Ind AS 101: First-time Adoption of Indian Accounting Standards – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Ind AS 101: First-time Adoption of Indian Accounting Standards – CA Final FR Study Material

Definitions (Previous Gaap; Transition Date Etc.) [Based On Appendix A To Ind As 101]

Question 1.

Company B is a foreign subsidiary-of Company A and has adopted IFRS as issued by IASB as its primary GAAP for its local financial reporting purposes. Company B prepares its financial statements as per Accounting Standards specified under Section 133 of the Companies Act, 2013 read with Rule 7 of the Companies (Accounts) Rules, 2014 for the purpose of consolidation with Company A. On transition of Company A to Ind-AS, what would be the previous GAAP of the foreign subsidiary Company B for its financial statements prepared for consolidation with Company A?

Answer:

Appendix A to Ind-AS 101 defines previous GAAP as the basis of accounting that a first-time adopter used for its statutory reporting requirements in India (emphasis added) immediately before adopting Ind-ASs.

For instance, companies preparing their financial statements in accordance with the Accounting Standards specified under Section 133 of the Companies Act, 2013 read with Rule 7 of the Companies (Accounts) Rules, 2014 shall consider those financial statements as previous GAAP financial statements.

Accordingly, the previous GAAP of the foreign subsidiary for the purpose of consolidation under Ind-AS with the parent company would be accounting standards specified under Section 133 of the Companies Act, 2013 read with Rule 7 of the Companies (Accounts) Rules, 2014 and not the IFRS as issued by the IASB since the first-time adoption has to be considered in the context of India only.

Scope (Based On Para Nos. 2 To 5)

Question 2.

A Ltd. is required to first time adopt Indian Accounting Standards (Ind AS) from April 1, 2016. The management of A Ltd. has prepared its financial statements in accordance with Ind AS and an explicit and unreserved statement of compliance with Ind AS has been given. However, the auditor’s report oil those financial statements contains a qualification because of disagreement on application of one Ind AS. Can such financial statements of A Ltd. be treated as first Ind AS financial statements?

Answer:

Ind AS 101 defines first Ind AS financial statements as “The first annual financial statements in which an entity adopts Indian Accounting Standards (Ind ASs), by an explicit and unreserved statement of compliance with Ind ASs.”

In accordance with the above definition, if an explicit and unreserved statement of compliance with Ind AS has been given in the financial statements, even if the auditor’s report contains a qualification because of disagreement on application of Indian Accounting Standard(s), it would be considered that A Ltd. has done the first-time adoption of Ind AS.

In such a case, exemptions given under Ind AS 101 cannot be availed again. If, however, the unreserved statement of compliance with Ind AS is not given in the financial statements, such financial statements would not be considered to be first Ind AS financial statements.

![]()

Opening Balance Sheet And Accounting Policies (Based On Para Nos. 6 To 12)

Question 3.

Y Ltd. is required to adopt Ind AS from April 1, 2016, with compara-tives for one year, i.e., for 2015-16. What will be its date of transition?

Answer:

The date of transition for X Ltd. will be April 1, 2015 being the beginning of the earliest comparative period presented. To explain it further, Y Ltd. is required to adopt an Ind AS from April 1, 2016, and it will give comparatives as per Ind AS for 2015-16. Accordingly, the beginning of the comparative period will be April 1, 2015 which will be considered as date of transition.

Question 4.

A Ltd. was using cost model for its property, plant and equipment (tangible fixed assets) till March 31, 2016 under previous GAAP. On April 1, 2015, i.e., the date of its transition to Ind AS, it used fair values as the deemed cost in respect of its fixed assets. Whether it will amount to a change in accounting policy?

Answer:

Use of fair values on the date of transition will not tantamount to a change in accounting policy. The fair values of the property, plant and equipment on the date on transition will be considered as deemed cost without this being considered as a change in accounting policy.

Question 5.

A Ltd. was using cost model for its property, plant and equipment till Alarch 31, 2016 under previous GAAP. The Ind AS become applicable to the company for financial year beginning April 1, 2016. On April 1, 2015, i.e., the date of its transition to Ind AS, it used fair value as the deemed cost in respect of its property, plant and equipment.

X Ltd. w ants to follow revaluation model as its accounting policy in respect of its property, plant and equipment for the’ first annual Ind AS financial statements. Whether use of fair values as deemed cost on the dale of transition and use of revaluation model in the first annual Ind AS financial statements would amount to a change in accounting policy?

Answer:

A Ltd. is using revaluation model for property, plant and equipment for the first annual Ind AS financial statements and using fair value of property, plant and equipment on the date of the transition, as deemed cost. Since the entity is using fair value at the transition date as well as in the first Ind AS financial statements, there is no change in accounting policy and mere use of the term ‘deemed cost’ would not mean that there is a change in accounting policy.

![]()

Question 6.

While preparing an opening balance sheet on the date of transition, an entity is required to:

(a) recognize all assets and liabilities whose recognition is required by Ind ASs;

(b) not recognize items as assets or liabilities if Ind ASs do not permit such recognition;

(c) reclassify items that it recognized in accordance with previous GAAP as one type of asset, liability or component of equity, but are a different type of asset, liability or component of equity in accordance with Ind ASs; and

(d) apply Ind ASs in measuring all recognized assets and liabilities. Give examples for each of the above 4 categories.

Answer:

The examples of the items that an entity may need to recognize, derecognize, remeasure, reclassify on the date of transition are as under:

(a) Recognize all assets and liabilities whose recognition is required by Ind ASs:

- customer related intangible assets if an entity elects to restate business combinations

- share-based payment transactions with non-employees

- recognition of deferred tax on land

(b) Not recognize items as assets or liabilities if Ind ASs do not permit such recognition:

- proposed dividend’

(c) Reclassify items that it recognized in accordance with previous GAAP as one type of asset, liability or component of equity, but are a different type of asset, liability or component of equity in accordance with Ind ASs:

- redeemable preference shares that would have earlier been clas-sified as equity;

- non-controlling interests which would have been earlier classified outside equity; and

(d) Apply Ind ASs in measuring all recognized assets and liabilities:

- discounting of long-term provisions

- measurement of deferred income taxes for all temporary differences instead of timing differences.

Estimates (Based On Para Nos. 14 To 17)

Question 7.

An entity has made an estimate in accordance with the previous GAAP. At the time of transition to Ind AS, whether the entity can continue with the same estimate?

Answer:

Paragraph 14 of Ind AS 10 states that “An entity’s estimates in accor-dance with Ind ASs at the date of transition to Ind ASs shall be consistent with estimates made for the same date in accordance with previous GAAP (after adjustments to reflect any difference in accounting policies), unless there is objective evidence that those estimates were in error.”

Accordingly, the entity is required to continue with the same estimate unless the estimate needs adjustment for any differences in accounting policies or there is objective evidence that the estimate was in error.

In case the entity receives new information after the transition date with re-gard to a previously made estimate (in accordance with the previous GAAP) then an entity should treat the receipt of that information in the same way as non-adjusting events after the reporting period in accordance with Ind AS 10, Events after the Reporting Period

![]()

Question 8.

In case an entity has not made an estimate since it was hot required to be made as per the previous GAAP, whether the entity should now make an estimate under Ind AS?

Answer:

Yes, the entity is required to make an estimate even if this was not required under previous GAAP. To achieve consistency with Ind AS 101, the estimates in accordance with Ind AS should reflect conditions that existed at the date of transition to Ind AS.

Reconciliations; Presentation And Disclosure (Based On Para Nos. 20 To 28)

Question 9.

Does Ind AS 101 provide any exemptions from the presentation and disclosure requirements in other Ind AS?

Answer:

No, paragraph 20 of Ind AS 101 provides that Ind AS 101 does not provide exemptions from the presentation and disclosure requirements in other Ind AS.

Question 10.

Does an entity need to provide comparatives as per Ind AS in its first Ind AS complied financial statements?

Answer:

Yes, in accordance with Ind AS 101, a first-time adopter needs to provide the corresponding previous period financial statements in accordance with Ind AS when it reports its first Ind AS financial statements.

Paragraph 21 of Ind AS 101 provides that an entity’s first Ind AS financial statements include at least three balance sheets, two statements of profit and loss, two statements of cash flows and two statements of changes in equity and related notes, including comparative information for all periods presented.

Question 11.

While transitioning from previous GAAP to Ind AS, an entity becomes aware of certain errors and now corrects them. How should it explain those errors?

Answer:

In accordance with paragraph 26 of Ind AS 101, if an entity becomes aware of errors, the reconciliations and disclosures required by paragraph 24(a) and (b) should distinguish the correction of those errors from changes in accounting policies.

Question 12.

While preparing its first Ind AS financial statements, an entity may change some of its accounting policies to comply with the requirements of various Ind AS. How should an entity explain these changes in accounting policies in terms of Ind AS 8, Accounting Policies, Changes in Accounting Estimate and Errors, in its first Ind AS financial statements?

Answer:

Paragraph 27 of Ind AS 101 provides that Ind AS 8 does not apply to changes in accounting policies that an entity makes when it adopts Ind ASs or to changes in those policies until after it presents its first Ind AS financial statements. Therefore, requirements of Ind AS 8 about changes in accounting policies do not apply in an entity’s first Ind AS financial statements.

If, during the period covered by its first Ind AS financial statements, an entity changes its accounting policies or its use of the exemptions contained in this Ind AS, it should explain the changes between its first Ind AS interim financial report and its first Ind AS financial statements, in accordance with paragraph 23, and it should update the reconciliations required by paragraph 24(a) and (b).

![]()

Question 13.

Can an entity after presenting its first Ind AS interim financial statements but before presenting its first annual Ind AS financial statements change its accounting policies or its use of exemptions contained in Ind AS?

Answer:

An entity after presenting its first interim Ind AS financial statements but before presenting its first annual Ind AS compliant financial statements may change its accounting policies or its use of exemptions contained in Ind AS.

If an entity does so, it should explain the changes between its first Ind AS interim financial report and its first annual Ind AS financial statements, in accordance with paragraph 23, and update the disclosures required by paragraph 24(a) and (b) [paragraph 27A of Ind AS 101].

Further, if an entity changes its accounting policies or its use of the exemptions contained in this Ind-AS, it should explain the changes in each such interim financial report in accordance with paragraph 23 and update the reconciliations required by para 32(a) or 32(b) [paragraph 32(c) of Ind AS 101]

Deemed Cost (Based On Para No. 30)

Question 14.

For the purpose of deemed cost oil the date of transition, an entity has the option of using the carrying value as the deemed cost. In this context, suggest which carrying value is to be considered as deemed cost: original cost or net book value? Also examine whether this would have any impact on future depreciation charge?

Answer:

For the purpose of deemed cost on the date of transition, if an entity uses the carrying value as the deemed cost, then it should consider the net book value on the date of transition as the deemed cost and not the original cost because carrying value here means net book value.

The future depreciation charge will be based on the net book value and the remaining useful life on the date of transition. Further, as per the requirements of Ind AS 16, the depreciation method, residual value and useful life need to be reviewed at least annually.

As a result of this, the depreciation charge may or may not be the same as the depreciation charge under the previous GAAP.

Question 15.

Revaluation under previous GAAP can be considered as deemed cost if the revaluation was, at the date of the revaluation, broadly comparable to fair value or cost or depreciated cost of assets in accordance with Ind AS, adjusted to reflect, e.g., changes in a general or specific price index. What is the acceptable time gap of such revaluation from the date of transition? Can adjustments be made to take effects of events subsequent to revaluation?

Answer:

There are no specific guidelines in Ind AS 101 to indicate the acceptable time gap of such revaluation from the date of transition. The management of an entity needs to exercise judgment in this regard. However, generally, a period of 2-3 years may be treated qs an acceptable time gap of such revaluation from the date of transition. In any case, adjustments should be made to reflect the effect of material events subsequent to revaluation.

Question 16.

Fair value measurement on an event like privatization or initial public offering can be treated as deemed cost for Ind AS at the date of that measurement. What is the acceptable time gap of such event from the date of transition? Can adjustments be made to take effects of events subsequent to event?

Answer:

There are no specific guidelines in Ind AS 101 to indicate the acceptable time gap. The management of an entity needs to exercise judgment in this regard. However, generally, a period of 2-3 years may be treated as an acceptable time gap. In any case, adjustments should be made to take effect of material events subsequent to value measurement on such events.

Question 17.

Company A intends to restate its past business combinations with effect from 30 June 2010 (being a date prior to the transition date). If business combinations are restated, whether certain other exemptions, such as the deemed cost exemption for property, plant and equipment (PPE), can be adopted?

Answer:

Paragraph 18 to Ind-AS 101 prescribes that an entity may elect to use one or more of the exemptions contained in Appendices C-D of the Standard. As such, an entity may choose to adopt a combination of optional exemptions in relation to the underlying account balances.

When the past business combinations after a particular date (30 June 2010 in the given case) are restated, it requires retrospective adjustments to the carrying amounts of acquiree’s assets and liabilities on account of initial acquisition accounting of the acquiree’s net assets, the effects of subsequent measurement of those net assets (including amortization of non-current assets that were recognized at its fair value), goodwill on consolidation and the consolidation adjustments. Therefore, the goodwill and equity (including non-controlling interest (NCI)) cannot be computed by considering the deemed cost exemption for PPE.

However, the entity may adopt the deemed cost exemption for its property, plant and equipment other than those acquired through business combinations.

Mandatory Exemptions [Based On Appendix B To Ind As 101]

Question 18.

XYZ Bank Ltd. had derecognized certain loan assets upon securiti-zation in the financial year 2008-09 in accordance with the RBI Guidelines on Securitization. XYZ Bank Ltd. adopts Ind AS from. April 1, 2018 and accordingly the date of transition is April 1, 2017. How would the securitized loan assets be accounted for upon such transition?

Answer:

According to paragraph B2 of Appendix B of Ind AS 101, a first-time adopter shall apply the derecognition requirements in Ind AS 109 prospectively for transactions occurring on or after the date of transition to Ind ASs.

If a first-time adopter derecognized non-derivative financial assets or non-derivative financial liabilities in accordance with the previous GAAP as a result of a transaction that occurred before the date of transition to Ind-AS, it shall not recognize those assets and liabilities in accordance with Ind-AS. Thus, securitized loan assets are not required to be recognized by XYZ Bank Ltd. at the date of transition to Ind AS.

![]()

Question 19.

X Ltd. has entered into a hedge transaction in its previous GAAP wherein the hedging instrument is a written option. On the date of transition to Ind AS, can it continue the hedge accounting in respect of this transaction?

Answer:

In accordance with paragraph B5 of Appendix B of Ind AS 101 an entity shall not reflect in its opening Ind-AS Balance Sheet a hedging relationship of a type that does not qualify for hedge accounting in accordance with Ind AS 109

Since Ind-AS 109 does not permit designating a written option as a hedging instrument, the hedge does not meet the conditions for hedge accounting in Ind AS 109, the entity shall apply paragraph 6.5.6 of Ind AS 109 to discontinue hedge accounting.

Optional Exemptions [Based On Appendix D To Ind As 101]

Question 20.

A Ltd. is a first-time adopter of Ind AS. The date of transition is April 1, 2015. On the date of transition, there is a long-term foreign currency monetary liability of ₹ 60 crores (US $ 10 million converted at an exchange rate of US $ 1 = ₹ 60). The accumulated exchange difference on the date of transition is nil since Y Ltd. was following AS 11 notified under the Companies (Accounting Standards) Rules, 2006 and has not exercised the option provided in paragraph 46/46A of AS 11.

The Company wants to avail the option under paragraph 46A of AS 11 prospectively or retrospectively on the date of transition to Ind AS. How should it account for the translation differences in respect of this item under Ind AS 101?

Answer:

The answer is based on Paragraph D13AA of Ind AS 101.

A Ltd. has not been using the option provided in Para 46/46A of AS 11, hence, it will not be permitted to use the option given in Para D13AA of Ind AS 101 retrospectively.

Question 21.

Y Ltd. is a first-time adopter of Ind AS. The date of transition is April 1, 2015. On April 1, 2010, it obtained a 7-year US$ 1,00,000 loan. It has been exercising the option provided in Paragraph 46/46A of AS 11 and has been amortizing the exchange differences in respect of this loan over the balance period of such loan. On the date of transition, the company wants to continue the same accounting policy with regard to amortizing of exchange differences. Whether the Company is permitted to do so?

Answer:

Paragraph D13AA of Ind AS 101 provides that a first-time adopter may continue the policy adopted for accounting for exchange differences arising from translation of long-term foreign currency monetary items recognized in the financial statements for the period ending immediately before the beginning of the first Ind AS financial reporting period as per the previous GAAP.

Thus, the Company can continue to follow the existing accounting policy of amortizing the exchange differences in respect of this loan over the balance period of such long-term liability.

Question 22.

A Ltd. is a first-time adopter of Ind AS. The date of transition is April 1, 2015. On April 1, 2010, it obtained a 7-year US$ 1,00,000 loan. It has been exercising the option provided in Paragraph 46/46A of AS 11 and has been amortizing the exchange differences in respect of this loan over the balance period of such loan.

On the date of transition to Ind AS, Y Ltd. wants to discontinue the accounting policy as per the previous GAAP and follow the requirements of Ind AS 21. The Effects of Changes in Foreign Exchange Rates with respect to recognition of foreign exchange differences. Whether the Company is permitted to do so?

Answer:

Paragraph D13AA of Ind AS 101 gives an option to continue the existing accounting policy. Hence, A Ltd. may opt for discontinuation of accounting policy as per previous GAAP and follow the requirements of Ind AS 21. The cumulative amount lying in the FCMITDA should be derecognized by an adjustment against retained earnings on the date of transition.

Question 23.

A company has chosen to elect the deemed cost exemption in accordance with Para D7AA of Ind AS 101. However, it does not wish to continue with its existing policy of capitalizing exchange fluctuation on long term foreign currency monetary items to fixed assets i.e. it does not want to elect the exemption available as per Para D13AA of Ind AS 101. In such a case, how would the company be required to adjust the foreign exchange fluctuation already capitalized to the cost of property, plant and equipment under previous GAAP?

Answer:

The answer is based on Paras D7AA and D13AA of Ind AS 101.

Para D7AA permits to continue with the carrying value for all of its property, plant and equipment as per the previous GAAP and use that as deemed cost for the purposes of first time adoption of Ind AS. Accordingly, the carrying value of property, plant and equipment as per previous GAAP as at the date of transition need not be adjusted for the exchange fluctuations capitalized to property, plant and equipment.

Also, Para D13AA allows a company to continue with its existing policy for accounting for exchange differences arising from translation of long-term foreign currency monetary items recognized in the financial statements for the period ending immediately before the beginning of the first Ind AS financial reporting period as per the previous GAAP.

Accordingly, given that Ind AS 101 provides these two choices independent of each other, it may be possible for an entity to choose the deemed cost ex-emption as per Para D7AA for all of its property, plant and equipment and not elect the exemption of continuing the previous GAAP policy of capitalizing exchange fluctuation to property, plant and equipment.

In such a case, in the given case, a harmonious interpretation of the two exemptions would require the company to recognize the property, plant and equipment at the transition date at the previous GAAP carrying value (without any adjustment for the exchanges differences capitalized under previous GAAP) but for the purposes of the first (and all subsequent) Ind AS financial statements, foreign exchange fluctuation on all long term foreign currency borrowings would be recognized in the statement of profit and loss.

![]()

Question 24.

XYZ Ltd. is a first-time adopter of Ind AS. The date of transition is April 1, 2016. It has given 200 stock options to its employees. Out of these, 75 options have vested on November 30, 2015 and the remaining 125 will vest on November 30, 2016. What are the options available to X Ltd. at the date of transition?

Answer:

Paragraph D2 of Ind AS 101 provides that a first-time adopter is encouraged, but not required, to apply Ind AS 102 on ‘Share-based Payment’ to equity instruments that vested before the date of transition to Ind-AS. However, if a first-time adopter elects to apply Ind AS 102 to such equity instruments, it may do so only if the entity has disclosed publicly the fair value of those equity instruments, determined at the measurement date, as defined in Ind AS 102.

Having regard to the above, XYZ Ltd. has the following options:

For 75 options that vested before the date of transition:

(a) To apply Ind AS 102 and account for the same accordingly, provided it has disclosed publicly the fair value of those equity instruments, determined at the measurement date, as defined in Ind AS 102.

(b) Not to apply Ind AS 102. However, for all grants of equity instruments to which Ind AS 102 has not been applied, ie., equity instruments vested but not settled before date of transition to Ind AS, X Ltd. would still need to disclose the information required by paragraphs 44 and 45 of Ind AS 102.

For 125 options that will vest after the date of transition:

XYZ Ltd. will need to account for the same as per Ind AS 102.

Question 25.

Ind AS has given the option to consider previous GAAP carrying value of property, plant and equipment (PPE) as deemed cost for assets acquired before the transition dale. Whether an entity has the option of fair valuing few items of PPE and taking carrying amounts of the remaining items of PPE as the deemed cost on the date of transition?

Answer:

In accordance with paragraph D7AA, where there is no change in its functional currency on the date of transition to Ind ASs, a first-time adopter to Ind ASs may elect to continue with the carrying value of all of its property, plant and equipment as at the date of transition measured as per the previous GAAP and use that as its deemed cost at the date of transition after making necessary adjustments in accordance with paragraphs D21 and D21A of Ind AS 101. If a first-time adopter chooses this option then the option of applying this on selective basis to some of the items of property, plant and equipment and using fair value for others is not available.

Question 26.

X Ltd. is the holding company of Y Ltd. X Ltd. is required to adopt Ind AS from April 1, 2016. X Ltd. wants to avail the optional exemption of using the previous GAAP carrying values in respect of its property, plant and equipment whereas Y Ltd. wants to use fair value of its property, plant and equipment as its deemed cost on the date of transition.

Examine whether X Ltd. can do so for its consolidated financial statements. Also, examine whether different entities in a group can use different basis for arriving at deemed cost for property, plant and equipment in their respective standalone financial statements.

Answer:

In accordance with paragraph D7AA, where there is no change in its functional currency on the date of transition to Ind ASs, a first-time adopter to Ind ASs may elect to continue with the carrying value of all of its property, plant and equipment as at the date of transition measured as per the previous GAAP and use that as its deemed cost at the date of transition after making necessary adjustments in accordance with paragraphs D21 and D21A of Ind AS 101.

If a first-time adopter chooses this option then the option of applying this on selective basis to some of the items of property, plant and equipment and using fair value for others is not available. There is nothing in paragraph D7AA that prevents different entities within a group to choose different basis for arriving at deemed cost for the standalone financial statements.

However, in Consolidated Financial Statements, the entire group should be treated as one reporting entity. Accordingly, it will not be permissible to use different basis for arriving at the deemed cost of property, plant and equipment on the date of transition by different entities of the group for the purpose of preparing Consolidated Financial Statements.

Question 27.

X Ltd. is required to implement Ind AS from April 1, 2016. X Ltd. wants to avail the optional exemption of using the previous GAAP carrying value in respect of its property, plant and equipment whereas for intangible assets it wants to use fair value as its deemed cost. Examine whether it is permitted to do so?

Answer:

Para D7AA of Ind AS 101 provides that where there is no change in its functional currency on the date of transition to Ind ASs, a first-time adopter to Ind ASS may elect to continue with the carrying value for all of its prop-erty, plant and equipment as recognized in the financial statements as at the date of transition to Ind AS, measured as per the previous GAAP and use that as its deemed cost as at the date of transition after making necessary adjustments in accordance with paragraphs D21 and D21A, of Ind AS 101.

It further provides that this option can also be availed for intangible assets covered by Ind AS 38, Intangible Assets and investment property covered by Ind AS 40 Investment Property. There is nothing in paragraph D7AA that suggest that if the previous GAAP carrying value has been used as the deemed cost for property, plant and equipment then the same need to be done for all items of intangible assets as well.

Thus, X Ltd. can use previous GAAP carrying value for all of its items of property, plant and equipment and fair value for all of its intangible assets as its deemed cost on the date of transition. However, the fair value can be used for intangible assets only in accordance with and subject to conditions specified in Ind AS 38, Intangible Assets.

![]()

Question 28.

Is it possible for an entity to allocate cost as per the previous GAAP to a component based on its fair value on the date of transition even when it does not have the component-wise historical cost?

Answer:

Yes, an entity can allocate cost to a component based on its fair value on the date of transition. This is permissible even when the entity does not have component-wise historical cost.

Question 29.

Can an intangible asset if not recognized as per the previous GAAP, be recognized on first-time adoption on fair value basis?

Answer:

In this case, there are principally two issues:

- Whether an intangible asset if not recognized as per the previous GAAP can be recognized on first-time adoption.

- Secondly, if the answer to the first question is in the affirmative, whether the same can be recognized on fair value basis.

On the issue of recognition of an intangible asset that has not been recognized as per the previous GAAP, Ind AS 101 provides that an entity’s opening Ind AS balance sheet:

(a) excludes all intangible assets and other intangible items that do not meet the criteria for recognition in accordance with Ind AS 38 at the date of transition to Ind AS; and

(b) includes all intangible assets that meet the recognition criteria in Ind AS 38 at that date, except for intangible assets acquired in a business combination that was not recognized in the acquirer’s consolidated financial statements in accordance with the previous GAAP and also would not qualify for recognition in accordance with Ind AS 38 in the separate balance sheet of the acquiree.

The criteria in Ind AS 38 require an entity to recognize an intangible asset if, and only if:

(a) it is probable that the future economic benefits that are attributable to the asset will flow to the entity; and

(b) the cost of the asset can be measured reliably.

Ind AS 38 supplements these two criteria with further, more specific, criteria for internally generated intangible assets. In accordance with Ind AS 38, an entity capitalizes the costs of creating internally generated intangible assets prospectively from the date when the recognition criteria are met. Ind AS 38 does not permit an entity to use hindsight to conclude retrospectively that these recognition criteria are met.

If an internally generated intangible asset qualifies for recognition at the date of transition to Ind AS, an entity should recognize the asset in its opening Ind AS balance sheet even if it has treated the related expenditure as an expense in accordance with the previous GAAP. If the asset does not qualify for recognition in accordance with Ind AS 38 until a later date, its cost is the sum of the expenditure incurred from that later date. The criteria discussed above also apply to an intangible asset acquired separately.

If based on the above, an entity recognizes an intangible asset in its opening Ind AS balance sheet, it can do so on any of the basis permitted under Ind AS 101. Since fair value is also one of the bases permitted under Ind AS 101, one may conclude that an entity can recognize an intangible asset that has not been recognized under previous GAAP in the opening Ind AS balance sheet on the basis of its fair value on the date of transition. However, the fair value can be used for intangible assets only in accordance with and subject to conditions specified in Ind AS 38.

Question 30.

On April 1, 2014, S Ltd. issued 30,000; 6% convertible debentures of face value of ₹ 100 per debenture at par. The debentures are redeemable at a premium of 10% on March 31, 2018 or these may be converted into ordinary shares at the option of the holder. The interest rate for equivalent debentures without conversion rights would have been 10%. The date of transition to Ind AS is April 1, 2016.

Suggest how should S Ltd. account for this compound financial instrument on the date of transition.

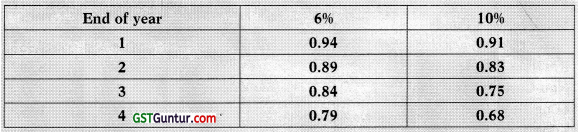

The present value of Re. 1 receivable at the end of each year based on discount rates of 6% and 10% can be taken as:

Answer:

In the present case, since the liability is outstanding on the date of transition, S Ltd. will need to split the convertible debentures into debt and equity portion on the date of transition. Accordingly, we will first measure the liability component by discounting the contractually determined stream of future cash flows (interest and principal) to present value by using the discount rate of 1096 p.a. (being the market interest rate for similar debentures with no conversion option).

| (₹) | |

| Interest payments p.a. on each debenture | 6 |

| Present Value (PV) of interest payment for years 1 to 4 (6 × 3.17) | 19.02 |

| PV of principal repayment (including premium) 110 × 0.68 | 74.80 |

| Total liability component | 93.82 |

| Total equity component (Balancing figure) | 6.18 |

| Face value of debentures | 100.00 |

| Equity component per debenture | 6.18 |

| Total equity component for 30,000 debentures | 1,85,400 |

| Total debt amount (30,000 × 93.82) | 28,14,600 |

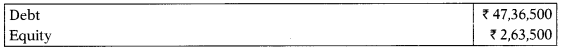

Thus, on the date of transition, the amount of ₹ 30,00,000 being the amount of debentures will be split as under:

Debt ₹ 28,14,600

Equity ₹ 1,85,400

Question 31.

X Pvt. Ltd. is a company registered under the Companies Act, 2013 following Accounting Standards notified under Companies (Accounting Standards) Rules, 2006. The Company has decided to voluntary adopt Ind AS w.e.f. 1st April, 2018 with a transition date of 1st April, 2017.

The Company has one Wholly Owned Subsidiary and one Joint Venture which are into manufacturing of automobile spare parts.

The consolidated financial statements of the Company under Indian GAAP are as under:

Consolidated Financial Statements

| Particulars | 31.03.2018 | 31.03.2017 |

| Shareholder’s Funds | ||

| Share Capital | 7,953 | 7,953 |

| Reserves & Surplus | 16,547 | 16,597 |

| Non-Current Liabilities | ||

| Long Term Borrowings | 1,000 | 1,000 |

| Long Term Provisions | 1,101 | 691 |

| Other Long-Term Liabilities | 5,202 | 5,904 |

| Current Liabilities | ||

| Trade Payables | 9,905 | 8,455 |

| Short Term Provisions | 500 | 475 |

| Total | 42,208 | 41,075 |

| Non-Current Assets | ||

| Property Plant & Equipment | 21,488 | 22,288 |

| Goodwill on Consolidation of subsidiary and JV | 1,507 | 1,507 |

| Investment Property | 5,245 | 5,245 |

| Long Term Loans & Advances | 6,350 | 6,350 |

| Current Assets | ||

| Trade Receh ables | 4,801 | 1,818 |

| Investments | 1,263 | 3,763 |

| Other Current Assets | 1,554 | 104 |

| Total | 42,208 | 41,075 |

Additional Information:

The Company has entered into a joint arrangement by acquiring 50% of the equity shares of ABC Pvt. Ltd. Presently, the same has been accounted as per the proportionate consolidated method. The proportionate share of assets and liabilities of ABC Pvt. Ltd. included in the consolidated financial statement of XYZ Pvt. Ltd. is as under:

| Particulars | ₹ in Lakhs |

| Property, Plant & Equipment | 1,200 |

| Long Term Loans &Advances | 405 |

| Trade Receivables | 280 |

| Other Current Assets | 50 |

| Trade Payables | 75 |

| Short Term Provisions | 35 |

The Investment is in the nature of Joint Venture as per Ind AS 111.

The Company has approached you to advice and suggest the accounting adjustments which are required to be made in the opening Balance Sheet as on 1st April, 2017.

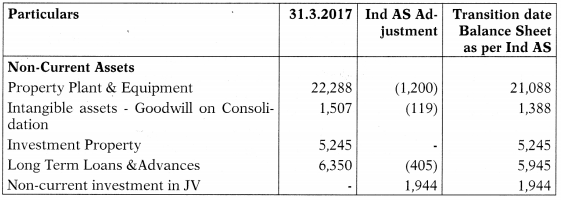

Answer:

As per paras D31AA and D31AB of Ind AS 101, when changing from proportionate consolidation to the equity method, an entity shall recognise its investment in the joint venture at transition date to Ind AS.

That initial investment shall be measured as the aggregate of the carrying amounts of the assets and liabilities that the entity had previously propor-tionately consolidated, including any goodwill arising from acquisition. If the goodwill previously belonged to a larger cash-generating unit, or to a group of cash-generating units, the entity shall allocate goodwill to the joint venture on the basis of the relative carrying amounts of the joint venture and the cash-generating unit or group of cash-generating units to which it belonged.

The balance of the investment in joint venture at the date of transition to Ind AS, determined in accordance with paragraph D31AA above is regarded as the deemed cost of the investment at initial recognition.

Accordingly, the deemed cost of the investment will be

| Property, Plant & Equipment | 1,200 |

| Goodwill (Refer Note below) | 119 |

| Long Term Loans & Advances | 405 |

| Trade Receivables | 280 |

| Other Current Assets | 50 |

| Total Assets | 2054 |

| Less: Trade Payables | 75 |

| Short Term Provisions | 35 |

| Deemed cost of the investment in JV | 1944 |

Calculation of proportionate goodwill share of Joint Venture i.e. A Pvt. Ltd.

| Property, Plant & Equipment | 22,288 |

| Goodwill | 1,507 |

| Long Term Loans & Advances | 6,350 |

| Trade Receivables | 1,818 |

| Other Current Assets | 104 |

| Total Assets | 32,067 |

| Less: Trade Payables | 8,455 |

| Short Term Provisions | 475 |

| 23,137 |

Proportionate Goodwill of Joint Venture

= [(Goodwill on consolidation of subsidiary and JV/Total relative net asset) × Net asset of JV]

= (1507/23,137) × 1825 = 119 (approx.)

Accordingly, the proportional share of assets and liabilities of Joint Venture will be removed from the respective values assets and liabilities appearing in the balance sheet on 31.3.2017 and Investment in JV will appear under non-current asset in the transition date balance sheet as on 1.4.2017.

Adjustments made in I GAAP balance sheet to arrive at Transition date Ind AS Balance Sheet

Question 32.

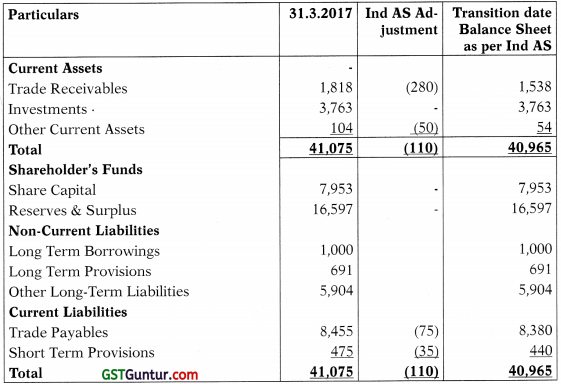

G Limited on 1 st April, 2015 issued 50,000,7% convertible debentures of face value of ₹ 100 per debenture at par. The debentures are redeemable at a premium of 10% on 31st March, 2020 or these may be converted into ordinary shares at the option of the holder. The interest rate for equivalent debentures without conversion rights would have been 10%. The date of transition to Ind AS is 1st April, 2017.

Suggest how G Limited should account for this compound financial instru-ment on the date of transition. Also discuss Ind AS on ‘Financial Instrument’ presentation in the above context.

The present value of ₹ 1 receivable at the end of each year based on discount rates of 7% and 10% can be taken as:

| End of Year | 1 | 2 | 3 | 4 | 5 |

| 7% | 0.94 | 0.87 | 0.82 | 0.76 | 0.71 |

| 10% | 0.91 | 0.83 | 0.75 | 0.68 | 0.62 |

Answer:

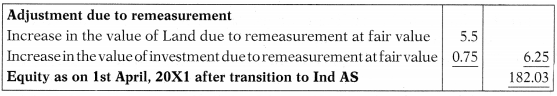

Since the liability is outstanding on the date of Ind AS transition, G Ltd. is required to split the convertible debentures into debt and equity portion on the date of transition. Accordingly, first the liability component will be measured discounting the contractually determined stream of future cash flows (interest and principal) to present value by using the discount rate of 10% p.a. (being the market interest rate for similar debentures with no conversion option).

Calculation of Equity & Liability component on initial recognition

Thus, on the date of transition, the amount of ₹ 50,00,000 being the amount of debentures will split as under:

![]()

Question 33.

X Ltd. has a subsidiary Y Ltd. On first time adoption of Ind AS by Y Ltd., it availed the optional exemption of not restating its past business combinations. However, X Ltd. in its consolidated financial statements has decided to restate all its past business combinations.

Whether the amounts recorded by subsidiary need to be adjusted while pre-paring the consolidated financial statements of X Ltd. considering that X Ltd. does not avail the business combination exemption? Will the answer be different if X Ltd. adopts Ind AS after Y Ltd?

Answer:

As per para Cl of Appendix C of Ind AS 101, a first-time adopter may elect not to apply Ind AS 103 retrospectively to past business combinations (business combinations that occurred before the date of transition to Ind AS). However, if a first-time adopter restates any business combination to comply with Ind AS 103, it shall restate all later business combinations and shall also apply Ind AS 110 from that same date.

Based on the above, if X Ltd. restates past business combinations, it would have to be applied to all business combinations of the group including those by subsidiary Y Ltd. for the purpose of Consolidated Financial Statements.

Para D17 of Appendix D of Ind AS 101 states that if an entity becomes a first-time adopter later than its subsidiary the entity shall, in its consolidated financial statements, measure the assets and liabilities of the subsidiary at the same carrying amounts as in the financial statements of the subsidiary, after adjusting for consolidation and equity accounting adjustments and for the effects of the business combination in which the entity acquired the subsidiary. Thus, in case where the parent adopts Ind AS later than the subsidiary then it does not change the amounts already recognised by the subsidiary.

Business Combinations (Based On Appendix C To Ind As 101)

Question 34.

A Ltd. has a subsidiary B Ltd. On first time adoption of Ind AS by ‘B Ltd., it availed the optional exemption of not restating its past business combinations. However, A Ltd. in its consolidated financial statements has decided to restate all its past business combinations. Whether the amounts recorded by subsidiary need to be adjusted while preparing the consolidated financial statements of A Ltd. considering that A Ltd. does not avail the business combination exemption? Will the answer be different if the A Ltd. adopts Ind AS after the B Ltd?

Answer:

Paragraph Cl of Ind AS 101:

“A first-time adopter may elect not to apply Ind AS 103 retrospectively to past business combinations (business combinations that occurred before the date of transition to Ind ASs). However, if a first-time adopter restates any business combination to comply with Ind AS 103, it shall restate all later business combinations and shall also apply Ind AS 110 from that same date.

For example, if a first-time adopter elects to restate a business combination that occurred on 30 June 2010, it shall restate all business combinations that occurred between 30 June 2010 and the date of transition to Ind ASs, and it shall also apply Ind AS 110 from 30 June 2010. ”

Based on the above, if A Ltd. restates past business combinations, it would have to be applied to all business combinations of the group including those by subsidiary B Ltd. for the purpose of Consolidated Financial Statements.

Paragraph D17 of Ind AS 101:

“However, if an entity becomes a first-time adopter later than its subsidiary (or associate or joint venture) the entity shall, in its consolidated financial statements, measure the assets and liabilities of the subsidiary (or associate or joint venture) at the same carrying amounts as in the financial statements of the subsidiary (or associate or joint venture), after adjusting for consolidation and equity accounting adjustments and for the effects of the business combination in which the entity acquired the subsidiary.”

Thus, in case where the parent adopts Ind AS later than the subsidiary then it does not change the amounts already recognized by the subsidiary.

Question 35.

What are the significant implications of restating past business combinations?

Answer:

Ind AS 101 permits a first-time adopter to restate past business combi-nations retrospectively in accordance with Ind ASs. However, retrospective restatement may be a difficult exercise in certain circumstances. This is pri-marily due to the requirement that the information available to restate the past business combinations must have been available at the time of the acquisition; the use of hindsight is prohibited.

This may cause a practical difficulty for a first-time adopter, because it may not have been aware of all of the informa-tion to be collected at the date of acquisition in order to record the business combination on a basis consistent with Ind ASs.

In case the past business combinations are restated:

- mandatory exceptions relating to non-controlling interests as contained in paragraph B7 to Ind AS 101 continue to apply in relation to those transactions that occurred prior to the date after which all past business combination transactions are restated;

- optional exemptions need to be evaluated specifically on a case to case basis (e.g. deemed cost exemption relating to property, plant and equip-ment).

- normal consolidation procedures apply from the date of restated past business combinations.

Some of the general issues that may be encountered are:

- calculating the consideration transferred in the business combination in accordance with Ind-ASs and assessing whether any contingent con-sideration should be recognized without the use of hindsight;

- assessing whether to recognize contingent liabilities at the acquisition date, without the use of hindsight;

- measuring the fair value of assets acquired and liabilities assumed at the acquisition date on a basis consistent with Ind ASs;

- testing goodwill for impairment in a restated business combination.

There is no specific requirement in Ind AS 101 that goodwill acquired in a re-stated business combination be tested for impairment at the date of transition. However, the corresponding IFRS 1 provides some guidance .that suggests that the impairment standard in IFRSs is applied at the date of transition in determining whether any impairment loss exists at that date.

Question 36.

Mathur India Private Limited has to present its First financials under Ind AS for the year ended 31st March, 20X3. The transition date is 1st April, 20X1.

The following adjustments were made upon transition to Ind AS:

(a) The Company opted to fair value its land as on the dale on transition. The fair value of the land as on 1st April, 20X1 was ₹ 10 crores. The carrying amount as on 1st April, 20X1 under the existing GAAP was ₹ 4.5 crores.

(b) The Company has recognised a provision for proposed dividend of ₹ 60 lacs and related dividend distribution tax of ₹ 18 lacs during the year ended 31st March, 20X1. It was written back as on opening balance sheet date.

(c) The Company fair values its investments in equity shares on the date of transition. The increase on account of fair valuation of shares is ₹ 75 lacs.

(d) The Company has an Equity Share Capital of ₹ 80 crores and Redeem-able Preference Share Capital of ₹ 25 crores.

(e) The reserves and surplus as on 1st April, 20X1 before transition to Ind AS was ₹ 95 crores representing ₹ 40 crores of general reserve and ₹ 5 crores of capital reserve acquired out of business combination and balance is surplus in the Retained Earnings.

(f) The company identified that the preference shares were in nature of financial liabilities.

What is the balance of total equity (Equity and other equity) as on 1st April, 20X1 after transition to Ind AS? Show reconciliation between total equity as per AS (Accounting Standards) and as per Ind AS to be presented in the opening balance sheet as on 1st April, 20X1.

Ignore deferred tax impact. [RTP-November 2019]

Answer:

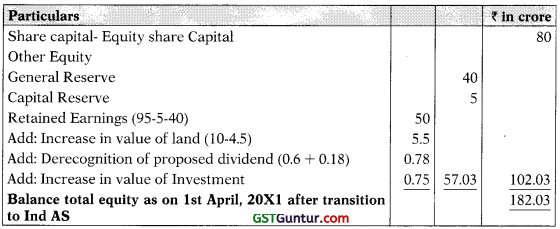

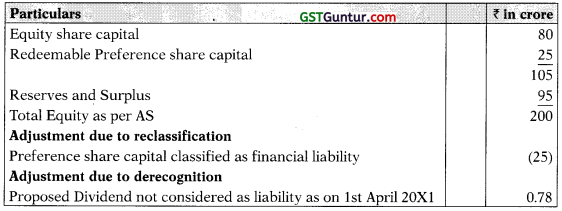

Computation of balance total equity as on 1st April, 20X1 after transition to Ind AS

Reconciliation between Total Equity as per AS and Ind AS to be presented in the opening balance sheet as on 1st April, 20X1

![]()

Comprehensive Question

Question 37.

Case Study

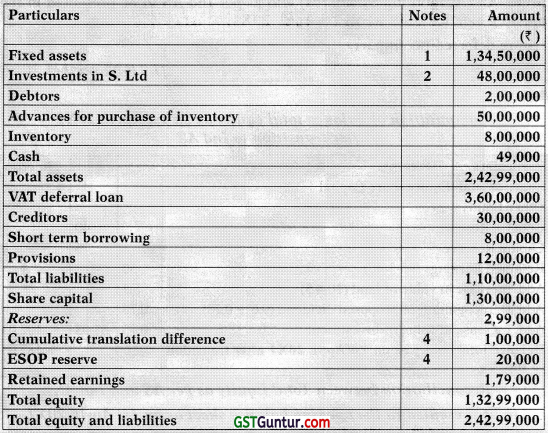

H Ltd. has the following assets and liabilities as at March 31, 2016, prepared in accordance with previous GAAP:

The following GAAP differences were identified by the Company on first-time adoption of Ind AS with effect from April 1, 2016:

1. In relation to tangible fixed assets (property, plant and equipment), the following adjustments were identified:

- Fixed assets comprise land held for capital appreciation purposes costing ₹ 4,50,000 and was classified as investment property as per Ind AS 40.

- Exchange differences of ₹ 1,00,000 were capitalized to depreciable fixed assets on which accumulated depreciation of ₹ 40,000 was recognized.

- There were no asset retirement obligations.

- The management intends to adopt deemed cost exemption for using the previous GAAP carrying values as deemed cost as at the date of transition for PPE and investment property.

2. The Company had made an investment in S Ltd. (subsidiary of H Ltd.) for ₹ 48,00,000 that carried a fair value of ₹ 68,00,000 as at the transition date. The Company intends to recognize the investment at its fair value as at the date of transition.

3. Financial instruments:

- VAT deferral loan: ₹ 60,00,000

The VAT deferral loan of ₹ 60,00,000 was obtained on March 31, 2016, for setting up a business in a backward region with a condition to create certain defined targets for employment of local population of that region. The loan does not carry any interest and is repayable in full at the end of 5 years. In accordance with Ind AS 109, the discount factor on the loan is to be taken as 10%, being the incremental borrowing rate.

Accordingly, the fair value of the loan as at March 31, 2016, is ₹ 37,25,528. The entity chooses to exercise the option given in paragraph Bll of Ind AS 101, i.e., the entity chooses to apply the requirements of Ind AS 109, Financial Instruments and Ind AS 20, Accounting for Government Grants and Disclosure of Government Assistance, retrospectively as required information had been obtained at the time of initially accounting for VAT deferral loan.

4. The retained earnings of the Company contained the following:

* ESOP reserve of ₹ 20,000:

The Company had granted 1,000 options to employees out of which 800 have already vested. The Company followed an intrinsic value method for recognition of ESOP charge and recognized ₹ 12,000 towards the vested options and ₹ 8,000 over a period of time as ESOP charge and a corresponding reserve. If fair value method had been followed in ac-cordance with Ind AS 102, the corresponding charge would have been ₹ 15,000 and ₹ 9,000 for the vested and unvested shares respectively. The Company intends to avail the Ind AS 101 exemption for share-based payments for not restating the ESOP charge as per previous GAAP for vested options.

* Cumulative translation difference: ₹ 1,00,000 The Company had a non-integral foreign branch in accordance with AS 11 and had recognized a balance of ₹ 1,00,000 as part of reserves. On first-time adoption of Ind AS, the Company intends to avail Ind AS 101 exemption of resetting the cumulative translation difference to zero.

Answer:

Adjustments for opening balance sheet as per Ind AS 101

1. Fixed assets:

As the land held for capital appreciation purposes qualifies as investment property, such investment property should be reclassified from property, plant and equipment (PPE) to investment property and presented separately;

As the Company has adopted the previous GAAP carrying values as deemed cost, all items of PPE and investment property should be car-ried at its previous GAAP carrying values. As such, the past capitalized exchange differences require no adjustment in this case.

2. Investment in subsidiary:

On first time adoption of Ind AS, a parent company has an option to carry its investment in subsidiary at fair value as at the date of transition in its separate financial statements. As such, the Company can recognize such investment at a value of ₹ 68,00,000.

3. Financial instruments:

As the VAT deferral loan is a financial liability under Ind AS 109, that liability should be recognized at its present value discounted at an ap-propriate discounting factor. Consequently, the VAT deferral loan should be recognized at ₹ 37,25,528 and the remaining ₹ 22,74,472 would be recognized as deferred government grant.

4. ESOPs:

Ind AS 101 provides an exemption of not restating the accounting as per the previous GAAP in accordance with Ind AS 102 for all options that have vested by the transition date. Accordingly, out of 1000 ESOPs granted, the first-time adoption exemption is available on 800 options that have already vested. As such, its accounting need not be restated. However, the 200 options that are not vested as at the transition date, need to be restated in accordance with Ind AS 102. As such, the addi-tional impact of ₹ 1,000 (ie., 9,000 less 8,000) would be recognized in the opening Ind AS balance sheet.

5. Cumulative translation difference:

As per paragraph D12 of Ind AS 101, the first-time adopter can avail an exemption regarding requirements of Ind AS 21 in context of cumulative translation differences. If a first-time adopter uses this exemption the cumulative translation differences for all foreign operation are deemed to be zero as at the transition date. In that case, the balance is transferred to retained earnings. As such, the balance of ₹ 1,00,000 should be transferred to retained earnings.

6. Retained earnings should be increased by ₹ 20,99,000 on account of the following:

- Increase in fair value of investment in subsidiary (note 2) ₹ 20,00,000

- Additional ESOP charge on unvested options (note 4) ₹ (1,000)

- Transfer of cumulative translation difference balance to retained earnings (note 5) ₹ 1,00,000

After the above adjustments, the carrying values of assets and liabilities for the purpose of opening Ind AS balance sheet of Company H should be as under:

| Particular | Notes | Previous | Adjustments | Ind AS GAAP |

| Non-Current Assets | ||||

| Fixed assets | 1 | 1,34,50,000 | (4,50,000) | 1,30,00,000 |

| Investment property | 1 | 0 | 4,50,000 | 4,50,000 |

| Investment in S Ltd. | 2 | 48,00,000 | 20,00,000 | 68,00,000 |

| Advances for purchase of inventory | 50,00,000 | 50,00,000 | ||

| Current Assets | ||||

| Debtors | 2,00,000 | 2,00,000 | ||

| Inventory | 8,00,000 | 8,00,000 | ||

| Cash | 49,000 | 49,000 | ||

| Total assets | 2,42,99,000 | 20,00,000 | 2,62,99,000 | |

| Non-current Liabilities | ||||

| Sales tax deferral loan | 3 | 60,00,000 | (22,74,472) | 37,25,528 |

| Deferred government grant | 3 | 0 | 22,74,472 | 22,74,472 |

| Current Liabilities | ||||

| Creditors | 30,00,000 | 30,00,000 | ||

| Short term borrowing | 8,00,000 | 8,00,000 | ||

| Provisions | 12,00,000 | 12,00,000 | ||

| Total liabilities | 1,10,00,000 | 0 | 1,10,00,000 |