GST in India – An Introduction – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

GST in India – An Introduction – CA Inter Tax Question Bank

Question 1

List any six state levies, which are subsumed in GST. (May 2018, 3 marks)

Answer:

The six state levies which are subsumed in GST are as follows:

- State Value Added Tax/Sales Tax

- Entertainment Tax (other than the tax levied by the local bodies)

- Central Sales Tax (levied by the Centre and collected by the States)

- Octroi and Entry tax

- Purchase Tax

- Luxury tax

Question 2.

List any four Central levies, which are subsumed in GST. (Nov 2018, 2 marks)

Answer:

The Central levies which are subsumed in GST are as under:-

(a) Central Excise Duty and Additional Excise Duties

(b) Service tax

(c) Excise duty under Medicinal and Toilet Preparation Act

(d) CVD

(e) Special CVD

(f) Central Sales Tax

(g) Central surcharges and cesses in so far as they relate to supply of goods and services

Note: Any of the four points may be mentioned

![]()

Question 3.

Difference between Direct Taxes & Indirect Taxes

Answer:

| Particulars | Direct Taxes | Indirect Taxes |

| Meaning | Direct Taxes are those taxes where the incidence and impact falls on the same person. | Indirect Tax is a tax where incidence and impact fall on two different person. |

| Nature of tax | Direct Tax is progressive in nature. | Indirect Taxes is regressive in nature. |

| Taxable Value | Taxable income of the Assessees. | Value of supply of goods services. |

| Levy & Collection | Levied and collected from the Assessee. | Levied & collected from the consumer but paid to the Exchequer by the Dealer. |

| Shifting of Burden | Directly borne by the Assessee. Hence, cannot be shifted. | Tax burden is shifted to the subsequent/ ultimate user. |

| Collected | After the Income for a year is earned | At the time of supply of goods or services. |

Question 4.

Whether CGST & SGST/UTGST is applicable on import of goods or service or both?

Answer:

In terms of Section 7 of the IGST Act, 2017, import of goods or services or both are shall be treated to be a supply in the course of inter-State trade or commerce. Accordingly, tax under the provisions of IGST Act, 2017 (IGST) shall apply on import of goods or services or both.

Question 5.

Define Supplier under CGST Act.

Answer:

Supplier in relation to any goods or services or both, shall mean the person supplying the said goods or services or both and shall include an agent acting as such on behalf of such supplier in relation to the goods or services or both supplied.

Question 6.

What are the taxes that are levied on an intra-State supply?

Answer:

In terms of Section 9 of the CGST Act, 2017, intra-State supplies are liable to CGST & SGST. In terms of Section 7 of UTGST Act, 2017, intra-State supplies effected by a taxable person located in Union Territory (within the Union Territory) will be liable to CGST & UTGST.

Multiple choice questions

Question 1.

First country to introduce GST in world?

(a) UK

(b) France

(c) Canada

(d) Brazil

Answer:

(b) France

![]()

Question 2.

Article ____ of the constitution of India empowers parliament to impose IGST in India.

(a) 69A

(b) 279A

(c) 265A

(d) None of the above

Answer:

(d) None of the above

Question 3.

Dual GST model is mainly drawn from:

(a) Australia

(b) France

(c) Canada

(d) USA

Answer:

(c) Canada

Question 4.

Under GST law tax is levied:

(a) Simultaneously by union and state laws

(b) Exclusively by union and state laws

(c) Only by union laws

(d) Only by state laws

Answer:

(a) Simultaneously by union and state laws

Question 5.

GST rates on goods and services are:

(a) 0%, 5%, 12%, 16%, 28%

(b) 0%, 6%, 12%, 18%, 28%

(c) 0%, 5%, 12%, 18%, 28%

(d) 0%, 5%, 12%, 18%, 26%

Answer:

(c) 0%, 5%, 12%, 18%, 28%

Question 6.

What is the maximum rate prescribed under CGST?

(a) 12%

(b) 28%

(c) 20%

(d) 18%

Answer:

(c) 20%

Question 7.

Under ____ Amendment Act, 2016 constitution was amended to introduce GST in India.

(a) 121st

(b) 122nd

(c) 101st

(d) None of the above

Answer:

(c) 101st

Question 8.

One of the following taxes is already subsumed in GST.

(a) Taxes on motor spirit

(b) Tax on electricity

(c) Luxury tax

(d) Tax on production of alcohol

Answer:

(c) Luxury tax

Question 9.

GST is-

(a) Applicable to state of J& K

(b) Not applicable to state of J& K

(c) Going to be applicable at a later date

(d) Both (b) and (c) above

Answer:

(a) Applicable to state of J& K

![]()

Question 10.

Who will notify the rate of tax to be levied under CGST?

(a) Central Government suomoto

(b) State Government suomoto

(c) GST Council suomoto

(d) Central Government as per the recommendations of the GST Council

Answer:

(d) Central Government as per the recommendations of the GST Council

GST in India – An Introduction Notes

Basic for Taxation

India is a socialist, democratic and republic country, Constitution of India is supreme law of land. All other laws, including the Income Tax Act, Central Goods and Services Tax Act are subordinate to the Constitution of India. The Constitution provides that ‘no tax shall be levied or collected except by Authority of Law’.

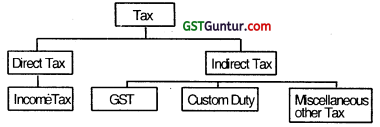

Direct Taxes and Indirect Taxes

(A) Direct Taxes: They are imposed on a person’s income. Direct Taxes charge in on person concern and burden is borne by person on whom it is imposed.

Example: Income Tax

(B) Indirect Taxes: They are imposed on goods/services. The immediate liability to pay is of supplier but its burden is transferred to the ultimate consumers of such goods/ services.

Example: GST, Customs Duty etc.

Genesis of GST in India

1. It has now been more -than a decade since the idea of National Goods and Services Tax (GST) was mooted by Kelkar Task Force in 2004. The Task Force strongly recommended fully integrated ‘GST’ on national basis.

2. Subsequently, the then Union Finance Minister, Shri P. Chidambaram,’ while presenting the Central Budget (2007-2008), announced that GST would be introduced from April 1, 2010. Since then, GST missed several deadlines.

3. Internationally, GST was first introduced in France in 1954 and now more than 160 countries have introduced GST.

4. Most of the countries, depending on their own socio-economic formation, have introduced National level GST (levy by centre) or Dual GST (simultaneous levy by centre and state). India has adopted Dual GST model as followed in Canada and Brazil.

Power to tax GST (Constitutional Provisions)

The Constitution (101st Amendment) Act, 2016 as notified on 8th September, 2016 paved the way for implementation of GST.

Article 246A has been inserted in the Constitution, which is as under:

246A(1)

Parliament and the Legislature of every State, have power to make laws with respect to goods and services tax imposed by the Union or by such State.

246A(2)

Parliament has exclusive power to make laws with respect to goods and services tax where the supply of goods, or of services, or both takes place in the course of inter-State trade or commerce.

Extent and Commencement

- It extends to the whole of India including the State of Jammu and” Kashmir.

- It has come into force on 1st July 2017. However, different dates have been appointed for applicability of different provisions of GST.

- India is a summation of three categories of territories namely –

- States (29);

- Union Territories with Legislature (2); and

- Union Territories without Legislature (5).

1. Features of Indirect Taxes

(i) An important source of revenue: Indirect taxes are a major source of tax revenues for Governments worldwide and continue to grow as more countries move to consumption oriented tax regimes. In India, indirect taxes contribute more than 50% of the total tax revenues of Central and State Governments.

(ii) Tax on commodities and services: It is levied on commodities at the time of manufacture or purchase or sale or import/export thereof. Hence, it is also known as commodity taxation. It is also levied on provision of services.

(iii) Shifting of burden: There is a clear shifting of tax burden in respect of indirect taxes. For example, GST paid by the supplier of the goods is recovered from the buyer by including the tax in the cost of the commodity.

(iv) No perception of direct pinch: Since, value of indirect taxes is generally inbuilt in the price of the commodity, most of the time the tax payer pays the same without actually knowing that he is paying tax to the Government. Thus, tax payer does not perceive a direct pinch while paying indirect taxes.

(v) Inflationary: Tax imposed on commodities and services causes an all-round price spiral. In other words, indirect taxation directly affects the prices of commodities and services and leads to inflationary trend.

(vi) Wider tax base: Unlike direct taxes, the indirect taxes have a wide tax base. Majority of the products or services are subject to indirect taxes with low thresholds.

(vii) Promotes social welfare: High taxes are imposed on the consumption of harmful products (also known as ‘sin goods’) such as alcoholic products, tobacco products etc. This not only checks their consumption but also enables the State to collect substantial revenue.

(viii) Regressive in nature: Generally, -the indirect taxes are regressive in nature. The rich and the poor have to pay the same rate of indirect taxes on certain commodities of mass consumption. This may further increase the income disparities between the rich and the poor.

![]()

Taxes which have been subsumed under GST

| Central taxes | State taxes | ||

| 1. | Central Excise Duty | 1. | State VAT |

| 2. | Duties of Excise (Medicinal and Toilet Preparations) | 2. | Purchase Tax ‘ |

| 3. | Additional Duties of Excise (Goods of Special Importance) | 3. | Luxury Tax |

| 4. | Additional Duties of Excise (Textiles and Textile Products) | 4. | Entry Tax (All forms Entertainment Tax (except those levied by the local bodies) |

| 5. | Additional Duties of Customs (commonly known as CVD) | 5. | Taxes on advertisements |

| 6. | Special Additional’ Duty of Customs (SAD) | 6. | Taxes on lotteries, betting and gambling |

| 7. | Service Tax | 7. | State cesses and surcharges in so far as they relate to supply of goods or services |

| 8. | Cesses and surcharges insofar as they relate to supply of goods or services |

Taxes not likely to be subsumed in GST

Central Tax

1. BCD

2. Other Custom Duty like anti dumping duty, safeguard duty etc.

3. Export Duty

State Tax

1. Road and passenger tax

2. Toll tax

3. Property tax

4. Stamp Duty

5. Electricity Duty

6. Entertainment Tax & amusement levied and collected by panchayat or municipality or district council.

Benefit of GST

Benefit to Government

- A unified common national market to boost Foreign Investment and Make In India” campaign:

- Boost to export/manufacturing activity, generation of more employment, leading to reduced poverty and increased GDP growth:

- Improving the overall investment climate in the country which will benefit the development 0f States;

- Uniform SGST and IGST rates to reduce the incentive for tax evasion.

Benefit to Customer

- Simpler tax system;

- Reduction in prices of goods and services due to elimination of cascading;

- Uniform prices throughout the country;

- Transparency in taxation system.

Benefit of Trade and industry

- Reduction in multiplicity of taxes;

- Mitigation of cascading/double taxation;

- More efficient neutralization of taxes especially for exports:

- Development of common national market.