Ind AS on Measurement based on Accounting Policies – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Ind AS on Measurement based on Accounting Policies – CA Final FR Study Material

Ind AS 8: Accounting Policies, Changes in Accounting Estimates and Errors

Change In Accounting Policies (Based On Para Nos. 14 To 27)

Question 1.

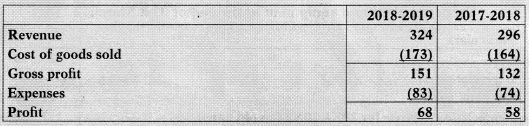

A Ltd. changed its method adopted for inventory valuation in the year 2018-2019. Prior to the change, inventory was valued using the first in first out method (FIFO). However, it was felt that in order to match current practice and to make the financial statements more relevant and reliable, a weighted average valuation model would be more appropriate.

The effect of the change in the method of valuation of inventory was as follows:

- 31st March, 2017 – Increase of ₹ 10 million

- 31st March, 2018 – Increase of ₹ 15 million

- 31st March, 2019 – Increase of ₹ 20 million

Profit or loss under the FIFO valuation model are as follows:

Retained earnings at 31st March, 2017 were ₹ 423 million

Present the change in accounting policy in the profit or loss and produce an extract of the statement of changes in equity in accordance with Ind AS 8.

Answer:

Profit or loss under weighted average valuation method is as follows:

Statement of changes in Equity (extract)

![]()

Question 2.

[Based on Para No. 25]

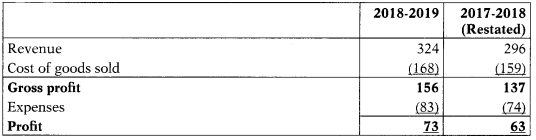

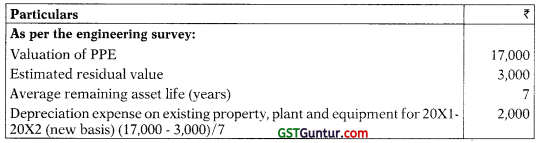

During the year ended 31st March, 20X2, Blue Ocean Group changed its accounting policy for depreciating property, plant and equipment, so as to apply components approach fully, whilst at the same time adopting the re valuation model.

In years before 20X1-20X2, Blue Ocean Group’s asset records were not suffi-ciently detailed to apply a component approach fully. At the end of 31st March, 20X1, management commissioned an engineering survey, which provided in-formation on the components held and their fair values, useful lives, estimated residual values and depreciable amounts at the beginning of 20X1-20X2.

The results are shown as under:

Property, plant and equipment at the end of 31st March, 20X1

However, the survey did not provide a sufficient basis for reliably estimating the cost of those components that had not previously been accounted for separately, and the existing records before the survey did not permit this information to be reconstructed.

The board of directors considered how to account for each of the two aspects of the accounting change. They determined that it was not practicable to account for the change to a fuller component approach retrospectively, or to account for that change prospectively from any earlier date than the start of 20X1-20X2.

Also, the change from a cost model to a revaluation model is required to be accounted for prospectively. Therefore, management concluded that it should apply Blue Ocean Group’s new policy prospectively from the start of 20X1-20X2.

Blue Ocean Group’s tax rate is 30 percent.

Compute the impact of change in accounting policy related to change in carrying amount of Property, Plant & Equipment under revaluation method and impact on taxes based on the basis of information provided.

Show the impact of each item affected on financial statements by the analysis of stated issue. [MTP-May 2020]

Answer:

As per Ind AS 8 prospective application of a change in accounting policy has to be done since retrospective application is not practicable.

Property, plant and equipment at the end of 31st March, 20X2:

Extract from Notes to Accounts:

From the start of 20X1-20X2, Blue Ocean Group changed its accounting policy for depreciating property, plant and equipment, so as to apply components approach, whilst at the same time adopting the revaluation model. Management takes the view that this policy provides reliable and more relevant information because it deals more accurately with the components of property, plant and equipment and is based on up-to-date values.

The policy has been applied prospectively from the start of the year 20X1 -20X2 because it was not practicable to estimate the effects of applying the policy either retrospectively or prospectively from any earlier date. Accordingly, the adoption of the new policy has no effect on prior years.

Impact on the financial statements for 20X1-20X2 would be as under:

| Particulars | ₹ |

| Increase the carrying amount of PPE at the start of the year (17,000-11,000) | 6,000 |

| Increase the opening deferred tax provision (6,000 × 30%) | 1,800 |

| Create a revaluation surplus at the start of the year (6,000 – 1,800) | 4,200 |

| Increase depreciation expense by (₹ 2,000 – ₹ 1,500) | 500 |

| Reduce tax expense on depreciation (30%) | 150 |

![]()

Change In Accounting Estimate (Based On Para Nos. 32 To 40)

Question 3.

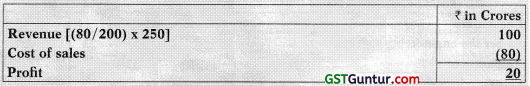

A is a construction contract company involved in building commercial properties. Its current policy for determining the percentage of completion of its contracts is based on the proportion of cost incurred to date compared to the total expected cost of the contract.

One of A’s contracts has an agreed price of ₹ 250 crores and estimated total costs of ₹ 200 crores. The cumulative progress of this contract is:

| Year ended | 31st March 20X1 | 31st March 20X2 |

| Cost incurred | 80 | 145 |

| Work certified and billed | 75 | 160 |

| Amount received against bills | 70 | 150 |

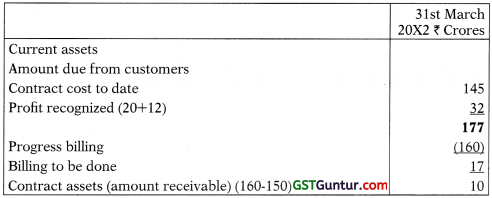

A prepared and published its financial statements for the year ended 31st March 20X1. Relevant extracts are:

Balance Sheet (Extracts)

A has received some adverse publicity in the financial press for taking its profit too early in the contract process, leading to disappointing profits in the later stages of contracts. Most of A’s competitors take profit based on the percentage of completion as determined by the work certified compared to the contract price.

Required

(a) Assume that A changes its method of determining the percentage of completion of contracts to that used by its competitors, as this would represent a change in an accounting estimate. Prepare equivalent extracts to the above for the year ended 31st March 20X2.

(b) Identify, whether the above change represents a change in accounting estimate or a change in accounting policy and why?

Answer:

(i) A’s income statement (extracts) for the year ended:

Statement of financial position (extracts) as on

(ii) The relevant issue here is what constitutes the accounting policy for construction contracts. Where there is uncertainty in the outcome of a contract, the appropriate accounting policy would be the completed contract basis (i.e. no profit is taken until the contract is completed). Similarly, any expected losses should be recognised immediately.

Where the outcome of a contract is reasonably foreseeable, the appropriate accounting policy is to accrue profits by the percentage of completion method. If this is accepted, it becomes clear that the different methods of determining the percentage of completion of construction contracts are different accounting estimates. Thus the change made by A in the year to 31st March 20X2 represents a change of accounting estimate.

Prior Period Errors (Based On Para Nos. 41 To 48)

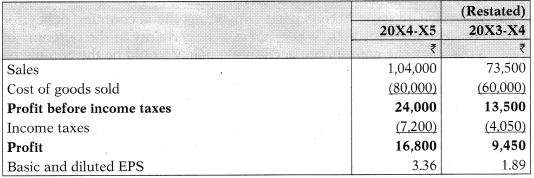

Question 4.

During 20X4-X5, Cheery Limited discovered that some products that had been sold during 20X3-X4 were incorrectly included in inventory at 31st March, 20X4 at ₹ 6,500.

Cheery Limited’s accounting records for 20X4-X5 show sales of ₹ 104,000, cost of goods sold of ₹ 86,500 (including ₹ 6,500 for the error in opening in ventory), and income taxes of ₹ 5,250.

In 20X3-X4, Cheery Limited reported:

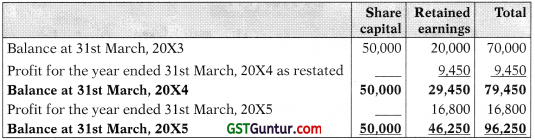

The 20X3-X4 opening retained earnings was ₹ 20,000 and closing retained earnings was ₹ 34,000. Cheery Limited’s income tax rate was 30% for 20X4- X5 and 20X3-X4. It had no other income or expenses.

Cheery Limited had ₹ 50,000 (5,000 shares of ₹ 10 each) of share capital throughout, and no other components of equity except for retained earnings.

State how the above will be treated/accounted in Cheery Limited’s Statement of profit and loss, statement of changes in equity and in notes wherever required for current period and earlier period(s) as per relevant Ind AS.

[RTP-November 2019]

Answer:

Statement of Profit and Loss [Extract]

Statement of Changes in Equity [SOCE]

Extract from the Notes

Some products that had been sold in 20X3-X4 were incorrectly included in inventory at 31st March, 20X4 at ₹ 6,500. The financial statements of 20X3-X4 have been restated to correct this error.

The effect of the restatement on those financial statements is summarized below:

| Effect on 20X3-X4 | |

| (Increase) in cost of goods sold | (6,500) |

| Decrease in income tax expenses | 1,950 |

| (Decrease) in profit | (4,550) |

| (Decrease) in basic and diluted EPS | (0.91) |

| (Decrease) in inventory | (6,500) |

| Decrease in income tax payable | 1,950 |

| (Decrease) in equity | (4,550) |

There is no effect on the balance sheet at the beginning of the preceding period i.e. 1st April, 20X3.

Ind AS 10: Events after the Reporting Period

Approval Process (Based On Para Nos. 4 To 7)

Question 1.

What is the date of approval for issue of the financial statements prepared for the reporting period from April 1, 2018 to March 31, 2019, in a situation where following dates are available?

Completion of preparation of financial statements : May 28, 2019

Board reviews and approves for issue : June 19, 2019

Available to shareholders : July 1,2019

Annual General Meeting : September 15, 2019

Filed with regulatory authority : October 16, 2019

Answer:

As per Ind AS 10 the date of approval for issue of financial statements is the date on which the financial statements are approved by the Board of Directors in case of a company, and, by the corresponding approving authority in case of any other entity.

Accordingly, in the given case, the date of approval is the date on which the financial statements are approved by the Board of Directors of the company, i.e., June 19, 2019.

![]()

Question 2.

A Ltd. prepared interim financial report for the quarter ending June 30, 2018. The interim financial report was approved for issue by the Board of Directors on July 15, 2018. Whether events occurring between end of the interim financial report and date of approval by Board of Directors, i.e., events between July 1, 2018 and July 15, 2018 that provide evidence of conditions that existed at the end of the interim reporting period shall be adjusted in the interim financial report ending June 30, 2018?

Answer:

Ind AS 10 does not define what is reporting period in the absence of any specific guidance regarding reporting period implies that any term for which reporting is done by preparing financial statements is the reporting period for the purpose of Ind AS 10.

Accordingly, financial reporting done for interim period by preparing either complete set of financial statements or by preparing condensed financial statements will be treated as reporting period for the purpose of Ind AS 10.

Thus, an entity describing that its interim financial report is in compliance with Ind ASs, has to comply with all the Ind ASs including Ind AS 10.

Therefore, in order to comply with the requirements of Ind AS 10, each in terim financial report should be adjusted for the adjusting events occurring between end of the interim financial report and the date of approval by Board of Directors.

Therefore, in the above case, events occurring between July 1, 2018 and July 15, 2018 that provide evidence of conditions that existed at the end of the interim reporting period should be adjusted in the interim financial report ending June 30, 2018.

Question 3.

The Board of Directors of A Ltd. approved the financial statements for the reporting period 2017-18 for issue on June 15, 2018. The manage ment of A Ltd. discovered a major fraud and decided to reopen the books of account. The financial statements were subsequently approved by the Board of Directors on June 30, 2018. What is the date of approval for issue as per Ind AS 10 in the given case?

Answer:

In the above case, there are two dates of approval by Board of Directors. The financial statements were reopened for further adjustments subsequent to initial approval. The date of approval should be taken as the date on which financial statements are finally approved by the Board of Directors. Therefore, in the given case, the date of approval for issue as per Ind AS 10 should be considered as June 30, 2018.

Adjusting Events (Based On Para Nos. 3 + 8 To 11)

Question 4.

While preparing its financial statements for the year ended 31 st March, 2019, a company made a general provision for bad debts @ 5% of its debtors. In the last week of February, 2019 a debtor for ₹ 2 lakhs had suffered heavy loss due to an earthquake; the loss was not covered by any insurance policy.

Considering the event of earthquake, the company made a provision @ 50% of the amount receivable from that debtor apart from the general provision of 5% on remaining debtors.

In April 2019 the debtor became bankrupt. Can the company provide for the full loss arising out of insolvency of the debtor in the financial statements for the year ended 31st March, 2019?

Would the answer be different if earthquake had taken place after March 31, 2019, and therefore, X Ltd. did not make any specific provision in context that debtor and made only general provision for bad debts @ 5% on total debtors?

Answer:

The answer is based on paragraph 8 of Ind AS 10.

In the above case, the earthquake took place before the end of the reporting period, ie., in February 2019. Therefore, the condition exists at the end of the reporting date though the debtor is declared insolvent after the reporting period.

Accordingly, full provision for bad debt amounting to ₹ 2 lakhs should be made to cover the loss arising due to the bankruptcy of the debtor in the financial statements for the year ended March 31, 2019. Since provision for bad debts on account of amount due from that particular debtor was made @ 50%, X Ltd. should provide for the remaining amount as a consequence of declaration of this debtor as bankrupt.

In case, the earthquake had taken place after the end of the reporting period, ie., after March 31, 2019, and X Ltd. had not made any specific provision for the debtor who was declared bankrupt later on, since the earthquake occurred after the end of the reporting period no condition existed at the end of the reporting period.

The company had made only general provision for bad debts in the ordinary business course and not to recognize the impact of earthquake. Accordingly, bankruptcy of the debtor in this case is a non-adjusting event. With regard to non-adjusting events, disclosure required by paragraph 21 of Ind AS 10 will be made.

![]()

Question 5.

X Ltd. had taken a large-sized civil construction contract, for a public sector undertaking, valued at ₹ 200 Crores. Execution of the project started during 2018-19, and continued in the next financial year also.

During the course of execution of the work on May 29, 2019, the company found while raising the foundation work that it had met a rocky surface and cost of contract would go up by an extra ₹ 50 crore, which would not be recoverable from the contractee as per the terms of the contract.

The Company’s financial year ended on March 31, 2019, and the financial statements were considered and approved by the Board of Directors on June 15, 2019. How will you treat the above in the financial statements for the year ended 31st March 2019?

Answer:

In the above case, the execution of work started during the F.Y. 2018-19 and the rocky surface was there at the end of the reporting period, though the existence of rocky surface is confirmed after the end of the reporting period as a result of which it became evident that the cost may escalate by ₹ 50 Crores.

Since the rocky surface was there, the condition was existing at the end of the reporting period, therefore, it is an adjusting event. The cost of the project and profit should be accounted for accordingly.

Question 6.

X Lid. sells goods to its customer with a promise to give discount of 5% on list price of the goods provided that the payments are received from customer within 15 days. X Ltd. sold goods of ₹ 5 lakhs to A Ltd. between March 17, 2019 and March 31, 2019. ABC Ltd. paid the dues by April 15, 2019 with respect to sales made between March 17,2019 and March 31,2019.

Financial statements were approved for issue by Board of Directors on May 31, 2019. Stale whether discount will be adjusted from the sales at the end of the reporting period.

Answer:

As per Ind AS 115, if the consideration promised in a contract includes a variable amount, an entity shall estimate the amount of consideration to which the entity will be entitled in exchange for transferring the promised goods or services to a customer.

In the given case, the condition that sales have been made exists at the end of the reporting period and the receipt of payment with 15 days-time after the end of the reporting period and before the approval of the financial statements confirms that the discount is to be provided on those sales. Therefore, it is an adjusting event. Accordingly, X Ltd. should adjust the sales made to A Ltd. with respect to discount of 5% on the list price of the goods.

Question 7.

Whether the fraud related to 2016-17 discovered after the end of the reporting period but before the date of approval of financial statements for 2017-18 is an adjusting event?

Answer:

In the instant case, the fraud is discovered after the end of the reporting period of 2017-18, which related to F.Y. 2016-17. Since the fraud has taken place before the end of the reporting period, the condition was existing which has been confirmed by the detection of the same after the end of the reporting period but before the approval of financial statements. Therefore, it is an adjusting event.

Note:

Ind AS 10 in paragraph 9, specifically provides that the discovery of fraud or error after the end of the reporting period, that shows that financial statements are incor-rect, is an adjusting event.

![]()

Question 8.

X Ltd. was having investment in form of equity shares in another company as at the end of the reporting period, i.e., March 31, 2019. After the end of the reporting period but before the approval of the financial statements it has been found that value of investment was fraudulently inflated by com-mitting a computation error. Whether such event should be adjusted in the financial statements for the year 2017-18?

Answer:

Since it has been detected that a fraud has been made by committing an intentional error and as a result of the same financial statements present an incorrect picture, which has been detected after the end of the reporting period but before the approval of the financial statements. The same is an adjusting event.

Accordingly, the value of investments in the financial statements should be adjusted for the fraudulent error in computation of value of investments.

Question 9.

ABC Ltd. received a demand notice on 15th June, 2017 for an addi-tional amount of ₹ 28,00,000 from the Excise Department on account of higher excise duty levied by the Excise Department compared to the rale at which the company was creating provision and depositing the same.

The financial statements for the year 2016-17 are approved on 10th August, 2017. In July, 2017, the company has appealed against the demand of ₹ 28,00,000 and the company has expected that the demand would be settled at ₹ 15,00,000 only.

Show how the above event will have a bearing on the financial statements for the year 2016-17. Whether these events are adjusting or non-adjusting events and explain the treatment accordingly. [RTP-November 2019]

Answer:

Ind AS 10 defines ‘Events after the Reporting Period’ as under:

Events after the reporting period are those events, favourable and unfavourable, that occur between the end of the reporting period and the date when the financial statements are approved by the Board of Directors in case of a company, and, by the corresponding approving authority in case of any other entity for issue. Two types of events can be identified:

(a) those that provide evidence of conditions that existed at the end of the reporting period (adjusting events after the reporting period); and

(b) those that are indicative of conditions that arose after the reporting period (non-adjusting events after the reporting period)

Analysis:

In the instant case, the demand notice has been received on 15th June, 2017, which is between the end of the reporting period and the date of approval of financial statements. Therefore, it is an event after the reporting period.

This demand for additional amount has been raised because of higher rate of excise duty levied by the Excise Department in respect of goods already manufactured during the reporting period.

Accordingly, condition exists on 31st March, 2017, as the goods have been manufactured during the reporting period on which additional excise duty has been levied and this event has been confirmed by the receipt of demand notice.

Conclusion:

Therefore, it is an adjusting event.

In accordance with the principles of Ind AS 37, the company should make a provision in the financial statements for the year 2016-17, at best estimate of the expenditure to be incurred, i.e., ₹ 15,00,000.

Question 10.

Discuss with reasons whether these events are in nature of adjusting or non-adjusting and the treatment needed in light of accounting standard Ind AS 10.

(i) Moon Ltd. won an arbitration award on 25th April, 2019 for ₹ 1 Crore. From the arbitration proceeding, it was evident that the Company is most likely to win the arbitration award. The directors approved the financial statements of year ending 31.03.2019 on 1st May, 2019. The management did not consider the effect of the above transaction in FY-2018-19, as it was favourable to the Company and the award came after the end of the financial year.

(ii) Zoom Ltd. have a trading business of Mobile telephones. The Company has purchased 1000 mobiles phones at ₹ 5,000 each on 15th March, 2019. The manufacturers of phone had announced the release of the new version on 1st March, 2019 but not announced the price. Zoom fM’ Ltd. has valued inventory at cost of ₹ 5,000 each at the year ending 31st March, 2019.

Due to arrival of new advance version of Mobile Phone on 8th April, 2019, the selling prices of the mobile stocks remaining with Company was dropped at ₹ 4,000 each. The financial statements of the company valued mobile phones @ ₹ 5,000 each and not at the value @ ₹ 4,000 less expenses on sales, as the price reduction in selling price was effected after 31.03.2019.

(iii) There was an old due from a debtor amounting to ₹ 15 Lakhs against whom insolvency proceedings was instituted prior to the financial year ending 31st March, 2019. The debtor was declared insolvent on 15th April, 2019.

(iv) Assume that subsequent to the year end and before the financial state-ments are approved, Company’s management announces that it will restructure the operation of the company. Management plans to make significant redundancies and to close a few divisions of company’s business; however, there is no formal plan yet. Should management recognize a provision in the books if the company decides subsequent to end of the accounting year to restructure its operations? [Nov. 2019 -8 Marks]

Answer:

(i) Ind AS 10 + Ind AS 37 – Could not be recognized on balance sheet date as it was not virtually certain as per Ind AS 37. But now as per Ind AS 10 it can be recognized.

(ii) Adjusting event.

(iii) Adjusting event.

(iv) Based on Ind AS 37 – no provision to be made as no formal plan has been made.

Question 11.

M Ltd. Purchased goods on credit from Toy Ltd. for ₹ 580 lakhs for export. The export order was cancelled. M Ltd. decided to sell the same goods in the local market with a price discount. T Ltd. was requested to offer a price discount of 10%. T Ltd. wants to adjust the sales figure to the extent of the discount requested by M Ltd. Discuss whether such a treatment in the books of T Ltd. is justified as per the provisions of the relevant Ind AS.

Also, T Ltd. entered into a sale deed for its Land on 15th March, 20X1. But registration was done with the registrar on 20th April, 20X1. But before reg-istration, is it possible to recognize the sale and the gain at the balance sheet date? Give reasons in support of your answer.

Answer:

T Ltd. had sold goods to M Ltd. on credit worth for ₹ 580 lakhs and the sale was completed in all respects. M Ltd.’s decision to sell the same in the domestic market at a discount does not affect the amount recorded as sales by T Ltd.

The price discount of 10% offered by T Ltd. after request of M Ltd. was not in the nature of a discount given during the ordinary course of trade because otherwise the same would have been given at the time of sale itself. However, there appears to be an uncertainty relating to the collectability of the debt, which has arisen subsequent to sale.

Therefore, it would be appropriate to make a separate provision to reflect the uncertainty relating to collectability rather than to adjust the amount of revenue originally recorded. Hence such discount should be charged to the Statement of Profit and Loss and not shown as deduction from the sales figure.

With respect to sale of land, both sale and gain on sale of land earned by T Ltd. shall be recognized in the books at the balance sheet date. In substance, the land was transferred with significant risk & rewards of ownership to the buyer before the balance sheet date and what was pending was merely a formality to register the deed. The registration post the balance sheet date only confirms the condition of sale at the balance sheet date as per Ind AS 10 “Events after the Reporting Period.”

![]()

Question 12.

On 5th April, 20X2, fire damaged a consignment of inventory at one of the J Ltd.’s warehouse. This inventory had been manufactured prior to 31st March 20X2 costing ₹ 8 lakhs. The net realisable value of the inventory prior to the damage was estimated at ₹ 9.60 lakhs. Because of the damage caused to the consignment of inventory, the company was required to spend an ad ditional amount of ₹ 2 lakhs on repairing and re-packaging of the inventory. The inventory was sold on 15th May, 20X2 for proceeds of ₹ 9 lakhs.

The accountant of J Ltd. treats this event as an adjusting event and adjusted this event of causing the damage to the inventory in its financial statement and accordingly re-measures the inventories as follows:

| ₹ lakhs | |

| Cost | 8.00 |

| Net realisable value (9.6 -2) | 7.60 |

| Inventories (lower of cost and net realisable value) | 7.60 |

Analyse whether the above accounting treatment made by the accountant in regard to financial year ending on 31.03.20X2 is in compliance of the Ind AS. If not, advise the correct treatment along with working for the same.

Answer:

The answer is based on Paragraph 9 of Ind AS 2; and Paragraphs 3 and 10 of Ind AS 10.

Accountant of J Ltd. has re-measured the inventories after adjusting the event in its financial statement which is not correct and nor in accordance with provision of Ind AS 2 and Ind AS 10.

Accordingly, the event causing the damage to the inventory occurred after the reporting date and as per the principles laid down under Ind AS 10 ‘Events After the Reporting Date’ is a non-adjusting event as it does not affect conditions at the reporting date. Non-adjusting events are not recognised in the financial statements, but are disclosed where their effect is material.

Therefore, as per the provisions of Ind AS 2 and Ind AS 10, the consignment of inventories shall be recorded in the Balance Sheet at a value of ₹ 8 lakhs calculated below:

| ₹ lakhs | |

| Cost | 8.00 |

| Net realisable value | 9.60 |

| Inventories (lower of cost and net realisable value) | 8.00 |

IND AS 10 + IND AS 37

Question 13.

A Ltd. was required to pay penalty for a breach in the performance of a contract. A Ltd. believed that the penalty was payable at a lower amount than the amount demanded by the other party. A Ltd. created provision for the penalty but also approached the arbitrator with a submission that the case may be dismissed with costs. A Ltd. prepared the financial statements for the year 2018-19, which were approved in July 2019.

The arbitrator, in June 2019, awarded the case in favour of A Ltd. As a result of the award of the arbitrator, the provision earlier made by A Ltd. was required to be reduced. The arbitrator also decided that cost of the case should be borne by the other party. Now, whether A Ltd. is required to remeasure its provision and what would be the accounting treatment of the cost that will be recovered by A Ltd., which has already been charged to the Statement of Profit and Loss as an expense for the year 2018-19?

Answer:

A Ltd. approached the arbitrator before the end of the reporting period, who decided the award after the end of the reporting period but before ap-proval of the financial statements for issue. Accordingly, the conditions were existing at the end of the reporting date because A Ltd. had approached the arbitrator before the end of the reporting period whose outcome has been confirmed by the award of the arbitrator.

Therefore, it is an adjusting event. Accordingly, the measurement of the provision is required to be adjusted for the event occurring after the reporting period.

As far as the recovery of the cost by A Ltd. from the other party is concerned, this right to recover was a contingent asset as at the end of the reporting period.

We need to answer this based on Paragraph 35 of Ind AS 37.

A contingent asset should be recognized in the financial statements of the period in which the realization of asset and the related income becomes virtually certain. In the given case, the recovery of cost became certain when the arbitrator decided the award during F.Y. 2018-19. Accordingly, the recovery of cost should be recognized in the financial year 2018-19.

Non-Adjusting Events (Based On Para Nos. 3 + 21 To 22)

Question 14.

Certain significant non-adjusting events occurring after the end of the reporting period are required to be disclosed in the Directors’ Report under existing Indian GAAP. What are the requirements under Ind AS 10 in this regard?

Answer:

As per AS 4, significant non-adjusting events may require a disclosure in the report of the approving authority to enable users of financial statement to make proper evaluations and decisions.

However, Paragraph 21 of Ind AS 10 requires that if non-adjusting events after the reporting period are material, non-disclosure could influence the economic decisions that users make on the basis of the financial statements.

Therefore, under Ind AS such material non-adjusting events are required to be disclosed in the financial statements itself and not only in the report of approving authority, i.e., Directors’ Report.

Carve Out (Based On Para No. 3)

Question 15.

Is there any exception to the principle that adjusting events are those that provide evidence of conditions that existed at the end of the reporting period?

Answer:

There has been a carve out in Ind AS 1 to clarify that long term loan arrangement need not be classified as current on account of breach of a material provision, for which the lender has agreed to waive before the approval of financial statements for issue, an exception has been provided to the adjusting events in Ind AS 10.

Based on this carve-out, in case of breach of a material provision of a long term loan arrangement on or before the end of the reporting period with the effect that the liability becomes payable on demand on the reporting date, if the lender, before the approval of the financial statements for issue, agrees to waive the breach, it shall be considered as an adjusting event.

Dividend (Based On Para Nos. 12 And 13)

Question 16.

What is the treatment of Proposed Dividend under Ind AS 10?

Answer:

If dividends are declared after the reporting period but before the finan-cial statements are approved for issue, the dividends are not recognized as a liability at the end of the reporting period because no obligation exists for that liability as at the end of the reporting period. Such dividends are disclosed in the notes in accordance with Ind AS 1, Presentation of Financial Statements.

Question 17.

How treatment of interim dividend declared and paid during financial year beginning from April 1, 2018 and ending on March 31, 2019 is different from the dividend proposed after March 31, 2018?

Answer:

Interim dividend is declared and paid before the end of the reporting period, the same should be recognized as a distribution to equity shareholders in the financial statements for the F.Y. 2018-19.

![]()

Question 18.

What would be the treatment for dividends declared to redeemable preference shareholders after the reporting period but before the financial statements are approved for issue for the year 2018-19. Whether Ind AS 10 prescribes any accounting treatment for such dividends?

Answer:

Dividend payments to such preference shares are recognized as expense in the same way as interest on a bond. Since interest will be charged on time basis, the requirements of Ind AS 10 regarding date of declaration of dividend not relevant for its recognition.

Going Concern (Based On Para Nos. 14 To 16)

Question 19.

Company X Ltd. was formed to secure the tenders floated by a tele com company for publication of telephone directories. It bagged the tender for publishing directories for Pune circle for 5 years. It has made a profit in 2013-14, 2014-15, 2015-16 and 2016-17. It bid in tenders for publication of directories for other circles – Nagpur, Nashik, Mumbai, Hyderabad but as per the results declared on 23rd April, 2017, the company failed to bag any of these. Its only activity till date is publication of Pune directory.

The contract for publication of directories for Pune will expire on 31 st December 2017. The financial statements for the F.Y. 2016-17 have been approved by the Board of Directors on July 10, 2017. Whether it is appropriate to prepare financial statements on going concern basis?

Answer:

The answer is based on Paragraphs 14 and 15 of Ind AS 10.

In the given case, since contract is expiring on 31st December 2017 and it is confirmed on 23rd April, 2017, ie., after the end of the reporting period and before the approval of the financial statements, that no further contract is secured, implies that the entity’s operations are expected to come to an end.

Accordingly, if entity’s operations are expected to come to an end, the entity needs to make a judgment as to whether it has any realistic possibility to con-tinue or not. In case, the entity determines that it has no realistic alternative of continuing the business, preparation of financial statements for 2016-17 and thereafter the going concern basis may not be appropriate.

Question 20.

In the plant of P Ltd., there was a fire on 10.05.2019 in which the entire plant was damaged and the loss of ₹ 40,00,000 is estimated. The claim with the insurance company has been filed and a recovery of ₹ 27,00,000 is expected. The financial statements for the year ending 31.03.2019 were approved by the Board of Directors on 12th June 2019. Show how should it be disclosed?

Answer:

Since fire took place after the end of the reporting period, it is a non-adjust ing event. However, in accordance with paragraph 21 of Ind AS 10, disclosures regarding non-adjusting event should be made in the financial statements, ie., the nature of the event and the expected financial effect of the same.

With regard to going concern basis followed for preparation of financial state-ments, the company needs to determine whether it is appropriate to prepare the financial statements on going concern basis, since there is only one plant which has been damaged due to fire.

If the effect of deterioration in operating results and financial position is so pervasive that management determines after the reporting period either that it intends to liquidate the entity or to cease trading, or that it has no realistic alternative but to do so, preparation of financial statements for the F.Y. 2018-19 on going concern assumption may not be appropriate. In that case, the financial statements may have to be prepared on a basis other than going concern.

However, if the going concern assumption is considered to be appropriate even after the fire, no adjustment is required in the financial statements for the year ending 31.03.2019.

Question 21.

X Ltd. was formed to secure the tenders floated by a telecom company for publication of telephone directories. It bagged the tender for publishing directories for Pune circle for 5 years. It has made a profit in 2013-14, 2014 15, 2015-16 and 2016-17. It bid in tenders for publication of directories for other circles – Nagpur, Nashik, Mumbai, Hyderabad but as per the results declared on 23rd April, 2017, the company failed to bag any of these.

Its only activity till date is publication of Pune directory. The contract for publication of directories for Pune will expire on 31st December 2017. The financial statements for the F.Y. 2016-17 have been approved by the Board of Directors on July 10, 2017.

Whether it is appropriate to prepare financial statements on going concern basis?

Answer:

The answer is based on Paragraphs 14 and 15 of Ind AS 10.

In accordance with the above, an entity needs to change the basis of accounting if the effect of deterioration in operating results and financial position is so pervasive that management determines after the reporting period either that it intends to liquidate the entity or to cease trading, or that it has no realistic alternative but to do so.

In the instant case, since contract is expiring on 31st December 2017 and it is confirmed on 23rd April, 2017, ie., after the end of the reporting period and before the approval of the financial statements, that no further contract is secured, implies that the entity’s operations are expected to come to an end.

Accordingly, if entity’s operations are expected to come to an end, the entity needs to make a judgment as to whether it has any realistic possibility to con-tinue or not. In case, the entity determines that it has no realistic alternative of continuing the business, preparation of financial statements for 2016-17 and thereafter on going concern basis may not be appropriate.

Ind AS 113: Fair Value Measurement

Principal Market (Based On Para Nos. 15 To 21)

Question 1.

An asset is sold in 2 different active markets at different prices. An entity enters into transactions in both markets and can access the price in those markets for the asset at the measurement date.

In Market A:

The price that would be received is ₹ 78, transaction costs in that market are ₹ 9 and the costs to transport the asset to that market are ₹ 6.

In Market B:

The price that would be received is ₹ 75, transaction costs in that market are ₹ 3 and the costs to transport the asset to that market are ₹ 6.

You are required to calculate:

(i) The fair value of the asset, if market A is the principal market, and

(ii) The fair value of the asset, if none of the markets is principal market.

Answer:

(i) If Market A is the principal market

If Market A is the principal market for the asset (ie., the market with the greatest volume and level of activity for the asset), the fair value of the asset would be measured using the price that would be received in that market, after taking into account transport costs.

Fair Value of the asset will be

| ₹ | |

| Price receivable | 78 |

| Less: Transportation cost | (6) |

| Fair value of the asset | 72 |

(ii) If neither of the market is the principal market

If neither of the market is the principal market for the asset, the fair value of the asset would be measured using the price in the most advantageous market. The most advantageous market is the market that maximises the amount that would be received to sell the asset, after taking into account transaction costs and transport costs (ie., the net amount that would be received in the respective markets).

Determination of most advantageous market:

| ₹ | ₹ | |

| Market A | Market B | |

| Price receivable | 78 | 75 |

| Less: Transaction cost | (9) | (3) |

| Less: Transportation cost | (6) | (6) |

| Fair value of the asset | 63 | 66 |

Since the entity would maximise the net amount that would be receivec for the asset in Market B i.e. X 66, the fair value of the asset would be measured using the price in Market B.

| ₹ | |

| Price receivable | 75 |

| Less: Transportation cost | (6) |

| Fair value of the asset | 69 |

![]()

Question 2.

An asset is sold in 2 different active markets (a market in which transaction for the asset or liability takes place with sufficient frequency and volume to provide pricing information on an ongoing basis) at different prices.

An entity enters into transactions in both markets and can access the price in those markets for the asset at the measurement date.

In Market A:

The sale price of the asset is ₹ 26, transaction cost is ₹ 3 and the cost to trans-port the asset to Market A is ₹ 2 (i.e., the net amount that would be received is ₹ 21).

In Market B:

The sale price of the asset is ₹ 25, transaction cost is Re. 1 and the cost to transport the asset to Market B is ₹ 2 (i.e., the net amount that would be received is ₹ 22).

Determine the fair value of the asset by supporting your answer with proper reason.

Answer:

If Market A is the principal market for the sale of asset (ie., the market with the greatest volume and level of activity for the asset), the fair value of the asset would be measured using the price that would be received in that mar ket, after taking into account transport cost of ₹ 24. The price in the principal (or most advantageous) market used to measure the fair value of the asset or liability shall not be adjusted for transaction costs.

If neither market is the principal market for the sale of asset, the fair value of the asset would be measured using the price in the most advantageous market. The most advantageous market is the market that maximises the amount that would be received by selling the asset, after taking into account transport cost (ie., the net amount that would be received in the respective markets).

Since the entity would maximise the net amount that would be received for the asset in Market B, the fair value of the asset would be measured using the price in that market ie. sale of asset ₹ 25 less transport cost ₹ 2, resulting in a fair value measurement of ₹ 23.

Question 3.

An asset is sold in two different active markets at different prices. Manor Ltd. enters into transactions in both markets and can access the price in those markets for the asset at the measurement date.

In Mumbai market, the price that would be received is ₹ 290, transaction costs in that market are ₹ 40 and the costs to transport the asset to that market are ₹ 30. Thus, the net amount that would be received is ₹ 220.

In Kolkata market the price that would be received is ₹ 280, transaction costs in that market are ₹ 20 and the costs to transport the asset to that market are ₹ 30. Thus, the net amount that would be received in Kolkata market is ₹ 230.

(i) What should be the fair value of the asset if Mumbai Market is the principal market? What should be fair value if none of the markets is principal market?

(ii) If the net realisation after expenses is more in export market, say ₹ 280, but Government allows only 15% of the production to be exported out of India. Discuss what would be fair value in such case.

(Nov. 2019 – 8 Marks)

Answer:

(i) If Market (Mumbai) is the principal market for the asset (ie., the market with the greatest volume and level of activity for the asset), the fair value of the asset would be measured using the price that would be received in that market, after taking into account transport costs.

| Particulars | Mumbai Market |

| For Fair Value: | |

| Market Price | 290 |

| Less: Transport costs | 30 |

| Fair Value | 260 |

If neither of the market is the principal market?

If neither of the market is the principal market for the asset, the fair value of the asset would be measured using the price in the most advantageous market. The most advantageous market is the market that maximises the amount that would be received to sell the asset, after taking into account transaction costs and transport costs (ie., the net amount that would be received in the respective markets).

Determination of most advantageous market:

| Particulars | ₹ Market Mumbai |

₹ Market Kolkata |

| Market Price | 290 | 280 |

| Less: Transaction cost | 40 | 20 |

| Less: Transportation cost | 30 | 30 |

| Fair value of the asset | 220 | 230 |

Since the entity would maximise the net amount that would be received for the asset in Market Kolkata ie. ₹ 230, the fair value of the asset would be measured using the price in Market Kolkata.

Fair value of the asset will be:

| Particulars | ₹ |

| Market Price | 290 |

| Less: Transportation cost | 30 |

| Fair value of the asset | 260 |

(ii) The answers would not change.

![]()

Highest And Best Use (Based On Para Nos. 27 To 30)

Question 4.

Comment on the following by quoting references from appropriate Ind AS.

(i) DS Limited holds some vacant land for which the use is not yet deter-mined. The land is situated in a prominent area of the city where lot of commercial complexes are coming up and there is no legal restriction to convert the land into a commercial land.

The company is not interested in developing the land to a commercial complex as it is not its business objective. Currently the land has been let out as a parking lot for the commercial complexes around.

The Company has classified the above property as investment property. It has approached you, an expert in valuation, to obtain fair value of the land for the purpose of disclosure under Ind AS.

On what basis will the land be fair valued under Ind AS?

(ii) DS Limited holds equity shares of a private company. In order to de-termine the fair value’ of the shares, the company used discounted cash flow method as there were no similar shares available in the market.

Under which level of fair value hierarchy will the above inputs be clas-sified?

What will be your answer if the quoted price of similar companies were available and can be used for fair valuation of the shares? [RTP – November 2019]

Answer:

(i) As per Ind AS 113, a fair value measurement of a non-financial asset takes into account a market participant’s ability to generate economic benefits by using the asset in its highest and best use or by selling it to another market participant that would use the asset in its highest and best use.

The highest and best use of a non-financial asset takes into account the use of the asset that is physically possible, legally permissible and financially feasible, as follows:

(a) A use that is physically possibly takes into account the physical characteristics of the asset that market participants would take into account when pricing the asset (e.g. the location or size of a property).

(b) A use that is legally permissible takes into account any legal restrictions on the use of the asset that market participants would take into account when pricing the asset (e.g. the zoning regulations applicable to a property).

(c) A use that is financially feasible takes into account whether a use of the asset that is physically possible and legally permissible generates adequate income or cash flows (taking into account the costs of converting the asset to that use) to produce an investment return that market participants would require from an investment in that asset put to that use.

Highest and best use is determined from the perspective of market par-ticipants, even if the entity intends a different use. However, an entity’s current use of a non-financial asset is presumed to be its highest and best use unless market or other factors suggest that a different use by market participants would maximize the value of the asset.

To protect its competitive position, or for other reasons, an entity may intend not to use an acquired non-financial asset actively or it may intend not to use the asset according to its highest and best use. Nevertheless, the entity shall measure the fair value of a non-financial asset assuming its highest and best use by market participants.

Analysis:

In the given case, the highest best possible use of the land is to develop a commercial complex. Although developing a business complex is against the business objective of the entity, it does not affect the basis of fair valuation as Ind AS 113 does not consider an entity specific restriction for measuring the fair value.

Also, its current use as a parking lot is not the highest best use as the land has the potential of being used for building a commercial complex.

Conclusion:

Therefore, the fair value of the land is the price that would be received when sold to a market participant who is interested in developing a 1 commercial complex.

(ii) As per Ind AS 113, unobservable inputs shall be used to measure fair value to the extent that relevant observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for

the asset or liability at the measurement date. The unobservable inputs shall reflect the assumptions that market participants would use when pricing the asset or liability, including assumptions about risk.

Analysis and conclusion:

In the given case, DS Limited adopted discounted cash flow method, commonly used technique to value shares, to fair value the shares of the private company as there were no similar shares traded in the market.

Hence, it falls under Level 3 of fair value hierarchy.

Level 2 inputs include the following:

(a) quoted prices for similar assets or liabilities in active markets.

(b) quoted prices for identical or similar assets or liabilities in markets that are not active.

(c) inputs other than quoted prices that are observable for the asset or liability.

If an entity can access quoted price in active markets for identical assets or liabilities of similar companies which can be used for fair valuation of the shares without any adjustment, at the measurement date, then it will be considered as observable input and would be considered as Level 2 inputs.