Students should practice Issue & Redemption of Debentures – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Issue & Redemption of Debentures – Corporate and Management Accounting MCQ

Question 1.

Which of the following statements is TRUE?

(A) A debenture holder is an owner of the company.

(B) A debenture holder can get his money back only on the liquidation of the company.

(C) A debenture issued at a discount can be redeemed at a premium.

(D) A debenture holder receives interest only in the event of profits.

Answer:

(C) A debenture issued at a discount can be redeemed at a premium.

Question 2.

Premium on redemption of debentures account appearing in the balance sheet is

(A) A real account

(B) A nominal account income

(C) A personal account

(D) A nominal account expenditure

Answer:

(C) A personal account

Question 3.

Which of the following statements is FALSE?

(A) At maturity, debenture holders get back their money as per the terms and conditions of redemption.

(B) Debentures can be forfeited for non-payment of call money.

(C) In the company’s balance sheet, debentures are shown under secured loans.

(D) Interest on debentures is charged against profits.

Answer:

(B) Debentures can be forfeited for non-payment of call money.

Question 4.

Which of the following statements is false?

(A) A company can issue convertible debentures.

(B) Debentures cannot be secured.

(C) A company can issue redeemable debentures.

(D) Debentures have no right to participate in profits over and above their fixed interest.

Answer:

(B) Debentures cannot be secured.

Question 5.

Debenture interest

(A) is payable only in case of profits.

(B) accumulates in case of losses or inadequate profits.

(C) is payable after the payment of preference dividend but before the payment of equity dividend.

(D) is payable before the payment of any dividend on shares.

Answer:

(D) is payable before the payment of any dividend on shares.

Question 6.

Which of the following is NOT a characteristic of Bearer Debentures?

(A) They are treated as negotiable instruments.

(B) Their transfer requires a deed of transfer.

(C) They are transferable by mere delivery.

(D) The interest on it is paid to the holder irrespective of identity

Answer:

(B) Their transfer requires a deed of transfer.

Question 7.

When debentures are issued as collateral security, the final entry for recording the collateral debentures in the books is:

(A) Credit Debentures A/c and debit Cash A/c

(B) Debit Debenture suspense A/c and credit Cash A/c

(C) Debit Debenture suspense A/c and credit Debentures A/c

(D) Debit cash A / c and credit the loan A/c for which security is given

Answer:

(C) Debit Debenture suspense A/c and credit Debentures A/c

Question 8.

Debentures can be

I. Mortgage Debentures or Simple Debentures.

II. Registered Debentures or Bearer Debentures.

III. Redeemable Debentures or Irredeemable Debentures.

IV. Convertible Debentures or Non-convertible Debentures

Select the correct answer from the options given below.

(A) Both (I) and (II) above

(B) Both (I) and (III) above

(C) Both (II) and (III) above

(D) All (I), (II), (III), and (IV) or above

Answer:

(D) All (I), (II), (III), and (IV) or above

Question 9.

Which of the following statements is false?

(A) Debenture is a form of public borrowing.

(B) It is customary to prefix debentures with the agreed rate of interest in case of fixed interest.

(C) Debenture interest is a charge against profits.

(D) The issue price and redemption value of debentures cannot differ.

Answer:

(D) The issue price and redemption value of debentures cannot differ.

Question 10.

Interest on debentures is calculated on:

(A) Its face value

(B) Its issue price

(C) Its market price

(D) Its redemption price

Answer:

(A) Its face value

Question 11.

Which of the following is true with regard to 10% Debentures issued at a discount of 20%?

(A) The carrying amount of debentures gets reduced each year at a rate of 20%.

(B) Issue price and the carrying amount of debentures are equal.

(C) At the time of redemption, the debenture holder will be paid the issue price.

(D) The face value and the carrying amount of debentures are equal.

Answer:

(D) The face value and the carrying amount of debentures are equal.

Question 12.

Discount on issue of debentures is a:

(A) ‘Revenue loss to be charged in the year of issue.

(B) Capital loss to be written off from capital reserve.

(C) Capital loss to be written off over the tenure of the debentures.

(D) Capital loss to be shown as goodwill.

Answer:

(C) Capital loss to be written off over the tenure of the debentures.

Question 13.

When debentures are issued as collateral security against any loan then the holder of such debentures is entitled to:

(A) Interest only on the amount of loan.

(B) Interest only on the face value of debentures.

(C) Interest both on the amount of the loan and on the debentures.

(D) None of the above.

Answer:

(A) Interest only on the amount of loan.

Question 14.

When debentures are redeemable at different dates, the total amount of discount on the issue of debentures should be written off:

(A) Every year by applying the sum of the year’s digit method

(B) Every year by applying the straight-line method

(C) To profit and loss account in full in the year of final or last redemption

(D) To profit and loss account in full in the year of the first redemption.

Answer:

(A) Every year by applying the sum of the year’s digit method

Question 15.

Non convertible debentures refer to

(A) Owner’s capital

(B) Loan capital

(C) Short term fund

(D) Deferred investment

Answer:

(B) Loan capital

Question 16.

“Interest accrued & due on debentures” is shown

(A) Under debentures

(B) As other current liabilities

(C) As provisions

(D) As a reduction of bank balance

Answer:

(B) As other current liabilities

Question 17.

“Interest accrued & not due on debentures” is shown

(A) Under debentures

(B) As current liabilities

(C) As provisions

(D) As a reduction of bank balance

Answer:

(B) As current liabilities

Question 18.

Tax deducted at source on interest on debenture is shown as

(A) Expense

(B) Asset

(C) Liability

(D) Income

Answer:

(C) Liability

Question 19.

Debenture premium cannot be used

(A) Write off the premium on redemptions of shares or debenture

(B) Write off the discount on the issue of debentures

(C) Pay dividends

(D) Write off capital losses

Answer:

(C) Pay dividends

Question 20.

Debentures can be redeemed out of-

(A) Profits

(B) Provisions

(C) Capital

(D) Any of the above

Answer:

(D) Any of the above

Question 21.

Debentures normally cannot be redeemed at

(A) Premium

(B) Discount

(C) Par

(D) All of the above

Answer:

(B) Discount

Question 22.

If debentures are issued at discount and redeemed at a premium

(A) Loss on Issue of Debentures A/c is debited

(B) Debentures A/c is credited

(C) Premium on Redemption of Debentures A/c is credited.

(D) All of the above are correct.

Answer:

(D) All of the above are correct.

Question 23.

Profit on cancellation of debentures is transferred to

(A) Capital reserve

(B) Capital redemption reserve

(C) Profit & loss account

(D) General reserve

Answer:

(A) Capital reserve

Question 24.

As a sound accounting policy when debentures are redeemed amount equal to

(A) Redemption price is transferred to profit & loss account.

(B) Original issue price is transferred to the general reserve account.

(C) Redemption price is transferred to the general reserve account

(D) Face value is transferred to the general reserve account

Answer:

(D) Face value is transferred to the general reserve account

Question 25.

Statement I:

Debentures can be converted into shares as per the terms of the issue of debentures.

Statement II:

Shares cannot be converted into debentures in any circumstances.

Select the correct answer from the options given below

(A) Statement I is true while Statement II is false.

(B) Statement II is true while Statement I is false.

(C) Statement I and Statement II both are false.

(D) Statement I and Statement II both are true.

Answer:

(D) Statement I and Statement II both are true.

Question 26.

Arrange the priority of payment in case of liquidation of the company:

I. Preference shares holders

II. Secured creditors

III. Equity shareholders

IV. Unsecured creditors

V. Debenture holders

Select the correct answer from the options given below

(A) II, IV, V, I, III

(B) II, V, IV, I, III

(C) II, V, I, IV, III

(D) II, I, III, V, IV

Answer:

(B) II, V, IV, I, III

Question 27.

Discount on issue of debentures, being a capital loss must be shown

(A) On the assets side under the heading “Miscellaneous Expenditures”.

(B) As a deduction from the “Non-cur-rent Liabilities” on the liability side of the balance sheet.

(C) As a deduction from the “Share-holders Funds” on the liability side of the balance sheet.

(D) As a footnote to the balance sheet.

Answer:

(C) As a deduction from the “Share-holders Funds” on the liability side of the balance sheet.

Question 28.

Sound business policy demands that discount on the issue of debenture should be written off

(A) As quickly as possible

(B) In 5 years

(C) In 10 years

(D) As agreed at the time of the issue

Answer:

(A) As quickly as possible

Question 29.

Which of the following is not a method of writing off discount on the issue of debentures?

(A) Fixed installment method

(B) Fluctuating installment method

(C) Adjusted discount policy method

(D) All of the above

Answer:

(C) Adjusted discount policy method

Question 30.

If the company acquires some assets from the vendor and instead of paying the vendor in cash, the company may allot debentures in payment of purchase consideration. In such case, if the face value of debentures issued is more than the value of assets acquired then the difference will be

(A) Credited to the capital reserve account

(B) Debited goodwill account

(C) Credited to premium on debentures account

(D) Credited to profit and loss account

Answer:

(B) Debited goodwill account

Question 31.

If the company acquires some assets from the vendor and instead of paying the vendor in cash, the company may allot debentures in payment of purchase consideration. In such case, if the face value of debentures issued is less than the value of assets acquired then the difference will be

(A) Credited to the capital reserve account

(B) Debited goodwill account

(C) Credited to premium on debentures account

(D) Credited to profit and loss account

Answer:

(A) Credited to the capital reserve account

Question 32.

Debentures Suspense Account

(A) is treated as a deferred asset account.

(B) is shown on the assets side of the balance sheet under the head ‘Current Assets’.

(C) is a capital loss and must be written off over the tenure of the debentures.

(D) is shown on the assets side of the balance sheet under the head ‘Non-Current Assets’.

Answer:

(D) is shown on the assets side of the balance sheet under the head ‘Non-Current Assets’.

Question 33.

Which of the following is not required to create Debenture Redemption Reserve?

(A) All India Financial Institutions

(B) NBFCs

(C) Infrastructure companies

(D) All of the above

Answer:

(A) All India Financial Institutions

Question 34.

Every company required to create DRR shall on or before the 30th day of April in each year, invest or deposit, as the case may be, a sum which shall 7.5 not be less than, of the number of its debentures maturing during the year ending on the 31st day of March of the next year

(A) 100%

(B) 50%

(C) 25%

(D) 15%

Answer:

(D) 15%

Question 35.

Another name of Debenture Redemption Fund Method is

(A) Sum of year digit method

(B) Depreciation fund method

(C) Double decline method

(D) None of the above

Answer:

(D) None of the above

Question 36.

Another name of Debenture Redemption Fund Method is

(A) Redemption Fund Method

(B) Sinking Fund Method

(C) Both (A) and (B)

(D) Neither (A) nor (B)

Answer:

(C) Both (A) and (B)

Question 37.

Debenture redemption fund investment account will appear on the assets side of the balance sheet under the head, while debenture redemption fund account will appear on the liabilities side under the head

(A) Reserves & Surplus; Non-Current Assets

(B) Non-Current Assets; Reserves & Surplus

(C) Investments; Reserves & Surplus

(D) Current Assets; Non-Current Liabilities

Answer:

(B) Non-Current Assets; Reserves & Surplus

Question 38.

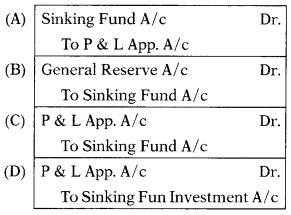

Which of the following is the correct journal entry for the annual contribution to the sinking fund created for the redemption of debentures?

Answer:

(C)

Question 39.

Loss on sale of Debenture Redemption Fund Investment account must be set-off against

(A) Profit & loss account

(B) General reserve account

(C) Sinking fund account

(D) All of the above

Answer:

(C) Sinking fund account

Question 40.

If the purchase price for the debentures includes interest for the expired period, the quotation is said to be

(A) Ex-interest

(B) Cum-interest

(C) Carrying interest

(D) Sinking interest

Answer:

(C) Carrying interest

Question 41.

If nothing is stated, purchase & sale of debentures, government securities should be taken to be on

(A) Cum-interest

(B) Ex-interest basis

(C) (A) or (B) at the option of seller

(D) (A) or (B) at the option buyer

Answer:

(B) Ex-interest basis

Question 42.

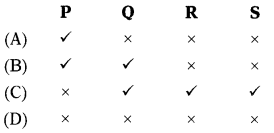

Which of the following statement is true (✓) and which is false (✗)?

P. A debenture holder receives interest only in the event of profits.

Q. A debenture issued at discount originally cannot be redeemed at a premium.

R. Debenture holder is the owner of the company.

S. A debenture holder can get back his money only at the time of liquidation.

Select the correct answer from the options given below

Answer:

(D)

Question 43.

If debentures are issued at discount but redeemable at a premium then

(A) Loss on Issue of Debentures A/c will be credited

(B) Debentures A/c will be debited

(C) Loss on Issue of Debentures A/c will be debited

(D) Premium on Redemption of Debentures A/c will be debited

Answer:

(C) Loss on Issue of Debentures A/c will be debited

Question 44.

Debenture issued at par but redeemable at price less than face value then

(A) Loss must be debited to Loss on Issue of Debenture A/c

(B) Profit on redemption will be ignored and Bank A/c and Debentures A/c both will be recorded at face value.

(C) Premium on Redemption of Debenture A/c must be credited.

(D) None of the above

Answer:

(B) Profit on redemption will be ignored and Bank A/c and Debentures A/c both will be recorded at face value.

Question 45.

Correct entry to transfer interest received on sinking fund investment is

(A) Debit Interest on Sinking Fund Investment A/c and Credit Profit & Loss A/c

(B) ZtetoProfit & Loss A/c and Credit Interest on Sinking Fund Investment A/c

(C) Debit Interest on Sinking Fund Investment A/c and Credit Sinking Fund A/c

(D) Debit Sinking Fund A/c and Credit Interest on Sinking Fund Investment A/c

Answer:

(C) Debit Interest on Sinking Fund Investment A/c and Credit Sinking Fund A/c

Question 46.

ZPA Ltd. issued 10,000, 12% Debentures of ₹ 100 each at per payable in full on application by 1st April 2019. Applications were received for 11,000 Debenture. Debentures were allotted on 7th April 2019. Excess money was refunded. The amount that will appear in the balance sheet as “12% Debenture” =?

(A) ₹ 11,00,000

(B) ₹ 10,00,000

(C) ₹ 9,00,000

(D) ₹ 10,80,000

Hint:

In balance sheet face of debentures issued will appear. 10,000 × 100 = 10,00,000

Answer:

(B) ₹ 10,00,000

Question 47.

Z Ltd. issued 10,000,12% Debentures of ₹ 100 each at a discount of 10% payable in full on application by 31st May 2019. Applications were received for 12,000 debentures. Debentures were allotted on 9th June 2019. ‘ Excess monies were refunded on the same date. The amount that will appear in [ balance sheet as “ 12% Debentures” =?

(A) ₹ 11,00,000

(B) ₹ 10,00,000

(C) ₹ 9,00,000

(D) ₹ 10,80,000

Hint:

In balance sheet face of debentures issuedwiR appear even though debentures are issued at discount. 10,000 × 100 = 10,00,000.

Answer:

(B) ₹ 10,00,000

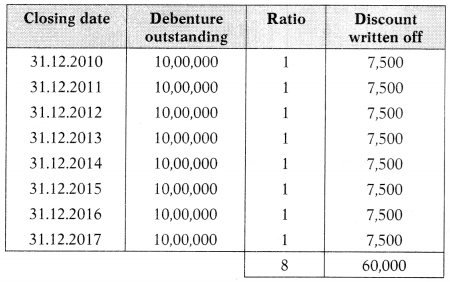

Question 48.

ZPA Ltd. issued 10,000, 12% Debentures of ₹ 100 each at ₹ 94 on 1st January 2010. Under the terms of the issue, the debentures are redeemable at the end of 8 years from the date of the issue. Calculate the amount of discount to be written-off in each of the 8 years.

(A) ₹ 8,000

(B) ₹ 7,500

(C) ₹ 6,000

(D) ₹ 5,000

Hint:

Total discount = 10,000 × 6 = 60,000

Answer:

(B) ₹ 7,500

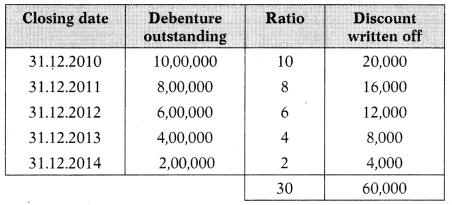

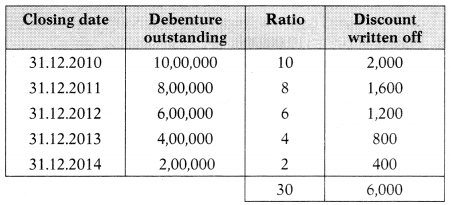

Question 49.

HDC Ltd. issued 10,000, 12% Debentures of ₹ 100 each at ₹ 94 on 1st January 2010. Under the term of issue, 1 / 5th of the debentures are annually redeemable by drawings, the first redemption occurring on 31 st December, 2010. Calculate the amount of discount to be written off in 2010 & 2011.

(A) ₹ 20,000 & ₹16,000

(B) ₹ 16,000 & ₹ 12,000

(C) ₹ 16,000 & ₹ 12,000

(D) ₹ 12,000 & ₹ 8,000

Hint:

Total discount = 10,000 × 6 = 60,000

Answer:

(A) ₹ 20,000 & ₹ 16,000

Question 50.

Z Ltd. issued 10% Debentures of ₹ 10 to a vendor having a face value of ₹ 2,50,000 for purchase of fixed assets of ₹ 2,00,000. No. of debentures to issued to vendors =?

(A) 25,000 debentures

(B) 20,000 debentures

(C) 10,000 debentures

(D) 30,000 debentures

Hint:

Debenture A/c is always credited by face value whether debentures are issued at par, discount or premium.

Answer:

(A) 25,000 debentures

Question 51.

X Ltd. obtained a loan from IDBI of ₹ 10,00,000, giving as collateral security of ₹ 15,00,000, 14% Debenture on 1st April 2019. Which of the following accounting treatment is correct to issue debenture as collateral security?

(A) No accounting entry is required

(B) Debenture Suspense A/c Dr. 15,00,000

To 14% Debenture A/c 15,00,000

(C) Either (A) or (B)

(D) None of above

Answer:

(C) Either (A) or (B)

Question 52.

The following data is available from the records of NS Ltd.:

Issued capital ₹ 20,00,000

Call in arrear ₹ 10,000

P& LA/con 1.4.2018 ₹ 67,000

Profit for the year ₹ 1,90,610

The company wants to create a debenture redemption reserve and transfer ₹ 50,000 every year. The company declared a 10% dividend. Balance of surplus after effecting the above transaction?

(A) ₹ 6,000

(B) ₹ 6,810

(C) ₹ 68,100

(D) ₹ 8,610

Hint:

Dividend = (20,00,000 – 10,000) × 10% = 1,99,000 67,000 + 1,90,610 – 50,000 – 1,99,000 = 8,610

Answer:

(C) ₹ 68,100

Question 53.

Z Ltd. issued ₹ 1,00,000 debenture at a discount of 6% on 1.1.2019 repayable in 5 equal installment. Discount to be written off in each 5 calendar year

(A) ₹ 900, ₹ 1,200, ₹ 1,200, ₹ 1,200 & ₹ 300 in 1st, 2nd, 3rd, 4th & 5th year

(B) ₹ 2,000, ₹ 1,600, ₹ 1,200, ₹ 800 & ₹ 400 in 1st, 2nd, 3rd, 4th & 5th year

(C) ₹ 400, ₹ 800, ₹ 1,200, ₹ 1,600 & ₹ 2,000 in 1st, 2nd, 3rd, 4th & 5th year

(D) ₹ 1,200, ₹ 1,200, ₹ 1,200, ₹ 1,200 & ₹ 1,200 in 1st, 2nd, 3rd, 4th & 5th year

Hint:

Total discount = 1,00,000 × 6% = 6,000

Answer:

(B) ₹ 2,000, ₹ 1,600, ₹ 1,200, ₹ 800 & ₹ 400 in 1st, 2nd, 3rd, 4th & 5th year

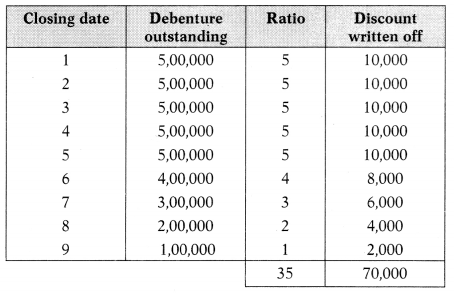

Question 54.

Moon Ltd. issued 5,000 debentures of ₹ 100 each at a discount of 10%.

The expenses on issue amounted to ₹ 20,000. The company wants to redeem the debentures at the rate of ₹ 1,00,000 each year commencing with the end of the 5th year. How much discount and expenses should be written off in each year?

(A) ₹ 10,000, ₹ 10,000, ₹ 10,000, ₹ 10,000,₹ 10,000,₹ 8,000,₹ 6,000, ₹ 4,000, ₹ 2,000 in each year respectively

(B) ₹ 10,000, ₹ 10,000, ₹ 10,000, ₹ 10,000,₹ 10,000,₹ 4,000,₹ 6,000, ₹ 6,000, ₹ 8,000 in each year respectively

(C) ₹ 2,000, ₹ 6,000, ₹ 8,000, ₹ 10,000, ₹ 10,000, ₹ 10,000, ₹ 10,000, ₹ 10,000, ₹ 10,000 in each year respectively

(D) ₹ 7,000, ₹ 7,000, ₹ 7,000, ₹ 7,000, ₹ 7,000, ₹ 7,000, ₹ 7,000, ₹ 7,000, ₹ 7,000 in each year respectively

Hint:

Total discount & expenses = 5,00,000 × 10% = 50,000 + 20,000 = 70,000

Answer:

(A) ₹ 10,000, ₹ 10,000, ₹ 10,000, ₹ 10,000,₹ 10,000,₹ 8,000,₹ 6,000, ₹ 4,000, ₹ 2,000 in each year respectively

Question 55.

Ganga Ltd. purchased a fixed asset of ₹ 2,00,000. The consideration was paid by the issue of 12% Debentures of ₹ 100 each at a discount of 20%. Debenture A/c to be credited with

(A) ₹ 1,60,000

(B) ₹ 2,40,000

(C) ₹ 2,50,000

(D) ₹ 2,60,000

Hint:

No. of debentures to be issued = \(\frac{2,00,000}{80}\) = 2,500

Debenture A/c is always credited by face value; 2,500 × 100 = 2,50,000.

Answer:

(C) ₹ 2,50,000

Question 56.

N Ltd. purchased a fixed asset of ₹ 4,00,000 out of ₹ 1,30,000 paid in cash and balance in debentures. The consideration was paid by the issue of 12% Debentures of ₹ 100 each at a 10% discount. No. debentures to be issued = ?

(A) 3,000 debentures

(B) 4,000 debentures

(C) 4,444 debentures

(D) 30,000 debentures

Hint:

No. of debentures to be issued = \(\frac{2,70,000}{90}\) = 3,000

Answer:

(A) 3,000 debentures

Question 57.

F Ltd. purchased Machinery from G Company for a book value of ₹ 4,00,000. The consideration was paid by the issue of 10% debentures of ₹ 100 each at a premium of 25%. The debenture account was credited with.

(A) ₹ 4,00,000

(B) ₹ 5,00,000

(C) ₹ 3,20,000

(D) ₹ 4,80,000

Hint:

No. of debentures to be issued = \(\frac{4,00,000}{125}\) = 3,200

Debenture A/c is always credited by face value. 3,200 × 100 = 3,20,000

Answer:

(C) ₹ 3,20,000

Question 58.

T Ltd. has issued 14% Debentures of ₹ 20,00,000 at a discount of 10% on April 1, 2017, and the company pays interest half-yearly on June 30, and December 31 every year. On March 31, 2019, the amount is shown as “interest accrued but not due” in the Balance Sheet will be

(A) ₹ 70,000

(B) ₹ 2,10,000

(C) ₹ 1,40,000

(D) ₹ 2,80,000

Hint:

1.1.2019 to 31.3.2019: 20,00,000 × 1496 × 3/12 = 70,000

Answer:

(A) ₹ 70,000

Question 59.

On May 1, 2018, U WB Ltd. issued 7% 10,000 convertible debentures of ₹ 100 each at a premium of 20%. Interest is payable on September 30 and March 31 every year. Assuming that the interest runs from the date of issue, the total amount of interest expenditure debited to profit and loss account for the year ended March 31, 2019, will be:

(A) ₹ 70,000

(B) ₹ 58,333

(C) ₹ 84,000

(D) ₹ 64,167

Hint:

1.5.2018 to 31.3.2019: 10,00,000 × 1% × 11/12 = 64,167

Answer:

(D) ₹ 64,167

Question 60.

W Ltd. issued 20,000,8% debentures of ₹ 10 each at par, which are redeemable after 5 years at a premium of 20%. The amount of loss on redemption of debentures to be written off every year will be:

(A) ₹ 40,000

(B) ₹ 10,000

(C) ₹ 20,000

(D) ₹ 8,000

Hint:

Premium on redemption = 20,000 × 10 × 2096 = 40,000

Premium to be written off every year = 40,000/5 = 8,000

Answer:

(D) ₹ 8,000

Question 61.

P Ltd. issued 5,000,12% debentures of ₹ 100 each at a premium of 10%, which are redeemable after 10 years at a premium of 20%. The amount of loss on redemption of debentures to be written off every year =?

(A) ₹ 80,000

(B) ₹ 40,000

(C) ₹ 10,000

(D) ₹ 8,000

Hint:

Premium on redemption = 5,000 × 100 × 2096 = 1,00,000

Premium to be written off every year = 1,00,000/10 = 10,000

Answer:

(C) ₹ 10,000

Question 62.

Rama Ltd. issued 40,000, 8% debentures of ₹ 10 each which are redeemable after 5 years at a premium of 20%. The amount of loss on redemption of Debentures to be written off every year will be

(A) ₹ 80,000

(B) ₹ 20,000

(C) ₹ 8,000

(D) ₹ 16,000

Hint:

40,000 × 10 × 20% = 80,000

Answer:

(A) ₹ 80,000

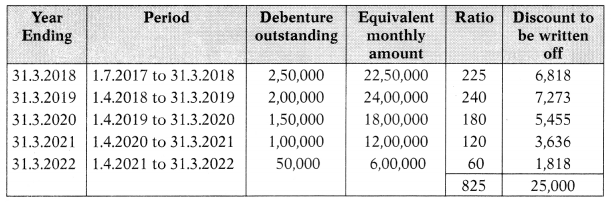

Question 63.

On 1 st July, 2017a company issued 2,500,9% debentures of ₹ 100 each at a discount of 10%. The debentures were redeemable by five annual drawings of ₹ 50,000 on 31st March each year. Calculate the amount of discount on debentures to be written off at the end of each year on 31st March.

(A) ₹ 6,818, ₹ 7,273, ₹ 5,455, ₹ 3,636, ₹ 1,818 for the year ended 31.3.2018 to 31.3.2022.

(B) ₹ 6,188, ₹ 7,723, ₹ 5,545, ₹ 3,366, ₹ 1,188 for the year ended 31.3.2018 to 31.3.2022.

(C) ₹ 6,881, ₹ 7,237, ₹ 5,455, ₹ 3,663, ₹ 1,881 for the year ended 31.3.2018 to 31.3.2022.

(D) None of the above is correct

Hint:

Total discount = 2,500 × 10 = 25,000

Answer:

(A) ₹ 6,818, ₹ 7,273, ₹ 5,455, ₹ 3,636, ₹ 1,818 for the year ended 31.3.2018 to 31.3.2022.

Question 64.

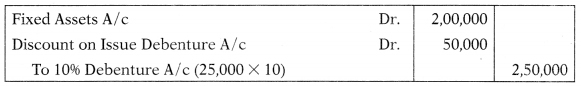

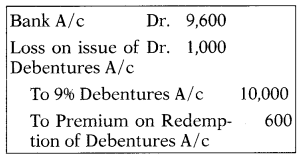

Following journal entry appears in the books of KAKA Ltd.:

Debentures must have been issued for

(A) Discount of 6%

(B) Discount of 4%

(C) Discount of 10%

(D) Premium of 6%

Answer:

(B) Discount of 4%

Question 65.

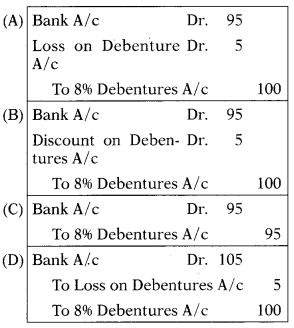

Does P Ltd. issue 896 Debenture of ₹ 100 at a discount of 5%, redeemable at the end of 5 years at par. Which of the following entry is correct?

Answer:

(B)

Question 66.

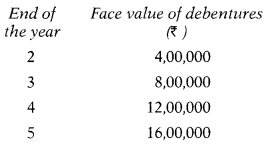

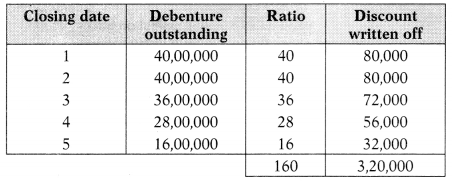

Janardhan Ltd. issued 40,00,000, 15% Debentures at 8% discount. Debentures are to be redeemed as per the schedule given below:

Amount of discount to be written off in each the 5 calendar years

(A) ₹ 80,000, ₹ 80,000, ₹ 72,000, ₹ 56,000, ₹ 32,000 in years 1 to 5.

(B) ₹ 64,000 every year

(C) ₹ 32,000, ₹ 32,000, ₹ 28,800, ₹ 25,600, ₹ 12,800 in years 1 to 5.

(D) ₹ 3,20,000 in last year

Hint:

Total discount = 40,00,000 × 8% = 3,20,000

Answer:

(A) ₹ 80,000, ₹ 80,000, ₹ 72,000, ₹ 56,000, ₹ 32,000 in years 1 to 5.

Question 67.

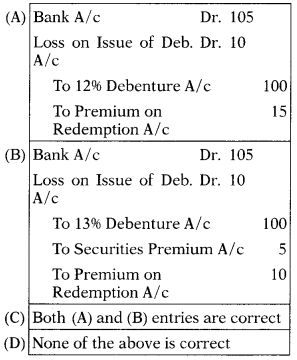

Q Ltd. issues 1196 Debenture of ₹ 100 at par, redeemable at the end of 5 years at a premium of 596. Which of the following entry is correct?

Answer:

(D)

Question 68.

Following journal entry appears in the books of KAKA Ltd.:

Debentures are redeemable at a premium of

(A) 5%

(B) 10%

(C) 10.53%

(D) 15.79%

Answer:

(B) 10%

Question 69.

Sana Ltd. issues a 13% Debenture of ₹ 100 at a premium of 5%, redeemable at the end of 5 years at a premium of 10%. Which of the following entry is correct?

Answer:

(B)

Question 70.

Eagle Ltd. issued a 15% Debenture of ₹ 100 each at a discount of 5%, but redeemable at a premium of 5% at the end of 4 years then

(A) Loss on Issue of Debenture A/c will be credited by ₹ 5

(B) Premium on Redemption of Debenture A/c will be debited by ₹ 5

(C) Loss on Issue of Debenture A/c will be debited by ₹ 10

(D) Premium on Redemption of Debenture A/c will be debited by ₹ 10

Answer:

(C) Loss on Issue of Debenture A/c will be debited by ₹ 10

Question 71.

On 1.1.2015 X Ltd. issued 10,000 fifteen years 10% debentures of ₹ 100 each. On 1.4.2020 the company gave notice to the debenture holders of its intention to redeem the debentures on 1.10.2020 either by payment in cash or by allotment of 11% preference shares of ₹ 100 each at ₹ 130 per share or 11% the second debenture of ₹ 100 at ₹ 96 per debenture. Holders of 4,000 debentures accepted the offer of the preference shares. How many preference shares will be issued if debentures are to be redeemed at a 4% premium?

(A) 3,077 Preference shares

(B) 3,200 Preference shares

(C) 4,160 Preference shares

(D) 3,560 Preference shares

Hint:

Total amount due to debenture holder = 4,000 × 104 = 4,16,000 4,16,000

\(\frac{4,16,000}{130}\) = 3.200 Preference shares

Answer:

(B) 3,200 Preference shares

Question 72.

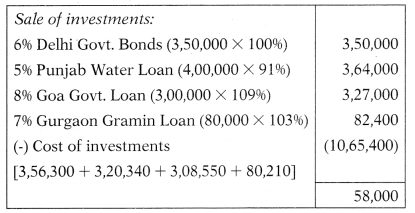

Following balances stood in books X Ltd.:

3.50.0. 6, Delhi Govt. Bonds 3,56,300

4.0. 000, 5% Punjab Water Loan 3,20,340

3.0. 000, 8% Goa Govt. Loan 3,08,550

80.0, 7% Gurgaon Gramin Loan 80,210

Investments were sold as follows:

6% Delhi Govt. Bond at par

5% Punjab Water Loan at ₹ 91

8% Goa Govt. Loan at ₹ 109

1% Gurgaon Gramin Loan at ₹ 103

How much profit will be transferred to the debenture redemption fund account on the sale of the above investments?

(A) ₹ 63,000

(B) ₹ 58,000

(C) ₹ 46,000

(D) ₹ 43.600

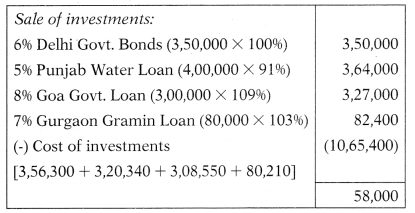

Hint:

Answer:

(B) ₹ 58,000

Question 73.

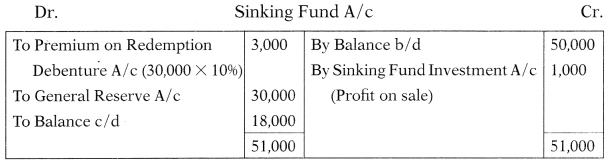

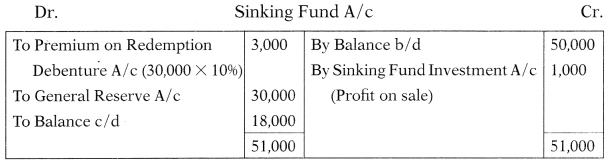

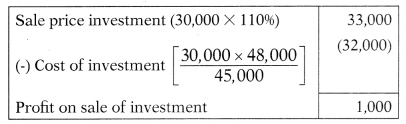

Following balances appeared in the books of Bright Ltd.:

(A) Sinking fund account ₹ 50,000

(B) Sinking fund investment account ₹ 48,000 (10% Govt, securities, nominal value ₹ 45,000)

(C) 12% Debenture account ₹ 1,00,000.

The company sold ₹ 30,000 Govt, securities at 110%, and redeemed part of the debentures at a premium of 10%. The closing balance of Sinking Fund A/c will be

(A) ₹ 48,000

(B) ₹ 17,000

(C) ₹ 18,000

(D) ₹ 21,000

Hint:

Calculation of profit or loss on sale of investment:

Answer:

(C) ₹ 18,000

Question 74.

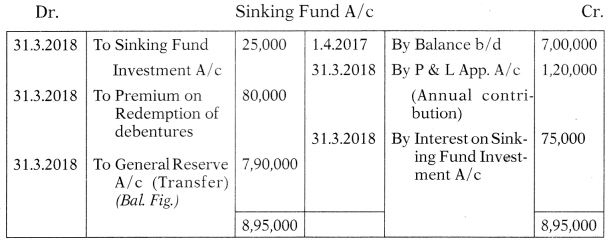

Following balances appeared in the books of R Ltd.:

12% Debentures – ₹ 8,00,000

Sinking fund – ₹ 7,00,000

Sinking fund investment – ₹ 7,00,000

(Represented by 10% – ₹ 7,50,000 secured bonds of Government of India)

The annual contribution to the sinking fund was ₹ 1,20,000 made on 31st March each year. On 31.3.2018, the balance at the bank was ₹ 3,50,000 before receipt of interest. The company sold the investments at 90% for the redemption of debenture at a premium of 10% on the above date. Amount to be transferred to general reserve after redemption of debentures will be

(A) ₹ 5,90,000

(B) ₹ 7,90,000

(C) ₹ 8,70,000

(D) ₹ 8,20,000

Hint:

Answer:

(B) ₹ 7,90,000

Question 75.

Following balances appeared in the books of JKJ Ltd.:

(a) Sinking fund account ₹ 62,500

(b) Sinking fund investment account ₹ 60,000( 10% Govt, securities, nominal value ₹ 56,250)

(c) 12% Debenture account ₹ 1,25,000.

The company sold ₹ 37,500 Govt, securities at 110% and redeemed part of the debentures at a premium of 10%. The closing balance of Sinking Fund A/c will be

(A) ₹ 60,000

(B) ₹ 21,250

(C) ₹ 22,500

(D) ₹ 26,2500

Answer:

(C) ₹ 22,500