Students should practice Income from Business or Profession – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Income from Business or Profession – CS Executive Tax Laws MCQ Questions

Question 1.

Where the assessee does not himself carry on scientific research but makes contributions to an approved university, college, or institution, to be used for scientific research related or unrelated to the business of the assessee, then the amount of deduction from income of business shall be allowed on such contribution to the extent of

(A) 125%

(B) 150%

(C) 100%

(D) 200% [Dec. 2014]

Hint:

w.e.f A.Y. 2021-22, as per provision of section 35(l)(h), deduction w.r.t expenditure/payment to scientific research association, approved unit, college, or institution shall be equal to such payment.

Answer:

(C) 100%

Question 2.

In the case of companies, capital expenditure incurred for the purpose of promoting family planning amongst the employees would be deductible to the extent

(A) Equal to 1 /5th in each year for 5 years

(B) Equal to 1 / 6th in each year for 6 years

(C) Equal to 1 /4th in each year for 4 years

(D) Equal to 1 / 10th in each year for

10 years [Dec. 2014]

Answer:

(A) Equal to 1 /5th in each year for 5 years

Question 3.

A person carrying on profession will have to get his accounts audited before the specified date if gross receipts from the profession for a previous year or years relevant to the assessment year exceed

(A) ₹ 50 Lakh

(B) ₹ 10 Lakh

(C) ₹ 1 Crore

(D) ₹ 25 Lakh [Dec. 2014]

Answer:

(A) ₹ 50 Lakh

Question 4.

The rate of depreciation chargeable on temporary wooden structure for the AY 2021-22 is

(A) 25%

(B) 10%

(C) 40%

(D) 50% [Dec. 2014]

Answer:

(C) 40%

Question 5.

Anuj owns 6 goods carriage vehicles {other than heavy goods vehicle) out of which 2 goods vehicles are acquired by him on 15th January 2021. His taxable income u/s 44AE will be

(A) ₹ 4,05,000

(B) ₹ 3,24,000

(C) ₹ 2,46,000

(D) ₹ 3,60,000 [Dec. 2014]

Hint:

(4 × 12 × 7,500) + (2 × 3 × 7,500) = 4,05,000

Answer:

(A) ₹ 4,05,000

Question 6.

‘Notional Profit’ from speculative business is

(A) Taxable under the head ‘income from profits and gains of business and profession’

(B) Taxable under the head ‘income from other sources

(C) Taxable either as income from other sources or as income from profits and gains of business and profession

(D) Not taxable [June 2015]

Answer:

(D) Not taxable

Question 7.

A person carrying a specified profession will have to maintain books of account prescribed by Rule 6F of the Income-tax Rules, 1962 if gross receipts are more than ₹ 1,50,000 for

(A) All preceding 5 years

(B) Any of the preceding 5 years

(C) All preceding 3 years

(D) Any of the preceding 3 years [June 2015]

Answer:

(C) All preceding 3 years

Question 8.

If a block of assets ceases to exist on the last day of the previous year, depreciation admissible for the block of assets will be

(A) Nil

(B) 50% of the value of the block of assets on the first day of the previous year

(C) The total value of the block of assets on the first day of the previous year

(D) 50% of the value of the block of assets on the last day of the previous year [June 2015]

Answer:

(A) Nil

Question 9.

U/s 40A(3) which of the following payment for an expenditure incurred would not be admissible as a deduction from business income

(A) ₹ 15,000 paid in cash to a transporter

(B) ₹ 5,000 paid in cash to a dealer in the morning and ₹ 5,000 paid in cash to the same dealer in the evening

(C) ₹ 40,000 sent through NEFT to the bank account of the dealer for goods purchased

(D) ₹ 19,000 paid through bearer cheque to the dealer for goods purchased. [June 2015]

Answer:

(D) ₹ 19,000 paid through bearer cheque to the dealer for goods purchased. [June 2015]

Question 10.

Sameer sold goods worth ₹ 50,000 at credit on 1st April 2019. However, he has written off ₹ 10,000 of it as bad debts and claimed a deduction for the same during the year 2019-20. On 4th April 2020, the defaulting debtor made a payment of ₹ 45,000. The taxable amount of bad debts recovered for the year 2020-21 would be

(A) ₹ 5,000

(B) ₹ 50,000

(C) ₹ 45,000

(D) ₹ 10,000 [June 2015]

Answer:

(A) ₹ 5,000

Question 11.

Under the Income-tax Act, 1961, which of the following outlays incurred by Sun Ltd. during the previous year ended 31st March 2021 will not be admissible as deduction while computing its business income

(A) Contribution to a political party in cash

(B) Interest on loan taken for payment of income-tax

(C) Capital expenditure on advertisement

(D) All of the above [June 2015]

Answer:

(D) All of the above

Question 12.

Which of the following business commenced during August 2016 will not be eligible for deduction u/s 35 AD?

(A) Setting-up and operating a cold chain facility

(B) A production unit of fertilizer in India

(C) Operating of a 1-star hotel in a village

(D) Building a hospital of 200 beds. [June 2015]

Answer:

(C) Operating of a 1-star hotel in a village

Question 13.

Provisions of Section 44AD for computation of presumptive income are not applicable to

(A) Limited liability partnership

(B) Partnership firm

(C) Resident Hindu Undivided Family

(D) Resident individual [June 2015]

Answer:

(A) Limited liability partnership

Question 14.

Vaibhav, deriving business income, owns a car whose WD V as of 1 st April 2019 was ₹ 3,00,000. This is the only asset in the block of assets with a rate of 15%. It is estimated that one-third of the total usage of the car is for personal use in both years. The WDV of the block of assets as of 31 st March 2021 would be

(A) ₹ 2,16,750

(B) ₹ 2,43,000

(C) ₹ 2,55,000

(D) None of the above [June 2015]

Hint:

| WDV on 1.4.2019 | 3,00,000 |

| (-) Depreciation for PY 2019-20 (3,00,000 × 15% × 2/3) | (30,000) |

| WDV on 31.3.2020 | 2,70,000 |

| (-) Depreciation for PY 2020-21 (2,66,250 × 15% × 2/3) | (27,000) |

| WDV on 31.3.2021 | 2,43,000 |

Answer:

(B) ₹ 2,43,000

Question 15.

A charitable trust acquired two air-conditioners for ₹ 1,40,000 on 10th June 2020. It claimed the acquisition as the application of income. The amount it can claim by way of depreciation for the said air-conditioners for the AY 2021-22 is

(A) ₹ 21,000

(B) ₹ 1,40,000

(C) ₹ 35,000

(D) Nil [Dec. 2015]

Answer:

(D) Nil

Question 16.

Sunil acquired a building for ₹ 15 lakh in June 2018 in addition to the cost of land beneath the building of ₹ 3 lakh. It was used for personal purposes until he commenced business in June 2020 and since then it was used for business purposes. The amount of depreciation eligible in his case for the AY 2021-22 would be

(A) ₹ 1,50,000

(B) ₹ 75,000

(C) ₹ 37,500

(D) ₹ 1,21,500 [Dec. 2015]

Hint:

Depreciation is available on building only not on land. ₹ 15 lakh does not include the cost of land. Read the MCQ carefully.

| Cost on 1.6.2018 | 15,00,000 |

| (-) Depreciation for PY 2018-19 | (1,50,000) |

| WDV on 31.3.2019 | 13,50,000 |

| (-) Depreciation for PY 2019-20 | (1,35,000) |

| WDV on 31.3.2020 | 12,15,000 |

Depreciation for PY 2020-21 = 12,15,000 × 10% = 1,21,500.

Answer:

(D) ₹ 1,21,500

Question 17.

X Ltd. paid ₹ 10 lakh to an approved college to be used for scientific research unrelated to its business. The amount eligible for deduction u/s 35(l)(n) is

(A) ₹ 5 lakh

(B) ₹ 17.5 lakh

(C) ₹ 10,00,000

(D) ₹ 15,00,000 [Dec. 2015]

Hint:

W.e.f A.Y. 2021-22 deduction w.r.t amount paid to Scientific Research Association, Univ., College is allowed as dead. = 100%.

Answer:

(C) ₹ 10,00,000

Question 18.

Saraswathi Ltd. made a provision of ₹ 12 lakh for a bonus payable for the year ended 31st March 2021. It paid ₹ 7 lakh on 31st July 2021; ₹ 3 lakh on 30th September 2021; and ₹ 2 lakh on 15th December 2021.

The amount eligible for deduction u/s 43B would be

(A) ₹ 10 lakh

(B) ₹ 12 lakh

(C) ₹ 7 lakh

(D) ₹ 3 lakh [Dec. 2015]

Answer:

(A) ₹ 10 lakh

Question 19.

The maximum penalty leviable for failure to get accounts audited or to furnish report u/s 44AB is

(A) ₹ 75,000

(B) ₹ 1,00,000

(C) ₹ 1,50,000

(D) ₹ 3,00,000

Answer:

(C) ₹ 1,50,000

Question 20.

When a cash payment of ₹ 15,000 is made on 10th May 2020 towards the purchase of raw material affected in the earlier year, ie., on 5th June 2019, the amount liable for disallowance u/s 40A(3A) would be

(A) Nil

(B) 100% of payment

(C) 20% of such payment

(D) 30% of such payment [Dec. 2015]

Answer:

(B) 100% of payment

Question 21.

When a person carries on the business of carrying goods for hire for the whole year with 5 self-owned and 3 leasehold goods vehicles (other than heavy goods vehicles), the presumptive income chargeable to tax u/s 44AE would be

(A) ₹ 4,80,000

(B) ₹ 7,20,000

(C) ₹ 3,96,000

(D) ₹ 3,36,000 [Dec. 2015]

Hint:

8 × 7,500 × 12 = 7,20,000

Answer:

(B) ₹ 7,20,000

Question 22.

X, Manager of XYZ Ltd. since 2006 was terminated by the company on 1 st August 2020 by paying a compensation of ₹ 200 lakh. Such compensation is

(A) Chargeable under the Wealth-tax Act, 1957

(B) Not chargeable under the Income-tax Act, 1961

(C) Chargeable u/s 17(3)(z)(e?)

(D) Chargeable u/s 28(n)(a) [Dec. 2015]

Answer:

(D) Chargeable u/s 28(n)(a)

Question 23.

Ramson Industries acquired a factory building for self-use in November 2020. The value of the land underneath the building was ₹ 5 lakh and the value of the building was ₹ 10 lakh. The amount of eligible depreciation allowable for assessment year 202122 is

(A) ₹ 1,50,000

(B) ₹ 25,000

(C) ₹ 1,00,000

(D) ₹ 50,000 [June 2016]

Hint:

10,00,000 × 10% × Vi = 50,000. Depreciation is not available on land. On building half depreciation is eligible as an asset put to use is less than 180 days.

Answer:

(D) ₹ 50,000

Question 24.

Chola Ltd., engaged in manufacture acquired machineries for ₹ 27 Crore in April, 2020 All the machines were used within 45 days of acquisition. The deduction under Section 32AD for the AY 2021-22 will be

(A) ₹ 4,05,00,000

(B) ₹ 4,50,00,000

(C) ₹ 8,55,00,000

(D) ₹ 8,40,00,000 [June 2016]

Hint:

32AD: Applicable only for plant & machine purchased within 1/4/2015 -31/3/2020.

∴ No deduction in this case. The answer shall be NIL.

Answer:

Question 25.

Where an asset used for scientific research for more than three years is sold without having been used for other purposes, then the sale proceeds to the extent of the cost of the asset already allowed as deduction under section 35 in the past shall be treated as

(A) Business income

(B) Long-term capital gain

(C) Short-term capital gain

(D) Exempted income [June 2016]

Answer:

(A) Business income

Question 26.

Where an assessee doing business expenditure in respect of which payments made to a person in a day exceeds ₹ 10,000 should be paid through account payee cheque or demand draft to claim a deduction for such expenditure. This restriction does not apply to

(A) Payments made to RBI

(B) Payments made to cultivators

(C) Payment of terminal benefits to employees not exceeding ₹ 50,000

(D) All of the above [June 2016]

Answer:

(D) All of the above

Question 27.

Appu Ltd. contributed ₹ 8,70,000 towards the provident fund account of its employees. It actually remitted ₹ 5,00,000 up to 31st March and ₹ 2,50,000 up to the due date for filing the return specified in Section 139(1). The amount liable to tax in its assessment would be

(A) ₹ 3,70,000

(B) ₹ 1,20,000

(C) Nil

(D) ₹ 8,70,000 [June 2016]

Answer:

(B) ₹ 1,20,000

Question 28.

Under the head ‘profits and gains of business or profession’, the method of accounting that should be followed by an assessee is

(A) Cash system only

(B) Mercantile system only

(C) Hybrid system only

(D) Cash system or mercantile system only [June 2016]

Answer:

(D) Cash system or mercantile system only

Question 29.

Madhu Ltd. owns machinery (rate of depreciation is 15%) the written down value of which as of 1 st April 2020 ₹ 30,00,000. Due to fire, entire assets in the block were destroyed and the insurer paid ₹ 25,00,000. The eligible depreciation in respect of this machinery is

(A) ₹ 4,50,000

(B) ₹ 75,000

(C) ₹ 5,00,000

(D) Nil [June 2017]

Hint:

The amount received from the insurance company is more than WDV hence the excess amount of ₹ 5,00,000 (30,00,000 – 25,00,000) will be STCG and liable to tax under the head ‘Capital Gain’. Since all assets are destroyed WDV for charging depreciation will be zero.

Answer:

(D) Nil

Question 30.

Ashwin has speculation business loss brought forward of the assessment years 2015-16 ₹ 1,00,000; 2016-17 ₹ 70,000 and 2017-18 ₹ 60,000. He has income from the same speculation business for the assessment year 2021-22 ₹ 5,40,000. His total income chargeable to tax for assessment year 2021-22 would be

(A) ₹ 3,10,000

(B) ₹ 4,10,000

(C) ₹ 4,80,000

(D) ₹ 4,40,000 [June 2017]

Hint:

5,40,000 – 60,000 = 4,80,000. Speculation business loss can be carried forward and set-off only for 4 years.

Answer:

(C) ₹ 4,80,000

Question 31.

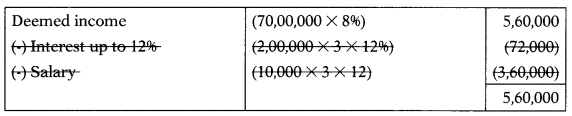

DP & Co. is a partnership firm with 3 partners. The capital of each partner was ₹ 2 lakh. The partnership deed authorized interest on capital @15% and working partner salary to each partner @ ₹ 10,000 per month for all the partners. The total sales amounted to ₹ 70 lakh. The total income of the firm under Section 44AD would be

(A) ₹ 5,60,000

(B) ₹ 4,32,000

(C) ₹ 1,28,000

(D) ₹ 3,50,000 [June 2017]

Hint:

Where the eligible assessee is firm, salary and interest paid to partners shall be deducted from the deemed income subject to conditions and limits of Section 40(b). [This provision is deleted]

Answer:

(A) ₹ 5,60,000

Question 32.

Ekta (P) Ltd., engaged in manufacturing activity, acquired new plant and machinery for ₹ 100 lakh for its manufacturing unit located in Bihar. The acquisition and use were from 1st June 2020. The assessee is eligible for additional depreciation of –

(A) ₹ 30 lakh

(B) ₹ 20 lakh (20%)

(C) ₹ 35 lakh

(D) ₹ 10 lakh [Dec. 2017]

Hint:

Additional Depreciation w.r.t P&M in the unit in notified backward area of A.P/ W.B/Telangana & Bihar was @ 35% if purchased between 1/04/2015-31/3/2020. Now 20% as for any other assessee.

Answer:

(B) ₹ 20 lakh (20%)

Question 33.

A Company incurred capital expenditure on scientific research viz., (i) land ₹ 5 lakh (ii) building ₹ 10 lakh (iii) equipment ₹ 7 lakh. The amount of expenditure eligible for deduction under Section 35 would be –

(A) ₹ 22 lakh

(B) ₹ 17 lakh

(C) ₹ 15 lakh

(D) ₹ 5 lakh

Hint:

| Capital expenditure on scientific research | |

| Land (not eligible) | – |

| Building | 10 lakh |

| Equipment | 7 lakh |

| 17 lakh |

Answer:

(B) ₹ 17 lakh

Question 34.

Which of the following is not deductible while calculating taxable income from business:

(A) GST

(B) Income-tax

(C) Customs duty

(D) Local taxes [Dec. 2016]

Answer:

(B) Income-tax

Question 35.

Swan (Pvt.) Ltd. acquired machinery for ₹ 5,75,000 which included a GST of ₹ 75,000 eligible for the input tax credit. It borrowed ₹ 3,00,000 from a bank for the purchase of the said machine. Interest on the bank loan up to the date of usage of the machine was ascertained as ₹ 5,000. The machine was put to use from 15th September 2020. Assume the rate of depreciation at 15%. The eligible amount of deprecation will be –

(A) ₹ 90,000

(B) ₹ 78,750

(C) ₹ 86,250

(D) ₹ 75,000 [Dec. 2016]

Hint:

5,75,000 – 75,000 × 15% = 75,000

Answer:

(D) ₹ 75,000

Question 36.

As per Section 35DDA, total expenditure in a voluntary retirement scheme is deductible in

(A) 5 equal installments

(B) 10 equal installments

(C) 15 equal installments

(D) The same year [Dec. 2016]

Answer:

(A) 5 equal installments

Question 37.

Any capital expenditure incurred on acquiring a telecom license is deductible in

(A) 5 equal installments

(B) 10 equal installments

(C) 15 equal installments

(D) Equally over the period of the license [Dec. 2016]

Answer:

(D) Equally over the period of the license

Question 38.

Varun Ltd. paid fees for technical services of ₹ 6 lakh has and omitted to deduct tax at source and such omission continued till the ‘due date’ for filing the return of income specified in Section 139(1). The amount of expenditure available for disallowance would be –

(A) ₹ 1,80,000

(B) ₹ 6,00,000

(C) ₹ 1,20,000

(D) Nil [Dec. 2016]

Answer:

(A) ₹ 1,80,000

Question 39.

Dr. Sen has surgical equipment whose WDV as of 1.4.2020 was ₹ 4,10,000. He acquired some more equipment in December 2020 for ₹ 3,50 000. He sold equipment in March 2020 for ₹ 2,00,000 whose original cost was ₹ 1,70,000. The written down value of the block for the purpose of computing depreciation for the assessment year 2021-22 is:

(A) ₹ 5,90,000

(B) ₹ 5,60,000

(C) ₹ 7,30,000

(D) ₹ 4,30,000 [June 2017]

Hint:

| WDV of equipment on at the beginning | 4,10,000 |

| (+) Addition during year | 3,50,000 |

| (-) Sold during year | (2,00,000) |

| WDV for charging depreciation | 5,60,000 |

Answer:

(B) ₹ 5,60,000

Question 40.

Rosy Ltd. engaged in the manufacture of bio-medicines in August 2020 converted one piece of equipment that was used for scientific research purposes previously, for regular business use. The original cost of the plant is ₹ 15 lakhs which was acquired in April 2019. The company had claimed deduction at 150% under section 35(2AB) in the assessment year 2020-21. The plant used for scientific research would be included in the block of assets now at a value of:

(A) Nil

(B) ₹ 15,00,000

(C) ₹ 30,00,000

(D) ₹ 12,75,000

Answer:

(A) Nil

Question 41.

Which of the following is a ‘specified business’ eligible for deduction under section 35AD?

(A) Operating warehousing facility for storage of agriculture produce

(B) Operating leather manufacturing unit

(C) Operating unit for manufacture of toothpaste

(D) Units operating in Jammu & Kashmir [June 2017]

Answer:

(A) Operating warehousing facility for storage of agriculture produce

Question 42.

Malick & Co. engaged in trading activity could not recover ₹ 5 lakhs from a customer. It claimed the entire amount as a bad debt by writing it off in the books of account. The aggregate sale made during the year to the party amounts to ₹ 30 lakhs. The amount eligible for deduction by way of bad debt is:

(A) Nil

(B) ₹ 3 lakhs

(C) ₹ 5 lakhs

(D) ₹ 60,000 [June 2017]

Answer:

(C) ₹ 5 lakhs

Question 43.

Andhra Traders a partnership firm paid ₹ 80,000 as contract charges to AKP & Co. (firm). No tax was deducted at source for the above said payment The amount liable for disallowance under section 40(a)(ii) for the assessment year 2021-22 is:

(A) Nil

(B) ₹ 80,000

(C) ₹ 40,000

(D) ₹ 24,000 [June 2017]

Hint:

80,000 × 3096 = 24,000

Answer:

(D) ₹ 24,000

Question 44.

Ravi & Co. paid ₹ 40,000 in cash to Mr. Balu a supplier on 5.9.2020. The cash payment was made on the day on which the bank was on strike.

The amount of expenditure liable for disallowance under section 40A(3) is:

(A) ₹ 40,000

(B) ₹ 12,000

(C) ₹ 20,000

(D) Nil [June 2017]

Hint:

w.e.f 29/1/2020 – Payment in excess of prescribed limit made otherwise than by prescribed account of holiday or strike would attract disallowance u/s 40A(3).

Answer:

(A) ₹ 40,000

Question 45.

Where the payment of expenditure claimed as a deduction by any assessee carrying on business or profession other than who is in transport business exceeds ₹ 10,000, it should be paid by:

(A) Crossed cheque/draft

(B) Account payee cheque/account payee draft

(C) Account payee cheque

(D) Any mode other than cash [June 2017]

Answer:

(B) Account payee cheque/account payee draft

Question 46.

Raju succeeded to the business of his father Ramu consequent to the demise of Ramu on 1.2.2021. Raju recovered ₹ 30,000 due from a customer which was written off by late Ramu as bad debt and allowed in the assessment year 2016-2017. The amount recovered is:

(A) Exempt from tax

(B) Fully-taxable as business income

(C) ₹ 15,000 being 50% taxable as business income

(D) To be set off against current year bad debts [June 2017]

Answer:

(A) Exempt from tax

Question 47.

Mr. Siraj engaged in retail trade reports a turnover of ₹ 43 lakhs for the previous year 2020-2021. He deposited ₹ 30,000 in his PPF account held with SBI. Turnover or gross receipts represents the amount received by an account payee cheque or an account payee bank draft or use of an electronic clearing system through a bank account during the previous year or before the due date specified in Section 139(1). His total income for the assessment year 2021-22 by applying section 44AD provision is:

(A) ₹ 3,14,000

(B) ₹ 3,44,000

(C) ₹ 2,28,000

(D) ₹ 4,00,000 [June 2017]

Hint:

| Deemed income u/s 44AD (43,00,000 × 6%) | 2,58,000 |

| (-) Deduction u/s 80C | (30,000) |

| Total income | 2,28,000 |

Answer:

(C) ₹ 2,28,000

Question 48.

DPM Ltd. constructed staff quarters and let out the same during the financial year 2020-21. Its rent received ₹ 7,50,000 by way of rent from employees during the year. The rental receipt is taxable as:

(A) Income from house property

(B) Income from business

(C) Perquisite in the hands of employees

(D) Income from ‘other sources’ [Dec. 2017]

Answer:

(B) Income from business

Question 49.

Vikram Mfg. Co. Ltd. located in a backward area in the State of Andhra Pradesh acquired some machinery for ₹ 20 lakh on 10.8.2020. It was put to use from 1.9.2020. The applicable rate of depreciation is 15%.

How much would be the eligible additional depreciation for the assessment year 2021-22 in respect of the said machinery?

(A) ₹ 3,00,000

(B) ₹ 4,00,000 (20% only)

(C) ₹ 7,00,000

(D) ₹ 20,00,000 [Dec. 2017]

Hint:

20,00,000 × 2096 = ₹ 4,00,000.

Answer:

(B) ₹ 4,00,000 (20% only)

Question 50.

When ABC Ltd. incurred ₹ 10 lakh in FY 2020-21 as capital expenditure for the purpose of family planning amongst the employees, the expenditure allowable for the assessment year 2021-22 would be:

(A) Nil

(B) ₹ 2,00,000

(C) ₹ 10,00,000

(D) ₹ 5,00,000 [Dec. 2017]

Hint:

10,00,000 × 1 /5 = 2,00,000.

Answer:

(B) ₹ 2,00,000

Question 51.

Alpha & Co is a proprietary concern owned by Vimala. The total turnover for the Year 2020-21 is ₹ 52 lakhs which includes proceeds realized through banking channel ₹ 12 lakhs. The presumptive income under Section 44AD would be:

(A) ₹ 4,16,000

(B) ₹ 2,60,000

(C) ₹ 3,92,000

(D) ₹ 5,20,000 [Dec. 2017]

Hint:

(12,00,000 × 696) + (40,00,000 × 896) = 3,92,000.

Answer:

(C) ₹ 3,92,000

Question 52.

Dr. Ravi practicing medicine has gross receipt of ₹ 18,40,000 for the financial year 2020-21. His presumptive income under Section 44ADA would be:

(A) ₹ 1,47,200 @8%

(B) ₹ 92,000 @5%

(C) ₹ 9,20,000 @ 50%

(D) ₹ 4,60,000 @ 25% [Dec. 2017]

Answer:

(C) ₹ 9,20,000 @ 50%

Question 53.

Rahim had 5 goods carriage vehicles on 1.4.2020. He acquired and used 3 vehicles from 1.9.2020. What is the presumptive income under Section 44AE?

(A) ₹ 8,10,000

(B) ₹ 3,64,500

(C) ₹ 2,02,500

(D) ₹ 6,07,500 [Dec. 2017]

Hint:

(5 × 7,500 × 12) + (3 × 7,500 × 7) = 6,07,500.

Answer:

(D) ₹ 6,07,500

Question 54.

Books of account of an individual are liable for tax audit under section 44 AB on a mandatory basis, if the annual turnover exceeds:

(A) ₹ 40 lakh

(B) ₹ 60 lakh

(C) ₹ 100 lakh/500 lakhs

(D) ₹ 200 lakh [Dec. 2017]

Answer:

(C) ₹ 100 lakh/500 lakhs

Question 55.

Ranga & Co. had as of 1.4.2020 plant and machinery whose written down value was ₹ 12,00,000. It acquired 2 plants on 3.11.2020 for ₹ 6 lakhs. The applicable depreciation rate is 15%. The eligible depreciation including additional depreciation for the AY 2020-2021 would be:

(A) ₹ 2,70,000

(B) ₹ 2,55,000

(C) ₹ 2,85,000

(D) ₹ 2,25,000 [Dec. 2017]

Hint:

| Regular depreciation: | |

| On asset put to use more than 180 days (12,00,000 × 15%) | 1,80,000 |

| On asset put to use less than 180 days (6,00,000 × 7.5%) | 45,000 |

| Additional depreciation on new assets: | |

| On asset put to use less than 180 days (6,00,000 × 10%) | 60,000 |

| Total depreciation | 2,85,000 |

Answer:

(C) ₹ 2,85,000

Question 56.

Which out of the following elements you find are sufficient for bringing to tax as income from Business or profession?

(i) Ownership of the business is not necessary

(ii) Business must be legal

(iii) Income may be earned in cash or kind

(iv) Profit motive is the sole consideration

Select correct answer from the options given below:

(A) (i), (ii) and (iv)

(B) All the four

(C) (i) and (iii)

(D) (i), (iii) and (iv) [June 2018]

Answer:

(C) (i) and (iii)

Question 57.

Sakshi Pvt. Ltd. has spent a sum of ₹ 30 lakh towards meeting its Corporate Social Responsibility (CSR) obligation. The amount of deduction available while computing the business income is:

(A) ₹ 30 lakh

(B) Nil

(C) ₹ 37.5 lakh

(D) ₹ 45 lakh [June 2018]

Answer:

(B) Nil

Question 58.

Expenses not specifically being allowed under any of sections 30 to 36 and incurred for the purpose of business or profession are allowable as per section 37(1) of the Act.

Following expenses are allowable under this section:

(i) Expenditure on the issue of share capital

(ii) Expenses for the installation of new telephone

(iii) Annual listing fees paid to the stock exchange

(iv) Loss caused by robbery or dacoity incidental to the business.

Select the correct answer from the options given below:

(A) (i) and (iv)

(B) (ii), (iii) and (iv)

(C) (ii) and (iii)

(D) All the four [June 2018]

Answer:

(C) (ii) and (iii)

Question 59.

John Miller & Co. of UK is maintaining and operating a branch in India for the sale of its garment products. The adjusted total income of the branch for the year prior to the charge of HO expenses of ₹ 20 lakh is ₹ 100 lakh. Indian branch intends to know the maximum amount of HO expenses as allowable during the year under the Act.

Specify the amount:

(A) ₹ 20 lakh

(B) Nil as HO is a non-resident

(C) ₹ 5 lakh

(D) 8% of adjusted total income [June 2018]

Hint:

Head office expenditure is allowable to the extent of the lower of the following:

| 5% of adjusted total income (100 lakh × 5%) or | ₹ 5 lakh |

| Amount of so much of expenditure in the nature of head office expenditure incurred by the assessee as is attributable to the business of the assessee in India. | ₹ 20 lakh |

Thus, the deduction available will be ₹ 5 lakh.

Answer:

(C) ₹ 5 lakh

Question 60.

Additional depreciation on the factory building constructed during the PY 2020-21 and put to use for manufacturing of garments on 1st February 2021 having the cost of ₹ 100 lakh shall be allowed in AY 2021-22 at a rate of:

(A) 596

(B) 1096

(C) 1596

(D) Nil [June 2018]

Hint:

Additional depreciation is available for ‘Plant & Machinery’ not for ‘Building’.

Answer:

(D) Nil

Question 61.

Amount of ₹ 5,00,000 received by Ram & Co., as compensation for premature termination of the contract of agency is to be treated as:

(A) Income from other sources

(B) Taxable under section 28(n)(c)

(C) Revenue receipt which is exempt

(D) Capital receipt which is not chargeable to tax [June 2018]

Answer:

(B) Taxable under section 28(n)(c)

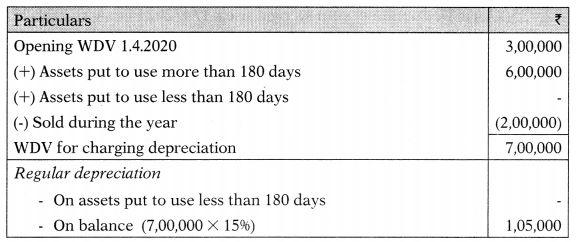

Question 62.

The WDV of a block of asset depreciated @ 1596 as of 1st April 2020 was ₹ 3,00,000. Out of this block, one machine was sold for ₹ 2,00,000 on 1st July 2020 and a new machine of ₹ 6,00,000 added on 1 st August 2020 was put to use only from 1 st Sept. 2020.

The amount of depreciation to be claimed (in the manner most beneficial to the assessee ignoring additional depreciation) in the AY 2021-22 shall be:

(A) ₹ 1,20,000

(B) ₹ 96,000

(C) ₹ 1,05,000

(D) ₹ 60,000 [June 2018]

Hint:

Answer:

(C) ₹ 1,05,000

Question 63.

Zing Zang is an individual, manufacturing a product. He has a turnover of ₹ 98,50,000 which is inclusive of the amount of ₹ 25 lakh received through the electronic clearing system. The accounts are not properly maintained and you have advised him to pay tax u/s 44AD of the Act. On how much income he will pay tax for AY 2021-22?

(A) ₹ 7,88,000

(B) ₹ 7,38,000

(C) Manufacturers not allowed u/s 44AD

(D) ₹ 5,91,000 [June 2018]

Hint:

(73,50,000 × 896) + (25,00,000 × 696) = 7,38,000.

Answer:

(B) ₹ 7,38,000

Question 64.

XYZ Ltd., engaged in the manufacture of a product, has incurred an expenditure of ₹ 3 lakh on notified skill development project u/s 35CCD. The deduction available for such expenditure is lakh.

(A) ₹ 3

(B) ₹ 3.75

(C) ₹ 4.5

(D) None of the above [June 2018]

Answer:

(C) ₹ 4.5

Question 65.

SH made three different cash payments of ₹ 10,000, ₹ 10,000, and ₹ 11,500 to a supplier for the purchase of goods and material on 11th Sept. The payments were made during different times in the day. Amount to be disallowed u/s 40A(3) is:

(A) ₹ 11,500

(B) ₹ 31,500

(C) NIL

(D) None of the above [June 2018]

Answer:

(B) ₹ 31,500

Question 66.

An employee director of a company was paid ₹ 5 lakh as a lump sum consideration for resigning from the directorship by XYZ Ltd. The amount so paid shall be treated in the accounts of the company as

(A) Deferred Revenue expenses

(B) Revenue expenses

(C) Capital expenses

(D) Gift to employee director [Dec. 2018]

Answer:

(B) Revenue expenses

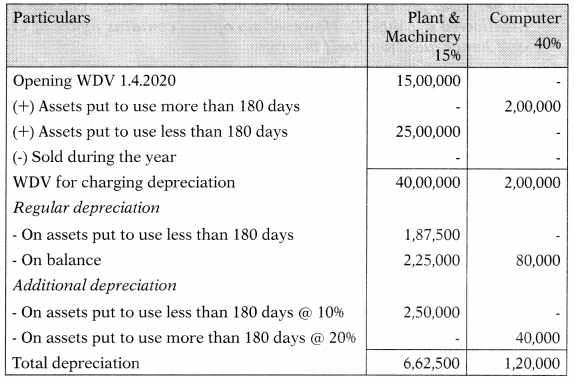

Question 67.

Hari Krishna Vidhyut Company Ltd. engaged in the business of generation and distribution of power and electricity has opted WD V method for claiming depreciation on its assets. The opening balance of the block of Plant and Machinery depreciated @ 1596 on 1st April 2020 was ₹ 15,00,000. New machines of an amount of ₹ 25,00,000 were purchased on 15th Nov. 2020 but put to use from 1st December 2020. Computers for ₹ 2,00,000 were purchased on 9th Sept. 2020 and put to use in business since that date. The depreciation including the additional depreciation available to the company on plant and machinery and on the computers shall be of an amount of for AY 2021-22.

(A) ₹ 4,92,500

(B) ₹ 5,32,500

(C) ₹ 7,82,500

(D) ₹ 7,42,500 [Dec. 2018]

Hint:

Net Total – 6,62,500 + 1,20,000 = 7,82,500.

‘Computer’ also comes in a block of ‘plant & machinery’ and eligible for additional depreciation.

It is assumed, that computers are not used in the office.

Answer:

(C) ₹ 7,82,500

Question 68.

Radhey a trader having turnover of ₹ 90,00,000 from textile business inclusive of turnover of ₹ 20,00,000 carried through banking channel by way of drafts and online payments had opted to pay tax as per Section 44AD of the Income-tax Act. The amount of income which shall be taken for the purpose of tax for AY 2021-22 under the head income from business and profession is

(A) ₹ 9,00,000

(B) ₹ 6,80,000

(C) ₹ 7,20,000

(D) ₹ 5,40,000 [Dec. 2018]

Hint:

(70,00,000 × 896) + (20,00,000 × 696) = 6,80,000

Answer:

(B) ₹ 6,80,000

Question 69.

Sardar Sukhdev Singh engaged in the business of plying, hiring, or leasing of heavy goods carriages owned 6 vehicles during the period 1st April 2020 to 31st March 2021 which were given on lease for plying to GS Transport Company at a fixed rate of ₹ 5,000 p.m. per truck for a whole year. He had opted to pay tax as per Section 44AE of the Income-tax Act. The amount of income that shall be taken for all such trucks for the purpose of tax for AY 2021 -22 is

(A) ₹ 5,40,000

(B) ₹ 3,60,000

(C) ₹ 6,48,000

(D) ₹ 6,84,000 [Dec. 2018]

Hint:

6 × 7,500 × 12 = 5,40,000.

Answer:

(A) ₹ 5,40,000

Question 70.

DAS Pvt. Ltd. fulfilling all the conditions as being specified in Section 3 5 AD of the Income-tax Act, 1961 has incurred capital expenditure of ₹ 30 lakh on purchase of land, ₹ 80 lakh (₹ 75 lakh by cheque and ₹ 5 lakh in cash) on the construction of the building and ₹ 10 lakh on the plant and machinery during the previous year 2020-21 for setting up and operating a warehouse for the storage of sugar. The warehouse became operational on 1st March 2021.

The amount of deduction which the company can claim for such capital expenditure as per Section 3 5AD in AY 2021-22 shall be

(A) ₹ 120 lakh

(B) ₹ 180 lakh

(C) ₹ 85 lakh

(D) ₹ 90 lakh [Dec. 2018]

Hint:

Deduction on the construction of building ₹ 75 lakh and on plant and machinery ₹ 10 lakh will be available. Thus, the total deduction will be 185 lakh.

Answer:

(C) ₹ 85 lakh

Question 71.

Depreciation whether to be allowed on the purchase and installation of a fire extinguisher by a practicing CS in his office, even when the same is not put to use or used during the year of acquisition as stipulated under section 32 the Income-tax Act, 1961:

(A) No, Failure to use for the profession or business

(B) Yes, Safety measures and kept stand by, treated as passive use and eligible for depreciation

(C) Yes, Allowable @ 10% of the cost

(D) Yes, Allowable @ 50% of the cost [Dec. 2018]

Answer:

(B) Yes, Safety measures and kept stand by, treated as passive use and eligible for depreciation

Question 72.

Radha engaged in the trading business and had contributed a sum of ₹ 1 lakh to an approved university in July 2020 to be used for scientific research, which is not related to her business. The amount of deduction for which she is eligible under section 35 of income-taxAct, 1961 for Assessment Year 2020-2021 would be:

(A) ₹ 1 lakh

(B) ₹ 1.5 lakh

(C) ₹ 1.75 lakh

(D) ₹ 2 lakh [Dec. 2018]

Hint:

₹ 1 lakh × 150% = ₹ 1.5 lakh

35(2AA): Deduction = sum so paid w.e.f 1/4/2021 i.e. A.Y. 2021-22.

Answer:

(A) ₹ 1 lakh

Question 73.

The assessee opting to pay tax under the provisions of Section 44AD A is not be required to maintain books of accounts as per Section 44AA and gets the accounts audited under Section 44AB of the Income-tax Act, 1961 where

(A) It claims that the profit and gains from the profession are higher than the deemed profit and gains

(B) Total gross receipts should not exceed ₹ 60 lakh

(C) Its income does not exceed the maximum amount which is not chargeable to income-tax

(D) Both (A) and (C) [Dec. 2018]

Answer:

(D) Both (A) and (C)

Question 74.

Income of a non-resident from airline business under section 44BBA of Income-tax Act, 1961 is calculated at the rate of percentage of the aggregate amounts specified, on a presumptive basis.

(A) 7.5%

(B) 5%

(C) 10%

(D) 15% [Dec. 2018]

Answer:

(B) 5%

Question 75.

Raghav Housing Finance Ltd., an NBFC is eligible to claim a deduction in the case of provision made for bad and doubtful debts to the extent of total income.

(A) 10%

(B) 5%

(C) 2%

(D) 1% [June 2019]

Answer:

(B) 5%

Question 76.

XYZ Ltd. paid ₹ 5 lakh on 22.1.2020 to a national level laboratory for carrying scientific research unrelated to the business of the company. The amount of deduction eligible under section 35(2AA) of the Income-tax Act, 1961 is:

(A) ₹ 5,00,000 @ 100%

(B) ₹ 6,25,000 @ 125%

(C) ₹ 7,50,000 @ 150%

(D) ₹ 10,00,000 @ 200% [June 2019]

Answer:

(A) ₹ 5,00,000 @ 100%

Question 77.

Patel, a textile dealer, purchases goods worth ₹ 65,000 from Anand and made the payments:

(i) ₹ 12,000 by account payee cheque on 5th June 2020,

(ii) ₹ 8,000 by cash on 16th August 2020,

(iii) ₹ 15,000 by bearer cheque on 7th November 2020 and

(iv) ₹ 30,000 by ECS on 21st March, 2021.

The amount of expenditure not allowable as per provisions of section 40A(3) would be:

(A) NIL

(B) ₹ 8,000

(C) ₹ 23,000

(D) ₹ 38,000 [June 2019]

[Note: Above MCQ is wrongly drafted. For further clarification please see the hints.]

Hint:

Expenditure exceeding ₹ 10,000 [Section 40A(3)]: Where assessee incurs an expenditure, which is allowable and claimed as a deduction and the payment or aggregate of payments made to a person in a day in respect of such expenditure, otherwise than by an account payee cheque drawn on a bank or account payee bank draft or use of electronic clearing system exceeds ₹ 10,000 then no deduction shall be allowed in respect of such expenditure. In the case of payment made for plying, hiring, or leasing goods carriages, the aforesaid limit shall be ₹ 35,000 instead of ₹ 10,000.

If payment is made for any liability of earlier years in the current year otherwise than account payee cheque and such payment exceeds ₹ 10,000 then such expenditure is not allowed to be deducted while computing profits and gains of business and profession.

As per data given in question 115,000 paid by the bearer, the cheque will be disallowed u/s 40A(3). However, no option contains a figure of ₹ 15,000, and hence question itself is wrong.

Answer:

Question 78.

Deccan Ltd. incurred an amount of ₹ 16 lakh as preliminary expenses for setting up a project costing ₹ 100 lakh during the financial year 2020-21. The amount of amortization available as deduction during the AY 2021-22 for the preliminary expenses would be:

(A) ₹ 1,60,000

(B) ₹ 3,20,000

(C) ₹ 16,00,000

(D) ₹ 1,00,000 [June 2019]

Hint:

As per Section 35D, a minimum of the following two will qualify for the deduction:

| The aggregate amount of eligible expenditure | 16,00,000 |

| Higher of 5% of Cost of the project or 5% of Capital employed | 5,00,000 |

Deduction = 5,00,000 × 1/5 = 1,00,000.

Answer:

(D) ₹ 1,00,000

Question 79.

Tulip & Co. is a partnership firm of two partners. The total turnover of the firm during the financial year 2020-21 is ₹ 160 lakh inclusive of ₹ 60 lakh made through account payee cheques and ECS. The partnership deed provided for the monthly working salary of ₹ 30,000 to each of the partners. The income of the firm by applying Section 44AD for AY 2021-22 would be:

(A) ₹ 11,60,000

(B) ₹ 12,80,000

(C) ₹ 5,00,000

(D) ₹ 4,40,000 [June 2019]

Hint:

(100 lakh × 8%) + (60 lakh × 6%) = 11.6 lakh.

Deduction for remuneration of partners is not available while computing deemed income u/s 44AD.

Answer:

(A) ₹ 11,60,000

Question 80.

Zed Ltd., a domestic company engaged in manufacturing activity in Mumbai acquired a plant for ₹ 5 lakh on 7th January 2021 which is eligible for depreciation @ 1596. It paid ₹ 4 lakh through the ECS system from the bank and balance ₹ 1 lakh in cash on 23rd February 2021. The plant was put to use on 12.3.2021.

The amount of depreciation (normal and additional) on this plant for AY 2021-22 shall be:

(A) ₹ 40,000

(B) ₹ 30,000

(C) ₹ 70,000

(D) ₹ 60,000 [June 2019]

Hint:

Where the assessee incurs any expenditure for acquisition of any asset or part thereof in respect of which a payment or aggregate of payments made to a person in a day, otherwise than by an account payee cheque drawn on a bank or an account payee bank draft or use of electronic clearing system through a bank account, exceeds ₹ 10,000, such expenditure shall be ignored for the purposes of determination of actual cost. Thus depreciation cannot be claimed on such an amount.

Depreciation rate = 7.5% (regular) +10% (additional) = 17.5% [As put to use less than 180 days]

4,00,000 × 17.5% = 70,000

Answer:

(C) ₹ 70,000

Question 81.

A professional is required to get his accounts audited under Section 44AB of the Income-tax Act, 1961 where the gross receipts from profession during the financial year 2021-22:

(A) Exceeds ₹ 100 lakh

(B) Equals to or exceeds ₹ 50 lakh

(C) Equals to or exceeds ₹ 100 lakh

(D) Exceeds ₹ 50 lakh [June 2019]

Answer:

(D) Exceeds ₹ 50 lakh [June 2019]

Question 82.

‘A’ Transport company engaged in the business of plying goods carriage with 4 heavy vehicles and 3 non-heavy vehicles. All the non-heavy vehicles were sold on 10th May 2019, and 2 heavy vehicles were acquired on the same date. Transporter wants to declare its income for AY 2021-22 as per

(A) ₹ 5,70,000

(B) ₹ 5,47,500

(C) ₹ 5,55,000

(D) ₹ 3,60,000 [June 2019]

[Note: Above MCQ is wrongly drafted. For further clarification please see the hints.]

Hint:

Section 44AE is amended by Finance Act, 2018 whereas the question is designed as per old provisions, and hence question itself is wrong.

Answer:

Question 83.

Maintenance of books of account in the case of a HUF carrying business is mandatory if the turnover or gross receipts in any one of the three years immediately preceding the previous year exceeds:

(A) ₹ 10 lakh

(B) ₹ 15 lakh

(C) ₹ 25 lakh

(D) ₹ 100 lakh [June 2019]

Answer:

(C) ₹ 25 lakh

Question 84.

A company engaged in manufacturing steel balls acquired computers at a cost of ₹ 3 lakh on 10th July 2020. The depreciation allowance for the AY 2021-22 under Income-tax Act, 1961 would be:

(A) ₹ 1,80,000

(B) ₹ 1,20,000

(C) ₹ 3,00,000

(D) f 45,000 [June 2019]

Hint:

Depreciation rate = 40% (regular) + 20% (additional) = 60%

[As put to use more than 180 days]

3.0. 000 × 60% = 1,80,000.

Answer:

(A) ₹ 1,80,000

Question 85.

Kant is engaged in the business of purchase and sale of pieces of various lands. During the FY 2020-21, he sold pieces of land for ₹ 32 lakh. All these sales were made through cheques and Electronic Clearing System (ECS). The valuation of these pieces of land for stamp duty purposes was ₹ 41 lakh. He wants to pay tax on the income as per section 44AD.

The income as per this section for AY 2021-22 shall be:

(A) ₹ 2,46,000

(B) ₹ 3,28,000

(C) ₹ 2,56,000

(D) ₹ 1,92,000 [June 2019]

Hint:

41,00,000 × 6% = 2,46,000.

Answer:

(A) ₹ 2,46,000

Question 86.

Assets put to use in business for more than 180 days during the previous year consisting

(i) Factory Building,

(ii) Computers,

(iii) Motor Vehicles used for Commercial Purposes, and

(iv) Intangible Assets shall be depreciated at the rate of respectively.

(A) 596, 1596, 3096, 2596

(B) 1096,4096,3096,2596

(C) 1096, 1596, 2596, 2596

(D) 596, 4096, 1596, 2596 [Dec. 2019]

Answer:

(B) 1096,4096,3096,2596

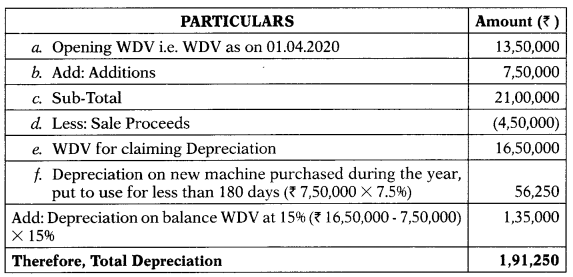

Question 87.

The WDV of the block of asset of plant & machinery depreciated @ 1596 as of 1st April 2020 was of ₹ 13,50,000. Out of this block, one machine was sold on 1st July 2020 for ₹ 4,50,000 and a new machine of ₹ 7,50,000 was purchased on 1st August 2020 which could be put to use from 1st March 2021. The amount of depreciation to be claimed on the block of plant & machinery in the computation of income for A.Y. 2021-22 shall be :

(A) ₹ 1,35,000

(B) ₹ 2,47,500

(C) ₹ 1,91,250

(D) ₹ 2,53,125 [Dec. 2019]

Hint:

Computation of depreciation of Plant and Machinery for Assessment Year 2021-22:

Answer:

(C) ₹ 1,91,250

Question 88.

A machine owned by AB & Co. was transferred to XYZ & Co. on 1st January 2021 for ₹ 5 lakh of which actual cost and WDV was of ₹ 3 lakh and 2 lakh respectively. However, the fair market value on the date of transfer of the machine was ₹ 4 lakh. XYZ & Co. will be allowed depreciation on such machine by taking value thereof at ₹…

(A) 5 Iakh

(B) 2 iakh

(C) 3 lakh

(D) 4lakh [Dec. 2019]

Answer:

(D) 4lakh

Question 89.

Any asset, on which depreciation is claimed on the basis of Straight Line Method (SLM) is sold and the amount by which money payable together with scrap value, fall short of the Written Down Value (WDV) of such asset, the amount of such deficiency in value of the asset is allowed to be written off in the year of sale as

(A) Balancing charge

(B) Terminal depreciation

(C) Loss on sale of an asset

(D) Residual value of asset [Dec. 2019]

Answer:

(B) Terminal depreciation

Question 90.

Anirudh had made payment of (i) ₹ 30,000 to IIT, Kanpur for an approved scientific research program (ii) ₹ 45,000 revenue expenditure on in house R&D facility as approved by the prescribed authority and (iii) ₹ 1,00,000 to Indian Institute of Science, Bengaluru for scientific research, wants to know about the deduction available while computing the income under “Profits and gains from business’’ in the Assessment Year 2021-22.

(A) ₹ 2,40,000

(B) ₹ 1,75,000

(C) ₹ 2,62,500

(D) ₹ 2,65,000 [Dec. 2019]

Answer:

(B) ₹ 1,75,000

Question 91.

XAB Ltd. has incurred an amount of ₹ 4,00,000 towards capital expenditure and ₹ 1,50,000 towards bona fide revenue expenditure for the purpose of promoting family planning amongst its employees during the year 2020-21. The company can claim a deduction of an amount of ₹ for such expenses in the return to be filed for A. Y. 2021 -22.

(A) 5096 of ₹ 5,50,000

(B) ₹ 2,30,000

(C) Such expenses are not allowed

(D) 2096 of ₹ 5,50,000 [Dec. 2019]

Answer:

(B) ₹ 2,30,000

Question 92.

Ping Pong is a Proprietorship firm of Pinga, resident in India having turnover from manufacturing and sale of Steel balls for the year 2020-21 of ₹ 148 lakh which is inclusive of the amount of ₹ 42 lakh received through electronic clearing system/RTGS/NEFT. The accounts are not properly maintained by Pinga and therefore he wants to pay tax on the income computed under section 44AD of the Act. Advise Pinga, how much income he will be required to pay tax for A.Y. 2021- 22 as per section 44AD :

(A) ₹ 11,84,000

(B) Not allowed to opt 44AD being turnover above ₹ 100 lakh

(C) ₹ 11,00,000

(D) ₹ 8,88,000 [Dec. 2019]

Hint:

Computation of PGBP of Pinga from Ping Pong as per section 44AD:

| ₹ | |

| a. On 42,00,000 at 6% | 2,52,000 |

| b. On balance ₹ 1,06,00,000 at 8% (1,48,00,000 – 42,00,000) | 8,48,000 |

| c. Total | 11,00,000 |

Answer:

(C) ₹ 11,00,000

Question 93.

Mr. Ramanad, engaged in the business of plying, hiring, or leasing of goods carriers as of 1st April 2020 was having 3 trucks of gross vehicles weight of fewer than 12,000 kgs. each. One truck out of these 3 trucks was sold by him on 23rd July 2020 and after its sale, 2 more trucks (1 of less than 12,000 kgs. and 1 of 16,900 kgs.) were purchased on 5th September 2020. He wants to declare the income of trucks as per provisions of section 44AE of the Act and be required to declare such income at ₹ in the return for A.Y. 2021 – 22 from plying of these vehicles during the previous year ended on 31st March 2020.

(A) ₹ 3,54,500

(B) ₹ 3,81,500

(C) ₹ 3,15,000

(D) ₹ 3,74,000

Hint:

Computation of presumed income from the business of Rarnanad under section 44AE:

| ₹ | |

| a. 3 Other than heavy goods carriages for 4 months Including 90,000 part thereof (April – July 2020) (₹ 7,500 × 3 X 4) | 90,000 |

| b. 2 Other than heavy goods carriages for August (₹ 7,500 × 2 X 1) | 15,000 |

| c. 3 Other than heavy goods carriages for 7 months Including 1,57,500 part thereof (Sept. 2020 – March 2021) (₹ 7,500 × 3 × 7) | 1,57,500 |

| d. 1 Heavy goods carriage for 7 months (17 tonnes × ₹ 1,000 per tonne × 7) | 1,19,000 |

| Total Income under section 44AE | 3,81,500 |

Answer:

(B) ₹ 3,81,500