Chapter 1 Insolvency Concepts and Evolution – CS Professional Insolvency Law and Practice Notes is designed strictly as per the latest syllabus and exam pattern.

Insolvency Concepts and Evolution – CS Professional Insolvency Law and Practice Study Material

Question 1.

Explain the concept of Insolvency/ Bankruptcy.

Answer:

Insolvency is a state when an individual, corporation, or other organization cannot meet its financial obligations for paying debts as they become due. Bankruptcy is not exactly the same as insolvency. Technically, bankruptcy occurs when a court has determined insolvency, and given legal orders for it to be resolved. Bankruptcy is a determination of insolvency made by a court of law with resulting legal orders intended to resolve the insolvency. Insolvency describes a situation where the debtor is unable to meet his/her obligations. Bankruptcy is a legal scheme in which an insolvent debtor seeks relief.

![]()

Question 2.

What historical developments of Insolvency laws took place in India?

Answer:

- The law of Insolvency in India owes its origin to English law. Before the British came to India there was no law of Insolvency in the country.

- The earliest insolvency legislation can be traced to sections 23 and 24 of the Government of India Act, 1800 (39 and 40 Geo III c 79), which conferred insolvency jurisdiction on the Supreme Court.

- The passing of Statute 9 in 1828 (Geo- IV c 73) can be said to be the beginning of the special insolvency legislation in India.

- Under this Act, the relief for insolvent debtors were provided in the Presidency-towns.

- A further step in the development of Insolvency Law was taken when the Indian Insolvency Act, 1848 was passed. However, the Provisions were found to be inadequate to meet the changing conditions.

- The Act of 1848 was in force in the Presidency-towns until the enactment in 1909 of the Presidency-towns Insolvency Act, 1909. The Presidency Towns Insolvency Act, 1909 and Provisional Insolvency Act, 1920 are two major enactments that deal with personal insolvency and have parallel provisions and their substantial content is also similar but the two differ in respect of their territorial jurisdiction.

- While Presidency Towns Insolvency Act, 1909 applies in Presidency towns namely, Kolkata, Mumbai and Chennai, Provincial Insolvency Act, 1920 applies to all provinces of India.

- These two Acts are applicable to individuals as well as to sole proprietorships and partnership firms. Under the Constitution of India ‘Bankruptcy & Insolvency’ is provided in Entry 9 List III – Concurrent List, (Article 246 -Seventh Schedule to the Constitution) i.e. both Center and State Governments can make laws relating to this subject.

- The major legislations governing Corporate Insolvency were I Companies Act, 1956, relating to winding up of companies. I The Sick Industrial Companies (Special Provisions) Act, 1985.

Question 3.

What reforms took place in insolvency law in last two decades?

Answer:

- The Indian financial system has undergone tremendous transformation in last two decades. Various financial sector reforms have been initiated aimed at promoting an efficient, well-diversified and competitive financial system with the ultimate objective of improving the allocative efficiency of resources so as to accelerate economic development.

- As India swiftly moves to the centre stage of world economy there has been a consistent effort by the policy makers to undertake comprehensive reforms in the laws and systems to bring them at par with international standards and incentives the foreign investors to invest in the Indian economy.

Question 4.

How did SICA and BIFR came into existence?

Answer:

- Industrial sickness had started right from the pre-Independence days.

- Government had earlier tried to counter the sickness with some ad-hoc measures

- Nationalisation of Banks and certain other measures provided some temporary relief

- RBI monitored the industrial sickness

- A study group, came to be known as Tandon Committee was appointed by RBI in 1975

- In 1976, H.N. Ray committee was appointed

- In 1981, Tiwari Committee was appointed to suggest a comprehensive special legislation designed to deal with the problem of sickness laying down its basic objectives and parameters, remedies necessary for revival of sick Units

- The committee submitted its report to the Govt, in September 1983 and suggested the following:

(a) Need for a special legislation

(b) Need for setting up of exclusive quasi-judicial body. - Thus, the SICA came into existence in 1985 and BIFR started functioning from 1987.

![]()

Question 5.

Why and how was Eradi Committee formed?

Answer:

- In the year 1999, the Government of India set up a High Level Committee headed by Justice V.B. Eradi, to examine and make recommendations with regard to the desirability of changes in existing law relating to winding up of companies so as to achieve more transparency and avoid delays in the final liquidation of the companies.

- The Committee recognized after considering international practices that the law of insolvency should not only provide for quick disposal of assets but in Indian economic scene, it should first look at the possibilities of rehabilitation and revival of companies.

- The Committee also recommended that the jurisdiction, power and authority relating to winding up of companies should be vested in a National Company Law Tribunal instead of the High Court as at present.

- The Committee strongly recommended appointing Insolvency Professionals who are members of ICAI, ICSI, ICWAI, Bar Councils or corporate managers who are well versed in Corporate management on lines of U.K. Insolvency Act.

Question 6.

Explain the key points addressed and recommended by Eradi Committee

Answer:

- The Committee recognized after considering international practices that the law of insolvency should not only provide for quick disposal of assets but, should first look at the possibilities of rehabilitation and revival of companies.

- The Committee noted that there are three different agencies namely, (i) the High Courts, which have powers to order winding up of companies under the provisions of the Companies Act, 1956; (ii) the Company Law Board to exercise powers conferred on it by the Act or the powers of the Central Government delegated to it and (iii) Board for Industrial and Financial Reconstruction (BIFR) which deals with the references relating to rehabilitation and revival of sick industrial companies.

- The committee brought out the dismal of time taken to wind up a company in India – it may run on an average upto 25 years.

Question 7.

What are the recommendations made by N L Mitra Advisory group?

Answer:

- The Advisory Group examined the details of conflicting decisions on tribunalisation of justice. Tribunalised justice is a special character of civil law system.

- In a common law culture, there is an emphasis on judicial form and formalities.

- The conflict between the two systems is nothing new in India.

- Both the systems, that is the common law and the civil law systems, are now coming closer, common law systems adopting structure of administrative authority including administrative justice for the management of various state functions: and the civil law system on the other hand, incorporating the principles of accusive system and judicial process.

- In India, we have under the present constitutional paradigm partially adopted tribunalised form of justice under article 323 A and 323 B20. But there are also judicial observations. It is true that in L. Chandrakumar21, Supreme Court finally gave its nod in favour of tribunalised system of justice. But the reservation of judiciary against the erosion of judicial power especially at the High Court level is quite evident. It is not possible to oust the jurisdiction of the High Court under Articles 226 and 227 without amending the provision of Article 323B.

Question 8.

What two methods were given by the N L Mitra Advisory Group?

Answer:

The advisory group discussed in details the possibility of avoiding the

dualism in the system so that the whole process can be put into a straight

line to avoid delay. In that context the following two methods have been

discussed.

(a) Constituting a National Tribunal with benches at the jurisdiction of each High Court to receive and deal with all petitions for bankruptcy, restructuring and finally for insolvency with an appeal lying to the High Court and SLP to the Supreme Court; and

(b) Having a completely dedicated bench in each High Court dealing with the entire matter of bankruptcy; reorganisation; and insolvency proceedings ensuring fast track liquidation, the only appeal being by way of a special leave petition to the Supreme Court.

![]()

Question 9.

Give the highlights of J J Irani Committee (2005).

Answer:

The Insolvency Tribunal should have a general, non-intrusive and supervisory role in the rehabilitation and liquidation process. Greater intervention of the Tribunal is required only to resolve disputes by adopting a fast track approach. The Tribunal should adopt a commercial approach to dispute resolution observing the established legal principles of fairness in the process.

- The Tribunal should set standards of high quality and be able to meet requisite level of public expectations of fairness, impartiality, transparency and accountability. Selection of President and Members of the Tribunal should be such so as to enable a wide mix of expertise for conduct of its work.

- The Tribunal will require specialized expertise to address the issues referred to it. The law should prescribe an adequate qualification criterion for appointment to the Tribunal as well as training and continuing education forjudges/members.

- Rules should be made in such way that ensure ready access to court records, court hearings, debtors and financial data and other public information.

- Standards to measure the competence, performance and services of the Tribunal should be framed and adopted so that proper evaluation is done and further improvements can be suggested.

- The Tribunal should have clear authority and effective methods of enforcing its judgments. It should have adequate powers to deal with illegal activity or abusive conduct.

Question 10.

What were the highlights of the BLRC COMMITTEE (2014)?

Answer:

- Post announcement by the Hon’ble Finance Minister in his Budget Speech of 2014-15 that an entrepreneur friendly legal bankruptcy framework would be developed for SMEs to enable easy exit, Bankruptcy Law Reforms Committee (BLRC) was set up under Shri TK Viswanathan, former Secretary General, Lok Sabha and former Union Law Secretary, on 22.8.2014 to study the corporate bankruptcy legal framework in India and submit a report.

- The objectives of the Committee were to resolve insolvency with lesser time involved, lesser loss in recovery, and higher levels of debt financing across instruments.

- The Committee has recommended a consolidation of the existing legal framework, by repealing two laws and amending six others. It has proposed to repeal the Presidency Towns Insolvency Act, 1909 and the Provincial Insolvency Act, 1920. In addition, it has proposed to amend: (i) Companies Act, 2013, (ii) Sick Industrial Companies (Special Provisions) Repeal Act, 2013, (iii) Limited Liability Partnership Act, 2008, (iv) Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, (v) Recovery of Debts Due to Banks and Financial Institutions Act, 1993 and (vi) Indian Partnership Act, 1932.

- The Committee has proposed to establish a creditors committee, where the financial creditors will have votes in proportion to their magnitude of debt. The creditors committee will undertake negotiations with the debtor, to come up with a revival or repayment plan.

- The report outlines the procedure for insolvency resolution for companies and individuals. The process may be initiated by either the debtor or the creditors.

- Presently, only secured financial creditors (creditors holding collateral against loans), can file an application for declaring a company sick. The Committee has proposed that operational creditors, such as employees whose salaries are due, be allowed to initiate the insolvency resolution process (IRP).

- The entire IRP will be managed by a licensed insolvency professional. During the IRP, the professional will control and manage the assets of the debtor, to ensure that they are protected, while the negotiations take place.

- The Committee has proposed to set up Insolvency Professional Agencies. The agencies will admit insolvency professionals as members and develop a code of conduct.

- The report recommends speedy insolvency resolution and time bound negotiations between creditors and the debtors. To ensure this, a 180 day time period for completion of the IRP has been recommended. For cases with high complexity, this time period may be extended by 90 days, if 75% of the creditors agree.

- The committee has proposed to establish information utilities which will maintain a range of information about firms, and thus avoid delays in the IRP, typically caused by a lack of data.

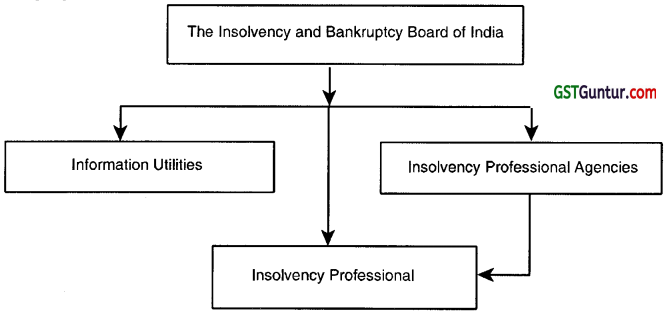

- The Committee has proposed to establish the Insolvency and Bankruptcy Board of India as the regulator, to maintain oversight over insolvency resolution in the country. The Board will regulate the insolvency professional agencies and information utilities, in addition to making regulations for insolvency resolution in India.

- The Committee proposed two tribunals to adjudicate grievances under the law: (i) the National Company Law Tribunal will continue to have jurisdiction over insolvency resolution and liquidation of companies and limited liability partnerships; and (ii)the Debt Recovery Tribunal will have jurisdiction over insolvency and bankruptcy resolution of individuals.

![]()

Question 11.

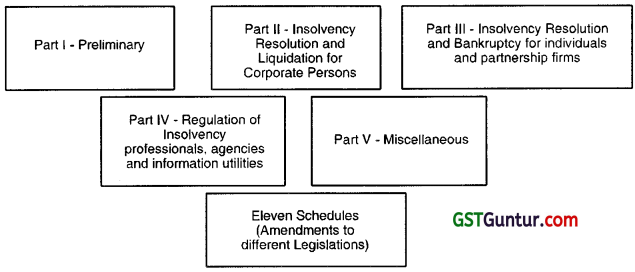

Give the framework of the Insolvency and Bankruptcy Code, 2016.

Answer:

Framework of the Insolvency and Bankruptcy Code 2016

The framework of Part II- Insolvency Resolution and Liquidation for Corporate Persons

Question 12.

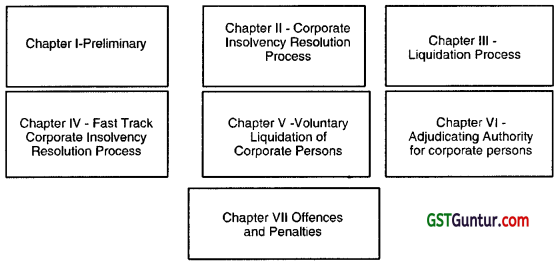

Explain the regulatory mechanism of the Insolvency and Bankruptcy Code, 2016.

Answer:

The Insolvency Adjudication Process

![]()

Question 13.

Explain the regulatory framework of Insolvency Code in UK.

Answer:

- The 1982 Report of the Insolvency Law review Committee, Insolvency Laws and Practice (commonly known as “the Cork Report”) recommended the adoption in the United Kingdom of Unified Insolvency legislation.

- The Insolvency Act, 1986 deals with the insolvency of individuals and companies.

- The Act is divided into three groups and 14 Schedules as follows:

- Group 1 deals with Company Insolvency

- Group 2 deals with Insolvency of Individuals and

- Group 3 deals with Miscellaneous Matters bearing on both Company and Individual Insolvency.

- Basically, a company in financial difficulties may be made subject to any of five statutory procedures.

- administration

- company voluntary arrangement

- scheme of arrangement

- receivership (including administrative receivership); and

- liquidation (winding-up).

- With the exception of schemes of arrangement, which fall within the ambit of the Companies Act, 2006, these are formal insolvency procedures governed by the Insolvency Act, 1986.

- The administration procedure was introduced by the insolvency Act, 1986 and substantially revised by the Enterprise Act, 2002 to include a streamlined procedure allowing the company or (more often) its directors to appoint an administrator without the involvement of the Court subject to conditions.

- Firms are in fact liquidated if they become the subject of a compulsory liquidation order obtained from the court by a creditor, shareholder or director. Alternatively, the company may itself decide to pass a liquidation resolution – subject to the approval of a creditors’ meeting – for the company to be wound-up (a Creditors Voluntary Liquidation).

Either way, the result of both these procedures is the winding-up of the company. Neither process makes any attempt to rescue or sustain the company as a legal entity. - The Insolvency Act 1986 also introduced three new procedures that held out the possibility of a company being brought back to life as a viable entity. These measures represented an attempt to emulate the ‘rescue culture’ that characterised the corporate sector in the US. The first of these procedures – ‘company voluntary arrangements’ (CVAs) – provides a way in which a company in financial difficulty can come to a binding agreement with its creditors. The second procedure – ‘administration’ – offers companies a breathing space during which creditors are restrained from taking action against them. During this period, an administrator is appointed by a court to put forward proposals to deal with the company’s financial difficulties. A third option – ‘administrative receivership’ – permits the appointment of a receiver by certain creditors (normally the holders of a floating charge) with the objective of ensuring repayment of secured debts.

- The Enterprise Act 2002 attempted to embed a rescue culture by creating entry routes into administration that did not require a court order, and simplified the means by which a company could ‘emerge’ from administration. It also prohibited – with certain exceptions – the right of creditors to appoint an administrative receiver (which had previously blocked a company’s ability to opt for administration). In addition, the Act explicitly established a ‘hierarchy of purposes’ for the administration process. The primary duty of administrators was defined as rescuing the company as a going concern (a duty that does not exist for an administrative receiver).

Question 14.

Brief note on US Bankruptcy laws.

Answer:

- The English bankruptcy system was the model for bankruptcy laws in the English colonies in America and in the American states after independence from England in 1776.

- Early American bankruptcy laws were only available to merchants and generally involved imprisonment until debts were paid or until property was liquidated or creditors agreed to the release of the debtor. The laws were enacted by each individual state and were inconsistent and discriminatory.

- The system was not uniform and some states became known as debtor’s havens because of their unwillingness to enforce commercial obligations. The lack of uniformity in bankruptcy and debt enforcement laws hindered business and commerce between the states.

- The United States Constitution as adopted in 1789 provides in Article I, Section 8, Clause 4 that the states granted to Congress the power to establish uniform laws on the subject of bankruptcies throughout the United States. However, until 1898 there was no bankruptcy law in continuous effect in the United States.

- The Congress enacted temporary bankruptcy statutes in 1800,1841 and 1867 to deal with economic downturns. However, those laws were temporary measures and were repealed as soon as economic conditions stabilized. The Act of 1800 was repealed in 1803.

- The Act of 1841 was repealed in 1843 and the Act of 1867 only lasted until 1878. These early laws only permitted merchants, traders, bankers and factors to be placed in bankruptcy proceedings. The Acts of 1800 and 1841 vested jurisdiction in the federal district courts.

- The district court judges were given the power to appoint commissioners or assignees to take charge of and liquidate a debtor’s property. A permanent bankruptcy statute was not enacted until 1898. The National Bankruptcy Act of 1898 was based upon the liquidation of a debtor’s non-exempt assets to pay creditors. In 1938 the law was amended to provide for the rehabilitation or reorganization of a debtor as an alternative to liquidation of assets.

- The Bankruptcy Act of 1898, together with its amendments, was known as the Bankruptcy Act. Under the Bankruptcy Act, the district court had jurisdiction over bankruptcy cases, but could appoint a referee in bankruptcy to oversee the administration of bankruptcy cases, the allowance of claims and the distribution of payments to creditors.

- The Bankruptcy Act governed bankruptcy in the United States for 80 years. After a series of critical studies and review of the then existing law and practice, Congress passed the Bankruptcy Reform Act of 1978.

![]()

Question 15.

Brief note on US Bankruptcy Code, 1978.

Answer:

- The US Congress enacted the “Bankruptcy Code” in 1978. The Bankruptcy Code, which is codified as title 11 of the United States Code, has been amended several times since its enactment. It is the uniform federal law that governs all bankruptcy cases.

- The procedural aspects of the bankruptcy process are governed by the Federal Rules of Bankruptcy Procedure (often called the “Bankruptcy Rules”) and local rules of each bankruptcy court.

- The Bankruptcy Rules contain a set of official forms for use in bankruptcy cases. The Bankruptcy Code and Bankruptcy Rules (and local rules) set forth the formal legal procedures for dealing with the debt problems of individuals and businesses.

Six basic types of bankruptcy cases are provided for under the Bankruptcy Code.

- Chapter 7 bankruptcy leading to liquidation. In this type of bankruptcy, a court-appointed trustee or administrator takes possession of any nonexempt assets, liquidates these assets (for example, by selling at an auction), and then uses the proceeds to pay creditors.

- Chapter 9, entitled Adjustment of Debts of a Municipality, provides essentially for reorganization. Only a “municipality” may file under chapter 9, which includes cities and towns, as well as villages, counties, taxing districts, municipal utilities, and school districts.

- Chapter 11 entitled Reorganization, ordinarily is used by commercial enterprises that desire to continue operating a business and repay creditors concurrently through a court-approved plan of reorganization.

- Chapter 12 allows a family farmer or fisherman to continue to operate the business while the plan is being carried out.

- Chapter 13 enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make instalments to creditors over three to five years.

- Chapter 15 is to provide effective mechanisms for dealing with insolvency cases involving debtors, assets, claimants, and other parties of interest involving more than one country.