Ind AS 41: Agriculture – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Ind AS 41: Agriculture – CA Final FR Study Material

Gain Or Loss (Based On Para Nos. 26 To 29)

Question 1.

As at 31st March, 2017, a plantation consists of 100 Pinus Radiata trees that were planted 10 years earlier. The tree takes 30 years to mature, and will ultimately be processed into building material for houses or furniture. The enterprise’s weighted average cost of capital is 6% p.a.

Only mature trees have established fair values by reference to a quoted price in an active market. The fair value (inclusive of current transport costs to get 100 logs to market) for a mature tree of the same grade as in the plantation is:

As at 31st March, 2017: ₹ 171

As at 31st March, 2018: ₹ 165

Assume that there would be immaterial cash flow between now and point of harvest.

The present value factor of ₹ 1 @ 6% for

19th year = 0.331

20th year = 0.312

Determine the value of such plantation as on 31st March, 2017 and 2018 and the gain or loss to be recognised as per Ind AS.

Answer:

As at 31st March, 2017, the mature plantation would have been valued at ₹ 17,100 (₹ 171 × 100).

As at 31st March, 2018, the mature plantation would have been valued at ₹ 16,500 (₹ 165 × 100).

Assuming immaterial cash flow between now and the point of harvest, the fair value (and therefore the amount reported as an asset on the statement of financial position) of the plantation is estimated as follows:

As at 31st March, 2017: ₹ 17,100 × 0.312 = ₹ 5,335.20.

As at 31st March, 2018: ₹ 16,500 × 0.331 = ₹ 5,461.50.

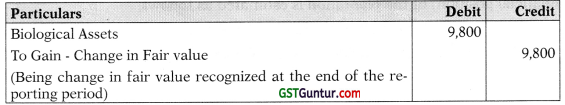

Gain or loss

The difference in fair value of the plantation between the two year end dates is ₹ 126.30 (₹ 5,461.50 – ₹ 5,335.20), which will be reported as a gain in the statement or profit or loss (regardless of the fact that it has not yet been realised).

![]()

[Based On Para Nos. 12 And 26]

Question 2.

Entity A purchased cattle at an auction on 30th June 2019

| Purchase price at 30th June 2019 | ₹ 1,00,000 |

| Costs of transporting the cattle back to the entity’s farm | ₹ 1,000 |

| Sales price of the cattle at 31st March, 2020 | ₹ 1,10,000 |

The company would have to incur similar transportation costs if it were to sell the cattle at auction, in addition to an auctioneer’s fee of 2% of sales price.

Calculate the amount at which cattle is to be recognized in books on initial recognition and at year end 31st March, 2020. [RTP November 2020]

Answer:

Computation of Value for Initial recognition of cattle:

| Particulars | ₹ |

| Fair value less costs to sell [₹ 1,00,000 – ₹ 1,000 – ₹ 2,000 (2% of 1,00,000)

Cash outflow [₹1,00,000 + ₹ 1,000 + ₹ 2,000 (2% of 1,00,000)] Loss on initial recognition |

97,000

1,03,000 |

| 6,000 |

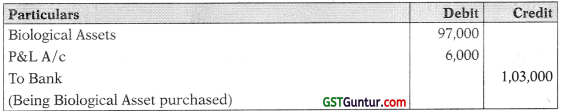

Journal Entry – (On date of Purchase):

Computation of Value at the end of Reporting period:

| Cattle Measurement at year end: | Amount |

| Fair value less costs to sell [₹ 1,10,000 – 1,000 – (2% × 1,10,000)| | 1,06,800 |

Journal Entry – (At the end of reporting period):