Ind AS on Measurement based on Accounting Policies – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Ind AS on Measurement based on Accounting Policies – CA Final FR Study Material

Loans Below Market Rate Of Interest (Based On Para No. 10a)

Question 1.

A Limited received from the government a loan of ₹ 1,00,00,000 @ 5% payable after 5 years in a bulleted payment. The prevailing market rate of interest is 12%. Interest is payable regularly at the end of each year. Calculate the amount of government grant and Pass necessary journal entry. Also examine how the Government grant be realized. Also state how the grant will be recognized in the statement of profit or loss assuming that the loan is to finance a depreciable asset.

Answer:

The fair value of the loan is calculated at ₹ 74,76,656.

| Year | Opening Balance | Interest calculated @ 12% | Interest paid @ 5% on ₹ 1,00,00,000 + principal paid | Closing Balance |

| (a) | (b) | (c) = (b) × 12% | (d) | (e) = (b) + (c) – (d) |

| 1 | 74,76,656 | 8,97,200 | 5,00,000 | 78,73,856 |

| 2 | 78,73,856 | 9,44,862 | 5,00,000 | 83,18,718 |

| 3 | 83,18,718 | 9,98,246 | 5,00,000 | 88,16,964 |

| 4 | 88,16,964 | 10,58,036 | 5,00,000 | 93,75,000 |

| 5 | 93,75,000 | 11,25,000 | 1,05,00,000 | Nil |

A Limited will recognise ₹ 25,23,344 (₹ 1,00,00,000 – ₹ 74,76,656) as the govern-ment grant and will make the following entry on receipt of loan:

Bank Account Dr. ₹1,00,000

To Deferred Income ₹ 25,23,344

To Loan Account ₹ 74,76,656

₹ 25,23,344 is to be recognised in profit or loss on a systematic basis over the periods in which A Limited recognise the related costs (which the grant intends to compensate) as expenses.

If the loan is to finance a depreciable asset, ₹ 25,23,344 will be recognised in profit or loss on the same basis as depreciation.

Accounting For Government Grants (Based On Para Nos. 17 To 31)

Question 2.

Arun Ltd. is an entity engaged in plantation and farming on a large scale and diversified across India. On 1st April, 2018, the company has received a Government Grant for ₹ 20 lakhs subject to a condition that it will continue to engage in plantation of eucalyptus tree for a coming period of five years.

The management has a reasonable assurance that the entity will comply with condition of engaging in the plantation of eucalyptus tree for specified period of five years and accordingly it recognizes proportionate grant for ₹ 4 lakhs in Statement of Profit and Loss as income following the principles laid down under Ind AS 20 Accounting for Government Grants and Disclosure of Government Assistance.

Required:

Evaluate whether the above accounting treatment made by the management is in compliance with the applicable Ind AS. If not, advise the correct treatment. [Nov. 2019 – 4 Marks]

Answer:

Based on Para Nos. 7,12 and 29 of Ind AS 20, the management view is correct.

![]()

Question 3.

How will you recognize and present the grants received from the Government in the following cases as per Ind AS 20?

(i) A Ltd. received one acre of land to set-up a plant in backward area (fair value of land ₹ 12 lakh and acquired value by Government is ₹ 8 lakhs).

(ii) B Ltd. received an amount of loan for setting up a plant at concessional rate of interest from the Government.

(iii) D Ltd. received an amount of ₹ 25 lakh for immediate start-up of a business without any condition.

(iv) S Ltd. received ₹ 10 lakh for purchase of machinery costing ₹ 80 lakh. Useful life of machinery is 10 years. Depreciation on this machinery is to he charged on straight line basis.

(v) Government gives a grant of ₹ 25 lakh to U Limited for research and development of medicine for breast cancer, even though similar medicines are available in the market but are expensive. The company is to ensure by developing a manufacturing process over a period of two years so that the cost comes down at least to 50%.

Answer:

(i) The land and government grant should be recognized by A Ltd. at fair value of ₹ 12,00,000 and this government grant should be presented in the books as deferred income. (Refer Note 1)

(ii) As per para 10A of Ind AS 20 ‘Accounting for Government Grants and Disclosure of Government Assistance’, loan at concessional rates of in terest is to be measured at fair value and recognised as per Ind AS 109. Value of concession is the difference between the initial carrying value of the loan determined in accordance with Ind AS 109, and the proceeds received. The benefit is accounted for as Government grant.

(iii) ₹ 25 lakh has been received by D Ltd. for immediate start-up of business. Since this grant is given to provide immediate financial support to an entity, it should be recognised in the Statement of Profit and Loss im mediately with disclosure to ensure that its effect is clearly understood, as per para 21 of Ind AS 20.

(iv) ₹ 10 lakh should be recognized by S Ltd. as deferred income and will be transferred to profit and loss over the useful life of the asset. In this case, ₹ 1,00,000 [₹ 10 lakh/10 years] should be credited to profit and loss each year over period of 10 years. (Refer Note 2)

(v) As per para 12 of Ind AS 20, the entire grant of ₹ 25 lakh should be recognized immediately as deferred income and charged to profit and loss over a period of two years based on the related costs for which the grants are intended to compensate provided that there is reasonable assurance that U Ltd. will comply with the conditions attached to the grant.

Note 1:

As per the amendment made by MCA in Ind AS 20 on 21st September, 2018, alternatively if the company is following the policy of recognising non-mone- tary grants at nominal value, the company will not recognise any government grant. Land will be shown in the financial statements at ₹ 1.

Note 2:

As per the amendment made by MCA in Ind AS 20 on 21st September, 2018, alternatively if the company is following the policy of reducing PPE; the amount of PPE will be equal to ₹ 70 lacs.

Question 4.

Mediquick Ltd. has received the following grants from the Central Government of for its newly started pharmaceutical business:

- ₹ 50 lakhs received for immediate start-up of business without any condition.

- ₹ 70 lakhs received for research and development of drugs required for the treatment of cardiovascular diseases with following conditions :

(i) That drugs should be available to the public at 20% cheaper from current market price; and

(ii) The drugs should be in accordance with quality prescribed by the Govt. Drug Control Department.

- Three acres of land (fair Value : ₹ 20 Lakhs) received for set up plant.

- ₹ 4 Lakhs received for purchase of machinery of ₹ 10 lakhs. Useful life of machinery is 4 years. Depreciation on this machinery is to be charged on straight-line basis.

How should Mediquick Ltd. recognize the government grants in its books of account as per relevant Ind AS ?

Answer:

Mediquick Ltd. should recognise the grants in the following manner:

- ₹ 50 lakhs which has been received for immediate start-up of business. This should be recognised in Statement of Profit and Loss immediately as there are no conditions attached to the grant.

- ₹ 70 lakhs should be recognised in profit or loss on a systematic basis over the periods which the entity recognises as expense the related costs for which the grants are intended to compensate provided that there is reasonable assurance that Mediquick Ltd. will comply with the conditions attached to the grant.

- Land should be recognised at fair value of ₹ 20 lakhs and government grants should be presented in the balance sheet by setting up the grant as deferred income or reduced from the cost of land.

- ₹ 4 lakhs should be recognised as deferred income and will be transferred to profit and loss over the useful life of the asset. In this case, ₹ 1,00,000 [₹ 4 lakhs/4] should be credited to profit and loss each year over period of 4 years. Alternatively, it can be reduced from PPE.

![]()

Question 5.

[Based on Para No. 12]

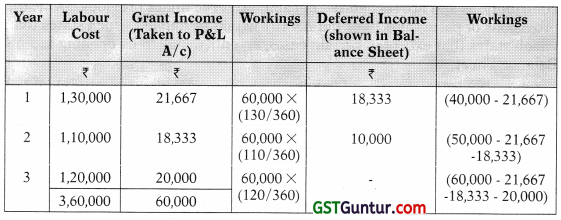

Entity A is awarded a government grant of ₹ 60,000 receivable over three years (₹ 40,000 in year 1 and ₹ 10,000 in each of years 2 and 3), contingent on creating 10 new jobs and maintaining them for three years. The employees are recruited at a total cost of ₹ 30,000, and the wage bill for the first year is ₹ 1,00,000, rising by ₹ 10,000 in each of the subsequent years.

Calculate the grant income and deferred income to be accounted for in the books for years 1, 2 and 3. [RTP – November 2020]

Answer:

Conclusion:

The income of ₹ 60,000 should be recognized over the three-year period to compensate for the related costs.

Computation of Grant Income and Deferred Income:

First Time Adoption (Based On Ind As 101 – Para No. B1o)

Question 6.

A Ltd. is a Government company and is a first-time adopter of Ind AS. As per the previous GAAP, the contributions received by A Ltd. from the government (which holds 100% shareholding in A Ltd.) which is in the nature of promoters’ contribution have been recognised in capital reserve and treated as part of shareholders’ funds in accordance with the provisions of AS 12, Accounting for Government Grants.

State whether the accounting treatment of the grants in the nature of promoters’ contribution as per AS 12 is also permitted under Ind AS 20 Accounting for Government Grants and Disclosure of Government Assistance. If not, then what will be the accounting treatment of such grants recognised in capital reserve as per previous GAAP on the date of transition to Ind AS.

Answer:

Paragraph 2 of Ind AS 20, “Accounting for Government Grants and Disclosure of Government Assistance” inter alia states that the Standard does not deal with government participation in the ownership of the entity.

Since ABC Ltd. is a Government company, it implies that government has 100% shareholding in the entity. Accordingly, the entity needs to determine whether the payment is provided as a shareholder contribution or as a government. Equity contributions will be recorded in equity while grants will be shown in the Statement of Profit and Loss.

Where it is concluded that the contributions are in the nature of government grant, the entity shall apply the principles of Ind AS 20 retrospectively as specified in Ind AS 101 ‘First Time Adoption of Ind AS’. Ind AS 20 requires all grants to be recognised as income on a systematic basis over the periods in which the entity recognises as expenses the related costs for which the grants are intended to compensate.

Unlike AS 12, Ind AS 20 requires the grant to be classified as either a capital or an income grant and does not permit recognition of government grants in the nature of promoter’s contribution directly to shareholders’ funds.

Where it is concluded that the contributions are in the nature of shareholder contributions and are recognised in capital reserve under previous GAAP, the provisions of paragraph 10 of Ind AS 101 would be applied which states that, which states that except in certain cases, an entity shall in its opening Ind AS Balance Sheet:

(a) recognise all assets and liabilities whose recognition is required by Ind AS;

(b) not recognise items as assets or liabilities if Ind AS do not permit such recognition;

(c) reclassify items that it recognised in accordance with previous GAAP as one type of asset, liability or component of equity, but are a different type of asset, liability or component of equity in accordance with Ind AS; and

(d) apply Ind AS in measuring all recognised assets and liabilities.” Accordingly, as per the above requirements of paragraph 10(c) in the given case, contributions recognised in the Capital Reserve should be transferred to appropriate category under ‘Other Equity’ at the date of transition to Ind AS.