Ind AS on Liabilities of the Financial Statements – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Ind AS on Liabilities of the Financial Statements – CA Final FR Study Material

Ind AS 19: Employee Benefits

Short Term Employee Benefits (Based On Para Nos. 13 To 18)

Question 1.

In 2017-18, Diana Ltd. has around 3,000 employees in the company. As per the company policy, the employees are given 30 days of Privilege Leave (PL), 12 days of Sick Leave (SL) and 12 days of Casual Leave. Out of the total PL and SL, 10 PL and 5 SL can be carried forward to next year. On the basis of past trends, it has been noted that 1,000 employees will take 5 days of PL and 2 days of SL and 2,000 employees will avail 10 as PL and 5 as SL. Also the company has been incurring profits since incorporation. It has been decided in 2017-18 to distribute profits to its employees @ 8% during the year. However, due to the employee turnover in the organisation, the expected pay-out of the Diana Ltd. is to be around 7%. The profits earned during 2017-18 is ₹ 12,000 lakhs.

Diana Ltd. also has a post-employment benefit plan available which is in the nature of defined contribution plan where contribution to this fund amounts to ₹ 500 lakhs which will fall due within 12 months from the end of accounting period.

The company has paid ₹ 120 lakhs to its employees in 2017-18. What is the treatment for the short-term compensating absences, profit-sharing plan and the defined contribution plan by Diana Ltd. as per the provisions of relevant Ind AS ? [May 2019 – 5 Marks]

Answer:

(i) Diana Ltd. will recognise a liability in its books to the extent of 5 days of PL for 1,000 employees and 10 days of PL for remaining 2,000 employees and 2 days of SL for 1,000 employees and 5 days of SL for remaining 2,000 employees in its books as an unused entitlement that has accumulated in 2017-18.

(ii) Diana Ltd. will recognise ₹ 840 lacs (12,000 lacs × 7 %) as a liability and expense it books of account.

(iii) When an employee has rendered service to an entity during a period, the entity shall recognise the contribution payable to a defined contribution plan in exchange for that service:

(a) Under Ind AS 19, the amount of ₹ 380 lacs may be recognised as a liability (accrued expense), after deducting any contribution already paid (500 -120). However, if the contribution already paid would have exceeded the contribution due for service before the end of the reporting period, an entity shall recognise that excess as an asset (prepaid expense); and

(b) Also, ₹ 380 lacs will be recognised as an expense which will be disclosed as an expense in the statement of profit or loss.

It can also be seen that the contributions are payable within 12 months from the end of the year in which the employees render the related service, they will not be discounted. However, where contributions to a defined contribution plan do not fall due wholly within twelve months after the end of the period in which the employees render the related service, they shall be discounted using the discount rate.

![]()

Defined Contribution Plan (Based On Para Nos. 50 To 54)

Question 2.

A Ltd. prepares its financial statements to 31st March each year. It operates a defined benefit retirement benefits plan on behalf of current and former employees. A Ltd. receives advice from actuaries regarding contribution levels and overall liabilities of the plan to pay benefits. On 1st April, 2017, the actuaries advised that the present value of the defined benefit obligation was ₹ 6,00,00,000. On the same date, the fair value of the assets of the defined benefit plan was ₹ 5,20,00,000. On 1st April, 2017, the annual market yield on government bonds was 5%. -During the year ended 31st March, 2018, A Ltd. made contributions of ₹ 70,00,000 into the plan and the plan paid out benefits of ₹ 42,00,000 to retired members. Both these payments were made on 31st March, 2018.

The actuaries advised that the current service cost for the year ended 31st March, 2018 was ₹ 62,00,000. On 28th February, 2018, the rules of the plan were amended with retrospective effect. These amendments meant that the present value of the defined benefit obligation w as increased by ₹ 15,00,000 from that date.

During the year ended 31st March, 2018, A Ltd. was in negotiation with employee representatives regarding planned redundancies. The negotiations were completed shortly before the year end and redundancy packages were agreed. The impact of these redundancies was to reduce the present value of the defined benefit obligation by ₹ 80,00,000. Before 31 st March, 2018, A Ltd. made payments of ₹ 75,00,000 to the employees affected by the redundancies in compensation for the curtailment of their benefits. These payments were made out of the assets of the retirement benefits plan.

On 31st March, 2018, the actuaries advised that the present value of the defined benefit obligation was ₹ 6,80,00,000. On the same date, the fair value of the assets of the defined benefit plan were ₹ 5,60,00,000.

Examine and present how the above event would be reported in the financial statements of A Ltd. for the year ended 31st March, 2018 as per Ind AS.

Answer:

All figures are ₹ in ‘000.

On 31st March, 2018, A Ltd. will report a net pension liability in the statement of financial position. The amount of the liability will be 12,000 (68,000 – 56,000).

For the year ended 31st March, 2018, A Ltd. will report the current service cost as an operating cost in the statement of profit or loss. The amount reported will be 6,200. The same treatment applies to the past service cost of 1,500.

![]()

For the year ended 31st March, 2018, A Ltd. will report a finance cost in profit or loss based on the net pension liability at the start of the year of 8,000 (60,000 – 52,000). The amount of the finance cost will be 400 (8,000 × 5%).

The redundancy programme represents the partial settlement of the curtailment of a defined benefit obligation. The gain on settlement of 500 (8,000 – 7,500) will be reported in the statement of profit or loss.

Other movements in the net pension liability will be reported as remeasurement gains or losses in other comprehensive income.

For the year ended 31st March, 2018, the remeasurement loss will be 3,400 (Refer W. N.).

Working Note:

Remeasurement of gain or loss

| ₹ in ’000 | |

| Liability at the start of the year (60,000 – 52,000) | 8,000 |

| Current service cost | 6,200 |

| Past service cost | 1,500 |

| Net finance cost | 400 |

| Gain on settlement | (500) |

| Contributions to plan | (7,000) |

| Remeasurement loss (balancing figure) | 3,400 |

| Liability at the end of the year (68,000 – 56,000) | 12,000 |

Note: (All numbers in ₹ ’000 unless otherwise stated)

![]()

Question 3.

ABL Ltd. operates a defined retirement benefits plan on behalf of current and former employees. ABL Ltd. receives advice from actuaries regarding contribution levels and overall liabilities of the plan to pay benefits. On 1st April, 20X1, the actuaries advised that the present value of the defined benefit obligation was ₹ 60,000. On the same date, the fair value of the assets of the defined benefit plan was ₹ 52,000. On 1st April, 20X1, the annual market yield on high quality corporate bonds was 5%.

During the year ended 31st March 20X2, ABL Ltd. made contributions of ₹ 7,000 into the plan and the plan paid out benefits of ₹ 4200 to retired members. Assume that both these payments were made on 31st March 20X2. The actuaries advised that the current service cost for the year ended 31st March 20X2 was ₹ 6,200. On 28th February, 20X2, the rules of the plan were amended with retrospective effect. These amendments meant that the present value of the defined benefit obligation was increased by ₹ 1500 from that date.

During the year ended 31st March, 20X2, ABL Ltd. was in negotiation with employee representatives regarding planned redundancies. The negotiations were completed shortly before the year end and redundancy packages w’ere agreed. The impact of these redundancies was to reduce the present value of the defined benefit obligation by ₹ 8000. Before 31st March, 20X2, ABL Ltd. made payments of ₹ 7500 to the employees affected by the redundancies in compensation for the curtailment of their benefits. These payments were made out of the assets of the retirement benefits plan. On 31st March, 20X2, the actuaries advised that the present value of the defined benefit obligation was ₹ 68,000. On the same date, the fair value of the assets of the defined benefit plan were ₹ 56,000. [RTP-Novem ber 2019]

Note: (All numbers in ₹ ‘000 unless otherwise stated)

Answer:

On 31st March 20X2, ABL Ltd. will report a net pension liability in the statement of financial position.

The amount of the liability will be ₹ 12,000 (68,000 – 56,000).

For the year ended 31st March 20X2, ABL Ltd. will report the current service cost as an operating cost in the statement of profit or loss.

The amount reported will be ₹ 6,200. The same treatment applies to the past service cost of ₹ 1,500.

For the year ended 31st March 20X2, ABL Ltd. will report a finance cost in profit or loss based on the net pension liability at the start of the year of ₹ 8,000 (60,000 – 52,000). The amount of the finance cost will be ₹ 400 (8,000 × 5%).

The redundancy programme represents the partial settlement of the curtailment of a defined benefit obligation. The gain on settlement of ₹ 500 (8,000 – 7,500) will be reported in the statement of profit or loss.

![]()

Other movements in the net pension liability will be reported as remeasurement gains or losses in other comprehensive income.

For the year ended 31st March 20X2, the remeasurement loss will be ₹ 3,400 (refer W.N.).

Working Note:

Calculation of remeasurement gain or loss:

| ₹ ‘000 | |

| Liability at the start of the year (60,000 – 52,000) | 8,000 |

| Current service cost | 6,200 |

| Past service cost | 1,500 |

| Net finance cost | 400 |

| Gain on settlement | (500) |

| Contributions to plan | (7,000) |

| Remeasurement loss (balancing figure) | 3,400 |

| Liability at the end of the year (68,000 – 56,000) | 12,000 |

Ind AS 37: Provisions, Contingent Liabilities and Contingent Assets

Definition And Recognition (Based On Para Nos. 10, 11 And 14)

Question 1.

Determine whether the following obligations will be classified as provisions in the financial statements:

(a) Amount payable for utilities like electricity, gas, etc.

(b) Amount payable for goods received but invoice not received

(c) Financial guarantee given by the parent to the bank for loan taken by its subsidiary

(d) Warranty obligation

(e) Accrued interest payable on borrowings

(f) Unearned revenue/Advance received

Answer:

| Point | Particulars | Do we recognize a provision? (Yes/No) | Analysis and Conclusion |

| (a) | Amount payable for utilities like electricity, gas, etc. | No | It represents an accrual of liability to pay for services that have been received. The amount and timing of payment can be determined with a reasonable certainty.

A reliable estimate of the amount of payment can be made based on the quantum of consumption, prevailing rates or on the basis of earlier bills. |

| (b) | Amount payable for goods or services received but invoice not received | No | In such a case, amount and timing of payment would be driven by the terms agreed with the supplier. |

| (c) | Financial guarantee given by the parent to lenders for loan taken by its subsidiary | No | Financial guarantees are within the scope of Ind AS 109 |

| (d) | Warranty obligation | Yes | It is in the nature of provision as there is an uncertainty associated with the amount and timing of the liability. |

| (e) | Accrued interest payable on borrowings | No | The amount and timing of payment is known. |

| (f) | Unearned revenue/Advance received | No | It is covered by Ind AS 115. |

![]()

Question 2.

The entity is an automobile component manufacturer. The automobile manufacturer has specified a delivery schedule, non-adherence to which will entail a penalty. As on March 31,2018, the reporting date, the manufacturer has a delivery scheduled for June 2018. However, the manufacturer is aware that he will not be able to meet the delivery schedule in June 2018. Determine whether the entity has a present obligation as at March 31, 2018, requiring recognition of provision.

Answer:

In the above case, there is no present obligation arising out of a past event as the goods are scheduled for delivery in June 2018 and there is no delay as at March 31, 2018. Hence, there is no present obligation to pay the penalty in the current year. Therefore, no provision can be recognized in the present case.

Question 3.

An entity is a telecom operator. Laying of cables across the world is a requirement to enable the entity to run its business. Cables are also laid under the sea and contracts are entered into for the same. By virtue of laws of the countries through which the cable passes, the entity is required to restore the sea bed at the end of the contract period. What is the nature of obligation that the entity has in such a case?

Answer:

Provision should be recognized as soon as the obligating event takes place because the entity is under legal obligation to restore the sea bed, provided the other recognition criteria stated in paragraph 14 reproduced above are met.

Moreover, the amount of the provision would depend on the extent of the obligation arising from the obligating event. In the instant case, an obligating event is the laying of cables under the sea. To the extent the cables have been laid down under the sea, a legal obligation has arisen and to that extent provision for restoration of sea bed should be recognized.

![]()

Question 4.

Entity A is a dealer in washing machines. Entity A offers to its customers a scheme whereby it states that after a period of 3 years, the entity offers to buy back the washing machine at a fixed price which is expected to be less than the fair value of the machine at the end of three years. The credit emanating therefrom will be required to be used by the customer for buying a new washing machine, i.e., new washing machine will be sold at a discounted price. Past experience indicates that customers generally opt for this scheme. At the time of sale of the first washing machine should entity A recognize any provision in this regard?

Answer:

Assuming that the entity recognizes the entire revenue on the sale of first washing machine, a provision for expected cost of meeting the obligation of selling the second machine at discounted price should be recognized because sale of first washing machine is the past event. Moreover, past experience indicates that customers generally opt for this scheme, therefore, probability of outflow of resources is more likely than not. Since it is a normal practice which the entity follows, reliable estimate of the amount of meeting the obligation can also be made.

Question 5.

What is the meaning of the word “probable” in the context of Ind AS 37?

Answer:

For the purpose of Ind AS 37, the word ‘probable’ is defined as ‘more likely than not’.

‘More likely than not’ means that the probability that the event will occur is greater than the probability that it will not occur.

Note:

A percentage of over 50% chance that the event will occur can be used for this purpose.

![]()

Question 6.

Entity X is engaged in the manufacture and sale of central chillers. Sale of chillers is subject to a warranty for repairs of manufacturing defects that are identified within two years of sale. Past experience has shown that the entity receives claims for warranty. Is a provision for warranty required under Ind AS 37?

Answer:

Yes, a separate provision for warranty should be made because:

(a) the entity has a legal obligation which arises on sale of the chiller

(b) Past experience indicates that it is more likely than not that there will be an outflow of economic benefits

(c) Reliable estimate of the obligation can be made based on past experience.

[Based On Para No. 14 – Parameters For Recognizing Provision + Ind As 12+Accounting For Expenditure On CSR Activities]

Question 7.

In order to encourage companies and organisations to generously contribute to the Government’s COVID-19 relief fund, taxation laws have been amended to reckon these contributions as deductible for the current financial year i.e. year ending March 31, 2020 even if the contributions are made after the year end but within three months after year end. Similarly, such contributions to COVID-19 funds are considered for compliance with annual spends on corporate social responsibility (CSR) for the current accounting year under the Companies Act, 2013.

In this scenario, whether the contributions to COVID-19 Relief Funds made subsequent to reporting date of the current accounting period can be provided for as expenses of the current accounting period?

Also show its impact on deferred tax, if any. [RTP-November 2020]

Note:

The same Question has also been covered in the chapter of ‘Impact of COVID on Financial Statements’.

Answer:

In the above given case, the entity needs to analyse the accounting treatment in the light of the following:

| S. No. | Applicable Law/ Ind AS | Remarks |

| 1. | Section 135(5) of the Companies Act, 2013 | It may be noted that the said section has been amended recently to make the obligation to spend the CSR amounts as mandatory, but the amended section is not yet effective. |

| 2. | Ind AS 37 (Para No. 14) | In the fact pattern given above, the accounting implications for the financial year 2019-2020 based on the requirements of the accounting standards/Guidance Note given above is as follows:

♦ Do not recognize expense/liability for the contribution to be made subsequent to the year ended March 31 2020 as it does not meet the criteria of a present obligation as at the balance sheet date. However, the expected spend may be explained in the notes to the accounts as the same will also be considered in measurement of deferred tax liability. ♦ If the entity claims a deduction in the Income Tax return for the financial year 2019-20 for that contribution made subsequent to March 31,2020, recognise Deferred Tax Liability as there would be a tax saving in financial year 2019-2020 for a spend incurred in subsequent year. |

| 3. | Guidance Note on Accounting for Expenditure on Corporate Social Responsibility Activities |

Analysis and Conclusion:

Government of India issued the notification on 31st March 2020 by way of an Ordinance and hence, it is most unlikely for any entity to have had a present obligation on 31st March 2020, for such a commitment. As these conditions are not met as of reporting date of financial year 2019-20, no provision should be recognised in the financial statements for that financial year.

If the entity claims a deduction in the Income Tax return for the financial year 2019 – 2020 for that contribution made subsequent to 31st March, 2020, recognise Deferred Tax Liability as there would be a tax saving in financial year 2019 – 2020 for a spend incurred in subsequent year.

![]()

Question 8.

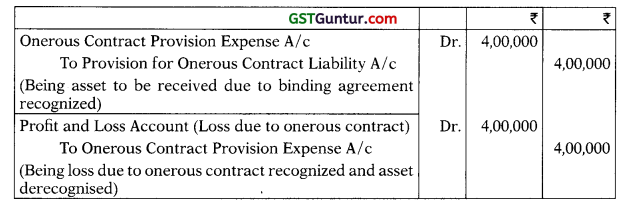

S Limited has entered into a binding agreement with M Limited to buy a custom-made machine for ₹ 4,00,000. At the end of 2017-18, before delivery of the machine, S Limited had to change its method of production. The new method will not require the machine ordered which is to be scrapped after delivery. The expected scrap value is nil. Given that the asset is yet to be delivered, should any liability be recognized for the potential loss? If so, give reasons for the same, the amount of liability as well as the accounting entry.

Answer:

As per Ind AS 37, Executory contracts are contracts under which

- neither party has performed any of its obligations; or

- both parties have partially performed their obligations to an equal extent.

The contract entered by S Ltd. is an executory contract, since the delivery has not yet taken place.

Ind AS 37 is applied to executory contracts only if they are onerous.

Ind AS 37 defines an onerous contract as a contract in which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received under it.

As per the facts given in the question, S Ltd. will not require the machine ordered. However, since it is a binding agreement, the entity cannot exit/cancel the agreement. Further, S Ltd. has to scrap the machine after delivery at nil scrap value.

These circumstances do indicate that the agreement/contract is an onerous contract. Therefore, a provision should be made for the onerous element of ₹ 4,00,000 i.e. the full cost of the machine.

![]()

Question 9.

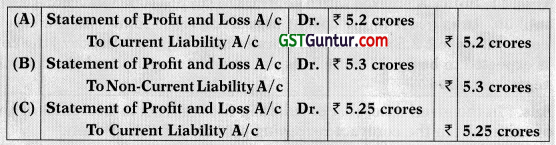

During the year, Q Ltd. delivered manufactured products to cus-tomer K. The products were faulty and on 1st October, 2016 customer K commenced legal action against the Company claiming damages in respect of losses due to the supply of faulty product. Upon investigating the matter, Q Ltd., discovered that the products were faulty due to defective raw material procured from supplier F. Therefore, on 1st December, 2016, the Company commenced legal action against F claiming damages in respect of the supply of defective raw materials.

Q Ltd. has estimated that it’s probability of success of both legal actions, the action of K against Q Ltd. and action of Q Ltd. against F, is very high.

On 1st October, 2016, Q Ltd. has estimated that the damages it would have to pay K would be ₹ 5 crores. This estimate w as revised to ₹ 5.2 crores as on 31st March, 2017 and ₹ 5.25 crores as at 15th May, 2017. This case was eventually settled on 1st June, 2017, when the Company paid damages of ₹ 5.3 crores to K.

On 1st December, 2016, 0 Ltd. had estimated that it would receive damages of ₹ 3.5 crores from F. This estimate was revised to ₹ 3.6 crores as at 31st March, 2017 and ₹ 3.7 crores as on 15th May, 2017. This case was eventually settled on 1st June, 2017 when F paid ₹ 3.75 crores to Q Ltd. Q Ltd. had, in its financial statements for the year ended 31st March, 2017, provided ₹ 3.6 crores as the financial statements were approved by the Board of Directors on 26th April, 2017.

(i) Whether the Company is required to make provision for the claim from customer K as per applicable Ind AS? If yes, please give the rationale for the same.

(ii) If the answer to (a) above is yes, what is the entry to be passed in the books of account as on 31 st March, 2017? Give brief reasoning for your choice.

(iii) What will the accounting treatment of the action of 0 Ltd. against supplier F as per applicable Ind AS?

Answer:

(i) Yes, Q Ltd. is required to make provision for the claim from customer K as per Ind AS 37 since the claim is a present obligation as a result of delivery of faulty goods manufactured. Also, it is probable that an outflow of resources embodying economic benefits will be required to settle the obligations. Further, a reliable estimate of ₹ 5.2 crore can be made of the amount of the obligation while preparing the financial statements as on 31st March, 2017.

(ii) Option (A) :

Statement of Profit and Loss A/c : Dr. : ₹ 5.2 crore

To Current Liability A/c : ₹ 5.2 crore

(iii) As per para 31 of Ind AS 37, 0 Ltd. shall not recognise a contingent asset. Here the probability of success of legal action is very high but there is no concrete evidence which makes the inflow virtually certain. Hence, it will be considered as contingent asset only and shall not be recognized.

![]()

Contingent Asset (Based On Para Nos. 10 + 31 To 35)

Question 10.

When should an entity disclose a contingent asset?

Answer:

| Particulars | Treatment under Ind AS 37 |

| An inflow of economic benefits is not probable | No description required in financial statements |

| An inflow of economic benefits is probable | Disclose as contingent asset |

| An inflow of economic benefits is virtually certain | Recognize as an asset |

Onerous Contracts (Based On Para Nos. 10 + 66 To 69)

Question 11.

Entity X entered into a contract to supply 1000 television sets for ₹ 2 million. An increase in the cost of inputs has resulted into an increase in the cost of sales to ₹ 2.5 million. The penalty for non-performance of the contract is expected to be ₹ 0.25 million. Is the contract onerous and provision in this regard required?

Answer:

In the given case, cost of fulfilling the contract is ₹ 0.5 million and cost of exiting from the contract by paying penalty is ₹ 0.25 million.

It is an onerous contract as cost of meeting the contract exceeds the economic benefits.

Therefore, the provision should be recognized at the best estimate of the unavoidable cost, which is lower of the cost of fulfilling it and any compensation or penalties arising from failure to fulfil it, i.e., at ₹ 0.25 million (lower of ₹ 0.25 million and ₹ 0.5 million).

![]()

Question 12.

An entity has entered into a contract to purchase specific quantity of coal at the rate of ₹ 50 per unit over a period of three years. The contract is not cancellable without payment of compensation. The current market price of coal is ₹ 45 per unit. The coal is purchased for consumption during the manufacturing process the output of which is sold in the market at a profit. Is the contract an onerous contract?

Answer:

The contract is not an onerous contract because the entity will derive economic benefits from the contract including the benefits of using the coal in the manufacturing process and the final product will be sold in the market at a profit.

Question 13.

Assume the same conditions as in question 18 above except that the final product is sold in the market at loss and the loss is primarily on account of high cost of coal. In this case, is the contract an onerous contract?

Answer:

In this case, since the entity is making losses in the contract and the contract is not cancellable without payment of compensation, the contact is onerous. Therefore, the present obligation under the contract should be recognized and measured as provision.

Measurement of Provision (Based On Para Nos. 36 To 65)

Question 14.

When a provision is created, where the corresponding debit should be taken to?

Answer:

Ind AS 37 does not specifically addresses where the debit corresponding to a provision should be taken to. Therefore, treatment in this regard would be determined in accordance with other relevant Ind AS. Although in most of the cases the debit will be taken to the Statement of Profit and Loss but sometimes recognition of a provision could result in the creation of an asset also.

Example:

Decommissioning obligations relating to creation of a fixed asset that are provided for in the books at the time when the asset comes into existence are normally capitalized and depreciated over the useful life of the asset.

![]()

Question 15.

How the best estimate of the amount of provision is determined?

Answer:

An entity may generally use the following techniques to make the best estimate of the amount of provision:

- Weighted average of all possible outcomes by their associated probabilities, known as ‘expected value’ or

- The single most likely outcome.

Example:

[Weighted average of all possible outcomes]

An entity is a retail chain distributing shoes. It faces 200 legal claims filed by its distributors. Each with a 30% likelihood of success with no cost and a 70% likelihood of failure with the cost of each claim to be ₹ 20,000.

Using expected value method, the best estimate of the provision should be measured using the following formula:

= 70% × 200 claims × ₹ 20,000 per claim = ₹ 28,00,000.

Example:

[Single most likely outcome]

An entity has a legal claim for damages filed by its customer of ₹ 2.50 million. There is a 40% chance that the entity will win the case and no cost will be involved. However, there is a 60% chance that decision will not be in the favour of the entity and it will have to pay for the damages.

In this case the outcome will either be zero cost or a cost of ₹ 2.5 million.

In this example, the provision should be measured at the most likely outcome which is ₹ 2.5 million.

Note:

When the provision relates to a single event, or a small number of events, expected value is not a valid technique.

![]()

Question 16.

(a) A manufacturer gives warranties at the time of sale to purchasers of its product. Under the terms of the contract for sale, the manufacturer undertakes to remedy, by repair or replacement, manufacturing defects that become apparent within three years from the date of sale. As this is the first year that the warranty has been available, there is no data from the firm to indicate whether there will be claim under the warranties. However, industry research suggests that it is likely that such claims will be forthcoming.

Should the manufacturer recognize a provision in accordance with the requirements of Ind AS 37. Why or why not?

(b) Assume that the firm has not been operating its warranty for five years, and reliable data exists to suggest the following:

- If minor defects occur in all products sold, repair costs of ₹ 20,00,000 would result.

- If major defects are detected in all products, costs of ₹ 50,00,000 would result.

- The manufacturer’s past experience and future expectations indicate that each year 80% of the goods sold will have no defects. 15% of the goods sold will have minor defects, and 5% of the goods sold will have major defects.

Calculate the expected value of the cost of repairs in accordance with the requirements of Ind AS 37, if any. .Ignore both income tax and the effect of discounting. [RTP-November 2019]

Answer:

(a) For a provision to be recognized, Para 14 of Ind AS 37 requires that:

- an entity has a present obligation (legal or constructive) as a result of a past event;

- it is probable that an outflow of resources embodying economic benefits will required to settle the obligation, and

- a reliable estimate can be made of the amount of the obligation.

Analysis:

Here, the manufacturer has a present legal obligation. The obligation event is the sale of the product with a warranty.

Ind AS 37 outlines that the future sacrifice of economic benefits is probable when it is more likely than less likely that the future sacrifice of economic benefits will be required. The probability that settlement will be required will be determined by considering the class of obligation (warranties) as a whole. In accordance with para 24 of Ind AS 37, it is more likely than less likely that a future sacrifice of economic benefits will be required to settle the class of obligations as a whole.

![]()

If a reliable estimate can be made the provision can be measured reliably. Past data can provide reliable measures, even if the data is not firm specific but rather industry based. Ind AS 37 notes that only in extremely rare cases, a reliable measure of a provision cannot be obtained. Difficulty in estimating the amount of a provision under conditions of significant uncertainty does not justify non-recognition of the provision.

Conclusion:

The manufacturer should recognize a provision based on the best es-timate of the consideration required to settle the present obligation as , at the reporting date.

(b) The expected value of cost of repairs in accordance with Ind AS 37 is:

(80% × nil) + (15% × ₹ 20,00,000) + (5% × ₹ 50,00,000) = 3,00,000 + 2,50,000 = 5,50,000

Question 17.

What factors should be considered while selecting the discount rate that should be used to determine the present value of the expected expenditure?

Answer:

As per Ind AS 37, provisions should be discounted where the effect of the time value of money is material. For this purpose, discount rate should be pre-tax rate which reflects the current market assessment of time value of money. Government bond rate can be used as discount rate, as it is a risk-free pre-tax rate reflecting the time value of money. This rate should be adjusted to reflect the risks specific to the liability, as Ind AS 37 requires that the discount . rate should reflect the risks specific to the liability. However, where future cash flows have been adjusted to reflect risks, the discount rate should not be adjusted to reflect such risks.

Further, as per paragraph 59 of Ind AS 37, provisions should be reviewed at the end of each reporting period and should be adjusted to reflect the change in estimates. For this purpose, the discount rate should also be reassessed at the end of each reporting period, including the interim reporting date, if any.

![]()

Question 18.

What is the accounting treatment for recognizing the impact of unwinding of discounting?

Answer:

Let us take an example to elaborate the concept.

Example:

An entity has a legal claim that is likely to be settled at the end of two years for an amount of ₹ 100 million. Assuming a discounting rate of 4.5%, the accounting will be as follows:

| Discounting factor @ 4.5% | NPV (₹ in Million) | Borrowing cost (₹ in Million) | |

| 0.9157 | 91.57 | ||

| End of Year 1 | 0.9569 | 95.69 | 4.12 |

| End of Year 2 | 1 | 100 | 4.31 |

The provision should be initially recognized at ₹ 91.57 million which is the present value of ₹ 100 million discounted at 4.5% for two years.

At the end of year 1, the provision increases to ₹ 95.69 million, and the difference of ₹ 4.12 million is recognized as borrowing cost.

In year 2, the provision will increase by ₹ 4.31 million, the increase being recognized as borrowing cost. Consequently, at the end of year 2 the amount of provision will be equal to the amount due, i.e., ₹ 100 million.

![]()

Question 19.

Management is making an assessment of provision required for site cleanup cost. This provision reflects the reasonable expectation of technical experts about the technology that would be available at the time of the cleanup taking into account, all available evidence. Consequently, cost reduction is being recognized for:

- increased experience in applying existing technology; and

- applying existing technology to a larger or more complex clean-up operation than has been carried out to date?

Should an entity take into consideration the impact of future events while determining the amount of provision?

Answer:

Since technical experts have reasonable expectation about the technology that will be available at the time of clean-up would result in cost reduction, the impact of the same should be taken into consideration while determining the amount of provision.

Question 20.

When and how ail entity should recognize the reimbursement from third party of some or all of the expenditure required to settle a provision?

Answer:

Where the entity is liable to pay the whole amount, even in case of failure by the third party to pay for the amount, provision is recognized for full amount and a separate asset is recognized for the expected reimbursement subject to meeting the virtual certainty criterion. Asset must not exceed the provision amount.

In the Statement of Profit and Loss, the expense for provision may be presented net of the amount of expected reimbursement.

Where the entity is not liable to pay the cost in case of failure to pay by the third party, no provision is required to be made by the entity.

![]()

Question 21.

Entity XYZ Is a power generation entity. In order to meet its decommissioning cost of ₹ 5 million, the entity makes an annual contribution of a fixed amount to a decommissioning fund. As per the fund scheme, in case of failure by the fund to meet the decommissioning obligation, the entity is liable to meet the same. Further, the entity is required to make additional contribution to the fund in case of shortfall in the value of investment assets held by the fund and the decommissioning obligation. As on March 31,2019, there is a shortfall in the fund of ₹ 2 million. How should an entity account for its obligation to pay for decommissioning cost to the fund and additional contribution?

Answer:

The answer is based on Paragraphs 7 and 10 of Appendix A to Ind AS 37.

Entity XYZ should recognize a liability of ₹ 5 million for its obligation to pay for decommissioning cost and the interest in the fund shall be recognized separately.

In accordance with paragraph 10 of Appendix A to Ind AS 37, the amount of shortfall of ₹ 2 million in the investment assets of the fund shall be disclosed as a contingent liability in accordance with the provisions of Ind AS 37. This liability for the shortfall will be recognized only if it is probable that the entity will be required to make additional contributions.

Question 22.

Will the accounting for a recognized provision undergo a change once the amount payable under the obligation becomes certain?

Answer:

Ind AS 37 defines a provision as a liability of uncertain timing on amount, accordingly, once the amount of the obligation is crystallized and there is no uncertainty associated with an obligation, the liability is no longer a provision. The same should be reclassified as an element within liabilities.

Example:

A customer X has made a claim of ₹ 2 million for liquidated damages, the entity is disputing the amount of claim. Due to the uncertainty involved in the amount payable, the entity recognizes this as a provision. After negotiation with the customer, the amount is agreed at ₹ 1.5 million. As there is no uncertainty involved relating to the amount payable, it no longer meets the definition of provision and should be reclassified to an appropriate category within liabilities.

![]()

Restructuring (Based On Para Nos. 70 To 83)

Question 23.

Entity A is in the process of finalizing a restructuring plan. As a result, it is likely that there will be closure of two units, a reduction in head count, potential new7 hires and additional training for developing new skills. Additionally, they are proposing hiring a new manager for whom the entity will have to bear relocation cost. The entity proposes to sell the assets at the unit on closure. Which of the following costs should be included while determining the provision for restructuring:

- Cost of employee termination

- Staff training cost

- Recruitment and relocation cost of new manager.

Should the provision for restructuring be made net of expected gain on disposal of assets at units?

Answer:

| Item | Conclusion |

| Cost of employee termination | It is an expenditure, which is necessarily entailed by restructuring. Therefore, it should be included in restructuring provision. |

| Staff training cost | It relates to future conduct of business, therefore should not be included. |

| Recruitment cost and cost of new manager | It relates to future conduct of business, therefore should not be included. |

| Gain on expected disposal of assets | Paragraph 83 clarifies that any gain on expected disposal of assets should not be taken into consideration while determining the cost of provision.

Accordingly, provision for restructuring should not be made net of any expected gain on disposal of assets at units. |

![]()

Question 24.

U Ltd. is a large conglomerate with a number of subsidiaries. It is preparing consolidated financial statements as on 31st March 2018 as per the notified Ind AS. The financial statements are due to be authorised for issue on 15th May 2018. It is seeking your assistance for some transactions that have taken place in some of its subsidiaries during the year.

G Ltd. is a wholly owned subsidiary of U Ltd. engaged in management consultancy services. On 31st January 2018, the board of directors of U Ltd. decided to discontinue the business of G Ltd. from 30th April 2018. They made a public announcement of their decision on 15th February 2018.

G Ltd. does not have many assets or liabilities and it is estimated that the outstanding trade receivables and payables would be settled by 31 st May 2018. 1 U Ltd. would collect any amounts still owed by G Ltd.’s customers after 31st May 2018. They have offered the employees of G Ltd. termination payments or alternative employment opportunities.

Following are some of the details relating to G Ltd.:

On the date of public announcement, it is estimated by G Ltd. that it would have to pay 540 lakhs as termination payments to employees and the costs for relocation of employees who would remain with the Group would be ₹ 60 lakhs. The actual termination payments totalling to ₹ 520 lakhs were made in full on 15th May 2018. As per latest estimates made on 15th May 2018, the total relocation cost is ₹ 63 lakhs.

G Ltd. had taken a property on operating lease, which was expiring on 31st March 2022. The present value of the future lease rentals (using an appropriate discount rate) is ₹ 430 lakhs. On 15th May 2018, G Ltd. made a payment to the lessor of ₹ 410 lakhs in return for early termination of the lease.

The loss after tax of G Ltd. for the year ended 31 st March 2018 was ₹ 400 lakhs. G Ltd. made further operating losses totalling ₹ 60 lakhs till 30th April 2018.

How should U Ltd. present the decision to discontinue the business of G Ltd. in its consolidated statement of comprehensive income as per Ind AS?

What are the provisions that the Company is required to make as per Ind AS 37?

Answer:

A discontinued operation is one that is discontinued in the period or classified as held for sale at the year end. The operations of G Ltd. were discontinued on 30th April 2018 and therefore, would be treated as discontinued operation for the year ending 31st March 2019. It does not meet the criteria for held for sale since the company is terminating its business and does not hold these for sale.

Accordingly, the results of G Ltd. will be included on a line-by-line basis in the consolidated statement of comprehensive income as part of the profit from continuing operations of U Ltd. for the year ending 31st March 2018.

As per para 72 of Ind AS 37 ‘Provisions, Contingent Liabilities and Contingent Assets’, restructuring includes sale or termination of a line of business. A constructive obligation to restructure arises when:

(a) an entity has a detailed formal plan for the restructuring

(b) has raised a valid expectation in those affected that it will carry out the restructuring by starting to implement that plan or announcing its main features to those affected by it.

![]()

The Board of directors of U Ltd. have decided to terminate the operations of G Ltd. from 30th April 2018. They have made a formal announcement on 15th February 2018, thus creating a valid expectation that the termination will be implemented. This creates a constructive obligation on the company and requires provisions for restructuring. A restructuring provision includes only the direct expenditures arising from the restructuring that are necessarily entailed by the restructuring and are not associated with the ongoing activities of the entity.

The termination payments fulfil the above condition. As per Ind AS 10 ‘Events after Reporting Date’, events that provide additional evidence of conditions existing at the reporting date should be reflected in the financial statements. Therefore, the company should make a provision for ₹ 520 lakhs in this respect.

The relocation costs relate to the future conduct of the business and are not liabilities for restructuring at the end of the reporting period. Hence, these would be recognised on the same basis as if they arose independently of a restructuring.

The operating lease would be regarded as an onerous contract. A provision would be made at the lower of the cost of fulfilling it and any compensation or penalties arising from failure to fulfil it. Hence, a provision shall be made for ₹ 410 lakhs.

Further operating losses relate to future events and do not form a part of the closure provision.

Therefore, the total provision required = ₹ 520 lakhs + ₹ 410 lakhs = ₹ 930 lakhs.