Income of other Persons Included in Assessee’s Total Income – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Income of other Persons Included in Assessee’s Total Income – CA Inter Tax Question Bank

Question 1.

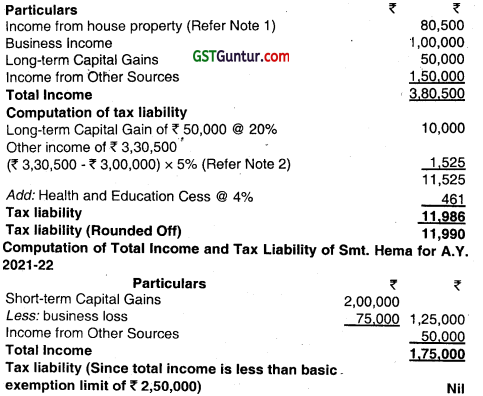

Shri Madan (age 67 years) gifted a building owned by him to his son’s wife Smt. Hema on 01-10-2020. The building fetched a rental income of ₹ 10,000 per month throughout the year. Municipal tax for the first half-year of ₹ 5,000 was paid in June, 2020 and the municipal tax for the second half-year was not paid till 30-09-2021.

Incomes of Shri Madan and Smt. Hema other than income from house property are given below:

| Name | Business income | Capital gain | Other sources |

| Shri. Madan | 1,00,000 | 50,000 (long-term) | 1,50,000 |

| Smt. Hema | -75000 | 2,00,000 (short-term) | 50,000 |

![]()

Note: Capital gain does not relate to gain from shares and securities. Compute the total income of Shri. Madan and Smt. Hema taking into account income from property given above and also compute their income-tax liability for the assessment year 202 1-22. (Nov 2011, 5 marks)

Answer:

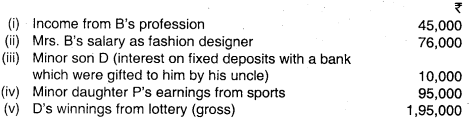

Computation of Total Income and Tax Liability of Smt. Hema for A.Y. 2021-22

Working Note:

1. As per Section 64(1 )(vi), the income arising to the son’s wife of an individual, directly or indirectly, from assets transferred to her, otherwise than for adequate consideration, by such individual, shall be included in the total income of the individual.

Therefore, the rental income from building transferred by Shri Madan to his son’s wife Smt. Hema without consideration on 01.10.2020 is includible in the hands of Shri Madan.

Computation of Income from House property

2. The basic exemption limit for A.Y. 2021-22 in respect of an individual who is of the age of 60 years or more but less than 80 years during the relevant previous year is ₹ 3,00,000. The same has been considered while calculating Madan’s tax liability.

![]()

Question 2.

Answer the question.

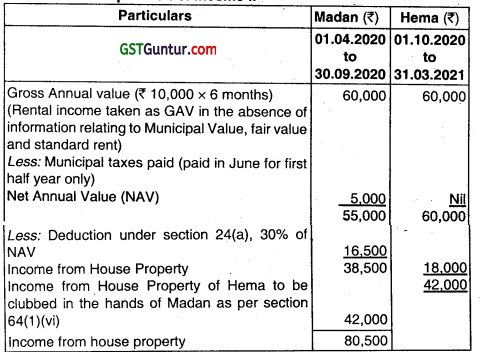

Mr. Sharma has four children consisting 2 daughters and 2 sons. The annual income of 2 daughters were ₹ 9,000 and ₹ 4,500 and of sons were ₹ 6,200 and ₹ 4,300 respectively. The daughter who has income of ₹ 4,500 was suffering from a disability specified under section 80U. Compute the amount of income earned by minor children to be clubbed in hands of Mr. Sharma. (May 2012, 4 marks)

Answer :

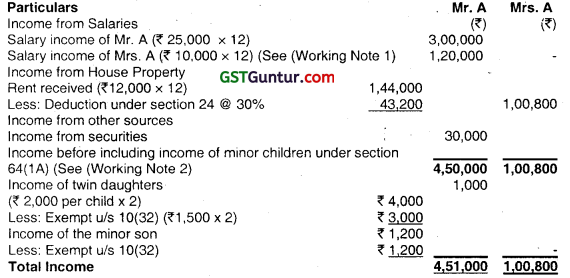

As per Section 64(1 A), in computing the total income of an individual, all such income accruing or arising to a minor child shall.be included. However, income of a minor child suffering from disability specified under Section 80U would not be included in the income of the parent but would be taxable in the hands of the minor child. Therefore, in this case, the inpome of daughter suffering from disability specified under section 80U should not be clubbed with the income of Mr. Sharma.

Under Section 10(32), income of each minor child includible in the hands of the parent under Section 64(1 A) would be exempt to the extent of the actual income or ₹ 1,500, whichever is lower. The remaining income’would be included in the hands of the parent.

![]()

Computation of income earned by minor children to be clubbed with the Income of Mr. Sharma

Note:

It has been assumed that:

- AIl the tour children are minor children;

- The income does not accrue or arise to the minor children on account of any manual work done by them or activity involving application of their skill, talent or specialized knowledge and experience;

- The income of Mr. Sharma, before including the minor children’s income, is greater than the income of Mrs. Sharma, due to which the income of the minor children would be included in his hands; and

- This is the first year in which clubbing provisions are attracted.

![]()

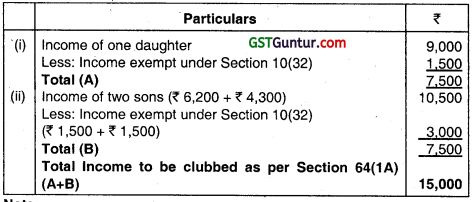

Question 3.

During the previous year 2020-21 the following transactions occurred in respect of Mr. A.

(a) Mr. A had a fixed deposit of ₹ 5,00,000 in Bank of India. He instructed the bank to credit the interest on the deposit @ 9% from 1 -4-2020 to 31 – 3-2021 to the savings bank account of Mr. B, son of his brother, to help him in his education.

(b) Mr. A holds 75% share in a partnership firm. Mrs. A received a commission of ₹ 25,000 from the firm for promoting the sales of the firm. Mrs. A oossesses no technical or professional qualification.

(c) Mr. A gifted a flat to Mrs. A on April 1,2020. During the previous year the flat generated a net income of ₹ 52,000 to Mrs. A.

(d) Mr. A gifted ₹ 2,00,000 to his minor son who invested the same in a business and he got a share income of ₹ 20,000 from the investment.

(e) Mr. A’s minor son derived an income of ₹ 20,000 through a business activity involving application of his skill and talent.

During the year Mr. A got a monthly pension of ₹ 10,000. He had no other income. Mrs. A received salary of ₹ 20,000 per month from a part time job.

Discuss the tax implications of each transaction and compute the total income of Mr. A, Mrs. A and their minor child. (May 2012, 8 marks)

Answer:

Computation of Total Income of Mr. A, Mrs. A and their minor son for the A.Y. 2021-22

![]()

Notes:

(1) As per section 60, in case there is a transfer of income without transfer of asset from which such income is derived, such income shall be treated as income of the transferor. Therefore, the fixed deposit interest of ₹ 45,000 transferred by Mr. A to Mr. B shall be included in the total income of Mr. A.

(2) As per Section 64(1 )(ii), in case the spouse of the individual receives any amount by way of income from any concern in which the individual has substantial interest (i.e. holding shares carrying at least 20% voting power or entitled to at least 20% of the profits of the concern), then, such income shall be included in the total income of the individual. The only exception is in a case where the spouse possesses any technical or professional qualifications and the income earned is solely attributable to the application of her technical or professional knowledge and experience, in which case, the clubbing provisions would not apply.

In this case, the commission income of ₹ 25,000 received by Mrs. A from the partnership firm has to be included in the total income of Mr. A, as Mrs. A does not possess any technical or professional qualification for earning such commission and Mr. A has substantial interest in the partnership firm as he holds 75% share in the firm.

(3) According to Section 27(i), an individual who transfers any house property to his or her spouse otherwise than for adequate consideration or in connection with an agreement to live apart, shall be deemed to be the owner of the house property so transferred. Hence, Mr. A shall be deemed to be the owner of the flat gifted to Mrs. A and hence, the income arising from the same shall be computed in the hands of Mr. A.

Note:

(i) If has been assumed that the net income from the flat i.e., ₹ 52,000 given in the question is the net income computed under the head “Income from house property”.

Note: Alternatively, the net income from the flat i.e., ₹ 52,000 given in the question may be taken as the net income before providing for deduction @ 30% under Section 24(a) and accordingly, the solution can be worked out on this basis.

(ii) The provisions of Section 56(2)(vii) would not be attracted in the hands of Mrs. A, since she has received immovable property without consideration from a relative i.e., her husband.

![]()

(4) As per Section 64(1 A), the income of the minor child is to be included in the total income of the parent whose total income (excluding the income of minor child to be so clubbed) is greater. Further, as per section 10(32), income of a minor child which is includible in the income of the parent shall be exempt to the extent of ₹ 1,500 per child.

Therefore, the income of ₹ 20,000 received by minor son from the investment made out of the sum gifted by Mr. A shall, after providing for exemption of ₹ 1,500 under Section 10(32), be included in the income of Mr. A, since Mr. A’s income of ₹ 2,42,000 (before including the income of the minor child) is greater than Mrs. A’s income of ₹ 2,40,000. Therefore, ₹ 18,500 (i.e., ₹ 20,000 – ₹ 1,500) shall be included in Mr. A’s income. It is assumed that this is the first year in which clubbing provisions are attracted.

Note:

(i) The provisions of Sec. 56(2)(vii) would not be attracted in the hands of the minor son, since he has received a sum of money exceeding ₹ 50,000 without consideration from a relative i.e., his father.

(ii) Since the question mentions “share income” from investment, it is possible to take a view that the same represents share income from a firm which is exempt under Section 10(2A), in which case the clubbing provisions under Section 64(1 A) cannot be applied.

(5) In case the income earned by the minor child is on account of any activity involving application of any skill or talent, then, such income of the minor child shall not be included in the income of the parent, but shall be taxable in the hands of the minor child.

Therefore, the income of ₹ 20,000 derived by Mr. A’s minor son through a business activity involving application of his skill and talent shall not be clubbed in the hands of the parent. Such income shall be taxable in the hands of the minor son.

![]()

Question 4.

MR. B is the Karta of a HUF, whose members derive income as given below:

Discuss the tax implications in the hands of Mr. and Mrs. B. (Nov 2012, 8 marks)

Answer:

Clubbing of income and other tax implications

As per the provisions of Section 64(1 A), in case the marriage of the parents subsist, the income of a minor child shall be clubbed in the hands of the parent whose total income, excluding the income of the minor child to be clubbed, is greater. In this problem, it has been assumed that the marriage of Mr. B and Mrs. B subsists.

Further, in case the income arises to the minor child on account of any manual work done by the child or as a result of any activity involving application of skill, talent, specialized knowledge or experience of the child, then, the same shall not be clubbed in the hands of the parent.

![]()

Tax Implications

(i) Income of ₹ 45,000 from Mr. B’s profession shall be taxable in the hands of Mr. B under the head “Profits and gains of business or profession’.

(ii) Salary of ₹ 76,000 received by Mrs. B as a fashion designer shall be taxable as “Salaries” in the hands of Mrs. B.

(iii) Income from fixed deposit of ₹ 10,000 arising to the minor.son D, shall be clubbed in the hands of the mother, Mrs. B as “Income from other sources”, since her income is greater than income of Mr. B before including the income of the minor child.

As per Section 10(32), income of a minor child which is includible in the income of the parent shall be exempt to the extent of ₹ 1,500 per child. The balance income would be clubbed in the hands of the parent as “Income from other sources”.

(iv) Income of ₹ 95,000 arising to the minor daughter P from sports shall not be included in the hands of the parent, since such income has arisen to the minor daughter on account of an activity involving application of her skill.

(v) Income of ₹ 1,95,000 arising to minor son D from lottery shall be included in the hands of Mrs. B as “Income from other sources”, since her Income is greater than the income of Mr. B before including the income of minor child. Note – She can reduce the tax deducted at source from such lottery income while computing her net tax liability.

![]()

Question 5.

Mr. A is an employee of Larsen Limited and has substantial interest in the company. His salary is ₹ 25,000 p.m. Mrs. A also is working in that company at a salary of ₹ 10,000 p.m. without any professional qualification.

Mr. A also receives ₹ 30,000 as income from securities, Mrs. A owns a house property which she has let out. Rent received from such house property is ₹ 12,000 p.m.

Mr. & Mrs. A have three minor children-two twin daughters and one son. Income of the twin daughters is ₹ 2,000 p.a. and that of his son is ₹ 1,200 p.a. Compute the income of Mr. and Mrs. A. (May 2013, 8 marks)

Answer:

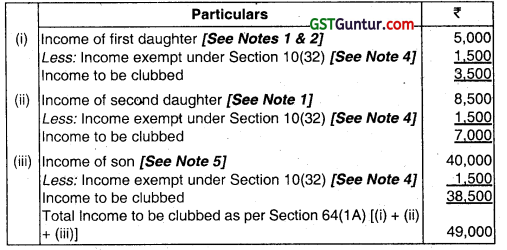

Computation of Total Income of Mr. A and Mrs. A for the A.Y. 2021-22

Working Notes:

(1) According to Section 64(1), in case the spouse of the individual receives any amount by way of income from any concern in which the individual has substantial interest, then, such income shall be included in the total income of the individual. The only exception is in a case where the spouse possesses any technical or professional qualifications and the income earned is solely attributable to the application of her technical or professional knowledge and experience, in which case, the clubbing provisions would not apply.

In the following case, the salary of ₹ 10,000 p.m. received by Mrs. Afrom the company has to be included in the total income of Mr. A, as Mrs. A does not possess any technical or professional qualification for earning such income and Mr. A has substantial interest in the company.

(2) According to Section 64(1 A), thd income of a minor child is to be included in the total income of the parent whose total income (excluding the income of minor child to be so clubbed) is greater. Further, as per section 10(32), income of a minor child which is includible in the income of the parent shall be exempt to the extent of ₹ 1,500 per child.

Hence, the income of minor children shall be included in the income of Mr. A, since Mr. A’s income of ₹ 4,50,000 (before including the income of the minor child) is greater than Mrs. A’s income of ₹ 1,00,800. .

![]()

Note – The above solution has been worked out on the basis of the following assumptions:

- It has been assumed that the income earned by the minor children is not on account of any activity involving application of any skill or talent.

- Rent received has been assumed as gross annual value in the absence of standard rent, municipal value and fair market value.

- Income of each twin daughter has been taken as ₹ 2,000 p.a.

Alternatively, the question can also be interpreted to mean that the cumulative income of the twin daughters is ₹ 2,000 p.a., in which case the income to be clubbed under Section 64(1 A) would be Nil, since the entire income would be exempt under Section 10(32). Consequently, the total income of Mr. A in such a case would be ₹ 4,50,000.

![]()

Question 6.

Mr. Mittal has four minor children consisting of three daughters and one son. The annual income of all the children for the Assessment Year 2021-22 were as follows:

First daughter (Including Scholarship received ₹ 5,000) – 10,000

Second Daughter – 8,500

Third Daughter (Suffering from disability specified U/s 80 U) – 4,500

Son – 40,000

Mr. Mittal gifted ₹ 2,00,000 to his minor Son who invested the same in the business and derived income of ₹ 20,000 which is included above. Compute the amount of Income earned by Minor Children to be clubbed in the hands of Mr. Mittal. (Nov 2014, 4 marks)

Answer:

Computation of income earned by minor children to be clubbed with the income of Mr. Mittal

Notes:

(1) As per Section 64(1 A), in computing the total income of an individual, all such income accruing or arising to his minor child shall be included.

(2) The income accruing or arising to a minor child on account of activity involving application of his/her skill, talent or specialized knowledge and experience is not includible in the total income of the parent. Therefore, scholarship received by the first daughter is not includible in the hands of Mr. Mittal, assuming that the same is received on account of skill, talent or specialized knowledge of the minor daughter. The balance income of ₹ 5,000 (₹ 10,000 – ₹ 5,000) is includible in the hands of Mr. Mittal after providing deduction of ₹ 1,500 under Section 10(32).

(3) Further, as per the provisions of Section 64(1 A), income of a minor child suffering from any disability of the nature specified in Section 80U would not be included in the total income of the parent. Therefore, in this case, the income of third daughter suffering from disability specified under Section 80U is not includible in the total income of Mr, Mittal.

(4) Under Section 10(32), income of each minor child includible in the hands *’ of the parent under Section 64(1 A) would be exempt to the extent of the actual income or ₹ 1,500, whichever is lower.

(5) The specific provision under Explanation 3 to Section 64 for inclusion of income from business where the assets transferred directly or indirectly by an individual are invested by the transferee in business are applicable in cases of transfer to spouse or son’s wife only. In case of minor, all income accruing or arising to him or her is, in any case, includible in the hands of the parent.

![]()

Question 7.

Mr. Ramesh gifted a sum of ₹ 5 lacs to his brother’s minor son on 16-4-2020. On 18-4-2020, his brother gifted debentures worth ₹ 6 lacs to Mrs. Ramesh. Son of Mr. Ramesh’ brother invested the amount in fixed deposit with Bank of India @ 9% p.a. interest and Mrs. Ramesh received interest of ₹ 45,000 on debentures received by her.

Discuss the implications under the provisions of the Income-tax Act, 1961. (May 2015, 4 marks)

Answer:

In the given case, Mr. Ramesh gifted a sum of ₹ 5 lacs to his brother’s minor son on 16.4.2020 and simultaneously, his brother gifted debentures worth ₹ 6 lacs to Mr. Ramesh’s wife on 18.4.2020. Mr. Ramesh’s brother’s minor son invested the gifted amount of ₹ 5 lacs in fixed deposit with Bank of India.

These transfers are in the nature of cross transfers. Accordingly, the income from the assets transferred would be assessed in the hands of the deemed transferor because the transfers are so intimately connected to form part of a single transaction and each transfer constitutes consideration for the other by being mutual or otherwise.

If two transactions are inter-connected and are part of the same transaction in such a way that it can be said that the circuitous method was adopted as a device to evade tax, the implication of clubbing provisions would be attracted.

![]()

As per Section 64(1 A), all income of’a minor child is includible in the hands of the parent, whose total income, before including minor’s income is higher. Accordingly, the interest income arising to Mr. Ramesh’s brother’s son from fixed deposits would be included in the total income of Mr. Ramesh’s brother, assuming that Mr. Ramesh’s brother’s total income is higher than his wife’s total income, before including minor’s income. Mr. Ramesh’s brother can claim exemption of ₹ 1,500 under section 10(32).

Interest on debentures arising in the hands of Mrs. Ramesh would be taxable in the hands of Mr. Ramesh as per section 64(1 )(iv).

This is because both Mr. Ramesh and his brother are the indirect transferors t of the income to their spouse and minor son, respectively, with an intention to reduce their burden of taxation.

In the hands of Mr. Ramesh, interest received by his spouse on debentures of ₹ 5 lacs alone would be included and not the entire interest income on the debentures of ₹ 6 lacs, since the cross transfer is only to the extent of ₹ 5 lacs.

Hence, only proportional interest (i.e., 5/6th of interest on debentures received) ₹ 37,500 would be includible in the hands of Mr. Ramesh.

The provisions of Section 56(2)(vii) are not attracted in respect of sum of money transferred or value of debentures transferred, since in both the cases, the transfer is from a relative.’

![]()

Question 8.

Discuss the taxability or otherwise in the. hands of the recipients, as per the provisions of the Income-tax Act, 1961: :

Mr. N, a member of his father’s HUF, transferred a house property to the HUF without consideration. The value of the house is ₹ 10 lacs as per the Registrar of stamp duty. (May 2016, 2 marks)

Answer:

Gift from a relative is not taxable in the hands of HUF.

Question 9.

Kamal gifted ₹ 10 lakhs to his wife, Sulochona on her birthday on, 1st January, 2020. Sulochona lent ₹ 5,00,000 out of the gifted amount to Krishna on 1st April, 2020 for six months on which she received interest of ₹ 50,000. The said sum of ₹ 50,000 was invested in shares of a listed company on 15th October, 2020, which were sold for ₹ 75,000 on 30th December, 2020. Securities transactions tax was paid on such sale. The balance amount of gift was invested as capital by Sulochona in a business. She suffered loss of ₹ 15,000 in the business in Financial Year 2020-21.

In whose hands the above income and loss shall be included in Assessment Year 2021 -22? Support your answer with brief reasons. (Nov 2017, 5 marks)

Answer:

As per Section 64(1 )(iv), in computing the total income of any individual, there shall be included all such income as arises directly or indirectly, to the spouse of such individual from assets transferred directly or indirectly, to the spouse by such individual otherwise than for adequate consideration or in connection with an agreement to live apart.

Accordingly, ₹ 50,000, being the amount of interest on loan received by Ms. Sulochana, wife of Mr. Kamal, would be includible in the total income of Mr. Kamal, since such loan was given by her out of the sum of money received by her as gift from her husband.

![]()

Assuming that the capital was invested in business by Ms. Sulochana on or before 1st April, 2020, and capital invested was entirely out of the funds gifted by her husband, the entire loss of ₹ 15,000 from the business carried on by Ms. Sulochana would also be includible in the total income of Mr. Kamal [As per Explanation 3 to Section 64(1 )(iv)].

If, however, it is assumed that capital invested was partly out of the funds gifted by her husband, the loss includible in the hands of Mr. Kamal has to be determined by apportioning the loss of ₹ 15,000 incurred during the year on the basis of the capital employed on 1.4.2019.

Since income includes loss as per Explanation 2 to Section 64, clubbing provisions would be attracted even if there is loss and not income.

The short-term capital gain of ₹ 25,000 (₹ 75,000, being the sale consideration less ₹ 50,000, being the cost of acquisition) arising in the hands of Ms. Sulochana from sale of shares acquired by investing the interest income of ₹ 50,000 earned by her (from the loan given out of the sum gifted to her by her husband), would not be included in the hands of Mr. Kamal.

Income from the accretion of the transferred asset is not liable to be included in the hands of the transferor and therefore such income is taxable in the hands of Ms. Sulochana. Since securities transaction tax has been paid, such short-term capital gain on sale of listed shares is taxable@ 15% in the hands of Ms. Sulochana.

![]()

Question 10.

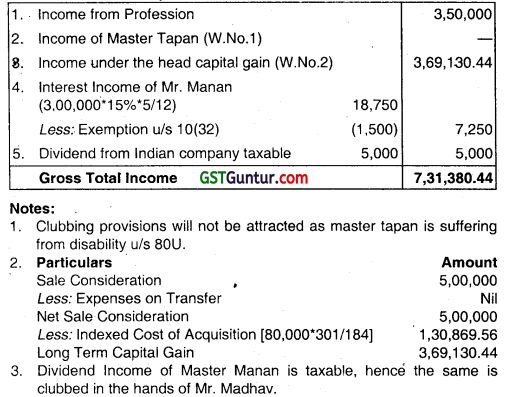

Mr. Madhav made a gift of ₹ 2,50,000 to his handicapped son, Master Tapan who was aged 12 years as on 31st March 2019, which he deposited in a fixed deposit account in a Nationalised bank at 10% interest p.a. compounded annually. The balance in this account as on 1st April, 2020 was ₹ 2,75,000 and the bank credited a sum of ₹ 27,500 as interest on 31st March, 2020.

Madhav’s father gifted equity shares worth ₹ 50,000 of an Indian company to Master Manan, another son of Mr. Madhav (Date of birth 10,sup>th April, 2011) in July 2011 which were purchased by him on 8th December, 2005 for ₹ 80,000. Manan received a dividend of ₹ 5,000 on these shares in October 2020. He sold these shares on 1st November, 2020 for ₹ 5,00,000 and deposited ₹ 3,00,000 in a company at 15% interest per annum.

Cost Inflation Index

Financial Year – Cost Inflation Index

2005-06 – 117

2011-12 – 184

2020-21 – 301

Mr. Madhav has a taxable income of ₹ 3,50,000 from his profession during the financial year 2020-21.

Compute his Gross Total Income for the A.Y. 2021 -22. (May 2018, 5 marks)

Answer:

Computation of Gross Total Income

![]()

Question 11.

Answer of the following.

Mrs. and Mr. Vinod Amin have two minor children M and N. The following are the receipts in the hands of M and N during the year ended 31-3-2021:

(i) M received a gift off ₹ 70,000 from her friend’s father on the occasion of her birthday.

(ii) M won a prize money of ₹ 3,00,000 in National Quiz Competition. This was invested in debentures of a company, from which interest of ₹ 1.9,000 (gross) accrued during the year.

(iii) N won prize in a lottery. The net amount received after deduction of tax at source was ₹ 1,05,000.

Mr. Vinod Amin’s income before considering clubbing provisions is higher than that of his wife. Discuss how these items will be considered for taxation under the provisions of the Income Tax Act, 1961. Detailed computation of income is not required. (Nov 2018, 5 marks)

Answer:

(i) Gift received from non-relative by minor daughter M

Gift of ₹ 70,000 received by minor daughter M, from non-relative would be taxable, since the amount of gift exceeds ₹ 50,000. It would be included in the hands of her father, Mr. Vinod Amin, since his income before considering clubbing provisions is higher than that of his wife.

![]()

(ii) Prize money of ₹ 3,00,000 in National Quiz Competition/Interest on debentures received by minor daughter M

Income derived by a minor child from any activity involving application of his/her skill, talent, specialised knowledge and experience is not to be included in the hands of parent. Hence, the prize money of ₹ 3,00,000 won in National Quiz Competition by minor daughter M from exercise of special talent would not be included in the income of either parent.

However, interest of ₹ 19,000 on debentures has to be included in the hands of her father, Mr. Vinod Amin, even if the investment is made out of income arising from application of special talent.

Exemption of ₹ 1,500 would be allowed in respect of the aggregate income of minor daughter M so included in the hands of Mr. Vinod Amin under section 10(32).

(iii) Winning from lottery by minor child N

Winnings of ₹ 1,50,000 (1,05,000 × 100/70) from lotteries by minor child N is includible in the hands of his father, Mr. Vinod Amin. Mr. Vinod Amin can claim credit of tax of ₹ 45,000 deducted at source from such lottery income.

Note : As regards availability of exemption under section 10(32) in respect of lottery income of minor child N includible in the hands of his father, there are two possible views. Since exemption of upto ₹ 1,500 under section 10(32) is available in respect of any income of minor child includible in the total income of parent, one view is that such exemption would also be ‘ available in respect of lottery income of a minor child includible in the hands of parent.

The alternate view is that since as per section 58(4), no deduction is allowable in respect of any expenditure or allowance in connection with lottery income under any provision of the Income-tax Act, 1961, exemption under section 10(32) would also not be available in respect of such income of minor child includible in the hands of the parent.

Further, lottery income is subject to tax at a flat rate of 30%, and hence, if any exemption is allowed in respect of such income, it would reduce the tax liability and the effective rate of tax.

![]()

Question 12.

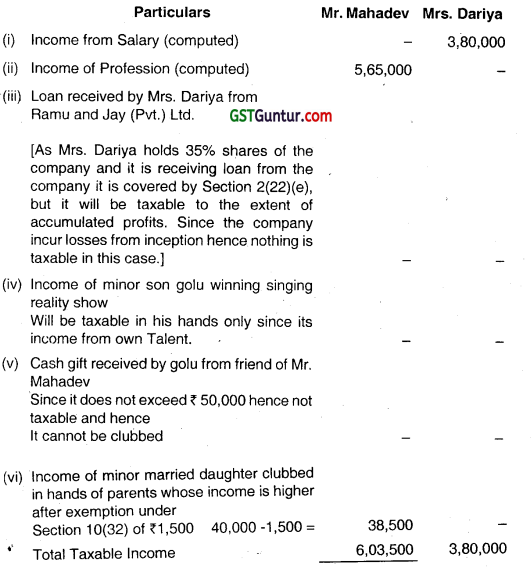

Mr. Mahadev, a noted bhajan singer of Rajasthan and his wife Mrs. Dariya furnish the following information relating to the Assessment Year 2021-22.

| ₹ | ||

| 1 | Income of Mr. Mahadev – professional bhajan singer (computed) | 5,65,000 |

| 2 | Salary income of Mrs. Dariya (computed) | 3,80,000 |

| 3 | Loan received by Mrs. Dariya from Ramu & Jay (Pvt) Ltd. (Mrs. Dariya holds 35% shares of the Co. The Co. has incurred losses since its inception 2 years back) | 2,50,000 |

| 4 | Income of their minor son Golu from winning singing reality show on T.V. | 2,50,000 |

| 5 | Cash gift received by Golu from friend of Mr. Mahadev on winning the show | 21,000 |

| 6 | Interest income received by minor married daughter Gudia from deposit with Ramu & Jay Pvt Ltd. | 40,000 |

![]()

Compute total taxable income of Mr. Mahadev & Mrs Dariya for the Assessment Year 2021-22. (Nov 2019, 5 marks)

Answer:

Computation of total taxable income of Mr. Mahadev and Mrs. Dariya for the Assessment Year 2021-22

![]()

Question 13.

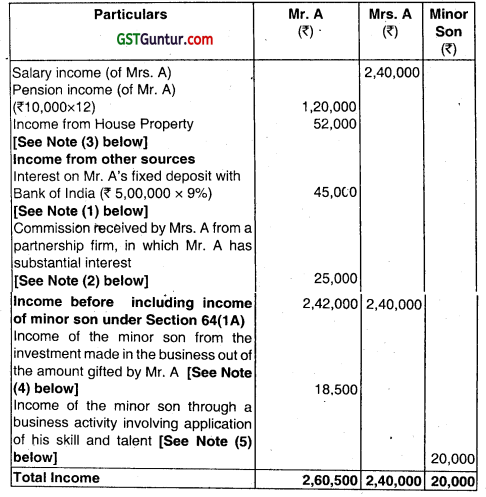

Determine the Gross total income of Shri Ram Kumar and Smt Ram Kumar for the assessment year 2021-22 from the following :

(i) Salary received by Shri Ram Kumar from a company ₹ 1,80,000 per annum and Smt Ram Kumar also doing job in a company and getting salary of ₹ 2,40,000 per annum.

(ii) Shri Ram Kumar transferred a flat to his wife Smt Ram Kumar on 1st September, 2020 for adequate consideration. The rent received from this let-out flat is ₹ 9,000 per month.

(iii) Shri Ram Kumar and his wife Smt. Ram Kumar both are partners in a firm. Shri Ram Kumar received ₹ 36,000 and Smt. Ram Kumar received ₹ 64,000 as interest from the firm and also had a share of profit of ₹ 12,000 and ₹ 26,000 respectively.

(iv) Smt. Ram Kumar transferred 10% debentures worth ₹ 3,00,000 to Shri Ram Kumar. The whole amount of ₹ 3,30,000 invested by Shri Ram Kumar in the similar investments and earned income of ₹ 39,000.

(v) Mother of Shri Ram Kumar transferred a property to Master Rohit (son of Shri Ram Kumar) in the year 2019. Master Rohit (Aged 13 years) received of ₹ 15,000 as income from this property on 20th February, 2021. (Nov 2020, 6 marks)

![]()

Question 14.

Mr. Vaibhav started a proprietary business on 01.04.2019 with a capital of ₹ 5,00,000. He incurred a loss of ₹ 2,00,000 during the year 2019-20. To overcome the financial position, his wife Mrs. Vaishaly, a software Engineer, gave a gift of ₹ 5,00,000 on 01.04.2020, which was immediately invested in the business by Mr. Vaibhav. He earned a profit of ₹ 4,00,000 during the year 2020-21. Compute the amount to be clubbed in the hands of Mrs. Vaishaly for the Assessment Year 2021 -22. If Mrs. Vaishaly gave the said amount as loan, what would be the amount to be clubbed?

Answer:

Section 64(1 )(iv) of the Income-tax Act, 1961 provides for the clubbing of income in the hands of the individual, if the income earned is from the assets (other than house property) transferred directly or indirectly to the spouse of the individual, otherwise than for adequate consideration or in connection with an agreement to live apart.

In this case, Mr. Vaibhav received a gift of ₹ 5,00,000 on 1.4.2020 from his wife Mrs. Vaishaly, which he invested in his business immediately. The income to be clubbed in the hands of Mrs. Vaishaly for the A.Y. 2021-22 is computed as under:

![]()

| Particulars | Mr. Vaibhav’s capital contribution (₹) | Capital contribution out of gift from Mrs. Vaishaly (₹) | Total (₹) |

| Capital as on 1.4.2020 | 3,00,000 (5,00,000 – 2,00,000) | 5,00,000 | 8,00,000 |

| Profit for P.Y. 2020-21 to be apportioned on the basis of capital employed on the first day of the previous year i.e. as on 1.4.2020 (3:5) | 1,50,000 (4,00,000 × \(\frac{3}{8}\)) |

2,50,000 (4,00,000 × \(\frac{5}{8}\)) |

4,00,000 |

Therefore, the income to be clubbed in the hands of Mrs. Vaishaly for the A.Y. 2021-22 is ₹ 2,50,000.

In case Mrs. Vaishaly gave the said amount of ₹ 5,00,000 as a bona tide loan, then, clubbing provisions would not be attracted.

Note: The provisions of Section 56(2)(x) would not be attracted in the hands of Mr. Vaibhav, since he has received a sum of money exceeding ₹ 50,000 without consideration from a relative i.e., his wife.

![]()

Question 15.

Mrs. Kasturi transferred her immovable property to ABC Co. Ltd. subject to a condition that out of the rental income, a sum of ₹ 36,000 per annum shall be utilized for the benefit of her son’s wife.

Mrs. Kasturi claims that the amount of ₹ 36,000 (utilized by her son’s wife) should not be included in her total income as she no longer owned the property.

State with reasons whether the contention of Mrs. Kasturi is valid in law.

Answer:

The clubbing provisions under Section 64(1 )(viii) are attracted in case of transfer of any asset, directly or indirectly, otherwise than for adequate consideration, to any person to the extent to which the income from such asset is for the immediate or deferred benefit of son’s wife.

Such income shall be included in computing the total income of the transferor-individual. Therefore, income of ₹ 36,000 meant for the benefit of daughter-in-law is chargeable to tax in the hands of transferor i.e., Mrs. Kasturi in this case. The contention of Mrs. Kasturi is, hence, not valid in law.

Note: In order to attract the clubbing provisions under Section 64(1)(viii), the transfer should be otherwise than for adequate consideration. In this case, it is presumed that the transfer is otherwise than for adequate consideration and therefore, the clubbing provisions are attracted.

If it is presumed that the transfer was for adequate consideration, the provisions of Section 64(1 )(viii) would not be attracted.

![]()

Question 16.

A proprietary business was started by Smt. Rani in the year 2018. As on 1.4.2019 her capital in business was ₹ 3,00,000.

Her husband gifted ₹ 2,00,000 on 10.4.2019 which amount Smt. Rani invested in her business on the same date. Smt. Rani earned profits from her proprietory business for the Financial year 2019-20 ₹ 1,50,000 and Financial year 2020-21 ₹ 3,90,000. Compute the income, to be clubbed in the hands of Rani’s husband for the Assessment year 2021-22 with reasons.

Answer:

Section 64(1) of the Income-tax Act, 1961 provides for the clubbing of income in the hands of the individual, if the income earned is from the assets transferred directly or indirectly to the spouse of the individual, otherwise than for adequate consideration. In this case Smt. Rani received a gift of ₹ 2,00,000 from her husband which she invested in her business. The income to be clubbed in the hands of Smt. Rani’s husband for AY. 2021-22 is computed as under:

![]()

| Particulars | Smt. Rani’s Capital Contribution | Capital Contribution Out of gift from husband | Total |

| ₹ | ?₹ | ?₹ | |

| Capital as at 1.4.2019 | 3,00,000 | — | 3,00,000 |

| Investment on 10.04.2019 out of gift received from her husband | 2,00,000 | 2,00,000 | |

| 3,00,000 | 2,00,000 | 5,00,000 | |

| Profit for F.Y. 2019-20 to be apportioned on the basis of capital employed on the first day of the previous year i.e., on 1.4.2019 | 1,50,000 | 1,50,000 | |

| Capital employed as at 1.4.2020 | 4,50,000 | 2,00,000 | 6,50,000 |

| Profit for F.Y.2020-21 to be apportioned on the basis of capital employed as at 1.4.2020 (i.e., 45 : 20) | 2,70,000 | 1,20,000 | 3,90,000 |

Therefore, the income to be clubbed in the hands of Smt. Rani’s husband for AX. 2021- 22 is ₹ 1,20,000.

![]()

Multiple Choice Question

Question 1.

Sections related to clubbing of income-

(a) Section 60 to 69

(b) Section 60 to 64

(c) Section 60 to 67

(d) Section 68 to 69

Answer:

(b) Section 60 to 64

Question 2.

Mr. ‘X’ transfers his house property to Mr. Y with a condition that 25% of the income therefrom should be handed over to him. Mr. Y earns ₹ 1,00,000 from such house property. In this case —

(a) Total amount ₹ 1,00,000 shall be assessed in the hands of X.

(b) Only ₹ 25,000 will be assessed in the hands of X.

(c) ₹ 25,000 will be assessed in the hands of X and ₹ 75,000 will be assessed in the hands of Y.

(d) Total amount ₹ 1,00,000 shall be assessed in the hands of Y.

Answer:

(c) ₹ 25,000 will be assessed in the hands of X and ₹ 75,000 will be assessed in the hands of Y.

![]()

Question 3.

Substantial interest for the purpose of clubbing provision u/s64(I)(ii) shall be of:

(a) The individual only

(b) The individual and his spouse taken together

(c) The individual along with his relatives

(d) None of the above

Answer:

(c) The individual along with his relatives

Question 4.

Relative for the purpose of Section 64(1 )(ii) shall include:

(a) spouse, brother and sister of the individual

(b) spouse, brother, sister or any lineal ascendant or descendent of that individual

(c) spouse, children and dependent brotherss and sisters of the individual

(d) spouse, children, dependent parents, dependent brothers and sisters of the individual

Answer:

(b) spouse, brother, sister or any lineal ascendant or descendent of that individual

Question 5.

As per Section 64(i)(iv), there shall be included in the income of an individual, any income arising from the gift to the spouse of:

(a) Any capital asset’

(b) Any asset

(c) Any asset other than house property

(d) None of the above

Answer:

(c) Any asset other than house property

![]()

Question 6.

Mr. A, a fashion designer having lucrative business, pays salary to his wife, who is a model. Remuneration received by Mrs. A shall be included in the total income of:

(a) Mrs. A

(b) Mr. A

(c) Mrs. A or Mr. A (whose total income is higher before this clubbing)

(d) Mr. A and Mrs. A proportionately.

Answer:

(a) Mrs. A

Question 7.

The Shares of Jetha Ltd. are held by Mr. Jetha 8%, Mrs. Jetha 10% and Mrs. Jetha’s Father-in-law 6%. Who amongst the following have substantial interest in Jetha Ltd.?

(a) Mr. Jetha

(b) Mrs. Jetha

(c) Mr. Jetha and Mrs. Jetha, both

(d) Neither Mr. Jetha, nor Mrs. Jetha

Answer:

(a) Mr. Jetha

Question 8.

Ranjan has sold 2000, 14% debentures of ₹ 100 each to his wife for ₹ 90,000. The market value of debentures on the date of transfer was ₹ 1,80,000. In this case, interest income to be included in the total income of R shall be:

(a) ₹ 28,000

(b) ₹ 14,000

(c) ₹ 25,200

(d) ₹ 12,600

Answer:

(b) ₹ 14,000

![]()

Question 9.

A has gifted ₹ 10,00,000 to his wife on 1.4.2017 The wife invested the above sum as capital contribution to the firm where she is a partner and earned interest every year. The total capital of Mrs. R as on 1.4.2020 including 3 years interest was ₹ 15,00,000. During the year she earned ₹ 2,70,000 as interest on such capital balance. The income to be clubbed in the hands of R shall be:

(a) ₹ 2,70,000

(b) ₹ 1,80,000

(c) Nil

(d) ₹ 90,000

Answer:

(b) ₹ 1,80,000

Question 10.

Mr. Ghose has four minor children consisting 2 daughters and 2 sons. The Annual income of 2 daughters was ₹ 7,500 and ₹ 5,000 and of sons was ₹ 5,500 and ₹ 1,250 respectively. The daughter who was having income of ₹ 5,000 was suffering from a disability specified under Section 80U. Work out the amount of income earned by minor children to be clubbed in the hands of Mr. Ghose.

(a) ₹ 19,250

(b) ₹ 14,250

(c) ₹ 9,750

(d) ₹ 10,000

Answer:

(d) ₹ 10,000