Students should practice Income from Capital Gains – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Income from Capital Gains – CS Executive Tax Laws MCQ Questions

Question 1.

Capital asset excludes all except

(A) Stock-in-trade

(B) Personal effects

(C) Jewellery

(D) Rural agricultural land in India [Dec. 2014]

Answer:

(C) Jewellery

Question 2.

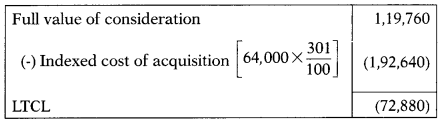

On 15th November 2020, Mohan sold 1 kg of gold, the sale consideration of which was ₹ 1,19,760. He had acquired the gold on 11th December 2000 for ₹ 64,000. The fair market value of 1 kg gold on 1st April 2001 was ₹ 62,000. The number of capital gains chargeable to tax for the AY 2021-22 shall be

(A) 17,200

(B) 50,000

(C) (72,880) loss

(D) (70,080) loss [Dec. 2014]

Hint:

Answer:

(C) (72,880) loss

Question 3.

Cost of acquisition in case of bonus shares allotted before 1.4.2001 will be

(A) Face value on the date of allotment

(B) Nil

(C) Market value as on 1.4.2001

(D) Current market value [Dec. 2014]

Answer:

(C) Market value as on 1.4.2001

Question 4.

Which of the following is not a requisite for charging income tax on capital gains?

(A) The transfer must have been effected in the relevant assessment year

(B) There must be a gain arising on transfer of capital asset

(C) Capital gains should not be exempt u/s 54

(D) Capital gains should not be exempt u/s 54EC [June 2015]

Answer:

(A) The transfer must have been effected in the relevant assessment year

Question 5.

In order to enjoy exemption u/s 54EC, the resultant long-term capital gains should be invested in specified

bonds within a period from the date of transfer.

(A) 36 Months

(B) 4 Months

(C) 6 Months

(D) 12 Months [June 2015]

Answer:

(C) 6 Months

Question 6.

Sarathhasreceivedasum of ₹ 3,40,000 as interest on enhanced compensation for compulsory acquisition of land by the State Government in May 2020. Of this, only ₹ 12,000 pertains to the current year and the rest pertains to earlier years. The amount chargeable to tax for the AY 2021-22 would be

(A) ₹ 12,000

(B) ₹ 6,000

(C) ₹ 3,40,000

(D) ₹ 1,70,000 [June 2015]

Hint:

50% interest on enhanced compensation is exempt and the balance 50% is taxable under the head’s income from other sources.

Answer:

(D) ₹ 1,70,000

Question 7.

In terms of Section 2(42A), unlisted securities are treated as a long-term capital asset, if they are held for a period of more than

(A) 24 Months

(B) 36 Months

(C) 12 Months

(D) 48 Months [June 2015]

Answer:

(A) 24 Months

Question 8.

For claiming exemption u/s 54G, an assessee has to invest the resultant capital gains within a specified period. Which of the following is not eligible .for such investment?

(A) Furniture

(B) Land

(C) Building

(D) Plant or machinery [June 2015]

Answer:

(A) Furniture

Question 9.

Long-term capital gains on zero-coupon bonds are chargeable to tax

(A) @2096 computed after indexation of such bonds

(B) @ 1096 computed without indexation of such bonds

(C) Higher of (A) or (B)

(D) Lower of (A) or (B) [June 2015]

Answer:

(D) Lower of (A) or (B)

Question 10.

Section 50C makes special provision for determining the full value of consideration in cases of transfer of

(A) Plant and machinery

(B) Land or building

(C) All movable property other than plant & machinery and computers

(D) Computers [June 2015]

Answer:

(B) Land or building

Question 11.

U/s 115E, the tax rate applicable for any income from investment or income from long-term capital gains of an asset other than a specified asset, for a non-resident as envisaged by Section 115C, is

(A) 5%

(B) 20%

(C) 15%

(D) 10% [June 2015]

Answer:

(B) 20%

Question 12.

A residential house is sold for ₹ 90 lakh and the long-term capital gains computed are ₹ 50 lakh. The assessee bought two residential houses for ₹ 30 lakh and ₹ 20 lakh respectively. The amount eligible for exemption u/s 54 would be

(A) ₹ 50 lakh

(B) ₹ 20 lakh

(C) ₹ 30 lakh

(D) Nil [Dec. 2015]

Hint:

Assuming that assessee had already in some earlier P.Y. claimed exemption u/s 54 by investing in 2 Houses in India, now in A.Y. 2021-22, the exemption will be given only for investment in 1 house in India.

Answer:

(C) ₹ 30 lakh

Question 13.

When shares of a listed company held for more than 36 months are transferred privately for ₹ 8 lakh, with the original cost of acquisition of ₹ 1 lakh whose indexed cost of acquisition is ₹ 2 lakh, the income-tax payable including cess would be

(A) ₹ 1,44,200

(B) ₹ 72,800

(C) ₹ 1,23,600

(D) ₹ 61,800 [Dec. 2015]

Hint:

| Sale consideration | 8,00,000 |

| (-) Cost | (1,00,000) |

| 7,00,000 |

| Sale consideration | 8,00,000 |

| (-) Indexed cost | (2,00,000) |

| 6,00,000 |

10% of 7,00,000 = 70,000

20% of 6,00,000= 1,20,000

70,000 + 2,800 (Education cess @ 4%) = 72,800

Answer:

(B) ₹ 72,800

Question 14.

Aman entered into an agreement with Brij for the sale of a building for ₹ 20 lakh in June 2020. Aman received an advance of ₹ 2 lakh. Subsequently, the agreement was canceled and Aman forfeited the advance money. The advance money is

(A) To be reduced from the cost of acquisition

(B) To be reduced from the indexed cost of acquisition

(C) Taxable as capital gains

(D) Taxable as income under the head’s income from other sources. [Dec. 2015]

Answer:

(D) Taxable as income under the head’s income from other sources.

Question 15.

Ramesh received ₹ 7 lakh by way of enhanced compensation in March 2021. A further sum of ₹ 2 lakh decreed by the Court is due but not received till 31st March 2021. The amount of income chargeable to tax for the AY 2021-22 would be

(A) ₹ 3,50,000

(B) ₹ 7,00,000

(C) ₹ 9,00,000

(D) ₹ 4,50,000 [Dec. 2015]

Answer:

(B) ₹ 7,00,000

Question 16.

Ms. Smita inherited a vacant site land consequent to the demise of her father on 10th June 2013. The land was acquired by her father on 10th April 1995 for ₹ 40,000. The fair market value of the land on 1 st April 2001 was ₹ 60,000 and on the date of inheritance, Le. 10th June 2013 was ₹ 2,00,000. The cost of acquisition for Ms. Smita is

(A) ₹ 10,000

(B) Nil

(C) ₹ 60,000

(D) ₹ 2,00,000 [June 2016]

Hint:

In case gift and inheritance cost to the previous owner has to take into consideration for the purpose of computation of capital gain. In the case of assets acquired before 1.4.2001, the option to take actual cost or FMV on 1.4.2001 is available. Hence, the cost to Ms. Smita will be ₹ 60,000.

Answer:

(C) ₹ 60,000

Question 17.

Under which section, the assessee has to reinvest the entire net consideration to claim a full exemption for the long-term capital gains earned during a previous year

(A) Section 54EC

(B) Section 54F

(C) Section 54GA

(D) Section 54D [June 2016]

Answer:

(B) Section 54F

Question 18.

Short-term capital gains arising from the transfer of equity shares in a company or units of an equity-oriented fund or units of a business trust charged with security transaction tax are subject to income tax at the rate of

(A) 10%

(B) 15%

(C) 205

(D) Normal rate [June 2016]

Answer:

(B) 15%

Question 19.

A foreign institutional investor (FIT) has total income which includes the short-term capital gains on the sale of listed shares of ₹ 30 lakh. The rate of tax for charging such income to tax is

(A) 10%

(B) 30%

(C) 15%

(D) 40% [June 2016]

Answer:

(C) 15%

Question 20.

Manoj acquired 1,000 equity shares of ₹ 10 each in a listed company for ₹ 35,000 on 1 st July 2013. The company issued 1,000 rights shares in April 2015 at ₹ 15 per share. The company issued 2,000 bonus shares in June 2020. The market price was ₹ 50 per share before the bonus issue and ₹ 25 after such an issue. The cost of the acquisition of bonus shares would be

(A) Nil

(B) ₹ 20,000

(C) ₹ 50,000

(D) ₹ 1,00,000 [June 2016]

Answer:

(A) Nil

Question 21.

Cost of acquisition of securities held with depositories is to be computed by –

(A) Average cost method

(B) First in first out

(C) Last in first out

(D) Weighted average cost method [Dec. 2016]

Answer:

(B) First in first out

Question 22.

Long-term capital gains on the sale of a long-term capital asset in October 2020 is 1105 lakh. The assessee invested 150 lakh in REC bonds in March 2021 and ₹ 55 lakh in MIAI bonds in May 2021.

The amount of exemption eligible under Section 54EC is

(A) Nil

(B) ₹ 50 lakh

(C) ₹ 55 lakh

(D) ₹ 105 lakh [Dec. 2016]

Answer:

(B) ₹ 50 lakh

Question 23.

Rajat purchased a car for his personal use for ₹ 5,00,000 in April 2020 and sold the same for ₹ 5,50,000 in July 2020. The taxable capital gains would be

(A) Nil

(B) ₹ 5,50,000

(C) ₹ 50,000

(D) ₹ 4,00,000 [Dec. 2016]

Hint:

Capital asset, as defined by Section 2(14) of Income-tax Act, 1961, does not include items held for personal use such as furniture, air-conditioners, refrigerators, motor cars, etc. Therefore, a car used for personal purposes (depreciation is not charged), is not a capital asset. When it is sold, no capital gains, either short-term or long-term can arise. The profit cannot be brought to income tax.

Answer:

(A) Nil

Question 24.

Mrs. Lakshmi purchased shares of ABB Ltd. for ₹ 5 lakhs on 3rd April 2018. The shares were sold on 5th June 2020 for ₹ 7 lakhs. She paid STT of ₹ 700 and brokerage of ₹ 500. Capital gain chargeable to tax:

(A) Nil, as it is exempt u/s 10(38)

(B) @ 10% u/s 112A without the benefit of indexation

(C) @20% u/s 112 without the benefit of indexation

(D) @ 10% u/s 112A with benefit of indexation [June 2017]

Answer:

(B) @ 10% u/s 112A without benefit of indexation

Question 25.

Ms. Netra acquired 1,000 equity shares of MMC Ltd. (unlisted company) for ₹ 4 lakh in April 2009. She received bonus shares on a 1:1 basis in April 2020 from the company. She sold bonus shares in January 2021 for ₹ 8 lakhs. The capital gain chargeable to tax in the hands of Ms. Netra for the assessment year 2021-22 is:

(A) ₹ 8 lakhs

(B) Nil, since the entire gain is exempt from tax

(C) ₹ 2 lakhs

(D) ₹ 80,000 [June 2017]

Hint:

| Sales price | 8,00,000 |

| (-) Cost of acquisition | – |

| Short term capital gain | 8,00,000 |

Answer:

(A) ₹ 8 lakhs

Question 26.

Mr. Madan sold vacant land for ₹ 120 lakh on 10.10.2020. The indexed cost of acquisition amounts to ₹ 18 lakhs. He deposited ₹ 50 lakhs in REC bonds in January 2021 and another ₹ 50 lakh in March 2021.

The amount of capital gain liable to tax after deduction under section 54EC is:

(A) ₹ 2 lakhs

(B) ₹ 52 lakhs

(C) ₹ 102 lakhs

(D) ₹ 18 lakhs [June 2017]

Hint:

| Sale price | 1,20,00,000 |

| (-) Indexed cost of acquisition | (18,00,000) |

| LTCG | 1,02,00,000 |

| (-) Exemption u/s 54EC | (50,00,000) |

| Taxable LTCG | 52,00,000 |

Answer:

(B) ₹ 52 lakhs

Question 27.

Which of the following is not a capital asset for Mr. Rao who is employed in a public sector bank?

(A) Urban land

(B) Agricultural land within 2 km from local limits of the municipality

(C) Deposit certificate issued under Gold Monetization Scheme, 2015

(D) Jewellery [Dec. 2017]

Answer:

(C) Deposit certificate issued under Gold Monetization Scheme, 2015

Question 28.

On 1.6.2020 Kamlesh transferred his vacant land to Raj esh for ₹ 12 lakhs. The land was acquired on 1.9.2017 for ₹ 3 lakh. The indexed cost of acquisition of the said land is ₹ 3,28,409.

The taxable capital gain would be:

(A) long term capital gain ₹ 8,29,091

(B) short-term capital gain ₹ 9 lakhs

(C) long-term capital gain ₹ 9 lakhs

(D) short term capital gain ₹ 8.70 lakhs [Dec. 2017]

Hint:

Since the period of holding is less than 36 months, there will be short-term capital gain.

Answer:

(B) short-term capital gain ₹ 9 lakhs

Question 29.

Dr. Sam sold vacant land to Mr. Roy for ₹ 36 lakhs. For stamp-duty purposes, the value of land was ₹ 41 lakhs. The indexed cost of acquisition of land was computed at ₹ 20 lakhs.

The taxable long-term capital gain would be:

(A) ₹ 21 lakhs

(B) ₹ 16 lakhs

(C) ₹ 5 lakhs

(D) ₹ 20 lakhs [Dec. 2017]

Answer:

(A) ₹ 21 lakhs

Question 30.

Out of the following, which income is chargeable as capital gain:

(i) from the transfer of self-generated goodwill of profession.

(ii) from the transfer of personal jewelry

(iii) from the transfer of paintings and art-work

(iv) from the transfer of furniture utilized for personal use

Select the correct answer from the options given below:

(A) (i)and(ii)

(B) (ii) and (iii)

(C) (i), (ii) and (iii)

(D) All the four [June 2018]

Answer:

(C) (i), (ii) and (iii)

Question 31.

Land or building, or both, if transferred on or after 1st April 2019 shall be treated as a long term capital asset, if it is being held immediately prior to the date of its transfer for more than:

(A) 36 months

(B) 12 months

(C) 24 months

(D) None of the above [June 2018]

Answer:

(C) 24 months

Question 32.

The base year for the purpose of calculation of the indexed cost of acquisition or the cost of improvement in respect of long term capital asset acquired prior to 1st April 2001 shall be taken as:

(A) 1981-1982

(B) 2001-2002

(C) 1991-1992

(D) 2011-2012 [June 2018]

Answer:

(B) 2001-2002

Question 33.

X entered into an agreement for the sale of his house located at Jaipur to Y on 1st April 2020 for a total sale consideration of ₹ 90 lakh. Y paid an amount of ₹ 20 lakh by account payee cheque to X on the date of the agreement and the balance was to be paid at the time of registration of the deed. However, the conveyance deed could not be executed till 1st September 2020. The Stamp Valuation Authority determined the value of the property on the date of registration of conveyance deed at ₹ 120 lakh and the value determined by the Stamp Valuation Authority on the date of the agreement was ₹ 100 lakh.

The value for the purpose of capital gain u/ s 50C shall be taken:

(A) ₹ 90 lakh

(B) ₹ 120 lakh

(C) ₹ 20 lakh

(D) ₹ 100 lakh

Answer:

(D) ₹ 100 lakh

Question 34.

The cost of improvement in relation to the capital asset being goodwill of the business shall be taken to be as:

(A) Cost incurred by the previous owner

(B) Actual cost incurred by the assessee

(C) Incurred cost after indexation

(D) None of the above [June 2018]

Answer:

(D) None of the above

Question 35.

In a scheme of buyback of shares, XYZ Ltd., a listed company, paid ₹ 6 lakh to a shareholder X on 12.3.2021. The buy-back was through the recognized stock exchange. The sum of ₹ 6 lakh received by X who had bought these shares 2 years back will be:

(A) Taxable in full

(B) Fully exempt u/s 10(34A)

(C) Taxable @ 20%

(D) Taxable at a normal rate of tax [June 2018]

Answer:

(B) Fully exempt u/s 10(34A)

Question 36.

Radhey has sold his house on 11th August 2020 for ₹ 80 lakh. The value applied by Stamp Valuation Authority is 1100 lakh. He disputed this valuation and the departmental valuation cell made the valuation at ₹ 110 lakh.

The value to be taken for calculation of capital gain as per Section 50C is:

(A) ₹ 80 lakh

(B) ₹ 110 lakh

(C) ₹ 100 lakh

(D) None of the above [June 2018]

Answer:

(C) ₹ 100 lakh

Question 37.

Radhey has sold his residential house on 11th Sept. 2020 for ₹ 75 lakh. The value applied by the Stamp Valuation Authority on the date of registration of the Conveyance Deed on 15th Sept. 2020 was ₹ 115 lakh. Radhey disputed the valuation made by the Stamp Valuation Authority and asked the departmental valuation officer to determine the value of the house on the date of registration of the deed. The departmental valuation officer determined the value of the house on the date of registration of the deed at ₹ 120 lakh.

The sale value of the house to be taken for calculation of capital gain in AY 2021-22 as per section…………..shall be……..

(A) 50C, ₹ 115 lakh

(B) 50C, ₹ 120 lakh

(C) 48, ₹ 75 lakh

(D) 45, Indexed cost of ₹ 75 lakh [Dec. 2018]

Answer:

(A) 50C, ₹ 115 lakh

38.

Exemption under section 54G on fulfilling of specified conditions is available on:

(A) Shifting of industrial undertaking from an urban area to a Special Economic Zone (SEZ)

(B) Shifting of industrial undertaking from urban Area by Government

(C) Compulsory acquisition of land and building

(D) Transfer of certain capital assets as specified [June 2019]

Answer:

(B) Shifting of industrial undertaking from urban Area by Government

Question 39.

Nair, a retired person of 68 years of age obtained ₹ 10,000 per month from 1st April 2020 on a reverse mortgage of his self-occupied residential property from a bank. The fair rent of the property is ₹ 15,000 per month. The income chargeable to tax in respect of amount received on reverse mortgage for his self-occupied house property for the FY 2020-21 would be:

(A) ₹ 1,20,000

(B) ₹ 1,26,000

(C) NIL

(D) (15,000 – 10,000) X 12 = 60,000 [June 2019]

Answer:

(C) NIL

Question 40.

B joined Avtar & Co. as a partner on 1st June 2020. He contributed his vacant land in the firm as his capital which was recorded in the books of the firm at ₹ 5 lakh. The land was inherited by B from his father in April 2010 and the Fair Market Value (FMV) on that date was ₹ 2 lakh. The land was originally acquired by his father in August 2005 for ₹ 1 lakh. The Fair Market Value (FMV) on 1st June 2018 was ₹ 10 lakh.

The full value of the consideration received as a result of the transfer of land by B as capital would be taken as:

(A) ₹ 1 lakh

(B) ₹ 2 lakh

(C) ₹ 5 lakh

(D) ₹ 10 lakh [June 2019]

Answer:

(C) ₹ 5 lakh

Question 41.

Durafon (P) Ltd., engaged in the steel industry, acquired a vacant piece of land on 15th May 2018. The company sold the said land in December 2020. The profit earned on the sale of vacant land of ₹ 10 lakh shall be taxable as:

(A) Business income

(B) Income from other sources

(C) Short term capital gain

(D) Long term capital gain [June 2019]

Hint:

In the case of the following assets if the period of holding is less than 24 months then they will be treated as short term capital assets:

- Unlisted shares;

- An immovable property being land or building or both.

As per data are given in the question, vacant land (non-depreciable asset) was sold after holding more than 24 months, and hence gain arising on such sale will be long-term capital gain.

Answer:

(D) Long term capital gain

Question 42.

D transferred Zero-Coupon Bonds on 20th August 2020. These bonds were acquired during the financial year 2011-2012. The capital gain computed on the redemption with indexation benefit is ₹ 2 lakh and without indexation benefit is ₹ 3 lakh.

The long term capital gain would be chargeable to tax on such Zero-Coupon Bonds in AY 2020-2021:

(A) @20% of LTCG (Net consideration – Indexed cost of acquisition)

(B) @ 10% of (Net consideration – Cost of acquisition without indexation)

(C) @30% of (Net consideration-Cost of acquisition without indexation)

(D) (A) or (B) whichever is less. [June 2019]

Hint:

In the case of zero-coupon bonds, capital gain tax shall be lower of following:

(1) 10% of (Net consideration – Cost of acquisition without indexation)

(2) 20% of LTCG (Net consideration – Indexed cost of acquisition).

Answer:

(B) @ 10% of (Net consideration – Cost of acquisition without indexation)

Question 43.

Indexed cost of acquisition of the house property purchased for ₹ 80 lakh in June 1998 and was sold in December 2020 will be ₹ (worked out by taking the CD of 1998-99 as 351; of the year 2001-02 as 100; of the year 2020-21: 301) and FMV of the house property as on 1st April 2001 of ₹ 90 lakh.

(A) ₹ 63,81,766

(B) ₹ 90 lakh

(C) ₹ 2,70,90,000

(D) ₹ 71,79,487 [Dec. 2019]

Hint:

Computation of Indexed Cost of Acquisition (ICOA):

₹ 90,00,000 * 301/100 = ? 2,70,90,000

Note:

As Asset is acquired before 01.04.2001, Cost of Acquisition is taken as the original cost of acquisition or FMV as of 01.04.2001, whichever is higher.

Answer:

(C) ₹ 2,70,90,000

Question 44.

Chirag entered into an agreement for the sale of his house property located at Jaipur to Yash on 1st August 2020 for a total sale consideration of ₹ 95 lakh. Yash paid an amount of ₹ 20 lakh by account payee cheque to Chirag on 1st August 2020, and the balance was agreed to be paid at the time of registration of the Conveyance Deed which could only be executed by Chirag on 1st September 2020. The Stamp Valuation Authority determined the value of the house property on the date of registration of deed at ₹ 140 lakh. However, the value determined by the Stamp

The valuation Authority of the house on the date of the agreement (1st August 2017) was ₹ 110 lakh. The sale value for the purpose of computing the capital gain of the property in A.Y. 2020-21 to be taken by Chirag shall be :

(A) ₹ 95 lakh

(B) ₹ 110 lakh

(C) ₹ 140 lakh

(D) ₹ 120 lakh [Dec. 2019]

Answer:

(B) ₹ 110 lakh