be charged in the statement of Profit and Loss

(ii) Loss on Exchange of Machine Particulars

(iii) Book Value of Machinery in the Balance Sheet as on 31.03.2011

Question 35.

M/s. Tiger Ltd. allotted 7500 equity shares of 100 each fully paid up to Lion Ltd. in consideration for supply of a special machinery. The shares exchanged for machinery are quoted at National Stock Exchange (NSE) at ₹ 95 per share at the time of transaction. In the absence of fair market value of the mach nery acquired, how the value of the machinery would be recorded in the books of Tiger Ltd? (May 2012, 4 marks)

Answer:

Provision:

According to AS 10 ‘Property, Plant and Equipment:’

Depreciation is a measure of wearing out, consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes.

Accordingly, depreciation may arise even when asset has not been used in the current year but was ready for use in that year.

The need for using the stand by bus may not have arisen during the year but that does not imply that the useful life of the bus has not been affected. Therefore, non-provision of depreciation on the ground that the bus was not used during the year is not tenable.

As per AS-10, ‘Property, Plant and Equipment,’ the gross book value of the self constructed fixed asset includes the costs of construction that relate directly to the specific asset and the costs that are attributable to the construction activity in general can be allocated to the specific asset.

If any Internal profit is there it should be eliminated. Saving of ₹ 1,50,000 on account of using its own workforce is an unrealized/internal profit, which should not be capitalized/recorded as per the standard.

Analysis and Conclusion:

Therefore only ₹ 4,50,000 should be debited to the factory building account and not ₹ 600,000.

Hence, the contention of the directors of the company to capitalize ₹ 6,00,000 as cost of factory building, on the ground that the company is killy entitled to employ an outside contractor is not justifiable.

Question 36.

A computer costing ₹ 60,000 is depreciated on straight line basis, assuming 10 years working life and Nil residual value, for three years. The estimate of remaining useful life after third year was reassessed at 5 years. Calculate depreciation as per the provisions of Accounting Standard 10 “Property, Plant and Equipment. (May 4 marks)

Answer:

Depreciation per year = ₹ 60,000/10 = ₹ 6,000

Depreciation on SLM charged for three years = ₹ 6,000 × 3 years = ₹ 18,000

Book value of the computer at the end of third year = ₹ 60,000 – ₹ 18,000

= ₹ 42,000

Remaining useful life as per previous estimate = 7 years

Remaining useful life as per revised estimate = 5 years

Depreciation from the fourth year onwards = ₹ 42,000/5 = ₹ 8,400 per annum

Question 37.

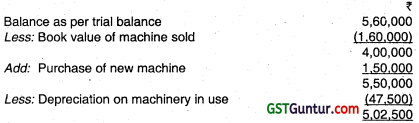

PQR Ltd. constructed a fixed asset and incurred the following expenses on its construction:

Materials : ₹ 16,00,000

Direct Expenses : ₹ 3,00,000

Total Direct Labour : ₹ 6,00,000

(1/15th of the total labour time was chargeable to the construction)

Total Office & Administrative Expenses 9,00,000

(4% is chargeable to the construction)

Depreciation on assets used for the construction of this asset 15,000

Calculate the cost of the fixed asset. (Nov 2012, 4 marks)

Answer:

Calculation of cost of fixed assets

Note: It is assumed that 4% of office and administrative expenses are specifically attributable to construction of a fixed asset. Alternatively, it may be assumed that 4% of office and administrative expenses are only allocated to construction project and is not specifically attributable to it. In such a case, the cost of fixed assets will be ₹ 19,55,000.

Question 38.

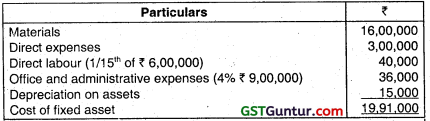

Amna Ltd. contracted with a supplier to purchase a specific machinery to be installed in Department A in two months time. Special foundations were required for the plant, which were to be prepared within this supply lead time. The cost of site preparation and laying foundations were ₹ 47,290. These activities were supervised by a technician during the entire period, who is employed for this purpose of ₹ 15,000 per month. The Technician’s services were given to Department A by Department B. which billed the services at ₹ 16,500 per month after adding 10% profit margin.

The machine was purchased at ₹ 52,78,000. GST was charged at 18% on the invoice. ₹ 18,590 transportation charges were incurred to bring the machine to the factory. An Architect was engaged at a fee of ₹ 10,000 to supervise machinery installation at the factory premises. Also, payment under the invoice was due in 3 months. However, the Company made the payment in 2nd month. The company operates on Bank Overdraft @ 11%. Ascertarn the amount at which the asset should be capitalized under AS 1o. (Nov 2013, 5 marks)

Answer:

Cost of machinery is calculated as under:

Note:

- 18% of 52,78,000 = ₹ 9,50,040

- Interest on Bank overdraft for earlier payment of invoice is not relevant under AS – 10.

- Internally booked profits should be eliminated in arriving àt the cost of Fixed Assets.

- It has been assumed that the purchase price of ₹ 52,78,000 excludes amount of GST.

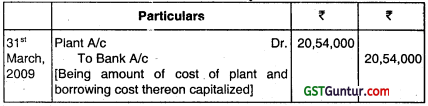

Question 39.

On 01.04.2010 a machine was acquired at ₹ 4,00,000. The machine was expected to have a useful life of 10 years. The residual value was estimated at 10% of the original cost. At the end of the 3rd year, an attachment was made to the machine at a cost of ₹ 1,80,000 to enhance its capacity. The attachment was expected to have a useful life of 10 years and zero terminal value. During the same time the original machine was revalued upwards by ₹ 90,000 and remaining useful life was reassessed at 9 years and residual value was reassessed at NIL.

Find depreciation for the year, if

(i) attachment retains its separate identity.

(ii) attachment becomes integral part of the machine, (May 2014, 5 marks)

Answer:

(i) disposed a machine having attachment retains its Separate Identity

Cost of Machine on 1.4.10 = 4,00,000

Less: Residual Value 10% = 40,000

Depreciable Value = 3,60,000

Estimated Useful life = 10 years

Dep. p.a. = 3,60,000 ÷ 10 = ₹ 36,000

Total Dep in 3 years = 36,000 × 3 = ₹ 1,08,000

WDV for 4th year = 4,00,000 – 1,08,000 = 2,92,000

Upward Revaluation of Original Machine = 90,000

WDV for 4th year after revaluation = 2,92,000 + 90,000 = 3,82,000

Remaining useful life = 9 years

Dep. in 4th year = 3,82,000 ÷ 9

Dep. on attachment = 1,80,000 ÷ 10

Total Depreciation = 42,444 + 18,000 = ₹ 60,444

Note:

1 Since, upward revaluation of the machine and reassessment of remaining useful life had been made at the end of the 3rd year, it is implied that depreciation for the 3rd year has been charged on the basis of od calculation & remaining useful life of 9 years is to be calculated from the beginning of the 4th year onwards.

2. Depreciation for The 4th year i.e. 2013-14 has been given in the solution.

(ii) If attachment becomes Integral part of Machine

In this case it will be added to the value of machine and depreciated along with machine over the life of machine.

Value of Machine after Revaluation = 3,82,000

Add: Cost of Attachment = 1,80000

Total Value = 5,62000

Life = 9 years

Depreciation = 5,62,000 ÷ 9 = ₹ 62,444

![]()

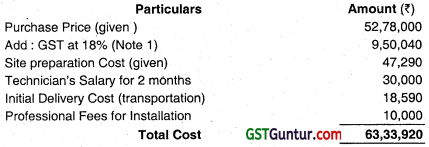

Question 40.

In the books of Optic Fiber Ltd., plant and machinery stood at ₹ 6,32,000 on 1.4.2013. However on scrutiny it was found that machinery worth ₹ 1,20,000 was included in the purchases on 1.6.201 3. On 30.6.2013 the company disposed a machine having book value of ₹ 1,89,000 on 1.4.2013 at ₹ 1,75,000 in part exchange of a new machine costing ₹ 2,56,000. The company charges depreciation @ 20% WDV on plant and machinery.

You are required to calculate:

(i) Depreciation to be charged to P/L

(ii) Book value of Plant and Machinery A/c as on 31.3.2014

(iii) Loss on exchange of machinery. (Nov 2014, 5 marks)

Answer:

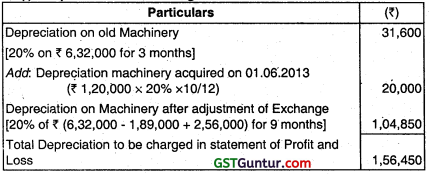

(i) Depreciation to be charged in the statement of Profit and Loss

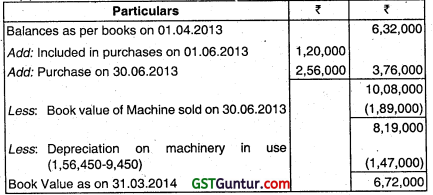

(ii) Book Value of Plant and Machinery A/c as on 31 .03.2014

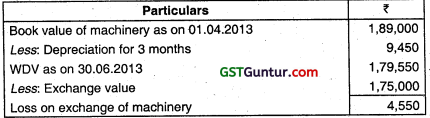

(iii) Loss on exchange of Machinery

Question 41.

From the following information state the amount to be capitalized as per AS 10. Give the explanations for your answers.

₹ 5 lakhs as routine repairs and ₹ 1 lakh on partial replacement of a part of a machine.

₹ 10 lakhs on replacement of part of a machinery which will improve the efficiency of a machine. (Nov 2014, 4 marks)

Answer:

As per AS-10 “Property, Plant and Equipment”, only those expenditures that increase the future benefits tram the existing assets, beyond its previously assessed standard of performance, are to be included in the gross book value.

Hence, in the given case, amount of ₹ 5 lakhs spent on routine repairs and ₹ 1 lakh on partial replacement of a part of the machinery should be charged to Profit and Loss Account as these amounts will help in maintaining the capacity but will not improve the efficiency of the machine.

However, ₹ 10 Lakhs incurred on replacement of a part of the machinery, which will increase the efficiency of a machine, should be capitalized by inclusion in the gross book value of machinery.

Question 42.

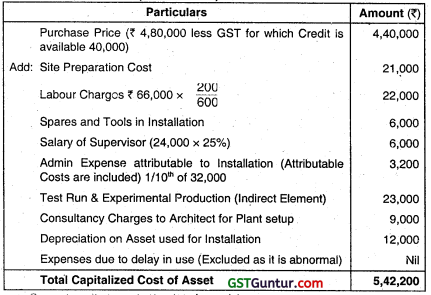

Versatile Limited purchased Machinery for ₹ 4,80,000 (inclusive of GST of ₹ 40,000). Input Tax credit is available for the GST paid. The Company incurred the following other expenses for installation.

Particulars : ₹

Cost of preparation of Site for installation : 21,000

Total labour charges (200 out of the total 600 man hours worked, were spent for installation of the Machinery) : 66,000

Spare parts and tools consumed in installation : 6,000

Total salary of supervisor (time spent for installation was 25% of the total time worked) : 24,000

Total administrative expenses (1/10 relates 40 the plant installation) : 32,000

Test rup and experimental production expenses : 23,000

Consultancy charges to architect for plant set up : 9,000

Depreciation on assets used for the installation : 12,000

The Machine was ready for use on 15th January but was used from 1st February. Due to this delay further costs ₹ 19,000 were incurred. Calculate the value at which the plant should be capitailzed. [Modified] (May 2015, 4 marks)

Answer:

Cost of PPE (ie. Machine) is calculated as under

Question 43.

A machinery with a useful life of 6 years was purchased on 1st April, 2012 for ₹ 1,50,000. Depreciation was provided on straight line method for first three years considering a residual value of 10% of cost.

In the beginning of fourth year the company reassessed the remaining useful life of the machinery at 4 years and residual value was estimated at 5% of original cost.

The accountant recalculated the revised depredation historically and charged the difference to profit and loss account. You are required to comment on the treatment by accountant and calculate the depreciation to be charged for the fourth year. (Nov 2015, 5 marks)

Answer:

According to AS-10 “Property, Plant and Equipment”, if the depreciable assets are revalued, the provision for depreciation should be based on the revalued amount and on the estimate of the remaining useful lives of such assets. In case the revaluation has a material effect on the amount of depreciation, the same should be disclosed separately in the year in which revaluation is carried out.

As per the standard, when there is a revision of the estimated useful life of an asset, the unamortized depreciable ãmount should be charged over the revised remaining useful life. Accordingly revised depreciation shall be calculated prospectively. Thus, the treatment done by the accountant regarding recalculating the revised depreciation historically i.e. retrospectively is incorrect.

Calculation of Depreciation

Depreciation per year charged for first three years = ₹ 1,35,000 /6 = ₹ 22,500

WDV of the machine at the beginning of the fourth year = ₹ 1,50,000 – (₹ 22500 × 3)

= ₹ 82,500

Depreciable amount after reassessment of residual value = ₹ 82,500 – 7,500

= 75,000

Remaining useful life as per revised estimate = 4 years

Depreciation from the fourth year onwards = ₹ 75,000/4

= ₹ 18,750

Question 44.

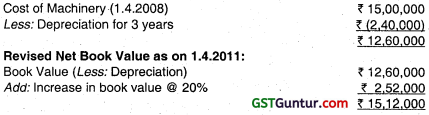

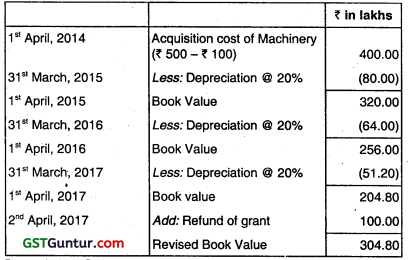

Hema Ltd. purchased a machinery on 1.04.2008 for ₹ 15,00,000. The company charged straight line depreciation based on 15 years working life estimate and residual value ₹ 3,00,000. At the beginning of the 4 year, the company by way of systematic evaluation revalued the machinery upward by 20% of net book value as on date and also re-estimated the useful life as 7 years and scrap value as nil. The increase in net book value was credited directly to revaluation reserves. Depreciation (on SLM basis) later on was charged to Profit & Loss Account. At the beginning of 8th year the company decided to dispose off the machinery and estimated the realizable value to ₹ 2,00,000.

You are required to ascertain the amount to be charged to Profit & Loss Account at the beginning of 8th year with reference to AS-10. (Nov 2016, 5 marks)

Answer:

Calculation of Depreciation:

Cost of Machinery as on 1.4.2008 = ₹ 15,00,000

Depreciation p.a. = \(₹ \frac{15,00,000-3,00,000}{15}\)

= ₹ 80,000

∴ Depreciation for 3 years (1.4.2008 to 31.3.2011) = ₹ 80,000 × 3

= ₹ 2,40,000

∴ Net Book Value of Machinery as on 1.4.2011

Thus:

Increase in Revaluation to be taken to Revaluation Reserve

= ₹ 12,60,000 — ₹ 15,12,000 = ₹ 2,52,000

Revised Depreciation (p.a.) = \(\frac{₹ 15,12,000-\mathrm{Nil}}{7}\) = ₹ 2,16,000

(Assumption: Useful life = 7 years)

∴ Depreciation br years (1.04.2011 to 31 03.2015)

= ₹ 2,16,000 × 4 = ₹ 8,64,000

Thus:

Net Book Value of Machinery as on 1.4.2015:

Thus:

Loss to be debited (Adjusted in Revaluation Reserve)

= ₹ 4,48,000 — ₹ 3,40,000 = ₹ 1,08,000

Amount to be debited (Adjusted in Profit and Loss A/c)

= ₹ 4,48,000 — 1,08,000 = ₹ 3,40,000

Balance in Revaluation Reserve transferred to General Reserve

= ₹ 2,52,000 – ₹ 1,08,000 = ₹ 1,44,000.

![]()

Question 45.

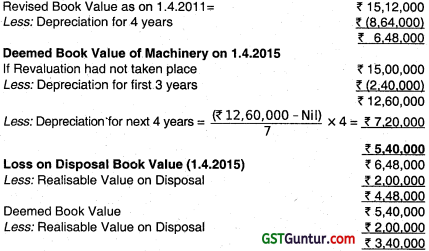

ABC Ltd. Is installing a new plant at its production facility. It provides you the following information:

Cost of the plant (cost as per suppliers invoice) : ₹ 31,25,000

Estimated dismantling costs to be incurred after 5 years : ₹ 2,50,000

Initial Operating losses before commercial production : ₹ 3,75,000

Initial delivery and handling costs : ₹ 1,85,000

Cost of site preparation : ₹ 4,50,000

Consultants used for advice on the acquisition of the plant : ₹ 6,50,000

Please advise ABC Ltd. on the costs that can be capitalised for plant in accordance with AS 10: Property, Plant and Equipment. (Nov 2017, 5 marks)

Answer:

As per AS-10, PPE, the costs will be capitalised as follows:

Question 46.

Neon Enterprise operates a major chain of restaurants located in different cities. The company has acquired a new restaurant located at Chandigarh. The new restaurant requires significant renovation expenditure. Management expects that the renovations will last for 3 months during which the restaurant will be closed.

Management has prepared the following budget for this period —

Salaries of the staff engaged in preparation of restaurant before its opening : ₹ 7,50,000

Construction arid remodelling cost of restaurant : ₹ 30,00,000

Explain the treatment of these expenditures as per the provisions of AS 10 Property, Plant and Equipment”. (Nov 2018, 5 marks)

Answer:

As per provisions of AS 10, any cost directly attributable to bring the assets to the location and conditions necessary for it to be capable of operating in the manner indicated by the management are called directly attributable costs and would be included ¡n the costs of an item of PPE.

Management should capitalise the costs of construction and remodeling the restaurants, because they are necessary to bring the store to the condition necessary for it to be capable of operating in the manner intended by management. The restaurant cannot be opened without incurring the remodeling expenditure and thus the expenditure should be considered part of the asset. So, construction and remodeling cost of restaurant of ₹ 30,00,000 should be capitalised.

However, if the cost of salaries, utilities and storage of goods are in the nature of operating expenditure that would be incurred if the restaurant was open, then these costs are not necessary to bring the store to the condition necessary for it to be capable of operating in the manner intended by management should be expensed. So, salaries of the stall engaged in preparation of restaurant before its opening shall not be capitalised (₹ 7,50,000).

Question 47.

Answer the following question:

A Ltd. had following assets. Calculate depreciation for the year ending 31st March, 2020 for each asset as per AS 10 (Revised)

(i) Machinery purchased for ₹ 10 lakhs on 1st April, 2015 and residual value after useful life 0f 5 years, based on 2015 prices is ₹ 10 lakhs.

(ii) Land for ₹ 50 lakhs.

(iii) A Machinery is constructed for ₹ 5,00,000 for its own use (useful life is 10 years). Construction is completed on 1st April, 2019, but the company does not begin using the machine until 31st March. 2020.

(iv) Machinery purchased on 1st April, 2017 for ₹ 50,000 with useful life of 5 years and residual value is NIL. On 1st April 2019, management decided to use this asset for further 2 years only. (Nov 2020, 5 marks)

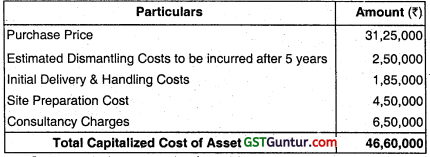

Question 48.

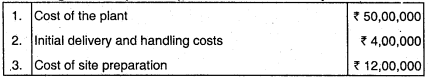

Preet Ltd. is installing a new plant at its production facility. It has incurred these costs:

Please advise Preet Ltd. on the costs that can be capitalised in accord with AS 10 (Revised).

Answer:

According to AS 10 (Revised), these costs can be capitailsed:

Note: Interest charges paid on Deferred credit terms” to the supplier of the plant (not a qualifying asset) of ₹ 4,00,000 and operating losses before commercial production amounting to ₹ 8,00,000 are not regarded as directly

attributable costs and thus cannot be capitalised. They should be written off to the Statement of Profit and Loss In the period they are incurred.

Question 49.

Explain “monetary Item” as per Accounting Standard 11. How are foreign currency monetary items to be recognized at each Balance Sheet date?

Classify the follôwing as monetary or non-monetary item:

(i) Share Capital

(ii) Trade Receivables

(iii) Investments

(iv) Fixed Assets (May 2013, 4 marks) (IPCC Gr. II)

Answer

According to AS 11 ‘The Effects of Changes in Foreign Exchange Rates, Monetary items are money held and assets and liablities to be received or paid in fixed or determinable amounts of money.

Foreign currency monetary items should be reported using the closing rate at each balance sheet date.

Whereas, in certain circumstances, the closing rate may not reflect with reasonable accuracy the amount in reporting currency that is likely to be realised from, or required to disburse, a foreign currency monetary item at the balance sheet date.

In such situation, the relevant monetary item should be reported in the reporting currency at the amount which is likely to be realised from or required to disburse, such item at the balance sheet date.

Question 50.

With reference to AS 11, define the following:

(i) Integral Foreign Operation.

(ii) Non-Integral Foreign Operation. (Nov 2016, 4 marks) [IPCC Gr. II]

Answer:

(i) integral Foreign Operation:

It is a foreign operation, the activities of which are an integral part of those of the reporting enterprise a foreign operation that is integral to the operations of the reporting enterprise carries on its business as if it were an extension of the reporting enterprise’s operation.

(ii) Non-Integral Foreign Operation:

It is a foreign operation that is not an integral foreign operation when there is a change between in the exchange rate between the reporting currency and the local currency. There is a little or no direct impact of the present and future cash flow from operations of either the non-integral foreign operation or the reporting enterprise the change in the exchange rate affects the reporting enterprise’s net investment in the non-integral foreign operation rather than the individual monetary and non-monetary Items held by the non-integral foreign operation.

Question 51.

: Exchange Rate

Goodš purchased on 1.1.2007 of US $ 10,000 : ₹ 45

Exchange rate on 31.3.2007 : ₹ 44

Date of actual payment 7.7.2007 : ₹ 43

Ascertain the loss/gain for financial years 2006-07 and 2007-08, also give their treatment as per AS-11. (Nov 2008, 4 marks) (IPCC Gr. II)

Answer:

Provision:

As per AS – 11 all foreign currency transaction should be recorded by applying the exchange rate at the date of transaction.

Analysis and Conclusion:

Therefore, goods purchased on 1.1.2007 and corresponding creditor would

be recorded at ₹ 45 = U$ 1. i.e; 10,000 × 45 = 4,50,000

As per AS 11 at the Balance Sheet date all monetary items should be reported using closing rate, therefore of US$ 10,000 outstanding on 31-3-2007 will be reported = 10,000 × 44 = 4,40,000.

Exchange Loss’Gain (4,40,000 – 4,50,000) = 10,000 Gain should be credited in P/L A/c for 2006-07.

As per AS-11, exchange difference on settlement on maturity items should be transferred to Profit and Loss A/c as gain or loss. Therefore 10,000 × 43 = 4,30,000 – 4,40,000 = ₹ 10,000 gain should be transferred to profit and loss for the year 2007 – 08.

Question 52.

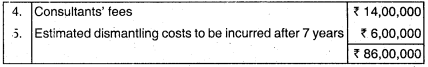

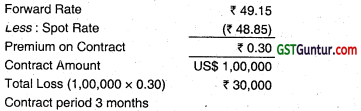

Sterling Ltd. purchased a plant for US $ 20,000 on 31st December, 07 payable after 4 months. The company entered into a forward contract for 4 months @ ₹ 48.85 per dollar. On 31st December, 07, the exchange rate was ₹ 47.50 per dollar.

How will you recognise the profit or loss on forward contract in the books of Sterling Limited for the year ended 31st March, 2008. (Nov 2009, 2 marks) (IPCC Gr. II)

Answer:

Calculation of profit or loss to be recognised In the books of Sterling Limited:

Balance loss of ₹ 6750 (i.e. ₹ 27,000 — ₹ 20,250) for the month of April, 2008 will be recognised in the financial year 2008 – 2009.

![]()

Question 53.

Sunshine Company Limited imported raw materials worth US Dollars 9,000 on 25th February, 2011, when the exchange rate was ₹ 44 per US Dollar. The transaction was recorded in the books at the above mentioned rate. The payment for the transaction was made on 10th April, 2011, when the exchange rate was ₹ 48 per US Dollar. At the year end 31st March, 2011, the rate of exchange was ₹ 49 per US Dollar.

The Chief Accountant of company passed an entry on 31st March, 2011 adjusting the cost of raw material consumed for the difference between ₹ 48 and f 44 per US Dollar. Discuss whether this treatment is justified as per the provisions of AS-11 (Revised). (Nov 2011, 4 marks) [IPCC Gr. II]

Answer:

Provision:

As per para 9 of AS 11, ‘The Effects of Changes in Foreign Exchange Rates’, initial recognition of a foreign currency transaction is done in the reporting currency by applying the exchange rate at the date of the transaction.

Analysis and Conclusion:

Accordingly, on 25th February 2011, the raw material purchased and its creditors will be recorded at US dollar 9,000 × ₹ 44 = ₹ 3,96,000.

Also, as per para 11 of the standard, on balance sheet date such transaction is reported at closing rate of exchange, hence it will be valued at the closing rate i.e. ₹ 49 per US dollar (USD 9,000 × ₹ 49 = ₹ 4,41,000) at 31st March, 2011, irrespective of the payment made for the same subsequently at lower rate in the next financial year.

The difference of ₹ 5 (49 – 44) per US dollar i.e. ₹ 45,000 (USD 9,000 × ₹ 5) will be shown as an exchange loss in the profit and loss account for the year ended 31st March, 2011 and will not be adjusted against the cost of raw materials.

In the subsequent year on settlement date, the company would recognize or provide the Profit and Loss Account an exchange gain of ₹ 1 per US dollar, i.e. the difference from balance sheet date to the date of settlement between ₹ 49 and ₹ 48 per US dollar i.e. ₹ 9,000. Hence, the accounting treatment adopted by the Chief Accountant of the company is incorrect i.e. it is not in accordance with the provisions of AS 11.

Question 54.

Beekay Ltd. purchased fixed assets costing to ₹ 5,000 lakh on 01.04.2012 payable in foreign currency (US $) on 05.04.2013. Exchange rate of 1 US $ = ₹ 50.00 and ₹ 54.98 as on 01.04.2012 and 31.03.2013 respectively.

The company also obtained a soft loan of US$ 1 lakh on 01.04.2012 payable in three annual equal instalments. First instalment was due on 01.05.2013. You are required to state, how these transactions would be accounted for in the books of accounts ending 31st March, 2013. (Nov 2013, 5 marks) [IPCC Gr. II]

Answer:

As per AS -11

(i) Difference arising on reporting of long-term foreign currency monetary items at rates different from those at which they were initially recorded during the period, or reported in previous financial statements, in so far as they relate to requisition of depreciable capital asset, can be added to or deducted from cost of asset.

(ii) The MCA has given an option to capitalize the exchange differences arising on reporting of long term foreign currency monetary items till 31st March, 2020.

Thus the company can capitalize the exchange differences arising due to long term loans linked with the acquisition of fixed assets.

1. Calculation of exchange difference on fixed assets

Foreign Exchange Liability = \(\frac{5,000}{50}\) = US $ 100 lakhs

Exchange Difference = US $ 100 lakhs × (₹ 54.98 – ₹ 50) = ₹ 498 lakhs.

Loss due to exchange difference amounting ₹ 498 lakhs will be capitalised and added in the carrying value of fixed assets. Depreciation on the unamortised amount will be provided in the remaining years.

2. Soft loan exchange difference (US $ 1 lakh i.e. ₹ 50 lakhs)

Value of loan 31.3.13 → US $ 1 lakh × 54.98 = ₹ 54,98,000

Now, AS -11 also provides that in case of liability such as longterm foreign currency monetary item, the exchange difference is to be accumulated in the Foreign Currency Monetary Item Translation Difference (FCMITD) and should be written off over the useful life of such long-term liability, by recognition as income or expenses in each of such periods.

Thus, Exchange difference between reporting currency (INR) and foreign currency (USD) as on 31.03.2013 = US $ 1.00 lakh × ₹ (54.98 – 50) = ₹ 4.98 lakhs.

Loan account is to be increased to 54.98 lakhs and FCMITD account is to be debited by 4.98 lakhs. Since loan is repayable in 3 equal annual instalments, ₹ 4.98 lakhs/3 = ₹ 1.66 lakhs is to be charged in Profit and Loss Account for the year ended 31st March, 2013 and balance in FCMITD A/c ₹ (4.98 lakhs – 1.66 lakhs) = ₹ 3.32 lakhs is to be shown on the ‘Equity & Liabilities’ side of the Balance Sheet as a negative figure under the head ‘Reserve and Surplus’ as a separate line item.

Question 55.

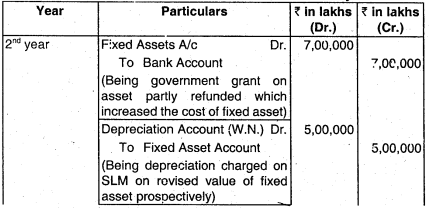

Stem Ltd. purchased a Plant for US$ 30,000 on 30th November, 2013 payable after 6 months. The company entered into a forward contract for 6 months @ ₹ 62.15 per dollar. On 30th November, 2013, the exchange rate was ₹ 60.75 per dollar.

How will you recognise the profit or loss on forward contract in the books of Stem Ltd. for the year ended 31st March, 2014? (Nov 2014, 5 marks) [IPCC Gr. II]

Answer:

Calculation of Profit or Loss

- Value at the rate prevailing at the inception of forward contract

= (USD ₹ 30,000 × 60.75) = ₹ 18,22,500 - Value at forward rate = (USD 30,000 × 62.15) = ₹ 18,64,500

- Total loss on entering into the forward contract = arising at inception for 6 months contract period = ₹ 42,000 (i.e. ₹ 18,64,500 – ₹ 18,22,500)

- Loss to be recognised for the year ended 31st March, 2014

= 42,000 × \(\frac{4}{6}\) = ₹ 28,000

Question 56.

Explain briefly the accounting treatment needed in the following cases as per AS 11 as on 31.3.2015.

Sundry Debtors include amount receivable from Umesh ₹ 5,00,000 recorded at the prevailing exchange rate on the date of sales, transactions recorded at US $ 1 = ₹ 58.50.

Long term loan taken from a U.S. Company, amounting to ₹ 60,00,000. It was recorded at US $ 1 = ₹ 55.60, taking exchange rate prevailing at the date of transaction.

US$ 1 = ₹ 61.20 on 31.3.2015 (Nov 2015, 5 marks) [IPCC Gr. II]

Answer:

As per AS -11 “Accounting for Foreign Exchange transaction on initial recognition should be recorded by applying the foreign currency at the date of the transaction.

But the transaction as on the balance sheet date should be recorded as follows:

Monetary Items: Monetary items are money held and assets and liabilities to be received or paid in fixed or determinable amounts of money. So that the monetary items as on balance sheet date should be reported by using the closing exchange rates.

Non – Monetary items: Non-Monetary items are other than monetary items. Such items which are carried in terms of historical cost denominated in a foreign currency should be reported using the exchange rate at the date of the transaction:

(i) Here the sundry debtors which include the receivable from Umesh ₹ 5,00,000 to be recorded initially by applying exchange rate as on the date of transaction. As on balance sheet date this receivable recorded as rate on the 31 /3/2015 i.e. ₹ 61.20 as it is monetary item as per AS 11. And such difference of rate i.e. (61.20 – 58.50) = 2.7 × 8,547 = ₹ 23,077 is to be credited to P&L A/c as foreign exchange gain.

(ii) In this case firstly loan from US Company recorded at rate of initial recognition ₹ 55.60. On the balance sheet date the rate is ₹ 61.20 so that the loss on the exchange transaction i.e. (61.20 – 55.60) = ₹ 5.6 × 1,07,914 = ₹ 6,04,317. So that loss of ₹ 6,04,317 is to be debited to foreign exchange account and the loan is recorded in B/S at ₹ 55-60.

Question 57.

Shan Builders Limited has borrowed a sum of US $ 10,00,000 at the beginning of Financial Year 2014-15 for its residential project at LIBOR + 3%. The interest is payable at the end of the Financial Year. At the time of availment, exchange rate was ₹ 56 per US $ and the rate as on 31st March, 2015 was ₹ 62 per US $. If Shan Builders Limited borrowed the loan in India in Indian Rupee equivalent, the pricing of loan would have been 10.50%. Compute Borrowing Cost and exchange difference for the year ending 31st March, 2015 as per applicable Accounting Standards. (Applicable LIBOR is 1%). (Nov 2015, 5 marks) [IPCC Gr. II]

Answer:

- Interest for the period 2014-15

= US$ 10 lakhs × 4% × ₹ 62 per US$ = ₹ 24.80 lakhs - Increase in the liability towards the principal amount = US $ 10 lakhs × ₹ (62- 56) = ₹ 60 lakhs

- Interest that would have resulted if the loan was-taken in Indian currency

= US$ 10 lakhs × ₹ 56 × 10.5% = ₹ 58.80 lakhs - Difference between interest on local currency borrowing and foreign currency borrowing = ₹ 58.80 lakhs – ₹ 24.80 lakhs = ₹ 34 lakhs.

Therefore, out of ₹ 60 lakhs increase in the liability towards principal amount, only ₹ 34 lakhs will be considered as the borrowing cost. Thus, total borrowing cost would be ₹ 58.80 lakhs being the aggregate of interest of ₹ 24.80 lakhs on foreign currency borrowings plus the exchange difference to the extent of difference between interest on local currency borrowing and interest on foreign currency borrowing of ₹ 34 lakhs.

Hence, ₹ 58.80 lakhs would be considered as the borrowing cost to be accounted for as per AS 16 “Borrowing Costs” and the remaining ₹ 26 lakhs (60 – 34) would be considered as the exchange difference to be accounted for as per AS 11 “The Effects of Changes in Foreign Exchange Rates”.

Question 58.

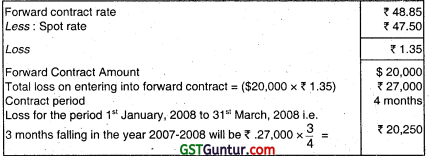

M/s Power Track Ltd. purchased a plant for US $ 50,000 on 31st October, 2015 payable after 6 months. The company entered into a forward contract for 6 months @ ₹ 64.25 per Dollar. On 31st October, 2015 the exchange rate was ₹ 61.50 per Dollar.

You are required to recognise the profit or loss on forward contract in the books of the company for the year ended 31st March, 2016. (May 2016, 5 marks) [IPCC Gr. II]

Answer:

Calculation of Profit or Loss to be charged or recognised in the books of M/s Power Track Ltd.

Thus, the loss amounting to ₹ 1,14,583 for the period is to be recognized in the year ended 31st March, 2016.

Question 59.

ABC Ltd. borrowed US $ 5,00,000 on 01/01/2017, which was repaid as on 31/07/2017. ABC Ltd. prepares financial statement ending on 31 /03/2017. Rate of Exchange between reporting currency (INR) and foreign currency (USD) on different dates are as under:

01/01/2017 1 US $ = ₹ 68.50

31/03/2017 1 US $ = ₹ 69.50

31/07/2017 1 US $ = ₹ 70.00

You are required to pass necessary journal entries in the books of ABC Ltd. as per AS 11. (May 2018, 5 marks)

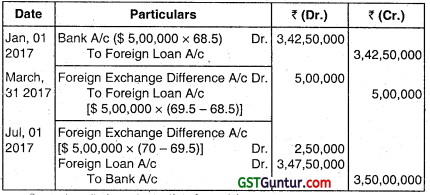

Answer:

Journal Entries in the books of ABC Ltd.

Question 60.

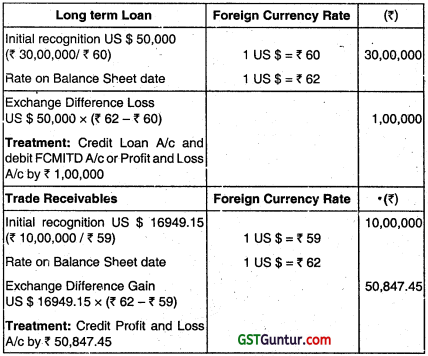

(i) ABC Ltd. a Indian Company obtained long term loan from WWW private Ltd., a U.S. company amounting to ₹ 30,00,000. It was recorded at US $1 = ₹ 60.00, taking exchange rate prevailing at the date of transaction. The exchange rate on balance sheet date (31.03.2018) was US $ 1 = ₹ 62.00.

(ii) Trade receivable includes amount receivable from Preksha Ltd., ₹ 10,00,000 recorded at the prevailing exchange rate on the date of sales, transaction recorded at US $1 = ₹ 59.00. The exchange rate on balance sheet date (31.03.2018) was US $ 1 = ₹ 62.00.

You are required to calculate the amount of exchange difference and also explain the accounting treatment needed in the above two cases as per AS 11 in the books of ABC Ltd. (Nov 2018, 5 marks)

Answer:

As per AS 11 “The effects of changes in Foreign Exchange Rates”, exchange differences arising on the settlement of monetary items or on reporting an enterprise’s monetary items at rates different from those at which they were initially recorded during the period, or reported in previous financial statements, should be recognised as income or as expenses in the period in which they arise.

However, at the option of an entity, exchange differences arising on operating of long-term foreign currency monetary items at rates different from those at which they were initially recorded during the period, or reported in previous financial statements, in so far as they relate to the acquisition of a non-depreciable capital asset can be accumulated in a “Foreign Currency Monetary Item Translation Difference Account” in the enterprises’s financial statements and amortised over the balance period of such long-term asset/liability, by recognition as income or expense in each of such periods.

Thus, Exchange Difference on Long term loan amounting ₹ 1,00,000 may either be charged to Profit and Loss A/c or to Foreign Currency Monetary Item Translation Difference Account but exchange difference on trade receivables amounting ₹ 50,847.45 is transferred to Profit & Loss A/c.

Question 61.

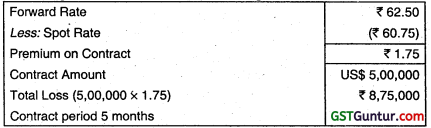

AXE Limited purchased fixed assets costing $ 5,00,000 on 1st Jan. 2018 from an American company IWs M&M Limited. The amount was payable after 6 months. The company entered into a forward contract on 1st January 2018 for five months @ ₹ 62.50 per dollar. The exchange rate per dollar was as follows:

On 1st January, 2018 : ₹ 60.75 per dollar

On 31st March, 2018 : ₹ 63.00 per dollar

You are required to state how the profit or loss on forward contract would be recognized in the books of AXE Limited for the year ending 2017-18, as per the provisions of AS 11. (Nov 2018, 5 marks)

Answer:

As per Para 39 of AS 11 ‘Changes in Foreign Exchange Rates’, in recording a forward exchange contract intended for trading or speculation purpose, the premium or discount on the contract is ignored and at each balance sheet date. the value of contract is marked to its Current market price and gain or loss on the contract is recognised.

3 months fallng in the year 2017-18; therefore loss to be recognized in 2017-18 (8,75,000/5) × 3 = ₹ 5,25,000. Rest ₹ 3,50,000 will be recognized in the following year 2018-19.

![]()

Question 62.

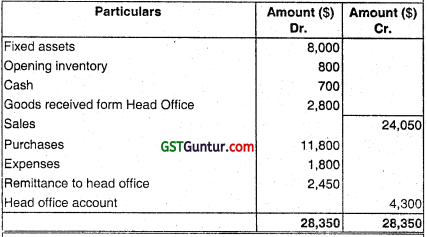

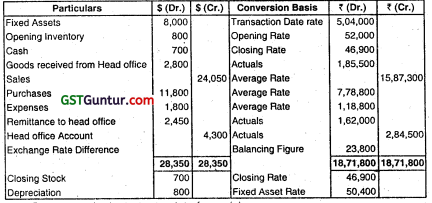

Karan Enterprises having its Head Office in Mangalore Karnataka has a branch in Greenville, USA. Following is the trial balance of Branch as at 31-3-2019:

(i) Fixed assets were purchased on 1st April, 2015.

(ii) Depreciation at 10% p.a. s to be charged on fixed assets on straight line method.

(iii) Closing inventory at branch is $ 700 as on 31 -3-2019.

(iv) Goods received form Head Office (HO) were recorded at ₹ 1,85,500 in HO books.

(v) Remittances to HO were recorded at ₹ 1,62,000 in HO books.

(vi) HO account is recorded in HO books at ₹ 2,84,500.

(vii) Exchange rates of US Dollar at different dates can be taken as:

1-4-2015 ₹ 63;

1-4-2018 ₹ 65 and

31-3-2019 ₹ 67.

Prepare the trial balance after been converted into Indian rupees in accordance with AS-11. (Nov 2019, 5 marks)

Answer:

Trial Balance of the Foreign Branch converted into Indian Rupees as on March 31, 2019:

Question 63.

‘Answer the following:

Explain briefly the accounting treatment needed in the following cases as per AS 11 as on 31.03.2020.

(i) Debtors include amount due from Mr. S ₹ 9,00,000 recorded at the prevailing exchange rate on the date of sales, transaction recorded

at US S 1 = ₹ 72.00

US $ 1 = ₹ 73.50 on 31st March, 2020

US $ 1 = ₹ 72.50 on 1st April, 2019

(ii) Long term loan taken on 1st April, 2019 from a U.S. company amounting to ₹ 75,00,000. ₹ 500,000 was repaid on 31st December, 2019, recorded at US $ 1 = ₹ 70.50. Interest has been paid as and when debited by the US company.

US$1 = ₹ 73.50 0n 31st March, 2020

US $ 1 = ₹ 72.50 on 1st April, 2019 (Jan 2021, 5 marks)

Question 64.

: Exchange Rate per $