Liability to Pay Tax in Certain Cases – CA Final IDT Study Material is designed strictly as per the latest syllabus and exam pattern.

Liability to Pay Tax in Certain Cases – CA Final IDT Study Material

Question 1.

Discuss the liability to pay in case of an amalgamation/merger under section 87 of the CGST Act, 2017. [(MTP, May 19), (RTP, Nov. 18 & 19), 5 Marks]

Answer:

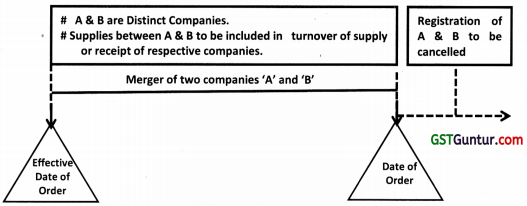

Section 87(1)

Provision

Turnover to be included

- When two or more companies are amalgamated or merged in pursuance of an order of court or of Tribunal or otherwise

- From a date earlier to the date of order and

- any two or more of such companies have supplied or received any goods or services or both to or from each other during the period commencing on the date from which the order takes effect till the date of the order, then

- Such supply and receipt shall be included in the turnover of supply or receipt of the respective companies and

- they shall be liable to pay tax accordingly.

Section 87(2)

Provision

Deemed Distinct Companies

- For the purposes of this Act,

- the said two or more companies

- shall be treated as distinct companies

- for the period up to the date of the said order.

Section 87(3)

Cancellation of Registration

- The registration certificates of the said companies

- shall be cancelled

- with effect from the date of the said order.

Let us revise the concept

![]()

Question 2.

Explain the provisions relating to liability for GST in case of company in liquidation (Section 88 of the CGST Act, 2017). [May 2018, 5 Marks]

Answer:

Section 88(1)

Provision

Intimation by liquidator to Commissioner

- When any company is being wound up whether under the orders of a court or Tribunal or otherwise

- every person appointed as receiver of any assets of a company (ie. “liquidator”) shall

- give intimation of his appointment to the Commissioner

- within 30 days after his appointment

Section 88(2)

Provision

Commissioner to Notify the Amount due from Such Company

- The Commissioner shall notify

- after making such inquiry or calling for such information as he may deem fit

- to the liquidator within 3 months from the date on which he receives intimation of the appointment of the liquidator

- the amount which in the opinion of the Commissioner would be sufficient to provide for any tax, interest or penalty which is then, or is likely thereafter to become, payable by the company.

Section 88(3)

Provision

Director Liable In case of Private Companies in Liquidation

- When any private company is wound up

- and any tax, interest or penalty determined under this Act on the company for any period, whether before or in the course of or after its liquidation,

- cannot be recovered, then

- ever person who was a director of such company at any time during the period for which the tax was due

- shall, jointly and severally, be liable for the payment of such tax, interest or penalty.

No liability of Director

- The director shall not be so liable

- if he proves to the satisfaction of the Commissioner

- that such non-recovery cannot be attributed to any gross neglect, misfeasance or breach of duty on his part in relation to the affairs of the company.

![]()

Question 3.

Who shall be liable to pay tax, Interest or penalty in case of Private Ltd. Company and conversion of Private Ltd. Company Into Public Ltd. Company?

Solution:

Section 89(1)

Provision

Director of a private company to be jointly and severally liable

- Not withstanding anything contained in the Companies Act, 2013

- where any tax, interest or penalty due from a private company in respect of any supply of goods or services or both for any period

- cannot be recovered, then

- every person who was a director of the private company during such period

- shall, jointly and severally, be liable

- for the payment of such tax, interest or penalty

No such liability of Director

- The director shall not be so liable

- if he proves

- that such non-recovery cannot be attributed to any gross neglect, misfeasance or breach of duty on his part in relation to the affairs of the company.

Section 89(2)

Provision

Liability dispensed off on conversion of Private company

- Where a private company is converted into a public company and

- the tax, Interest or penalty in respect of any supply of goods or services or both for any period during which such company was a private company cannot be recovered

- before such conversion.

- then, section 89(1) shall not applies to any person who was a director of such private company in relation to any tax, interest or penalty in respect of such supply of goods or services or both of such private company.

Proviso to 89(2)

Provision

Director still liable for personal penalty

- section 89(2) not applicable

- to any personal penalty imposed on such director.

Question 4.

With reference to the provisions of CGST Act, 2017, explain the liability of partners of firm to pay tax? [MTP: May, Nov. 18](5 Marks)

Solution:

Section 90

Provision

Partners liable jointly and severally

- Not withstanding any contract to the contrary and any other law for the time being in force

- Where any firm is liable to pay any tax, interest or penalty under this Act

- the firm and each of the partners of the firm

- shall, jointly and severally, be liable for such payment.

1st Provisio to section 90

Provision

When Intiniation is given within 1 month

- Where any partner retires from the firm

- he or the firm, shall intimate the date of retirement of the said partner

- to the Commissioner

- by a notice in that behalf in writing.

- Such partner shall be liable to pay tax, interest or penalty

- Due up to the date of his retirement

whether determined or not, on that date.

2nd Proviso to section 90

When Intimation Is NOT given within 1 month

- If no such intimation is given within 1 month from the date of retirement

- the liability of such partner shall continue

- until the date on which such intimation is received by the Commissioner

Question 5.

Discuss the liability of the retiring partner of a firm to pay any tax, interest or penalty, if any, leviable on the firm under CGST/IGST/SGST Act. [Nov. 2018 (0ld)](2 Marks)

Question 6.

What happens to the GST liability when the estate of a taxable person is under the control of Court of Wards?

Solution:

Section 92 of CGST Act, 2017

- Where the estate of a taxable person owning a business

- in respect of which any tax, interest or penalty is payable

- is under the control of the Court of Wards/Administrator General/Ofhcial Trustee/ Receiver or Manager appointed under any order of a Court

- the tax, interest or penalty shall be levied and recoverable

- from such Court of Wards/Administrator General/Official Trustee/Receiver or Manager

- to the same extent as it would be determined and recoverable from a taxable person.

![]()

Question 7.

In case of death of a person liable to pay tax, interest or penalty, who shall be liable to pay said dues? Discuss as per the provisions of section 93(1) of the CGST Act, 2017. [MTP, May 19, 4 Marks]

Solution:

Section 93(1) of CGST Act, 2017

Save as otherwise provided in the Insolvency and Bankruptcy Code, 2016

Where a person, liable to pay tax, interest or penalty under CGST Act, dies, then liability is determined as under:

If the Business carried on by the person is

Continued

after his death

- by his legal representative or any other person

- such legal representative or other person

- shall be liable

- to pay tax, interest or penalty due from such person under this Act.

Discontinued

whether before or after his death

- whether before or after his death

- his legal representative shall be liable to pay

- out of the estate of the deceased

- to the extent to which the estate is capable of meeting the charge, the tax, interest or penalty

- due from such person under this Act

Whether such tax, interest or penalty has been determined before his death but has remained unpaid or is determined after his death.

As per Circular No. 96/15/2019-GST dated 28-3-2019, “The successor shall be liable to pay any tax, interest or any penalty due from the transferor in cases of transfer of business due to death of sole proprietor.”