Job Work – CA Final IDT Study Material is designed strictly as per the latest syllabus and exam pattern.

Job Work – CA Final IDT Study Material

Question 1.

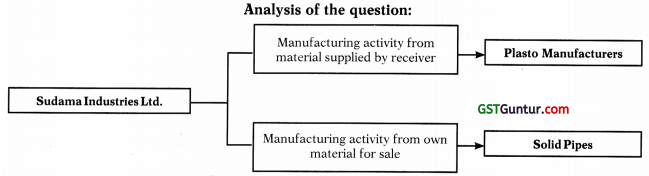

Sudama Industries Ltd., registered in the State of Jammu & Kashmir, manufactures plastic pipes for other suppliers on job work basis.

On 10.01.20XX, Plasto Manufacturers (registered in the State of Himachal Pradesh) sent plastic worth ₹ 4 lakh and moulds worth ₹ 50,000, free of cost, to Sudama Industries Ltd. to make plastic pipes. Sudama Industries Ltd. also used its own material – a special type of lamination material for coating the pipes – worth ₹ 1 lakh in the manufacture of pipes. It raised an invoice of ₹ 2 lakhs as job charges for making pipes and returned the manufactured pipes through challan to Plasto Manufacturers on 20.10.20XX.

The same quality and quantity of plastic pipes, as was made for Plasto Manufacturers, were made by Sudama Industries Ltd. from its own raw material and sold to Solid Pipes (registered in Jammu and Kashmir) for ₹ 7.5 lakhs on 20.10.20XX.

Examine the scenario and offer your views on the following issues with reference to the provisions relating to job work under the GST laws:

(i) Is there any difference between the manufacture of plastic pipes by Sudama Industries Ltd. for Plasto Manufacturers and for Solid Pipes? (2Vi Marks)

(ii) Whether Sudama Industries Ltd. can use its own material even when it is manufacturing the plastic pipes on job-work basis? (1 Mark)

(iii) Whether sending the plastic and moulds to Sudama Industries Ltd. by Plasto Manufacturers is a supply and a taxable invoice needs to be issued for the same? (3 Marks)

(iv) Whether Sudama Industries Ltd. should include the value of free of cost plastic supplied by Plasto Manufacturers in its job charges? (2xh Marks) [MTP, May 19]

Answer:

(i)

| Difference between Goods manufactured by Sudama Industries Ltd. for | |

| Plasto Manufacturers | for Solid Pipes |

| (a) It is job-work as the manufacturing process is undertaken on inputs (plastic and moulds) supplied by the principal (Plasto Manufacturers). | it is manufacture on own account as the pipes are manufactured from company’s own raw material. |

| (b) It is a supply of service in terms of para 3 of Schedule II to the CGST Act, 2017 | It is a supply of goods being manufacture of pipes on own account |

(ii) 45 per Circular No. 38/12/2018 GST dated 26.03.2018, the job worker, in addition to the goods received from the principal, his can use own goods for providing the services of job work. Thus, Sudama Industries Ltd. can use its own material even when it is manufacturing the plastic pipes on job-work basis.

(iii) Issue of Invoice for sending the plastic and moulds to Sudama Industries Ltd.

Section 143 of the CGST Act, 2017 provides that the registered principal may, without payment of tax, send inputs or capital goods to a job worker for job work. Subsequently, on completion of the job work, the principal shall either bring back the goods to his place of business or supply (including export) the same directly from the place of business/ premises of the job worker within one year in case of inputs or within three years in case of capital goods (except moulds and dies, jigs and fixtures or tools). Thus, the provision relating to return of goods is not applicable in case of moulds, dies, jigs, fixtures and tools. If Input/Capital goods not received within specified time limit, it will be treated as supply.

Therefore, sending of plastic and moulds by Plasto Manufacturers to Sudama Industries Ltd. (job worker) is not supply as the manufactured pipes are received back within the stipulated time and the provisions relating to return of goods are not applicable in case of moulds.

Rule 45 of the CGST Rules provides that the inputs, semi-finished goods or capital goods being sent for job work shall be sent under the cover of a challan issued by the principal.

Under cover of Challan: Plasto Manufacturers need not issue a taxable invoice for sending the inputs to Sudama Industries Ltd. but should send the inputs under the cover of a challan.

(iv) Inclusion of value of free of cost plastic in job charges:

Section 15(2)(b) of the CGST Act, 2017 provides that any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods or services or both, is includible in the value of supply. However, Sudama Industries Ltd. should not include the value of free of cost plastic supplied by Plasto Manufacturers in its job charges as Sudama Industries Ltd. is manufacturing the plastic pipes on job work basis.

The scope of supply of the Sudama Industries Ltd. is to manufacture plastic pipes from the raw material supplied by the Plasto Manufacturers. Thus, at no point of time was Sudama Industries Ltd. (supplier of job work service) liable to pay for the raw material and therefore, the value thereof should not be included in its job charges even though the same has been incurred by Plasto Manufacturers (recipient of job work service).

![]()

Question 2.

Alok Pvt. Ltd., a registered manufacturer, sent steel cabinets worth ₹ 50 lakh under a delivery challan to M/s. Prem Tools, a registered job worker, for job work on 28.01.20XX. The scope of job work included mounting the steel cabinets on a metal frame and sending the mounted panels back to Alok Pvt. Ltd.

The metal frame is to be supplied by M/s. Prem Tools. M/s. Prem Tools has agreed to a consideration of ₹ 5 lakh for the entire mounting activity including the supply of metal frame. During the course of mounting activity, metal waste is generated which is sold by M/s. Prem Tools for ₹ 45,000. M/s Prem Tools sent the steel cabinets mounted on the metal frame to Alok Pvt. Ltd. on 03.12.20XX.

Assuming GST rate for metal frame as 28%, for metal waste as 12% and standard rate for services as 18%, you are required to compute the GST liability of M/s. Prem Tools. Also, give reason(s) for inclusion or exclusion of the value of cabinets in the job charges for the purpose of payment of GST by M/s. Prem Tools. [MTP, May 2018, 7 Marks]

Answer:

The following points may be noted in this regard:

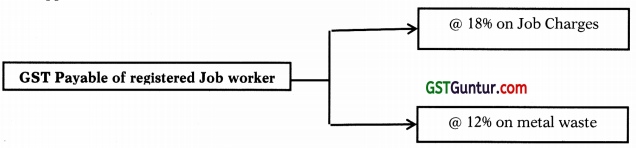

(1) Supply of services: M/s. Prem Tools (job worker) undertakes the process of mounting the steel cabinets of Alok Pvt. Ltd. (principal) on metal frames. In view of para 3 of Schedule II to the CGST Act cited above, the mounting activity classifies as service even though metal frames are also supplied as a part of the mounting activity. Accordingly, the job charges will be chargeable to rate of 18%, which is the applicable rate for services.

(2) Value of supply: The value of steel cabinets will not be included in the value of taxable supply made by M/s. Prem Tools as the supply of cabinets does not fall within the scope of supply to be made by M/s. Prem Tools. M/s. Prem Tools is only required to mount the steel cabinets, which are to be supplied by Alok Pvt. Ltd., on metal frames, which are to be supplied by it.

(3) Sale of waste: Since M/s. Prem Tools is registered, the tax leviable on the supply (sale of waste generated during the job work) will have to be paid by it in terms of section 143(5) of the CGST Act. This supply will be treated as supply of goods and subject to GST rate applicable for metal waste.

Computation of GST liability of M/s. Prem Tools

| Particulars | Amount (₹) |

| GST on Job charges (? 5,00,000 @ 18%) | 90,000 |

| GST on Sale of metal waste (? 45,000 @ 12%) | 5,400 |

| Total GST payable | 95,400 |

Question 3.

A Ltd. sends the machinery to B & Co. for fixing of some technical issue and intendance on 15-9-2018. The value of goods sent to B & Co. is ₹ 1,00,000. What are the tax implications,

in the following cases:

(i) B & Co. sends the machinery back to A Ltd. on 30-12-2019.

(ii) B & Co. sends the machinery back to A Ltd. on 30-10-2021. Assume GST Rate at 18%.

Answer:

In accordance with section 143 of the CGST Act, principle can remove the goods without payment of tax and take input tax credit provided capital goods sent for job work are returned back within three years of removal. Otherwise, it shall be deemed that such inputs had been supplied by the principal to the job worker on the day when the said inputs were sent out and it will be subject to the tax along with interest.

| B & Co. sends the machinery back to A Ltd. On: | Tax implication | Reason |

| (a) 30-12-2019 | No Tax | Since the machinery is received before completion of three years. |

| (b) 30-10-2021 | ₹ 9,000 (CGST) and ₹ 9,000 (SGST) along with specified interest on completion of 3 years. | As the machinery is received after the period of three years. Hence, B Ltd. needs to pay tax taken along with the interest. |

Question 4.

What is the procedure for removal of goods for job work under section 143 of CGST Act, 2017?

Answer:

The following is the procedure:

A registered person (Principal) can send inputs/capital goods under intimation and subject to certain conditions without payment of tax to a job-worker and from there to another job-worker and after completion of job-work bring back such goods without payment of tax. The principal is not required to reverse the ITC availed on inputs or capital goods dispatched to job-worker.

Principal can also send inputs/capital goods directly to the job-worker without bringing them to his premises and can still avail the credit of tax paid on such inputs or capital goods.

However, inputs and/or capital goods [other than moulds and dies, jigs and fixtures, or tools] sent to a job- worker are required to be returned to the principal within 1 year and 3 years respectively, from the date of sending such goods to the job-worker. The provision of return of goods is not applicable in case of moulds and dies, jigs and fixtures or tools supplied by the principal to job worker.

The period of 1 year and 3 years may, on sufficient cause being shown, be extended by the Commissioner for a further period not exceeding 1 year and 2 years respectively.

This amendment would cover situations where the period of 1 year specified is not adequate in respect of job works such as hull construction/fabrication of vessels (for defence purposes), since these processes complete in a period of around 14 to 16 months.

After processing of goods, the job-worker may clear the goods to-

-

- another job-worker for further processing, or

- dispatch the goods to any of the place of business of the principal without payment of tax.

![]()

Question 5.

What are the provisions relating to taking ITC in respect of inputs and capital goods sent for job work?

Answer:

The provisions relating to taking ITC in respect of inputs and capital goods sent for job work, are given under Section 19 of CGST Act, 2017. These are given as under :

| Section 19(1) | ITC to be allowed to principal | The principal shall, subject to such conditions and restrictions as may be prescribed, be allowed input tax credit on inputs sent to a job worker for job work. |

| Section 19(2) | Principal to get Credit even if Inputs sent directly to Job Worker | Notwithstanding anything contained in section 19(2)(b) of section 16, the principal shall be entitled to take credit of input tax on inputs even if the inputs are directly sent to a job worker for job work without being first brought to his place of business. |

| Section 19(3) | Deemed Supply of Goods | Where the inputs sent for job work are not received back by the principal after completion of job work or otherwise or are not supplied from the place of business of the job worker in accordance with section 19(1)(«) or section 19(1 ){b) within one year of being sent out, it shall be deemed that such inputs had been supplied by the principal to the job worker on the day when the said inputs were sent out:

Provided that where the inputs are sent directly to a job worker, the period of one year shall be counted from the date of receipt of inputs by the job worker. |

| Section 19(4) | Principal to get Credit even if Capital Goods are supplied to the Job Worker | The principal shall, subject to such conditions and restrictions as may be prescribed, be allowed input tax credit on capital goods sent to a job worker for job work. |

| Section 19(5) | Principal to get Credit even if Capital Goods are directly supplied to Job Worker | Not withstanding anything contained in section 16(2)(b), the principal shall be entitled to take credit of input tax on capital goods even if the capital goods are directly sent to a job worker for job work without being first brought to his place of business. |

| Section 19(6) | Deemed Supply of Capital Goods | Where the capital goods sent for job work are not received back by the principal within a period of three years of being sent out, it shall be deemed that such capital goods had been supplied by the principal to the job worker on the day when the said capital goods were sent out:

Provided that where the capital goods are sent directly to a job worker, the period of three years shall be counted from the date of receipt of capital goods by the job worker. |

| Section 19(7) | No Time Limit for Moulds, Dies, Jigs, Fixtures, Tools | Nothing contained in section 19(3) or section 19(6) shall apply to moulds and dies, jigs and fixtures, or tools sent out to a job worker for job work. |

Explanation. For the purpose of this section, “principal” means the person referred to in section 143.