Income from Other Sources – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Income from Other Sources – CA Inter Tax Question Bank

Question 1.

Answer the following:

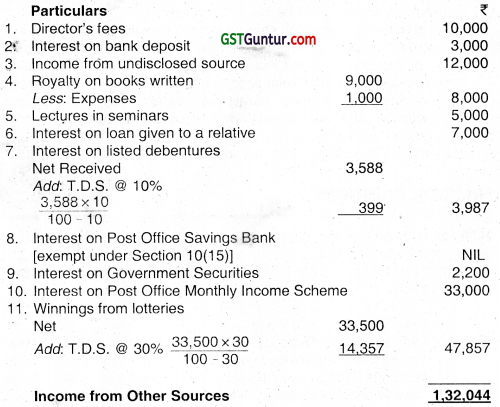

From the following particulars of Pankaj for the previous year ended 31st March, 2021 compute the Income under the head “Income from other Sources”:

(i) Directors Fee from a Company – ₹ 10,000

(ii) Interest on bank Deposits – ₹ 3,000

(iii) Income from undisclosed source – ₹ 12,000

(iv) Winnings from Lotteries (Net) – ₹ 33,500

(v) Royalty on a book written by him – ₹ 9,000

(vi) Lectures in Seminars – ₹ 5,000

(vii) Interest on loan given to a relative – ₹ 7,000

(viii) Interest on Debentures of a Company (listed in a Recognised Stock Exchange) Net of Taxes – ₹ 3,588

(ix) Interest on Post Office Savings Bank Account – ₹ 500

(x) Interest on Government Securities – ₹ 2,200

(xi) Interest on Monthly Income Scheme of Post-office – ₹ 33,000

He paid ₹ 1,000 for typing the manuscript of book written by him. (Nov 2009, 6 marks)

Answer :

Computation of income of Pankaj chargeable under the head from other sources” for the A.Y. 2021-22 Particulars

Note:

Royalty income would be charged to tax under the head “Income from Other Sources”, only if it is not chargeable to tax under the head “Profits and gains of business or profession”. This problem has been solved assuming that the same is not taxable under the head “Profits and gains of business or profession” and hence, is chargeable to tax under the head “Income from other sources”.

![]()

Question 2.

Answer the following :

The following details have been furnished by Mrs. Hemali, pertaining to the year ended 31-3-2021 :

(i) Cash gift of ₹ 51,000 received from her friend on the occasion of her “Shastiaptha Poorthi”, a wedding function celebrated on her husband completing 60 years of age. This was also her 25th wedding anniversary.

(ii) On the above occasion, a diamond necklace worth ₹ 2 lacs was presented by her sister living in Dubai.

(iii) When she celebrated her daughter’s wedding on 21-2-2021, her friend assigned in Mrs. Hemali’s favour, a fixed deposit held by the said friend in a scheduled bank; the value of the fixed deposit and the accrued interest on the said date was ₹ 51,000.

Compute the income, if any, assessable as income from other sources. (May 2011, 4 marks)

Answer :

(i) Any sum of money received by an individual on the occasion of the marriage of the individual is exempt. This provision is, however, not applicable to a cash gift received during a wedding function celebrated on completion of 60 years of age.

The gift of ₹ 51,000 received from a non-relative is, therefore, chargeable to tax under section 56(2)(vii) in the hands of Mrs. Hemali.

(ii) The provisions of Section 56(2)(vii) are not attracted in respect of any sum of money or property received from a relative. Thus, the gift of diamond necklace received from her sister is not taxable under section 56(2)(vii), even though jewellery falls within the definition of “property”.

(iii) Exemption from Section 56(2)(vii) is applicable if the property should be received on the occasion of the marriage of the individual, not that of the individual’s son or daughter. Therefore, this exemption provision is not attracted in this case.

Any sum of money received without consideration by an individual is chargeable to tax under Section 56(2)(vii), if the aggregate value exceeds ₹ 50,000 in a year. “Sum of money” has, however, not been defined under Section 56(2)(vii).

![]()

Therefore, there are two possible views in respect of the value of fixed deposit assigned in favour of Mrs. Hemali :

1. The first view is that fixed deposit does not fall within the meaning of “sum of money” and therefore, the provisions of Section 56(2)(vii) are not attracted. It may be noted that fixed deposit is also not included in the definition of “property”.

2. However, another possible view is that fixed deposit assigned in favour of Mrs. Hemali falls within the meaning of “sum of money” received.

Income assessable as “Income from other sources”

As per first view, the total amount chargeable to tax as “Income from other sources” would be ₹ 51,000, being cash gift received from a friend on her Shastiaptha Poorthi.

As per the second view, the provisions of Section 56(2)(vii) would be attracted in respect of the fixed deposit assigned and the “Income from other sources” of Mrs. Hemali would be ₹ 1,02,000 (₹ 51,000 + ₹ 51,000)’.

![]()

Question 3.

Discuss the taxability or otherwise in the hands of the recipients, as per the provisions of the Income-tax Act, 1961:

Mr. Kumar gifted a car to his sister’s son (Sunil) for achieving good marks in CA Final exam. The fair market value of the car is ₹ 5,00,000. (May 2016, 2 marks)

Answer:

Not Taxable. Car is not a property u/s 56(2).

Question 4.

Mr. Rakesh has 15% share holding in RSL (P) Ltd. and has also 50% share in Rakesh & Sons, a partnership firm.

The accumulated profit of RSL (P) Ltd. is 20 Lakh. Rakesh & Sons had taken a lean of ₹ 25 Lakh, from RSL (P) Ltd. Explain, whether the above loan is treated as dividend, as per the provision of Income Tax Act, 1961. (Nov 2016, 4 marks)

Answer:

As per Section 2(22)(e), any payment by a company, not being a company in which public are substantially interested, of any sum by way of advance or loan:

- to a shareholder, being a person who is the beneficial owner of shares holding not less than 10% of voting power, or

- to any concern in which such shareholder is a partner and in which he has a substantial interest (i.e., he is beneficially entitled to not less than 20% of the income of such concern) is deemed as dividend, to the extent the company possesses accumulated profits.

In the present case, the loan given by RSL(P) Ltd. to Rakesh & Sons, a partnership firm would be deemed as dividend, since Mr. Rakesh is the beneficial owner of 15% shareholding in RSL(P) Ltd. and also has substantial interest in Rakesh & Sons (as he is beneficially entitled to 50% of the income of the firm).”

However, the amount of loan would be deemed as dividend only to the extent RSL(P) Ltd. possesses accumulated profits. Therefore, out of the loan of ₹ 25 lakhs given to Rakesh & Sons, only ₹ 20 lakhs, being the amount of accumulated profit of RSL (P) Ltd., would be deemed as dividend.

![]()

Question 5.

State with reason whether the following receipt is taxable or not under the provision of Income-tax Act, 1961 ?

Mr. Suri received a sum of ₹ 5,00,000 as compensation, from ‘Yatra Foundation’, towards the loss of property on account of Flood Disaster at Chennai during December 2020. (Nov 2016, 2 marks)

It is assumed that lending of money is not a substantial part of business of RSL (P) Ltd.

Answer:

Taxability of receipt under the provision of the Income-tax Act, 1961

| Taxable/ Not Taxable | Reason |

| Taxable | As per Section 10(10BC), any amount received or receivable as compensation by an individual, on account of any loss or damage caused by disaster, from the Central Government, State Government or a local authority is exempt from tax, to the extent the individual has not been allowed deduction under any other provision of the Income-tax Act, 1961.

However, in this case, since Mr. Suri has received a compensation of ₹ 5 lakhs from Yatra Foundation, and not the Central or State Government or local authority, no exemption will be available under Section 10(10BC). |

![]()

Question 6.

Discuss the taxability of the following receipts in the hands of Mr. Sanjay Kamboj under the Income Tax Act, 1961 for A.Y. 2021-22 :

(i) ₹ 51,000 received from his sister living in US on 1-6-2020.

(ii) Received a car from his friend on payment of ₹ 2,50,000, the FMV of which was ₹ 5,50,000.

Provisions of taxability or Non-taxability must be discussed. (May 2018, 3 marks)

Answer:

Computation of Income from other sources:

(i) Gift received from relative is not taxable irrespective of amount. Since in the give case gift is received by sanjay from his sister, hence not taxable.

(ii) As per Sec. 56(2)(vii), motor car is not a movable property, hence in the given case it will not be chargeable to tax irrespective of amount.

![]()

Question 7.

Examine with brief reasons, whether the following are chargeable to income-tax and the amount liable to tax with reference to the provisions of the Income Tax Act, 1961:

During the previous year 2020-21, Mrs. Aishwarya, resident, received a sum of ₹ 8,50,000 as dividend from Indian companies and ₹ 4,00,000 as dividend from Indian equity oriented mutual fund units. (Nov 2018, 2 marks)

Answer:

| Chargeability | Amount liable to tax (₹) | Reason |

| Not Taxable | 8,50,000 | As per section 10(34), dividend received upto ₹ 10 lakhs from Indian companies taxable in the hands of shareholder.

As per section 10(35), income received from units of mutual fund is exempt. Hence, ₹ 8,50,000, being the dividend from Indian companies and ₹ 4,00,000, being the dividend from Indian equity oriented mutual fund units is not taxable in the hands of Mrs. Aishwarya. |

![]()

Question 8.

Ms. Julie received following amounts during the previous year 2020-21.

(1) Received loan of ₹ 5,00,000 year from the ABC Private Limited, a closely held company engaged in textile business. She is holding 10% of the equity share capital in the said company. The accumulated profit of the company was ₹ 2,00,000 on the date of the loan.

(2) Received Interest on enhanced compensation of ₹ 5,00,000. Out of this interest, ₹ 1,50,000 relates to the previous year 2017-18, ₹ 1,90,000 relates to previous year 2018-19 and ₹ 1,60,000 relates to previous year 2019-20. She paid ₹ 1 lakh to her advocate for his efforts in the matter.

Discuss the tax implications, if any, arising from these transactions in her hand with reference to Assessment Year 2021-22. (Nov 2020, 4 marks)

Question 9.

Discuss the taxability of the following transactions giving reasons, in the light of relevant provisions, for your conclusion.

Attempt the following:

Mr. R’ajpal took a land on rent from Ms. Shilpa on monthly rent of ₹ 10,000. He sub-lets the land to Mr. Manish for a monthly rent of ₹ 11,500. Manish uses the land for grazing of cattle required for agricultural activities. Mr. Rajpal wants to claim deduction of ₹ 10,000 (being rent paid by him to Ms. Shilpa) from the rental income received by it from Mr. Manish. (Jan 2021, 3 marks)

![]()

Question 10.

Rahul holding 28% of equity shares in a company, took a loan of ₹ 5,00,000 from the same company. On the date of granting the loan, the company had accumulated profit of ₹ 4,00,000, The company is engaged in some manufacturing activity.

(i) Is the amount of loan taxable as deemed dividend in the hands of Rahul, if the company is a company in which the public are substantially interested?

(ii) What would be your answer, if the lending company is a private limited company (i.e. a company in which the public are not substantially interested)?

Answer:

Any payment by a company, other than a company in which the public are substantially interested, of any sum by way of advance or loan to an equity shareholder, being a person who is the beneficial owner of shares holding not less than 10% of the voting power, is deemed as dividend under section 2(22)(e), to the extent the company possesses accumulated profits.

(i) The provisions of Section 2(22)(e), however, will not apply where the loan is given by a company in which public are substantially interested. In such a case, the loan would not be taxable as deemed dividend in the hands of Rahul.

(ii) However, if the loan is taken from a private company (i.e. a company in which the public are not substantially interested), which is a manufacturing company and not a company where lending of money is a substantial part of the business of the company, then, the provisions of Section 2(22)(e) would be attracted, since Rahul holds more than 10% of the equity shares in the company.

The amount chargeable as deemed dividend cannot, however, exceed the accumulated profits held by the company on the date of giving the loan. Therefore, the amount taxable as deemed dividend in the hands of Rahul would be limited to the accumulated profit i.e., ₹ 4,00,000 and not the amount of loan which is ₹ 5,00,000.

![]()

Question 11.

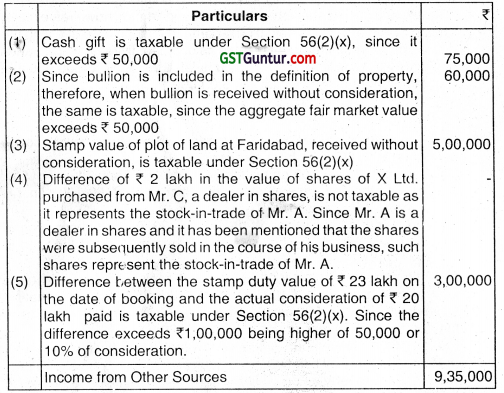

Mr. A, a dealer in shares, received the following without consideration during the P.Y. 2020-21 from his friend Mr. B,:

(1) Cash gift of ₹ 75,000 on his anniversary, 15th April, 2020,

(2) Bullion, the fair market value of which was ₹ 60,000, on his birthday, 19th June, 2020.

(3) A plot of land at Faridabad on 1st July, 2020, the stamp value of which is ₹ 5 lakh on that date. Mr. B had purchased the land in April, 2009.

Mr. A purchased from his friend Mr. C, who is also a dealer in shares, 1000 shares of X Ltd. @ ₹ 400 each on 19th June, 2020, the fair market value of which was ? 600 each on that date. Mr. A sold these shares in the course of his business on 23rd June, 2020.

Further, on 1st November, 2020, Mr. A took possession of property (building) booked by him two years back at ₹ 20 lakh. The stamp duty value of the property as on 1st November, 2020 was ₹ 32 lakh and on the date of booking was ₹ 23 lakh. He had paid ₹ 1 lakh by account payee cheque as down payment on the date of booking. On 1st March, 2021, he sold the plot of land at Faridabad for ₹ 7 lakh.

Compute the income of Mr. A chargeable under the head “income from other sources” and “Capital Gains” for A.Y. 2021-22.

Answer:

Computation of “Income from other sources” of Mr. A for the A.Y. 2021-22.

Computation of “Capital Gains” of Mr. A for the A.Y. 2021-22

Note: The resultant capital gains will be short-term capital gains since for calculating the period of holding, the period of holding of previous owner is not to be considered.

![]()

Question 12.

Discuss the taxability or otherwise of the following in the hands of the recipient under section 56(2)(x) the Income-tax Act. 1961 –

(i) Akhil HUF received ₹ 75,000 in cash from niece of Akhil (i.e., daughter of Akhil’s sister). Akhil is the Karta of the HUF.

(ii) Nitisha, a member of her father’s HUF, transferred a house property to the HUF without consideration. The stamp duty value of the house property is ₹ 9,00,000.

(iii) Mr. Akshat received 100 shares of A Ltd. from his friend as a gift on occasion of his 25th marriage anniversary. The fair market value on that date was ₹ 100 per share. He also received jewellery worth ₹ 45,000 (FMV) from his nephew on the same day.

(iv) Kishan HUF gifted a car to son of Karta for achieving good marks in XII board examination. The fair market value of the car is ₹ 5,25,000.

Answer:

| Taxable/ Non-taxable | Amount liable to tax (₹) | Reason | |

| (i) | Taxable | 75,000 | Sum of money exceeding ₹ 50,000 received without consideration from a non-relative is taxable under Section 56(2)(x). Daughter of Mr. Akhil’s sister is not a relative of Akhil HUF, since she is not a member of Akhil HUF. |

| (ii) | Non-taxable | Nil | Immovable property received without consideration by a HUF from its relative is not taxable under Section 56(2) (x). Since Nitisha is a member of the HUF, she is a relative of the HUF. However, income from such asset would be included in the hands of Nitisha under 64(2). |

| (iii) | Taxable | 55,000 | As per provisions of Section 56(2)(x), in case the aggregate fair market value of property, other than immovable property, received without consideration exceeds ₹ 50,000, the whole of the aggregate value shall be taxable. In this case, the aggregate fair market value of shares (₹ 10,000) and jewellery (₹ 45,000) exceeds ₹ 50,000.

Hence, the entire amount of ₹ 55,000 shall be taxable. |

| (iv) | Non-taxable | Nil | Car is not included in the definition of property for the purpose of section 56(2)(x), therefore, the same shall not be taxable. |

![]()

Question 13.

Mr. Han, a property dealer, sold a building ¡n the course of his business to his friend Rajesh, who ¡s a dealer in automobile spare parts, for ₹ 90 lakh on 1.1.2021, when the stamp duty value was ₹ 150 lakh. The agreement was, however, entered into on 1.9.2020 when the stamp duty value was ₹ 140 lakh. Mr. Han had received a down payment of ₹ 15 lakh by a crossed cheque from Rajesh on the dato of agreement. Discuss the tax implications in the hands of Han and Rajesh, assuming that Mr. Han has purchased the building for ₹ 75 lakh on 12th July, 2019.

Would your answer be different if Han was a share broker instead of a

property dealer?

Answer:

Case 1: Tax implications It Mr. Han is a property dealer

In the hands of Mr. Hari

In the hands of Hari, the provisions of Section 43CA would be attracted, since the building represents his stock-in- trade and he has transferred the same for a consideration less than the stamp duty value and the stamp duty value exceeds 110% of consideration. Under Section 43CA, the option to adopt the stamp duty value on the date of agreement can be exercised only if whole or part of the consideration has been received on or before the date of agreement by way of account payee cheque or account payee bank draft or use of electronic clearing system through a bank account or through credit card, debit card, net banking.

IMPS (Immediate payment Service), UPI (Unified Payment Interface), RTGS (Real Time Gross Settlement), NEFT (National Electronic Funds Transfer), and BHIM (Bharat Interface for Money) Aadhar Pay on or before the date of agreement. In this case, since the payment is made by crossed cheque, the option cannot be exercised.

Therefore, ₹ 75 lakh, being the difference between the stamp duty value on the date of transfer i.e 150 lakh, and the purchase price i.e., ₹ 75 lakh, would be chargeable as business income in the hands of Mr. Han. since stamp duty value exceeds 110% of the consideration.

![]()

In the hands of Mr. Rajesh

Since Mr. Rajesh is a dealer in automobile spare parts, the building purchased would be a capital asset in his hands. The provisions of Section 56(2)(x) would be attracted in the hands of Mr. Rajesh who has received immovable property, being a capital asset, for inadequate consideration and the difference between the consideration and stamp duty value exceeds ₹ 4.50,000, being the higher of ₹ 50.000 and 10% of consideration.

Therefore, ₹ 60 lakh. being the difference between the stamp duty value of the property on the date of registration (i.e., ₹ 150 lakh) and the actual consideration (i.e., ₹ 90 lakh) would be taxable under Section 56(2)(x) in the hands of Mr. Rajesh, since the payment on the date of agreement is made by crossed cheque and not account payee cheque/draft of ECS or through credit card, debit card, net banking, IMPS (Immediate payment Service), UPI (Unified Payment Interface), RTGS (Real Time Gross Settlement), NEFT (National Electronic Funds Transfer), and BHIM (Bharat Interface for Money) Aadhar Pay.

Case 2: Tax implications if Mr. Han is a stock broker

In the hands of Mr. Hari

In case Mr. Han is a stock broker and not a property dealer, the building would represent his capital asset and not stock-in-trade, In such a case, the provisions of Section 50C would be attracted in the hands of Mr. Han, since building is transferred for a consideration less than the stamp duty value and the stamp duty value exceeds 110% of consideration.

Thus, ₹ 75 lakh, being the difference between the stamp duty ‘dalue on the date of registration (i.e., ₹ 150 lakh) and the purchase price (i.e., ₹ 75 lakh) would be chargeable as short-term capital gains.

![]()

It may be noted that under Section 50G, the option to adopt the stamp duty value on the date of agreement can be exercised only if whole or part of the consideration has been received on or before the date of agreement by way of account payee cheque or account payee cheque or account payee bank draft or use of electronic clearing system through a bank account or through credit card. debit card, net banking, IMPS (Immediate payment Service), UPI (Unified Payment Interface), RTGS (Real Time Gross Settlement), NEFT (National Electronic Funds Transfer), and BHIM (Bharat Interface for Money) Aadhar Pay such other prescribed electronic mode on or before the date of agreement. In this case, since the payment on the date of agreement is made by crossed cheque, the option cannot be exercised.

In the hands of Mr. Rajesh

There would be no difference in the taxability in the hands of Mr. Rajesh, whether Mr. Han is a property dealer or a stock broker. Therefore, the provisions of Section 56(2)(x) would be attracted in the hands of Mr. Rajesh who has received immovable property, being a capital asset, for inadequate consideration and the difference between the consideration and stamp duty value exceeds ₹ 4,50,000 being the higher of ₹ 50,000 and 10% of consideration.

Therefore, ₹ 60 lakh, being the difference between the stamp duty value of the property on the date of registration (i.e., ₹ 150 lakh) and the actual consideration (i.e., ₹ 90 lakh) would be taxable under Section 56(2)(x) in the hands of Mr. Rajesh, since the payment on the date of agreement is made by crossed cheque and not account payee cheque/draft or ECS or through credit card, debit card, net banking, IMPS (Immediate payment Service), UPI (Unified Payment Interface), RTGS (Real Time Gross Settlement), NEFT (National Electronic Funds Transfer), and BHIM (Bharat Interface for Money) Aadhar Pay.

Note: As per Section 43CA, stamp duty value on the date of agreement can he adopted, if whole or part of consideration is received otherwise than by way of cash on or before the date of agreement.

However, both Section 50C and 56(2)(x) permit adoption of stamp value duty on the date of agreement Only it whole or part of consideration is received/paid, as the case may be, by way of account payee cheque or account payee bank draft or by use of ECS through a bank account.

![]()

Question 14.

Examine under which heads the following incomes are taxable:

(i) Rental income in case property held as stock-in-trade for 3 years

(ii) Dividend on shares in case of a dealer in shares

(iii) Saiary received by a partner from his partnership firm

(iv) Rental income of machinery

(v) Winnings from lotteries by a person having the same as business activity

(vi) Salaries payable to a Member of Parliament

(vii) Receipts without consideration

(viii) In case of retirement, interest on employee’s contribution if provident fund is unrecognized.

(ix) Rental income in case of a person engaged in the business of letting out of properties.

Answer:

| Particulars | Head of Income | |

| (i) | Rental income in case property held as stock-in trade for 3 years | Income from house property |

| (ii) | Dividend on shares in case of a dealer in shares | Income from other sources |

| (iii) | Salary by partner from his partnership firm | Profit and gains of business or profession |

| (iv) | Rental income of machinery (See Note below) | Income from other sources/ Profits and gains of business or profession |

| (v) | Winnings from lotteries by a person having the sarpe as business activity | Income from other sources |

| (Vi) | Salaries payable to a Member of Parliament | Income from other sources |

| (vii) | Receipts without consideration | Income from other sources |

| (viii) | In case of retirement, interest on employee’s contribution if provident fund is unrecognized | Income from other sources |

| (xi) | Rental income in case of a persorl engaged in the business of letting out of properties | Profits and gains from business or profession |

Note: As per Section 56(2)(ii), rental income of machinery would be chargeable to tac under the head “Income from Other Sources”, lithe same is not chargeable to income-tax under the head “Profits and gains of business or profession”.

![]()

Multiple Choice Question

Question 1.

Which is the charging section for income chargeable under the head Income from other sources?

(a) Section 6

(b) Section 17

(c) Section 22

(d) Section 56

Answer:

(d) Section 56

Question 2.

Following is not income from other sources-

(a) Sub-let out house

(b) Interest on Debentures

(c) Income from sale of shares

(d) Income from land let out.

Answer:

(c) Income from sale of shares

Question 3.

In which year dividend declared by a company or distributed or paid by it u/s 2(22) is deemed to be the income?

(a) Previous year in which it is discussed.

(b) Previous year in which it is given.

(c) Previous year, in which it is so declared.

(d) None of these, distributed or paid, as the case may be.

Answer:

(c) Previous year, in which it is so declared.

![]()

Question 4.

Interim Dividend declared by a company is accrued in which of the following year?

(a) Previous year in which it is declared.

(b) Previous year in which it is given.

(c) Financial year in which it is actually given.

(d) None of these.

Answer:

(a) Previous year in which it is declared.

Question 5.

The date fixed by a company for entitlement of dividend or by a mutual fund/administration/specified company for entitlement of dividend or bonus units is known as:

(a) Due date

(b) Record date

(c) Expiry date

(d) None of these

Answer:

(b) Record date

Question 6.

Where a closely held company gives an loan/advance to a shareholder who has 10% voting power in the company or to concern in which such ‘shareholder has 20% share in case such concern is a non company assessee or has substantial interest (20% voting power) in case it is a company then loan/advance so paid shall be deemed divided to the maximum extent of:

(a) accumulated profits whether capitalized or not

(b) accumulated profits excluding capitalized profits

(c) the loan or advance so paid

(d) None of the above

Answer:

(b) accumulated profits excluding capitalized profits

![]()

Question 7.

Ashni Ltd. reduced its share capital and for that distributed to its shareholders an amount of ₹ 55,00,000. The company possessed accumulated profits of ₹ 35,00,000 as on the date of distribution. What shall be the amount to be assessed as deemed dividend?

(a) ₹ 55,00,000

(b) ₹ 35,00,000

(c) ₹ 20,00,000

(d) No deemed dividend

Answer:

(b) ₹ 35,00,000

Question 8.

As per Section 2(22)(e), loan/advances given by a private company to a concern in which its shareholder has substantial interest, then to the extent of accumulated profits held by the private company (capitalised accumulated profits not included), it shall be considered as deemed dividend taxable in the hands of shareholder. A person is deemed to have a substantial interest:

(a) If he holds 20% of the voting power (equity shares) in the company;

(b) If he is beneficially entitled to 20% or more of the income of such concern.

(c) Either (a) or (b)

(d) None of these.

Answer:

(c) Either (a) or (b)

Question 9.

Income of Dhoni for playing Test match is taxable under the head –

(a) Professional income

(b) Income from salary

(c) Income from other sources

(d) None

Answer:

(c) Income from other sources

![]()

Question 10.

If no system of accounting is followed, interest on securities is taxable on:

(a) Due basis

(b) Receipts basis

(c) Due or receipt basis at the option of the assessee

(d) Due or receipt basis whichever is later

Answer:

(a) Due basis

Question 11.

John, engaged in fertilizer trade received rent by sub-letting a building. This will be taxable under the head—

(a) Income from House Property

(b) Income from Capital Gains

(c) Income from PGBP

(d) Income from other sources

Answer:

(d) Income from other sources

Question 12.

Ramesh received ₹ 7 Lacs by way of interest on enhanced compensation in March, 2021. A further sum of ₹2 Lacs decreed by court is due but not received till 31.03.2021. The amount of income chargeable to tax for the AY 2021 -22 would be:

(a) ₹ 3,50,000

(b) ₹ 7,00,000

(c) ₹ 9,00,000

(d) ₹ 4,50,000

Answer:

(a) ₹ 3,50,000

![]()

Question 13.

A private limited co. engaged in manufacturing activity had general reserve of ₹ 20 Lacs. It granted a loan of ₹ 5 Lacs to a director who held 13% shareholding cum voting rights in the co. The said loan was repaid by him before the end of the year. The amount of deemed dividend arising out of the above transaction is:

(a) ₹ 2,60,000

(b) ₹ 2,40,000

(c) ₹ 5,00,000

(d) Nil

Answer:

(c) ₹ 5,00,000

Question 14.

In order to be entitled to concessional rate of tax for dividend received from a foreign co., the Indian co. should have the following minimum shareholding in such foreign co.

(a) 10%

(b) 25%

(c) 26%

(d) 51%

Answer:

(c) 26%

Income from Other Sources Notes

Basis of charge of dividend

Any income by way of dividends received from a company, whether domestic or foreign, is taxable in the hands of shareholder at normal rates of tax. However, dividend distributed by a domestic company before 1.4.2020 and received by the shareholders on or after 1.4.2020 and on which tax under section 115-0, if applicable, has been paid would be exempt in the hands of the shareholders.

![]()

(4) Any sum of money or value of property received without consideration or for inadequate consideration to be subject to tax in the hands of the recipient [Section 56 (2) (x)]

(i) Any Sum of money or the value of any property received by ANY PERSON without consideration or the value of any property received for inadequate consideration.

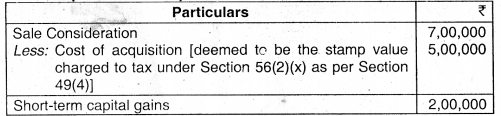

(i) The table below summarizes the scheme of taxability of gifts-

| Nature of asset | Taxable value | |

| 1 | Money | The whole amount if the same exceeds ₹ 50,000. |

| 2 | Movable Property | (i) Without consideration: The aggregate fair market value of the property, if it exceeds ₹ 50,000.(ii) Inadequate consideration: The difference between the aggregate fair market value and the consideration, if such difference exceeds ₹ 50,000. |

| 3 | Immovable property | (i) Without consideration: The stamp value of the property, if it exceeds ₹ 50,000.(ii) Inadequate consideration: The difference between the stamp duty value and the consideration, if such difference is more than the higher of ₹ 50,000 and 10% of consideration. |

![]()

I. Value to be considered where the date of agreement is different from date of registration: Taking into consideration the possible time gap between the date of agreement and the date of registration, the stamp duty value may be taken as on the date of agreement instead of the date of registration, if the date of the agreement fixing the amount of consideration for the transfer of the immovable property and the date of registration are not the same, provided whole or part of the consideration has been paid by way of an account payee cheque or an account payee bank account or through such prescribed electronic mode on or before the date of agreement.

The prescribed electronic modes notified are credit card, debit card, net banking, IMPS (Immediate payment Service), UPI (Unified Payment Interface), RTGS (Real Time Gross Settlement), NEFT (National Electronic Funds Transfer), and BHIM (Bharat Interface for Money) Aadhar Pay as other electronic modes of payment [CBDT Notification No. 8/2020 dated 29.01.2020].

II. If the stamp duty value of immovable property is disputed by the assessee, the Assessing Officer may refer the valuation of such property to a Valuation Officer. If such value is less than the stamp duty value, the same would be taken for determining the value of such property, for computation of income under this head in the hands of the buyer.

(ii) Movable Property [Property, other than immovable property]:

If movable property is received

(a) Without consideration: The aggregate fair market value so such property on the date of receipt would be taxed as the income of the recipient, if it exceeds ₹ 50,000.

(b) For inadequate consideration: If the difference between the aggregate fair market value and such consideration exceeds ₹ 50,000, such difference would be taxed as the income of the recipient.

![]()

(iii) Applicability of section 56(2)(x): The provisions of section 56(2)(x) would apply only to property which is the nature of a capital asset of the recipient and not stock-in-trade, raw material or consumable stores of any business of the recipient. There fore, only transfer of a capital asset, without consideration or for inadequate consideration would attract the provisions of sections 56(2)(x).

(iv) Non-applicability of section 56(2)(x): However, any sum of money or value of property received, in the following circumstances would be outside the ambit of section 56(2)(x)-

(a) from any relative; or

(b) on the occasion of the marriage of the individual; or

(c) under a will or by way of inheritance; or

(d) in contemplation of death of the payer or donor, as the case may be; or

(e) from any local authority; or

(f) from any fund or institution or hospital or other medical institution or any trust or institutions; or

(g) from or by any trust or institution registered under 12AA or section 12AB [w.e.f. 01.06.2020] ; or

(h) by any fund or trust or institution or any university or other educational institution or any hospital or other medical institution.

(i) by way of transaction not regarded as transfer under section 47 (i)/(iv)/(v)/(vi)/(vib)/(vid)/(vii).

(k) From such class of persons and subject to such conditions, as may be prescribed.

![]()

(v) Meaning of certain terms:

| Term Property | Meaning

A capital asset of the assessee, namely,- (a) immovable property being land or building or both, (b) shares and securities, (c) jewallery, (d) archaeological collections, (e) drawings, (f) paintings, (g) sculptures, (h) any work of artor (i) bullion. |

| Relative | (a) In case of an individual-

(i) spouse of the individual; (ii) brother or sister of the individual; (iii) brother or sister of the spouse of the individual; (iv) brother or sister or either of the parents of the individual; (v) any lineal ascendant or descendant of the individual: (vi) any lineal ascendant or descendant of the spouse of the individual; (vii) spouse of any of the persons referred in (i) to (vi) above. (b) In case of Hindu Undivided Family, any member there of. |

![]()

Share Premium in excess of the Fair Market Value to be treated as income [Section 56(2)(viib)] w.e.f. 01.04.2020 Section 56(2)(viib) is applicable as follows –

- Recipient is a company (not being a company in which the public are substantially interested).

- It receives consideration for issue of shares (preference shares or equity shares) from a resident person.

- The consideration received for issue of shares exceeds the face value of such shares. In other words, shares are issued at a premium.

If the above conditions are satisfied, the aggregate consideration received for such shares as exceeds the fair market value of the shares, shall be chargeable to income-tax in the hands of recipient-company under section 56(2)(viib) under the head “Income from other sources”.

The above provisions are not applicable in the following two cases- *

a. where the consideration for issue of shares is received by a venture capital undertaking from a venture capital company or a venture capital fund; or

b. where the consideration for issue of shares is received by a company from a class or classes or person as notified by the Central Government. “Provided further that where the provisions of this clause have not been applied to company on account of fulfilment of conditions specified in the notification issued under clause (ii) of the first proviso and such company fails to comply with any of those conditions then, any consideration received for issue of share that exceeds the fair market value of such share shall be deemed to be the income of that company chargeable to income-tax for the previous year in which such failure has taken place and, it shall also be deemed that the company has under-reported the said income in consequence of the misreporting referred to in sub-section (8) and sub-section (9) of section 270A for the said previous year.”;

![]()

(c) in the Explanation, after clause (a), the following clauses shall be inserted, namely:-

‘(aa) “specified fund” means a fund established or incorporated in India in the form of a trust or a company or a limited liability partnership or a body corporate which has been granted a certificate of registration as a Category I ora Category II Alternative Investment Fund and is regulated under the Securities and Exchange Board of India (Alternative Investment Fund) Regulations, 2012 made under the Securities and Exchange Board of India Act, 1992 (15 of 1992);

(ab) ’‘trust” means a trust established under the Indian Trusts Act, 1882 (2 of 1882) or under any other law for the time being in force,

The fair market value of the shares shall be the higher of the value-

(a) as may be determined in accordance with the method given in rules 11U and 11UA ; or

(b) as may be substantiated by the company to the satisfaction of the Assessing Officer, based on the value of its assets, including intangible assets, being goodwill, know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature.

![]()

Deductions allowable [Section 57]

| S.No. | Particulars | Deduction |

| 1. | In case of dividends (other than dividends u/s 115-0) [w.e.f 01.04.2021 only dividend will be omitted] or interest on securities | Any reasonable sum paid by way of commission or remuneration to a banker or any other person. |

| 2. | Income consists of recovery from employees as contribution to any PF, superannuation fund etc. | Amount of contribution remitted before the due date under the respective Acts, in accordance with the provisions of section 36 (1) (va) |

| 3. | Income from letting on hire of machinery, plant and furniture, with or without building | Current repairs to the machinery, plant, furniture or building, insurance premium, depreciation/ unabsorbed depreciation |

| 4 | Family Pension | Sum equal to – 33 1/3% of such income or – ₹ 15,000, whichever is less |

| 5. | Interest on compensation/ enhanced compensation received | 50% of such interest income |

![]()

Amendment of section 57.

In section 57 of the Income-tax Act, with effect from the 1st day of April, 2021,-

(b) the following proviso shall be inserted, namely : –

“Provided that no deduction shall be allowed from the dividend income, or income in respect of units of a Mutual Fund specified under clause (23D) of section 10 or income in respect of units from a specified company defined in the Explanation to clause (35) of section 10, other than deduction on account of interest expense, and in any previous year such deduction shall not exceed twenty per cent of the dividend income, or income in respect of such units, included in the total income for that year, without deduction under this section.”.