Ind AS on Disclosures in the Financial Statements – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Ind AS on Disclosures in the Financial Statements – CA Final FR Study Material

Identification of Related Party (Based On Para Nos. 9. 11 And 12)

Question 1.

A Ltd. is a long-standing customer of XYZ Ltd. Mrs. P whose husband is a director in X Ltd. purchased a controlling interest in entity A Ltd. on 1st June, 2017. Sales of products from X Ltd. to A Ltd. in the two-month period from 1st April 2017 to 31st May 2017 totalled ₹ 8,00,000. Following the shares purchased by Mrs. P, X Ltd. began to supply the products at a dis-count of 20% to their normal selling price and allowed A Ltd. three months’ credit (previously A Ltd. was allowed one month’s credit as per X Ltd.’s normal credit policy). Sales of products from X Ltd. to A Ltd. in the ten-month period from 1st June 2017 to 31st March 2017 totalled ₹ 60,00,000. On 31st March 2018, the trade receivables of X Ltd. included ₹ 18,00,000 in respect of amounts owing by A Ltd.

Analyse and show how the above event would be reported in the financial statements of X Ltd. for the year ended 31st March, 2018 and also mention the disclosure requirements as per Ind AS.

Answer:

X Ltd. would include the total revenue of ₹ 68,00,000 (₹ 60,00,000 + ₹ 8,00,000) from A Ltd. received/receivable in the year ended 31st March 2018 within its revenue and show ₹ 18,00,000 within trade receivables at 31st March 2018.

Mrs. P would be regarded as a related party of X Ltd. because she is a close family member of one of the key management personnel of X Ltd.

From 1 st June 2017, ABC Ltd. would also be regarded as a related party of X Ltd. because from that date A Ltd. is an entity controlled by another related party.

Because A Ltd. is a related party with whom X Ltd. has transactions, then X Ltd. should disclose:

- The nature of the related party relationship.

- The revenue of ₹ 60,00,000 from A Ltd. since 1st June 2017.

- The outstanding balance of ₹ 18,00,000 at 31st March 2018.

In the current circumstances it may well be necessary for X Ltd. to also disclose the favourable terms under which the transactions are carried out.

![]()

Question 2.

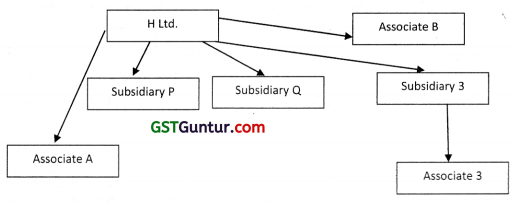

H Ltd. has a controlling interest in Subsidiaries P, 0 and R and has significant influence over Associates A and B. Subsidiary R has significant influence over Associate C.

Determine the related party relationship, as per Ind AS 24, of the entities referred in the question in the following financial statements:

- In consolidated financial statements of H Ltd.

- In individual financial statements of H Ltd.

- In individual financial statements of Subsidiary P

- In individual financial statements of Subsidiary Q

- In individual financial statements of Subsidiary R

- In individual financial statements of Associates A, B and C

Answer:

As per para 9(b)(i) and (it) of Ind AS 24,

“An entity is related to a reporting entity if any of the following conditions applies:

- The entity and the reporting entity are members of the same group (which means that each parent, subsidiary and fellow subsidiary is related to the others).

- One entity is an associate or joint venture of the other entity (or an associate or joint venture of a member of a group of which the other entity is a member).”

Accordingly,

- For H Ltd.’s consolidated financial statements- Associates A, B and C are related to the Group.

- For H Ltd.’s separate financial statements- Subsidiaries P, Q and C and Associates A, B and C are related parties.

- For Subsidiary P’s financial statements- Parent, Subsidiaries Q and R and Associates A, B and C are related parties.

- For Subsidiary Q’s separate financial statements- Parent, Subsidiaries P and R and Associates A, B and C are related parties.

- For Subsidiary R’s financial statements- Parent, Subsidiaries P and Q and Associates A, B and C are related parties.

- For the financial statements of Associates A, B and C-Parent and Subsidiaries

![]()

Question 3.

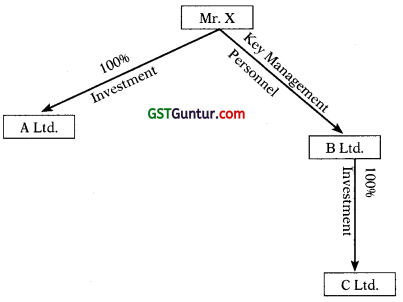

Mr. X has a 100% investment in A Ltd. He is also a member of the key management personnel (KMP) of B Ltd. B Ltd. has a 100% investment in C Ltd.

Examine related party relationship of A Ltd., as per Ind AS 24, in the financial statements of C Ltd.

Answer:

Para 9 of Ind AS 24 defines the term “key management personnel” as persons having authority and responsibility for planning, directing and controlling the activities of the entity directly or indirectly, including any director (whether executive or not). Further, significant influence is the power to participate in the financial and operating policy decisions of the investee but is not control or joint control of those policies.

Therefore, a key management personnel (KMP) has significant influence over the entity. Accordingly, Mr. X has significant influence over B Ltd. since he is a key management personnel of B Ltd.

Now, para 9(vzz) of the standard states that an entity is related to a reporting entity if the person identified in para 9(a)(z) (here KMP Le. Mr. X) has significant influence over the entity or is a member of the key management personnel of the entity (or of a parent of the entity)

Therefore, if C Ltd. is a reporting entity, A Ltd. is related to C Ltd. because a key management personnel of parent B Limited has control over A Limited. Therefore, the relationship of C Ltd. and A Ltd. will be “Entities controlled by key management personnel of the Parent Entity”.

![]()

Disclosures (Based On Para Nos. 13 To 19)

Question 4.

Mr. A is an independent director of a company X Ltd. He plays a vital role in the Management of X Ltd. and contributes in major decision making process of the organisation. X Ltd. pays sitting fee of ₹ 2,00,000 to him for every Board of Directors’ (BOD) meeting he attends. Throughout the year, X Ltd. had 5 such meetings which was attended by Mr. Atul.

Similarly, a non-executive director, Mr. N also attended 5 BOD meetings and charged ₹ 1,50,000 per meeting. The Accountant of X Ltd. believes that they being not the employees of the organisation, their fee should not be disclosed as per related party transaction in accordance with Ind AS 24.

Examine whether the sitting fee paid to independent director and non-executive director is required to be disclosed in the financial statements prepared as per Ind AS?

Answer:

As per paragraph 9 of Ind AS 24, Related Party Disclosures, “Key management personnel are those persons having authority and responsibility for planning, directing and controlling the activities of the entity, directly or indirectly, including any director (whether executive or otherwise) of that entity.”

Accordingly, key management personnel (KMP) includes any director of the entity who are having authority and responsibility for planning, directing and controlling the activities of the entity. Hence, independent director Mr. A and non-executive director Mr. N are covered under the definition of KMP in accordance with Ind AS.

Also as per paragraphs 7 and 9 of Ind AS 19, ‘Employee Benefits’, an emp-loyee may provide services to an entity on a full-time, part-time, permanent, casual or temporary basis. For the purpose of the Standard, Employees include directors and other management personnel.

Therefore, contention of the Accountant is wrong that they are not employees of X Ltd.

Paragraph 17 of Ind AS requires disclosure about employee benefits for key management personnel. Therefore, an entity shall disclose key management personnel compensation in total Le. disclosure of directors’ fee of (₹ 10,00,000 + ₹ 7,50,000) ₹ 17,50,000 is to be made as employees benefits (under various categories).

Since short-term employee benefits are expected to be settled wholly before twelve months after the end of the annual reporting period in which the employees render the related services, the sitting fee paid to directors will fall under it (as per Ind AS 19) and is required to be disclosed in accordance with the paragraph 17 of Ind AS 24.

![]()

Question 5.

An Indian company has a parent company outside India. Parent company negotiates software licenses with end vendor and based on number of licences, parent company get its reimbursement from Indian company. Say, license cost of ₹ 12 Lac is charged for calendar year of 2018. Parent company generates is invoice in February 2018. Indian company accounts full invoice in February 2018 and then for Indian financial year, accounts Reimbursement expense of ₹ 3.00 Lac during FY 2017-18 (for licencing cost relating to period January 2018 to March 2018) and Prepaid expenses of ₹ 9 Lac for licensing cost reimbursement relating to April 2018 to December 2018. Prepaid expense is subsequently reversed and expense of ₹ 9 Lac is accounted for in FY 2018-19.

What amount should be disclosed at Related party transaction?

Answer:

Paragraph 9 of Ind AS 24 Related Party Disclosures defines Related Party Transactions as under:

“A related party transaction is a transfer of resources, services or obligations between a reporting entity and a related party, regardless of whether a price is charged.”

Paragraph 6 of Ind AS 24 states as under:

“6 A related party relationship could have an effect on the profit or loss and financial position of an entity…”

In the given case, there is a transfer of resources to the extent of ₹ 12 lac from the company to the parent towards software license. Of this transfer of resources, the company has consumed the benefits relating to ₹ 3 lac of soft-ware license cost which is recognise in profit or loss. The benefits relating to ₹ 9 lac of software license cost will be consumed in the next reporting period and therefore is recognised in balance sheet as prepaid expenses.

Paragraph 18 of Ind AS 24 states as under:

“18 If an entity has had related party transactions during the periods covered by the financial statements, it shall disclose the nature of the related party relationship as well as information about those transactions and outstanding balances, including commitments necessary for users to understand the potential effect of the relationship of the financial statements. At a minimum, disclosures shall include:

(a) The amount of the transactions;

(b) The amount of outstanding balances, including commitments, and;

- Their terms and conditions, including whether they are secured, and the nature of the consideration to be provided in settlement; and

- Details of any guarantees given or received;

(c) Provisions for doubtful debts related to the amount of outstanding balances; and

(d) The expense recognised during the period in respect of bad and doubtful debts due from related parties.”

![]()

Therefore, the company has to disclose:

- The amount of transaction with the parent of ₹ 12 lac towards software license;

- Outstanding balance of ₹ 9 lac presented as prepaid expense along with the terms and conditions and state that the same will be settled in the next reporting period by receipt of software licensing services.

- The amount of ₹ 3 lac recognised as software license expense in profit or loss for the benefits consumed during the period to make it understandable to users.

Paragraph 113 of Ind AS 1 Presentation of Financial Statements states as under:

“113 An entity shall present notes in a systematic manner. An entity shall cross-reference each line items in the balance sheet and in the statement of profit and loss, and in the statement of changes in equity and of cash flows to any related information in the notes.”

Therefore, the company shall’cross-reference the software license expense recognised in profit or loss and prepaid expenses recognised in balance sheet to the notes idisclosing related party transactions.

Question 6.

Uttar Pradesh State Government holds 60% shares in PQR Limited and 55% shares in ABC Limited. PQR Limited has two subsidiaries namely P Limited and Q Limited. ABC Limited has two subsidiaries namely A Limited V and B Limited. Mr. KM is one of the Key management personnel in PQR Limited.

(a) Determine the entity to whom exemption from disclosure of related party transactions is to be given. Also examine the transactions and with whom such exemption applies.

(b) What are the disclosure requirements for the entity which has availed the exemption? [RTP-Nov. 2019]

Answer:

(a) As per para 18 of Ind AS 24, ‘Related Party Disclosures ’ if an entity had related party transactions during the periods covered by the financial statements, it shall disclose the nature of the related party relationship as well as information about those transactions and outstanding balances, including commitments, necessary for users to understand the potential effect of the relationship on the financial statements.

However, as per para 25 of the standard a reporting entity is exempt from the disclosure requirements in relation to related party transactions and outstanding balances, including commitments, with:

- a government that has control or joint control of, or significant influence over, the reporting entity; and

- another entity that is a related party because the same government has control or joint control of, or significant influence over, both the reporting entity and the other entity.

Analysis:

According to the above paras, for Entity P’s financial statements, .the exemption in paragraph 25 applies to:

- transactions with Government Uttar Pradesh State Government; and

- transactions with Entities PQR and ABC and Entities Q, A and B.

Similar exemptions are available to Entities PQR, ABC, Q, A and B, with the transactions with UP State Government and other entities controlled directly or indirectly by UP State Government. However, that exemption does not apply to transactions with Mr. KM.

Conclusion:

Hence, the transactions with Mr. KM needs to be disclosed under related party transactions.

![]()

(b) It shall disclose the following about the transactions and related out-standing balances referred to in paragraph 25:

(a) the name of the government and the nature of its relationship with the reporting entity (Le. control, joint control or significant influence);

(b) the following information in sufficient detail to enable users of the entity’s financial statements to understand the effect of related party transactions on its financial statements:

- the nature and amount of each individually significant transaction; and

- for other transactions that are collectively, but not individually, significant, a qualitative or quantitative indication of their extent.

Ind AS 33: Earnings Per Share

Question 1.

P Ltd. is a subsidiary company of ABC Ltd. It preparing both Separate Financial Statement (SFS) and Consolidated Financial Statements (CFS) for the year ending on 31st March, 20X1. It has net profit after tax of ₹ 20,00,000 as per SFS & ₹ 16,00,000 as per CFS. Share capital of P Ltd. is 2,00,000 shares of ₹ 10 each. ABC Ltd. has acquired 80% shares of P Ltd. Accountant of P Ltd. had calculated following Basic EPS for its SFS:

| Calculation of Basic EPS in its SFS | |

| Net Profit after tax | ₹ 16,00,000 |

| Number of equity shares attributable to Parent company ABC Ltd. (2,00,000 × 80%) | 1,60,000 shares |

| Basic EPS | ₹ 10 per share |

Examine the correctness of the above presentation of Basic EPS.

Answer:

As per paragraph 4 of Ind AS 33 “Earnings per Share”, when an entity presents both consolidated financial statements and separate financial statements prepared in accordance with Ind AS 110, Consolidated Financial Statements, and Ind AS 27, Separate Financial Statements, respectively, the disclosures required by this Standard shall be presented both in the consolidated financial statements and separate financial statements.

In consolidated financial statements such disclosures shall be based on consolidated information and in separate financial statements such disclosures shall be based on information given in separate financial statements. An entity shall not present in consolidated financial statements, earnings per share based on the information given in separate financial statements and shall not present in separate financial statements, earnings per share based on the information given in consolidated financial statements.

![]()

Also paragraph 9 of the standard states that an entity shall calculate basic earnings per share amounts for profit or loss attributable to ordinary equity holders of the parent entity and, if presented, profit or loss from continuing operations attributable to those equity holders.

Further, paragraph A1 of Appendix A of Ind AS 33 states that for the purpose of calculating earnings per share based on the consolidated financial statements, profit or loss attributable to the parent entity refers to profit or loss of the consolidated entity after adjusting for non-controlling interests.

Therefore, the requirements of paragraph 9 of Ind AS 33 have been provided in the context of calculating EPS in the consolidated financial statements of an entity.

The accountants of P Ltd. had followed this for calculation of Basic EPS in its SFS. As per ITFG Bulletin 11, for SFS analogy may be drawn from paragraph 9 of Ind AS 33 that in case of separate financial statements, the parent entity mentioned in paragraph 9 will imply the legal entity of which separate financial statements are being prepared and accordingly, when an entity presents EPS in its separate financial statements, then the same shall be calculated based on the profit or loss attributable to its equity shareholders.

Hence, the presentation of Basic EPS by the Accountant of P Ltd. on the basis of consolidated financial statements in its separate financial statements is not correct. The correct presentation of Basic EPS would be as follows:

| Calculation of Basic EPS of P Ltd. in SFS | |

| Net Profit after tax | ₹ 20,00,000 |

| No. of share issued | 2,00,000 shares |

| Basic EPS | ₹ 10 per share |

![]()

Diluted Eps – 1 Potential Equity Share [Based On Para Nos. 30, 31, 33. 36, 38 And 41]

Question 2.

An entity issues 2,000 convertible bonds at the beginning of Year 1. The bonds have a three-year term, and are issued at par with a face value of ₹ 1,000 per bond, giving total proceeds of ₹ 2,000,000. Interest is payable annually in arrears at a nominal annual interest rate of 6 per cent. Each bond is convertible at any time up to maturity into 250 ordinary shares. The entity has an option to settle the principal amount of the convertible bonds in ordinary shares or in cash.

When the bonds are issued, the prevailing market interest rate for similar debt without a conversion option is 9 percent. At the issue date, the market price of one ordinary share is ₹ 3. Income tax is ignored.

Calculate basic and diluted EPS when

| Profit attributable to ordinary equity holders of the parent entity Year 1

Ordinary shares outstanding Convertible bonds outstanding |

₹ 1,000,000

1,200,000 2,000 |

Answer:

Allocation of proceeds of the bond issue:

The liability and equity components would be determined in accordance with Ind AS 32. These amounts are recognised as the initial carrying amounts of the liability and equity components. The amount assigned to the issuer conversion option equity element is an addition to equity and is not adjusted.

![]()

Question 3.

Is an entity required to provide separate disclosures for each of its operating segments?

Answer:

No. The entity is required to determine its reportable segments and make disclosures accordingly.

Question 4.

Is it mandatory to aggregate segments if they meet all the criteria of paragraph 12 of Ind AS 108?

Answer:

No. It is optional. An entity, if it so desires, can still disclose separately information about segments that meet all the criteria of Paragraph 12.

Question 5.

What are the ‘economic characteristics’ that would need to be ‘similar’ for the purpose of aggregating operating segments?

Answer:

The Standard does not define the term or provide detailed guidance on the aggregation criteria and, therefore, the determination as to whether two or more operating segments are similar is dependent on the individual facts and circumstances and is subject to judgment.

While the Standard does not define the term ‘economic characteristics’, it states that ‘operating segments often exhibit similar long-term financial performance if they have similar economic characteristics.

Example:

Similar long-term average gross margins for two operating segments would be expected if their economic characteristics were similar.

Similar economic characteristics may also be indicated by metrics such as sales growth, return on assets, return on capital employed in a long term perspective and/or valuation metrics such as Enterprise Value (EV)/Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and Price-Earnings (PE) Ratios that embed the market’s perception of competitive and financial risks and opportunities related to such industries.

![]()

Question 6.

When can products/services, production processes, customers, distribution methods and regulatory environment said to be of similar nature?

Answer:

According to paragraph 12 of Ind AS 108, two or more operating segments may be aggregated into a single operating segment if aggregation is consistent with the core principle of Ind AS 108, i.e., the segments have similar economic characteristics, and the segments are similar in each of the following respects:

(a) Nature of the products and services: Similar products or services have similar purposes or end uses. Therefore, they may be expected to have similar rates of profitability, similar degrees of risk and similar opportunities for growth. The assessment of whether products or services are similar may depend, in part, on the nature and breadth of an entity’s product lines and overall operations.

An entity with a relatively narrow product line may not consider two products to be similar, while an entity with a broad product line may consider the same two products to be similar. For example, a highly diversified entity may consider all consumer products to be similar if it has other businesses such as financial services and road construction.

(b) Nature of the production process: Although no specific guidance is provided in the Standard, similarities in the nature of the production process may be demonstrated by sharing of common or interchangeable production, equipment, labour force or servicing and maintenance staff, or use of the same or similar basic raw materials. Similar degrees of labour or capital intensiveness may indicate a similarity in the production process.

(c) Type or class of customer for their products and services: ‘Similar type or class of customer’ criterion may be evaluated based on how chief operating decision maker views the customer, viz,, similar marketing and promotional efforts, common or interchangeable sales forces, customer demographics, etc. For example, customers of an entity engaged in production of fabric may be different from that of an entity engaged in manufacture of branded apparel.

(d) Methods used to distribute products or provide services: ‘Methods of distribution’ criterion may be evaluated based on the nature of the distribution channels (e.g., retail outlets, mail order, website) and the nature of the products sold (e.g., component parts, finished goods).

![]()

(e) Nature of regulatory environment: (e.g., banking, insurance, public utilities) — Applies only if a unique regulatory environment exists with respect to a part of the entity’s business. For example, where a component of the business is engaged in purchase and sale of units of mutual funds and other financial instruments and is regulated by RBI NBFC guidelines, whereas the other component deals in engineering goods and is not regulated, each segment is considered to operate in a different regulatory environment and, therefore, aggregation would not be appropriate.

Question 7.

How quantitative thresholds are determined based on profitability criteria when certain segments report profits and certain segments report losses?

Answer:

Let us take an example to elaborate the concept.

A Limited has 5 operating segments namely A, B, C, D and E. The profit/loss of respective segments for the year ended March 31, 2019 are as follows:

| Segment | Profit/(Loss) |

| (₹ in crore) | |

| A | 780 |

| B | 1,500 |

| C | (2,300) |

| D | (4,500) |

| E | 6,000 |

| Total | 1,480 |

In compliance with Ind AS 108, the segment profit/loss of respective segment will be compared with the greater of the following:

- All segments in profit, i.e., A, B and E – Total profit ₹ 8,280 crores.

- All segments in loss, i.e., C and D – Total loss ₹ 6,800 crores.

Greater of the above – ₹ 8,280 crores.

Based on the above, reportable segments will be determined as follows:

| Segment | Profit/ (Loss) | As Absolute % of 8,280 | Reportable |

| A | 780 | 9% | No |

| B | 1,500 | 18% | Yes |

| C | (2,300) | 28% | Yes |

| D | (4,500) | 54% | Yes |

| E | 6,000 | 72% | Yes |

| Total | 1,480 |

![]()

Question 8.

How should an entity perform the 10% test when different operating segments report different measures of segment profitability and segment assets?

Answer:

Ind AS 108 does not deal specifically with such a situation where segments report different measures of segment profitability, assets and liabilities. However, in such a situation a consistent basis of measurement should be developed by the entity to perform 10 percent test.

Example:

An entity has three operating segments. Each segment uses different measures of profitability. Profitability of Segment 1 is measured and reported to chief operating decision maker on the basis of Earnings Before Interest and Tax (EBIT). Whereas, profitability of Segment 2 and Segment 3 are measured and reported on the basis of Earning After Tax (EAT).

In this case, Earnings Before Interest and Tax (EBIT) is the lowest measure of profitability that is available and that is provided to the chief operating decision maker for all the three segments. This should be the measure used to perform 10% test in such a case.

![]()

Question 9.

How is the aggregation criteria stated in paragraph 12 different from the aggregation criteria stated in paragraph 14 of Ind AS 108?

Answer:

Two or more segments qualify for aggregation under paragraph 12, if aggregation is consistent with the core principle of Ind AS 108 and the segments have similar economic characteristics and meet the aggregation criteria, viz., nature of the products and services, production processes, type or class of customer for their products and services, distribution methods used, and if applicable, nature of regulatory environment.

However, paragraph 14 of Ind AS 108 deals with aggregation of two or more operating segments that do not exceed the quantitative threshold limits, but have similar economic characteristics and share a majority of the aggregation criteria stated above.

Question 10.

A company has determined its reportable segments in accordance with Ind AS 108 and has noted that the reportable segments constitute 72 per cent of consolidated revenue. If all the remaining operating segments are of similar size, which other operating segments should be reported separately to achieve the 75 percent threshold?

Answer:

Ind AS 108 does not specify which of the remaining operating segments should be selected to achieve the 75 percent threshold. Accordingly, an entity can report any additional operating segment as per its choice. However, to give useful information to the users of financial statements an entity should select the next most meaningful operating segment.

The next most meaningful operating segment may be the next largest in terms of revenue, but it need not necessarily be such in all the cases. Entities should consider both quantitative and qualitative factors when determining which segment would be most useful to users of financial statements.

Example:

An entity may select a small segment in terms of revenue contribution because it is a potential growth segment, which is expected to contribute materially to revenue of the entity in the future.

![]()

Question 11.

Can information about operating segments that are not reportable be combined and disclosed along with the reconciliation items, required by Ind AS 108?

Answer:

As per paragraph 16 of Ind AS 108, information about other business activities and operating segments that are not reportable shall be combined and disclosed in an ‘all other/residual segments’ category. Accordingly, this information should not be combined with the reconciling items in reconciliations required by paragraph 28 of Ind AS 108.

Question 12.

Is an entity required to separately disclose an operating segment that no longer meets the quantitative thresholds in the current period but qualified as a reportable segment in the prior period?

Answer:

As per paragraph 17 of Ind AS 108, if management judges that an operating segment identified as a reportable segment in the immediately preceding year to be of continuing significance, information about that segment should continue to be reported separately in the current period notwithstanding that it no longer exceeds any of the 10 percent thresholds.

There is no specific guidance provided as to the meaning of ‘continuing significance’, an operating segment would be normally regarded as having continuing significance for the current financial statements when, for example:

- its decline below the 10 percent thresholds is considered temporary and likely to reverse;

- if the management considers the segment to be of strategic importance.

The above list is not exhaustive. The management should ensure that usefulness of the financial information and consistency in reporting is maintained.

![]()

Question 13.

Can an operating segment that has never met the quantitative threshold be disclosed separately?

Answer:

As per paragraph 13 of Ind AS 108, an operating segment that does not meet any of the quantitative thresholds may also be considered reportable, and separately disclosed if management judges it to be useful to users of the financial statements.

Question 14.

Can an entity aggregate new businesses with existing businesses?

Answer:

Ind AS 108 lays down the criteria for aggregation of two or more operating segments. If the criteria prescribed in the Standard is met and new and existing businesses exhibit the similar long-term performance because both have similar economic characteristics, the same can be aggregated.

Question 15.

Can a company aggregate an operating segment that does not meet quantitative threshold individually with a reportable operating segment?

Answer:

The procedure for aggregation of operating segments is as follows:

Step 1:

In accordance with paragraph 12 of the Standard if two or more operating segments have similar economic characteristics and all the five criteria laid down therein are met, the same may be aggregated.

Step 2:

It is determined whether the operating segments identified or aggregated as above exceeds the quantitative thresholds.

The segments determined after applying the above steps are treated as reportable segments.

Step 3:

Remaining segments would be those which individually do not exceed the quantitative thresholds. As per paragraph 14 of Ind AS 108, an entity may combine information about two or more such operating segments that do not meet the quantitative thresholds to produce a reportable segment only if the operating segments have similar economic characteristics and share a majority of the aggregation criteria listed in paragraph 12 of Ind AS 108.

Thus, the Que. of aggregation of a non-reportable segment with a reportable segment does not arise.

![]()

Question 16.

X Ltd. has identified 4 operating segments for which revenue data is given below:

| External Sale (₹) | Internal Sale (₹) | Total (₹) | |

| Segment A | 30,00,000 | Nil | 30,00.000 |

| Segment B | 6,50,000 | Nil | 6,50,000 |

| Segment C | 8,50,000 | 1,00,000 | 9,50,000 |

| Segment D | 5,00,000 | 49,00,000 | 54,00,000 |

| Total Sales | 50,00,000 | 50,00,000 | 1,00,00,000 |

Additional information:

Segment C is a new business unit and management expect this segment to make a significant contribution to external revenue in coming years.

Which of the segments would be reportable under the criteria identified in Ind AS 108? [MTP-March 2018]

Answer:

Threshold amount is 110,00,000 (₹ 1,00,00,000 × 10%).

Segment A exceeds the quantitative threshold (₹ 30,00,000 > ₹ 10,00,000) and hence reportable segment.

Segment D exceeds the quantitative threshold (54,00,000 > ₹ 10,00,000) and hence reportable segment.

Segment B & C do not meet the quantitative threshold amount and may not be classified as reportable segment.

However, the total external revenue generated by these two segments A & D represent only 70% (₹ 35,000/50,000 × 100) of the entity’s total external revenue. If the total external revenue reported by operating segments constitutes less than 75% of the entity total external revenue, additional operating segments should be identified as reportable segments until at least 75% of the revenue is included in reportable segments.

In case of X Ltd., it is given that Segment C is a new business unit and management expect this segment to make a significant contribution to external revenue in coming years. In accordance with the requirement of Ind AS 108, X Ltd. designates this start-up segment C as a reportable segment, making the total external revenue attributable to reportable segments 87% (43,50,000/50,00,000 × 100) of total entity revenues.

![]()

DISCLOSURES (BASED ON PARA NOS. 20 TO 34)

Question 17.

What do key terms such as ‘segment profit’, ‘segment loss’, ‘segment assets’ and ‘segment liabilities’ signify in the absence of any definition in Ind AS 108?

Answer:

Ind AS 108 follows the management approach to segment reporting, which would enable users of financial statements to gain an insight into

the entity’s internal reporting system and thus view the entity ‘through the eyes of the management’. It allows any measure of segment profit or loss, segment assets and segment liabilities to be used so long as that measure is what is reported to and reviewed by the chief operating decision maker for the purposes of making decisions about allocating resources and assessing performance.

Question 18.

What are the disclosure requirements under the Standard?

Answer:

The following are the disclosure requirements under Ind AS 108:

| Disclosure requirements | Items |

| General information | (a) Factors used to identify the reportable segments.

(b) Types of product/service from which each reportable segment derives its revenue. |

| Information about profit or loss, revenue, expenses, assets, liabilities and the basis of measurement for each reportable segment | For each reportable segment:

(a) Measure of profit or loss (this has to be provided even if such amounts are not regularly provided to chief operating decision maker. (b) Total assets & liabilities if such amounts are regularly provided to chief operating decision maker. An entity shall also disclose the following about each reportable segment if the specified amounts are included in segment profit or loss reviewed by chief operating decision maker or presented regularly to the chief operating decision maker even if not included in that measure of segment profit/loss: (a) revenues from external customers; An entity shall disclose the following about each reportable segment if the specified amounts are included in the measure of segment assets reviewed by the chief operating decision maker or are otherwise regularly provided to the chief operating decision maker, even if not included in the measure of segment assets: |

| (a) Investments in associates/joint ventures accounted for by equity method.

(b) Additions to non-current assets other than financial instruments/deferred tax assets/post-employment benefit assets/rights arising under Insurance Contracts. Explanation of the measurement of the segment disclosures: (a) Basis of accounting for transactions between reportable segments. (b) Nature of differences between the measurements of segment disclosures and comparable items in the entity’s financial statements, e.g., accounting policy differences, provided these are not apparent from reconciliations provided under ‘segment information’. (c) Nature of changes from prior periods in the measurement methods used to determine reported segment profit or loss and the effect of those changes on the measure of segment profit or loss. (d) Nature and effect of any asymmetrical allocations to reportable segments. For example, an entity might allocate depreciation expense to a segment without allocating the related depreciable assets to that segment. |

|

| Reconciliations | (a) Total of reportable segments’ revenue, profit or loss, assets and liabilities and any other material segment items to the corresponding entity’s totals in the financial statements.

(b) Material reconciling items to be separately identified and described (e.g., arising from different accounting policies). |

| Entity-wide disclosures | (a) Revenues from external customers for each product and service, or each group of similar products and services (based on entity’s financial statements).

(b) Revenues from external customers attributed to the entity’s country of domicile and attributed to all foreign countries from which the entity derives revenues. (c) Revenues from external customers attributed to an individual foreign country, if material. (d) Non-current assets (other than financial instruments, deferred tax assets, post-employment benefit assets, and rights arising under insurance contracts) located in the entity’s country of domicile and in all foreign countries in which the entity holds assets. (e) Non-current assets in an individual foreign country, if material. Note: Extent of reliance on major customers. Where customer’s revenue is greater than 10% of the entity’s revenue, such fact to be disclosed along with total amount of revenue from such customer and the segment to which it relates. |

![]()

Question 19.

Is the identity of the customers which account for more than 10% of the entity’s revenue required to be disclosed?

Answer:

According to paragraph 34 of Ind AS 108, the disclosure of identity of such customer is not required. Disclosure of only the amount of revenue and the segment to which it relates is sufficient.

Question 20.

If a company has only a single operating segment, what disclosures, if any, are required?

Answer:

Even if an entity determines that it has only a single reportable operating segment, the entity-wide disclosures as stated in paragraphs 31 to 34 of Ind AS 108 are required.

Question 21.

If the measurement bases of the information provided to the chief operating decision maker differs from the measurement bases of the Ind AS financial statements, what needs to be done?

Answer:

Reconciliations are required that separately identify and describe each adjustment needed to reconcile the total of all the reportable segments’ profits or losses to the consolidated profit or loss.

To the extent that the nature of the measurement differences is not apparent from the reconciliations, they must be explained.

![]()

Question 22.

Paragraph 33 of Ind AS 108 states that geographical data need not be given if the necessary information is not available and cost to develop is excessive. When is the “cost to develop is excessive”?

Answer:

The Standard provides no guidance on when the cost to develop information is excessive. The entity will have to weigh the benefits of disclosing segmental information and the cost that will be incurred in developing the information. If it is time-consuming to prepare and the benefits to most of the users of financial statement are insufficient to justify the cost, such information need not be presented.

All entity-wide disclosures including geographical data are not required where the necessary information is not available and the cost to develop it would be excessive. However, because the information is on an entity-wide basis, it is not expected that this exemption will be invoked often. Most entities are likely to collect and retain information about their geographical operations and products and services. If the exemption is availed, that fact must be disclosed.

Question 23.

Paragraph 33 of Ind AS 108 requires an entity to provide breakup of revenue and non-current assets on the basis of geographical areas, divided into country of domicile and foreign countries. What is meant by the term ‘entity’s country of domicile’ since many a time country of principal operation is different from country of domicile?

Answer:

Ind AS 108 does not define the term ‘country of domicile’. Hence the meaning as understood in common parlance is to be considered. Country of domicile is a country or registration of an entity where it has its legal address or registered office or which is considered in law as the center of its corporate affairs. Thus, a country where the entity has its registered office/legal address is considered to be the country of domicile for that entity.

Thus, even though the principal activities of an entity are not located in its country of domicile, the disclosures would no way be different from the situation where its principal operations are located in its country of domicile.

![]()

Question 24.

An entity uses the weighted average cost formula to assign costs to inventories and cost of goods sold for financial reporting purposes, but the reports provided to the chief operating decision maker use the First-In, First- Out (FIFO) method for evaluating the performance of segment operations. Which cost formula should be used for Ind AS 108 disclosure purposes?

Answer:

The entity should use First-In, First-Out (FIFO) method for its Ind AS 108 disclosures, even though it uses the weighted average cost formula for measuring inventories for inclusion in its financial statements. Where chief operating decision maker uses only one measure of segment asset, same measure should be used to report segment information. Accordingly, in the given case, the method used in preparing the financial information for the chief operating decision maker should be used for reporting under Ind AS 108.

However, reconciliation between the segment results and results as per financial statements needs to be given by the entity in its segment report.