International Financial Management – CA Final SFM Study Material is designed strictly as per the latest syllabus and exam pattern.

International Financial Management – CA Final SFM Study Material

Part – 1 (Theory)

Question 1.

What are the instruments of International Finance? [Nov. 2015] [4 Marks]

Answer:

The following are the financial instruments dealt with in the international market:

- Euro Botids: A Euro bond is an international bond that is denominated in a currency not native to the country where it is issued. Also called external bond.

- Foreign Bonds: These are debt instruments denominated in a currency which is foreign to the borrower and is denominated in a currency that is native to the country where it is issued.

- Fully Hedged Bonds.ln foreign bonds, the risk of currency fluctuations exists. Fully hedged bonds eliminate that risk by selling in forward markets, the entire stream of interest and principal payments.

- Floating Rate Notes: These are debt instruments issued up to 7 years maturity. Interest rates are adjusted to reflect the prevailing exchange rates. They provide cheaper money than fixed rate debt instruments; however, they suffer from inherent interest rate volatility risk.

- Euro Commercial Papers: Euro Commercial Papers (ECPs) are shortterm money market instruments usually designated in US dollars. They are for maturities for less than a year.

Question 2.

Write short note on Global Depository Receipts. [May 2015] [4 Marks]

Answer:

A depository receipt is basically a negotiable certificate, denominated in a currency not native to the issuer, that represents the company’s publicly – traded local currency equity shares. Through the issue of depository receipts, companies in India have been able to tap global equity market to raise foreign currency funds by way of equity. GDR is an instrument in the form of a depository receipt or certificate by overseas depository bank outside India.

The GDR may be of two types:

(a) ADR: The Depository Receipts issued in the US are called American Depository Receipts (ADRs), which any way are denominated in USD

(b) GDR: The depository receipts issued outside of USA are called GDRs.

The DRs (depository receipts) are created when the local currency shares of an Indian company are delivered to the depository’s local custodian bank, against which the Depository bank issues depository receipts in US dollar. These depository receipts may trade freely in the overseas markets like any other dollar-denominated security, either on a foreign stock exchange, or in the over-the-counter market, or among a restricted group such as Qualified Institutional Buyers (QIBs).

Question 3.

What is the impact of GDR’s on Indian Capital Market? [Nov. 2009] [4 Marks]

Answer:

Since the inception of GDRs a remarkable change in Indian capital market has been observed as follows:

- Indian stock market to some extent is shifting from Bombay to Luxemburg.

- There is arbitrage possibility in GDR issues.

- Indian stock market is no longer independent from the rest of the world. This puts additional strain on the investors as they now need to keep updated with worldwide economic events.

- Indian retail investors are completely sidelined. GDRs/Foreign Institutional Investors’ placements free pricing imply that retail investors can no longer expect to make easy money on heavily discounted rights/public issues.

- As a result of introduction of GDRs a considerable foreign investment has flown into India.

![]()

Question 4.

Explain American depository Receipts. [Nov. 2012, May 2014] [4 Marks]

Answer:

An American Depository Receipts (ADR) is a stock that trade in the United States of America (USA) but represents a specified number of shares in a foreign corporation. Such receipts must be issued in accordance with the provisions stipulated by the Securities and Exchange Commission of USA (SEC) which are very stringent. The first ADR was introduced by J.R Morgan in 1927 for the British Retailer “Selfridges” on the New York Stock Exchange.

An ADR is generally created by the deposit of the securities of a non-United States company with a custodian bank in the country of incorporation of the issuing company. The custodian bank informs the depository in the United States that the ADRs can be issued. ADRs are United States dollar denominated and are traded in the same way as are the securities of United States companies. The ADR holder is entitled to the same rights and advantages as owners of the underlying securities in the home country.

Question 5.

Write the meaning and advantages of Netting. [May 2012] [4 Marks]

Answer:

The Optimization of Cash Flow movements is one of the basic objectives of International Cash Management. There are numerous ways of-optimizing cash inflows, netting is one of them. Netting is a technique of optimizing cash flow movements with the combined efforts of the subsidiaries thereby reducing administrative and transaction costs resulting from currency conversion.

There are two types of Netting:

(a) Bilateral Netting System – It involves transactions between the parent and a subsidiary or between two subsidiaries.

(b) Multilateral Netting System – Each affiliate nets all its inter affiliate receipts against all its disbursements. It transfers or receives the balance on the position of it being a net receiver or a payer.

Advantages from netting system include the following:

- Reduced administrative cost: The number of cross-border transactions

between subsidiaries is reduced, which decreases the overall administrative costs of such cash transfers. : - Reduced foreign currency conversion cost: Reduces the need for foreign exchange conversion and hence decreases transaction costs associated with foreign exchange conversion.

- Forecasting is possible: Improves cash flow forecasting since net cash transfers are made at the end of each period.

- Settlement of accounts: Gives an accurate report and settles accounts through co-ordinated efforts among all subsidiaries.

Question 6.

Write short note on Euro Convertible Bonds. [May 2013] [4 Marks]

Answer:

Euro convertible bonds are issued by Indian Companies in foreign market with the option to convert them into pre-determined number of equity shares of the company. Usually, the price of the equity shares at the time of conversion will have a premium element. The bonds carry a fixed rate of interest.

If the issuer company desires, the issue of such bonds may carry two options viz.

(i) Call Options: (Issuer’s option) – The issuer company has the option of calling (buying) the bonds for redemption before the date of maturity of the bonds. Where the issuer’s share price has appreciated substantially, i. e. far in excess of the redemption value of the bonds, the issuer company can exercise the option. This call option forces the investors to convert the bonds into equity.

(ii) Put options: – A provision of put option gives the holder of the bonds a right to put (sell) his bonds back to the issuer company at a pre-determinea price and date. In case of Euro-convertible bonds, the payment of interest on and the redemption of the bonds will be made by the issuer company in US dollars.

Question 7.

What are P-Notes? Why it is preferable route for foreigners to invest in India? [Nov. 2017] [4 Marks]

Answer:

The Fils registered with SEBI have the international access to the Indian Capital Markets. The other investors, interested in investing in India can open their account with any registered FII and the FII gets itself registered with SEBI as its sub-account. There are some investors who do not want to disclose their identity or who do not want to get themselves registered with SEBI. FII are not allowed to issue P-Notes to Indian nationals, person of Indian origin or overseas corporate bodies.

The foreign investors prefer P-Notes route for the following reasons:

(a) To hide identity: Some investors do not want to reveal their identities. P-Notes serve this purpose.

(b) Fewer Formalities: They can invest in Indian Shares without any formalities like registration with SEBI, submitting various reports etc.

(c) Cost Effective: Saving in cost of investing as no office is to be maintained.

(d) FOREX: No currency conversion is required.

Part – 2 (Numerical Problems)

Question 1.

XYZ Ltd., a company based in India, manufactures very high quality modern furniture and sells to a small number of retail outlets in India and Nepal. It is facing tough competition. Recent studies on marketability of products have clearly indicated that the customer is now more interested in variety and choice rather than exclusivity and exceptional quality. Since the cost of quality wood in India is very high, the company is reviewing the proposal for import of woods in bulk from Nepalese supplier.

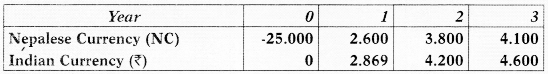

The estimate of net Indian (₹) and Nepalese Currency (NC) cash flows for this proposal is shown below:

Net Cash Flows (in millions)

The following information is relevant:

(i) XYZ Ltd. evaluates all investments by using a discount rate of 9% p.a. All Nepalese customers are invoiced in NC. NC cash flows are converted to India (₹) at the forward rate and discounted at the Indian rate.

(ii) Inflation rates in Nepal and India are expected to be 9% and 8% p.a. respectively. The current exchange rate is ₹ 1 = NC 1.6

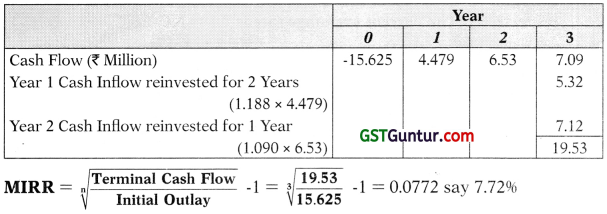

Assuming that you are the finance manger of XYZ Ltd., calculate the net present value (NPV) and modified internal rate of return (MIRR) of the proposal.

You may use following values with respect to discount factor for ₹ 1 @ 9%.

| Present Value | Future Value | |

| Year 1 | 0.917 | 1.188 |

| Year 2 | 0.842 | 1.090 |

| Year 3 | 0.772 | 1 |

[Nov. 2015] (8 Marks)

Answer:

Computation of Forward Rates

NC Cash Flows converted in Indian Rupees

Net Present Value (C Million)

Modified internal Rate of Return

![]()

Question 2.

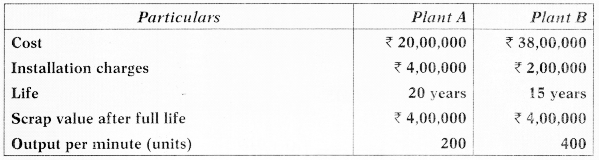

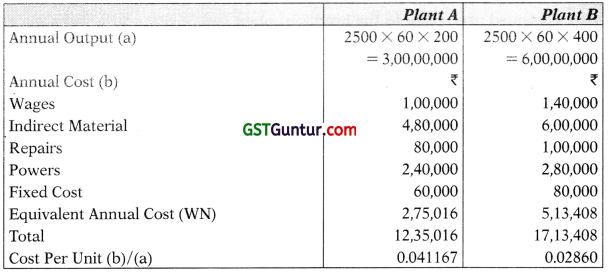

A manufacturing unit engaged in the production of automobile parts is considering a proposal of purchasing one of the two plants, details of which are given below:

The annual costs of the two plants are as follows:

Will it be advantageous to buy Plant A or Plant B? Substantiate your answer with the help of comparative units cost of the plants. Assume interest on

capital at 10 percent. Make other relevant assumptions:

[May 2015] [7 Marks]

Answer:

Computation of Cost per Unit

Decision: As the unit cost is less in proposed Plant B, it may be recommended that it is advantageous to acquire Plant B.

Working Notes:

Calculation of Equivalent Annual Cost

Question 3.

A multinational company is planning to set up a subsidiary company in India (where hitherto it was exporting) in view of growing demand for its product and competition from other MNCs. The initial project cost (consisting of Plant and Machinery including installation) is estimated to be US $ 500 million. The net working capital requirements are estimated at US $ 50 million.

The company follows straight line method of depreciation. Presently, the company is exporting two million units every year at a unit price of US $ 80, its variable cost per unit being US $ 40.

The Chief Financial Officer has estimated the following operating cost and other data in respect of proposed project:

(i) Variable operating cost will be US $ 20 per unit of production.

(ii) Additional cash fixed cost will be US $ 30 million p.a. and project’s share of allocated fixed cost will be US $ 3 million p.a. based on principal of ability to share;

(iii) Production capacity of the proposed project in India will be 5 million units;

(iv) Expected useful life of the proposed plant is five years with no salvage value;

(v) Existing working capital investment for promotion & sale of two milbon units through exports was US $ 15 million;

(vi) Export of the project in the coming year will decrease to 1.5 million units in case the company does not open subsidiary company in India, in view of the presence of competing MNCs that are in the process of setting up their subsidiaries in India;

(vii) Applicable Corporate Income Tax rate is 35%, and (viit) Required rate of return for such project is 12%.

Assuming that there will be no variation in the exchange rate of two currencies and all profits will be repatriated, as there will be no withholding tax, estimate Net Present Value (NPV) of the proposed project in India.

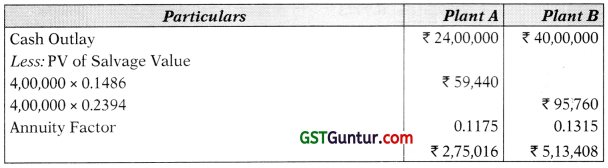

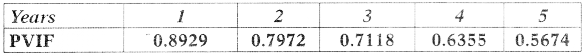

Present Value Interest Factors (PVIF) @ 12% for five years are as below:

[May 2014] [10 Marks]

Answer:

Financial Analysis, whether to set up the manufacturing units in India or not, may be carried using NPV technique as follows:

I Initial Cash Outflows:

| $ Million | |

| Cost of Plant and Machinery | 500.00 |

| Working Capital | 50.00 |

| Release of existing Working Capital | (15.00) |

| 535.00 |

II Incremental Cash Inflow after Tax (CFAT):

(a) Generated by investment in India for 5 years

| $ Million | |

| Sales Revenue (5 Million × 80) Less. Costs | 400.00 |

| Variable Cost (5 Million × $ 20) | 100.00 |

| Fixed Cost | 30.00 |

| Depreciation | 100.00 |

| EBIT | 170.00 |

| Taxes @ 35% | 59.50 |

| EAT | 110.50 |

| Add: Depreciation | 100.00 |

| CFAT (1-5 years) | 210.50 |

| Cash flow at the end of the 5 years (release of Working Capital) (50-15 released earlier) | 35.00 |

(b) Cash generation by exports

| $ Million | |

| Sales Revenue (1.5 Million × $ 80) | 120.00 |

| Less: Variable Cost (1.5 Million × $ 40) | 60.00 |

| Contribution before tax | 60.00 |

| Tax @ 35% | 21.00 |

| CFAT (1-5 Years) | 39.00 |

(c) Additional CFAT attributable to Foreign Investment

| $ Million | |

| Through setting up subsidiary in India Through Exports in India |

210.50 (39.00) |

| Additional CFAT (1-5 years) | 171.50 |

III. Determination of NPV:

Conclusion: Since NPV is positive the proposal should be accepted.

![]()

Question 4.

TG Ltd. a multinational company is planning to set up a subsidiary com-pany in India (where hitherto it was exporting) in view of growing demand for its product and competition from other MNCs, The initial project cost (consisting of plant and machinery including installation) is estimated to be US $ 500 million. The net working capital requirements are estimated at US $ 100 million. The company follows straight line method of depreciation. Presently, tne company is exporting 2 million units every year at a unit price of US $ 100, its variable cost per unit being US $ 50.

The Chief Financial Officer has estimated the following operating cost and other data in respect of the proposed project:

(a) Variable operating cost will be US $ 25 per unit of production.

(b) Additional cash fixed cost will be US $ 40 million per annum.

(c) Production and Sales capacity of the proposed project in India will be 5 million units.

(d) Expected useful life of the proposed plant is 5 years with no salvage value.

(e) Existing working capital investment for production and sale of 2 million units through exports was US $20 million.

(f) Export of the product in the coming year will decrease to 1.5 million units in case the company does not open subsidiary company in India, in view of the presence of competing MNCs that are in the process of setting up their subsidiaries in India.

(g) Applicable Corporate Income Tax rate is 30%.

(h) Required rate of return for such project is 12%.

Assume that there will be no variation in the exchange rate of two countries, all profits will be repatriated and there will be no withholding tax.

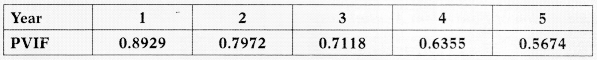

Estimate the Net Present Value (NPV) of the proposed project in India. Present Value Interest Factors (PVIF) @ 12% for 5 years are as under :

(Compute your workings to 4 decimals) [Nov. 2019] [8 Marks]

Answer:

Financial Analysis, whether to set up the manufacturing units in India or not, may be carried using NPV technique as follows:

I. Initial Cash Outflows:

| $ Million | |

| Cost of Plant and Machinery | 500.00 |

| Working Capital | 100.00 |

| Release of existing Working capital | (20.00) |

| Total Initial Cash outflow | 580.00 |

II. Incremental Cash Inflow after Tax (CFAT):

(a)

| $ Million | |

| Sales Revenue (5 Million × 100) | 500.00 |

| Less: Costs | |

| Variable Cost (5 Million × $ 25) | 125.00 |

| Fixed Cost | 40.00 |

| Depreciation | 100.00 |

| EBIT | 235.00 |

| Taxes (5) 30% | 70.5 |

| EAT | 164.50 |

| Add: Depreciation | 100 |

| CFAT (1-5 years) | 264.50 |

| Cash flow at the end of the 5 years (release of Working | 80.00 |

| Capital) (100-20 released earlier) |

(b) Cash generation by exports

| $ Million | |

| Sales Revenue (1.5 Million × $100) | 150.00 |

| Less: Variable Cost (1.5 Million × $ 50) | 75.00 |

| Contribution before tax | 75.00 |

| Tax @ 30% | 22.50 |

| CFAT (1-5 Years) | 52.50 |

(c) Additional CFAT attributable to Foreign Investment

| $ Million | |

| Through setting up subsidiary in India Through Exports in India |

264.50 52.5 |

| Additional CFAT (1-5 years) | 212.00 |

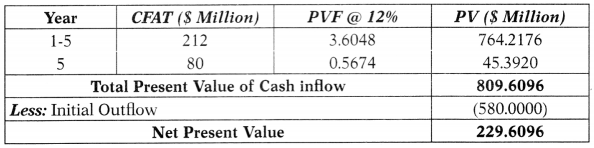

(III) Determination of NPV:

Conclusion: Since NPV is positive the proposal should be accepted.

Question 5.

XY Limited is engaged in large retail business in India. It is contemplating for expansion into a country of Africa by acquiring a group of stores having the same line of operation as that of India.

The exchange rate for the currency of the proposed African country is extremely volatile. Rate of inflation is presently 40% a year. Inflation in India is currently 10% a year. Management of XY Limited expects these rates likely to continue for the foreseeable future.

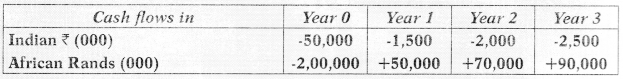

Estimated projected cash flows, in real terms, in India as well as African country for the first three years of the project are as follows:

XY Ltd. assumes the year 3 nominal cash flows will continue to be earned each year indefinitely. It evaluates all investments using nominal cash flows and a nominal discounting rate. The present exchange rate is African Rand 6 to ₹ 1.

You are required to calculate the net present value of the proposed investment considering the following:

(i) African Rand cash flows are converted into rupees and discounted at a risk adjusted rate.

(ii) All cash flows for these projects will be discounted at a rate of 20% to reflect its high risk.

(iii) Ignore taxation.

| Year 1 | Year 2 | Year 3 | |

| PVIF @ 20% | .893 | .694 | .579 |

[May 2013] [10 Marks]

Answer:

Calculation of NPV:

NPV of 3 years = -59,320 (₹ ‘000)

NPV of Terminal Value = \(\frac{16.637}{0.20}\) × 0579 = 48,164 (₹ ‘000)

Total NPV of the Project = -59,320 (₹ ‘000) + 48,164 (₹ ‘000) = -11,156 (₹ ‘000)

Question 6.

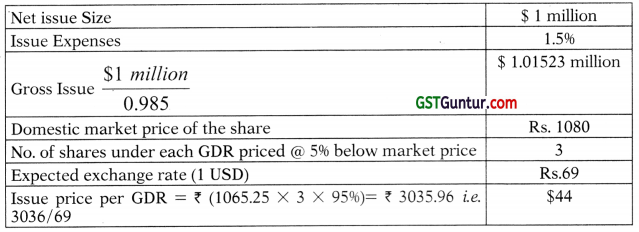

Supreme Limited is interested in expanding its business and planning to install manufacturing plant in US, for which it requires funds of $ 1 million, net of issue expenses which amount to 1.5% of the issue size. To finance this project, it proposes to issue GDRs. As a financial consultant, you are required to compute the number of GDRs to be issued and cost of the GDR with the help of following additional information.

(i) The expected market price of the share at the time of issue of GDR is ₹ 1065.25.(Face Value being Rs. 100)

(ii) 3 shares shall underlay each GDR and priced at 5% discount to the market price.

(iii) 30% dividend is expected to be paid with a growth rate of 7%.

(iv) Expected exchange rate is ₹ 69$

Answer:

(a) Number of GDR to be issued

\(\frac{\$ 1.01523 \text { million }}{\$ 44}\) = 23073.40

(b) Cost of GDR to Omega Ltd.

Dividend Per GDR (D) = ₹ 30 × 3= ₹ 90

Net Proceeds Per GDR = ₹ 3036 × 0.985 = ₹ 2990.46

Ke = \(\frac{D}{N P}\) + g

Ke = \(\frac{90}{2990.46}\) + 0.070 = 0.03009 + 0.07 = 0.10009 = 10% (approx)

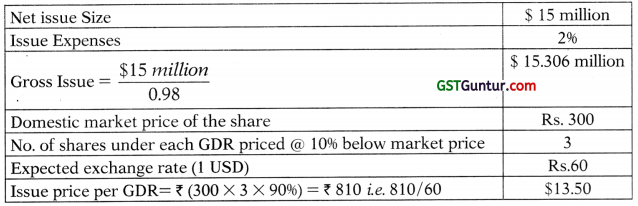

Question 7.

Odessa Limited has proposed to expand its operations for which it requires funds of $ 15 million, net of issue expenses which amount to 2% of the issue size. It proposed to raise the funds though a GDR issue. It considers the following factors in pricing the issue:

(i) The expected domestic market price of the share is ₹ 300

(ii) 3 shares under each GDR

(iii) Underlying shares are priced at 10% discount to the market price

(iv) Expected exchange rate is ₹ 60/$

You are required to compute the number of GDR’s to be issued and cost of GDR to Odessa Limited, if 20% dividend is expected to be paid with a growth rate of 20%. [Nov. 2014] [8 Marks]

Answer:

(b) Cost of GDR to Odessa Ltd.

Dividend Per GDR (D) = ₹ 2 × 3 = ₹ 6

(It is assumed each share to be of Face value Rs. 10)

Net Proceeds Per GDR = ₹ 810 × 0.98 = ₹ 793.80

Ke = \(\frac{D}{N P}\) + g

Ke = \(\frac{6.00}{793.80}\) + 0.20 = 20.76%

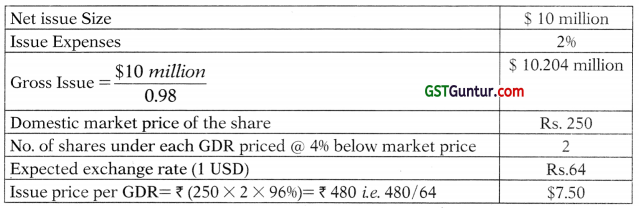

Question 8.

Omega Limited is interested in expanding its operations and planning to install manufacturing plant in US, for which it requires funds of $ 10 million, net of issue expenses which amount to 2% of the issue size. To finance this project, it proposes to issue GDRs. As a financial consultant, you are required to compute the number of GDRs to be issued and cost of the GDR with the help of following additional information.

(i) The expected market price of the share at the time of issue of GDR is ₹ 250. (Face Value being Rs. 100)

(ii) 2 shares shall underlay each GDR and shall be priced at 4% discount to ‘ the market price.

(iii) 15% dividend is expected to be paid with a growth rate of 12%.

(iv) Expected exchange rate is ₹ 64/$ [May 2018] [8 Marks]

Answer:

(a) Number of GDR to be issued

\(\frac{\$ 10.204 \text { million }}{\$ 7.50}\) = 1.3605 million

(b) Cost of GDR to Omega Ltd.

Dividend Per GDR (D) = ₹ 15 × 2 = ₹ 30

Net Proceeds Per GDR = ₹ 480 × 0.98 = ₹ 470.4

Ke = \(\frac{D}{N P}\) + g

Ke = \(\frac{30.00}{470.40}\) + 0.120 = 18.38%

Question 9.

Honey and Co. Ltd. is a Canadian Corporation with head quarters in Quebec. It has its operations in FMCG products, target markets in North American and Europe. Manufacturing operations are being carried out in Europe and Canada. The company intends to expand its operations and is willing to build a new plant in Belgium. For this purpose, it needs financing for one year. It subsidiary can borrow locally, i.e., in Belgium or use surplus cash of other subsidiaries. However, the Belgium Government imposes a 10% withholding tax on intra-corporate loans. This would add about 1.5% to the cost of such loans. The finance subsidiary of Honey and Co. Ltd. in Nassan has recently generated a surplus US Dollar 20 million, which may be used for the project. The company is willing to avoid payment of withholding tax. At the same time, it is anxious not to create a foreign exchange exposure for any of its subsidiaries. One year interest rates available in the market are as under:

Belgium Francs/EURO

| External and Domestic | 14% | Canadian Dollar | 9% |

| US Dollar | 15% | S Fr | 3% |

In case of a bank loan, a 1.5% spread is charged above these rates. On the basis of the above case, answer the following questions with justification:

(i) What are the available financing alternatives?

(ii) Among the available alternatives which is the best alternative? [Practice Question]

Answer:

(i) Available financing alternatives and its effective of financing

Alternative I: Borrow Locally in Belgium

| Cost of borrowing Belgium Frances/Euro locally in Belgium | 14.0% |

| Add: Cost of withholding | 1.5% |

| Net cost | 15.5% |

Alternative II: Borrow from Finance Subsidiary of Honey and Co. Ltd. in Nassan

| Cost of borrowing US dollars | 15.0% |

| Add: Cost of withholding | 1.5% |

| 16.5% | |

| Less: Forward premium obtained by selling US dollars | 1.0% |

| Net Cost | 15.5% |

Alternative III: Convert surplus dollars into S Fr and lend S Fr to the Belgium company at market rate of 3% and purchase interest rate forward

| Cost of borrowing S Fr | 3.0% |

| Add: Cost of withholding | 0.3 |

| 3.3% | |

| Add: Convert S Fr into Belgium Francs/Euro against future receivables by paying forward premium on S Fr @ 11% (ie. 14% – 3%) | 11.0% |

| Net cost | 14.3% |

(ii) Analysis: The third alternative is suggested, since the net cost of financing is lowest. The forward premium is due to interest rate differential.

![]()

Question 10.

A German subsidiary of an US based MNC has to mobilize 1,00,000 Euro’s working capital for the next 12 months. It has the following options :

| Loan from German Bank : | @ 5% p.a. |

| Loan from US Parent Bank : | @ 4% p.a. |

| Loan from Swiss Bank : | @ 3% p.a. |

Banks in Germany charge an additional 0.25%. p.a. towards loan servicing. Loans from outside Germany attract withholding tax of 8% on interest payments. If the interest rates given above are market determined, examine which loan is the most attractive using interest rate differential. [Nov. 2019 Old Syllabus] [5 Marks]

Answer:

(i) Available financing alternatives and its effective of financing

Alternative I: Borrow Locally in Germany

| Cost of borrowing Euro locally in Germany | 5% |

| Add: Loan servicing | 0.25% |

| Net cost | 5.25% |

Alternative II: Borrow from US parent Bank

| Cost of borrowing US dollars | 4% |

| Add: Cost of withholding @ 8% on interest (8% of 4%) | 0.32% |

| Total | 4.32% |

| Add: Forward premium on buying US dollars (596-496 i.e. interest rate differential ) | 1.0% |

| Net Cost | 5.32% |

Alternative III: Borrow from Swiss Bank

| Cost of borrowing S Fr | 3.0% |

| Add: Cost of withholding tax @ 8% on Interest (8% of 3%) | 0.24% |

| Total | 3.24% |

| Add: Forward premium on S Fr @ 2% (ie. 5% – 3%) | 2.0% |

| Net cost | 5.24% |

(ii) Analysis: The third alternative is suggested, since the net cost of financing is lowest. The forward premium is due to interest rate differential.

Question 11.

K Ltd. currently operates from 4 different building and wants to consoli-date its operations into one building which is expected to cost Rs.9G Crores. The Board of K Ltd. had approved the above plan and to fund the above cost, agreed to avail an external commercial Borrowing (ECB) of GBP 10m from G Bank Ltd. on the following conditions:

1. The loan will be availed on 1st April, 2019 with interest payable on half yearly rest.

2. Average Loan maturity life will be 3.4 years with an overall tenure of 5 years.

3. Upfront Fee of 1.20%.

4. Interest Cost is GBP 6 months LIBOR + Margin of 2.50%.

5. The 6 months LIBOR is expected to be 1.05%

K Ltd. also entered into a GBP-INR hedge at 1 GBP=INR 90 to cover the exposure on account of the above ECB Loan and the cost of the hedge is coming to 4% p.a. and taking 1 GBP=I\R 90:

As a finance manager, given the above information

(i) Calculate the overall cost both in percentage and rupee terms on an annual basis.

(ii) What is the cost of hedging in rupee terms?

(iii) If K Ltd. wants to pursue an aggressive approach, what would be the net gain/loss for K Ltd. if the INR depreciates/appreciates against GBP by 10% at the end of the 5 years assuming that the loan is repaid in GBP at the end of 5 years?

Ignore time value and taxes and calculate to two decimals. [May 2019] [8 Marks]

Answer:

(i) Calculation of Overall Cost

| 10 M @ 1.20%) | Rs. 1,20,000 |

| Interest Payment (GBP 10M × 3.55% × 3.4) | Rs. 12,07,000 |

| Hedging Cost (GBP 10M × 4% × 3.4) | Rs. 13,60,000 |

| Total | Rs. 26,87,000 |

Or Rs. 2.687 million

Overall cost in % terms on Annual Basis

= \(\frac{2.687 \text { million }}{(1,00,00,000-1,20,000)} \times \frac{1}{3.4}\)

= \(\frac{2.687}{9.88} \times \frac{1}{3.4}\) × 100 = 8%

Overall Cost in Rupee terms @ GBP1 = Rs. 90 × \(\frac{2.687}{3.4}\) × 100

= Rs.711.26 lakhs

OR

Overall cost in % terms on Annual Basis = \(\frac{2.687 \text { million }}{(1,00,00,000)} \times \frac{1}{3.4}\)

= \(\frac{2.687}{1.00} \times \frac{1}{3.4}\) × 100 = 7.9%

Overall Cost in Rupee terms @ GBP 1 = 10,000.000 × 7.90% × 90

= Rs. 71,100,000

OR

Calculation of overall cost

Internet & Margin (A) = 3.55%

Hedging cost (B) = 4%

= 7.55%

One time free = 1.20%

Average loan maturity = 3.4 years

Per annum cost 1.2/3.4 (C) = 0.35

Annual overall cost in % terms (A + B+C) = 7.9%

Overall Cost in Rupee terms @GBP 1 = 10,000,000 × 7.90% × 90

= Rs. 71,100,000

(ii) Cost of Hedging in terms of Rupees

Rs. 13,60,000 × 90 = Rs. 12,24,00,000 = Rs. 12.24 crores in Total

OR

GBP 10,000,000 × 90 × 4% = Rs. 3,60,00,000 on Annual Basis

(iii) If K Ltd. pursues an aggressive approach then Gain/Loss in INR Depreciation/Appreciation shall be computed as follows:

(a) If INR depreciates by 10%

Re. loss per GBP = 90 × 10% = Rs. 9

Total Losses GBP 10M = Rs. 90 Million

Less: Cost of Hedging = Rs. 36 Million

Net Loss = Rs. 54 million

(b) If INR appreciates by 10%

Rs. Gains per GBP = Rs. 90 × 10% = Rs. 9

Total Gain on Repayment of loan = 90 Million

Add: Saving in Cost of Hedging = 36 Million

Net Gain = 126 Million