Overheads: Absorption Costing Method – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Overheads: Absorption Costing Method – CA Inter Costing Question Bank

Question 1.

Distinguish between Fixed overheads and Variable overheads. (May 2010, 2 marks)

Answer:

Fixed Overheads Vs. Variable Overheads

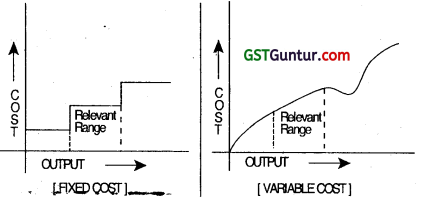

Fixed overheads are not affected by any variation in the volume of activity, e.g., managerial remuneration, rent etc. These remain the same from one period to another except when they are deliberately changed. Fixed overheads are generally variable per unit of output or activity e.g Rent, Insurance, Depreciation, Audit fees etc.

Whereas, the variable overheads that change in proportion to the change in the volume of activity or output, e.g., power consumed, consumable stores etc. The variable overheads are generally constant per unit of output or activity, e.g. direct material, direct labour, commission on sale.

![]()

Question 2.

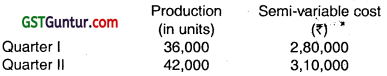

Following information is available for the first and second quarter of the year 2008-09 of ABC Limited:

You are required to segregate the semi-variable cost and calculate:

(a) Variable cost per unit; and

(b) Total fixed cost. (May 2009, 2 marks)

Answer:

Variable Cost per Unit = \(\frac{\text { Change in Semi Variable Cost }}{\text { Change in Production }}\)

= \(\frac{₹ 30,000}{6,000 \text { units }}\)

= ₹ 5 per units

Total Fixed Cost = Semi Variable Cost – (Production × Variable Cost per Unit)

Total fixed cost in Quarter I:

= 2,80,000 – (36,000 × 5)

= 2,80,000 – 1,80,000

= 1,00,000

Total fixed cost in Quarter II:

= 3,10,000 – (42,000 × 5)

= 3,10,000 – 2,10,000

= 1,00,000

![]()

Question 3.

Distinguish Between between cost allocation and cost absorption. (May 13, 4 marks)

Answer:

Cost allocation: It is defined as the process of allotment or identification or assignment of whole items to cost centers or costs units. Thus the charging of direct cost to a cost centre or a cost unit is the process of allocation of costs.

Cost absorption : It is the process of absorbing all indirect costs (or Overheads) allocated or apportioned over particular cost centre or production deptt. by the units produced.

Question 4.

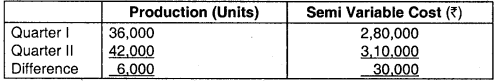

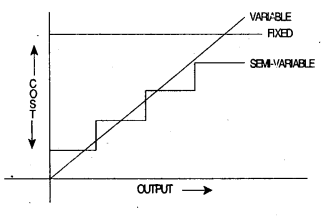

POR Ltd. has its own power plant, which has two users, Cutting Department and Welding Department. When the plans were prepared for the power plant, top management decided that its practical capacity should be 1.50,000 machine-hours. Annual budgeted practical capacity fixed costs are 9,00,000 and budgeted variable costs are ₹ 4 per machine-hour.

The following data are available :

Required:

(i) Allocate the power plant’s cost to the cutting and the Welding department using a single rate method n which the budgeted rate is calculated using practical capacity and costs are allocated based on actual usage.

(ii) Allocate the power plant’s cost to the cutting and welding departments, using the dual-rate method in which fixed costs are allocated based on practical capacity and variable costs are allocated based on actual usage.

(iii) Allocate the power plant’s cost to the cutting and welding1 departments using the dual-rate method in which the fixed-cost rate is calculated using practical capacity, but fixed costs are allocated to the cutting and welding department based on actual usage. Variable costs are allocated based on actual usage.

(iv) Comment on your results in requirements (i), (ii) and (iii). (May 2003, 2 + 2 + 2 + 2 = 8 marks)

Answer:

Working Notes :

1. Fixed Practical capacity cost per Machine Hour:

Practical Capacity (machine hours) – 1,50,000

Practical Capacity fixed cost (₹) – 9,00,000

Fixed Practical Capacity cost per machine hour

\(\left[\frac{₹ 9,00,000}{1,50,000 \mathrm{Hr}}\right]\) – ₹ 6

2. Budgeted rate per machine hour (Using practical capacity):

= Fixed Practical capacity cost per machine hour + Budgeted Variable cost per machine hour.

= ₹ 6 + ₹ 4 = ₹ 1o.

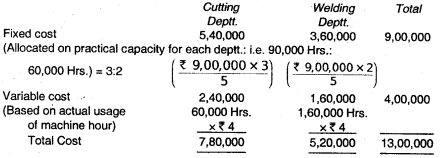

(i) Statement showing Power Plants cost allocation to the cutting and Welding deptts. by using single rate method on actual usage of machine Hours:

(ii) Statement showing power plants cost allocation to the cutting and welding deptts. by using actual rate method:

(iii) Statement showing Power Plant’s cost allocation to the cutting and welding deptts. using dual rate method :

(iv) Comments: Under dual rate method, under (iii) and under single rate method under (i), the allocation of fixed cost of practical capacity of plant over each deptt. are based on single rate. The major advantage of this approach is that the uses deptts. are allocated fixed capacity . cost only for the capacity used. The unused capacity cost of ₹ 3,00,000 (₹ 9,00,000 – ₹ 6,00,000) will not be allocated to the uses deptts. This highlights the cost of unused capacity.

Under (ii) fixed cost of capacity are allocated to operating deptts. on the basis of practical capacity, so all fixed costs are allocated and there is no unused capacity identified with the power plant.

![]()

Question 5.

Write a note on ‘classification’, ‘allocation’ and ‘absorption’ of overheads. How does it help in controlling overheads? (May 1998, 5 marks)

Answer:

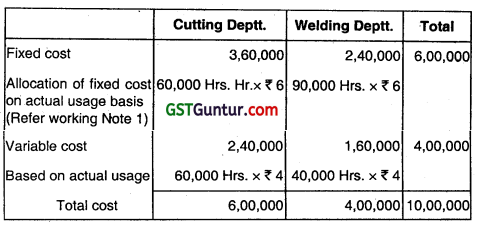

On the basis of a common base or characteristic features overheads are grouped into two or more classes: This is known as classification of OHE’s. There are no. of bases for classification. But the selection of a particular base for classification depends upon a no. of factors such as nature and size of the business, nature of product etc. However the following 3 bases are generally used for classification:

Answer:

On the basis of a common base or characteristic features overheads are grouped into two or more classes: This is known as classification of OHEs. There are no. of bases for classification. But the selection of a particular base for classification depends upon a no. of factors such as nature and size of the business, nature of product etc. However the following 3 bases are generally used for classification:

Function wise classification:

- Factory or Production O/H: It includes :

- Stores overhead (expenses connected with purchasing and handling of materials).

- Labour overhead (costs related to labour).

- Factory and administration overheads (expenses connected with administration of the factory.

- Office and Administration overhead: It includes :

- Office expenses (expenses on routine office work).

- Administration expenses (expenses on managerial personnel whether form in of salary or facilities).

- Selling and distribution overhead: It includes :

- Selling expenses (expenses incurred to persuade customers and maintenance and expansion of market).

- Distribution expenses (expenses incurred to execute the orders.)

![]()

Behavioural wise classification:

If costs are classified on the basis of tendency to change with change in production volume or sales volume or activity level, costs are classified as:

1. Fixed costs: Fixed cost is one whose total amount remains fixed irrespective of change in level of activity. It is also known as “Period cost” or policy cost”.

e.g.: Rent, insurance, depreciation, audit fees, salaries and allowances, direct labour (if paid on time rate basis).

2. Variable Cost: Variable costs are the costs whose total amount changes in proportion to the output activity level.

e.g. : Direct material, direct labour (if paid on piece rate basis), sales representatives, commission.

3. Semi Variable Costs: Semi variable costs containing both fixed and variable elements which is thus partly affected by fluctuations in the activity level.

Fixed cost element remains constant for the activity level while variable cost element varies proportionately with the activity level.

e.g.: Costs of electric power, telephone expenses etc.

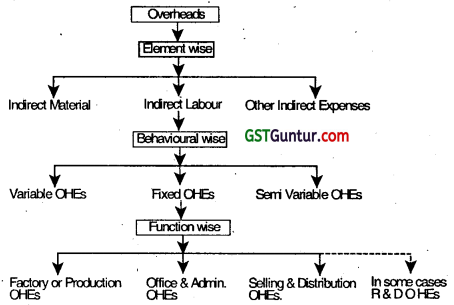

Graphically these 3 types of expenses are shown as below:

![]()

Note:

The amount of fixed cost times remains constant for a particular range of level of activity upto a specific period. This is known as “Relevant Range” and “ Relevant period’ respectively concept of relevant range is applicable to fixed cost as well as variable costs.

For Fixed Cost: It is related to the plant capacity or range of production level means after a certain range of production it can be hiked.

For Variable Cost: Per unit variable cost will behave differently outside the relevant range of production. It means it is constant upto that Relevant Range.

e.g.: Quantity discount available on the basis of certain limit.

Allocation of Costs:

Allocation is the process of identification of O/H with cost centre. If an expenses which is directly identifiable with a specific cost centre is known it is allocated to the same e.g.:

- Power if separate meter for each cost centre is there.

- Wage to indirect workers

- Depreciation of plant and machinery

- Insurance of plant and machinery

- Fuel oil for boiler, generation, ovens etc.

![]()

Absorption of OH :

Absorption is an excercise by which OH is properly spread over to production for the period. After OH is collected, a basis for absorption of OH is found out for each departments so that each product gets due share of OH. Thus OH absorption involves apportionment of OH relating to a department among units produced in that department.

Role of classification, allocation and absorption of overheads in controlling overheads:

The classification, allocation and absorption of overhead costs over different cost centres helps in two ways. Firstly, the overhead costs assigned to cost centres are used for cost control and performance evaluation purpose. These assigned costs are periodically totaled and listed on performance repeat which also has the figures of budgeted costs differences between budgeted and actual cost for each item of expenditure are highlighted in the performance reports and provide feedback information for performance evaluation and cost control purposes. Secondly, the accumulated production cost centre O/H costs are assigned in the second stage of the procedure to products to satisfy financial accounting requirements for inventory valuation.

![]()

Question 6.

Discuss the difference between allocation and apportionment of overhead. (May 2008, 2 marks)

OR

Distinguish between allocation and apportionment of cost. (May 2014, 4 marks)

Answer:

Cost allocation:

The term ‘allocation’ implies relating overheads directly to the various departments. The estimated amount of various items of manufacturing overheads should be allocated to various cost centers or departments.

Cost apportionment:

Those items of estimated overheads (like the salary of the works manager) which cannot be directly allocated to the various departments and cost centers are apportioned. Apportionment implies “the allotment of proportions of items of cost to cost centres or departments.” It implies that the unallocable expenses are to be spread over the various departments or cost centres on an equitable basis.

The differences between Allocation and Apportionment are as follows:

| Basis of Difference | Allocation | Apportionment |

| Meaning | Identifying a cost centre and charging its expenses in full. | Allotment of pro-porjions of common cost to various cost centre. |

| Nature of expenses | Specific and identifiable | General and common |

| Number of centre (Deptt.) | One | Many |

| Basis | Allocate directly | Allocate Indirectly |

| Amount of overhead | Charge in full | Charge in proportionable |

| Assumption | Not required | Required |

![]()

Question 7.

State the bases of apportionment of following overhead costs:

(i) Air-conditioning

(ii) Time keeping

(iii) Depreciation of plant and machinery

(iv) Power! steam consumption

(v) Electric power (Machine operation) (Nov 2018, 5 marks)

Answer:

Basis for apportionment of overhead costs:

| Overhead costs | Basis for Apportionment | |

| (i) | Air – Conditioning | Floor area, or volume of department |

| (ii) | Time – Keeping | Number of workers |

| (iii) | Depreciation of plant and machinery | Capital values |

| (iv) | Power/steam consumption | Technical estimates |

| (v) | Electric Power (Machine Operation) | Horse power of machines, or number of machine hour, or value of machines or units consumed. |

![]()

Question 8.

What are the methods of re-apportionment of service department expenses over the production departments? Discuss. (Nov 2010, 4 marks)

Answer:

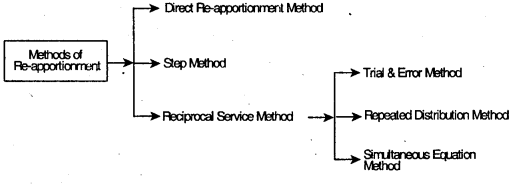

The following methods are generally used for re-apportionment according to the specified circumstances:

These are explained in detail as follows :

1. Direct Re-apportionment method:

- This method is used when cost of service departments are apportioned only to the production department directly.

- Therefore, number of re-apportionment will be equivalent to the number of service departments.

- It means each service department provides service to different ,

production department but not to other service departments.

![]()

2. Step method: When it is recognised that the service rendered by one service departments, to other service department has been done on partial basis, the re-apportionment procedure involves the following steps:

Step 1 : Find out such service departments, which give services to large no. of other departments Distribute the cost of this service departments to other departments (including other service departments) on an equitable basis.

Step 2 :Then identify other service departments which give services to next largest number of departments After that, distribute the cost of such service departments, to other departments (excluding the service department whose cost has already been apportioned) on some equitable basis.

Step 3 : Continue the distribution process till the cost of service departments, is apportioned fully.

Note: If all the service departments, provide service to equal no. of other departments, then it will be difficult to re-apportion the cost of service departments In such case, it is apportioned on the basis of largest amount to lowest one. It means first apportion largest amount, then the next largest and so on.

3. Reciprocal service method: This method is used when one Service department renders services to other department and vice-versa in addition to the services provided to the production departments That is on reciprocal basis, it means, before determining the cost of each service department, they should recognise the cost of inter service departmental services.

This method Is generally used for the dealing of such problems:

- Trial and Error Method,

- Repeated Distribution Method

- Simultaneous Equation Method

![]()

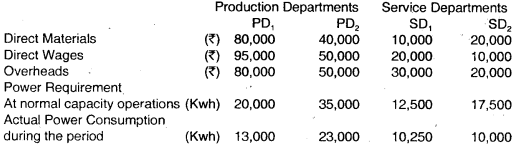

Question 9.

M/s. NOP Limited has its own power plant and generates its own power. Information regarding power requirements and power used are as follows:

| Production Dept. | Service Dept. | |||

| A | B | X | Y | |

| (Horse power hours) | ||||

| Needed capacity production | 20000 | 25000 | 15000 | 10000 |

| Used during the quarter ended September 2018 | 16000 | 20000 | 12000 | 8000 |

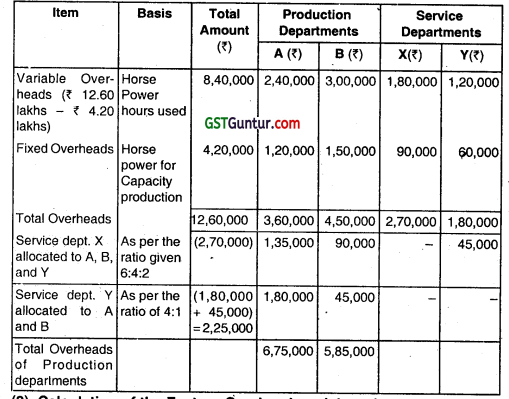

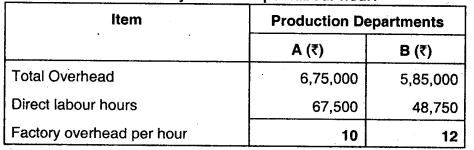

During the quarter ended September 2018, costs for generating power amounted to ₹ 12.60 Iakhs out of which ₹ 4.20 Iakhs was considered as. fixed cost.

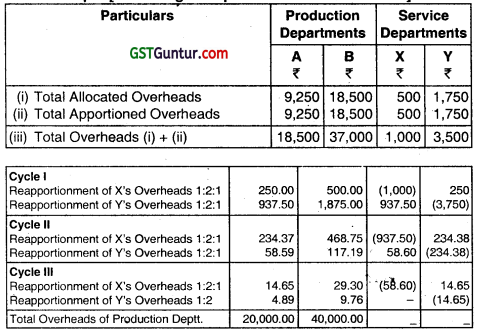

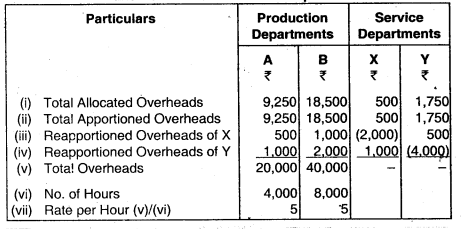

Service department X renders services to departments. A, B, and Y in the ratio of 6:4:2 whereas department Y renders services to department A and B in the ratio of 4:1. The direct labour hours of department A and B are 67500 hours and 48750 hours respectively.

Required:

(i) Prepare overheads distribution sheet.

(ii) Calculate factory overhead per labour hour for the dept. A and dept. B. (Nov 2018, 5 marks)

Answer:

(1) Overhead Distribution Sheet

(2) Calculation of the Factory Overhead per labour hour:

![]()

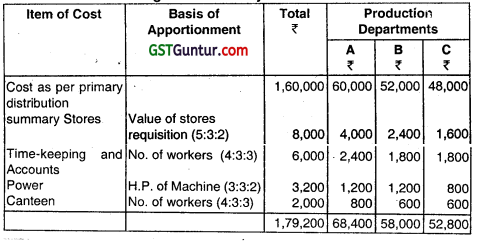

Question 10.

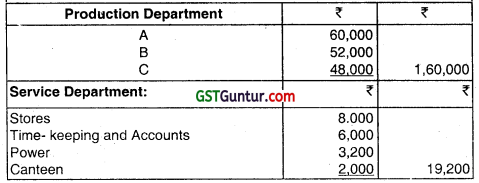

CAS Ltd. has three production departments and tour service departments. The expenses for departments as per Primary Distribution Summary are as follows:

The following information is also available in respect of the production departments:

Required: Apportion the costs of service departments over the production departments.

Answer:

Statement showing the Secondary Distribution of Overheads

![]()

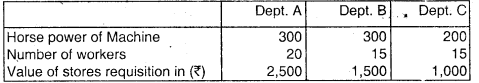

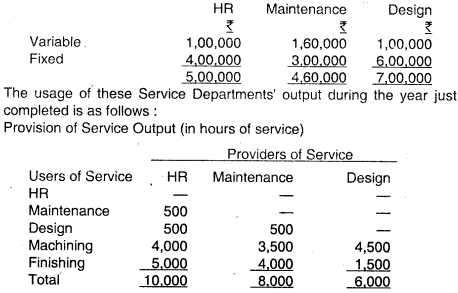

Question 11.

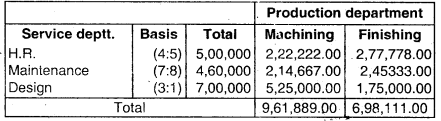

RST Ltd. has two production departments : Machining and Finishing. There are. three service departments : Human Resource (HR), Maintenance and Design. The budgeted costs in these service departments are as follows :

Required:

(i) Use the direct method to re-apportion RST Ltd’s service department cost to its production departments.

(ii) Determine the proper sequence to use In re-apportioning the firm’s service department cost by step-down method.

(iii) Use the step-down method to reapportion the firm’s service department cost. (Nov 2006, 3 + 1 + 3 = 7 marks)

Answer:

(i) Re-apportion of service departments cost to its production department by using direct method

(ii) Sequence of re-apportionment :- As H.R. department serves large number of departments so its cost should be first re-apportioned then overhead of maintenance department should be re-apportioned and lastly overhead of design department should be re-apportioned.

(iii) Use of step down method for re-apportioning overhead of service department:

![]()

Question 12.

Discuss the step method and reciprocal service method of secondary distribution of overheads. , (Nov 2004, 4 marks)

Answer:

Step Method: When it is recognised that the service rendered by one service department to other service department has been done on partial basis, the re-apportionment procedure involves the following steps:

Step 1: Find Out such service deptts., which gives services to large no. of other deptts. Distribute the cost of this service deptt. to other deptts. (including other service deptts.) on an equitable basis.

Step 2: Then identity other service deptts. which gives services to next largest number of deptts. After that, distribute the cost of such service deptt, to other deptts. (excluding the service deptt. Whose cost has already been apportioned) on some equitable basis.

Step 3: Continue the distribution process till the cost of service deptts., cost is apportioned fully.

Note: If all the service deptts. provide service to equa no. of other deptts.. then it will be dit ticult to re-apportion the cost of service deptts. In such case, it is apportioned on the basis of largest amount to lowest one, It means first apportion largest amount, then the next highest and so on.

![]()

Reciprocal Service Method:

This method Is used when one service deptt. renders services to other deptt. and vice-versa in addition to the services provided to the production deptts. That is reciprocal basis it means before determining the cost of each service deptt, they should recognise the cost of inter service departmental services.

This method is generally used for the dealing of such problems:

- Trial and Error Method,

- Repeated Distribution Method

- Simultaneous Equation Method

(i) Trial and Error Method:

Under this method, the total cost of each service deptt. will be determined as per primary distribution and the percentage of services rendered to each other:

After such process, total cost of each service cieptt. is determined by adding the above amounts (i.e. as per step 1 + step 2 + step 3).

(ii) Repeatec1 Distribution Method:

Under this method, the total overhead cost of all the deptts. (i.e. production and service) as per primary distribution summary are put on a line.

(iii) Simultaneous Equation Method:

This method is recommended where these are only two service deptts. If no. of service deptt is more than two then for finding out the unknown figures may possess problems in computation.

![]()

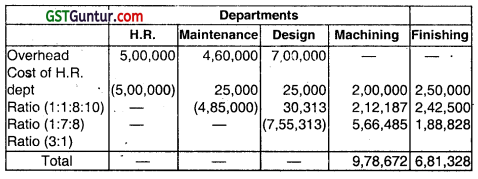

Question 13.

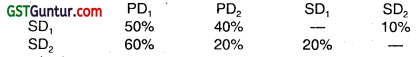

S Ltd. has two production departments P1 and P2 and two service departments S1 and S,. Expenses of these departments are as follows:

P1 – ₹ 51,837, P2 – ₹ 12,163, S1 – ₹ 40,000, S2 – ₹ 16,000

The expenses of service departments are to be apportioned are as follows:

| P1 | P2 | S1 | S2 | |

| S1

S2 |

50%

30% |

40%

50% |

–

20% |

10%

– |

Determine

Apportion the cost of service departments by using Trial and Error Method.

Answer:

Calculation of Total Costs of Each Service Department

![]()

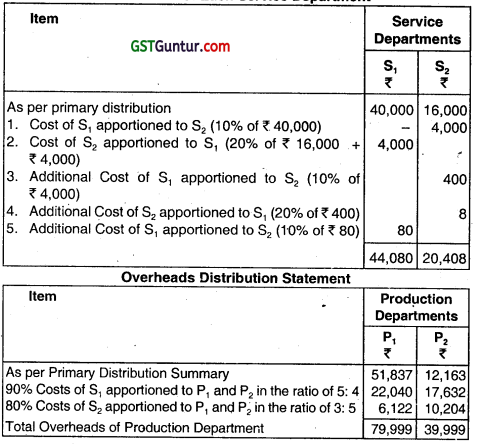

Question 14.

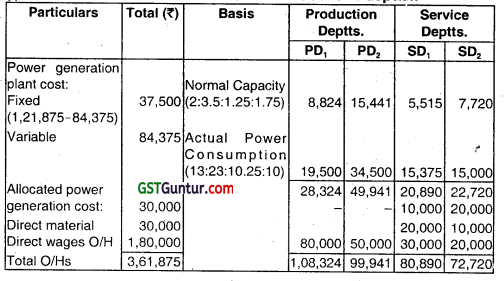

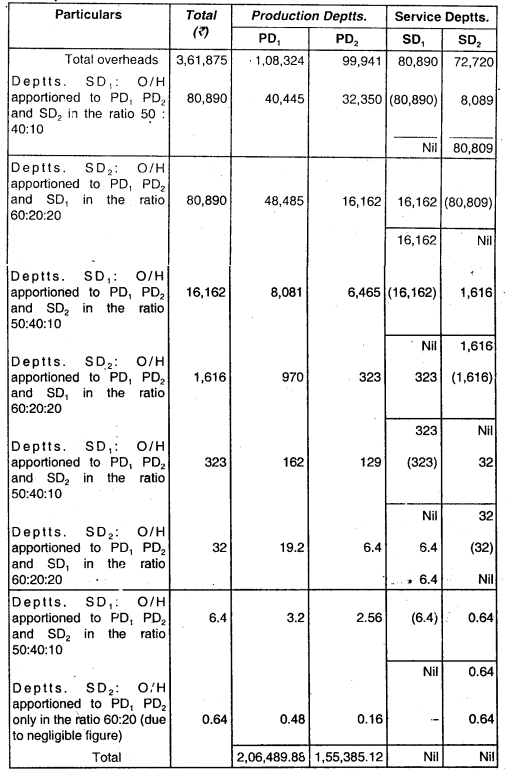

A company has two production departments and two service departments. The data relating to a period are as under:

The power requirement of these departments are met by a power generation plant. The said plant incurred an expenditure, which is not included above, of ₹ 1,21,875 out of which a sum of ₹ 84,375 was variable and the rest fixed.

After apportionment of power generation plant costs to the four departments, the service department overheads are to be redistributed on

the following bases:

You are required to:

(I). Apportion the power generation plant costs to the four departments.

(ii) Re-apportion service department cost to production departments.

(iii) Calculate the overhead rates per direct labour hour of production departments, given that the direct wage rates of PD1 and PD2 are 5 and 4 per hour respectively. (Nov 1996, 8 marks)

Answer:

(i) Statement of Power Generation Plant Cost of 4 deptts.:

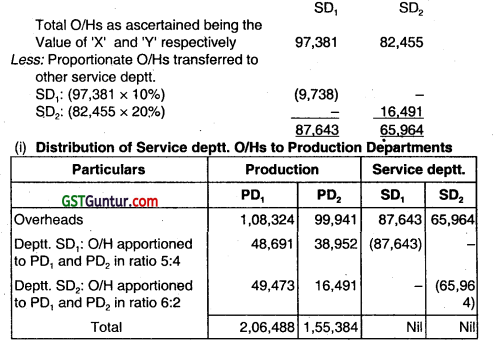

(ii) Re-apportionment of Service deptt. Cost to production deptt.-Under Repeated Distribution Method:

![]()

Alternatively,

By Equational approach –

Let total O/Hs of SD1 be ‘X’ and of SD2 be ‘Y’.

Thus,

x = 80,890 + 20% of y

y = 72,720 + 10% of x

Or x = 80890 + 0.2y

Or x – 0.2y = 80,890 ……………. (1)

Or y = 72,720 + 0.1 x

Or – 0.1 x + y = 72,720

Or – 0.02x + 0.2y = 14,544 (multiplying both the sides by 0.2) ……………. (ii)

Solving the above equation (i) and (ii),

We get,

Now, putting the value of ‘X’ in equation (i)

x – 0.2y = 80,890

– 97,381 – 0.2y = 80,890

– 0.2y = 16,491

y = ₹ 82,455

Total OMs SD1 and SD2:

Note: in such type of problems, if the problem is silent about the application of the method of redistribution of service deptt. O/H, then ‘Repeated Distribution Method’ for distributing service deptt. O/H to other deptts. should be adopted.

![]()

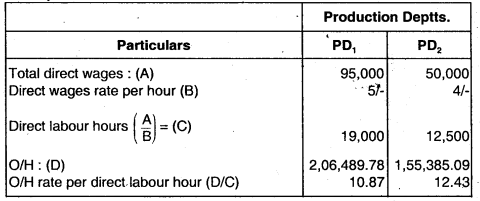

(iii) Computation of O/H Rates per direct labour hour of Production deptts.:

![]()

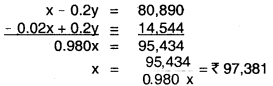

Question 15.

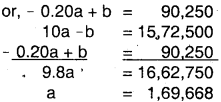

A company. has three production departments and two service departments. Distribution summary of overheads is as follows:

Production Departments

A – ₹ 13,600

B – ₹ 14,700

C – ₹ 12,800

Service Departments

X – ₹ 9,000

Y – ₹ 3,000

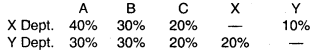

The expenses of service departments are charged on a percentage basis which is as follows:

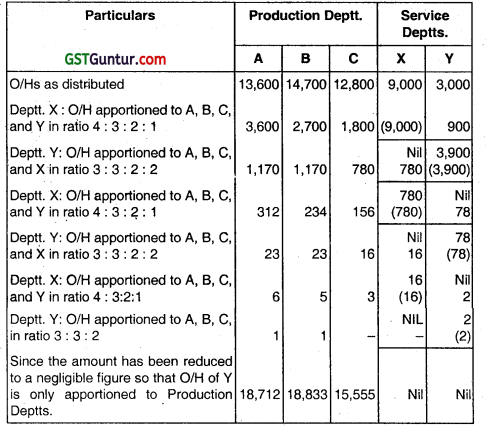

Apportion the cost of Service Departments by using the Repeated Distribution method. (Nov 1998, 8 marks)

Answer:

Statement of apportionment of Service Deptts. O/H to Production Depts. under Repeated Distribution Method:

![]()

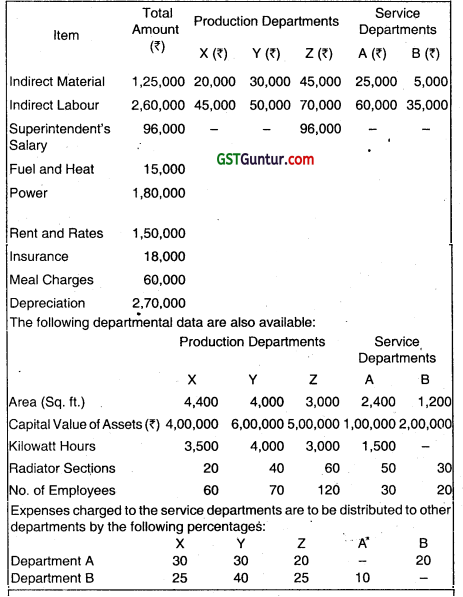

Question 16.

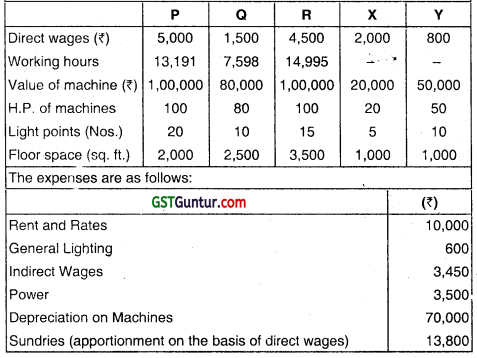

TEE Ltd. is a manufacturing company having three production departments ‘P’, ‘Q’ and ‘R’ and two service departments ‘X’ and ‘Y’ details pertaining to which are as under:

The expenses of Service Departments are allocated as under:

| (₹) | |

| Rent and Rates

General Lighting Indirect Wages Power Depreciation on Machines Sundries (apportionment on the basis of direct wages) |

10,000

600 3,450 3,500 70,000 13,800 |

Product ‘A’ is processed for manufacture in Departments P, Q and R for 6, 5 and 2 hours respectively.

Direct Costs of Product A are:

Direct material cost is 65 per unit and Direct labour cost is 40 per unit.

You are Required to:

(i) Prepare a statement showing distribution 01 overheads among the production and service departments.

(ii) Calculate recovery rate per hour of each production department after redistributing the service departments costs

(iii) Find out the Total Cost of a ‘Product A’. (Nov 2020, 10 marks)

![]()

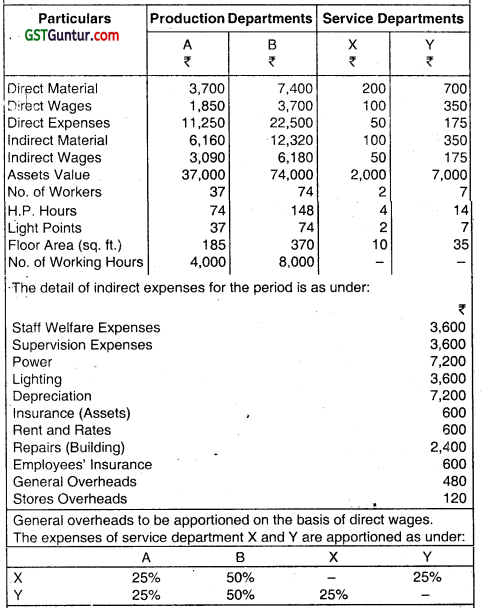

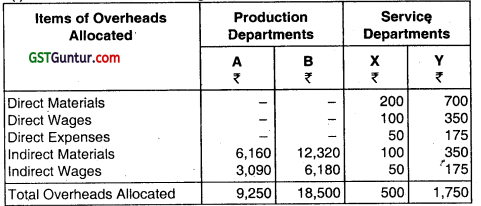

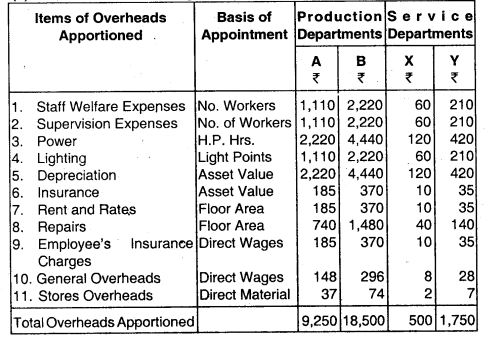

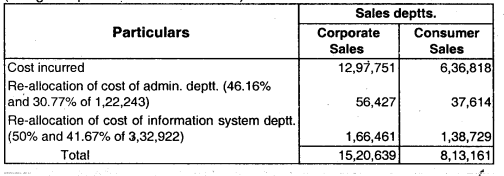

Question 17.

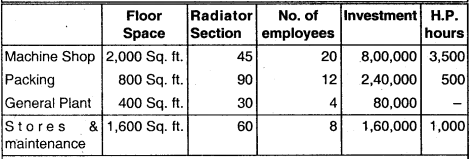

In a factory of ABC Ltd. the following particulars have been extracted for the period ended 31 .3.2001.

You are required to prepare the statements showing:

(i) The allocation of overheads;

(ii) The apportionment of overheads;

(iii) The distribution of service departments overheads by method of

(a) Repeated Distribution and (b) Algebraic Equations;

(iv) Overhead distribution summary and rates of overhead absorption.

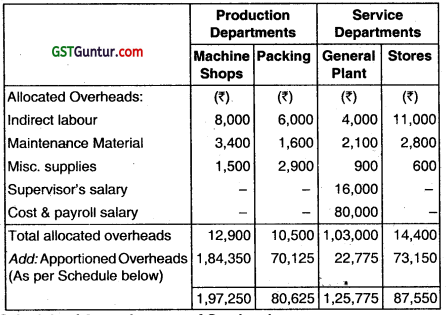

Answer:

(i) Statement showing the Allocation of Overheads

(ii) Statement showing the Apportionment of Overheads

![]()

(iii) Statement showing the Distribution of Overheads of Service Deptt. [According to Repeated Distribution Method]

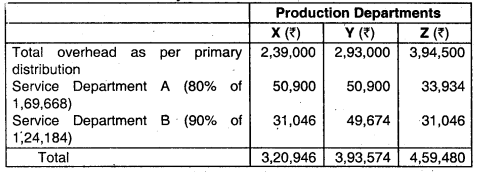

Distribution of Service Departments’ Overheads through Algebraic

Equations

Letx be the total overheads of Deptt. x

Let y be the total overheads of Deptt. y

Thus, x = 1,000 + 1/4y ………………. (i)

y = 3,500 + 1/4x ………….. (ii)

= 3,500 + 1/4 (1,000 + 1/4y) (Putting the value of x in equation II)

= 3500 + 250 + 1/16 y

16y = 60,000 + y

15y = 60,000

y = ₹ 4,000

x = 1,000 + 1/4 × 4,000 (Putting the value of y in equation I)

= ₹ 2,000

![]()

(iv) Statement showing Overheads Distribution Summary and Rates of Overhead Absorption

Question 18.

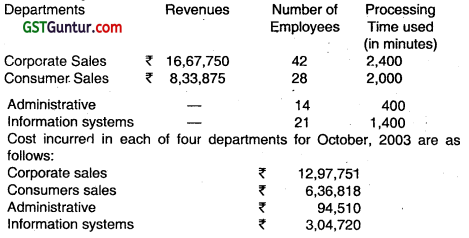

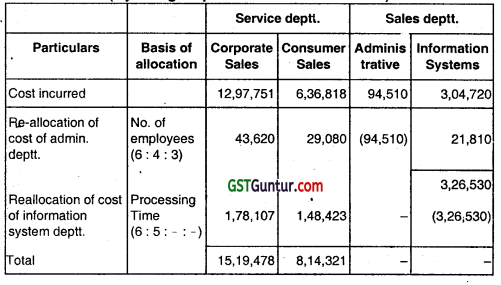

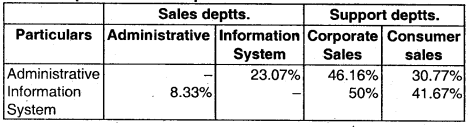

E-books is an online book retailer. The Company has tour departments. The two sales departments are Corporate Sales and Consumer Sales. The two support-departments are Administrative (Human resources, Accounting), and Information systems. Each of the sales departments conducts merchandising and marketing operations independently.

The following data are available for October, 2003:

The company uses number of employees as a basis to allocate Administrative costs and processing time as a basis to allocate Information systems costs.

Required:

(i) Allocate the support department costs to the sales departments using the direct method.

(ii) Rank the support departments based on percentage of their services rendered to other support departments. Use this ranking to allocate support costs based on the step-down allocation method.

(iii) How could you have ranked the support department differently?

(iv) Allocate the support department costs to two sales departments using the reciprocal allocation method. (Nov 2003, 2 + 2 + 1 + 5 = 10 marks)

Answer:

(i) Statement showing the allocation of support deptt. cost to the sales deptt: .

(Using the Direct Deptt.)

(ii) Ranking of support deptts. based on % of their services rendered to other support deptts.:

- Administration support deptt. provides 23.077% \(\left(\frac{21 \times 100}{42+28+21}\right)\) of its services to information systems.

Support thus deptt. 23.077% of ₹ 94,510 = ₹ 21,810/- - Information system support deptt. provides 8.33% \(\left(\frac{400}{2,400+2,000+400} \times 100\right)\) of its services to Admin. support deptt. thus 8.33% of ₹ 3,04,720 = ₹ 25,383/- .

Statement showing allocation of support costs

(By using step down allocation method)

(iii) An alternative ranking is based on the rupee amount of services rendered to other service deptt., using the rupee figures obtained under requirement (II). This approach would use the following sequence of ranking:

- Allocation of information systems 0/1-l as (i) (₹ 25,383 provided to administrative.)

- Allocated administrative OIHs as (ii) (₹ 21,810 provided to information systems.)

![]()

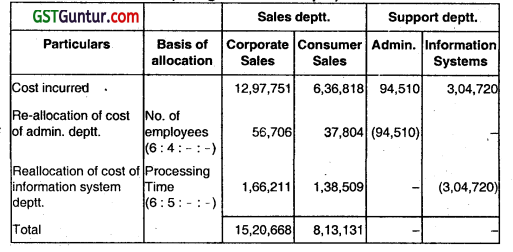

(iv) Working Notes:

1. Percentage of services provided by each service deptt. to other service deptt. and Sales deptts.:

2. Total cost of the support deptt.: (by using simultaneous equation method):

Let A and I be the total costs of support deptts. Administrative and Information Systems respectively. These cost can be determined by using the following Simultaneous equations:

A = 94,510 + 0.0833 I

I = 3,04,720 + 0.2307 A

or A = 94,510 + 0.0833 {3,04,720 + 0.2307 A)

or A = 94,510 + 25,383 + 0.01922 A

or 0.98078 A = 1,19,893

or A = ₹ 1,22,243/-

and I = ₹ 3,32,922/-

Statement showing the allocation of support deptts. cost to the sales deptt. (using Reciprocal allocation method):

![]()

Question 19.

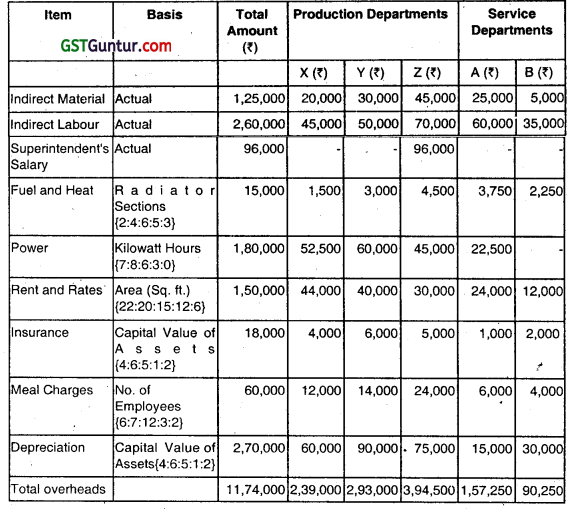

The following account balances and distribution of indirect charges are taken from the accounts of a manufacturing concern for the year ending 31st March, 2012:

Prepare an overhead distribution statement to show the total overheads of production departments after re-apportioning service departments’ overhead by using simultaneous equation method. Show all the calculations to the nearest rupee. (Nov 2012, 8 marks)

Answer:

Primary Distribution of Overheads

Re-distribution of Overheads of Service Department A and B

Total overheads of Service Departments may be distributed using simultaneous equation method

Let, the total overheads of A = a and the total overheads of B = b

a = 1,57,250 + 0.10 b ……………. (i)

or, 10a – b = 15,72,500 [(i) × 10]

b = 90,250 + 0.20 a (ii)

Putting the value of a in equation (ii), we get

b = 90,250 + 0.20 × 1,69,668

b = 1,24,184

Secondary Distribution of Overheads

![]()

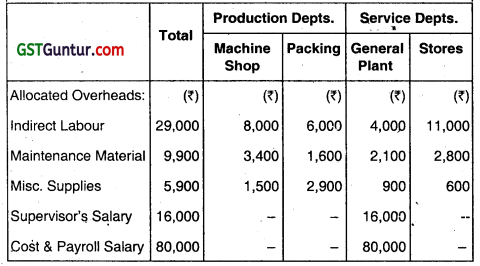

Question 20.

The Union Ltd. has the following account balances and distribution of direct charges on 31st March, 2019.

Overheads to be appórtioned:

Power – 78,000

Rent – 72,000

Fuel and Heat – 60,000

Insurance -12,000

Taxes – 8,400

Depreciation – 1,20,000

The following data were compiled by means of the factory survey made in the previous year:

Expenses charged to the stores departments are to be distributed to the other departments by the following percentages:

Machine shop 50%; Packing 20%; General Plant 30%:

General Plant overheads Is distributed on the basis of number of employees.

(a) PREPARE an overhead distribution statement with supporting schedules to show computations and basis of distribution.

(b) DETERMINE the service department distribution by simultaneous equation method.

Answer:

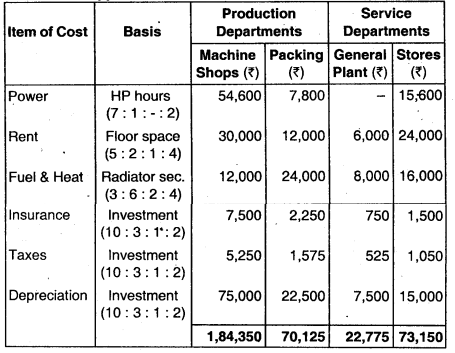

(a) Overheads Distribution Statement

Schedule of Apportionment of Overheads

![]()

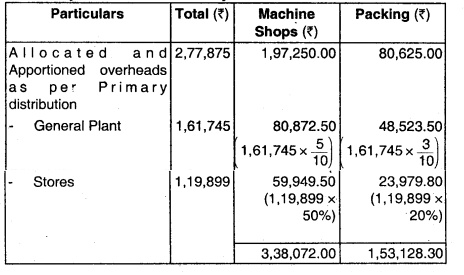

(b) Re-distribution of Overheads of Service Departments to Production Departments:

Let, the total overheads of General Plant = ‘a’ and the total overheads of Stores = ‘b’

a = 1.25,775 + 0.3b ………………… (i)

b = 87.550 + 0.2a …………… (ii)

Puting the value of ‘b’ in equation no. (i)

a = 1.25,775 + 0.3 (87,550 + 0.2a)

Or a = 1,25,775 + 26,265 + 0.06a

Or 0.94a = 1.52,040 Or a = 1,61,745 (appx.)

Putting the value of a = 1 61 ,745 in equation no. (ii) to get the value of ‘b’

b = 87,550 + 0.2 × 1,61,745 = 1,19,899

Secondary Distribution Summary

![]()

Question 21.

Explain, how under-absorption and over-absorption of overheads are treated in Cost Accounts. (May 2010, Nov 2010, Nov 2014, Nov 2015, 3, 4, 4, 4 marks)

Answer:

There are varieties of methods used for over or under absorption of OHEs in the accounts. However in the corporate sector 3 important methods are widely used for accounting of over and under absorption of POHEs:

- Use of supplementary OH absorption rates.

- Write oft to costing P&L A/c.

- Carry over to the next period accounts.

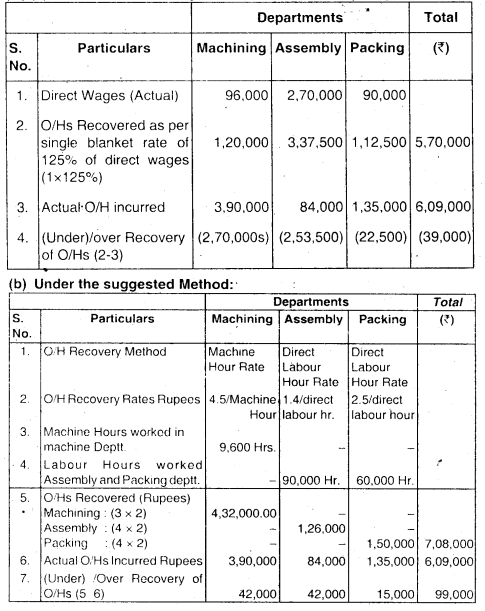

1. Use of supplementary OH absorption rates. :

This method is used when it is caused due to normal or avoidable reasons. When the amount of over & under absorbed POHEs is significant (i.e. more than 10% of total OH incurred), supplementary absorption rates are computed by way of addition or deduction. This rate may be called Negative Supplementary Rate if over absorbed amount is to be deducted, on the other hand, the supplementary rate may be called positive supplementary rate if under absorbed amount is to be added.

∴ Negative Supplementary Rate = \(\frac{\text { Over Absorbed POHEs }}{\text { Actual value of the Base output }}\)

And Positive Supplementary Rate = \(\frac{\text { Under absorbed POHEs }}{\text { Actual value of Base output }}\)

This method is preferred when:

- There are serious estimational errors.

- When there is a substantial change in the level of activities.

- When there is a major change in the production method.

- In case of contract on cost plus basis.

![]()

2. Write oft to costing P&L A/c. :

When the amount of over and under absorbed POHEs is not so significant, it may be written off to costing P&L A/c. But if it is significant (sizeable) and it arises due to:

- Some uncontrollable and abnormal factors.

- Estimation of output is contingent.

Then such over or under absorbed POHEs may be written off to costing P & L A/c. But it suffers from some limitation like it cannot he adjusted in the value of WIP, unsold stock or sold unit (it means pricing policy cannot be adjusted).

3. Carry over to the next period accounts.

This method is used when:

- Balance amount is comparatively small.

- In case of new product whose output is low in initial years due to lack of demand.

- Normal business cycle is of more than one accounting period.

Over under absorbed 0/H is carried over to next period in the hope that the same will automatically be adjusted or absOrbed. But under this method comparability of the performance is not properly feasible.

![]()

Question 22.

ABS Enterprises produces a product arid adopts the policy to recover factory overheads applying blanket rate based on machine hours. The cost records of the concern reveal following information:

Budgeted production overheads – ₹ 10,35,000

Budgeted machine hours – 90,000

Actual machine hours worked – 45,000

Actual production overheads – ₹ 8.80,000

Production overheads (actual) include —

Paid to worker as per court’s award – ₹ 50,000

Wages paid for strike period – ₹ 38,000

Stores written off – ₹ 22,000

Expenses of previous year booked in current year – ₹ 18,500

Production —

Finished goods – 30000 units

Sale of finished goods – 27000 units

The analysis of cost information reveals that 1/3 of the under absorption of overheads was due to defective production planning and the balance was attributable to increase in Costs.

You are required:

(i) To find out the amount of under absorbed production overheads.

(ii) To give the ways of treating it in Cost Accounts.

(iii) To apportion the under absorbed overheads over the items. (Nov 2019, 10 marks)

Answer:

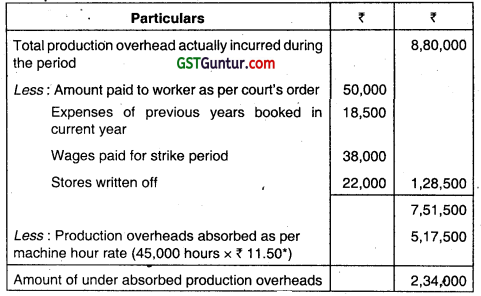

(i) Amount of Under Absorption of Production Overheads during the period:

Budgeted Machine hour rate (Blanket rate) = \(\frac{₹ 10,35,000}{90,000}\) = ₹ 11.50 per hour.

(ii) Accounting treatment of Under Absorbed Production Overheads:

(a) As. 1/3 of the under absorbed overheads were due to defective production polices, this being abnormal, hence should be debited to Costing Profit and Loss Account.

Amount to be debited to Costing (2,34,000 × 1/3)

Profit and Loss Account = ₹ 78,000

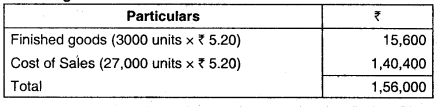

(b) Balance of under absorbed production overheads should be distributed over works in progress, Finished goods and cost of sales by applying supplementary rate:

Amount to be distributed = (₹ 2,34,000 × 2/3) = ₹ 1,56,000

Supplementary rate = \(\frac{₹ 1,56,000}{30,000 \text { units }}\) = ₹ 5.20 per unit

(iii) Apportionment of Under Absorbed Production Overheads over finished goods and Cost of Sales:

![]()

Question 23.

Why is the use of an overhead absorption rate based on direct labour hours generally preferable to a direct wages percentage rate for a labour incentive operation? (Nov 1995, 3 marks)

Answer:

A method of overhead absorption is considered appropriate if the total amount of overhead absorbed in a period does not fluctuate materially from the actual expenses incurred in the period direct wage % rate method do not posses the aforesaid feature. In other words, the O/H charged varies from period to period due to changes in direct wages.

In fact, O/H expenses are generally a function of time. Therefore, a time based O/H absorption rate method is always preferred over any other method. In the case of labour incentive operations. It is advisable to use labour hour method for O/H absorption.

![]()

Question 24.

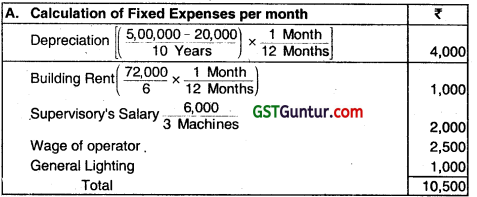

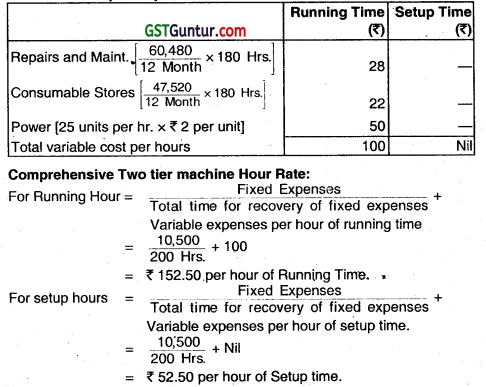

In a factory, a machine is considered to work for 208 hours In a month. It includes maintenance time of 8 hours and set up time of 20 hours.

The expense data relating to the machine are as under:

- Cost of the machine is ₹ 5,00,000. Life 10 years. Estimated scrap value at the end of life is ₹ 20,000.

- Repairs and maintenance per annum – ₹ 60,480

- Consumable stores per annum – ₹ 47,520

- Rent of building per annum (The machine under reference occupies 1/6 of the area) – ₹ 72,000

- Supervisor’s salary per month (Common to three machines) – ₹ 6,000

- Wages of operator per month per machine – ₹ 2,500

- General lighting charges per month allocated to the machine – ₹ 1,000

- Power 25 units per hour at ₹ 2 per unit.

Power is required for productive purposes only. Set up time, though productive, does not require power. The Supervisor and Operator are permanent. Repairs and maintenance and consumable stores vary with the running of the Machine.

Required:

Calculate a two-tier machine hour rate for (a) set up time and (b) running time. (May 2002, 8 marks)

Answer:

Calculation of Two tier Machine Hour Rate:

B. Effective Hour per month of the machine for recovery of fixed expenses

= 208 Hrs. – 8 Hrs.200 Hrs.

C. Effective Hrs per month of the machine for recovery of expenses = 208 Hrs. – 8 Hrs. – 20 Hrs. 180 Hrs.

D. Variable Expense per Hours:

![]()

Question 25.

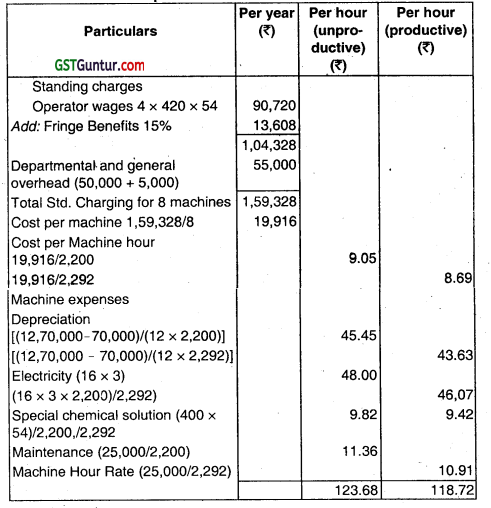

A manufacturing unit has purchased and installed a new machine of ₹ 12,70000 to its fleet of 7 existing machines. The new machine has an estimated life of 12 years and i expected to realise ₹ 70.000 as scrap at the end of its working life. Other relevant data are as follows:

- Budgeted working hours are 2,592 based on 8 hours per day for 324 days. This includes 300 hours for plant maintenance and 92 hours for setting up of plant.

- Estimated cost of maintenance of the machine is ₹ 25,00C’ (p.a.).

- The machine require a special chemical solution, which is replaced at the end of each week (6 days in a week) at a cost of 400 each time.

- Four operators control operation of 8 machines and the average wages per person amounts to ₹ 420 per week plus 15% fringe benefits.

- Electricity used by th machine during the production is 16 units per hour at a cost of ₹ 3 per unit. No current is taken during maintenance and setting up.

- Departmental, and general works overhead allocated to the operation during last year was 50,000. During the current year it is estimated to increase 10% of this amount.

Calculate machine hour rate, it (a) setting up time is unproductive; (b) setting up time is productive. (May 2005, 2 + 3 = 5 marks)

Answer:

Computation of Machine hour Rate

Working Notes:

Computation of Machine hours:

(ì) Setting time (unproductive) = 2,592 – 300 – 92 = 2,200 hrs.

(ii) Setting time (productive) = 2,592 – 300 = 2,292 hrs.

![]()

Question 26.

From the details furnished below you are required to compute a comprehensive machine-hour rate:

Original purchase price of the machine (subject to depreciation at 10% per annum on original cost) – ₹ 3,24,000

Normal working hours for the month (The machine works to only 75% of capacity) – 200 hours

Wages of Machine man – ₹ 125 per day (of 8 hours)

Wages for a Helper (Machine attendant) – ₹ 75 per day (of 8 hours)

Power cost f o the month for the time worked – ₹ 15,000

Supervision charges apportioned for the machine centre for the month – ₹ 3,000

Electricity and Lighting for the month – ₹ 7,500

Repairs and maintenance (machine) induding consumable stores per month – ₹ 17,500

Insurance of Plant and Building (apportioned) for the year – ₹ 16,250

Other general expenses per annum – ₹ 27,500

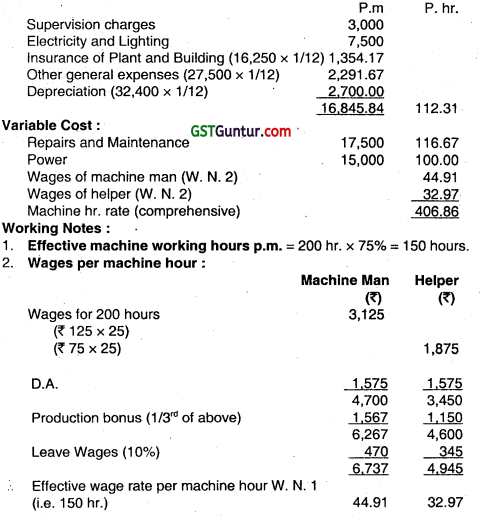

The workers are paid a fixed dearness allowance of ₹ 1,575 per month. Production bonus payable to workers in terms of an award is equal to 33.33% of basic wages and dearness allowance. Add 10% of the basic wage and dearness allowance against leave wages and holidays with pay to arrive at a comprehensive labour-wage for debit to production. (Nov 2005, 14 marks)

Answer:

Statement Showing Comprehensive MachIne Hour Rate

![]()

Question 27.

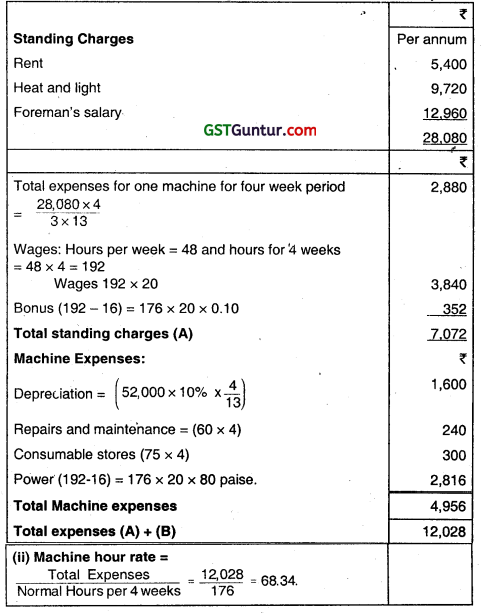

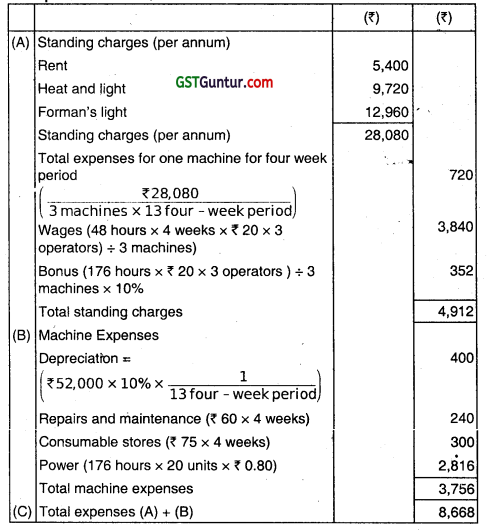

A machine shop cost centre contains three machines of equal capacities. Three operators are employed on each machine, payable 20 per hour each. The factory works for forty- eight hours in a week which includes 4 hours setup time. The work is jointly done by operators. The operators are paid fully for the forty-eight hours. In additions they are paid a bonus of 10 per cent of productive time. Costs are reported for this company on the basis of thirteen four-weekly period.

The company for the purpose of computing machine hour rate includes the direct wages of the operator and also recoups the factory overheads allocated to the machines. The following details of factory overheads applicable to the cost centre are available:

- Depreciation 10% per annum on original cost of the machine. Original cost of the each machine is 52000

- Maintenance and repairs per week per machine is ₹ 60.

- Consumable stores per week per machine are ₹ 75.

- Power: 20 units per hour per machine at the rate of 80 paise per unit.

- Apportionment to the cost centre: Rent per annum ₹ 5,400, Heat and Light per annum ₹ 9,720. and foreman’s salary per annum ₹ 12,960.

Required:

(i) Calculate the cost of running one machine for a four week period.

(ii) Calculate machine hour rate. (Nov 2007, 7+1 = 8 marks)

Answer:

(i) Computation of cost of running one machine for a four week period

![]()

Question 28.

You are given the following information of the three machines of a manufacturing department of X Ltd.:

There are 12 holidays besides Sundays in the year, of which two were on Saturdays. The manufacturing department works 8 hours in a day but Saturdays are half days. All machines work at 90% capacity throughout the year and 2% is reasonable for breakdown.

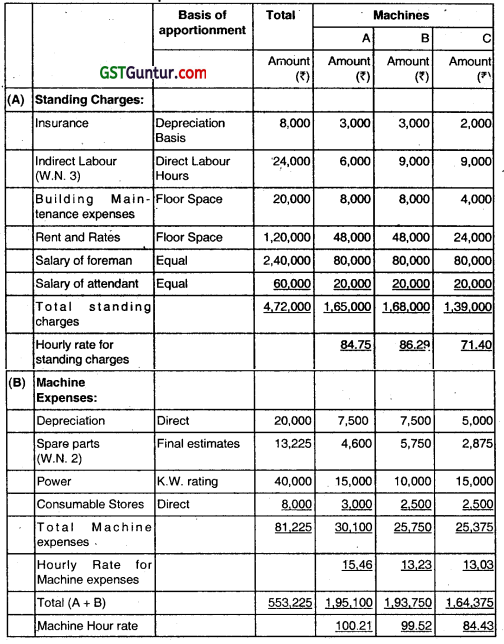

You are required to:

Calculate predetermined machine hour rates for the above machines after taking into consideration the following factors:

- An increase of 15% in the price of spare parts:

- An increase of 25% in the consumption of spare parts for machine ‘B’ & ‘C’ only.

- 20% general increase in wages rates. (May 2011, 8 marks)

Answer:

Computation of Machine Hour Rate

![]()

Working Notes:

1. Calculation of effective working hours:

No. of holidays 52 (Sundays) + 12 (other holidays) = 64

Saturday (52 – 2) = 50

No. of days (Work full time) = 365 – 64 – 50 = 251

4. Interest on capital outlay is a financial matter and therefore it hes been excluded from the cost accounts.

![]()

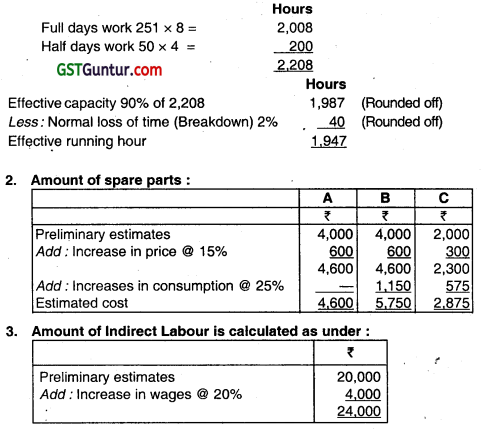

Question 29.

A machine costing ₹ 10 lacs was purchased on 1-4-2011. The expected life of the machine is 10 years. At the end of this period Its scrap value is likely to be ₹ 101000. The total cost of all the machines including new one was ₹ 90 lacs.

The other information is given as follows:

(i) Working hours of the machine for the year was 4,200 including 200 non-productive hours.

(ii) Repairs and maintenance for the new machine during the year was ₹ 5,000.

(iii) Insurance Premium was paid for all the machine ₹ 9,000.

(iv) New machine consumes 8 units of electricity per hour, the rate per unit being ₹ 3.75.

(v) The new machine occupies \(\frac{1}{10}\) area of the department. Rent of the department is ₹ 2,400 per month.

(vi) Depreciation is charged on straight line basis.

Compute machine hour rate for the new machine. (May 2012, 5 marks)

Answer:

Computation of machine hour rate of new Machine

![]()

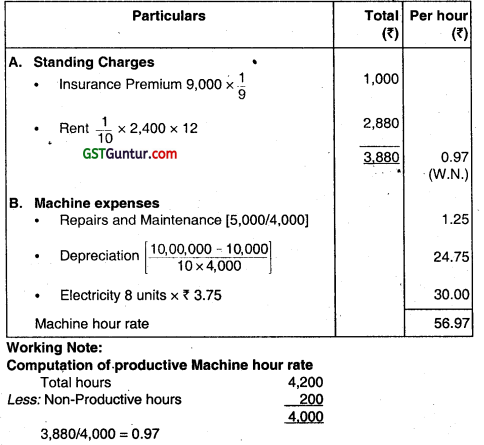

Question 30.

Calculate Machine Hour Rate from the following particulars:

Cost of Machine – ₹ 25,00,000

Salvage Value – ₹ 1,25,000

Estimated lite of the machine – ₹ 25,000 Hours

Working Hours (per annum) – ₹ 3,000 Hours

Hours required for maintenance – 400 Hours

Setting – up time required – 8% of actual working hours

Additional Information:

(i) Power 25 units @ ₹ 5 per unit per hour.

(ii) Cost of repairs and maintenance ₹ 26,000 per annum.

(lii) Chemicals required for Operating the machine ₹ 2,600 per month.

(iv) Overheads chargeable to the machine ₹ 18,000 per month.

(V) Insurance Premium (per annum) 2% of the cost of machine.

(vi) No. of operators – 02 (looking after three other machines also).

(vii) Salary per operator per month ₹ 18,500. (Nov 2013, 8 marks)

Answer:

Assumptions:

- Working hours (i.e.3,000 hours) are inclusive of maintenance and setting-up time.

- It is assumed that no power is consumed by the machine during unproductive hours i.e. during maintenance and unproductive setting-up hours.

- Depreciation is calculated on the basis of estimated life of the machine hours. Hence per unit machine hour rate of depreciation will be same.

![]()

Question 31.

A machine shop cost centre contains three machines of equal capacities. Three operators are employed on each machine, payable ₹ 20 per hour each. The factory works for 48 hours in a week which includes 4 hours set up time. The work is jointly done by operators. The operators are paid fully for the 48 hours. In addition, they are also paid a bonus of 10% of productive time. Costs are reported for this company on the basis of thirteen, four-weekly period.

The company, for the purpose of computing machine hour rate includes the direct wages of the operator and also recoups the factory overheads allocated to the machines. The following details of factory overheads applicable to the cost centres are available:

Original Cost of each machine – ₹ 52,000

Depreciation on the original cost of the machine – 10% p.a.

Maintenance and Repair per week per machine – ₹ 60

Consumable Stores per week per machine – ₹ 75

Power: 20 units per hour per machine – 80 paise per unit

Apportionment to the cost centre:

Rent per annum – ₹ 5,400

Heat and Light per annum – ₹ 9,720

Foreman’s Salary per annum – ₹ 12,960

Calculate:

(i) the cost of running one machine for a four week period.

(ii) machine hour rate. (May 2015, 8 marks)

Answer:

Effective Machine hour for four-week period

= Total working hours – unproductive set-up time

= {(48 hours × 4 weeks) – {(4 hours × 4 weeks))

= (192 – 16)hours)

= 176 hours.

![]()

(i) Computation of cost of running one machine for a four week period

(ii) Machine hour rate = \(\frac{₹ 8,668}{176 \text { hours }}\) = ₹ 49.25 If we assume that there are three different operators for three machines i.e. 9 operators. in that case Wages will be ₹ 11.520 (48 hours × 4 weeks × ₹ 20 × 3 operetors), Bonus will be ₹ 1,056 (176 hours × ₹ 20 × 3 operators × 10%) and accordingly the Machine hour rate will be \(\frac{₹ 17,052}{176 \text { hours }}\) = ₹ 96.89

![]()

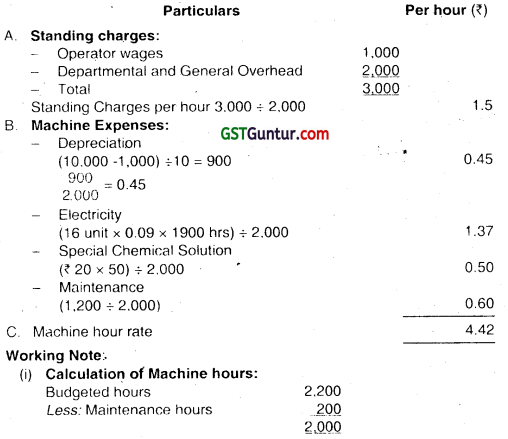

Question 31.

The following particulars refers to process used in the treatment of material subsequently, incorporated in a component forming part of an electrical appliance:

(i) The original cost of the machine used (Purchased in June 2008) was 10,000. Its estimated life is 10 years, the estimated scrap value at the end of its life is ₹ 1,000, and the estimated working time per year (50 weeks of 44 hours) is 2200 hours of which machine maintenance etc., is estimated to take up 200 hours.

No other loss of working time expected, setting up time, estimated at 100 hours, is regarded as productive time. (Holiday to be ignored).

(ii) Electricity used by the machine during production is 16 units per hour at cost of a 9 paisa per unit. No current is taken during maintenance or setting up.

(iii) The machine required a chemical solution which is replaced at the end of week at a cost of ₹ 20 each time.

(iv) The estimated cost of maintenance per year is ₹ 1,200.

(v) two attendants control the operation of machine together with five other identical machines. Their combined weekly wages. insurance and the employer s contribution to holiday pay amount ₹ 120

(vi) Departmental and general works overhead allocated to this machine for the current year amount to ₹ 2.000.

You are required to calculate the machine hour rate ot operating the machine. (May 2016, 5 marks)

Answer:

Statement Showing the Computation of Machine Hour Rate:

![]()

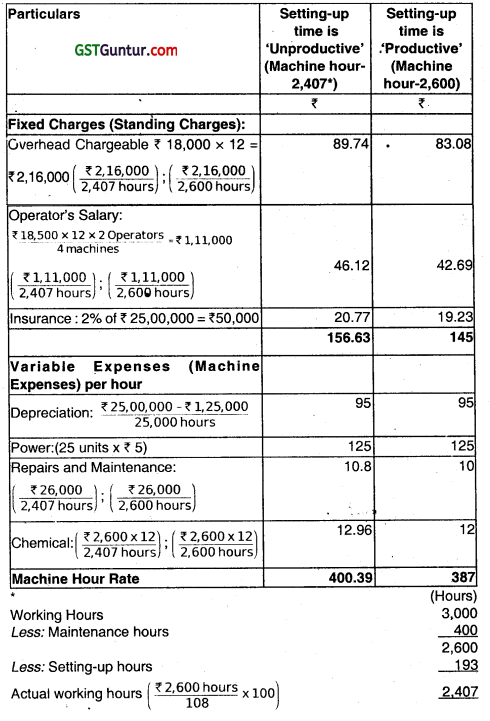

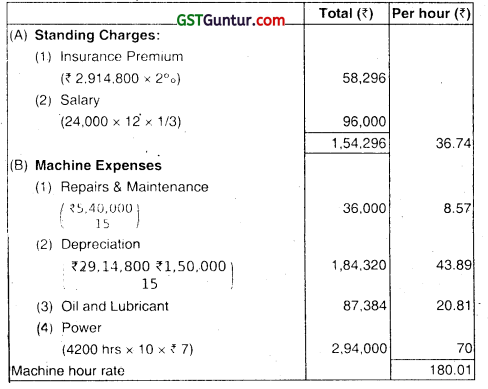

Question 32.

M/s. Zaina Private Limited has purchased a machine costing ₹ 29,14,800 and it is expected to have a salvage value of ₹ 1,50,000-at the end of its effective life of 15 years. Ordinarily the machine is expected to run for 4500 hours per annum but it is estimated that 300 hours per annum will be lost for normal repair & maintenance. The other details in respect of the machine are as follows:

(i) Repair & Maintenance during the whole life of the machine are expected to be ₹ 5,40,000.

(ii) Insurance premium (per annum) 2% of the cost of the machine.

(iii) Oil and Lubricants required tor operating the machine (per annum) ₹ 87,384

(iv) Power consumptions: 10 units per hour @ ₹ 7 per unit. No power consumption during repair and maintenance.

(v) Salary to operator per month ₹ 24,000. The operator devotes one third of his time to the machine.

You are required to calculate comprehensive machine hour rate. (May 2019, 5 marks)

Answer:

Calculation of Comprehensive Machine hour rate:

Working Note:

Calculation of Productive Machine hour rate:

Total hours = 4.500 (-) 300

= 4,200 hrs

![]()

Question 33.

Answer the following:

A machine shop has 8 identical machines manned by 6 operators The machine cannot work without an operator wholly engaged on it. The original cost of all the 8 machines works Out to ₹ 32,00,000. The following particulars are furnished for a six months period:

Normal available hours per month per operator – 208

Absenteeism (without pay) hours per operator – 18

Leave (with pay) hours per operator – 20

Normal unavoidable idle time – hours per operator – 10

Average rate of wages per day of 8 hours per operator – ₹ 100

Production bonus estimated – 10% on wages

Power consumed – ₹ 40,250

Supervision aid Indirect Labour – ₹ 16,500

Lighting and Electricity – ₹ 6,000

The following particulars are given for a year:

Insurance – ₹ 3,60,000

Sundry work Expenses – ₹ 50,000

Management Expenses allocated – ₹ 5,00,000

Depretation 100/0 on the original cost

Repairs and Maintenance (including consumables): 5% of the value of all the machines

Prepare a statement showing the comprehensive machine hour rate for the machine shop. (Jan 2021, 5 marks)

![]()

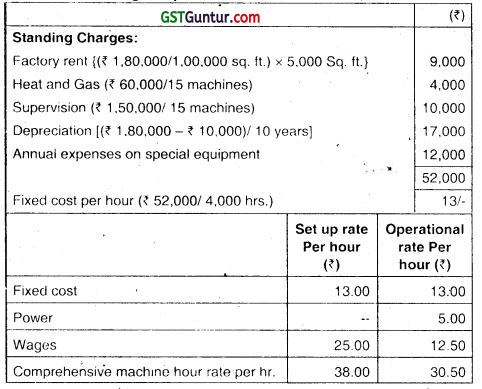

Question 34.

Sree Abet Ltd havtng fifteen different types of automatic machines furnishes information as under tor 2018-2019

(i) Overhead expenses Factory rent ₹ 1,80,000 (Floor area 1,00,000 sq ft), Heat and gas 60,000 and supervision 1 ,50,000.

(ii) Wages of the operator are ₹ 200 per day of 8 hours. Operator attends to one machine when it is under set up and two machines while they are under operation.

In respect of machine B (one of the above machines) the following particulars are furnished:

- Cost of machine ₹ 1,80,000, Lite of machine- 10 years and scrap value at the end of its life ₹ 10,000

- Annual expenses on special equipment attached to the machine are estimated as ₹ 12,000

- Estimated operation time of the machine is 3,600 hours while set up time is 400 hours per annum

- The machine occupies 5.000 sq. ft. of floor area.

- Power costs ₹ 5 per hour while machine s in operation.

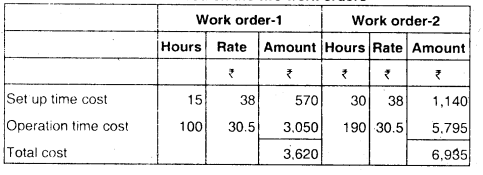

ESTIMATE the comprehensive machine hour rate of machine B. Also find out machine costs to be absorbed in respect of use of machine B on the following two work orders

| Work order-1 | Work order-2 | |

| Machine set up time (Hours) | 15 | 30 |

| Machine operation time (Hours) | 100 | 190 |

Answer:

Sree Ajeet Ltd.

Statement showing comprehensive machine hour rate of Machine B

Statement of ‘B’ machine costs to be absorbed on the two work orders

![]()

Question 35.

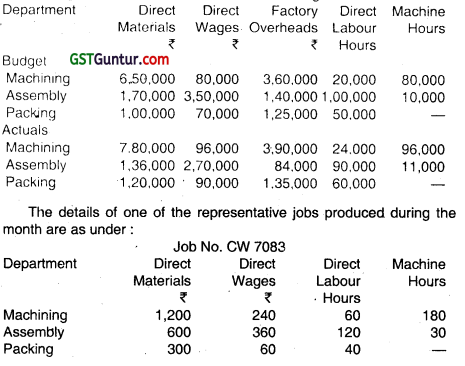

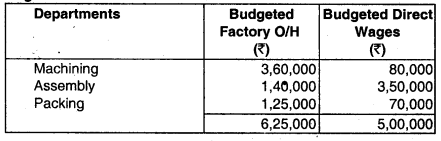

A factory has three production departments. The policy of the factory is to recover the production overheads of the entire factory by adopting a single blanket rate based on the percentage of total factory overheads to total factory wages. The relevant data for a month are given below:

The factory adds 30% on the factory cost to cover administration and selling overheads and profit.

Required:

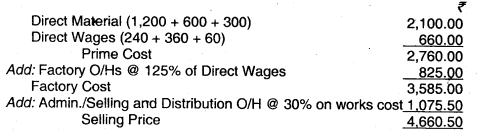

(i) Calculate the overhead absorption rate as per the current policy of the company and determine the selling price of the Job No. CW 7083.

(ii) Suggest any suitable alternative method(s) of absorption of the factory overheads and calculate the overhead recovery rates based on the method(s) so recommended by you.

(iii) Determine the selling price of Job CW 7083 based on the overhead application rates calculated in (ii) above.

(iv) Calculate the department wise and total under or over recovery of overheads based on the companys current policy and the method(s) recommended by you. (Nov 1994, 16 marks)

Answer:

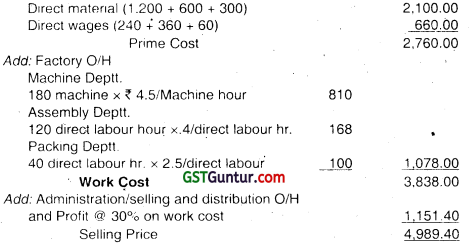

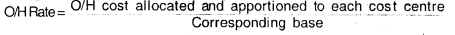

(i) Calculation of 0/H Recovery Rates as per the current policy i.e. single blanket rate based on % of factory 01H to total factory wages:

Blanket O/H Recovery Rate:

= \(\frac{\text { Total OHs (Budgeted) }}{\text { Total Direct Wages (Budgeted) }}\) × 100

= \(\frac{6,25,000}{5,00,000}\) × 100 = 125% on Direct Wages

Selling Price of Job No. CW 7083:

![]()

(ii) Machining Deptt.

Since, machine is a pre-dominant factor of production in this deptt, hence machine rate should be used to recover O/Hs:

Machine Hours Rate = \(\frac{\text { Budgeted Factory } \mathrm{O} / \mathrm{Hs}}{\text { Budgeted Machine } \mathrm{Hr} .}\)

= \(\frac{3,60,000}{80,000 \mathrm{Hr}}\) = ₹ 4.5/Machine hour

Assembly Deptt.:

Direct labour being the predominant factor of production in this deptt, hence direct labour hour rate should be used to recover O/Hs.

Direct Labour Hour rate = \(\frac{\text { Budgeted Factory O} / \mathrm{Hs}}{\text { Budgeted Direct Labour Hr. }}\)

= \(\frac{1,40,000}{1,00,000 \mathrm{Hrs}}\) = ₹ 1.4 pre direct labour hrs.

Packing Deptt:

Here also labour is the most important factor of production. Direct labour hour rate should be used to recovery the overheads in this deptt.

Direct labour Hour rate = \(\frac{\text { Budgeted Factory } \mathrm{O} / \mathrm{H}}{\text { Budgeted direct labour hour }}\)

= \(\frac{1,25,000}{50,000 \mathrm{Hr}}\)

= ₹ 2.5 per direct labour hour.

(iii) Selling Price of Job no. CW 7083 on the basis of O/H recovery rates recommended in pt. (ii) above:

(iv) (a) Under/Over Recovery of O/Hs under current policy:

![]()

Question 36.

Single and Multiple Overhead Rates. (Nov 2000, 4 marks)

Answer

Single O/H Rate –

Is also known as “Blanket or “Plant wide OH absorption Rate It is calculated as under:

Blanket rate = \(\frac{\text { OH cost for the entire factory }}{\text { Total quantity of the base selected }}\)

This method is used when the size of the company is small or when the burden of O/H is more or less uniform among all the production deptts. These ratio are easy to compute and require clerical cost but have a very limited use. The limitations of such rates are as under.

- Such rates may give misleading results where several product are manufactured and are required to be passed through various production departments.

- As the performance of the individual deptt. cannot be assessed properly with this rate, so no satisfactory managerial control is possible.

- Such rate may render the valuation of WIP erroneous.

- Multiple OH Rate: When different rates are computed for each producing department service department cost centre, each product or product line, each production factor and for fixed OH , variable OH then they are known as multiples rates. It is calculated as under:

![]()

Question 37.

Explain Blanket overhead rate. (Nov 2007, 2 marks)

Answer

Blanket OH Rate: Is also known as “Single” or “Planf ‘Wide OH absorption Rate”.

Blanket rate = \(\frac{\mathrm{OH} \text { cost for the entire factory }}{\text { Total quantity of the base selected }}\)

This method is used when the size of the company is small or when the burden of O/H is more or less uniform among all the production deptts.

These rates are easy to compute and require clerical cost but have a very limited use. The limitations of such rates are as under.

- Such rates may give misleading results where several products are manufactured and are required to be passed through various production departments.

- As the performance of the individual deptt. cannot be assessed properly with this rate, so no satisfactory managerial control is possible.

- Such rate may render the valuation of WIP erroneous.

![]()

Question 38.

Answer the following:

Explain Blanket Overhead Rate and Departmental Overhead Rate. How they are calculated? State the conditions required for the application of Blanket Overhead Rate. (Jan 2021, 5 marks)

Question 39.

Discuss the treatment of Under-absorbed and Over-absorbed overheads in Cost Accounting. (May 2006, 6 marks)

Answer:

There are varieties of methods used for over or under absorption of OHEs in the accounts. However in the corporate sector 3 important method are widely used for accounting of over and under absorption of POHEs

- Use of supplementary OH absorption rates.

- Write off to costing P&L A/c

- Carry over to the next period accounts.

1. Use of Supplementary OH Absorption Rates: This method is used when it is caused due to normal or avoidable reasons. When the amount of over and under absorbed POHEs is significant (i.e. more than 10% of total OH incurred), supplementary absorption rates are computed by way of addition or deduction. This rate may be called Negative SuppIementay Rate if over absorbed amount is to be deducted, on the other hand, the supplementary rate may be called positive supplementary rate if under absorbed amount is to be added,

This method is preferred when:

- There is a serious estimational errors.

- When there is a substantial change In the level of activities.

- When there is a major change m the production method.

- In case of contract on cost plus basis.

![]()

2. Writing off to Costing PSI A/c.: When the amount of over and under absorbed POHEs is not so significant, it may be written oft to costing

P&L A/c. But if it Is significant (sizeable) and it arises due to:

- Some uncontrollable and abnormal factors.

- Estimation of Output is contingent.

Then such over or under absorbed POHEs may be written off to costing P & L A/c. But it suffers from some limitation like it cannot be adjusted in the value of WIP, unsold stock or sold unit (it means pricing policy cannot be adjusted).

3. Carry-forward to next Periods Accounts: This method is used when:

- Balance amount is comparatively small.

- In case of new product whose output is low in initial years due to lack of demand.

- Normal business cycle is of more than one accounting period.

Over under absorbed O/H is carried over to next period in the hope that the same will automatically be adjusted or absorbed.

![]()

Question 40.

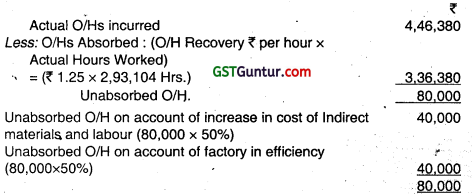

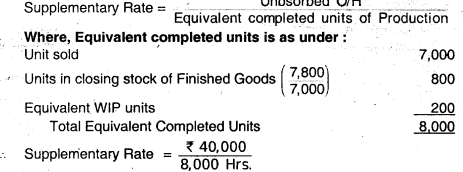

The total overhead expenses of a factory are ₹ 4,46,380. Taking into account the normal working of the factory, overhead was recovered in production at ₹ 1.25 per hour. The actual hours worked were 2,93,104. How would you proceed to close the books of accounts, assuming that besides 7,800 units produced of which 7,000 were sold, there were 200 equivalent unit in work-inprogress?

On investigation. it was found that 50% of the unabsorbed overhead was on account of increase in the cost of indirect materials and indirect labour and the remaining 50% was due to factory inefficiency. Also give the profit implication of the method suggested. (Nov 2000, 6 marks)

Answer:

Calculation of Unabsorbed Overheads:

t$U.UUL)

Treatment of Unabsorbed O/H and Its Implication on Profit:

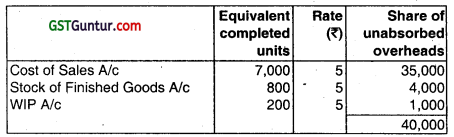

(i) The unabsorbed O/H on account of increase in cost of Indirect material and Labour of ₹ 40,000 should be adjusted in the cost books by applying Positive Supplementary Rates.

= ₹ 5 per equivalent completed units

The unabsorbed O/H of ₹ 40,000 should be applied by using supplementary Rate of ₹ 5 per equivalent completed unit proportionately on the basis of-equivalent completed unit among Cost of Sales A/c, Stock of Finished Goods A/c, and WIP A/c as under:

The above treatment of unabsorbed O/H will reduce the Profit by ₹ 35,000, the amount by which the cost of sales has been increased. More over, the value of stock of Finished Goods and WIP will increase by ₹ 4,000 and 1,000 respectively.

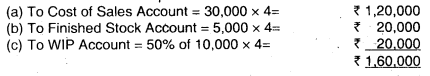

(ii) The unabsorbed O/H of ₹ 40,000 dueto factory in efficiency being in the nature of abnormal loss should be charged to costing P/L A/c and thereby the profit wouLd be reduced by ₹ 40,000.

![]()

Question 41.

Explain briefly the conditions when supplementary rates are used. (May 2007, 2 marks)

Answer:

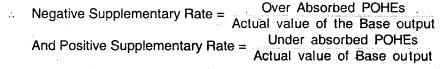

Use of Supplementary OH Absorption Rates: This method is used when it is caused due to normal or avoidable reasons. When the amount of over and under absorbed POHEs is significant (i.e. more than 10% of total O/H incurred), supplementary absorption rates are computed by way of addition or deduction. This rate may be called Negative supplementary rate if over absorbed amount is to be deducted. On the other hand, the supplementary rate may be called positive supplementary rate if under absorbed amount is to be added, therefore,

Negative Supplementary Rate = \(\frac{\text { Over Absorbed POHEs }}{\text { Actual value of the Base output }}\)

Positive Supplementary Rate = \(\frac{\text { Under absorbed POHEs }}{\text { Actual value of Base output }}\)

This method is preferred when:

- There is a serious estimational errors.

- When there is a substantial change in the level of activities.

- When there is a major change in the production method.

- In case of contract on cost plus basis.

![]()

Question 42.

X Ltd. recovers overheads at a pre-determined rate of ₹ 50 per man-day. The total factory overheads incurred and the man-days actually worked were ₹ 79 lakhs and 1 .5 lakhs days respectively. During the period 30,000 units were sold. At the end of the period 5,000 completed units were held in stock but there was no opening stock of finished goods. Similarly, there was no stock of uncompleted units at the beginning of the period but at the end of the period there were 10,000 uncompleted units which may be treated as 50% complete.

On analyzing the reasons, it was found that 60% of the unabsorbed overheads were due to defective planning and the balance were attributable to increase in overhead cost.

How would unabsorbed overheads be treated in cost accounts? (Nov 2011, 8 marks)

Answer:

Absorbed overheads = Actual Man days × Rate/day

= 1,50,000 × 50

= ₹ 75,00,000

Under absorption of overheads = Actual overheads – Absorbed overheads

= 79,00,000 – 75,00,000

= ₹ 4,00,000

Reasons for under-absorption: .

1. Defective Planning 4,00,000 × 60% = ₹ 2,40,000

2. Increase in overhead cost 4,00,000 × 40% = ₹ 1,60,000 .

Treatment in Cost Accounts:

(i) The unabsorbed overheads of ₹ 2,40,000 on account of defective planning to be treated as abnormal and thus be charged to Costing Profit and Loss account.

(ii) The balance of unabsorbed overheads i.e. 1,60,000 be charged as below on the basis of supplementary overhead absorption rate

Supplementary Rate = ₹ 1,60,000/ (30,000 + 5,000 + 50% of 10,000)

= ₹ 4 per unit

![]()

Question 43.

The budgeted expenses for the year are as follows:

Direct Material – ₹ 9,000

Direct Wages @ 10 per hour – ₹ 20,000

Direct Expenses – ₹ 1000

Works Overheads – ₹ 5,000

Administration Overheads – ₹ 3,500

Work overheads are charged at labour hour rate and admnistration overheads are charged as a percentage on work cost.

The details of Job are as follows:

Direct Materials – ₹ 2,250

Direct Wanes – ₹ 5,000

Direct Expenses – ₹ 250

Calculate:

(a) Calculate rate of absorption of administration overheads.

(b) What price should be charged to job so as to earn 1/6th profit on sales.

Answer:

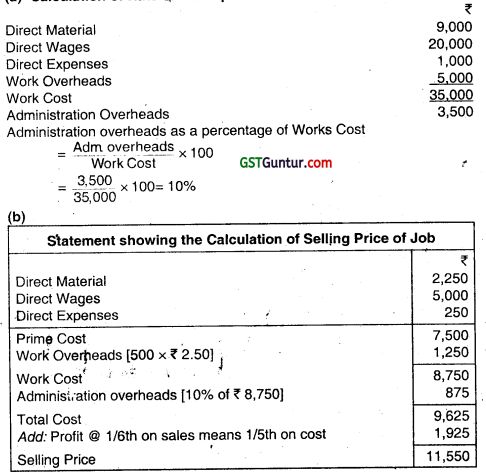

(a) Calculation of Rate of Absorption of Administration Overheads

Working Notes:

(i) Direct Labour hours = \(\frac{\text { Direct Wages }}{\text { Rate of hourly wages }}\)

= \(\frac{₹ 20,000}{₹ 10}\) = 2,000 labour hours

(ii) Rate of absorption of Works Overheads = \(\frac{\text { Work overheads }}{\text { Direçt labour hours }}\)

= \(\frac{75,000}{2,000}\)

= ₹ 2,50 per labour hour

![]()

Question 44.

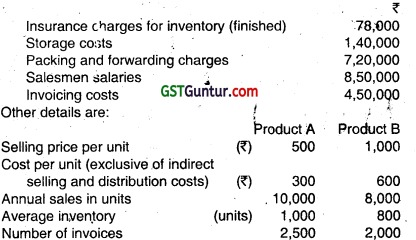

A company is making a study of the relative profitability of the two products – A and B. In addition to direct costs, indirect selling and distribution costs to be allocated between the two products are as under: (May 1996)

One unit of product A requires a storage space twice as much as product B. The cost to pack and forward one unit is the same for both the products. Salesmen are paid salary plus commission @ 5% on sales and equal amount of efforts are put forth on the sales of each of the products.

Required:

(i) Set up a schedule showing the apportionment of the indirect selling and distribution costs between the two products. (7 marks)

(ii) Prepare a statement showing the relative profitability of the two products. (3 marks)

Answer:

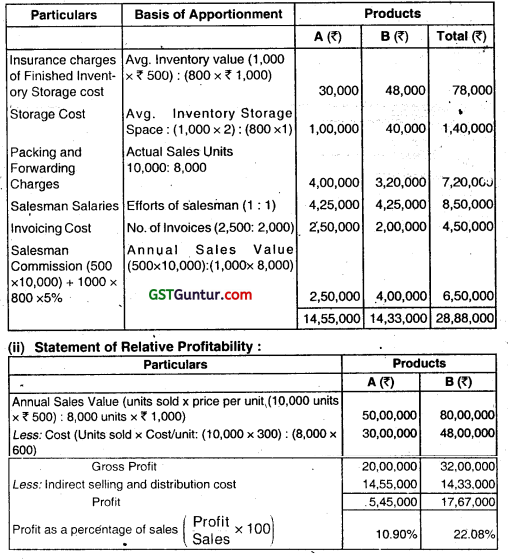

(i) Statement of apportionment of Indirect selling and distribution cost:

![]()

Question 45.

Discuss the accounting of Selling and Distribution overheads. (May 2006, 4 marks)

Answer:

CIMA England defines selling cost as “the cost seeking to create and stimulate demand and of securing order”.

and

Distribution cost as “The cost of the sequence of operation which begins with making the packed product available for dispatch and ends with making the reconditioned returned empty package, if any, availbIe4or reuse.”

Accounting Treatment:

Selling and distribution OHE’s are recovered either on the basis of products or channels of distribution or y territories or zones or by any other means. It is a very crucial decision what type of expenses relating to selling and distribution is recovered on what basis?

Since S & DOH are incurred for the benefit of many cost centres so a suitable base it to be established for apportiOning it to the various cost centres.

for e.g.

- Direct selling expenses: Apportioned on the basis of sales revenue.

- Cost of storage: Apportioned on the basis of sales volume, or size or weight, etc.

- Advertisement and sales promotion: Apportioned on the basis of sales value or volume.

- Transportation cost: Apportioned on the basis of sales volume, or weight or distance, or weight-distance.

- Credit collection cost: Apportioned on the basis of credit sale or no of invoices. etc.

After the allocation and apportionment they are absorbed on the basis of either the sales revenue or on the basis of sales volume.

![]()

Question 46.

How would you treat (tie idle capacity costs in Cost Accounts? (Nov 2001, 4 marks)

OR

How would you account for idle capacity cost in Cost Accounting? (Nov 2015, 4 marks)

Answer:

Idle Capacity Cost:

Idle capacity is that part of capacity of a plant, machine or equipment which cannot be used due to different reasons which may be avoidable or unavoidable. it is the difference between practical capacity and capacity based on sales expectancy.

Accounting for Idle Capacity in Cost Accounting:

Normal idle capacity cost cannot be avoided and it should be absorbed in cost by inflating the rate. But if it is due to un-avoidable reasons, it may be charged to Profit and Loss Account.

![]()

Question 47.

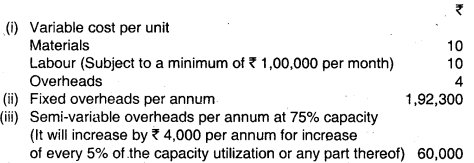

A Manufacturing Company has an installed capacity of 1,50,000 units per annum, Its cost structure is given below:

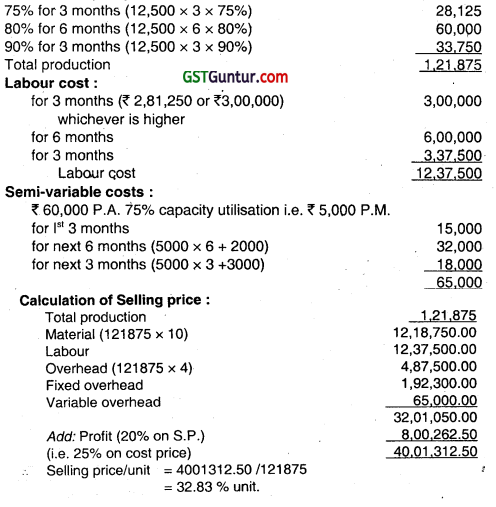

The capacity utilization for the next year is budgeted at 75% for first three months, 80% for the next six months and 90% for the remaining three months.

Required:

If the company is planning to have a profit of 20% on the selling price, calculate the selling price per unit for the next year. (Nov 2006, 10 marks)

Answer

Installed capacity 1,50,000 units per annum.

Per month capacity 1,50,000 ÷ 12 = 12,500 units

![]()

Question 48.

A machinery was purchased from a manufacturer who claimed that his machine could produce 36.5 tonnes in a year consisting of 365 days. Holidays, break-down. etc., were normally allowed in the factory for 65 days. Sales were expected to be 25 tonnes during the year and the plant actually produced 25.2 tonnes during the year. You are required to state the following figures:

(a) rated capacity

(b) practical capacity

(c) normal capacity

(d) actual capacity (Nov 2008, 2 marks)

Answer:

Rated Capacity:

(a) Rated capacity or ideal capacity is the maximum number of operating hours that could be available ignoring the stoppages due to down time, repairs, etc. .

Therefore, as per the information provided in the question, Rated capacity = 36.5 tonnes.

(b) Practical Capacity:

This measure represents the maximum level at which a company can realistically operate at full efficiency. This allows for unavoidable operating interruptions which means that practical capacity is less than ideal capacity.

Therefore,

Number of working days in a year = 365 – 65 = 300 days

Practical capacity = \(\frac{36.5 \times 300}{365}\) = 30 tonnes.

(c) Normal Capacity:

It is the rate of activity needed to meet average sales demand over a period that is sufficiently long to cover seasonal, cyclical and trend variations in the pattern of demand for company’s products.

It is the capacity of a plant.

Therefore, in the given question, normal capacity is 25 tonnes. utilised based on sales expectancy.

(d) Actual Capacity:

Actual capacity represents the actual activity which hàs’been performed like. It refers to capacity actually achieved.

Actual Capacity = 25.2 tonnes.

![]()

Question 49.

How do you deal with the following in Cost Accounts? Research and Development Expenses (Nov 2002, 2 marks)

OR

Discuss the treatment of research and development expenditures in cost accounting. (May 2005, 3 marks)

Answer:

Research and Development Cost: R&D expenditures is a differed expenditure because it is incurred not for benefitting a certain period, but for benefitting several accounting periods. Such expenditure is incurred for innovating a new product or improving the existing product or developing new methods of production.

Research Cost:

Research cost are incurred under 2 heads:

- Basic research cost which is incurred for improving the existing scientific and/or technical knowledge.

- Applied research cost applied research is done for the purpose of achieving some particular practical motto or objectives.

Treatment in Cost A/c’s:

1. Basic Research Cost: It should be treated as prod. OH for a particular period and absorb it in product cost, Because ills related to all existing products or methods or techniques of production etc.

2. Applied Research Cost: It is further classified into 2 parts for the costing purpose. They are:

- If it is incurred for the improvement of the existing product and methods of production it should be treated as POH and absorbed accordingly.

- If it is incurred for innovating new products or methods then such cost is absorbed on the basis of amortisation.

If whole of such expenditure is so huge, then it should be absorbed in subsequent years in which some benefit is received by the producer.

If applied research work becomes a failure, then such research expenditure is charged against profit in costing P&L A/c.

If size of such amount is heavy, then such amount is speared over in subsequent year also.

3. Development Cost: Development cost is the cost incurred during the implementation of the decision to produce a new product or improved new products or use new or improved methods.

Treatment of Development Cost: Cost incurred for development is treated similar as the treatment of applied research cost.

![]()

Question 50.

How do you deal with the following in Cost Accounts?

Bad debts (Nov 1999, 2 marks)

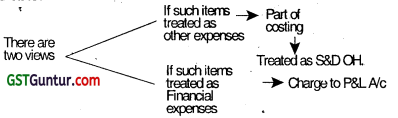

Answer:

Bad Debts:

If any bad debt arises due to exceptional circumstances, then such expenses are excluded from cost A/c and charged to P&L A/c.

Question 51.

Explain:

(i) Research and Development Costs

(ii) Training Costs. (Nov 2000, 4 marks)

Answer:

(ii) Training Expenses:

If labour turnover rate is very high (i.e. abnormally high) training cost in such case will also be very high. In such case over and above the normal limit cost should be excluded from the total training cost and transferred to costing P&L A/c.

Question 52.

Explain the cost accounting treatment of unsuccessful Research and Development cost. (Nov 2007, 2 marks)

![]()

Question 53.

How do you deal with the following in cost accounts? :

(i) Packing Expenses

(ii) Fringe benefits (May 2011, 4 marks)

Answer:

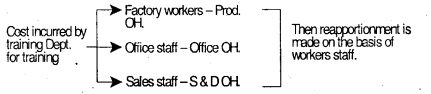

(i) Packing Expenses

(ii) Fringe Benefits: If any fringe benefits are incurred for factory workers, it should be treated as Factory OH or Production. OH and apportioned among all the production or service department on the basis of number of workers in each department.

Fringe benefits relating to office, selling and distribution staff should be treated as Office and Administration OH and Selling and Distribution OH and recovered accordingly.

![]()

Question 54.

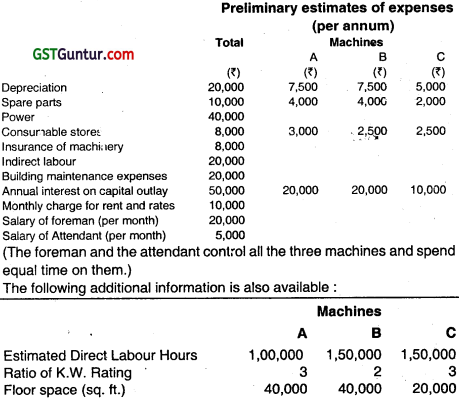

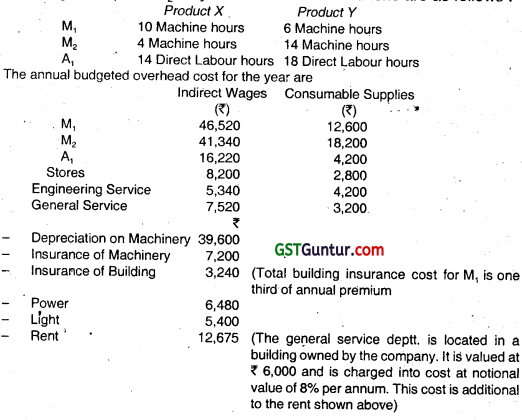

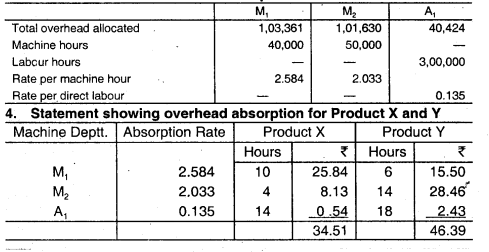

A company. has three production departments (M1, M2 and A1) and three service department, one of which Engineering service department, servicing the M1 and M2 only. The relevant informations are as follows:

The value of issues of materials to the production departments are in the same proportion as shown above for the Consumable supplies.

The following data are also available:

Required:

(i) Prepare a overhead analysis sheet, showing the bases of apportionment of overhead to departments.

(ii) Allocate service department overheads to production department ignoring the apportionment .of service department costs among service departments.

(iii) Calculate suitable overhead absorption rate for the production departments.

(iv) Calculate the overheads to be absorbed by two products, X and Y. (May 2007, 6 +4 + 3+2 = 15 marks)

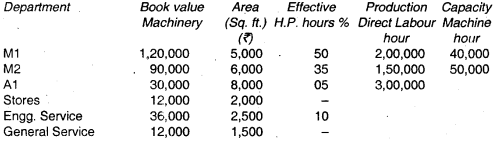

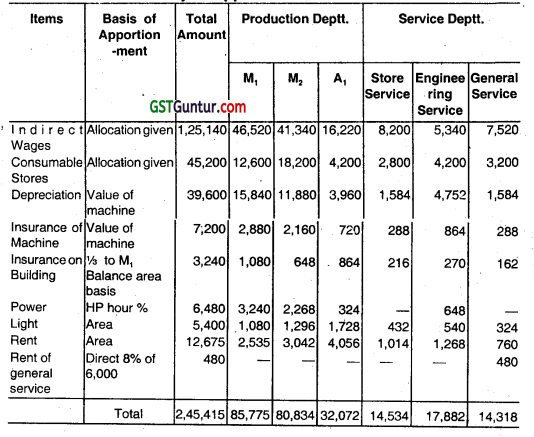

Answer:

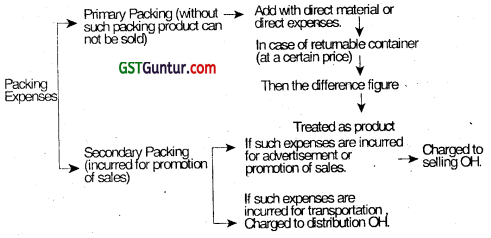

Summary of Appointment of Overheads

2. Allocation of service department overheads

3. Overhead absorption rate

![]()

Question 55.

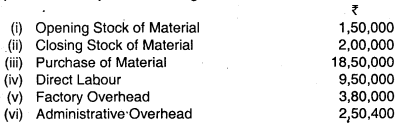

M. L. Auto Ltd. is a manufacturer of auto components and the details of its expenses for the year 2014 are given below:

During 2015, the company has received an order from a car manufacturer where it estimates that the cost of material and labour will be ₹ 8,00,000 and ₹ 4,50,000 respectively. M. L. Auto Ltd. charges factory overhead as a percentage of direct labour and administrative overhead as a percentage of factory cost based on previous year’s cost.

Cost of delivery of the components at customer’s premises is estimated at ₹ 45,000.

You are required to:

(i) Calculate the overhead recovery rates based on actual costs for 2014.

(ii) Prepare a detailed cost statement for the order received in 2015 and

the price to be quoted if the company wants to earn a profit of 10% on sales. (Nov 2015, 8 marks)

Answer:

Calculation of overhead recovery rates:

1. Factory Overhead Recovery Rate = \(\frac{\text { Factory Overhead }}{\text { Direct labour }}\)

= \(\frac{3,80,000}{9,50,000}\) 100

Factory overhead recovery rate = 40% of Direct labour.

2 (i) Administrative Overhead Recovery Rate

= \(\frac{\text { Administrative Overhead in } 2014}{\text { Factory Costs in } 2014 \text { (W.N.) }}\) × 100

= \(\frac{₹ 2,50,400}{₹ 31,30,000}\) × 100 = 8% of Factory Cost.

![]()

Working Note: CalcuLation of Factory Cost in 2014

| Particulars | Amount (₹) |

| Opening Stock of Material | 1,50,000 |

| Add: Purchase of Material ‘ | 18,50,000 |

| Less: Closing Stock of Material | (2,00,000) |

| Material Consumed | 18,00,000 |

| Direct Labour | 9,50,000 |

| Prime Cost | 27,50,000 |

| Factory Overhead | 3,80,000 |

| Factory Cost | 31,30,000 |

![]()

(ii) Detailed Cost Statement for the Order received from ML. Auto Ltd. during 2015