Hire Purchase and Instalment Sale Transactions – CA Inter Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Hire Purchase and Instalment Sale Transactions – CA Inter Accounts Question Bank

Question 1.

Explain the special features of hire purchase agreement. (Nov 2017, 4 marks)

Answer:

1. Possession:

The hire vender transfers possession of the goods to the hire purchaser immediately after the contract of hire purchase is made.

2. Installments:

The goods are delivered by hire vender on the condition that a hire purchaser should pay the amount in periodical installments.

3. Down Payment:

The hire purchaser generally makes a down payment i.e., an amount on signing the agreement.

4. Constituents of Hire Purchase Installments:

Each installment consists partly of a finance charges (interest) and partly of a capital payment.

5. Ownership:

The property in goods is to pass to the hire purchaser on the payment of the last installment and exercising the option conferred upon him under the agreement.

6. Repossession:

In case of default in respect of payment of even the last installment, the hire vendor has the right to take the goods back without making any compensation.

Question 2.

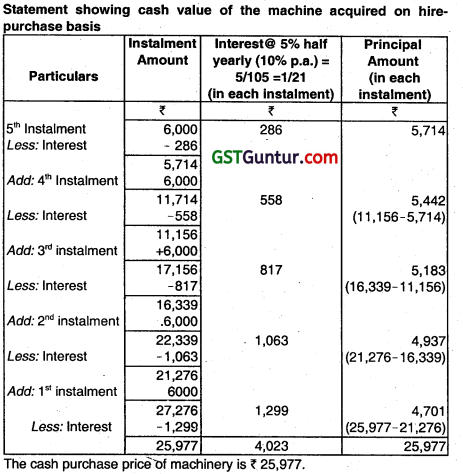

A acquired on 1st January 2003 a machine under a Hire-Purchase agreement which provides for 5 half-yearly Instalments of ₹ 6,000 each, the first installment being due on 1st July 2003. Assuming that the applicable rate of interest Is 10 percent per annum, calculate the cash value of the machine. All working should form part of the answer. (May 2003, 8 marks)

Answer:

Question 3.

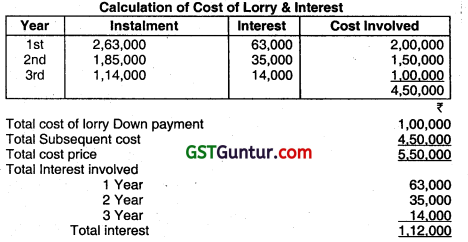

Ram & Co. acquired a motor lorry on hire- purchase basis. It has to make cash down payment of ₹ 1,00,000 at the beginning. The payments to be made subsequently are ₹ 2,63,000; ₹ 1,85,000 and ₹ 1,14,000 at the end of first year, second year and third year respectively, Interest charged is @ 14% per annum. Calculate th cost price of motor lorry and Interest paid in each installment. (May 2008, 4 marks)

Answer:

Working Note:

Third Instalment = ₹ 1,14,000

lnterest= \(\frac{1,14,000 \times 14}{114}\) = 14,000(I1)

Principal = ₹ 1,00,000 (P1)

Second Instalment = ₹ 1,85,000

Amount outstanding = ₹ 1,00,000

Total 1,85,000 + 1,00,000 = ₹ 2,85,000

Interest) = \(\frac{2,85,000 \times 14}{114} \) = 35,000 (I2)

∴ Principal = 1,50,000 (P2)

Question 4.

From the following. calculate the cash price of the asset:

| ₹ | |

| Hire purchase price of the asset | 50,000 |

| Down payment | 10,000 |

| Four annual installments at the end of each year | 10,000 |

| Rate of Interest | 5% p.a. |

(May 2010, 2 marks)

Answer:

Computation of Cash Price of the Asset

| Number of Instalments | Closing balance | Amount of Installment | Total | Interest 5/105 | Opening balance |

| 4 | 0 | 10,000 | 10,000 | 476 | 9,524 |

| 3 | 9,524 | 10,000 | 19,524 | 930 | 18,594 |

| 2 | 18,594 | 10,000 | 28,594 | 1,362 | 27,232 |

| 1 | 27,232 | 10,000 | 37,232 | 1,773 | 35,459 |

Cash price of the asset

= Down payment + ₹ 35,459

= ₹ 10,000 + ₹ 35,459

= ₹ 45,459

Question 5.

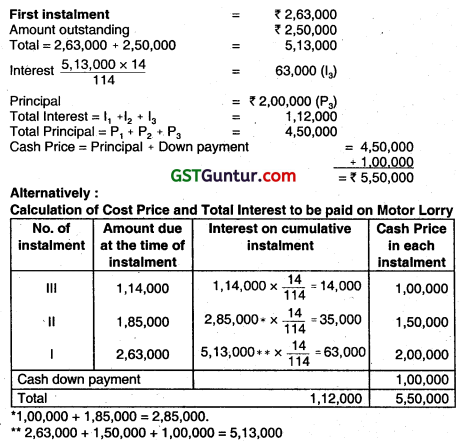

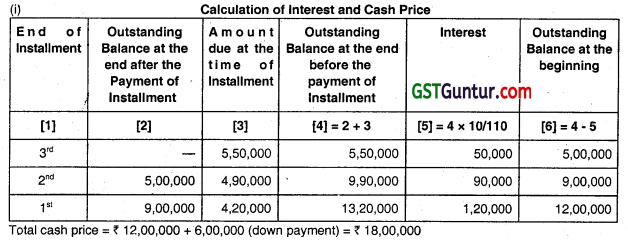

On 1st April 2012 Fastrack Motors Co. sells a truck on hire purchase basis to Teja Transport Co. for a total hire purchase price of ₹ 9,00,000 payable as to ₹ 2,40,000 as down payment and the balance in three equal annual installments of ₹ 2,20,000 each payable on 31st March 2013, 2014 and 2015. The hire vendor charges interest @10% per annum. You are required to ascertain the cash price of the truck for Teja Transport Co. Calculations may be made to the nearest rupee. (Nov 2012, 5 marks)

Answer:

Ratio of Interest and amount due = \(\frac{\text { Rate of Interest }}{100+\text { Rate of Interest }}=\frac{10}{110}=\frac{1}{11} \)

There is no interest element in the down payment as it is paid on the date of the transaction. Instalments paid after certain period include interest portion also. Therefore, to ascertain cash price, interest will be calculated from last instalment to first instalment in the following way:

Total cash price = 5,47,107 + 2,40,000 (down payment) = ₹ 7,87,107.

Working Notes:

(i) ₹ 2,00,000 + 2nd instalment of ₹ 2,20,000 = ₹ 4,20,000

(ii) ₹ 3,81,818 + 1st instalment of ₹ 2,20,000 = ₹ 6,01,818

![]()

Question 6.

A Ltd., purchased a machinery on hire purchase basis from B Ltd. on the following terms:

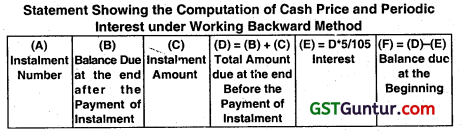

(a) Cash Down Payment – 33-1/3%, (b) Three hall-yearly instalments of ₹ 16,400, ₹ 14,880, and ₹ 12,600, the first to commence at the end of 6 months from the date of cash down payment, (c) Interest to be charged by the vendor 10% p.a. calculated on half yearly rests. Compute the Cash Price of the Machine.

Answer:

Let the Cash Price = X

X = ₹ 40,000+33 – 1/3% of X

66-2/3% of X =₹ 40,000

X =₹ 60,000

Question 7.

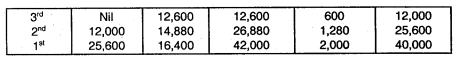

On 1.1.2018 XYZ Ltd. purchased a machine on hire purchase basis. The terms of agreement provided for 40% as cash down payment and the balance in three Instalments of ₹ 1,63,000 on 31.12.2018 ₹ 1,20,000 on 31.12.2019 and ₹ 1,10,000 on 31.12.2020. The rate of interest charged by the vendor is 10% p.a. compounded annually. Calculate the Cash Price.

Answer:

Let the Cash Price be X

X = ₹ 3,00,000 + 40% of X

0.6 X = ₹ 3,00,000

X = ₹ 3,00,000/0.6 = ₹ 5,00,000

Question 8.

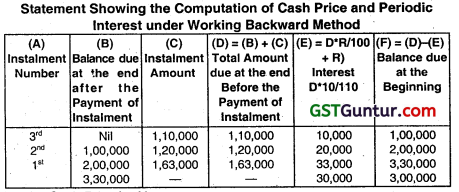

On 1.1.2017 XYZ Ltd. purchased a machine from ABC Ltd. on hire purchased basis. The terms of agreement provided for 40% as cash down payment and the balance in three instalments of ₹ 1,30,000 on 31.12.201 7, ₹ 1,20,000, on 31 .1 2.2018 and ₹ 1,21,000, on 31 .12.201 9. The rate of interest charged by the vendor is 10% p.a. compounded annually. Calculate the Cash Price.

Answer:

Let the Cash Price be X

X = ₹ 3,00,000 + 40% of X

0.6 X = ₹ 3,00,000

X = ₹ 3,00,000/0.6 = ₹ 5,00,000

Question 9.

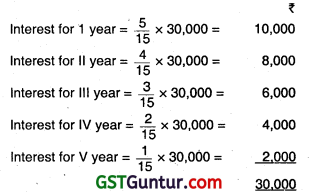

Mr. X purchased a machine on hire-purchase system. ₹ 30,000 being paid on delivery and the balance In five installments of ₹ 60,000 each, payable annually on 31st December. The cash price of the machine was ₹ 3,00,000. Compute the amount of interest for each year. (May 2009, 2 marks)

Answer:

1st year = Amount outstanding for interest after down payment, 3,00.000

2nd year = Amount outstanding for interest after 1st Instalment 2,40,000

3rd-year Amount outstanding for interest alter 2nd installment 1,80,000

4th year = Amount outstanding for interest after 3rd instalment 1,20,000

5th year = Amount outstanding for interest after 4th instalment 60,000

Total interest = Hire Purchase price – Cash Price

= 3,30,000 -3,00,000= 30,000

Installment outstanding ratio= 3.00,000:2,40,000:1,80,000:120,000:60,000 = 5:4:3:2:1

Question 10.

On 1st April 2009, a car company sold to Arya Bros., a motor car on hire- purchase basis. The total hire-purchase price was ₹ 4,60000 with down payment of ₹ 1,60,000. Balance amount was to be paid in three annual instalments of ₹ 1,00,000 each. The first instalment payable on 31st March 2010. The cash price of the car was ₹ 4,00,000. How will Arya Bros. account for interest over three accounting years assuming books of accounts are dosed on 31st March every year. (May 2010, 2 marks)

Answer:

Total interest on hire purchase transactions = ₹ 4,60,000 – ₹ 4,00,000 = ₹ 60,000

As balance payment is made in three equal installments, so interest is to be allocated in the ratio of 3 : 2: 1

Interest for 1st year = ₹ 60,000 x \(\frac{3}{6}\) = ₹ 30,000

2nd year = ₹ 60,000 x \(\frac{2}{6}\) = ₹ 20,000

3rd year = ₹ 60,000 x \(\frac{1}{6}\) = ₹ 10,000

Question 11.

Jai Ltd. purchased a machine on hire purchase basis from KM Ltd. on the following terms:

(a) Cash price ₹ 1,20,000.

(b) Down payment at the time of signing the agreement on 1-1-2016,₹ 32,433.

(c) 5 annual installments of ₹ 23,100, the first to commence at the end of twelve months from the date of down payment.

(d) Rate of interest is 10% p.a.

You are required to calculate the total interest and interest included in each installment. Also prepare the Ledger Account of KM Ltd. in the books of Jal Ltd. (Jan 2021, 8 marks)

Question 12.

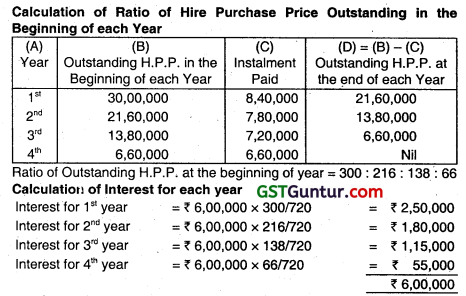

XYZ Ltd. purchased a machine on Hire Purchase System. The total cost price of the machine was ₹ 30,00,000 payable 20% down and four annual installments of ₹ 8,40,000, ₹ 7,80,000, ₹ 7,20,000 and ₹ 6,60,000 at the end of first, second, third and fourth years respectively. Calculate the interest included in each year’s instalment assuming that the sales were made at the beginning of the year.

Answer:

Hire Purchase Price = Down Payrrierit + Instalments

= ₹ 6,00.000 + (₹ 8,40,000 + ₹ 7,80,000 + ₹ 720,000 + ₹ 6,60,000)

Total Interest = H.P.Price – Cash Price =₹ 36,00,000 – ₹ 30,00,000 = ₹ 6,00,000

Question 13.

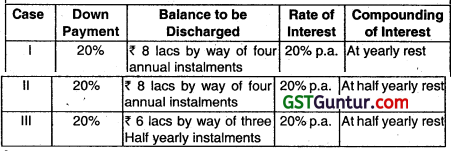

Calculate the amount of Interest and Instalments in each of the following alternatives.

Answer:

Question 14.

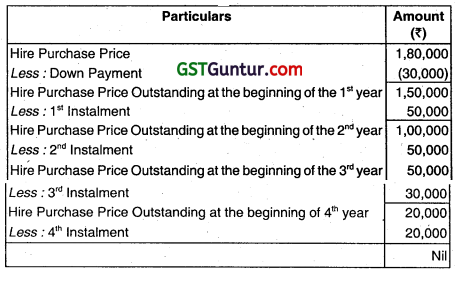

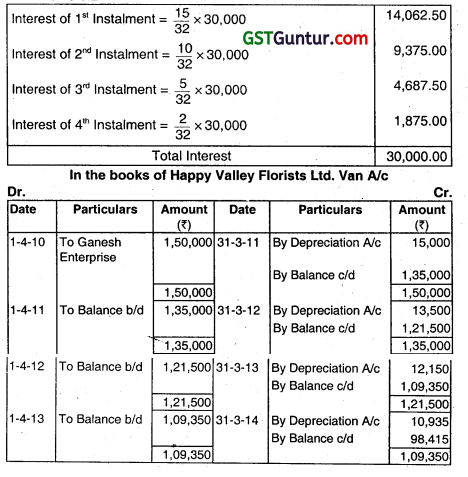

Happy Valley Florists Ltd. acquired a delivery van on hire purchase on 01.04.2010 from Ganesh Enterprises. The terms were as follows:

| Particulars | Amount (₹) |

| Hire Purchase Price | 1,80,000 |

| Down Payment | 30,000 |

| 1st installment payable after 1 year | 50,000 |

| 2nd installment after 2 years | 50,000 |

| 3rd installment after 3 years | 30,000 |

| 4th installment after 4 years, | 20,000 |

Cash price of van ₹ 1,50,000 and depreciation is charged at 10% WDV.

You are required to

(i) Calculate Total Interest and Interest induded in each installment.

(ii) Prepare Van A/c., Ganesh Enterprises A/c. in the books of Happy Valley Florists Ltd. up to 31.032014. (May 2014, 8 marks)

Answer:

CaIcultion of Total Interest & Interest Included In Each Installment.

Total Interest = Hire Purchase Price – Cash Price

= ₹ 1,80,000 – ₹1,50,000

= ₹ 30,000

Total Interest will be spread in the Ratio of Hire Purchase Price outstanding at the beginning of each year.

Ratio of Hire Purchase Price Outstanding at the beginning of each year

= 1,50,000:1,00,000:50,000:20,000

=15:10:5:2

Question 15.

On 1st April 2017, Mr. Nilesh acquired a Tractor on Hire purchase from Raj Ltd. The terms of contract were as follows;

(i) The Cash price of the Tractor was ₹ 11,50,000.

(ii) ₹ 2,50,000 were to be paid as down payment on the date of purchase.

(iii) The Balançe was to be paid in annual instalments of ₹ 3,00,000 plus interest at the end of the year.

(iv) Interest chargeable on the outstanding balance was 8% p.a.

(v) Deprecation @ 10% p.a is to be written off using straight line method.

Mr. Nilesh adopted the Interest Suspense method for recording his Hire purchase transactions.

You are required to:

Prepare the Tractor account, Interest Suspense account, and Raj Ltd.s’ account in the books of Mr. Nilesh. (Nov 2020, 8 marks)

![]()

Question 16.

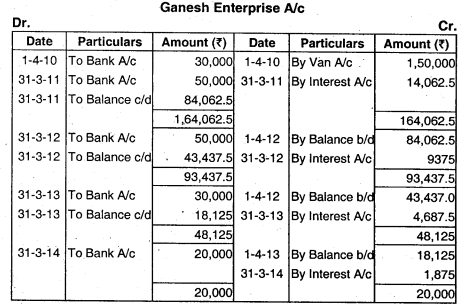

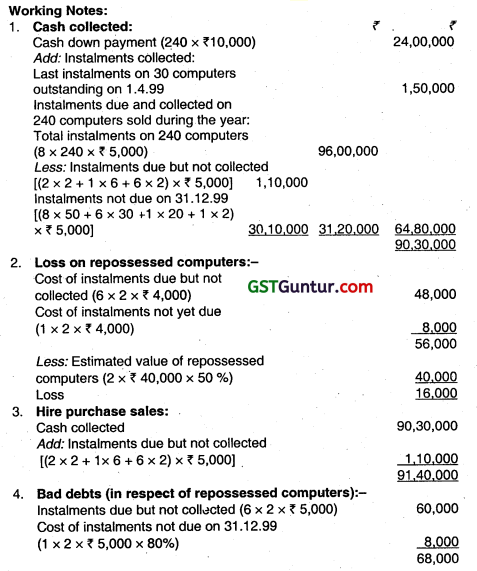

Omega Corporation sells computers on hire purchase basis at cost plus 25%. Terms of sales are ₹ 10,000 as down payment and 8 monthly instalments of ₹ 5,000 for each computer. From the following particulars prepare Hire Purchase Trading Account for the year 1999. As on 1st January, 1999 last Instalment on 30 computers was outstanding as these were flot due up to the end of the previous year.

During 1999 the firm sold 240 computers. As on 31st December, 1999 the position of instalments outstanding were as under:

1. Instalments due but not collected:

2 instalments on 2 computers and last instalment on 6 computers. Instalments not yet due: ‘

8 instalments on 50 computers, 6 instalments on 30 and last instalment on 20 computers.

Two computers on Which 6 instalments were due and one instalment not yet due on 31.12.99 had to be repossessed. Repossessed stock is valued at 50% of cost. All other instalments have been received. (May 2000, 10 marks)

Answer:

Question 17.

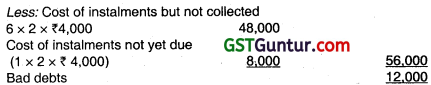

Welwash (Pvt.) Ltd. sells washing machines for outright cash as well as on hire-purchase basis. The cost of a washing machine to the company is ₹ 10,500. The company has fixed casti price of the machine at ₹ 12,300 and hire-purchase price at ₹ 13,500 payable as to ₹ 1,500 down and the balance in 24 equal monthly nstalments of ₹ 500 each.

On 1st April, ₹ 2000 the company had 26 washing machines lying in its showroom. On that date 3 instalments had fallen due, but not yet received and 675 instalments were yet to fall due in respect of machines lying with the hire-purchase customers.

During the year ended 31st March, 2001 the company sold 130 machines on cash basis and 80 machines on hire-purchase basis. After paying five monthly instalments, one customer failed to pay subsequent instalments and the company had to repossess the washing machine.

After spending ₹ 1,000 on it, the company resold it for ₹ 11,500.

On 31st March 2001 there were 21 washing machines in stock, 810 installments were yet to fall due and 5 installments had fallen due, but not yet received In respect of washing machines lying with the hire-purchase customers. Total selling expenses and office expenses including depreciation on fixed assets totaled ₹ 1,60,000 for the year. You are required to prepare for the Accounting Year ended 31st

March 2001:

(i) Hire-purchase Trading Account, and

(ii) Trading and Profit & Loss Account showing net profit earned by the company after making provision for Income-tax @ 35%. (Nov 2001,16 marks)

Answer:

Question 18.

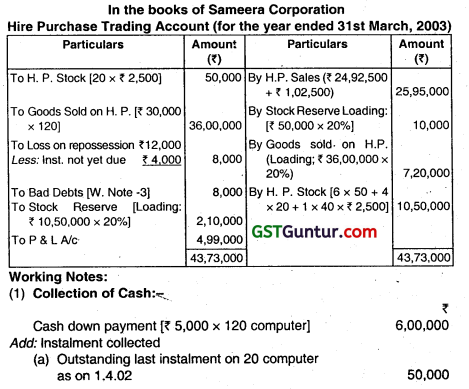

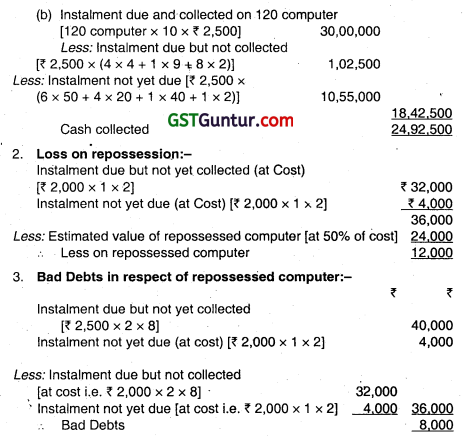

Sameera Corporation sells Computers on Hire-purchase basis at cost plus 25%. Terms of sales are 5,000/- as Down payment and 10 monthly instalments of 2,500/- for each Computer. From the following particulars. prepare Hire-purchase Trading A/c for the year 2002-03:

As on 1st April, 2002, last instalment on 20 Computers were Outstanding as these were not due upto the end of the previous year. During 2002-03, the Firm sold 120 Computers. As on 31st March 2003 the position of instalments outstanding were as under:

Instalments due but riot collected 4 Instalments on 4 Computers and Last instalment on 9 Computers.

Instalment not yet due 6 Instalments on 50 Computers, 4 Instalments on 20, and Last Instalment on 40 Computers.

Two Computers on which 8 Instalments were due and one Instalment not yet due on 31.03.2003, had to be repossessed. Repossessed stock is valued at 50% of cost. All other Instalments have been received. (May 2004, 14 marks)

Answer:

Question 19.

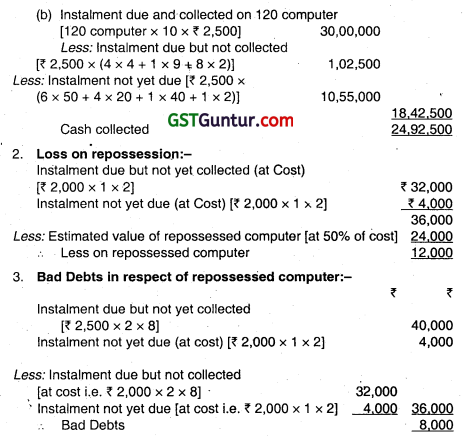

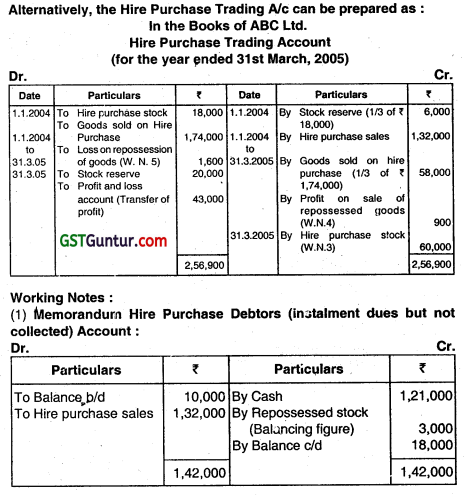

ABC Ltd. sells goods on Hire-purchase by adding 50% above cost from the following particulars, prepare Hire-purchase Trading account to reveal the profit for the year ended 31.3.2005:

| ₹ | ||

| 1.4.2004 | Installments due but not collected | 10,000 |

| 1.4.2004 | Stock at shop (at cost) | 36,000 |

| 1.4.2004 | Installment not yet due | 18,000 |

| 31.3.2005 | Stock at shop | 40,000 |

| 31.3.2005 | Installment due but not collected | 18,000 |

Others details:

Total instalments became due . 1,32,000

Goods purchased 1,20,000

Cash received from customers 1,21,000

Goods on which due instalments could not be collected were repossessed and valued at 30% below original cost. The vendor spent ₹ 500 on getting goods overhauled and then sold for ₹ 2,800. (May 2005, 16 marks)

Answer:

Question 20.

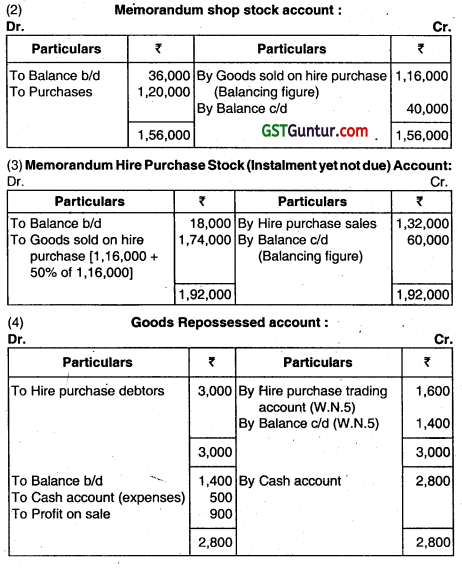

S Ltd. has a Hire-purchase department. Goods are sold on hire-purchase at cost plus 60%. From the following particulars draft Hire-purchase trading account and compute profit or loss for the year ended 31st March 2007:

Goods with customers on 1.4.2006 (installments are not due) 3.20.000

instalments due on 1.4.2006 (customers are paying) 20,000

Goods sold on hire-purchase during the year 16,00,000

(Le., from 1.4.2006 to 31.3.2007)

Cash received from customers 11,20,000

Goods re-possessed from customers valued at 40% 16,000

Unpaid instalments in respect of re-possessed goods 40,000

Goods with customers as on 31.3.2007 720,000

(at hire-purchase price) (May 2007, 8 marks)

Answer:

Working Notes:

1. Opening H.P. Stock reserve, 3,20,000 x \(\frac{60}{160}\) ₹ 1,20,000

2. Loading on goods sold on H.P 16,00,000 x \(\frac{60}{160}\) ₹ 6,00,000

3. Closing H.P. Stock reserve 7,20,000 x \(\frac{60}{160}\) ₹ 2,70,000

4. Commutation of instalments due at the end of the year Opening H.P. Stock + Opening Instalments clue + H.P. Sales

Question 21.

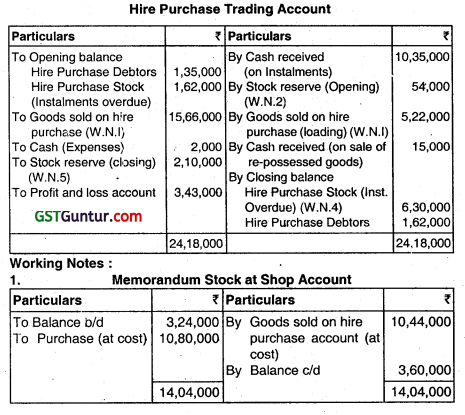

Wye sells goods on Hirepurchase. The term of purchase at cost plus 50% prepare Hire-purchase Trading A/c from the information given below:

| ₹ | |

| Stock with customers on hire-purchase price (Opening) | 1,62,000 |

| Stock in hand at shop (Opening) | 3,24,000 |

| Installments overdue (Opening) | 1,35,000 |

| Purchases during the year | 10,80,000 |

| Goods repossessed (Instalments not due 36,000) | 9,000 |

| Stock at shop excluding re-possessed goods (Closing) | 3,60,000 |

| Cash received during the year | 10,35,000 |

| Installments overdue (Closing) | 1,62,000 |

The vendor spent ₹ 2000 on goods re-possessed and then sold it for ₹ 15,000. (Nov 2008, 8 marks)

Answer:

Question 22.

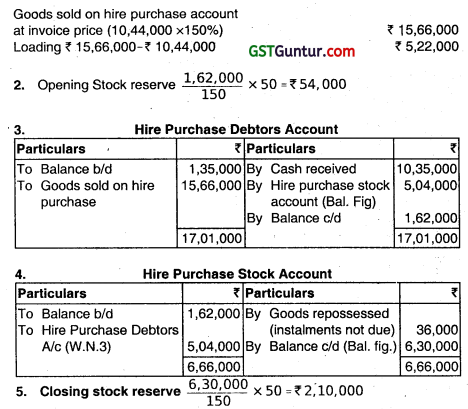

On 1st April. 2012, M/s. Power Motors sold on hire purchase basis a truck whose cash price was ₹ 9,00,000 to MIs. Singh & Singh, a firm of transporters. The terms of the contract were that the transporters were to pay ₹ 3,00,000 down and six four-monthly instalments of ₹ 1,00,000 plus interest on outstanding amount of cash price for the intervening four months. The instalments were payable on 31st July, 30th November and 31st March in each one of the two accounting years. Interest was calculated @ 12% per annum. M/s. Singh & Singh duly paid the instalment on 31st July 2012 but failed to pay the instalment on 30th November 2012. M/s. Power Motors, after legal formalities, repossessed the truck valuing it at ₹ 7,00000.

M/s. Power Motors spent? 80,000 on repairs and repainting of the truck and on 7th January 2013 sold it for ₹ 7,50,000 cash. You are required to prepare the account of M/s. Singh & Singh and Goods Repossessed Account in the books of Mis. Power Motors. (May 2013, 6 marks)

Answer:

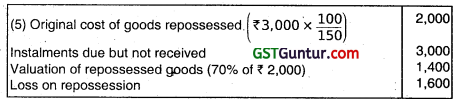

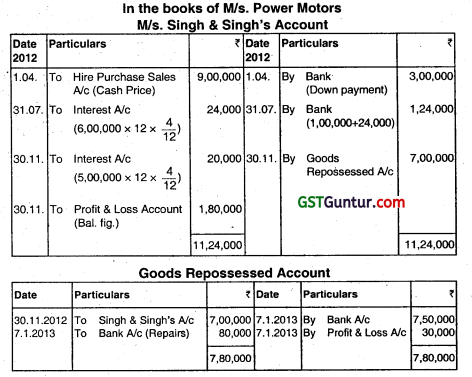

Question 23.

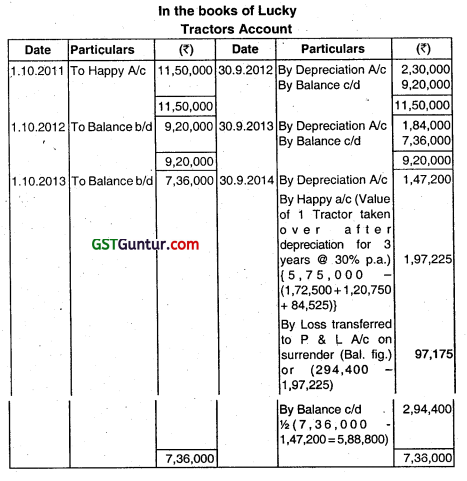

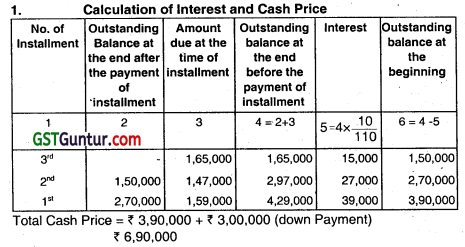

Lucky bought 2 tractors from Happy on 1-10-2011 on the following terms:

Down payment ₹ 5,00,000

1st installment at the end of first year ₹ 2,65,000

2nd installment at the end of 2nd year ₹ 2,45,000

3rd installment at the end of 3rd year ₹ 2,75,000

Interest is charged at 10% p.a.

Lucky provides depreciation @ 20% on the diminishing balances.

On 30-9-2014 Lucky failed to pay the 3”’ installment upon which Happy repossessed 1 tractor. Happy agreed to leave one tractor with Lucky and adjusted the value of the tractor against the amount due. The tractor taken over was valued on the basis of 30% depreciation annually on written down basis. The balance amount remaining in the vendor’s account after the above adjustment was paid by Lucky after 3 months with interest @ 18% p.a.

You are required to:

(1) Calculate the cash price of the tractors and the interest paid with each installment.

(2) Prepare Tractor Account and Happy Account In the books of Lucky assuming that books are closed on September 30 every year. Figures may be rounded off to the nearest rupee. (May 2015, 8 marks)

Answer:

![]()

Question 24.

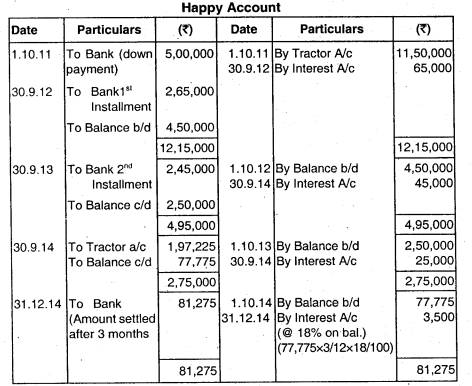

Girish Transport Ltd., purchased from NCR Motors 3 electric rickshaws costing ₹ 60,000 each on the hire purchase system on 1.1.2013. Payment was to be made ₹ 30,000 down and the remainder in 3 equal Installments payable on 31.12.2013,31.12.2014 and 31.12.2015 together with interest @ 10% p.a. Girish Transport Ltd. writes oft depreciation @ 20% p.a. on the reducing balance. It paid the installment due at the end of 1st year i.e. 31.12.2013 but could not pay next on 31.12.2014. NCR Motors agreed to leave one e-rickshaw with the purchaser on 31.12.2014 adjusting the value of the other two e-rickshaws against the amount due on 31.12.2014.

The e-rickshaws were valued on the basis of 30% depreciation annually on WDV basis.

Show the necessary Ledger accounts in the books of Girish Transport Ltd. for the year 2013, 2014 and 2015. (May 2016, 8 marks)

Answer:

Loss per Auto rickshaw

= 38,400 – 29,400

= 9,000

Total loss = 9,000 x 2 = 18,000

Question 25.

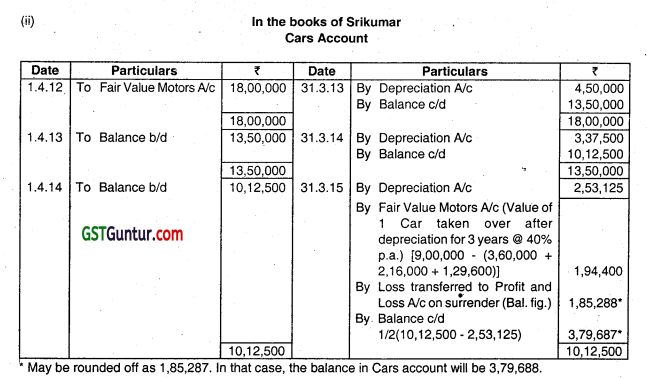

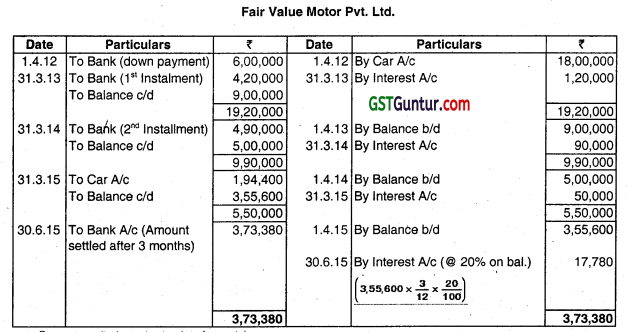

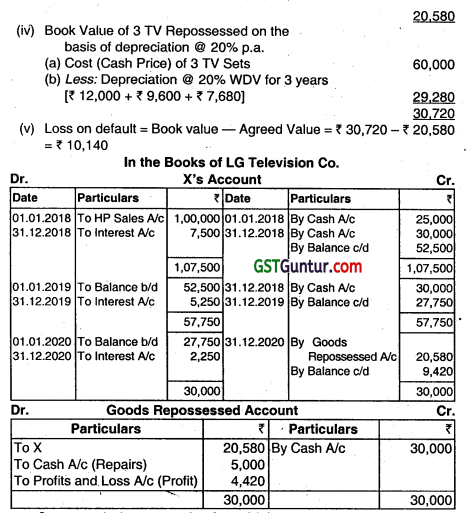

Srikumar bought 2 cars from ‘Fair Value Motors Pvt Ltd. on 1-4-2012 on the following terms:

Down payment 6,00.000

1st Installment at the end of first year 4,20,000

2nd Installment at the end of 2nd year 4.90,000

3rd Installment at the end of 3rd year 5,50.000

Interest is charged at 10% p.a.

Srikumar provides depreciation @ 25% on the diminishing balances.

On 31-3-15 Srikumar failed to pay the 3 installment upon which ‘Fair Value Motors Pvt Ltd.’ repossessed 1 car. Srikumar agreed to leave one car with Fair Value Motors Pvt Ltd. and adjusted the value of the car against the amount due. The car taken over was valued on the basis of 40% depreciation annually on written down basis.

The balance amount remaining in the vendor’s account after the above adjustment was paid by Srikumar after 3 months with interest @ 20% p.a.

You are required to:

(i) Calculate the cash price of the cars and the interest paid with each installment.

(ii) Prepare Car Account and Fair Value Motors Pvt Ltd. Account in the books of Srikumar assuming books are closed on March 31, every year. Figures may be rounded off to the nearest rupee. (Nov 2016, 8 marks)

Answer:

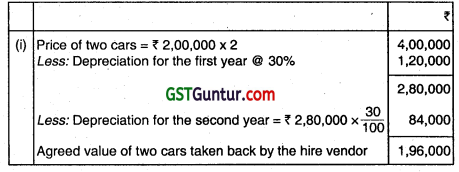

Question 26.

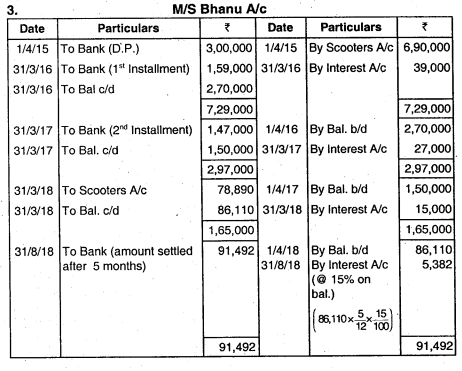

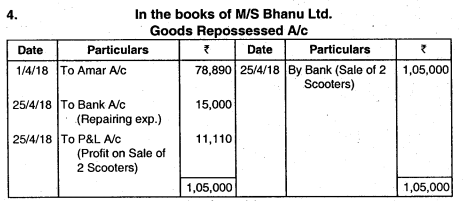

M/s Amar bought six Scooters from M/s Bhanu on 1” April 2015 on the following terms:

Down payment, ₹ 3,00,000

1st installment payable at the end of 1st year ₹ 1,59,000

2nd installment payable at the end of 2nd year ₹ 1,47,000

3rd instalment payable at the end of 3rd year ₹ 1,65,000

Interest is charged at the rate of 10% per annum.

M/s Amar provides depreciation @ 20% per annum on the diminishing balance method.

On 31st March, 2018 M/s Amar failed to pay the 3 instalment upon which M/s Bhanu repossessed two Scooters. M/s Bhariu agreed to leave the other four Scooters with M/s Amar and adjusted the value of the repossessed Scooters against the amount due. The Scooters taken over were valued on the basis of 30% depreciation per annum on written down value.

The balance amount remaining in the vendor’s account after the above adjustment was paid by M/s Amar after 5 months with interest @ 15% per annum. M/s Bhanu incurred repairing expenses of ₹ 15,000 on repossessed scooters and sold scooters for ₹ 1,05,000 on 25 April, 2018.

You are required to:

1. Calculate the cash price of the Scooters and the interest paid with each instalment.

2. Prepare Scooters Account and M/s Bhanu Account in the books of M/s Amar.

3. Prepare Goods Repossessed Account in the books of M/s Bhanu. (May 2019,10 marls)

Answer:

![]()

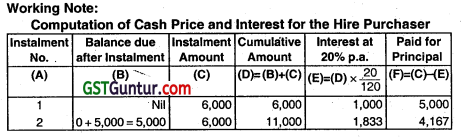

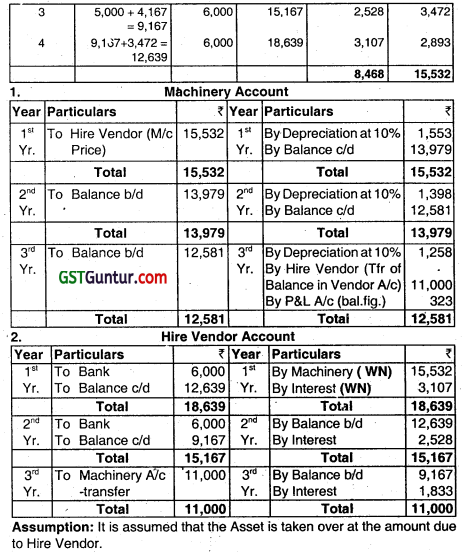

Question 27.

A Machinery is sold on l-lire Purchase. The terms of purchase is 4 Annual Instalments of ₹ 6000 at the end of ‚each year commencing from the date of agreement. Interest is charged @ 20% and is included in the annual payment of ₹ 6000. Show Machinery A/c and Hire Vendor A/c in the books of the Hire Purchaser who defaulted in the payment of the 3 yearly payments whereupon the Vendo repossessed the Machinery. The Hire Purchaser provides Depreciation on Machine at 10% p.a.

Answer:

Question 28.

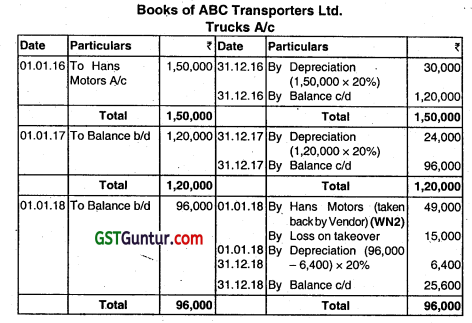

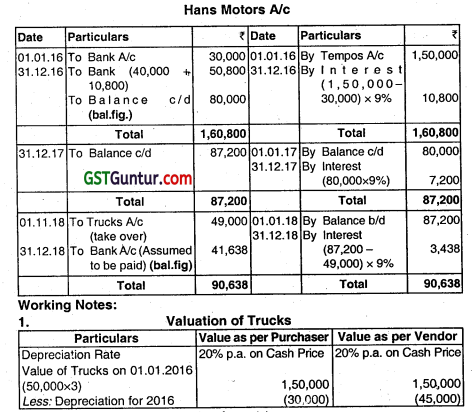

ABC Transporters Ltd. purchased from Hans Motors 3 Trucks costing ₹ 50000 each on the Hire Purchase System on 01.01.2016. Payment was to be made 30,000 clown and the remainder in 3 equal annual instalments payable on 31.12.2009, 31.12.2017 and 31.12.2018 together with interest at 9% pa. ABC Transporters Ltd. writes off depreciation at 20% on the diminishing balance. It paid the instalment due at the end of the first year i.e. 31.122016 but could not pay the next on 31.12.2017.

Hans Motors agreed to leave one Trucks with the purchaser on 01.01.2018 adjusting the value of other 2 Trucks against the amount due on 01.01.2018. The Trucks were valued on the basis of 30% depreciation annually. Prepare the necessary accounts in the books of ABC Transporters Ltd. for the years 2016, 2017 and 2018.

Answer:

Question 29.

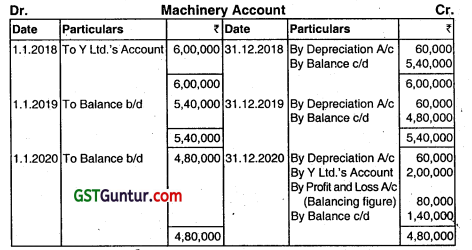

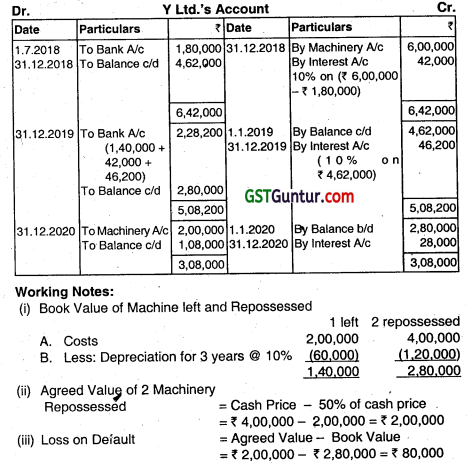

Y Ltd. sold 3 Machinery for a total cash salo price of 6,00,00 on hire purchase basis to X on 1.1.2018. The terms of agreement provided for 30% as cash down and the balance of the cash price in three equal instalments together with interest at 10% per annum compounded annually. The instalments were payable as per the following schedule:

1st instalment on 31.12.2019; 2nd instalment on 31.12.2020 and 3rd instalment on 31.12.2021. X paid the 1 instalment on time but failed to pay thereafter. On his failure to pay the second instalment, Y Ltd. repossessed two machineries and valued them at 50% of the cash price. X charges 10% p.a. depreciation on straight line method. Prepare necessary ledger accounts in the books of X for 2018-2020.

Answer:

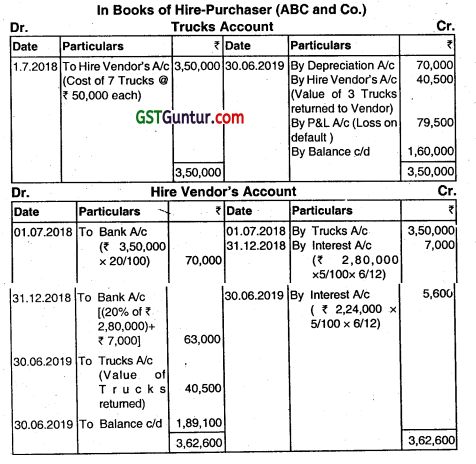

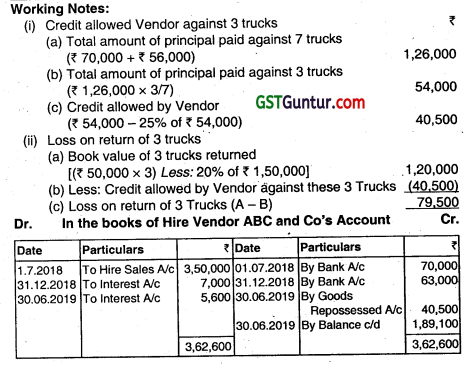

Question 30.

ABC and Co. purchased seven trucks on hire purchase on 1 July, 2018. The cash purchase price of each truck was ₹ 50,000. The company has to pay 20% of the cash purchase price at the time of delivery and the balance in five half-yearly instalment starting from 31st December. 2018 with interest at 5% per annum at half yearly rest. On the Company’s failure to pay the instalment due on 30th June 2019 it was agreed that the Company would return 3 trucks to the vendor and the remaining four

would be retained. The vendor agreed to allow him a credit for the amount paid against these 3 trucks less 25%. Vendor after spending ₹ 1,000 on repairs sold away all the three trucks for ₹ 40,000.

Prepare the relevant Accounts in the books of the purchaser and vendor assuming the books are closed in June every year and depreciation @ 20% p.a. is charged on Trucks.

Answer:

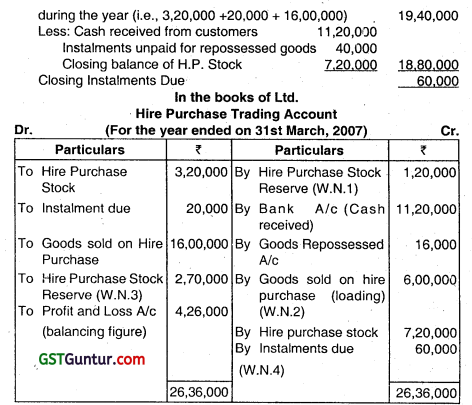

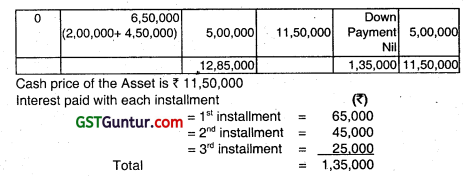

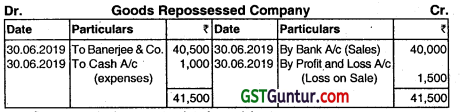

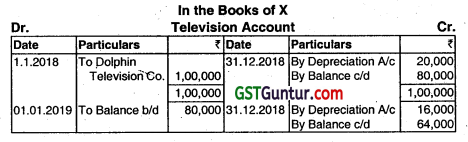

Question 31.

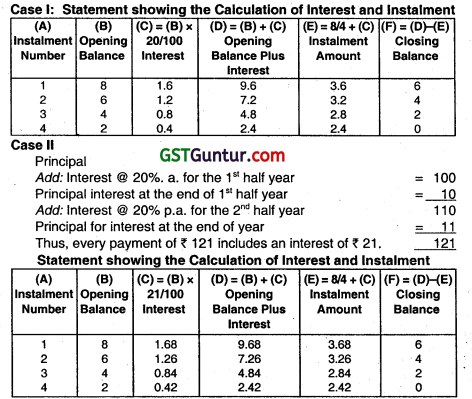

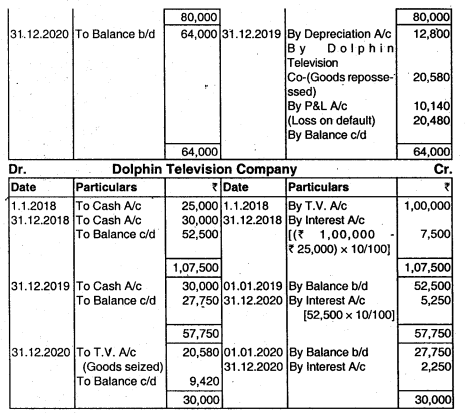

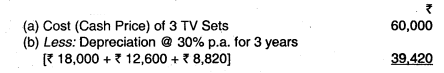

On 1.1.2018 X, a television dealer, bought 5 television sets from LG Television Co. on hire-purchase. The cash price of each set was ₹ 20,000. It was agreed that ₹ 25,000 should be paid immediately and the balance in three instalments of ₹ 30,000 each at the end of each year. The LG Television Co. charges interest @ 10% p.a. The buyer depreciates television sets at 20% p.a. on the diminishing balance method.

X paid cash down and two instalments but failed to pay the last instalment. Consequently, the LG Television Co. repossessed three sets, leaving two sets with the buyer and adjusting the value of 3 sets against the amount due. The sets repossessed were valued on the basis of 30% depreciation p.a. on the written down value. The sets repossessed were sold by the LG Television Co. for ₹ 30,000 after necessary repairs amounting to ₹ 5,000 on 30th June 2021. Open the necessary ledger account in the books of both the parties.

Answer:

Working Notes:

(i) Total Interest = Hire Purchase Price – Cash Price

= [₹ 25,000 + (₹ 30000 x 3)) – (₹ 20,000 x 5)

= ₹ 1,15,000 – ₹ 1,00,000 = ₹ 15,000

(ii) Interest for 3 year = ₹ 15,000 – ₹ 7,500 – ₹ 5,250 = ₹ 2,250

(iii) Agreed Value of 3 TV Repossessed on the bases of depreciation @ 30% p.a.

![]()

Question 32.

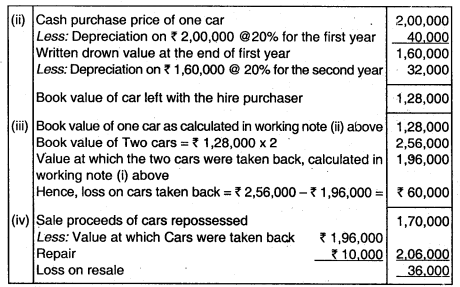

The following particulars relate to hire purchase transactions:

(a) X purchased three cars from Y on hire purchase basis, the cash price of each car being ₹ 2,00000.

(b) The hire purchaser charged depreciation @ 20% on diminishing balance method.

(c) Two cars were seized by on hire vendor when second installment was not paid at the end of the second year. The hire vendor valued the two cars at cash price less 30% depreciation charged under It diminishing balance method.

(d) The hire vendor spent 10,000 on repairs of the cars and then sold them for a total amount of ₹ 1,70,000.

You are required to compute:

(i) Agreed value of two cars taken back by the hire vendor.

(ii) Book value of car left with the hire purchaser.

(iii) Profit or loss to hire purchaser on two cars taken back by their hire vendor.

(iv) Profit or loss of cars repossessed when sold by the hire vendor.

Answer:

Question 33.

Distinguish between Hire Purchase system and Installment system. (Nov 2014, 4 marks each)

Answer:

Differences between Hire Purchase and Installment System

| Basis of Distinction | Hire Purchase Agreement’ | Installment Purchase Agreement |

| 1. Governing Act | It is governed by Hire Purchase Act, 1972. | It is governed by the Sale of Goods Act, 1930. |

| 2. Nature of Contract | It is an agreement of hiring. | It is an agreement of sale. |

| 3. Passing of Title (ownership) | The title to goods passes on last payment. | The title to goods passes immediately as in the case of usual sale. |

| 4. Right to Return goods | The hirer may return goods without further payment except for accrued installments. | Unless seller defaults, goods are not returnable. |

| 5. Seller’s right to repossess | The seller may take possession of the goods if hirer is in default. | The seller can sue for price the buyer is ¡n default. He cannot take possession of the goods. |

| 6. Right of Disposal | Hirer cannot hire out, sell, pledge or assign entitling transferee to retain possession as against the hire vendor. | The buyer may dispose off the goods and give good title to the bonafide purchaser. |

| 7. Responsibility for Risk of Loss | The hirer is not responsible for risk of loss of goods if he has taken reasonable precautions because the ownership has not yet been transferred. | The buyer is responsible for risk of loss of goods because the ownership has transferred. |

| 8. Name of Parties Involved | The parties involved are called Hirer and Hire vendor. |

The parties involved are called buyer and seller. |

| 9. Component other than cash price. | Component other than Cash Price included in installment is called Hire charges. | Component other than Cash Price included in Installment is called Interest. |