Job and Contract Costing – CA Inter Cost and Management Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Job and Contract Costing – CA Inter Costing Study Material

Job Costing

Treatment of spoiled and defective work:

Spoiled work – Quantity of production that has been totally rejected and cannot be rectified.

Defective work – Production that is hot perfect for sale but can be rectified by incurring some additional expenditure.

- Where percentage of defective work is allowed: If actual defectives are within normal limit, cost of rectification will be charged to whole job and spread over entire batch. If actual defectives exceeds the normal limit, cost of rectification wall be written off as a loss in Costing P&L

- Where defect is due to bad workmanship: Cost of rectification will be abnormal cost and shall be written off as loss, unless recovered as penalty from workman.

- Where defect is due to the Inspection Department wrongly accepting incoming material of poor quality: Cost of rectification will be charged to department and will not be considered as cost of manufacture of batch. Being an abnormal cost, it will be written off to Costing P&L

Contract Costing

- Value of Work Certified = Value of Contract × Work certified (%)

- Cost of Work Certified: = Cost of work to date – (Cost of work uncertified + Material in hand + Plant at site)

- Progress payment = Value of work certified-Retention money-Payment to date

- Retention Money = Value of work certified – Payment actually made/ cash paid

- Cash received = Value of work certified – Retention money

- Notional profit = Value of work certified – (Cost of work to date – Cost of work not yet certified)

- Estimated Profit = Contract Price – Estimated Total contract cost

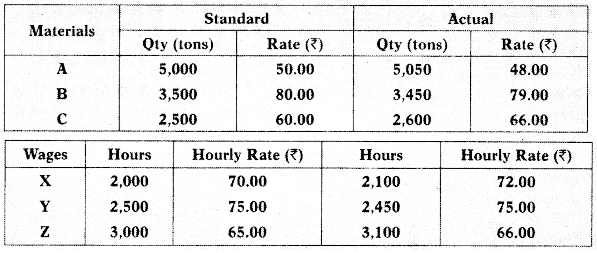

Escalation Clause: This clause which empowers a contractor to revise the price of contract in case of increase in prices of inputs. As per this clause, the contractor increases the contract price if the cost of materials, employees and other expenses increase hevond a certain limit.

![]()

Theory Questions

Question 1.

What Is meant by Job Costing? Give example of (any four) industries where it is used. [CA Inter May 2001, Nov. 2016, 4 Marks]

Answer:

Job costing is the category of basic costing methods which is applicable where the work consists of separate contracts, jobs or batches, each of which is authorised by specific order or contract. According to this method, costs are collected and accumulated according to jobs, contracts, products or work orders. Each job or unit of production is treated as a separate entity for the purpose of costing. Job costing is carried out for the purpose of ascertaining cost of each job and takes into account the cost of materials, employees and overhead etc.

Example: Job costing is applicable industries such as printing, furniture, hard-ware, ship-building, heavy machinery, interior decoration, repairs and other similar work.

Question 2.

Explain the terms ‘Notional profit’, ‘Retention money’ and ‘Progress payment’ in contract costing. [CA Inter Nov, 2017, Nov. 2011, 6 Marks]

Answer:

Notional Profit: It represents the difference between the value of work certi-fied and cost of work certified.

Notional Profit = Value of work Certified – Cost of work Certified (Cost of work to date – Cost of work not yet certified)

Retention money: In a contract, a contractee generally keeps some amount payable to contractor with himself as security deposit. To ensure that the work carried out by the contractor is as per the plan and specifications, the contractee upholds some money payable to contractor as a cushion against any defect or undesirable work. This security money upheld by the contractee is known as retention money. Thus, retention money provides a safeguard against the risk of loss due to faulty workmanship.

Retention Money = Value of work certified – Payment actually made/cash paid

Progress payment: A Contractor gets payments for work done on a contract based on work completion. Since, a contract takes longer period to complete and requires large investment in working capital to progress the contract work, hence, it is desirable by the contractor to have periodic payments from the contractee against the work done to avoid working capital shortage. For this a contactor enters into an agreement with the contractee and agrees on payment on some reasonable basis, which generally, includes percentage of work completion as certified by an expert.

Progress payment = Value of work certified – Retention money – Payment to date.

Question 3.

What is cost plus contract? What are its advantages? [CA Inter May 2008, May 2016, Nov. 2000, Nov. 2009, 4 Marks]

Answer:

Cost plus contract: Under cost plus contract, the value of the contract is determined by adding an agreed percentage of profit to the total cost. Such types of contracts are entered into when it is not possible to estimate the contract cost with reasonable accuracy due to unstable condition of factors that affect 1 the cost of material, employees, etc.

Advantages of cost plus contract:

- The contractor is assured of a fixed percentage of profit and there is no risk of incurring any loss on the contract.

- It is useful specially when the work to be done is not definitely fixed at the time of making the estimate.

- Contractee can ensure himself about the ‘cost of contract’ as he is empowered to examine the books and documents of the contractor to ascertain the veracity of the cost of contract.

Question 4.

State the Escalation clause In contract costing. [CA Inter Nov. 2000, Nov. 2007, Nov. 2013, May 2015, 4 Marks]

Answer:

Normally, a contract takes longer period to complete and the factors based on which price negotiation is done at the time of entering into the contract may change till the contract completes. The Escalation clause in a contract empowers a contractor to revise the price of the contract in case of increase , in the prices of inputs due to some macro-economic or other agreed reasons.

This protects the contractor from adverse financial impacts and empowers the contractor to recover the increased prices. .

As per this clause, the contractor increases the contract price if the cost of materials, employees and other expenses increase beyond a certain limit. Inclusion of such a clause in a contract deed is called an “Escalation Clause”.

Question 5.

What are the advantages and disadvantages of Job Costing? ; [ICAI Module]

Answer:

Advantages:

- Details of Cost of material, labour and overhead for all job is available to control.

- Profitability of each job can be derived.

- Facilitates production planning.

- Budgetary control and Standard Costing can be applied in job costing.

- Spoilage and detective can be identified and responsibilities can be fixed accordingly.

Disadvantages:

- Job Costing is costly and laborious method.

- Chances of error are more since lot of clerical process is involved.

- Not suitable in inflationary condition.

- Previous records of costs will be meaningless if there is any change in market condition.

Question 6.

Distinguish between Job Costing and Process Costing. [ICAI Module]

Answer:

| Job Costing | Process Costing |

| A Job is carried out or a product is produced by specific orders. | The process of producing the product has a continuous flow and the product produced is homogeneous. |

| Costs are determined for each job. | Costs are compiled on time basis ie., for production of a given accounting period for each process or department. |

| Each job is separate and independent of other jobs. | Products lose their individual identity as they are manufactured in a continuous flow. |

| Each job or order has a number and costs are collected against the same job number. | The unit cost of process is an average cost for the period. |

Practical Questions

Question 1.

A Ltd. is an engineering manufacturing company producing job orders on the basis of specifications provided by the customers. During the last month it has completed three jobs namely A, B and C. The following are the items of expenditures’ which are incurred in addition to direct materials and direct employee cost:

(i) Office and administration cost – ₹ 6,00,000

(ii) Product blueprint cost for job A – ₹ 2,80,000

(iii) Hire charges paid for machinery used in job work B – ₹ 80,000

(iv) Salary to office attendants – ₹ 1,00,000

(v) One time license fee paid for software used to make computerised graphics for job C – ₹ 1,00,000.

(vi) Salary paid to marketing manager – ₹ 2,40,000.

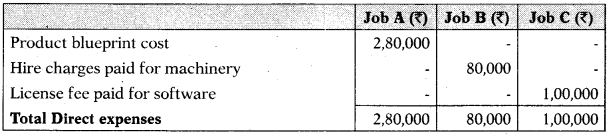

Required: CALCULATE direct expenses attributable to each job. [CA Inter MTP]

Answer:

(i) Calculation of Direct expenses

Question 2.

A factory uses job costing system. The following data are obtained from its books for the year ended 31st March, 2021:

| ₹ | |

| Direct materials | 18,00,000 |

| Direct wages | 15,00,000 |

| Selling and distribution overheads | 10.50,000 |

| Administration overheads | 8,40,000 |

| Factory overheads | 9,00,000 |

| Profit | 12,18,000 |

(i) PREPARE a Job Cost sheet indicating the Prime cost, Cost of Production, Cost of sales and the Sales value.

(ii) In 2020-21, the factory received an order for a job. It is estimated that direct materials required will be ₹ 4,80,000 and direct labour will cost ₹ 3,00,000. DETERMINE what should be the price for the job if factory intends to earn the same rate of profit on sales assuming that the selling and distribution overheads have gone up by 15%. The factory overheads is recovered as percentage of wages paid, whereas, other overheads as a percentage of cost of production, based on cost rates prevailing in the previous year. [CA Inter May 2020, RTP]

Answer:

(i) Production Statement

For the year ended 31st March, 2021

| ₹ | |

| Direct materials | 18,00,000 |

| Direct wages | 15,00,000 |

| Prime Cost | 33,00,000 |

| Factory overheads | 9,00,000 |

| Cost of Production | 42,00,000 |

| Administration overheads | 8,40,000 |

| Selling and distribution overheads | 10,50,000 |

| Cost of Sales | 60,90,000 |

| Profit | 12,18,000 |

| Sales value | 73,08,000 |

Calculation of Rates:

1. Percentage of factory overheads to direct wages

= \(\frac{9,00,000}{15,00,000}\) × 100 = 60%

2. Percentage of administration overheads to Cost of production

= \(\frac{8,40,000}{42,00,000}\) × 100 = 20%

3. Selling and distribution overheads = ₹ 10,50,000 × 115%

= 12,07,500 Selling and distribution overhead 96 to Cost of production ₹ 12,07,500

= \(\frac{₹ 12,07,500}{42,00,000}\) × 100 = 16.67%

4. Percentage of profit to sales = \(\frac{12,18,000}{₹ 73,08,000}\)

(ii) Calculation of price for the job received in 2020-21

| ₹ | |

| Direct materials | 4,80,000 |

| Direct wages | 3,00,000 |

| Prime Cost | 7,80,000 |

| Factory overheads (60% of ₹ 3,00,000) | 1,80,000 |

| Cost of Production | 9,60,000 |

| Administration overheads (20% of ₹ 9,60,000) | 1,92,000 |

| Selling and distribution overheads (28.75% of ₹ 9,60,000) | 2,76,000 |

| Cost of Sales | 14,28,000 |

| Profit (1/5 of ₹ 14,28,000) | 2,85,600 |

| Sales value | 17,13,600 |

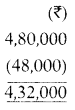

![]()

Question 3.

In the current quarter, a company has undertaken two jobs. The data relating to these jobs are as under:

| Job 1102 | Job 1108 | |

| Selling price | ₹ 1,07,325 | ₹ 1,57,920 |

| Profit as percentage on cost | 8% | 12% |

| Direct Materials | ₹ 37,500 | ₹ 54,000 |

| Direct Wages | ₹ 30,000 | ₹ 42,000 |

It is the policy of the company to charge Factory overheads as percentage on direct wages and Selling and Administration overheads as percentage on Factory cost.

The company has received a new order for manufacturing of a similar job. The estimate of direct materials and direct wages relating to the new order are ₹ 64,000 and ₹ 50,000 respectively. A profit of 20% on sales is required.

You are required to compute:

(i) The rates of Factory overheads and Selling and Administration to be charged

(ii) The Selling price of the new order. [CA Inter Nov. 2002, 9 Marks]

Answer:

(i) Computation of Factory Overhead Rates & Selling & Distribution . Overhead.

Let ‘F’ be the factory overhead rate as a % of direct wages, and

Let ‘S’ be the selling and distribution overhead as a % of factory cost.

Jobs Cost Sheet

| Job No. 1102 | Job No. 1103 | |

| Direct Materials | 37,500 | 54,000 |

| Direct wages | 30,000 | 42,000 |

| Prime Cost | 67,500 | 96,000 |

| Add: Factory Overheads | 30,000F | 42,000F |

| Factory Cost | (67,500 + 30,000F) | (96,000 + 42.000F) |

| Add: Selling and Dist. overheads | (67,500 + 30,000F)S | (96,000 + 42,000F)S |

| Total Cost | (67,500 + 30,000F)(1 + S) | (96,000 + 42,000F)(1 + S) |

Computation of Total Cost of Jobs:

Total cost of Job 1102 when profit is 8% on cost = ₹ 1,07,325/108 X100

= ₹ 99,375

Total cost of Job 1108 when profit is 12% on cost = ₹ 1,57,920/112 X100

= ₹ 1,41,000

Now, the total cost of Job 1102 is ₹ 99,375 and of Job 1108 is ₹ 1,41,000 and therefore, we have the following equations:

(67,500 + 30,000F)(1 + S) = ₹ 99, 375

(96,000 + 42,000F)(1 + S) = ₹ 1,41,000

Or, 67,500 + 30.000F + 67,500S + 30.000FS = ₹ 99, 375

Or, 96,000 + 42,000F + 96,000S + 42,000FS = ₹ 1,41,000

Or, 30,000F + 67,500S + 30,000FS = ₹ 31,875

Or, 42,000F + 96.000S + 42,000FS = ₹ 45,000

On solving this, we will get S = 0.25 and F = 0.40

Hence, Factory overheads is 40% of Direct wages, and

Selling distribution overheads is 25% of Factory cost.

(ii) Computation of Selling Price of New Order:

| Direct Materials | 64.000 |

| Direct Wages | 50.000 |

| Prime Cost | 1,14,000 |

| Factory Overhead (40% on ₹ 50,000) | 20,000 |

| Factory Cost | 1,34,000 |

| Selling & Administration Overhead (25% on ₹ 1,34,000) | 33,500 |

| Total Cost | 1,67,500 |

If selling price of new order is ₹ 100, then profit is ₹ 20 and cost is ₹ 80. Hence, selling price of new order = ₹ 1,67,500 × 100/80 = ₹ 2,09,375.

Question 4.

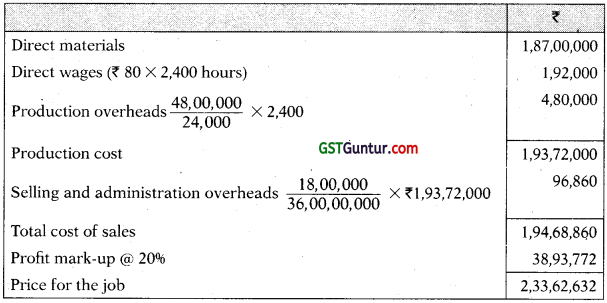

Ispat Engineers Limited (IEL) undertook a plant manufacturing wbrk for a client. It will charge a profit mark up of 20% on the full cost of the jobs. The following are the information related to the job.

Direct materials utilised – ₹ 1,87,00,000

Direct labour utilized – 2,400 hours at ₹ 80 per hour

Budgeted production overheads are ₹ 48,00,000 for the period and are recovered on the basis of 24,000 labour hours.

Budgeted selling and administration overheads are ? 18,00,000 for the period and recovered on the basis of total budgeted total production cost of ₹ 36,00,00,000.

Required:

CALCULATE the price to be charged for the job [CA Inter Nov. 2019, RTPJ

Answer:

Question 5.

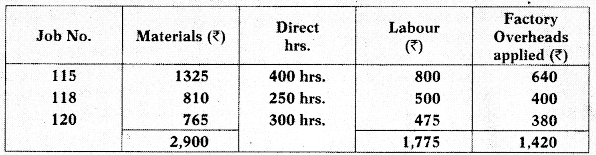

In a factory following the Job Costing Method, an abstract from the work-in-progress as on 30th September was prepared as under.

Materials used in October were as follows:

| Materials Requisition No. | Job No. | Cost (₹) |

| 54 | 118 | 300 |

| 55 | 118 | 425 |

| 56 | 118 | 515 |

| 57 | 120 | 665 |

| 58 | 121 | 910 |

| 59 | 124 | 720 |

| 3,535 |

A summary for labour hours deployed during October is as under:

A shop credit slip was issued in October, that material issued under Requisition No. 54 was returned back to stores as being not suitable. A material transfer note issued in October indicated that material issued under Requisition No. 55 for Job 118 was directed to Job 124.

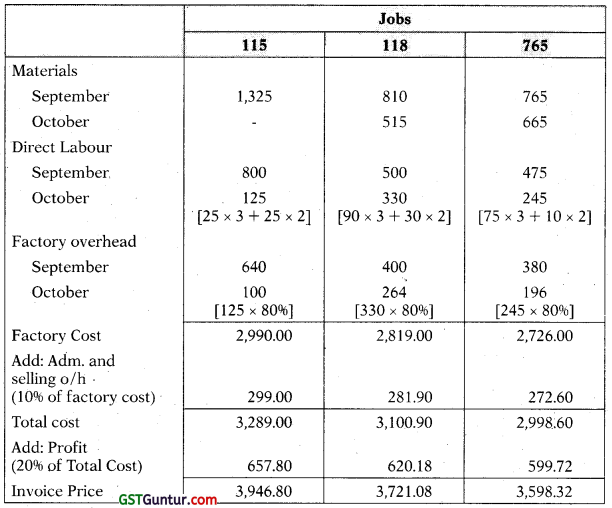

The hourly rate in shop A per labour hour is ₹ 3 per hour while at shop B, it is ₹ 2 per hour. The factory overhead is applied at the same rate as in September. Job 115, 118 and 120 were completed in October.

You are asked to compute the factory cost of the completed jobs. It is the practice of the management to put a 10% on the factory cost to cover administration and selling overheads and invoice the job to the customer on a total cost plus 20% basis. Determine the invoice price of these three jobs? [ICAI Module]

Answer:

Invoice Price of Complete Jobs

Notes:

(1) Material requisition no. 54 will not be included in cost of material of Job no. 118 since it was returned back to stores as being not suitable.

(2) Material requisition no. 55 will also not be included in cost of material of Job no. 118 since it was directed to Job 124.

(3) It is given that factory overheads will be applied in October at the same rate as in September. The factory overheads were applied @ 80 of direct labour cost in September.

Question 6.

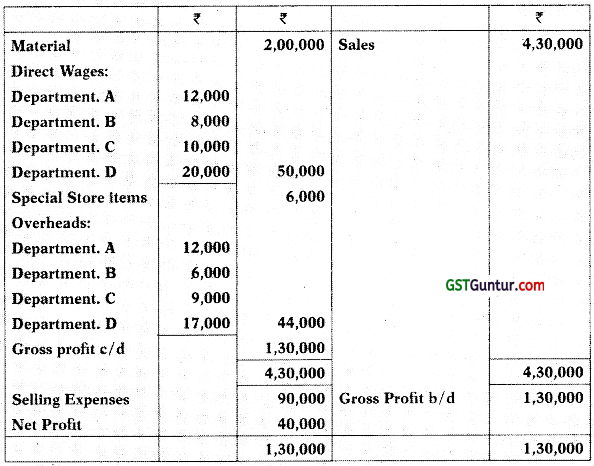

The following data presented by the supervisor of a factory for a Job.

| ₹ per unit | |

| Direct Material | 120 |

| Direct Wages @ ₹ 4 per hour (Departments A-4 hrs, B-7 hrs, C-2 hrs & D-2 hrs) | 60 |

| Chargeable Expenses | 20 |

| Total | 200 |

Analysis of the Profit and Loss Account for the year ended 31st March, 2021

(i) Prepare a Job Cost Sheet.

(ii) Calculate the entire revised cost using the above figures as the base.

(iii) Add 20% profit on selling price to determine the selling price. [CA Inter Nov. 2019, 5 Marks]

Answer:

![]()

Question 7.

M. L. Auto Ltd. is a manufacturer of auto components and the details of its expenses for the year 2020 are given below:

(i) Opening Stock of Material 1,50,000

(ii) Closing Stock of Material 2,00,000

(iii) Purchase of Material 18,50,000

(iv) Direct Labour 9,50,000

(v) Factory Overhead 3,80,000

(vi) Administrative Overhead 2,50,400

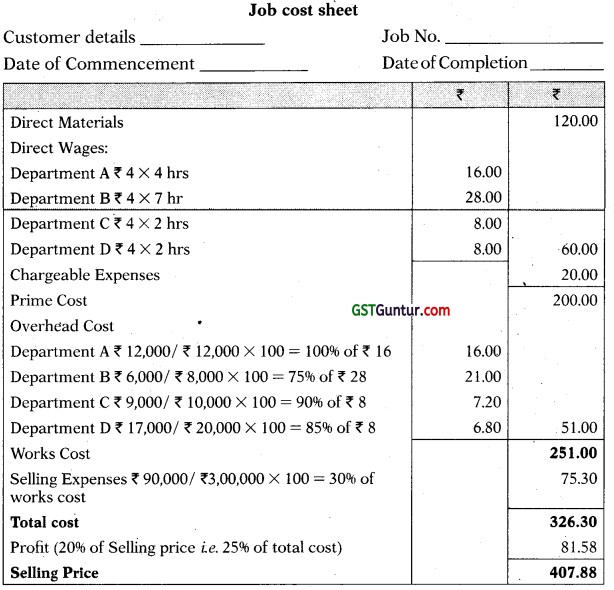

During 2021, the company has received an order from a car manufacturer where it estimates that the cost of material and labour will be t 8,00,000 and ₹ 4,50,000 respectively. M. L. Auto Ltd. charges factory overhead as a percentage of direct labour and administrative overhead as a percentage of factory cost based on previous year’s cost.

Cost of delivery of the components at customer’s premises is estimated at ? 45,000.

You are required to:

(i) Calculate the overhead recovery rates based on actual costs for 2020.

(ii) Prepare a job cost sheet for the order received in 2021 and the price to be quoted if the company wants to earn a profit of 10% on sales. [CA Inter Nov. 2015, 8 Marks]

Answer:

(i) Calculation of Overhead Recovery Rates:

Working Note: Calculation of Factory Cost in 2020

| ₹ | |

| Opening Stock of Material | 1,50,000 |

| Add: Purchase of Material | 18,50,000 |

| Less: Closing Stock of Material | 2,00,000 |

| Material consumed , | 18,00,000 |

| Direct labour | 9,50,000 |

| Prime cost | 27,50,000 |

| Factory overhead | 3,80,000 |

| Factory cost | 31,30,000 |

(ii) Job Cost Sheet for the Order received from M.L. Auto Ltd. during 2021

| ₹ | |

| Material | 8,00,000 |

| Labour | 4,50,000 |

| Factory Overhead (40% of 4,50,000) | 1,80,000 |

| Factory Cost | 14,30,000 |

| Administrative Overhead (8% of 14,30,000) | 1,14,400 |

| Cost of delivery | 45,000 |

| Total Cost | 15,89,400 |

| Add: Profit @ 10% of Sales or 11.11 % of cost or 1 / 9 of ₹ 15,89,400 | 1,76,600 |

| Sales value (Price to be quoted for the order) (₹ 15,89,400/0.9) | 17,66,000 |

Hence, the price to be quoted is ₹ 17,66,000 if the company wants to earn a profit of 10% on sales.

Question 8.

AP Ltd. received a job order for supply and fitting of plumbing materials. Following are the details related with the job work:

Direct Materials

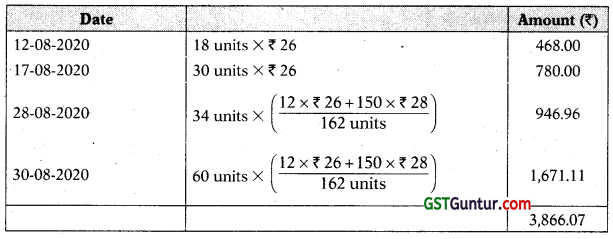

AP Ltd. uses a weighted average method for the pricing of materials issues. Opening stock of materials as on 12th August, 2020:

- 15mm GI Pipe, 12 units of (15 feet size) @ ₹ 600 each

- 20mm GI Pipe, 10 units of (15 feet size) @ ₹ 660 each

- Other fitting materials, 60 units @ ₹ 26 each

- Stainless Steel Faucet, 6 units @ ₹ 204 each

- Valve, 8 units @ ₹ 404 each Purchases:

On 16th August, 2020:

- 20mm GI Pipe, 30 units of (15 feet size) @ ₹ 610 each

- 10 units of Valve @ ₹ 402 each On 18th August, 2020:

- Other fitting materials, 150 units @ ₹ 28 each

- Stainless Steel Faucet, 15 units @ ₹ 209 each

On 27th August, 2020:

- 15mm GI Pipe, 35 units of (15 feet size) @ ₹ 628 each

- 20mm GI Pipe, 20 units of (15 feet size) @ ₹ 660 each

- Value, 14 units @ ₹ 424 each Issues for the hostel job:

On 12th August, 2020:

- 20mm GI Pipe, 2 units of (15 feet size)

- Other fitting materials 18 units

On 17th August, 2020:

- 15mm GI Pipe, 8 units of (15 feet size)

- Other fitting materials, 30 units On 28th August, 2020:

- 20mm GI Pipe, 2 units of (15 feet size)

- 15mm GI Pipe, 10 units of (15 feet size)

- Other fitting materials, 34 units

- Valve, 6 units On 30th August, 2020:

- Other fitting materials, 60 units

- Stainless Steel Faucet, 15 units Direct Labour:

Plumber: 180 hours @ ₹ 100 per hour (includes 12 hours overtime)

Helper: 192 hours @ ₹ 70 per hour (includes 24 hours overtime)

Overtimes are paid at 1.5 times of the normal wage rate.

Overheads:

Overheads are applied @ ₹ 26 per labour hour.

Pricing policy:

It is company’s policy to price all orders based on achieving a profit margin of 25% on sales price.

You are required to

(a) CALCULATE the total cost of the job

(b) CALCULATE the price to be charged from the customer. [CA Inter Nov. 2020, RTP]

Answer:

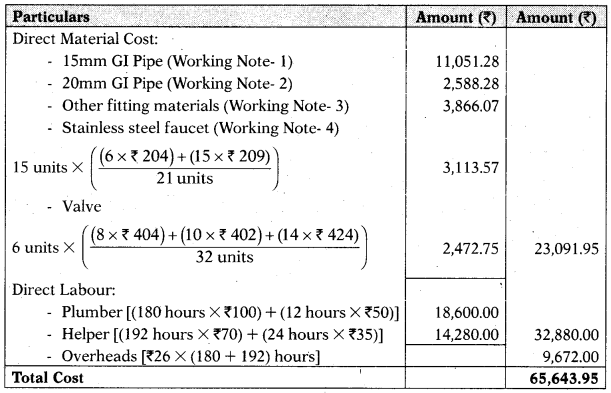

(a) Calculation of Total Cost for the Job:

(b) Price to be charged for the job work:

Working Note:

1. Cost of 15mm GI Pipe

2. Cost of 20mm GI Pipe

3. Cost of Other fitting materials

Question 9.

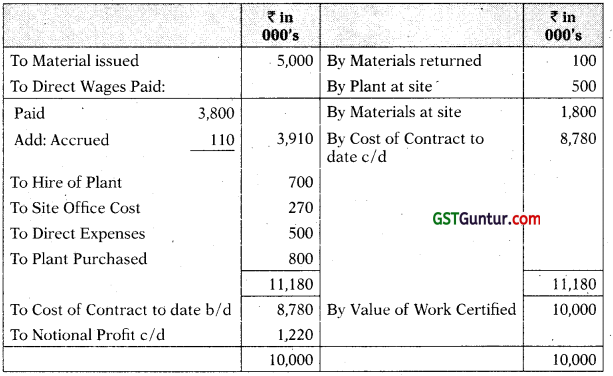

A construction company undertook a contract at an estimated price of ₹ 108 lakhs, which includes a budgeted profit of ₹ 18 lakhs. Relevant data for the year ended 31.3.2021 are as under:

| (₹ 000’s) | |

| Materials issued to site | 5,000 |

| Direct wages paid | 3,800 |

| Plant hired | 700 |

| Site office costs | 270 |

| Materials returned from site | 100 |

| Direct expenses | 500 |

| Work certified | 10,000 |

| Progress payments received | 7,200 |

A special plant was purchased specifically for this contract at ₹ 8,00,000 and after use on this contract till the end of 31.3.2021, it was valued at ₹ 5,00,000. The cost of materials at site at the end of the year was estimated at ₹ 18,00,000. Direct wages accrued as on 31.3.2021 was ₹ 1,10,000.

Required:

Prepare the Contract Account for the year ended 31st March, 2021 and compute the notional profit. . [CA Inter Nov. 2002, 6 Marks]

Answer:

Contract Account for the year ended on 31.03.2021

Question 10.

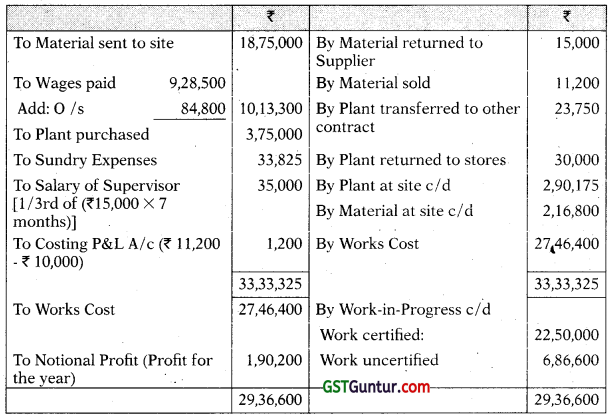

A contractor prepares his accounts for the year ending 31st March each year. He commenced a contract on 1st September, 2020. The following information relates to contract as on 31st March, 2021:

| Material sent to site | ₹ 18,75,000 |

| Wages paid | ₹ 9,28,500 |

| Wages outstanding at end | ₹ 84,800 |

| Sundry Expenses | ₹ 33,825 |

| Material returned to supplier | ₹ 15,000 |

| Plant purchased | ₹ 3,75,000 |

| Salary of supervisor (Devotes 1/3 of his time on contract) | ₹ 5,000 per month |

| Material at site as on 31-03-2021 | ₹ 2,16,800 |

Some of material costing ₹ 10,000 was found unsuitable and was sold for ₹ 11,200. On 31-12-2020 plant which costs ₹ 25,000 was transferred to some other contract and on 31-01-2021 plant which costs ₹ 32,000 was returned to stores. The plant is subject to annual depreciation @ 15% on WDV method. The contract price is ₹ 45,00,000. On 31st March, 2021 2/3rd of the contract was completed. The architect issued certificate covering 50% of the contract price. Prepare Contract A/c and show the notional profit or loss as on 31st March, 2021. [CA Inter May 2019, 10 Marks]

Answer:

Contract Account as on 31st March, 2021

Working Notes:

1. Value of plant transferred to other contract:

₹ 25,000 less Depreciation for 4 months = ₹ 25,000 – (₹ 25,000 × 15% × 4/12) = ₹ 23,750

2. Value of plant returned to stores:

₹ 32,000 less Depreciation for 5 months

= ₹ 32,000 – (₹ 32,000 × 15% × 5/12) = ₹ 30,000

3. Value for Work Uncertified:

The cost of 2/3rd of the contract is ₹ 27,46,400

So, the cost of 100°6 of the contract will be ₹ 41,19,600 (₹ 27,46,400/2 × 3)

Now, the cost of 50% of the contract which has been certified by the architect is ₹ 20,59,800 (₹ 41,19,600/2). Also, the cost of l/3rd of the contract, which has been completed but not certified bv the architect is ₹ 6,86,600 (₹ 27,46,400 – ₹ 20,59,800).

![]()

Question 11.

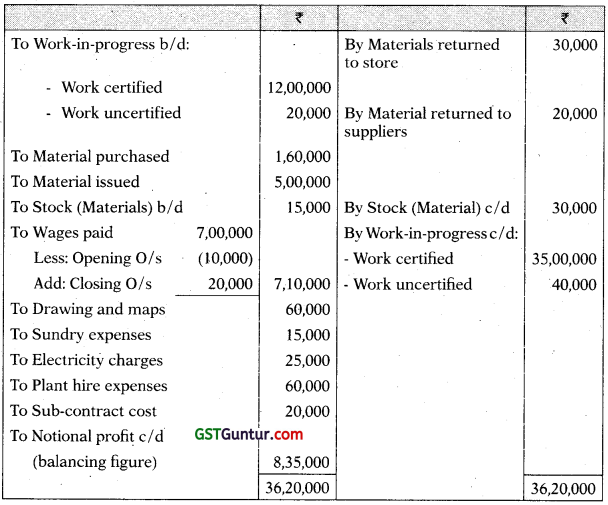

Z Limited obtained a contract No. 999 for ₹ 50 lakhs. The following details are available in respect of this contract for the year ended March 31st, 2021:

| ₹ | |

| Materials purchased | 1,60,000 |

| Materials issued from stores | 5,00,000 |

| Wages and salaries paid | 7,00,000 |

| Drawing and maps | 60,000 |

| Sundry expenses | 15,000 |

| Electricity charges | 25,000 |

| Plant hire expenses | 60,000 |

| Sub-contract cost | 20,000 |

| Materials returned to stores | 30,000 |

| Materials returned to suppliers | 20,000 |

The following balances relating to the contract No. 999 for the year ended on March 31st, 2020 and March 31st, 2021 are available:

| As on 31.03.2020 (₹) | As on 31.03.2021 (₹) | |

| Work certified | 12,00,000 | 35,00,000 |

| Work uncertified | 20,000 | 40,000 |

| Materials at site | 15,000 | 30,000 |

| Wages outstanding | 10,000 | 20,000 |

The contractor receives 75% of work certified in cash.

Prepare Contract Account and Contractee’s Account. [CA Inter Nov. 2014, 8 Marks]

Answer:

Contract No. 999 Account for the year ended 31.03.2021

Note: It is assumed that expenses incurred for drawing and maps are used exclusively for this contract only.

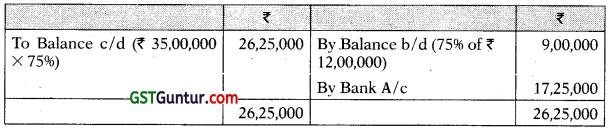

Contractee’s Account

Question 12.

A contractor commenced a contract on 1-7-2020 The costing records concerning the said contract reveal the following information as on 31 -3-2021:

| ₹ | |

| Material sent to site | 7,74,300 |

| Labour paid | 10,79,000 |

| Labour outstanding as on 31-3-2021 | 1,02,500 |

| Salary to Engineer | 20,500 p.m. |

| Cost of plant sent to site (1-7-2020) | 7,71,000 |

| Salary to Supervisor (3/4 time devoted to contract) | 9,000 p.m. |

| Administration & other expenses | 4,60,600 |

| Prepaid Administration expenses | 10,000 |

| Material in hand at site as on 31-3-2020 | 75,800 |

Plant used for the contract has an estimated life of 7 years with residual val¬ue at the end of life ₹ 50,000. Some of material costing ₹ 13,500 was found unsuitable and sold for ₹ 10,000. Contract price was ₹ 45,00,000. On 31-3-2021 two-third of the contract was completed. The architect issued certificate covering 50% of the contract price and contractor has been paid ₹ 20,00,000 on account. Depreciation on plant is charged on straight line basis. Prepare Contract Account. [CA Inter May 2012, 8 Marks]

Answer:

Contract A/c

(For the period 01.07.2020 to 31.03.2021)

Working Note:

1. Calculation of depreciation on Plant

Estimated life 7 Years

Depreciation per annum ₹ 1,03,000

Depreciation for 9 months = ₹ 1,03,000 × 9/12 = ₹ 77,250

2. Cost of work uncertified

= Cost incurred to date – 50% of the total cost of contract

= ₹ 26,39,600 – ₹ 19,79,700

= ₹ 6,59,900

Question 13.

M/s. SD Private Limited commenced a contract on 1st July 2020 and the company closes its account for the year on 31st March every year. The following information relates to the contract as on 3lst March 2021.

(i) Material issued – ₹ 9,48,000

(ii) Direct wages – ₹ 4,57,200

(iii) Prepaid direct wages as on 31.3.2021-₹ 1,08,000

(iv) Administration charges-₹ 7,20,000

(v) A supervisor, who is paid ₹ 50,000 per month, has devoted 2/3rd of his time to this contract.

(vi) A plant costing ₹ 7,85,270 has been on the site for 185 days, its working life is estimated at 9 years and its scrap value is ₹ 75,000.

The contract price is ₹ 42 lakhs. On 31st March, 2021,2/3rd of the contract was completed. The Architect issued certificate covering 50% of the contract price and the contractor had been paid ₹ 15.75 lakhs on account.

Assuming 365 days in a year, you are required to:

(i) Prepare a Contract Account showing work cost

(ii) Calculate Notional Profit or Loss as on 31st March, 2018. [CA Inter Nov. 2018, 5 Marks]

Answer:

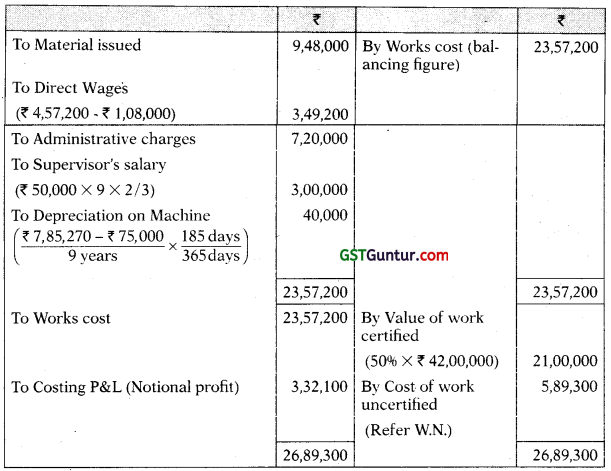

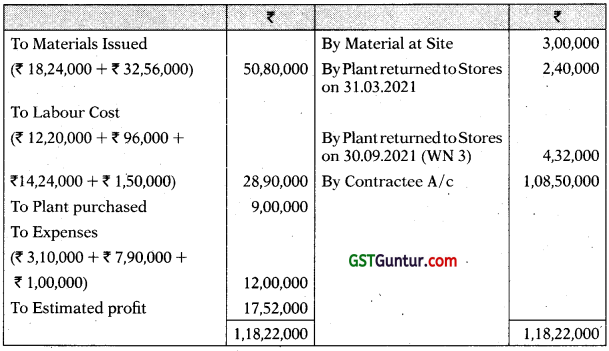

Contract Account

![]()

Question 14.

A construction company has obtained a contract of ₹ 30 lakhs contract price.

The following details are available in respect of this contract for the year ended March 31, 2021:

| Particulars | ₹ |

| Materials purchased | 2,00,000 |

| Materials issued from stores | 8,00,000 |

| Wages paid | 1,50,000 |

| Plant Supervisor Salary | 2,40,000 |

| Drawing and maps | 50,000 |

| Sundry expenses | 30,000 |

| Electricity charges | 40,000 |

| Plant hire expenses paid | 75,000 |

| Sub-contract cost | 40,000 |

| Materials returned to stores | 35,000 |

| Materials returned to suppliers | 50,000 |

The following balances related to the contract for the year ended on March 31, 2020 and March 31, 2021 are available:

| As on 31st March, 2020 (₹) | As on 31st March, 2021 (₹) | |

| Work certified | 2,50,000 | 70% of Contract Price |

| Work uncertified | 10,000 | |

| Materials at site | 35,000 | 25,000 |

| Wages outstanding | 15,000 | 22,000 |

| Plant hire charges outstanding | 20,000 | 15,000 |

Further informations are as under:

1. An additional plant was used for 270 days costing ₹ 5,00,000 with a residual value of ₹ 20,000 having life of 4 years.

2. During the year, material costing ₹ 40,000 was sold for ₹ 20,000.

3. Plant supervisor has devoted 1 /3rd of his time to this contract.

4. As on 31.03-2021, 80% of the contract was completed.

You are required to prepare Contract Account and show the notional profit or loss as on 31st March, 2021 (Assume 360 days in a year). [CA Inter Dec. 2021,10 Marks]

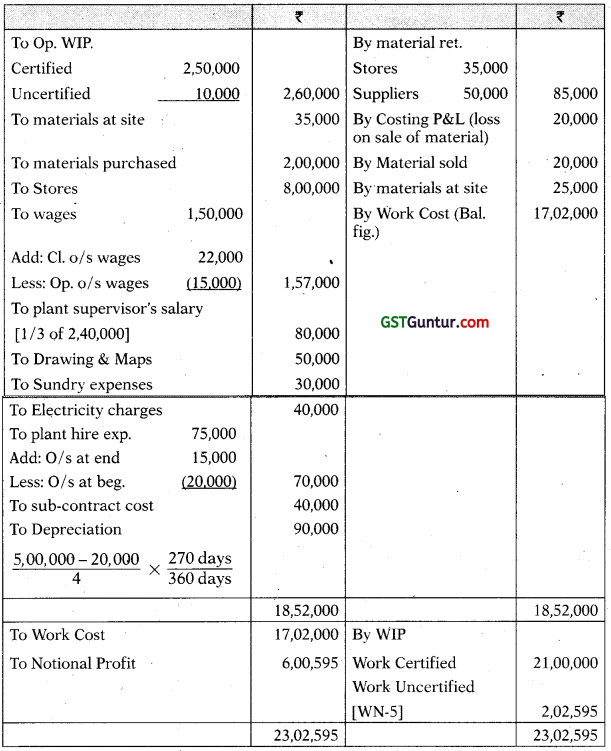

Answer:

Working Notes:

Calculation of work uncertified:

Work Cost = ₹ 17,02,000 it includes ₹ 2,50,000 opening work certified.

Cost of work during the year + Opening uncertified

= Work Cost – Opening work certified

= ₹ 17,02,000 – ₹ 2,50,000 = ₹ 14,52,000

Percentage of Work Completed = Cost of 80% (-) \(\frac{₹ 2,50,000}{₹ 30,00,000}\)

= 80% – 8.33% = 71.67%.

Cost of 71.67% = ₹ 14,52,000 .

Work uncertified during current year = 10% of contract

ie \(\frac{10 \%}{71.67 \%}\) × 14,52,000 = ₹ 2,02,595

Question 15.

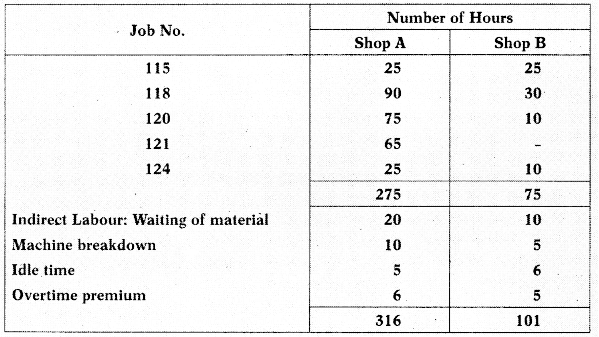

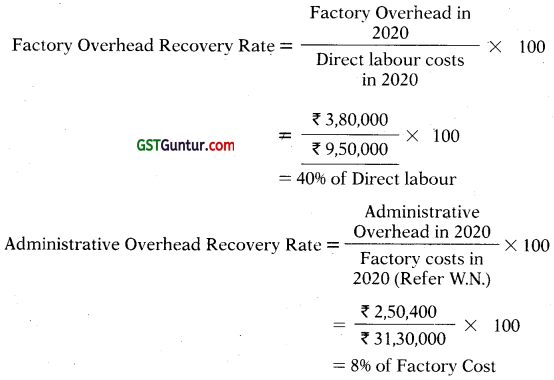

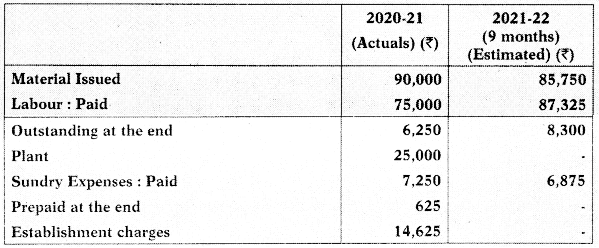

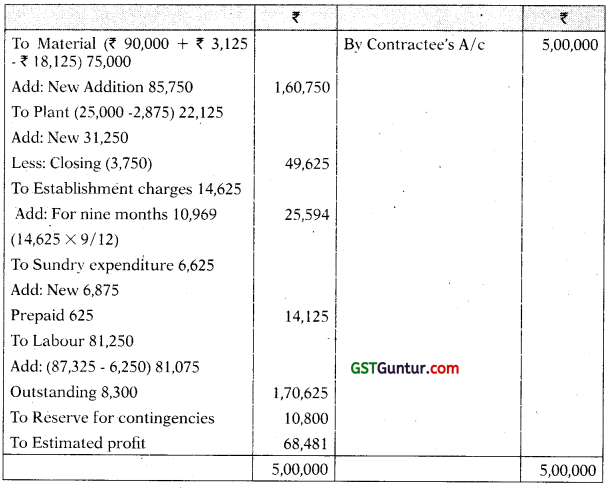

AKP Builders Ltd. commenced a contract on April 1st, 2020. The total contract was for ₹ 5,00,000. Actual expenditure for the period April 1st, 2020 to March 31st, 2021 and estimated expenditure for April 1st, 2021 to December 31st, 2021 are given below :

A part of the material was unsuitable and was sold for ₹ 18,125 (Cost being ₹ 15,000) and a part of plant was scrapped and disposed of for ₹ 2,875. The value of plant at site on 31st March, 2021 was ₹ 7,750 and the value of material at site was ₹ 4,250. Cash received on account to date was ₹ 1,75,000, representing 80% of the work certified. The cost of work uncertified was valued at ₹ 27,375. The contractor estimated further expenditure that would be incurred in completion of the contract:

- The contract would be completed by 31st December, 2021.

- A further sum of ₹ 31,250 would have to be spent on the plant and the residual value of the pant on the completion of the contract would be ₹ 3,750.

- Establishment charges would cost the same amount per month as in the previous year.

- ₹ 10,800 would be sufficient to provide for contingencies.

Required:

Prepare Contract account and calculate estimated total profit on this contract. [CA In ter May 2007, 8 Marks ]

Ans.

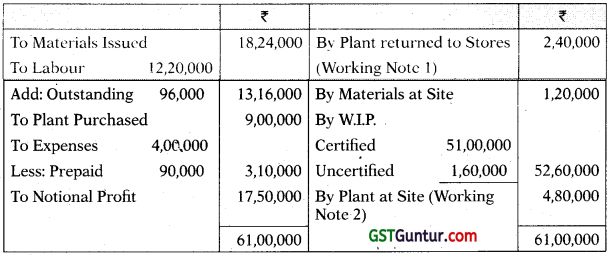

AKP Builders Ltd.

Contract Account

(1st April, 2020 to 31st March, 2021)

im-23

Memorandum Contract Account (9 Months)

![]()

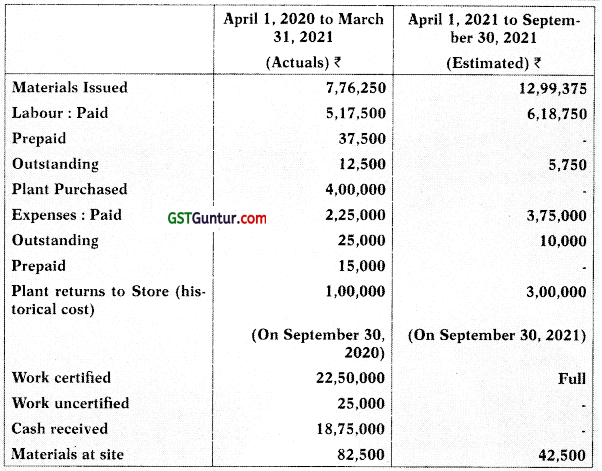

Question 16.

RST Construction Ltd. commenced a contract on April 1st, 2020. The total contract was for ₹ 49,21,875. It was decided to estimate the total Profit on the contract and to take to the Credit of P/L A/c that proportion of estimated profit on cash basis, which work completed bore to total Contract. Actual expenditure for the period April 1st, 2020 to March 31st, 2021 and estimated expenditure for April 1,2021 to September 30,2021 are given below:

The plant is subject to annual depreciation @ 25% on written down value method. The contract is likely to be completed on September 30, 2021.

Required:

(i) Prepare the contract A/c.

(ii) Determine notional profit & estimated profit. [CA Inter Nov. 2010, May 2006, Nov. 2004, May 2000, 10 Marks]

Answer:

RST Construction Ltd.

Contract Account

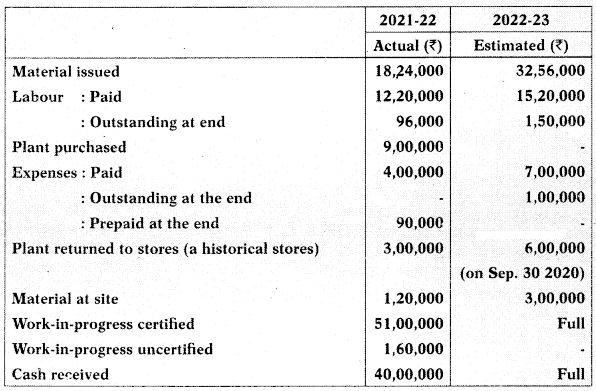

(1st April, 2020 to 31st March, 2021)

RST Construction Ltd.

Contract Account

(1st April, 2020 to 31th September, 2021)

(For computing estimated profit)

Working Notes:

1. Value of Plant returned to Stores on 31.03.2021:

Historical Cost of Plant returned = 1,00,000

Less: Depreciation @ 25% of WDV cost for 6 months (30.09.2020 to 31.03.2021) = 12,500

2. Value of Plant at Site on 31.03.2021

Historical cost of Plant at site (4,00,000 – 1,00,000) = 3,00,000

Less: Depreciation @ 25% of WDV cost for 1 year = 75,000

3. Value of plant returned to store on 30th Sept., 2021

Value of the plant on 31st March, 2021 = 2,25,000

Less: Depreciation (a 25% of WDV for a period of 6 months = 28,125

Question 17.

GVL Ltd. commenced a contract on April 1st, 2021. The total contract was for ₹ 1,08,50,000. It was decided to estimate the total profit and to take to the credit of Costing P & L A/c the proportion of estimated profit on cash basis which work completed bear to the total contract. Actual expenditure in 2021-21 and estimated expenditure in 2021-22 are given below:

The plant is subject to annual depreciation @ 20% of WDV cost. The contract is likely to be completed on September 30, 2022.

Required:

(i) PREPARE the Contract A/c for the year 2021-22

(ii) ESTIMATE the profit for the contract. [CA Inter Nov. 2019]

Answer:

GVL Ltd.

Contract Account

(April 1st, 2021 to March 31st, 2022)

GVL Ltd. Contract Account

(April 1st, 2021 to March 31st, 2022)

(For Computing estimated profit)

Working Notes:

1. Value of the Plant returned to Stores on 31.03.2022

Historical Cost of the Plant returned = 3,00,000

Less: Depreciation @ 20% of WDV for one year = (60,000)

2. Value of Plant at Site 31.03.2022

Historical Cost of Plant at Site (₹ 9,00,000 – ₹ 3,00,000) = 6,00,000

Less: Depreciation @ 20% on WDV for one year = (1,20,000)

3. Value of Plant returned to Stores on 30.09.2022

Value of Plant (WDV) on 31.3.2022

Less: Depreciation (a 20% of WDV for a period of 6 months

4. Expenses Paid for the year 2021-22

Total expenses paid

Less: Prepaid at the end

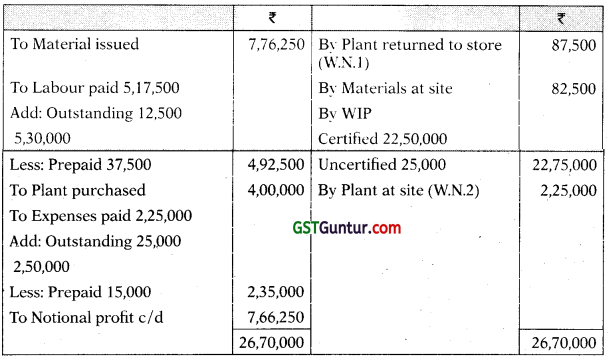

Question 18.

PVK Constructions commenced a contract on 1st April, 2019. Total contract value was ? 100 lakhs. The contract is expected to be completed by 31st December, 2021. Actual expenditure during the period 1st April, 2019 to 31st March, 2020 and estimated expenditure for the period 1st April, 2020 to 31st December, 2021 are as follows:

| 1st April, 2019 to 31st March, 2020 Actual (₹) | 1st April, 2020 to 31st Dec, 2021 Estimated (₹) | |

| Material issued | 15,30,000 | 21,00,000 |

| Direct Wages paid | 10,12,500 | 12,25,000 |

| Direct Wages outstanding | 80,000 | 1,15,000 |

| Plant purchased | 7,50,000 | |

| Expenses paid | 3,25,000 | 5,40,000 |

| Prepaid Expenses | 68,000 | – |

| Site office expenses | 3,00,000 | – |

Part of the material procured for the contract was unsuitable and was sold for ₹ 2,40,000 (cost being ₹ 2,55,000) and a part of plant was scrapped and disposed of for ₹ 80,000. The value of plant at site on 31st March, 2015 was ₹ 2,50,000 and the value of material at site was ₹ 73,000. Cash received on account to date was ₹ 36,00,000; representing 80% of the work certified. The cost of work uncertified was valued at ₹ 5,40,000. Estimated further expenditure for completion of contract is as follows:

- An additional amount of ₹ 4,62,500 would have to be spent on the plant and the residual value of the plant on the completion of the contract would be ₹ 67,500.

- Site office expenses would be the same amount per month as charged in the previous year.

- An amount of ₹ 1,57,500 would have to be incurred towards consultancy charges.

Required:

Prepare Contract Account and calculate estimated total profit on this contract. [CA Inter Nov. 2015, 8 Marks]

Answer:

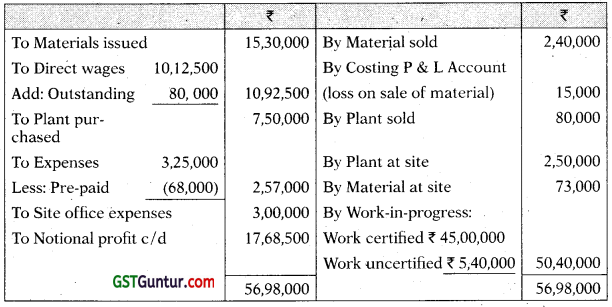

PVK Constructions

Contract Account for the year 2019-20

Calculation of Estimated Profit (April 2019 to December 2020)

Question 19.

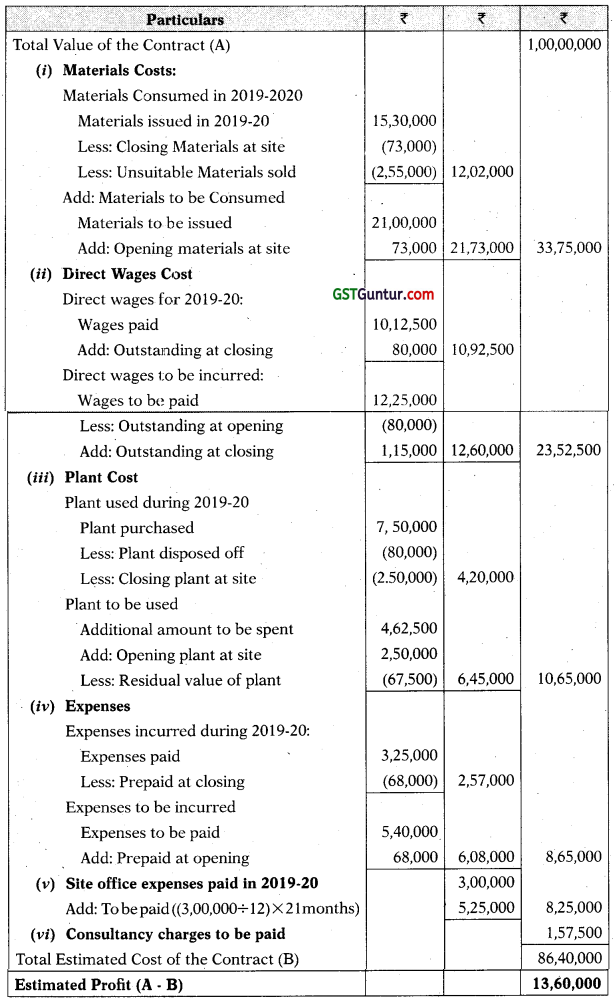

W Limited undertook a contract for ₹ 5,00,000 on 1st July, 2020. On 30th June, 2021 when the accounts were closed, the following details about the contract were gathered:

| ₹ | |

| Materials purchased | 1,00,000 |

| Wages paid | 45,000 |

| General expenses | 10,000 |

| Materials on hand (30-6-2021) | 25.000 |

| Wages accrued (30-6-2021) | 5,000 |

| Work certified | 2,00,000 |

| Cash received | 1.50,000 |

| Work uncertified | 15,000 |

The above contract contained “Escalation clause” which read as follows:

“In the event of increase in the prices of materials and rates of wages by more than 5%, the contract price would be increased accordingly by 25% of the rise in the cost of materials and wages beyond 5% in each case.” It was found that since the date of signing the agreement, the prices of materials and wage rates increased by 25%. The value of the work certified does not take into account the effect of the above clause.

Calculate the ‘value of work certified’ after taking the effect of ‘Escalation Clause’ as on 30th June, 2021. [CA Inter Nov. 2020, 5 Marks]

Answer:

(i) Percentage of work certified:

\(\frac{\text { Value of work certified }}{\text { Contract price }}\) × 100 = \(\frac{2,00,000}{5,00,000}\) × 100 = 40%

(ii) Value of material and labour used in the contract:

Price of materials and wages has been increased by 25%, the value before price increase is:

\(\frac{1,25,000}{125}\) × 100 = 1,00,000

(iii) Calculation of Value of work certified:

The value of the contract would be increased by 25% of the price in¬creased beyond 5%.

Price increased beyond 5% = ₹ 25,000 – 5% of ? 1,00,000 = ₹ 20,000

Value of contract would be increased by 25% of ? 20,000 = ₹ 5,000

Therefore, the revised contract value = ₹ 5,00,000 + ₹ 5,000 = ₹ 5,05,000

Calculation of the Value of work certified after taking the effect of escalation clause:

= Revised contract value × Percentage of work certified

= ₹ 5,05,000 × 40% = ₹ 2,02,000

![]()

Question 20.

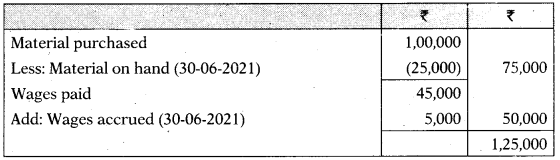

Brick Constructions Ltd. commenced a contract on April 1, 2020. The contract was for t 10,00,000. The following information relates to the Contract as on 31st March, 2021:

- The value of work completed up to Feb. 28, 2021 was certified by the architect and as a matter of policy; the contractee has retained ₹ 1,30,000 as retention money which is 20% of the certified work and paid the balance amount.

- The cost of work completed subsequent to the architect’s certificate was of ₹ 30,000.

- The expenditure incurred related to material purchase, wages and other chargeable expenses were ₹ 5,10,000.

Materials of the value of ₹ 20,000 were lying on the site.

A special plant was purchased specifically for this contract at ₹ 40,000 and after use on this contract till 31st March, 2021; it was valued at ₹ 25,000.

You are required to compute the value of work Certified, Cash received for certified work and Notional profit of the contract for the year ended on 31st March, 2021. [CA Inter July 2021, 5 Marks]

Answer:

Value or work certified = \(\frac{\text { Retention Money }}{20 \%}=\frac{₹ 1,30,000}{20 \%}\) = ₹ 6,50,000

Cash received for certified work = Work certified × 80%

= ₹ 6,50,000 × 80% = ₹ 5,20,000

Notional profit

= Work certified + Work uncertified – Cost to date

= ₹ 6,50,000 + ₹ 30,000 – (₹ 5,10,000 + ₹ 40,000 – ₹ 25,000 – ₹ 20,000)

= ₹ 1,75,000

Question 21.

Premier Construction Company undertook a contract for ₹ 5,00,000 on 1st August, 2020. On 31st March, 2021 when the accounts were closed, the following information was available;

| Cost of work uncertified | ₹ 1,20,000 |

| Cash received | ₹ 2,50,000 (80% of work certified) |

| Cost of work till date | ₹ 2,82,500 |

Calculate:

(i) The value of work in progress certified

(ii) Degree of completion of contract

(ii) Notional Profit and [CA Inter Nov. 2017, 5 Marks]

Answer:

(i) Value of work in progress certified:

Since, Cash Received of ₹ 2,50,000 is 80% of work certified

Therefore, Value of work in progress certified = \(\frac{₹ 2,50,000}{80 \%}\) = ₹ 3,12,500

(ii) Degree of completion of contract:

= \(\frac{\text { Value of work certified }}{\text { Value of contract }}\) × 100 = \(\frac{₹ 3,12,500}{₹ 5,00,000}\) × 100 = 62.5%

(iii) Notional Profit:

= Work certified + Work uncertified – Cost to date

= ₹ 3,12,500 + ₹ 1,20,000 – ₹ 2,82,500 = ₹ 1,50,000

Question 22.

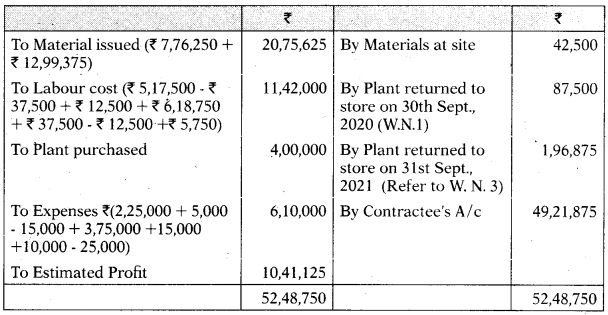

XYZ Construction Company took a contract for construction of a stadium on 1st April, 2020 at a price of 160 lakhs. The relevant information for the year ended 31st March, 2021 are as under:

| ₹ in’000 | |

| Material purchased for the contract | 6,800 |

| Direct wages paid | 3,450 |

| Salaries | 200 |

| Direct wages prepaid at the end of the year | 50 |

| Salaries outstanding at the end of the year | 100 |

| Material returned to stores | 150 |

| Materia) at site as on 31st March, 2021 | 175 |

| Payment received from the contractee (80% of work certified) | 9,440 |

| Work done but not certified | 500 |

A plant was purchased for ₹ 12,00,000 on 1st November, 2020 and was in use at the site upto 31st March, 2021. Depreciation is to be charged on plant @15% per annum on straight line basis. Material costing f 50,000 was stolen from the site.

You are required to:

(i) Prepare contract account for the year ended 31st March, 2021.

(ii) Prepare Balance Sheet showing the relevant items. [CA Inter May 2018, 10 Marks]

Answer:

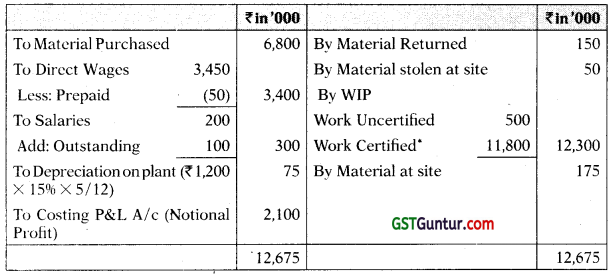

(i) Contract Account for the year ended 31.03.2021

* Work Certified = ₹ 94,40,000/80% = ₹ 1,18,00,000

(ii) Balance sheet (Extracts) as on 31.03.2021

![]()

Question 23.

M/s. AB1D Constructions undertook a contract at a price of ₹ 171.00 lakhs.

The relevant data for the year ended 31st March, 2021 are as under:

| ₹ in’ 000 | |

| Material issued at site | 7,700 |

| Direct Wages paid | 3,300 |

| Site office cost | 550 |

| Material return to store | 175 |

| Work certified : | 12,650 |

| Work uncertified | 225 |

| Progress Payment Received | 10,120 |

| Prepaid site office cost as on 31:03.2021 | 50 |

| Direct wages outstanding as on 31.03.2021 | 100 |

| Material at site as on 31.03.2021 | 110 |

Additional Information:

(a) A plant was purchased for the contract at ₹ 8,00,000 on 01.12.2020.

(b) Depreciation @15% per annum is to be charged.

(c) Material which cost ₹ 1,30,000 was destroyed by fire.

Prepare:

(i) Contract Account for the year ended 31st March, 2021.

(ii) Account of Contractee. [CA Inter May 2014, 4 Marks]

Answer:

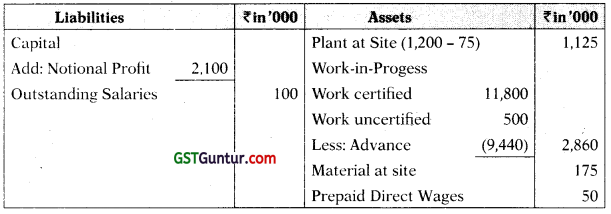

(i) Contract account of M/s. ABID Constructions for the year ended 31.03.2021

(ii) Contractee’s Account

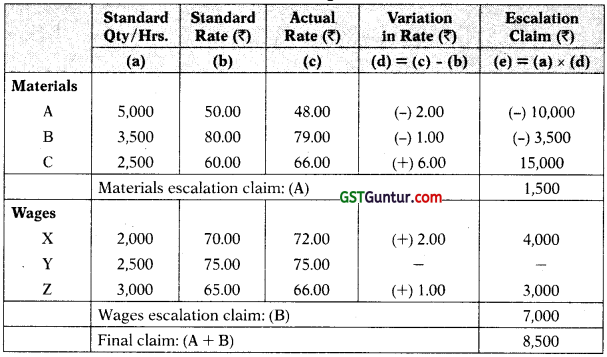

Question 24.

A contractor has entered into a long term contract at an agreed price of ₹ 17,50,000 subject to an escalation clause for materials and wages as spelt out in the contract and corresponding actual are as follows:

Reckoning the full actual consumption of material and wages, the company has claimed a final price of ₹ 17,73,600. Give your analysis of admissible escalation claim and indicate the final price payable. [ICAI Module]

Answer:

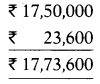

Statement showing final claim

Statement showing final price payable

The claim of the company of claiming a final price of ₹ 17,73,600 is based on the total increase in cost as shown below:

Statement showing total increase in cost

Contract price = ₹ 17,50,000

Add: Increase in cost = ₹ 23,600

The final price claimed by the company = ₹ 17,73,600

This claim is not admissible because escalation clause covers only that part of increase in cost, which has been caused by inflation. It is fundamental principle that the contractee would compensate the contractor for the increase in costs which are caused by factors beyond the control of contractor and not for increase in costs which are caused due to inefficiency or wrong estimation.