Chapter 1 Indian Equity-Public Funding – Corporate Funding and Listing in Stock Exchange ICSI Study Material is designed strictly as per the latest syllabus and exam pattern.

Indian Equity-Public Funding – Corporate Funding & Listing in Stock Exchange Study Material

Question 1.

Write notes on the following:

(i) Promoters contribution

(iv) Basis of allotment (June 2012, 4 marks each)

Answer:

(i) Minimum Promoters Contribution:

Regulation 113 of SEBI (ICDR) provides for minimum promoters’ contribution

Case-1: Minimum promoters contribution in case of Pure Securities [Reg.113(1)): The promoters shall contribute in the public issue as follows:

(a) either to the extent of 20% of the proposed issue size or to the extent of 20% of the post-issue capital;

(b) in case of a composite issue (i.e. further public offer cum rights issue), either to the extent of 20% of the proposed issue size or to the extent of 20% of the post-issue capital excluding the rights issue component.

Case-II: Minimum promoters contribution in case of Convertible Securities ( Reg.113(2)]:

In case of a public issue or composite issue of convertible securities, the minimum promoter& contribution shall be as follows:

(a) the promoters shall contribute 20% as stipulated in clause (a) or (b) of Regulation 113(1), as the case may be, either by way of equity shares or by way of subscription to the convertible securities:

Provided that if the price of the equity shares allotted pursuant to conversion is not pre-determined and not disclosed in the offer document, the promoters shall contribute only by way of subscription to the convertible securities being issued in the public issue and shall undertake in writing to subscribe to the equity shares pursuant to conversion of such securities.

(b) in case of any issue of convertible securities which are convertible or exchangeable on different dates and if the promoters’ contribution is by way of equity shares (conversion price being pre-determined), such contribution shall not-be at a price lower than the weighted average price of the equity share capital arising out of conversion of such securities.

Case – III: Minimum promoters’ contribution in case of further Securities [Reg. 113(3)]:

In case of a further public offer or composite issue where the promoters contribute more than the stipulated minimum promoters’ contribution, the allotment with respect to excess contribution shall be made at a price determined in terms of the provisions of Regulation 164 or the issue price, whichever is higher.

(iv) Basis of allotment:

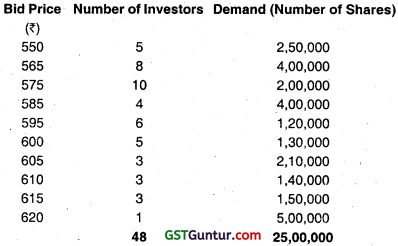

After the closure of the issue, the bids received are aggregated under different categories i.e., firm allotment, Qualified Institutional Buyers (QIBs), Non-Institutional Buyers (NIBs), Retail, etc. The oversubscription ratios are then calculated for each of the categories as against the shares reserved for each of the categories in the offer document.

Within each of these categories, the bids are then segregated into different buckets based on the number of shares applied for. The oversubscription ratio is then applied to the number of shares applied for and the number of shares to be allotted for applicants in each of the buckets is determined. Then, the number of successful allottees is determined. This process is followed in case of proportionate allotment. In case of allotment for QIBs, it is subject to the discretion of the post issue lead manager.

The authorised employees of the designated stock exchange along with the lead manager(s) and registrars to the issue shall ensure that the basis of allotment is finalised in a fair and proper manner in accordance with the allotment procedure as specified in Part A of Schedule XIV.

Question 2.

Write notes on the following:

(i) Promoters’ minimum contribution

(v) Qualified institutional buyers (QIBs) (Dec 2012, 4 marks each)

Answer

(v) Qualified Institutional Buyers (QIBs)

Regulation 2(1)(ss) of SEBI (ICDR) Regulations, 2018 defines “qualified institutional buyer” means:

- a mutual fund, venture capital fund, alternative investment fund and foreign venture capital investor registered with the Board;

- a foreign portfolio investor other than Category III foreign portfolio investor, registered with the Board;

- a public financial institution;

- a scheduled commercial bank;

- a multilateral and bilateral development financial institution;

- a state industrial development corporation;

- an insurance company registered with the Insurance Regulatory and Development Authority of India;

- a provident fund with minimum corpus of ₹ 25 crores;

- a pension fund with minimum corpus of ₹ 25 crores;

- National Investment Fund set up by resolution no. F. No. 2/3/2005-DDI! dated November 23, 2005 of the Government of India published in the Gazette of India;

- insurance funds set up and managed by army, navy or air force of the Union of India; and

- insurance funds set up and managed by the Department of Posts, India; and

- systemically important non-banking financial companies.

![]()

Question 3.

Write a note on the following:

(iii) Voluntary delisting of securities (June 2013, 4 marks)

Answer:

Voluntary delisting of securities: According to SEBI (Delisting of Equity Shares) Regulations, 2021, a company can voluntarily apply to the concerned stock exchange(s) for delisting. There are two types of delisting as follows:

(I) Delisting from some of the recognised stock exchanges [Regulation 5]:

A company may delist its equity shares from one or more of the recognised stock exchanges on which it is listed without providing an exit opportunity to the public shareholders, if after the proposed delisting, the equity shares remain listed on any recognised stock exchange that has nationwide trading terminals.

(II) Delisting from all the recognised stock exchanges [Regulation 7]: The equity shares of a company may be delisted from all the recognised stock exchanges having nationwide trading terminals on which they are listed, after an exit opportunity has been provided by the acquirer to all the public shareholders holding the equity shares sought to be delisted, in accordance with Chapter IV of these regulations and after following the procedure as mentioned in Part-B of this Chapter.

Question 4.

Write notes on the following:

(iv) Draft offer document (Dec 2013, 4 marks)

Answer:

Draft Offer Document:

(I) Draft Offer Document: [Regulation 2(n)]: It means the draft offer document filed with the Board in relation to a public issue under SEBI (ICDR) Regulation, 2018.

(II) Important provisions about Draft Offer Document [Regulations. 25, 26]:

(a) Disclosures in the draft offer document and offer document [Reg. 24]

24. (1) The draft offer document and offer document shall contain all material disclosures which are true and adequate to enable the applicants to take an informed investment decision.

(b) Filing of the draft offer document and offer document [Sec.25] Prior to making an initial public offer, the issuer shall file three copies of the draft offer document with the concerned regional office of the Board under the jurisdiction of which the registered office of the issuer company is located, in accordance with Schedule IV, along with fees as specified in Schedule III, through the lead manager(s).

(c) Draft offer document and offer document to be available to the public [Sec.26]

The draft offer document filed with the Board shall be made public for comments, if any, for a period of at 21 days from the date of filing, by hosting it on the websites of the Board, stock exchanges where specified securities are proposed to be listed and lead manager(s) associated with the issue.

Question 5.

Write a note on the following:

(ii) Differential pricing of securities. (June 2016, 4 marks)

Answer:

Regulation 30 of SEBI (ICDR) Regulation, 2018 permits the issuer to offer its specified securities at different prices, subject to the following:

(a) retail individual investors or retail individual shareholders or employees entitled for reservation made under Regulation 33 may be offered specified securities at a price not lower than by more than 10% of the price at which net offer is made to other categories of applicants, excluding anchor investors;

(b) in case of a book built issue, the price of the specified securities offered to the anchor investors shall not be lower than the price offered to other applicants;

(c) In case the issuer opts for the alternate method of book building in terms of Part D of Schedule XIII, the issuer may offer the specified securities to its employees at a price not lower than by more than 10% of the floor price.

(d) Discount, if any, shall be expressed in rupee terms in the offer document.

Question 6.

Write notes on the following:

(v) Price and Price Band. (June 2017, 4 marks)

Answer:

Following are the provisions of “Price and price band” as per SEBI (ICDR) Regulations, 2018, specified under Regulation 127:

(1) The issuer may mention a price or a price band in the offer document (in case of a fixed price issue) and a floor price or a price band in the red herring prospectus (in case of a book built issue) arid determine the price at a later date before registering the prospectus with the Registrar of Companies:

However, the prospectus registered with the Registrar of Companies shall contain only one price or the specific coupon rate, as the case may be.

(2) The cap on the price band, and the coupon rate in case of convertible debt instruments, shall be less than or equal to 120% of the floor price.

Provided that the cap of the price band shall be at least 105% of the floor price.

(3) The floor price or the final price shall not be less than the face value o the specified securities.

(4) Where the issuer opts not to make the disclosure of the floor price or price band in the red herring prospectus, the issuer shall announce the floor price or the price band at least one working day before the opening of the bid in the same newspapers in which the pre-issue advertisement was released or together with the pre-issue advertisement in the format prescribed under Part A of Schedule X.

(5) The announcement referred to in sub-regulation (4) shall contain relevant financial ratios computed for both upper and lower end of the price band and also a statement drawing attention of the investors to the section title “basis of issue price” of the offer document.

(6) The announcement referred to in sub-regulation (4) and the relevant financial ratios referred to in sub-regulation (5) shall be disclosed on the websites of the stock exchange(s) and shall also be pre-filled in the application forms to be made available on the websites of the stock exchange(s).

![]()

Question 7.

Write notes on the following:

(iii) Institutional Placement Programme (Dec 2017, 4 marks)

Answer:

Institutional Placement Programme (IPP):

When a listed issuer makes a further public offer of equity shares, or offer for sale of shares by promoter / promoter group of listed issuer in which, the offer allocation and allotment of such shares is made only to QIBs in terms of chapter VIIIA of SEBI (ICDR) Regulations, 2018 for the purpose of achieving minimum public shareholding it is called an IPP.

Question 8.

Write note on the following:

(iii) Fast Track Issue. (June 2018, 4 marks)

Answer:

(I) Fast Track Issues: It may be defined as a time saving manner for bringing public issue by a listed company, satisfying the prescribed conditions of Regulations 155 of SEBI (ICDR) Regulation, 2018. As per the Regulation 155, a listed company can bring further public offer, without fulfilling the requirements of Regulation 123, which are as follows:

(a) No need to file three copies of the draft offer document with the concerned regional office of the Board;

(b) No need to file the draft offer document with the stock exchange(s) where the specified securities are proposed to be listed,

(II) Provision Related to Fast Track issue:

(a) Minimum Listing Period: Equity shares of the issuer have been listed on any stock exchange for a period of at least three years immediately preceding the reference date;

(b) Demat Form: Entire shareholding of the promoter group of the issuer is held in dematerialised form on the reference date.

(c) Average Market Capitalisation: Average Market Capitalisation of public shareholding of the issuer is at ₹ 1000 crores in case of public issue

| EXPLANATION | average market capitalisation of public shareholding |

| It means the sum of daily market capitalisation of public shareholding for a period of one year up to the end of the quarter preceding the month in which the proposed issue was approved by the shareholders or the board of the Issuer, as the case may be, divided by the number of trading days. | |

(d) Annualised trading turnover: Annualised trading turnover of the equity shares of the issuer during 6 calendar months immediately preceding the month of the reference date has been at least 2% of the weighted average number of equity shares listed during such 6 months’ period.

(e) Annualized delivery-based trading turnover: Annualized delivery-based trading turnover of the equity shares during six calendar months immediately preceding the month of the reference date has been at least 10% of the annualised trading turnover of the equity shares during such 6 months’ period.

(f) Compliance with Listing Agreement: Issuer has been in compliance with the equity listing agreement or the SEBI (LODR) Regulations, 2015, as applicable, for a period of at least 3 years immediately preceding the reference date.

(g) Grievances Redressed: Issuer has redressed at least 95% of the complaints received from the investors till the end of the quarter immediately preceding the month of the reference date;

(h) No Prosecution: No show-cause notices have been issued or prosecution proceedings have been initiated by the Board and pending against the issuer or its promoters or whole-time directors as on the reference date;

(i) No Settlement: Issuer or Promoter or Promoter group or Director of the issuer has not settled any alleged violation of securities laws through the consent or settlement mechanism with the Board during 3 years immediately preceding the reference date.

(j) No Suspension of Trading: Equity shares of the issuer have not been suspended from trading as a disciplinary measure during last 3 years immediately preceding the reference date.

(k) No Conflict of interest: There shall be no conflict of interest between the lead manager(s) and the issuer or its group companies in accordance with the applicable regulations.

(l) Impact of Audit qualifications: Impact of Audit qualifications, if any and where quantifiable, on the audited accounts of the issuer in respect of those financial years for which such accounts are disclosed in the letter of offer does not exceed 5% of the net profit or loss after tax of the issuer for the respective years.

Question 9.

Distinguish between the following :

(ii) Private Placement and Preferential Allotment (Dec 2019, 5 marks)

Answer:

Following are the main difference between private placement and preferential allotment:

| Private Placement | Preferential Allotment |

| 1. Private Placement can be described as an offer or invitation to offer made to specified investors by issuing securities, so as to raise funds. | On the contrary, Preferential Allotment is the issue of shares or debentures to a particular group of persons is made by a listed company, to raise funds. |

| 2. Private Placement is governed by Section 42 of the Companies Act, 2013. | Conversely, in the case of Preferential Allotment Section 62 (I) of the Companies Act, 2013 will apply. |

| 3. In the case of private placement, ‘Private placement offer letter’ is sent to the investors for inviting them to subscribe for shares. | As against, in the case of preferential allotment, no such offer document is issued to people. |

| 4. In private placement, application money can be received through cheques, demand draft or any other banking modes but not cash. | Unlike, preferential allotment in which the money is received in cash or kind. |

| 5. In private placement, the application money is kept in the separate bank account of a scheduled commercial bank. | On the contrary, no such account is required in case of preferential allotment. |

| 6. The private placement must be authorized by the articles of association of the company. | In contrast, no such authorization is required in case of preferential allotment. |

Question 10.

Discuss briefly the following methods of raising funds from the primary capital market:

(i) Public issue

(ii) Rights issue

(iii) Preferential issue

(iv) Private placement.

(v) Qualified institutional placement (QIP). (June 2012, 3 marks each)

Answer:

(i) When an issue/offer of securities is made to new investors for becoming part of shareholders’ family of the issuer it is called a public issue. Public issue can be further classified into Initial public offer (IPO) and Further public offer (FPO).

(ii) When an issue of securities is made by an issuer to its shareholders existing as on a particulars date fixed by the issuer (i.e. record date), it is called a rights issue. The right are offered in a particular ratio to the number of securities held as on the record date.

(iii) Preferential issue means issuance of equity shares to promoter group or selected investors. It covers allotment of fully convertible debentures, partly convertible debentures or any other financial instruments that could be converted into equity shares at a later date’. The investors could be institutional investors, private equity investors, high net-worth individuals, or companies.

(iv) Private placement [Sec. 42(2)] means offer of securities or invitation to subscribe securities made to such number of persons not exceeding 50 or such higher number as may be prescribed i.e. 200, in a financial year.

Here, for the purpose of 200 persons, Securities Offered to following will be excluded:

(a) qualified institutional buyers; and

(b) employees of the company, to whom securities are offered under employees stock option.

(v) “Qualified Institutional Placement” means issue of eligible securities by a listed issuer to qualified institutional buyers on a private placement basis and includes an offer for sale of specified securities by the promoters and/or promoter group on a private placement basis, in terms of SEBI(ICDR) Regulation, 2018. Here following terms are important:

(a) “eligible securities” include equity shares, non-convertible debt instruments along with warrants and convertible securities other than warrants;

(b) “relevant date” means:

(i) in case of allotment of equity shares, the date of the meeting in which the board of directors of the issuer or the committee of directors duly authorised by the board of directors of the issuer decides to open the proposed issue;

(ii) in case of allotment of eligible convertible securities, either the date of the meeting in which the board of directors of the issuer or the committee of directors duly authorised by the board of directors of the issuer decides to open the issue of such convertible securities or the date on which the holders of such convertible securities become entitled to apply for the equity shares.

Question 11.

Explain the concept of ASBA in an IPO. (June 2012, 5 marks)

Answer:

ASBA is an application for subscribing to an issue, containing an authorization to block the application money in a bank account. In all public issues and rights issues, where not more than one payment option is given, the issuer shall provided the facility of ASBA in accordance with the procedure and eligibility criteria specified by SEBI. However in case of qualified institutional buyers and non-institutional investors the issuer shall accept bids using ASBA facility only. ASBA process is applicable to all book-built public issues which provide for not more than one payment option.

Question 12.

What are the criteria for compulsory delisting by stock exchanges? (June 2012, 5 marks)

Answer:

The Compulsory delisting by a stock exchange is given in Regulation 32 of SEBI (Delisting of Equity Shares) Regulation, 2021. Following are the relevant provisions in this regard:

(1) Reasonable opportunity of being heard [Reg. 32(1)]: ARSE may, by a reasoned order, delist equity shares of a company on any ground prescribed in the rules made under the Securities Contracts (Regulation) Act, 1956, by giving a reasonable opportunity of being heard.

(2) Constitution of Panel [Reg. 32(2)]: The decision regarding the compulsory delisting shall be taken by a panel to be constituted by the recognised stock exchange consisting of –

(a) two directors of the recognised stock exchange one of whom shall be a public representative;

(b) one representative of an investor association recognised by the Board;

(c) one representative of the Ministry of Corporate Affairs or Registrar of Companies; and

(d) the Executive Director or Secretary of the recognised stock exchange.

(3) Publication in Newspaper [Reg. 32(3)]: Before passing an order for delisting, the RSE shall also give a notice in at least one English national newspaper with wide circulation, one Hindi national newspaper with wide circulation in their all India editions and one vernacular newspaper of the region where the relevant recognised stock exchange is located, of the proposed delisting, giving a time period of not less than fifteen working days from the date of such notice, within which representations, if any, may be made to the recognised stock exchange by any person aggrieved by the proposed delisting and shall also display such notice on its trading systems and website.

(4) Considering the representation [Reg. 32(4)]: The RSE shall, while passing any order under sub-regulation (1), consider the representation, if any, made by the company and also any representation received in response to the notice given under sub-regulation (3), and shall comply with the guidelines provided in Schedule III of these regulations.

(5) Publication of Notice of delisting [Reg. 32(5)]: Where the RSE passes an order under sub-regulation (1), it shall, –

(a) forthwith publish a notice in one English national newspaper with wide circulation, one Hindi national newspaper with wide circulation in their all India editions and one vernacular newspaper of the region where the relevant recognised stock exchange is located, of the fact of such delisting, disclosing therein the name and address of the company, the fair value of the delisted equity shares determined under sub-regulation (1) of regulation 33 of these regulations and the names and addresses of the promoters of the company who would be liable under sub-regulation (4) of regulation 33 of these regulations;

(b) inform all other stock exchanges where the equity shares of the company are listed, about such delisting; and

(c) upload a copy of the said order on its website.

(6) Non Applicability [Reg. 32(6)]: The provisions of Chapter IV of these regulations shall not be applicable to a compulsory delisting made by a RSE under this Chapter.

![]()

Question 13.

Explain the following statements:

(ii) “Pre-marketing is a tool through which syndicate members evaluate the prospects of the issue.”

(iii) “SEBI has provided alternative eligibility norms for the public issues of securities.”

(iv) “Preferential issue is not for retail investors.”

(vi) “Market making is compulsory for public issues.”

(vii) “An issuer can offer specified securities at different prices.” (Dec 2012, 4 marks each)

Answer:

(ii) Pre-marketing is a tool through which the syndicate members evaluate the prospectus of the issue. This is normally done closer to the issue. The research analysts along with the sales force of the syndicate members meet the prospective investors during pre-marketing road show. This enables the syndicate members to understand the market and the probable response from the prospective investors.

The pre-marketing exercise helps in assessing the depth of investors’ interest in the proposed issued, their view about the valuation of the share and the geographical locations of the investors who are interested in the issue. The response received during pre-marketing provides vital information for taking important decisions relating to timing, pricing and size of the issue. This would also help the syndicate members in evolving strategies for marketing the issue.

(iii) An issuer not satisfying the condition stipulated in Regulation 6(1) of SEBI (Issue of Capital & Disclosure Requirements) Regulations, 2018 shall be eligible to make an initial public offer only if the issue is made through the book-building process and the issuer undertakes to allot at least 75% of the net offer to qualified institutional buyers and to refund the full subscription money if it fails to do so. The purpose of alternative eligibility route is to provide sufficient flexibility and also to ensure that genuine companies do not suffer on account of rigidity of the parameters.

(iv) Preferential issue means issuance of equity shares to promoter group or selected investors. It covers allotment of fully convertible debentures, partly convertible debentures or any other financial instruments that could be converted into equity shares at a later date. The investors could be institutional investors, private equity investors, high networth individuals, or companies. Thus, preferential issue is not for retail investors.

(vi) The given statement that “Market making is compulsory for public issues” following are the relevant points in this regard:”

(1) The lead manager(s) shall ensure compulsory market making through the stock brokers of the SME exchange(s) appointed by the issuer, in the manner specified by the Board for a minimum period of 3 years from the date of listing of the specified securities or from the date of migration from the Main Board in terms of Regulation 276.

(2) The market maker or issuer, in consultation with the lead manager(s) may enter into agreements with the nominated investors for receiving or delivering the specified securities in market making, subject to the prior approval of the SME exchange.

(3) The issuer shall disclose the details of the market making arrangement in the offer document.

(4) The specified securities being bought or sold in the process of market making may be transferred to or from the nominated investors with whom the lead manager(s) and the issuer have entered into an agreement for market making: Provided that the inventory of the market maker, as on the date of allotment of the specified securities, shall be at least 5% of the specified securities proposed to be listed on SME exchange.

(5) The market maker shall buy the entire shareholding of a shareholder of the issuer in one lot, where the value of such shareholding is less than the minimum contract size allowed for trading on the SME exchange: Provided that market maker shall not sell in lots less than the minimum contract size allowed for trading on the SME exchange.

(6) The market maker shall not buy the shares from the promoters or persons belonging to the promoter group of the issuer or any person who has acquired shares from such promoter or person belonging to the promoter group during the compulsory market making period.

(vii) yes, an issuer can issue specified securities at different prices. Following are important points in this regard relating to different prices, given in Regulation 30:

(1) The issuer may offer its specified securities at different prices, subject to the following:

(a) retail individual investors or retail individual shareholders or employees entitled for reservation made under Regulation 33 may be offered specified securities at a price not lower than by more than ten percent, of the price at which net offer is made to other categories of applicants, excluding anchor investors;

(b) in case of a book built issue, the price of the specified securities offered to the anchor investors shall not be lower than the price offered to other applicants;

(c) In case the issuer opts for the alternate method of book building in terms of Part D of Schedule XIII, the issuer may offer the specified securities to its employees at a price not lower than by more than ten percent, of the floor price.

(2) Discount, if any, shall be expressed in rupee terms in the offer document.

Question 14.

Discuss briefly the SEBI regulations for preferential issue of shares by listed companies. (Dec 2012, 5 marks)

Answer:

1. Conditions for preferential Issue: A listed issuer making a preferential issue of specified securities shall ensure that:

(a) all equity shares allotted by way of preferential issue shall be made fully paid up at the time of the allotment;

(b) a special resolution has been passed by its shareholders;

(c) all equity shares held by the proposed allottees in the issuer are in dematerialised form;

(d) the issuer is in compliance with the conditions for continuous listing of equity shares as specified in the listing agreement with the stock exchange where the equity shares of the issuer are listed and the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements), 2015, as amended, and any circular or notification issued by the Board thereunder;

(e) the issuer has obtained the Permanent Account Numbers of the proposed allottees, except those allottees which may be exempt from specifying their Permanent Account Number for transacting in the securities market by the Board.

2. The issuer shall not make preferential issue of specified securities to any person who has sold any equity shares of the issuer during the six month preceding the relevant date.

3. Any person belonging to promoter(s) or the promoter group has previously subscribed to warrants of an issuer but failed to exercise the warrants, the promoter(s) and promoter group shall be ineligible for issue of specified securities of such is jer on preferential basis for a period of one year from:

- the date of expiry of the tenure of the warrants due to non- exercise of the option to convert, or

- the date of cancellation of the warrant.

Question 15.

(b) What are the eligibility conditions for making a fast track issue (FTI)? (June 2013, 5 marks)

(c) What do you understand by Qualified Institutional Placement (QIP)? (June 2013, 5 marks)

(d) State the SEBI regulations relating to issue of rights Shares. (June 2013, 5 marks)

Answer:

(b) Regulation 155 of SEBI (ICDR) Regulations, Institutions provides for following conditions for fast track public issue:

(a) Minimum listing period: Equity shares of the issuer have been listed on any stock exchange for a period of at least 3 years immediately preceding the reference date;

(b) Demat Form: Entire shareholding of the promoter group of the issuer is held in dematerialised form on the reference date.

(c) Average Market Capitalisation: Average market capitalisation of public shareholding of the issuer is at ₹ 1,000 crores in case of public issue.

| EXPLANATION | Average market capitalisation of public shareholding |

| It means the sum of daily market capitalisation of public shareholding for a period of one year up to the end of the quarter preceding the month in which the proposed issue was approved by the shareholders or the board of the Issuer, as the case may be, divided by the number of trading days. | |

(d) Annualised trading turnover: Annualised trading turnover of the equity shares of the issuer during 6 calendar months immediately preceding the month of the reference date has been at least 2% of the weighted average number of equity shares listed during such 6 months period.

(e) Annualized delivery-based trading turnover: Annualized delivery-based trading turnover of the equity shares during six calendar months immediately preceding the month of the reference date has been at least 10% of the annualised trading turnover of the equity shares during such 6 months period.

(f) Compliance with Listing Agreement: Issuer has been in compliance with the equity listing agreement or the SEBI (LODR) Regulations, 2015, as applicable, for a period of at least 3 years immediately preceding the reference date.

(g) Grievances Redressed: Issuer has redressed at least 95% of the complaints received from the investors till the end of the quarter immediately preceding the month of the reference date;

(h) No Prosecution: No show-cause notices have been issued or prosecution proceedings have been initiated by the Board and pending against the issuer or its promoters or whole-time directors as on the reference date;

(i) No Settlement: Issuer or promoter or promoter group or director of the issuer has not settled any alleged violation of securities laws through the consent or settlement mechanism with the Board during 3 years immediately preceding the reference date.

(j) No suspension of Trading: Equity shares of the issuer have not been suspended from trading as a disciplinary measure during last 3 years immediately preceding the reference date.

(k) No conflict of interest: There shall be no conflict of interest between the lead manager(s) and the issuer or its group companies in accordance with the applicable regulations.

(l) Impact of audit qualifications: Impact of audit qualifications, if any and where quantifiable, on the audited accounts of the issuer in respect of those financial years for which such accounts are disclosed in the letter of offer does not exceed 5% of the net profit or loss after tax of the issuer for the respective years.

(c) (I) Definition of Qualified Institutions Placement [Reg.2(tt)]: “Qualified institutions placement” means issue of eligible securities by a listed issuer to qualified institutional buyers on a private placement basis and includes an offer for sale of specified securities by the promoters and/or promoter group on a private placement basis, in terms of these regulations.

(II) Qualified Institutions Placement: A listed issuer may make a qualified institutions placement of eligible securities if it satisfies the following conditions:

(a) a special resolution approving the qualified institutions placement has been passed by its shareholders; Provided that no shareholders’ resolution will be required in case the qualified institutions placement is through an offer for sale by promoters or promoter group for compliance with minimum public shareholding requirements specified in the Securities Contracts (Regulation) Rules, 1957;

(b) that allotment pursuant to the special resolution shall be completed within a period of 365 days from the date of passing of the resolution.

(c) the equity shares of the same class, which are proposed to be allotted through qualified institutions placement or pursuant to conversion or exchange of eligible securities offered through qualified institutions placement, have been listed on a stock exchange for a period of at least 1 year prior to the date of issuance of notice to its shareholders for convening the meeting to pass the special resolution:

(d) An issuer shall be eligible to make a qualified institutions placement if any of its promoters or directors is not a fugitive economic offender.

(e) All eligible securities issued through a qualified institutions placement shall be listed on the recognised stock exchange where the equity shares of the issuer are listed. Provided that the issuer shall seek approval under Rule 19(7) of the Securities Contracts (Regulation) Rules, 1957, if applicable.

(f) The issuer shall not make any subsequent qualified institutions placement until the expiry of 6 months from the date of the prior qualified institutions placement made pursuant to one or more special resolutions.

(d) Securities and Exchange Board of India (SEBI) has issued circular No. SEBI/HO/CFD/DIL2/CIR/P/2020/13 dated January 22, 2020 regarding Streamlining the Process of Rights Issue by amending SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (“ICDR Regulations”) and SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“LODR Regulations”). This circular shall be applicable for all rights issues and fast track rights issue where Letter of Offer (LoF) is filed with the stock exchanges on or after February 14, 2020.

The Securities and Exchange Board of India (SEBI), has simplified the rights issue process to make it more efficient and effective, by amending the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (“ICDR Regulations”) and SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“LODR Regulations”). Accordingly, following changes are made with respect to the Rights Issue process :

1. The period for advance notice to stock exchange(s) under Regulation 42(2) of LODR Regulations has been reduced from at least 7 working days to at least 3 working days (excluding the date of intimation and the record date), for the purpose of rights issue.

2. Issuance of newspaper advertisement disclosing date of completion of dispatch and intimation of same to the stock exchanges for dissemination on their websites, as per Regulation 84 (1) of ICDR Regulations, shall be completed by the issuer at least 2 days before the date of opening of the issue.

3. Introduction of dematerialized Rights Entitlements (REs) –

- In the letter of offer and the abridged letter of offer, the issuer shall disclose the process of credit of REs in the demat account and renunciation thereof.

- REs shall be credited to the demat account of eligible shareholders in dematerialized form.

- In REs process, the REs with a separate ISIN shall be credited to the demat account of the shareholders before the date of opening of the issue, against the shares held by them as on the record date.

- Physical shareholders shall be required to provide their demat account details to Issuer / Registrar to the Issue for credit of REs not later than two working days prior to the issue closing date, such that credit of REs in their demat account takes place at least one day before the issue closing date.

4. Trading of dematerialized REs on stock exchange platform –

1. REs shall be traded on secondary market platform of Stock exchanges, with T+2 rolling settlement, similar to the equity shares. Trading in REs on the secondary market platform of stock exchanges shall commence along with the opening of the issue and shall be closed at least four days prior to the closure of the rights issue.

2. Investors holding REs in dematerialized mode shall be able to renounce their entitlements by trading on stock exchange platform or off-market transfer. Such trades will be settled by transferring dematerialized REs through depository mechanism, in the same manner as done for all other types of securities.

5. Payment mode – Application for a rights issue shall be made only through ASBA facility.

6.

- No withdrawal of application shall be permitted by any shareholder after the issue closing date.

- The detailed procedures on the Rights Issue process are given at Annexure I for due compliance.

- This circular shall be applicable for all rights issues and fast track rights issue where Letter of Offer (LoF) is filed with the stock exchanges on or after February 14, 2020.

- All entities involved in the Rights Issue process are advised to take necessary steps to ensure compliance with this circular including the procedures stated at Annexure I of this circular.

- This circular is being issued in exercise of the powers under section 11 read with section 11A of the Securities and Exchange Board of India Act, 1992.

![]()

Question 16.

Explain the following terms associated with public offering of equity shares. Attempt any five:

(i) Subscription list

(ii) Issue opening date

(iii) Differential pricing

(iv) Lock-in-period

(v) Price band

(vi) Red-herring prospectus. (June 2013, 4 marks each)

Answer:

(i) Subscription List:

(I) Meaning of subscription list: It means a list or record of subscription and subscribers. In case of issue of securities subscription list or subscription record is kept open for a certain period, which is known as “ Period of subscription”.

(II) Subscription period: As per Regulation 45 subscription period is as follows:

(1) Except as otherwise provided in these regulations, an initial public offer shall be kept open for at least three working days and not more than ten working days.

(ii) Issue Opening Date:

(I) Meaning of “Issue Opening date”: It means the maximum period, within which shares must be offered to public for subscription.

(II) Provision relating to “Opening of the issue”[ Reg. 140]:

(1) Subject to the compliance with the provisions of the Companies Act, 2013, a public issue may be opened within 12 months from the date of issuance of the observations by the Board under sub-regulation (4) of Regulation 123; or Provided that in case of a fast track issue, the issue shall open within the period specifically stipulated under the Companies Act, 2013.

(2) In case of shelf prospectus, the first issue may be opened within 3 months of issuance of observations by the Board.

(3) The issue shall be opened after at least 3 working days from the date of filing the red herring prospectus with the Registrar of Companies in case of book built issues and prospectus with the Registrar of Companies in case of fixed price issues.

(iii) Differential pricing:

Yes, an issuer can offer specified securities at different prices. Regulation 30 of SEBI (ICDR) Regulation, 2018 permits the issuer to offer its specified securities at different prices, subject to the following conditions

(a) Discounted price for retail individual investors or retail individual shareholders or employees entitled for reservation made under Regulation 33 may be offered specified securities at a price not lower than by more than 10% of the price at which net offer is made to other categories of applicants, excluding anchor investors;

(b) No lower price for anchor investor in case of a book built issue, the price of the specified securities offered to the anchor investors shall not be lower than the price offered to other applicants;

(c) Discounted price in case of alternate book building in case the issuer opts for the alternate method of book building in terms of Part D of Schedule XIII, the issuer may offer the specified securities to its employees at a price not lower than by more than 10% of the floor price.

(d) Disclosure of Discount: Discount, if any, shall be expressed in rupee terms in the offer document.

(iv) Lock-in-period: The specified securities held by the promoters shall not be transferable (hereinafter referred to as “lock-in”) for the periods as stipulated hereunder:

(a) minimum promoters’ contribution including contribution made by AIFs, FVCs etc, shall be locked-in for a period of 3 years from the date of commencement of commercial production or date of allotment in the initial public offer, whichever is later;

(b) promoters’ holding in excess of minimum promoters’ contribution shall be locked-in for a period of 1 year from the date of allotment in the initial public offer.

(v) Price and Price Band :

(I) Meaning of Price Band: It means a range of prices within which investors can bid. This pricing technique is used in case of book building process.

(II) Regulation about Price Band [Regulation 29]:

(1) The issuer may mention a price or a price band in the offer document (in case of a fixed price issue) and a floor price or a price band in the red herring prospectus (in case of a book built issue) and determine the price at a later date before filing the prospectus with the Registrar of Companies: Provided that the prospectus filed with the Registrar of Companies shall contain only one price or the specific coupon rate, as the case may be.

(2) The cap on the price band and coupon rate in case of convertible debt instruments shall be less than or equal to 120% of the floor price. Provided that the cap of the price band shall be at least 105% of the floor price.

(3) The floor price or the final price shall not be less than the face value of the specified securities.

(4) Where the issuer opts not to make the disclosure of the floor price or price band in the red herring prospectus, the issuer shall announce the floor price or the price band at least 2 working days before the opening of the issue in the same newspapers in which the pre-issue advertisement was released or together with the pre-issue advertisement in the format prescribed under Part A of Schedule X.

(5) The announcement referred to in sub-regulation (4) shall contain relevant financial ratios computed for both upper and lower end of the price band and also a statement drawing attention of the investors to the section titled “basis of issue price” of the offer document.

(6) The announcement referred to in sub-regulation(4) and the relevant financial ratios referred to in sub-regulation(5) shall be disclosed on the website of the stock exchange(s) and shall be made available on the websites of the stock exchange(s).

(vi) Red-herring prospectus: Red-herring prospectus (RHP) is a prospectus, which does not have details of either price or number of shares being offered, or the amount of issue. A RHP for a Further Public Offer (FPO) can be filed with the ROC without the price band and the issuer, in such a case will notify the floor price or a price band by way of an advertisement.

In the case of book-built issues, it is a process of price discovery and the price cannot be determined until the bidding process is completed. Hence, such details are not shown in the Red Herring Prospectus filed with ROC in terms of the provisions of the Companies Act. Only on completion of the bidding process, the details of the final price are included in the offer document. The offer document thereafter with ROC is called a prospectus.

Question 17.

Comment on the following statements:

(a) Book-building process of determining price of a public issue is preferred in case of initial public offer (IPO) while fixed price process is used for further public offer (FPO).

(d) A company cannot offer shares at different prices to different sets of people in a particular public issue.

(e) Every institutional buyer is a qualified institutional buyer (QIB). (Dec 2013, 4 marks each)

Answer:

(a) False:

‘Fixed price process’ and ‘Book Building process’ are pricing mechanisms in the issue of shares through public offer. When an issuer at the outset decides the issue price and mentions in the offer document, it is commonly known as “Fixed price issue”. On the other hand, when the price of an issue is discovered on the basis of demand received from the prospective investors at various price levels, it is called as “Book Built Issue”.

A company, whether issues shares through Initial Public Offer (IPO) or Further Public Offer (FPO) has the option to choose the pricing mechanism, under ‘Fixed Price Issue’ or ‘Book Built Issue’, subject to conditions specified under SEBI (ICDR) Regulations, 2018.

(d) The given statement i.e. “A company can’t offer shares at different prices to different sets of people in a particular public issue” is not correct. As per Regulation 30 of SEBI (ICDR) Regulations, 2018 an issuer company can offer specified securities at different prices, subject to following conditions:

(1) The issuer may offer its specified securities at different prices, subject to the following:

(a) retail individual investors or retail individual shareholders or employees entitled for reservation made under Regulation 33 may be offered specified securities at a price not lower than by more than ten percent, of the price at which net offer is made to other categories of applicants, excluding anchor investors;

(b) in case of a book built issue, the price of the specified securities offered to the anchor investors shall not be lower than the price offered to other applicants;

(c) In case the issuer opts for the alternate method of book building in terms of Part D of Schedule XIII, the issuer may offer the specified securities to its employees at a price not lower than by more than ten percent, of the floor price.

(2) Discount, if any, shall be expressed in rupee terms in the offer document.

(e) False:

Every ‘Institutional Buyer’ is not a ‘Qualified Institutional Buyer (QIB)’. SEBI (ICDR) Regulations, 2018 defines “Qualified Institutional Buyers”. Accordingly, “Qualified Institutional Buyers” shall mean the following:

- A mutual fund, venture capital fund, alternative investment fund and foreign venture capital investor registered with SEBI;

- A foreign portfolio investor other than category III foreign portfolio investor registered with SEBI.

- Public Financial Institutions within the meaning of Section 2(72) of Companies Act, 2013;

- Scheduled Commercial Banks;

- Multilateral and Bilateral Development Financial Institutions;

- State Industrial Development Financial Corporations;

- Insurance Companies;

- Provident Funds with minimum corpus of ₹ 25 Crores;

- Pension Funds with minimum corpus of ₹ 25 Crores; and

- National Investment Fund;

- Insurance Funds set up and managed by Army, Navy or Air Force; and

- Insurance Funds set up and managed by the Department of Posts. So it is obvious that only selected institutional buyers are covered here, so it will be wrong to say that “Every institutional buyer is a qualified institutional buyer”.

Question 18.

The shares of Runfast Ltd. were listed in Delhi Stock Exchange. The stock exchange delisted the shares of the company. The aggrieved company approaches you as a Company Secretary in Practice to know the remedy available to the company. Give your suggestions to the company keeping in view the provisions of the Securities Contracts (Regulation) Act, 1956. (Dec 2014, 10 marks)

Answer:

Section 21A provides that a recognised stock exchange may delist the securities, after recording the reasons therefor, from any recognised stock exchange on any of the ground or grounds as may be prescribed under this Act. The securities of a company shall not be delisted unless the company concerned has been given a reasonable opportunity of being heard.

A listed company or an aggrieved investor may file an appeal before the Securities Appellate Tribunal against the decision of the recognised stock exchange delisting the securities within 15 days from the date of the decision of the recognized stock exchange delisting the securities and the provisions of Sections 22B to 22E of this Act, shall apply, as far as may be, to such appeals.

The Securities Appellate Tribunal may, if it is satisfied that the company was prevented by sufficient cause from filing the appeal within the said period, allow it to be filed within a further period not exceeding 1 month. So in the instant case ‘Runfast Ltd.’ should file an appeal to the SAT against the delisting decision of Delhi Stock Exchange within 15 days or such extended period not exceeding 1 (one) month after showing sufficient cause of not filing within 15 days.

![]()

Question 19.

What is ‘market-making’? Discuss in brief the obligation of a market-maker. (June 2015, 5 marks)

Answer:

(I) Meaning of Market Making:

Market making is a process whereby two way quotes are offered for the purpose of facilitating trading in respect of certain scrips. Market-making is aimed at infusing liquidity in securities that are not frequently traded on stock exchanges. It adds liquidity to scrips, for which market making is being done, the main advantage of market making is that it affords much needed liquidity to the securities. It also increases the supply of scrips in the market and also triggers demand for the scrips in the market.

(II) Obligations of Market Maker:

The person(s) who offers the facility of market making is known as ‘Market Maker’. Following are the obligations of market maker:

(i) A market-maker is responsible for enhancing the demand supply situation in securities such as stocks and futures & options (F&O).

(ii) A market-maker usually is responsible for enhancing activity in a few chosen securities. In the process, the market-maker provides both a buy and a sell quote for his chosen securities. He profits from the spread between buy and sell quotes. For example, if the market-maker gives a bid-ask quote of ₹ 505-500 (which means the market – maker will buy from the market at ₹ 500 and sell at ₹ 505), then the profit is ₹ 5. For illiquid securities, the profit spreads are usually higher (within a regulator-prescribed band) because of the higher risk taken by the market-maker.

(iii) Market-makers are obligated to buy or sell the security at a price and size they have quoted.

(iv) One may wonder the role of a market-maker in the computerised system, as investors can transact directly without a third party. The market-maker’s role here is to ensure supply of stocks at any given point in time. Market-makers are helpful as they are always ready to buy or sell as long as investors are willing to pay the price quoted by them.

Question 20.

What do you mean by ‘reservation on competitive basis’? Who are the persons eligible in case of issue made through book building process? (June 2015, 5 marks)

Answer:

(I) Meaning: Reservation on competitive basis means reservation wherein specified securities are allotted in portion of the number of specified securities applied for in respect of a particular reserved category to the number of specified securities reserved for that category.

(II) Eligible Persons: As per Regulation 130(1) of SEBI (ICDR) Regulations 2018, the issuer may make reservations on a competitive basis out of the issue size excluding promoters’ contribution in favour of the following categories of persons:

(a) employees;

(b) shareholders (other than promoters and promoter group) of listed subsidiaries or listed promoter companies.

Provided that the issuer shall not make any reservation for the lead manager(s), registrar, syndicate member(s), their promoters, directors and employees and for the group or associate companies (as defined under the Companies Act, 2013) of the lead manager(s), registrar and syndicate member(s) and their promoters, directors and employees.

Question 21.

Comment on the following statement:

(c) Delisting is not permissible under certain circumstances. (June 2015, 4 marks)

Answer:

In following cases delisting is not permissible as per SEBI (Delisting of Equity Shares) Regulations, 2021:

(a) Buy back of equity shares by the company; or

(b) Preferential allotment made by the company; or

(c) Unless a period of three years has elapsed since the listing of that class of equity shares; or

(d) Instruments which are convertible into the same class of equity shares that are sought to be delisted are outstanding.

(e) Delisting of convertible securities.

(f) No promoter shall directly or indirectly employ the funds of the company to finance an exit opportunity or an acquisition of shares made pursuant to provided under these regulation.

(g) Employ any device, scheme or artifice to defraud any shareholder or other person; or

(h) Engage in any transaction or practice that operates as a fraud or deceit upon any shareholder or other person; or

(i) Engage in any act or practice that is fraudulent, deceptive or manipulative in connection with such delisting.

Question 22.

What is SME exchange? Explain the benefits of listing on SME exchange. (Dec 2015, 4 marks)

Answer:

(I) Meaning of SME exchange:

(a) It means a trading platform of a recognised stock exchange having nationwide trading terminals permitted by SEBI to list the specified securities issued in accordance with SEBI (ICDR) Regulation and includes a stock exchange granted recognition for this purpose but does not include the Main Board.

(b) Here Main Board means a recognized stock exchange having nationwide trading terminals, other than SME exchange.

(c) The two stock exchange of India i.e. Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) have begun their SME listing platforms. While BSE SME Exchange began its operation in March, 2012, NSE’s SME exchange titled EMERGE commenced operations in September, 2012.

(II) Benefits of Listing on SME Exchange:

(a) Access to capital and future financing opportunities: Going public would provide the-MSME’s with equity financing opportunities to grow their business from expansion of operations to acquisitions.

(b) increased visibility and prestige:

Going public is likely to enhance the company’s visibility. Greater public awareness gained through media coverage, publicly filed documents and coverage of stock by sector investment analysts can provide the SME with greater profile and credibility. This can result in a more diversified group of investors, which may increase the demand for that company’s shares leading to an increase in the company’s value.

(c) Participation by Venture Capital (VC):

It has been seen that there is greater vitality of venture capital in stock market-centered systems. The underdeveloped equity culture has made it difficult for companies to both get into the VC phase as well as graduate from venture capital/startups phase to a scale of operations that would make them internationally competitive. A vibrant equity market would provide prove to be an added incentive for greater venture capital participation by providing an exit option leading to a reduction in their lock-in period.

(d) Liquidity for shareholders:

Becoming a public company establishes a market for the company’s shares, providing its investors with an efficient and regulated vehicle in which to trade their own shares. Greater liquidity in the public market can lead to better valuation for shares than would be seen through private transactions.

(e) Create employee incentive mechanisms:

The employees of the SME enterprises can participate in the ownership of their own company and benefit from being a shareholder.

(f) Facilitate growth through Mergers and Acquisitions:

As a public company, company’s shares can be utilized as an acquisition currency to acquire target companies, instead of a direct cash offering. Using shares for an acquisition can be a tax efficient and cost effective vehicle to finance such a transaction.

(g) Encourages Innovation and Entrepreneurial Spirit:

The ability of companies in their early stages of development to raise funds in the capital markets allows these companies to grow very quickly. This growth helps speed up the dissemination of new technologies throughout the economy. In addition, by raising the returns available from pursuing new ideas, technologies etc the capital markets facilitate entrepreneurial activities.

Question 23.

Whether fast track issue can be proceeded just like an IPO or, are there any other conditions to fast track issue? Explain. (Dec 2015, 8 marks)

Answer:

No, in case of fast track issue the company has to fulfill some additional conditions which are as:

(a) Minimum listing period: Equity shares of the issuer have been listed on any stock exchange for a period of at least three years immediately preceding the reference date;

(b) Demat Form: Entire shareholding of the promoter group of the issuer is held in dematerialised form on the reference date.

(c) Average Market Capitalisation: Average market capitalisation of public shareholding of the issuer is at ₹ 1000 crores in case of public issue.

(d)

| EXPLANATION | average market capitalisation of public sharehoiding |

| It means the sum of daily market capitalisation of public shareholding for a period of one year up to the end of the quarter preceding the month in which the proposed issue was approved by the shareholders or the board of the Issuer, as the case may be, divided by the number of trading days. | |

(e) Annualized delivery-based trading turnover: Annualized delivery- based trading turnover of the equity shares during six calendar months immediately preceding the month of the reference date has been at least 10% of the annualised trading turnover of the equity shares during such 6 months period.

(f) Compliance with Listing Agreement: Issuer has been in compliance with the equity listing agreement or the SEBI(LODR) Regulations, 2015, as applicable, for a period of atleast 3 years immediately preceding the reference date.

(g) Grievances Redressed: Issuer has redressed at least 95% of the complaints received from the investors till the end of the quarter immediately preceding the month of the reference date;

(h) No Prosecution: No show-cause notices have been issued or prosecution proceedings have been initiated by the Board and pending against the issuer or its promoters or whole-time directors as on the reference date;

(i) No Settlement: Issuer or promoter or promoter group or director of the issuer has not settled any alleged violation of securities laws through the consent or settlement mechanism with the Board during 3 years immediately preceding the reference date.

(j) No suspension of Trading: Equity shares of the issuer have not been suspended from trading as a disciplinary measure during last 3 years immediately preceding the reference date.

(k) No conflict of interest: There shall be no conflict of interest between the lead manager(s) and the issuer or its group companies in accordance with the applicable regulations.

(l) Impact of audit qualifications: Impact of audit qualifications, if any and where quantifiable, on the audited accounts of the issuer in respect of those financial years for which such accounts are disclosed in the letter of offer does not exceed 5% of the net profit or loss after tax of the issuer for the respective years.

Question 24.

Comment on the following:

(b) A company cannot offer its shares at different prices to different sets of people in a particular public issue. (Dec 2015, 5 marks)

(c) Book-building process of determining price of a public issue is preferred in case of initial public offer (IPO) while fixed price process is used for further public offer (FPO). (Dec 2015, 5 marks)

Answer:

(b) Yes, an issuer company can offer specified securities at different prices. However, it has to satisfy following conditions:

(a) retail individual investors or retail individual shareholders or employees entitled for reservation made under Regulation 33 may be offered specified securities at a price not lower than by more than 10% of the price at which net offer is made to other categories of applicants, excluding anchor investors;

(b) in case of a book built issue, the price of the specified securities offered to the anchor investors shall not be lower than the price offered to other applicants;

(c) In case the issuer opts for the alternate method of book building in terms of Part D of Schedule XIII, the issuer may offer the specified securities to its employees at a price not lower than by more than 10% of the floor price.

(d) Discount, if any, shall be expressed in rupee terms in the offer document.

Question 25.

Comment on the following and support your answer with necessary reasons:

(iii) The market makers infuse liquidity in securities that are not frequently traded on stock exchanges. (June 2016, 4 marks)

Answer:

(i) Nature of Statement: The given statement i.e. “The market makers infuse liquidity in securities that are not frequently traded on stock exchanges” is correct.

(ii) Reason: A market-maker is responsible for enhancing the demand supply situation in securities such as stocks and futures. In the process, the market-maker provides both a buy and a sell quote for his chosen securities. Market-makers are obligated to buy or sell the security at a price and size they have quoted.

![]()

Question 26.

Can a company issue shares at differential price in a public issue? If yes, to whom and under what circumstances the shares can be issued at differential price? (Dec 2016, 4 marks)

Answer:

Yes, a company can issue shares at differential prices in a public issue as per SEBI (ICDR) Regulations, 2018, an issuer company can offer specified securities at different prices, subject to following conditions:

The Statement i.e. “A Company can’t offer shares at different prices to different sets of people in a particular public issue” is not correct. As per SEBI (ICDR) Regulation 2018, an issuer company, can offer specified securities at different prices, subject to following conditions:

(a) retail individual investors or retail individual shareholders or employees entitled for reservation made under regulation 33 may be offered specified securities at a price not lower than by more than 10% of the price at which net offer is made to other categories of applicants, excluding anchor investors;

(b) in case of a book built issue, the price of the specified securities offered to the anchor investors shall not be lower than the price offered to other applicants;

(c) In case the issuer opts for the alternate method of book building in terms

of Part D of Schedule XIII, the issuer may offer the specified securities to its employees at a price not lower than by more than 10% of the floor price.

(d) Discount, if any, shall be expressed in rupee terms in the offer document.

Question 27.

As a Company Secretary of Lucky Ltd., prepare a Board note giving various requirements of SEBI guidelines for rights issue and enumerate the various major steps involved in such an issue. (Dec 2016, 8 marks)

Answer:

To

The Board of Directors

Date:———

Lucky Limited

Sub: SEBI Regulation for right issue and major steps for right issue Sir/ Madam,

We are highlighting SEBI Regulations for right issue for your consideration:

1. Check whether the rights issue is within the authorised share capital of the company. If not, steps should be taken to increase the authorised share capital.

2. In case of a listed company, notify the stock exchange concerned the date of Board Meeting at which the rights issue is proposed to be considered at least 2 days in advance of the meeting.

3. Rights issue shall be kept open for at least 15 days and not more than 30 days.

4. Convene the Board Meeting and place before it the proposal for rights issue.

5. The Board of Directors should decide on the following matters:

- Quantum of issue and the proportion of rights shares.

- Alteration of share capital, if necessary, and offering shares to persons other than existing holders of shares in terms of Section 62 of the Companies Act, 2013.

- Fixation of record date.

- Appointment of merchant bankers and underwriters (if necessary).

- Approval of draft letter of offer or authorisation of managing director/ company secretary to finalise the letter of offer in consultation with the managers to the issue, the stock exchange and SEBI.

6. Immediately after the Board Meeting notify the concerned Stock Exchanges about particulars of Board’s of Directors decision.

7. If it is proposed to offer shares to persons other than the shareholders of the company, a General Meeting has to be convened and a resolution is to be passed for the purpose in terms of Section 62 of the Companies Act, 2013.

8. Forward 6 sets of letter of offer to concerned Stock Exchange(s).

9. Dispatch letters of offer to shareholders by registered post.

10. Check that an advertisement giving date of completion of dispatch of letter of offer has been released in at least an English National Daily, one Hindi National Paper and a Regional Language Daily where registered office of the issuer company is situated.

11. Check that the advertisement contains the list of centres where shareholders or persons entitled to rights may obtain duplicate copies of composite application forms in case they do not receive original application form along with the prescribed format on which application may be made.

12. The applications of shareholders who apply both on plain paper and also in a composite application form are liable to be rejected.

13. Make arrangement with bankers for acceptance of share application forms.

14. Prepare a scheme of allotment in consultation with Stock Exchange.

15. Convene Board Meeting and make allotment of shares.

16. Make an application to the Stock Exchange(s) where the company’s shares are listed for permission of listing of new shares.

Thanking you

Your Sincerely

Sd/- ‘

(———)

(Signature)

Question 28.

Define the following:

(i) Fast track issue (Dec 2016, 3 marks)

Answer:

(I) Fast Track Issues: It may be defined as a time saving manner for bringing public issue by a listed company, satisfying the prescribed conditions of Regulations 155 of SEBI (ICDR) Regulation, 2018. As per the Regulation 155, a listed company can bring further public offer, without fulfilling the requirements of Regulation 123, which are as follows:

(a) No need to file three copies of the draft offer document with the concerned regional office of the Board;

(b) No need to file the draft offer document with the stock exchange(s) where the specified securities are proposed to be listed,

(II) Provision Related to Fast Track issue:

(a) Minimum Listing Period: Equity shares of the issuer have been listed on any stock exchange for a period of at least three years immediately preceding the reference date;

(b) Demat Form: Entire shareholding of the promoter group of the issuer is held in dematerialised form on the reference date.

(c) Average Market Capitalisation: Average Market Capitalisation of public shareholding of the issuer is at ₹ 1000 crores in case of public issue

| EXPLANATION | average market capitalisation of public shareholding |

| It means the sum of daily market capitalisation of public shareholding for a period of one year up to the end of the quarter preceeding the month in which the proposed issue was approved by the shareholders or the board of the Issuer, as the case may be, divided by the number of trading days. | |

(d) Annualised trading turnover: Annualised trading turnover of the equity shares of the issuer during 6 calendar months immediately preceding the month of the reference date has been at least 2% of the weighted average number of equity shares listed during such 6 months period.

(e) Annualized delivery-based trading turnover: Annualized delivery-based trading turnover of the equity shares during six calendar months immediately preceding the month of the reference date has been at least 10% of the annualised trading turnover of the equity shares during such 6 months period.

(f) Compliance with Listing Agreement: Issuer has been in compliance with the equity listing agreement or the SEBI (LODR). Regulations, 2015, as applicable, for a period of at least 3 years immediately preceding the reference date.

(g) Grievances Redressed: Issuer has redressed at least 95% of the complaints received from the investors till the end of the quarter immediately preceding the month of the reference date;

(h) No Prosecution: No show-cause notices have been issued or prosecution proceedings have been initiated by the Board and pending against the issuer or its promoters or whole-time directors as on the reference date;

(i) No Settlement: Issuer or Promoter or Promoter group or Director of the issuer has not settled any alleged violation of securities laws through the consent or settlement mechanism with the Board during 3 years immediately preceding the reference date.

(j) No Suspension of Trading: Equity shares of the issuer have not been suspended from trading as a disciplinary measure during last 3 years immediately preceding the reference date.

(k) No Conflict of interest: There shall be no conflict of interest between the lead manager(s) and the issuer or its group companies in accordance with the applicable regulations.

(l) Impact of Audit qualifications: Impact of Audit qualifications, if any and where quantifiable, on the audited accounts of the issuer in respect of those financial years for which such accounts are disclosed in the letter of offer does not exceed 5% of the net profit or loss after tax of the issuer for the respective years.

Question 29.

Comment on the followings:

(b) Benefits available to a company on listing at SME Exchange. (June 2017, 5 marks)

Answer:

Benefits of Listing on SME Exchange:

(a) Access to capital and future financing opportunities

(b) Going public would provide the MSME’s with equity financing opportunities to grow their business – from expansion of operations to acquisitions. Companies in the growth phase tend to get over-leveraged at which point, banks are reluctant to provide further credit. Equity capital is then necessary to bring back strength to the balance sheet.

(c) The option of equity financing through the equity market allows the firm to not only raise long-term capital but also get further credit due through an additional equity infusion. The issuance of public shares expands the investor base, and this in turn will help set the stage for secondary equity financings, including private placements.

(d) In addition, Issuers often receive more favourable lending terms when borrowing from financial institutions.

(e) The mechanics of listing on a stock exchange (audited balance sheets, being subject to corporate governance norms etc.) would address many of the transparency and informational asymmetry constraints that the financial institutions face in lending to the SME sector. In addition, equity financing lowers the debt burden leading to lower financing costs and healthier balance sheets for the firms. The continuing requirement for adhering to the stock market rules for the issuers lower the on-going information and monitoring costs for the banks.

(f) Increased visibility and prestige:

Going public is likely to enhance the company’s visibility. Greater public awareness gained through media coverage, publicly filed documents and coverage of stock by sector investment analysts can provide the SME with greater profile and credibility. This can result in a more diversified group of investors, which may increase the demand for that company’s shares leading to an increase in the company’s value.

Question 30.

Answer the following:

Briefly explain the provisions relating to delisting of equity shares under SEBI Regulations, 2021. (June 2017, 4 marks)

Answer:

(I) About Delisting: The term “delisting” of securities means permanent removal of securities of a listed company from a stock exchange. As

a consequence of delisting, the securities of that company would no longer be traded at that stock exchange. Delisting can be Voluntary or Compulsory as per SEBI (Delisting of Equity Shares) Regulations, 2021.

(II) Provisions regarding Delisting:

(a) Regulation 6 & 7: A company may delist its equity shares from one or more recognised stock exchanges where they are listed and continue their listing on one or more other recognised stock exchanges, if after the proposed delisting the equity shares:

- would remain listed on any recognised stock exchange which has nationwide trading terminals, no exit opportunity needs to be given to the public shareholders; and,

- do not remain listed on any recognised stock exchange having nation wide trading terminals, exit opportunity shall be given to all the public shareholders holding the equity shares sought to be delisted.

(b) Regulation 27: Further Regulation 35 of the SEBI (Delisting of Equity Shares) Regulations, 2021 provides special provisions for small Companies to be delisted from all the recognised stock exchanges where they are listed.

Question 31.

Answer the following:

(a) SEBI in exercise of the powers conferred by Section 31 read with Section 21A of the Securities Contracts (Regulation) Act, 1956, Section 30, Sub-section (1) of Section 11 and Sub-section (2) of Section 11A of SEBI Act, 1992 made the SEBI (Delisting of Equity Shares) Regulations 2021. Explain the framework and complete process of delisting as per regulations. (8 marks)

Answer:

Delisting” through Regulation 5 to 12:

The procedure of voluntary delisting can be conveniently summarized under two heads i.e.

Case I: Conditions and procedure for delisting where exit opportunity is not required (Reg.5-6)

(1) Delisting from some of the recognised stock exchanges [Reg. 5]:

A company may delist its equity shares from one or more of the recognised stock exchanges on which it is listed without providing an exit opportunity to the public shareholders, if after the proposed delisting,! the equity shares remain listed on any recognised stock exchange that has nationwide trading terminals.

(2) Procedure for delisting where no exit opportunity is required [Reg. 6]:

(1) Any company desirous of delisting its equity shares under the provisions of regulation 5 of these regulations shall –

(a) obtain the prior approval of its Board of Directors;

(b) make an application to the relevant recognised stock exchange(s) for delisting its equity shares;