Income from Salaries – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Income from Salaries – CA Final DT Question Bank

Question 1.

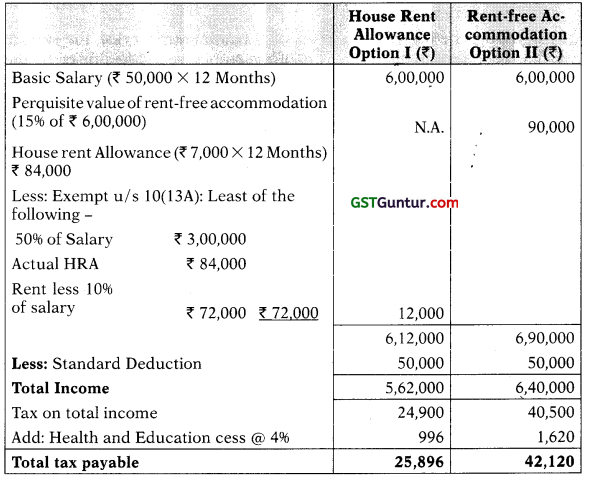

Mr. Jainani is entitled to a salary of ₹ 50,000 p.m. He is given an option by his employer cither to take house rent allowance or a rent free accommodation which is owned by the company. The HRA amount payable was ₹ 7,000 p.m. The rent for the hired accommodation was ₹ 11,000 p.m. at New Delhi. Advice Mr. Jainam whether it would be beneficial for him to avail HRA or Rent Free Accommodation. Give your advice on the basis of “Net Take Home Cash benefits” assuming that he does not opt for Sec. 115BAC. [CA Final Nov. 2009] [6 Marks]

Answer:

Computation of tax liability of Jainam under both the options

Net take Home Cash flows

| Option I HRA (₹) | Option II RFA (₹) | |

| Inflow: Salary (Basic salary + HRA) | 6,84,000 | 6,00,000 |

| Less: Outflow: Rent paid | 1,32,000 | – |

| Tax on total income | 25,896 | 42,120 |

| Net inflow | 5,26,104 | 5,57,880 |

Since the net cash inflow under option II (RFA) is higher than in option I (HRA), it is benclicial for Mr. Jainam to avail Option 11, i.e. RenL free accommodation.

![]()

Question 2.

Discuss the taxability of the Balance amount withdrawn by an employee from the recognized provident fund at the time of leaving the service? [CA Final May 2010] [5 Marks]

Answer:

As per section 10(12), the accumulated balance due and becoming payable to an employee participating in a recognised provident fund shall be excluded from the computation of his total income-

- if he has rendered continuous service with his employer for a period of five years or more, or

- if, though he has not rendered such continuous service, the service has been terminated by reason of the employee’s ill-health, or by the contraction or discontinuance of the employer’s business or any other cause beyond the control of the employee, or

- if, on the cessation of his employment, the employee obtains employment – with any other employer, to the extent the accumulated balance due and becoming payable to him is transferred to his individual account in any recognised provident fund maintained by such other employer.

However in a situation mentioned under clause (iii) above for calculating period of service for clauses (i) and (ii) above the period for which such employee rendered continuous service under his former employer or employers aforesaid shall also be included.

In any other case, the accumulated balance of recognised provident fund shall be taxable in the hands of the employee at the time of leaving of services.

![]()

Question 3.

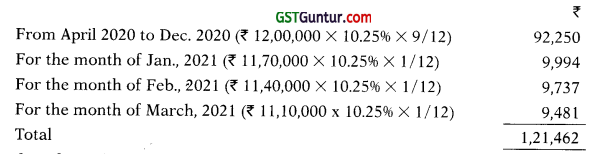

Sanket has taken an interest-free loan of ₹ 12 lakhs from his company. The amount is utilized by him for purchasing a house on 30.06.2019. The house is self-occupied. As per the scheme of the company, loan would be s recovered in 40 equal monthly instalments recoverable immediately after the completion of 18th month from the date of purchase. Assuming the 1 SBI lending rate of similar loan on 1.4.2020 was 10.25%. Calculate the perquisite value of such loan in the hands of Sanket for the A.Y. 2021-22. Is it possible to get deduction of perquisite value of interest under section 24(5)? Does it make any difference, if the house is given on rent? [CA Final Nov. 2010] [4 Marks]

Answer:

First instalment will be due on 1 st January, 2021. Amount of instalment to be repaid will be: ₹ 12,00,000 ÷ 40 = ₹ 30,000. Value of perquisite for interest-free loan will be calculated by applying the interest rate charged by the State Bank of India on the first day of the relevant previous year, on the outstanding amount of loan as reduced by the interest, if any, actually paid by the employee. Therefore, the value of perquisite will be as follows:

Therefore, the perquisite value of interest-free loan will be ₹ 1,21,462.

Interest paid or payable on capital borrowed for the purchase, construction, re-construction, repair or renewals of house property is deductible under section 24(5). In this case, capital is borrowed from the employer without interest. There is no interest paid or payable in respect of the amount of loan of? 12 lakhs. Consequently, no deduction u/s 24(5) would be available even though the interest benefit is taxable as perquisite, whether the house is self-occupied or let out.

![]()

Question 4.

Mr. Divyesh avails the benefit of LTC and went by air (economy class) on a holiday in India on 25.01.2021 along with his wife and three children consisting of son aged 4 years and twin daughters of 1 year age. Total cost of tickets reimbursed by his employer was ₹ 1,20,000 (₹ 90,000 for 2 adults and ₹ 30,000 for the three children). State with reasons the amount which can be claimed by Mr. Divyesh out of the reimbursement as not subject to tax? Will your answer be different where among his three children the twin daughters were of 4 years of age and the age of the son was of 1 year? [CA Final May 2011] [4 Marks]

Answer:

Exemption for LTC u/s 10(5) is available to employee only in respect of fare for going anywhere in India along with family twice in a block of 4 years. The maximum amount of exemption in this case is:

- Actual air fare incurred by Mr. Divyesh; or

- The amount of economy class air fare of Air India (the National Carrier) by shortest route,

whichever is lower.

The above exemption shall not be available for more than 2 children of the assessee. However, this restriction does not apply in case of multiple births after the first child. If twin daughters were born after the birth of the first child, Mr. Divyesh can avail the benefit of exemption in respect of air fare reimbursed by the employer for all the three children. But, if the son was born after the birth of twin daughters, then the benefit of exemption in respect of the air fare reimbursed by the employer pertaining to the third child, i.e., ₹ 10,000 shall not be available.

![]()

Question 5.

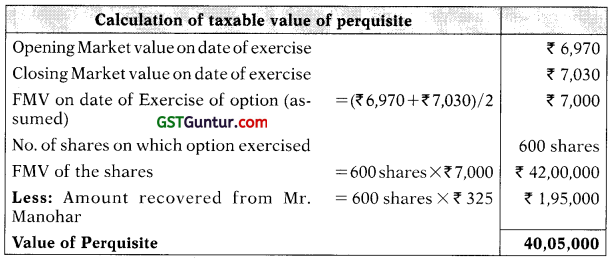

Mr. Manohar is working with Hans Ltd for the last 10 years. He was granted an option on 01.07.2018 by the Company to purchase 1000 equity shares at a price of ₹ 325 per share. The period during which the option can be exercised commence on 01.07.2018 and end on 31.03.2021. Mr. Manohar exercised the option on 15.03.2020 to purchase 600 shares. The opening and closing price on the said date was ₹ 6,760 per share and ₹ 6,800 per share respectively on the Bombay Stock Exchange and ₹ 6,970 per share and ₹ 7,030 per share respectively on the National Stock Exchange. The NSE has recorded the higher volume of trading in that share.

The Company has allotted him 600 shares on 24th April, 2020. The opening and closing on the date of allotment was ₹ 7,290 per share and ₹ 7,310 per share respectively on NSE and ₹ 7,200 per share and ₹ 7,240 per share on the BSE that has recorded the higher volume of trading in that share. The option was granted for making available’ rights in the nature of Intellectual Property Rights.

Determine the taxability of Perquisite. Does it make any difference if the option was granted for providing Technical Know how? [CA Final May 2011] [4 Marks]

Answer:

The perquisite is taxable in the previous year in which shares are allotted for making available right in the nature of intellectual property. The taxable value of such shares shall be the fair market value of such shares on the date on which the option is exercised by the assessee, as reduced by any amount actually paid by, or recovered from, the assessee in respect of such shares.

As per Rule 40C of the Income-tax Rules, 1962, the fair market value of a share on the date of exercising the option shall be the average of opening price and closing price of the share on the recognised stock exchange which records the highest volume of trading in the share.

It will not make any difference whether sweat equity shares option was granted for making available rights in the nature of intellectual property rights or for providing technical know-how.

![]()

Question 6.

Mr. Ramanand, after putting 25 years of service, opted for voluntary retirement and under approved scheme received an amount of ₹ 20 lakhs as VRS compensation on 01.01.2021. He was advised by his tax consultant to claim exemption to the extent as specified in section 10(10C) and also the relief under section 89. He consults you and asks whether such a treatment of VRS compensation is permissible under the Act. [CA Final May 2011] [4 Marks]

Answer:

To prevent employees from claiming both the relief u/s 10(10C) and u/s 89, the following provisos are laid down:

(i) Proviso to Sec. 10(10C): Where any relief has been allowed to an assessee u/s 89 for any A.Y. in respect of any amount received or re-ceivable on his voluntary retirement, no exemption under this clause shall be allowed to him in relation to such, or any other, assessment year.

(ii) Proviso to Sec. 89: When an assessee has claimed exemption u/s 10(10C) in respect of such, or any other, assessment year, then no such relief shall be granted in respect of any amount received or receivable on his voluntary retirement or termination of his service, in accordance with any scheme or schemes of voluntary retirement or in the case of a public sector company referred to section a scheme of voluntary separation.

Thus, where any relief is allowed u/s 89 for any A.Y. in respect of any amount received or receivable on voluntary retirement, no exemption u/s 10(10C) shall be allowed in respect of the said sum in that A.Y. or any other A.Y. Similarly, relief u/s 89 cannot be claimed if benefit of exemption has been claimed u/s 10(10C).

![]()

In the present case Mr. Ramanand can opt to claim exemption of ₹ 5 lakhs under section 10(10C) or relief under section 89(1) in respect of compensation received on voluntary retirement, but not both.

Therefore, in the given case, an employee cannot claim both the exemption under section 10(10C) and relief under section 89 and the advice given by his tax consultant is not correct.