Ind AS on Assets of the Financial Statements – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Ind AS on Assets of the Financial Statements – CA Final FR Study Material

Ind AS 2: Inventories

Scope (Based On Para Nos. 3 To 5)Scope (Based On Para Nos. 3 To 5)

Question 1.

Ind AS 2 does not apply to the measurement of inventories held by certain categories of persons. In this case, whether the other requirements of this Standard are applicable to these inventories?

Answer:

Measurement criteria is not applicable to the inventories held by pro-ducers of agricultural and forest products, agricultural produce after harvest, and minerals and mineral products, to the extent that they are measured at net realizable value and inventories held by the commodity broker-traders who measure their inventories at fair value less cost to sell.

Note:

Paragraphs 4 and 5 of Ind AS 2 clearly state that these types of inventories are excluded from only the measurement requirements of this Standard.

Thus, the other requirements laid down in the Standard are applicable. For example, disclosure requirements of this Standard are applicable to these types of inventories.

Cost (Based On Para Nos. 10 To 17)

Question 2.

Inventories include ‘materials and supplies awaiting use in the production process’.

Whether packing material and publicity material are covered by the term ‘materials and supplies awaiting use in the production process’?

Answer:

While the primary packing material may be included within the scope of the term ‘materials and supplies awaiting use in the production process’ but the secondary packing material and publicity material cannot be so included, as these are selling costs which are required to be excluded as per Ind AS 2.

Where,

Primary packing material is one which is essential to bring an item of inventory to its saleable condition, for example, bottles, cans etc., in case of food and beverages industry.

Other packing material required for transporting and forwarding the material will normally be in the nature of secondary packing material.

![]()

Question 3.

As per Ind AS 2, selling costs are excluded from the cost of inventories and are required to be recognized as an expense in the period in which these are incurred, whereas, AS 2 excludes both selling and distribution costs.

Whether the distribution costs would now be included in the cost of inventories under Ind AS 2?

Answer:

Selling and distribution costs are generally used as single term because both are related, as selling costs are incurred to effect the sale and the distribution costs are incurred by the seller to complete a sale transaction by making the goods available to the buyer from the point of sale to the point at which the buyer takes possession. Since these costs are not related to bringing the goods to their present location and condition, the same are not included in the cost of inventories.

Accordingly, though the word ‘distribution costs’ is not specifically mentioned in Ind AS 2, these costs would continue to be excluded from the cost of inventories, as being done as per AS 2.

Question 4.

X Limited has a plant with the normal capacity to produce 10,00,000 units of a product per annum and the expected fixed overhead is ₹ 30,00,000, Fixed overhead, therefore based on normal capacity is ₹ 3 per unit.

Determine Fixed overhead as per Ind AS 2 ‘Inventories’ if

(i) Actual production is 7,50,000 units.

(ii) Actual production is 15,00,000 units.

Answer:

(i) Actual production is 7,50,000 units : Fixed overhead is not going to change with the change in output and will remain constant at ₹ 30,00,000, therefore, overheads on actual basis is ₹ 4 per unit (30,00,000/7,50,000).

Hence, by valuing inventory at ₹ 4 each for fixed overhead purpose, it will be overvalued and the losses of ₹ 7,50,000 will also be included in closing inventory leading to a higher gross profit then actually earned. Therefore, it is advisable to include fixed overhead per unit on normal capacity to actual production (7,50,000 × 3) ₹ 22,50,000 and balance ₹ 7,50,000 shall be transferred to Profit & Loss Account.

(ii) Actual production is 15,00,000 units: Fixed overhead is not going to change with the change in output and will remain constant at ₹ 30,00,000, therefore, overheads on actual basis is ₹ 2 (30,00,000/15,00,000).

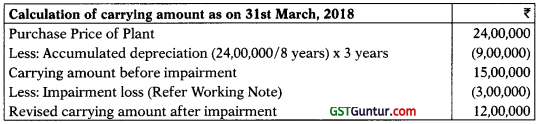

Hence by valuing inventory at ₹ 3 each for fixed overhead purpose, we will be adding the element of cost to inventory which actually has not been incurred. At ₹ 3 per unit, total fixed overhead comes to ₹ 45,00,000 whereas, actual fixed overhead expense is only ₹ 30,00,000. Therefore, it is advisable to include fixed overhead on actual basis (15,00,000 × 2) – 30,00,000.

Joint And By-Products (Based On Para No. 14)

Question 5.

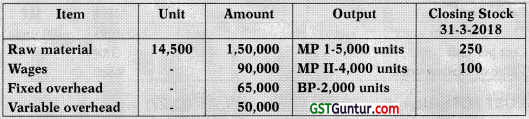

In a manufacturing process of S Ltd., one by-product BP emerges besides two main products MP1 and MP2 apart from scrap. Details of cost of production process are hereunder:

Average market price of MP1 and MP2 is ₹ 60 per unit and ₹ 50 per unit respectively, by-product is sold @ ₹ 20 per unit. There is a profit of ₹ 5,000 on sale of by-product after incurring separate processing charges of ₹ 8,000 and packing charges of ₹ 2,000, ₹ 5,000 was realised from sale of scrap.

Calculate the value of closing stock of MP1 and MP2 as on 3 1-03-2018. [MTP-October 2018]

Answer:

As per Ind AS 2 ‘Inventories’, most by-products as well as scrap or waste materials, by their nature, are immaterial. They are often measured at net realizable value and this value is deducted from the cost of the main product.

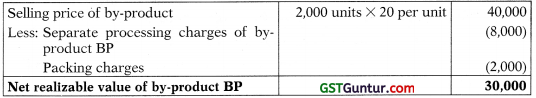

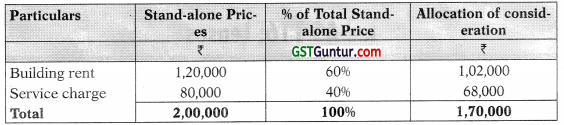

(1) Calculation of NRV of By-product BP

(2) Calculation of cost of conversion for allocation between joint products MP1 and MP2

(3) Determination of “basis for allocation” and allocation of joint cost to MP1 and MP2

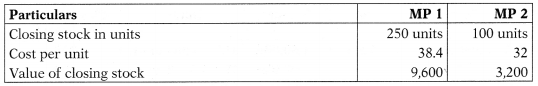

(4) Determination of value of closing stock of MP1 and MP2

![]()

Cost Formula (Based On Para Nos. 23 To 27)

Question 6.

AS 2 specifically provides that the formula used in determining the cost of an item of inventory should reflect the fairest possible approximation to the cost incurred in bringing the items of inventory to their present location and condition whereas Ind AS 2 does not specifically state so.

Does this mean that Ind AS 2 allows free choice between FIFO and weighted average methods?

Answer:

Yes, any of the permitted methods, i.e., FIFO or weighted average method can be used when specific identification method is not possible.

Question 7.

Whether an entity can use different cost formulae for inventories held at different geographical locations having similar nature and use to it.

Answer:

The answer is based on Paragraph 25 of Ind AS 2.

An entity shall use the same cost formula for all inventories having similar nature and use to it.

In the given case, since the inventories held at different geographical location are of similar nature and use to the entity, different cost formula cannot be used for inventory valuation purposes.

Valuation Of Inventory (Including Raw Material) [Based On Para Nos. 9 And 32]

Question 8.

On 31 March 20X1, the inventory of A includes spare parts which it had been supplying to a number of different customers for some years. The cost of the spare parts was ₹ 10 million and based on retail prices at 31 March 20X1, the expected selling price of the spare parts is ₹ 12 million. On 15 April 20X1, due to market fluctuations, expected selling price of the spare parts in stock reduced to ₹ 8 million. The estimated selling expense required to make the sales would be ₹ 0.5 million. Financial statements were authorised by Board of Directors on 20th April 20X1.

As at 31st March 20X2, Directors noted that such inventory is still unsold and lying in the warehouse of the company. Directors believe that inventory is in a saleable condition and active marketing would result in an immediate sale. Since the market conditions have improved, estimated selling price of inventory is ₹ 11 million and estimated selling expenses are same ₹ 0.5 million.

What will be the value inventory at the following dates:

(a) 31st March 20X1

(b) 31st March 20X2 [RTP-May 2018]

Answer:

As per Ind AS 2 ‘Inventories’, inventory is measured at lower of ‘cost’ or ‘net realisable value’. Further, as per Ind AS 10: ‘Events after Balance Sheet Date’, decline in net realisable value below cost provides additional evidence of events occurring at the balance sheet date and hence shall be considered as ‘adjusting events’.

(a) In the given case, for valuation of inventory as on 31 March 20X1, cost of inventory would be ₹ 10 million and net realisable value would be ₹ 7.5 million (ie. Expected selling price ₹ 8 million-estimated selling expenses ₹ 0.5 million). Accordingly, inventory shall be measured at ₹ 7.5 million ie. lower of cost and net realisable value. Therefore, inventory write down of ₹ 2.5 million would be recorded in income statement of that year.

(b) As per para 33 of Ind AS 2, a new assessment is made of net realizable value in each subsequent period. It Inter alia states that if there is increase in net realizable value because of changed economic circumstances, the amount of write down is reversed so that new carrying amount is the lower of the cost and the revised net realizable value. Accordingly, as at 31 March 20X2, again inventory would be valued at cost or net realisable value whichever is lower. In the present case, cost is ₹ 1 million and net realisable value would be ₹ 10. 5 million (ie. expected selling price ₹ 11 million – estimated selling expense ₹ 0.5 million). Accordingly, inventory would be recorded at ₹ 10 million and inventory write down carried out in previous year for ₹ 2.5 million shall be reversed.

![]()

Net Realisable Value (Based On Para Nos. 28 To 33)

Question 9.

What is the difference between ‘Net Realizable Value’ and ‘Fair Value’? Explain with suitable example.

Answer:

Refer definitions of NRV and Fair Value in Ind AS 2.

Based on the definitions, net realizable value refers to the net amount that an entity expects to realize from the sale of inventory in the ordinary course of business. Whereas, fair value reflects the price at which an orderly transaction to sell the same inventory in the principal (or most advantageous) market for that inventory would take place between market participants at the measurement date.

The former is an entity-specific measurement; the latter is market-based measurement.

Note:

Net realizable value for inventories may not be equal to fair value less costs to sell.

Example:

An entity holds inventories of 10,000 units and it could sell the same in the market @ ₹ 10 each after selling expenses. The entity has an order in hand to sell the inventories @ ₹ 11. In this situation, fair value is ₹ 10 each, but net realizable value is ₹ 11 each.

Question 10.

How the recognition and disclosure of amount of reversal of any write-down of inventories as a reduction to inventories is to be made?

Answer:

The answer is based on Paragraphs 34 and 36(f) of Ind AS 2.

The reversal of any write-down needs to be recognized in the statement of profit and loss by way of reduction in the amount of inventories recognized as an expense.

Specimen disclosure:

Notes to account:

| 2018-19 | 2017-18 | |

| (₹ in thousands) | (₹ in thousands) | |

| Raw Material | 9,000 | 8,000 |

| Product in progress | 800 | 600 |

| Finished products | 28,000 | 26,000 |

| Total | 37,800 | 34,600 |

Cost of Inventories recognized as expense:

| 2018-19 | 2017-18 | |

| (₹ in thousands) | (₹ in thousands) | |

| Cost of Inventories recognised as expenses including | 1,00,000 | 90,000 |

| — Write-down of inventories | 2,000 | 800 |

| — Reversal of earlier write-down | (100) | – |

Question 11.

Whether the following costs should be considered while determining the Net Realizable Value (NRV) of the inventories?

(a) Costs of completion of work-in-progress;

(b) Trade discounts expected to be allowed on sale; and

(c) Cash discounts expected to be allowed for prompt payment.

Answer:

Point Remarks

| Point | Remarks |

| (a) | Costs of completion of work-in-progress are incurred to convert the work- in-progress into finished goods. Thus, the same should be deducted from the estimated selling price to determine the NRV of work-in-progress. |

| (b) | Trade discount is allowed either expressly through an agreement or through prevalent commercial practices in the terms of the trade and the same is adjusted in arriving at the selling price. Thus, the trade discount expected to be allowed should be deducted to determine the estimated selling price. |

| (c) | These costs are not incurred to make the sale, therefore, the same should not be considered while determining NRV. |

Disclosures (Based On Para Nos. 36 To 39)

Question 12.

Paragraph 36(h) of Ind AS 2 requires the disclosure with regard to the carrying amount of inventories pledged as security for liabilities. Whether the term pledge covers other kinds of charges/encumbrances?

Answer:

The term ‘pledge’ has not been defined in Ind AS 2.

In common parlance, ‘pledge’ is understood as bailment of personal property as a security for some debt or engagement, redeemable on certain terms, and with an implied power of sale on default.

The purpose of use of term ‘pledge’ for the purpose of disclosure of carrying amount of pledged inventory under this Ind AS seems to be broad, Le., to provide the information to the user about restrictions on an entity’s inventory whether physically in the possession of the entity or not.

Thus, for the purposes of disclosures required under Ind AS 2, pledge would include all charges/encumbrances where restriction has been put by the charge holder on the use of that asset.

Ind AS 16: Property, Plant and Equipment

Definition (Based On Para No. 6)

Question 1.

Company A has exhibited certain rare and expensive paintings and sculptures for aesthetic purposes at entrance hall, conference rooms. The entity does not trade in these items in the ordinary course of business. How such items should be recognized in the financial statements of Company A?

Answer:

The answer is based on paragraph 6 of Ind AS 16.

In the given case, Company A is not in the business of trading in paintings and sculptures but is holding them for aesthetic purpose which is considered to be administrative in nature.

Assuming these paintings and sculptures are expected to be used during more than one period, the same should be capitalized as an item of property, plant and equipment.

However, there may be situations wherein an entity holds rare piece of art or antique paintings that are protected by legal or contractual rights such as copyrights (e.g. signature of the painter).

Further, it may be possible that their value appreciates with time. An entity needs to evaluate that whether such artistic related items are tangible or in-tangible assets. It is probable that the future economic benefits are expected to be derived from the intangible element and hence such rare piece of art may therefore be artistic related intangible assets. Such items should be disclosed as a separate class of intangible asset.

![]()

Scope (Based On Para Nos. 2 To 5)

Question 2.

An entity has recognized some assets held under finance lease as property, plant and equipment in its balance sheet. The entity has also recognized items of property, plant and equipment owned by it, of similar nature and use. The entity uses the revaluation model prescribed under Ind AS 16 for the entire class of property, plant and equipment. Whether properly, plant and equipment held under finance lease are classified as a separate class of assets from the assets owned by the entity?

Answer:

The assets that are held under a finance lease and owned assets of similar nature and use should be classified as one class of assets and revaluation principles will apply to the entire class of assets.

Recognition [Based On Para Nos. 7 To 10 And 16(B)]

Question 3.

A manufacturing company has acquired agricultural land for setting up a factory building. For construction of the building, certain permissions are required from regulatory authorities. The company has to incur significant costs (non-refundable) for obtaining such permissions such as environmental clearance and change of land use, etc. Whether such cost can be capitalized? If yes, whether this can be capitalized as a cost of construction of the factory ‘ building?

Answer:

The answer is based on paragraphs 7, 10 and 16 of Ind AS 16.

For assessing whether costs incurred for obtaining permission should be capitalized, judgment is required, at the time when the expenditure is incurred, of whether it is probable that the relevant permission will be granted and as a result of which future economic benefits will flow to the entity.

In some cases, regulatory permission may be a formality.

Example:

- the company regularly obtains such permission; or

- has been told informally that the permission will be granted; or

- as per the past experience of the company, it will be able to obtain such permission in a short span of time.

In such cases, there may be sufficient evidence that it is probable that future economic benefits will flow to the entity.

In other situations where consent from regulatory authority is not a formality.

Example:

If the company has been trying to get permission for some time and still has no indication of whether it will be granted, it seems unlikely that the company can demonstrate access to future economic benefit.

In the given case since these costs are directly attributable for bringing the factory building to the location and condition necessary for it to be capable of operating in the manner intended by management and if the company anticipates that the grant of permission is probable, then the expenditure incurred for obtaining permission should be capitalized in the cost of factory building.

If these costs do not meet the recognition criteria as envisaged in paragraph 7, then such costs should be charged as an expense in the Statement of profit and loss. Once expensed, if there is subsequently a change in circumstances, then these costs cannot be capitalized.

![]()

Question 4.

A Ltd. is setting up a new refinery outside the city limits. In order to facilitate the construction of the refinery and its operations, A Ltd. is required to incur expenditure on the construction/development of railway siding, road and bridge. Though A Ltd. incurs (or contributes to) the expenditure on the construction/development, it will not have ownership rights on these items and they are also available for use to other entities and public at large. Whether A Ltd. can capitalize expenditure incurred on these items as property, plant and equipment (PPE)? If yes, how should these items be depreciated and presented in the financial statements of A Ltd.?

Answer:

The answer is based on Paragraphs 7, 9 and 16 of Ind AS 16.

In the given case, railway siding, road and bridge are required to facilitate the construction of the refinery and for its operations. Expenditure on these items is required to be incurred in order to get future economic benefits from the project as a whole which can be considered as the unit of measure for the purpose of capitalization of the said expenditure even though the company cannot restrict the access of others for using the assets individually.

It is apparent that the aforesaid expenditure is directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management.

In view of this, even though A Ltd. may not be able to recognize expenditure incurred on these assets as an individual item of property, plant and equipment in many cases (where it cannot restrict others from using the asset), expenditure incurred may be capitalized as a part of overall cost of the project. From this, it can be concluded that, in the above case the expenditure incurred on these assets, ie., railway siding, road and bridge, should be considered as the cost of constructing the refinery and accordingly, expenditure incurred on these items should be allocated and capitalized as part of the items of property, plant and equipment of the refinery.

Depreciation:

For this we need to answer based on Paragraphs 43 and 45 of Ind AS 16.

If these assets have a useful life which is different from the useful life of the item of property, plant and equipment to which they relate, it should be depreciated separately. However, if these assets have a useful life and the depreciation method that are the same as the useful life and the depreciation method of the item of property, plant and equipment to which they relate, these assets may be grouped in determining the depreciation charge.

Nevertheless, if it has been included in the cost of property, plant and equipment as a directly attributable cost, it will be depreciated over the useful lives of the said property, plant and equipment. The useful lives of these assets should not exceed that of the asset to which it relates.

Presentation:

These assets should be presented within the class of asset to which they relate.

Question 5.

Let’s consider in the above question, A Ltd. under an understanding with local authorities also construct a school, which will be subsequently handed over to be managed by an independent trust. Though A Ltd. incurs expenditure on the construction/development of the school, it will not have ownership rights and the assets will also be available for use to the general public (however, preference will be given to employees of the Company). Whether A Ltd., can capitalize expenditure incurred as its property, plant and equipment?

Answer:

In the given case, if there is no obligation to construct the school and if A Ltd. will be able to construct the refinery without constructing the school. It cannot be considered as directly attributable to bringing the refinery to its working condition for the intended use as the incurrence of this expenditure is not necessary for construction or operations of the refinery.

Therefore, the expenditure incurred on construction of school should not be capitalized.

![]()

Question 6.

M Ltd. is setting up a new factory outside the Delhi city limits. In order to facilitate the construction of the factory and its operations, M Ltd. is required to incur expenditure on the construction/development of electric-substation. Though M Ltd. incurs (or contributes to) the expenditure on the construction/development, it will not have ownership rights on these items and they are also available for use to other entities and public at large. Whether M Ltd. can capitalise expenditure incurred on these items as property, plant and equipment (PPE)? If yes, how should these items be depreciated and presented in the financial statements of M Ltd. as per Ind AS? /ATov. 2019 -8 MarksJ

Answer:

Paragraph 7 of Ind AS 16 states that “the cost of an item of property, plant and equipment shall be recognized as an asset if, and only if:

(a) it is probable that future economic benefits associated with the item will flow to the entity; and

(b) the cost of the item can be measured reliably.”

Further paragraph 9 of Ind AS 16 provides that, “This Standard does not prescribe the unit of measure for recognition, Le., what constitutes an item of property, plant and equipment. Thus, judgment is required in applying the recognition criteria to an entity’s specific circumstances. It may be appropriate to aggregate individually insignificant items, such as moulds, tools and dies, and to apply the criteria to the aggregate value.”

Paragraph 16 of Ind AS 16, inter alia, states that the cost of an item of property, plant and equipment comprise any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management.

In the given case, construction/development of electric-sub-station are required to facilitate the construction of the factory and its operations. Expenditure on these items is required to be incurred in order to get future economic benefits from the project as a whole which can be considered as the unit of measure for the purpose of capitalization of the said expenditure even though the company cannot restrict the access of others for using the assets individually. It is apparent that the aforesaid expenditure is directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management.

In view of this, even though M Ltd. may not be able to recognize expenditure incurred on these assets as an individual item of property, plant and equipment in many cases (where it cannot restrict others from using the asset), expenditure incurred may be capitalized as a part of overall cost of the project. From this, it can be concluded that, in the extant case the expenditure incurred on these assets, should be considered as the cost of constructing the factory and accordingly, expenditure incurred on these items should be allocated and capitalized as part of the items of property, plant and equipment.

Depreciation

As per paragraph 43 of Ind AS 16, each part of an item of property, plant and equipment with a cost that is significant in relation to the total cost of the item shall be depreciated separately.

Further paragraph 45 provides that, a significant part of an item of property, plant and equipment may have a useful life and a depreciation method that are the same as the useful life and the depreciation method of another significant part of that same item. Such parts may be grouped in determining the depreciation charge.

In view of the above, if these assets have a useful life which is different from the useful life of the item of property, plant and equipment to which they relate, it should be depreciated separately. However, if these assets have a useful life and the depreciation method that are the same as the useful life and the depreciation method of the item of property, plant and equipment to which they relate, these assets may be grouped in determining the depreciation charge.

Nevertheless, if it has been included in the cost of property, plant and equipment as a directly attributable cost, it will be depreciated over the useful lives of the said property, plant and equipment. The useful lives of these assets should not exceed that of the asset to which it relates.

Presentation

These assets should be presented within the class of assets to which they relate.

Question 7.

A large manufacturing company expenses off items purchased below a certain threshold set by the management. Whether such a policy is permissible under Ind AS?

Answer:

In deciding that an individual item is insignificant and the same may not be recognized as property, plant and equipment is a matter of professional judgment which requires careful assessment of facts and circumstances including qualitative aspects.

Accordingly, individual insignificant assets below a threshold determined by management may not be recognized as property, plant and equipment.

These may be expensed if their cumulative aggregate cost for that category of asset is not material.

![]()

Question 8.

A Company produces fertilizers at various manufacturing units. The manufacturing units use various processes/technologies for manufacture of fertilizers. The Company has machinery spares (which are customized by the supplier as per the requirements of the company) and are expected to be used for more than one period. How’ should machinery spares be accounted for as per Ind AS?

Answer:

The answer is based on paragraphs 6 and 8 of Ind AS 16:

In the given case, the machinery spares are held for use in the production of goods and are expected to be used for more than one period. Hence, the same should be capitalized as property, plant and equipment in accordance with this Standard irrespective of whether procured at the time of purchase of the equipment or subsequently.

Question 9.

The management of a Company has set an internal limit for capitalization of spares to be ₹ 50,000 i.e., any item of spare having useful life of more than 1 year and value more than ₹ 50,000 would be capitalized by the Company.

Further, spares which are used collectively need to be capitalized, if the collective total of the same exceeds ₹ 50,000. Whether such spares should be capitalized from the date of its purchase or date of actual issu.e of that spare into use since such spares are procured in advance and kept in stores till the time they are issued for use?

How should ‘expected to be used during more than one period’ be interpreted.

Whether a spare that has a life of less than one year but is being used in two financial year periods as per the date of issue, can be capitalized?

Answer:

The answer is based on Paragraphs 8 and 9 of Ind AS 16:

The Standard does not distinguish between different types of spares.

In the given case, the spares are not individually significant compared to the overall asset. The nature and purpose of such spares need to be carefully eval-uated. If it is probable that future economic benefits associated with the item would flow to the company and cost of the item can be measured reliably then these items should be recognized as property, plant and equipment.

Depreciation:

Based on paragraph 55 of Ind AS 16:

Depreciation on the spares recognized as item of property, plant and equipment shall begin from the date of its purchase.

More than one period:

The term ‘more than one period’ is not defined in Ind AS. Ordinarily, the accounting policies are determined for preparing and presenting financial statements on annual basis. Accordingly, the term ‘period’, should ordinarily be construed to be the annual period.

In the given case, spares that are not expected to be used during more than one annual period should not be capitalized as item of property, plant and equipment.

Question 10.

A section of a mall is renovated by constructing a food court and gaming zone so as to increase the footfall in the mall. The food court and gaming zone are expected to result in a significant increase in sales for the shops and outlets of the mall. Whether this cost of construction of food court and gaming zone should be capitalized as property, plant and equipment or expensed off in the Statement of Profit and Loss?

Answer:

The answer is based on Paragraphs 7 and 10 of Ind AS 16.

Since it is probable that the construction of food court and gaming zone will result into flow of future economic benefits to the entity in the form of increase in sales and the cost of construction can be measured reliably, accordingly, the subsequent cost of construction of food court and gaming zone should be capitalized in the cost of mall as an item of property, plant and equipment.

Question 11.

An entity buys five machines for use in its manufacturing facility. Simultaneously it purchases a spare motor which can be used as a replacement in case the motor of any one of the five machines breaks down. The motor will be used in the production of goods and, once brought into service, will be operated during more than one period. How should the spare motor be accounted for?

Answer:

The spare motor is classified as property, plant and equipment.

Spare parts will have to be depreciated along with the corresponding main asset. The depreciation period for any spare part capitalized should not exceed its useful life. Spare parts are depreciated when they are available for use. Hence, the motor should be depreciated when available for use over the lesser of its useful life and the remaining useful life of the asset to which it relates.

Question 12.

X Limited was negotiating a deal to purchase large plant and machinery. During the negotiations, X Limited had asked for minimum 1 % additional discount. Since the vendor was also not agreeable to give this discount, the broker agreed to pass on 75% of its sales commission (that it received from the vendor) to X Limited so as to induce it to purchase the machinery. Based on this offer, the final deal was struck and X purchased the machine.

The management of X Limited is of the view that it has not received commission rebate from the vendor and therefore it cannot be reduced from the cost of machinery. Rather, it should be treated as other income in the period in which it purchased the machine. Is the management view tenable?

Answer:

It does not matter whether such discounts or rebates are received from the vendor directly or indirectly through the broker. Therefore, the commission passed on by the broker is in the nature of trade discounts and rebates received.

Moreover, X Ltd. has entered into only one transaction, ie., purchase of the machine and from the facts of the case, it is clear that X Ltd. asked for a minimum discount to buy the machine.

Accordingly, the cost of acquisition of the machine is net of the amount of commission passed on by the broker to the entity, therefore, the commission passed on by the broker should be deducted from the purchase price of the plant and machinery.

![]()

Subsequent Costs (Based On Para Nos. 12 To 14)

Question 13.

An entity is engaged in refining of petroleum products. It has a captive power plant with Gas Turbine Generators. Critical parts of generators are exposed all the time to very high temperatures leading to fracture of these parts. As a result, various components of generators need regular overhauling in line with scheduled cycle of number of hours of operations prescribed as per manufacturers’ manual.

At the time of such overhauling, these parts are required to be replaced. Certain servicing charges are also incurred at the time of overhaul. How should such costs incurred on replacement of critical parts be accounted for under Ind AS?

Answer:

The answer is based on Paragraphs 7 and 13 of Ind AS 16.

In the given case, since, the critical parts of the generator are required to be replaced at regular intervals to run the gas turbine generator to generate the power, accordingly, it implies that future economic benefits associated with the replaced item will flow to the entity.

Assuming the cost of these items can be measured reliably, the company should recognize the cost of replacing these parts in the carrying amount of generators. The carrying amount of the replaced part should be derecognized as per derecognition principles of Ind AS 16.

Further, the day to day servicing charges incurred are expensed to the state-ment of profit and loss. However, servicing charges which incurred at the time of replacing the part or in connection with replacing the part should be capitalized (Le., where these charges do not relate to ongoing day-to-day ser-vices, and which are directly attributable and meet the definition of property, plant and equipment).

Question 14.

A Company acquires a ship for ₹ 500 crores. The useful life of the ship is 20 years. The ship is mandatorily required to undergo major periodic inspection and repairs as per statute (dry-docking) at least once in every three years. Dry-docking costs are estimated to be ₹ 100 crores for similar ships based on current market price which comprises of inspection costs of ₹ 30 crores and replacement of parts amounting to ₹ 70 crores. How will the company treat these dry dock cost when incurred?

Answer:

Dry docking costs incurred on items which meet the recognition criteria are capitalized. Otherwise, the same may be charged to the profit and loss.

In the given case, the company should recognize the cost of replacing part of ₹ 70 crores in the carrying amount of the ship, if the recognition criteria laid down in the paragraph 7 of Ind AS 16 is met. The carrying amount of replaced parts should be derecognized. The company will depreciate the cost of parts to be replaced totalling to ₹ 70 crores over the period of three years in accordance with paragraph 13 of Ind AS 16.

Major inspection cost amounting to ₹ 30 crores should also be recognized in the carrying amount of the ship and the same will be depreciated over the period of three years till the next dry-docking.

Initial Measurement (Based On Para Nos. 15 To 27)

Question 15.

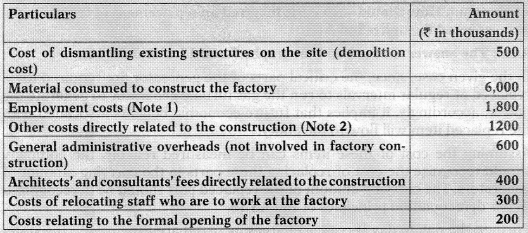

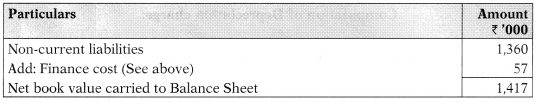

On 1 April 2018, X Limited began the construction of a new factory. Costs relating to the factory, incurred in the year ended 31 March 2019, are as follows:

Note 1: The factory was constructed in the eight months ended 30 November 2018. It was brought into use on 31 December 2018. The employment costs are for the nine months to 31 December 2018. The employees were engaged in construction and related activities.

Note 2: Other costs directly related to the construction include an abnormal cost of ₹ 200, in respect of repairing the damage which resulted from a gas leak.

What will be the initial carrying value of the factory building?

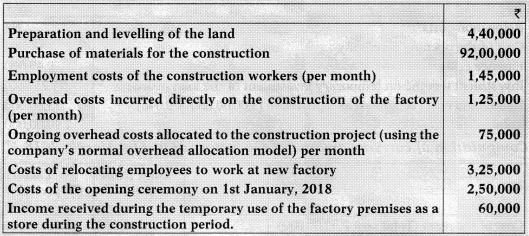

Answer:

The initial carrying value of the factory is computed as below:

| Particulars | Amount (₹ 000) |

Reason |

| Costs of dismantling existing structures on the site (demolition costs) | 500 | Directly attributable to the building. |

| Material consumed to construct the factory | 6,000 | Directly attributable cost |

| Employment costs | 1,600 | Employment costs for the period of 8 months are directly attributable. Therefore, costs to be capitalized is ₹ 1600 (ie., 8/9 X 1,800) |

| Other costs directly related to the construction | 1,000 | Directly attributable cost excluding abnormal cost |

| General administrative overheads | Nil | General overhead costs are not cost of an item of property, plant and equipment unless if it can be clearly demonstrated that they |

| are directly attributable to construction | ||

| Architects’ and consultants’ fees directly related to the construction | 400 | Directly attributable cost |

| Costs of relocating staff who are to work at the factory | Nil | This is not required for getting the asset ready for use |

| Costs relating to the formal opening of the factory | Nil | Specifically disallowed by Ind AS 16. |

| Total Cost | 9,500 |

![]()

Question 16.

Fly wing Airways Ltd is a company which manufactures aircraft parts and engines and sells them to large multinational companies like Boeing and Airbus Industries.

On 1 April 20X1, the company began the construction of a new production line in its aircraft parts manufacturing shed.

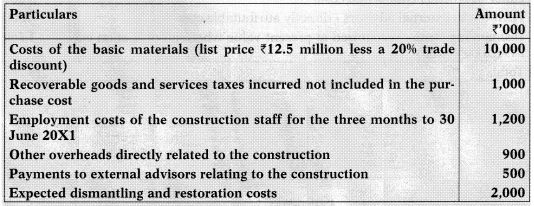

Costs relating to the production line are as follows:

Additional Information:

The construction staff was engaged in the production line, which took two months to make ready for use and was brought into use on 31 May 20X1.

The other overheads were incurred in the two months period ended on 31 May 20X1. They included an abnormal cost of ₹ 3,00,000 caused by a major electrical fault.

The production line is expected to have a useful economic life of eight years. At the end of that time Flywing Airways Ltd is legally required to dismantle the plant in a specified manner and restore its location to an acceptable standard. The amount of ₹ 2 million mentioned above is the amount that is expected to be incurred at the end of the useful life of the production line. The appropriate rate to use in any discounting calculations is 5%. The present value of Re.1 payable in eight years at a discount rate of 5% is approximately Re.0-68.

Four years after being brought into use, the production line will require a major overhaul to ensure that it generates economic benefits for the second half of its useful life. The estimated cost of the overhaul, at current prices, is ₹ 3 million.

The Company computes its depreciation charge on a monthly basis. No im-pairment of the plant had occurred by 31 March 20X2.

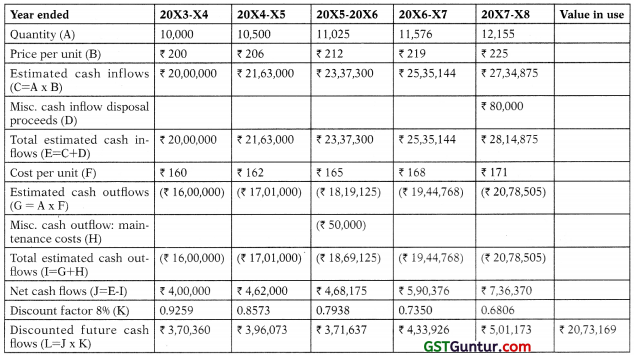

Analyze the accounting implications of costs related to production line to be recognized in the balance sheet and profit and loss for the year ended 31 March, 20X2. [MTP-May 2020]

Answer:

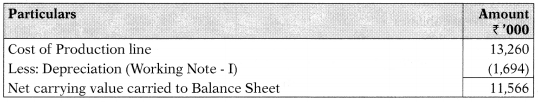

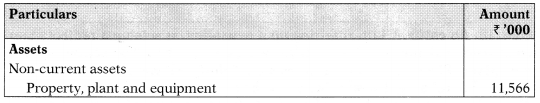

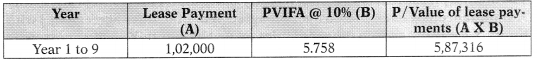

Statement showing Computation of Cost of Production line:

Computation of Carrying value of Production line:

(as on 31st March, 20X2)

Working Note -1:

Computation of Depreciation charge:

Note:

In accordance with Ind AS 16 the asset is split into 2 depreciable components:

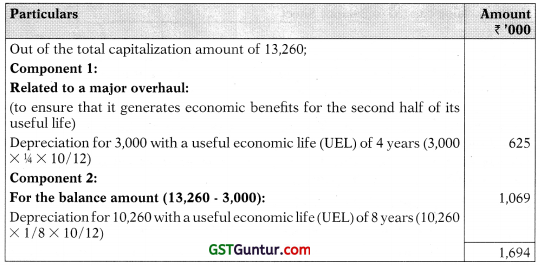

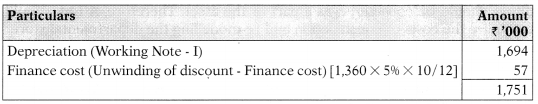

Statement of Profit & Loss

[Extract]

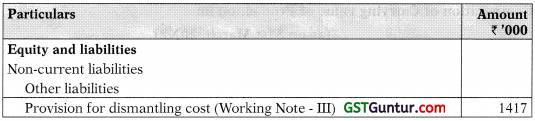

Balance Sheet

[Extract]

Working Note – II:

Computation of Provision for Dismantling cost:

Question 17.

A Ltd. is engaged in retail business and it has a chain of departmental stores across the country. It has acquired a new store at another location. In order to start the new store significant renovation expenditure are required at that location and the management expects that the renovations would continue for the period of six months.

Management has prepared the budget for this period including expenditure related to construction and re-modelling costs, salaries of staff participating in hiring (not related to construction), salary costs of staff on the bench, training, etc. Can A Ltd. capitalize all the costs incurred during the period of six months?

Answer:

The answer is based on paragraphs 15 and 19 of Ind AS 16:

Costs of construction and re-modelling the departmental store, are necessary to bring the store to the condition necessary for it to be capable of operating in the manner intended by management. The departmental store cannot be opened without incurring the re-modelling expenditure, and thus the expenditure should be considered as a part of the asset. Therefore, A Ltd. should capitalize the costs of construction and re-modelling the departmental store.

The cost of salaries of staff on the bench, staff participating in training, hiring, etc. are operating expenditures. These costs are not necessary to bring the store to the condition necessary for it to be capable of operating in the manner intended by management and should be expensed.

However, salary, if any, paid to workers for renovation of store should be capitalized.

Question 18.

An entity A Ltd. is setting up a new plant. It sets up a project team comprising existing employees who will be responsible for setting up the new plant. The employees will work on a full-time basis and installation is expected to take eight weeks. Whether the cost of the project team including all employee benefits which will be paid otherwise should be capitalized?

Answer:

The cost of the project team, including all employee benefits, during the period of installation is directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management, therefore the same should be included in the cost of the new plant. These costs are to be capitalized even if these costs would have been incurred otherwise also because for cost to be directly attributable it need not to be external.

Question 19.

Company X plans to construct a hotel on a site which is currently occupied by the residents of a small town. The Company XYZ agrees to pay the cost of relocating the residents to another site. Whether the cost of relocating should be capitalized as part of the cost of land for the hotel?

Answer:

The cost of relocating the existing residents should be capitalized to the cost of land because the relocation is a direct result of the decision to acquire the land and is in the nature of cost of site preparation. Hence, it is directly attributable cost to bring the land to the condition necessary for it to be capable of operating in the manner intended by management.

![]()

Question 20.

A manufacturing company enters into a contract with a supplier to procure equipments over a period of 3 years. The Company has to pay cancellation fees for terminating the contract. The cancellation fees would only be in respect of those equipments which are not procured by the Company as per the contract.

The Company decides to terminate the contract at the end of year 1 since it has identified another supplier which would result in a significant reduction in cost for the company. It pays the cancellation fees in respect of the remaining equipments not yet procured. Whether the cancellation fee paid by the Company should be capitalized as part of the cost of the equipments purchased?

Answer:

The cancellation fees incurred is not directly attributable costs as they are not directly related to the acquisition of the equipment and are not required to bring the item to the location and condition necessary for it to be capable of operating in the manner intended by management.

Hence, the cancellation fee should not be capitalized as part of the cost of the equipments purchased from another supplier, instead it should be expensed off as and when incurred.

Question 21.

An entity has employed a contractor for construction of chemical plant. The terms of the agreement clearly specify that the liquidated damages are paid as compensation for failure to meet performance conditions in terms of the desired quality and level of output subsequent to commissioning of the plant. The damages will be calculated based on the shortfall in the output as a percentage of the contract price. Whether such liquidated damages received be deducted from the cost of the related asset or recognized as income?

Answer:

The amount of liquidated damages received are not directly attributable to the construction of the chemical plant like trade discounts and rebates. Such damages are as a result of the inefficiencies on the part of the contractor. Further, the amount of liquidated damages is directly linked to performance parameters for the plant subsequent to commissioning of the plant.

Therefore, the liquidated damages should not be deducted from the cost of related asset and the same should be accounted as income.

Question 22.

An entity P Ltd. employed a contractor to build a power plant on turnkey project basis for a total consideration of? 100 crores. As per the terms of the contract, if there is more than one-month delay in the completion of construction, P Ltd. is entitled to recover liquidated damages at 0.25% of the contract value for every week of delay subject to the maximum of 5% of contract value.

The contractor delayed the completion of construction by 45 days and therefore, P Ltd. received liquidated damages from the contractor. The management believes that liquidated damages basically compensate it for its loss of revenue for the period of 45 days. What will be the treatment of these liquidated damages received on delays by the contractor?

Answer:

The treatment of liquidated damages received on delays by the contractor depends on the facts and circumstances. Hence, whether or not the liquidated damages should be adjusted against the project cost would depend upon the fact whether the liquidated damages are directly identifiable with the project and whether, in fact, they are received for mitigating extra project costs to be incurred by the entity which will be capitalized as part of the cost of the plant. Where and to the extent the liquidated damages meet the aforesaid stipulations in affirmative, the same should be adjusted in the cost of the project. Otherwise the same should be accounted for as income.

Question 23.

Company A is constructing a building for its business use. The construction of the building is interrupted because of protests by the farmers for additional compensation for land sold by them in that area for an indefinite period. Company A continues to incur certain fixed cost. Whether such fixed costs, including abnormal costs, incurred during the period of interruption will be capitalized to the cost of building?

Answer:

Based on the principles of Ind AS 23, the cost incurred during an inter-ruption should also be capitalized only if the interruption is temporary and is a necessary part of bringing the asset to the condition for it to be capable of operating in the manner intended by the management e.g. the cost of delays for obtaining permits for the eventual operation of the asset.

In the given case, interruption due to protest by farmers for additional com-pensations is not a necessary part of bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. Moreover, the interruption is not a temporary delay or routine in nature. Accordingly, such interruption is abnormal in nature.

Therefore, fixed costs incurred during the period of interruption should not be capitalized to the cost of building.

Question 24.

Entity X has a warehouse which is closer to factory of Entity Y and vice versa. The factories are located in the same vicinity. Entity X and Entity Y agree to exchange their warehouses. The carrying value of warehouse of Entity X is ₹ 1,00,000 and its fair value of ₹ 1,25,000. It exchanges its warehouse with that of Entity Y, the fair value of which is ₹ 1,20,000. It also receives cash amounting to ₹ 5,000. How should Entity X account for the exchange of warehouses?

Answer:

In the given case, the transaction lacks commercial substance as the company’s cash flows are not expected to significantly change as a result of the exchange because the factories are located in the same vicinity le. it is in the same position as it was before the transaction. ,

Therefore, Entity X will have to recognize the assets received at the carrying amount of asset given up, i.e., ₹ 1,00,000 being carrying amount of existing warehouse of Entity X and ₹ 5,000 received will be deducted from the cost of property, plant and equipment. Therefore, the warehouse of Entity Y is recognized as property, plant and equipment with a carrying value of ₹ 95,000 in the books of Entity X.

Question 25.

Entity A acquired Entity B and measured the assets acquired at the acquisition date fair values in accordance with the requirement of Ind AS 103.

Ind AS 16 prescribes that where an item of property, plant and equipment is revalued, the entire class of property, plant and equipment to which that asset belongs should be revalued. In accordance with Ind AS 103 does this mean that Entity A is required to revalue its own existing tangible fixed assets that are classified in the same class of assets?

Answer:

As per paragraph 18 of Ind AS 103, Business Combinations, the acquirer shall measure the identifiable assets acquired and the liabilities assumed at their acquisition-date fair values. Accordingly, Entity A measured the fixed assets acquired at the acquisition date fair values.

The fair value measurement of assets acquired as per the requirements of Ind AS 103 does not mean that revaluation has taken place from a group’s perspective. The acquisition date fair value is just an initial recognition of the asset at cost (which is fair value in this case). It does not tantamount to adoption of revaluation model by the entity as per Ind AS 16. It is only an allocation of the purchase price (for initial recognition) as part of the cost model and does not relate to revaluation.

Therefore, the existing tangible fixed assets of the same class held by the group do not need to be revalued assuming that the group has a policy of measuring its assets at cost.

Question 26.

A Ltd. is setting up a new refinery outside the city limits. In order to facilitate the construction of the refinery and its operations, A Ltd. is required to incur expenditure on the construction/development of railway siding, road and bridge. Though A Ltd. incurs (or contributes to) the expenditure on the construction/development, it will not have ownership rights on these items and they are also available for use to other entities and public at large. Whether A Ltd. can capitalise expenditure incurred on these items as property, plant and equipment (PPE)? If yes, how should these items be depreciated and presented in the financial statements of A Ltd, as per Ind AS?

Answer:

The answer is based on Paragraphs 7, 9 and 16 of Ind AS 16.

Though A Ltd. may not be able to recognize expenditure incurred on these assets as an individual item of property, plant and equipment in many cases (where it cannot restrict others from using the asset), expenditure incurred may be capitalised as a part of overall cost of the project. From this, it can be concluded that, in the extant case the expenditure incurred on these assets, i.e., railway siding, road and bridge, should be considered as the cost of con-structing the refinery and accordingly, expenditure incurred on these items should be allocated and capitalised as part of the items of property, plant and equipment of the refinery.

Depreciation

As per paragraphs 43 and 47 of Ind AS 16, if these assets have a useful life which is different from the useful life of the item of property, plant and equipment to which they relate, it should be depreciated separately. However, if these assets have a useful life and the depreciation method that are the same as the useful life and the depreciation method of the item of property, plant and equipment to which they relate, these assets may be grouped in determining the depreciation charge. Nevertheless, if it has been included in the cost of property, plant and equipment as a directly attributable cost, it will be depreciated over the useful lives of the said property, plant and equipment.

The useful lives of these assets, should not exceed that of the asset to which it relates.

Presentation

These assets should be presented within the class of asset to which they relate.

![]()

Question 27.

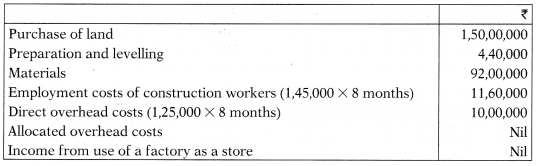

On 1st April, 2017 G Limited purchased some land for ₹ 1.5 crore (including legal cost of ₹ 10 lakhs) for the purpose of constructing a new factory. Construction work commenced on 1st May, 2017. G Limited incurred the following costs in relation to its construction.

Income received during the temporary use of the factory premises as a store during the construction period.

The construction of the factory was completed on 31st December, 2017 and production began on 1st February, 2018. The overall useful life of the factory building was estimated at 40 years from the date of completion. However, it is estimated that the roof will need to be replaced 20 years after the date of completion and that the cost of replacing the roof at current prices would be 25% of the total cost of the building.

At the end of the 40 years period, Good Time Limited has a legally enforceable obligation to demolish the factory and restore the site to its original condition. The company estimates that the cost of demolition in 40 years’ time (based on price prevailing at that time) will be ₹ 3 crore. The annual risk adjusted discount rate which is appropriate to this project is 8%. The present value of ₹ 1 payable in 40 years time at an annual discount rate of 8% is 0.046.

The construction of the factory was partly financed by a loan of ₹ 1.4 crore taken out on 1st April, 2017. The loan was at an annual rate of interest of 9%. During the period 1st April, 2017 to 30th September, 2017 (when the loan proceeds had been fully utilized to finance the construction), G Limited received investment income of ₹ 1,25,000 on the temporary investment of the proceeds.

You are required to compute the cost of the factory and the carrying amount of the factory in the Balance Sheet of Good Time Limited as at 31st March, 2018.

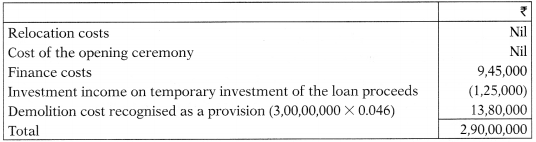

Answer:

Computation of the cost of the factory

Computation of carrying amount of the factory as at 31st March, 2018 (₹)

Note:

- Interest cost has been capitalised based on nine month period. This is because, purchase of land would trigger off capitalisation.

- All of the net finance cost of ₹ 8,20,000 (₹ 9,45,000 – ₹ 1,25,000) has been allocated to the depreciable asset i.e. Factory. Alternatively, it can be allocated proportionately between land and factory.

Question 28.

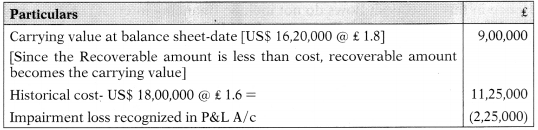

On 1st April, 2017, A Ltd. assumes a decommissioning liability in a business combination.

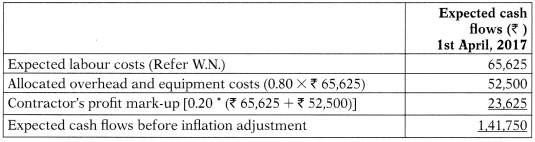

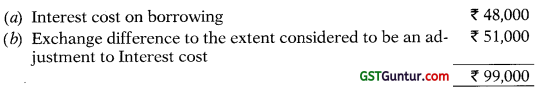

The entity is legally required to dismantle and remove an offshore oil platform at the end of its useful life, which is estimated to be 10 years. A Ltd. uses the expected present value technique to measure the fair value of the decommissioning liability. If A Ltd. was contractually allowed to transfer its decommissioning liability to a market participant, it concludes that a market participant would use the following inputs, probability-weighted as appropriate, when estimating the price, it would expect to receive:

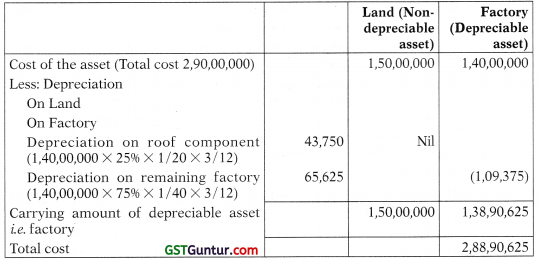

(i) Labour costs are developed on the basis of current market place wages, adjusted for expectations of future wage increases, required to hire con-tractors to dismantle and remove offshore oil platforms. A Ltd. assigns probability assessments (based on A Ltd.’s experience with fulfilling obligations of this type and its knowledge of the market) to a range of cash flow estimates as follows:

(ii) A Ltd. estimates allocated overhead and equipment operating costs to be 80% of expected labour costs in consistent with the cost structure of market participants.

(iii) A Ltd. estimates the compensation that a market participant would require for undertaking the activity and for assuming the risk associated with the obligation to dismantle and remove the asset as follows:

- A third-party contractor typically adds 20% mark-up on labour and allocated internal costs to provide a profit margin on the job.

- A Ltd. estimates 5% premium of the expected cash flows, includ-ing the effect of inflation for uncertainty inherent in locking in today’s price for a project that will not occur for 10 years.

(iv) Entity A assumes a rate of inflation of 4% over the 10-year period on the basis of available market data.

(v) The risk-free rate of interest for a 10-year maturity on 1st April, 2017 is 5 %. A Ltd. adjusts that rate by 3.5 per cent to reflect its risk of non-per-formance (i.e. the risk that it will not fulfil the obligation), including its credit risk.

A Ltd. concludes that its assumptions would be used by market participants.

In addition, A Ltd. does not adjust its fair value measurement for the existence of a restriction preventing it from transferring the liability. Measure the fair value of its decommissioning liability.

Discount factor:

Answer:

(a) Measurement of the fair value of its decommissioning liability

Working Note:

Subsequent Measurement (Based On Para Nos. 29 To 42)

Question 29.

If the revaluation model is adopted, Ind AS 16 specifies that all items within a class of assets are to be revalued simultaneously to prevent selective revaluations. What does ‘class of asset’ represent?

Answer:

Paragraph 37 of Ind AS 16 provides that, a class of property, plant and equipment is a grouping of assets of a similar nature and use in an entity’s operations.

Following are examples of separate classes:

(a) land;

(b) land and buildings;

(c) machinery;

(d) ships;

(e) aircraft;

(f) motor vehicles;

(g) furniture and fixtures;

(h) office equipment; and

(i) bearer plants.

The above-mentioned is a broad illustration of the classes of assets and it is possible that there may be other classes of assets based on their similar nature and use.

Example:

Buildings could be further classified as office buildings and factory buildings as separate classes of asset. Similarly, machinery may also be classified based on use for example, mining machinery, captive power plants, pollution control equipment etc.

Ultimately it is a matter of judgment in the context of the specific operations of an individual entity.

![]()

Question 30.

Company A has textile manufacturing facilities in two different geographical locations for similar products or products with similar markets. The company wants to classify both the manufacturing facilities as different class of property, plant and equipment, based on their different geographical location. Whether the company is permitted to do so?

Would the response be different if the company manufactured different products, say pharmaceuticals and textiles in the same geographical location?

Answer:

The Company A cannot classify both the manufacturing facilities as separate class of property, plant and equipment.

In the given case, the different geographical locations do not justify to classify the assets in different classes, as the manufacturing facilities in both regions are used for manufacturing similar products. Hence, the manufacturing facilities in both the locations should be classified as one class of property, plant and equipment.

However, if the entity manufactured pharmaceuticals and textiles, both in the same geographical location, then these could be classified as a separate class if it is sufficiently justified that the assets are of different nature and use as the nature and use of the assets should be assessed with respect to the business segment for which they are used, rather than their geographic location.

Question 31.

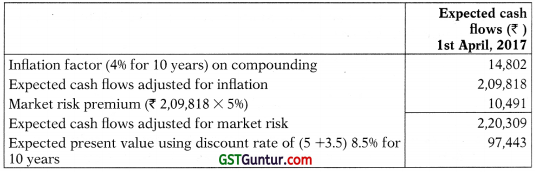

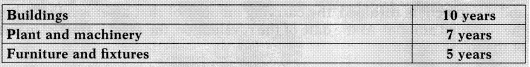

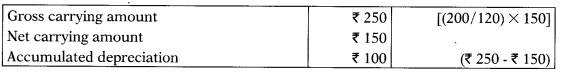

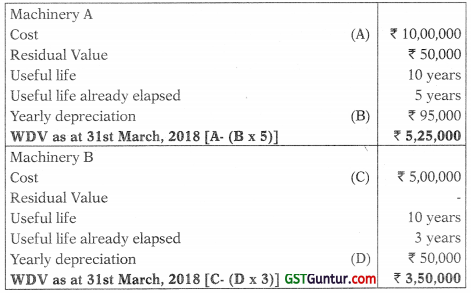

Company X performed a revaluation of all of Its plant and machinery at the beginning of 2018-19. The following information relates to one machinery:

The useful life of the machinery is 10 years and the company uses straight line method of depreciation. The revaluation was performed at the end of 4 years.

How should the Company account for revaluation of plant and machinery and depreciation subsequent to revaluation?

Answer:

Option I:

Gross carrying amount ₹ 250

[(200/120) × 150]

Net carrying amount ₹ 150

Accumulated depreciation ₹ 100

(250- 150)

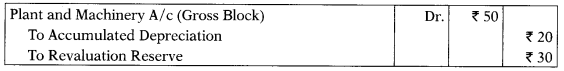

Journal entry

Fixed Assets (Gross Block)……….Dr. 50

To Accumulated Depreciation 20

To Revaluation Surplus 30

Option II:

Gross carrying amount is restated to ₹ 150 to reflect the fair value and Accu-mulated depreciation is set at zero.

Journal entry

Accumulated Depreciation …….. Dr. 80

To Fixed Asset (Gross Block) 80

Fixed Asset (Gross Block) ……… Dr. 30

To Revaluation surplus 30

Depreciation

Option I:

Since the Gross Block has been restated, the depreciation charge will be ₹ 25 per annum (₹ 250/10 years).

Option II:

Since the Revalued amount is the revised Gross Block, the useful life to be considered is the remaining useful life of the asset which results in the same depreciation charge of ₹ 25 per annum as per Option A (150/6 years).

Question 32.

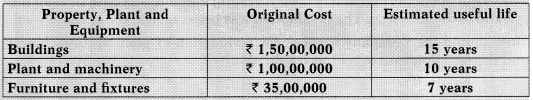

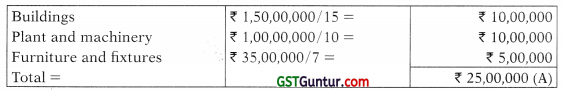

A Ltd. purchased some Property, Plant and Equipment on 1st April, 20X1, and estimated their useful lives for the purpose of financial statements prepared on the basis of md AS: Following were the original cost, and useful life of the various components of property, plant, and equipment assessed on 1st April, 20X1:

A Ltd. uses the straight-line method of depreciation. On 1st April, 20X4, the entity reviewed the following useful lives of the property, plant, and equipment through an external valuation expert:

There were no salvage values for the three components of the property, plant, and equipment either initially or at the time the useful lives were revised.

Compute the impact of revaluation of useful life on the Statement of Profit and Loss for the year ending 31st March, 20X4.

Answer:

The annual depreciation charges prior to the change in useful life were:

The revised annual depreciation for the year ending 31 st March, 20X4, would be:

The impact on Statement of Profit and Loss for the year ending 31 st March, 20X4 = ₹ 26,00,000 – ₹ 25,00,000 = ₹ 1,00,000

This is a change in accounting estimate which is adjusted prospectively in the period in which the estimate is amended and, if relevant, to future periods if they are also affected. Accordingly, from 20X4-20X5 onward, excess of ₹ 1,00,000 will be charged in the Statement of Profit and Loss every year till the time there is any further revision.

![]()

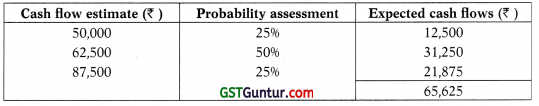

Question 33.

Company X performed a revaluation of all of its plant and machinery at the beginning of 2018-2019. The following information relates to one of the machinery:

The useful life of the machinery is 10 years and the company uses Straight line method of depreciation. The revaluation was performed at the end of the 4th year.

How should the Company account for revaluation of plant and machinery and depreciation subsequent to revaluation?

Answer:

According to paragraph 35 of Ind AS 16, when an item of property, plant and equipment is revalued, the carrying amount of that asset is adjusted to the revalued amount. At the date of the revaluation, the asset is treated in one of the following ways:

(a) The gross carrying amount is adjusted in a manner that is consistent with the revaluation of the carrying amount of the asset. For example, the gross carrying amount may be restated by reference to observable market data or it may be restated proportionately to the change in the carrying amount.

The accumulated depreciation at the date of the revaluation is adjusted to equal the difference between the gross carrying amount and the carrying amount of the asset after taking into account accumulated impairment losses; or

(b) The accumulated depreciation is eliminated against the gross carrying amount of the asset.

The amount of the adjustment of accumulated depreciation forms part of the increase or decrease in carrying amount that is accounted for in accordance with the paragraphs 39 and 40 of Ind AS 16.

If the Company opts for the treatment as per option (a), then the revised carrying amount of the machinery will be:

Journal entry

If the balance of accumulated depreciation is eliminated as per option (b), then the revised carrying amount of the machinery will be as follows:

Gross carrying amount is restated to ₹ 150 to reflect the fair value and Accumulated depreciation is set at zero.

Journal entry

Depreciation

Option (a) – Since the Gross Block has been restated, the depreciation charge will be ₹ 25 per annum (₹ 250/10 years).

Option (b) – Since the Revalued amount is the revised Gross Block, the useful life to be considered is the remaining useful life of the asset which results in the same depreciation charge of ₹ 25 per annum as per Option A (₹ 150/6 years).

Depreciation (Based On Para Nos. 43 To 62a)

Question 34.

A company acquires a land with an existing building for a consideration of ₹ 200 lakhs. The company has no intention of using the existing building. The fair market value of the land is ₹ 160 lakhs and that of the building is ₹ 40 lakhs. The planned redevelopment necessitates the demolition of that building and its replacement with a new building as an owner-occupied property. How the acquisition of land with the existing building will be accounted for in the books of account of the real estate developer?

Answer:

Paragraph 58 of Ind AS 16, inter alia, states that, land and buildings are separable assets and are accounted for separately, even when they are acquired together.

In accordance with above paragraph, in ordinary course, on initial recognition, the building and land should be recognized as two separate items of property, plant and equipment under Ind AS 16.

However, in the given case, the entity has no intention of utilizing the existing building for its business activities and the acquisition does not relate to a group of assets being acquired. The existing building is unusable to the entity and the same is to be demolished after acquisition.

Thus, although the company has acquired both land as well as building and fair- values of the land and existing building are available, the purpose of acquiring the land is to construct a new building for self-occupation. The entity has no intention of utilizing the existing building for self-occupation.

Accordingly, the amount paid for building should be included in the cost of land, ie., the entire amount of ₹ 200 should be treated as cost of land.

Question 35.

In accordance with Schedule II of the Companies Act, 2013, if the company uses a different useful life than as specified in Schedule II or a residual value of more than 5%, it is required to disclose the same in the financial statements and provide justification duly supported by the technical advice. Whether such technical advice is to be necessarily obtained from external experts?

Answer:

The Company may obtain technical advice from external or internal experts.

Irrespective of whether the useful life is determined as per the Schedule II to the Companies Act, 2013 a company should evaluate the reasonableness of the useful life of assets. Schedule II to the Companies Act, 2013 is silent regarding – whether the technical advice is to be necessarily obtained from external experts.

Determination of useful life is a matter of judgment and may be decided on a case to case basis. If a company has adequate internal technical expertise, it may be appropriate for the companies to rely on the judgments of such internal experts regarding the useful lives and residual value of the property, plant and equipment.

It should be supported by adequate documentation to be able to demonstrate that the company has obtained advice from such internal technical experts and the criteria and assumptions involved in making such determination of useful lives and residual value.

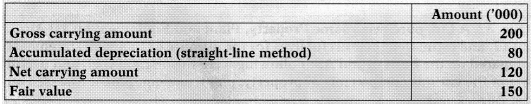

Question 36.

A manufacturing company has recently acquired a new factory, which cost ₹ 15,00,000 for the freehold land and building. The land has a fair value of ₹ 5,00,000. The factory building has a residual value of ₹ 1,00,000 at the end of 30 years, Which is the expected useful life of the building. This factory has a flat roof, which needs replacement after every ten years. The current cost of replacement is ₹ 1,00,000. How should the Company depreciate the entire factory?

Answer:

The company may consider the roof as a significant part of the item and depreciate the cost of the roof of ₹ 1,00,000 over the period of 10 years, giving a depreciation charge of ₹ 10,000 per annum and to depreciate the remaining value of the factory of ₹ 9,00,000 to its residual value of ₹ 1,00,000 over 30 years, giving depreciation charge of ₹ 26,667.

At the end of year 10 when the roof will be replaced the carrying amount attributable to the replaced roof would be nil, with no profit or loss on disposal.

![]()

Question 37.

Company A has purchased a captive power plant for ₹ 150 crores. Plant consists of significant components like boiler, turbine blades and generator. Company applies component accounting and depreciate all the 3 components as per their respective useful life. Company does not have the breakup of cost component-w’ise in the invoice. How will the total cost be allocated to the components?

Answer:

In case, the separate cost of each significant component of an asset is not available in the books of account then for the purpose of determining the cost of such component, the following criteria can be used in the order given below:

(a) Break-up cost provided by the vendor;

(b) Cost break-up given by internal/external technical expert;

(c) Fair values of various components; or

(d) Current replacement cost of component of the related asset and applying the same basis on the historical cost of asset.

Question 38.

An automotive company A has various types of tools that are used in the car manufacturing process. These tools are specific to a particular variant of a car and cannot be used for any other purpose. The number of units that can be produced or serviced through the use of these tools is estimated based on their utilization and the company maintains a detailed five-year production plan. Can the Company apply the units of production (UOP) method of depreciation?

Answer:

Based on the above facts, the depreciation of the tools can be provided based on the number of units expected to be obtained from the use of the asset, generally known as the UOP method. The Company maintains a detailed five- year plan, production plan so that it is able to reliably estimate the number of units that can be used or serviced through the use of these tools. By relating depreciation to the proportion of productive capacity the depreciation method reflects the pattern in which the future economic benefits are expected to be consumed by the entity.

Company A should periodically review the number of units that can be produced or serviced from the asset in the future. Where such an asset is idle for a long period of time, the Company should assess whether the use of UOP method is still appropriate.

Compensation (Based On Para Nos. 64 And 66)

Question 39.

Entity A has five manufacturing units across India. On 1 April, 2018, a major fire broke at one of the manufacturing units. All the fixed assets are insured under a fire insurance policy. The carrying value of the fixed assets in the manufacturing unit was ₹ 8 crores. Entity A received the insurance claim amounting to ₹ 12 crores including ₹ 10 crores for reconstructing the unit and ₹ 2 crores for loss of profits. The actual cost of rebuilding the unit is ₹ 11 crores. How will the Entity A account for the same?

Answer:

The Company will recognize the following in accordance with paragraph 66 of Ind AS 16:

(a) Loss of ₹ 8 crores for writing off the carrying value of the manufacturing unit.

(b) Insurance claim receivable of ₹ 12 crores when it becomes receivable as compensation for loss of manufacturing unit (to be included in Other Income);

(c) Cost of reconstruction of manufacturing unit amounting to ₹ 11 crores will be considered as new item of property, plant and equipment.

Decommissioning Cost (Based On Appendix A Of Ind As 16)

Question 40.

Company A has received a land on lease for 99 years from the government to carry out its activities. As per the terms and conditions of the lease, the Company is supposed to return the land to (he government after 99 years on a “as it is where it is basis”. At the inception of the lease the land is utilized by the company and a building has been constructed.

As per Ind AS 16, the cost of an item of property, plant and equipment comprises the initial estimate of the cost of dismantling and removing the item and restoring the site on which it is located. Management is of the view that the scrap value derived at the end of the lease period from the demolition of the project will compensate for the cost of demolition of the project.

How should the Company account for such decommissioning and restoration costs?

Answer:

In the above case, the decommissioning liability would be the liability associated with the costs of demolishing the building and making good the land to be returned to the government as per the terms and conditions of the agreement without considering the scrap value which will be derived from the demolition of the project at the end of the lease period.

All site restoration costs and other environmental restoration and similar costs need to be estimated and capitalized at initial recognition, in order that such costs can be recovered over the life of the item of property, plant and equipment even if the expenditure will only be incurred at the end of the item’s life.

Where an obligation exists to dismantle or remove an asset or restore a site to its former condition at the end of its useful life, the present value of the related future payments is capitalized along with the cost of acquisition or construction upon completion and a corresponding liability is recognized.

The total decommissioning cost is estimated, discounted to its present value and it is this amount which forms the initial provision. This ‘initial estimate of the costs of dismantling and removing the item and restoring the site’ is added to the corresponding asset’s cost. Thereafter, the asset is depreciated over its useful life, while the discounted provision is progressively unwound, with the unwinding charge shown as a finance cost.

Question 41.

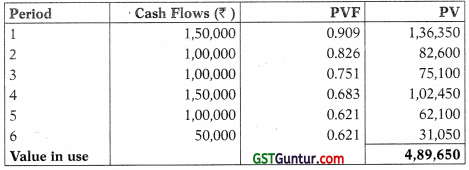

An entity has a nuclear power plant and a related decommissioning liability. The nuclear power plant started operating on April 1,2015. The plant has a useful life of 40 years. Its initial cost was ₹ 1,20,000. This included an amount for decommissioning costs of ₹ 10,000, w hich represented ₹ 70,400 in estimated cash flows payable in 40 years discounted at a risk-adjusted rale of 5 per cent. The entity’s financial year ends on March 31. Assume that a market-based discounted cash flow valuation of ₹ 1,15,000 is obtained at March 31, 2018.

It includes an allowance of ₹ 11,600 for decommissioning costs, w’hich represents no change to the original estimate, after the unwinding of three years’ discount. On March 31, 2019, the entity estimates that, as a result of technological advances, the present value of the decommissioning liability has decreased by ₹ 5,000. The entity decides that a full valuation of the asset is needed at March 31, 2019, in order to ensure that the carrying amount does not differ materially from fair value. The asset is now valued at ₹ 1,07,000, which is net of an allowance for the reduced decommissioning obligation.

How the entity will account for the above changes in decommissioning liability if it adopts revaluation model?

Answer:

Notes:

- Valuation obtained of ₹ 1,15,000 plus decommissioning costs of ₹ 11,600, allowed for in the valuation but recognised as a separate liability = ₹ 1,26,600.