Chapter 17 Introduction to Foreign Exchange – CS Professional Banking Law and Practice Notes is designed strictly as per the latest syllabus and exam pattern.

Introduction to Foreign Exchange – CS Professional Banking Law and Practice Study Material

Question 1.

Attempt the following:

Write a note on ‘off-shore banking’. (Dec 2007, 5 marks)

Answer:

Off-shore banking :

The term “off-shore banking” is used to apply to any centre where international business may be done in a favourable, hospitable, tax and regulatory climate. Off shore finance centres enjoy the following advantages over other banking centres -a regulatory climate in which controls on tax enough to permit the unrestricted transfer of capital among non-residents, minimal taxation and relatively small, reserve requirements.

Off-shore Banking refers to wholesale International banking business involving non-resident foreign currency denominated assets and liabilities. It refers only to non-resident fund and does not mix with domestic banking. Off-shore Banking centres are an extended form of Euro markets.

They are a sort of privileged parking centres of wholesale International banking set up by the host countries by giving freedom from exchange control regulations, Monetary and banking controls and offering fiscal incentives such as tax exemptions, etc.

Off-shore banking units carry on their activities of deposit taking and lending from/to International investors and enterprises without attracting domestic banking and monetary regulations. Off-shore Banking comprises mainly wholesale banking services like project financing, Syndication of large loans, issue of short term and medium term financial instruments like CDs/ErCDs foreign currency denominated bonds etc.

![]()

Question 2.

What is regulatory capital? State the composition of regulatory capital for banks under Basel III norms. (June 2016, 5 marks)

Answer:

Regulatory Capital:

Regulatory capital is the amount of risk capital held by financial services company to enable them to survive any difficulties such as market or credit risks.

One of the key principles of supervisory review identified by the Basel Committee on Banking Supervision (BCBS) is that the Supervisors should ensure that the banks maintain and operate above the minimum regulatory capital ratios.

Under the Basel II framework, the total regulatory capital comprises of Tier 1 (core capital) and Tier 2 capital (supplementary capital).

In order to improve the quality and quantity of regulatory capital, capital will predominantly consist of common Equity under Basel III.

Non equity Tier 1 and Tier 2 capital would continue to form part of regulatory capital subject to eligibility criteria as prescribed under Basel III capital regulations on an ongoing basis.

The total regulatory capital fund will consist of the sum of the following categories:

(i) Tier 1 Capital (Going concern capital*) Comprises of:

(a) Common Equity Tier 1 capital

(b) Additional Tier 1 capital

(ii) Tier 2 Capital (Gone concern capital**)

(*from regulatory capital perspective, going – concern capital is the capital which can absorb losses without triggering bankruptcy of the Bank.)

(** Gone concern capital is the capital which will absorb losses only in a situation of liquidation of the Bank.)

![]()

Question 3.

Banks play an important role in facilitating international trade, as they enable the exporter and importer operating at different locations to receive and pay for the goods sold and bought. Describe in brief the instruments issued by banks which apart from facilitating payment towards the trade also facilitate grant of advance and storage facility for the goods to be exported. (June 2017, 5 marks)

Answer:

1. A Letter of Credit with a special clause which allows the beneficiary (exporter) to avail of pre-shipment advance (a type of export finance granted to an exporter, prior to the export of goods) for procuring, manufacturing and export of the goods is called Red Clause Letter of Credit. This special clause used to be printed (highlighted in red colour), hence it is called “Red Clause” credit.

The issuing bank undertakes to repay such advances, even if shipment does not take place. In case of a “Green Clause” credit, the exporter is entitled for an advance for storage (warehouse) facilities of goods. The advance would be granted only when the goods to be shipped have been warehoused and against an undertaking by the exporter that the transportation documents would be delivered by an agreed date.

2. Rupee Export Credit (pre-shipment and post-shipment): Bank provides both pre and post shipment credit to the Indian exporters through Rupee Denominated Loans as well as foreign currency loans in India. Rupee Export Credit is available generally for a period of 180 days from the date of first disbursement. In deserving cases extension may be permitted within the guidelines of RBI.

![]()

3. Pre-shipment Credit in Foreign Currency (PCFC): Bank offers PCFC in the foreign currency to the exporters enabling them to fund their procurement, manufacturing/processing and packing requirements. PCFC is generally available for a period of 180 days from date of first disbursement. In deserving cases extension may be permitted within the guidelines of RBI.

4. Export Bill Rediscounting: Bank provides financing of export by way of discounting of export bills, as a post shipment finance to the exporters at competitive international rate of interest. This facility is available in four currencies i.e. US$, Pound Sterling, Euro and JPY.

5. Bank Guarantees: Bank, on behalf of exporter constituents, issues guarantees in favour of beneficiaries abroad. The guarantees may be Performance and Financial. For Indian exporters, guarantees are issued in compliance to RBI guidelines.

![]()

Question 4.

Bretton Woods System paved the way for the formation of three important multilateral international institutions. Name them. (Dec 2017, 2 marks)

Answer:

Bretton Woods System paved the way for the formation of three important multilateral international institutions. These are:

- International Monetary Fund (IMF)

- International Bank for Reconstruction and Development (IBRD) popularly known as “World Bank”.

- International Trade Organisation.

![]()

Question 5.

“The Central bank has changed the emphasis of the monetary policy from meeting the medium-term targets of aggregates of money supply to monitoring daily changes in the liquidity position of the market.” What are the targets against which easing or tightening of the monetary policy can be defined? With reference to each target explain how the easing or tightening can be brought about. (Dec 2018, 5 marks)

Answer:

Once the goals of monetary policy have been decided, the next step is implementation. Whatever the goals, implementation means easing or tightening as the circumstances warrant. We can specify the degree of easing or tightening in terms of its effects. Target of monetary policy is an economic variable whose desired value is used to define the stance of a monetary policy. The target can be stated in terms of any one of the effects of an easing or tightening-money growth,-the interest rate, or the exchange rate.

A Money – Growth Target: Monetary policy can be defined in terms of a money-growth target. Depending on its goals, the Central Bank decides on the appropriate rate of growth of the quantity of money. It then increases reserves through open market operations at a rate that will achieve this target.

To ease monetary policy, the Central Bank raises its target rate of growth. To tighten monetary policy, it lowers its target rate of growth. The reason for the change might be that the current policy is failing to achieve its desired goal; for example, inflation may be higher or lower than intended. Or the reason might be a change in goals: worries about inflation might give way to worries about unemployment.

![]()

An Interest-Rate Target: Monetary policy can be defined instead in terms of an interest rate target. Depending on its goals, the Central Bank decides on the appropriate level of the interest rate. It then increases reserves through open market operations at a rate that will achieve this target.

If the interest rate is above target, increasing the rate of growth of reserves will increase monetary growth and bring the interest rate down. If the interest rate is below target, reducing the rate of growth of reserves will decrease monetary growth and push the interest rate up. To ease monetary policy, it raises its target level of interest rate.

An Exchange-Rate Target: Bank decides on the appropriate level of the exchange rate. It then increases reserves through open market operations at a rate that will achieve this target. If the exchange rate is above target, increasing the rate of growth of reserves will increase monetary growth, lower interest rates, and bring the exchange rate down.

If the exchange rate is below target, reducing the rate of growth of reserves will decrease monetary growth, raise interest rates, and push the exchange rate up.

To ease monetary policy, the Central Bank lowers its target level of exchange rate: it devalues the currency. To tighten monetary policy, the Central Bank raises its target level of exchange rate. It revalues the currency.

![]()

Question 6.

Explain and narrate all those important factors having influence on forex markets movements more frequently. (June 2019, 6 marks)

Answer:

The factors that influence the forex markets measurement are:

Foreign Exchange Rates – Fundamental factors

- Balance of Payments – Surplus leads to a stronger currency while a deficit resulting to weakening of a currency.

- Economic Growth Rates – Rise in value of imports leads to a fall in the currency and vice-versa.

- Monetary Policy – The way Central bank attempts to influence and control interest rates and money supply.

- Interest Rate – High interest rate attracts overseas capital and appreciates currency in short run, in the longer term, however high interest rates slow the economic growth, thus weakening the currency.

Foreign Exchanges Rates – Technical factors - Governance Government Control – This can lead to unrealized value of currency resulting in violent exchange rate.

- Speculation – Speculative forces can have a major effect on exchange rates.

![]()

Alternative Answer 3 (b)

1. Interest Rate Differentials: Higher rate of interest for an investment in a particular currency can push up the demand for that currency, which will increase the exchange rate in favour of that currency.

2. Inflation Rate Differentials: Different countries have differing inflation rates, and as a result, purchasing power of one currency may depreciate faster than currency of some other country. This contributes to movement in exchange rate.

3. Government Policies: Government may impose restriction on currency transactions. Through RBI, the Government, may also buy or sell currencies in huge quantity to adjust the prevailing exchange rates.

4. Market Expectations: Expectations regarding change in Government, change in taxation policies, foreign trade, inflation, etc. contribute to demand for foreign currencies, thereby affecting the exchange rates.

5. Investment Opportunities: Increases in investment opportunities in one country leads to influx of foreign currency funds to that country. Such huge inflow will result into huge supply of foreign currency, thereby bringing down the exchange rate of the concerned country.

6. Speculations: Speculators and Treasury Managers influence movement in exchange rates by buying and selling foreign currencies with expectations of gains by exploiting market inefficiencies. The quantum of their operations affects the exchange rates.

![]()

Question 6.

Bank X entered into a spot Forex deal with Bank Y. Bank X agreed to sell US$ 1 million to Bank Y at a particular exchange rate. On the date of delivery, Bank Y settle the equivalent rupee funds to Bank X. However, Bank X could not deliver the US$ 1 million.

Examine the above case with reference to Credit Risk and Market Risk involved. (Dec 2017, 5 marks)

Answer:

Credit Risk and Market Risk involved in the given case.

Credit Risk: In today’s complicated international financial markets, the credit risk arises on account of non-performance of obligations by counterparty in respect of on Balance Sheet items as well as off Balance Sheet contracts such as forward contracts, interest rate swaps and currency swaps and counterparty risk in the interbank market. These have necessitated prescribing maximum exposure limits for individual counterparties for fund and non-fund exposures.

Market Risk: Market Risk arises on account of the external factors, i.e., market forces of demand and supply factors. Market risk arises from the adverse movements in market price. Market risk can also be defined as the risk of losses on account of on-Balance Sheet and off-Balance Sheet positions due to the movements in market prices.

In the given case, Bank Y is facing a Credit Risk, also called Settlement Risk. This would lead to further risks for Bank Y. There would be shortage of funds in the Nostro account of Bank Y. Bank Y needs to fund the account and should (a) either arrange for a fresh deal and / or (b) borrow in USS at the market interest rate. The non-receipt of US$ has created not only credit risk, but also liquidity as well as mismatch risk in the assets and liabilities of the bank Y.

Further on account of approaching the Forex market, to enter into a new forex deal and to borrow funds in the US$, bank Y would also face market risks (viz, exchange rate risk and interest rate risk respectively).

![]()

Question 7.

A customer approached you as bank on 1st January, 2018 for sale to him :

(i) US Dollar 2,00,000 delivery on 31st March, 2018

(ii) US Dollar 1,00,000 delivery on 30th March, 2018

Assumptions to be taken as to Rate and Margin :

- Spot interbank 66.5000/5100

- Forward premia January 0.1350/0.1450

February 0.3050/0.3150

March 0.5500/0.5600

April 0.7700/0.7800 - Exchange margin @ 0.125%.

Calculate the rates to be quoted to the customer by the bank. Take last two digit in the multiples of 25. (June 2019, 6 marks)

Answer:

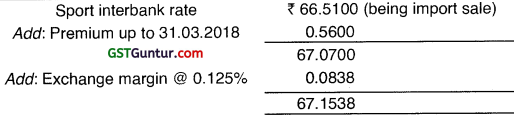

(i) The Importer customer approached on 01.01.2018 for buying of US $ 2,00,000 delivery on 31st March, 2018.

Rounded off to ₹ 67.1550

(ii) Us $ 1,00,000 delivery on 30th March, 2018

Rounded off to ₹ 67.1550

The rates to be quoted by the bank for USD 2,00,000 @ 67.1550 and US $ 1,00,000 @67.1550.

![]()

Question 8.

An export customer has a bill for £ 100,000, the bank has to purchase £ (Pound Sterling) from him and give an equivalent amount in rupees to the customer.

Presuming the inter-bank market quotations for spot delivery are as follows:

US$ 1 = ₹ 60.8450/545

The London market is quoting as under :

£ 1 = US$ 1.9720/40

Calculate the amount in ? to be received by the customer (Dec 2019, 6 marks)

Answer:

There are two transactions for the Bank:

Sell £ 1,00,000 in the London Market against US$

The bank has to sell £’s in the London market at US$ 1.9720, i.e. the market’s buying rate for £1.

Sell US$ in the local Interbank Market against Rupees.

The US dollars so obtained have to be disposed-off in the local inter-bank market at US$ 1 = ₹ 60.8450 (market’s buying rate) for US$.

By chain rule, we get:

£ 1 = 1.9720 × 60.8450 = ₹ 119.9863

Total amount in Rupees for £ 1,00,000 = 1,00,000 × 119.9863 = 19,98,630

![]()

Question 9.

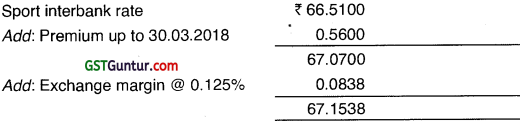

M/s Ramesh Kumar Export Pvt. Ltd. (Customer) requested Bank to book a forward sale contract for US $ 100000 deliver after 3 months. US $ are quoted in the local interbank market as under:

Spot US $ 1 = ₹ 68.7400/7500

One month forward premium : 0.0850/0.0900

Two months forward premium : 0.3650/0.3700

Three months forward premium : 0.6300/0.6350

Additional information :

(a) Exchange profit must be included in the rate quoted to the Customer.

(b) Rate quoted should be nearest to the fourth decimal in multiples of 0.0025.

(c) Brokerage and other charges may be ignored.

(d) Bank is entitled to exchange profit of 0.10% on the transaction.

Calculate the rate which will be quoted by you as a banker to M/s Ramesh Kumar Export Pvt. Ltd. What will be bank’s profit from this transaction ? (Dec 2019, 6 marks)

Answer:

Calculation of Bank’s profit from Transaction

![]()

Question 10.

On 20th March, 2019 in the interbank market the US Dollar is quoted as under:

Spot US Dollar 1 = ₹ 42.4000/4200

Spot/April : 2000/2100

Spot/May : 3500/3600

Your Exporter Customer wants to knowlhe Selling and Buying rates for:

(a) Spot Delivery

(b) Forward delivery April 2019

(c) Forward delivery May 2019. (Dec 2020, 6 marks)

Answer:

The buying and selling rates will be as under:

| Buying Rate | Selling Rate | |

| (a) Spot Delivery | US Dollar 1 = ₹ 42.4000 | ₹ 42.4200 |

| (b) Forward Delivery April, 2019 | ₹ 42.6000 | ₹ 42.6300 |

| (c) Forward Delivery May, 2019 | ₹ 42.7500 | ₹ 42.7800 |

![]()

Working Note:

| Buying Rate | Selling Rate | |||

| April | May | April | May | |

| Spot Rate | 42.4000 | 42.4000 | 42.4200 | 42.4200 |

| Add: Premium | 0.2000 | 0.3500 | 0.2100 | .0.3600 |

| Forward rates | 42.6000 | 42.7500 | 42.6300 | 42.7800 |

![]()

Question 11.

From the following data, calculate the amount to be credited in the Customer’s account. Sight Bill tendered for USD 5,00,000 on 10th November, 2020 drawn under the Letter of Credit issued by the UK Bank.

Interbank USD Rate : 73.2600

Exchange Margin : 0.10%

Interest Rate : 7%

Interest Period : 15 Days

Rounding off to nearest multiples of 0.0025. (Aug 2021, 6 marks)

Answer:

Spot Rate as given – 73,2600

Less : Exchange Margin of 0.10% – 0.0733

Total – 73.1867

Rounded off to nearest multiples of 0.0025 – 73.1875

USD 5,00,000 @ 73.1875 – 3,65,93,750.00

Less : Interest @ 7% for 15 days (365 days in a year) – 1,05,269.69

Net Payable – 3,64,88,480.31

Net payable (Rounded off to nearest multiples of rupees) – 3,64,88,480.00

![]()

Question 12.

Read the following case study and answer the questions that follow: (Dec 2021)

Execution of Forward Contracts

ABC Bank, Kanpur branch is an Authorized Dealer in ‘Foreign Exchange’ and authorized dealer status given by Reserve Bank of India as “A Category”. Number of Export/Import oriented units located in SEZ, Kanpur are the clients of ABC Bank, Kanpur Branch. As ABC Bank, Kanpur is only one ‘Forex Authorized Branch’ located in Kanpur, Exporters and Importers situated within the radius of 60 KM are visiting to the Branch to clarify their doubts with regard to discounting of Export Bills/Import Bills/Letter of Credit etc. from Chief Manager, Foreign Exchange Division of ABC Bank, Kanpur Branch.

The Controlling Authority of ABC Bank, Kanpur observed the above situation and instructed the Branch to conduct Exporters/Importers Meet on 9th April, 2020 to mobilize ‘Foreign Exchange Business’ from Exporters and Importers to the Branch books.

Accordingly, ABC Bank, Kanpur Branch followed the instructions of their Controller and invited all the Exporters/Importers surrounding to the Branch and also within a radius of 60 KM. They conducted Meet in a Five Star Hotel in Kanpur in a big way.

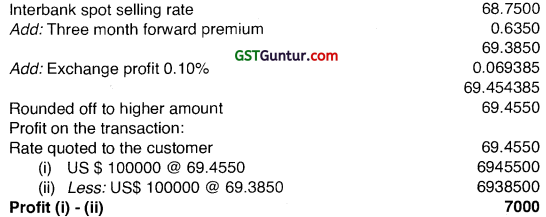

During the Export/Importers Meet number of questions were raised by prospective customers and the same was suitably replied by Senior Staff members of the Bank. Existing and prospective customers were satisfied with the replies given by Bank officials. One clarification sought by ‘Number of Customers’ is on “Forward Contract” Product of International Banking. Most of them are not utilized this Product offered by ABC Bank, Kanpur. Mr. Suresh, Chief Manager of the Branch explain the ‘Forward Contracts’ Product features offered by the Branch as follows :

![]()

Forward Contract is the traditional method by which Exporters and Importers were hedging their foreign currency exposure. It affords perfect hedge for foreign currency exposures.

The uncertainty about the rate that would prevail on a future date is known as the ‘exchange risk’. For the exporter the exchange risk is that the foreign currency in which the transaction is designated may depreciate in future and may bring less than the expected realization in local currency terms.

The importer too faces exchange risk when the transaction is designated in a foreign currency. The risk is that the foreign currency may appreciate in value and he may be compelled to pay in local currency an amount higher than that was originally contemplated. Importers generally make arrangements for loans for payment for the imports. If the foreign currency appreciates subsequent to the arrangement of the loan, the importer may find that the resources are not sufficient to meet the importer bill putting him in a difficult situation.

Forward contract provides perfect hedge against fluctuations, but it also takes away the opportunity to make profits from favorable movements in exchange rates. Forward contracts impose an obligation on the parties to execute it on the due date irrespective of the spot rate prevailing. On execution, only the rate agreed to in the contract will be applied. If one wants to cancel the contract to take advantage of the better rate in the spot market, the counterparty will levy cancellation charges which will be greater than the benefit obtained in the spot market.

![]()

By definition, the time and amount of foreign exchange to be delivered are predetermined under a forward contract and the customer is bound by the agreement. So, theoretically, there should not be any variation and on the due date of the forward contract the customer will either deliver or take delivery of the fixed sum of foreign exchange agreed upon. But, in practice, quite often the delivery under a forward contract may take place before or after the due date, or delivery of foreign exchange may not take place at all.

The bank generally agrees to these variations provided the customer agrees to bear the loss if any, that the bank may have to sustain on account of the variation.

The foreign exchange may be delivered on the due date as per the forward contract. Or, the delivery may take place earlier or later than the due date. Alternatively, the customer may request cancellation of the contract. This request for cancellation may be made on the due date,, before the due date or later than the due date. Yet another alternative is that the customer may request postponement of the date of delivery under the forward contract. This request for postponement may be made on the due date, earlier than the due date or after the due date.

The various possibilities of forward contracts are summarized in the form of table below:

It is clear that a forward contract may end up in any of the following ways:

(a) Delivery on the Due Date.

(b) Early Delivery.

(c) Late Delivery.

(d) Cancellation on the Due Date.

(e) Early Cancellation.

(f) Late Cancellation.

(g) Extension on the Due Date.

(h) Early Extension.

(i) Late Extension.

![]()

Cancellation: The Exporter may approach the bank for cancellation when the underlying transaction becomes infructuous, or for any other reason he wishes not to execute the forward contract. If the underlying transaction is likely to take place on a day subsequent to the maturity of the forward contract already booked, he may seek extension in the due date of the contract. Such requests for cancellation or extension can be made by the customer on or before the maturity of the forward contract.

Extension: An exporter finds that he is not able to export on due date but expects to do so in about two months. An importer is unable to pay on due date but is confident of making payment a month later. In both these cases they may approach their bank with which they have entered into forward contracts to postpone the due date of the contract. Such postponement of the date of delivery under a forward contract is known as the extension of forward contract.

Based on the above information, read the following case study and answer the questions that follows:

On the next day of Exporters/Importers Meet of the Bank, an Import Customer approached ABC Bank, Kanpur Branch and booked a forward contract with the Bank on 10th April for USD 20,000 due 10th June at ₹ 49.4000. The bank covered its position in the market at 49.2800.

| Particulars | 10th June | 20th June |

| Spot | USD 1 = 48.8000/8200 | 48.6800/7200 |

| Spot/June | 48.9200/9500 | 48.8000/8500 |

| July | 49.0500/0900 | 48.9300/9900 |

| August | 49.3000/3500 | 49.1800/2500 |

| September | 49.6000/6600 | 49.4800/5600 |

Exchange margin 0.10%.

Interest on outlay of funds 12%.

![]()

Based on the above particulars, please answer the following questions: How will ABC Bank, Kanpur react if the Importer Customer request on

20th June:

(i) Calculate the following in case the Contract is Cancelled.

(a) The Exchange Difference amount. (5 marks)

(b) How much the Swap Loss Amount ? (5 marks)

(c) Interest to be charged by the Bank on Outlay of Funds.(5 marks)

(d) Charges for Cancellation by the Bank. (5 marks)

(ii) Calculate the amount in Execution of the Contract. (6 marks)

(iii) What will be exchange rate to extend the contract with due date to fall on 10th August? (6 marks)

(iv) What is Roll Over of a Forward Contract ? How is it done? (8 marks)

(Note: Foreign Exchange Rates are dynamic, the above-mentioned rates are not the current market rates. Use the above rates for calculation purpose.)

Answer:

(i) Cancellation:

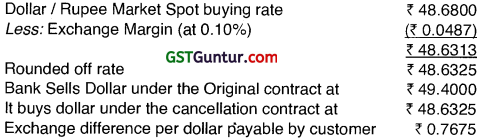

(a) Exchange Difference: The forward sale contract will be cancelled at the Spot TT purchase rate of the bank for dollar prevailing on the

date of cancellation.

Exchange difference for USD 20,000 is ₹ 15,300

(Although the exchange difference amount works out to ₹ 15,350, due to FEDAI rules the amount of ₹ 50 is ignored hence the exchange difference is ₹ 15,300)

![]()

(b) Swap Loss: On 10th June, the bank does a swap of spot sale of dollar at the market buying rate of ₹ 48.8000 and forward purchase for June at the market selling rate of ₹ 48.9500.

Bank buys at : ₹ 48.9500

It sells at : ₹ 48.8000

Swap loss per dollar : 0.1500

Swap Loss for USD 20,000 is ₹ 3,000 (20000 × 0.15).

(c) Interest on Outlay of Funds: On 10th April, the bank receives delivery under the cover contract at ₹ 49.2800 and sells spot at

₹ 48.8000.

Bank buys at : ₹ 49.2800

It sells at : ₹ 48.8000

Outlay per dollar : ₹ 0.4800

Outlay for USD 20,000 is : ₹ 9,600

Interest on ₹ 9,600 at 12% for 10 days is ₹ 32.

![]()

(d) Charges for Cancellation:

Exchange difference : ₹ 15,300

Swap Loss : ₹ 3,000

Interest on outlay of funds : ₹ 32

Total Charges for Cancellation : ₹ 18,332

(ii) Execution of Contract: Cancellation charges of ₹ 18,332 as computed in above part will be recovered. The contract shall be executed at the Spot TT selling rate calculated as follows:

Dollar/Rupee interbank spot selling rate : ₹ 48.7200

Add: Exchange Margin at 0.10% : ₹ 0.0487

₹ 48.7687

Rounding off, the rate applicable is ₹ 48.7675

![]()

(iii) Extension of Contract: Cancellation charges of ₹ 18,332 as computed in above part will be recovered.

The contract will be extended at the current rate.

Dollar/Rupee Market forward selling rate for August : ₹ 49.2500

Add: Exchange Margin at 0.10% : ₹ 0.0492

₹ 49.2992

The exchange rate applied for the extended contract is ₹ 49.3000

(iv) In respect of transactions like deferred payment imports/exports, repayment of instalment and interest on foreign currency loans, the customer may require long-term forward cover, i.e., for periods beyond six months.

When suitable cover is available in the market, the banks may book forward contract for long terms.

More often, the cover is made available on roll-over basis.

That is, the initial contract may be made for a period of six months, and, thereafter, as each deferred instalment is delivered, outstanding balance of forward contract may be extended for further periods of six months each.

The rules relating to and charges for cancellation /extension of long-term forward contracts are the same as those for other forward contracts.

![]()

Question 13.

An Exporter in India wishes to Discount Trade Bill of SGD of 10,000.

Interbank transaction, India spot rate : USD 1 $ = 74.10/20 Rupees and Forward rate at the time of contract.

| 1 Month | 0.15/0.10 |

| 2 Months | 0.25/0.20 |

| 3 Months | 0.45/0.30 |

Buy transaction: Forward rates USD VS INR. Interbank rate, consider margin, In India, we buy dollars and send’ rupees (Buying rate).

Singapore spot rate: USD 1 $ = 1.35/36 SGD and Forward rate at the time of contract.

| 1 Month | 0.03/04 |

| 2 Months | 0.04/05 |

| 3 Months | 0.05/06 |

![]()

Sell Transaction: Forward rates USD VS SGD, in Singapore we sell the dollar and take SGD {Selling Rate).

The Exchange Margin is 0.15%.

The interest rate is 5%.

The transit period is 25 days.

The rate of interest is 8%.

What is the amount credited in Indian rupees to the exporters’ current account? (June 2022, 6 marks)