Students should practice Marginal Costing – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Marginal Costing – Corporate and Management Accounting MCQ

Question 1.

Dec 2014: Which of the following formula cannot be used for calculating the P/V ratio

(A) (Sales value minus variable cost) / Sales value

(B) (Fixed cost plus profit)/Sales value

(C) Change in profits/Change in sales

(D) Profit/Sales value

Answer:

(D) Profit/Sales value

Question 2.

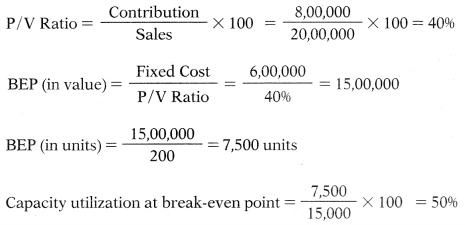

Dec 2014: For a given product, the sales of a company @ ₹ 200 per unit is ₹ 20,00,000. Variable cost is ₹ 12,00,000 and fixed cost is ₹ 6,00,000. The capacity of the factory is 15,000 units. Capacity utilization at break-even point level

(A) 40%

(B) 50%

(C) 60%

(D) 100%

Hint:

Sales – Variable Cost = Contribution

20,00,0000 – 12,00,000 = 8,00,000

Answer:

(B) 50%

Question 3.

Dec 2014: The costing method in which fixed factory overheads are added to inventory is known as

(A) Direct costing

(B) Marginal costing

(C) Absorption costing

(D) Activity-based costing

Answer:

(C) Absorption costing

Question 4.

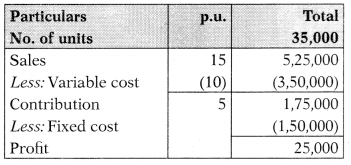

Dec2014: For a given product, the selling price per unit is 15, the variable cost per and units sold during the period are 35,000. The margin of safety is

(A) ₹ 25,000

(B) ₹ 75,000

(C) ₹ 15,000

(D) ₹ 5,000

Hint:

Answer:

(B) ₹ 75,000

Question 5.

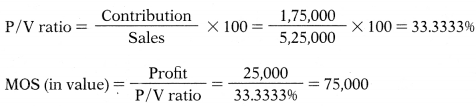

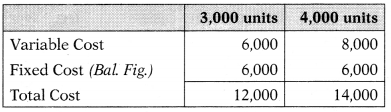

Dec 2014: When the volume is 3,000 units, the average cost is ₹ 4 per unit. When the volume is 4,000 units, the average cost is ₹ 3.50 per unit. The break-even point is 5,000 units.

What is the P/V ratio of the firm

(A) 35%

(B) 37.5%

(C) 40%

(D) 32.5%

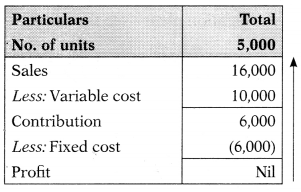

Hint:

Total cost at 3,000 units = 3,000 × 4 12,000

Total cost at 4,000 units = 4,000 × 3.5 = 14,000

Variable cost per unit = \(\frac{\text { Change in cost }}{\text { Change in units }}=\frac{2,000}{1,000}\) = 2 per unit

At the break-even point profit is NILL.

P/V ratio = \(\frac{\text { Contribution }}{\text { Sales }}\) × 100 = \(\frac{6,000}{16,000}\) × 100 = 37.5%

Answer:

(B) 37.5%

Question 6.

Dec 2014: Which of the following formula cannot be used for calculating the contribution

(A) Fixed cost plus profit

(B) Fixed cost minus loss

(C) Sales minus variable cost

(D) Fixed cost plus loss

Answer:

(D) Fixed cost plus loss

Question 7.

Dec 2014: A product is sold at a price of ₹ 120 per unit and its variable cost is ₹ 80 per unit. The fixed expenses of the business are ₹ 8,000 per year. Break-even point is

(A) ₹ 24,000

(B) ₹ 120,000

(C) ₹ 116,000

(D) ₹ 28,000

Hint:

Contribution per unit = 120 – 80 = 40

P/V Ratio = \(\frac{\text { Contribution }}{\text { Sales }}\) × 100 = \(\frac{40}{120}\) × 100 = 33.3333%

BEP (in value) = \(\frac{\text { Fixed Cost }}{\mathrm{P} / \mathrm{V} \text { Ratio }}=\frac{8,000}{33.3333 \%}\) = 24,000

Answer:

(A) ₹ 24,000

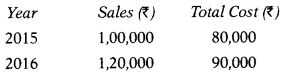

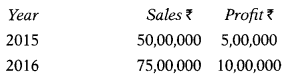

Question 8.

Dec 2014: The following information relates to a product:

Direct materials: 10 kg @ ₹ 0.50 per kg.

Direct labour: 1 hour 30 minutes @ ₹ 4 per hour

Variable overheads: 1 hour 30 minutes @ ₹ 1 per hour

Fixed overheads @ ₹ 2 per hour (based on a budgeted production volume of 90,0 direct labour hours for the year)

Selling price per unit: ₹ 17 The break-even point is

(A) ₹ 40,000 units

(B) ₹ 40,000

(C) ₹ 20,000 units

(D) ₹ 7,200 units

Hint:

Total variable cost per unit = (10 × 0.50) + (1.5 × 4) + (1.5 × 1) = 12.5

Total fixed cost = 90,000 × 2 = 1,80,000

| Sales | 17 |

| Less: Variable cost | (12.5) |

| Contribution | 4.5 |

P/V Ratio = \(\frac{\text { Contribution }}{\text { Sales }}\) × 100 = \(\frac{4.5}{17}\) × 100 = 26.4706%

P/V Ratio = \(\frac{\text { Fixed Cost }}{\text { Contribution p.u. }}=\frac{1,80,000}{4.5}\) = 40,000

Answer:

(A) ₹ 40,000 units

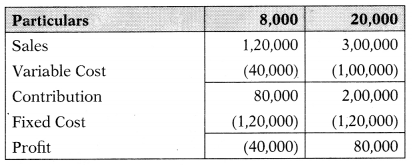

Question 9.

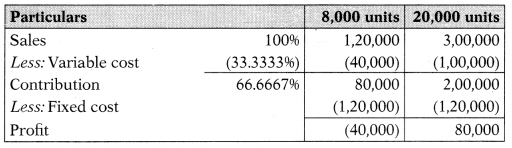

Dec 2014: A company sells its product at ₹ 15 per unit. In a period, if it produces and sells 8,000 units, it incurs a loss of ₹ 5 per unit. If the volume is raised to 20,000 units, it earns a profit of ₹ 4 per unit. The break-even point of the company in rupee terms will be

(A) ₹ 1,60,000

(B) ₹ 2,00,000

(C) ₹ 1,80,000

(D) ₹ 2,20,000

Hint:

P/V Ratio = \(\frac{\text { Change in Profit }}{\text { Change in Sales }}\) × 100 = \(\frac{1,00,000}{4,00,000}\) × 100 = 25%

Answer:

(C) ₹ 1,80,000

Question 10.

Dec 2014: A company that has a margin of safety of ₹ 4,00,000 makes a profit of ₹ 1,00,000. If its fixed cost is ₹ 5,00,000, then break-even sales are:

(A) ₹ 20 lakh

(B) ₹ 25 lakh

(C) ₹ 12.5 lakh

(D) ₹ 15 lakh

Answer:

(A) ₹ 20 lakh

Question 11.

Dec 2014: Which of the following costs tire treated as product cost under variable costing:

(A) Only direct costs

(B) Only variable production costs

(C) Only material and labour costs

(D) All variable and fixed manufacturing costs

Answer:

(B) Only variable production costs

Question 12.

Dec 2014: What is the margin of safety, if profit is equal to 140,000 and P/V ratio is 25%

(A) ₹ 1,60,000

(B) ₹ 1,00,000

(C) ₹ 16,000

(D) ₹ 10,000

Hint:

MOS (in value) = \(\frac{\text { Profit }}{\mathrm{P} / \mathrm{V} \text { ratio }}=\frac{40,000}{25 \%}\) = 1,60,000

Answer:

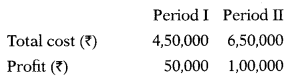

(A) ₹ 1,60,000

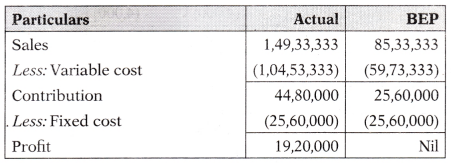

Question 13.

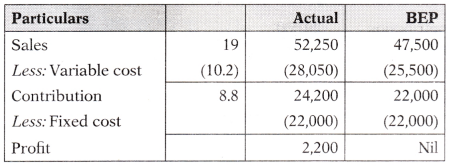

June 2015: The costing method in which fixed factory overheads are added to inventory is

(A) Activity-based costing

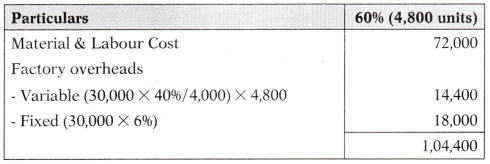

(B) Marginal costing

(C) Direct costing

(D) Absorption costing

Answer:

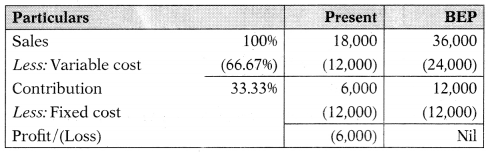

(D) Absorption costing

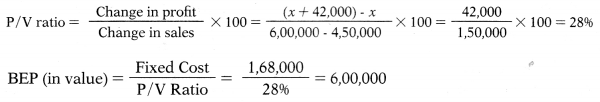

Question 14.

June 2015: A company has an annual fixed cost of ₹ 1,68,000. In the year 2013-2014, sales amounted to ₹ 6,00,000 as compared to ₹ 4,50,000in the preceding year 2012-2013. The profit in the year 2013-2014 was ₹ 42,000 more than that in the year 2012-2013. The break-even sales of the company are

(A) 6,00,000

(B) 6,20,000

(C) 5,60,000

(D) 4,08,000

Hint:

Let the profit of last year be ‘x’.

So the profit of current year will be ‘x + 42,000’

Answer:

(A) 6,00,000

Question 15.

June 2015: Sunny Ltd. makes product-A which sells at ₹ 80 per unit.

Total fixed costs are ₹ 28,000 and marginal cost ₹ 42 per unit. The sales level (in units) that will provide a profit of ₹ 10,000 is

(A) 1,200 Units

(B) 1,500 Units

(C) 1,250 Units

(D) 1,000 Units

Hint:

Let the sales unit be x.

| Sales | 80x |

| Less: Variable cost | (42x) |

| Contribution | 38x |

Net Profit + Fixed Cost = Contribution

28,000 + 10,000 = 38,000

Hence, 38x = 38,000

x = No. of units = 1,000

Answer:

(D) 1,000 Units

Question 16.

June 2015: When the sales increase from ₹ 45,000 to ₹ 60,000, the profit increases by ₹ 5,000. P/V Ratio would be

(A) 20%

(B) 30%

(C) 33.33%

(D) 66.67%

Hint:

P/V Ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{5,000}{15,000}\) × 100 = 33.33%

Change in sales 15,000

Answer:

(C) 33.33%

Question 17.

June 2015: The margin of safety can be calculated using the formula

(A) Total sales – Break-even sales

(B) Fixed cost 4- P/V ratio

(C) P/V ratio 4- Profit

(D) Fixed cost 4- Contribution

Answer:

(A) Total sales – Break-even sales

Question 18.

June2015:A product is sold at ₹ 150 per unit and its variable cost is ₹ 70 per unit. The fixed expenses of the business are ₹ 8,000 per year. The Break-even point (in units) is

(A) 200 units

(B) 50 units

(C) 115 units

(D) 100 units

Hint:

Sale Price – Variable Cost Contribution

150 – 70 = 80

BEP (in units) = \(\frac{\text { Fixed Cost }}{\text { Contribution p.u. }}=\frac{8,000}{80}\) = 100 units

Answer:

(D) 100 units

Question 19.

June 2015: Profit-Volume ratio can be improved by

(A) Increasing selling price per unit

(B) Reducing the direct and variable costs

(C) Switching the production to products showing the higher profit-volume ratio

(D) All of the above

Answer:

(D) All of the above

Question 20.

June 2015: The selling price of a product is 1550 per unit, variable cost ₹ 50 per unit and fixed cost ₹ 10,000. The number of units required to be sold to earn a profit of ₹ 10,000 will be –

(A) 400

(B) 40

(C) 36

(D) 220

Hint:

Sale Price – Variable Cost = Contribution 50 – 20 = 30

Contribution per kg= \(\frac{30}{2}\) = 15 per kg

Answer:

(B) 40

Question 21.

June 2015: Make or buy decisions are made by comparing cost with the outside purchase price.

(A) Fixed

(B) Variable

(C) Sunk

(D) Joint

Answer:

(B) Variable

Question 22.

June 2015: The selling price of a product-X is ₹ 50 per unit, variable cost ₹ 20 per unit and 2 kg of raw material are needed to produce a unit of product-X. The contribution per kg of raw material will be –

(A) ₹ 30

(B) ₹ 15

(C) ₹ 60

(D) ₹ 50

Hint:

Answer:

(B) ₹ 15

Question 23.

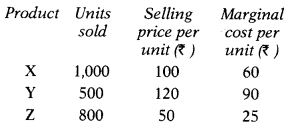

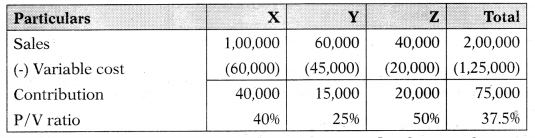

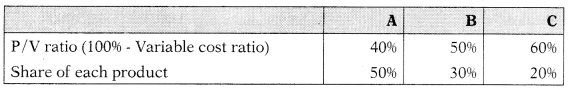

Dec 2015: Following data is given for Gopal Ltd:

Overall P/V ratio of the company will be:

(A) 42.5%

(B) 37.5%

(C) 42.8%

(D) 46.7%

Hint:

Answer:

(B) 37.5%

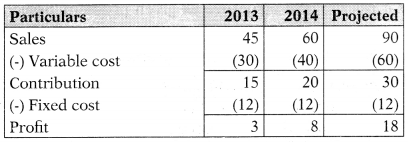

Question 24.

Dec 2015: Z Ltd. recorded sales of ₹ 60 lakh in 2014 as compared to ₹ 45 lakh in 2013. Profit for 2014 was ₹ 5 lakh higher than that in 2013. If the annual fixed costs amount to ₹ 12 lakh, the profit on projected sales of ₹ 90 lakh will be

(A) ₹ 15 lakh

(B) ₹ 14 lakh

(C) ₹ 12 lakh

(D) ₹ 18 lakh

Hint:

Profit in 2014 is higher by ₹ 5 lakhs than the profit of 2013. That mean change in profit is ₹ 5 lakhs.

60 – 45 = 15 (change in sales)

P/V Ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) x 100

= \(\frac{5}{15}\) x 100

= 33.3333%

Variable cost ratio = 100% – 33.3333% = 66.6667%

Answer:

(D) ₹ 18 lakh

Question 25.

Dec 2015: Statement-I:

The contribution concept is based on the theory that the fixed expenses of a business are not a joint cost.

Statement-II:

Fixed expenses can be equitably apportioned to different segments of the business.

Choose the correct option

(A) Both statements are correct

(B) Both statements are incorrect

(C) Statement-I is correct, but statement-II is incorrect

(D) Statement-I is incorrect, but statement-II is correct.

Hint:

Contribution or the contributory margin is the difference between sales value and the marginal cost [Contribution (C) = Sales (S) – Variable Cost], It is obtained by subtracting marginal cost from sales revenue of a given activity. It can also be defined as the excess of sales revenue over the variable cost. The contribution concept is based on the theory that the profit and fixed expenses of a business is a ‘joint cost’ that cannot be equitably apportioned to different segments of the business. In view of this difficulty, the contribution serves as a measure of the efficiency of operations of various segments of the business.

Answer:

(B) Both statements are incorrect

Question 26.

Dec 2015: The following information is given about Zac Ltd. dealing in musical instruments:

P/V ratio 50% Margin of safety 40%

If the sales volume is ₹ 50,00,000 the net profit will be

(A) ₹ 15,00,000

(B) ₹ 10,00,000

(C) ₹ 20,00,000

(D) ₹ 5,00,000

Hint:

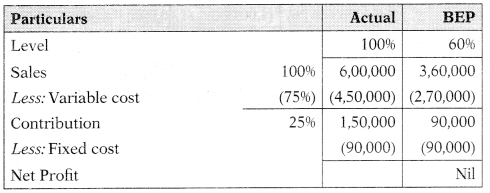

If actual sales assumed at 100% then BEP must be at 60% as the Margin of safety is 40%.

BEP Sales = 50,00,000 × 60% = 30,00,000

Contribution at BEP = 30,00,000 × 50% = 15,00,000

At BEP Contribution = Fixed cost hence Fixed Cost is also ₹ 15,00,000

Answer:

(B) ₹ 10,00,000

Question 27.

Dec 2015: Assertion (A):

In management accounting, firm decisions on pricing policy can be taken.

Reason (R):

As the marginal cost per unit is constant from period to period within a short span of time.

Select the correct answer from the option given below

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true, but R is not the correct explanation of A

(C) A is true, but R is false

(D) A is false, but R is true

Answer:

(A) Both A and R are true and R is the correct explanation of A

Question 28.

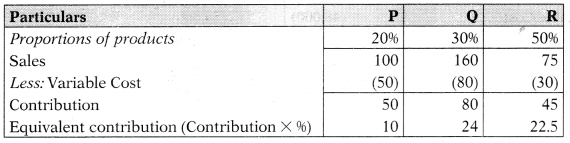

Dec 2015: Manoj Ltd. manufactures three products P, Q and R. The unit selling price of these products are ₹ 100, ₹ 160 and ₹ 75 respectively. The corresponding unit variable costs are ₹ 50, ₹ 80 and ₹ 30. The proportions (quantity-wise) in which these products are manufactured and sold are 20%, 30% and 50% respectively. Total fixed costs are ₹ 14,80,000. Overall breakeven quantity is

(A) 26,195 Units

(B) 27,195 Units

(C) 27,165 Units

(D) 28,165 Units

Hint:

Total equivalent contribution = 10 + 24 + 22.5 = 56.5

Composite BEP = \(\frac{14,80,000}{56.5}\) = 26,194.69 say 26,195 units

Answer:

(A) 26,195 Units

Question 29.

Dec 2015: Profits in a company can be increased by:

(1) Decreasing the selling price per unit

(2) Increasing the selling price per unit

(3) Decreasing the volume of sales

(4) Increasing the volume of sales

(5) Decreasing the fixed or variable expenses

(6) Increasing the fixed or variable expenses

(7) Giving more weightage for products having a higher P/V ratio

(8) Giving less weightage for products having a higher P/V ratio

Select the correct answer from the options given below

(A) (1), (3), (5) and (7)

(B) (2), (4), (6) and (8)

(C) (2), (4), (5) and (7)

(D) (1), (3), (6) and (8)

Answer:

(C) (2), (4), (5) and (7)

Question 30.

Dec 2015: Assertion (A):

The business earns a surplus of sale revenue over variable costs, which is called a contribution.

Reason (R):

Once fixed costs are fully recovered such excess contribution is termed as profit.

Select the correct answer from the options given below

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true, but R is not the correct explanation of A

(C) A is true, but R is false

(D) A is false, but R is true

Answer:

(B) Both A and R are true, but R is not the correct explanation of A

Question 31.

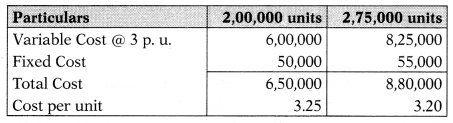

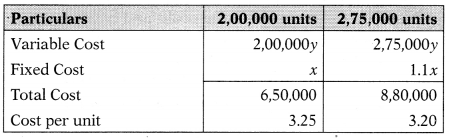

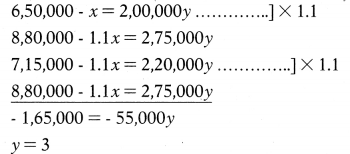

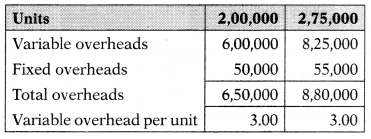

Dec 2015: A manufacturer produces 2,00,000 units of a product at a cost of ₹ 3.25 per unit. Later on, he produces 2,75,000 units at a cost of ₹ 3.20 per unit, when its fixed overheads have increased by 10%. The marginal cost per unit and originally fixed overheads will be:

(A) ₹ 2 and ₹ 45,000 respectively

(B) ₹ 4 and ₹ 47,000 respectively

(C) ₹ 3 and ₹ 50,000 respectively

(D) ₹ 5 and ₹ 45,000 respectively

Hint:

Total cost at 2,00,000 units = 2,00,000 × 3.25 = 6,50,000

Total cost at 2,75,000 units = 2,75,000 × 3.20 = 8,80,000

Check the given option and apply the variable cost and fixed cost as given in option and verify whether it fits the cost structure as given problem. Select the option.

Data are given in Option (C) fits the cost structure as a given problem.

Alternatively,

Answer:

(C) ₹ 3 and ₹ 50,000 respectively

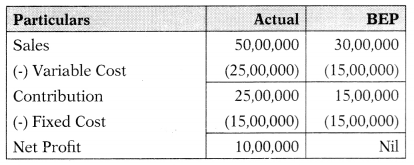

Question 32.

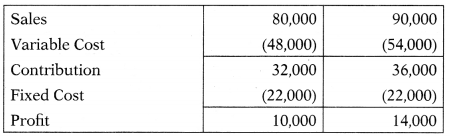

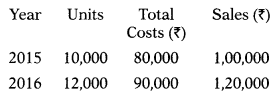

Dec 2015: The following data is obtained from the records of Mayur Ltd:

Break-even-point in rupees is

(A) ₹ 45,000

(B) ₹ 52,000

(C) ₹ 55,000

(D) ₹ 55,500

Hint:

P/V Ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{4,000}{10,000}\) × 100 = 40%

BEP (in value) = \(\frac{\text { Fixed Cost }}{\mathrm{P} / \mathrm{V} \text { Ratio }}=\frac{22,000}{40 \%}\) = 55,000

Answer:

(C) ₹ 55,000

Question 33.

Dec 2015:

Assertion (A):

The profit volume ratio is considered to be the best indicator of the profitability of the business.

Reason (R):

If the profit volume ratio is improved, it will result in better profits.

Select the correct answer from the options given below

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true, but R is not the correct explanation of A

(C) A is true, but R is false

(D) A is false, but R is true

Answer:

(A) Both A and R are true and R is the correct explanation of A

Question 34.

Dec 2015:Which of the following are advantages of marginal costing :

(1) Pricing decision

(2) True profit

(3) Difficulty to classify

(4) Ignores time value

(5) Break-even analysis

(6) Contribution is not final

(7) Control over expenditure

Select the correct answer from the options given below

(A) (1), (2). (5) and (7)

(B) (1), (3), (5) and (7)

(C) (3), (4), (6) and (7)

(D) (1), (2), (6) and (7)

Answer:

(A) (1), (2). (5) and (7)

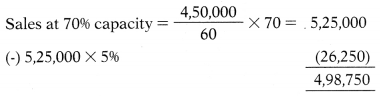

Question 35.

Dec 2015: If sales revenue at 60% capacity is ₹ 4,50,000, sales revenue at 70% capacity on a fall in selling price by 5% would be

(A) ₹ 4,98,750

(B) ₹ 7,50,000

(C) ₹ 5,25,000

(D) ₹ 7,12,000

Hint:

Answer:

(A) ₹ 4,98,750

Question 36.

Dec 2015: Match the following:

| List-I | List-II |

| P. Classification of costs | 1. Contribution to fixed and variable costs |

| Q. Difference between sales and variable

costs |

2. P/V ratio |

| R. Both fixed and variable costs are charged to product costing | 3. Marginal |

| S. Relative profitability | 4. Absorption |

Select the correct answer from the following options

Answer:

(C)

Question 37.

Dec 2015:

Statement-I:

The margin of safety represents the difference between sales at the break-even point and total sales.

Statement-II:

The margin of safety can be expressed as a percentage of total sales or in value or in terms of quantity.

Select the correct answer from the options given below

(A) Both statements are correct

(B) Both statements are incorrect

(C) Statement-I is correct, but Statement-II is incorrect

(D) Statement-I is incorrect, but Statement-II is correct.

Answer:

(A) Both statements are correct

Question 38.

Dec 2015: Match the following:

| List-I | List-II |

| P. Excess of actual sales over break-even sale volume | 1. Contribution |

| Q. Sum of fixed cost and profit | 2. Cost-volume-profit analysis |

| R. Break-even analysis | 3. No profit, no loss |

| S. Break-even point | 4. Margin of safety |

Select the correct answer from the options given below

Answer:

(A)

Question 39.

Dec 2015: Match the following:

| List-I | List-II |

| P. Absorption costing | 1. Is a logical extension of marginal costing |

| Q. Fixed expenses | 2. Relationship of change in cost and change in profit |

| R. Marginal costing | 3. Contribution = _____ + Profit |

| S. Break-even analysis | 4. Uses classification of costs according to their functions |

Select the correct answer from the options given below

Answer:

(D)

Question 40.

Dec 2015: A company sells its product at ₹ 15 per unit. In a period, it produces and sells 8,000 units and incurs a loss of ₹ 5 per unit. If the sales volume were to be raised to 20,000 units, it could earn a profit of ₹ 4 per unit. The Break-even point (in units) will be

(A) 24,000 Units

(B) 12,000 Units

(C) 16,000 Units

(D) 30,000 Units

Hint:

Sales = 8,000 × 15 = 1,20,000; Loss = 8,000 × 5 = 40,000

Sales = 20,000 × 15 = 3,00,000; Profit = 20,000 × 4 = 80,000

P/V Ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{-40,000-80,000}{1,80,000}\) × 100 = 66.67%

Contribution per unit = \(\frac{80,000}{8,000}\) = 10

BEP (in units) = \(\frac{\text { Fixed Cost }}{\text { Contribution per unit }}=\frac{1,20,000}{10}\) = 12,000

Answer:

(B) 12,000 Units

Question 41.

Dec 2015:

Statement-1:

At the time of replacement of plant, according to marginal cost technique, the proposal which yields the lowest contribution is to be selected.

Statement-II:

According to the total cost technique, the proposal which involves the highest costs is to be selected.

Select the correct answer from the following

(A) Both statements are correct

(B) Both statements are incorrect

(C) Statement-I is correct, but Statement-II is incorrect

(D) Statement-I is incorrect, but Statement-II is correct

Answer:

(B) Both statements are incorrect

Question 42.

Dec 2015: Choose the correct statements from the following:

(1) Marginal costing and absorption costing are the same

(2) For decision making, absorption costing is more suitable than marginal costing

(3) Cost-volume-profit relationship also denotes break-even point

(4) Marginal costing is based on the distinction between fixed and variable costs.

Correct option is

(A) (1) and (2)

(B) (2) and (3)

(C) (3) and (4)

(D) (2) and (4)

Answer:

(C) (3) and (4)

Question 43.

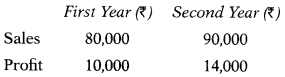

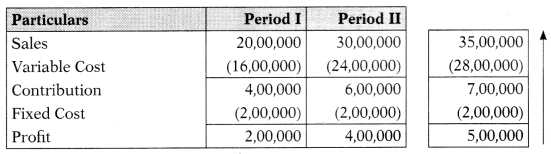

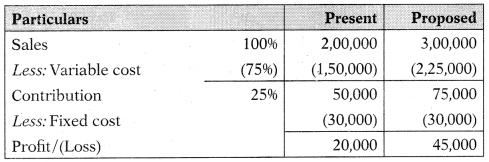

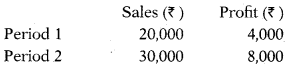

Dec 2015: The sales and profit during the two periods were as follows:

Sales required to earn a profit of ₹ 5,00,000 is

(A) ₹ 30 lakh

(B) ₹ 40 lakh

(C) ₹ 35 lakh

(D) ₹ 28 lakh

Hint:

P/V Ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{2,00,000}{10,00,000}\) × 100 = 20%

Sales = \(\frac{7,00,000}{20 \%}\) = 35,00,000

Answer:

(C) ₹ 35 lakh

Question 44.

Dec 2015: Match the following:

| List-I | List-II |

| P. Marginal cost | 1. ____= Contribution ÷ Sales |

| Q. P/V ratio | 2. Contribution = Selling price – ____ |

| R. Profit | 3. ____ = Sales × (1 – P/V ratio) |

| S. Variable cost | 4. Margin of safety = ____ ÷ P/V Ratio |

Select the correct answer from the options given below

Answer:

(B)

Question 45.

Dec 2015: Cost-volume-profit (CVP) analysis is based on several assumptions. Which one of the following is not relevant for such an analysis

(A) Inventory quantity changes in the year

(B) Sales mix of the products is constant

(C) Material price and labour rates do not change

(D) Behaviour of both sales and variable cost is linear throughout the year

Answer:

(A) Inventory quantity changes in the year

Question 46.

Dec 2015: The fixed expenses are ₹ 4,000 and the break-even point is ₹ 10,000. The new break-even point, if the selling price is reduced by 20% is

(A) ₹ 14,000

(B) ₹ 15,000

(C) ₹ 16,000

(D) ₹ 17,000

Hint:

Assume that the selling price per unit is ₹ 10

New selling price per unit after reduction of 20% = 10 – 2 = 8

Answer:

(C) ₹ 16,000

Question 47.

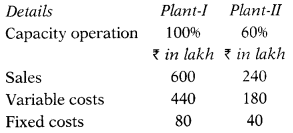

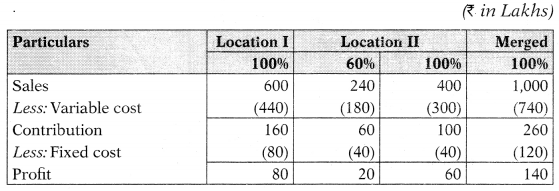

June 2016: There are two similar plants under the same management. The management desires to merge these two plants. The following particulars are available:

The capacity of the merged plant to be operated for the purpose of break-even will be

(A) 45.14%

(B) 48.12%

(C) 50.76%

(D) 46.15%

Hint:

P/V Ratio (Merged plant) = \(\frac{\text { Contribution }}{\text { Sales }}\) × 100 = \(\frac{260}{1,000}\) × 100 = 26%

BEP(in value) (Merged plant) = \(\frac{\text { Fixed cost }}{\mathrm{P} / \mathrm{V} \text { ratio }}=\frac{120}{26 \%}\) = 461.54 Lakhs

Capacity of merged plant at BEP = \(\frac{461.54}{1,000}\) × 100 = 46.15%

Answer:

(D) 46.15%

Question 48.

June 2016: Which of the following statements is/are false?

(i) Product can be sold below marginal cost in certain special circumstances

(ii) Cost per unit of the key factor is the basis of ranking products on profitability

(iii) When there are no inventories, profit figures under marginal and absorption costing are identical.

Select the correct answer from the options given below

(A) (ii) only

(B) (i) and (ii)

(C) (i) and (iii)

(D) (ii) and (iii)

Answer:

(A) (ii) only

Question 49.

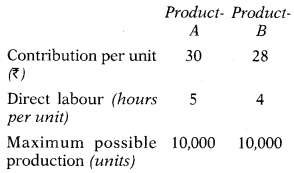

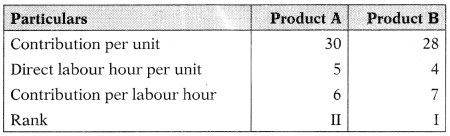

June 2016: Following data are given:

Direct labour hours available are 72,000 hours.

What should be the number of units of A and B to be produced to maximize the profit of the company?

(A) A-10,000 units, B-5,500 units

(B) B-10,000 units, A-5,500 units

(C) B-10,000 units, A-6,400 units

(D) 10,000 units of each A and B

Hint:

Total hours for producing 10,000 units of Product B = 10,000 × 4 = 40,000

Hours available for producing Product A = 72,000 – 40,000 = 32,000

Possible production of Product A = \(\frac{32,000}{5}\) = 6,400

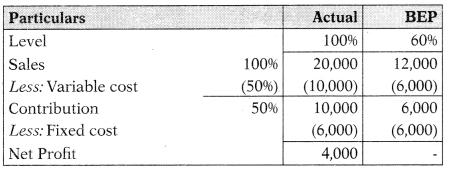

50. BEP = 100% – 4096 = 6096

BEP sales = \(\frac{8,000}{40}\) × 60 = 12,000

Contribution at BEP = 12,000 – 6,000 = 6,000

At BEP, Contribution = Fixed Cost

Answer:

(C) B-10,000 units, A-6,400 units

Question 50.

June 2016: The margin of safety is ₹ 8,000 which represents 40% of sales. The P/V ratio is 50%. Fixed cost will be

(A) ₹ 6,000

(B) ₹ 5,500

(C) ₹ 6,500

(D) ₹ 7,000

Answer:

(A) ₹ 6,000

Question 51.

June 2016: Cost-Volume-Profit analysis is based on several assumptions. Which one of the following is not one of these assumptions

(A) Sales mix of the products is constant

(B) The behaviour of both sales and variable cost is linear throughout the relevant range

(C) Variable cost per unit will remain constant

(D) Productivity and operational efficiency will change according to output

Answer:

(D) Productivity and operational efficiency will change according to output

Question 52.

June 2016: Under marginal costing, unit product cost would most likely be increased by

(A) A decrease in the number of units produced

(B) An increase in the number of units produced

(C) An increase in the commission paid to the salesman for each unit sold

(D) A decrease in the commission paid to the salesman for each unit sold

Answer:

(A) A decrease in the number of units produced

Question 53.

June 2016: A company producing three products, viz., X, Y and Z has a sales mix in the ratio of 2:1:3. The profit volume ratio of the products X, Y and Z are 15%, 30% and 20% respectively. The total fixed cost of the company is ₹ 3,50,000. The break-even point of the company will be

(A) ₹ 16,15,390

(B) ₹ 17,50,000

(C) ₹ 23,33,333

(D) ₹ 11,66,667

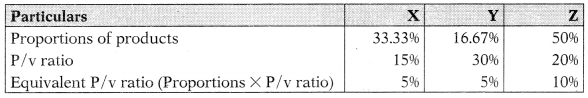

Hint:

Sales mix is 2:1:3 means 33.33%:16.67%:50%

Total Equivalent P/v ratio = 596 + 596 + 10% = 20%

Composite BEP = \(\frac{3,50,000}{20 \%}\)= 17,50,000

Answer:

(B) ₹ 17,50,000

Question 54.

Dec 2016: From the following particulars, calculate the selling price per unit, if the break-even point is brought down to 10,000 units :

Selling price per unit: ₹ 20

Variable cost per unit: ₹ 16

Fixed expenses: ₹ 60,000

Choose the correct option

(A) ₹ 25

(B) ₹ 20

(C) ₹ 22

(D) ₹ 32

Hint:

At BEP: Contribution = Fixed cost, hence Contribution = 60,000

Contribution p. u. = \(\frac{60,000}{10,000}\) = 6 p. u.

Contribution p. u. + Variable cost p. u. = Selling price p. u.

6 + 16 = 22

Answer:

(C) ₹ 22

Question 55.

June 2016: Aman Ltd. sells its products at ₹ 16 per unit. In a period, if it produces and sells 20,000 units, it incurs a loss of ₹ 2 per unit. If the volume is doubled, it earns a profit of ₹ 2.20 per unit. The amount of fixed cost and breakeven point (in units) will be

(A) ₹ 1,68,000 and 26,250 units

(B) ₹ 8,000 and 53,333 units

(C) ₹ 1,60,000 and 25,000 units

(D) ₹ 1,70,000 and 42,500 units

Answer:

(A) ₹ 1,68,000 and 26,250 units

Question 56.

June 2016:

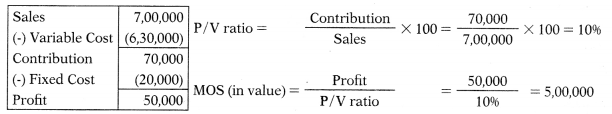

Profit : ₹ 50,000

Contribution : ₹ 70,000

Sales : ₹ 7,00,000

The amount of margin of safety will be

(A) ₹ 4,00,000

(B) ₹ 5,00,000

(C) ₹ 2,50,000

(D) ₹ 1,45,000

Hint:

Answer:

(B) ₹ 5,00,000

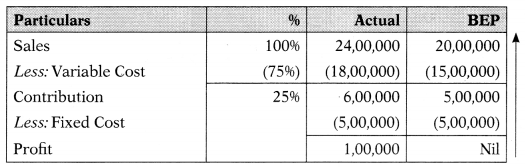

Question 57.

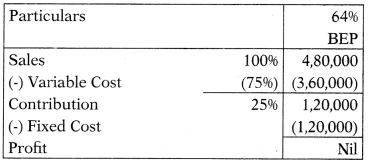

June 2016: The ratio of variable cost to sales is 75%. The break-even point occurs at 64% of the capacity sales when fixed cost is ₹ 1,20,000. The 100% capacity sales will be

(A) ₹ 4,80,000

(B) ₹ 12,50,000

(C) ₹ 7,50,000

(D) None of the above

Hint:

Sales at 100% = \(\frac{4,80,000}{64}\) × 100 = 7,50,000

Answer:

(C) ₹ 7,50,000

Question 58.

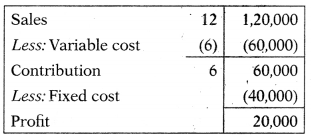

Dec 2016: Raj Ltd. furnishes the following information:

Production: 10,000 units

Sales: 5,000 units

Selling price: ₹ 12 per unit

Variable cost: 6 per unit

Fixed costs: ₹ 40,000 p.a.

Profit/loss under marginal costing method will be

(A) ₹ 10,000 (Profit)

(B) ₹ 10,000 (Loss)

(C) ₹ 20,000 (Profit)

(D) ₹ 20,000 (Loss)

Hint:

| Sales | 60,000 |

| (-) Variable cost | (30,000) |

| Contribution | 30,000 |

| (-) Fixed cost | (40,000) |

| Loss | (10,000) |

Answer:

(B) ₹ 10,000 (Loss)

Question 59.

Dec 2016: A radio manufacturer finds that while it costs 16.25 per unit to make a component, the same is available in the market at ₹ 5.75 each. Continuous supply is also fully assured. The break-up of costs per unit is as follows:

Materials: ₹ 2.75

Labour: ₹ 1.75

Other variable expenses: ₹ 0.50

Depreciation & other fixed costs: ₹ 1.25

The best option for the manufacturer will be

(A) To make

(B) To buy

(C) To sell

(D) None of the above

Hint:

In ‘make or buy decisions, it is profitable to buy from outside only when the supplier’s price is below the firm’s own variable cost.

Buying cost = 5.75

Making variable cost = 2.75 + 1.75 + 0.50 = 5

A radio manufacturer is advised to make the component.

Answer:

(A) To make

Question 60.

Dec 2016: Following data is obtained from the cost records of Moon Ltd.:

P/V ratio will be

(A) 40%

(B) 46%

(C) 52%

(D) 50%

Hint:

P/V Ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{30,000-20,000}{1,20,000-1,00,000}\) × 100 = \(\frac{10,000}{20,000}\) × 100 = 50%

Answer:

(D) 50%

Question 61.

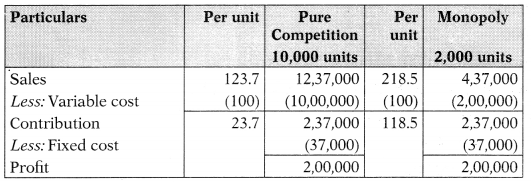

Dec 2016: In a purely competitive market, 10,000 pocket transistors can be manufactured and sold and certain

profit is generated. It is estimated that 2.0 pocket transistors need to be manufactured and sold in a monopoly market to earn the same profit. Profit under both conditions is targeted at ₹ 2,00,000. The variable cost per transistor is ₹ 100 and total fixed costs are ₹ 37,000. Unit selling price per transistor under monopoly condition will be

(A) ₹ 218.50

(B) ₹ 234.50

(C) ₹ 267.25

(D) ₹ 274.35

Hint:

| Units | Monopoly market 2,000 |

| Sales | 4,37,000 |

| (-) Variable cost | (2,00,000) |

| Contribution | 2,37,000 |

| (-) Fixed cost | (37,000) |

| Profit | 2,00,000 |

Unit selling price = \(\frac{4,37,000}{2,000}\) = 218.50

Answer:

(A) ₹ 218.50

Question 62.

Dec 2016: Following information is related to Product-A:

In 2015, the variable cost was 7200per unit and fixed cost ₹ 40 per unit. Production was 1,20,000 units. It is expected that production in 2016 will increase to 1.60.0 units. The variable cost will increase by 25% and fixed cost by 10% in 2016. The amount of fixed cost in 2016 will be

(A) ₹ 52,80,000

(B) ₹ 70,40,000

(C) ₹ 64,00,000

(D) ₹ 48,00,000

Hint:

1,20,000 × 40 × 110%= 52,80,000

Answer:

(A) ₹ 52,80,000

Question 63.

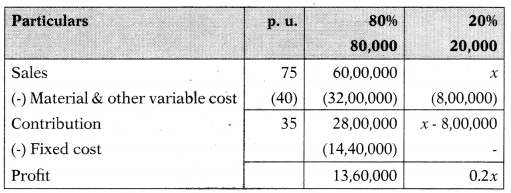

Dec 2016: Following information is given for a product of a manufacturing company:

Material ₹ 18 per unit; other variable costs ₹ 22 per unit; and fixed expenses ₹ 18 per unit. The selling price is ₹ 75 per unit. The company is presently producing 80.0 units at 80% capacity. The company received an offer for 20,000 units from a foreign customer. The minimum price to be accepted from a foreign customer, if the company wants to earn 20% on foreign sales will be

(A) ₹ 50

(B) ₹ 58

(C) ₹ 72.50

(D) ₹ 69.60

Hint:

x – 8,00,000 = 0.2.x

0.8x = 8,00,000

x = 10,00,000

Price per unit = 10,00,000/20,000 = 50

Answer:

(A) ₹ 50

Question 64.

Dec 2016: Margin of safety in a company can be improved by:

(1) Reducing the fixed cost and variable cost

(2) Increasing sales volume and price of sales

(3) Increasing stock of material in the expectation of price rise

(4) Expanding business to fulfil the demand of the market

(5) Changing the product mix to increase contribution.

Select the correct answer from the options given below

(A) (1), (2) and (3)

(B) (1), (2) and (5)

(C) (1), (3) and (4)

(D) (2), (3) and (5)

Answer:

(B) (1), (2) and (5)

Question 65.

Dec 2016:

Statement -1

When there are no inventories, the profit figure under marginal costing and absorption costing is identical.

Statement – II

Inventories are valued at cost of production in absorption and marginal costing systems.

Select the correct answer from the options given below

(A) Both statements are correct

(B) Both statements are incorrect

(C) Statement-I is incorrect, but Statement-!! is correct

(D) Statement-I is correct, but Statement-II is incorrect

Answer:

(D) Statement-I is correct, but Statement-II is incorrect

Question 66.

Dec 2016: The P/V ratio of Akhil & Co. is 50% and margin of safety is 40%. The company sold 500 units for ₹ 5,00,000. The break-even point sales will be

(A) ₹ 2,50,000

(B) ₹ 3,00,000

(C) ₹ 3,50,000

(D) ₹ 4,00,000

Hint:

Margin of safety = Actual sales – Break even sales

4096 = 100% – Break even sales

Break even sales = 60%

5,00,000 × 60% = 3,00,000

Answer:

(B) ₹ 3,00,000

Question 67.

June 2017: Ramya Ltd. furnishes the following information:

Production 10,000 units,

Sales 10,000 units,

Selling price ₹ 12 per unit,

Variable cost ₹ 6 per unit,

Fixed costs ₹ 40,000 per annum (normal capacity of 10,000 units)

Profit/Loss under marginal costing method will be:

(A) ₹ 10,000

(B) ₹ 30,000

(C) ₹ 20,000

(D) ₹ 25,000

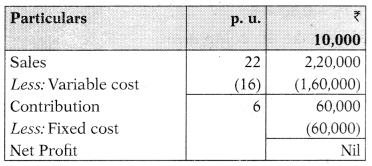

Hint:

Answer:

(C) ₹ 20,000

Question 68.

June 2017: A manufacturer produces 2,00,000 units of a product at a cost of ₹ 3.25 per unit. Later on, he produces 2,75,000 units at a cost of ₹ 3.20 per unit, when its fixed overheads have increased by 10%. The originally fixed overheads will be:

(A) ₹ 50,000

(B) ₹ 55,000

(C) ₹ 30,000

(D) ₹ 40,000

Hint:

A simple way to solve this MCQ is to apply the figures of the given option in the following ways:

Let’s take the figure of Option (A) ₹ 50,000 as fixed overhead.

Since the variable overhead per unit remains the same, Option (A) is correct.

Answer:

(A) ₹ 50,000

Question 69.

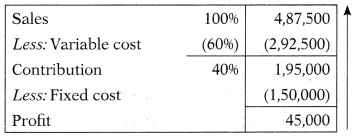

June 2017: Mr Mahesh has a sum of ₹ 3,00,000 which invested in a business. He wishes for a 15% return on his fund. It is revealed from the present cost data analysis that the variable cost of operation is 60% of sales and fixed costs are ₹ 1,50,000 p.a. On the basis of this information, you are required to find out the sales volume to earn a 15% return.

(A) ₹ 4.875 Lakhs

(B) ₹ 4.675 Lakhs

(C) ₹ 4.775 Lakhs

(D) ₹ 5.875 Lakhs

Hint:

Required return = 3,00,000 × 1596 = 45,000

Answer:

(A) ₹ 4.875 Lakhs

Question 70.

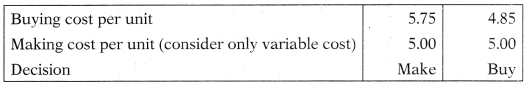

June 2017: A radio manufacturer finds that it costs ₹ 6.25 per unit to make component M-140 and the same is available in the market at ₹ 5.75 each. Continuous supply is also fully assured. The break-down cost per unit as follows: Materials ₹ 2.75, Labour ₹ 1.75 other variable expenses ₹ 0.50, Depreciation and other fixed cost ₹ 1.25. What would be your decision, if the supplier offered the component at ₹ 4.85 per unit?

(A) Make

(B) Buy

(C) Sell

(D) None of the above

Hint:

The present MCQ is based on “make or buy”.

Variable cost of making = 2.75 + 1.75 + 0.50 = 5.00

Answer:

(B) Buy

Question 71.

June 2017: In a purely competitive market, 10,000 pocket transistors can be manufactured and sold and certain profit is generated. It is estimated that 2,0 pocket transistors need to be manufactured and sold in a monopoly market to earn the same profit. Profit under both conditions is targeted at ₹ 2,00,000. The variable cost per transistor is ₹ 100 and the total fixed costs are ₹ 37,000. You are required to find out the unit selling price per transistor under competitive condition.

(A) ₹ 125.70

(B) ₹ 123.70

(C) ₹ 128.70

(D) ₹ 228.70

Hint:

Answer:

(B) ₹ 123.70

Question 72.

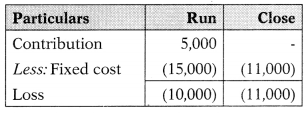

June 2017: A firm has given the following data:

Fixed expenses at 50% ₹ 15,000, Fixed expenses when factory is close down ₹ 10,000, Additional expenses in closing down ₹ 1,000, Production at 50% capacity 5,000 units, contribution per unit ₹ 1. Advise whether to run the factory or close it down:

(A) Close

(B) Run

(C) Continue

(D) None of the above

Hint:

Since the loss is greater when the factory is closed, it advised running the factory.

Answer:

(B) Run

Question 73.

June 2017: From the following data, the P/V ratio will be:

(A) 50%

(B) 10%

(C) 20%

(D) 40%

Hint:

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{10,00,000-5,00,000}{75,00,000-50,00,000}\) × 100 = \(\frac{5,00,000}{25,00,000}\) × 100 = 20%

Answer:

(C) 20%

Question 74.

June 2017: You are requested to report to the top management of Eastern India Engineering Company the point of sales in terms of rupee to break-even. For the purpose, you obtain that:

Fixed overheads remain constant at ₹ 12,000

Variable costs will rise zero to ₹ 12,000 Selling price is ₹ 600 per ton

The tonnage produced and sold is 30 tons.

(A) ₹ 36,000

(B) ₹ 32,000

(C) ₹ 30,000

(D) ₹ 38,000

Hint:

Answer:

(A) ₹ 36,000

Question 75.

June 2017: In a period sales amount to ₹ 2,00,000, net profit ₹ 20,000 and Fixed overheads are ₹ 30,000. If sales ₹ 3,00,000 profit will be:

(A) ₹ 48,000

(B) ₹ 50,000

(C) ₹ 40,000

(D) ₹ 45,000

Hint:

Answer:

(D) ₹ 45,000

Question 76.

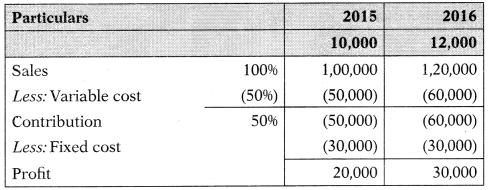

June 2017: Reliance Furniture House places before you the following trading results:

Fixed cost will be:

(A) ₹ 15,000

(B) ₹ 10,000

(C) ₹ 30,000

(D) ₹ 60,000

Hint:

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{30,000-20,000}{1,20,000-1,00,000}\) × 100 = \(\frac{10,000}{20,000}\) × 100 = 50%

Answer:

(C) ₹ 30,000

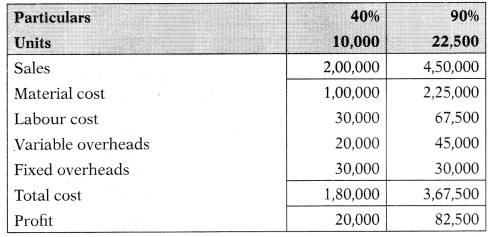

Question 77.

June 2017: A factory engaged in manufacturing plastic buckets is working at 40% capacity and produces 10,0 buckets per annum. The present cost-break-up for one bucket is as under:

| Materials | ₹ 10 |

| Labour | ₹ 3 |

| Overheads | ₹ 5 (60% fixed) |

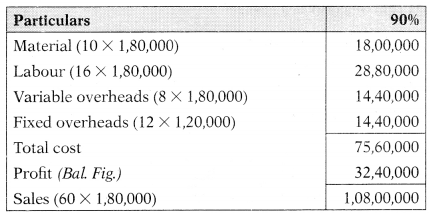

The selling price per bucket ₹ 20. If the factory operates 90% of capacity the profit will be:

(A) ₹ 75,000

(B) ₹ 80,000

(C) ₹ 82,500

(D) ₹ 92,500

Hint:

Answer:

(C) ₹ 82,500

Question 78.

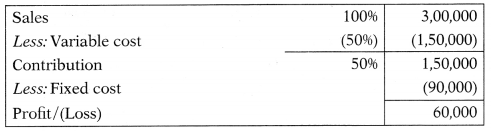

June 2017: A company has fixed costs of ₹ 90,000 with sales of ₹ 3,00,000 and profit of ₹ 60,000. Margin of safety will be:

(A) ₹ 1,00,000

(B) ₹ 1,20,000

(C) ₹ 1,50,000

(D) ₹ 1,30,000

Hint:

MOS (in value) = \(\frac{\text { Profit }}{\mathrm{P} / \mathrm{V} \text { ratio }}=\frac{60,000}{50 \%}\) = 1,20,000

Answer:

(B) ₹ 1,20,000

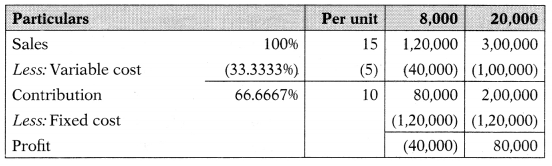

Question 79.

June 2017: A company sells its product at ₹ 15 per unit. In a period if it produces and sells 8,000 units, it incurs a loss of ₹ 5 per unit. If the volume is raised to 20,000 units, it earns a profit of ₹ 4 per unit. Break-even point in units will be:

(A) 13,000 units

(B) 12,000 units

(C) 14,000 units

(D) 10,000 units

Hint:

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{80,000-(-40,000)}{3,00,000-1,20,000}\) × 100 = \(\frac{1,20,000}{1,80,000}\) × 100 = 66.6667%

BEP (in units) = \(\frac{\text { Fixed cost }}{\text { Contribution p. u. }}=\frac{1,20,000}{10}\) = 12,000 units

Answer:

(B) 12,000 units

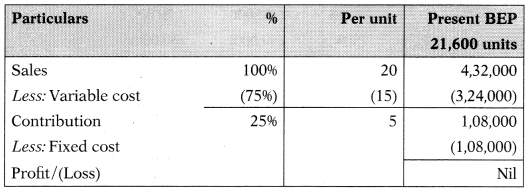

Question 80.

June 2017: The cost accountant of M Ltd. has ascertained the selling price of a product is ₹ 20 per unit. The variable cost is ₹ 15 per unit and the break-even point is 21,600 units. Management has decided to treat 12,000 units of B.E.P. because the production department cannot produce more than this at the moment. The selling price for 12,000 units B.E.P. will be:

(A) ₹ 20 per unit

(B) ₹ 24 per unit

(C) ₹ 26 per unit

(D) ₹ 28 per unit

Hint:

Answer:

(B) ₹ 24 per unit

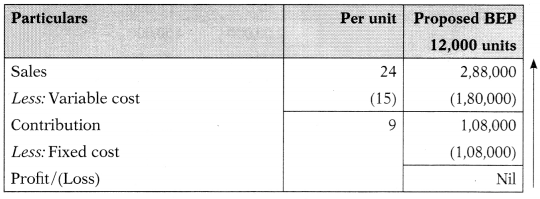

Question 81.

June 2017: Yadhav Co. has an annual fixed cost of ₹ 1,20,000. In 2015 sales amounted to ₹ 6,00,000 as compared to ₹ 4,50,000 in 2014 and prophet in 2015 was ₹ 50,000 higher than in 2014. If there is no need to expand the company’s capacity. The prophet or loss in 2016 on a forecasted sales of ₹ 9,00,000 will be:

(A) ₹ 1,80,000

(B) ₹ 1,90,000

(C) ₹ 1,70,000

(D) ₹ 1,85,000

Hint:

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{50,000}{1,50,000}\) × 100 = 33.3333%

Answer:

(A) ₹ 1,80,000

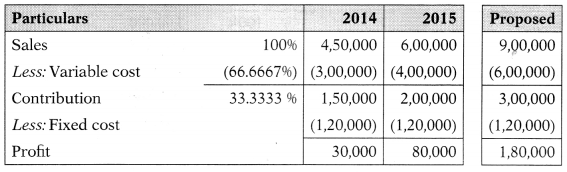

Question 82.

June 2017: A company manufactures and sells three types of product namely A, B and C. Total sales per month is ₹ 80,000 in which the share of these three products are 50%, 30% and 20% respectively. The variable cost of these products is 60%, 50% and 40% respectively. The combined P/V Ratio will be:

(A) 49%

(B) 48%

(C) 47%

(D) 50%

Hint:

Combined P/V ratio = (40 × 50%) + (50 × 30%) + (60 × 20%) = 47%

Variable cost per unit = \(\frac{\text { Change in cost }}{\text { Change in units }}=\frac{20,000}{10,000}\) = 2

Answer:

(C) 47%

Question 83.

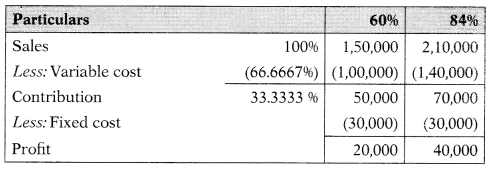

June 2017: A plant is operating at 60% capacity. The fixed costs are ₹ 30,000, the variable costs are ₹ 1,00,000 and the sales amount to ₹ 1,50,000. The percentage of capacity at which the plant should operate to earn a prophet of ₹ 40,000 will be:

(A) 80%

(B) 84%

(C) 90%

(D) 94%

Hint:

\(\frac{60}{1,50,000}\) × 2,10,000 = 84%

Answer:

(B) 84%

Question 84.

June 2017: When the margin of safety is 20% and the P/V ratio is 60%, the prophet will be:

(A) 30%

(B) 33.3333%

(C) 12%

(D) None of the above

Hint:

Margin of safety = \(\frac{\text { Profit }}{\mathrm{P} / \mathrm{V} \text { ratio }}\)

20% = \(\frac{x}{60 \%}\)

x = Profit = 20 × 60% = 12%

Answer:

(C) 12%

Question 85.

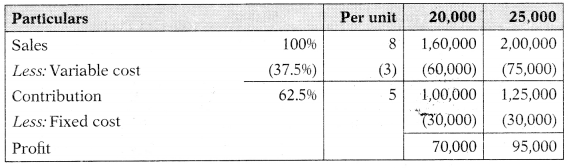

June 2017: If the total cost of producing 20,000 units of a product is ₹ 90,000 and if 25,000 units will be produced, then the total cost will be ₹ 1,05,000 and the selling price is ₹ 8 per unit. The break-even point will be:

(A) 10,000 units

(B) 8,000 units

(C) 6,000 units

(D) 5,000 units

Hint:

Profit at 20,000 units = 1,60,000 – 90,000 = 70,000

Profit at 25,000 units = 2,00,000 – 1,05,000 = 95,000

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{25,000}{40,000}\) × 100 = 62.5%

BEP (in units) = \(\frac{\text { Fixed Cost }}{\text { Contribution p.u. }}=\frac{30,000}{5}\) = 6,000

Answer:

(C) 6,000 units

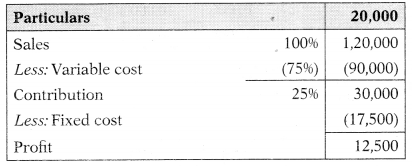

Question 86.

June 2017: P/V ratio 25%, Sales ₹ 1,20,000 and Fixed costs ₹ 17,500, Profit will be:

(A) ₹ 12,500

(B) ₹ 30,000

(C) ₹ 17,500

(D) ₹ 20,000

Hint:

Answer:

(A) ₹ 12,500

Question 87.

June 2017: Under marginal costing system, product costs are:

(A) Equal to fixed cost plus variable costs

(B) Equal to only marginal costs

(C) Equal to semi-variable costs

(D) None of the above

Answer:

(B) Equal to only marginal costs

Question 88.

June 2017: Prime cost plus variable overheads gives:

(A) Cost of sales

(B) Marginal costs

(C) Works cost

(D) Cost of production

Answer:

(B) Marginal costs

Question 89.

Which of the following is not true?

(A) P/V Ratio = \(\frac{\text { Profit }}{\text { Margin of Safety}}\) × 100

(B) Break-even Point = \(\frac{\text { Fixed Cost }}{\mathrm{P} / \mathrm{V} \text { ratio }}\)

(C) Break-even Point = \(\frac{\text { Fixed Cost }}{\mathrm{P} / \mathrm{V} \text { ratio }}\) × 100

(D) P/V Ratio = \(\frac{\text { Fixed Cost }}{\text { B.E.P. }(\operatorname{in} ₹)}\) × 100

Answer:

(C) Break-even Point = \(\frac{\text { Fixed Cost }}{\mathrm{P} / \mathrm{V} \text { ratio }}\) × 100

Question 90.

June 2017:

Assertion (A):

In management accounting firm decisions on pricing policy can be taken.

Reason (R):

As the marginal cost per unit is constant from period to period within a short span of time.

Codes:

(A) A is true, but R is false

(B) A is false, but R is true

(C) Both A & R are true and R is the correct explanation of A

(D) Both A & R are true but R is not the correct explanation of A

Answer:

(C) Both A & R are true and R is the correct explanation of A

Question 91.

June 2017:

Assertion (A):

ProRt volume ratio is considered to be the best indicator of the profitability of the business.

Reason (R):

If the profit volume ratio improved, it will result in better profits.

Codes:

(A) A is false, but R is true

(B) A is true, but R is false

(C) Both A & R are true but R is not the correct explanation of A

(D) Both A & R are true and R is the correct explanation of A

Answer:

(C) Both A & R are true but R is not the correct explanation of A

Question 92.

June 2017:

Statement I:

The margin of safety represents the difference between the sales at the breakeven point and the total sales.

Statement II:

Margin safety can be expressed as a percentage of total sales or in value or in terms of quantity.

Codes:

(A) Statement I is correct but statement II is incorrect

(B) Statement I is incorrect but statement II is correct

(C) Both statements are correct

(D) Both statements are incorrect

Answer:

(C) Both statements are correct

Question 93.

June 2017: Match the following:

| List I | List II |

| (a) Classification of costs into a fixed and variable cost | (1) Contribution |

| (b) Difference between sales and variable cost | (2) P/V ratio |

| (c) Both fixed and variable cost are charged to the product | (3) Marginal Costing |

| (d) Relative profitability | (4) Absorption |

Codes:

Answer:

(B)

Question 94.

June 2017: Consider the following statements:

(1) Marginal costing and absorption costing are the same.

(2) For decision-making, absorption costing is more suitable than marginal costing.

(3) Cost-volume-profit relationship also denotes the break-even point.

(4) Marginal costing is based on the distribution between fixed and variable costs.

Which of the statements given above are correct?

(A) 4 and 2

(B) 2 and 3

(C) 3 and 4

(D) 1 and 2

Answer:

(C) 3 and 4

Question 95.

June 2017: Which of the following are the advantages of marginal costing?

(1) Pricing decision

(2) True profit

(3) Difficulty to classify

(4) Ignores time value

(5) Break-even analysis

(6) Contribution is not final

(7) Control over expenditure Codes:

(A) 1,3, 5 and 7

(B) 1,2, 5 and 7

(C) 3, 4, 6 and 7

(D) 1, 2, 6 and 7

Answer:

(B) 1,2, 5 and 7

Question 96.

Dec 2017: Marginal Costing in America is called as:

(A) Differential costing

(B) Out-of-pocket costing

(C) Direct costing

(D) Variable costing

Answer:

(C) Direct costing

Question 97.

Dec 2017:

Statement-I:

Break-even analysis has gradually become a popular service tool for modern financial management.

Statement-II:

No concrete limitations have been raised anywhere against the utility of break-even analysis.

Select the correct answer from the option given below:

(A) Both statements are correct

(B) Both statements are wrong

(C) Statement I is correct but statement II is not correct

(D) Statement I is not correct but statement II is correct

Answer:

(C) Statement I is correct but statement II is not correct

Question 98.

Dec 2017: When fixed costs are ₹ 90,000, the ratio of variable cost to sales is 75% and the break-even point occurs at 60% of the capacity sales, the capacity sales are:

(A) ₹ 4,50,000

(B) ₹ 5,60,000

(C) ₹ 6,00,000

(D) ₹ 7,50,000

Hint:

Answer:

(C) ₹ 6,00,000

Question 99.

Dec 2017: The P/V ratio of a company is 40%. If the company reduces its selling price by 20%, the required percentage of increase in sales value to maintain the same profit is:

(A) 20%

(B) 40%

(C) 60%

(D) 75%

Hint:

The following data is assumed:

Selling price per unit = 20; No. of units = 500; Fixed cost = 1,000.

If the company reduces its selling price by 20% the required percentage of increase in sales value to maintain the same profit is as shown below:

Percentage increase in sales value = \(\frac{16,000-10,000}{10,000}\) × 100 = 60%

Answer:

(C) 60%

Question 100.

Dec 2017: Mr. R’s sales and profit in 2015 were respectively ₹ 1,20,000 and ₹ 8,000. His sales & profit in 2016 were ₹ 1,40,000 & ₹ 13,000 respectively. In this case his margin of Safety in 2016 was:

(A) ₹ 32,000

(B) ₹ 52,000

(C) ₹ 88,000

(D) ₹ 1,36,000

Hint:

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{13,000-8,000}{1,40,000 \cdot 1,20,000}\) × 100 = 40%

MOS (in value) = \(\frac{\text { Profit }}{\mathrm{P} / \mathrm{V} \text { ratio }}=\frac{13,000}{25 \%}\) = 52,000

Answer:

(B) ₹ 52,000

Question 101.

Dec 2017: Z Ltd. has a margin of safety of 4,000 units and break-even sales at 1,000 units. If its margin of safety sales is ₹ 2,00,000, total sales shall be:

(A) ₹ 8,00,000

(B) ₹ 6,00,000

(C) ₹ 4,00,000

(D) ₹ 2,50,000

Hint:

\(\frac{2,00,000}{4,000}\) × 5,000 = 2,50,000

Answer:

(D) ₹ 2,50,000

Question 102.

Dec 2017: R.V. Ltd., made a sale for ₹ 4,50,000 in the first half and for ₹ 5,00,000 in the second half of 2016. In this year the total cost for the first and the second half of the year were respectively ₹ 4,00,000 and ₹ 4,30,000. If there is no change in selling price and variable cost and that the fixed expenses are incurred equally, the break-even sales for the whole year is:

(A) ₹ 6,50,000

(B) ₹ 6,00,000

(C) ₹ 5,00,000

(D) ₹ 4,50,000

Hint:

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{20,000}{50,000}\) × 100 = 40%

BEP = \(\frac{\text { Fixed Cost }}{\mathrm{P} / \mathrm{V} \text { Ratio }}=\frac{2,60,000}{40 \%}\) × 100 = 6,50,000

Answer:

(A) ₹ 6,50,000

Question 103.

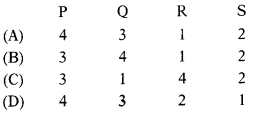

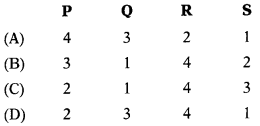

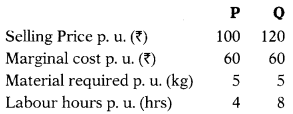

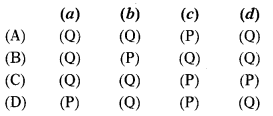

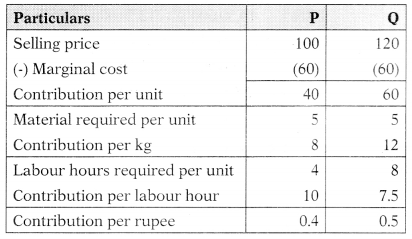

Dec 2017: Following are the particulars relating to products P and Q:

Which product is more profitable when?

(a) Material is the key factor.

(b) Labour hour is the key factor.

(c) Sales potential in units is the key factors.

(d) Sales potential in rupees is the key factors.

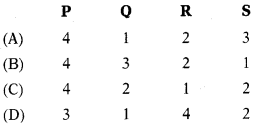

Codes:

Hint:

(a) Material is a key factor: Product Q is better as contribution per kg is high.

(b) Labour hour is a key factor: Product P is better as contribution per labour hour is high.

(c) Sales potential in units is the key factor: Product Q is better as contribution per unit is high.

(d) Sales potential in rupee is the key factor: Product Q is better as contribution per rupee is high.

Answer:

(B)

Question 104.

June 2018: If the P/V ratio of a product is 25% and the selling price is ₹ 25 per unit, the marginal cost of the product would be:

(A) ₹ 18.75

(B) ₹ 16

(C) ₹ 15

(D) ₹ 20

Hint:

The P/V ratio is 25%. This means the variable cost ratio is 75%.

Variable cost per unit = 25 × 75% = 18.75

Answer:

(A) ₹ 18.75

Question 105.

June 2018: Contribution is the difference between:

(A) Selling price and Fixed cost

(B) Selling price and Total cost

(C) Selling price and Variable cost of sales

(D) Selling price and Profit

Answer:

(C) Selling price and Variable cost of sales

Question 106.

June 2018: Which of the statement is not true in respect of cost-volume-profit analysis?

(A) In order to forecast profit accurately, it is essential to know the relationship between profits and costs on the one hand and volume on the other.

(B) Cost-volume analysis is not suitable for setting up flexible budgets which indicate costs at various levels of activity.

(C) Cost-volume-profit analysis is of assistance in performance evaluation for the purpose of control.

(D) Analysis of cost-volume-profit relationship may assist in formulating price policies to suit particular circumstances by projecting the effect which different price structures have on costs and profits.

Answer:

(C) Cost-volume-profit analysis is of assistance in performance evaluation for the purpose of control.

Question 107.

June 2018: Total cost of a product: ₹ 10,000; Profit: 25% on Selling Price; Profit is:

(A) ₹ 2,500

(B) ₹ 3,000

(C) ₹ 3,333

(D) ₹ 2,000

Hint:

Profit is 25% on selling price which means it is 33.33% on cost.

10,000 × 33.33% = 3,333

Answer:

(C) ₹ 3,333

Question 108.

June 2018: A manufacturing company provides you with the following information for the coming month:

| Budgeted sales revenue | ₹ 7,50,000 |

| Budgeted contribution | ₹ 3,00,000 |

| Budgeted profit | ₹ 75,000 |

What will be the budgeted break-even sales volume?

(A) ₹ 9,37,500

(B) ₹ 5,25,000

(C) ₹ 5,62,500

(D) ₹ 6,75,000

Hint:

P/V ratio = \(\frac{3,00,000}{7,50,000}\) × 100 = 40%

Fixed cost = 3,00,000 + 75,000 = 3,75,000

BEP (in value) = \(\frac{\text { Fixed Cost }}{\mathrm{P} / \mathrm{V} \text { ratio }}=\frac{3,75,000}{40 \%}\) = 9,37,500

Answer:

(A) ₹ 9,37,500

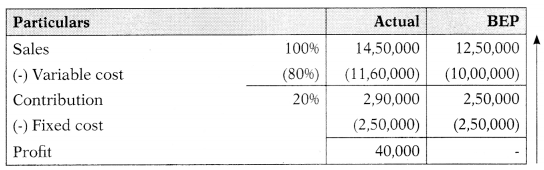

Question 109.

June 2018: A company, which has a margin of safety of ₹ 2,00,000 makes a profit of ₹ 40,000. If the fixed cost is ₹ 2,50,000, break-even sales of the company would be:

(A) ₹ 15,00,000

(B) ₹ 12,50,000

(C) ₹ 10,00,000

(D) ₹ 20,00,000\

Hint:

MOS (in value) = \(\frac{\text { Profit }}{\mathrm{P} / \mathrm{V} \text { ratio }}\)

2,00,000 = \(\frac{40,000}{x}\)

x = P/V ratio = 20%

Answer:

(B) ₹ 12,50,000

Question 110.

June 2018: The P/V ratio of a company is 50% and the margin of safety is 40%. If present sales are ₹ 30,00,000 then Break-Even Point will be:

(A) ₹ 9,00,000

(B) ₹ 18,00,000

(C) ₹ 5,00,000

(D) None of the above

Hint:

The margin of safety is 40%; this means BEP will occur at 60%.

30,00,000 × 60% = 18,00,000

Answer:

(B) ₹ 18,00,000

Question 111.

June 2018: When the sales increase from ₹ 40,000 to ₹ 60,000 and profit increases by ₹ 5,000, the P/V ratio is:

(A) 20%

(B) 30%

(C) 25%

(D) 40%

Hint:

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{5,000}{20,000}\) × 100 = 25%

Answer:

(C) 25%

Question 112.

June 2018:

Assertion (A):

Marginal costing furnishes a better and more logical basis for fixation of sales prices as well as tendering for contracts.

Reason (R):

Marginal cost provides management with information regarding the behaviour of costs and the incidence of such cost on the profitability of an undertaking.

Select the correct answer from the options given below:

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true but R is not the correct explanation of A

(C) A is true but R is false

(D) A is false but R is true

Answer:

(A) Both A and R are true and R is the correct explanation of A

Question 113.

June 2018: Actual overheads for the year ending 31st March 2017 were ₹ 21,000, whereas the overhead absorbed shows an over absorption of ₹ 1,000 for the same period. If the direct labour cost is ₹ 1,00,000, then the overhead absorption rate based on direct wages would be:

(A) 20%

(B) 21%

(C) 22%

(D) 25%

Hint:

Overhead Absorbed = 21,000 + 1,000 = 22,000

Overhead Absorption Rate = \(\frac{\text { Overhead Absorbed }}{\text { Direct Wages }}\) × 100 = \(\frac{22,000}{1,00,000}\) × 100 = 22%

Answer:

(C) 22%

Question 114.

June 2018: If the sales of a product are ₹ 94,080 and the profit margin cost 12%, the amount of profit will be:

(A) ₹ 7,800

(B) ₹ 11,290

(C) ₹ 8,580

(D) ₹ 10,080

Hint:

94,080 × 12/112 = 10,080

Answer:

(D) ₹ 10,080

Question 115.

June 2018: ABC Ltd. shows break-even sales of ₹ 40,500 and budgeted sales of ₹ 50,000. Compute the margin of safety ratio?

(A) 19%

(B) 81%

(C) 1.81%

(D) Require more data to calculate

Hint:

[(50,000 – 40,500)/50,000] × 100 = 19%

Answer:

(A) 19%

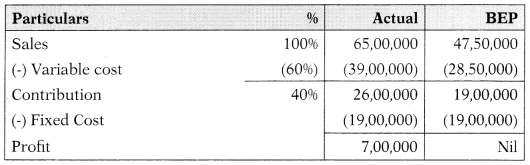

Question 116.

Dec 2018: P/V Ratio 4096; Sales

₹ 65,00,000 and BEP ₹ 47,50,000. Proht will be:

(A) ₹ 26,00,000

(B) ₹ 19,00,000

(C) ₹ 45,00,000

(D) ₹ 7,00,000

Hint:

Answer:

(D) ₹ 7,00,000

Question 117.

Dec 2018: If the standard output for 8 hours is 200 units and the actual output in 10 hours is 350 units, the efficiency level will be:

(A) 175%

(B) 140%

(C) 57.14%

(D) 71.42%

Hint:

For 8 hrs – 200 units

For 10 hrs – ?

(10 × 200)/8 = 250 units

Efficiency % = \(\frac{\text { Actual output }}{\text { Standard output }}\) × 100 = \(\frac{350}{250}\) × 100 = 140%

Answer:

(B) 140%

Question 118.

Dec 2018: From the following data, the P/V Ratio will be:

(A) 12%

(B) 25%

(C) 20%

(D) 33.33%

Note: ThisMCQ is not properly drafted; for further clarification please see the hints.

Hint:

None of the title given options is correct; see title calculation below:

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{10,00,000}{20,00,000}\) × 100 = 50%

Answer:

Question 119.

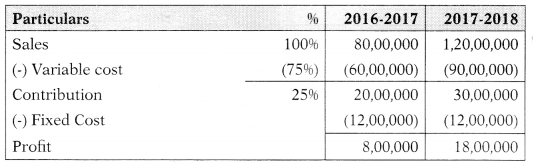

Dec 2018: Given, Sales ₹ 80 Lakh; Net Profit ₹ 8 Lakh and Fixed Cost ₹ 12 Lakh. On the basis of the data, if sales is ₹ 120 Lakh, then the profit will be:

(A) ₹ 18 Lakh

(B) ₹ 12 Lakh

(C) ₹ 10 Lakh

(D) ₹ 6 Lakh

Hint:

Answer:

(A) ₹ 18 Lakh

Question 120.

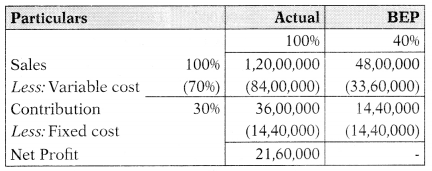

Dec 2018: A factory engaged in manufacturing LED Lamps is working at 6096 capacity and produces 1,20,000 LED Lamps per annum. The present cost-break-up and selling price for one LED Lamp is as under:

| ₹ | |

| Direct Material | 10 |

| Direct Labour | 16 |

| Overheads (60% fixed) | 20 |

| Selling Price | 60 |

If the factory operates its 90% capacity, then profit will be:

(A) ₹ 16,80,000

(B) ₹ 32,40,000

(C) ₹ 25,20,000

(D) ₹ 67,20,000

Hint:

Answer:

(B) ₹ 32,40,000

Question 121.

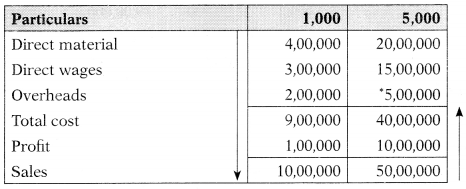

Dec 2018: The production cost of 1,0 units of an article is as follows:

| Costs | ₹ |

| Direct Material | 4,00,000 |

| Direct Wages | 3,00,000 |

| Fixed & Variable Overheads | 2,00,000 |

The company produced 5,000 units and sold at ₹ 1,000 per unit and earned a profit of ₹ 10,00,000. The amount of variable overhead per unit is:

(A) ₹ 200

(B) ₹ 75

(C) ₹ 100

(D) ₹ 120

Hint:

Variable overheads per unit = \(\frac{\text { Change in overheads }}{\text { Change in units }}=\frac{3,00,000}{4,000}\) = 75

Answer:

(B) ₹ 75

Question 122.

Dec 2018: P/V Ratio for the firm is 60%, Total fixed costs are ₹ 10,40,000 and variable cost per unit is ₹ 720. If the sales are 20,000 units, then the selling price per unit will be:

(A) ₹ 1,200

(B) ₹ 772

(C) ₹ 1,930

(D) ₹ 1,800

Answer:

(D) ₹ 1,800

Question 123.

Dec 2018: If the P/V Ratio is 30%, Margin of Safety is 40% and BEP is ₹ 48 Lakh, then the profit will be:

(A) ₹ 9.60 Lakh

(B) ₹ 14.40 Lakh

(C) ₹ 5.76 Lakh

(D) ₹ 24 Lakh

Note: This MCQ is not properly drafted; for further clarification please see the hints.

Hint:

The margin of safety is 40% which means BEP occurs at 40%

Net profit is 21,60,000 hut none of the option given contains this figure.

Answer:

Question 124.

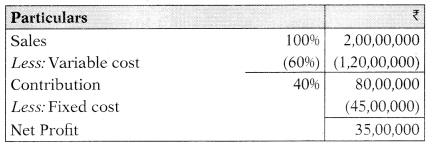

Dec 2018: Fixed costs ₹ 45 Lakh, Variable costs ₹ 120 Lakh and Profit ₹ 35 Lakh, then P/V Ratio is:

(A) 29.17%

(B) 37.5%

(C) 66.67%

(D) 40%

Hint:

Answer:

(D) 40%

Question 125.

Dec 2018: Which of the following techniques of costing is also known as out-of-pocket costing?

(A) Standard Costing

(B) Historical Costing

(C) Marginal Costing

(D) Uniform Costing

Answer:

(C) Marginal Costing

Question 126.

Dec 2018: Sales increased from ₹ 750 Lakh to ₹ 875 Lakh. If P/V Ratio is 30%, then the increase in the contribution will be:

(A) ₹ 262 Lakh

(B) ₹ 225 Lakh

(C) ₹ 37.50 Lakh

(D) ₹ 125 Lakh

Answer:

(C) ₹ 37.50 Lakh

Question 127.

June 2019: The following information is given:

Selling price ₹ 20 per unit, Variable cost ₹ 15 per unit and Fixed cost ₹ 48,000. What will be BEP sales (in ₹ ) and Profit if actual sales are 40% more than BEP sales?

(A) ₹ 1,92,000 and 20,800

(B) ₹ 1,80,000 and ₹ 18,000

(C) ₹ 96,000 and ₹ 9,600

(D) ₹ 1,92,000 and ₹ 19,200

Hint:

Contribution = 20 – 15 = 5

P/V ratio = \(\frac{\text { Contribution }}{\text { Sales }}\) × 100 = \(\frac{5}{20}\) × 100 = 25%

BEP (in value) = \(\frac{\text { Fixed cost }}{\mathrm{P} / \mathrm{V} \text { ratio }}=\frac{48,000}{25 \%}\) = 1,92,000

Answer:

(D) ₹ 1,92,000 and ₹ 19,200

Question 128.

June 2019:

Statement I:

When a factory operates at full capacity, Fixed cost also becomes relevant for make or buy decision.

Statement II:

The margin of safety is the difference between actual sales and standard sales.

Select the correct answer from the options given below:

(A) Both statements are correct

(B) Both statements are incorrect

(C) Statement I is incorrect, but Statement II is correct

(D) Statement I is correct, but Statement II is incorrect

Answer:

(D) Statement I is correct, but Statement II is incorrect

Question 129.

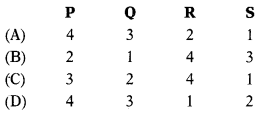

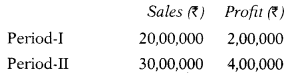

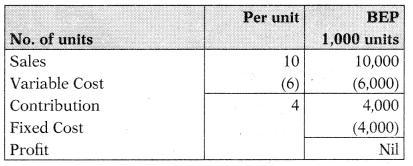

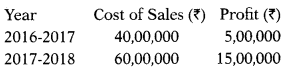

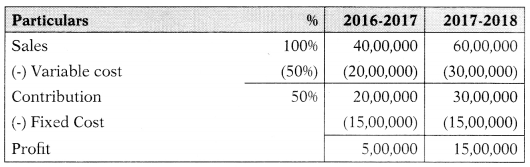

June 2019: The total cost and profit during two periods are as follows:

The profit volume ratio will be:

(A) 15%

(B) 25%

(C) 20%

(D) 33.33%

Hint:

Sales of Period I = 4,50,000 + 50,000 = 5,00,000

Sales of Period 2 = 6,50,000 + 1,00,000 = 7,50,000

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{50,000}{2,50,000}\) × 100 = 20%

Answer:

(C) 20%

Question 130.

June 2019: If profit, fixed cost and margin of safety are ₹ 19,20,000; ₹ 25,60,000 and ₹ 64,00,000 respectively, then break-even point will be:

(A) ₹ 44,80,000

(B) ₹ 85,33,333

(C) ₹ 38,40,000

(D) ₹ 48,00,000

Hint:

Answer:

(B) ₹ 85,33,333

Question 131.

June 2019: Selling price per unit ₹ 20, Trade discount 5% of selling price, cash discount 2% on sales, Material cost ₹ 3, Labour cost ₹ 4, Fixed overheads ₹ 22,000 and variable overheads 80% of labour cost. what would be the net profit if sales are 10% above the BEP?

(A) ₹ 2,000

(B) ₹ 2,500

(C) ₹ 2,200

(D) ₹ 1,850

Hint:

Trade discount = 20 × 5% = 1

Variable cost = 3 + 4 + 3.2 = 10.2

A cash discount is not considered in cost accounts.

Answer:

(C) ₹ 2,200

Question 132.

June 2019: A firm manufactures 15,0 units per annum, each taking 1.5 direct labour hours. The direct labour rate is ₹ 8 per hour and pays rise of 15% is awarded halfway through the year.

What is the total annual direct labour budget amount?

(A) ₹ 1,20,000

(B) ₹ 1,93,500

(C) ₹ 1,80,000

(D) ₹ 2,07,000

Answer:

(B) ₹ 1,93,500

Question 133.

June 2019: A factory is presently working at 50% capacity and producing 4,0 units. The cost data are as follows: Material and labour cost per unit ₹ 15, Factory overheads (40% variable) ₹ 30,000. What will be the cost of the work for 60% capacity?

(A) ₹ 1,04,400

(B) ₹ 1,12,400

(C) ₹ 1,18,600

(D) ₹ 1,22,200

Hint:

Answer:

(A) ₹ 1,04,400

Question 134.

June 2019: Based on cost accounting information, which is the tool of Management Accounting for decision-making?

(A) Marginal Costing

(B) Standard Costing

(C) Differential Costing

(D) All of the above

Answer:

(D) All of the above

Question 135.

June 2019: The effect of sale price reduction always reduces the P/V ratio to raise and shorten the

(A) BEP and Margin of Safety

(B) Fixed Cost and BEP

(C) Margin of Safety and BEP

(D) Profit and BEP

Answer:

(A) BEP and Margin of Safety

Question 136.

June 2019: ABC Ltd. had a marginal costing profit of ₹ 1,25,500 in April 2018. The opening stock was 1,800 units and the closing stock was 1,260 units. The company is considering changing to an absorption costing system. The fixed overhead absorption rate is ₹ 6 per unit. Profit under absorption costing will be:

(A) ₹ 1,28,740

(B) ₹ 1,22,260

(C) ₹ 1,14,700

(D) ₹ 1,33,060

Hint:

The difference in profit change in inventory’ level × fixed overhead per unit

Difference in profit = (1,800 – 1.260) × ₹ 6 = ₹ 3,240

The inventory level decreased during the period therefore the absorption costing profit is less than the marginal costing profit.

Profit as per absorption costing profit = 125,500 – 3,240 = 1,22,260.

Answer:

(B) ₹ 1,22,260

Question 137.

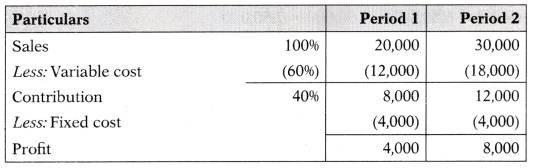

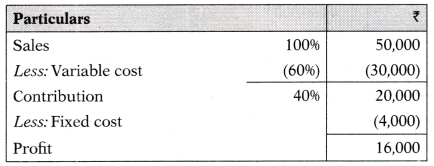

June 2019: The following information is given:

Sales to earn a profit of ₹ 16,000 will be:

(A) ₹ 40,000

(B) ₹ 60,000

(C) ₹ 50,000

(D) ₹ 75,000

Hint:

P/V ratio = \(\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100 = \(\frac{4,000-8,000}{20,000-30,000}\) × 100 = 40%

Sales to earn a profit of ₹ 16,000:

Required sales = \(\frac{\text { Contribution }}{\mathrm{P} / \mathrm{V} \text { ratio }}=\frac{20,000}{40 \%}\) = 50,000

Answer:

(C) ₹ 50,000

Question 138.

June 2019: P/V Ratio is 25% and margin of safety is ₹ 6,00,000, the amount of profit is:

(A) ₹ 2,00,000

(B) ₹ 1,60,000

(C) ₹ 1,50,000

(D) ₹ 1,20,000

Hint:

MOS (in value) = \(\frac{\text { Profit }}{\mathrm{P} / \mathrm{V} \text { ratio }}=\frac{x}{25 \%}\) = 6,00,000

Profit = 1,50,000

Answer:

(C) ₹ 1,50,000