Income which do not form Part of Total Income – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Income which do not form Part of Total Income – CA Inter Tax Question Bank

Question 1.

State with reason, any whether the following statements are true or false with regard to the provisions of the Income-tax Act, 1961 for the Assessment year 2021 -22 :

Compensation on account of disaster received from local authority by an individual or his/her legal heir is taxable. (Nov 2008, 2 marks)

Answer:

False : Compensation received from the Central Govt, or a State Govt, or a local authority by an Individual or his legal heir on account of any disaster, is exempt from Tax u/s 10(10BC). However, the exemption will not be available in respect of the amount received or receivable to the extent such individual or his legal heir has been allowed a deduction under the Act on account of any loss or damage caused by such disaster.

![]()

Question 2.

Answer the following:

Discuss with reason, whether the following statements are true or false, as per the provisions of the Income-tax Act, 1961:

(A) Any amount received by an individual or his legal heir as compensation for natural disaster from the Government, is taxable.

(B) Dividend received (on which no Dividend Distribution Tax has been paid) by a dealer in shares or one engaged in buying/selling of shares, is chargeable under the head “Income from other sources”. (Discussion must be on the head of income).(May 2016, 4 marks)

Answer:

(A) False: As per Sec. 10 (1OBC) any amount received or receivable from the Central Government or State Government or a local Authority by an individual or his legal heir by way of compensation on account of any disaster shall be exempt. Exemption is not allowable on account of any loss or damage caused by such disaster.

(B) True: Dividend taxable as Income from other sources as held in D.G. Goenka 129 ITR 260 (Bom) & Sangam Investments Ltd. (All).

Question 3.

Answer the following with reference to the provisions of the Income-tax Act, 1961 for the assessment year 2021-2022:

Whether the income derived from saplings or seedlings grown in a nursery is taxable under the Income-tax Act, 1961 ? (May 2009, 2 marks)

Answer:

As per Explanation 3 to Section 2(1 A) of the Act, income derived from saplings or seedlings grown in a nursery shall be deemed to be agricultural income and exempt from tax, whether or not the basic operations were carried out on land.

Question 4.

Which income of Sikkimese individual is exempted from tax under Section 10 (26AAA)? (Nov 2010, 4 marks)

Answer:

Income of Sikkimese Sec. 10 (26AAA):

Following income of an individual; being a Sikkimese is exempt

- From any source in the state of sikkim; or

- By way of dividend or interest on securities.

Note: The exemption is not available to a Sikkimese woman who, on or after 1/4/2008, marries an individual who is not a Sikkimese.

Question 5.

Briefly explain the exemption available under section 10(48) of the Income-tax Act, 1961 in respect of income received by certain foreign companies from sale of crude oil. (Nov 2013, 4 marks)

Answer:

Any Income received in India, in Indian Currency by a Foreign Company on account of sale of Crude Oil, or (w.e.f. 01.04.2015, any other goods or rendering of services), as notified by Central Government in this behalf, to any person is exempt, based on following conditions:

- Such income is received in India by the Foreign Company, pursuant to an agreement or arrangement entered into by Central Government or approved by Central Government.

- Having regard to the national interest, the Foreign Company and the agreement or arrangement are notified by the Central Government in this behalf. (Note: National Iranian Oil Company is notified vide Notification No. 22/2012 dt. 14.6.2012).

- The Foreign Company is not engaged in any activity in India, other than the receipt of such income.

![]()

Question 6.

Discuss with brief reasons, whether rent received for letting out agricultural land for a movie shooting and amounts received from sale of seedlings in a nursery adjacent to the agricultural lands owned by an assessee can be regarded as agricultural income, as per the provisions of the Income- tax Act, 1961. (May 2017, 4 marks)

Answer:

1. Rent received for letting out agricultural land for a movie shooting:

As per Section 2(1 A), “agricultural income” means, inter alia,

- any rent or revenue derived from land

- which is situated in India and is used for agricultural purposes.

In the present case, rent is being derived from letting out of agricultural land for a movie shoot, which is not an agricultural purpose and hence, it does not constitute agricultural income.

2. Income from sale of seedlings in a nursery:

As per Explanation 3 to Section 2(1 A), income derived from saplings or seedlings grown in a nursery is deemed to be agricultural income, whether or not the basic operations were carried out on land. Therefore, the amount received from sale of seedlings in a nursery adjacent to the agricultural lands owned by the assessee constitutes agricultural income.

Question 7.

Discuss the taxability of the following transactions giving reasons, in the light of relevant provisions, for your conclusion.

Attempt the following:

Mr. Netram grows paddy on land. He then employs mechanical operations on grain to make it fit for sale in the market, like removing hay and chaff from the grain, filtering the grain and finally packing the rice in gunny bags. He claims that entire income earned by him from sale of rice is agricultural income not liable to income-tax since paddy as grown on land is not fit for sale in its original form. (Jan 2021, 3 marks)

Question 8.

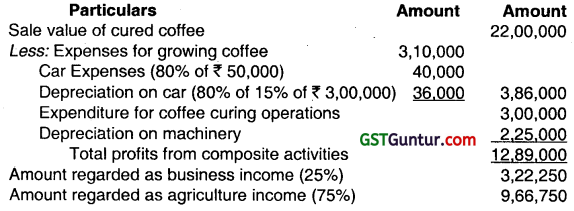

Mr. Tenzingh is engaged in composite business of growing and curing (further processing) Coffee in Coorg, Karnataka. The whole of coffee grown in his plantation is cured. Relevant information pertaining to the year ended 31.3.2021 are given below :

Besides being used for agricultural operations, the car is also used for personal use; disallowance for personal use may be taken at 20%. The expenses incurred for car running and maintenance are ? 50,000. The machines were used in coffee curing business operations

Compute the income arising from the above activities for the assessment year 2021 -22. Show the WDV of the assets as on 31.3.2021. (May 2010, 6 marks)

Answer:

Where an assessee is engaged in composite business of growing and curing of coffee, the income will be bifurcated between agricultural income and business income as per Rule 7 B of Income tax Rules,1962.

As per the above rule, income derived from sale of coffee grown and cured by the seller in India shall be computed as if it was income derived from business and 25% of such income shall be deemed to be income liable to tax. The balance 75% will be treated as agricultural income.

Computation of value of Depreciation as on 31.3.2021

![]()

Question 9.

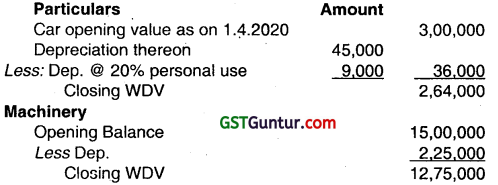

Nathan Aviation Ltd. is running two industrial undertakings, one in a SEZ (Unit S) and another in a normal area (Unit N). The brief summarized details for the year ended 31-3-2021 are as under:

| (₹ in lacs) | ||

| S | N | |

| Domestic turnover | 10 | 100 |

| Export turnover | 120 | Nil |

| Gross Drofit | 20 | 10 |

| Less : Expenses and depreciation | 7 | 6 |

| Profits derived from the unit | 13 | 4 |

The brought forward business loss pertaining to Unit N is ₹ 2 lacs. Briefly compute the business income of the assessee. (May 2011, 5 marks)

Answer:

Computation of Business Income of Nathan Aviation Ltd.

Note: Under section 10AA, 100% of the profit derived from export of articles or things or from services is eligible for deduction

Assumption: It has been assumed that F.Y. 2020-21 falls within the first five year period commencing from the year of manufacture or production of articles or things or provision of services by the Unit in SEZ.

Question 10.

State with brief reasoning whether the following receipts are chargeable to income-tax or are exempt (if chargeable, the amount taxable is to be mentioned) for the assessment year 2021-22:

| Nature of receipt | Amount (₹) |

| Interest on enhanced compensation received on 12-3-2021 for acquisition of urban land, of which 40% relates to the earlier year. | 96,000 |

| Rent received for letting out agricultural land for a movie shooting. | 72,000 |

Computation is NOT required. (Nov 2013, 4 marks)

Answer:

| Item and Taxability | Taxable Amount ₹ |

| 1. Interest on Enhanced Compensation received in the current year is taxable under the head Income from Other Sources. | 48,000 |

| 2. However u/s 57, 50% of deduction is available on such enhanced compensation received. | |

| Rent Received for letting out Agricultural Land for a movie shooting is fully taxable, as it is not considered as Agricultural Income. | 72,000 |

![]()

Question 11.

Mr. Pranay is running two industrial undertakings, one in a SEZ (Unit A) and another in a DTA (Unit B). The brief details for the year ended 31.03.2021 are as under:

| (₹ in lacs) | (₹ in lacs) | |

| S | N | |

| Domestic turnover | 10 | 100 |

| Export turnover | 120 | Nil |

| Gross Profit | 20 | 10 |

| Less: Expenses and depreciation | 07 | 06 |

| Profits derived from the units | 13 | 5 |

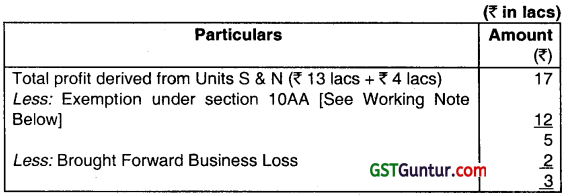

The brought forward business loss pertaining to assessment year 2018-19 for Unit B is ₹ 3.2 lacs. Briefly compute the business income of the assessee. (Nov 2013, 4 marks)

Answer:

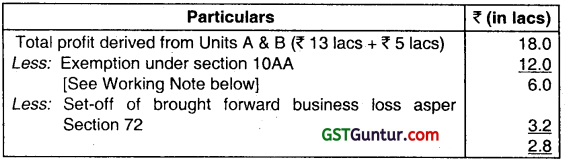

Computation of business income of Mr. Pranay

Working Note:

Computation of exemption under section 10A in respect of unit A located in a SEZ

Note: 100% of the profit derived from export of articles or things or services is eligible for deduction under section 10AA, assuming that F. Y.2020-21 falls within the first five year period commencing from the year of manufacture or production of articles or things or provision of services by Unit A in SEZ.

![]()

Question 12.

Rudra Ltd. has one unit at Special Economic Zone (SEZ) and other unit at Domestic Tariff Area (DTA), the company provides the following details for the previous year 2020-21.

| Particulars | Rudra Ltd. (₹) | Unit in DTA (₹) |

| Total Sales | 6,00,00,000 | 2,00,00,000 |

| Export Sales | 4,60,00,000 | 1,60,00,000 |

| Net Profit | 80,00,000 | 20,00,000 |

Calculate the eligible deduction under section 10AA of the Income-tax Act, 1961, for the Assessment Year 2021 -22, in the following situations:

(i) If both the units were set up and start manufacturing from 22-05-2014.

(ii) If both the units were set up and start manufacturing from 14-05-2018. (May 2015, 8 marks)

Answer:

Computation of deduction under section 10AA of the Income-tax Act,

1961. As per Section 10AA, in computing the total income of Rudra Ltd. from its unit located in a Special Economic Zone (SEZ), which begins to manufacture or produce articles or things or provide any services during the previous year relevant to the assessment year commencing on or after 01.04.2006, there shall be allowed a deduction of 100% of the profit and gains derived from export of such articles or things or from services for a period of five consecutive assessment years beginning with the assessment year relevant to the previous year in which the Unit begins to manufacture or produce such articles or things or provide services, as the case may be, and 50% of such profits for further five assessment years subject to fulfillment of other conditions specified in Section 10AA.

Computation of eligible deduction under section 10AA [See Working Note below]:

(i) If Unit in SEZ was set up and began manufacturing from 22-05-2014:

Since A.Y. 2021-22 is the 7th assessment year from A.Y. 2015-16, relevant to the previous year 2014-15, in which the SEZ unit began manufacturing of articles or things, it shall be eligible for deduction of 50% of the profits derived from export of such articles or things, assuming all the other conditions specified in section 10AA are fulfilled.

= Profits of unit in SEZ × \(\frac{\text { Export turnover of Unit in SEZ }}{\text { Total turnover of Unit in SEZ }}\) × 50%

= 60 lakhs × \(\frac{300 \text { lakhs }}{400 \text { lakhs }}\) × 50% = ₹ 22.50 lakhs

(ii) If Unit in SEZ was set up and began manufacturing from 14-05-2018:

Since A.Y.2021-22 is the 3rd assessment year from A.Y. 2019-20, relevant to the previous year 2017-18, in which the SEZ unit began manufacturing of articles or things, it shall be eligible for deduction of 100% of the profits derived from export of such articles or things, assuming all the other conditions specified in section 10AA are fulfilled.

= Profits of Unit in SEZ × \(\frac{\text { Export turnover of Unit in SEZ }}{\text { Total turnover of Unit in SEZ }}\) × 100%

= 60 lakhs × \(\frac{300 \text { lakhs }}{400 \text { lakhs }}\) × 100% = ₹ 45 lakhs

The unit set up in Domestic Tariff Area is not eligible for the benefit of deduction under section 10AA in respect of its export profits, in both the situations.

Working Note:

Computation of total sales, export sales and net profit of unit in SEZ

| Particulars | Rudra Ltd. (₹) | Unit in DTA (₹) | Unit in SEZ (₹) |

| Total Sales | 6,00,00,000 | 2,00,00,000 | 4,00,00,000 |

| Export Sales | 4,60,00,000 | 1,60,00,000 | 3,00,00,000 |

| Net Profit | 80,00,000 | 20,00,000 | 60,00,000 |

![]()

Question 13.

Mr. Suresh has set up an undertaking in SEZ (Unit A) and another undertaking in DTA (Unit B) in the financial year 2015-16. In the previous year 2020-21, total turnover of the unit A is ₹ 180 lacs and total turnover of Unit B is ₹ 120 lacs. Export turnover of Unit A for the year is ₹ 150 lacs and the profit for the unit A is ₹ 60 lacs.

Calculate the deduction available, if any, to Mr. Suresh under Section 10AA of the Income-tax Act, 1961, for the Assessment year 2021-22, if the manufacturing started in Unit A in the financial year 2015-16. (May 2016, 4 marks)

Answer:

Computation of deduction available under section 10AA to Mr. Suresh for A.Y.2021-22:

As per Section 10AA, in computing the total income of an assessee from its unit located in a Special Economic Zone (SEZ), which begins to manufacture or produce articles or things or provide any services during the previous year relevant to the assessment year commencing on or after 01.04.2006, there shall be allowed a deduction of 100% of the profit and gains derived from export of such articles or things or from services for a period of five consecutive assessment years beginning with the assessment year relevant to the previous year in which the Unit begins to manufacture or produce such articles or things or provide services, as the case may be, and 50% of such profits for further five assessment years subject to fulfillment of other conditions specified in Section 10AA.

Mr. Suresh has set up an undertaking in SEZ (Unit A) and started manufacturing in the financial year 2015-16. For A.Y. 2021 -22, being the 6th year of operation, he will be eligible for deduction of 50% of the profit of such unit, assuming all the other conditions specified in Section 10AA are fulfilled.

= Profits of Unit in SEZ × \(\frac{\text { Export turnover of Unit in SEZ }}{\text { Total turnover of Unit in SEZ }}\) × 50%

= 60 lacs × \(\frac{150 \text { lakhs }}{180 \text { lakhs }}\)

= ₹ 25 lacs.

Mr. Suresh is not eligible for deduction under section 10AA in respect of Unit set up in DTA.

Question 14.

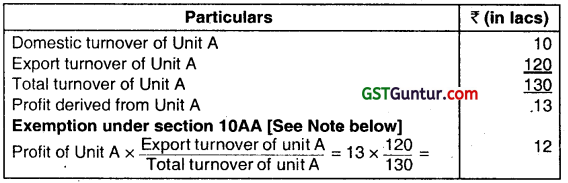

Mr. Kamal grows paddy and uses the same for the purpose of manufacturing of rice in his own Rice Mill. The cost of cultivation of 40% of paddy produce is ₹ 7,00,000 which is sold for ₹ 15,00,000; and the cost of cultivation of balance 60% of paddy is ₹ 12,00,000 and the market value of such paddy is ₹ 24,00,000. To manufacture the rice, he incurred ₹ 2,00,000 in the manufacturing process on the balance (60%) paddy.

The rice was sold for ₹ 30,00,000.

Compute the Business income and Agriculture Income of Mr. Kamal. (Nov 2016, 4 marks)

Answer:

Computation of Business Income and Agriculture Income of Mr. Kama

Question 15.

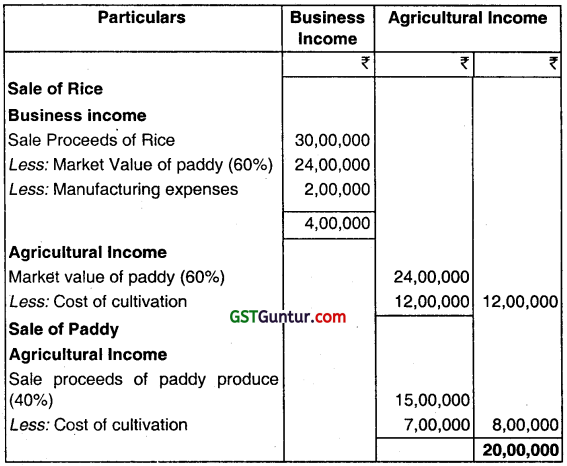

Mr. Avani, a resident aged 25 years, manufactures tea leaves from the tea plants grown by him in India. These are then sold in the Indian market for ₹ 40 lakhs. The cost of growing tea plants was ₹ 15 lakhs and the cost of manufacturing tea leaves was ? 10 lakhs.

Compute her tax liability for the Assessment Year 2021-22. (May 2018, 7 marks)

Answer:

| Particulars | Amount (₹) |

| Sale Value of Tea | 40,00,000 |

| Less: Cost of growing tea plant | (15,00,000) |

| Less: Cost of Manufacturing tea | (10,00,000) |

| Business Income (before Rule 8) | 15,00,000 |

| Less: Agricultural Income(60%. Exempted as per Rule 8) | (9,00,000) |

| Taxable Business Income | 6,00,000 |

| Tax Liability (WN) | 1,09,200 |

Working Note:

![]()

Question 16.

Mrs. Vibha Gupta, a resident individual, is running a SEZ unit, as well as a unit in Domestic Tariff Area (DTA). She furnishes the following details relating to the year ended 31-3-2021, pertaining to these two units (₹ in lakhs)

| DTA Unit | SEZ Unit | |

| Export turnover | 100 | 1000 |

| Total turnover | 400 | 1100 |

| Net profit | 50 | 220 |

Compute the deduction available u/s 10 AA:

(i) When the SEZ unit had been set up on 12-3-2013, and

(ii) When the SEZ unit had been set up on 12-8-2018. (Nov 2018, 6 marks)

Answer:

Computation of deduction under section 10AA

(i) If Unit in SEZ was set up on 12-03-2013:

Since A.Y. 2020-21 is the 9th assessment year from A.Y. 2013- 14, relevant to the previous year 2011-12, in which the SEZ unit was set up, it shall be eligible for deduction of 50% of the profits derived from export, assuming all the other conditions specified in section 10AA are fulfilled.

= Profits of Unit in SEZ func × \(\frac{\text { Export turnover of Unit in SEZ }}{\text { Total turnover of Unit in SEZ }}\) × 50%

= 220 lakhs × \(\frac{1,000 \text { lakhs }}{1,100 \text { lakhs }}\)× 50% = ₹ 100 lakhs

(ii) If Unit in SEZ was set up on 12-08-2018:

Since A.Y.2021-22 is the 3rd assessment year from A.Y. 2019-20, relevant to the previous year 2018-19, in which the SEZ unit was set up, it shall be eligible for deduction of 100% of the profits derived from export, assuming all the other conditions specified in section 10AA are fulfilled.

= Profits of Unit in SEZ × \(\frac{\text { Export turnover of Unit in SEZ }}{\text { Total turnover of Unit in SEZ }}\) × 100%

= 220 lakhs × \(\frac{1,000 \text { lakhs }}{1,100 \text { lakhs }}\) × 100% = ₹ 200 lakhs

The unit set up in Domestic Tariff Area is not eligible for the benefit of deduction under section 10AA in respect of its export profits, in both the situations.

Note:

As per section 10AA, in computing the total income of Mrs. Vibha Gupta from her unit located in a Special Economic Zone (SEZ), which begins to manufacture or produce articles or things or provide any services during the previous year relevant to the assessment year commencing on or after 1.4.2007 but before 1.4.2022, a deduction of 100% of the profit and gains derived from export of such articles or things or from services is allowable for a period of five consecutive assessment years beginning with the assessment year relevant to the previous year in which the Unit begins to*manufacture or produce such articles or things or provide services, as the case may be, and 50% of such profits for further five assessment years subject to fulfillment of other conditions specified in section 10AA. In this case, it is assumed that the manufacturing or production commenced from the year in which the SEZ was set up.

Question 17.

Mr. Xavier, an Indian resident individual, set up an unit in Special Economic Zone (SEZ) in the financial year 2016-17 for production of Mobile Phones. The unit fulfills all the conditions of Section 10AA of the Income-tax Act, 1961.

During the financial, year 2019-20, he has also set up a warehousing facility in a district of Tamil Nadu for storage of agricultural produce. It fulfills all the conditions of section 35 AD.

Capital expenditure in respect of warehouse amounted to ₹ 93 lakhs (including cost of land ₹ 13 lakhs). The warehouse became operational with effect from 1st April, 2020 and the expenditure of ₹ 63 lakhs was capitalized in the books on that date.

Further details relevant for the financial year 2020-21 are as follows:

| Particulars |

| Profit from operation of warehousing facility before claiming deduction under section 35 AD |

| Net Profit of SEZ (Mobile Phone) Unit |

| Export sales of SEZ (Mobile Phone) Unit |

| Domestic Sales of SEZ (Mobile Phone) Unit |

Compute income tax (including AMT under 115JC) payable by Mr. Xavier for Assessment Year 2021-22 (Jan 2021, 6 marks)

![]()

Question 18.

Mr. B grows sugarcane and uses the same for the purpose of manufacturing sugar in his factory. 30% of sugarcane produce is sold for ₹ 10 lacs, and the cost of cultivation of such sugarcane is ₹ 5 lacs. The cost of cultivation of the balance sugarcane (70%) is ₹ 14 lacs and the market value of the same is ₹ 22 lacs. After incurring ₹ 1.5 lacs in the manufacturing process on the balance sugarcane, the sugar was sold for ₹ 25 lacs. Compute B’s business income and agricultural income.

Answer:

Income from sale of sugarcane gives rise to agricultural income and from f sale of sugar gives rise to business income.

Business Income = Sales (-) Market value of 70% of sugarcane produce (-) Manufacturing expenses

= ₹ 25 lacs – ₹ 22 lacs – ₹ 1.5 lacs = ₹ 1.5 lacs.

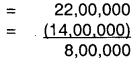

Agricultural Income = Market value of sugar (70%) = 22,00,000

(-) Cost of cultivation = (14,00,000)

Sale of Sugarcane

Agricultural income = Sale produce of sugarcane (30%) i.e. 10,00,000 (-)

Cost of cultivation i.e. 5 lacs = 5,00,000

Total Agriculture Income = 8,00,000 + 5,00,000 = 13,00,000

Agricultural income = Market value of sugarcane produce – Cost of cultivation

= [₹ 10 lacs + ₹ 22 lacs] – [ ₹ 5 lacs + ₹ 14 lacs]

= ₹ 32 lacs – ₹ 19 lacs

= ₹ 13 lacs.

Question 19.

Mr. C manufactures latex from the rubber plants grown by him in India. These are then sold in the market for ₹ 30 lacs. The cost of growing rubber plants is ₹ 10 lacs and that of manufacturing latex is ₹ 8 lacs. Compute his total income.

Answer:

The total income of Mr. C comprises of agricultural income and business income. Total profits from the sale of latex= ₹ 30 lacs – ₹ 10 lacs – ₹ 8 lacs = ₹ 12 lacs.

Agricultural income = 65% of ₹ 12 lacs = ₹ 7.8 lacs

Business income = 35% of ₹ 12 lacs = ₹ 4.2 lacs

Question 20.

Mr. X, a resident, has provided the following particulars of his income for the P.Y. 2020-21.

(i) Income from salary (computed) – ₹ 2,80,000

(ii) Income from house property (computed) – ₹ 2,50,000

(iii) Agricultural income from a land in Jaipur – ₹ 4,80,000

(iv) Expenses incurred for earning agricultural income – ₹ 1,70,000

Compute his tax liability assuming his age is

(a) 45 years

(b) 70 years

Answer:

Computation of total income of Mr. X for the A. Y.2021 -22

(a) Computation of tax liability (age 45 years)

For the purpose of partial integration of taxes, Mr. X has satisfied both the conditions i.e.

1. Net agricultural income exceeds ₹ 5,000 p.a., and

2. Non-agricultural income exceeds the basic exemption limit of ₹ 2,50,000. His tax liability is computed in the following manner:

| Particulars | ₹ | ₹ |

| Income from salary (computed) | – | 2,80,000 |

| Income from house property | – | 2,50,000 |

| Net agricultural income [₹ 4,80,000 – ₹ 1,70,000] | 3,10,000 | – |

| Less: Exempt under section 10(1) | (3,10,000) | – |

| Gross Total Income | – | 5,30,000 |

| Less: Deductions under chapter VI-A | – | – |

| Total Income | – | 5,30,000 |

Step 1: ₹ 5,30,000 + ₹ 3,10,000 = ₹ 8,40,000

Tax on ₹ 8,40,000 = ₹ 80,500

Step 2: ₹ 3,10,000 + ₹ 2,50,000 = ₹ 5,60,000

Tax on ₹ 5,60,000 = ₹ 24,500

Step 3: ₹ 80,500 – ₹ 24,500 = ₹ 56,000

Step 4 & 5: Total tax payable = ₹ 56,000

= ₹ 56,000 + 4% of ₹ 56,000

= ₹ 58,240.

(b) Computation of tax liability (age 70 years)

For the purpose of partial integration of taxes, Mr. X has satisfied both the conditions i.e.

1. Net agricultural income exceeds ₹ 5,000 p.a., and

2. Non-agricultural income exceeds the basic exemption limit of ₹ 3,00,000. His tax liability is computed in the following manner:

Step 1: ₹ 5,30,000 + ₹ 3,10,000 = ₹ 8,40,000

Tax on ₹ 8,40,000 = ₹ 78,000

Step 2: ₹ 3,10,000 + ₹ 3,00,000 = ₹ 6,10,000

Tax on ₹ 6,10,000 = ₹ 32,000

Step 3: ₹ 78,000-₹ 32,000 = ₹ 46,000.

Step 4 & 5: Total tax payable = ₹ 46,000

= ₹ 46,000 + 4% of ₹ 46,000 = ₹ 47,840.

![]()

Question 21.

Mr. A, a member of a HUF, received ₹ 10,000 as his share from the income of the HUF. Is such income includible in his chargeable income? Examine with reference to the provisions of the Income-tax Act, 1961.

Answer:

No. Such income is not includible in Mr. A’s chargeable income since section 10(2) exempts any sum received by an individual as a member of a HUF where such sum has been paid out of the income of the family.

Question 22.

Examine whether the following are chargeable to tax, and if so, compute the amount liable to tax:

(i) Arvind received ₹ 20,000 as his share from the income of the HUF.

(ii) Mr. Xavier, a ‘ParamVir Chakra’ awardee, who was formerly in the service of the Central Government, received a pension of ₹ 2,20,000 during the financial year 2020-21.

(iii) Agricultural income of ₹ 1,27,000 earned by a resident of India from a land situated in Malaysia.

(iv) Rent of ₹ 72,000 received for letting out agricultural land for a movie shooting.

Answer:

| Taxable/ Not Taxable | Amount liable to tax (₹) | Reason |

| Not Taxable | – | Share received by member out of the income of the HUF is exempt under Section 10(2). |

| Not Taxable | – | Pension received by Mr. Xavier, a former Central Government employee who is a ‘Param Vir Chakra’ awardee, is exempt under Section 10(18). |

| Taxable | 1,27,000 | Agricultural income from a land in any foreign country is taxable in the case of a resident taxpayer as income under the head “Income from other sources”. Exemption under Section 10(1) is not available in respect of such income. |

| Taxable

|

72,000

|

Agricultural income is exempt from tax as per Section 10(1). Agricultural income means, inter alia, any rent or revenue derived from land which is situated in India and is used for agricultural purposes. In the present case, rent is being derived from letting out of agricultural land for a movie shoot, which is not an agricultural purpose. In effect, the land is not being put to use for agricultural purposes. Therefore, ₹ 72,000, being rent received from letting out of agricultural land for movie shooting, is not exempt under Section 10(1). The same is chargeable to tax under the head “Income from other sources”. |

Question 23.

Examine with reasons in brief whether the following statements are true or false with reference to the provisions of the Income-tax Act, 1961:

(i) Pension received by a recipient of gallantry award is exempt from income-tax.

(ii) Mr. A, a member of a HUF, received ₹ 10,000 as his share from the income of the HUF. The same is to be included in his chargeable income.

Answer:

(i) True: Section 10(18) exempts any income by way of pension received by individual who has been awarded “Param Vir Chakra” or “Maha Vir Chakra” or “Vir Chakra” or such other gallantry award as the Central Government, may, by notification in the Official Gazette, specify in this behalf.

(ii) The total income of Mr. C comprises of agricultural income and business income. Total profits from the sale of latex = ₹ 30 lacs – ₹ 10 lacs – ₹ 8 lacs = ₹ 12 lacs.

Agricultural income = 65% of ₹ 12 lacs

= ₹ 7.8 lacs

Business income = 35% of ₹ 12 lacs

= ₹ 4.2 lacs

![]()

Question 24.

Mr. X, a resident, has provided the following particulars of his income for the P.Y. 2020-21.

(i) Income from salary (computed) – ₹ 2,80,000

(ii) Income from house property (computed) – ₹ 2,50,000

(iii) Agricultural income from a land in Jaipur – ₹ 4,80,000

(iv) Expenses incurred for earning agricultural income – ₹ 1,70,000 Compute his tax liability assuming his age is –

(a) 45 years

(b) 70 years

Answer:

Computation of total income of Mr. X for the A. Y.2021 -22

(a) Computation of tax liability (age 45 years)

For the purpose of partial integration of taxes, Mr. X has satisfied both the conditions i.e.

1. Net agricultural income exceeds ₹ 5,000 p.a., and

2. Non-agricultural income exceeds the basic exemption limit of ₹ 2,50,000. His tax liability is computed in the following manner.

| Particulars | ₹ | ₹ |

| Income from salary (computed) | 2,80,000 | |

| Income from house property | 2,50,000 | |

| Net agricultural income [₹ 4,80,000 – ₹ 1,70,000] | 3,10,000 | |

| Less: Exempt under section 10(1) | ||

| Gross Total Income | 5,30,000 | |

| Less: Deductions under Chapter VI-A | ||

| Total Income | 5,30,000 |

Step 1: ₹ 5,30,000 + ₹ 3,10,000 = ₹ 8,40,000

Tax on ₹ 8,40,000 = ₹ 80,500

Step 2: ₹ 3,10,000 + ₹ 2,50,000 = ₹ 5,60,000

Tax on ₹ 5,60,000 = ₹ 24,500

Step 3: ₹ 80,500 – ₹ 24,500 = ₹ 56,000

Step 4 & 5: Total tax payable = ₹ 56,000

= ₹ 56,000 + 4% of ₹ 56,000

= ₹ 58,240.

(b) Computation of tax liability (age 70 years)

For the purpose of partial integration of taxes, Mr. X has satisfied both the conditions i.e.

1. Net agricultural income exceeds ₹ 5,000 p.a., and

2. Non-agricultural income exceeds the basic exemption limit of ₹ 3,00,000. His tax liability is computed in the following manner:

Step 1: ₹ 5,30,000 + ₹ 3,10,000 = ₹ 8,40,000

Tax on ₹ 8,40,000 = ₹ 78,000

Step 2: ₹ 3,10,000 + ₹ 3,00,000 = ₹ 6,10,000

Tax on ₹ 6,10,000 = ₹ 32,000

Step 3: ₹ 78,000 – ₹ 32,000 = ₹ 46,000.

Step 4 & 5: Total tax payable = ₹ 46,000

= ₹ 46,000 + 4% of ₹ 46,000

= ₹ 47,840.

![]()

Question 25.

Mr. A, a member of a HUF, received ₹ 10,000 as his share from the income of the HUF. Is such income includible in his chargeable income? Examine with reference to the provisions of the Income-tax Act, 1961.

Answer:

No. Such income is not includible in Mr. A’s chargeable income since section 10(2) exempts any sum received by an individual as a member of a HUF where such sum has been paid out of the income of the family.

Question 26.

Examine whether the following are chargeable to tax, and if so, compute the amount liable to tax:

(i) Arvind received ₹ 20,000 as his share from the income of the HUF.

(ii) Mr. Xavier, a ‘Param Vir Chakra’ awardee, who was formerly in the service of the Central Government, received a pension of ₹ 2,20,000 during the financial year 2020-21.

(iii) Agricultural income of ₹ 1,27,000 earned by a resident of India from a land situated in Malaysia.

(iv) Rent of ₹ 72,000 received for letting out agricultural land for a movie shooting.

Answer:

| Taxable/ Not Taxable | Amount liable to tax (?) | Reason |

| (i)Not Taxable | Share received by member out of the income of the HUF is exempt under Section 10(2). | |

| (ii) Not Taxable | Pension received by Mr. Xavier, a former Central Government employee who is a ‘Param Vir Chakra’ awardee, is exempt under Section 10(18). | |

| (iii) Taxable | 1,27,000 | Agricultural income from a land in any foreign country is taxable in the case of a resident taxpayer as income under the head “Income from other sources”. Exemption under Section 10(1) is not available in respect of such income. |

| (iv) Taxable

|

72,000

|

Agricultural income is exempt from tax as per Section 10(1). Agricultural income means, inter alia, any rent or revenue derived from land which is situated in India and is used for agricultural purposes. In the present case, rent is being derived from letting out of agricultural land for a movie shoot, which is not an agricultural purpose. In effect, the land is not being put to use for agricultural purposes. Therefore, ₹ 72,000, being rent received from letting out of agricultural land for movie shooting, is not exempt under Section 10(1). The same is chargeable to tax under the head “Income from other sources”. |

Question 27.

Examine with reasons in brief whether the following statements are true or false with reference to the provisions of the Income-tax Act, 1961:

(i) Pension received by a recipient of gallantry award is exempt from income-tax.

(ii) Mr. A, a member of a HUF, received ₹ 10,000 as his share from the income of the HUF. The same is to be included in his chargeable income.

Answer:

(i) True: Section 10(18) exempts any income by way of pension received by individual who has been awarded “Param Vir Chakra” or “Maha Vir Chakra” or “Vir Chakra” or such other gallantry award as the Central Government, may, by notification in the Official Gazette, specify in this behalf.

(ii) False: Section 10(2) exempts any sum received by an individual as a member of a HUF where such sum has been paid out of the income of the family. Therefore, ₹ 10,000 should not be included in Mr. A’s chargeable income.

![]()

Question 28.

Briefly explain the exemption available u/s 10(48B) of the Income Tax Act, 1961 in respect of income received by foreign company on account of leftover stock?

Answer:

Exemption under Section 10(48B) is available to a foreign company on account of sale of leftover stock of crude oil after the expiry of the agreement or arrangement subject to such conditions as may be notified by the Central Government.

The benefit of exemption is presently not available on sale out of the leftover stock of crude in case of termination of the said agreement.

As these Foreign Companies benefitting India by augmenting its strategic petroleum reserves, it is proposed to amend section 10(48B) to provide that the benefit of tax exemption in respect of income from left over stock will be available even if the agreement or the arrangement is terminated in accordance with the terms mentioned therein.

Multiple Choice Questions

Question 1.

Agricultural income is exempt provided that:

(a) Agricultural Land is situated in India

(b) Land is situated in any rural area in India

(c) Land is situated whether in India or outside India.

(d) None of the above

Answer:

(a) Agricultural Land is situated in India

Question 2.

If the assessee is engaged in the business of growing and manufacturing tea in India, the agricultural income in that case shall be:

(a) 40% of the income from such business

(b) 60% of the income from such business

(c) Market value of the agricultural produce minus the expenses on cultivation of such agricultural produce

(d) None of the above

Answer:

(b) 60% of the income from such business

Question 3.

If a firm earns agricultural income, it will be exempt:

(a) in the hands of firm

(b) in the hands of firm but taxable in the hands of the partners

(c) in the hands of firm as well its partners

(d) in the hands of the firm as well its partners but would be included in the other income of partners for computation of tax on his other incomes.

Answer:

(c) in the hands of firm as well its partners

Question 4.

Mr. Z received compensation of ₹ 3,60,000 from the Central Government on account of disaster. He claimed ₹ 1,20,000 as a deduction on account of loss or damage caused by such disaster under this Act. What amount of compensation received shall be exempt?

(a) ₹ 3,60,000

(b) ₹ 2,40,000

(c) ₹ 1,20,000

(d) Nil

Answer:

(b) ₹ 2,40,000

![]()

Question 5.

Any sum received under a Life Insurance Policy including bonus shall be exempt:

(a) in all kinds of policies

(b) in all kinds of policies except when received under a Keyman Insurance Policy

(c) in all kinds of policies except when received under Keyman Policy or under a policy covered under Section 80DDA(3).

(d) in all kinds of policies except when received under Keyman insurance Policy or such policy as is covered under Section 80DD(3) or policy issued, if the premium paid for any year exceeds 10%/15% as the case may be, of actual capital sum assured, except on death.

Answer:

(d) in all kinds of policies except when received under Keyman insurance Policy or such policy as is covered under Section 80DD(3) or policy issued, if the premium paid for any year exceeds 10%/15% as the case may be, of actual capital sum assured, except on death.

Question 6.

Interest from post office saving bank account is:

(a) Fully exempt

(b) Exempt to the maximum extent of ₹ 3,500

(c) Exempt to the maximum extent of ₹ 3,500 in case of an individual account, and ₹ 7000 in case of joint account

(d) None of the above

Answer:

(c) Exempt to the maximum extent of ₹ 3,500 in case of an individual account, and ₹ 7000 in case of joint account

Question 7.

Where the income of an individual includes the income of minor children, such individual shall be entitled to an exemption of:

(a) ₹ 1,500

(b) ₹ 1,500 per minor child

(c) ₹ 1,500 per minor child or to the extent of income of the minor child included in the total income of the assessee whichever is less.

(d) None of the above

Answer:

(c) ₹ 1,500 per minor child or to the extent of income of the minor child included in the total income of the assessee whichever is less.

Question 8.

In case of a unit established by an entrepreneur in SEZ, which begins to manufacture or produce articles or things or provide any services on or after 1 -4-2006, deduction for next 5 years(6lh to 10th year) will be allowed as follows-

(a) 50% of profits and gains from export business

(b) 75% of profits and gains from export business

(c) 100% for first two years and 80% for remaining three years

(d) No deduction

Answer:

(a) 50% of profits and gains from export business

Question 9.

Income received from which fund shall be unconditionally exempt:

(a) Swachh Bharat Kosh

(b) Pradhan Mantri Jan Dhan Yojana

(c) National foundation for communal harmony

(d) NAREGA

Answer:

(a) Swachh Bharat Kosh

![]()

Question 10.

Exempted income is

(a) Not taxable under Income Tax

(b) Not Included in total Income

(c) Agricultural income

(d) All of above.

Answer:

(d) All of above.

Income which do not form Part of Total Income Notes

Section 10(4D) [Inserted w.e.f 01.04.2020]

Any income accrued or arisen to, or received by a specified fund as a result *’of transfer of capital asset referred to in clause (viiab) of section 47. on a recognised stock exchange located in any International Financial Services Centre and where the consideration for such transaction is paid or payable in 18a[Convertible foreign exchange, to the extent such income accrued or arisen to, or is received in respect of units held by a non-resident], Explanation.-For the purposes of this clause, the expression-

(a) “convertible foreign exchange” means foreign exchange which is for the time, being treated by the Reserve Bank of India as convertible foreign exchange for the purposes of the Foreign Exchange Management Act, 1999 (42 of 1999) and the rules made thereunder;

(b) “manager” shall have the meaning assigned to it in clause (q) of sub¬regulation (1) of regulation 2 of the Securities and Exchange Board of India (Alternative Investment Fund) Regulations, 2012, made under the Securities and Exchange Board of India Act, 1992 (15 of 1992);

(c) “specified fund” means a fund established or incorporated in India in the form of a trust or a company or a limited liability partnership or a body corporate,

(i) which has been granted a certificate of registration as a Category III Alternative Investment Fund and is regulated under the Securities and Exchange Board of India (Alternative Investment Fund) Regulation, 2012, made under the Securities and Exchange Board of India Act, 1992 (15 of 1992);

(ii) which is located in any International Financial Services Centre;

(iii) of which all the units are held by non-residents other than unit held by a sponsor or manager;

(d) “sponsor” shall have the meaning assigned to it in clause (w) of sub¬regulation (1) of regulation 2 of the Securities and Exchange Board of India (Alternative Investment Fund) Regulation, 2012, made under the Securities and-Exchange Board of India Act, 1992 (15 of 1992);

(e) “trust” means a trust established under the Indian Trusts Act, 1882 (2 of 1882) or under any other law for the time being in force;

(f) “unit” means beneficial interest of an investor in the fund and shall include shares or partnership interests;]

10(15)(ix) any incomp by way of interest payable to a non-resident by a unit located in an International Financial Services Centre in respect of monies borrowed by it on or after the 1st day of September, 2019.

Explanation.- For the purposes of this sub-clause,-

(a) “International Financial Services Centre” shall have the meaning assigned to it in clause (q) of section 2 of the Special Economic Zones Act, 2005 (28 of 2005);

(b) “unit” shall have the meaning assigned to it in clause (zc) of section 2 of { the Special Economic Zones Act, 2005 (28 of 2005);]

Section 10 (23C) any income received by any person on behalf of- ]

(i) the Prime Minister’s National Relief Fund [or the Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES FUND) w.e.f. 01,04.2020]; or

(ii) the Prime Minster’s Fund (Promotion of Folk Art); or

(iii) the Prime Minister’s Aid to Students Fund; or

(iiia) the National Foundation for Communal Harmony; or (iiiaa) the Swachh Bharat Kosh set up by the Central Government; or (iiiaaa) the Clean Ganga Fund, set up by the Central Government; or (‘

(iiiaaaa) the Chief Minster’s Relief Fund or the Lieutenant Governor’s Relief Fund in respect of any State or Union territory as referred to in sub clause (iiihf) of clause (a) of sub-section (2) of section 80G: or (iiiab) any university or other educational institution existing solely for educational purposes and not for purposes of profit, and which is wholly or substantially financed by the Government; or

(iiiac) any hospital or other institution for the reception and treatment of persons suffering from illness or mental defectiveness or for the reception and treatment of persons during convalescence or ol persons requiring medical attention or rehabilitation, existing solely for philanthropic purposes and not for purposes of profit, and which is wholly or substantially financed by the Government.

Explanation: For the purposes of sub-clauses (iiiab) and (iiiac), any university or other educational institution, hospital or other institution referred therein, shall be considered as being substantially firianced by the Government for any previous year, if the Government grant to such university or other educational institution, hospital or other institution exceeds such percentage of the total receipts including any voluntary contributions, as may be prescribed, of such university or other educational institution, hospital or other institution, as the case may be, during the relevant previous year; or

(iiiad) any university or other educational institution existing solely for educational purposes and not for purposes of profit if the aggregate annual receipts of such university or educational institution do not exceed the amount of annual receipts as may be prescribed; or

(iiiae) any hospital or other institution for the reception and treatment of persons suffering from illness or mental defectiveness or for the reception and treatment of persons during convalescence or of persons requiring medical attention or rehabilitation, existing solely for philanthropic purposes and not for purposes of profit, if the aggregate annual receipts of such hospital or institution do not exceed the amount of annual receipts as may be prescribed; or

![]()

(iv) any other fund or institution established for charitable purposes which may be approved by the prescribed authority, having regard 10 the objects of the fund or institution and its importance throughout India or throughout any State or States; or

(v) any trust (including any other legal obligation) or institution wholly for public religious purposes or wholly for public religious and charitable purposes, which may be approved by the prescribed authority, having regard to the manner in which the affairs of the trust or institution are administered and supervised for ensuring that the income accruing thereto is properly applied for the objects thereof;

(vi) any university or other educational institution existing solely for educational purposes and not for purposes of profit, other than those mentioned in sub-clause (iiiab) or sub-clause (iiiad) and which may be approved by the prescribed authority; or

(via) any hospital or other institution for the reception and treatment of persons suffering from illness or mental defectiveness or for the reception and treatment of persons during convalescence or of persons requiring medical attention or rehabilitation, existing solely for philanthropic purposes and not for purpose of profit, other than those mentioned in sub-clause (iiiae) or sub-clause (iiiae) and which may be approved by prescribed authority:

[w.e.f. 01.06.2020]

Provided that the fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via), shall make an application in the prescribed form and manner to the prescribed authority for the purpose of grant of the exemption, or continuance thereof, under sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via):

Provided further that the prescribed authority, before approving any fund or trust or institution or any university or other educational institution or any hospital or other medical institution, under sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via), may call for such documents (including audited annua! accounts) or information from the fund or trust or institution or any university or other educational institution or any hospital or other medical institution, as the case may be, as it thinks necessary in order to satisfy itself about the genuineness of the activities of such fund or trust or institution or any university or other educational institution or any hospital or other medical institution, as the case may be, and the compliance of such requirements under any other law for the time being in force by such fund or trust or institution or any university or other educational institution or any hospital or other medical institution, as the case may be, as are material for the purpose of achieving its objects and the prescribed authority may also make such inquiries as it deems necessary in this behalf:]

Following first and second provisos shall be substituted for first and second provisos to clause (23C) of section 10 by the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020, w.e.f. 1-4-2021:

Provided that the exemption to the fund or trust or institution or university or Other educational institution or hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via), under the respective sub-clauses, shall not be available to it unless such fund or trust or institution or university or other educational institution or hospital or other medical institution makes an application in the prescribed form and manner to the Principal Commissioner or Commissioner, for grant of approval,-

1. where such fund or trust or institution or university or other educational institution or hospital or other medical institution is approved under the second proviso [as it stood immediately before its amendment by the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020], within three months from the 1st day of April, 2021;

2. where such fund or trust or institution or university or other educational institution or hospital or other medical institution is approved and the period of such approval is due to expire, at least six months prior to expiry of the said period;

3. where such fund or trust or institution or university or other educational institution or hospital or other medical institution has been provisionally approved, at least six months prior to expiry of the period of the provisional approval or within six months of commencement of its activities, whichever is earlier;

4. in any other case, at least one month prior to the commencement of the previous year relevant to the assessment year from which the said approval is sought, and the said fund or trust or institution or university or other educational institution or hospital or other medical institution is approved under the second proviso:

![]()

Provided further that the Principal Commissioner or Commissioner, on receipt of an application made under the first proviso, shall,-

(i) where’ the application is made under clause (i) of the said proviso, pass an order in writing granting approval to it for a period of five years;

(ii) where the application is made under clause (ii) or clause (iii) of the said proviso,-]

(a) call for such documents or information from it or make such inquires as he thinks necessary in order to satisfy himself about

(A) the genuineness of activities of such fund or trust or institution or university or other educational institution or hospital or other medical institution; and

(B) the compliance of such requirements of any other law for the time being in forced by it as are material for the purpose of achieving its objects; and

(b) after satisfying himself about the objects and the genuineness of its activities under item (A), and compliance of the requirements under item (B), of sub-clause (a),

(A) pass an order in writing granting approval to it for a period of five years;

(B) if he is not so satisfied, pass an order in writing rejecting such application and also cancelling its approval after affording it a reasonable opportunity of being heard;

(iii) where the application is made under clause (iv) of the said proviso, . pass an order in writing granting approval to it provisionally for a period J of three years from the assessment year from which the registration is sought, and send a copy of such order to the fund or trust or institution or university or other educational institution or hospital or other medical institution:

Provided also that the fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub clause (vi) or sub-clause (via)-

(a) applies its income, or accumulates ‘it for application, wholly and exclusively the objects for which it is established and in a case where more than fifteen per cent of its income is accumulated on or after the 1st 1 day of April, 2002, the period of the accumulation of the amount exceeding fifteen per cent of its income shall in no case exceed five years; and

(b) does not invest or deposit its funds, other than-

(i) any assets held by the fund, trust or institution or any university or other educational institution or any hospital or other medical institution where such assets form part of the corpus of the fund, trust or institution or any university or other educational institution or any hospital or other medical institution as on the 1st day of June,

1973;

(ia) any asset, being equity shares of a public company, held by any university or other educational institution or any hospital or other medical institution where such assets form part of the corpus of any university or other educational institution or any hospital or other medical institution as on the 1st day of June, 1998;

(ii) any assets (being debentures issued by, or on behalf of, any company or corporation), acquired by the fund, trust or institution or any university or other educational institution or any hospital or other medical institution before the 1st day of March, 1983;

(iii) any accretion to the shares, forming part of the corpus mentioned in sub-clause (i) and sub-clause (ia), by way of bonus shares allotted to the fund, trust or institution or any university or other educational institution or any hospital or other medical institution;

(iv) voluntary contributions received and maintained in the form of jewellery, furniture or any other article as the Board may, by notification in the Official Gazette, specify,

for any period during the previous year otherwise than in any one or more of the forms or modes specified in sub-section (5) of section 11. [Explanation.- For the removal of doubts, it is hereby clarified that for the purposes of this proviso, the income of the funds or trust or institution or any university or other educational institution or any hospital or other medical institution, shall not include income in the form of voluntary contributions made with a specific direction that they shall form part of the corpus of such funds or trust or institution or any university or other educational institution or any hospital or other medical institution;]

Provided also that the exemption under sub-clause (iv) or sub-clause (v) shall not be denied in relation to any funds invested or deposited before the 1st day of April, 1989, otherwise than in any one or more of the forms or modes specified in sub-section (5) of section 11 if funds do not continue to remain so invested or deposited after the 30th day of March, 1993 :

Provided also that the exemption under sub-clause (vi) or sub-clause (via) shall not be denied in relation to any funds invested or deposited before the 1s’ day of June, 1998, otherwise than in any one or more of the forms or modes specified in sub-section (5) of section 11 if such funds donot continue to remain so invested or deposited after the 30th day of March, 2001:

![]()

Provided also that the exemption under sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) shall not be denied in relation to voluntary contribution, other than voluntary contribution in cash or voluntary contribution of the nature referred to in clause (b) of the third proviso to this sub-clause, subject to the condition that such voluntary contribution is not held by the trust or institution or any university or other education institution or any hospital or other medical institution, otherwise than in any one or more of the forms or modes specified in sub-section (5) of section 11. after the expiry of one year from the end of the previous year in which such asset is acquired or the 31sl day of March, 1992, whichever is later:

Provided also that nothing contained in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) shall apply in relation to any income of the fund or trust or institution or any university or other education institution or any hospital or other medical institution, being profits and gains of business, unless the business is incidental to the attainment of its objectives and separate books of account are maintained by it in respect of such business: Provided also that any notification issued by the Central Government under sub-clause (iv) or sub-clause (v), before the date on which the Taxation Laws (Amendment) Bill, 2006 receives the assent of the President, shall, at any one time, have effect for such assessment year or years, not exceeding three assessment years (including an assessment year or years commencing before the date on which such notification is issued) as may be specified in the notification:

Provide also that where an application under the first proviso is made on or after the date on which the Taxation Laws (Amendment) Bill, 2006 receives the assent of the President, every notification under sub-clause (iv) or sub-clause (v) shall be issued or approval under sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) shall be granted or an order rejecting the application shall be passed within the period of twelve months from the end of the month in which such application was received:]

Following eighth and ninth provisos shall be substituted for existing eighth and ninth provisos to clause (23C) of section 10 by the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020, w.e.f. 1-4-2021 :

Provided also that any approval granted under the second proviso shall apply in relation to the income of the fund or trust or institution or university or other educational institution or hospital or other medical institution,-

(i) where the application is made under clause (i) of the first proviso, from the assessment year from which approval was earlier granted to it;

(ii) where the application is made under clause (iii) of the first proviso, from the first of the assessment years for which it was provisionally approved;

(iii) in any other case, from the assessment year immediately following the financial year in which such application is made:

Provided also that the order under clause (i), sub-clause (b) of clause (ii) and clause (iii) of the second proviso shall be passed, in such form and manner as may be prescribed, before expiry of the period of three months, six months and one month, respectively, calculated from the end of the month in which the application was received:

Provided also that where the total income, of the fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub¬clause (vi) or sub-clause (via), without giving effect to the provisions of the said sub-clauses, exceeds the maximum amount which is not chargeable to tax in any previous year, such trust or institution or any university or other educational institution or any hospital or other medical institution shall get its accounts audited in respect of that year by an accountant as defined in the Explanation below sub-section (2) of [section 288 before the specified date referred to in section 44AB and furnish by that dat], the report of such audit in the prescribed form duly signed and verified by such accountant and setting forth such particulars as may be prescribed:

Provided also that any amount of donation received by the fund or institution in terms of clause (d) of sub-section (2) of section 80G in respect of which accounts of income and. expenditure have not been rendered to the authority prescribed under clause (v) of sub-section (5C) of that section, in the manner specified ip that clause, or which has been utilised for purposes other than providing relief to the victims of earthquake in Gujarat or which remains unutilised in terms of sub-section (5C) of section 80G and not transferred to the Prime Minister’s National Relief Fund on or before the 31st day of March, 2004 shall be deemed to be the income of the previous year and shall accordingly be charged to tax:

![]()

Provided also that any amount credited or paid out of income of any fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to [in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via), to any other fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) or trust or institution registered under [section 12AA]. being volbntary contribution made with a specific direction that they shall form part of the corpus,] shall not be treated as application of income to the objects for which such fund or trust or institution or university or educational institution or hospital or other medical institution, as the case may be, is established:

Provided also that for the purposes of determining the amount of application under item (a) of the third proviso, the provisions of sub-clause (ia) of clause (a) of section 40 and sub-sections (3) and (3A) of section 40A, shall, mutatis mutandis, apply as they apply in computing the income chargeable under the head “Profits and gains of business or profession”:

Provided also that the fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub clause (vi) or sub-clause (via)-does not apply its.income during the year of receipt and accumulates it, any payment or credit out of such accumulation to any trust of institution referred to in sub-clause (vi) or sub-clause (v) or sub clause (vi) or sub-clause (via) shall not be treated as application of income to the objects for which such

fund or trust or institution or university or educational institution or hospital or other medical institution, as the case may be, is established:

Provided also that where the fund or institution referred to in sub-clause (iv) nr trust or institution referred to in sub-clause (v) is notified by the Central Government or is approved by the prescribed authority, as the case may be, or any university or other educational institution referred to in sub-clause (via), is approved by the prescribed authority and subsequently that Government or the prescribed authority is satisfied that –

1. such fund or institution or trust or any university or other educational institution or any hospital or other medical institution has not- (A) applied its income in accordance with the provisions contained in clause (a) of the third proviso; or

(B) invested or deposited its funds in accordance with the provisions contained in clause (b) of the third proviso; or

2. the activities of such fund or institution or trust or any university or other educational institution or any hospital or other medical institution-

(A) are not genuine; or

(B) are not being carried out in accordance with all or any or any of the conditions subject to which it was notified or approved; or

3. such fund or institution or trust or any university or other educational institution or any hospital or other medical institution has not complied with the requirement of any other law for the time being in force, and the order, direction or decree, by whatever name called, holding that such non-compliance has occurred, has either not been disputed or has attained finality,]

it may, at any time after giving a reasonable opportunity of showing cause against the proposed action to the concerned fund or institution or trust or any university or other educational institution or any hospital or other medical institution, rescind the notification or, by order, withdraw the approval, as the case may be, and forward a copy of the order rescinding the notification or withdrawing the approval to such fund or institution or trust or any university or other educational institution or any hospital or other medical institution and to the Assessing Officer:

[Provided also that in case the fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to in the first proviso makes an application on or after the 1st day of June, 2006. for the purposes of grant of exemption or continuance thereof, such application shall be made on or before the 30th day of September of the relevant assessment year from which the exemption is sought:]

Provided also that any anonymous donation referred to in section 115BBC on which tax is payable in accordance with the provisions of the said section shall be included in the total income :]

[Provided also that all pending applications, on which no notification has been issued under sub-clause (iv) or sub-clause (v) before the 1st day of June, 2007, shall stand transferred on that day to the prescribed authority and the prescribed authority may proceed with such applications under those sub-clause from the stage at which they were on that day:]

![]()

Following eighteenth proviso shall be substituted for existing eighteenth proviso to clause (23C) of section 10 by the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, w.e.f. 1-4-2021 :

Provided also that all applications made under the first proviso [as it stood before its amendment by the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020] pending before the Principal Commissioner or Commissioner, on which no order has been passed before the 1st day of April, 2021, shall be deemed to be an applications made under clause (iv) of the first proviso on that date:

Provided also that the income of a trust or institution referred to in sub¬clause (iv) or sub-clause (v) shall be included in its total income of the previous year if the provisions of the first proviso to clause (15) of section 2 become applicable to such trust or institution in the said previous year, whether or not any approval granted or notification issued in respect of such trust or institution has been withdrawn or rescinded :

Provided also that where the fund or institution referred to in sub-clause (iv) or the trustor institution referred to in sub-clause (v) has been notified by the Central Government or approved by the prescribed authority, as the case may be, or any university or other educational institution referred to in sub¬clause (via), has been approved by the prescribed authority, and the notification or the approval is in force for any previous year, then nothing contained in any other provision of this section [other than clause (1) thereof] shall operate to exclude any income received on behalf of such fund or trust or institution or university or other educational institution or hospital or other medical institution, as the case may be, from the total income of the person in receipt thereof for that previous year.

Explanation.- In this clause, where any income is required to be applied or accumulated, then, for such purpose the income shall be determined without any deduction or allowance by way of depreciation or otherwise in respect of any asset, acquisition of which has been claimed as an application of income under this clause in the same or any other previous year;

Section 10 (48C) any income accruing or arising to the Indian Strategic Petroleum Reserves Limited, being a wholly owned subsidiary of the Oil Industry Development Board under the Ministry of Petroleum and Natural Gas, as a result of arrangement for replenishment of crude oil stored in its storage facility in pursuance of directions of the Central Government in this behalf:

provided that nothing contained in this clause shall apply to an arrangement, if the crude oil is not replenished in the storage facility within three years from the end of the financial year in which the crude oil was removed from the storage the storage facility for the first time.

Tax Holiday for Units Established in Special Economic Zones [Section 10AA]

A deduction of profits and gains which are derived by an assessee being an entrepreneur from the export of articles or things or providing any service, shall be allowed from the total income of the assessee.

Assessees who are eligible for exemption

Exemption is available to all categories of assessees who derive any profits or gains from an undertaking, being a unit, engaged in the manufacturing or production of articles or things or provision of any service. Such assessee should be an entrepreneur referred to in section 2(j) of the SEZ Act, 2005 i.e., a person who has been granted a letter of approval by the Development Commissioner under section 15(9) of the said Act.

Essential conditions to claim exemption

The exemption shall apply to an undertaking which fulfils the following conditions:

It has begun to manufacture or produce articles or things or provide any service in any SEZ during the previous year relevant to A.Y.2006-07 or any subsequent assessment year but not later than A.Y.2020-21.

(i) The assessee should furnish in the prescribed form, before the date specified in section 44AB i.e., one month prior to the due date for furnishing return of income u/s 139(1), the report of a chartered accountant certifying that the deduction has been correctly claimed. Example: An individual, subject to tax audit u/s 44AB, claiming deduction u/s 10AA is required to furnish return of income on or before 31.10.2021 and the report of a chartered accountant before 30.9.2021, certifying the deduction claimed u/s 10AA.

![]()

Period for which deduction is available

The unit of an entrepreneur, which begins to manufacture or produce any article or thing or provide any service in a SEZ on or after 1.4.2005, shall be allowed a deduction of:

- 100% of the profits and gains derived from the export, of such articles or things or. from services for a period of 5 consecutive assessment years beginning with the assessment year relevant to the previous year in which the Unit begins to manufacture or produce such articles or things or provide services, and

- 50% of such profits and gains for further 5 assessment years.

- so much of the amount not exceeding 50% of the profit as is debited to the profit and loss account of the previous year in respect of which the deduction is to be allowed and credited to a reserve account (to be called the “Special Economic Zone Re-investment Reserve Account”) to be created and utilised in the manner laid down under section 10AA(2) for next 5 consecutive years.