Ind AS 115: Revenue from Contracts with Customers – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Ind AS 115: Revenue from Contracts with Customers – CA Final FR Study Material

Question 1.

ABC Ltd. provides internet-based advertising services to publishing companies. It purchases advertisement space on various websites from a selection of publishers as per the following scenarios:

(i) ABC Ltd. pre-purchases the advertisement space from the publishers before it finds advertisers for that space.

(ii) ABC Ltd. provides the service of matching the advertisers with the publishers.

In each of the above cases, which party will be identified as the customer?

Answer:

In transactions involving multiple parties, it requires judgment to identify which counterparties are customers of the entity as it depends on specific terms and conditions of the underlying contracts. An entity is required to consider all relevant facts and circumstances, such as the purpose of the activities undertaken by the counterparty, to determine whether the counterparty is a customer.

The identification of the performance obligations in a contract can also have a significant effect on the determination of which party is the entity’s customer:

(i) It is assumed that ABC Ltd. is acting as a principal in accordance with Ind AS 115.

ABC Ltd. pre-purchases advertisement space on various websites from a selection of publishers, the companies (i.e., advertiser) to whom it will provide the advertising space will be identified as its customers.

(ii) It is assumed that ABC Ltd. is acting as an agent of the publisher in accordance with Ind AS 115.

ABC Ltd., does not provide any ad-targeting services or purchase the advertising space from the publishers before it finds advertisers for that space. It only provides the service of matching the ad placement for advertisers with the publishers. Accordingly, the publisher to whom ABC Ltd. is providing services will be identified as its customer.

Scope (Based On Para Nos. 5 To 8)

Question 2.

Mubu TV released an advertisement in ET, a vernacular daily. Instead of paying for the same, Mubu TV allowed ET a free advertisement spot, which was duly utilised by ET.

How revenue for these non-monetary transactions m the area of advertising will be recognised and measured?

Answer:

The above case, will be covered under Ind AS 115 since the same is exchange of dissimilar goods or services because both of the entities deal in different mode of media, ie., one is print media and another is electronic media and both parties are acting as customers and suppliers for each other.

Further, it seems it is for consumption by the said parties.

Even if it was to facilitate sales to customers or potential customers, it would not be scoped out since the parties are not in the same line of business.

Ind AS 115 provides that to determine the transaction price for contracts in which a customer promises consideration in a form other than cash, an entity shall measure the non-cash consideration (or promise of non-cash consider-ation) at fair value.

Therefore, Mubu TV and ET should measure the revenue promised in the form of non-cash consideration as per the above referred principles of Ind AS 115.

![]()

Question 3.

A Ltd. and B Ltd. both are engaged in manufacturing of homogeneous bottles. A Ltd. operates in northern, eastern and central parts of India. B Ltd. operates in western and southern parts of India. A Ltd. fulfils the demands of its customers based on western and southern India by using the bottles manufactured by B Ltd. Similarly, B Ltd. fulfils the demands of customer based on northern, eastern and central parts of India by delivering bottles manufactured by A Ltd.

How A Ltd. and B Ltd. should recognise the revenue?

Answer:

In industries with homogeneous products, it is common for entities in the same line of business to exchange products in order to sell them to customers or potential customers other than parties to exchange. It is to be noted that all contracts (including contract for non-monetary exchanges) should have commercial substance before an entity can apply the other requirements in the revenue recognition model prescribed in Ind AS 115.

In this case, the exchange of bottles qualifies as a non-monetary exchange between customers in the same line of business.

Accordingly, A Ltd. and B Ltd. should not recognise any revenue on account of exchange of goods as Ind AS 115 will not apply to the contract.

Question 4.

A Ltd. and B Ltd. are both engaged in the extraction and supply of natural gas to different parts of India. A Ltd. is located in western India while B Ltd. is located in Southern part of India. A Ltd. contracts to supply natural gas to a large corporate customer, X Ltd., located in the South-eastern region of India, who is engaged in supply of natural gas to homes.

B Ltd. on the other hand contracts to supply natural gas to Y Ltd. which is located closer to A Ltd. Consequently, A Ltd. purchases from B Ltd. to supply natural gas to Y Ltd. and B Ltd. purchases from A Ltd. to supply natural gas to X Ltd. The price of natural gas for this transaction would be based on actual delivery date of gas by either party.

Further, the parties would do a monthly calculation of supplies and receipts of gas and do a net settlement based on the prices calculated as above. In the said industry, price varies based on different product categories and also varies based on point of sale.

How will this situation be treated under Ind AS 115?

Answer:

All contracts (including contract for non-monetary exchanges) should have’ commercial substance before an entity can apply the other requirements in the revenue recognition model prescribed in Ind AS 115.

In the above case, entities A Ltd. & B Ltd. operate in the same line of business and agree to supply the same units of natural gas to each other’s customers due to ease of supplying in geographically closer areas. However, they calculate the price based on date of delivery and do a net settlement every month and hence, the contracts have commercial substance. Thus, the above case falls within the scope of Ind AS 115, even though the timing of transfer of goods or services may be different.

Hence, A Ltd. will book revenue from sale of goods to B Ltd. and also book revenue from sale of goods to X Ltd. A Ltd. will also recognise purchase of good from B Ltd.

Similarly, B Ltd. will also record relevant corresponding accounting entries.

![]()

Question 5.

A Ltd. a telecommunication company, entered into an agreement with B Ltd. which is engaged in generation and supply of power. The agreement provided that A Ltd. will provide 1,00,000 minutes of talk time to employees of B Ltd. in exchange for getting power equivalent to 20,000 units. A Ltd. normally charges Re.0.50 per minute and B Ltd. charges ₹ 2.5 per unit.

How should revenue be measured in this case?

Answer:

The above case will be covered under Ind AS 115 since the same is ex-change of dissimilar goods or services.

Revenue recognised by A Ltd.:

Consideration in the form of power units that it expects to be entitled for talk-time sold, i.e. ₹ 50,000 (20,000 units × ₹ 2.5).

Revenue recognised by B Ltd.:

Consideration in the form of talk time that it expects to be entitled for the power units sold, i.e., ₹ 50,000 (1,00,000 minutes × Re. 0.50).

Step 1: Identify The Contract (Based On Para Nos. 9 To 16)

Question 6.

An entity G Ltd. enters into a contract with a customer P Ltd. for the sale of a machinery for ₹ 20,00,000. P Ltd. intends to use the said machinery to start a food processing unit. The food processing industry is highly com-petitive and P Ltd. has very little experience in the said industry. P Ltd. pays a non-refundable deposit of ₹ 1,00,000 at inception of the contract and enters into a long-term financing agreement with G Ltd. for the remaining 95 per cent of the agreed consideration which it intends to pay primarily from in-come derived from its food processing unit as it lacks any other major source of income.

The financing arrangement is provided on a non-recourse basis, which means that if P Ltd. defaults then G Ltd. can repossess the machinery but cannot seek further compensation from P Ltd., even if the full value of the amount owed is not recovered from the machinery. The cost of the ma-chinery for G Ltd. is ₹ 12,00,000. P Ltd. obtains control of the machinery at contract inception.

When should G Ltd. recognize revenue from sale of machinery to P Ltd. in accordance with paragraph 9 of Ind AS 115? [RTP-Nov. 19]

Answer:

In the above case, it is not probable that G Ltd. will collect the consid-eration to which it is entitled in exchange for the transfer of the machinery. P Ltd.’s ability to pay may be uncertain due to the following reasons:

(a) P Ltd. intends to pay the remaining consideration (which has a significant balance) primarily from income derived from its food processing unit (which is a business involving significant risk because of high competition in the said industry and P Ltd.’s little experience);

(b) P Ltd. lacks other income or assets that could be used to repay the bal-ance consideration; and

(c) P Ltd.’s liability is limited because the financing arrangement is provided on a non-recourse basis. In accordance with the above, the criteria in paragraph 9 of Ind AS 115 are not met.

Read this after understanding Paras 15 and 16:

Further, G Ltd. should account for the non-refundable deposit of ₹ 1,00,000 payment as a deposit liability as none of the events described in paragraph 15 have occurred—that is, neither the entity has received substantially all of the consideration nor it has terminated the contract.

Accordingly, as per paragraph 16, G Ltd. will continue to account for the initial deposit as well as any future payments of principal and interest as a deposit liability until the criteria in paragraph 9 are met (i.e. the entity is able to con-clude that it is probable that the entity will collect the consideration) or one of the events in paragraph 15 has occurred.

Note:

G Ltd. will continue to assess the contract in accordance with paragraph 14 to determine whether the criteria in paragraph 9 are subsequently met or whether the events in paragraph 15 of Ind AS 115 have occurred.

Question 7.

On March 1st, 2017, P Ltd agrees to sell 1,000 bath fittings to X Ltd. which are manufactured by using customized screws supplied by a specific vendor. The payment terms between P Ltd. and X Ltd. have not been decided as they are dependent on the price of the customized screws which is yet to be finalized. As a token of confirmation, P Ltd. received a non-refundable amount of ₹ 1,000.

How will this arrangement be treated under Ind AS 115 in the books of P Ltd., if P Ltd. is a principal in this transaction?

Answer:

In the given case, since the payment terms are not identified yet, the said contract does not meet all of the criteria of paragraph 9.

Read this after understanding Paras 14, 15 and 16:

P Ltd. shall account for the non-refundable amount of ₹ 1,000 as a liability as none of the events described in paragraph 15 have occurred—that is, neither the entity has received substantially all of the consideration nor it has termi-nated the contract.

Accordingly, as per paragraph 16, P Ltd. will continue to account for the non-refundable amount as well as any future payments as a liability until the criteria in paragraph 9 are met (i.e. the payment terms are identified) or one of the events in paragraph 15 has occurred.

Note:

P Ltd. will continue to assess the contract in accordance with paragraph 14 to determine whether the criteria in paragraph 9 are subsequently met or whether the events in paragraph 15 of Ind AS 115 have occurred.

Question 8.

X Ltd. provides IT support services to its customers from a distant location. Customers call up the support team of X Ltd., who understand the client’s requirement over the phone and provide necessary advice to the cus-tomer to resolve their issue. Before providing advice, the support team member will understand the client’s problem and inform them about the price for the services to be provided.

Once the problem is resolved, the customer will make the agreed payment to X Ltd. through online banking mode. X Ltd. considers that collection is probable and the oral contract is enforceable as per the laws applicable in the jurisdiction of X Ltd.

In such a case, whether there is a valid contract in accordance with Ind AS 115?

Answer:

Assessment of 5 conditions:

Condition (a):

The contract has been approved orally and X Ltd. will work to resolve the customer’s problem and in return it will be eligible to receive the agreed price.

Conclusion – Condition met.

Condition (b):

Each party’s rights can be clearly identified.

Reason:

The right of the customer is to receive the agreed service to resolve his prob-lem while X Ltd. is eligible to receive the agreed price in case the problem is successfully resolved.

Conclusion – Condition met.

Condition (c):

Payment terms are identified.

Reason:

The customer has understanding that he will be required to pay the agreed amount through online banking mode, the payment amount and the method of payment are clearly identified.

Conclusion – Condition met.

Condition (d):

Contract has commercial substance.

Reason:

It involves efforts and time of the support team of X Ltd. to resolve the cus-tomer’s problem and in return they will become eligible to receive the agreed price which will impact the risk and timing of the expected cash flow, it can be said that there is commercial substance in the contract.

Conclusion – Condition met.

![]()

Condition (e):

Collection is probable.

Reason:

It is given in the facts that X Ltd. considers collection is probable.

Conclusion – Condition met.

Overall Conclusion:

Based on the above assessment and since in the given case, the oral contract is enforceable as per the laws applicable in the jurisdiction, the contract satisfies all the criteria of paragraph 9, even though it is an oral contract.

Accordingly, in the given case, there is a contract in accordance with Ind AS 115.

Step 1: Special Issues – Combining Of Contracts (Based On Para No. 17)

Question 9.

Company A, a manufacturer of specialized construction equipment enters into a contract with Customer B to manufacture and deliver a custom-ized lift for ₹ 95,000. The total cost to Company A of designing, manufacturing and delivering the lift is estimated to be ₹ 70,000. Two days later, Company A enters into another contract with Customer B to deliver four lift tyres that Customer B will use on the customized lift in the future after the original tyres deteriorate. The contract price per tyre is ₹ 800, however, the cost of each tyre is estimated at ₹ 900.

Whether these two contracts should be treated as a single contract?

Answer:

In the given case. Company A enters into two contracts with the same party at about the same time, i.e. within two days.

In addition, the contracts should satisfy one or more of the criteria in paragraph 17 of Ind AS 115 for the contracts to be combined.

In the given case, criterion (a) of paragraph 17 for combining contracts is met because the two contracts are negotiated as a bundle with one business objective.

The relationship between the consideration in the contracts (i.e., the price in-terdependence) is such that if those contracts were not combined, the amount of consideration allocated to the performance obligations in each contract might not faithfully depict the value of the goods or services transferred to the customer. In other words, Company A would have incurred a loss of ₹ 400 [(₹ 900 – ₹ 800) × 4 = ₹ 400] on the second contract, if it was not combined with the first contract.

Thus, considering that the contracts were entered into at about the same time, it seems that two contracts are negotiated as a package with a single commercial objective, i.e. the tyres have not been sold at a loss instead the consideration of ₹ 95,000 stated for the lift includes a part of consideration for the tyres as well.

Therefore, Company A should combine the two contracts for revenue recog-nition.

Step 1: Special Issues – Modifications (Based On Para Nos. 18 To 21)

Question 10.

Entity A Ltd. enters into a three-year service contract with a customer C Ltd. for ₹ 4,50,000 (₹ 1,50,000 per year). The standalone selling price for one year of service at inception of the contract is ₹ 1,50,000 per year. A Ltd. accounts for the contract as a series of distinct services.

At the beginning of the third year, the parties agree to modify the contract as follows:

- Fee for the third year is reduced to ₹ 1,20,000; and

- C Ltd. agrees to extend the contract for another three years for ₹ 3,00,000 (₹ 1,00,000 per year).

The standalone selling price for one year of service at the time of modification is ₹ 1,20,000.

How should A Ltd. account for the modification?

Answer:

In the given case, even though the remaining services to be provided are distinct, the modification should not be accounted for as a separate contract because the price of the contract did not increase by an amount of consider-ation that reflects the standalone selling price of the additional services.

The modification would be accounted for, from the date of the modification, as if the existing arrangement was terminated and a new contract created (i.e. on a prospective basis) because the remaining services to be provided are distinct.

A Ltd. should reallocate the remaining consideration to all of the remaining services to be provided (i.e. the obligations remaining from the original contract and the new obligations). A Ltd. will recognize a total of ₹ 4,20,000 (₹ 1,20,000 + ₹ 3,00,000) over the remaining four-year service period (one year remaining under the original contract plus three additional years) or ₹ 1,05,000 per year.

Step 2 : Identify Performance Obligations (Based On Para Nos. 22 To 30)

Question 11.

A car company C Ltd. grants company X a license to use its name in a new car with solar technology and also promises to manufacture the car for X. Whether the license to use company’s name a separate performance obligation?

Answer:

C Ltd. assesses that no other company can manufacture the car due to highly specialized nature of the solar car manufacturing process. As a result, the license cannot be separately purchased from the company.

C Ltd. also determines that Company X cannot be benefited from the license without the manufacturing service, therefore, the criterion in paragraph 27(a) of Ind AS 115 is not met.

Conclusion:

The license and the manufacturing service are not distinct and C Ltd. accounts for the license and the manufacturing service as a single performance obligation.

Alternatively:

If C Ltd. is able to determine that the manufacturing process used for the car is not unique or specialized and other companies could also manufacture the car for Company X, then the criterion in paragraph 27(a) of Ind AS 115 is met because Company X can be benefited from the license together with readily available resources other than C Ltd.’s manufacturing service (because there are other entities that can provide the manufacturing service), and can benefit from the manufacturing service together with the license transferred to it (Company X) at the start of the contract.

Company X would also consider whether it will be able to purchase the license separately without significantly affecting its ability to benefit from the license and that neither the license nor the manufacturing service is significantly modified by the other and C Ltd. is not providing services to integrate those items, [i.e. evaluation of Paragraph 27(b) – Parameter 1, 2 or 3].

In such case, C Ltd. shall conclude that its promise to grant the license and to provide the manufacturing service are distinct and there are two performance obligations:

- License to use name

- Manufacturing of car.

![]()

Step 3 : Determine Transaction Price (Based On Para Nos. 46 To 72)

Question 12.

A car manufacturer sells a car at ₹ 1,28,000 which includes GST of ₹ 28,000. What is the amount to be recognised as revenue?

Answer:

Amounts collected on behalf of third parties such as sales taxes, goods and services taxes and value added taxes are not economic benefits which flow to the entity. Therefore, they are excluded from revenue. Collection of GST by an entity would not be an inflow on the entity’s own account but it shall be made on behalf of the government authorities.

Accordingly, the revenue should be presented net of GST. Therefore, in the present case, the revenue should be recognised at ₹ 1,00,000.

Question 13.

Can the amount of revenue recognised for a particular transaction in the financial statements be different from the amount of sales for the purposes of GST?

Answer:

Yes, in certain situations, it may be possible that the value determined for the purpose of GST is not equal to the value determined for the purposes of financial reporting.

Example:

If there is a sale made with deferred consideration over five years for a value of say, ₹ 1,00,000, the sale value for the purposes of GST could be ₹ 1,00,000 but the revenue for the purposes of financial reporting would be the fair value after excluding the financing element for the deferred consideration.

Question 14.

A TV manufacturer sells TV sets to Its dealers at the list price of ₹ 10,000 per TV. If a dealer takes more than 8,000 sets during the contract period, then it is eligible for a discount of 5% on the list price retrospectively (i.e. for all sets purchased since the commencement of the agreement). The contract period starts in June and ends in May of each year.

On the reporting date, i.e., March 31, 2018, a particular dealer has purchased 5,000 sets. Based on the past trends, it is expected that the total purchases to be made by dealer during the contract period up to May 2018 will be more than 8,000 sets.

Should revenue be adjusted for the discount expected to be availed by such a dealer?

Answer:

In the instant case, based on past trends and other available evidences, it is probable that the total purchases made by the dealer during the contract period up to May 2018 will exceed 8,000 sets and thus, it is probable that a 5% discount will have to be allowed.

Therefore, the amount of revenue should be adjusted for the probable discount that may have to be allowed, as the economic benefits to that extent may not flow to the entity.

Revenue should be adjusted for probable discount on sales made till March 31,2018.

Note:

While estimating the amount of discount expected to be allowed, events occurring be-tween the end of the reporting period and the date when the financial statements are approved for issuance should also be considered in accordance with the requirements of Ind AS 10.

![]()

Question 15.

On 1st April, 2018, Entity X enters into a contract with Entity Y to sell mobile chargers for ₹ 100 per charger. As per the terms of the contract, if Entity Y purchases more than 1,000 chargers till March 2019, the price per charger will be retrospectively reduced to ₹ 90 per unit. Till September 2018, Entity X sold 95 chargers to Entity Y.

Entity X estimates that Entity Y’s pur-chases by March 2019 will not exceed the required threshold of 1,000 char-gers. In October 2018, Entity Y acquires another Entity C and from October to December 2018, the Entity X sells an additional 600 chargers to Entity Y. Due to these developments, the Entity X estimates that purchases of Entity Y will exceed the 1,000 charger’s threshold for the period and therefore, it will be required to retrospectively reduce the price per charger to ₹ 90.

How should the revenue be recognized in such a situation?

Answer:

Entity X estimates that the consideration in the above contract is variable. Therefore, in accordance with paragraphs 56 and 57 of Ind AS 115, Entity X is required to consider the constraints in estimating variable consideration.

Entity X determines that it has significant experience with this product and with the purchasing pattern of the Entity Y. Thus, if Entity X concludes that it is highly probable that a significant reversal in the cumulative amount of revenue recognized (i.e. ₹ 100 per unit) will not occur when the uncertainty is resolved (i.e. when the total amount of purchases is known), then the Entity X will recognize revenue of ₹ 9,500 (95 chargers × ₹ 100 per charger) for the half year ended 30 September 2018.

Further analysis:

Based on Paragraphs 87 and 88 of Ind AS 115:

In accordance with the above paragraphs;

In the month of October 2018, due to change in circumstances on account of Entity Y acquiring Entity C and consequential increase in sale of chargers to Entity Y, Entity X estimates that Entity Y’s purchases will exceed the 1,000 charger’s threshold till March 2019 for the period and therefore, it will be re-quired to retrospectively reduce the price per charger to ₹ 90.

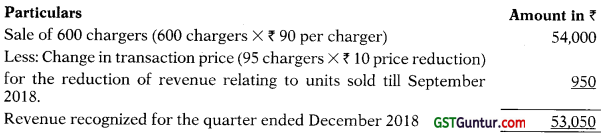

Consequently, the Entity X will recognize revenue of ₹ 53,050 for the quarter ended December 2018 which is calculated as follows:

Question 16.

Entity X is a dealer in electronic goods. Entity X has entered into a contract to sell a television to a customer for a consideration of ₹ 1,00,000. The payment for the equipment is to be made after 2 years. The cash selling price of the product is ₹ 80,000 which represents the amount that the cus-tomer would pay upon delivery for the same product sold under otherwise identical terms and conditions as at contract inception. The prevailing rate of interest is 12%.

Should revenue be measured at ₹ 1,00,000 or at ₹ 80,000?

Answer:

Entity X should assess whether the contract includes a significant financing component.

In the given case, this is evident from the difference between the amount of promised consideration of ₹ 1,00,000 and the cash selling price of ₹ 80,000 at the date that the television are transferred to the customer.

Also, Entity X assesses that the contract includes an implicit interest rate of 12%, i.e. the interest rate that discounts the promised consideration of ₹ 80,000 over 24 months. Entity X concludes that the rate of 12% is commensurate with the rate in a separate financing transaction between Entity X and the customer.

Entity is required to evaluate the probability that whether it will be able to collect the consideration to which it is entitled to in exchange for the television that will be transferred to the customer in accordance with the criterion of paragraph 9(c) of Ind AS 115 which is assumed to have been met in the given case.

Conclusion:

Accordingly, on transfer of television to the customer, Entity X will recognise revenue with a corresponding receivable equal to the cash selling price of ₹ 80,000. Until Entity X receives the cash payment from the customer, interest revenue should be recognised in accordance with Ind AS 109.

Question 17.

An entity enters into 1,000 contracts with customers. Each contract includes the sale of one product for ₹ 50 (1,000 total products × ₹ 50 = ₹ 50,000 total consideration). Cash is received when control of a product transfers. The entity’s customary business practice is to allow a customer to return any unused product within 30 days and receive a full refund. The entity’s cost of each product is ₹ 30.

The entity applies the requirements in Ind AS 115 to the portfolio of 1,000 contracts because it reasonably expects that, in accordance with paragraph 4, the effects on the financial statements from applying these requirements to the portfolio would not differ materially from applying the requirements to the individual contracts within the portfolio. Since the contract allows a customer to return the products, the consideration received from the customer is variable.

To estimate the variable consideration to which the entity will be entitled, the entity decides to use the expected value method (see paragraph 53(a) of Ind AS 115) because it is the method that the entity expects to better predict the amount of consideration to which it will be entitled. Using the expected value method, the entity estimates that 970 products will not be returned.

The entity estimates that the costs of recovering the products will be immaterial and expects that the returned products can be resold at a profit.

Determine the amount of revenue, refund liability and the asset to be rec-ognised by the entity for the said contracts.

Answer:

The entity also considers the requirements in paragraphs 56-58 of Ind AS 115 on constraining estimates of variable consideration to determine whether the estimated amount of variable consideration of ₹ 48,500 (₹ 50 × 970 products not expected to be returned) can be included in the transaction price. The entity considers the factors in paragraph 57 of Ind AS 115 and determines that although the returns are outside the entity’s influence, it has significant experience in estimating returns for this product and customer class.

In addition, the uncertainty will be resolved within a short time frame (i.e. the 30-day return period). Thus, the entity concludes that it is highly probable that a significant reversal in the cumulative amount of revenue recognised (i.e. ₹ 48,500) will not occur as the uncertainty is resolved (i.e. over the return period).

The entity estimates that the costs of recovering the products will be immaterial and expects that the returned products can be resold at a profit.

Upon transfer of control of the 1,000 products, the entity does not recognise revenue for the 30 products that it expects to be returned. Consequently, in accordance with paragraphs 55 and B21 of Ind AS 115, the entity recognises the following:

(a) revenue of ₹ 48,500 (₹ 50 × 970 products not expected to be returned);

(b) a refund liability of ₹ 1,500 (₹ 50 refund × 30 products expected to be returned); and

(c) an asset of ₹ 900 (₹ 30 × 30 products for its right to recover products from customers on settling the refund liability).

![]()

Question 18.

[Based on Para Nos. 76 and 81]

An entity enters into a contract for the sale of Product A for ₹ 1,000. As part of the contract, the entity gives the customer a 40% discount voucher for any future purchases up to ₹ 1,000 in the next 30 days. The entity intends to offer a 10% discount on all sales during the next 30 days as part of a seasonal promotion. The 10% discount cannot be used in addition to the 40% discount voucher.

The entity believes there is 80% likelihood that a customer will redeem the voucher and, on an average, a customer will purchase ₹ 500 of additional products.

Determine how many performance obligations does the entity have and their stand-alone selling price and allocated transaction price? [MTP-May 2020]

Answer:

Analysis:

Since all customers will receive a 10% discount on purchases during the next 30 days, the only additional discount that provides the customer with a material right is the incremental discount of 30% on the products purchased. The entity accounts for the promise to provide the incremental discount as a separate performance obligation in the contract for the sale of Product A.

The entity believes there is 80% likelihood that a customer will redeem the voucher and, on an average, a customer will purchase ₹ 500 of additional products. Consequently, the entity’s estimated stand-alone selling price of the discount voucher is ₹ 120 (₹ 500 average purchase price of additional products × 30% incremental discount X 80% likelihood of exercising the option).

Stand-alone selling prices:

(of Product A and discount voucher)

| Performance obligations | Stand-alone selling price |

| Product A | ₹ 1,000 |

| Discount voucher | ₹ 120 |

| Total | ₹ 1,120 |

Allocation of Transaction price:

| Performance obligations | Allocated Transaction price (rounded off to the nearest ₹ 10) |

|

| Product A | (₹ 1000 ÷ ₹ 1120 × ₹ 1000) | ₹ 890 |

| Discount voucher | (₹ 120 ÷ ₹ 1120 × ₹ 1000) | ₹ 110 |

| Total | ₹ 1000 |

Revenue Recognition:

The entity allocates ₹ 890 to Product A and recognizes revenue for Product A when control transfers. The entity allocates ₹ 110 to the discount voucher and recognizes revenue for the voucher when the customer redeems it for goods or services or when it expires.

Question 19.

A contractor enters into a contract with a customer to build an asset for ₹ 1,00,000, with a performance bonus of ₹ 50,000 that will be paid based on the timing of completion. The amount of the performance bonus decreases by 10% per week for every week beyond the agreed-upon completion date. The contract requirements are similar to those of contracts that the contractor has performed previously, and management believes that such experience is predictive for this contract. The contractor concludes that the expected value method is most predictive in this case.

The contractor estimates that there is a 60% probability that the contract will be completed by the agreed-upon completion date, a 30% probability that it will be completed one week late, and a 10% probability that it will be completed two weeks late.

Determine the transaction price. [RTP-November 2020]

Answer:

Analysis:

| Step | Para No. | Particulars | Remarks |

| 1. | 51 | Is the performance bonus variable? | Yes |

| 2. | 56 | Is it highly probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved? | Yes |

| 3. | 53 | Which method will apply to measure the variable consideration? | Expected Value |

Conclusion:

The transaction price should include management’s estimate of the amount of consideration to which the entity will be entitled for the work performed.

Measurement of Transaction Price (including Variable Consideration):

| Particulars | Amount |

| ₹ 1,50,000 (fixed fee plus full performance bonus) × 60%

₹ 1,45,000 (fixed fee plus 90% of performance bonus) × 30% ₹ 1,40,000 (fixed fee plus 80% of performance bonus) × 10% Total probability-weighted consideration |

₹90,000

₹ 43,500 ₹ 14,000 |

| ₹ 1,47,500 |

Note:

The contractor will update its estimate at each reporting date (as per Para No. 59).

Step 4 : Allocation Of Transaction Price To Performance Obligations (Based On Para Nos. 73 To 90)

Question 20.

P Ltd. is a technology company and regularly sells Software S, Hardware H and Accessory A. The stand-alone selling prices for these items are stated below:

Software S : ₹ 50,000

Hardware H : ₹ 1,00,000 and

Accessory A : ₹ 20,000.

Since the demand for Hardware H and Accessory A is low, P Ltd. sells H and A together at ₹ 1,00,000. P Ltd. enters into a contract with Z Ltd. to sell all the three items for a consideration of ₹ 1,50,000.

What will be the accounting treatment for the discount of ₹ 20,000 in the financial statements of P Ltd., considering that the three items are three dif-ferent performance obligations which are satisfied at different points in time?

Answer:

In the given case, the contract includes a discount of ₹ 20,000 on the overall transaction, which should have been allocated proportionately to all three performance obligations when allocating the transaction price using the relative stand-alone selling price method.

However, as P Ltd. meets all the criteria specified in paragraph 82 above, i.e., it regularly sells Hardware H and Accessory A together for ₹ 1,00,000 and Software S for ₹ 50,000, accordingly, it is evident that the entire discount should be allocated to the promises to transfer Hardware H and Accessory A.

In the given case, since the contract requires the entity to transfer control of Hardware H and Accessory A at different points in time, then the allocated amount of ₹ 1,00,000 should be individually allocated to the promises to transfer Hardware H (stand-alone selling price of ₹ 1,00,000) and Accessory A (standalone selling price of ₹ 20,000).

| Product | Allocated transaction price (₹) |

| Hardware H | 83,333 (1,00,000/120,000 × 100,000) |

| Accessory A | 16,667 (20,000/120,000 × 100,000) |

| Total | 1,00,000 |

Note:

If P Ltd. would have transferred the control of Hardware H and Accessory A at the same point in time, then the P Ltd. could, as a practical matter, account for the transfer of those products as a single performance obligation. That is, P Ltd. could allocate ₹ 1,00,000 of the transaction price to the single performance obligation and recognise revenue of ₹ 1,00,000 when Hardware H and Accessory A simultaneously transfer to Z Ltd.

![]()

Question 21.

Company A sells a photocopier machine for ₹ 1,00,000 with a con-tractual understanding that it will also do maintenance for five years. In cer-tain other transactions where the Company A has sold photocopier machines without maintenance, the value is ₹ 80,000. If the maintenance contract is taken separately for 5 years, its value is ₹ 30,000.

How should the revenue be recognised in such a situation?

Answer:

In this case, there are two separately identifiable performance obligations:

Performance Obligation 1:

Sale of a photocopier machine

Performance Obligation 2:

Maintenance contract for five years

For recognition of revenue, relative stand-alone selling price of the individual components may be taken and the consideration allocated in proportion of relative fair values, i.e. 80,000:30,000.

Hence, the sale of photocopier machine should be recognised at ₹ 72,727 (₹ 1,00,000 × 8/11) when all other conditions for sale of photocopier machine are fulfilled and the revenue from maintenance services of ₹ 27,273 (100,000 × 3/11) should be the service revenue recognised over a period of five years as per its stage of completion.

Question 22.

An entity enters into a contract with a customer for two intellectual property licences (Licences A and B), which the entity determines to represent two performance obligations each satisfied at a point in time. The stand-alone selling prices of Licences A and B are ₹ 1,600,000 and ₹ 20,00,000, respectively. The entity transfers Licence B at inception of the contract and transfers Licence A one month later.

Case A—Variable consideration allocated entirely to one performance obligation

The price stated in the contract for Licence A is a fixed amount of ₹ 1,600,000 and for Licence B the consideration is three per cent of the customer’s future sales of products that use Licence B. For purposes of allocation, the entity estimates its sales-based royalties (i.e. the variable consideration) to be ₹ 2,000,000. Allocate the transaction price.

Case B—Variable consideration allocated on the basis of stand-alone selling prices

The price stated in the contract for Licence A is a fixed amount of ₹ 600,000 and for Licence B the consideration is five per cent of the customer’s future sales of products that use Licence B. The entity’s estimate of the sales-based royalties (i.e. the variable consideration) is ₹ 3,000,000. Allocate the transac-tion price and determine the revenue to be recognised for each licence and the contract liability, if any.

Answer:

Case A— Variable consideration allocated entirely to one performance obligation

To allocate the transaction price, the entity considers the criteria in paragraph 85 and concludes that the variable consideration (ie. the sales-based royalties) should be allocated entirely to Licence B. The entity concludes that the criteria are met for the following reasons:

(a) the variable payment relates specifically to an outcome from the performance obligation to transfer Licence B (ie. the customer’s subsequent sales of products that use Licence B).

(b) allocating the expected royalty amounts of ₹ 2,000,000 entirely to Licence B is consistent with the allocation objective in paragraph 73 of Ind AS 115. This is because the entity’s estimate of the amount of sales-based royalties (₹ 2,000,000) approximates the standalone selling price of Licence B and the fixed amount of ₹ 1,600,000 approximates the stand-alone selling price of Licence A.

The entity allocates ₹ 1,600,000 to Licence A. This is because, based on an assessment of the facts and circumstances relating to both licences, allocating to Licence B some of the fixed consideration in addition to all of the variable consideration would not meet the allocation objective in paragraph 73 of Ind AS 115.

The entity transfers Licence B at inception of the contract and transfers Li-cence A one month later. Upon the transfer of Licence B, the entity does not recognise revenue because the consideration allocated to Licence B is in the form of a sales-based royalty. Therefore, the entity recognises revenue for the sales-based royalty when those subsequent sales occur.

When Licence A is transferred, the entity recognises as revenue the ₹ 1,600,000 allocated to Licence A

CaseB— Variable consideration allocated on the basis of stand-alone selling prices

To allocate the transaction price, the entity applies the criteria in paragraph 85 of Ind AS 115 to determine whether to allocate the variable consideration (ie. the sales-based royalties) entirely to Licence B.

In applying the criteria, the entity concludes that even though the variable payments relate specifically to an outcome from the performance obligation to transfer Licence B (i.e. the customer’s subsequent sales of products that use Licence B), allocating the variable consideration entirely to Licence B would be inconsistent with the principle for allocating the transaction price. Allocating ₹ 600,000 to Licence A and ₹ 3,000,000 to Licence B does not reflect a reasonable allocation of the transaction price on the basis of the stand-alone selling prices of Licences A and B of ₹ 1,600,000 and ₹ 2,000,000, respectively. Consequently, the entity applies the general allocation requirements of Ind AS 115.

The entity allocates the transaction price of ₹ 600,000 to Licences A and B on the basis of relative stand-alone selling prices of ₹ 1,600,000 and ₹ 2,000,000, respectively. The entity also allocates the consideration related to the sales- based royalty on a relative stand-alone selling price basis. However, when an entity licenses intellectual property in which the consideration is in the form of a sales-based royalty, the entity cannot recognise revenue until the later of the following events: the subsequent sales occur or the performance obligation is satisfied (or partially satisfied).

Licence B is transferred to the customer at the inception of the contract and Licence A is transferred three months later. When Licence B is transferred, the entity recognises as revenue ₹ 333,333 [(₹ 2,000,000 × ₹ 600,000/₹ 3,600,000] allocated to Licence B. When Licence A is transferred, the entity recognises as revenue ₹ 266,667 [(₹ 1,600,000 × ₹ 600,000/ ₹ 3,600,000] allocated to Licence A.

In the first month, the royalty due from the customer’s first month of sales is ₹ 400,000. Consequently, the entity recognises as revenue ₹ 222,222 (₹ 2,000,000 × ₹ 400,000/₹ 3,600,000) allocated to Licence B (which has been transferred to the customer and is therefore a satisfied performance obligation). The entity recognises a contract liability for the ₹ 177,778 (₹ 1,600,000 – ₹ 3,600,000 × ₹ 400,000) allocated to Licence A. This is because although the subsequent sale by the entity’s customer has occurred, the performance obligation to which the royalty has been allocated has not been satisfied.

![]()

Step 5 : Recognition Of Revenue (Based On Para Nos. 31 To 45)

Question 23.

A enters into a contract with Customer B to manufacture and install a product. These products need significant amount of installation to make them operational and the installation will be done by the Entity A. Entity A dispatches these goods to Customer B to be installed later and raises an invoice of ₹ 8,00,000 for these goods as at March 31, 2018. The standalone value of the product is ₹ 7,00,000 and installation is ₹ 2,00,000.

Assuming the installation is completed by June 2018, when should the revenue be recognized?

Answer:

In the given case, it needs to be ascertained whether installation is complex and whether company A offers manufacturing and installation services in combination or separately to its customers. In case the company offers these services in combination, and the customer cannot benefit from the installation services on its own or together with other readily available resources (for instance, only company A can install the product because of its complicated nature), then there is only one performance obligation.

Additionally, the entity must also establish whether it satisfies the performance obligation at a point in time or over time. Assuming the product cannot be used before installation and the customer cannot obtain the benefits of using the product before installation (i.e. the money received will have to be returned unless the installation of the product is successful), performance obligation is satisfied at a point in time when installation is completed.

Also, Ind AS 115 requires revenue from sale of goods to be recognized when the control of goods has passed to the customer.

Thus, in such a case, revenue of ₹ 8,00,000 will be recognized when installation is complete, i.e., in June 2018.

Further analysis:

If the company offers these services individually and the customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer, then there are two performance obligations:

(i) Sale of the product; and

(ii) Installation of the product ₹ 8,00,000 would be allocated to goods and installation services respectively as per their stand-alone selling prices i.e. ₹ 7,00,000 and ₹ 2,00,000 respectively. Accordingly, the revenue from goods to be recorded for the year ended March 31, 2018 is ₹ 6,22,222.22 (800000 × 700000/900000) and for installation services during the period ended June 30, 2018 is ₹ 177,777.78.

Question 24.

Company A enters into a contract to manufacture a turbine for Customer. The turbine is designed and manufactured to Customer’s specifi-cations. Company A could redirect the turbine to another customer, but only if Company A incurs significant cost to reconfigure the turbine. Assume the following additional facts:

(a) The contract contains one performance obliga-tion as the goods and services to be provided are not distinct. (b) Customer is obligated to pay Company A an amount equal to the costs incurred plus an agreed profit margin if it cancels the contract.

How should Company A recognize revenue from this contract?

Answer:

In the given case the Company A should consider whether the turbine in its completed state will have an alternative use to the entity. Although the contract does not preclude the entity from directing the completed turbine to another customer, Company A will have to incur significant costs to reconfigure the turbine to direct it to another customer.

Consequently, the asset, i.e. the turbine has no alternative use to Company A because the customer-specific design of the turbine limits the Company A’s practical ability to readily direct the turbine to another customer. Further, Company A also has a right to payment for performance completed to date.

Accordingly, the criterions under paragraph 35(c) are met for a performance obligation satisfied over time. Hence, Company A can recognize revenue over time as it builds the turbine, provided it is able to fulfil all other conditions of paragraph 9.

Question 25.

X Lid. a knowledge management company, entered into an agree-ment with ABC, an educational institute, to formulate some study material on a particular subject for a total consideration of ₹ 10,00,000. The contract terms stipulated that X Ltd. has to complete the contract before March 31, 2018, and in the event of failure to complete the same within the stipulated time, it will be reimbursed only 75% of the cost incurred by it.

X Ltd. could complete only 85% of the assignment till March 31, 2018. Till that date X Ltd. has incurred cost of ₹ 4,00,000 and has sought an extension of time but it is not sure whether the extension will be granted or not.

How and when X Ltd. should recognise revenue?

Note:

Ignore the element of onerous contract.

Answer:

In the present case, the outcome of the contract cannot be measured reliably, but it is certain that X Ltd. can recover the 75% of the cost incurred as per terms of the agreement.

Accordingly, X Ltd. can recognise 75% of the cost incurred as revenue, i.e., ₹ 3,00,000 (4,00,000 × 75/100).

Question 26.

Entity A, a large payroll processing firm enters into a contract with Entity B to provide monthly payroll processing services. The term of the contract is for one year. Entity B promises to pay ₹ 1,00,000 per month for the service.

How should revenue be recognised?

Answer:

In accordance with paragraphs 22(b) and 23 of Ind AS 115, the promised payroll processing services are accounted for as single performance obligation.

Entity B simultaneously receives and consumes the benefits of the Entity A performance in processing each payroll transaction as and when each trans-action is processed.

Entity A therefore, concludes that the performance obligation is satisfied over time in accordance with paragraph 35(a) of Ind AS 115.

Entity A therefore recognises revenue over time by measuring its progress towards complete satisfaction of that performance obligation. Consequently, Entity A concludes that a time-based measure is the best measure of progress towards complete satisfaction of the performance obligation over time and hence, it recognises revenue on a straight-line basis throughout the year at ₹ 1,00,000 per month.

Question 27.

A Ltd. runs a departmental store which awards 10 points for every purchase of ₹ 500 which can be discounted by the customers for further shopping with the same merchant. Each point is redeemable on any future purchases of A Ltd.’s products within 3 years. Value of each point is ₹ 0.50. During the accounting period 2017-2018, the entity awarded 1,00,00,000 points to various customers of which 18,00,000 points remained undiscounted (to be redeemed till 31st March, 2020). The management expects only 80% of the remaining will be discounted in future.

The Company has approached your firm with the following queries and has asked you to suggest the accounting treatment (Journal Entries) under the applicable Ind AS for these award points:

| (a) | How should the recognition be done for the sale of goods worth ₹ 10,00,000 on a particular day? |

| (b) | How should the redemption transaction be recorded in the year 20172018? The Company has requested you to present the sale of goods and redemption as independent transaction. Total sales of the entity is ₹ 5,000 lakhs. |

| (0 | How much of the deferred revenue should be recognised at the year- end (2017-2018) because of the estimation that only 80% of the outstanding points will be redeemed? |

| (d) | In the next year 2018-2019, 60% of the outstanding points were discounted Balance 40% of the outstanding points of 2017-2018 still remained outstanding. How much of the deferred revenue should the merchant recognize in the year 2018-2019 and what will be the amount of balance deferred revenue? |

| (e) | How much revenue will the merchant recognized in the year 20192020, if 3,00,000 points are redeemed in the year 2019-2020? |

Answer:

(a) Points earned on ₹ 10,00,000 @ 10 points on every ₹ 500 = [(10,00,000/500) × 10] = 20,000 points.

Value of points = 20,000 points × ₹ 0.5 each point = ₹ 10,000

Journal Entry

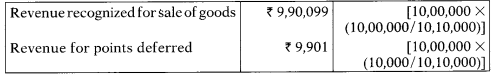

(b) Points earned on ₹ 50,00,00,000 @ 10 points on every ₹ 500 = [(50,00,00,000/500) × 10] = 1,00,00,000 points.

Value of points = 1,00,00,000 points × ₹ 0.5 each point = ₹ 50,00,000

Revenue recognized for sale of goods = ₹ 49,50,49,505 [50,00,00,000 × (50,00,00,000/50,50,00,000)]

Revenue for points = ₹ 49,50,495 [50,00,00,000 × (50,00,000/ 50,50,00,000)]

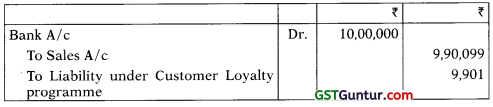

Journal Entries in the year 2017-18

Revenue for points to be recognized

Undiscounted points estimated to be recognized next year 18,00,000 × 80% = 14,40,000 points

Total expected points to be redeemed in 2018-2019 and 2019-2020 = [(1,00,00,000 – 18,00,000) + 14,40,000] = 96,40,000

Revenue to be recognised with respect to discounted point = 49,50,495 × (82,00,000/96,40,000) = 42,11,002

(c) Revenue to be deferred with respect to undiscounted point in 2017-2018 = 49,50,495 – 42,11,002 = 7,39,493

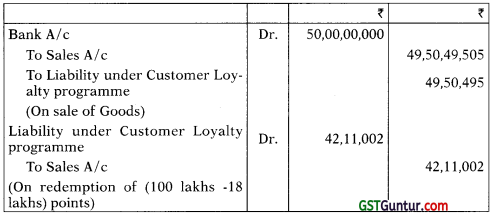

(d) In 2018-2019, A Ltd. would recognize revenue for discounting of 60% of outstanding points as follows:

Outstanding points = 18,00,000 × 60% = 10,80,000 points

Total points discounted till date = 82,00,000 + 10,80,000 = 92,80,000 points

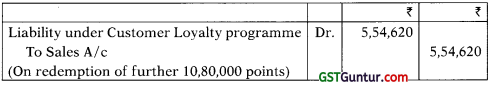

Revenue to be recognized in the year 2018-2019 = [{49,50,495 × (92,80,000/96,40,000)} – 42,11,002] = ₹ 5,54,620.

Journal Entry in the year 2018-2019

The Liability under Customer Loyalty programme at the end of the year 2018-2019 will be ₹ 7,39,493 – 5,54,620 = 1,84,873.

![]()

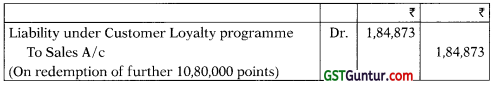

(e) In the year 2019-2020, the merchant will recognized the balance revenue of ₹ 1,84,873 irrespective of the points redeemed as this is the last year for redeeming the points. Journal entry will be as follows:

Journal Entry in the year 2019-2020

Question 28.

Orange Ltd. contracts to renovate a five star hotel including the installation of new elevators on 01.10.2017. Orange Ltd. estimates the trans-action price of f 480 lakhs. The expected cost of elevators is ₹ 144 lakhs and expected other costs is ₹ 240 lakhs. Orange Ltd. purchases elevators and they are delivered to the site six months before they will be installed. Orange Ltd. uses an input method based on cost to measure progress towards completion. The entity has incurred actual other costs of ₹ 48 lakhs by 31.03.2018.

How much revenue will be recognised as per relevant Ind AS for the year ended 31st March, 2018, if performance obligation is met over a period of time ? [May 2019 – 5 Marks]

Answer:

The revenue to be recognized is measured as follows:

| Particulars | Amount (₹) |

| Transaction price | 480 lacs |

| Costs incurred: | |

| (a) Cost of elevators | 144 lacs |

| (b) Other costs | 48 lacs |

| Measure of progress: | 48/240 = 20% |

| Revenue to be recognised: | |

| (a) For costs incurred (other than elevators) | Total attributable revenue = 336 lacs % of work completed = 20% Revenue to be recognised = 67.2 lacs |

| (b) Revenue for elevators | 144 lacs (equal to costs incurred) |

| Total revenue to be recognised | 67.2 lacs +144 lacs = 211.2 lacs |

Therefore, for the year ended 31 March, 2018, the Company shall recognize revenue of ₹ 211.2 lacs on the project.

Question 29.

Nivaan Limited commenced work on two long-term contracts during the financial year 31st March, 2019.

The first contract with A & Co. commences on 1st June, 2018 and had a total sales value of ₹ 40 lakhs. It was envisaged that the contract would run two years and that the total expected costs would be ₹ 32 lakhs. On 31st March, 2019 Nivaan Limited revised its estimate of the total expected cost to ₹ 34 lakhs on the basis of the additional rectification cost of ₹ 2 lakhs incurred on the contract during the current financial year. An independent surveyor has estimated at 31st March, 2019 that the contract is 30% complete. Nivaan Limited has incurred costs up to 31st March, 2019 of ₹ 16 lakhs and has re-ceived payments on account of ₹ 13 lakhs.

The second contract with B & Co. commenced on 1st September, 2018 and was for 18 Months. The total sales value of contract was ₹ 30 lakhs and the total expected costs ₹ 24 lakhs. Payments on account already received were ₹ 9.50 lakhs and total costs incurred to date were ₹ 8 lakhs. Nivaan Limited had insisted on a large deposit from B & Co. because the companies had not traded together prior to the contract. The independent surveyor estimated that 31st March, 2019 the contract was 20% complete.

The two contracts meet the requirement of Ind AS-115 ‘Revenue from Con-tracts with Customers’ to recognize revenue over time as the performance obligations are satisfied over time.

The company also has several other contracts of between twelve and eighteen months in duration. Some of these contracts fall into two accounting periods and were not completed as at 31st March, 2019. In absence of any financial data relating to the other contracts, you are advised to ignore these other contracts while preparing the financial statements of the company for the year ended 31st March, 2019.

Prepare financial statement extracts for Nivaan Limited in respect of the two construction contracts for the year ending 31st March, 2019. (Nov. 2020 -12 Marks)

Hint:

| Contract I: | ||

| Workings | Amount | |

| % completion | 16/34 = 47% | |

| Sales value | 40 × 47% | 18.8 lacs |

| Cost incurred | (16 lacs) | |

| Profit | 2.80 lacs | |

| Contract II: | ||

| % completion | 8/24 = 33.33% | |

| Sales value | 30 × 33.33% | 10 lacs |

| Cost incurred | (8 lacs) | |

| Profit | 2 lacs |

Special Issues – Consignment Arrangement (Based On Para Nos. B77 To B78 Of Appendix B Of Ind As 115)

Question 30.

Company A is into the business of manufacturing seasonal item such as Diwali gift baskets, Christmas ornaments, Halloween items etc. Company A enters into a consignment agreement with Retailer R assuring the retailer that whatever is not sold will be taken back by the Company A. The right to determine the selling price and the risk of non-payment by the customer is with Company A.

When should revenue be recorded by Company A?

Answer:

In the current scenario, retailer R does not obtain the control of goods in accordance with paragraphs 33, B77-B78 of Ind AS 115.

Since the goods will be returned to Company A, if they remain unsold and the right to determine the selling price and the credit risk is entirely borne by it, the revenue will be recognised by Company A only when the goods are sold to the final customer.

Special Issues – Sale With A Right To Return (Based On Para Nos. B20 To B27 Of Appendix B Of Ind As 115)

Question 31.

A Ltd. is a manufacturer of garments and sells garments to certain retailers with a right to return in case the retailer is not satisfied with the quality of garments. Full amount is refunded to retailer provided that garments are undamaged. Based on past experience, at the end of the year, it is expected that 5% of goods sold during the year will be returned by the retailers in the next financial year. The gross margin on sale of garments is 10%.

How should revenue be recognised by A Ltd.?

Answer:

In the present case, A Ltd. should recognise revenue only for 95% of the goods based on past experience and a refund liability will be recognised for the balance 596.

A Ltd. will also recognise an asset equal to the amount reflecting the 5% goods expected to be returned adjusting it for any impairment in value, if any, ie., the asset will be measured by reference to the carrying value (example inventory) less any expected costs to recover those products including potential decreases in the value to the entity of the returned product.

Customer Unexercised Rights (Based On Para Nos. B44 To B51 Of Appendix B Of Ind As 115)

Question 32.

An operator offers a subscriber a finite number of call minutes for a fixed amount per month with the option of rolling over any unused minutes to the following month. At the end of the month, the subscriber has some unused minutes to roll over to the next month. The subscriber can use the unused minutes for the following two months, after which they expire. The operator has a history of enforcing expiry dates.

How does a telecommunication operator account for unused minutes that a subscriber holds?

Answer:

Revenue is recognised in the accounting period in which the services are rendered, which in this case would be when the contracted call minutes are provided (ie., the allocation is to minutes and not periods). The operator recognises revenue when the minutes are used. The operator recognises any unused minutes at the end of each month as contract liability.

Paragraphs B44 and B46 oflnd AS 115 state that:

Paragraph B44:

Upon receipt of a prepayment from a customer, an entity shall recognise a contract liability in the amount of the prepayment for its performance obliga-tion to transfer, or to stand ready to transfer, goods or services in the future.

An entity shall derecognise that contract liability (and recognise revenue) when it transfers those goods or services and, therefore, satisfies its performance obligation.

Paragraph B46:

If an entity expects to be entitled to a breakage amount in a contract liability, the entity shall recognise the expected breakage amount as revenue in proportion to the pattern of rights exercised by the customer. If an entity does not expect to be entitled to a breakage amount, the entity shall recognise the expected breakage amount as revenue when the likelihood of the customer exercising its remaining rights becomes remote. To determine whether an entity expects to be entitled to a breakage amount, the entity shall consider the requirements of constraining estimates of variable consideration.

In some instances, the operator has reliable and robust evidence that shows that the customer will not use a portion of those minutes before the expiration of the validity period. Hence, in accordance with paragraph B46 stated above, if an entity expects to be entitled to a breakage amount in a contract liability, the entity shall recognise the expected breakage amount as revenue in proportion to the pattern of rights exercised by the customer.

Accordingly, in that case, the operator could consider a revenue recognition policy that considers the probability of unused minutes at the end of the validity period into the computation of the revenue per minute used by the subscriber. This results in allocating a higher fixed amount of revenue per minute used.

When the validity period expires, the operator recognises any remaining bal-ance of unused minutes as revenue immediately, since the obligation of the operator to provide the contractual call minutes is extinguished.

Special Issues – Repurchase Agreements (Based On Para Nos. B64 To B76 Of Appendix B Of Ind As 115)

Question 33.

An entity enters into a contract with a customer for the sale of equipment for ₹ 5 crores on 4th April, 2018. The contract includes a call option that gives the entity a right to repurchase the equipment for ₹ 5.3 crores on or before 31st March, 2019.

How will this transaction be treated under Ind AS 115?

Answer:

If the repurchase price of the asset is greater than the original selling price of the asset, it constitutes a financing arrangement.

Thus, the entity should continue to recognise the asset and also recognise a financial liability for any consideration received from the customer.

The difference between the amount received from the customer and the amount of consideration to be paid to the customer (ie., ₹ 30,00,000 in this case) shall be treated as interest expense.

![]()

Question 34.

An entity enters into a contract with a customer for the sale of an equipment for ₹ 5 crores on 4th April, 2018. The contract includes a put op-tion that creates an obligation for the entity to repurchase the equipment at the customer’s request for ₹ 4.8 crores on or before 31st March, 2019. The market price is expected to be ₹ 4.5 crores.

How will this transaction be treated under Ind AS 115?

Answer:

At the inception of the contract, the entity assesses whether the customer has a significant economic incentive to exercise the put option, to determine the accounting for the transfer of the asset.

In the given case, as the repurchase price is significantly greater than the expected market value, the entity concludes that the customer has a significant economic incentive to exercise its right, ie., the put option. The entity determines there are no other relevant factors to consider when assessing whether the customer has a significant economic incentive to exercise the put option.

Consequently, the entity concludes that control of the asset does not transfer to the customer, because the customer is limited in its ability to direct the use of, and obtain substantially all. of the remaining benefits from, the asset.

Accordingly, the entity accounts for the transaction as a lease in accordance with Ind AS 17.

Special Issues- Bill And Hold (Based On Para Nos. B79 To B82 Of Appendix B Of Ind As 115)

Question 35.

Company A has an agreement to supply certain goods to Company B which has to be supplied by March 15, 2018. Company A manufactures the goods, but prior to its despatch on March 15, 2018, it receives intimation from Company B that the project has been delayed for a month and they will be unable to pick up the goods on agreed time.

Hence, Company B requests Company A to store the goods on its behalf. Company A cannot use the goods itself or direct them to another customer. Company B has already made the payment and has the legal title of the goods. Company B has inspected and accepted the goods.

When should revenue be recognised by Company A?

Answer:

Company A should assess the indicators in paragraph 38 of Ind AS 115 to determine the point in time at which control of goods transfers to Company B, noting that the Company A has received payment, the Company B has legal title to the goods and inspected and accepted the goods.

In addition, if Company A concludes that all of the criteria in paragraph B81 of Ind AS 115 are met, which is necessary for it to recognise revenue in a bill- and-hold arrangement, the Company A shall recognise revenue for the goods on 31 March, 2018 when control transfers to Company B.

Further, as per paragraph B82 of Ind AS 115, Company A shall assess whether it has remaining performance obligations (for example, for custodial services) in which case Company A shall allocate a portion of the transaction price and recognise revenue for custodial service over time.

Contract Costs (Based On Para Nos. 91 To 98)

Question 36.

Company A is a telecommunication company that pays discretionary annual bonus to its employees of the sales department based on annual sales target, EBITDA target and employees’ ratings.

Will the annual bonus be incremental cost of obtaining contracts and hence eligible for capitalisation?

Answer:

The entity does not recognise an asset for the annual bonuses paid to sales employees because the bonuses are not incremental cost to obtain a contract.

The amounts are discretionary and are based on other factors, including the EBITDA of the entity and the employees’ performance. The bonuses are not directly attributable to identifiable contracts.

Question 37.

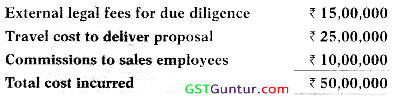

Company X provides consultancy services to its customers. It has won a contract through a tender process and incurs following costs to obtain the contract:

Will the annual bonus be incremental cost of obtaining contracts and hence eligible for capitalisation?

Answer:

Com missions payable to sales employees are an incremental cost to obtain the contract, because they are payable only upon successfully obtaining the contract. Company X therefore recognises an asset for the sales commissions of ₹ 10,00,000, subject to recoverability.

Company X would have incurred legal fees and travel costs regardless of whether the contract was obtained. Therefore, those costs are recognised as expenses when incurred, unless they are within the scope of another Standard, in which case, the relevant provisions of that Standard apply.

Question 38.

Entity B pays 10% sales commission to its salesperson on each contract that he or she obtains. In addition, the following employees of the entity receive sales commissions on each signed contract negotiated by the salesperson: 3% to the manager and 1% to the regional manager.

How will these costs be treated in accordance with Ind AS 115?

Answer:

To determine whether a cost is incremental, an entity should consider whether it would incur the cost if the customer (or the entity) decides, just as the parties are about to sign the contract, that it will not enter into the contract.

If the costs would have been incurred even if the contract is not executed, the costs are not incremental to obtaining that contract. For example, salaries and benefits of sales employees that are incurred regardless of whether a contract is obtained are not incremental costs.

In the given case, all of the commissions are incremental because the com-missions would not have been incurred if the contract had not been obtained.

Ind AS 115 does not distinguish between commissions paid to the employee(s) based on the function or the title of the employee(s) that receives a commission. It is the entity that decides which employee(s) are entitled to a commission as a result of obtaining a contract.