Ind AS on Items impacting the Financial Statements – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Ind AS on Items impacting the Financial Statements – CA Final FR Study Material

Computation of DTA An DTL (Based On Para Nos. 15 And 24)

Question 1.

A’s Ltd. profit before tax according to Ind AS for Year 20X1-20X2 is ₹ 100 thousand and taxable profit for year 20X1-20X2 is ₹ 104 thousand. The difference between these amounts arose as follows:

On 1st February, 20X2, it acquired a machine for ₹ 120 thousand. Depreciation is charged on the machine on a monthly basis for accounting purpose. Under the tax law, the machine will be depreciated for 6 months. The machine’s useful life is 10 years according to Ind AS and for tax purposes. In the year 20X1-20X2, expenses of ₹ 8 thousand were incurred for charitable donations. These are not deductible for tax purposes.

You are required to prepare necessary entries as at 31st March 20X2, taking current and deferred tax into account. The tax rale is 25%.

Also prepare the tax reconciliation in absolute numbers as well as the tax rate reconciliation.

Answer:

Current tax = Taxable profit × Tax rate = ₹ 104 thousand × 25% = ₹ 26 thousand.

Computation of Taxable Profit:

| ₹ in thousand | ₹ in thousand | |

| Profit & loss A/c Dr.

To Current Tax |

26 |

26 |

Deferred tax:

Machine’s carrying amount according to Ind AS is ₹ 118 thousand (₹ 120 thousand – ₹ 2 thousand)

Machine’s carrying amount for taxation purpose = ₹ 114 thousand (₹ 120 thousand – ₹ 6 thousand)

Deferred Tax Liability = ₹ 4 thousand × 25%

| ₹ in thousand | ||

| Profit & loss A/c Dr.

To Deferred Tax Liability |

1 |

1 |

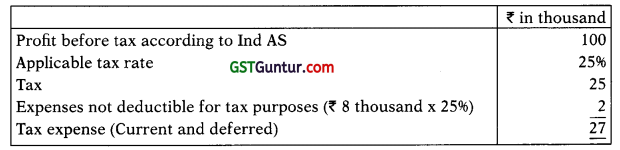

Tax reconciliation in absolute numbers:

Tax rate reconciliation

![]()

Question 2.

X Ltd. prepares consolidated financial statements to 31st March each year. During the year ended 31st March 2018, the following events affected the tax position of the group:

(i) Y Ltd., a wholly owned subsidiary of X Ltd., made a loss adjusted for tax purposes of ₹ 30,00,000. Y Ltd. is unable to utilise this loss against previous tax liabilities. Income-tax Act does not allow Y Ltd. to transfer the tax loss to other group companies. However, it allows Y Ltd. to carry the loss for ward and utilise it against company’s future taxable profits. The directors of X Ltd. do not consider that Y Ltd. will make taxable profits in the foreseeable future.

(ii) lust before 31st March, 2018, X Ltd. committed itself to closing a division after the year end, making a number of employees redundant. Therefore, X Ltd. recognised a provision for closure costs of ₹ 20,00,000 in its statement of financial position as at 31 st March, 2018. Income-tax Act allows tax deductions for closure costs only when the closure actually takes place. In the year ended 31st March 2019, X Ltd. expects to make taxable profits which are well in excess of ₹ 20,00,000. On 31st March, 2018, X Ltd. had taxable temporary differences from other sources which were greater than ₹ 20,00,000.

(iii) During the year ended 31st March, 2017, X Ltd. capitalised development costs which satisfied the criteria in paragraph 57 of Ind AS 38 ‘Intangible Assets’. The total amount capitalised was ₹ 16,00,000. The development project began to generate economic benefits for X Ltd. from 1st January, 2018. The directors of X Ltd. estimated that the project would generate economic benefits for five years from that date. The development expenditure was fully deductible against taxable profits for the year ended 31st March, 2018.

(iv) On 1st April, 2017, X Ltd. borrowed ₹ 1,00,00,000. The cost to X Ltd. of arranging the borrowing was ₹ 2,00,000 and this cost qualified for a tax deduction on 1st April, 2017. The loan was for a three-year period. No interest was payable on the loan but the amount repayable on 31st March, 2020 will be ₹ 1,30,43,800. This equates to an effective annual interest rate of 10%. As per the Income-tax Act, a further tax deduction of ₹ 30,43,800 will be claimable when the loan is repaid on 31st March, 2020.

![]()

Explain and show how each of these events would affect the deferred tax assets/liabilities in the consolidated balance sheet of X Ltd. group at 31st March, 2018 as per Ind AS. Assume the rate of corporate income tax is 20%.

Answer:

(i) The tax loss creates a potential deferred tax asset for the group since its carrying value is nil and its tax base is ₹ 30,00,000.

However, no deferred tax asset can be recognised because there is no prospect of being able to reduce tax liabilities in the foreseeable future as no taxable profits are anticipated.

(ii) The provision creates a potential deferred tax asset for the group since its carrying value is ₹ 20,00,000 and its tax base is nil.

This deferred tax asset can be recognised because X Ltd. is expected to generate taxable profits in excess of ₹ 20,00,000 in the year to 31st March, 2019.

The amount of the deferred tax asset will be ₹ 4,00,000 (₹ 20,00,000 × 20%).

This asset will be presented as a deduction from the deferred tax liabilities caused by the (larger) taxable temporary differences.

(iii) The development costs have a carrying value of ₹ 15,20,000 (₹ 16,00,000 – (₹ 16,00,000 × 1/5 × 3/12)).

The tax base of the development costs is nil since the relevant tax deduction has already been claimed.

The deferred tax liability will be ₹ 3,04,000 (₹ 15,20,000 × 20%). All deferred tax liabilities are shown as non-current.

(iv) The carrying value of the loan at 31st March, 2018 is ₹ 1,07,80,000

(₹ 1,00,00,000 – ₹ 2,00,000 + (₹ 98,00,000 × 10%)). c

The tax base of the loan is ₹ 1,00,00,000.

This creates a deductible temporary difference of ₹ 7,80,000(₹ 1,07,80,000 – ₹ 1,00,00,000) and a potential deferred tax asset of ₹ 1,56,000 (₹ 7,80,000 × 20%).

Due to the availability of taxable profits next year (see part (it) above), this asset can be recognised as a deduction from deferred tax liabilities.

![]()

Question 3.

P Ltd., a manufacturing company, prepares consolidated financial statements to 31st March each year. During the year ended 31st March, 2018, the following events affected the tax position of the group:

Q Ltd., a wholly owned subsidiary of P Ltd., incurred a loss adjusted for tax purposes of 30,00,000. Q Ltd. is unable to utilise this loss against previous tax liabilities. Income-tax Act does not allow Q Ltd. to transfer the tax loss to other group companies. However, it allows Q Ltd. to carry the loss forward and utilise it against company’s future taxable profits. The directors of P Ltd. do not consider that OPR Ltd. will make taxable profits in the foreseeable future.

During the year ended 31 st March, 2018, P Ltd. capitalised development costs which satisfied the criteria as per Ind AS 38 ‘Intangible Assets’. The total amount capitalised was 7 16,00,000. The development project began to generate economic benefits for P Ltd. from 1st January, 2018. The directors of P Ltd. estimated that the project would generate economic benefits for five years from that date. The development expenditure was fully deductible against taxable profits for the year ended 31st March, 2018.

On 1st April, 2017, P Ltd. borrowed ₹ 1,00,00,000. The cost to P Ltd. of arranging the borrowing was ₹ 2,00,000 and this cost qualified for a tax deduction on 1st April 2017. The loan was for a three-year period. No interest was payable on the loan but the amount repayable on 31st March 2020 will be ₹ 1,30,43,800. This equates to an effective annual interest rate of 10%. As per the Income-tax Act, a further tax deduction of ₹ 30,43,800 will be claimable when the loan is repaid on 31st March, 2020.

Explain and show how each of these events would affect the deferred tax assets/liabilities in the consolidated balance sheet of P Ltd. group at 31st March, 2018 as per Ind AS. The rate of corporate income tax is 30%.

Answer:

Impact on consolidated balance sheet of P Ltd. group at 31 st March, 2018

The tax loss creates a potential deferred tax asset for the PQR Ltd. group since its carrying value is nil and its tax base is ₹ 30,00,000. However, no deferred tax asset can be recognised because there is no prospect of being able to reduce tax liabilities in the foreseeable future as no taxable profits are anticipated.

![]()

The development costs have a carrying value of ₹ 15,20,000 (₹ 16,00,000 – (₹ 16,00,000 × 1/5 × 3/12)). The tax base of the development costs is nil since the relevant tax deduction has already been claimed. The deferred tax liability will be ₹ 4,56,000 (₹ 15,20,000 × 30%). All deferred tax liabilities are shown as non-current.

The carrying value of the loan at 31st March, 2018 is ₹ 1,07,80,000 (₹ 1,00,00,000 – ₹ 200,000 + (₹ 98,00,000 × 10%)). The tax base of the loan is 1,00,00,000. This creates a deductible temporary difference of ₹ 7,80,000 and a potential deferred tax asset of ₹ 2,34,000 (₹ 7,80,000 × 30%).

Question 4.

A Limited recognises interest income in its books on accrual basis. However, for income tax purposes the method is ‘cash basis’. On December 31, 20X1, it has interest receivable of ₹ 10,000 and the tax rate was 25%. On February 28, 20X2, the finance bill is introduced in the legislation that changes the tax rate to 30%. The finance bill is enacted as Act on May 21, 20X2. Determine the treatment of deferred tax, as per Ind AS, in case the reporting date of A Ltd.’s financial statement is December 31,20X1 and these are approved for issued on May 31, 20X2.

Answer:

The difference of ₹ 10,000 between the carrying value of interest receivable of ₹ 10,000 and its tax base of NIL is a taxable temporary difference.

A Limited has to recognise a deferred tax liability of ₹ 2,500 (10,000 × 25%) in its financial statements for the reporting period ended on December 31, 20X1.

It will not recognise the deferred tax liability @ 30% because as on December 31, 20X1, this tax rate was neither substantively enacted or enacted on the reporting date. However, if the effect of this change is material, A Limited should disclose this difference in its financial statements.

![]()

Question 5.

QA Ltd. is in the process of computation of the deferred taxes as per applicable Ind AS. QA Ltd. had acquired 40% shares in GK Ltd. for an aggregate amount of ₹ 45 crores. The shareholding gives QA Ltd. significant influence over GK Ltd. but not control and therefore the said interest in GK Ltd. is accounted using the equity method. Under the equity method, the carrying value of investment in GK Ltd. was ₹ 70 crores on 31st March, 2017 and ₹ 75 crores as on 31 st March, 2018. As per the applicable tax laws, profits recognised under the equity method are taxed if and when they are distributed as dividend or the relevant investment is disposed of.

QA Ltd. wants you to compute the deferred tax liability as on 31st March, 2018 and the charge to the Statement of Profit for the same. Consider the tax rate at 20%.

Answer:

DTL created on accumulation of undistributed profits as on 31.3.2018

| Carrying value | Value as per tax records | Tax base | Taxable temporary differences | Total Deferred tax liability @ 20% | Charged to P&L during the year | |

| a | b | c | d | E = b – d | F = e × 20% | g |

| 31st March, 2017 | 70 crore | 45 crore | 45 crore | 25 crore | 5 crore | 5 crore |

| 31st March, 2018 | 75 crore | 45 crore | 45 crore | 30 crore | 6 crore | 1 crore (6 crore – 5 crore) |

![]()

Question 6.

Q Ltd. is in the process of computation of the deferred taxes as per applicable Ind AS and wants guidance on the tax treatment for the following:

(i) Q Ltd. does not have taxable income as per the applicable tax laws, but pays ‘Minimum Alternate Tax’ (MAT) based on its books profits. The tax paid under MAT can be carried forward for the next 10 years and as per the Company’s projections submitted to its bankers, it is in a position to get credit for the same by the end of eighth year. The Company is recognising the MAT credit as a current asset under IGAAP. The amount of MAT credit as on 31st March, 2016 is ₹ 8.5 crores and as on 31st March, 2017 is ₹ 9.75 crores;

(ii) The Company measures its head office property using the revaluation model. The property is revalued every year as on 31st March. On 31st March, 2016, the carrying value of the property (after revaluation) was ₹ 40 crores whereas its tax base was ₹ 22 crores. During the year ended 31st March, 2017, the Company charged depreciation in its Statement of Profit and Loss of ₹ 2 crores and claimed a tax deduction for tax depreciation of ₹ 1.25 crores. On 31st March, 2017, the property was revalued to ₹ 45 crores. As per the tax laws, the revaluation of Property, Plant & Equipment does not affect taxable income at the time of revaluation.

The Company has no other temporary differences other than those indicated above. The Company wants you to compute the deferred tax liability as on 31 st March, 2017 and the charge/credit to the Statement of Profit and Loss and/ or Other Comprehensive Income for the same. Consider the tax rate at 20%.

Answer:

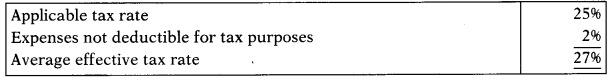

Computation of Deferred Tax Liability

(i) MAT credit as on 31st December of ₹ 9.75 crore will be presented in the Balance Sheet as Deferred tax asset. DTA in the current year will be ₹ 1.25 crore (₹ 9.75 crore – ₹ 8.50 crore)

(ii) (a) In case defer tax is created only on account of depreciation

| Carrying value without revaluation | Value as per tax records | Tax base | Taxable/ (deductible) temporary difference | Total Deferred tax liability/(asset) @ 20% | Credit to P&L during the year | |

| 1 | 2 | 3 = 1 – 2 | 4 = 3 × 20% | |||

| 31st March, 2016 | 22 crore | 22 crore | 22 crore | nil | nil | nil |

| Less: Depreciation for the year 2016-17 | (2 crore) | (1.25 crore) | ||||

| Carrying value as on 31st March, 2017 | 20 crore | 20.75 crore | 20.75 crore | (0.75 crore) | DTA (0.15 crore) | DTA (0.15 crore) |

![]()

(b) Computation of tax effect taking into account the revalued figures and adjusting impact of tax effect on account of difference in depreciation

Note:

As per para 65 of Ind AS 12, when an asset is revalued for tax purposes and that revaluation is related to an accounting revaluation of an earlier period, or to one that is expected to be carried out in a future period, the tax effects on account of revaluation of asset and the adjustment of the tax base are recognised in other comprehensive income in the periods in which they occur.

Here, it is important to understand that only the tax effects on account of revaluation of asset and the adjustment of the tax base are recognised in other comprehensive income. However, tax effects on account of depreciation of asset and the adjustment of the tax base are recognized in profit and loss.

Accordingly, first of all the tax effect has been calculated assuming that there is no revaluation (Refer Table (a) above) [Since the information for the carrying value before revaluation has not been mentioned. It is assumed to be equal to the carrying amount as per the tax records].

Later the DTA arrived due to difference in depreciation is adjusted with the DTL created due to revaluation. DTA of ₹ 0.15 crore on account of depreciation will be charged to Profit and Loss and DTL of ₹ 1.40 crore will be charged to OCI. Net effect in the year 31.3.2017 will be DTL 1.25 crore (DTL 1.4 crore – DTA 0.15 crore) [Refer Table (b) above.]

![]()

Question 7.

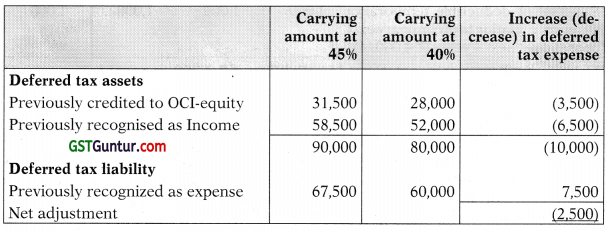

An entity is finalizing its financial statements for the year ended 31st March, 20X2. Before 31st March, 20X2, the government announced that the tax rate was to be amended from 40 percent to 45 percent of taxable profit from 30th June, 20X2.

The legislation to amend the tax rate has not yet been approved by the legislature. However, the government has a significant majority and it is usual, in the tax jurisdiction concerned, to regard an announcement of a change in the tax rate as having the substantive effect of actual enactment (i.e. it is substantively enacted).

After performing the income tax calculations at the rate of 40 percent, the entity has the following deferred tax asset and deferred tax liability balances:

| Deferred tax asset | ₹ 80,000 |

| Deferred tax liability | ₹ 60,000 |

Of the deferred tax asset balance, ₹ 28,000 related to a temporary difference. This deferred tax asset had previously been recognised in OCI and accumulated in equity as a revaluation surplus.

The entity reviewed the carrying amount of the asset in accordance with para 56 of Ind AS 12 and determined that it was probable that sufficient taxable profit to allow utilization of the deferred tax asset would be available in the future.

Show the revised amount of Deferred tax asset & Deferred tax liability and present the necessary journal entries. [RTP-November 2019]

Answer:

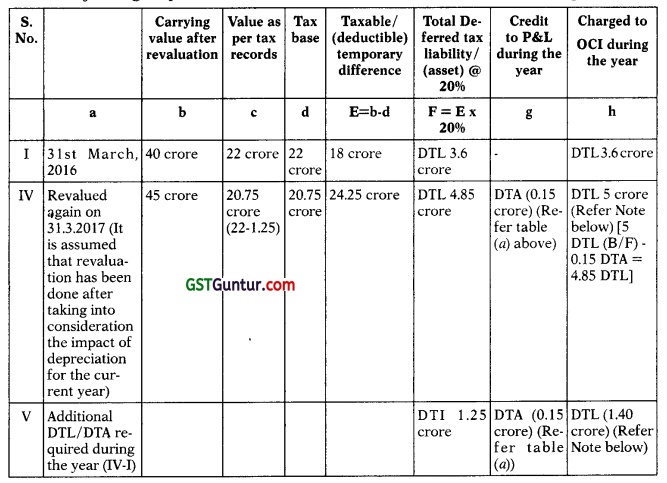

Computation of Deductible temporary differences:

Deferred tax asset = ₹ 80,000

Existing tax rate = 40&

Deductible temporary differences = 80,000/40%

= ₹ 2,00,000

![]()

Computation of Taxable temporary differences:

Deferred tax liability = ₹ 60,000

Existing tax rate = 40%

Deductible temporary differences = 60,000/40%

= ₹ 1,50,000

Of the total deferred tax asset balance of ₹ 80,000, ₹ 28,000 is recognized in OCI

Hence, Deferred tax asset balance of Profit & Loss is ₹ 80,000 – ₹ 28,000 = ₹ 52,000

Deductible temporary difference recognized in Profit & Loss is ₹ 1,30,000 (52,000/40%)

Deductible temporary difference recognized in OCI is ₹ 70,000 (28,000/40%)

The adjusted balances of the deferred tax accounts under the new tax rate are:

The net adjustment to deferred tax expense is a reduction of ₹ 2,500, Of this amount, ₹ 3,500 is recognised in OCI and ₹ 1,000 is charged to P&L.

The amounts are calculated as under:

Journal Entry:

| ₹ | ₹ | ||

| Deferred tax asset | Dr. | 10,000 | |

| Deferred tax expense | Dr. | 1,000 | |

| To OCI -revaluation surplus | 3,500 | ||

| To Deferred tax liability | 7,500 |

![]()

Creation of DTA (3 Step Criteria) (Based On Para Nos. 28 To 30)

Question 8.

B Limited is a newly incorporated entity. Its first financial period ends on March 31, 20X1. As on the said date, the following temporary differences exist:

(a) Taxable temporary differences relating to accelerated depreciation of ₹ 9,000. These are expected to reverse equally over next 3 years.

(b) Deductible temporary differences of ₹ 4,000 expected to reverse equally over next 4 years.

It is expected that B Limited will continue to make losses for next 5 years. Tax rate is 30%. Losses can be carried forward but not backwards.

Discuss the treatment of deferred tax as on March 31, 20X1.

Answer:

The year-wise anticipated reversal of temporary differences is as under:

| Particulars | Year ending on March 31, 20X2 | Year ending on March 31, 20X3 | Year ending on March 31, 20X4 | Year ending on March 31, 20X5 |

| Reversal of taxable temporary difference relating to accelerated depreciation over next 3 years (₹ 9,000/3) | 3,000 | 3,000 | 3,000 | Nil |

| Reversal of deductible temporary difference relating to preliminary expenses over next 4 years (₹ 4,000/4) | 1,000 | 1,000 | 1,000 | 1,000 |

B Limited will recognise a deferred tax liability of ₹ 2,700 on taxable temporary difference relating to accelerated depreciation of ₹ 9,000 @ 30%.

However, it will limit and recognise a deferred tax asset on reversal of deductible temporary difference relating to preliminary expenses reversing up to year ending March 31, 20X4 amounting to ₹ 900 (₹ 3,000 @ 30%). No deferred tax asset shall be recognized for the reversal of deductible temporary difference for the year ending on March 31, 20X5 as there are no taxable temporary differences.

Further, the outlook is also a loss. However, if there are tax planning opportunities that could be identified for the year ending on March 31, 20X5 deferred tax asset on the remainder of ₹ 1,000 (₹ 4,000 – ₹ 3,000) of deductible temporary difference could be recognised at the 30% tax rate.

![]()

Ind AS 21: The effects of changes in Foreign Exchange Rate

Identification Of Functional Currency

Question 1.

What is the functional currency of an entity?

What are the primary and secondary factors that influence determination of functional currency? [Nov. 2019 – 4 Marks]

Recognition of Foreign Exchange Gain/Loss (Based On Para Nos. 21. 23 To 25, 28, 30 And 32)

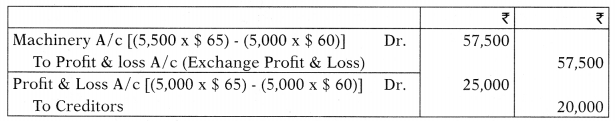

Question 2.

On 30th January, 20X1, A Ltd. purchased a machinery for $5,000 from USA supplier on credit basis. A’s Ltd. functional currency is the Rupee. The exchange rate on the date of transaction is 1 $= ₹ 60. The fair value of the machinery determined on 31st March, 20X1 is $ 5,500. The exchange rate on 31st March, 20X1 is 1$ = ₹ 65. The payment to overseas supplier done on 31st March 20X2 and the exchange rate on 31st March 20X2 is 1$= ₹ 67.The fair value of the machinery remain unchanged for the year ended on 31st March 20X2. Prepare the Journal entries for the year ended on 31st March 20X1 and year 20X2 according to Ind AS 21.

Answer:

Journal Entries

Purchase of Machinery on credit basis on 30th January 20X1:

Exchange difference arising on translating monetary item on 31st March 20X1:

Exchange difference arising on translating monetary item and settlement of creditors on 31st March 20X2:

![]()

Ind AS 21: The effects of changes in Foreign Exchange Rate

Identification Of Functional Currency

Question 3.

On 1st January, 2018, P Ltd. purchased a machine for $ 2 lakhs. The functional currency of P Ltd. is Rupees. At that date the exchange rate was $1 = ₹ 68. P Ltd. is not required to pay for this purchase until 30th June, 2018. Rupees strengthened against the $ in the three months following purchase and by 31st March, 2018 the exchange rate was $1 = ₹ 65. CFO of P Ltd. feels that these exchange fluctuations wouldn’t affect the financial statements because P Ltd. has an asset and a liability denominated in rupees, which was initially the same amount. He also feels that P Ltd. depreciates this machine over four years so the future year-end amounts won’t be the same.

Examine the impact of this transaction on the financial statements of P Ltd. for the year ended 31st March, 2018 as per Ind AS.

Answer:

As per Ind AS 21 ‘The Effects of Changes in Foreign Exchange Rates’ the asset and liability would initially be recognised at the rate of exchange in force at the transaction date Le. 1st January, 2018. Therefore, the amount initially recognised would be ₹ 1,36,00,000 ($ 2,00,000 × ₹ 68).

The liability is a monetary item so it is retranslated using the rate of exchange in force at 31st March, 2018. This makes the closing liability of ₹ 1,30,00,000 ($ 2,00,000 × ₹ 65).

The loss on re-translation of ₹ 6,00,000(₹ 1,36,00,000 – ₹ 1,30,00,000) is recognised in the Statement of profit or loss.

The machine is a non-monetary asset carried at historical cost. Therefore, it continues to be translated using the rate of ₹ 68 to $1.

Depreciation of ₹ 8,50,000 (₹ 1,36,00,000 × 1/4 × 3 /12) would be charged to profit or loss for the year ended 31st March, 2018.

The closing balance in property, plant and equipment would be ₹ 1,27,50,000 (₹ 1,36,00,000 – ₹ 8,50,000). This would be shown as a non-current asset in the statement of financial position.

![]()

Question 4.

Supplier, A Ltd., enters into a contract with a customer, B Ltd., on 1st January, 2018 to deliver goods in exchange for total consideration of USD 50 million and receives an upfront payment of USD 20 million on this date. The functional currency of the supplier is INR. The goods are delivered and revenue is recognised on 31st March, 2018. USD 30 million is received on 1st April, 2018 in full and final settlement of the purchase consideration.

State the date of transaction for advance consideration and recognition of revenue. Also state the amount of revenue in INR to be recognized on the date of recognition of revenue. The exchange rates on 1st January, 2018 and 31st March, 2018 are ₹ 72 per USD and ₹ 75 per USD respectively.

Answer:

This is the case of Revenue recognised at a single point in time with multiple payments. As per the guidance given in Appendix B to Ind AS 21:

A Ltd. will recognise a non-monetary contract liability amounting ₹ 1,440 million, by translating USD 20 million at the exchange rate on 1st January, 2018 i.e. ₹ 72 per USD.

A Ltd. will recognise revenue at 31st March, 2018 (that is, the date on which it transfers the goods to the customer).

A Ltd. determines that the date of the transaction for the revenue relating to the advance consideration of USD 20 million is 1st January, 2018. Applying paragraph 22 of Ind AS 21, A Ltd. determines that the date of the transaction for the remainder of the revenue as 31st March, 2018.

On 31st March, 2018, A Ltd. will:

- derecognise the non-monetary contract liability of USD 20 million and recognize USD 20 million of revenue using the exchange rate as at 1st January, 2018 i.e. ₹ 72 per USD; and

- recognise revenue and a receivable for the remaining USD 30 million, using the exchange rate on 31st March, 2018 i.e. ₹ 75 per USD.

- The receivable of USD 30 million is a monetary item, so it should be translated using the closing rate until the receivable is settled.

![]()

Translation of Foreign Operations (Based On Para Nos. 44 – 47)

Question 5.

XYZ Global Ltd. has a functional currency of USD and needs to translate its financial statements into the functional and presentation currency of XYZ Info. (Euro).

The following is the statement of financial position of XYZ Global Ltd. prior to translation:

Additional information:

Relevant exchange rates are :

Rate at beginning of the year – Euro 1 = USD 1.25

Average rate for the year – Euro 1 = USD 1.20

Rate at end of the year – Euro 1 = USD 1.15

You are required to :

(i) Translate the statement of financial position of XYZ Global Ltd. into Euro ready for consolidation by XYZ Info. (Share capital and opening retained earnings have been pre-populated.)

(ii) Prepare a working of the cumulative balance of the foreign currency translation reserve as per relevant Ind AS. [May 2019 – 5 Marks]

Answer:

Translation of the financial statements

| USD | Rate | Euro | |

| Property, plant and equipment | 60,000 | 1.15 | 52,174 |

| Receivables | 9,00,000 | 1.15 | 7,82,609 |

| Total assets | 9,60,000 | 8,34,783 | |

| Issued capital | 40,000 | – | 25,000 |

| Opening retained earnings | 25,000 | – | 15,000 |

| Profit for the year | 22,000 | 1.20 | 18,333 |

| Accounts payable | 8,15,000 | 1.15 | 7,08,696 |

| Accrued liabilities | 58,000 | 1.15 | 50,435 |

| Total equity and liabilities USD | 9,60,000 | 8,17,464 | |

| Foreign Currency Translation Reserve (proof below) | 17,319 | ||

| Total equity and liabilities Euro | 8,34,783 |

Working of the cumulative balance of the FCTR:

| Particulars | Actual translated amount in Euro | Amount translated at closing rate of 1.15 | Difference |

| Issued capital | 25,000 | 34,783 | 9,783 |

| Opening retained earnings | 15,000 | 21,739 | 6,739 |

| Profit for the year | 18,333 | 19,130 | 797 |

| 62,350 | 86,725 | 17,319 |

![]()

Question 6.

Global Limited, an Indian company acquired on 30th September, 20X1 70% of the share capital of Mark Limited, an entity registered as company in Germany. The functional currency of Global Limited is Rupees and its financial year end is 31st March, 20X2.

(i) The fair value of the net assets of Mark Limited was 23 million EURO and the purchase consideration paid is 17.5 million EURO on 30th September, 20X1.

The exchange rates as at 30th September, 20X1 was ₹ 82/EURO and at 31st March, 20X2 was ₹ 84/EURO.

What is the value at which the goodwill has to be recognised in the financial statements of Global Limited as on 31st March, 20X2?

(ii) Mark Limited sold goods costing 2.4 million EURO to Global Limited for 4.2 million EURO during the year ended 31st March, 20X2. The ex-change rate on the date of purchase by Global Limited was ₹ 83/EURO and on 31st March, 20X2 was ₹ 84/EURO. The entire goods purchased from Mark Limited are unsold as on 31st March, 20X2. Determine the unrealised profit to be eliminated in the preparation of consolidated financial statements. [RTP-November 2019]

Answer:

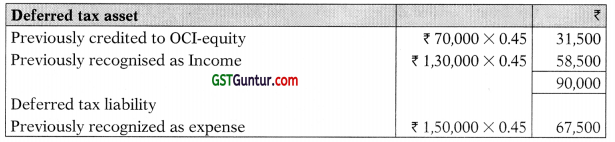

(i) Amount of goodwill will be as follows:

Net identifiable asset : Dr. : 23 million

Goodwill (bal. fig.) : Dr. : 1.4 million

To Bank : 17.5 million

To NCI (23 × 30%) : 6.9 million

Thus, goodwill on reporting date would be 1.4 million EURO million

![]()

(ii)

| Particulars | EURO in million |

| Sale price of Inventory | 4.20 |

| Unrealised Profit [a] | 1.80 |

Exchange rate as on date of purchase of Inventory [b] ₹ 83 /Euro

Unrealized profit to be eliminated [a × b] ₹ 149.40 million

In the given case, purchase of inventory is an expense item shown in the statement profit and loss account. Hence, the exchange rate on the date of purchase of inventory is taken for calculation of unrealized profit which is to be eliminated on the event of consolidation.