Income from House Property – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Income from House Property – CA Final DT Question Bank

Question 1.

Sakshi purchased a residential flat from Dev in November 2020. However, the deed of conveyance has not been registered in the name of Sakshi till 31.03.2021. Sakshi has let out the flat at a monthly rent of ₹ 30,000 to Mohan. Sakshi claims that rent received is not chargeable un-der the head “Income from house property”, but the same is chargeable under the head “Income from other sources” and she can claim deduction for expenses on repair and insurance premium on actual basis and also depreciation. Examine the correctness of Sakshi’s claim. [CA Final May 2009] [3 Marks]

Answer:

In order to assess income under the head “Income from house property” the assessee must be the owner of the house property. In the case of CIT vs. Poddar Cement Pvt. Ltd. (1997) the Supreme Court held that so long as a person is entitled to receive income from the house property in his own right, it is not necessary that the sale deed must be registered in his name to treat him as the owner of the property for the purpose of section 22.

In such a case, the income derived from the property is chargeable to tax under the head “Income from house property”. The fact that registration ‘ is not yet complete does not affect the chargeability of such income under the head “Income from house property”.

Therefore, the claim of Sakshi that rent should be assessed under the head “Income from other sources” and deduction of various expenses and depreciation should be allowed there on is not tenable.

![]()

Question 2.

Ankit Private Limited has, in its return of income, claimed a sum of ₹ 40,000 as a deduction on account of payments for stamp duty and registration charges from the income shown under the head “Income from house property”. The Assessing Officer disallowed the claim of the assessee company in the assessment order passed u/s 143(3). Examine the correctness of the action of the Assessing Officer. [CA Final May 2010] [3 Marks]

Answer:

After determining the Gross Annual Value (GAV), sec. 23 provides for deducting the municipal taxes paid by the owner in the determination of the Net Annual Value (NAV) of the property. Once the NAV is determined, sec. 24 provides for statutory deduction @ 30% of net annual value and deduction in respect of interest on borrowed capital taken for the purpose of acquiring, constructing, renewing or repairing the house property. Thus, the amount spent by the assessee towards stamp duty and registration charges cannot be allowed as deduction in determining the income from house property.

Therefore, the action of the Assessing Officer in disallowing the deduction in respect of stamp duty and registration charges, is correct.

![]()

Question 3.

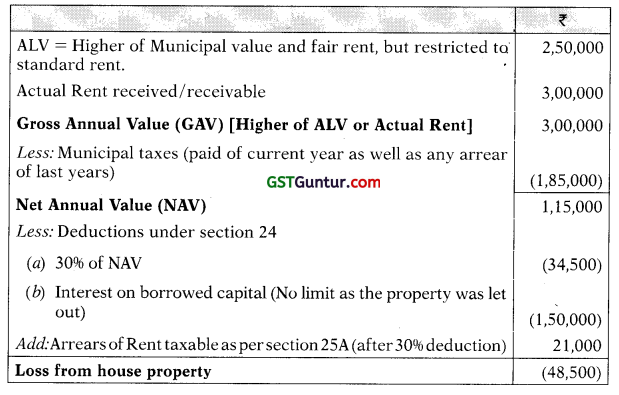

Following arc the details of income provided by Mr. Singh, the assessee for the year ended 31s1 March, 2021:

- Rental income from property at Bangalore – ₹ 3,00,000, Standard rent – ₹ 2,50,000, Fair rent – ₹ 2,80,000.

- Municipal and water tax paid during 2020-21: Current year – ₹ 35,000, Arrears – ₹ 1,50,000.

- Interest on loan borrowed towards major repairs to the property – ₹ 1,50,000.

- Arrears of rent of ₹ 30,000 received during the year, which was not charged to tax in earlier years. [CA FinaLNov. 2014] [4 Marks]

Answer:

![]()

Question 4.

Wellcare Warehousing Ltd. is engaged in the business of warehousing, handling and transport along with the relevant auxiliary services like pest control, rodent control, fumigation and security etc. Statement of profit and loss of company shows that the main source of income is storage charges and maintenance or user charges. The substantial part of expenses relate to salaries of employees engaged in maintenance and upkeep of warehouses. The company has filed return of income showing income from letting out of buildings and godown space as “Income from Business’*. The Assessing Officer rejected the view of the assessee and assessed the same as “Income from House Property”.

Comment on the validity of action taken by Assessing Officer. [CA Final Nov 2016] [4 Marks]

Answer:

The issue is whether the income from letting out of buildings and godown space by the company, engaged in the business of warehousing, handling and transport having the main source of income as storage charges and maintenance or user charges, is chargeable to tax under the head “Income from Business” or under the head “Income from House Property”.

The facts of this case are similar to the facts of CIT v. NDR Warehousing P. Ltd. (2015), where the Madras High Court observed that the assessee’s activity was not merely letting out of warehouses but also storage of goods with provision of several auxiliary services such as pest control, fumigation service to prevent the goods stored from being affected by moisture and temperature and provision of security and protection to the goods stored. Therefore, the assessee carries on the activity including provision of auxiliary services which is more than mere letting out of the godown.

![]()

The court also noted that the profit and loss account of the assessee-company shows that its main source of income is storage and maintenance charges or usage charges. Even substantial part of the expenses also relate to the salaries of employees engaged in the maintenance and upkeep of the godowns and warehouses.

Accordingly, the High Court held that the income earned by the assessee from letting out of godowns and provision of warehousing services is chargeable to tax under the head “Profits and gains of business or profession” and not under the head “Income from house property”.

Applying the rationale of the above judicial decision, the income from letting out of buildings and godown space earned by Wellcare Warehousing Ltd. shall be chargeable to tax under the head “Profits and Gains of Business or Profession”. Therefore, the view of the Assessing Officer to tax such income under the head “Income from House Property” is not correct.