Miscellaneous Provisions – CA Final Law Study Material is designed strictly as per the latest syllabus and exam pattern.

Miscellaneous Provisions – CA Final Law Study Material

Question 1.

The Board of Directors of M/s APCO Limited a listed company, for carrying out the valuation of the immovable properties standing in the name of the company as required under the provisions of the Companies Act, 2013 proposes to appoint Mr. Mehta, an individual as the valuer. Referring to the provisions of the Companies Act, 2013 read with The Companies (Registered Valuers and Valuation) Rules, 2017, the Audit Committee is of the opinion that the Board of Directors does not have right to appoint the valuer. Decide. [Nov. 18-Old Syllabus (4 Marks), RTP – May 19]

Answer:

Appointment of Valuer:

Sec. 247 of Companies Act, 2013, deals with the provisions relating to registered valuers. Accordingly, Where a valuation is required to be made in respect of

- any property, stocks, shares, debentures, securities or goodwill or any other assets (herein referred to as the assets) or

- net worth of a company or

- its liabilities under the provision of this Act,

it shall be valued by a person having prescribed qualifications and experience and registered as a valuer and is a member of a recognised organization.

- Valuation shall be done in such manner and on such terms and conditions as may be prescribed.

- Valuer will be appointed by the audit committee or in its absence by the Board of Directors of that company.

Conclusion: Opinion of audit committee is correct as appointment of valuer is to be made by audit committee. Board of Directors can appoint valuer only in absence of Audit Committee.

Question 2.

M/s KIL Limited, a listed company, proposed to acquire a plant for consideration other than cash from Mr. KK, a director. The Managing Director of the Company identified Mr. JK a registered valuer under the provisions of the Companies Act, 2013 for the purpose of valuation of the plant. Mr. KK acquired the plant 48 months back from a partnership firm in which the spouse of Mr. )K is a partner. The Managing Director of the Company issued an order appointing Mr. JK as a registered valuer. Examine and decide whether the decision of appointment and the mode of appointment is valid under the provisions of the Companies Act, 2013? (Nov. 19 – New Syllabus (4 Marks)]

Answer:

Appointment of Valuer:

Sec. 247 of Companies Act, 2013, deals with the provisions relating to registered valuers. Accordingly, Valuer will be appointed by the audit committee or in its absence by the Board of Directors of that company. The valuer appointed u/s 247(1) shall not undertake valuation of any assets in which he has a direct or indirect interest or becomes so interested at any time during a period of 3 years prior to his appointment as valuer.

As per Sec. 177 of Companies Act, 2013, company being a listed company is required to have an audit committee. Hence, appointment of valuer is to be made by audit committee.

As per Sec. 192 of Companies Act, 2013, if an asset is acquired for consideration other than cash, by a company from a director, then prior approval of members shall be required and value of such asset shall be duly determined by a registered valuer.

In the present case, M/s KIL Limited, a listed company, proposed to acquire a plant for consideration other than cash from Mr. KK, a director. The Managing Director of the Company identified Mr. JK a registered valuer under the provisions of the Companies Act, 2013 for the purpose of valuation of the plant. Mr. KK acquired the plant 48 months back from a partnership firm in which the spouse of Mr. JK is a partner. The Managing Director of the Company issued an order appointing Mr. JK as a registered valuer.

Conclusion: Based on the provisions as stated above, following conclusion may be drawn:

- Decision to appoint Mr. JK as registered valuer is valid as he is duly qualified.

- Appointment of valuer is not valid as appointment can be made by Audit committee, not by managing director on his own.

![]()

Question 3.

Eminence Ltd. after passing special resolution filed an application to the registrar for removal of the name of company from the register of companies. On the complaint of certain members, Registrar came to know that already an application is pending before the Tribunal for the sanctioning of a compromise or arrangement proposal. The application was filed by the Eminence Ltd. two months before the filing of this application to the Registrar.

Determine the given situations in the lights of the given facts as per the Companies Act, 2013:

(i) Legality of filing an application by Eminence Ltd. before the registrar.

(ii) Consequences if Eminence Ltd. files an application in the above given situation.

(iii) In case registrar notifies eminence Ltd. as dissolved under section 248 in compliances to the required provisions, what remedy will be available to the aggrieved party? [MTP-March 18, Oct. 19, May 20]

Answer:

Removal of names of companies from the register of companies:

As per Sec. 248(2) of the Companies Act, 2013, a company may, after extinguishing all its liabilities, by a special resolution, or consent of 75% members in terms of paid-up share capital, file an application in the prescribed manner to the Registrar for removing the name of the company from the register of companies on all or any of the grounds specified u/s 248(1) and the Registrar shall, on receipt of such application, cause a public notice to be issued in the prescribed manner.

As per Sec. 249 of the Companies Act, 2013, an application u/s 248 on behalf of a company shall not be made if, at any time in the previous 3 months, the company-

(a) has changed its name or shifted its registered office from one State to another;

(b) has made a disposal for value of property or rights held by it, immediately before cesser of trade or otherwise carrying on of business, for the purpose of disposal for gain in the normal course of trading or otherwise carrying on of business;

(c) has engaged in any other activity except the one which is necessary or expedient for the purpose of making an application under that section, or deciding whether to do so or concluding the affairs of the company, or complying with any statutory requirement;

(d) has made an application to the Tribunal for the sanctioning of a compromise or arrangement and the matter has not been finally concluded; or

(e) is being wound up under Chapter XX of this Act or under the Insolvency and Bankruptcy Code, 2016.

- If a company files an application in violation of restriction given u/s 249, it shall be punishable with fine which may extend to ₹ 1 lakh.

- An application filed under above circumstances, shall be withdrawn by the company or rejected by the Registrar as soon as conditions are brought to his notice.

As per section 252(1), any person aggrieved by an order of the Registrar, notifying a company as dissolved u/s 248, may file an appeal to the Tribunal Within a period of 3 years from the date of the order of the Registrar and if the Tribunal is of the opinion that the removal of the name of the company from the register of companies is not justified in view of the absence of any of the grounds on which the order was passed by the Registrar, it may order restoration of the name of the company in the register of companies. However, a reasonable opportunity is given to the company and all the persons concerned.

Conclusion: Applying the provisions of Sections 248, 249 and 259 as stated above, following conclusions may be drawn:

(i) Filing of application by Eminence Ltd. is not valid as an application u/s 248 on behalf of a company shall not be made if, at any time in the previous 3 months, the company has made an application to the Tribunal for the sanctioning of a compromise or arrangement and the matter has not been finally concluded.

(ii) Company shall be punishable with fine which may extend to ₹ 1 lakh. Application so filed, shall be withdrawn by the company or rejected by the Registrar as soon as conditions are brought to his notice.

(iii) Appeal may be preferred to Tribunal u/s 252.

Question 4.

Kojol Research Development Ltd. was registered to innovate unique business idea emerging from research and development in a new area. It is a future project and the company has no significant accounting transactions and business activities.

Therefore, the company made an application to ROC for obtaining the status of a Dormant Company. The application is under process. In the meantime, ‘ the company without extinguishing all its liabilities filed an application to ROC for removing the name of the company, after passing a special resolution giving effect to this.

In the light of the provisions of the Companies Act, 2013, analyse the following:

1. Whether the application is tenable under the Act?

2. What are the restrictions imposed under the act for making application by a company to remove the name of the company from the register of ROC?

3. What are the penal consequences in case of violation of restrictions? [May 18 – New Syllabus (8 Marks)]

Answer:

Removal of Name of company from Register of Companies:

Sec. 248(2) of Companies Act, 2013 provides that a company may, after extinguishing all its liabilities, by a special resolution or consent of 75% members in terms of paid-up share capital, file an application in the prescribed manner to the Registrar for removing the name of the company from the register of companies on all or any of the grounds:

(a) company has failed to commence its business within one year, of its incorporation;

(b) company is not carrying on any business or operation for a period of 2 immediately preceding financial years and has not made any application within such period for obtaining the status of a dormant company u/s 455.

In the present case, company has filed an application to ROC for obtaining status of Dormant company. While the application is under process, company without extinguishing all its liabilities filed an application to ROC for removing the name of the company, after passing a special resolution.

Conclusion: Application made by the company is not tenable by virtue of provisions of Sec. 248.

Restrictions on making application u/s 248 in certain situations:

Sec. 249(1) of Companies Act, 2013 provides that an application u/s 248(2) on behalf of a company shall not be made if, at any time in the previous 3 months, the company:

(a) has changed its name or shifted its registered office from one State to another;

(b) has made a disposal for value of property or rights held by it, immediately before cesser of trade or otherwise carrying on of business, for the purpose of disposal for gain in the normal course of trading or otherwise carrying on of business;

(c) has engaged in any other activity except the one which is necessary or expedient for the purpose of making an application under that section, or deciding whether to do so or concluding the affairs of the company, or complying with any statutory requirement;

(d) has made an application to the Tribunal for the sanctioning of a compromise or arrangement and the matter has not been finally concluded; or

(e) is being wound up under Chapter XX of this Act or under the IBC, 2016.

Penal consequences in case of violation of restrictions:

Sec. 249(2) of Companies Act, 2013 provides that if a company files an application u/s 248(2) in violation of Sec. 249(1), it shall be punishable with fine which may extend to ₹ 1 lakh.

![]()

Question 5.

Rudraksh Ltd. related to manufacturing of tyres works, was incorporated in January 2019. Due to certain cause, it failed to commence its business for 1 year. In April, 2020, Rudraksh Ltd. filed a 1 application to the tribunal for the merger of the company with the Shri Narayan Ltd.

In between, in August 2020, Rudraksh Ltd. after extinguishing all its liabilities in compliance, filed an application to the Registrar for the removal of its name from the register of companies.

Shri Narayan Ltd. came to know of the fact of their filing of an application for removal of names. It took the plea that section 248 w.r.t. filing of application for removal of names shall not be applicable on the Rudraksh Ltd., due to pendency of an application of a proposed merger scheme.

Determine as per the given facts, whether the objection made by the Shri Narayan Ltd. against the filing of an application for removal of name by Rudraksh Ltd, is tenable. [MTP-Aug. 18|

Answer:

Removal of Name of company from Register of Companies:

As per Sec. 248 of the Companies Act, 2013, the name of the companies can be removed from the register of companies either by Registrar or through an application of the company by itself on the ground as mentioned below:

(a) company has failed to commence its business within one year of its incorporation, or;

(b) company is not carrying on any business or operation for a period of 2 immediately preceding

financial years and has not made any application within such period for obtaining the status of a dormant company u/s 455. ”

Sec. 249(1) of Companies Act, 2013 provides that an application u/s 248 on behalf of a company shall not be made if, at any time in the previous 3 months, the company:

(a) has changed its name or shifted its registered office from one State to another;

(b) has made a disposal for value of property or rights held by it, immediately before cesser of trade or otherwise carrying on of business, for the purpose of disposal for gain in the normal course of trading or otherwise carrying on of business;

(c) has engaged in any other activity except the one which is necessary or expedient for the purpose of making an application under that section, or deciding whether to do so or concluding the affairs of the company, or complying with any statutory requirement;

(d) has made an application to the Tribunal for the sanctioning of a compromise or arrangement and the matter has not been finally concluded; or

(e) is being wound up under Chapter XX of this Act or under the IBC, 2016.

In the instant case, Rudraksh Ltd. was incorporated in January 2019 and due to certain cause, it failed to commence its business for 1 year. In April, 2020, Rudraksh Ltd. filed a application to the tribunal for the merger of the company with the Shri Narayan Ltd. In between, in August 2020, Rudraksh Ltd. after extinguishing all its liabilities in compliance, filed an application to the Registrar for the removal of its name from the register of companies.

Conclusion: Application u/s 248 was filed after the period of 3 months from the date of filing of application for the sanction of proposal of Merger. So objection raised by Shri Narayanan Ltd. is not tenable and Rudraksh Ltd. can file an application for removal of its name from register of companies.

Question 6.

Buina Limited has discontinued its business since 2016 and has not been filing annual returns. The Register of companies issued a notice for striking off the company. Since no reply was received within the time specified in the notice, the name of the company was struck off from the register of companies.

There were tax arrears and a notice was sent to the company by the tax recovery officer. The Directors contended that since the company’s name has been struck off, the company does not exist and not liable to pay the tax. Referring to and analysing the relevant provisions of the Companies Act, 2013 examine the validity of the Company’s claim. [May 19 – Old Syllabus (4 Marks)]

Answer:

Consequences of Removal of Name from register of companies:

Proviso to Sec. 248(6) of Companies Act, 2013 provides that in case name of the company was struck off from the register of companies, assets of the company shall be made available for the payment or discharge of all its liabilities and obligations even after the date of the order removing the name of the company from the register of companies.

In the present case, company has discontinued its business since 2016 and has not been filing annual returns. The ROC issued a notice for striking off the company and in the absence of any reply, the name of the company was struck off from the register of companies. There were tax .arrears and a notice was sent to the company by the tax recovery officer. The Directors contended that since the company’s name has been struck off, the company does not exist and not liable to pay the tax.

Conclusion: Company claim is not valid considering the provisions of proviso to Sec. 248(6) as stated above.

Question 7.

Fine Electric Scooter Pvt. Ltd. incorporated in November, 2017 has not commenced or carried on any business since its inception. Promoters of the Company being two subscribers have decided to dissolve the Company and get the name of the Company strike off from the Registrar of Companies under the Fast Track Exit Mode. The promoters’ Directors seek your advice for dissolving the Company. Advise. [Nov. 19 – Old Syllabus (4 Marks)]

Answer:

Removal of Name on Application by company through Fast Track Exit Mode:

Sec. 248(2) of Companies Act, 2013 deals with the provisions related to removal of name of company on application of company under the Fast Track Exit Mode. Accordingly, a company may, after extinguishing all its liabilities, by

(a) a special resolution or

(b) consent of 75% members in terms of paid-up share capital,

file an application in the prescribed manner to the Registrar for removing the name of the company from the register of companies on all or any of the grounds:

(a) company has failed to commence its business within 1 year of its incorporation;

(b) company is not cariying on any business or operation for a period of 2 immediately preceding financial years and has not made any application within such period for obtaining the status of a dormant company u/s 455.

- Company shall file an application in the prescribed manner to the Registrar for removing the name of the company from the register of companies after satisfying all conditions.

- Registrar shall, on receipt of such application, cause a public notice to be issued in the prescribed manner.

- Notice issued u/s 248(2) shall be published in the prescribed manner and also in the Official Gazette for the information of the general public.

At the expiry of the time mentioned in the notice, the Registrar may, unless cause to the contrary is shown by the company, strike off its name from the register of companies, and shall publish notice thereof in the Official Gazette, and on the publication in the Official Gazette of this notice, the company shall stand dissolved.

![]()

Question 8.

Digital Era Limited (DEL), is a start-up Company, incorporated in the year 2017 under the provisions of the Companies Act, 2013. The main object of the Company is to manufacture and market two wheelers adopting a new technology of using hydrogen as a fuel to run the vehicle in lieu of petrol.

Despite several experiments, the technology of hydrogen fuelled engine for the two wheelers was not successful. As per the requirements of the Companies Act, 2013, no business was commenced and no financial statements were filed with the Registrar of Companies (ROC). Eventually the Board of Directors of the Company resolved to apply to the RoC for getting the name of the Company struck-off from the Register of Companies.

The RoC, after satisfying that all the compliances specified under Section 248 of the Companies Act, 2013 have been met by the Company and after publishing a notice for general public and also in the official gazette, the name of the Company was struck-off from the Register of Companies w.e.f. 7th January, 2020.

Earlier in the year 2018, Mr. Amrit, had supplied certain spares to the Company for ₹ 2,50,000and despite his several requests, the amount was not settled by the Company. In September 2020, he came to know from his close aides that DEL has some assets available with them. Thereafter, with a view to recover his dues from the Company, he approached you seeking your professional guidance. As a competent professional, advise Mr. Amrit, the following, in the light of the provisions of the Companies Act, 2013:

(i) Whether the assets of the Company shall be made available for the discharge of its liabilities even after the date of the order removing the name of the Company from the Register of Companies?

(ii) Can an aggrieved person file an appeal against the order of the ROC? If so, state the legal provisions in this regard.

(iii) When and under what circumstances can the RoC restore the name of the Company?

(iv) State the circumstances and the time frame within which the Tribunal can order the name of

the Company to be restored to the Register of Companies?

(v) Can the name of a Company registered under Section 8 of the Companies Act, 2013 be removed

from the Register of Companies? [Nov. 20 – New Syllabus (8 Marks)]

Answer:

Provisions relating with Removal of name of company:

(i) Availability of Assets of company after removal of name:

Proviso to Sec. 248(6) of Companies Act, 2013 provides that the assets of the company shall be made available for the payment or discharge of all its liabilities and obligations even after the date of the order removing the name of the company from the register of companies.

(ii) Appeal to Tribunal:

As per Sec. 252(1) of the Companies Act, 2013, any person aggrieved by an order of the Registrar, notifying a company as dissolved u/s 248, may file an appeal to the Tribunal within a period of 3 years from the date of the order of the Registrar and if the Tribunal is of the opinion that the removal of the name of the company from the register of companies is not justified in view of the absence of any of the grounds on which the order was passed by the Registrar, it may order restoration of the name of the company in the register of companies:

Provided that before passing any order under this section, the Tribunal shall give a reasonable opportunity of making representations and of being heard to the Registrar, the company and all the persons concerned.

(iii) Restoration of name of Company by ROC:

Proviso to Sec. 252(1) of Companies Act, 2013 provides that if the Registrar is satisfied, that the name of the company has been struck off from the register of companies either inadvertently or on the basis of incorrect information furnished by the company or its directors, which requires restoration in the register of companies, he may within a period of 3 years from the date of passing of the order dissolving the company u/s 248, file an application before the Tribunal seeking restoration of name of such company.

(iv) Order of Tribunal for restoration of name of company:

As per Sec. 252(3) of Companies Act, 2013, the Tribunal on an application made by the company, member, creditor or workman before the expiry of 20 years from the publication in the Official Gazette of the notice u/s 248(5) may, if satisfied that the company was, at the time of its name being struck off, carrying on business or in operation or otherwise it is just that the name of the company be restored to the register of companies, order the name of the company to be restored to the register of companies.

(v) Removal of Name of Sec. 8 company:

As per Sec. 248(2) of Companies Act, 2013, a company may, after extinguishing all its liabilities, by a special resolution or consent of 75% members in terms of paid-up share capital, file an application in the prescribed manner t0 the Registrar for removing the name of the company from the register of companies on all or any of the grounds specified in Sec. 248(1).

However, Sec. 248(3) provides that nothing in Sec. 248(2) shall apply to a Sec. 8 company. Hence Sec. 8 company cannot apply for removal of its name on its own.

Question 9.

Examine with reference to the provisions of the Companies Act, 2013 whether MN Limited and PQ Limited can be considered as Government Company.

(i) C.G. and Government of Maharashtra together hold 40% of the paid-up share capital of MN Limited. A government company also holds 20% of the paid-up share capital in MN Limited.

(ii) PQ Limited is a subsidiary but not a wholly owned subsidiary of a government company.

Answer:

Determination of status of company:

As per Sec. 2(45) of the Companies Act, 2013, “Government company” means any company in which not less than fifty-one percent of the paid-up share capital is held by the Central Government, or by any State Government or Governments, or partly by the Central Government and partly by one or more State Governments, and includes a company which is a subsidiary company of such a Government company.

Status of MN Limited: The C.G. and Government of Maharashtra together hold 40% of the paid- up share capital of MN Limited. A government company also holds 20% of the paid-up share capital in MN Limited. In this case, MN Limited is not a Govt, company as the holding of the C.G. and Govt, of Maharashtra is only 40%. Holding of government company in MN Limited of 20% is not considered for the purpose of Sec. 2(45).

Status of PQ Limited: PQ Limited is a Govt, company, being a subsidiary company of a Government company. It is immaterial whether the subsidiary is a wholly owned subsidiary or not.

![]()

Question 10.

M/s Kashi Mutual Benefits Nidhi Ltd. is incorporated as a Nidhi company under the companies Act, 2013. The board of directors of the company seeks your advice on the following issues as per the provisions of the Companies Act, 2013 read with rules. Advice.

(i) The Board of Directors is planning to issue preference shares.

(ii) The Board of Directors have decided to provide Locker Facilities on rent to its members and have estimated that rental income from such letting will be around 30% of the gross income of the company.

(iii) The Board of Directors of the company is planning to declare dividend for the current year at 45%.

(iv) The Board of Directors of the company have decided to appoint Mr. Prince (a minor) as a member of the company. [May 18 – Old Syllabus (4 Marks)]

Answer:

Nidhi Companies – Miscellaneous Provisions:

(i) A Nidhi Company cannot issue preference shares [Rule 6 of Nidhi Rules, 2014).

(ii) A Nidhi company is not allowed to carry on any business other than the business of borrowing or lending in its own name. However Nidhis which have adhered to all the provisions of these rules may provide locker facilities on rent to its members subject to the rental income from such facilities not exceeding 20% of the gross income of the Nidhi at any point of time during a financial year (Rule 6 of Nidhi Rules, 2014). So, the board of directors cannot provide locker facilities on rent to its members on which the rental income will be around 30% of the gross income of the company. ”

(iii) A Nidhi company cannot declare dividend in excess of 25% (Rule 18 of Nidhi Rules, 2014).

(iv) A Minor cannot be admitted as member of a Nidhi Company (Rule 8 of Nidhi Rules, 2014).

Question 11.

Akri Nidhi Limited proposes:

(i) To reappoint Mr. X, a Director who has completed a term of 10 consecutive years as a Director of the Nidhi.

(ii) To pay dividend at the rate of 45%.

Examine and analyse the validity of the above proposals with reference to Nidhi Rules, 2014 formulated under Companies Act, 2013. [May 19 – Old Syllabus (4 Marks)]

Answer:

Nidhi Companies – Miscellaneous Provisions:

As per Rule 17 of Nidhi Rules, 2014, the Director of a Nidhi shall hold office for a term up to 10 consecutive years on the Board of Nidhi. The Director shall be eligible for re-appointment only after the expiration of 2 years of ceasing to be a Director.

As per Rule 18 of Nidhi Rules, 2014, a Nidhi company cannot declare dividend in excess of 25% (Rule 18 of Nidhi Rules, 2014).

Conclusion: Considering the provisions stated above, following conclusions may be drawn:

(i) Proposal to reappoint Mr. X, a Director is not valid as on completion of tenure of 10 consecutive years, such Director shall be eligible for re-appointment only after the expiration of 2 years of ceasing to be a Director.

(ii) Proposal to pay dividend at a rate of 45% is not valid as a Nidhi company cannot declare dividend in excess of 25%.

Question 12.

Explain the meaning of ‘Fraud’ in relation to the affairs of a company and the punishment provided for the same in Section 447 of the Companies Act, 2013.

Answer:

Meaning of Fraud:

Section 447 defines the term fraud as:

“Fraud” in relation to affairs of a company or anybody corporate, includes any act, omission, concealment of any fact or abuse of position committed by any person or any other person with the connivance in any manner, with intent to deceive, to gain undue advantage from, or to injure the interests of, the company or its shareholders or its creditors or any other person, whether or not there is any wrongful gain or wrongful loss.

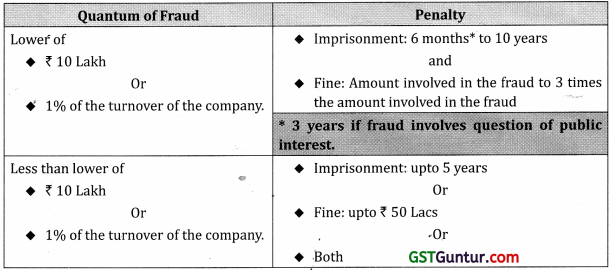

Punishment provided u/s 447:

Question 13.

JKL Research Development Limited is a registered Public Limited Company. The company has a unique business idea emerging from research and development in a new area. However, it is a future project and the company has no significant accounting transactions and business activities at present. The company desires to obtain the status of a ‘Dormant Company’. Advise the company regarding the provisions of the Companies Act, 2 013 in this regard and the procedure to be followed in this regard. [MTP-Oct.18, RTP-Nov.18]

Answer:

Provisions as to Dormant Company:

Provisions related to the Dormant companies is covered u/s 455 of the Companies Act, 2013. Accordingly,

(i) Where a company is formed and registered under this Act for a future project or to hold an asset or intellectual property and has no significant accounting transaction, such a company or an inactive company may make an application to the Registrar in such manner as may be prescribed for obtaining the status of a dormant company.

(ii) The Registrar shall allow the status of a dormant company to the applicant and issue a certificate after considerating of the application,

(iii) The Registrar shall maintain a register of dormant companies in such form as may be prescribed.

(iv) In case of a company which has not filed financial statements or annual returns for two financial years consecutively, the Register shall issue a notice to that company and enter the name of such company in the register maintained for dormant companies.

(v) A dormant company shall have such minimum number of directors, file such documents and pay such annual fee as may be prescribed to the Registrar to retain its dormant status in the register and may become an active company on an application made in this behalf accompanied by such documents and fee as may be prescribed.

(vi) The Registrar shall strike off the name of a dormant company from the register of dormant companies, which has failed to comply with the requirements of this section.

Question 14.

Rudraksh Ltd., a public company, was incorporated for supply of solar panels for the emerging project of government for construction of highways. However, the said project did not turn up for two years due to some legal implications. During the said period, no any significant accounting transaction was made and so the company did not file financial statements and annual returns during the last two financial years.

In the meantime, the Board proposed for Mr. Ram & Mr. Rahim to be appointed as an Independent Directors for their independent and expertise knowledge and experience for better working and improvement of financial position of the company.

Evaluate in the light of the given facts, the following legal position:

(a) Comment upon the accountability for non-filing of financial statements and annual returns for last two financial years of the Rudraksh Ltd.

(b) Nature of the proposal for an appointment of Mr. Ram & Mr. Rahim in the Rudraksh Ltd. for

improvement of the company. [RTP-May 19]

Answer:

Provisions as to Dormant Company:

(i) Accountability for non-filing of financial statements and annual returns for last two financial years:

As per Sec. 455 of the Companies Act, 2013, where a company is formed and registered under this Act for a future project or to hold an-asset or intellectual property and has no significant accounting transaction, such a company or an inactive company may make an application to the Registrar in such manner as may be prescribed for obtaining the status of a dormant company.

As per the stated facts, Rudraksh Ltd. is an inactive company and has not filed financial statements or annual returns for 2 financial years consecutively, the Registrar shall issue a notice to that effect and enter the name in the register maintained for dormant companies.

(ii) Proposal for Independent Directors:

Proposal for appointment of Independent Director (Mr. Ram & Mr. Rahim) is not necessitated as a dormant company is not required to have independent director.

Question 15.

Gulmohar Ltd. is a company registered in India for last 5 years. Since last 2 financial years, it has not been carrying on any business or operations and has not filed financial statements and annual returns saying that it has not made any significant accounting transaction during the last two financial years. Considering the current situation, Directors of the Company is contemplating to apply to Registrar of Companies to obtain the status of dormant or inactive company. Advise them on:

(i) Whether Gulmohar Ltd. is eligible to apply to Registrar of Companies to obtain dormant status for the company?

(ii) Will your answer be different if Gulmohar Ltd. is continuing payment of fees to Registrar of Companies and payment of rentals for its office and accounting records for last two financial years?

(iii) Is special resolution in general meeting a pre-requisite to make an application to Registrar of Companies for obtaining the status of dormant company?

(iv) What will be your answer if it found after making an application of dormant company to Registrar of Companies that an investigation is pending against the company which was ordered 6 months ago? [May 19 – New Syllabus (8 Marks)]

Answer:

Provisions as to Dormant Company:

As per Sec. 455 of the Companies Act, 2013, where a company is formed and registered under this Act for a future project or to hold an asset or intellectual property and has no significant accounting transaction, such a company or an inactive company may make an application to the Registrar in such manner as may be prescribed for obtaining the status of a dormant company.

Inactive company means a company which has not been carrying on any business or operation, or has not made any significant accounting transaction during the last 2 financial years, or has not filed F.S. and annual returns during the last 2 financial years.

“Significant accounting transaction” means any transaction other than

(a) payment of fees by a company to the Registrar;

(b) payments made by it to fulfil the requirements of this Act or any other law;

(c) allotment of shares to fulfil the requirements of this Act; and

(d) payments for maintenance of its office and records.

Rule 3 of Companies (Miscellaneous) Rules, 2014 prescribes the manner and conditions subject to which status of dormant company may be obtained. In accordance with Rule 3, a company may make an application to the Registrar for obtaining the status of a Dormant Company after passing a special resolution to this effect in the general meeting of the company or after issuing a notice to all the shareholders of the company for this purpose and obtaining consent of at least 3/4th shareholders (in value).

Further, a company shall be eligible to apply under this rule only, if no inspection, inquiry or investigation has been ordered or taken up or carried out against the company;

Conclusion: Based on the provisions as stated above, following conclusions may be drawn:

- Company is eligible to apply as it falls within the definition of inactive company.

- Answer will remain same as payment of fees to ROC and payments for its office and accounting records do not fall within the meaning of significant accounting transactions.

- Special Resolution is a pre-requisite. However company has an option to issue a notice to all shareholders for this purpose and obtaining consent of atleast 3/4th of shareholders in value.

- Application will not be considered as investigation is pending against the company.

![]()

Question 16.

M & N Project Engineering Services Private Limited had applied to the Registrar of Companies to be considered as Dormant company as the project got delayed due to the non-clearance from the National Green Tribunal. The RoC has granted the certificate to allow the status of dormant company in May 2018. Now the company is granted clearance from National Green Tribunal. The Board of the company wants to revive the status as active company. They seek your advice on approval by the Registrar for revival of status as active company. [Nov. 20 – Old Syllabus (4 Marks)]

Answer:

Application for seeking status of an active company:

Provision relating to revival of status of active company are provided by Rule 8 of the Companies (Miscellaneous] Rules, 2014. Accordingly,

(1) An application for obtaining the status of an active company shall be made in Form MSC-4 along with prescribed fees and shall be accompanied by a return in Form MSC-3 in respect of the financial year in which the application for obtaining the status of an active company is being filed.

However, the Registrar shall initiate the process of striking off the name of the company if the company remains as a dormant company for a period of consecutive 5 years.

(2) The Registrar shall, after considering the application filed for obtaining the status of an active company, issue a certificate in Form MSC-5 allowing the status of an active company to the applicant.

(3) Where a dormant company does or omits to do any act mentioned in the Grounds of application in Form MSC-1 submitted to Registrar for obtaining the status of dormant company, affecting its status of dormant company, the directors shall within 7 days from such event, file an application for obtaining the status of an active company.

(4) Where the Registrar has reasonable cause to believe that any company registered as ‘dormant company’ under his jurisdiction has been functioning in any manner, directly or indirectly, he may initiate the proceedings for enquiry u/s 206 of the Act and if, after giving a reasonable opportunity of being heard to the company in this regard, it is found that the company has actually been functioning, the Registrar may remove the name of such company from register of dormant companies and treat it as an active company.