Go through this Introduction to Company Accounts-Issue of Debentures – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Meaning:

- A debenture is a bond issued by a company acknowledging a debt and containing provisions for repayment of interest and principal.

- It refers to the loan capital of the company or a source of long-term borrowing.

- The interest on debentures is a charge against profits of the company.

- The holders of debentures are known as the debenture holders.

- Debenture holders are not the owner of the company and hence, do not have voting rights.

- Debentures may or may not create a charge on the assets of the company.

- Debentures may be issued at par, premium or discount.

- Interest on debenture is to be paid even if the company does not earn any profits i.e. at loss also.

Distinction between Shares and Debentures:

| Shares | Debentures |

| 1. Shareholders are owners of company. | Debenture holders are creditors of the company. |

| 2. Shareholders have voting rights. | Debenture holders do not have voting rights. |

| 3. Dividend on equity shares is not fixed and is an appropriation of profit. | Interest on debentures is at a fixed rate and is a charge against profit. |

| 4. Shares are owned capital of the company. | Debentures are the loan capital of the company. |

| 5. In Balance Sheet, shares are shown under Shareholders fund. | Debentures are shown in the Balance Sheet under the head Non-Current liabilities. |

Types of Debentures:

- Secured Debentures: These are secured by a charge on the assets of the company.

- Unsecured Debentures: These are not secured by any charge on the assets of the company.

- Convertible Debentures: Debentures which have an option of conversion into equity shares at some point of time are called convertible debentures.

- Non-convertible Debentures: These can never be converted into equity shares.

- Redeemable Debentures: These debentures have to be redeemed after a fixed period of time.

- Irredeemable Debentures: Also known as perpetual debentures, these are not redeemable and will be repaid only at the time of liquidation.

- Registered Debentures: These debentures are payable only to that person whose name is present in the Register of Debenture holders. These are not transferred by mere delivery.

- Bearer Debentures: Debentures which are transferred by mere delivery and not entered in Register are bearer debentures.

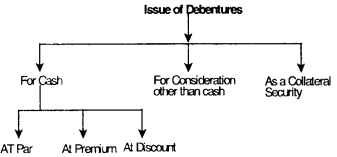

Issue of Debentures:

1. Issue of Debentures for cash:

(a) Debentures issued at par and redeemable at par –

→ If full amount is paid at once:

(i) Bank A/c Dr.

To Debenture Application A/c (Being receipt of application money)

(ii) Debenture Application A/c Dr.

To Debentures A/c (Being debentures allotted)

→ If payment is made in installments:

(i) Bank A/c Dr.

To Debenture Application A/c (Being amount received on application)

(ii) Debenture Application A/c Dr.

To Debenture A/c (Being debentures allotted)

(iii) Debenture Allotment A/c Dr.

To Debenture A/c (Being allotment due)

(iv) Bank A/c Dr.

To Debenture Allotment A/c (Being allotment money received)

(v) Debenture Calls A/c Dr.

To Debenture A/c (Being call due)

(vi) Bank A/c Dr.

To Debenture Call A/c (Being call amount received)

(b) Issue of Debentures at a premium:

If premium is to be received at the time of allotment:

Debenture Allotment A/c Dr.

To Debenture A/c To Securities Premium A/c

(c) Issue of Debentures at discount:

Debenture Allotment A/c Dr.

Discount on issue of debenture A/c Dr.

To Debentures A/c

(Being Debentures issued at a discount)

All other entries will be same.

Note:

Discount on issue of debenture being a Capital Loss must be shown specifically on the asset side under the heading Non-Current Assets. Discount on issue of debentures should be written off as quickly as possible. However, it can be treated as deferred revenue expenditure and written off over the life of the debentures.

Introduction to Company Accounts-Issue of Debentures MCQ Questions

1. Unless written off, the loss on issue of debentures is shown:

(a) On the assets side of Balance Sheet

(b) On the debit side of Profit and Loss Account

(o) By way of deduction from the amount of debentures

(d) On the liabilities side of Balance Sheet.

Answer:

(a) On the assets side of Balance Sheet

2. If debentures are issued as consideration for purchase of any fixed asset, the entry is:

(a) Debit Asset A/c; Credit Vendor A/c

(b) Debit Asset A/c; Credit Bank A/c

(c) Debit Asset A/c; Credit Debentures A/c

(d) Debit Debenture A/c; Credit Asset A/c.

Answer:

(c) Debit Asset A/c; Credit Debentures A/c

3. When debentures are issued as collateral security, the final entry for recording the transaction in the books is:

(a) Credit Debentures A/c and Debit Cash A/c

(b) Debit Debenture Suspense A/c and Credit Cash A/c

(c) Debit Debentures Suspense A/c and Credit Debenture A/c

(d) Debit Cash A/c and Credit the Loan A/c for which security is given.

Answer:

(c) Debit Debentures Suspense A/c and Credit Debenture A/c

4. Interest payable on debentures is:

(a) an appropriation of profits of the company

(b) a charge against profit of the company

(c) transferred to sinking fund investment account

(d) transferred to general reserve.

Answer:

(b) a charge against profit of the company

5. A company issues 14%, debentures of ₹ 10,00,000 at a discount of 10%. The discount allowed will be treated in the account books as:

(a) Capital Expenditure

(b) Revenue Expenditure

(c) Deferred Revenue Expenditure

(d) Capital Loss

Answer:

(d) Capital Loss

6. Which of the following statements is false?

(a) At maturity, debenture holders get back their money

(b) Debentures can be forfeited for non – payment of call money.

(c) In company’s balance sheet, debentures are shown under the head Secured Loans.

(d) Interest on debentures is charged against profits.

Answer:

(b) Debentures can be forfeited for non – payment of call money.

7. Discount on issue of debentures is a:

(a) revenue loss to be charged in the year of issue

(b) capital loss to be written off from capital reserve

(c) capital loss to be written off over the period of the debentures

(d) capital loss to be shown as goodwill.

Answer:

(c) capital loss to be written off over the period of the debentures

8. When debentures are issued at par and are redeemable at premium, the credit given to Premium of Redemption of Debenture Account is in the nature of:

(a) Personal Account

(b) Real Account

(c) Nominal A/c – Exps.

(d) Nominal Account – Income

Answer:

(a) Personal Account

9. Loss on issue of debentures is treated as:

(a) Intangible Asset

(b) Non Current Asset

(c) Non Current Liability

(d) Miscellaneous Expenditure

Answer:

(b) Non Current Asset

10. Which of the following is false?

(a) A Company can issue redeemable debentures.

(b) A Company can issue debentures with voting rights.

(c) A Company can issue convertible debentures.

(d) A Company can buy its own debentures and shares.

Answer:

(b) A Company can issue debentures with voting rights.

11. The following journal entry appears in the books of X Co. Ltd:

Bank A/c Dr. ₹ 4,75,000

Loss on Issue of Debenture A/c Dr. ₹ 25,000

To 12% Debentures A/c 5,00,000

Debentures have been issued at a discount of:

(a) 15%

(b) 5%

(c) 10%

(d) 20%.

Answer:

(b) 5%

12. X Co. Ltd. purchased assets worth ₹ 28,80,000. It issued debentures of ₹ 100 each at a discount of 4% in full satisfaction of the purchase consideration. The number of debentures issued to the vendors of asset are:

(a) ₹ 30,000

(b) ₹ 28,000

(c) ₹ 32,000

(d) ₹ 35,000

Answer:

(a) ₹ 30,000

13. How many debentures will a company be required to issue for satisfying the purchase consideration of ₹ 28,80,000, if debentures of ₹ 100 are issued at a premium of ₹ 20 per debenture?

(a) ₹ 24,000

(b) ₹ 28,000

(c) ₹ 36,000

(d) ₹ 32,000

Answer:

(a) ₹ 24,000

14. F Ltd. purchased machinery from G company for a book value of ₹ 4,00,000. The consideration was paid by issue of 10% debentures of ₹ 100 each at a discount of 20%. The debenture account will be credited by:

(a) ₹ 4,00,000

(b) ₹ 5,00,000

(c) ₹ 3,20,000

(d) ₹ 4,80,000.

Answer:

(b) ₹ 5,00,000

15. T Ltd. has issued 15% Debentures of ₹ 20,00,000 at a discount of 10% on April 01,2004 and the company pays interest half-yearly on June 30 and December 31 every year. On March 31,2006, the amount shown as “interest accrued but not due” in the Balance Sheet will be:

(a) ₹ 75,000

(b) ₹ 2,25,000

(c) ₹ 1,50,000

(d) ₹ 3,00,000.

Answer:

(a) ₹ 75,000

16. When debentures of ₹ 1,00,000 are issued as Collateral Security against a loan of ₹ 1,50,000, the entry for issue of debentures will be:

(a) Credit Debentures ₹ 1,50,000 and debit cash A/c ₹ 1,50,000

(b) Debit Debenture Suspense A/c ₹ 1,00,000 and Credit Cash A/c ₹ 1,00,000

(c) Debit Debenture Suspense A/c ₹ 1,00,000 and Credit Debentures A/c ₹ 1,00,000

(d) Debit Cash A/c ₹ 1,50,000 and Credit Bank A/c ₹ 1,50,000.

Answer:

(c) Debit Debenture Suspense A/c ₹ 1,00,000 and Credit Debentures A/c ₹ 1,00,000

17. P Ltd. issued 10,000, 12% debentures of ₹ 100 each at a premium of 10%, which are redeemable after 10 years at a premium of 20%. The amount of loss on redemption of debentures to be written off every year will be ________.

(a) ₹ 1,60,000

(b) ₹ 80, 000

(c) ₹ 20,000

(d) ₹ 16,000

Answer:

(c) ₹ 20,000

18. On May 01, 2003, Y Ltd. issued 7%, 40,000 convertible debentures of ₹ 100 each at a premium of 20%. Interest is payable on September 30 and March 31, every year. Assuming that the interest runs from the date of issue, the amount of interest expenditure debited to profit and loss account for the year ended March 31,2004 is:

(a) ₹ 2,80,000

(b) ₹ 2,33,333

(c) ₹ 3,36,000

(d) ₹ 2,56,667

Answer:

(d) ₹ 2,56,667

19. W Ltd. issued 20,000, 8% debentures of ₹ 10 each at par which are redeemable after 5 years at a premium of 20%. The amount of loss on redemption of debentures to be written off every year is:

(a) ₹ 40,000

(b) ₹ 10,000

(c) ₹ 20,000

(d) ₹ 8,000

Answer:

(d) ₹ 8,000

20. Which of the following statements is false ________.

(a) Debenture is a form of public borrowing.

(b) It is customary to prefix debentures with the agreed rate of interest.

(c) Debenture interest is a charge against profits.

(d) The issue price and redemption value of debentures cannot differ.

Answer:

(d) The issue price and redemption value of debentures cannot differ.

21. Which of the following is not a characteristic of Bearer Debentures?

(a) They are treated as negotiable instruments.

(b) Their transfer requires a deed of transfer.

(c) They are transferable by mere delivery.

(d) The interest on it is paid to the holder irrespective of identity.

Answer:

(b) Their transfer requires a deed of transfer.

22. The debentures which are secured by a charge upon some or all assets of the company are known as:

(a) First mortgage debenture

(b) Second mortgage debenture

(c) Bearer debenture

(d) Secured debenture

Answer:

(d) Secured debenture

23. When debentures are to be redeemed at premium an extra entry has to be made at the time of issue of debentures, which a/c should be credited in this entry?

(a) Loss on issue of debentures A/c

(b) Debenture redemption premium A/c

(c) Bank A/c

(d) Debenture holder’s A/c

Answer:

(b) Debenture redemption premium A/c

24. When debentures are issued at par and are redeemable at premium, the credit given to premium on redemption of debentures account is in nature of:

(a) Personal A/c

(b) Real A/c

(c) Nominal A/c

(d) None of the above

Answer:

(a) Personal A/c

25. When debentures are issued at a discount, it is prudent to write off the discount:

(a) In the year of the issue of debentures

(b) During the life of the debentures if it is treated as deferred revenue expenditure.

(c) Within 3 years of the issue of debentures

(d) In the year of redemption of debentures

Answer:

(b) During the life of the debentures if it is treated as deferred revenue expenditure.

26. Ansh Ltd. issued 5,000 Debentures of ₹ 10 each for subscription. 4,000 Debentures were subscribed by the public by paying ₹ 3 as application money. Number of debentures allotted to public by Ansh Ltd. will be:

(a) 5,000 shares

(b) 4,000 shares

(c) 3,000 shares

(d) 1,000 shares

Answer:

(b) 4,000 shares

27. Interest received on debenture redemption fund investment is:

(a) Capital reserve a/c

(b) General reserve a/c

(c) Debenture redemption fund A/c

(d) None of the above

Answer:

(c) Debenture redemption fund A/c

28. Puru Ltd. issued 10,000 12% Debentures of ₹ 100 each at a discount of 10% payable in full on application by 31st March, 2007. Application were received for 12,000 debentures. Debentures were allotted on 9th June, 2007. The amount of excess money refunded on the same date will be:

(a) ₹ 1,80,000

(b) ₹ 1,00,000

(c) ₹ 1,10,000

(d) ₹ 1,50,000

Answer:

(a) ₹ 1,80,000

29. “Non-convertible” debentures is inferred as:

(a) Owner’s capital

(b) Loan capital

(c) Short term debts

(d) None of these

Answer:

(b) Loan capital

30. Tahil Ltd. has issued 14% Debentures of ₹ 20,00,000 at a discount of 10% on April 01, 2005 and the company pays interest half-yearly on June 30, and December 31 every year. On March 31,2007, the amount shown as “interest accrued but not due” in the balance sheet will be:

(a) ₹ 70,000 shown along with Debentures

(b) ₹ 2,10,000 under current liabilities

(c) ₹ 1,40,000 shown along with Debentures

(d) ₹ 2,80,000 under current liabilities

Answer:

(a) ₹ 70,000 shown along with Debentures

31. XYZ Ltd. purchased a machinery for ₹ 10,00,000 from Mohan Ltd. and the consideration was paid by the issue of 18% debentures of ₹ 100 each at a discount of 20%. Calculate the number of debentures to be issued:

(a) 12,500

(b) 10,000

(c) 9,333

(d) None of the above

Answer:

(a) 12,500

32. Yadav Ltd. purchased a building from Gandhi Ltd. for ₹ 50,00,000 and the consideration was paid by the issue of debentures of ₹ 100 each at a premium of ₹ 25 each. Calculate the number of debentures to be issued to Gandhi Ltd.

(a) 50,000

(b) 40,000

(c) 66,667

(d) None of the above

Answer:

(b) 40,000

33. Debenture holders are called the ________ of a company.

(a) Banker

(b) Owner

(c) Creditor

(d) Debtor

Answer:

(c) Creditor

34. ABC Ltd. purchased a machinery from Microtee Ltd. for ₹ 50,00,000 and the consideration was paid by issuing debentures of ₹ 100 each at a discount of 20%. Calculate the amount to be credited to the debenture account:

(a) ₹ 50,00,000

(b) ₹ 43,00,000

(c) ₹ 75,00,000

(d) ₹ 62,50,000

Answer:

(d) ₹ 62,50,000

35. Ram Ltd. purchased a car from Harish Ltd. for ₹ 10,00,000 and the consideration was paid by issuing debentures of ₹ 10 each at a premium of ₹ 2.5 each. Calculate the amount to be credited to Debentures Account:

(a) ₹ 8,00,000

(b) ₹ 13,33,000

(c) ₹ 12,50,000

(d) None of these

Answer:

(a) ₹ 8,00,000

36. Morseny Ltd. issued 2,000,15% debentures of ₹ 100 each at a premium of 10% which are redeemable after 10 years at a premium of 20%. Thus the discount of loss on debenture is to be written off:

(a) ₹ 20,000

(b) ₹ 10,000

(c) ₹ 40,000

(d) None of these

Answer:

(c) ₹ 40,000

37. ABCD Ltd. issued 1,000, 9% debentures of ₹ 100 each at a discount of 10%, which will be redeemed after 5 years at a premium of 10%. Calculate the discount on loss of issue of debentures to be written off each year:

(a) ₹ 40,000

(b) ₹ 20,000

(c) ₹ 10,000

(d) ₹ 5,000

Answer:

(c) ₹ 10,000

38. When the debentures are issued as a collateral security then what entry will be passed?

(a) No entry

(b) Debit Debenture Suspense A/c and Credit Debentures A/c

(c) Both (a) & (b)

(d) Neither (a) nor (b)

Answer:

(c) Both (a) & (b)

39. Which of the following statement is NOT true?

(a) On maturity the debenture holders get back their money

(b) Debentures can be forfeited for non payment of call money

(c) In the balance sheet, debentures are shown under secured loans

(d) Interest on debentures is payable even in case of loss

Answer:

(b) Debentures can be forfeited for non payment of call money

40. Interest on debentures issued as a collateral security is paid on:

(a) Nominal value of debentures

(b) No interest is paid

(c) Face value of debentures

(d) Paid up value of debentures

Answer:

(b) No interest is paid

41. A debenture holder is entitled to:

(a) Fixed dividend

(b) Share in profits

(c) Voting rights in the company

(d) Interest at the fixed rates

Answer:

(d) Interest at the fixed rates

42. If the debentures allotted for consideration other than cash are more than the agreed purchase price, the difference shall be debited to:

(a) Goodwill Account

(b) P&LA/c

(c) Securities Premium A/c

(d) Debentures A/c

Answer:

(a) Goodwill Account

43. If the debentures allotted for consideration other than cash are less than the agreed purchase price, the difference is credit to:

(a) Goodwill A/c

(b) Capital Reserve A/c

(c) P&LA/c

(d) None of these

Answer:

(b) Capital Reserve A/c

44. Shares may be issued ________.

(a) For cash

(b) For consideration other than cash.

(c) For both (a) and (b)

(d) None of the above

Answer:

(c) For both (a) and (b)

Generally a company issue shares to raise his capital for cash but company may also issue shares for consideration other than cash to vendor who sell some assets to the company.

Thus, shares can be issued both for cash or consideration other than cash.

45. Which of the following will be the journal entry for recording the issue of shares at par against purchase of Machinery?

(a) Debit Machinery A/c, Credit Share Capital A/c

(b) Debit Share Capital A/c, Credit Machinery A/c

(c) Debit Bank A/c, Credit Share Capital A/c

(d) Debit Machinery A/c, Credit Cash A/c

Answer:

(a) Debit Machinery A/c, Credit Share Capital A/c

Following entry will be passed for recording the issue of shares at par against purchase of Machinery –

Machinery A/c Dr.

To Share Capital A/c

46. Debentures of a company can be issued ________.

(a) For cash

(b) For consideration other than cash

(c) As a collateral security

(d) Any of the above.

Answer:

(d) Any of the above.

Debentures are issued for cash by a company. A company may allot debentures to the vendors for acquiring some assets as payment for purchase consideration. A company obtains a loan from a bank or insurance policy, it may issue its own debentures to the lender as collateral security against the loan in addition to any other security that may be offered.

Thus, answer is all of the above.

47. On issue of debentures as a collateral security, which account is credited?

(a) Debentures Account

(b) Bank Loan Account

(c) Debenture holdings Account

(d) Debenture Suspense Account

Answer:

(a) Debentures Account

On issue of debentures as a collateral security, the following entry will be passed –

Debentures Suspense A/c Dr.

To Debentures A/c

Here, Debentures A/c will be credited

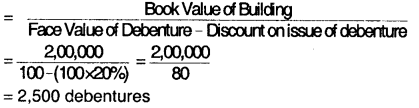

48. G Ltd. purchased land and building from H Ltd. at a book value of ₹ 2,00,000. The consideration was paid by issue of 12% debentures of ₹ 100 each at a discount of 20%. For this transaction, the debentures account would be credited with ________

(a) ₹ 2,60,000

(b) ₹ 2,50,000

(c) ₹ 2,40,000

(d) ₹ 1,60,000

Answer:

(b) ₹ 2,50,000

No. of Debentures will be

Debentures A/c will be credited by = No. of debentures x Face value of debentures = 2,500 x 100 = 2,50,000

49. A limited company issued a prospectus inviting application for 2,000 shares of ₹ 10 each at premium of ₹ 2 per share payable as follows:

On application – ₹ 2

On allotment – ₹ 5

(including premium)

On Ist call – ₹ 3

On IInd final call – ₹ 2

Application were received for 3,000 shares and allotment was made on pro-rata basis to applicant of 2,400 shares. Money received in excess on application was adjusted towards allotment.

Ramesh whom 40 shares were allotted, failed to pay allotment money & first call his shares were forfeited. Find the number of shares Ramesh has applied for₹

(a) 52

(b) 50

(c) 42

(d) 48

Answer:

(d) 48

Allotment to applicants of 2,400 shares = 2,000.

Ramesh applied for some shares.

He is allotted 40 shares.

He applied for shares = \(\frac{2,400}{2,000}\) x 40

= 48 shares

Hence, option (d) is correct.

50. T Ltd. has issued 14% Debentures of ₹ 20,00,000 at a discount of 10% in April 2013 and the company pays interest half- yearly on June 30 and December 31 every year. On March 31, 2014, the amount shown as ‘interest accrued but not due’ in the balance sheet will be:

(a) ₹ 70,000

(b) ₹ 2,80,000

(c) ₹ 1,40,000

(d) ₹ 2,10,000

Answer:

(a) ₹ 70,000

Accrued but not due means amount of interest computed as per the period of the computation but the payment of amount of installment is not due. So, on March, 31,2014, the amount shown as interest “accrued but not due” in the Balance sheet will be:

20,00,000 x \(\frac{14}{100}\) x \(\frac{3}{12}\) = ₹ 70,000

51. T Ltd. has issued 14% debentures of ₹ 20,00,000 at a discount of 10% in April, 2013 and the company pays interest half yearly on June 30, and December 31, every year. On March 31, 2014 the amount shown as interest accrued but not due in the balance sheet will be:

(a) ₹ 1,40,000

(b) ₹ 2,10,000

(c) ₹ 2,80,000

(d) ₹ 70,000

Answer:

(d) ₹ 70,000

Accrued interest but not due is that interest which has been earned since the last coupon payment. Because the bond hasn’t expired yet or the next payment is not yet due, the owner of the bond hasn’t officially received the money.

∴ Interest accrued but not due as on 31st March, 2014

→ \(\frac{20,00,000 \times 14 \% \times \frac{6}{12}}{2}\)

→ ₹ 70,000

52. The holder of debentures issued as collateral security to a loan is entitled to interest on:

(a) The amount of loan only

(b) On the face value of debentures

(c) Neither loan nor debentures

(d) Both the loan amount and debentures.

Answer:

(a) The amount of loan only

Where a company obtains a loan from a bank or insurance company, it may issue its own debentures to the lender as collateral security against the loan in addition to any other security that may be offered. The holder of such debentures is entitled to interest only on the amount of loan, but not on the debentures. Such an issue of debenture is known as “Debentures issued as collateral security.”

53. K Ltd. Issued ₹ 15,000, 12% Debentures of ₹ 50/- each at premium of 10% payable as ₹ 20/- on application and balance on allotment Debentures are redeemable at per after 6 years. All the money due on allotment was called up and revised. The amount of premium will be:

(a) ₹ 3,00,000

(b) ₹ 2,25,000

(c) ₹ 75,000

(d) ₹ 5,25,000

Answer:

(c) ₹ 75,000

K Ltd. issued deb = 15,000

Face Value = ₹ 50/-

Premium = 10% on face value

Amount of premium = \(\frac { 10 }{ 100 }\) x 50 = ₹ 5

Total premium = ₹ 5 x 15,000

= ₹ 75,000

54. Debenture is issued as a collateral security to a loan, interest will be given on ________.

(a) On debentures only

(b) Both loan & debentures

(c) On loan but not on debentures

(d) None of the following

Answer:

(c) On loan but not on debentures

The term ‘Collateral Security’ implies additional security given for a loan. Where a company obtains a loan from a bank or insurance company, it may issue its own debentures to the lender as collateral security against the loan in addition to any other security that may be offered. In such a case, the lender has the absolute right over the debentures until and unless the loan is repaid.

On repayment of the loan, however, the lender is legally bound to release the debentures forthwith. But in case the loan is not repaid by the company on the due date or in the event of any other breach of agreement, the lender has the right to retain these debentures and to realise them. The holder of such debentures is entitled to interest only on the amount of loan, but not on the debentures. Such an issue of debentures is known as “Debentures issued as Collateral Security”.

55. Which of the following statement is true?

(a) A Debenture holder is an owner of the company.

(b) A Debenture is issued at a discount and can be redeemed at a premium.

(c) A Debenture Holder can get his money back only on liquidation.

(d) A Debenture Holder receives interest only in the event of profit

Answer:

(b) A Debenture is issued at a discount and can be redeemed at a premium.

A Shareholder is the owner of the company.

A Debenture is issued at discount and redeemed at premium.

A Debenture holder can get his money back on redemption also.

A Debenture holder gets profit irrespective of the fact that the company is earning profit or not.

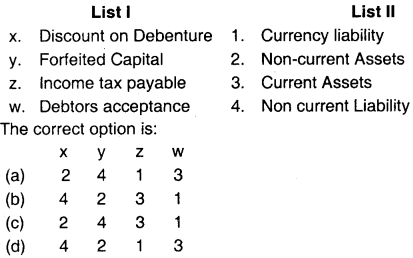

56. Match list l with list II and select the correct answer using the codes given below the list:

Answer:

(d) 4 2 1 3

Discount on debenture is non-current liability because debenture cannot be redeemed within a year so, discount on debenture is not a current liability.

57. If shares are reissued, then they are issued at:

(a) Par

(b) Premium

(c) Discount

(d) All of the above.

Answer:

(d) All of the above.

If shares are reissued the would be issued at:

Forfeited share can be issued at Par, Premium and discount any of these. Hence, option (d) is correct.

58. G Ltd. purchased land and building from H Ltd. at a book value of ₹ 2,00,000. The consideration was paid by issue of 12% debentures of ₹ 100 each at a discount of 20%. For this transaction, the debentures account would be credited with:

(a) ₹ 2,60,000

(b) ₹ 2,50,000

(c) ₹ 2,40,000

(d) ₹ 1,60,000

Answer:

Journal entries would be as follows:

(a) Land and Building A/c Dr. 2,00,000

To H Ltd. 2,00,000

(b) H Ltd.’s A/c Dr. 2,00,000

Debenture Discount A/c Dr. 50,000

To 12% Debentures A/c 2,50,000

(\(\frac { 2,00,000 }{ 80 }\) = 2,500 debentures of ₹ 100/each on)

59. Total amount issued for shares is ₹ 3,60,000 at the rate of ₹ 10 each and premium of 20%. What is the number of issued shares.

(a) 36,000

(b) 2,460

(c) 3,000

(d) 4,000

Answer:

(a) 36,000

The Amount Issued for Share = ₹ 3,60,000

It issued @ 10 each.

Hence no. of shares issued = \(\frac {Amount issued }{ issued price }\)

= \(\frac { 3,60,000 }{ 10 }\)

= 36,000 shares.