Joint Products and By Products – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Joint Products and By Products – CA Inter Costing Question Bank

Question 1.

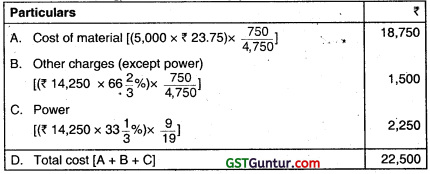

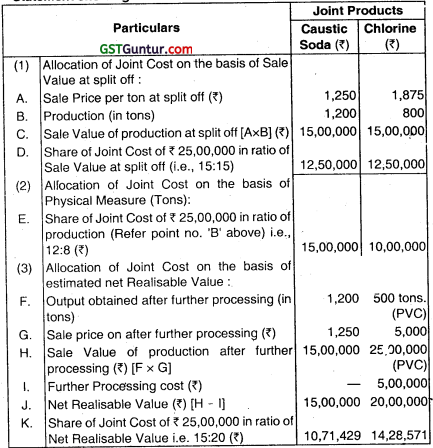

Inorganic Chemicals purchases salt and processes it into more-refined products such as caustic soda, chlorine, and PVC (Polyvinyl chloride). During the month of April, 2000, Inorganic Chemicals purchased salt for ₹ 10,000. Conversion cost of ₹ 15,00,000 were incurred upto the split- off point, at which time two saleable products were produced: Caustic soda and chlorine. Chlorine can be further processed into PVC. The April production and sales information are as follows:

All 800 tons of chlorine were further processed, at an incremental cost of ₹ 5,00,000 to yield 500 tons of PVC. There were no by products or scrap from this further processing of chlorine. There were no beginning or ending inventories of caustic soda, chlorine or PVC in April.

There is an active market for chlorine. Inorganic Chemicals could have sold all its April production of chlorine at ₹ 1,875 a ton.

Required:

(i) Calculate, how the joint costs of ₹ 25,00,000 would be allocated between Caustic soda and Chlorine under each of the following methods:

(1) sales value at split off;

(2) physical measure (tons); and

(3) estimated net realizable value.

(ii) What is the gross margin percentage of Caustic soda and PVC under the three methods cited in requirement (i)?

(iii) Lifetime Swimming Pool Products offer to purchase 800 tons of Chlorine in May, 2000 at ₹ 1,875 at ton. This sale would mean that no PVC would be produced in May. How would accepting the offer affect May Operating Income? (May 2000, 12 marks)

Answer:

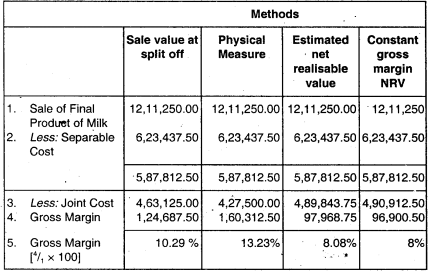

Statement showing allocation of Joint Cost under different basis:

(ii) Statement of Gross Margin Percentage under the three methods:

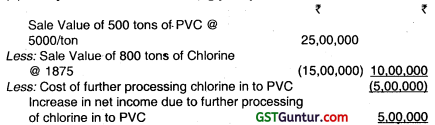

(iii) Analysis of lite time swimming pool products:

On the basis of above analysis we find that there is a reduction of operating income in the month of May by ₹ 5,00,000 when the company accept the after of ‘Life time Swimming Pool Products.”

Hence, the offer should not be accepted.

![]()

Question 2.

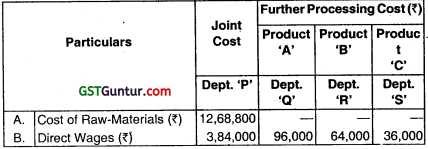

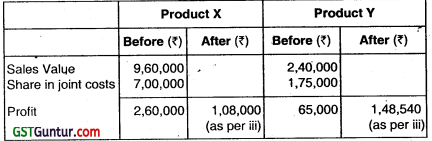

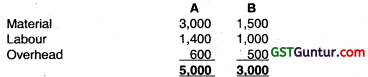

In a chemical manufacturing company, three products A, B and C emerge at a single split off stage in department P. Product A is further processed in department Q, product B in department R and product C in department S. There is no loss in further Processing of any of the three products. The cost data for a month are as under:

Cost of raw materials introduced In department P ₹ 12,68,800

Factory overheads of ₹ 4,64,000 are to be apportioned to the departments on direct wages basis.

During the month under reference, the company sold all three products after processing them further as under: –

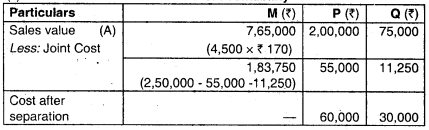

![]()

There are no Opening or Closing Stocks. If these products were sold at the split off stage, that is, without further processing, the selling prices would have been ₹ 20, ₹ 22 and ₹ 10 each per kg. respectively for A, B and C.

Required:

(i) Prepare a statement showing the apportionment of joint costs to joint products.

(ii) Present a statement showing product-wise and total profit for the month under reference as per the company current processing policy,

(iii) What processing decision should have been taken to improve the profitability of the company.

(iv) Calculate the product-wise and total profit arising from your recommendation in (iii) above. (May 2002, 12 marks)

Answer:

Answer:

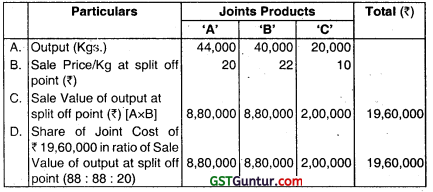

(i) Statement showing the apportionment of Joint Costs to Joint Products:

(ii) Statement sh,wlng product wise and total profit under company’s current processing policy:

Alternative Approach:

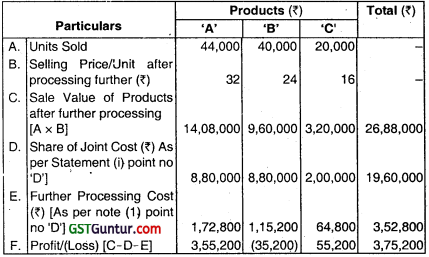

(iii) Decision regarding Improvement of the profitability of the company:

From the above observation we find that the further processing in required for the product ‘A and ‘Ç because the incremental sales revenue generated after further processing is more than the further processing cost incurred. Product ‘B should be sold at the split off point because the incremental revenue generated after processing is less than the further processing cost.

(iv) Product wise and total profit arising based on the above recommendation (iii) is as follows:

| Product | A | B | C | Total |

| Profit (₹) | 3,55,200 | Nil | 55,200 | 4,10,400 |

Working Note:

1. Statement showing Total Joint Cost & Further Processing Cost:

2. Joint cost and further processing costs:

(i) Joint cost of products A, B and C are the total cost incurred in the department P. Which is equal to ₹ 19,60,000.

(ii) Cost incurred in Depts. Q, R and S are the further processing costs of the products.

So, ₹ 1,72,800, ₹ 1,15,200 and ₹ 64,800 are the further processing cost of the products A, B and C respectively.

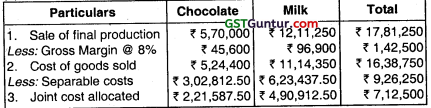

Question 3.

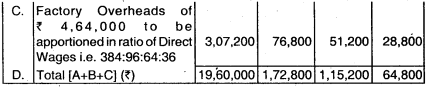

Pokemon Chocolates manufactures and distributes chocolate products. It purchases Cocoa beans and processes them into two intermediate products:

- Chocolate powder liquor base.

- Milk-chocolate liquor base.

These two intermediate products become separately identifiable at a single split off point. Every 500 pounds of cocoa beans yields 20 gallons of chocolate-powder liquor base and 30 gallons of milk-chocolate liquor base.

The chocolate powder liquor base is further processed into chocolate powder. Every 20 gallons of chocolate-powder liquor base yields 200 pounds of chocolate powder. The milk chocolate liquor base is further processed into milk-chocolate. Every 30 gallons of milk-chocolate liquor base yields 340 pounds of milk chocolate.

Production and sales data for October, 2004 are:

Cocoa beans processed 7,500 pounds

Costs of processing Cocoa beans to split oil point

(including purchase of beans) = ₹ 7,12,500

The October, 2004 separable costs of processing chocolate-powder liquor into chocolate powder are ₹ 3,02,812.50. The October, 2004 separable costs of processing milk-chocolate liquor base into milk-chocolate are ₹ 6,23,437,50.

Pokemon fully processes both of its intermediate products into chocolate powder or milk-chocolate. There is an active market for these intermediate products. In October, 2004, Pokemon could have sold the chocolate powder liquor base for ₹ 997.50 a gallon and the milk-chocolate liquor base for ₹ 1,235 a gallon.

Required:

(i) Calculate how the joint cost of ₹ 7,12,500 would be allocated between the chocolate powder and milk-chocolate liquor bases under the following methods:

(a) Sales value at split off point

(b) Physical measure (gallons)

(c) Estimated net realisable value, (NRV) and

(d) Constant gross-margin percentage NRV.

(ii) What is the gross-margin percentage of the chocolate powder and milk-chocolte liquor bases under each of the methods in requirement (i)?

(iii) Could Pokemort have increased its operating Income by a change in its decision to fully process both of its intermediate products? Show your computations. (Nov 2004, 8 + 2 + 3 = 13 marks)

Answer:

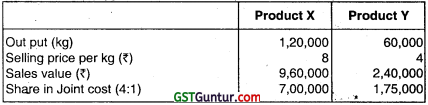

Computation of Joint Cost allocation under different methods:

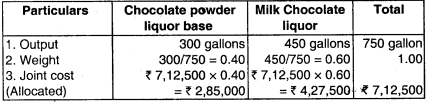

(a) Sale Value at split oil point:

(b) Physical measure method

(c) Net Realisable Value(NRV) method:

(d) Constraint gross – Margin Perculage(NRV) :

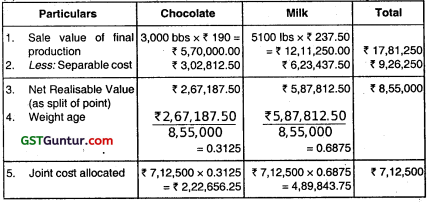

Competition of Gross margin %:

Sale value of final production = ₹ 17,81.250

Less:Joint & separable cost (₹ 7,12,500 + ₹ 9,26,250) = ₹ 16,38,750

Gross margin = ₹ 1,42,500

Gross margin % = \(\frac{₹ 1,42,500}{₹ 17,81,250}\) × ₹ 100= 8%

(ii) Computation of gross – margin under different of:

(a) Chocolate power liquor base (in ₹)

(b) Milk Chocolate liquor base (in ₹)

(iii) Further processing of Chocolate powder liquor base into

Chocolate powder (in ₹)

(a) Incremental revenue:

[₹ 5,70,000 – (₹ 997.50 × 300)] = 2,70,750

(b) Incremental Costs = 3,02,812.50

(c) Incremental Operating income = (32,062.50)

Further processing of Milk Chocolate base into milk chocolate (in ₹)

![]()

From the above analysis are we find that, chocolate could increase operating activities, of chocolate liquor base is sold at split off point and milk chocolate base is processed further.

![]()

Question 4.

A company produces two joint product X and Y, from the same basic materials.

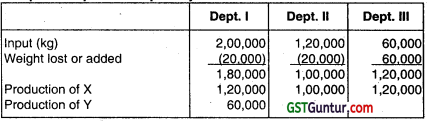

The processing is completed in three departments

Materials are mixed in department I. At the end of this process X and Y get separated. After separation X is completed in the department II and Y is finished in department III. During a period 2,00,000 kgs of raw material were processed in department I, at a total cost of ₹ 8,75,000, and the resultant 60% becomes X and 30% becomes Y and 10% normally lost in processing.

In department II 1/6 of the quantity received from department I is lost in processing. X is further processed in department II at a cost of ₹ 180,000.

In department Ill further new material added to the material received from department I and weight mixture is doubled, there is no quantity loss in the department and further processing cost (with material cost) is ₹ 1,50,000.

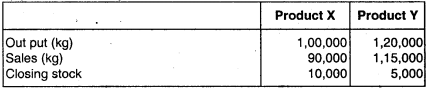

The details of sales during the year:

![]()

There were no opening stocks. If these products sold at split-oil-point, the selling price of X and Y would be ₹ 8 and ₹ 4 per kg respectively.

Required:

(i) Prepare a statement showing the apportionment of joint cost to X and Y in proportion of sales value at split off point.

(ii) Prepare a statement showing the cost per kg. of each product indicating joiñt cost, processing cost and total cost separately.

(iii) Prepare a statement showing the product wise profit for the year.

(iv) On the basis of profits before and after further processing of product X and Y, give your comment that products should be further processed or not. (May 2005, 2 + 3 + 2 + 2 = 9 marks)

Answer:

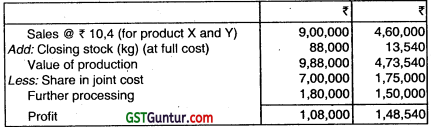

Computation produced quantity:

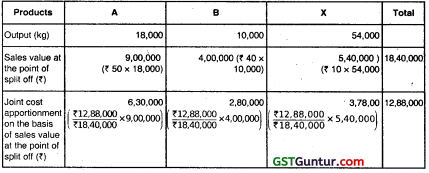

(i) Statement of apportionment of Joint cost:

(Apportionment of Joint Cost ₹ 8,75,000)

(ii) Statement of cost per kg:

(iii) Statement of profit:

(iv) Profitability statement, before and after processing:

Product X should be sold at split off point and product Y will be sold out after processing because of higher profitability.

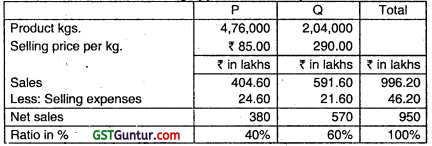

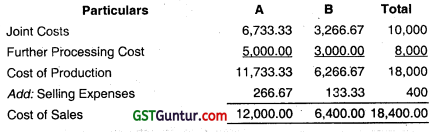

Question 5.

A Company produces two joint products A and Q in 70 : 30 ratio from basic raw materials In department A. The input output ratio of department P is 100 : 85. Product P can be sold at the split o stage or can be processed further at department B and sold as product AR. The input output ratio is 100: 90 of department B. The department B is created to process product A only and to make it product AR.

The selling prices per kg. are as under:

Product P : ₹ 85

Product Q : ₹ 290

Product AR : ₹ 115

The production will be taken up in the next month.

Raw materials 8,00,000 Kgs.

Purchase price ₹ 80 per Kg.

Selling Expenses: ₹ in Lacs

Product P : 24.60

Product Q : 21.60

Product AR : 16.80

Required:

(i) Prepare a statement showing the apportionment of joint costs.

(ii) State whether it is advisable to produce product AR or not. (May 2007, 8 marks)

Answer:

Input in Department ‘A’ is 80,000 kgs. & Yield is 85%

Output = 85% of 8,00,000 = 6,80,000 kgs.

Ratio of output for P and Q = 70:30.

Product of P 70% 0f 6,80,000= 4,76,000 kgs.

Product of Q = 30% of 6,80,000= 2,04,000 kgs.

Statement showing apportionment of joint cost

Apportionment of Joint Cost (In the ratio of Net Sales ie. P:Q., is 40%:60%)

Joint Cost of ‘P’ = ₹ 316 lakhs

Joint Cost of Q’ = ₹ 474 lakhs

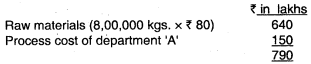

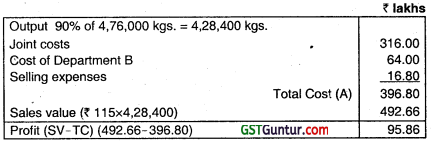

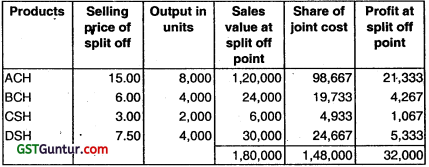

Statement showing the profitability of further processing of product P’ and converted into product ‘AR

Product ‘AR

If ‘P’ is not processed, then profitability is as under.

Advise: Further processing of product P and converting into product AR is beneficial to the company because the profit increases by ₹ 31.86 lakhs (i.e. 95.86 – 64.00).

![]()

Question 6.

Describe briefly, how joint costs upto the point of separation may be apportioned amongst the joint products under the following methods:

(i) Average unit cost method

(ii) Contribution margin method

(iii) Market value at the point of separation

(iv) Market value after further processing

(v) Net realizable value method (May 2009, 9 marks)

Answer:

Methods of apportioning joint cost among the joint products

(i) Average Unit Cost method

- In this method, total process cost (upto the point of separation) is divided by total units of joint products produced.

- On division average cost per unit of production is obtained. The effect of application of this method is that all joint products will have uniform cost per unit.

(ii) Contribution Margin Method

- In this method joint costs are segregated into two parts – variable and fixed. The variable costs are apportioned over the joint products on the basis of units produced (average method) or physical quantities.

- When the products are further processed, then all variable cost incurred be added to the variable cost determined earlier.

- After that contribution is calculated by deducting variable cost from their respective sales values.

- The fixed costs are then apportioned over the joint products on the basis of contribution ratios.

(iii) Market Value at the Time of Seperation

- This method used for apportioning joint costs to joint products upto the split off point.

- This method is difficult to apply if the market value of the poducts at the point of separation are not available.

- The joint cost may be apportioned in the ratio of sales values of different joint products.

(iv) Market value after Further Processing

- Under this method the basis of apportionment of joint costs is the total sales value of finished products at the further processing.

- The use of this method is unfair where further processing costs after the point of separation are disproportionate or when all the joint products are not subjected to further processing.

(v) Net Realisable Value Method

1. Under this method joints costs are apportioned on the basis of net realisable value of the joint products,

Net Realisable Value = Sale value of joint products (at finished stage)

(-) estimated profit margin

(-) selling & distribution expenses, it any

(-) post split off cost

Question 7.

How apportionment of joint costs upto the point of separation amongst the joint products using market value at the point of separation and net realizable value method is done? Discuss. (Nov 2010, 4 marks)

Answer:

Apportionment of Joint Cost amongst Joint Products using: Market value at the point of separation

Under this method, the market value of the joint products at the separation point is ascertained and the total cost is ascertained in the ratio of the value. It is difficult to apply if the market value of the product at the point of separation are not available. It is useful method where further processing costs are incurred disproportionately.

Net realizable value Method

Under this method from the sales value of joint products (at finished stage) are deducted:

- Estimated profit margins

- Selling distribution expenses, if any

- Post split off costs.

The resultant figure so obtained is known as net realizable value of joint products. Joint costs are apportioned in the ratio of net realizable value.

![]()

Question 8.

A Factory produces two products, ‘A’ and ‘B’ from a single process.

The joint processing cost’s during a particular month are:

Direct Material : ₹ 30,000

Direct Labour : ₹ 9,600

Variable Overheads : ₹ 12,000

Fixed Overheads : ₹ 32,000

Sales: A – 100 units @ ₹ 600 per unit; B – 120 units @ ₹ 200 per unit

Apportion joints costs on the basis of:

(i) Physical Quantity of each product.

(ii) Contribution Margin method, and

(iii) Determine Profit or Loss under both the methods. (Nov 2019, 5 marks)

Answer:

(i) Apportionment of Joint Cost on the basis of Physical Quantity of each product:

Total Cost = ₹ 30,000 + ₹ 9,600 + ₹ 12,000 + ₹ 32,000 = ₹ 83,600

Total units = ₹ 1oo units + ₹ 120 units

= ₹ 220 units

A = ₹ 83,600 × \(\frac{100}{220}\) = ₹ 38,000

B = ₹ 83,600 × \(\frac{120}{220}\) = ₹ 45,600

(ii) Apportionment of Joint Cost on the basis of Contribution Margin Method:

Total Variable Cost = 30,000 + ₹ 9,600 + ₹ 12,000 = 51,600

Apportionment as per units

A = ₹ 51,600 × \(\frac{100}{220}\) = ₹ 23.455

B = ₹ 51,600 × \(\frac{120}{220}\) = ₹ 28,145

Fixed Cost ₹ 32,000 to be apportioned over contribution margin i.e.

36545: (4145)

Total fixed cost is allocated to A = ₹ 32,000

Profit or loss under both method:

(i) Physical Quantity

A = (₹ 60,000 – ₹ 38,000) = 22,000

B = (₹ 24,000 – ₹ 45,600) = (₹ 21,600)

(ii) Contribution Margin Method:

A = (₹ 60,000 – ₹ 23,455 – ₹ 32000) = (₹ 4,545) loss

B = (₹ 24,000 – ₹ 28,145) = (₹ 4,145) loss

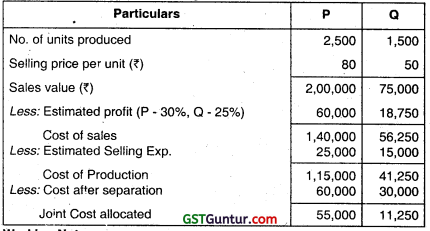

Question 9.

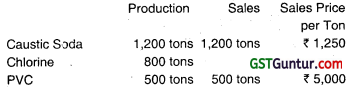

A company’s plant processes 6,750 units of a raw material in a month to produce two products ‘M’ and ‘N’.

The process yield is as under:

Product M : 80%

Product N : 12%

Process Loss : 8%

The cost of raw material is ₹ 80 per unit.

Processing cost is ₹ 2,25,000 of which labour cost is accounted for 66%.

Labour is chargeable to products ‘M’ and ‘N’ in the ratio of 100 : 80.

Prepare a Comprehensive Cost Statement for each product showing:

(i) Apportionment of joint cost among products ‘M’ and ‘N’ and

(ii) Total cost of the products ‘M’ and ‘N’. (Nov 2020, 5 marks)

Question 10.

Mayura Chemicals Ltd. buys a particular raw material at ₹ 8 per litre. At the end of the processing in Department-1, this raw material splits-off into products KY and Z. Product X is sold at the split-off point, with no further processing. Products Y and Z require further processing before they can be sold. Product Y is processed in Department-2, and Product Z is processed in Department-3. Following is a summary of the costs and other related data for the year 2019-20:

| Particulars | Department | ||

| 1 | 2 | 3 | |

| Cost of Raw Material | ₹ 4,80,000 | – | – |

| Direct Labour | ₹ 70,000 | ₹ 4,50,000 | ₹ 6,50,000 |

| Manufacturing Overhead | ₹ 48,000 | ₹ 2,10,000 | ₹ 4,50,000 |

| Products | |||

| X | Y | Z | |

| Sales (litres) | 10,000 | 15,000 | 22,500 |

| Closing inventory (litres) | 5,000 | – | 7,500 |

| Sale price per litre (₹) | 30 | 64 | 50 |

There were no opening and closing inventories of basic raw materials at the beginning as well as at the end of the year, All finished goods inventory in litres was complete as to processing. The company uses the Net-realisable value method of allocating joint costs.

You are required to prepare:

- Schedule showing the allocation of joint costs.

- Calculate the Cost of goods sold of each product and the cost of each item in Inventory.

- A comparative statement of Gross profit. (Jan 2021, 10 marks)

Question 11.

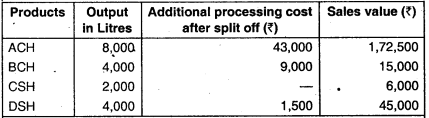

In an Oil Mill four products emerge from a refining process. The total cost of input during the quarter ending March 2018 is ₹ 1,48,000. The output, sales and additional processing costs are as under

In case these products were disposed-off at the split off point that is before further processing, the selling price per litre would have been:

| ACH (₹) | BCH (₹) | CSH (₹) | DSH (₹) |

| 15.00 | 6.00 | 3.00 | 7.50 |

PRODUCE a statement of profitability based on:

(i) It the products are sold after further processing is carried out in the mill.

(ii) It they are sold at the split off point.

Answer:

(i) Statement of profitability of the Oil Mill (after carrying out further processing) for the quarter ending 31st March, 2018.

(ii) statement of profitability at the split off point

Note: Share of Joint Cost has been arrived at by considering the sales value at split off point.

![]()

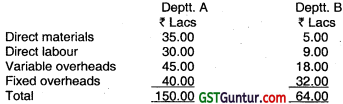

Question 12.

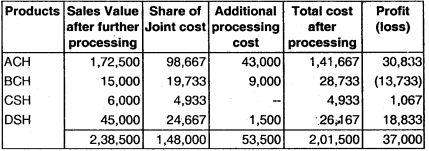

A company processes a raw material in its Department 1 to produce three products, viz. A, B and X at the same split-off stage. During a period 1,80,000 kgs of raw materials were processed in Department 1 at a total cost of ₹ 12,88,000 and the resultant output of A, B and X were 18,000 kgs, 10,000 kgs and 54,000 kgs respectively. A and B were further processed in Department 2 at a cost of ₹ 1,80,000 and ₹ 1,50,000 respectively.

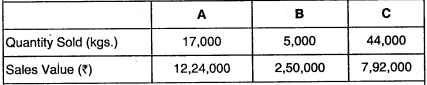

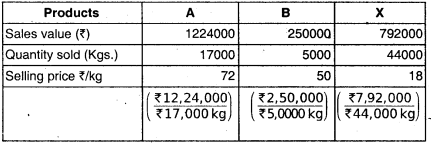

X was further processed in Department 3 at a cost of ₹ 1,08,000. There is no waste in further pocessing. The details of sales affected during the period were as under:

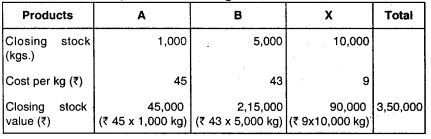

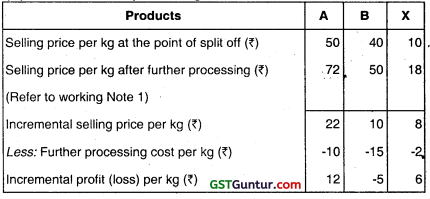

There were no opening stocks. 1f these products were sold at split-off stage, the selling prices of A, B and X would have been ₹ 50, ₹ 40 and ₹ 10 per kg respectively.

Required:

(i) PREPARE a statement showing the apportionment of joint costs to A, B and X.

(ii) PRESENT a statement slowing the cost per kg of each product indicating joint cost and further processing cost and total cost separately.

(iii) PREPARE a statement showing the product wise and total profit for the period.

(iv) STATE with supporting calculations as to whether any or all the products should be further processed or not

Answer:

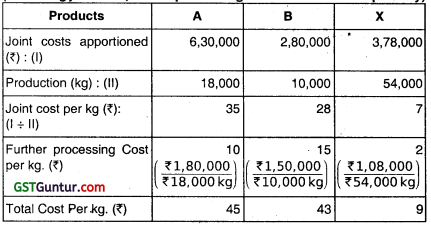

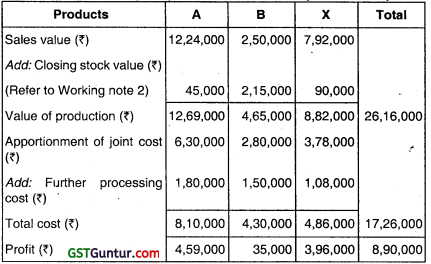

(i) Statement showing the apportionment of joint costs to A, B and X

(ii) Statement showing the cost per kg. of each product

(indicating joint cost; further processing cost and total cost separately)

(iii) Statement showing the product wise and total profit for the period

Working Notes.

1.

2. Valuation of closing stock:

Since the selling price per kg of Products A, B and X is more than their total costs, therefore closing stock will be valued at cost.

(iv) Calculations for processing decision

Product A and X has an incremental profit per unit after further processing, hence, these two products may be further processed. However, further processing of product B is not profitable hence, product B shall be sold at split off point.

Method of Apportionment of Joint Cost to By Products and Treatment of By Product Cost

Question 13.

How would you account for by-product in cost accounting:

(i) When they are of small total value. (May 1997, 2 marks)

(ii) When they are of considerable total value. (May 1997, 4 marks)

(iii) When they require further prccessing. (May 1997, 4 marks)

Answer:

From cost accounting point of view by products may be classified as under:

(a) By-products of small total value

(b) By-products of considerable total value

(c) By-products which require further processing

Treatment of by products of small total value: When the by products are off small total value then the amount realised from its sale may be either;

(a) Credited to P & L A/c as miscellaneous income or as additional sales revenue.

Or

(b) Deducted from the either the cost of production or from cost of sales.

Treatment of by products of considerable total value: When the by products are of considerable total value then they are considered some as joint products and treated in the same way as that of joint products.

Treatment of by products which require further processing : When the by products require further processing, the net relisable value at split off point is computed as under:

If NRV is a small value then s credited to P&L A/c.

If NRV is a considerable value it is considered as a joint product and is treated like wise.

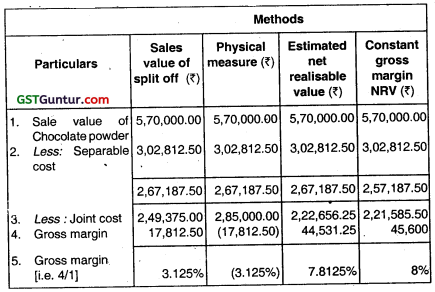

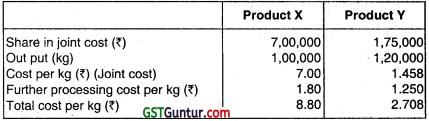

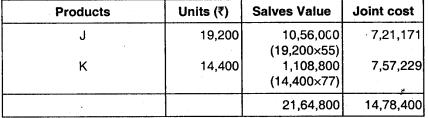

Question 14.

JKL Limited produces two products—J and K—together with a by-product L from a single main process (process I). Product J is sold at the point of separation for ₹ 55 per kg, whereas product K is sold for ₹ 77 per kg after further processing into product K2. By-product L is sold without further processing for ₹ 19.25 per kg.

Product J : 500 kg

Product K : 350 kg

Product L : 100 kg

Toxic waste : 50 kg

The toxic waste is disposed at a cost of ₹ 16.50 per kg, and arises at the end of processing.

Process II which is used for further processing of product K into product K2, has the following cost structure:

Fixed costs : ₹ 2,64,000 per week

Variable cost : ₹ 16.50 per kg processed

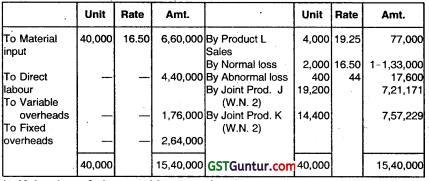

The following actual data relate to the first week of the month:

Process I

Opening Work-in-progress : Nil

Material input : 40,000 kg costing ₹ 6,60,000

Direct Labour : ₹ 4,40,000

Variable Overheads : ₹ 1,76,000

Fixed Overheads : ₹ 2,64,000

Outputs:

Product J : 19,200 kg

Product K : 14,400 kg

Product L : 4,000 kg

Toxic waste : 2,400 kg

Closing Work-in-progress : Nil

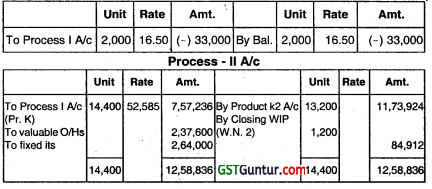

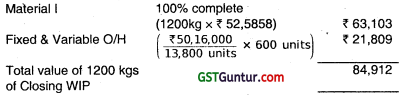

Process II

Opening Work-in-progress : Nil

Input of product K : 14,400 kg

Output of product K2 : 13200 kg

Closing Work-in-progress (50% converted and conversion costs were incurred in accordance with the planned cost structure) : 1,200 kg

Required:

(i) Prepare Process I account for the first week of the month using the final sales value method of attribute the pre-separation costs to join products.

(ii) Prepare The toxic waste account and Process II account for the first week of the month.

(iii) Comment on the method used by the JKL Limited to attribute the pre-separation costs to joint products.

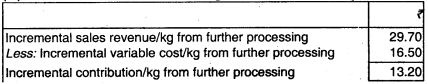

(iv) Advise the management of JKL Limited whether or not, on purely financial grounds, it should continue to process product K into product. K2:

(a) If product K could be sold at the point of separahon for ₹ 47.30 per kg; and

(b) If thé 60% of the weekly fixed costs of Process II were avoided by not processing product K further. (May 2004, 3+3+2+2=10 marks)

Answer:

1. Process – I A/c

Valuation of abnormal loss per kg

(using physical measure method) \(=\frac{1,540,000-77,000+33,000}{40,000 \mathrm{Kg} \times 0.85}\)

= \(\frac{₹ 14,96,000}{34,000 \mathrm{Kg} .}\)

= ₹ 44 kg.

(ii) Toxic waste A/c

Working Notes:

(1) Calculation of joint cost of the output:

= ₹ 15,40,000 – ₹ 77,000 – ₹ (-) 33,000 – ₹ 17,600

= ₹ 14,78,400

(2) Allocation of joint cost over joint products J & K:

(3) Valuation of 1200 kgs of closing products J & K

Comment on the method used by the JKL Ltd:

(For attribute the pro- separation costs to joint Products) attributing the joint costs over joint products J & K, L Ltd used the basis of final sales value. This is one of the popular method used m the industry.

Other methods can also be used for the purpose, some are

- Physical Measure method (if both products are equally complex)

- Constant gross margin % method

- Net realizable vàlue method.

(iv) Advise to the Management of JKL Ltd.

Break even point \(=\frac{\text { Avoidable Fixed Cost }}{\text { Incremental Contribution } / \mathrm{kg}}\)

= \(\frac{₹ 1,58,400}{₹ 1,320}\) = ₹ 12,000 kgs.

Hence, further processing should be undertaken only if output is expected to exceed 12,000 kgs per week.

![]()

Question 15.

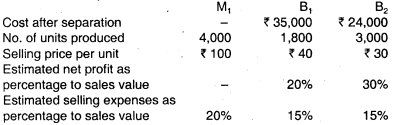

A company manufactures one main product (M1) and two by-products B1 and B2. For the month of January 2013, following details are available:

Total Cost upto Separation point ₹ 2,12,400

There are no beginning or closing inventories.

Prepare statement showing:

(i) Allocatiön of joint cost; and

(ii) Product-wise and overall profitability of the company for January 2013. (May 2013, 8 marks)

Answer:

(i) Statement Showing Allocation of Joint Cost

(ii) Statement of Profitability

Question 16.

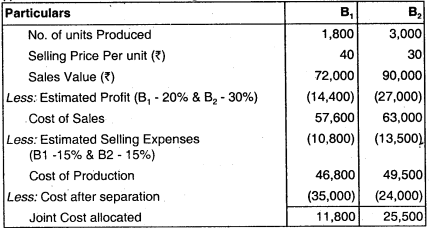

A factory producing article A also produces a by-product B which is further processed into finished product. The joint cost of manufacture is given below:

Subsequent cost in are given below:

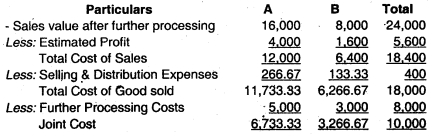

Estimated profit on selling prices is 25% for A and 20%, for B.

Assume that selling and distribution expensés are in proportion of sales prices. Show how you would apportion joint çosts of manufacture and prepare a statement showing cost of production of A and B. (May 2016, 8 marks)

Answer:

Statement Showing the Apportionment of Joint Cost:

Statement Showing Cost of Production:

Question 17.

A Ltd. produces M as a main product and gets two by products – ‘P’ and ‘Q’ in the course of processing.

Following information are available for the month of October, 2017:

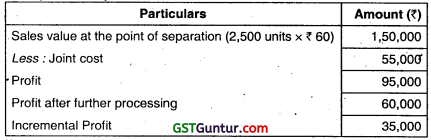

| M | P | Q | |

| Cost after separation | – | ₹ 60,000 | ₹ 30,000 |

| No. of units produced | 4500 | 2500 | 1500 |

| Selling price (per unit) | ₹ 170 | ₹ 80 | ₹ 50 |

| Estimated Net profit to sales | – | 30% | 25% |

The joint cost of manufacture upto separation point amounts to ₹ 2,50,000. Selling expenses amounting to ₹ 85,000 are to be apportioned to the three products in the ratio of sales units.

There is no opening and dosing stock. Prepare the statement showing:

(i) Allocation of joint cost.

(ii) Product wise over all profitability and

(iii) Advise the company regarding results if the by product ‘P’ is not further processed and is sold at the point of separation at ₹ 60 per unit without incurring selling expenses. (Nov 2017, 8 marks)

Answer:

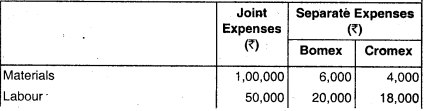

(i) Statement showing Allocation of Joint Cost

Working Note:

Calculation, of selling exp.

P = \(\frac{85,000}{8,500}\) × 2,500 = 25,000

Q = \(\frac{85,000}{1,500}\) × 1,500 = 15,000

M = \(\frac{85,000}{8,500}\) × 4,500 = 45,000

(ii) Statement of Probability

(iii) If the by-product P is not further processed and is sold at the point of separation:

If the by-product P is sold at the point of separation, it will give an additional profit of ₹ 35,000 to the company, hence, the company should sell by product P without further processing.

Question 18.

Answer the following:

How are By-products treated in Costing? (Nov 2018, 5 marks)

Answer-

Treatment of By-Products in Costing:

(a) When they are of small total value:

When the by-products are of small total value, the amount realised from their sale may be dealt in any one the following two ways:

1. The sales value of the by-products may be credited to the costing profit and loss Account and no credit be given in the Cost Accounts. The credit to the costing Profit and Loss Account here is treated either as miscellaneous income or as additional sale revenue.

2. Sales proceeds of the by-product may be treated as deductions from the total costs. The sale proceeds in fact should be deducted hither from the production cost or from the cost of sales.

(b) When the by-products are of considerable total value:

Where by-products are of considerable total value, they may be regarded as joint products rattier than as by-products.

To determine exact cost of by-products the costs incurred upto the point of separation, should be apportioned over by-products and joint products by using a logical bases. In this case, the joint costs may be divided over joint products and by-products by using relative market values; physical output method (at the point of split off) or ultimate selling prices (it sold).

(c) Where they require further processing:

In this case, the net realisable value of the by-product at the split off point may be arrived at by subtracting the further processing cost from the relisable value of by-product.

If total sales value of by-products at split-off point is small, it may be treated as per the provisions discussed above under (a).

In the contrary case, the amount realised from the sale of by-products will be considerable and thus it may be treated as discussed under (b).

Question 19.

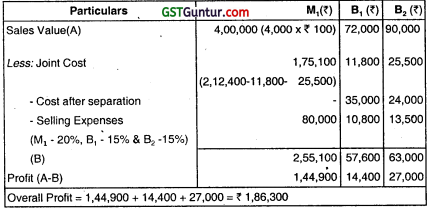

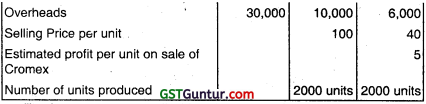

A Factory is engaged in the production of chemical Bomex arid in the course of its manufacture a by product Cromex is produced which after further processing has a commercial value. For the month of April 2019 the following are the summarised cost data:

The factory uses net realisable value method for apportionment of joint cost to by-products.

You are required to prepare statements showing:

(i) Joint cost allocable to Cromex

(ii) Product wise and overall profitability of the factory for April 2019. (May 2019, 5 marks)

Answer:

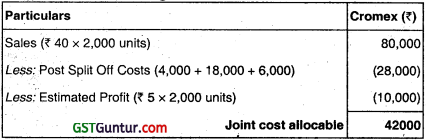

(i) Statement Showing Joint Cost Allocation to ‘Cromex’

(ii) Statement Showing Product Wise and Overall Profitability

(*) 1,80,000 – 42,000

Question 20.

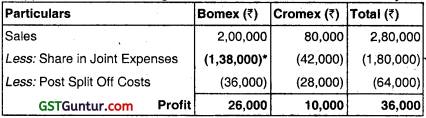

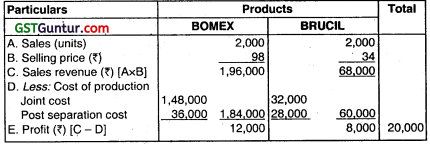

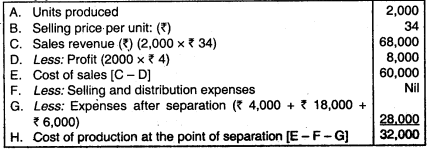

A factory is engaged in the production of a chemical BOMEX and in the course of its manufacture, a by – product BRUCIL is produced, which after further processing has a commercial value. For the month of April 2016, the following are the summarised cost data:

The factory uses reverse cost method of accounting for by-products whereby the sales value of by-products after deduction of the estimated profit, post separation costs and selling and distribution expenses relating to the by – products is credited to the joint process cost account.

Required: Prepare statements showing :

(i) the joint cost allocable to BOMEX.

(ii) the product-wise and overall profitability of the factory for April 2016.

Answer:

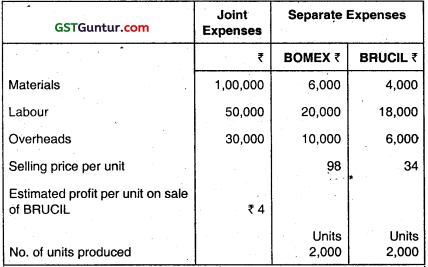

(i) Statement of Joint Cost Allocable to BOMEX

(ii) Statement showing Productwise and Overall Profitability for the month of April, 2016

Working Note: Computation of the share of Joint Expenses allocable to the by-product BRUCIL

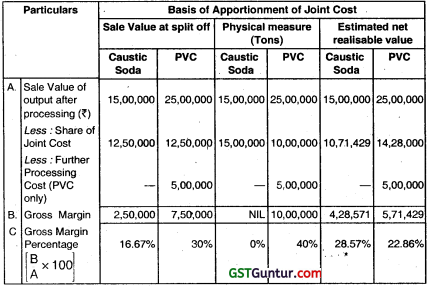

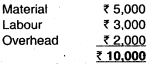

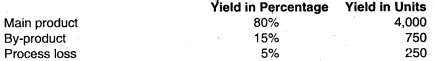

Question 21.

The yield of a certain process is 80% as to the main product, 15% as to the by-product and 5% as to the process loss. The material put in process (5,000 units) cost ₹ 23.75 per unit and all other charges are ₹ 14,250 of which power cost accounted for 33 1/3%. It is ascertained that power is chargeable as to the main product and by – product in the ratio of 10:9.

Required: Draw up a statement showing the cost of the by-product.

Answer:

Working Note: Calculation of yield per 5,000 input units

Statement showing the Cost of the By-product